Author: Alan Weissberger

GSA 5G SA Core Network Update Report

GSA is tracking the emergence of the 5G SA core network, including the availability of chipsets and devices for customers, plus the testing and deployment of 5G SA networks by public mobile network operators as well as private network operators.

5G SA networks can be deployed in a variety of scenarios: as an overlay for a public 5G non-SA network, as a greenfield 5G deployment for a public network operator without a separate LTE network, or as a private network deployment for an enterprise, utility, education, government or other organization requiring its own private campus network.

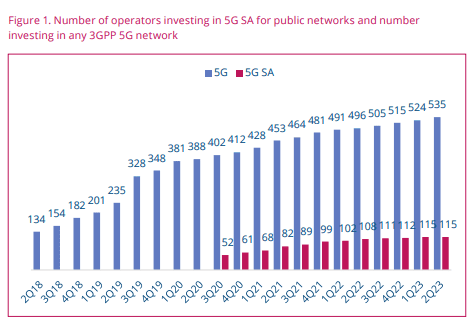

GSA has identified 115 operators in 52 countries and territories worldwide that have been investing (?) in public 5G SA networks in the form of trials, planned or actual deployments (see Figure 1.). This equates to 21.4% of the 535 operators known to be investing in 5G licenses, trials or deployments of any type.

At least 36 operators in 25 countries and territories are now understood to have launched or deployed public 5G SA networks, two of which have only soft-launched their 5G SA networks.

NOTE: Incredibly, that’s a DECREASE from GSA’s June 5G SA report which stated “GSA has catalogued 41 operators as having deployed or launched 5G standalone (SA) in public networks.”

Also, 19 cellular network operators have been catalogued as deploying or piloting 5G SA for public networks, and 29 as planning to deploy or evaluating, testing or trialing the technology.

Several organizations are testing, piloting or deploying 5G SA technologies for private networks. As of May 2024, 66 (just over 13% of total cellular private networks) organizations are known to be working with 5G SA core networks. These organizations include manufacturers, academic institutions, commercial research institutes, construction, communications and IT services, rail and aviation industries.

The number of 5G SA devices as a percentage of all 5G devices announced has been steadily increasing. They accounted for 35.6% of 5G devices in December 2019, 49.7% in December 2020 and 54.6% in December 2021 and a large increase to 81.8% in December 2022. As of June 2023, they account for 85.8%.

Software upgrades are almost always needed to enable 5G SA capability for existing 5G devices. There is a range of form factors to cater for different users, including modules for equipment manufacturers and vendors; customer-premises equipment (CPE), routers and gateways for enterprise or industrial customers or their systems integrators; CPE for home and business broadband; phones; and battery-operated hot spots for portable services.

Smartphones make up over half (59.0%) of the announced 5G devices with stated 5G SA support (1,034 phones), followed by fixed wireless access CPE (246) and modules (220).

Spectrum Support in 5G SA Devices:

Selected sub-6 GHz frequencies are increasingly well supported in 5G SA devices. The pattern of most-supported bands in sub-6 GHz 5G SA devices largely matches the pattern for most-supported bands across all 5G devices, with C-band, 2.6 GHz, 2 GHz, 1.8 GHz and 700 MHz.

Sub-6 GHz support by band, announced 5G SA devices, most-supported bands by most devices. Support for millimeter wave is not yet common.

Chipsets are being developed to support this capability — GSA has currently only catalogued eight chipsets specifically supporting 5G SA in millimeter-wave spectrum (eight mobile processors and platforms). 320 393 397 421 449 519 739 741 743 817 846 979 1,025 1,115 1,183 1,257 1,309 1,444 1,465 n48 n25 n66 n71 n12 n2 n20 n40 n79 n38 n7 n8 n5 n3 n28 n77 n1 n41 n78 We can expect support for spectrum bands above 6 GHz to increase in the future, as these bands are being promoted as an option for deployment of private 5G networks by regulators in various countries, as well as being promoted as capacity bands for high-traffic locations in public networks.

Summary:

The market is seeing the emergence of a strong 5G SA ecosystem with chipsets, devices of many types and users of public as well as private networks. We can expect to see the market go from strength to strength.

–>This author opines the 5G SA market is going from nowhere to no place!

As it does, GSA will continue to track its evolution and will be looking out for important new trends as they emerge.

Topics likely to become more important in the coming year in this context include 5G carrier aggregation in SA networks, ultrareliable low-latency communications (can’t be accomplished till 3GPP Release 16 URLLC in the RAN spec has been completed and performance tested) capabilities to support machine-to-machine connections in 5G SA systems, increasing support for millimeter-wave connections, network slicing in 5G networks and the introduction of VoNR in 5G SA networks.

……………………………………………………………………………………………………………………..

References:

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

5G SA networks (real 5G) remain conspicuous by their absence

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

We noted in a recent IEEE Techblog post that the 5G spending slowdown in the U.S. is broader than many analysts and executives expected. Well, it’s worse than that! The previously referenced negative comments from the CEO of Crown Castle, were corroborated by American Tower last week:

“The recent pullback was more abrupt than our initial expectations,” said Rod Smith, the CFO for cell tower firm American Tower, during his company’s quarterly conference call last week, according to Seeking Alpha. Smith was discussing the reduction in US operator spending on 5G, a situation that is now cutting $40 million out of American Tower’s margin expectations. “The initial burst of 5G activity has slowed down,” agreed the financial analysts at Raymond James in a note to investors following the release of American Tower’s earnings.

Cell tower giant SBA Communications said it too is seeing the broad pullback in spending that has affected its cell tower competitors (i.e. American Tower and Crown Castle). But the company’s management sought to reassure investors with promises of continued growth over the long term. During their earnings call, SBA executives said they expect activity to increase next year as T-Mobile looks to add 3.45GHz and C-band spectrum to its network, and as Dish Network restarts its network buildout.

