5G in the U.S.

T‑Mobile achieves record 5G Uplink speed with 5G NR Dual Connectivity

T-Mobile US claims it broke a world record with its 5G standalone (SA) network via a new feature called New Radio Dual Connectivity (5G DC) [1.]. With 5G DC. The so called “Un-carrier” was able to massively increase uplink throughput and capacity, reaching peak speeds of 2.2 Gbps — that’s the fastest recorded anywhere in the world — and demonstrates the technology’s potential to create serious efficiencies in how data is transmitted from devices to the network.

Note 1. New Radio Dual Connectivity (NR-DC) is a dual connectivity configuration that uses the 5G standalone core (specified by 3GPP but not standardized by ITU-R or ITU-T). In this configuration, both the primary and secondary RAN nodes are 5G gNBs. NR-DC was was specified in 3GPP Release 15 along with simultaneous receive (Rx) / transmit (Tx) band combinations for NR CA/DC.

…………………………………………………………………………………………………………………………………..

To put T-Mo’s 2.2 Gbps uplink speed into context, the latest report from connectivity data specialist Ookla puts the median mobile upload speed in the U.S. at 8.41 Mbps, although that’s across networks. T-Mobile is ahead of major rivals AT&T and Verizon with a median upload speed of 12.19 Mbps.

In June Ookla stated that while U.S. network operators have invested heavily in improving 5G download speeds, “5G upload and latency performance need more attention.” Its data at the time showed Verizon and T-Mobile had comparable 5G upload at just above 15 Mbps, while AT&T lagged somewhat at closer to the 10 Mbps mark.

5G DC enables the Un-carrier to aggregate 2.5 GHz and mmWave spectrum, allowing for an insane boost to uplink throughput and capacity. In this test, T-Mobile was able to allocate 60% of the mmWave radio resources for uplink where previous use cases typically allowed up to 20%. Completed on T-Mobile’s 5G SA production network in SoFi Stadium in Southern California with equipment and 5G DC solution from Ericsson and a mobile test smartphone powered by a flagship Snapdragon® X80 5G Modem-RF System from Qualcomm Technologies, Inc., this test changes the game for providers looking to offer customers and businesses the best experience possible at crowded events.

“With 5G DC, T-Mobile is pushing the boundaries of what’s possible to create better experiences in the places that matter most to our customers,” said Ulf Ewaldsson, President of Technology at T-Mobile. “This accomplishment is a testament to the network we’ve built over the last five years and our ability to deliver unparalleled capabilities that extend beyond the devices in our pockets.”

For those in the know, download speeds typically reign as the top network performance metric, but with recent strides in uplink capabilities and increasingly demanding tasks, upload speed is becoming more important than ever, especially for live events, mobile gaming and extended reality applications.

Because of this, SoFi Stadium served as the perfect test site for 5G DC. Every year, millions of people flock to the stadium for the latest football game or to catch their favorite artists in concert. Naturally, all these people want to post, livestream and share their experiences in real-time, which can sometimes be a challenge at crowded events with limited capacity. Not to mention broadcast crews who need to upload high-definition content to production teams in real-time for those watching at home. With 5G DC and T-Mobile, all of this gets done faster than ever, alleviating posting FOMO and production crew headaches.

Mårten Lerner, Head of Product Area Networks at Ericsson, said: “High uplink speeds are essential for delivering immersive experiences and reliable 5G connectivity. This mirrors one of our key objectives with the recent launch of Ericsson 5G Advanced, which is to elevate user experience by enhancing network performance for more interactive applications. This 5G uplink speed milestone, achieved with T-Mobile and Qualcomm, underscores our commitment to taking user experience to unprecedented levels.”

“We are incredibly proud to achieve yet another world record with T-Mobile. This groundbreaking achievement shows what could be possible with 5G DC and how it can bring new, unparalleled experiences to consumers, especially at large events like football games and concerts,” said Sunil Patil, Vice President, Product Management, Qualcomm Technologies, Inc. “We will continue our close collaboration with global innovators like T-Mobile and Ericsson to push the boundaries and unlock the full potential of 5G.”

5G network covers more than 330 million people across two million square miles. More than 300 million people nationwide are covered by T-Mobile’s super-fast Ultra Capacity 5G with over 2x more square miles of coverage than similar mid-band 5G offerings from the Un-carrier’s closest competitors.

For more information on T-Mobile’s network, visit T-Mobile.com/coverage.

