Author: Alan Weissberger

TrendForce forecast: Chinese 5G smartphones to hold 4 of top 6 spots by production volume in 2020

Annual 5G smartphone production is expected to reach 235 million units in 2020, an 18.9 percent penetration rate, according to the latest research from TrendForce. Total smartphone production is forecast to reach 1.24 billion in 2020.

Ranked by production volume, Chinese brands are expected to account for 4 of the top 6 spots for 5G smartphone brands in 2020. Huawei tops the ranking, and is expected to produce around 74 million 5G smartphones in 2020. Apple is in 2nd place with a forecast yearly 5G smartphone production of around 70 million units. Samsung will be in 3rd place with production of 29 million 5G smartphones. They are followed by Chinese brands Vivo, Oppo and Xiaomi in 4th, 5th and 6th place with 5G smartphone production volumes of 21 million, 20 million and 19 million units respectively.

Note that this is a forecast, especially for Apple which has not yet announced a 5G smartphone.

Mid-to-low end 5G chipsets released by AP suppliers are expected to raise the penetration rate of 5G smartphones in 2021

TrendForce’s analysis of future developments in the 5G market shows that an aggressive push by mobile processor manufacturers will lead to the rapidly increasing presence of 5G chipsets in the mid-to-low end market, driving 5G smartphone production to surpass 500 million units in 2021, which will potentially account for about 40% of the total smartphone market. Once 5G chip prices reach a stable level this year, smartphone brands may look to gain additional shares in the 5G smartphone market by sacrificing gross margins. In doing so, they are likely to accelerate the drop of 5G smartphones’ retail prices, and the market may see the arrival of 5G smartphones around the RMB 1000 price level by the end of this year. Incidentally, it is worth noting that the penetration rate of 5G smartphones does not equal the usage rate of the 5G network, which depends on the progress of base station construction. Since the current 5G infrastructure build-out is pushed back as a result of the pandemic, the global 5G network coverage will be unlikely to surpass 50% before 2025 at the earliest, with complete coverage taking even longer.

Editor’s Questions:

In the absence of any true 5G standard, e.g. IMT-2020.SPECs, will any of these 5G smartphones work on a 5G network other than the one they are subscribed to? Or will they fall back to 4G-LTE? Will the 5G smartphones sold in 2020 be upgraded to comply with IMT-2020.SPECs and/or 3GPP Release 16 specs?

References:

http://www.trendforce.com/presscenter/news/20200722-10398.html

T-Mobile US: 5G SA Core network to be deployed 3Q-2020; cites 5G coverage advantage

Yet another wireless telco is moving to a 5G Stand Alone (SA) core network, without any standard or even specification (yes, we know about 3GPP TS 23.501 5G Systems Architecture spec in R15 and R16) in place.

In a blog post to assess the progress in the (new) T-Mobile US network four months after the Sprint acquisition, CTO Neville Ray wrote:

We’re also hard at work getting ready to light up standalone 5G this quarter, having recently completed the world’s first standalone 5G data session on a multi-vendor radio and core network, and the first standalone 5G data session of any kind in North America. Standalone 5G will expand our coverage and bring with it improved latency and faster uploads. It will also pave the way for applications that require real-time responses and massive connectivity such as mobile augmented and virtual reality, cloud gaming, smart factories and meters and even connected vehicles.

Analysis:

To the best of our knowledge, there are no 5G SA core networks deployed yet. All the so called “5G” deployments are based on NSA or a LTE anchor via EPC. With a rush of recent 5G SA core announcements, that will soon change

Yet it’s critical to note that ALL of the 5G core work is done in 3GPP– not in any SDO. Moreover, ITU-T SG 13 which is responsible for IMT 2020 Non Radio Aspects recommendations has not received any of the 3GPP R16 documents. And finally, URLLC for both the 5G radio access network and core are not yet complete as there has been no performance testing yet. So how will “improved latency” be realized?

In the absence of any standard or detailed implementation spec, any 5G SA core network deployed within the next year (or longer) will be based on a joint specification effort between the wireless network operator and its 5G core vendor (e.g. Huawei, Ericsson, Nokia, ZTE, possibly Cisco and NEC?).

Here’s what Dell-Oro had to say about 5G SA/5G Core:

During 2020, the industry will progress toward 5G SA. Lab proof-of-concepts and field trials are well underway around the world. Vendors and SPs are working together to learn about the intricacies of implementing 5G SA, which primarily means implementing the 5G Core for 5G NR base stations (a.k.a. Option 2). Some SPs will operate multiple 5G Cores dedicated to consumers, enterprise, public safety, and Internet of Things (IoT). They believe that dedicated 5G Core networks will be able to deliver new agile business solutions at a quicker pace for their respective user bases and more efficient network management.

The 3GPP release schedule is highlighted to emphasize that 5G, and especially the 5G Core standard (3GPP TS 23.501, the overarching specification), still has a long way to go before the full potential of 5G will be achieved. While the industry has been touting 5G for several years, it cannot be realized without the 5G Core.

The 5G Core is known as a Service-Based Architecture (SBA). At a high level, it consists of the User Plane, the Control Plane, and the Shared Data Layer Network Functions. This enables a more resilient core network (CN). Hardware and software disaggregation creates what is known as stateless Virtual Network Functions (VNFs) that run on COTS Network Function Virtualization Infrastructure (NFVi). If a hardware failure occurs, a new virtual machine (VM) or Container can spin up on a new server without loss of data because it resides in the Shared Data Layer.

This structure allows for Cloud computing with container-based Cloud-Native Network Functions (CNFs) that permit microservices tailor-made for smaller groups of subscribers. CNFs enable SPs to build a web-scale core with greater degrees of orchestration and automation to bring new services to the market in a few hours or days, as compared to months or years.

More specifically, TS 23.501 -Release 16 provides guidelines for 5G Core virtualized deployments, but does not specify how to implement any of those deployments. Here’s the relevant text:

5.21.0 General

5GC supports different virtualized deployment scenarios, including but not limited to the options below:

– A Network Function instance can be deployed as distributed, redundant, stateless, and scalable NF instance that provides the services from several locations and several execution instances in each location.

– This type of deployments would typically not require support for addition or removal of NF instances for redundancy and scalability. In the case of an AMF this deployment option may use enablers like, addition of TNLA, removal of TNLA, TNLA release and rebinding of NGAP UE association to a new TNLA to the same AMF.

– A Network Function instance can also be deployed such that several network function instances are present within a NF set provide distributed, redundant, stateless and scalability together as a set of NF instances.

– This type of deployments may support for addition or removal of NF instances for redundancy and scalability. In the case of an AMF this deployment option may use enablers like, addition of AMFs and TNLAs, removal of AMFs and TNLAs, TNLA release and rebinding of NGAP UE associations to a new TNLA to different AMFs in the same AMF set.

– The SEPP, although not a Network Function instance, can also be deployed distributed, redundant, stateless, and scalable.

– The SCP, although not a Network Function instance, can also be deployed distributed, redundant, and scalable.

Also, deployments taking advantage of only some or any combination of concepts from each of the above options is possible.

………………………………………………………………………………………………………………………………………………………….

Other T-Mo Highlights:

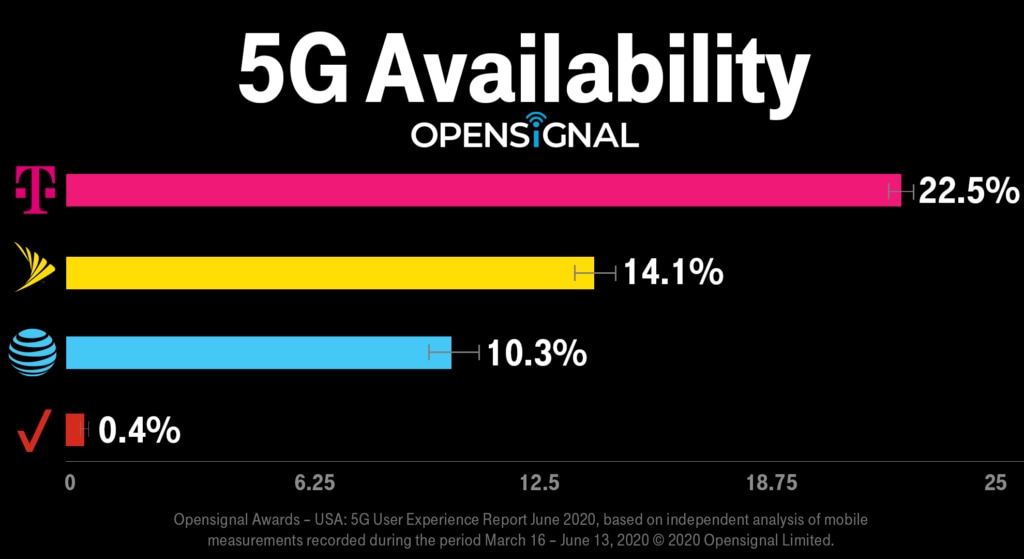

Ray referred to recent analysis from OpenSignal and Ookla on T-Mobile US’ 5G network availability. T-Mo’s reliance on far-reaching 600 MHz spectrum for its “5G foundation,” assures that its 5G footprint significantly outstrips the other national carriers’ 5G coverage areas. Ray wrote:

A new report from Opensignal ranks the T-Mobile network first for 5G availability, meaning Un-carrier customers get a 5G signal more often than customers on any other network – more than twice as often as AT&T and 56 times more often than Verizon! Plus, a new report from Ookla measuring 4G and 5G from over one million customer devices shows that T-Mobile has 5G in nearly 4X more cities than Verizon and AT&T (and 32X more cities than Verizon alone). And T-Mobile customers with a 5G-capable device experience faster overall download and upload speeds than Verizon customers. And look at the Verizon availability score – yep – no typo here – that’s 0.4%…..