The two largest 5G network equipment vendors that sell gear in the U.S. are seeing similar CAPEX cutbacks. “We see some recovery in the second half of the year but it will be slower than previously expected,” Nokia CEO Pekka Lundmark said earlier this month during his company’s quarterly conference call, in response to a question about the company’s sales in North America. His comments were transcribed by Seeking Alpha. Ericsson’s CEO, Borje Ekholm, is experiencing similar trends: “We see the buildout pace being moderated,” he said of the North American market, according to a Seeking Alpha transcript

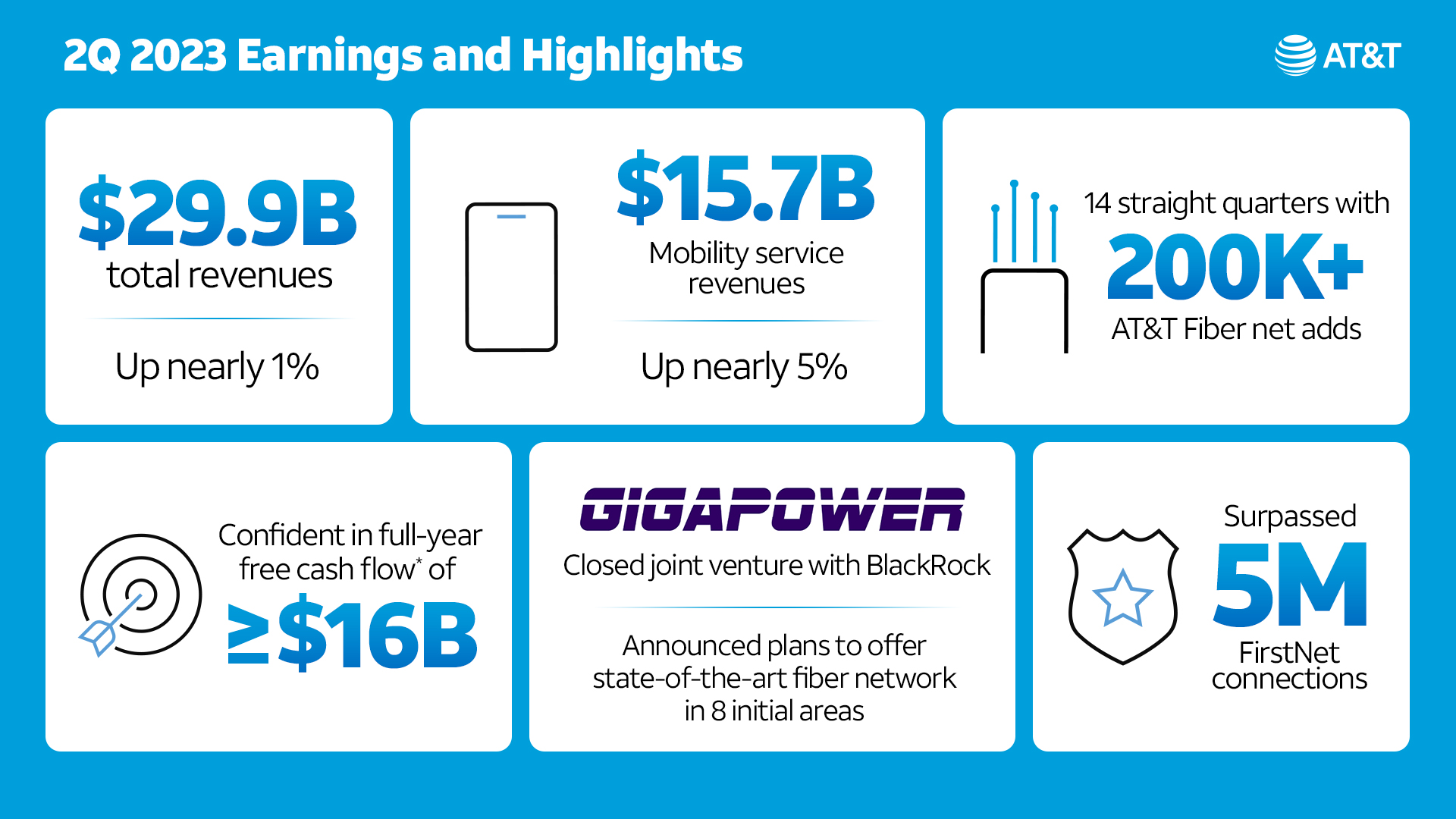

AT&T’s CFO Pascal Desroches confirmed the #1 U.S. network operator is slowing its network spending. “We expect to move past peak capital investment levels as we exit the year,” he said during AT&T’s quarterly conference call, as per a Seeking Alpha transcript. AT&T’s overall CAPEX would be $1 billion lower in the second half of 2023 when compared with the first half of this year due to greatly reduced 5G network build-outs.

“This implies full year capex of ~$23.7 billion, which management believes is consistent with their prior full year 2023 capex guidance of ‘~$24 billion, near consistent with 2022 levels’ and includes vendor financing payments,” wrote the financial analysts at Raymond James in their assessment of AT&T’s second quarter results, citing prior AT&T guidance.

“Although management declined to guide its 2024 outlook, it has suggested that it expects capital investments to come down as it progresses past the peak of its 5G investment and deployments. We believe the trends present largely known CY23 [calendar year 2023] headwinds for direct 5G plays CommScope, Ericsson and Nokia. Opportunities from FWA [fixed wireless access] might provide modest offsets and validate Cambium’s business. AT&T’s focus on meeting its FCF [free cash flow] targets challenge all of its exposed suppliers, which also include Ciena, Infinera and Juniper,” the financial services firm added.

Verizon CEO Hans Vestberg told a Citi investor conference in January that CAPEX would drop to about $17bn in 2024, down from $22bn in 2022″ “We continue to expect 2023 capital spending to be within our guidance of $18.25 billion to $19.25 billion. Our peak capital spend is behind us, and we are now at a business-as-usual run rate for capex, which we expect will continue into 2024,” explained Verizon CFO Tony Skiadas during his company’s quarterly conference call last week, according to Seeking Alpha.

“After years of underperformance, perhaps the best argument for Verizon equity is that expectations are very low. They are coming into a phase where capex will fall now that they’ve largely completed their 5G network augmentation. Higher free cash flow will flatter valuations, but it will also, more importantly, lead to de-levering first, and potentially even to share repurchases down the road,” speculated the analysts at MoffettNathanson in a research note to investors following the release of Verizon’s earnings.

T-Mobile USA had previously said its expansive 5G build-out had achieved a high degree of scale and it would reduce its capex sharply starting in 2023.”We expect capex to taper in Q3 and then further in Q4,” said T-Mobile USA’s CFO Peter Osvaldik during his company’s quarterly conference call last week, according to Seeking Alpha. He said T-Mobile’s capex for 2023 would total just under $10 billion. T-Mobile hopes to cover around 300 million people with its 2.5GHz midband network by the end of this year. Afterward, it plans to invest in its network only in locations where such investments are necessary.

