4G

Verizon realizes operational efficiencies as massive cost cutting continues; 4G-LTE Home (Fixed Wireless Access)

Speaking at the Citi 2021 Global TMT investor conference on January 5, 2021, Verizon executive Ronan Dunne said the telco’s operational efficiency has continued to increase, largely due to cutting $10 billion in costs, which was first announced four years ago by then CEO Lowell McAdam.

Dunne said Verizon has been reaping billions of dollars every year in operational efficiencies from the core of how it builds network to the efficient way it carries traffic on that network with its One Fiber strategies. Verizon’s One Fiber project, which has been underway for five years, combined all of the telco’s fiber needs and planning into one project. It also allows Verizon to plot out its fiber uses cases and purchasing plans across all of its sectors.

“But as regards (to) the focus of operational efficiency, it’s a ruthless, consistent focus inside the business in exactly the same way as balance sheet strength has always been a watchword of Verizon. And so rest assured those will continue to be as important in ’21 and ’22 as they have been in the last few years.”

Regarding cost cutting, Dunne had this to say: “So yes, Matt (Verizon CFO Matt Ellis) has talked about our commitment to a $10 billion cost program, and we’ve made excellent progress on that. But in my time in the wireless business originally and then consumer, we’ve made significant strides. We’re talking about billions of dollars every year in operational efficiencies. From — right from the core of how we build the network, to be highly, highly efficient, how we carry traffic on the network with our One Fiber strategies to how we serve customers and deliver experiences. And across all of those vectors, we see continued opportunity.”

In addition to densification of the wireless network, backhaul and fronthaul, and enabling wireline access, having fiber deep is key for supporting radio access networks (RAN) as well as provisioning an increasing number of small cells. Verizon CTO Kyle Malady built the telco’s Intelligent Edge Network, which has allowed Verizon to lower its operational costs by benefiting “from efficiencies within the core and right through the business.”

“The particular area that I’m focused on in my part of the business is really AI at scale,” Dunne said. “That really allows us to improve our CRM (Customer Relationship Management) efficiency. So the efficiency of every dollar invested in acquisition and retention. Also the efficiency of every dollar invested in those elements that are customer service elements, and distribution elements,” he added.

Dunne opined that when you think about Verizon you recognize its network as a platform, it’s distribution as a platform and it’s billing and services platforms. He believes the opportunity to improve the efficiency of those platforms through investment in technology.

He also talked about the relationships with Microsoft and AWS for edge computing as a new platform capability that’s available both to us internally but also available to customers and partners. “So that’s the strategy. So we see the opportunity to grow highly efficiently as well as serve the existing base more efficiently and lots more to come there.”

“I’m not building a fixed wireless access network,” said Dunne, expressing a bit of frustration regarding a question of whether the company is on target to hit that 30 million homes passed goal. “I’m building a 5G mobility network with a second use case where it’s appropriate, where it covers 5G Office and 5G Home, so we just shouldn’t lose sight of that.”

Dunne says that he believes they are still on track, but the reality on the ground has Verizon constantly updating its 5G mobility strategy of where and how the service gets deployed. That reality impacts the ramp up of 5G Home, potentially slowing its deployment. The service is currently in 12 markets, with very limited footprints in those markets.

Verizon’s recently launched 4G LTE Home fixed wireless service (intended for rural subscribers) should also be included in a discussion of the company’s overall fixed wireless goals. The carrier’s 5G Home service and the goals associated with it pre-date the launch of the new 4G LTE based fixed wireless service, that Verizon initially said would target smaller markets.

Image Credit: Getty

……………………………………………………………………………………………………………………………………………………………………………………………….

“One of the other things that I think is important for people to think about is that as we build out the 5G network, we’ve also built 4G Home and we’ve seen significant response to that,” said Dunne. “My addressable market for Home, for me, has always been not limited to the specific of a 5G fixed wireless, but a broader ambition to be able to participate in the home.”

4G LTE fixed wireless access offers peak speeds of 50 Mbps for now, compared to its 5G Home service which claims average speeds of 300 Mbps. Nevertheless, Dunne sees this broader footprint of 4G and 5G fixed wireless combined with mobility, as a formidable competitor to cable broadband, and its fixed wireless homes passed goal attainment should be agnostic to the underlying wireless technology.

Can 5G fixed wireless access be an alternative to cable?

“Well, then my strong view is, yes, it can. But to be clear, we only build where there’s a mobility case to build. We’re not building a stand-alone 5G fixed wireless network. So sometimes when respectfully, people get frustrated with us and say, well, hold on a second. What about — I want to see all your discrete reporting of 5G fixed wireless or why aren’t you there or there or there? The answer, which — forgive me, but I keep repeating is because I’m not building a fixed wireless access network. I’m building a 5G mobility network with a second use case, where it’s appropriate, where it covers 5G office and 5G home. So we shouldn’t lose sight of that.

So as I build over that sort of 7-, 8-year horizon, one of the realities is that I will be updating my mobility deployment patterns all the time. So we’re not really — we’re not saying that, that sort of 7, 8 years for the 30 million homes time line is shifting. But what I am saying is we continue to optimize the mobility 5G deployment strategy. And as a result, we continue to finesse and update the practicalities of that relative to the homes past. But one of the other things that I think is important for people to think about is that as we build out the 5G network, we’ve also built 4G home, and we’ve seen significant response to that. And yes, that’s a maybe a 50 meg product rather than a 500 meg product. But for a lot of people, that’s important. And that also affords us this opportunity that as we build out 5G, as we put more nodes in place, but also as we put more carriers out there, deploy more spectrum, et cetera, we have this ability to build a home portfolio, which is carrier — basically bearer-agnostic. And I think the thing for us is that we see the opportunities to participate in tens of millions of homes across the U.S. as really attractive.

What I want to do is have toolkit that says, in my Fios footprint, if fiber is the right thing to do, great. If anywhere in the U.S. 5G ultra-wideband is available to me, I have that. And in other places, I have my 4G increasingly enhanced performance in that network, which may ultimately be a 5G nationwide solution. So my addressable market for home for me has always been not limited to the specific of a 5G fixed wireless but a broader ambition to be able to participate in the home and to bring the scale benefits of that to my customers who see Verizon as the partner of choice.”

We think we have a very strong growth opportunity, which is stimulate the base, spread through our network and distribution as

a platform, our access to the market across all of the available segments and really execute on a very strong, high performance, both network, but also a set of experiences….

