Author: Alan Weissberger

NTT: Biggest challenges to effectively integrate private 5G into existing infrastructure and applications?

by Shahid Ahmed of NTT

Introduction:

For most countries, the public 5G networks are expected to enable users to experience a whole new level of connectivity. Enterprises are wanting to make the most of the network as well. While the public 5G networks do offer enterprise solutions and services, a private 5G network might just be the better option for them.

Why should enterprises consider a private 5G network?

Shahid Ahmed, Group EVP, New Ventures and Innovation at NTT Ltd.

…………………………………………………………………………………………………………………………….

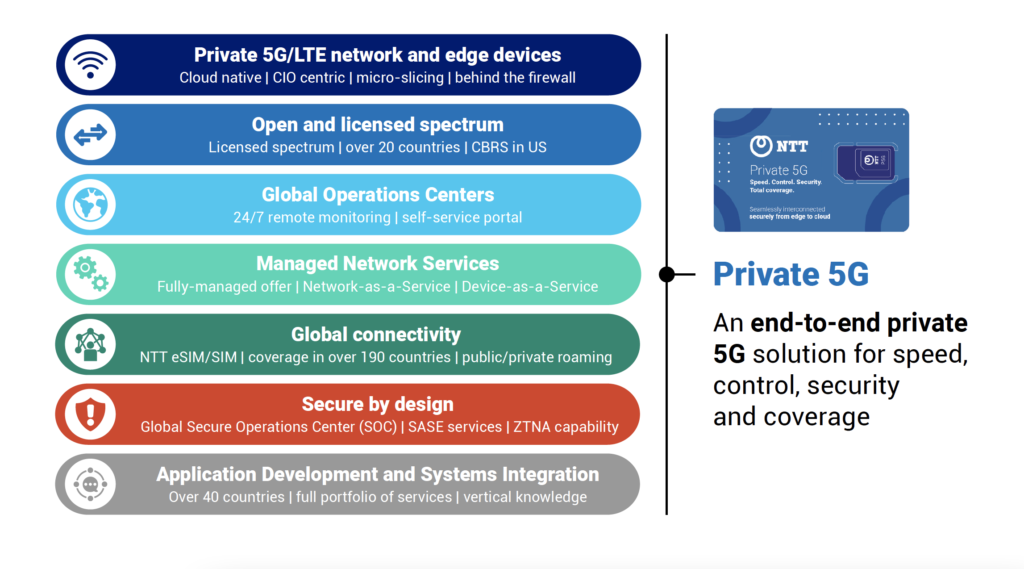

As enterprises continue supporting wider digitization, the demands on secure and reliable connectivity solutions are increasing. NTT recently partnered with the Economist Impact and interviewed over 200 CIOs globally, and our findings show they expect to benefit from the improved data control, privacy, and security as the most anticipated outcomes of implementing private 5G networks followed closely by improving workforce productivity through automation.

Advanced connectivity is an essential element for industrial automation applications in manufacturing facilities, Automotive, Hospitals, and Warehousing Facilities. Hence, private 5G networks provide a single network for mission-critical operational technology (OT) using micro-slicing to support manufacturing workflow automation, autonomous guided robots, and machine vision AI applications.

For most industrial applications, the cost of ownership for private 5G wireless is better than alternative technologies operating in an unlicensed spectrum. The TCO of private 5G wireless networks is lower (when compared to WiFi) because these networks provide wider (especially outdoor) coverage requiring far fewer access points which means less overall infrastructure to install and manage.

What are the biggest challenges when it comes to effectively integrating private 5G into existing infrastructure and applications?

Through NTT’s recently conducted CIO survey alongside secondary research, our findings revealed that the most common (44%) barrier to deploying private 5G networks is integrating the technology with legacy systems and networks. The complexity surrounding the deployment and management of private 5G networks was also cited as another significant barrier by 37% of respondents given that 5G technology is still in the early stages of its adoption lifecycle. Employees lacking the technical skills and expertise to manage 5G networks was the third most common barrier facing 30% of firms.

In view of these challenges, organizations could consider outsourcing their private 5G deployment to a managed service provider who will have the expertise when it comes to implementing private 5G networks. This is likely to be the most common approach to private 5G adoption, preferred by 38% of survey respondents. Buying a private 5G network ‘as-a-service’ can accelerate the adoption process and offer a better end-user experience and return on investment for companies.

Additionally, it is important to integrate the private 5G network into business operational workflows. For example, in cases such as safety and maintenance, these business processes and employee and machine workflows must be directly integrated into the network.

Source – NTT

………………………………………………………………………………………………………………………

How is NTT helping enterprises with their private 5G adoption? Are there any use case examples to share?

We have a range of commercial out of the box use cases and device solutions available; for example, autonomous guided robots, machine vision worker safety PPE detection, machine vision AI smart factory and smart building solutions, group communication Push to Talk (PTT), AR/VR connected workforce, and automate manufacturing workflow solutions. These are just some examples of use cases NTT has curated internally or together with our partners.

NTT’s private 5G (P5G) fully managed Network as a Service (NaaS) solution is ideally suited for enterprises in need of better security, data management, and privacy supporting their wider enterprise digitization initiatives. NTT further provides system design and integration services to integrate the network existing systems and application and network management upon completion of the network. The solution is pre-integrated with leading network suppliers, offering clients the flexibility to seamlessly work with any industry-certified applications.

When it comes to cybersecurity, will private 5G enable enterprises to have better visibility and control over their network?

Security is the main draw for enterprises when it comes to private 5G adoption. This was also one of the key findings from the Economist Impact survey with 83% of executives citing it as the number one reason why they wanted to build a private 5G network.

Private 5G enabled networks are built around Zero Trust (ZTNA) principles leveraging SIM-based (multi-factor) authentication and authorization, enhanced end-user data encryption, enhanced authentication, and data encryption between network sub-components and network slicing.

Together, these enhancements provide end-to-end security and strict access control, through device authentication and protecting sensitive data with network isolation. It enables true granular micro[1]slicing capabilities where traffic within the facilities and warehouses can be segmented according to enterprise IT/OT SLA needs.

Lastly, the 5G network has been making headlines in the US over concerns it can affect aircraft radar. Should businesses be concerned if a private 5G network might affect other machinery in their plants?

With regards to concerns relating to 5G networks affecting aircraft radar, discussion among wireless carriers as well as the airline industry and regulators are still ongoing, and it is too early to speculate on the way forward.