Similarly, Verizon and AT&T are completing deployments of their midband C-band 5G networks, and will slow spending after doing so. That’s even though neither telco has deployed a 5G SA core network which involves major expenses to build, operate and maintain.

Dish Network managed to meet a federal deadline to cover 70% of the U.S. population with it’s 5G OpenRAN in June. As a result, the company said it would pause its spending until next year at the earliest.

American Tower was a bit more hopeful that CAPEX would pick up in the future:

- “Moderation in carrier spend following the recent historic levels of activity we’ve seen in the industry isn’t unexpected and is consistent with past network generation investment cycles,” explained CFO Rod Smith.

- “The cycles typically progress as there’s a coverage cycle. It’s what we’ve seen in past cycles, including 3G and 4G. It’s an initial multiyear period of elevated coverage capex, and it’s tied to new G spectrum aimed at upgrading the existing infrastructure,” said American Tower’s CEO Tom Bartlett. “And then later in the cycle, it will fill back into a capacity stage where we’ll start to see more densification going on. So I’m hopeful that our investor base doesn’t get spooked by the fact that this is a pullback. It’s very consistent. The cadence is really spot on with what we’ve seen with other technologies.”

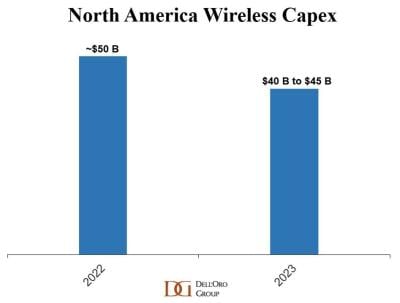

In April, Dell’Oro Group analyst Stefan Pongratz forecast global telecom capex is projected to decline at a 2% to 3% CAGR over the next 3 years, as positive growth in India will not be enough to offset sharp capex cuts in North America. He also predicted that wireless CAPEX in the North America (NA) region would decline 10% to 20% in 2023 as per this chart:

Now, that NA CAPEX decline seems more like 30% this year!

……………………………………………………………………………………………………………………………………………

References:

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

USA’s 5G capex bubble will burst this year as three main operators cut back

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

Worldwide Telecom Capex to Decline in 2023, According to Dell’Oro Group

https://www.fiercewireless.com/wireless/wireless-capex-north-america-expected-decline-10-20-2023

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

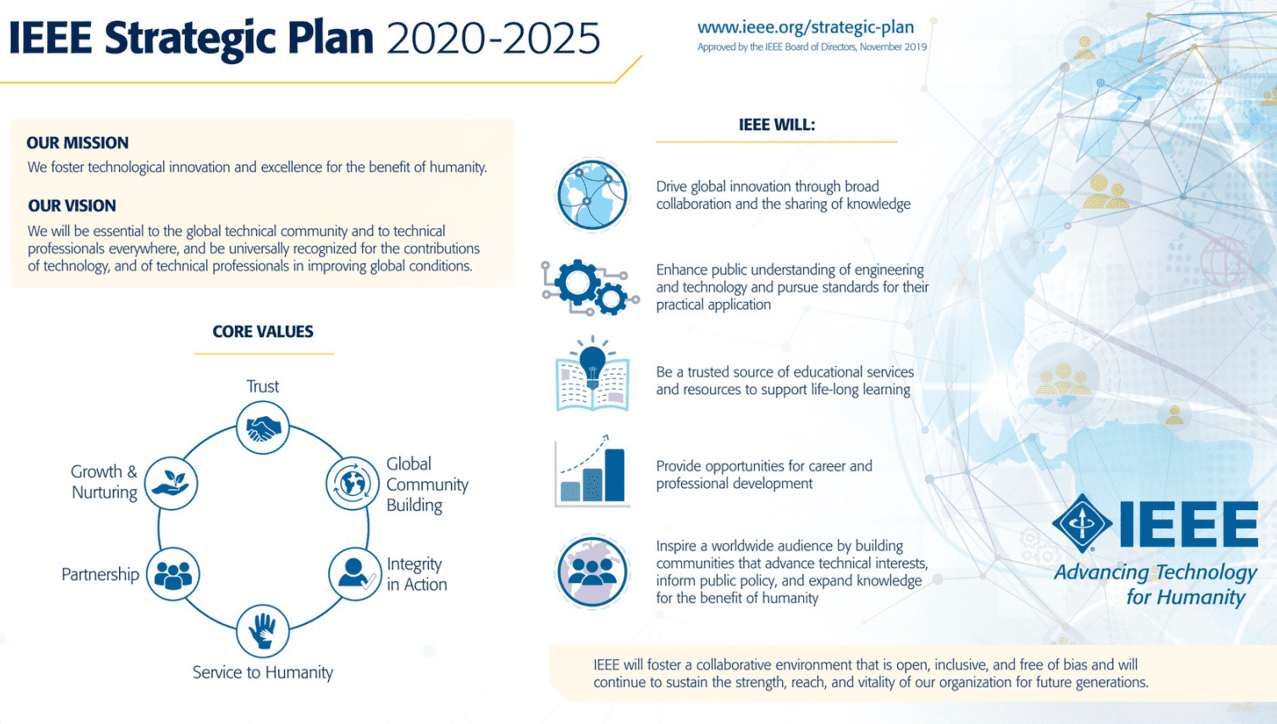

IEEE President Elect: IEEE Overview, 2024 Priorities and Strategic Plan

by Tom Coughlin, IEEE President Elect (edited by Alan J Weissberger)

IEEE at a Glance:

- 420,000 members in 190+ countries

- Sponsors 2,000+ conferences in 96 countries annually

- 5 million+ documents in the IEEE Xplore® digital library, with 15 million+ downloads each month

- Publishes approximately 200 transactions, journals, and magazines; IEEE is 3 out of the top 5 publications on AI, Automation and Control Systems, and Computer Science HW and SW

- Leader in tech patents granted

- 1,076 active standards (including IEEE 802.3 Ethernet and IEEE 802.11 WiFi)

- 900+ standards under development

- 46 Societies and Technical Councils

- IEEE members have won 21 Nobel Prizes

- Lots of volunteer opportunities!

Technical Expertise that is Broad and Deep:

IEEE is the most-cited publisher in new patents from top patenting organizations!