References:

https://www.verizon.com/about/investors/citi-2021-global-tmt-west-virtual-conference

https://www.verizon.com/about/sites/default/files/2021-01/Citi-Conf-Transcript-01052021.pdf

https://www.fiercetelecom.com/telecom/verizon-closes-its-10-billion-cost-cutting-goal

https://www.pcmag.com/news/verizon-launches-unlimited-4g-home-internet-for-rural-users-here-are-the

Work from Home Reality Impacts Market for New Networking Technologies

SOURCE: Bigleaf Networks

Introduction:

Hype around next generation wireless standards (e.g. WiFi6/IEEE 802.11ax, 5G: ITU-R IMT 2020.SPECS/3GPP Release 16) has become a distraction, according to Bigleaf Networks founder and CEO, Joel Mulkey. Marketers are promoting these new technologies which sacrifice reliability to push faster speeds that are mostly useless in the new work from home era.

Mulkey and Bigleaf Vice President of Product, Jonathan Petkevich, looked into the reality behind the marketing hype around 5G and WiFi 6, as well as other networking trends such as satellite networks and artificial intelligence, in a wide-ranging panel discussion hosted for the company’s customers, partners, and agents.

As IT leaders look to regain their footing in 2021, many tech conversations that were trending at the beginning of 2020 picked up where they left off, while other trends emerged. Below are selected highlights from Mulkey and Petkevich’s conversation:

The Work From Home Reality:

“If you look at some of the Stay-At-Home mandates that have happened over the course of 2020, we estimate that about 85 million people are working from home, and that’s a big shift towards where we were at the start of 2020,” said Mulkey. “Starting at about the mid-March timeframe, 88% of organizations asked employees or required employees to work from home. About 57% of the US workforce started to work from home on a regular basis. So that was a big shift towards most people working in the office, with a few people working remotely in regional or local areas. And a lot of organizations have been talking about how they’re switching to a more long-term remote work-from-home strategy.”

Adapting to this new work from home reality meant frantically moving technology to the cloud. Part of that shift meant IT and network infrastructure teams needed to revamp their networks to support the connection reliability and application performance required in this kind of new normal.

“You need to have a healthy path between the device you’re using and the cloud server, otherwise you’re not going to have a usable experience,” said Mulkey. “One of the things we’re seeing companies running into is a sudden realization that quality of connectivity is really important.”

The Danger of WiFi 6:

According to Gartner, WiFi (IEEE 802.11) is the primary high performance network technology that companies will use through 2024. Today, roughly 96% of organizations use some form of wireless technology with many of those companies looking to move to faster versions of those networking capabilities in the next couple of years. Mulkey and Petkevich say the hype is hurting companies.

“Ensuring that you have technology that’s built on the latest standards makes sense,” said Petkevich. “I don’t know that 5G or WiFi 6 are drastically changing how a business operates day-to-day. There’s a little bit of over-hype around the speed and performance and some of the promise that’s with both of these.”

“WiFi 6 is a bit misplaced in our industry’s priorities and 5G is a marketing mess,” said Mulkey. “WiFi 6 is good for really dense, high bandwidth needs. So if you have an office with 1,000 people in a small area or you’re trying to provide WiFi offload in a stadium, WiFi 6 has technologies that will help you out. But if you’re a normal person and you’ve got a house with a couple of kids and you need to make sure your WiFi doesn’t drop-out when you’re on Zoom calls, I don’t see WiFi 6 moving the needle there. In fact, I think it’s harmful. The WiFi industry has become so focused on a story of faster, faster, faster, that the pace of innovation comes at the sacrifice of reliability. What you really need is stable WiFi connectivity that doesn’t drop out, that deals really well with roaming, that has some more intelligence to the quality of connectivity rather than prioritizing speed.”

5G Hype and Rural America:

“Now, 5G is interesting because there’s some really promising stuff there,” continued Mulkey. “Imagine if you didn’t even need WiFi, you just had always-on connectivity from all your devices at say, 100 megabits a second. That was the vision cast for it. The problem is, it’s almost all hype. What you need for the really high speeds is millimeter wave connectivity, which is really only going to be available in dense urban areas. So the folks that absolutely need good 5G today in rural areas or suburban areas without good landline connectivity, are probably not gonna get that millimeter wave behavior, surely not in rural areas.”

“We really have most of the benefits, if not all of them, with 4G today, so the evolution from a 4G to 5G in these longer distance connections is minimal to nothing,” added Mulkey. “It’s just a marketing term slapped on 4G. Now, 4G has gotten better since your phone first said 4G on it, but you’re not going to magically be able to stream 3D Star Wars style holograms because your phone has a 5G icon on it. That may come some day, but it won’t be 2021.”

Satellites:

Those who have the toughest time with WAN internet connectivity are those in rural areas or suburban areas that have been abandoned by the telecom and cable operators. An area Mulkey and Petkevich see low Earth orbit satellite networks moving beyond hype.

“The issue with traditional satellites is latency,” said Petkevich. “Starlink fixes that. So it’ll be interesting to see that play out in 2021.”

Artificial Intelligence in the Network:

44% of IT decision-makers believe that AI and machine learning can help companies optimize their network performance, and more than 50% identify AI as a priority investment needed to deliver their ideal network and make things work for them.

“There are two main ways that AI is in use today. You have a consumer-facing flavor — Siri on my iPhone, or the way that Google can find me images of apples; and then you have the hidden AI that nobody knows about — the instantaneous response of a Google search, where they’ve built smart technology that would fall under the definitions of AI to make sure that your request for Google gets to the right server from the right path and gets back to you as efficiently and effectively as possible,” said Mulkey. “Those technologies are available today. The challenge is they’re not available to the everyday person. This is an area where we, ourselves, have dedicated people and resources to figure out, ‘How can we make our network behave in an autonomous manner far better than it could if there were just people controlling it?'”

“There’s a kind of a misconception that when we talk about AI, the first thought is all the wonderful movies that have come out over the years,” quipped Petkevich. “Where we are today is there’s a lot of innovation going on to make this more tangible and more practical for businesses to use on the smaller scale, and not reserve it for the large enterprises of the world, and make it more generally available. This is definitely an area where a technology is moving beyond its hype.”

About Bigleaf Networks:

Bigleaf Networks is the intelligent networking service that optimizes Internet and Cloud performance by dynamically choosing the best connection based on real-time usage and diagnostics. Inspired by the natural architecture of leaves, the Bigleaf Cloud-first SD-WAN platform leverages redundant connections for optimal traffic re-routing, failover and load-balancing. The company is dedicated to providing a better Internet experience and ensuring peace of mind with simple implementation, friendly support and powerful technology. Founded in 2012, Bigleaf Networks is investor-backed, with service across North America.

Bigleaf combines a simple on-site installation, intelligent hands-off operations, and redundancy at every level to turn commodity broadband connections into a worry-free, Enterprise-grade connection to your applications.

…………………………………………………………………………………………………………………………………………………………………………………………..