References:

https://www.t-mobile.com/news/network/t-mobile-shatters-for-5g-uplink-speed

https://www.telecoms.com/5g-6g/t-mobile-us-uses-5g-dc-to-claim-uplink-speed-record

Telstra achieves 340 Mbps uplink over 5G SA; Deploys dynamic network slicing from Ericsson

Finland’s Elisa, Ericsson and Qualcomm test uplink carrier aggregation on 5G SA network

Ericsson and MediaTek set new 5G uplink speed record using Uplink Carrier Aggregation

Samsung-Mediatek 5G uplink trial with 3 transmit antennas

Dish Wireless with Qualcomm Technologies and Samsung test simultaneous 5G 2x uplink and 4x downlink carrier aggregation

BT, Nokia and Qualcomm demonstrate 2CC CA on uplink of a 5G SA network

5G Americas/Omdia: 2023 global 5G connections reach 1.76 billion

5G connections accelerated in 2023, reaching 1.76 billion globally by end-December, following the addition of 700 million connections in the 12-month period, according to a report from 5G Americas, with data provided by Omdia.

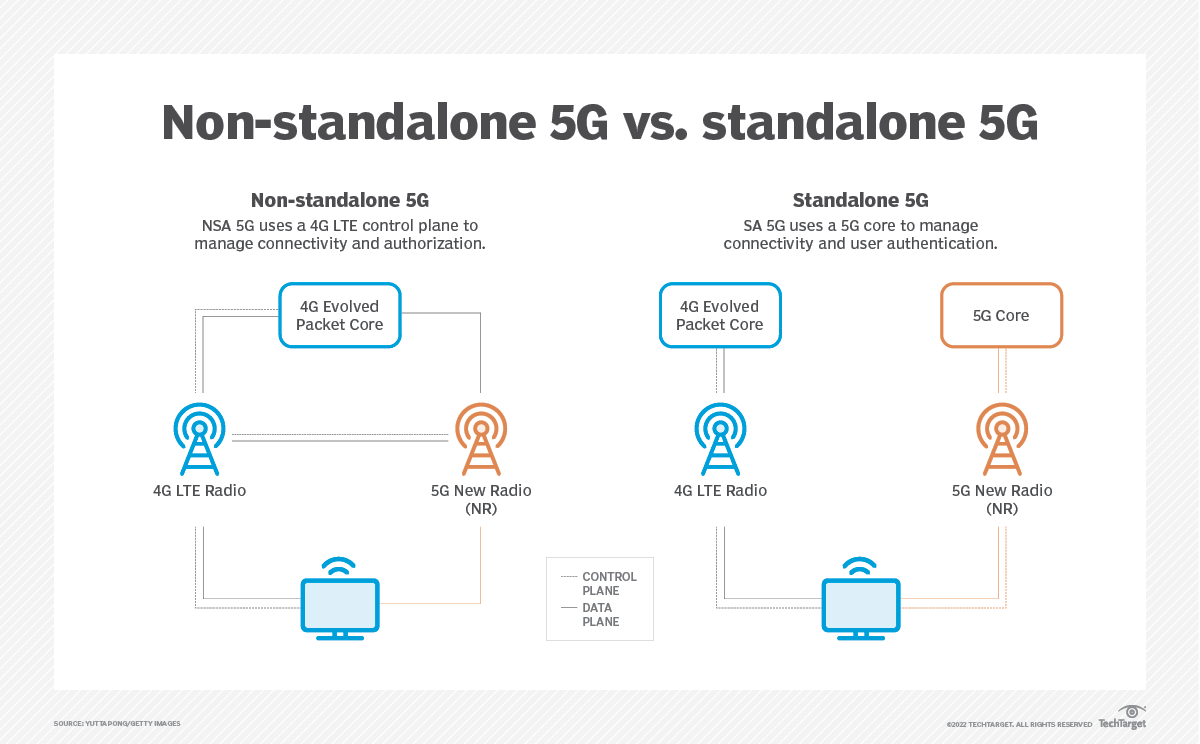

Of course, most of those connections were 5G NSA, which does not offer any 3GPP defined 5G features (including 5G Security and Network Slicing). According to a Dell’Oro Group report, 12 new 5G SA core networks were deployed in 2023, down from 18 in 2022. The report also notes that AT&T, Verizon, British Telecom EE, Deutsche Telekom, and other Mobile Network Operators (MNOs) did not deploy 5G SA networks in 2023.

Chris Pearson, President of 5G Americas, said, “The wireless telecommunications industry stands at the cusp of a new era, driven by innovation, collaboration, and a shared vision for a connected future. With Fixed Wireless Access (FWA) continuing to drive consumer broadband demand, new technology milestones are advancing unparalleled connectivity experiences worldwide.”

North America emerged as a leader in 5G adoption, with connections in the region comprising 29% of all North American connections by the end of 2023. Notably, the region experienced a staggering 64% year-over-year growth in 5G connections, adding 77 million new connections to its network. By the end of 2023, North American 5G connections totaled 197 million.

–>This author believes that most of the new 5G connections in the U.S. were FWA from Verizon and T-Mobile.

Latin America also witnessed substantial progress in both 4G LTE and 5G connections, with LTE connections reaching 582 million by the close of 2023, adding 40 million new connections year over year. Moreover, the region embraced the 5G revolution, with 39 million 5G connections established by year-end, setting the stage for further expansion in the years to come.