A study of the top 50 patenting organizations ranks IEEE #1 again:

- Nearly 3x more citations than any other publisher

- Patent referencing to IEEE increased 864% since 1997

- Analyzed by discipline, IEEE is the #1 most referenced publisher in AI, Blockchain, Computing, Cybersecurity, IoT, Power Systems, Semiconductors, Telecom and more

- The importance of sci-tech literature in patents is rising IEEE research is increasingly valuable to innovators

IEEE Priorities for 2024:

- Increasing outreach to younger IEEE members

- Increase engagement with industry groups

- Increasing our outreach to the broader public

- Make investments in new products and services

- Improve the communications and coordination between standards activities and the technical societies

Strengthening IEEE’s Value to Industry:

This will require serious work at the local section level as well as by various IEEE Organizational Units. Goals and objectives:

- Get members from industry involved in your local section leadership

- Work with your local companies

- Participate in local trade shows (exhibits, talks)

- Recognize local companies for their activities

- Getting IEEE engaged with industry is an important element in retaining and attracting younger members (one of our 2024 IEEE Priorities)

- IEEE organizational units must be part of this effort!

Note: IEEE will need to create a new strategic plan out to 2030.

FCC proposes 100 Mbps download as U.S. minimum broadband speed

Federal Communications Commission (FCC) Chairwoman Jessica Rosenworcel proposed a national goal of 100% affordable broadband access in the U.S. According to the official FCC release, Rosenworcel seeks to gauge the progress of broadband deployment, focusing on crucial characteristics such as affordability, adoption, availability, and equitable access for all Americans.

“In today’s world, everyone needs access to affordable, high-speed internet, no exceptions,” said Chairwoman Rosenworcel. “It’s time to connect everyone, everywhere. Anything short of 100% is just not good enough.”

As part of the plan, FCC now proposes to increase the national fixed broadband standard to 100 Mbps for download and 20 Mbps for upload, pushing internet service providers to enhance their offerings and reach more Americans. That’s up from 25 Mbps for download and 3 Mbps for upload which was established in 2015.

Anticipating future demands, Rosenworcel outlined a separate national goal of 1 Gbps for download and 500 Mbps for upload, ensuring that the United States remains at the forefront of digital innovation.

By increasing the national fixed broadband standard and setting ambitious targets, the FCC is taking decisive steps towards digital inclusion, opening up a world of opportunities in education, business, healthcare, and beyond.

References:

5G subscription prices rise in U.S. without killer applications or 5G features (which require a 5G SA core network)

According to 9to5Mac, both AT&T and Verizon are now increasing the cost of their legacy smartphone mobile service pricing plans by around $3 per line per month. That’s after both Verizon and AT&T raise their prices this Spring. The increased prices from both Verizon and AT&T are set to take effect in August. Verizon is increasing prices on: 5G Start, Go Unlimited, Beyond Unlimited, Beyond Unlimited w/5G Ultra Wideband, Above Unlimited, Above Unlimited w/5G Ultra Wideband, and Single Unlimited Talk & Text 500MB. That’s according to this reddit thread, which has several customers confirming the new incoming charges.

The AT&T support page that details the new fees that 5G subscribers will pay says that the price increase will “allow [AT&T] to continue to deliver the great wireless service you expect.”

–>Does anyone really believe that?

The 5G price increases from AT&T and Verizon seem particularly egregious as neither telco has deployed a 5G SA core network, without which there are no 5G features (e.g. network slicing, security, automation/ orchestration, MEC, etc).

These are just the latest price and fee hikes enacted by the nation’s big 5G network service providers. For example, Verizon is increasing the price on its 5G home broadband service to new customers by $10 per month. Separately, T-Mobile, AT&T and Verizon are reducing their autopay discounts for customers who use credit cards. Even some prepaid cellular network providers, like T-Mobile’s Metro, are raising prices.

Here’s what each company said on this topic during their earnings calls this week:

“We look for opportunities to alter that value equation back to the customer where they perceive that they’re getting a better value and better service and something more and it accretes into the business in terms of us being able to grow ARPUs [average revenues per user],” said AT&T CEO John Stankey this week during his company’s second quarter earnings call, according to Seeking Alpha, in response to a question about pricing. “As you can see, our profitability numbers have been really, really strong. And that all comes from managing the complete equation.”

Verizon’s CFO offered a similar take this week: “We continued to benefit from pricing actions, including a recent change to our Verizon Mobile Protect offering,” Tony Skiadas said during Verizon’s own second quarter call, according to Seeking Alpha. “We continue to assess opportunities to take targeted pricing actions to better monetize our products and services as we deliver great value for our customers. For example, we recently announced an increase in our FWA [fixed wireless access] bundle pricing for new customers, which we expect will provide service revenue benefits in the second half of the year.”

Analyst Comments:

“5G was supposed to offer connectivity products that could be adapted to different device types, verticals and industries, geographies, vehicles, drones,” wrote analyst Patrick Lopez, with Core Analysis. “The 5G business case hinges on enterprises, verticals and government adoption and willingness to pay for enhanced connectivity services. By and large, this hasn’t happened yet. There are several reasons for this, the main one being that to enable these, a network overall is necessary.”

“Recent administrative rate plan adjustments on older phone plans, a $10 bump to fixed wireless pricing, and the introduction of myPlan (along with comps from last year’s price increases) boosted consumer ARPA [average revenue per account] growth to +6.2% in Q2, and it should likely sustain at +4.5% or higher in the 2H of 2023,” wrote the financial analysts at Wells Fargo in a note to investors following the release of Verizon’s second quarter earnings [1.] . “These adjustments should put wireless service revenue growth at ~3.1% for FY’23, well within the range despite continued challenges on the consumer subs front,” they added.

Note 1. Verizon has struggled with sluggish customer gains. The company Verizon reported total postpaid phone net customer additions of roughly 8,000 during the second quarter. That figure includes approximately 136,000 net customer losses in Verizon’s consumer-focused business, offset by 144,000 net customer additions in Verizon’s business-focused division.

“With T-Mobile continuing its performance lead over Verizon and AT&T in independent studies and usually offering more affordable plans, these August price increases could be a net gain for the Un-carrier,” Michael Potuck, 9to5mac.com

…………………………………………………………………………………………………………………………………………………………………………………..

In the U.S. only T-Mobile and Dish Network have deployed 5G SA core networks, but neither have touted any 5G features available. T-Mobile states on its website, “T-Mobile and other CSPs are still in the early stages of 5G network slicing implementation. Gartner describes the industry as being in the “get started” phase of a three-phase rollout [2.].