References:

Omdia and Dell’Oro Group increase Open RAN forecasts

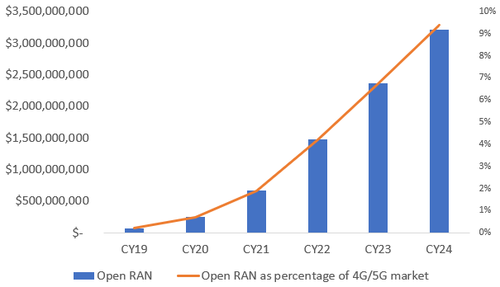

In an updated forecast out this month, Informa owned Omdia predicts that Open RAN is likely to generate about $3.2 billion in annual revenues by 2024. That would make it about 9.4% of the total 4G and 5G cellular market.

That forecast implies a massive increase on last year’s sales of just $70 million (see Dell’Oro forecast below), and Omdia’s Open RAN numbers have been raised significantly in the last few months. Previously, it was expecting Open RAN to generate about $2.1 billion in revenues in 2024.

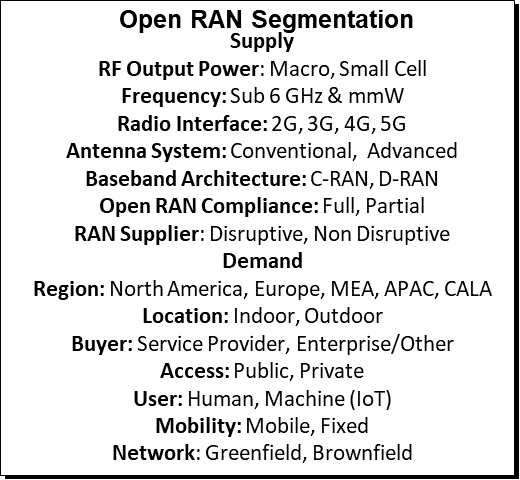

Telco buy-in and support is critical, according to Daryl Schoolar, practice leader at Omdia responsible for the firm’s Open RAN forecasts. “Mobile operators remain the real driving force behind the development of open virtual RAN,” he says. “I see this as a positive sign for the market versus other technology and network developments I have seen during my career that were driven by vendors and ultimately went nowhere. The bigger market opportunity is with brownfield deployments, but this takes more time to accomplish as operators have to integrate open RAN with their legacy network systems and make sure those legacy networks and services are not adversely impacted,” Schoolar added.

Here are some of the network operators that have committed to OpenRAN:

- Japan’s Rakuten, which already operates a 4G and 5G network based on open RAN. While customer numbers remain low, its early success has undoubtedly encouraged others.

- Telefónica and Rakuten have announced a partnership to accelerate the development of Open RAN technology for 5G access and core networks, and the associated operations support systems (OSS). They will jointly test, develop and procure Open RAN systems.

- Dish Network, is another greenfield builder that is using open RAN technology to roll out a fourth mobile network in the US. which is primarily focused on business customers.

- Orange sees a role for Open RAN vendors to provide more “plug and play” indoor coverage for businesses through 2021 and 2022. Open RAN could also play a part in the macro network, although that is more likely to come from 2023, and still requires work.

Dell’Oro Group (see forecast below) says: “Dish is running into delays in the US market, Rakuten is moving forward at a rapid pace in Japan deploying a variety of both sub 6 GHz and mmWave RAN systems. In addition, some of the Japanese telecom equipment vendors (e.g. NEC) are reporting that the lion share of their radio shipments are already O-RAN compatible.”

Open RAN progress:

Source: Omdia

……………………………………………………………………………………………………………………

Omdia notes that Open RAN is a potential dilemma for the big telco equipment vendors like Ericsson and Nokia (which intends to supply Open RAN products). The risk is that it decreases their market share for traditional cellular gear, as wireless network providers opt for Open RAN products developed by alternative suppliers. Yet open RAN might also bring opportunities in new markets for the old guard. “Either way, vendors cannot ignore this market trend,” says Omdia.

Gabriel Brown, a principal analyst at Heavy Reading, a sister company to Omdia and Light Reading, says he is positive about Open RAN but warns against expectations of liftoff next year. “The right timeline to view it on is a four-to-five-year timeline,” he said in a discussion with Light Reading this week. “I think next year continues to be primarily trials, scaling the trials … and some operators moving into production networks, but I don’t think it’s the year when it all takes off.”

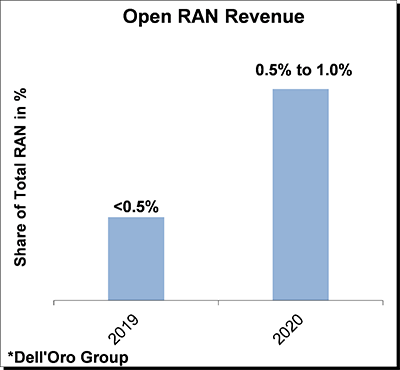

Separately, Dell’Oro Group’s latest Open RAN forecast, projects that Open RAN baseband and radio investments—including hardware, software, and firmware excluding services—will more than double in 2020 with cumulative investments on track to surpass $5B over the forecast period.

Open and Virtual RAN continues to gain momentum, bolstered by Ericsson now formalizing its support with its Cloud-RAN announcement. The uptake remains mixed. In this blog we will discuss three key takeaways for the 3Q20 quarter including:

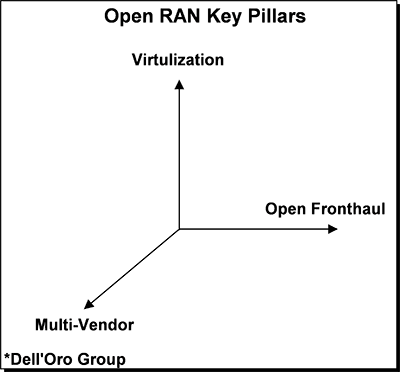

1) The primary objective of Open RAN is to address market concentration and vendor lock-in;

2) Open RAN revenues are trending ahead of schedule;

3) Not all Open RAN is disruptive.

Source: Dell’Oro Group

Dell”Oro says that the more favorable Open RAN outlook to a confluence of factors including:

- Verification from live networks the technology is working in some settings;

- Three of the five incumbent RAN suppliers are planning to support various forms of Open RAN – “Partial Open RAN” (open and virtual but not multi-vendor) are at this juncture captured in the Open RAN estimates meaning we require the first two pillars but we are excluding the third multi-vendor requirement as a necessity to reflect the Open RAN movement;

- The geopolitical uncertainty has escalated significantly in the past six months, with multiple operators reassessing and/or reviewing their reliance on Huawei’s RAN portfolio, resulting in an improved entry point for the Open RAN suppliers;

- Progress with full virtualization is firming up, with multiple suppliers announcing the commercial availability of V-RAN, consisting of both vCU and vDU;

- Operators are increasingly optimistic the technology will move beyond the rural settings for brownfield deployments;

- Policies to stimulate Open RAN are on the rise.