“4G LTE is still the strongest technology across the region,” said Jose Otero, Vice President of Latin America, and the Caribbean for 5G Americas. “Although various factors, including 5G handset mass market availability and completion of spectrum auctions will see an increase in 5G coverage, and subscriber growth in the coming year.”

Looking ahead, Omdia forecasts paint a picture of the telecommunications landscape we can expect to see throughout this decade. Global 5G connections are projected to skyrocket to 7.9 billion by 2028, with North America forecasted to boast an impressive 700 million 5G connections by the same year.

Omdia principal analyst Kristin Paulin points out, “With this forecast, 5G will reach the global milestone of accounting for more than half of all connections by 2028. For North America, as an early leader, 5G will be more than 80% of connections.”

Additionally, 5G data traffic is expected to be 76% of all technology data traffic as it reaches a staggering 2.6 billion TB (or 2600 EB), with all technology data traffic reaching 3.4 billion TB (or 3400 EB) by 2028, reflecting the exponential growth trajectory of 5G connectivity.

While 5G technology continues to dominate headlines, the Internet of Things (IoT) ecosystem remains a vital component of the digital revolution. Currently, global IoT subscriptions stand at 3.1 billion, complemented by 6.6 billion smartphone subscriptions. Forecasts suggest that IoT subscriptions will reach 4.5 billion, while smartphone subscriptions will surge to 7.4 billion by 2026, highlighting the evolving nature of connectivity and the interconnectedness of our digital world.

Globally, the number of deployed 5G networks shows strength compared to 4G LTE deployments, and in the case of North America almost matches 4G LTE networks deployed. Currently, there are 314 commercial 5G networks worldwide, and this number is anticipated to grow to 450 by 2025, reflecting significant investments in 5G infrastructure worldwide.

The number of 5G and 4G LTE network deployments as of March 18, 2024, are summarized below:

5G:

- Global: 314

- North America: 17

- Latin America and Caribbean: 39

4G LTE:

- Global: 714

- North America: 18

- Latin America and Caribbean: 135

Visit www.5GAmericas.org for more information, statistical charts, and a list of LTE and 5G deployments by operator and region. Subscriber and forecast data is provided by Omdia and deployment data by 5G Americas and TeleGeography (GlobalComm).

About 5G Americas: The Voice of 5G and Beyond for the Americas

5G Americas is an industry trade organization composed of leading telecommunications service providers and manufacturers.

The organization’s mission is to facilitate and advocate for the advancement of 5G and beyond toward 6G throughout the Americas. 5G Americas is invested in developing a connected wireless community while leading 5G development for all the Americas. 5G Americas is headquartered in Bellevue, Washington. More information is available at 5G Americas’ website.

5G Americas’ Board of Governors Members include Airspan Networks Inc., Antel, AT&T, Ciena, Cisco, Crown Castle, Ericsson, Liberty Latin America, Mavenir, Nokia, Qualcomm Incorporated, Rogers Communications, Samsung, T-Mobile US, Inc., Telefónica, and WOM.

…………………………………………………………………………………………………………………….

References:

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

GSMA Intelligence: 5G connections to double over the next two years; 30 countries to launch 5G in 2023

Bundenetzagentur: 5G was 28.5% of broadband speed measurements in Germany (Oct 2022 thru Sept 2023)

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

According to market research firm Omdia, there were 1.8 billion global 5G subscribers at the end of 2023 with 7.9 billion forecast by 2028. This growth trajectory, while substantial, is subject to various influencing factors such as infrastructure development, spectrum availability, device availability, and consumer demand. Kristin Paulin, Principal Analyst at Omdia, has a cautiously optimistic outlook for 5G. She emphasizes that innovation and cooperation are key to unlocking the full potential of 5G and its transformative impact.

Globally, the number of deployed 5G networks is now comparable to 4G LTE deployments. There are currently 296 commercial 5G networks worldwide, a number expected to grow to 438 by 2025.

In North America, 5G deployment was at 176 million connections as of the third quarter of 2023, a 14% increase from the previous quarter. This represents a 26% market share and a 46% penetration rate. However, there were only two U.S. 5G SA network providers – T-Mobile US and Dish Wireless– as of the end of 2023.

in contrast, Latin America and the Caribbean are still in the early stages of 5G adoption. However, the region shows promise with an expected quadrupling of 5G connections in 2023, reaching 46 million. By 2028, it is anticipated that the region will have 492 million 5G connections.

Jose Otero, Vice President of Caribbean and Latin America for 5G Americas, acknowledges the significance of 4G LTE and 5G as vital mobile communication technologies in Latin America. He anticipates more robust opportunities for 5G in the region, driven by upcoming spectrum auctions and wider access to 5G devices in 2024.

“The global 5G landscape shows positive momentum as innovation and collaboration continue to be the mainstays for long term progress.” said Chris Pearson, President of 5G Americas. “With the World Radio Conference wrapping up, it is important that international co-operation and efforts continue to ensure that spectrum and technology standards continue to propel this growth.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

According to a recent report by Dell’Oro Group, the Mobile Core Network (MCN) market growth rate has been reduced to less than a 1% CAGR (2023-2028).

“This is the fourth consecutive time we reduced the growth rate of the MCN market as the build-out of 5G Standalone (5G SA) networks continues to wane compared to 5G Non-standalone (5G NSA) networks,” said Dave Bolan, Research Director at Dell’Oro Group. “The buildout of 5G SA networks is going slower than anticipated which is restraining growth in the marketplace. To date, we count fifty 5G SA eMBB (enhanced Mobile BroadBand) networks that have been commercially deployed worldwide by Mobile Network Operators (MNOs). We counted 18 new 5G SA networks in 2022, but only 12 were launched in 2023. On a positive note, we believe a lot of work has been done in the background, preparing for 5G SA launches by Mobile Network Operators (MNOs) and we expect 2024 to have more launches than 2022.”

Note 1. Importantly, a 5G SA core network is required to realize 3GPP defined 5G features, like 5G Security, Network Slicing (3GPP’s technical specification (TS) 23.501 defines 5G system architecture with slicing included. TS 22.261 specifies the provisioning of network slices, association of devices to slices, and performance isolation during normal and elastic slice operation).

The 5G SA core network relies on a “Service-Based Architecture” (SBA) framework, where the architecture elements are defined in terms of “Network Functions” (NFs) rather than by “traditional” Network Entities.

5G SA core networks require “cloud-native” hardware and software that has a service-based architecture and decentralized functions. A “cloud-native” 5G core allows for flexible and efficient operation, as well as the effective adoption of new services.

………………………………………………………………………………………………………..

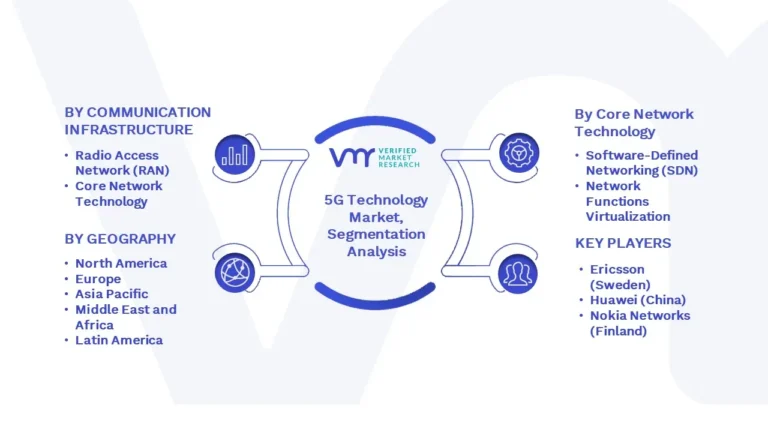

According to Verified Market Research, when the full 5G SA feature set is supported, enterprises can realize the following benefits:

- Further improvements to speed and reach, beyond what 5G NSA brings.

- Support for higher-density deployments of devices.

- Support for low-latency and real-time use cases.

- Support for enhanced enterprise site connectivity via network slicing.

- Better security than 5G NSA (which uses 4G LTE security methods and procedures).

- Simplification of the RAN and core compared to 5G NSA since 5G SA supports only 5G and leaves 4G and older standards behind — and even though the 5G SA core alone is more complex than a pure 4G core alone.

GSA claims that more than 121 network operators in 55 countries and territories have invested in public 5G standalone (SA) networks (but they don’t disclose how many of those have been commercially deployed (for example, AT&T and Verizon have been talking up 5G SA for years, but have yet to deploy it!). We trust Dell’Oro’s number of 5G SA eMBB networks deployed.

Findings from the latest GSA update on the 5G SA ecosystem/devices [2.] include:

- There are 2,130 announced devices with claimed support for 5G SA, up 35.7% from 1,569 at the end of 2022.

- Devices with support for 5G SA account for 90.3% of all 5G devices, as of the end of 2023, up from 35.6% in December 2019.

- 93 modems or mobile processors/platform chipsets state support for 5G SA, 90 of which are understood to be commercially available.

Note 2. It’s crucially important to realize that since all 5G SA core networks are different, a 5G SA device that works on one carrier’s network won’t work on any other without a new 5G SA download.

By the end of December 2023, GSA had identified:

• 28 announced form factors • 261 manufacturers with announced available or forthcoming 5G devices

• 2,358 announced devices, including regional variants, but excluding operator-branded devices that are essentially rebadged versions of other phones. Of these, at least 1,964 are understood to be commercially available:

• 1,255 phones, up 34 from November 2023. At least 1,168 of these are now commercially available, up 56 from November 2023

• 308 fixed wireless access customer-premises equipment (CPE) devices for indoor and outdoor uses, at least 209 of which are now commercially available

• 243 modules • 64 tablets • 33 laptops or notebooks • 77 battery-operated hot spots

• 179 industrial or enterprise routers, gateways or modems

• 13 in-vehicle routers, modems or hot spots

• 29 USB terminals, dongles or modems

• 168 other devices, including drones, head-mounted displays, robots, TVs, cameras, femtocells/small cells, repeaters, vehicle on-board units, keypads, a snap-on dongle/adapter, a switch, a vending machine and an encoder

• 1,098 announced devices with declared support for standalone 5G in sub-6 GHz bands, 904 of which are commercially available.

According to Verified Market Research, the market drivers for the 5G Technology Market can be influenced by various factors. These may include:

- Enhanced Data Speed and Capacity: In comparison to its predecessors (4G/LTE), 5G technology offers far faster data rates and more network capacity. Supporting the increasing need for high-bandwidth applications like virtual reality (VR), augmented reality (AR), and Internet of Things (IoT) devices is imperative.

- Low Latency: The goal of 5G networks is to offer low-latency communication, which shortens the time it takes to send and receive data. This is critical for real-time interactive applications like industrial automation, remote surgery, and driverless cars.

- Growing Need for IoT Devices: One of the main factors driving 5G adoption is the spread of IoT devices across a number of industries, including manufacturing, healthcare, smart cities, and agriculture. 5G is ideally suited for Internet of Things applications due to its low latency and capacity to connect a large number of devices concurrently.

- Rise of Edge Computing: The growth of edge computing is intimately related to 5G networks. Edge computing improves speed and lowers latency by bringing computing resources closer to end users and devices; this makes it a crucial enabler for applications like driverless cars and smart cities.

- Industry 4.0 and Smart Manufacturing: By facilitating effective and dependable communication in smart factories, 5G is anticipated to play a significant role in the fourth industrial revolution, or Industry 4.0. It makes it easier to incorporate technology like automation, robotics, and artificial intelligence into production processes.

- Telecommunications Infrastructure Upgrade: on order to roll out 5G networks, telecommunications service providers are actively spending on infrastructure upgrades. To improve capacity and coverage, new base stations and tiny cells must be installed.

- Government Initiatives and Support: Through legislative frameworks, financial aid, and other means, numerous governments across the globe are actively promoting the rollout of 5G technology. In the global digital landscape, these programmes seek to promote innovation, economic growth, and competitiveness.

- Competitive Environment and Industry Cooperation: Businesses are investing in 5G technology to obtain a competitive advantage due to the highly competitive nature of the telecommunications sector. Furthermore, partnerships between IT firms, telecom service providers, and other relevant parties are quickening the creation and implementation of 5G networks.

Several factors can act as restraints or challenges for the 5G Technology Market. These may include:

- Infrastructure Costs: Given that a large-scale deployment of base stations and small cells is necessary to support 5G, telecom operators may be discouraged by the substantial upfront expenditure necessary for creating and upgrading infrastructure.

- Spectrum Allocation and Availability: The effective operation of 5G networks depends on the allocation and availability of appropriate spectrum bands. Regulatory and geopolitical obstacles can make it difficult to get the necessary spectrum, which can hinder the deployment of 5G services.

- Security Concerns: There are worries about possible cybersecurity attacks due to the vast number of devices connected to 5G networks and the increased connection. Building confidence and promoting wider adoption require overcoming these issues and guaranteeing the security of network infrastructure.

- Interoperability Problems: There are interoperability problems since different generations of cellular technologies coexist. A seamless transition and the prevention of service interruptions depend on the seamless integration of various technologies.

- Regulatory Obstacles: The implementation of 5G networks faces a number of regulatory obstacles, such as spectrum auctions, licence requirements, and local law compliance. Uncertainties surrounding regulations may cause hold-ups and impede the rapid deployment of 5G services.

- Public Health and Safety Concerns: The general public’s reception of 5G networks may be impacted by worries about the possible health impacts of increasing exposure to radiofrequency radiation. Building public trust requires resolving these issues and maintaining clear lines of communication.

- Absence of Killer Applications: The deployment of 5G may be slowed back by the absence of compelling and widely applicable use cases. Creating cutting-edge, impactful apps that take advantage of 5G’s special features is essential to increasing demand.

- Global Economic uncertainty: Businesses’ and operators’ willingness to invest in the rollout of 5G technology can be impacted by economic downturns and uncertainty. Delays in infrastructure upgrades could result from financial considerations and budgetary restrictions.

Charts courtesy of Verified Market Research

References:

5G Continues Robust Momentum Growth and Drives Demand for More Wireless Spectrum

https://www.3gpp.org/technologies/5g-system-overview

https://www.techtarget.com/searchnetworking/definition/5G-standalone-5G-SA

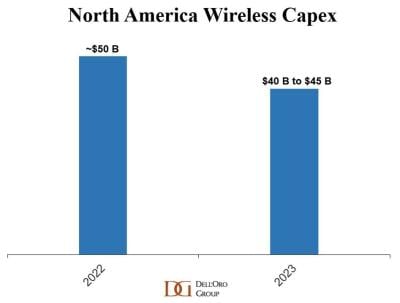

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

We noted in a recent IEEE Techblog post that the 5G spending slowdown in the U.S. is broader than many analysts and executives expected. Well, it’s worse than that! The previously referenced negative comments from the CEO of Crown Castle, were corroborated by American Tower last week:

“The recent pullback was more abrupt than our initial expectations,” said Rod Smith, the CFO for cell tower firm American Tower, during his company’s quarterly conference call last week, according to Seeking Alpha. Smith was discussing the reduction in US operator spending on 5G, a situation that is now cutting $40 million out of American Tower’s margin expectations. “The initial burst of 5G activity has slowed down,” agreed the financial analysts at Raymond James in a note to investors following the release of American Tower’s earnings.

Cell tower giant SBA Communications said it too is seeing the broad pullback in spending that has affected its cell tower competitors (i.e. American Tower and Crown Castle). But the company’s management sought to reassure investors with promises of continued growth over the long term. During their earnings call, SBA executives said they expect activity to increase next year as T-Mobile looks to add 3.45GHz and C-band spectrum to its network, and as Dish Network restarts its network buildout.

The two largest 5G network equipment vendors that sell gear in the U.S. are seeing similar CAPEX cutbacks. “We see some recovery in the second half of the year but it will be slower than previously expected,” Nokia CEO Pekka Lundmark said earlier this month during his company’s quarterly conference call, in response to a question about the company’s sales in North America. His comments were transcribed by Seeking Alpha. Ericsson’s CEO, Borje Ekholm, is experiencing similar trends: “We see the buildout pace being moderated,” he said of the North American market, according to a Seeking Alpha transcript

AT&T’s CFO Pascal Desroches confirmed the #1 U.S. network operator is slowing its network spending. “We expect to move past peak capital investment levels as we exit the year,” he said during AT&T’s quarterly conference call, as per a Seeking Alpha transcript. AT&T’s overall CAPEX would be $1 billion lower in the second half of 2023 when compared with the first half of this year due to greatly reduced 5G network build-outs.

“This implies full year capex of ~$23.7 billion, which management believes is consistent with their prior full year 2023 capex guidance of ‘~$24 billion, near consistent with 2022 levels’ and includes vendor financing payments,” wrote the financial analysts at Raymond James in their assessment of AT&T’s second quarter results, citing prior AT&T guidance.

“Although management declined to guide its 2024 outlook, it has suggested that it expects capital investments to come down as it progresses past the peak of its 5G investment and deployments. We believe the trends present largely known CY23 [calendar year 2023] headwinds for direct 5G plays CommScope, Ericsson and Nokia. Opportunities from FWA [fixed wireless access] might provide modest offsets and validate Cambium’s business. AT&T’s focus on meeting its FCF [free cash flow] targets challenge all of its exposed suppliers, which also include Ciena, Infinera and Juniper,” the financial services firm added.

Verizon CEO Hans Vestberg told a Citi investor conference in January that CAPEX would drop to about $17bn in 2024, down from $22bn in 2022″ “We continue to expect 2023 capital spending to be within our guidance of $18.25 billion to $19.25 billion. Our peak capital spend is behind us, and we are now at a business-as-usual run rate for capex, which we expect will continue into 2024,” explained Verizon CFO Tony Skiadas during his company’s quarterly conference call last week, according to Seeking Alpha.

“After years of underperformance, perhaps the best argument for Verizon equity is that expectations are very low. They are coming into a phase where capex will fall now that they’ve largely completed their 5G network augmentation. Higher free cash flow will flatter valuations, but it will also, more importantly, lead to de-levering first, and potentially even to share repurchases down the road,” speculated the analysts at MoffettNathanson in a research note to investors following the release of Verizon’s earnings.

T-Mobile USA had previously said its expansive 5G build-out had achieved a high degree of scale and it would reduce its capex sharply starting in 2023.”We expect capex to taper in Q3 and then further in Q4,” said T-Mobile USA’s CFO Peter Osvaldik during his company’s quarterly conference call last week, according to Seeking Alpha. He said T-Mobile’s capex for 2023 would total just under $10 billion. T-Mobile hopes to cover around 300 million people with its 2.5GHz midband network by the end of this year. Afterward, it plans to invest in its network only in locations where such investments are necessary.

Similarly, Verizon and AT&T are completing deployments of their midband C-band 5G networks, and will slow spending after doing so. That’s even though neither telco has deployed a 5G SA core network which involves major expenses to build, operate and maintain.

Dish Network managed to meet a federal deadline to cover 70% of the U.S. population with it’s 5G OpenRAN in June. As a result, the company said it would pause its spending until next year at the earliest.

American Tower was a bit more hopeful that CAPEX would pick up in the future:

- “Moderation in carrier spend following the recent historic levels of activity we’ve seen in the industry isn’t unexpected and is consistent with past network generation investment cycles,” explained CFO Rod Smith.

- “The cycles typically progress as there’s a coverage cycle. It’s what we’ve seen in past cycles, including 3G and 4G. It’s an initial multiyear period of elevated coverage capex, and it’s tied to new G spectrum aimed at upgrading the existing infrastructure,” said American Tower’s CEO Tom Bartlett. “And then later in the cycle, it will fill back into a capacity stage where we’ll start to see more densification going on. So I’m hopeful that our investor base doesn’t get spooked by the fact that this is a pullback. It’s very consistent. The cadence is really spot on with what we’ve seen with other technologies.”

In April, Dell’Oro Group analyst Stefan Pongratz forecast global telecom capex is projected to decline at a 2% to 3% CAGR over the next 3 years, as positive growth in India will not be enough to offset sharp capex cuts in North America. He also predicted that wireless CAPEX in the North America (NA) region would decline 10% to 20% in 2023 as per this chart:

Now, that NA CAPEX decline seems more like 30% this year!

……………………………………………………………………………………………………………………………………………

References:

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

USA’s 5G capex bubble will burst this year as three main operators cut back

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

Worldwide Telecom Capex to Decline in 2023, According to Dell’Oro Group

https://www.fiercewireless.com/wireless/wireless-capex-north-america-expected-decline-10-20-2023

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

5G subscription prices rise in U.S. without killer applications or 5G features (which require a 5G SA core network)

According to 9to5Mac, both AT&T and Verizon are now increasing the cost of their legacy smartphone mobile service pricing plans by around $3 per line per month. That’s after both Verizon and AT&T raise their prices this Spring. The increased prices from both Verizon and AT&T are set to take effect in August. Verizon is increasing prices on: 5G Start, Go Unlimited, Beyond Unlimited, Beyond Unlimited w/5G Ultra Wideband, Above Unlimited, Above Unlimited w/5G Ultra Wideband, and Single Unlimited Talk & Text 500MB. That’s according to this reddit thread, which has several customers confirming the new incoming charges.

The AT&T support page that details the new fees that 5G subscribers will pay says that the price increase will “allow [AT&T] to continue to deliver the great wireless service you expect.”

–>Does anyone really believe that?

The 5G price increases from AT&T and Verizon seem particularly egregious as neither telco has deployed a 5G SA core network, without which there are no 5G features (e.g. network slicing, security, automation/ orchestration, MEC, etc).

These are just the latest price and fee hikes enacted by the nation’s big 5G network service providers. For example, Verizon is increasing the price on its 5G home broadband service to new customers by $10 per month. Separately, T-Mobile, AT&T and Verizon are reducing their autopay discounts for customers who use credit cards. Even some prepaid cellular network providers, like T-Mobile’s Metro, are raising prices.

Here’s what each company said on this topic during their earnings calls this week:

“We look for opportunities to alter that value equation back to the customer where they perceive that they’re getting a better value and better service and something more and it accretes into the business in terms of us being able to grow ARPUs [average revenues per user],” said AT&T CEO John Stankey this week during his company’s second quarter earnings call, according to Seeking Alpha, in response to a question about pricing. “As you can see, our profitability numbers have been really, really strong. And that all comes from managing the complete equation.”

Verizon’s CFO offered a similar take this week: “We continued to benefit from pricing actions, including a recent change to our Verizon Mobile Protect offering,” Tony Skiadas said during Verizon’s own second quarter call, according to Seeking Alpha. “We continue to assess opportunities to take targeted pricing actions to better monetize our products and services as we deliver great value for our customers. For example, we recently announced an increase in our FWA [fixed wireless access] bundle pricing for new customers, which we expect will provide service revenue benefits in the second half of the year.”

Analyst Comments:

“5G was supposed to offer connectivity products that could be adapted to different device types, verticals and industries, geographies, vehicles, drones,” wrote analyst Patrick Lopez, with Core Analysis. “The 5G business case hinges on enterprises, verticals and government adoption and willingness to pay for enhanced connectivity services. By and large, this hasn’t happened yet. There are several reasons for this, the main one being that to enable these, a network overall is necessary.”

“Recent administrative rate plan adjustments on older phone plans, a $10 bump to fixed wireless pricing, and the introduction of myPlan (along with comps from last year’s price increases) boosted consumer ARPA [average revenue per account] growth to +6.2% in Q2, and it should likely sustain at +4.5% or higher in the 2H of 2023,” wrote the financial analysts at Wells Fargo in a note to investors following the release of Verizon’s second quarter earnings [1.] . “These adjustments should put wireless service revenue growth at ~3.1% for FY’23, well within the range despite continued challenges on the consumer subs front,” they added.

Note 1. Verizon has struggled with sluggish customer gains. The company Verizon reported total postpaid phone net customer additions of roughly 8,000 during the second quarter. That figure includes approximately 136,000 net customer losses in Verizon’s consumer-focused business, offset by 144,000 net customer additions in Verizon’s business-focused division.

“With T-Mobile continuing its performance lead over Verizon and AT&T in independent studies and usually offering more affordable plans, these August price increases could be a net gain for the Un-carrier,” Michael Potuck, 9to5mac.com

…………………………………………………………………………………………………………………………………………………………………………………..

In the U.S. only T-Mobile and Dish Network have deployed 5G SA core networks, but neither have touted any 5G features available. T-Mobile states on its website, “T-Mobile and other CSPs are still in the early stages of 5G network slicing implementation. Gartner describes the industry as being in the “get started” phase of a three-phase rollout [2.].

Note 2. Gartner report: “Create Value and Drive Revenue With 5G Network Slicing Phased Approach,” Susan Welsh de Grimaldo, April 6, 2021.

References:

Verizon and AT&T raising prices for the second time this year, here’s who is impacted – 9to5Mac

https://www.droid-life.com/2023/07/28/verizon-5g-start-unlimited-price-increase/

The latest 5G innovation: Even more price increases | Light Reading

Another Opinion: 5G Fails to Deliver on Promises and Potential

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

The 5G spending slowdown in the U.S. is broader than many analysts and executives expected. Dell’Oro’s Stefan Pongratz recently wrote:

“Even if it is early days in the broader 5G journey, the challenge now is the comparisons are becoming more challenging in the more mature 5G markets and the upside with the slower-to-adopt 5G regions is not enough to extend the growth streak. Meanwhile, growth from new revenue streams including Fixed Wireless Access and enterprise LTE/5G is not ramping fast enough to change the trajectory. With 5G-Advanced not expected to trigger a new capex cycle, the question now is no longer whether RAN will grow. The question now is, rather, how much will the RAN market decline before 6G comes along?”

AT&T, Verizon, T-Mobile and Dish Network broadly spent 50% less on their 5G network build-outs than Crown Castle [1.] CEO Jay Brown expected. As a result, Crown Castle cut $90 million in expected services revenues from its full year 2023 financial forecast.

……………………………………………………………………………………………………………………………………

Note 1. Crown Castle offers services including new cell site development and equipment installation. The company has a nationwide footprint of 40K+ cell towers, ~115K small cell nodes on air or under contract and more than 80K route miles of fiber optic cable.

…………………………………………………………………………………………………………………………………….

“So the back half of 2023, we did see a change relative to what we previously expected,” Brown said last week during his company’s quarterly conference call, as per a Seeking Alpha transcript. “The first half of 2023 came in exactly where we thought it was going to, and we saw the change in activity during the quarter. And that’s what affected our second half of the year, the activity that we’ll see in the – we believe we’ll see in the third and the fourth quarter.”

“I believe this initial surge in tower activity [among U.S. network operators] has ended,” Brown said, arguing that early 5G network buildout programs are coming to an end. “In the second quarter, we saw tower activity levels slowed significantly. As a result, we are decreasing our 2023 outlook primarily as a result of lower tower services margin.”

“From our perspective, this new guidance is as close to a disaster as it gets,” wrote the financial analysts at KeyBanc Capital Markets in a note to investors last week. The analysts said the cell tower industry broadly is very stable, and warnings like those from Crown Castle are few and far between. “We struggle to understand how the … trajectory could change so materially.”

…………………………………………………………………………………………………………………………….

Nokia and Ericsson take a hit:

5G network equipment vendor Nokia experienced a huge revenue drop of 40% from the North America market. Nokia CFO Marco Wiren stated that was “a result of declines across all business groups as inventory digestion continued and [communication service providers] reevaluated their spending plans.”

“The weakness was clearly visible,” Nokia CEO Pekka Lundmark said earlier this month, according to Seeking Alpha.

Nokia’s 5G FWA business has run into some market challenges, specifically tied to the vendor being “highly sensitive to a very small number of customers.” “Especially in North America, now when those deployments are significantly more slow, there is inherently some volatility here,” Lundmark explained.

Likewise, Ericsson’s CEO Borje Ekholm said the vendor’s quarterly sales in North America represented “one of the lowest shares we’ve seen in many years. But on the other hand, we see India growing very, very fast.”

…………………………………………………………………………………………………………………………….

“We believe AT&T is a primary culprit with slow spending, but inventory absorption is occurring with other operators too,” wrote the financial analysts at Raymond James in a recent note to investors. “CommScope has exposure to the same mobile and fixed access projects as well as an operator bias to its business. Ciena has high exposure to the North American operators (fiber backhaul from cell sites), but we think guidance it offered in early June reflected AT&T absorbing inventory. Ciena, Infinera, and Juniper have material cloud exposure that we believe is improving as an offset to slower telcos.”

References:

https://www.sdxcentral.com/articles/analysis/open-ran-growth-slows-to-a-crawl/2023/07/