Note 2. Gartner report: “Create Value and Drive Revenue With 5G Network Slicing Phased Approach,” Susan Welsh de Grimaldo, April 6, 2021.

References:

Verizon and AT&T raising prices for the second time this year, here’s who is impacted – 9to5Mac

https://www.droid-life.com/2023/07/28/verizon-5g-start-unlimited-price-increase/

The latest 5G innovation: Even more price increases | Light Reading

Another Opinion: 5G Fails to Deliver on Promises and Potential

Global Telco AI Alliance to progress generative AI for telcos

- Four major global telcos joined forces to launch the Global Telco AI Alliance to accelerate AI transformation of the existing telco business and create new business opportunities with AI services.

- They signed a Multilateral MOU for cooperation in the AI business, which includes the co-development of the Telco AI Platform.

Deutsche Telekom, e&, Singtel and SK Telecom have established a new industry group that aims to progress generative AI. Called the Global Telco AI Alliance, it represents a coordinated effort by these four operators to accelerate the AI-fuelled transformation of their businesses, and to develop new, AI-powered business models.

The Telco AI Platform will serve as the foundation both for new services – like chatbots and apps – as well as enhancements to existing telco services. The alliance members plan to establish a working group whose task will be to hammer out co-investment opportunities and the co-development of said platform.

Members will also support one another in operating AI services and apps in their respective markets, and cooperate to foster the growth of a telco AI-based ecosystem.

As of today, all the operators have done is sign a memorandum of understanding (MoU), under which they pledge to carry out all this work. A signing ceremony took place in Seoul, Korea, and was attended – either in person or virtually – by the CEOs of e&, Singtel and SK Telecom, and Deutsche Telekom’s board member for technology and innovation, Claudia Nemat. The Global Telco AI Alliance will also have to ensure that any AI-based services they develop are capable of accounting for cultural differences. They won’t get very far if their virtual assistants make culturally insensitive recommendations, for example.

The seniority of these signatories represents a strong statement of intent though, and the group said it will discuss appointing C-level representatives from each member to the Alliance.

“In order to make the most of the possibilities of generative AI for our customers and our industry, we want to develop industry-specific applications in the Telco AI Alliance. I am particularly pleased that this alliance also stands for bridging the gap between Europe and Asia and that we are jointly pursuing an open-vendor approach. Depending on the application, we can use the best technology. The founding of this alliance is an important milestone for our industry,” said Claudia Nemat, Board Member Technology and Innovation at Deutsche Telekom.

“We recognize AI’s immense potential in reshaping the telecommunications landscape and beyond and are excited to embark on this transformative journey with the formation of the Global Telco AI Alliance. The alliance signifies a strategic commitment to driving innovation and fostering collaborative efforts. Our shared goal is to redefine industry paradigms, establish new growth drivers through AI-powered business models, and pave the way for a new era of strategic cooperation, guiding our industry towards an exciting and prosperous future,” said Khalifa Al Shamsi, CEO of e& life.

“This alliance will enable us and our ecosystem of partners to significantly expedite the development of new and innovative AI services that can bring tremendous benefits to both businesses and consumers. With our advanced 5G network, we are well-placed to leverage AI to ideate and co-create and are already using it to enhance our own customer service and employee experience, increase productivity and drive learning,” said Yuen Kuan Moon, Group Chief Executive Officer of Singtel.

It is not clear at this stage of proceedings whether the operators plan to develop their own in-house AI assets, or license them from the likes of OpenAI’s ChatGPT, or Google Bard. On the one hand, going with a third party that has done most of the legwork offers efficiencies, but on the other hand, the Global Telco AI Alliance might prefer an AI that specialises in telecoms, rather than a generalist.

Japanese vendor NEC showed earlier this month – with the launch of its own large language model (LLM) for enterprises in its home market – that generative AI isn’t necessarily the preserve of Silicon Valley big tech. It also highlighted the desire to develop localised AI for different languages.

The announcement also doesn’t attempt to grapple with any potential ethical pitfalls that might befall the Alliance. While it’s a fairly safe bet that responsible AI development will be an important consideration, it’s always better when companies make that clear.

Even big tech has come round to that way of thinking, with the launch earlier this week of the Frontier Model Forum. Established by Google, Microsoft, OpenAI and self-styled ethical AI company Anthropic, the group aims to advance the development of responsible artificial intelligence for the benefit of humanity.

References:

https://telecoms.com/522891/telcos-team-up-for-ai-platform-project/

https://telecoms.com/522865/google-microsoft-anthropic-and-openai-launch-ai-safety-body/

https://telecoms.com/522603/nec-launches-its-own-generative-ai/

AT&T, Verizon and Comcast all lost fixed broadband subscribers in 2Q-2023

The three most dominant broadband wireline ISPs in the U.S. all lost wireline subscribers in Q2-2023.

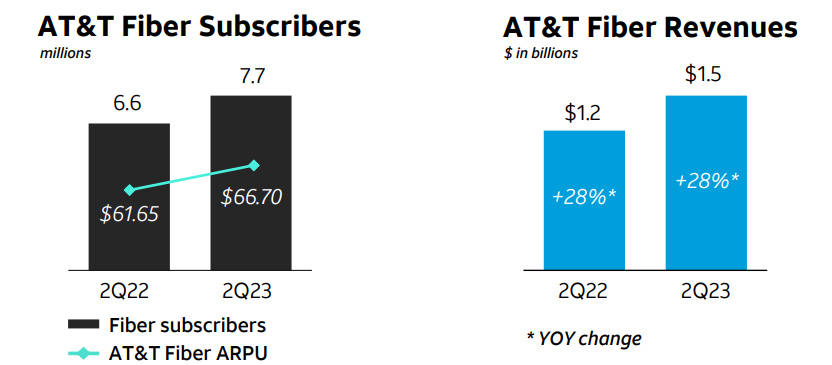

1. AT&T’s net total broadband access showed a loss of 35,000 subscribers in Q2-2023, which widened from a loss of -25,000 in the year-ago quarter. AT&T ended Q2 with 15.3 million broadband connections (including DSL), down 1.3% from 15.5 million a year earlier.

AT&T continued to add new fiber subscribers, but the pace of that growth slowed. AT&T added 251,000 fiber subs in Q2, down from +316,000 in the year-ago quarter and down from +272,000 in the prior quarter.

AT&T ended the period with 7.73 million fiber subs. Fiber average revenue per user (ARPU) was $62.26, up from $57.64 in the year-ago period.

(Source: AT&T Q2 2023 earnings presentation)

AT&T added about 500,000 fiber locations during the quarter, ending Q2 with 20.2 million. CEO Stankey said AT&T remains on track to build fiber-to-the-premises (FTTP) tech to 30 million locations by 2025.

AT&T’s average fiber penetration rate is hovering at 38%. “Everywhere we put fiber in the ground, we feel good about our ability to win with consumers,” Stankey said.

AT&T shed 286,000 non-fiber subscribers in the quarter, lowering that total to 5.95 million. AT&T also lost another 25,000 DSL subs in the quarter, ending the period with just 259,000.

Source: AT&T

…………………………………………………………………………………………………………………..

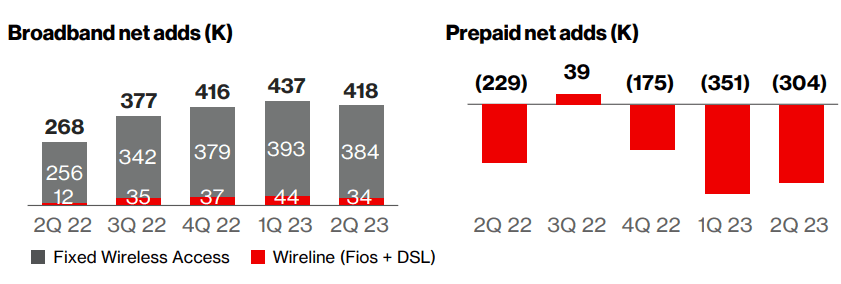

2. While Verizon added 54K FiOS internet subscribers in 2Q-2023 (51K FiOS net adds from Consumer, 3K from Business customers), it had a net loss of 304K wireline broadband subs when the loss of DSL subscribers was factored in.

From Verizon’s 2Q-2023 earnings call presentation:

Source: Verizon

Remarkably, Verizon added a net 384K fixed wireless subscribers, an increase from 256,000 fixed wireless net additions in second-quarter 2022. Verizon now has nearly 2.3 million subscribers on its fixed wireless service.

Due to FWA growth, Verizon reported total broadband net additions of 418,000 in 2Q-2023.

……………………………………………………………………………………………………………………………..

Comcast, the largest U.S. ISP, lost 20,000 residential broadband subscribers, lowering its total to 29.79 million. Comcast’s total broadband subscriber loss of 19,000 (including a gain of 1,000 business broadband customers), was better than the -74,000 expected by Wall Street analysts.

Comcast, which lost 10,000 residential broadband subs in the year-ago quarter, warned in April that it doesn’t expect to see much in the way of broadband subscriber growth gains in the near-term. The company also noted that it expected those numbers to be even lower in Q2 due to a slow housing move market paired with traditional “seasonality” driven by students and retirees returning for the summer.

Dave Watson, president and CEO of Comcast Cable, said on today’s earnings call that he expects Comcast to return to broadband subscriber growth “over time.” One way Comcast is pursuing subscriber growth is through network expansion and edge-outs that will total about 1 million locations in 2023. Comcast, which operates in 39 US states, also intends to participate in the Broadband Equity Access and Deployment (BEAD) program, which recently announced state-by-state funding allocations.

Comcast has cited average revenue per user (ARPU) growth as the key metric of its broadband business. And Comcast’s broadband ARPU grew 4.5% in the quarter, matching the ARPU growth rate it posted in the prior quarter.

……………………………………………………………………………………………………………………..

Here are the top 20 broadband wireline ISPs in the U.S.:

| # | Internet Service Provider | Type | States |

| 1 | Comcast | Cable | National |

| 2 | Charter Communications | Cable | National |

| 3 | AT&T | Fiber | National |

| 4 | Verizon | Fiber | Mid-Atlantic, Northeast |

| 5 | Cox Communications | Cable | National |

| 6 | Altice USA | Cable/Fiber | National |

| 7 | Lumen Technologies | Fiber | West, Florida |

| 8 | Frontier Communications | Fiber | National |

| 9 | Mediacom Communications | Cable | Midwest, Southeast |

| 10 | Astound Broadband | Cable/Fiber | National |

| 11 | Windstream Holdings | Fiber | South, Midwest, Northeast |

| 12 | Brightspeed | Fiber | Midwest, Southeast |

| 13 | Cable One | Cable | West, Midwest, South |

| 14 | Breezeline | Cable/Fiber | East Coast |

| 15 | WideOpenWest (WOW!) | Cable/Fiber | AL, FL, GA, MI, SC, TN |

| 16 | TDS Telecom | Cable/Fiber | National |

| 17 | Midco (Midcontinent Communications) | Cable | MN, ND, SD, WI, KS |

| 18 | Consolidated Communications | Fiber | National (22 states) |

| 19 | Google Fiber | Fiber | National (16 states) |

| 20 | Ziply Fiber | Fiber | WA, OR, ID, MT |

Source: https://dgtlinfra.com/top-internet-providers-us/

……………………………………………………………………………………………………………………………..

References:

https://about.att.com/story/2023/q2-earnings.html

SatCom market services, ITU-R WP 4B, 3GPP Release 18 and ABI Research Market Forecasts

Satellite Communications (SatCom) market services will include fixed broadband Internet access, satellite Internet of Things (IoT), and Non-Terrestrial Network (NTN) mobile (satellite-to-cell services). These services will experience growth due to more satellite players launching networks in Low Earth Orbit (LEO), alongside an increasing interest in terrestrial and satellite network convergence.

The market is expanding rapidly and major players are quickly recognizing its potential. While satellite networks are experiencing rapid changes due to innovations in small satellites and nanosatellites, Software-Defined Networking (SDN) applications, High Throughput Satellites (HTS), and inter-satellite links, terminals on the ground continue to see growth, with Very Small Aperture Terminals (VSAT) SatCom solutions maintaining dominance in the market.

According to Research & Markets, the SATCOM equipment market is valued at $22.6 billion in 2023 and is projected to reach $38.7 billion by 2028, at a CAGR of 11.3% from 2023 to 2028. Based on frequency, the multiband frequency is projected to register the highest during the forecast period 2023-2028.

………………………………………………………………………………………………………………………………..

ITU-R Working Party 4B (WP 4B) is responsible for recommendations related to: Systems, air interfaces, performance and availability objectives for FSS, BSS and MSS, including IP-based applications and satellite news gathering.

WP 4B has a working document which is a preliminary draft new Report ITU-R M.[SAT IOT] – Technical and operational aspects of satellite Internet of Things (IoT) applications, a work plan and working document on Work plan for development of a preliminary draft new Report ITU-R M.[DEVELOPMENT AND TECHNOLOGY TRENDS FOR THE SATELLITE COMPONENT OF INTERNATIONAL MOBILE TELECOMMUNICATIONS]. WP5D last meeting was July 2023, but the following meeting won’t be till April 29 to May 5, 2024!

Yet the real SatCom air interface specifications work is being done by 3GPP, under the umbrella term of NTN:

3GPP Release 17 introduced new network topologies that are based on High-Altitude Platforms (HAPs) and LEO and Geostationary Orbit (GEO) satellites. Crucially, these laid out the foundation for satellite IoT and NTN mobile as Release 17 extended the cellular IoT protocols, LTE-M and Narrowband (NB)-IoT for satellites. This enabled two new standards for satellite networks, IoT-NTN and New Radio-NTN (NR-NTN). SatCom with individual mobile devices will close gaps in the terrestrial cellular networks to provide global connectivity. It will target issues like unreachability and service continuity in underserved regions and improve network resilience around the world.

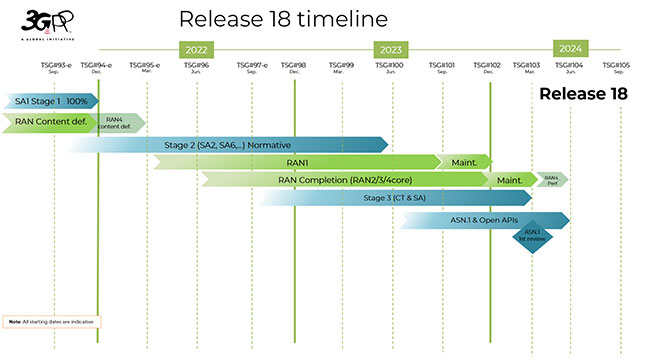

The discussion items in the upcoming 3GPP Release 18 are expected to enhance NTN Mobile and Satellite IoT as key satellite enabled services. While Release 17 established the standards for IoT-NTN and NR-NTN, Release 18 will evolve both those specifications for IoT and satellite-to-mobile broadband connectivity. For NR-NTN, there are plans to run NR-NTN on Radio Frequency (RF) spectrum above 10 Gigahertz (GHz) to serve the aerospace and maritime industry, alongside businesses and buildings (with building-mounted devices). Release 18 is also expected to include enhancements in satellite backhaul, specifically the dedication of more spectrum for Mobile Satellite Services (MSS), with approximately 80 Megahertz (MHz) of uplink in the L-band and downlink in the S-band.

At the same time, improvements targeted toward Fixed Satellite Services (FSS) will be brought about by Release 18 as well, with the consideration of more bands in the Ka frequency bands for downlink (17.7 – 20.2 GHz) and uplink (27.5 – 30 GHz). While the specifics of 3GPP Release 18 are still in development, 3GPP has already established the boundaries of Release 18 that will benefit the SatCom market. Furthermore, with the recent mergers of Eutelsat and OneWeb in 2022 and Viasat and Inmarsat in 2023, in addition to the launch of Infrastructure for Resilience, Interconnectivity and Security by Satellite (IRIS2), a project endorsed by the European Union (EU) in 2022 to enhance connectivity throughout the EU, more partnerships and agreements are expected to arise ahead of the official launch of 3GPP Release 18 in 2024.

ABI Research says that 3GPP Release 18 aims to unlock new capabilities toward the evolution of 5G-Advanced and establish new regulatory requirements, along with new bands, while optimizing satellite access performance. The market research firm forecasts the market value for worldwide SatCom to be US$94.9 billion by 2027 (MD-SATCC-102). The growth of NTN mobile, in addition to broadband, will drive the market moving forward, with special mention of NTN mobile revenue likely to shoot from 0.2% of the total revenue in 2023 to 8.8% of the overall SatCom revenue by 2027. ABI Research recognizes that greater value has been placed on the protocols, such as 3GPP Release 18 and beyond, that will develop and nurture the SatCom space.

Strategic partnerships between terrestrial and NTN operators, solution providers/Communication Service Providers (CSPs), and wireless end-user equipment vendors are currently on the rise and will be critical in expanding the ecosystem and market toward 2027. For instance, MediaTek and Qualcomm have partnered with Inmarsat and Iridium, respectively, to target the NTN mobile market.

Meanwhile, AST SpaceMobile has agreements with AT&T, Rakuten Mobile, and several other mobile network operators. Where satellite IoT is concerned, CSPs like Deutsche Telekom have established partnerships with Intelsat and Skylo, whereas Telefónica and Sateliot are working together to trial satellite IoT connectivity. While partnerships are a good indicator of SatCom’s market potential, it is important that operators consider differentiated and unique product offerings for clients.

The value proposition that SatCom players can offer their target market will be essential for this process. Some examples might include integrated end-to-end IoT solutions for maritime, offshore connectivity, or end-to-end NTN mobile solutions that marry NTN hardware and software for satellite connectivity. Nonetheless, the creation of new value added services will benefit from 3GPP Release 18, in addition to driving the overall momentum and agenda of the Satellite Communications market.

References:

https://www.itu.int/en/ITU-R/study-groups/rsg4/rwp4b/Pages/default.aspx

ABI Research’s Highlights & Developments in the SatCom NTN Market (PT-2740)

https://finance.yahoo.com/news/global-satellite-communication-satcom-equipment-214500758.html

https://www.3gpp.org/specifications-technologies/releases/release-18

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

China Mobile Partners With ZTE for World’s First 5G Non Terrestrial Network Field Trial

ITU-R M.2150-1 (5G RAN standard) will include 3GPP Release 17 enhancements; future revisions by 2025

Intel to make custom 5G system-on-chip (SoC) for Ericsson

Intel has agreed to manufacture custom 5G system-on-chip (SoC)s for Ericsson, which the Swedish wireless equipment company will use to develop what promises to be “highly differentiated” networking products. The chips will be based on Intel’s latest fabrication process, 18A (1.8nm), which is so new that it has yet to begin commercial production.

When it does, the chips will offer up to a 10% improvement in performance per watt compared to current production processes. This is important because the faster the processor, the faster the network (think lower latency).