Source: Dell’Oro Group

“We estimate total open RAN revenues are tracking ahead of schedule,” wrote Stefan Pongratz of Dell’Oro Group, noting the market research firm recently raised its 2020 open RAN revenue forecast to $300,000 from $200,000. “On the other hand, the lion share of any ‘security’ related RAN swaps are still going to the traditional RAN players, suggesting the technology for basic radio systems remains on track but the smaller players also need to ramp up investments rapidly to get ready for prime time and secure larger brownfield wins.”

…………………………………………………………………………………………………………….

References:

https://www.lightreading.com/open-ran/open-ran-will-be-$32b-market-in-2024-says-omdia/d/d-id/765889?

https://omdia.tech.informa.com/OM011039/Open-RAN-commercial-progress-in-2020 (must be an Omdia client to access)

https://www.delloro.com/open-ran-results-mixed-in-3q20/

Dell’Oro: RAN growth accelerates due to “torrid pace” of 5G NR in 3Q2020

Dell’Oro has upgraded its near-term outlook for the RAN market to reflect stronger-than-expected activity in China, Europe and North America. The market researcher now expects the market to approach USD 70-80 billion over the combined 2020 and 2021 period.

The improved outlook in Dell’Oro’s Q3 RAN market report indicates continued positive momentum. The upswing begun in the second half of 2018 extended into the third quarter, with surging demand for 5G propelling the RAN market to robust year-over-year growth, the researcher said. It estimates that the overall 2G to 5G RAN market advanced 10-20 percent year-on-year in the third quarter, meaning annual growth in eight out of the last nine quarters.

“While we correctly identified that the RAN market would appear disconnected from the underlying economy throughout this year, we also underestimated the pace and the magnitude of these 5G rollouts,” said Stefan Pongratz, analyst with the Dell’Oro Group. “This shift from 4G to 5G, including low-band-and mid-band 5G NR, continued to accelerate at a torrid pace in the quarter, underpinned by stronger-than-expected 5G activity in multiple regions.”

Additional highlights from the 3Q20 RAN report:

- RAN revenue shares were impacted to some degree by the state of the 5G rollouts in China and North America, resulting in share gains for both Huawei and ZTE over the 1Q20-3Q20 period.

- The near-term outlook remains favorable for both macro and small cells, with combined 2020 and 2021 2G-4G and 5G base station shipments projected to eclipse 10 M units.

- We have adjusted the near-term RAN market outlook upward, to reflect stronger than expected activity in China, Europe, and North America, with total RAN projected to approach $70 B to $80 B for the combined 2020 and 2021 period.

Editor’s Note: The RAN market today is almost entirely provided by a handful of vendors making cellular base stations and small cells. Those are: Huawei, Ericsson, Nokia, Samsung, ZTE, and Fujitsu. In the future, there is a movement to both Open RAN and Cloud RAN which would disrupt the current deployments with disaggregated hardware and open software. We are very skeptical of those two over hyped industry initiatives.

Radio Access Network illustration from Resource Gate

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ revenue, transceivers or RF carrier shipments, macro cell and small cell BTS shipments for 5G NR Millimeter Wave, 5G NR Sub 6 GHz, LTE, and WCDMA/GSM. The report tracks the RAN market by region and includes market data for Massive MIMO. The report also includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com

References:

Surging Demand for 5G Accelerates RAN Growth, According to Dell’Oro Group

GSA forms new 4G and 5G Fixed Wireless Access Forum; FWA Market Review & Analysis

The Global mobile Suppliers Association (GSA) today announced the establishment of the GSA 4G-5G Fixed Wireless Access Forum to bring together leading chipset, module, and terminal vendors – as well as other telecommunications industry representatives, who wish to promote 4G and 5G Fixed Wireless Access (FWA) technology, products and services – to report on progress of FWA deployments, identify use cases and encourage global adoption.

The GSA 4G-5G FWA Forum will build on the work done by the recently formed GSA Fixed Wireless Access Working Group to coordinate industry initiatives to deliver fixed wireless broadband services based on LTE and 5G access networks. The founding members of the FWA Working Group are Ericsson, Huawei, Nokia, Samsung and ZTE. Membership to GSA Working Groups is open to all GSA Executive and Ordinary Members.

Underpinning the work of the new GSA 4G-5G FWA Forum is GSA’s research and role as the voice of the mobile ecosystem. GSA publishes regular industry reports and market data determine the extent and nature of fixed wireless access broadband service availability based on LTE or 5G around the world. As part of its industry advocacy,

GSA’s research team will share its latest global fixed wireless access update in its next GSA Snapshot Webinar on 24 November (16:00 GMT). Details on how to register for and attend the free webinar are available here https://gsacom.com/webinar-fixed-wireless-access/

Joe Barrett, President, Global mobile Suppliers Association, commented: “In a relatively short space of time, fixed wireless broadband access has become a mainstream service. Today we see hundreds of operators selling LTE-based fixed wireless access services around the world, and dozens more already live with 5G FWA services for home or business broadband. In addition, fixed wireless access device vendors have grown to over 100 globally and against this backdrop of real and significant market demand, the onus is on the FWA community to work together to drive business success.

“GSA has an unrivalled track record and experience in bringing together vendors, regulators and operators from across the 4G and 5G ecosystems and the formation of the new GSA 4G-5G FWA Forum will bring this experience to Fixed Wireless Access to help accelerate its development globally,” Barrett continued.

The scope of the new GSA 4G-5G FWA Forum includes:

· Sharing trends in the industry, identifying directions in technical development, accumulating and promoting successful experiences

· Improving the 4G and 5G FWA technologies required to provide wireless broadband connection solutions with increased performance and cost-effectiveness

· Fostering collaboration among FWA suppliers to improve the industry’s ecosystem and ensure business success

· Promoting the success of the FWA industry to accelerate the provisioning of broadband access to anyone, anywhere

The new GSA 4G-5G FWA Forum and Fixed Wireless Access Working Group is a key pillar of GSA’s growing industry advocacy; this work also includes the GSA Spectrum Group, the largest single spectrum advocacy team in the mobile industry representing the vendor ecosystem in 4G and 5G spectrum discussions with governments, regulators and other policy makers.

Membership and participation in the GSA 4G-5G FWA Forum is open to chipset, module, and terminal vendors, together with industry representatives from across the telecommunications ecosystem who wish to promote Fixed Wireless Access (FWA) technology, products and services.