Verizon in particular relied on millimeter wave for its initial deployments, and AT&T has moved to a mix of high- and low-band 5G deployments. Verizon expects to be able to dramatically expand its 5G coverage via the use of Dynamic Spectrum Sharing later this year.

T-Mo’s 5G Spectrum holdings are depicted in this graphic (courtesy of T-Mobile US):

Image Credit: T-Mobile USA

……………………………………………………………………………………………………………………………………………………………………

Regarding 5G speeds, low-band 5G performance tends to look pretty similar to 4G, while mmWave-based 5G is spotty but speedy. Post-Sprint merger, T-Mo is leveraging Sprint’s mid-band spectrum holdings to boost its 5G speed performance and also utilizes mmWave in some urban areas, per its “layer cake” 5G spectrum strategy as per the above graphic.

Ray said in his blog post that T-Mobile US is “rapidly deploying critical mid-band 2.5 GHz spectrum from Sprint” to increase capacity and speed, and announced that mid-band 5G from T-Mo is now live in parts of Chicago, Illinois; Houston, Texas; and Los Angeles, California.

Ray said that mid-band 5G testing is showing average download speeds of more than 300 Mbps and peak speeds of 1200 Mbps. T-Mobile US has also tested the reach of its low-band 5G, recently completing tests with Ericsson, Qualcomm and OnePlus that demonstrated a 5G connection reaching 60 miles from the base station (on 600 MHz).

The T-Mo exec also said that the carrier’s 600 MHz spectrum is finally repacked and cleared of broadcasters, a little more than three years after being auctioned. Virginia Beach, Norfolk and Richmond, Va., Topeka, Kan., Sussex County, Del., and coming soon in Buffalo, N.Y.

Related to the carrier’s commitments to the Federal Communications Commission as part of the merger with Sprint, Ray said that T-Mo is moving ahead with the expansion of its wireless broadband internet service pilot. In Grand Rapids, Michigan, the carrier has started offering the service to people who aren’t existing T-Mobile US customers. Ray noted that the carrier plans to offer T-Mobile Home Internet in more than 50% of all U.S. zip codes.

References:

https://www.t-mobile.com/news/network/accelerating-5gforall

Reliance Jio claim: Complete 5G solution from scratch with 100% home grown technologies

Indian wireless upstart Reliance Jio has developed its own 5G solution “from scratch,” according to Jio Chairman Mukesh Ambani (India’s richest man). The company plans to launch “a world-class 5G service in India…using 100% home grown technologies and solutions,” he said in a statement at the Reliance Industries annual shareholders meeting. “Once Jio’s 5G solution is proven at India-scale, Jio Platforms would be well-positioned to be an exporter of 5G solutions to other telecom operators globally, as a complete managed service,” he added.

–>Please see references 1. and 2. below for video clips of Ambani’s speech.

The company’s equipment is ready for deployment this year, as soon as 5G spectrum is available, Ambani said (more details below). A roll-out will be relatively easy, thanks to its existing all-IP 4G network, according to Ambani.

The development supports the India government’s local production push, to develop home-grown alternatives to technology from China (Huawei, ZTE), Ericsson, Nokia, Samsung, etc. Ambani did not outline the exact components developed, but he said the company would look to export the 5G system to other countries as well.

Nor did he comment on India’s IMT 2020 Low Mobility Large Cell (LMLC) submission from TSDSI which is moving forward as a 5G Radio Interface Technology (RIT) that will be standardized by ITU-R in IMT-2020.SPECS late this year.

The regulatory environment for Jio has been incredibly benign for its entire existence, from being given a special national license to the crippling historical license fees being imposed on its competitors. As a result Jio now sees itself as the world’s first ‘super operator’ and it seems to have the full backing of the Indian state in that ambition.

…………………………………………………………………………………………………………………………………………………………………….

The Business Standard reports that Jio has applied to the Department of Telecom for trial 5G spectrum. The company is reportedly seeking 800 MHz in the mmWave bands 26 and 24 GHz and 100 MHz in the 3.5 GHz band for field trials of its new network in a few metro areas.

If Jio really does have 5G Radio and Core technology, it will be in competition with global wireless network infrastructure giants, such as Huawei, ZTE, Ericsson, Nokia, and Samsung, which dominate the global wireless telecom market.

According to India Department of Telecom (DOT) sources, Jio has said its 5G network solution is ready and it can start trials immediately after spectrum is allocated. It has also revealed that it took the company three years and a few hundred engineers to turn this dream into reality. DOT sources say that, in a communication on July 17th, Jio made a strong pitch for spectrum in the mmwave band, arguing that countries like the US, South Korea, Japan, and Canada are veering towards preference of the 28- GHZ band for 5G deployment, while others like Australia, the UK, and European countries want to be in the 26- GHZ band.

Jio’s reasoning is that, given its plans to offer its 5G products in the global market, it is essential for it to have trial runs of the technology on these crucial frequency bands. It plans to test and successfully deploy the 5G technology on its own network, after which it can be sold overseas to other wireless telcos.

Moreover, it would like to test the technology in dense urban environments in India. Once it has proved itself there, it’s likely to work well in large big cities overseas.

As a result, Jio has requested that 800 MHZ of spectrum be assigned to it in 26.5–29.5 GHZ and 24.25-27.5 GHZ in the mmWave bands. It has also asked for 100 MHZ in the 3.5- GHZ mid spectrum band.

The government’s upcoming auction process is expected to kick-start by August, but it might be limited to only 4G spectrum. The Telecom Regulatory Authority of India has currently given its recommendation for the base price of spectrum in the 3.5-GHZ band for 5G auctions and not for mmwave bands. The DOT is expected to inform the regulator soon about the pricing of the mmwave bands for auction.

The Jio announcement comes at a time when Chinese telecom gear makers Huawei and ZTE face serious challenges, with numerous countries banning the use of their 5G equipment which they allege is, or can be, used by China to spy on them. Samsung is one player that is overly dependent on Jio as it is Jio’s largest client for 4G telecom gear and had earlier applied to the government to undertake 5G trial runs together. Jio’s 5G technology is based on a ‘virtualised 5G network’, which will ensure the current hardware-dependent networks shift to software-centric platforms.

This poses a challenge to current networks, which are based on proprietary technology, where both the hardware and software have to be bought from the same vendor, who then maintains and upgrades the system, leaving operators with limited flexibility.

The new networks being developed will be built on open platforms, so that operators will have the choice of buying hardware or software separately from different vendors or even building the latter on their own on an open platform. They could also ally with information technology companies to undertake system integration between the hardware and software and run the networks.

Apart from flexibility, this will bring down network costs substantially for 5G. According to cloud-native network software provider Mavenir, the new virtualized networks would lead to a saving of 40 per cent in capital expenditure and 34 per cent in terms of lower operations cost for operators.

………………………………………………………………………………………………………………………………………………………………….

References:

https://www.pressreader.com/india/business-standard/20200720/281573768006663

https://telecoms.com/505654/jio-lobbies-for-a-head-start-on-its-5g-network/

Barracuda CloudGen SD-WAN runs on Microsoft Azure Virtual WAN Hubs; 5G Next Target for CSPs?