Private 5G networks in the US are different than Public 5G. Additionally, most private networks in the US will leverage the CBRS band which is an FCC-approved and shared band, much further removed from the frequencies used for aviation altimeters systems while operating at much lower power than public 5G networks.

Similarly, the risks of deploying private 5G to an organization’s machinery is unlikely – and because the networks are custom, the individual network can be configured properly so there is ZERO RISK. Companies may benefit from leveraging a managed service provider who will be able to manage the infrastructure, implementation process, and any ongoing operational risks.

References:

https://techwireasia.com/2022/02/enabling-more-enterprise-use-cases-with-private-5g-networks/

América Móvil: 5G deployment 1H-2022; pay-TV service in Mexico under discussion by IFT

América Móvil will begin this year the deployment of its 5G network in Mexico and all the countries in the Latin American region where it operates, with the exception of Colombia, said Daniel Hajj, CEO of the company.

The company, owned by magnate Carlos Slim, will invest around eight billion dollars this year, said the executive in a conference call with analysts. América Móvil expects to have 5G connectivity ready in 90 percent of its markets.

Hajj pointed out that although there is no specific date for the launch of the 5G network, he expects it to take place during the first half of this year. “I don’t have a specific date, but all over the year we’re working on a launch. I hope we can do it in the first semester of this year,” said Hajj said about 5G on a call with investors.

America Movil operates in at least 10 markets, mainly in Latin America.

The company on Tuesday reported that its fourth-quarter net profit more than tripled from the year-ago period, boosted by its sale of its TracFone wireless unit to Verizon Communications Inc. It posted a net profit of 135.6 billion pesos ($6.6 billion), compared with 37.3 billion pesos a year earlier.

The CEO also referred to the company’s plans to offer pay-TV service in Mexico, a request that is under discussion at Mexico’s telecom regulator- the Federal Telecommunications Institute (IFT).

At the end of January, the Plenary of the IFT reversed a project that denied the concession of a pay TV channel to Claro TV, a subsidiary of América Móvil, which postponed the decision on the request made by Carlos Slim‘s company more than three years ago.

However, Hajj said that they expect to have positive news on the matter and assured that the request before the regulator complies with all the regulations in force, in addition to the fact that it would benefit consumers.

“It is clear that competition would be good for consumers and the sector, and we believe that Claro and América Móvil is a clear alternative, so that will have to be determined by the IFT, and we expect positive news on that front,” a company executive said.

References:

Gartner: Accelerated Move to Public Cloud to Overtake Traditional IT Spending in 2025

Enterprise IT spending on public cloud computing, within addressable market segments, will overtake spending on traditional IT in 2025, according to Gartner, Inc.

Gartner’s ‘cloud shift’ research includes only those enterprise IT categories that can transition to cloud, within the application software, infrastructure software, business process services and system infrastructure markets. By 2025, 51% of IT spending in these four categories will have shifted from traditional solutions to the public cloud, compared to 41% in 2022. Almost two-thirds (65.9%) of spending on application software will be directed toward cloud technologies in 2025, up from 57.7% in 2022.

“The shift to the cloud has only accelerated over the past two years due to COVID-19, as organizations responded to a new business and social dynamic,” said Michael Warrilow, research vice president at Gartner. “Technology and service providers that fail to adapt to the pace of cloud shift face increasing risk of becoming obsolete or, at best, being relegated to low-growth markets.”

In 2022, traditional offerings will constitute 58.7% of the addressable revenue (see Figure 1), but growth in traditional markets will be much lower than cloud. Demand for integration capabilities, agile work processes and composable architecture will drive continued shift to the cloud, as long-term digital transformation and modernization initiatives are brought forward to 2022. Technology product managers should use the cloud shift as measure of market opportunity.

In 2022, more than $1.3 trillion in enterprise IT spending is at stake from the shift to cloud, growing to almost $1.8 trillion in 2025, according to Gartner. Ongoing disruption to IT markets by cloud will be amplified by the introduction of new technologies, including distributed cloud. Many will further blur the lines between traditional and cloud offerings.

Enterprise adoption of distributed cloud has the potential to further accelerate cloud shift because it brings public cloud services into domains that have primarily been non-cloud, expanding the addressable market. Organizations are evaluating it because of its ability to meet location-specific requirements, such as data sovereignty, low-latency and network bandwidth.

To capitalize on the shift to cloud, Gartner recommends technology and services providers target segments where the shift is occurring most aggressively, in addition to seeking new high-growth cloud opportunities. For example, infrastructure-related segments have a lower level of cloud penetration and are expected to grow faster than segments such as enterprise applications that are already highly penetrated. Providers should also target specific personas, adoption profiles and use cases with go-to-market initiatives.

*Note to editors: Gartner’s research on cloud shift provides a high-level view of the market impact of cloud computing by measuring the ratio of enterprise IT spending on public cloud services compared with traditional (non-cloud) for a given set of market segments. It compares only those markets where cloud is a meaningful trend that can be exploited by technology providers. It excludes consumer spending and markets that cannot transition to cloud, for example, mobile devices.

More detailed analysis is available to Gartner clients in the report “Market Impact: Cloud Shift — 2022 Through 2025.” More information on cloud trends is available in the Gartner webinar “The Gartner Hype Cycle for Cloud Computing.”

Telcos Move to Public Cloud:

Dish Network is perhaps the poster child for this shift, with its ambitious plan to deploy its greenfield 5G network on Amazon Web Services (AWS). After a few delays, the big switch-on is expected to begin this year. Similarly, AT&T struck a deal last June to migrate its 5G network onto Microsoft Azure. Verizon is also using Azure, in this case to underpin its private mobile edge cloud service. North of that particular border, Bell Canada in July inked a deal to migrate various critical workloads – including IT, network functions and applications – to Google Cloud. It came less than two months after Bell teamed up with AWS to overhaul its business and consumer applications, as well as offer AWS-powered multi-access edge computing (MEC) services.

More recently, Telenor expanded its partnership with Amazon to jointly offer 5G and edge services to various industry verticals. In short, more and more telcos are coming to the conclusion that hyperscale public cloud offers a ready-made route for them, not just to address the enterprise IT market, but to also make their own networks cloud native.

References:

Public cloud forecast to account for majority of IT spending by 2025

China to accelerate 5G roll-outs while FCC faces “rip and replace” funding shortfall

China Daily reports that local governments in China are doubling down on plans to accelerate 5G rollouts in 2022. More than 20 provincial and municipal governments in China have emphasized efforts to accelerate construction of “new infrastructure” like 5G and data centers in their work plans for this year.