For more information or a GSA 4G-5G FWA Forum Application Forum, please email [email protected].

………………………………………………………………………………………………………………………………………………………………………………….

About GSA:

GSA is the voice of the global mobile ecosystem representing companies engaged in the supply of infrastructure, semiconductors, test equipment, devices, applications and mobile support services. The organization plays a central role in promoting 3GPP technology, advocating spectrum policies and stimulating IMT industry development. The association is a single source of information for industry reports and market intelligence

The GSA GAMBoD database is a unique search and analysis tool that has been developed to enable searches of LTE and 5G devices and new global data on Mobile Broadband Networks, Technologies and Spectrum (NTS). Results are presented as a list or in charts. Charts may be inserted into documents or presentations, subject to accreditation of GSA as the source.

GAMBoD is a resource dedicated to promoting the success and growth of the Mobile Broadband (MBB) industry and ecosystem and is fully available to all employees of GSA Executive and Ordinary Member companies and GSA Associates who subscribe to the service.

- More information on GAMBoD is available at: https://gsacom.com/gambod/

- Press Release for New GSA FWA Forum: https://gsacom.com/press-release/new-gsa-fwa-forum/

………………………………………………………………………………………………………………………………………………………………………………….

STL Partners — FWA Market Review and Analysis:

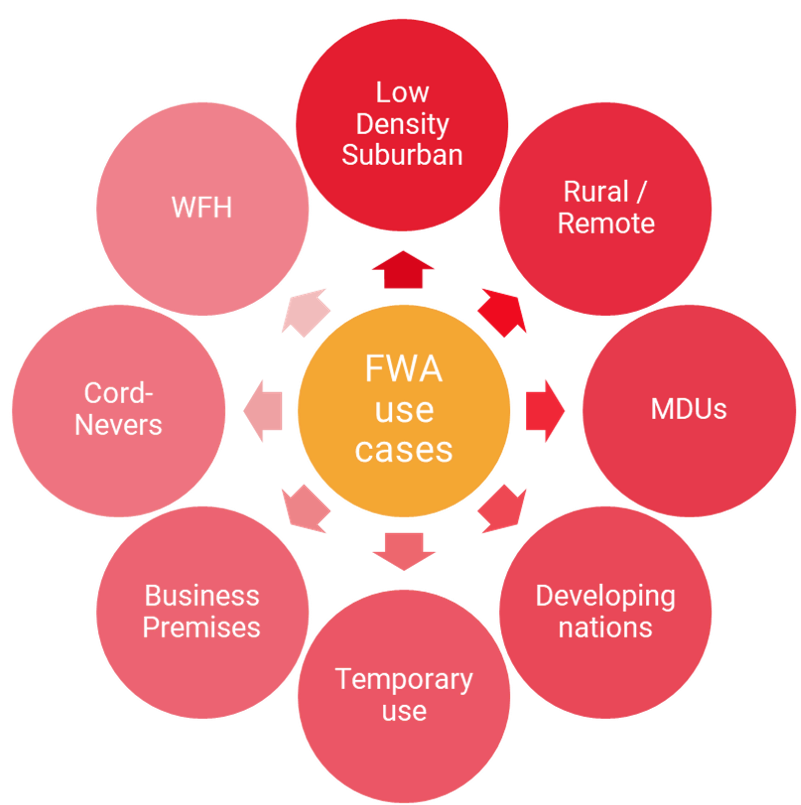

Today, fixed-wireless access (FWA) is used for perhaps 8-9% of broadband connections globally, although this varies significantly by definition, country and region. There are various use cases (see below), but generally FWA is deployed in areas without good fixed broadband options, or by mobile-only operators trying to add an additional fixed revenue stream, where they have spare capacity.

FWA via 4G -LTE using licensed spectrum has already experienced rapid growth of in numerous markets, such as South Africa, Japan, Sri Lanka, Italy, and the Philippines. This past week, T-Mobile announced an expansion of their 4G FWA called Home Internet service.

This growth has been driven by the combined impact of mobile network operators (MNOs) commercialising FWA services to households in underserved urban areas, the slow pace of fibre roll-out in some countries, government subsidies for rural broadband, and improvements in network planning tools and customer premise equipment with easier self-install options.According to STL Partners’ latest research and market forecasts, 5G is likely to have a major impact for operators in the coming years, especially from 2022 onwards as more spectrum becomes available to more operators, and equipment prices fall.

Nonetheless, 4G – LTE will continue to be more important than 5G in the FWA market overall at a global level over the next 5 years; the technology is much further down the cost- and experience curve, as well as using existing network infrastructure and spectrum.

Historically, most FWA has required an external antenna and professional installation on each individual house, although it also gets deployed for multi-dwelling units (MDUs, i.e. apartment blocks) as well as some non-residential premises like shops and schools. More recently, self-installed indoor CPE with varying levels of price and sophistication has helped broaden the market, enabling customers to get terminals at retail stores or delivered direct to their home for immediate use.

Looking forward, the arrival of 5G mass-market equipment and larger swathes of mmWave and new mid-band spectrum – both licensed and unlicensed – is changing the landscape again, with the potential for fibre-rivalling speeds, sometimes at gigabit-grade.

STL believes that the biggest changes and opportunities catalysed by 5G FWA will be:

• Alternative source of gigabit broadband in urban areas without fibre, or with poor competition and pricing.

• Mobile-only operators will target attractive demographic or sub-regional niches that fit with their existing and planned 5G footprint.

• Fixed and fixed-mobile converged broadband providers will use 5G FWA as a backup or enhancement for fixed-line services.

• The growing democratisation of 5G, with better support of unlicensed spectrum, plus cloud-delivered core networks and edge offload, will broaden its range beyond traditional MNOs to some wireless internet service providers (WISPs), cable operators, and others.

• Local licensing and new tranches of unlicensed spectrum will create options for municipalities, education agencies, and other public-sector bodies to offer 5G FWA for home-schooling, telemedicine, and other applications.

• In the longer term (2023 onwards) improved mmWave technology, including repeaters and other forms of signal-booster, could expand the addressable market for gigabit FWA.

FWA Use Cases…. Source STL Partners

………………………………………………………………………………………………………………………………………………………………………………….

References:

T‑Mobile expands Home Internet to over 130 additional cities

T‑Mobile expands Home Internet to over 130 additional cities

T-Mobile US will increase its Home Internet service to more than 130 additional cities and towns across Michigan, Minnesota, New York, North Dakota, Ohio, Pennsylvania, South Dakota, West Virginia and Wisconsin. The move comes after it massively expanded its home broadband pilot to more than 20 million households in October.