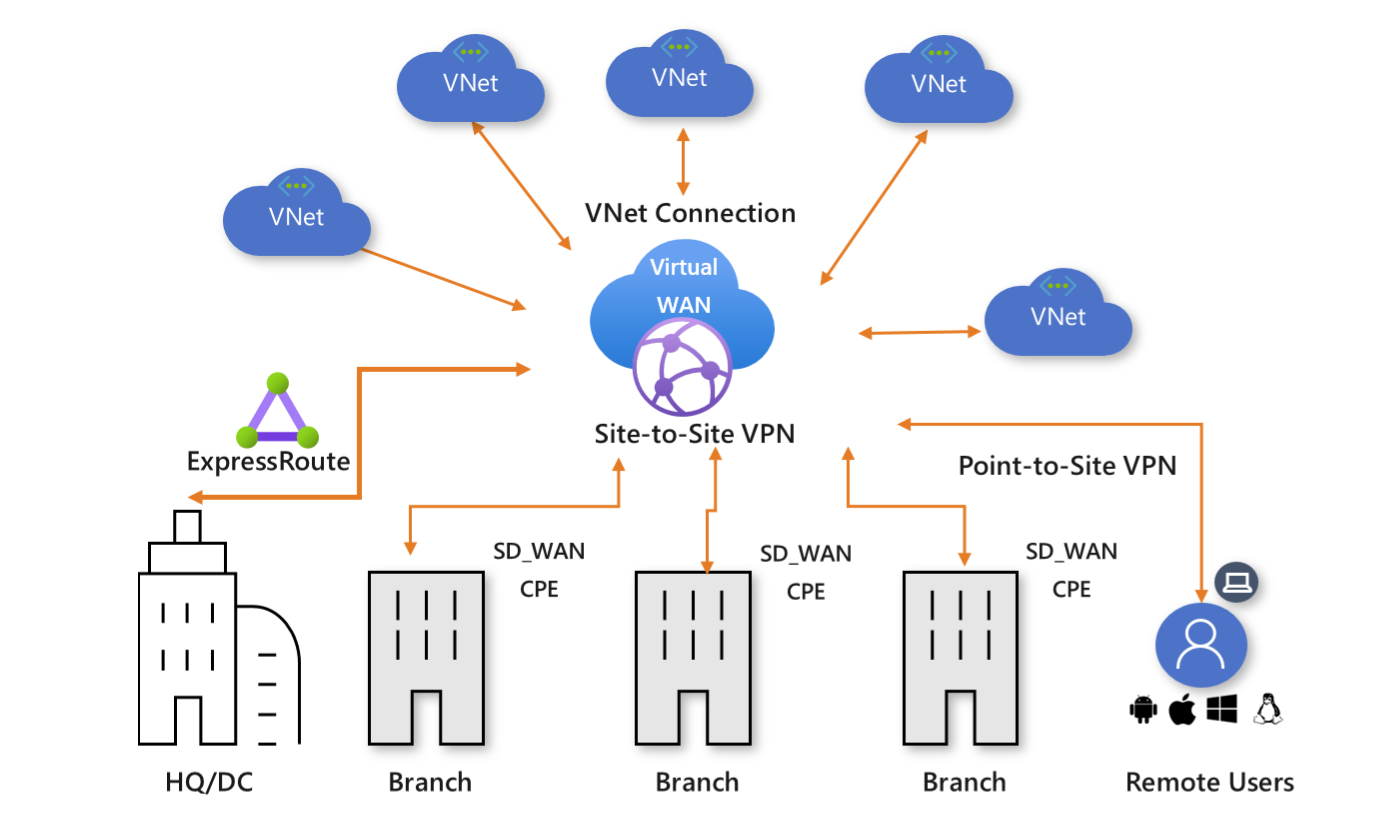

In the new world of cloud service providers (CSPs) taking over every aspect of communications, Microsoft Azure will now be used as the basis of what Barracuda calls “the first SD-WAN service built natively inside Azure Virtual WAN Hubs.” Those so called “hubs” are interconnected through Microsoft’s Global Network.

The new Barracuda CloudGen SD-WAN is a SaaS deployed directly from the Azure Marketplace for as many regions as needed and administered centrally in the CloudGen WAN portal for all office locations and remote endpoints. Since the Microsoft Global Network is automatically provisioned as the backbone for anywhere, anytime application access, service providers can create a pragmatic SASE platform in the public cloud tailored to their specific needs.

Illustration of Azure Virtual WAN from Microsoft (see reference below)

Microsoft says its Virtual WAN offers the following advantages:

- Integrated connectivity solutions in hub and spoke: Automate site-to-site configuration and connectivity between on-premises sites and an Azure hub.

- Automated spoke setup and configuration: Connect your virtual networks and workloads to the Azure hub seamlessly.

- Intuitive troubleshooting: You can see the end-to-end flow within Azure, and then use this information to take required actions.

………………………………………………………………………………………………………………………………………………………….

Barracuda said that their CloudGen WAN architecture can replace costly, inflexible network connectivity circuits, and the entire network can be dynamically sized to match current traffic workload, which can optimize network performance and minimize cost.

“A cloud-first strategy asks for a different approach on connectivity,” said Leon Sevriens, program manager, IT at Humankind, a large organization in the Netherlands that offers daycare and after-school care, with over 3,000 employees and over 450 locations. “We have invested heavily in Microsoft Office 365 adoption across the organization, and traditional connectivity doesn’t fit the bill anymore. We need a solution that is focused on delivering application performance, not just ‘plain’ connectivity. That’s why we’re moving forward with Barracuda CloudGen WAN,” he added.

In the recent report “Secure SD-WAN: The Launch Pad into Cloud,” Barracuda found that SD-WAN is being used by more than half of those who have added security to their public cloud. As the report explains, “SD-WAN can help overcome the top two security challenges organizations are facing when it comes to public cloud: lack of access control and backhauling traffic.”

Cloud-native, secure SD-WAN:

The perimeter is changing, and organizations need to be ready to adapt. According to Gartner, “The enterprise perimeter is no longer a location; it is a set of dynamic edge capabilities delivered when needed as a service from the cloud.”1

Secure SD-WAN services built natively on the cloud combine ease of use, full security, and cloud-scalable SD-WAN connectivity to use the Microsoft Global Network as the WAN backbone instead of leased lines. The new Barracuda CloudGen WAN is a SaaS service deployed directly from the Azure Marketplace for as many regions as needed and administered centrally in the CloudGen WAN portal for all office locations and remote endpoints. Since the Microsoft Global Network is automatically provisioned as the backbone for anywhere, anytime application access, service providers can create a pragmatic SASE solution in the public cloud tailored to their specific needs.

“With an all-in-one, secure SD-WAN solution natively built on the public cloud network, enterprises can finally make the shift to more public cloud deployments, both faster and more securely,” said Hatem Naguib, COO at Barracuda. “We appreciate the relationship we have developed with Microsoft over the years and the close collaboration over many months to integrate Barracuda SD-WAN technology natively on Microsoft Azure Virtual WAN Hubs. We know this is the future of networking in the public cloud, and we’re excited to be on this forefront with Microsoft.”

Yousef Khalidi, Corporate Vice President, Azure Networking at Microsoft said, “Cloud-native, secure SD-WAN technology, like the new CloudGen WAN service from Barracuda, provides a fast, reliable, and direct path to Microsoft Azure. We’re pleased to collaborate with Barracuda for this new wave of faster public cloud adoption to help our joint customers optimize network performance.”

Opinion: The huge implication here is that the major cloud service providers (Amazon AWS, Microsoft Azure and Google Cloud) will be replacing traditional telco networks. In this case, it’s SD-WAN access and Microsoft’s WAN backbone, but in the future it will likely be 5G network access built mostly from software building blocks. Why else did Microsoft acquire Affirmed Networks and Metaswitch?

For an Amazon AWS executive’s take on this topic (“we’re partners with telco’s”) read this Light Reading piece.

………………………………………………………………………………………………………………………………………………………………….

References:

https://docs.microsoft.com/en-us/azure/virtual-wan/virtual-wan-about

Will Hyperscale Cloud Companies (e.g. Google) Control the Internet’s Backbone?

Resources from Barracuda:

For more information about Barracuda CloudGen WAN, visit https://www.barracuda.com/products/cloudgenwan

Read the Barracuda blog post: http://cuda.co/40855

Read the Microsoft blog post from Yousef Khalidi: https://aka.ms/vwan-sdwan

Watch Reshmi Yandapalli’s session on “Use Azure networking services to accelerate, scale or re-architect your customer’s global network” for Microsoft Inspire: https://aka.ms/T4D193

Read the market report: https://www.barracuda.com/sdwan-report-2020

Find out Barracuda was recognized as a finalist for Commercial Marketplace 2020 Microsoft Partner of the Year: http://cuda.co/40853

1 Gartner, “The Future of Network Security Is in the Cloud”, Neil MacDonald, Lawrence Orans, Joe Skorupa, 30 August 2019.

……………………………………………………………………………………………………………………………………………………………………………

Tutorial on Advanced Antenna Systems (AAS) for 5G Networks

Editor’s Note:

Rec. ITU‑R M.2101 uses the term AAS to mean Advanced Antenna System(s), while 3GPP uses the term AAS to mean Active Antenna System (s).

Definition:

Advanced antenna systems (AAS) is the general term used to describe antenna systems utilizing techniques aiming at improving performance and spectral efficiency of radiocommunication transceivers taking advantage of antenna array theory and practice.

These techniques include adaptive beamforming, multiple input multiple output (MIMO), and space division multiple access (SDMA) among other ones. These multi-antenna techniques are generally applicable to any frequency band or radio application and can be implemented using passive or active antennas.

In higher frequency bands, such as those around the millimetric wave bands, active advanced antenna systems are the prevalent technology choice.

- Smart antennas

- Adaptive beamforming

- Phased arrays

- Spatial multiplexing and MIMO

- Space Division Multiple Access (SDMA)

- Active and passive antennas

- Antenna Array Theory

Basic concepts:

Multiple antennas can be arranged in space in specific configurations to form a highly directive pattern. These arrangements are referred to as “arrays.” In an array antenna, the fields from the individual elements add constructively in some directions and destructively (cancel) in others thus creating an overall array radiation pattern different from that of the individual elements.

The major advantage of antenna arrays over a single antenna element is their electronic scanning capability; that is, the major lobe can be steered toward any direction by changing the phase of the excitation current at each array element (phased array antennas). Furthermore, by also controlling the magnitude of the excitation current, a large variety of radiation patterns and sidelobe level characteristics can be produced. Adaptive antennas (also called “smart antennas” in mobile communication applications) go a step further than phased arrays and can direct their main lobe (with increased gain) in a desired direction (e.g., a mobile user in a cellular communication system) and nulls in the directions of interference or jammers.

AAS enables state-of-the-art beamforming and MIMO techniques that are powerful tools for improving end-user experience, capacity and coverage. As a result, AAS significantly enhances network performance in both uplink and downlink. Finding the most suitable AAS variants to achieve performance gains and cost efficiency in a specific network deployment requires an understanding of the characteristics of both AAS and of multi-antenna features.

Multi-antenna techniques

Multi-antenna techniques, here referred to as AAS features, include beamforming and MIMO. Such features are already used with conventional systems in today’s LTE networks. Applying AAS features to an AAS radio results in significant performance gains because of the higher degrees of freedom provided by the larger number of radio chains, also referred to as Massive MIMO.