Highlights:

- Announcement signals confidence in 18A process technology and underscores progress on Intel’s five-nodes-in-four-years roadmap to regain process leadership.

- News shows continued collaboration between the companies to optimize standard Intel® Xeon® Scalable processor-based platforms for Ericsson’s Cloud RAN solutions.

- Industry leaders advance the adoption of 5G, building sustainable and resilient networks of the future.

Intel and Ericsson have also agreed to work more closely together to optimize the performance of Intel’s latest Xeon RAN processors on Ericsson’s cloud RAN hardware, taking aim at capacity, energy efficiency, flexibility and scalability.

In June, Ericsson laid claim to being the first vendor to use the new chip – the 4th Gen Intel Xeon Scalable processor with Intel vRAN Boost, to use its official but not exactly succinct name – to carry out an end-to-end cloud RAN call. That in itself was an achievement given that the processor made its official debut at Mobile World Congress a few months earlier.

“As our work together evolves, this is a significant milestone with Ericsson to partner broadly on their next-generation optimized 5G infrastructure. This agreement exemplifies our shared vision to innovate and transform network connectivity, and it reinforces the growing customer confidence in our process and manufacturing technology,” said Sachin Katti, senior vice president and general manager of the Network and Edge group at Intel. “We look forward to working together with Ericsson, an industry leader, to build networks that are open, reliable and ready for the future.”

18A is Intel’s most advanced node on the company’s five-nodes-in-four-years roadmap. After new gate-all-around transistor architecture – known as RibbonFET – and backside power delivery – called PowerVia – appear first in Intel 20A, Intel will deliver ribbon architecture innovation and increased performance along with continued metal linewidth reduction in 18A. Combined, these technologies will put Intel back in the process leadership position in 2025, elevating future offerings its customers bring to market.

“Ericsson has a long history of close collaboration with Intel, and we are pleased to expand this further as we utilize Intel to manufacture our future custom 5G SoCs on their 18A process node, which is in line with Ericsson’s long-term strategy for a more resilient and sustainable supply chain,” said Fredrik Jejdling, executive vice president and head of Networks at Ericsson. “In addition, we will be expanding our collaboration that we announced at MWC 2023 to work together with the ecosystem to accelerate industry-scale open RAN utilizing standard Intel Xeon-based platforms.”

As 5G deployments continue, the future lies in fully programmable, open software-defined networks powered by the same cloud-native technologies that transformed the data center, delivering unparalleled agility and automation.

To realize the best performance, innovation and global scale, the industry needs to work together and continue to synchronize network specifications as part of one global set of standards. Intel and Ericsson collaborate with other leading technology companies to bring these benefits to their customers toward industry-scale open RAN.

References:

https://telecoms.com/522857/intel-to-produce-custom-5g-chips-for-ericsson/

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

The 5G spending slowdown in the U.S. is broader than many analysts and executives expected. Dell’Oro’s Stefan Pongratz recently wrote:

“Even if it is early days in the broader 5G journey, the challenge now is the comparisons are becoming more challenging in the more mature 5G markets and the upside with the slower-to-adopt 5G regions is not enough to extend the growth streak. Meanwhile, growth from new revenue streams including Fixed Wireless Access and enterprise LTE/5G is not ramping fast enough to change the trajectory. With 5G-Advanced not expected to trigger a new capex cycle, the question now is no longer whether RAN will grow. The question now is, rather, how much will the RAN market decline before 6G comes along?”

AT&T, Verizon, T-Mobile and Dish Network broadly spent 50% less on their 5G network build-outs than Crown Castle [1.] CEO Jay Brown expected. As a result, Crown Castle cut $90 million in expected services revenues from its full year 2023 financial forecast.

……………………………………………………………………………………………………………………………………

Note 1. Crown Castle offers services including new cell site development and equipment installation. The company has a nationwide footprint of 40K+ cell towers, ~115K small cell nodes on air or under contract and more than 80K route miles of fiber optic cable.

…………………………………………………………………………………………………………………………………….

“So the back half of 2023, we did see a change relative to what we previously expected,” Brown said last week during his company’s quarterly conference call, as per a Seeking Alpha transcript. “The first half of 2023 came in exactly where we thought it was going to, and we saw the change in activity during the quarter. And that’s what affected our second half of the year, the activity that we’ll see in the – we believe we’ll see in the third and the fourth quarter.”

“I believe this initial surge in tower activity [among U.S. network operators] has ended,” Brown said, arguing that early 5G network buildout programs are coming to an end. “In the second quarter, we saw tower activity levels slowed significantly. As a result, we are decreasing our 2023 outlook primarily as a result of lower tower services margin.”

“From our perspective, this new guidance is as close to a disaster as it gets,” wrote the financial analysts at KeyBanc Capital Markets in a note to investors last week. The analysts said the cell tower industry broadly is very stable, and warnings like those from Crown Castle are few and far between. “We struggle to understand how the … trajectory could change so materially.”

…………………………………………………………………………………………………………………………….

Nokia and Ericsson take a hit:

5G network equipment vendor Nokia experienced a huge revenue drop of 40% from the North America market. Nokia CFO Marco Wiren stated that was “a result of declines across all business groups as inventory digestion continued and [communication service providers] reevaluated their spending plans.”

“The weakness was clearly visible,” Nokia CEO Pekka Lundmark said earlier this month, according to Seeking Alpha.

Nokia’s 5G FWA business has run into some market challenges, specifically tied to the vendor being “highly sensitive to a very small number of customers.” “Especially in North America, now when those deployments are significantly more slow, there is inherently some volatility here,” Lundmark explained.

Likewise, Ericsson’s CEO Borje Ekholm said the vendor’s quarterly sales in North America represented “one of the lowest shares we’ve seen in many years. But on the other hand, we see India growing very, very fast.”

…………………………………………………………………………………………………………………………….

“We believe AT&T is a primary culprit with slow spending, but inventory absorption is occurring with other operators too,” wrote the financial analysts at Raymond James in a recent note to investors. “CommScope has exposure to the same mobile and fixed access projects as well as an operator bias to its business. Ciena has high exposure to the North American operators (fiber backhaul from cell sites), but we think guidance it offered in early June reflected AT&T absorbing inventory. Ciena, Infinera, and Juniper have material cloud exposure that we believe is improving as an offset to slower telcos.”

References:

https://www.sdxcentral.com/articles/analysis/open-ran-growth-slows-to-a-crawl/2023/07/