The $50/month Home Internet pilot service will be deployed in underserved rural markets — through LTE-based coverage, with 5G service coming soon. The company says that only 63 percent of adults in rural America currently have access to high-speed internet.

“Home broadband has been broken for far too long, especially for those in rural areas, and it’s time that cable and telco ISPs have some competition,” said Dow Draper, T-Mobile EVP, Emerging Products. “We’ve already brought T-Mobile Home Internet access to millions of customers who have been underserved by the competition. But we’re just getting started. As we’ve seen in our first few months together with Sprint, our combined network will continue to unlock benefits for our customers, laying the groundwork to bring 5G to Home Internet soon.”

T-Mobile Home Internet is just $50/month all-in and features many of the same benefits that have made T-Mobile the fastest growing wireless provider for the past seven years:

- Self-installation. That means there’s no need for installers to come to your home.

- Taxes and fees included.

- No annual service contracts.

- No maddening “introductory” price offers. What you pay at sign-up is what you’ll pay as long as you have service.

- No hardware rental, sign-up fee or installation costs (because set-up is so easy!).

- No data caps.

- Customer support from the team that consistently ranks #1 in customer service satisfaction year after year.

Now that customers have had access to T-Mobile Home Internet since 2019, the reviews are in … and the feedback speaks for itself. Customers give T-Mobile Home Internet an average Net Promoter Score (NPS) of 42, compared to -75 (that’s a negative 75!) for their previous provider. Seventy-three percent report saving money with T-Mobile Home Internet, with 50% saving more than $30 per month (that’s $360 annually!).

The Home Internet pilot provides home broadband on the Un-carrier’s LTE network. With additional capacity unlocked by the merger with Sprint, T-Mobile is preparing to launch 5G Home Internet commercially nationwide, covering more than 50% of U.S. households within six years and providing a badly needed alternative to incumbent cable and telco ISPs.

Home broadband is one of the most uncompetitive and hated industries in America. Rural areas in particular lack options: more than three-quarters have no high-speed broadband service or only one option available. And when there’s no choice, customers suffer. It’s no wonder internet service providers have the second lowest customer satisfaction ratings out of 46 industries, beating cable and satellite TV companies by just one point according to the ACSI (American Customer Satisfaction Index)!

T-Mobile Home Internet service is available on a first-come, first-served basis, where coverage is eligible, based on equipment inventory and local network capacity, which is expanding all the time. For more information on T-Mobile Home Internet or to check availability for your home in these areas, visit t-mobile.com/isp.

Reference:

Vodafone says Open RAN ready for prime time as Huawei is phased out in the UK

Vodafone has made a major commitment to use Open RAN at about 2,600 mobile base stations currently served by Huawei. That’s about 35% of the Chinese telecom equipment vendor’s installed base within Vodafone’s network, according to a spokesperson for the UK service provider after it was reported by the Financial Times (subscription required).

Approximately 2,600 sites in rural Wales and the south west of England will be switched to OpenRAN by the government-imposed deadline, a process that will commence in 2022. Vodafone wants to be viewed as a trailblazer for OpenRAN, which increasingly looks like the most likely source of telecoms vendor diversity in the wake of Huawei’s blacklisting by the U.S., UK and other countries.

“This commitment can get Open RAN ready for prime time,” Scott Petty, chief technology officer at Vodafone UK, told the Financial Times. He added that although open RAN was still a nascent technology more suited to rural coverage than dense urban areas, including such a large chunk of its network would create an opportunity for it to push into the mainstream. Spanish telecom operator Telefónica is also exploring greater use of open RAN systems for future upgrades.

Vodafone’s plan represents a boost for the UK government, after a task force launched to help strip Huawei equipment out of the country’s 5G networks by 2027 identified open RAN as a potential growth opportunity for the UK. It could also support a government ambition to rebuild a foothold in the telecoms equipment market if growing Open RAN use is used to justify research and development subsidies and companies in the field based themselves in Britain.

“The UK could regain a foothold which it hasn’t had since the break-up of Marconi,” said Mr Petty, referring to the collapsed British telco. Recommended Huawei Technologies Huawei develops plan for chip plant to help beat US sanctions US companies Mavenir, Parallel Wireless and Altiostar have emerged as open RAN specialists in recent years, hoping to compete with larger companies, while hardware vendors like Samsung, NEC and Fujitsu are hoping to win market share as Huawei kit is removed. The move to ban Huawei, the world’s biggest telecoms equipment maker, from 5G networks has meant networks have turned to Ericsson and Nokia to fill the void.

BT has signed deals with both the Ericsson and Nokia to replace Huawei base stations over time, putting the cost of complying with the government phase out at £500m. Ian Livingston, the former BT chief executive and trade minister heading up the government’s telecoms task force, told MPs last week that the push to foster Open RAN would grant telecoms companies a greater choice of vendors in the wake of the Huawei ban and avoid a bottleneck in the supply chain. Using Open RAN is a more costly exercise which has led to some calls within the industry for more financial support. Mr Petty said this need not be in the form of direct subsidies to use the equipment but could be directed at speeding up the development of chips and software to compete with established companies such as Huawei.

Vodafone’s pledge to use emerging open RAN tech for at least 2,600 masts and rooftops is the largest confirmed promise made by a European carrier © Alamy Stock Photo

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Analysis & Opinion:

Vodafone is likely interested in Open RAN because that could boost supplier diversity in a market where there are currently few viable alternatives to the giant kit vendors. Trials in various geographies have already been carried out with Mavenir and Parallel Wireless, two U.S. developers of Open RAN software. Many telecom operators have complained that today’s systems force them to rely on one company for all the RAN technologies at a particular site. Thanks to other “virtualization” schemes, they would be able to run open RAN software on commoditized, general-purpose equipment.

Vodafone hasn’t named any of the vendors that will help it with this initiative. Telecoms.com was told that it’s committing a fair bit to OpenRAN R&D and that it definitely sees a significant role for the technology across its entire radio estate. It seems the UK government has actually been of some help in this matter too, with the creation of a taskforce charged with improving vendor diversity considered a step in the right direction.

Vodafone seems to be trying to set the agenda when it comes to emerging technology trends. For years it promoted NB-IoT, but it’s been silent on that LPWAN (for IoT) lately. OpenRAN suffers from the classic paradox of new technologies in that companies are reluctant to invest much in being first movers. Vodafone is putting its money where its mouth is regarding OpenRAN and it will be watched closely by other operators looking for reassurance before deploying this untested technology.

Vodafone is under pressure to comply with a government deadline for the removal of all Huawei’s 5G products by the end of 2027. This would be fairly straightforward with mainstream technologies from Ericsson and Nokia. Using open RAN as a substitute, even across only 35% of these sites in rural areas, may be tough.