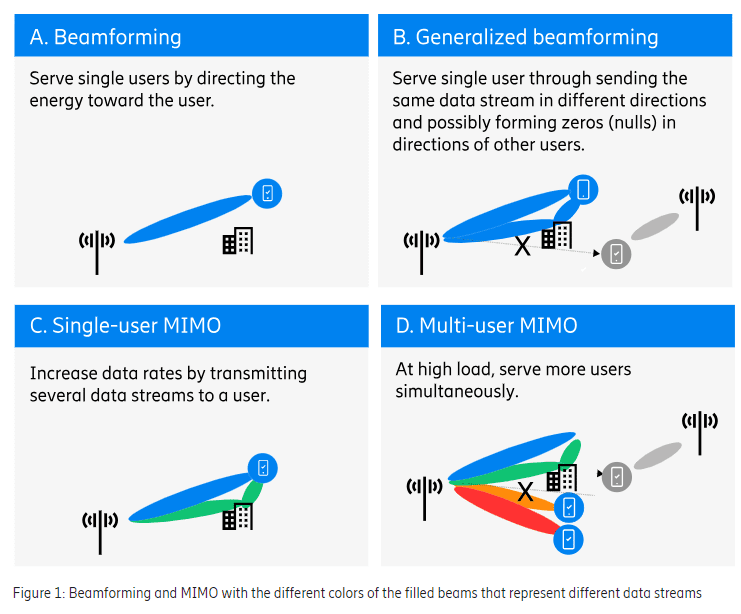

Beamforming

When transmitting, beamforming is the ability to direct radio energy through the radio channel toward a specific receiver, as shown in the top left quadrant of Figure 1. By adjusting the phase and amplitude of the transmitted signals, constructive addition of the corresponding signals at the UE receiver can be achieved, which increases the received signal strength and thus the end-user throughput. Similarly, when receiving, beamforming is the ability to collect the signal energy from a specific transmitter. The beams formed by an AAS are constantly adapted to the surroundings to give high performance in both UL and DL.

Although often very effective, transmitting energy in only one direction does not always provide an optimum solution. In multi-path scenarios, where the radio channel comprises multiple propagation paths from transmitter to receiver through diffraction around corners and reflections against buildings or other objects, it is beneficial to send the same data stream in several different paths (direction and/or polarization) with phases and amplitudes controlled in a way that they add constructively at the receiver. This is referred to as generalized beamforming, as shown in the upper right quadrant of Figure 1. As part of generalized beamforming, it is also possible to reduce interference to other UEs, which is known as null forming. This is achieved by controlling the transmitted signals in a way that they cancel each other out at the interfered UEs.

MIMO (Multiple Input, Multiple Output) techniques:

Spatial multiplexing, here referred to as MIMO, is the ability to transmit multiple data streams, using the same time and frequency resource, where each data stream can be beamformed. The purpose of MIMO is to increase throughput. MIMO builds on the basic principle that when the received signal quality is high, it is better to receive multiple streams of data with reduced power per stream, than one stream with full power. The potential is large when the received signal quality is high and the streams do not interfere with each other. The potential diminishes when the mutual interference between streams increases. MIMO works in both UL and DL, but for simplicity the description below will be based on the DL.

Single-user MIMO (SU-MIMO) is the ability to transmit one or multiple data streams, called layers, from one transmitting array to a single user. SU-MIMO can thereby increase the throughput for that user and increase the capacity of the network. The number of layers that can be supported, called the rank, depends on the radio channel. To distinguish between DL layers, a UE needs to have at least as many receiver antennas as there are layers.

SU-MIMO can be achieved by sending different layers on different polarizations in the same direction. SU-MIMO can also be achieved in a multi path environment, where there are many radio propagation paths of similar strength between the AAS and the UE, by sending different layers on different propagation paths, as shown in the bottom left quadrant of Figure 1.

In multi-user MIMO (MU-MIMO), which is shown in the bottom right quadrant of Figure 1. above, the AAS simultaneously sends different layers in separate beams to different users using the same time and frequency resource, thereby increasing the network capacity. In order to use MU-MIMO, the system needs to find two or more users that need to transmit or receive data at the very same time. Also, for efficient MU-MIMO, the interference between the users should be kept low. This can be achieved by using generalized beamforming with null forming such that when a layer is sent to one user, nulls are formed in the directions of the other simultaneous users.

The achievable capacity gains from MU-MIMO depend on receiving each layer with good signal-to-interference-and-noise-ratio (SINR). As with SU-MIMO, the total DL power is shared between the different layers, and therefore the power (and thus SINR) for each user is reduced as the number of simultaneous MU-MIMO users increases. As the number of users grows, the SINR will further deteriorate due to mutual interference between the users. The wireless network capacity (the number of devices that can use a wireless network at the same time and the bandwidth consumed) typically improves as the number of MIMO layers increases, to a point at which power sharing and interference between users result in diminishing gains, and eventually losses.

It should be noted that the practical benefits of many layers in MU-MIMO are limited by the fact that in today’s real networks, even with a high number of simultaneous connected users, there tends not to be many users who want to receive data simultaneously. This is due to the bursty (chatty) nature of data transmission to most users. Since the AAS and the transport network must be dimensioned for the maximum number of layers, the MNO needs to consider how many layers are required in their networks. In typical MBB deployments with the current 64T64R AAS variants, the vast majority of the DL and UL capacity gains can be achieved with up to 8 layers.

References:

https://www.ericsson.com/en/reports-and-papers/white-papers/advanced-antenna-systems-for-5g-networks

IBM and Verizon Business Collaborate on 5G, Edge Computing and AI Solutions for Enterprise Customers

Verizon Business and IBM are working together on 5G and edge computing innovation to help enable the future of “Industry 4.0.” The two companies plan to combine the high speed and (yet to be proven) low latency of Verizon’s 5G and Multi-access Edge Compute (MEC) functionalities, IoT devices and sensors at the edge, and IBM’s expertise in AI, hybrid multi-cloud, edge computing, asset management and connected operations. These will be jointly offered with IBM’s Maximo Monitor with IBM Watson and advanced analytics. The combined products may help clients detect, locate, diagnose and respond to system anomalies, monitor asset health and help predict failures in near real-time. The first solutions to be aimed at helping improve industrial quality, availability and performance.

“Through this collaboration, we plan to build upon our longstanding relationship with Verizon to help industrial enterprises capitalize on joint solutions that are designed to be multi-cloud ready, secured and scalable, from the data center all the way out to the enterprise edge,” IBM’s Bob Lord, SVP of cognitive applications, blockchain and ecosystems, said in a press release from the companies.

“Through this collaboration, we plan to build upon our longstanding relationship with Verizon to help industrial enterprises capitalize on joint solutions that are designed to be multi-cloud ready, secured and scalable, from the data center all the way out to the enterprise edge.”

“This collaboration is all about enabling the future of industry in the Fourth Industrial Revolution,” said Tami Erwin, CEO, Verizon Business. “Combining the high speed and low latency of Verizon’s 5G UWB Network and MEC capabilities with IBM’s expertise in enterprise-grade AI and production automation can provide industrial innovation on a massive scale and can help companies increase automation, minimize waste, lower costs, and offer their own clients a better response time and customer experience.”

Image Credit: iStockphoto/LHG

…………………………………………………………………………………………………………………………………………………………………………….

IBM and Verizon said their first offerings would target “mobile asset tracking and management solutions,” and that, eventually, they hope to offer products for remote control robotics, real-time video analysis and plant automation. The two companies also plan to collaborate on potential joint solutions to address worker safety, predictive maintenance, product quality and production automation.

Many industrial enterprises are today seeking ways to use edge computing to accelerate access to near real-time, actionable insights into operations to improve productivity and reduce costs. To address industrial firms’ need for edge computing ways to accelerate access to near real-time insights into operations, the first products planned from this collaboration are mobile asset tracking and management products to help enterprises improve operations, optimise production quality, and help clients enhance worker safety.

IBM and Verizon are also working on potential combined products for 5G and MEC-enabled use cases such as near real-time cognitive automation for the industrial environment.

Verizon and IBM also plan to collaborate on potential joint products to address worker safety, predictive maintenance, product quality and production automation.

Light Reading’s Mike Dano had this comment:

For IBM, the announcement underscores its efforts to offer products and services in the edge computing marketplace, an area that’s becoming a key focus for a variety of businesses looking for speedy computing services via nearby or onsite facilities.

And for Verizon, the announcement adds further momentum to its 5G and edge computing ambitions. Company executives have long argued that the combination of 5G and edge computing has a wide range of enterprise applications, and Verizon’s new pairing with IBM could open the doors to more potential customers for such services.

To be clear, Verizon has been working to stamp out a position in the 5G and edge computing sector for years. The company hopes to offer its high-speed, millimeter-wave 5G network across 60 cities by the end of this year, and concurrently it has said it will launch nationwide 5G on lowband spectrum in that same timeframe. Separately, Verizon late last year announced it would team up with Amazon to support its AWS edge computing initiative.

But Verizon’s edge computing efforts don’t stop there. The company joined América Móvil, KT, Rogers, Telstra and Vodafone to establish the “5G Future Forum” in January in part to accelerate the development of Multi-access Edge Computing (MEC)-enabled solutions. The group this week announced it will release its first technical specifications in the third quarter.

………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.lightreading.com/the-edge/verizon-ibm-team-up-on-5g-and-edge-computing/d/d-id/762452?

Executive Summary: IMT-2020.SPECS defined, submission status, and 3GPP’s RIT submissions

Introduction – IMT-2020.SPECS:

The forthcoming ITU-R recommendation “IMT-2020.SPECS” identifies the terrestrial radio interface technologies of International Mobile Telecommunications-2020 (IMT-2020) and provides the detailed radio interface specifications.

IMPORTANT: This new ITU-R standard will NOT include IMT 2020 non-radio aspects, such as 5G Core Network, Signaling, Network Slicing, Virtualization, Network Management/Maintenance, Security/Privacy, Fault Detection/Recovery, Codecs, Interworking, etc.