Shanghai plans to build more than 25,000 5G base stations this year (do you really believe that?) to push forward the in-depth coverage of the superfast wireless network. The city also has ambitions to build super large computing power platforms to meet growing demand.

Zhao Zhiguo, spokesman for the Ministry of Industry and Information Technology, China’s top industry regulator, said earlier:

“2022 is a critical year for the large-scale development of 5G applications. We will continue to improve 5G network coverage and accelerate the in-depth integration of 5G and vertical industries.”

One of the priorities is to moderately speed up the coverage of 5G in counties and rural towns in China, Zhao said.

Ten ministries, including the Cyberspace Administration of China, recently unveiled a digital rural development action plan for the period from 2022 to 2025, which called for an intensified push to promote digital infrastructure upgrades in rural areas.

Telecom operators are also moving fast. China Mobile, the nation’s largest telecom carrier, said it aims to achieve continuous 5G coverage in rural towns across the country by the end of this year.

Telecom carriers’ 5G plans seek to harness the power of more than 1.4 million 5G base stations that were deployed in China by the end of last year (but can you really trust that China government reported number?). 5G signals are already available in urban areas of all of China’s prefecture-level cities, more than 98% of county-level towns and 80 percent of rural towns, MIIT data showed.

5G Cell Tower in China. Image courtesy of China Daily

…………………………………………………………………………………………………………………………….

In the U.S., it’s a different story. The Federal Communications Commission (FCC) found a shortfall in funding for its plan to replace Chinese telecom equipment. Inadequate finance is likely to pose connectivity challenges to people in remote areas in the US, experts said.

According to a report on MobileWorld Live, a telecom industry website, the FCC said local telecom operators’ requests for funding to replace network equipment made by Chinese companies Huawei and ZTE totaled $5.6 billion, almost three times the $1.9 billion allocated by the US federal government. Network operators serving less than 10 million customers which used government subsidies to buy Huawei or ZTE equipment before 30 June 2020 were eligible to apply for funding to cover costs associated with removing, replacing and disposing of the Chinese network equipment.

In a statement released last week, FCC Chairwoman Jessica Rosenworcel said that 181 carriers submitted initial reimbursement application requests totaling approximately $5.6 billion. Carriers are required to remove and replace existing network gear from Huawei and ZTE after the vendors were deemed national security risks. Congress in late 2020 set aside around $1.9 billion to fund and carry out the effort under the Secured and Trusted Communications Act 2019.

“Last year Congress created a first-of-its kind program for the FCC to reimburse service providers for their efforts to increase the security of our nations communications networks,” Rosenworcel said. “We’ve received over 181 applications from carriers who have developed plans to remove and replace equipment in their networks that pose a national security threat,” she added.

The FCC banned U.S. telecom carriers from buying Huawei and ZTE’s equipment via federal subsidies, citing what it alleged were national security concerns. The two Chinese tech companies have repeatedly denied the accusations, which they said are groundless.

Xiang Ligang, director-general of the Information Consumption Alliance, a telecom industry association in China, said Huawei and ZTE’s products are currently used by US telecom carriers to offer network and broadband services in some of the most remote regions in the US. Xiang said that the U.S. order to replace Huawei/ZTE wireless network equipment in rural areas will result in the lack of quality telecom services.

Steve Berry, president and CEO of the Competitive Carriers Association, a trade group for about 100 wireless providers in the US, issued a statement calling on the U.S. government to ensure the FCC program is fully funded so that connectivity is maintained during the operators’ transition to new wireless telecom equipment for their cellular networks.

…………………………………………………………………………………………………………………………….

Table 1: All the companies asking for FCC “rip and replace” funding

| Company | Applicant | Wireless | Wireline | Total | Vendor |

| Viaero Wireless | NE Colorado Cellular Inc | X | $1,194,000,000 | Ericsson | |

| Union Wireless | Union Telephone Company | X | $688,000,000 | Nokia | |

| ATN International | Commnet Wireless, | X | $418,768,726 | ||

| Gogo | Gogo Business Aviation LLC | X | $332,770,202 | ||

| NTCH | PTA-FLA, Inc. | $273,971,426 | |||

| Lumen | Level 3 Communications, LLC | X | $269,999,994 | ||

| Stealth Communications | X | $199,066,226 | |||

| SI Wireless, LLC | X | $181,023,489 | |||

| United Wireless Communications, Inc. | X | $173,471,477 | |||

| Hotwire Communications, Ltd. | X | $141,299,003 | |||

| Latam Telecommunications, L.L.C. | $138,060,092 | ||||

| NEMONT TELEPHONE COOPERATIVE INC | X | $125,551,024 | |||

| NTUA Wireless, LLC | X | $124,447,019 | |||

| Windstream Communications LLC | X | $118,271,652 | |||

| Rise Broadband | Skybeam, LLC | X | $106,159,884 | ||

| Pine Telephone Company | X | $87,095,419 | |||

| Mediacom Communications Corporation | X | $86,171,976 | |||

| Flat Wireless, LLC | X | $76,284,671 | |||

| Pine Belt Cellular, Inc. | X | $74,856,191 | |||

| James Valley Cooperative Telephone Company | X | $53,000,000 | |||

| AST Telecom, LLC d/b/a Bluesky | X | $49,959,592 | |||

| Country Wireless LLC | X | $47,508,982 | |||

| Point Broadband Fiber Holding, LLC | X | $47,172,086 | |||

| Board of Trustees, Northern Michigan University | X | $45,796,636 | |||

| Hargray Communications Group, Inc. | X | $42,785,933 | |||

| NfinityLink Communications, Inc. | $37,535,905 | ||||

| Plateau Telecommunications, Incorporated | X | $30,000,000 | |||

| Texas 10, LLC | $29,088,795 | ||||

| Mark Twain Communications Company | X | $29,000,000 | |||

| Panhandle Telecommunication Systems Inc | $28,925,552 | ||||

| TelAlaska Cellular, Inc. | X | $26,567,517 | |||

| Central Louisiana Cellular, LLC | X | $26,264,528 | |||

| TRANSTELCO INC. | X | $25,573,213 | |||

| Beamspeed, L.L.C. | X | $19,596,157 | |||

| Triangle Telephone Cooperative Association, Inc. | X | $18,336,507 | Mavenir | ||

| Eastern Oregon Telecom, LLC | X | $18,122,185 | |||

| Puerto Rico Telephone Company, Inc. | X | $16,857,851 | |||

| Vitelcom Cellular, Inc. d/b/a Viya Wireless | X | $15,716,011 | |||

| Santel Communications Cooperative, Inc. | X | $14,604,337 | |||

| MHG Telco LLC | X | $14,456,482 | |||

| WorldCell Soutions, LLC | X | $12,673,559 | |||

| LIGTEL COMMUNICATIONS INC. | X | $12,000,000 | |||

| Point Broadband Fiber Holding, LLC | X | $11,344,724 | |||

| Copper Valley Wireless, LLC | X | $11,151,417 | |||

| Premier Holdings LLC | $9,759,680 | ||||

| Eltopia Communications, LLC | X | X | $7,741,951 | ||

| Metro Fibernet, LLC | X | $7,567,518 | |||

| Bestel (USA), Inc. | $6,887,500 | ||||

| PocketiNet Communications Inc. | $6,741,452 | ||||

| Carrollton Farmers Branch ISD | X | $5,943,974 | |||

| Windy City Cellular | X | $5,562,067 | |||

| Bristol Bay Cellular Partnership | X | $5,269,183 | |||

| Kings County Office of Education | $5,221,191 | ||||

| Interoute US LLC | $4,867,140 | ||||

| Pasadena ISD | $4,387,311 | ||||

| Velocity Communications, Inc. | X | $4,158,729 | |||

| Advantage Cellular Systems, Inc. | X | $3,479,000 | |||

| New Wave Net Corp | $3,365,772 | ||||

| FirstLight Fiber, Inc. | $3,306,644 | ||||

| Gigsky, Inc. | X | $3,128,678 | |||

| Triangle Communication Systems Inc | $2,779,371 | ||||

| FIF Utah LLC | X | $2,662,538 | |||

| Gallatin Wireless Internet, LLC | X | $2,399,162 | |||

| Moore Public Schools | $2,023,243 | ||||

| HUFFMAN ISD | $1,920,588 | ||||

| Crowley ISD | $1,720,496 | ||||

| Castleberry Independent School District | X | $1,672,527 | |||

| One Ring Networks, Inc. | $1,649,281 | ||||

| University of San Francisco | $1,570,437 | ||||

| Leaco Rural Telephone Cooperative, Inc. | $1,511,617 | ||||

| Zito West Holding, LLC | X | $1,453,469 | |||

| Southern Ohio Communication Services Inc | $1,312,844 | ||||

| Xtreme Enterprises LLC | X | $1,097,283 | |||

| Virginia Everywhere, LLC | X | $562,001 | |||

| South Canaan Telephone Company | $542,139 | ||||

| Palmer ISD | $520,146 | ||||

| Waxahachie ISD | X | $457,396 | |||

| Hunter Communications & Technologies LLC | $432,348 | ||||

| Utah Telecommunication Open Infrastructure Agency | $413,760 | ||||

| COMMSELL | $302,400 | ||||

| VTel Wireless, Inc. | X | $283,618 | |||

| Trinity Basin Preparatory, Inc. | $242,510 | ||||

| NTInet, inc | $198,340 | ||||

| LakeNet LLC | X | $193,277 | |||

| IdeaTek Telcom, LLC | X | $181,899 | |||

| Millennium Telcom, L.L.C., dba OneSource Communications | $165,195 | ||||

| Inland Cellular LLC | X | $117,183 | |||

| Roome Telecommunications Inc | $92,144 | ||||

| Milford Independent School District | $40,399 | ||||

| Angeles Enterprises | X | $33,368 | |||

| Crystal Broadband Networks | X | $28,704 | |||

| Natural G.C. Inc. | $27,313 | ||||

| Webformix Internet Company | X | $22,400 | |||

| Northern Cambria School District | $14,400 | ||||

| Deer Creek Independent School District | $- | ||||

| $5,609,338,024 | |||||

| This FCC data was initially compiled by vendor Mavenir and then expanded, checked and edited by Light Reading staff. | |||||

“We’ve received over 181 applications from carriers who have developed plans to remove and replace equipment in their networks that pose a national security threat. While we have more work to do to review these applications, I look forward to working with Congress to ensure that there is enough funding available for this program to advance Congress’s security goals and ensure that the US will continue to lead the way on 5G security,” FCC Chairwoman Jessica Rosenworcel said in a statement.

References:

http://www.chinadaily.com.cn/a/202202/09/WS620303dfa310cdd39bc85734.html

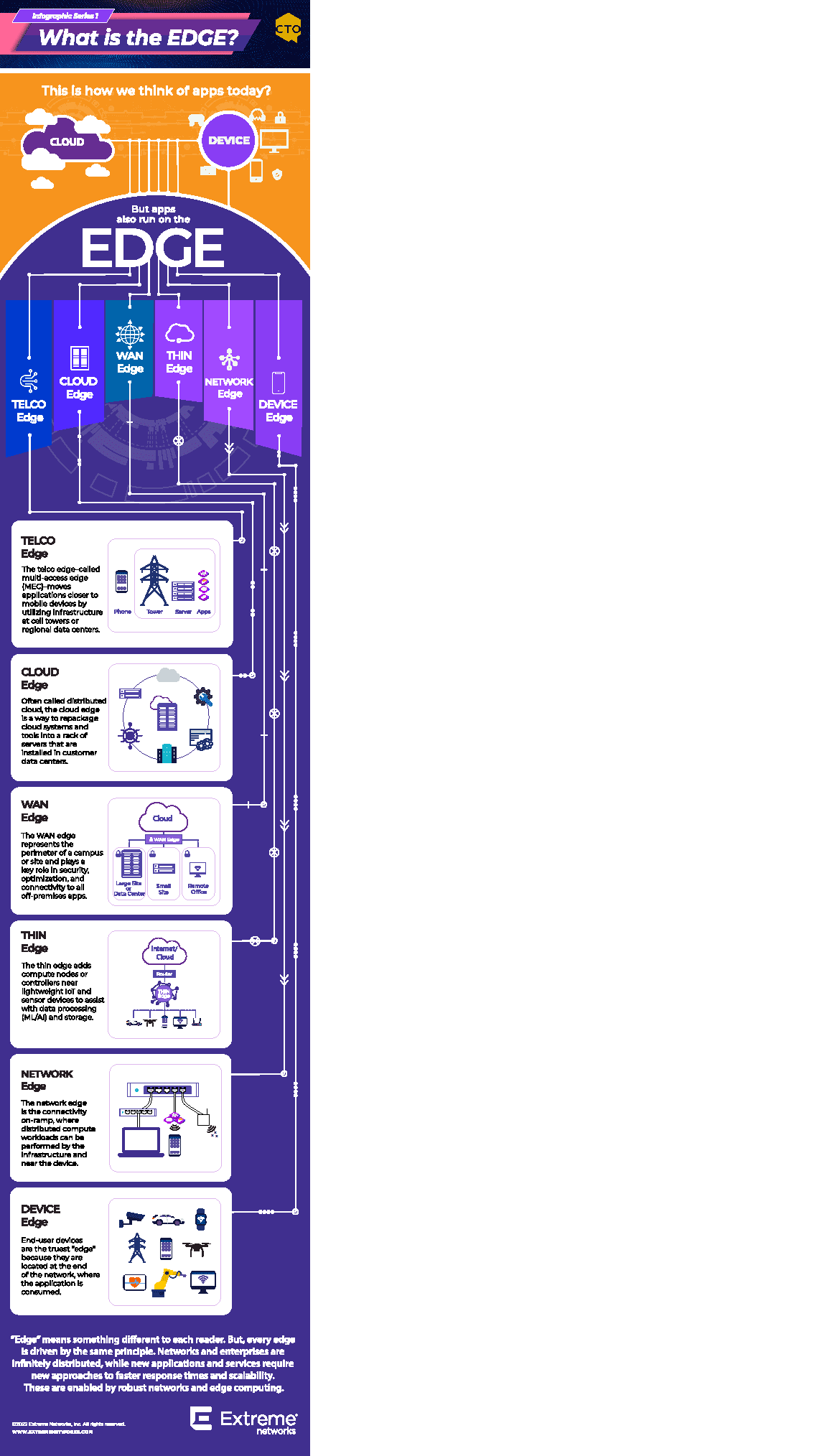

The Amorphous “Edge” as in Edge Computing or Edge Networking?

There are many definitions for where the “edge” is actually located. To datacenter experts, the edge is a small datacenter closer to users. For telecom people, the edge is regional data center or carrier owned point of presence that is not in the cloud. To enterprise users, the edge can be on premises. What does the “edge” mean to you?

Extreme Networks suggests the edge is “any form of application delivery that is not in the cloud. To illustrate the concept, and the multiplicity of edges, the company created an infographic that highlights some of the most common meanings of “edge.”

Image Courtesy of Extreme Networks

References:

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

Nokia delivers private 4G fixed-wireless access (FWA) network for underserved students living in rural California

Nokia completed the first of a two-phase deployment of 4G fixed-wireless access (FWA) network with partner AggreGateway, to provide broadband internet connectivity to underserved students in the Dos Palos Oro Lomo (DPOL) school district of California.

The district comprises five campuses and serves a population of 5,000 residents. The Nokia platform will provide internet access to the homes of 2,400 students using Nokia Private 4.9G/LTE Digital Automation Cloud (NDAC) operating in the CBRS/On-Go GAA spectrum, and customer premises equipment including Nokia FastMile 4G Gateways and WiFi Beacons.

The DPOL technology team will operate its new LTE network through the centrally secure Nokia DAC Cloud monitoring application. DPOL will also provision LTE / Wi-Fi hotspots to students to be used with any standard laptop or tablet to access broadband internet.

The project’s first phase was completed in November 2021. Nokia and AggreGateway will complete the second phase in 2022.

The Federal Communications Commission (FCC) has reported nearly 17 million school children in the USA lack internet access at home, creating a nationwide ‘homework gap’ (Federal Communications Commission). This became even more pronounced during the pandemic as schools closed and distance learning became the new normal.

Image Credit: Nokia

Paoze Lee, Technology Systems Director of the Dos Palos-Oro Loma school district, said: “As we put a plan in place for distance learning during the pandemic we found we could only provide coverage for approximately 50% of DPOL students via commercial wireless network providers. Working with Nokia and AggreGateway, we are taking the next steps to level the field and ensure every student has the same access to our learning facilities.”

Octavio Navarro, President of AggreGateway, said: “Growing up in a rural small town like Dos Palos-Oro Loma, I experienced the digital divide firsthand. Being able to implement a Nokia private wireless solution for the students has been beyond rewarding. The IT staff from DPOL, AggreGateway, and Nokia worked seamlessly together to achieve this goal. We are excited, proud, and look forward to the continued success.”

Matt Young, Head of Enterprise for North America at Nokia, said: “We are pleased to help close the digital divide in the Dos Palos-Oro Loma school district. For many rural areas of the US it’s not commercially viable to build out networks, and often families on the lowest income suffer. Leveraging our DAC and FastMile FWA technologies we can enable the delivery of much needed internet connectivity to students in the area.”

The project’s first phase was completed in November 2021. Nokia and AggreGateway will complete the second phase in 2022.

About Nokia:

As a trusted partner for critical networks, we are committed to innovation and technology leadership across mobile, fixed and cloud networks. We create value with intellectual property and long-term research, led by the award-winning Nokia Bell Labs.

Adhering to the highest standards of integrity and security, we help build the capabilities needed for a more productive, sustainable and inclusive world.

About AggreGateway:

Based in San Diego, California, AggreGateway is a unique group of network and wireless engineers that are experienced in designing networks within the private, public safety, transportation, utilities, government, and educational verticals. AggreGateway provides network consulting services, wireless solutions, LAN/WAN design and implementation, network security, systems integration, and managed services. Our goal is to provide a range of robust and flexible network solutions that are customized to each individual network.

References:

E-Space announces $50M in seed funding to put 100K sustainable satellites in orbit and clean up space debris

Greg Wyler, the space entrepreneur who founded founded both O3b Networks and OneWeb [1.], plans to put up to 100,000 satellites in orbit this decade with his latest satellite business venture named E-Space. The company on Monday said it had raised $50 million in seed funding (largest space seed round ever) from Prime Movers Lab, a fund that invests in breakthrough scientific start-ups.

E-Space says it will enable a new generation of space-based communications capabilities. The start-up plans to create a vast “mesh” network of small satellites that can deliver bespoke and commercial services to business and government, from secure communications to remote infrastructure management.

In a world where satellites are becoming space polluters, the new E-Space systems have the double bottom line of sustainability as they will eventually actively and sacrificially capture and deorbit small debris in space while performing their function as communications satellites.

“One of the best ways to understand and manage Earth is from space,” said Wyler, founder and chairman of E-Space. “We designed E-Space to democratize space, to enable the collection of continuous data about our planet with real-time information of sensors and devices across the world to combat climate change, and to upgrade our electric grids. Importantly, we’ve built sustainability into everything we do. We are designing our systems to not only prevent space debris generation, but to eventually actively reduce space debris so generations to come will be able to access the power of space.”

Wyler’s plans come as the world becomes increasingly concerned about the risk of collisions in orbit and resulting space debris. Since 2019 the number of working satellites has risen 50 per cent to roughly 5,000, largely because new commercial groups are exploiting lower launch costs to build businesses in low-earth orbit, 150km-200km above the earth. Elon Musk aims to launch some 40,000 satellites for his Starlink internet service.

Wyler insisted E-Space will leave low-earth orbit cleaner than before its satellites are launched, with a network that will collect and deorbit debris even as it provides connectivity services. The satellites have a substantially smaller cross section than rivals, Wyler told the Financial Times, and will be designed to “crumple” rather than break apart when struck. They will also “entrain” any debris they encounter and automatically deorbit when a certain amount has been collected.

“Like oysters in the river that filter the river and clean it, our satellites are the first to be designed to clean space. The more satellites we have, the cleaner space will be,” Wyler added.

Greg Wyler while at OneWeb in 2019. IMAGE courtesy of Sarah L Voisin/The Washington Post/Getty

………………………………………………………………………………………………………………………………………………….

Anton Brevde, partner at Prime Movers Lab and on the board of E-Space, suggested Wyler’s innovative design would do for satellites what Apple’s iPhone did for mobile phones.

“Greg is an icon of space innovation with an unparalleled track record of pushing the industry forward by turning bold ideas into everyday reality. E-Space is uniquely built to bring the power of space to any business or government while actively reducing the existential threat of space debris. The company already has several advanced conversations with major customers and is poised to take satellite mesh networks mainstream.

”How do you minimize a 300kg satellite to something that is an order of magnitude smaller? How do you go from the personal computer to the iPhone, something that is smaller and thinner. It’s a whole bunch of innovation that came together. He has been brainstorming for years on how to make communications satellites as small and cheap as possible,” Brevde added.

E-Space “must be able to freely decide on its technology path, on its vendor selection and on its component path, where shareholders are purely financial as opposed to strategic,” he added. The start-up plans to launch its first test satellites next month and a second batch at the end of the year, after which it aims to start building its constellation. Wyler acknowledged that E-Space was likely to require another funding round but insisted his network would cost a fraction of existing LEO constellations. “The historical model of spending $5bn-$10bn is broken,” he said. “We are running at about 10 per cent of the cost of prior LEO constellations.”

E-Space has all the licenses needed to be able to deliver the service on multiple frequencies, Wyler said. The licenses had been acquired through Rwanda, which last year applied to the International Telecommunications Union (ITU) in Geneva to license more than 300,000 satellites. [The Rwandan government was an original investor in OneWeb.]

Note 1. Wyler founded OneWeb in 2012 under the name WorldVu and was the company’s first CEO. OneWeb went bankrupt when investors pulled out in 2020, and the company was brought back under an ownership consortium led by Bharti Global, including the United Kingdom government, Eutelsat, and Softbank. OneWeb was also formed with the mission of connecting the world. The company still promotes that mission, along with providing connectivity to enterprise verticals.

……………………………………………………………………………………………………………………………

E-Space will provide the world’s first federated systems that can dynamically extend satellite capacity for a multitude of applications, ranging from secure communications to managing remote infrastructure.

Core to this approach is E-Space’s new generation of satellites that make space affordable and accessible, enabling custom networks for companies and governments globally while providing unparalleled security and resiliency. E-Space’s novel peer-to-peer satellite communication model enables real-time command and control and global insights. Dedicated constellations ensure sovereignty and eliminate exposure to foreign entities, using a “Zero Trust” topology to protect data.

E-Space places sustainability at the heart of its architecture, building on five key design tenets to make space safe:

- Minimize satellite debris on collision: Satellites should minimize the number of new debris objects that are generated, with zero being the ideal goal.

- Capture and deorbit: Satellites should be designed to minimize the debris from objects they hit and capture debris they contact to prevent further collisions.

- Fail safe: Satellites should be designed to fail into a high-drag configuration where they passively, and quickly, deorbit.

- 100% demise: Satellites must fully demise upon re-entry into the Earth’s atmosphere.

- Small cross section: Large cross-section satellites crowd others from space and will cause collisional cascading and debris creation. Small cross-sections make satellites much less vulnerable to collision and LEO constellations should limit their individual and cumulative cross-sections. System-wide cross-sections should be tracked and considered relative to calculations on total orbital carrying capacity, for individual altitudes to enable appropriate sharing.

The investment fully funds E-Space’s “Beta 1” launch of its first test satellites in March 2022 as well as its second “Beta 2” launch later this year. Mass production is slated for 2023. The company is composed of two independent entities based in France (E-Space SAS) and the United States (E-Space, Inc.).

About E-Space:

E-Space is democratizing space with a mesh network of secure multi-application satellites that empowers businesses and governments to access the power of space to solve problems on Earth. Founded by industry pioneer Greg Wyler, E-Space provides satellite constellation deployments with higher capabilities and lower cost to enable a new generation of services and applications, from 5G communications to command and control systems. The company puts sustainability at the forefront, with a purposeful design that minimizes and reduces debris and destruction while preserving access to space for future generations. Learn more at e-space.com.

Addendum:

China is also in the smart satellite business. A Financial Times editorial on Monday by William Schneider stated:

“Both China and Russia have well developed advanced offensive capabilities in space. In late January, for example, China’s Shijian 21 (CJ-21) satellite disappeared from its regular position in geostationary orbit 22,000 miles above the earth. The CJ-21 maneuvered close to one of China’s malfunctioning satellites in its 35-satellite Beidou constellation. There it used a grappling arm to move the malfunctioning satellite to a “graveyard” orbit.”

…………………………………………………………………………………………………………………………………………..

References:

https://www.ft.com/content/0db57559-a8d0-4e9b-aeef-e3e7d796d635

https://www.ft.com/content/7d566088-7d25-4fde-9b02-311f86eb845e

China to complete Beidou satellite-based positioning system by June 2020- to be used with 5G

Deutsche Telekom expands its fiber optic network in 78 cities and communities

Deutsche Telekom said it has expanded its fiber optic network for almost 7,000 companies in 78 cities and communities. Telekom is providing the companies with up to 1 Gbps speeds. The German based telco has connected industrial parks in the municipalities of Ahrensburg, Deggendorf, Lastrup, Lauf, Mainz and Mannheim among others.

Telekom is laying 560 km of fiber-optic networks to carry out the project and to connect the companies. It is using a trenching process to expand its fiber network.

“Telekom is Germany’s digital engine. That is why we are building our network seven days a week, 24 hours a day. In the city as well as in the countryside. We are massively accelerating our roll-out. In the coming year, we will go one better and invest around six billion euros in Germany. By 2030, every household and every company in Germany should have a fiber-optic connection. We will build a large part of this. But our competitors are also in demand,” said Srini Gopalan, Member of the Board of Management of Telekom Deutschland.

He also commented on the new German government’s plans in terms of digitization: “The new coalition is focusing on FTTH as THE technology of digitization. We explicitly welcome this. Faster processes – including for applications and approvals – will also help us to speed up fiber roll-out. We support the digital set off in our country. Digital networks should bring people together. Their roll-out should no longer be stuck in paper files.”

References:

https://www.telecompaper.com/news/deutsche-telekom-expands-network-for-7000-companies–1413189

https://www.telekom.com/en/media/media-information/archive/turbo-for-fiber-and-5g-643014

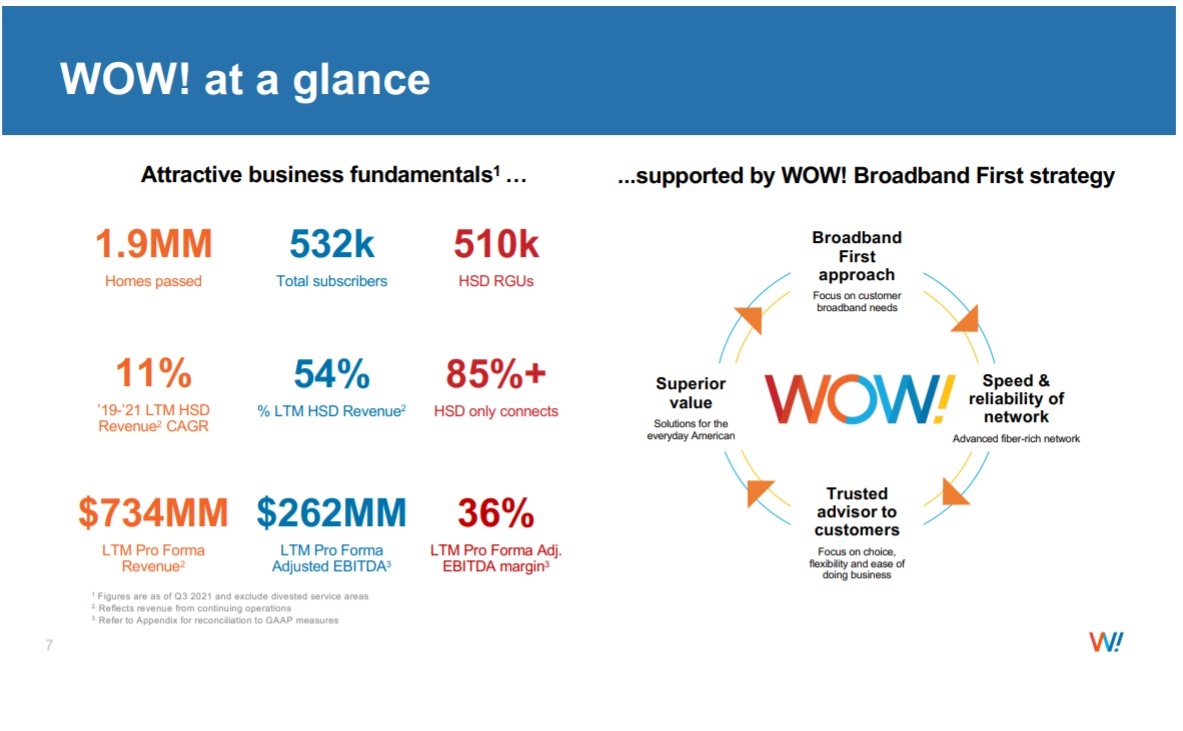

WideOpenWest picks Seminole County, FL as its 1st greenfield area for FTTP deployments

Like so many legacy and regional telcos, cablecos, WideOpenWest (WOW) [1.] is pursuing aggressive fiber-to-the-premises (FTTP) deployments. The company is targeting a part of Seminole County, Florida located near Orlando, as the first area for its ambitious plan to deploy FTTP Internet access to greenfield areas. Cableco Charter Communications currently provides broadband internet service to Seminole County.

This new expansion is part of the company’s larger Greenfield initiative to build new markets non-adjacent to its existing network and bring its advanced fiber technology and award-winning customer service to customers across its growing footprint. WOW! already serves Pinellas County and Panama City in Florida and identified Seminole County as a new community ripe for innovation and growth. The company plans to reach more than 60,000 homes passed upon completion of the project.

Note 1. WideOpenWest is the sixth largest cable operator in the United States with their network passing 3,248,600 homes and businesses. The company offers landline telephone, and broadband Internet services, and IPTV. As of December 31, 2020, WOW! has about 850,600 subscribers. They offer up to 1 Gb/sec downstream fiber internet service in some areas.

………………………………………………………………………………………………………………

WOW estimates it will invest at least $60 million in the county for its FTTP deployment. The estimated cost of $1,000 per passing is consistent with prior expectations.

“We are excited to announce Seminole County as the first service area to kick off our Greenfield initiative,” said Teresa Elder, CEO of WOW!. “We are delighted to offer communities in Seminole County a better broadband choice so they can work, learn and be entertained using WOW!’s multi-Gig fiber-to-the-home network. Area residents and businesses will be pleasantly surprised by our reliable network, super-fast speeds and choice of exceptional products to meet their broadband usage needs.”

Work on the new all-fiber infrastructure in Seminole County has already begun. Once completed, customers will benefit from WOW!’s innovative technology and product suite that provides the best in choice, reliability, speed and value. Customers will have access to multi-Gig HSD service, WOW!’s fastest broadband speed available, home and business WiFi solutions to support streaming, remote work and small business needs as well as WOW! tv+, its premier IP-based video service.

“Investing in Seminole county is investing in its community, its people, and its growth,” said Kirk Zerkle, VP of Market Expansion at WOW!. “We are thrilled to give residents and businesses in Seminole County the service they deserve. We know how important it is to be connected in every aspect of our lives and look forward to WOW! becoming an integral part of this county.”

The selection of Seminole county comes almost two months after WOW announced that building FTTP networks to greenfield markets [2.] will play a big role in fueling growth over the next five years. WOW recently sold off a handful of systems for $1.8 billion to help fund this growth initiative. The company intends to build out fiber networks to greenfield areas passing at least 200,000 homes and businesses by 2027, with the potential to expand that to 400,000 locations.

Note 2. WOW has identified greenfield areas as those that are not-adjacent to its existing markets which have low density. The company expects to announce additional greenfield markets later this year.

WOW! continues to pursue expansion opportunities across the country and expects to announce additional markets later this year.

“We’ve reached an inflection point in the industry where fiber-to-the-home build costs have reached parity with HFC [hybrid fiber/coax],” Henry Hryckiewicz, WOW’s chief technology officer, explained at an investor day held in December 2021.

About WOW! Internet, Cable & Phone:

WOW! is one of the nation’s leading broadband providers, with an efficient, high-performing network that passes 1.9 million residential, business and wholesale consumers. WOW! provides services in 14 markets, primarily in the Midwest and Southeast, including Michigan, Alabama, Tennessee, South Carolina, Florida and Georgia.

With an expansive portfolio of advanced services, including high-speed Internet services, cable TV, phone, business data, voice, and cloud services, the company is dedicated to providing outstanding service at affordable prices. WOW! also serves as a leader in exceptional human resources practices, having been recognized eight times by the National Association for Business Resources as a Best & Brightest Company to Work For, winning the award for the last four consecutive years.

Source: WideOpenWest

………………………………………………………………………………………………………………….

Please visit wowway.com for more information.

………………………………………………………………………………………………………………….

WOW! Media Contact:

Jamie Mayer

[email protected]

References:

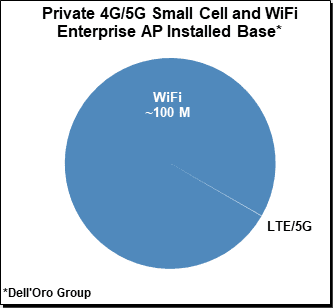

Dell’Oro: LTE still dominates private wireless market; will transition to 5G NR (with many new players)

Dell’Oro Group just published an updated Private Wireless market report with a 5-year forecast. According to the report, private wireless RAN revenues for the full-year of 2021 are slightly weaker than initially projected.

“The markdown is more driven by the challenges of converting these initial trials to commercial deployments than a sign that demand is subsiding,” said Stefan Pongratz, Vice President at Dell’Oro Group. “In fact, a string of indicators suggest private wireless activity is firming up not just in China but also in other regions,” continued Pongratz.

Additional highlights from the Private Wireless Advanced Research Report:

- Private wireless projections have been revised downward just slightly to factor in the reduced 2021 baseline.

- Total private wireless RAN revenues, including macro and small cells, are still projected to more than double between 2021 and 2026.

- The technology mix has not changed much with LTE dominating the private market in 2021 and 5G NR still on track to surpass LTE by the outer part of the forecast period, approaching 3 percent to 5 percent of the total 5G private plus public RAN market by 2026.

- Risks are broadly balanced. On the upside, the 5G enterprise puzzle has still not been solved. The successful launch of private 5G services by suppliers with strong enterprise channels could accelerate the private 5G market at a faster pace than expected. On the downside, 5G awareness is improving but it will take some time for enterprises to fully understand the value of private LTE/5G.

Comment & Analysis:

This author notes a bevy of new activity in the 5G private network space. It’s almost approaching a frenzy!

Yesterday, Cisco announced a “private 5G service that simplifies both 5G and IoT operations for enterprise digital transformation.” The company promised to show off the new product at the upcoming MWC trade show in Barcelona, Spain. Cisco to sell its 5G private network under an “as-a-service” model, such that enterprise customers who purchase it will only pay for what network resources they actually use. The company said that it would partner with unnamed vendors for all the necessary components, adding that it will run over midband spectrum. The company did not provide any further details. It should be noted that Cisco has never had ANY 2G/3G/4G/5G RAN products, as their wireless network portfolio has always been focused on WiFi (now for enterprise customers).

In late November 2021, Amazon unveiled its new AWS Private 5G service that will allow users to launch and manage their own private mobile network in days with automatic configuration, no per-device charges, and shared spectrum operation. AWS provides all the hardware, software, and SIMs needed for Private 5G, making it a one-stop solution that is the first of its kind. Dell’Oro Group’s VP Dave Bolan wrote in an email, “What is new about this (AWS Private 5G) announcement, is that we have a new Private Wireless Network vendor (AWS) with very deep pockets that could become a major force in this market segment.”

In addition, Mobile network operators like Deutsche Telekom, AT&T and Verizon offer private 5G networks, as do other cloud computing companies, mobile network equipment vendors like Ericsson and Nokia, system integrators like Deloitte, as well as startups like Betacom and Celona. So it’s a crowded market with suppliers each expecting a chunk of a very big pie.

I posed the seemingly contradictory finding of a less than forecast 2021 private wireless market vs the new private 5G players to Dell’Oro’s Pomengratz. In his email reply, Stefan wrote:

“If I had to summarize all our various projections I will just say that the things we know (public 5G MBB/FWA) are generally accelerating at a faster pace than expected while the things that we don’t know (private 5G/critical IoT etc.) are developing at a slower pace than expected.

And for this particular update, slower-than-expected comment was more related to revenues than activity. I agree with you that activity both when it comes to private trials and entering this space remains high.

At the same time, we have talked about private cellular for a long time but the reality is that we have not yet crossed the enterprise chasm. Nevertheless, we have a very large market opportunity ($10B to $20B for just the private 4G/5G RAN) that is still up for grabs, hence the high level of interest.”

References:

Private Wireless Weaker Than Expected in 2021, According to Dell’Oro Group

https://www.cisco.com/c/en/us/products/wireless/private-5g/index.html

Deloitte to co-ordinate 5G private network field trial at the largest hospital in Latin America