The payoff for Open RAN is a much larger choice of telecom equipment and software vendors. That might even include UK firms, which have not featured in the network equipment sector since the days of Marconi, eventually bought by Ericsson in 2006. Lime Microsystems, based in the UK town of Guildford, is one player that might benefit. It is already supplying 4G equipment to a Vodafone site in Wales that was supposed to be used during this year’s Royal Welsh Show, an agricultural event canceled in 2020 because of the coronavirus pandemic.

Japan’s Rakuten Mobile and U.S. based Dish Network have already made significant open RAN commitments. Yet both of those companies are building their networks from scratch as greenfield wireless carriers. With today’s update, Vodafone is taking a bigger step into the unknown than any other brownfield telco in a developed market has taken, including Telefonica.

………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.ft.com/content/a872a299-2f49-45b3-b3ff-9200f6ce8247

https://www.lightreading.com/vodafone-uk-to-swap-big-part-of-huawei-for-open-ran/d/d-id/765104?

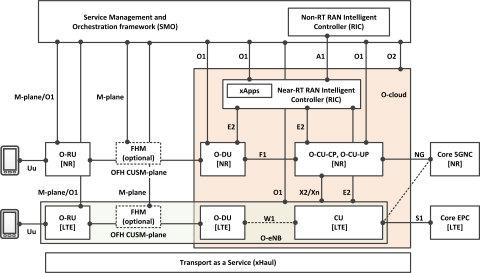

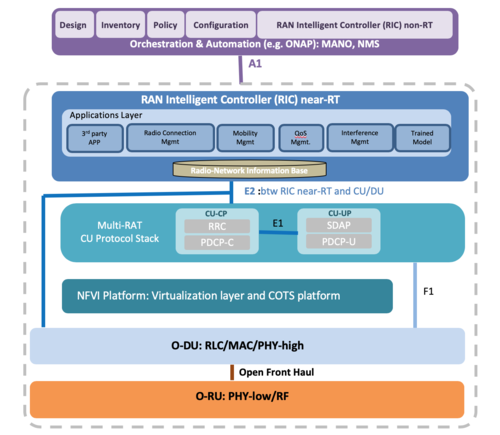

Global O-RAN Plugfests Across 5 Countries with 4G and 5G Lab and Field Test Platforms

Plugfests in Europe and India have been demonstrating the interoperability of telecom equipment using the Open Radio Access Network (O-RAN) specifications. The plugfests were organized by the leading telecom communications service providers (CSPs) and the O-RAN Alliance with a series of on-site demonstrations in multiple countries. The plugfest involved a series of on-site demonstrations in multiple countries, conducted in September and October 2020. In a multi-vendor based O-RAN environment, ensuring interoperability will become the network operator’s principal concern.

O-RAN Plugfest 2020 Integration and Testing Configuration

Image Credits: O-RAN Alliance

………………………………………………………………………………………………………………………………………………………………………..

Test equipment provider Viavi was involved in the plugfests with its Test Suite for O-RAN Specifications to validate that all interfaces are working correctly, including the RF, signaling and interoperability, timing and synchronization. The VIAVI Test Suite for O-RAN Specifications offers comprehensive, integrated solutions to validate that all interfaces are working correctly – including RF, signaling and interoperability, timing and synchronization – and equipment is performing to specifications even under load and stress. In the lab, the TM500 and TeraVM families deliver UE, O-RAN subsystem and core network simulation to enable conformance, interoperability and performance testing of both complete base station and core network testing as well as wraparound testing of individual O-RAN subsystems and core network elements. In both the lab and the field, T-BERD/MTS-5800 validates critical synchronization parameters with necessary precision using its Timing Extension Module (TEM), delivering a highly stable reference signal for synchronizing test equipment and O-RAN components. CellAdvisor 5G characterizes and analyzes 4G and 5G RF signals. ONT-800 tests transport network performance up to 800G.

- The plugfest in Berlin, Germany, was hosted by Deutsche Telekom, with demonstrations of radio access equipment from Baicells, Benetel, Foxconn, QCT, Wind River, Wiwynn and other vendors. Viavi provided its TM500 including UE emulation for performance testing and O-DU emulation for O-RU subsystem testing; TeraVM for core emulation and traffic generation; MTS-5800 for transport and synchronization test; and CellAdvisor 5G for RF signal analysis.

- In a plugfest in Torino, Italy, hosted by TIM, VIAVI provided the MTS-5800 for timing and synchronization in demonstrations of radio access equipment from Commscope, WNC, Wiwynn and other vendors.

- Madrid, Spain plugfest was hosted by a major Spanish service provider, with demonstrations of O-RAN x-haul (fronthaul and midhaul) transport with equipment from multiple vendors. VIAVI provided the MTS-5800 for timing and synchronization, and ONT-800 for multi-port transport test.

- Bengaluru (Bangalore), India plugfest was hosted by Airtel, with demonstrations of multi-vendor integration of O-RAN compliant radio access software and equipment from Altiostar, NEC, VVDN and Xilinx. The VIAVI TM500-C-5G 5G NR UE emulator and TM500 O-RU emulator were used for in-depth verification of the O-DU’s compliance to the WG4 open fronthaul (C/U/S planes) specification. • Tokyo, Japan. This plugfest was hosted by Japanese service providers, with demonstrations of radio equipment from major O-DU/O-CU and O-RU vendors. VIAVI provided the TM500 for 5G NR UE emulation.

“As a champion of interoperability test methodologies, and the first company to introduce a comprehensive test suite for O-RAN specifications, VIAVI has worked closely with ecosystem partners and operators worldwide to help identify, isolate and resolve performance issues with disaggregated networks,” said Sameh Yamany, Chief Technology Officer, VIAVI. “The successful results of the global O-RAN ALLIANCE plugfest represent a significant step forward in the advancement of multi-vendor O-RAN environments, which are essential to scaling and sustaining 5G networks.”

………………………………………………………………………………………………………………………………………………………………………………………………………..

Viavi is a global provider of network test, monitoring and assurance solutions for communications service providers, enterprises, network equipment manufacturers, government and avionics. We help these customers harness the power of instruments, automation, intelligence and virtualization to Command the network. VIAVI is also a leader in light management solutions for 3D sensing, anti-counterfeiting, consumer electronics, industrial, automotive, and defense applications. Learn more about VIAVI at www.viavisolutions.com.