This new recommendation was developed by ITU-R WP5D (aka 5D) over the last five years. It consists of IMT 2020 (5G) Radio Interface Technologies (RIT) and Sets of Radio Interface Technologies (SRIT).

The final IMT-2020.SPECS is expected to be approved in late November 2020 at the ITU-R SG 5 (parent of WP 5D) meeting. Here’s the related ITU-R meeting schedule for the remainder of 2020:

|

WP 5D |

36 |

5 October 20 |

16 October 20 |

Geneva |

10 day meeting |

|

WP 5D |

36bis |

17 November 20 |

19 November 20 |

Geneva |

Focused WP 5D meeting on the technology aspects and related administrative activities for finalization of Step 8 of the IMT-2020 process for draft new Recommendation ITU-R M.[IMT-2020.SPECS] |

|

SG 5 |

23 November 20 |

24 November 20 |

Geneva |

Anticipated dates |

………………………………………………………………………………………………………………………………………………………………………….

IMT 2020 RIT/SRIT submission status:

IMT 2020 RIT submissions from 3GPP/China/Korea [1.], TSDSI [2], DECT/ETSI, and Nufront are all being considered by 5D. The latter two submissions have defined their own version of 5G New Radio (NR) as they do NOT use 3GPP’s 5G NR.

Note 1. ATIS found the China and Korea IMT 2020 RIT/SRIT submissions to be technically identical to 3GPPs. Please see IMT-2020 Consensus Building and Decision by 5D for more detail.

Note 2. The TSDSI submission uses 3GPP’s 5GNR but also ADDS functional capability to support Low Mobility Large Cell (LMLC).

->Hence, there are potentially three different 5G NRs (as the basis for the respective RIT submissions) that may be standardized in IMT-2020.SPECS if the DECT/ETSI and Nufront submissions achieve final approval from WP5D. 5D requested additional work for both DECT/ETSI and Nufront RIT submissions before they can be progressed to the next step at 5D’s October 2020 meeting. Those submissions will NOT be included in the first IMT-2020.SPECS recommendation 5D will send to ITU-R SG5 in late November 2020. If 5D subsequently approves them, they will be included in a revision of IMT-2020.SPECS in 2021.

At its July virtual meeting, 5D determined that the IMT-2020 candidate technology submission proposals from DECT/ETSI and Nufront will require additional evaluation to conclude their respective final assessment through Steps 6 and 7 of the current process. They will, therefore, on an exceptional basis continue in the process, rewinding to Step 4 in order to consider additional material.

– Candidate SRIT submission from ETSI (TC DECT) and DECT Forum (Acknowledgement of submission under Step 3 of the IMT-2020 process in IMT‑2020/17(Rev.1)).

– Candidate RIT submission from Nufront (Acknowledgement of submission under Step 3 of the IMT-2020 process in IMT-2020/18(Rev.1)).

The process extension for these two candidate technology submissions will not impact the schedule for the first release of Recommendation ITU-R M.[IMT-2020.SPECS] and the inclusion of the identified Proponent submissions identified below (IMT-2020 RIT/SRIT Submissions being progressed by 5D) that will proceed into Step 8. If these two proponent submission satisfy 5D requirements, they might then be included in a 2021 revision of IMT-2020.SPECS, but they won’t be in the initial recommendation expected to be approved at the end of 2020.

……………………………………………………………………………………………………………………………………………………………………………..

Sidebar: DECT-2020 NR

The “DECT-2020 NR” Radio Interface Technology (RIT) is designed to provide a slim but powerful technology foundation for wireless applications deployed in various use cases and markets. It utilizes the frequency bands below 6 GHz identified for International Mobile Telecommunication (IMT) in the ITU Radio Regulations.

The DECT-2020 radio technology includes, but is not limited to: Cordless Telephony, Audio Streaming Applications, Professional Audio Applications, consumer and industrial applications of Internet of Things (IoT) such as industry and building automation and monitoring, and in general solutions for local area deployments for Ultra-Reliable Low Latency (URLLC) and massive Machine Type Communication (mMTC) as envisioned by ITU-R for IMT-2020.

–>ETSI supports this DECT RIT mainly because of its URLLC capabilities, according to an email received from ETSI.

DECT-2020 NR is claimed by its sponsor to be a technology foundation is targeted for local area wireless applications, which can be deployed anywhere by anyone at any time. The technology supports autonomous and automatic operation with minimal maintenance effort. Where applicable, interworking functions to wide area networks (WAN). e.g. PLMN, satellite, fibre, and internet protocols foster the vision of a network of networks. DECT-2020 NR can be used as foundation for: Very reliable Point-to-Point and Point-to-Multipoint Wireless Links provisioning (e.g. cable replacement solutions); Local Area Wireless Access Networks following a star topology as in classical DECT deployment supporting URLLC use cases, and Self-Organizing Local Area Wireless Access Networks following a mesh network topology, which enables to support mMTC use cases.

……………………………………………………………………………………………………………………………………………………………………………

5D has approved the 3GPP and TSDSI RIT/SRIT submissions to be progressed to the next step at their recent e-Meeting which ended July 9, 2020. From the July 13, 2020 DRAFT NEW REPORT ITU-R M.[IMT-2020.OUTCOME]:

1.] Summary of the evaluations received for the candidate RIT submission (Document IMT-2020/14) from 3GPP Proponent:

There were ten relevant evaluation reports received for the candidate 3GPP RIT submission. The relevant received evaluation reports confirmed that the candidate 3GPP RIT proposal in IMT-2020/14 fulfils the minimum requirements for the five test environments comprising the three usage scenarios.

2.] The evaluated candidate RIT proposal (Document IMT-2020/19(Rev.1)) from TSDSI is assessed by ITU-R as satisfactorily fulfilling the minimum requirements for the five test environments comprising the three usage scenarios. Thus, this TSDSI RIT proposal is ‘a qualifying RIT’ and therefore will go forward for further consideration in Step 7.

……………………………………………………………………………………………………………………………………

IMT-2020 RIT/SRIT Submissions being progressed by 5D:

Each of the following IMT-2020 candidate technology submission proposals will be accepted for inclusion in the standardization phase described in Step 8.

– IMT-2020/13 – Acknowledgement of candidate SRIT submission from 3GPP proponent under step 3 of the IMT-2020 process.

– IMT-2020/14 – Acknowledgement of candidate RIT submission from 3GPP proponent under step 3 of the IMT-2020 process.

– IMT-2020/15 – Acknowledgement of candidate RIT submission from China (People’s Republic of) under step 3 of the IMT-2020 process.

– IMT-2020/16 – Acknowledgement of candidate RIT submission from Korea (Republic of) under Step 3 of the IMT-2020 process

– IMT-2020/19(Rev.1) – Acknowledgement of candidate RIT submission from TSDSI under step 3 of the IMT-2020 process.

………………………………………………………………………………………………………………………………………………………….

However, there is still confusion (at least for this author) as to whether the China and Korea submissions (which were stated to be technically identical to 3GPP submissions) will ultimately be included in IMT-2020.SPECs as independent/separate text or merged with the 3GPP RIT/SRIT submissions. That may be decided at the October or November 2020 5D meetings.

–>If they are all included as separate texts, it will pose a version change challenge with 3 technically identical sets of IMT 2020 RIT/SRITs with each proponent able to revise the spec at any time, independent of the others.

………………………………………………………………………………………………………………………

Overview of IMT-2020.SPECS:

The radio interface specifications in IMT-2020.SPECS detail the feature and parameters of IMT-2020. This Recommendation indicates that IMT-2020 enables worldwide compatibility, international roaming, and access to the services under all three usage scenarios, including enhanced mobile broadband (eMBB), massive machine type communications (mMTC) and ultra-reliable and low latency communications (URLLC).

The capabilities of IMT-2020 include:

– very high peak data rate;

– very high and guaranteed user experienced data rate;

– quite low air interface latency;

– quite high mobility while providing satisfactory quality of service;

– enabling massive connection in very high density scenario;

– very high energy efficiency for network and device side;

– greatly enhanced spectral efficiency;

– significantly larger area traffic capacity;

– high spectrum and bandwidth flexibility;

– ultra high reliability and good resilience capability;

– enhanced security and privacy.

These features enable IMT-2020 to address evolving user and industry needs. The capabilities of IMT-2020 systems are being continuously enhanced in line with user and industry trends, and consistent with technology developments.

IMT-2020 Frequencies and Arrangements:

It’s vitally important to recognize that the frequencies to be used by IMT-2020 RITs, including five sets of mmWave bands, will NOT be in IMT-2020.SPECS. Instead, they will be included in a revision of ITU-R M.1036 Recommendation (see below). At their July 2020 meeting, 5D could not reach consensus on the draft revision of M.1036, because the Russian Federation expressed concerns about the current version of the revision. Hence, this work item was carried over to 5D’s October 2020 meeting.

The highly touted and ultra hyped mmWave frequency arrangements (five such frequency arrangements were recommended by WRC 19) have yet to be added to the M.1036 revision. Frequency arrangements in the bands: 24.25-27.5 GHz, 37-43.5 GHz, 45.5-47 GHz, 47.2-48.2GHz, and 66-71 GHz will all use unpaired frequency arrangement with Time Division Duplexing (TDD) used to separate transmit and receive channels for full duplex communications.

Related ITU-R References:

– Recommendation ITU-R M.1036 Frequency arrangements for implementation of the terrestrial component of International Mobile Telecommunications (IMT) in the bands identified for IMT in the Radio Regulations

– Recommendation ITU-R M.2083 IMT vision -Framework and overall objectives of the future development of IMT-2020 and beyond

– Recommendation ITU-R M.1822 Framework for services supported by IMT

– Report ITU-R M.2320 Future technology trends of terrestrial IMT systems

– Report ITU-R M.2370 IMT traffic estimates for the years 2020-2030

– Report ITU-R M.2376 Technical feasibility of IMT in bands above 6 GHz

Report ITU-R M.2411 Requirements, evaluation criteria and submission templates for the development of IMT-2020

– Report ITU-R M.2410 Requirements related to technical performance for IMT-2020 radio interface(s)

– Report ITU-R M.2412 Guidelines for evaluation of radio interface technologies for IMT-2020

– Resolution ITU-R 56 Naming for International Mobile Telecommunications

– Resolution ITU-R 65 Principles for the process of development of IMT for 2020 and beyond

– Document IMT-2020/1 IMT-2020 Background 2020

– Document IMT-2020/2(Rev.2) Submission and evaluation process and consensus building for IMT-2020

– Document IMT-2020/20 Process and the use of Global Core Specification (GCS), references, and related certifications in conjunction with Recommendation ITU‑R M.IMT-[2020.SPECS]

……………………………………………………………………………………………………………………………………….

IMT-2020 Independent Evaluation Groups:

Under Step 4 of IMT-2020 process, candidate RITs or SRITs were evaluated by Independent Evaluation Groups (IEG) that registered with the ITU-R in conformance with the process. In this step, the candidate RITs or SRITs were assessed based on Reports ITU-R M.2411 and ITU-R M.2412.

The IEGs utilized the defined ITU-R evaluation methodology and criteria established in the relevant ITU-R Reports covering IMT-2020. ITU-R concluded that the IEGs had fulfilled their role in the process and that the inclusion of views from organizations external to the ITU‑R.

Considering the requirements, evaluation criteria and submission templates for the development of IMT-2020 included in Report ITU-R M.2411, the minimum requirements related to technical performance for IMT‑2020 radio interface(s) in Report ITU-R M.2410, and the guidelines for evaluation of radio interface technologies for IMT‑2020 are included in Report ITU‑R M.2412, the conclusions have been reached for each of the IMT-2020 RIT/SRITs submitted by 3GPP, China, Korea, TSDSI (India), DECT/ETSI, and Nufront. Those detailed conclusions are beyond the scope of this article.

………………………………………………………………………………………………………………………………………..

Overview of 3GPP’s radio interface technologies (E-UTRA/LTE and 5G NR):

The IMT-2020 RIT/SRIT specifications known as “5G” have been developed by 3GPP and consist of LTE and 5G NR Releases 15, 16, and beyond.

In 3GPP terminology, the term Evolved-UMTS Terrestrial Radio Access (E-UTRA) is also used to signify the LTE radio interface. 5G is a Set of Radio Interface Technologies (RITs) consisting of E-UTRA/LTE as one component RIT and (5G) NR as the other component RIT. Both components are designed for operation in IMT defined spectrum.

5G fulfills all technical performance requirements in all five selected IMT-2020 test environments : Indoor Hotspot – enhanced Mobile Broadband (eMBB), Dense Urban – eMBB, Rural – eMBB, Urban Macro – Ultra Reliable Low Latency Communication (URLLC) and Urban Macro – massive Machine Type Communication (mMTC).

5G also fulfills the service and the spectrum requirements. Both component RITs, NR and E-UTRA/LTE, utilize the frequency bands below 6 GHz identified for International Mobile Telecommunication (IMT) in the ITU Radio Regulations. In addition, the NR component RIT can also utilize the frequency bands above 6 GHz, i.e., above 24.25 GHz, identified for IMT in the ITU Radio Regulations. The complete set of standards for the terrestrial radio interface of IMT-2020 identified as 5G includes not only the key characteristics of IMT-2020 but also the additional capabilities of 5G both of which are continuing to be enhanced.

ITU-R WP5D’s conclusion on 3GPP’s 5G SRIT and 5G RIT is shown in the table below:

|

Radio Interface Technologies: |

NAME: (3GPP 5G:1 SRIT) |

|

Proponents (submission in): |

3GPP Proponent (IMT-2020/13)2 |

|

Determination whether the RIT or SRIT meets the requirements of Res. ITU‑R 65, resolves 6 e) and f), for the five test environments comprising the three usage scenarios |

YES |

|

Inclusion in the standardization phase described in Step 8 |

YES |

|

Radio Interface Technologies: |

NAME: (3GPP 5G:3 RIT) |

|

Proponents (submission in): |

3GPP Proponent (IMT-2020/14) China (People’s Republic of) (IMT-2020/15) Korea (Republic of) (IMT-2020/16) |

|

Determination whether the RIT or SRIT meets the requirements of Res. ITU‑R 65, resolves 6 e) and f), for the five test environments comprising the three usage scenarios |

YES |

|

Inclusion in the standardization phase described in Step 8 |

YES |

1 Developed by 3GPP as 5G, Release 15 and beyond (as indicated in Documents 5D/1215 and 5D/1216)

2 The NB-IoT part of IMT-2020/15 (China) candidate technology proposal is technically identical to the specifications for the NB-IoT part of IMT-2020/13 (3GPP SRIT).

3 Developed by 3GPP as 5G, Release 15 and beyond (as indicated in Documents 5D/1215 and 5D/1217)

…………………………………………………………………………………………………………………………………………………………………………..

The 3GPP 5G System (5GS) also includes specifications for its non-radio aspects, such as the core network elements (the Enhanced Packet Core (EPC) Network and 5G Core (5GC) Network), security, codecs, network management, etc.

–>These non-radio specifications are not included in the so-called “Global Core Specifications (GCS)” of IMT-2020.

Support of Industry Verticals:

The E-UTRA/LTE and 5G NR component RITs from 3GPP support a diverse set of mobile broadband (eMBB) services and other so-called industry “verticals,” including URLLC, Industrial IoT, Automotive/V2X, Private Networks (NPN), and others. NR RIT supports in-band coexistence with NB-IoT and eMTC. For optimal support of specific verticals, the 5G NR RIT has been designed, or enhanced, with certain key features, or set of features.

A short summary of relevant NR RIT capabilities for a few industry verticals is provided below.

Ultra-Reliable and Low Latency Communications (URLLC) and Industrial IoT (IIoT):

For support of Ultra-Reliable and Low Latency Communications services, some of the main features supported by the 5G NR RIT are:

• Logical Channel Priority (LCP) restrictions

• Packet duplication with DC or CA

• New QCI table for block error rate 10*-5

• Physical layer short transmission time interval (TTI)

From 3GPP Rel-16 onwards, URLLC and Industrial IoT use cases are further facilitated by:

• NR PDCP duplication enhancements,

• Prioritization/multiplexing enhancements,

• NR Time Sensitive Communications (TSC) related enhancements,e.g. Ethernet header compression, and

• Precise time information delivery

Factory Automation and “Industry 4.0”:

5G URLLC in Release 16 (RAN and 5G core) was said to improve link reliability by as much as 99.9999%. These types of applications are best served by a coordinated multi-point (CoMP) approach that leverages multiple transmission and reception (multi-TRP) architecture to provide redundant communication paths with some degree of spatial diversity.

Vehicle-to-everything (V2X) communications:

From 3GPP Rel-16, NR RIT includes support of Vehicle-to-everything (V2X), mainly by means of NR sidelink communication over the PC5 interface, partly leveraging what was defined for E-UTRA V2X sidelink communication.

Sidelink transmission and reception over the PC5 interface are supported when the UE is inside NG-RAN coverage, irrespective of which RRC state the UE is in, and when the UE is outside NG-RAN coverage.

………………………………………………………………………………………………………………………………………………………………..

IMT-2020 Consensus Building and Decision by 5D:

– IMT-2020/15 (China) candidate technology proposal is technically identical to the IMT‑2020/14 (3GPP RIT) candidate technology proposal and NB-IoT part of IMT‑2020/13 (3GPP SRIT) candidate technology proposal;

– IMT-2020/16 (Korea) candidate technology proposal is technically identical to the IMT‑2020/14 (3GPP RIT) candidate technology proposal;

Additionally, consensus building has been performed with the objective of achieving global harmonization and having the potential for wide industry support for the radio interfaces that are developed for IMT‑2020. (?????)

As a result of the consensus building in ITU-R among the seven technology proposals, the following groupings are agreed by ITU-R:

– The SRIT proposed in IMT-2020/13 including NB-IoT part to which China (People’s Republic of) (NB-IoT part of IMT-2020/15) is technically identical, is identified in ITU as “3GPP 5G SRIT”1, developed by the Third Generation Partnership Project (3GPP), for Step 7 and subsequent IMT-2020 development.

– The RITs proposed in IMT-2020/14, NR part of IMT-2020/15 and IMT-2020/16 are grouped into the technology identified in ITU as “3GPP 5G RIT”, developed by the Third Generation Partnership Project (3GPP), for Step 7 and subsequent IMT-2020 development.

……………………………………………………………………………………………………………………………….

Future plans for the IMT process:

IMT is an on-going process of development and updates within ITU-R WP 5D.

In 2021, ITU-R will define the schedule for future general revisions of the Recommendation ITU-R M.[IMT-2020.SPECS], to accommodate any future new, improved, or updated IMT-2020 candidate technology proposals beyond the first release, utilizing the same baseline IMT ‘revision and update process’ currently in place, as applied to IMT 2020.

………………………………………………………………………………………………………………………………………………………………….

Future IEEE Techblog posts on 3GPP Rel 16 and IMT 2020.SPECS:

This author has been in dialog with 3GPP leaders via the 3GPP Marketing Communications Manager to accurately assess 3GPP Rel 16 completed work items related to 5G (both radio and non-radio aspects).

In particular, we are very much interested in the 3GPP Rel 16 URLLC specification, performance simulation(s), and performance testing (not yet started). Only after independent performance testing will we know if the URLLC test implementation meets the required performance parameters specified by 3GPP and/or Minimum requirements related to technical performance for IMT-2020 radio interface(s) [ITU M.2410].

The IEEE Techblog Editorial Team is soliciting guest blog posts related to 3GPP Rel 16 and/or issues with IMT-2020.SPECS as well as other topics listed here.

…………………………………………………………………………………………………………………………………………………………….

References:

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

https://techblog.comsoc.org/?q=IMT%202020#gsc.tab=0&gsc.q=IMT%202020&gsc.page=1

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/submission-eval.aspx

https://ieeexplore.ieee.org/stamp/stamp.jsp?arnumber=9114983

No stopping Huawei: 1st half 2020 revenues rose 13.1%, to $64.9 billion despite U.S. led boycott; ~60% of biz from China!

Huawei Technologies Co Ltd, the #1 telecom equipment company #2 smartphone maker, reported a 13.1% rise in revenue in the first half of the year, showing slower growth as U.S. officials continue to pressure the company’s suppliers and customers. Revenue rose to 454 billion yuan ($64.90 billion) in the first half of the year. ($1 = 6.9958 Chinese yuan renminbi or RMB). That was compared to 401.3 billion yuan revenues the year before. Huawei’s growth rate was down from 23.2% in the first half 2019. Huawei said net profit margins were 9.2%, up from 8.7% in the first half 2019.

FILE PHOTO: Huawei’s new flagship store is seen ahead of tomorrow’s official opening in Shanghai, following the coronavirus disease (COVID-19) outbreak, China June 23, 2020.

REUTERS/Aly Song/File Photo: REUTERS

……………………………………………………………………………………………………………………

The results were published as Huawei fights a U.S.-led campaign to ban it from Europe’s 5G markets and choke off its supplies of components based on U.S. design expertise or manufacturing technology. Speculation has risen that UK authorities will this week move to exclude Huawei from the country’s 5G market just months after saying they would restrict it to 35% of any radio access or fiber broadband network.

The UK government previously thought such restrictions – combined with a ban on Huawei in the intelligent “core” of any network – would mitigate the risk and minimize disruption to service providers reliant on Huawei technology.

But security watch dogs are now worried the latest U.S. sanctions would heighten risks and potentially threaten Huawei’s ability to continue serving UK operators.

While other European governments and operators have similar concerns, Huawei has been able to rely on a 5G rollout in China for sales growth.

Victor Zhang, the company’s head of government affairs, told UK officials last week that Huawei will this year erect about half a million base stations for Mobile, Telecom and Unicom, China’s three national operators.

The company has referred to the scale of the Chinese deployment in refuting suggestions it may run out of components early next year. With the current 35% cap on its UK role, it needs components for only about 20,000 UK base stations, which it can easily supply through existing inventory, said a Huawei spokesperson.

A breakdown of the figures released today indicates growth in all three of Huawei’s business lines.

At the carrier division, which develops network products for communications service providers, sales were up 9%, to RMB159.6 billion ($22.8 billion), despite coronavirus-triggered lockdowns in some of Huawei’s most important markets.

While Huawei did not provide a regional breakdown of the numbers, a Chinese splurge on 5G equipment is likely to have fueled the increase given the pressure elsewhere.

Last year, the Chinese market accounted for nearly 60% of Huawei’s entire business, a figure that proves any European restrictions would have only a limited effect on the company.

Huawei’s relatively small enterprise business managed a 15% increase in sales, to RMB36.3 billion ($5.2 billion), while its device-making consumer business – which last year blamed U.S, sanctions for wiping about $10 billion off sales – said revenues were up 16%, to about RMB255.8 billion ($36.6 billion).

“Our business depends on delivering what our customers need,” said Zhang in a prepared statement about the latest numbers. “These results show that they continue to choose Huawei when they want reliability, security and value.”

Zhang said: “Our priority here is to build a better-connected UK where everyone can benefit from 5G and fiber broadband, no matter where they live.”

BT and Vodafone, the UK operators most heavily reliant on Huawei’s products, have told UK officials they need at least five years to phase out the Chinese vendor. Anything less and customers would face major disruption, including outages as equipment is replaced, said technology executives during a parliamentary committee last week.

…………………………………………………………………………………………………………..

Huawei’s rise in sales comes after more than a year of pressure from American officials on the company’s suppliers and customers. The company sells 5G networking equipment to carriers and smart phones and laptops to consumers.

American officials placed Huawei on a blacklist in May of last year, restricting sales to the company of U.S.-made goods such as semiconductors. Huawei built up inventories and also continued to design its own chips and have them manufactured by Taiwan Semiconductor Manufacturing Co Ltd and others.

“Huawei has promised to continue fulfilling its obligations to customers and suppliers, and to survive, forge ahead, and contribute to the global digital economy and technological development, no matter what future challenges the company faces,” the company said in a statement on Monday.

In May, U.S. officials announced new rules aimed at constricting Huawei’s ability to self-supply chips, an ability that is critical to its efforts to sell 5G networking gear.

The first half results showed faster growth than Huawei’s first quarter results released in April. For the first quarter, revenues rose by about 1% to 182.2 billion yuan, versus 39% growth posted a year previous. Net profit margin in the first quarter narrowed to 7.3% from about 8% a year earlier.

Huawei did not report unit shipments of phones. Research firm IDC reported Huawei was the second largest phone maker in the first quarter of 2020, with 17.8% market share, behind No. 1 Samsung Electronics Co Ltd and ahead of No.3 Apple Inc.

References:

Bloomberg Opinion: China Is Winning the 5G Base Station Race

By Anjani Trivedi

China is building tens of thousands of 5G base stations every week. Whether it wins technological dominance or not, domestic supply chains may be revived and allow the country to maintain – and advance — its position as the factory floor of the world, even as Covid-19 forces a rethink in how globalization is done.

By the end of this year, China will have more than half a million of these 5G cell towers on its way to a goal of 5 million, a fast climb from around 200,000 already in use, enabling faster communication for hundreds of millions of smartphone users. By comparison, South Korea has a nearly 10% penetration rate for 5G usage, the highest globally. The much-smaller Asian country had 115,000 such 5G base stations operating as of April.

5G base stations are sprouting all over China. Photo Credit: China News Service/Visual China Group/Getty

……………………………………………………………………………………………………………………………………………….

The coronavirus shut down factories and industrial sectors, triggering a rethink of supply chains – away from China. What analysts are calling “peak” globalization and the rise of factory automation could shift production to higher-cost countries in North America and Southeast Asia. It will take a while, but the global dependence on China will come down, the thinking goes. Still, with trade ravaged by Covid-19, other countries and telecom operators will struggle to match China’s spending.

For China, there’s an opportunity to clear the way to forcefully implement its industrial policy agenda, without interference from criticism over subsidies and unfair competition. The so-called Central Comprehensively Deepening Reforms Commission, headed by President Xi Jinping, has approved a three-year plan to give state-owned enterprises yet more sway in the economy.

Beijing’s ambitious programs are still in the construction phase. Macro base stations are the nuts and bolts of building out 5G networks, and will exceed their 4G predecessors by almost 1.5 times. Capital expenditure could peak at $30 billion this year, according to Goldman Sachs Group Inc. analysts, up from $5 billion last year. Beijing wants more local governments and companies to get involved. Each station costs around 500,000 yuan ($71,361) and has a long value chain that includes electrical components, semiconductors, antenna units and circuit boards. The vast number of companies spawned by the project are all contributing to China’s push to get ahead.

For the industrial complex, the onset of 5G will enable greater connectivity between machines and much more data transfer and collection. Fifth-generation technology is expected to have a big impact through increasingly efficient and automated factory equipment, and tracking the movement of inventory and progress of production lines and assets. Manufacturing is expected to account for almost 40% of 5G-enabled industry output, according to Bernstein Research analysts.

From sensors and data clouds, to chips and collaborative robots and computer-controlled machinery, a whole universe of little-known Chinese companies is coming to the fore. Memory chip maker Gigadevice Semiconductor (Beijing) Inc. has ridden the trend, as has Yonyou Network Technology Co., China’s version of Salesforce.com Inc. For some of these companies, government subsidies are a significant part of earnings, as my colleague Shuli Ren has noted. Stock prices have surged in recent months for firms like Shennan Circuits Co., which makes printed circuit boards, and Maxscend Microelectronics Co., a manufacturer of radio frequency chips. Some are seeing their market capitalization values balloon by billions of dollars as Beijing has upped the ante on new infrastructure.

As Covid-19 absorbs the world’s attention, Beijing’s steady focus on implementing this industrial policy may make China the manufacturer of parts that most countries will need – soon. In other words, it will yet again become the factory floor, mastering the production of all things 5G.

Article originally published at https://www.bloomberg.com/opinion/articles/2020-07-12/china-s-next-trillion-dollar-war-is-over-5g-manufacturing

References:

https://techblog.comsoc.org/?q=China%205G#gsc.tab=0&gsc.q=China%205G&gsc.page=1

https://www.cnet.com/news/5g-will-change-the-world-and-china-wants-to-lead-the-way/

https://www.voanews.com/east-asia-pacific/chinas-long-term-plan-shape-future-technology

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

by Yigang Cai, PhD

Introduction:

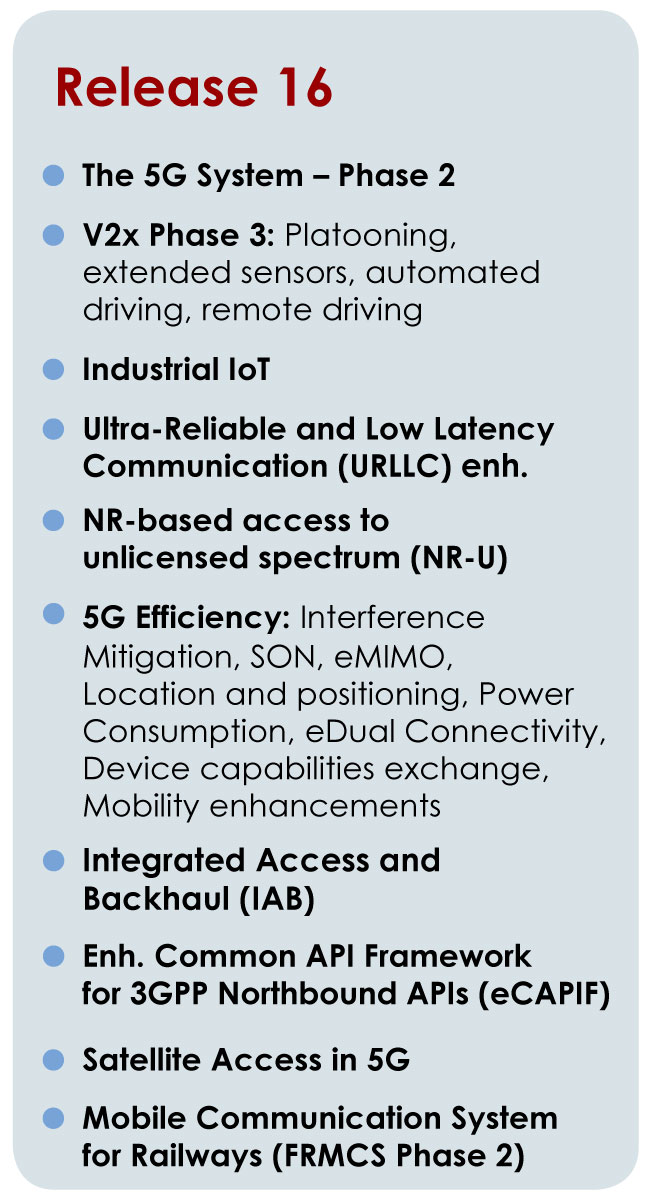

On July 3, 2020, 3GPP (the organization that generates all the specifications for cellular networks) announced that its Release 16 (R16) specification was frozen, and thereby declared the completion of the first evolution of “5G New Radio (NR).” As 3GPP’s specs have “no official standing,” they must be transposed by SDOs, like ITU, ETSI, ATIS, TSDSI (India), etc. The international standard for 5G Radio aspects is known as IMT 2020.specs, which includes the Radio Interface Technology (RIT) and Set of Radio Interface Technologies (SRIT) from various proponents, including 3GPP (IMT-2020/14, and /IMT-2020/13, respectively).

3GPP R16 is the first technical specification in the history of 3GPP that was reviewed and finalized through an e-meeting (due to the COVID-19 travel and meeting restrictions). The declared R16 completion was the result of collaboration and coordination amongst many global companies, government agencies and telecom regulators.

From the 3GPP website: “Rel-16 is now officially Frozen. Rel-15 and Rel-16 constitute the basis for 5G and this is a great achievement and recommended that delegates hold a personal celebration for this.”

The complete R16 spec not only enhances the functions of 5G, but also allows 5G to enter a new digital ecosystem. It takes into account factors such as cost and efficiency, so that the basic investment in wireless communications infrastructure can play a greater role and further help the digital transformation of the social economy. Let’s examine 3GPP’s 5G NR in the context of R15 and R16:

- “5G NR” in R15 was frozen in 2018. It strived to produce a “usable” specification for Physical (PHY) layer transmit/receive in 5G trials/pilots and early (pre-IMT 2020 standard) 5G networks.

- In contrast, “5G NR” in R16 will achieve an “easy to use” and more robust 5G transmit/receive capability.

3GPP R16 is a major release for the project as noted in an earlier IEEE Techblog post. It brings the specification organization’s ITU-R WP 5D submission “IMT-2020 Radio Interface Technology/Set of Radio Interface Technologies (RIT/SRIT)” to a more complete 5G system; what 3GPP calls “5G Phase 2.”

3GPP R16 is supposed to enhance Ultra-Reliable (UR) Low Latency Communications (URLLC), support V2V (vehicle-to-vehicle) and V2I (vehicle-to-roadside unit) direct connection communications, and support 5GS Enhanced Vertical and LAN Services as reported in the earlier IEEE Techblog article. Please refer to References below for further information.

URLLC is 1 of 3 use cases for 5G/IMT 2020. It is intended for mission critical, precise, accurate, always ON/never down, real time communications that require low latency in the 5G access and core networks.

SOURCE: 3GPP

…………………………………………………………………………………………………………………………………………………………………….

Editor’s Note: ONLY the 3GPP “5G Radio Aspects” are included in the forthcoming ITU-R IMT 2020.SPEC (RIT/SRIT) recommendation, which is expected to be approved in late November 2020 by ITU-R SG D. All the non-radio aspects, such as 5G Core Network, network slicing, network management, privacy and security, etc. will NOT be part of IMT 2020. However, those declared R16 completed work items are likely to be transposed by ETSI into international standards.

From 3GPP: “5G non-radio specs in R16 are handled by 3GPP Working Groups. None of the work is done in the SDOs – 3GPP does all of the work. See the 3GPP Work Plan at to see how the work is split between groups.”

……………………………………………………………………………………………………………………………………………………………………

Perspective on 5G Standard Essential Patents (SEPs):

The announcement of the 3GPP R16 freeze also means the “War of SEPs (Standard Essential Patents [1.]),” i.e. those patents that are related to 5G NR standards/specifications might come to the end of a critical stage. However, it’s likely that a new SEP war will start soon. But that is a subject for another day.

Note 1. A standard essential patent (SEP) is a patent that claims an invention that must be used to comply with a technical standard or specification to be standardized by an accredited standards development organization (SDO).

…………………………………………………………………………………………………………………………………………………………………………..

During 5G NR specification development, industries and companies have competed in a 5G patent race and generated thousands of SEPs. A recent study, published in the IEEE Techblog, found that Huawei was the undisputed leader in 5G SEPs. Some companies tried to convince the world they are leading the SEP war. However, the news and hype about published SEPs has often misled the public.

From this author’s standards and patent experiences, there are some facts of 5G SEPs which have been neglected in the SEP war:

- There is no one-to-one mapping between declared SEP and 5G standards feature. In fact, one standards contribution (e.g., WID, CR, WF or others in 3GPP) may be declared with one or multiple SEPs, or one SEP is declared in multiple contributions. SEP number declared does not match standards features.

- Many of SEP relevant standards contributions are not taken or baselined by standards bodies in standards specifications. Someone can do statistics what percentages (overall and/or per contributing company) of SEP relevant standards are agreed or approved in standards bodies.

- Some declared SEPs, including filed and published patents, may not be granted, or may even be rejected, after standards contributions are baselined.

- One standards contribution may be co-authored/co-signed with multiple companies, it is very likely multiple companies filed multiple patents for the same standards contribution.

There is no doubt SEPs can accelerate 5G standards development and enhance standards feature quality. But, the war of SEPs also brings some confusions in 5G technology development, implementation, deployment and applications.

First of all, the patent war lead to industries creating numerous patents which actually may not be “essential.” We all understand that a considerable percentage of those patents have no real value, i.e. they are not implementable or deployable and so not at all profitable.

Companies try to earn IPR revenues from SEPs and spend enormous efforts and finances focusing on creation of SEPs (for example, giving over the half of total IPR budget to SEP generation) because they probably believe licensing of granted SEPs can bring IPR revenue much quick. However, simple number of declared SEPs is much less important than innovation of critical 5G features and functions.

The 5G SEP war we have recently experienced concentrates on patent number; not patent quality. In fact, a feature critical invention can be much better and heavier than dozens of banal and non-essential SEPs which have been seen almost every aspect.

Conclusions:

Industry success relies on innovations, such as technique innovation, cultural innovation, and business innovation. There is no single high-tech company that has succeeded by starting numerous DEPs. Relying on licensing of granted patents cannot produce a great company. It does not mean patent productivities not important. Inventions in 5G should create more useful and reliable features, products, applications and capability to meet commerce and consumer needs (unfortunately, we have not seen many consumer-related 5G features so far).

5G and “5G Beyond” or “6G” (?) SEPs can strive for implementable and economic inventions, including investment and cost saving, energy saving and green communications. Innovations should drive ecosystem end-to-end solutions and use cases. Currently there are hundreds of 5G use cases that have been identified. Unfortunately, many of them (like the IoT use cases) can also be realized by existing 4G/LTE or enhanced WiFi.

Closing Note on URLLC (Ultra Reliable, ultra Low latency Communications):

URLLC is one of three use cases defined by ITU for the IMT 2020 standard and “5G” networks worldwide. It is included for both the 5G RAN and 5G Core Network in 3GPP Release 16. From a 3GPP report on URLLC:

“New 3GPP R16 URLCC use cases with higher requirements include: Factory automation Transport Industry, including the remote driving use case, and Electrical Power Distribution. A 3GPP “Study on Physical layer enhancements for NR ultra-reliable and low latency communication (URLLC)” concludes that it is beneficial to support a set of enhancements to URLLC, and further establishes detailed recommendations as given in Section 9.2 in TR 38.824.”