……………………………………………………………………………………………………………………………………………………………………………………………………………

References:

China Mobile has 114M “5G Package” subscribers vs 204M broadband wireline customers

China Mobile announced yesterday that it had approximately 946 million mobile customers as at 30 September 2020, which was down about 1 million from the previous quarter. There were 770 million 4G customers and 114 million 5G package customers. The latter number is a 44 million increase in the past three months. However, the growth in 5G subscribers is not quite what it seems. Like China Telecom, China Mobile uses the term “5G package customers,” which counts 4G customers on 5G plans. [The 3rd state owned China telco – China Unicom – does not yet give a breakout of 5G subs from its mobile subscriber base.] The 4G subscriber base, reflecting some migration to 5G package plans, shrank by 10 million during Q3-2020.

During the first three quarters of the year, China Mobile handset data traffic increased by 35.0% year-on-year to 65.3 billion GB with handset data DOU reaching 9.1GB. Total voice usage dropped by 7.1% year-on-year to 2,258.0 billion minutes, showing a further reduced rate of decline. Total SMS usage rose by 15.5% year-on-year to 713.0 billion messages and maintained favourable growth. Mobile ARPU continued to demonstrate a flattened rate of decline, dropping by 2.6% year-on-year to RMB48.9 for the first three quarters of the year.

As of 30 September 2020, China Mobile’s total number of broadband wireline customers was 204 million, with a net increase of 17.17 million for the first three quarters of the year. Wireline broadband ARPU amounted to RMB32.4.

Image Credit: China Mobile

China Mobile said it will “continue to put in an all-out effort to implement the “5G+” plan, further promote scale-based and value-oriented operations and foster the all-round development of CHBN markets, thereby maintaining growth in telecommunications services revenue for the full-year of 2020.” The Group acknowledged the increasing cost associated with 5G operations and maintenance, but did not elaborate on what those costs were:

Facing the challenges resulting from increasing costs incurred by 5G operations and maintenance and business transformation, the Group will allocate resources by adhering to the principle of ensuring a sufficient budget for areas essential to promote growth, while reducing and controlling expenses on certain selected areas. In addition, it will take further measures to reduce costs and enhance efficiency, alongside efforts to maintain good profitability. The Group will maintain stable profit attributable to equity shareholders for the full-year of 2020, continuously creating value for investors.

Ericsson, which previously received a $593 million 5G contract with China Mobile for base stations wrote in an email to Light Reading: “”We have been riding on the investments in China and there are likely to be more than 500,000 base stations by the end of the year in China launched on 5G and of course we are quite pleased to participate in that rather fundamental and quite strong rollout.”

Market research firm Dell’Oro forecasts that China’s 5G rollout will drive an 8% increase in worldwide sales of radio access network products this year. Excluding China, it forecasts no growth in the RAN infrastructure market. Additional highlights from Dell’Oro’s 2Q2020 RAN report:

- 5G NR radio shipments accelerated 5x to 6x during 1H20, driven by robust growth in China.

- Millimeter Wave 5G NR deployments continued to advance rapidly, with revenues growing nearly four-fold.

- Initial estimates suggest that vendor rankings remained stable between 2019 and 1H20, while revenue shares changed somewhat as the Chinese suppliers reached new revenue share highs.

- Near-term RAN forecast has been adjusted upward, to reflect the faster-than-expected growth in China.

………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.chinamobileltd.com/en/file/view.php?id=237832

https://www.lightreading.com/5g/china-mobile-5g-subs-top-114m-in-q3/d/d-id/764778?

https://www.lightreading.com/5g/ericsson-rides-high-on-china-5g-boom/d/d-id/764770?

Huawei Executive: “China’s 5G user experience is fake, dumb and poor”-is it a con game?

RAN Market Growth Accelerated in 1H20, According to Dell’Oro Group

Tech Mahindra: “We can build and run an entire 4G and 5G or any enterprise network”

India based IT services provider Tech Mahindra says it has the capability to build and run an entire 4G or 5G network in India. The company’s partnership with Japanese greenfield telco Rakuten Mobile [1.] will help it get more meaningful business in India’s telecom industry, a senior executive said.

Note 1. Rakuten Mobile, together with NEC, is building a 5G Open RAN and cloud native 5G core network based on their own specifications. Open RAN and cloud native 5G core network are two different and independent initiatives.

“We can build and run an entire 4G and 5G or any enterprise network. We have done that already. We bring to the table our ability to design, to plan, to integrate and deploy and then to manage the entire suite of network capabilities, including designing various parts to it in a disaggregated world,” Manish Vyas – President, Communications, Media & Entertainment Business, and the CEO, Network Services, Tech Mahindra, told the Economics Times of India.

In August, the company announced German telecoms company Telefonica Deutschland had selected it for its network and services operations, in addition to further developing 5G, artificial intelligence, and machine learning use cases.

“We are pleased to announce this partnership with Tech Mahindra. We are supported by a globally experienced service provider to consistently drive forward the development of our network and services operations, thus leading to further enhancement of 5G, artificial intelligence and data analysis use cases,” said Mallik Rao, Chief Technology & Information Officer of Telefonica Deutschland.

“This strategic partnership strengthens our long-standing relationship with Telefonica, in which we support the company in realizing its vision of becoming the ‘Mobile Customer and Digital Champion’ by 2022,” said Vikram Nair, President, Europe, Middle East and Africa (EMEA) of Tech Mahindra.

In October 2019, the company launched a 5G enabled Factory of the Future solution. Nilesh Auti, Global Head Manufacturing Industry unit, Tech Mahindra, said:

“Factory equipment holds a great deal of meaningful data which is key to any successful Industry 4.0 project. Tech Mahindra’s solution in partnership with Cisco, will enable us to leverage this data and empower manufacturers to build factories of the future. As part of our TechMNxt charter we are focused on leveraging 5G technologies to address our customer’s evolving and dynamic needs, and enable them to RISETM.”

Tech Mahindra is also looking for strategic investments and acquisition in companies to further bolster its telecom product and services portfolio. The company says the following about their 5G capabilities and experience:

Tech Mahindra provides range of services that enable enterprises to establish private wireless network to span areas of operations & enable a plethora of IoT use cases. Our services remove inefficiencies related to slow, insufficient wireless connectivity & have a strong roadmap to support growing traffic demands for 5G establishment. From media to medicine we believe 5G is “The NXT of Everything.”

Tech Mahindra ccomplishments listed are these:

- 1M+ carrier grade cellular sites designed, delivered and managed

- Enabling 3 of the first 5 carrier 5G introductions in the world

- Strong Telco partnership/reach (80+ Global Tier 1 Telcos)

- 4 smart cities projects launched, Largest WIFI deployments in the world

- 5 connected vehicles engagements, 40+ Connected factories, 12000+ factory Assets

- 600+ Turbines and 100+ aircrafts connected; 2000+ remote healthcare patients supported

…………………………………………………………………………………………………………………………………………………………………………………….

References: