Fiber deployments

Nokia and CityFibre sign 10 year agreement to build 10Gb/second UK broadband network

UK wholesale fiber network operator CityFibre [1.] is building an open access network which will connect up to 8 million premises in 285 cities, towns and villages, reaching a third of the country. Nokia’s Lightspan access nodes will be used by CityFibre to offer its wholesale customers multi-gigabit/sec residential broadband (up to 10Gb/s in both directions) and higher bandwidth services such as connecting enterprises and providing backhaul for mobile networks.

Note 1. CityFibre operates the UK’s largest and finest independent Full Fibre platform. Their high quality digital infrastructure enables wholesale customers to serve ultra-reliable, gigabit speed and futureproof broadband, ethernet and 5G services to homes, businesses, schools, hospitals and GP surgeries – plus anything else that need a digital connection.

……………………………………………………………………………………………………………………………………………………

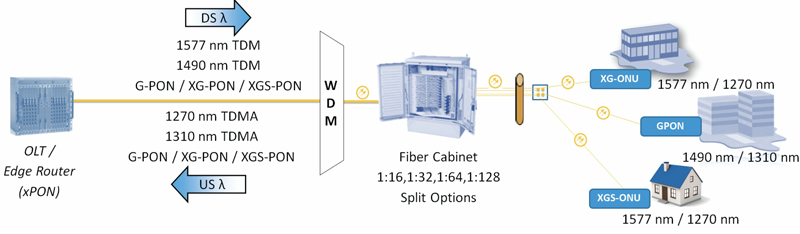

Nokia recently announced a 10-year XGS-PON broadband equipment agreement with CityFibre including access nodes for its nationwide network of purpose-built Fibre Exchanges, fiber modems for customer homes and IP aggregation switches.

Using Nokia’s Quillion chipset, the same access nodes can be used for both XGS-PON and 25G PON (25Gb/s) on the same fiber, should CityFibre wish to do this in the future. Successful delivery of 25G PON for 5G transport using the same Lightspan access node has already been proven by CityFibre, Nokia and the University of Glasgow during a trial undertaken at the end of 2021.

John Franklin, Chief Technology and Information Officer at CityFibre said: “CityFibre is committed to building a Full Fibre network that is ”Better By Design”, providing our partners and their customers with the fastest and most reliable services at the best value. By partnering with Nokia we have enlisted a trusted and market-leading technology vendor to help support a nationwide 10Gbps XGS-PON technology deployment programme.”

Sandy Motley, President, Fixed Networks at Nokia, said: “The demand for ever-faster speeds continues and we’re delighted that our 25G ready solution has been chosen by CityFibre to enable their GPON to 10G XGS-PON national network upgrade program, supporting their mission to offer the highest capacity wholesale services into the UK market.”

John Franklin, Chief Technology and Information Officer at CityFibre said: “CityFibre is committed to building a Full Fibre network that is ”Better By Design”, providing our partners and their customers with the fastest and most reliable services at the best value. By partnering with Nokia we have enlisted a trusted and market-leading technology vendor to help support a nationwide 10Gbps XGS-PON technology deployment programme.”

Sandy Motley, President, Fixed Networks at Nokia, said: “The demand for ever-faster speeds continues and we’re delighted that our 25G ready solution has been chosen by CityFibre to enable their GPON to 10G XGS-PON national network upgrade program, supporting their mission to offer the highest capacity wholesale services into the UK market.”

Usually located in fiber exchanges, Nokia’s high-capacity optical line terminals are deployed for massive scale fiber roll-outs. They connect thousands of users via optical fiber, aggregate their broadband traffic and send it deeper in the network. The fiber access nodes can support multiple fiber technologies including GPON, XGS-PON, 25G PON and Point-to-Point Ethernet to deliver a wide range of services with the best fit technology.

Nokia ONT (Optical Network Termination) devices, or fiber modems, are located at the user location. They terminate the optical fibre connection and delivers broadband services within the user premises or cell sites.

Included in the deal:

- Lightspan MF optical line terminals family (access nodes)

- XS-010X-Q optical network terminations (fiber modems)

- 7220 IXR-D3L IP Aggregation Switch

References:

Future Market Insights: Lit Fiber Market to reach US$ 20B by 2032

The global lit fiber market is expected to witness an impressive growth rate of 16.7% over the forecasted years of 2022 to 2032, according to a new report by Future Market Insights, Inc. The lit fiber market size is anticipated to reach a valuation of around US$ 20 Billion by the end of year 2032 from the current valuation of US$ 4.28 Billion in 2022.

Lit fiber has been used in the IT and telecommunications sectors for a number of noteworthy applications since its beginnings. But in recent years, the sales of lit fiber have grown as a result of the discovery of various more unique applications.

Compared to conventional copper lines, lighted fiber is more durable and extremely resistant to the dangers and traffic found in the previous system. Over the years, the demand for lit fiber has strengthened as an active cable that is set up, controlled, and maintained exclusively by service providers.

Elevated level of data transfer via short- and long-distance communications is made possible by fiber optics that is observed to have strengthened the lit fiber market opportunities. For connectivity, industrial, IT and communications, and security applications, a number of international businesses have started providing illuminated fiber connectivity proliferating the market further.

Increased investment in research and development by key actors leads to the creation of new technologies, and advancements in fiber optic connectivity that is predicted to increase the competition among lit fiber market participants.

Key Takeaways from Market Study:

- The overall growth of the global lit fiber market is estimated to be around US$ 15.7 Billion during the coming decade by following the average CAGR of 16.7%.

- The global market for lit fiber is dominated by multi-modal fiber segment, which is estimated to grow at a rate of 16.3%, while the single-mode segment is projected to develop at the fastest pace of 17.2%.

- The higher selling segment, which accounts for over 60% of the sales revenue, is the lit fiber on-net connectivity items that is expected to grow at a CAGR of 17% during the projection period. And from the other front, the off-net lit fiber segment has grown in popularity recently and is expected to increase the sales of lit fiber over the years 2022 to 2032.

- With a market dominance the networking application segment have historically been the key driver of lit fiber industry expansion. However, due to the product’s growing popularity, a 31.7% growth rate in this segment is anticipated throughout the anticipated time frame.

- Of the world’s major geographical areas, North America accounts for more than 28% of the global lit fiber market. In contrast, the Asia Pacific lit fiber market has recently picked up steam and is expected to increase at an above average CAGR from 2022 to 2032.

Competitive Landscape:

The global lit fibre industry is highly fragmented and is anticipated to see an increased competition in the coming days as a result of the existence of several illuminated fibre market rivals. The major lit fibre companies are prioritising growing their customer base and serving underdeveloped areas at the same time as their major strategy to penetrate wider market.

Some of the well-known market players are among

- AT&T

- Attice USA

- Comcast

- Crown Castle Fiber

- Frontier

- GigabitNow

- Lumen

- Spectrum Enterprise

- Verizon

- Zayo among others

Recent Developments in the Global Lit Fiber Market:

- In line with the target of providing lit plus dark fibre connectivity at Coloblox’s ATL1 Atlanta data centre, FiberLight, LLC, which is a vendor of optical equipment, joined forces in August 2021.

References:

https://www.futuremarketinsights.com/reports/brochure/rep-gb-15116

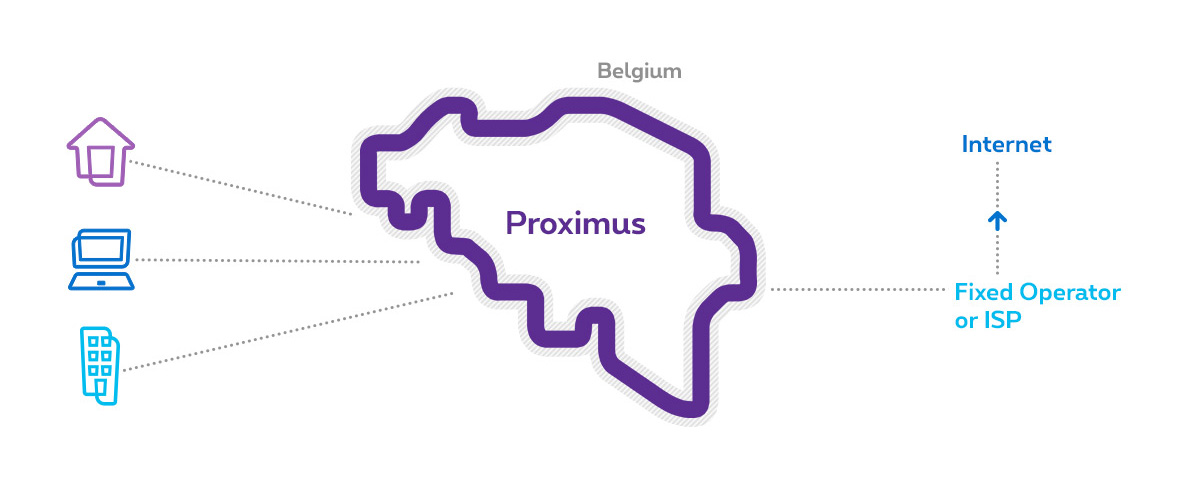

Proximus to extend fiber coverage to 95% of Belgian premises

Belgian network operator Proximus is teaming up with private equity partners in a bid to deliver gigabit fiber service to 95% of the country. The telco is planning to reach a final joint venture (JV) agreement with I4B by the end of 2022.

The company this week inked a memorandum of understanding (MOU) with I4B – The Belgian Infrastructure Fund – whose founding investors are the Federal Holding and Investment Company (SFPI-FPIM), AG Insurance and Synatom, will act as an anchor investor to the project. I4B’s mission is to finance the development of infrastructure with a positive impact on Belgium’s economic development, while taking into account societal and environmental requirements.

One of the joint ventures will focus on rollouts in the French-speaking Wallonia region of the country while the other will zero in on Dutch-speaking Flanders. Proximus will serve as a minority shareholder for each JV and the anchor tenant on the networks built in each region.

Proximus and I4B plan to spend around €4 billion (approximately $4.2 billion) between the two JVs. Petra De Sutter, Belgium’s deputy prime minister, said in a statement the partnership between Proximus and I4B will help ensure internet access in areas with “no or insufficient connectivity today.”

According to a report released by the FTTH Council Europe in May, Belgium topped the list as the fastest growing fiber market in the European Union (including the U.K.) by percentage. Its figures showed Belgium’s number of homes passed grew 109% between September 2020 and September 2021, outpacing Israel (107%) Greece (90%), Cyprus (83% and the U.K. (80%).

FFTH Council Europe forecast the number of homes passed by fiber in Belgium will skyrocket 568% by 2027 to reach a total of 3.9 million.

References:

https://www.fiercetelecom.com/telecom/proximus-inks-mou-push-fiber-17m-more-locations-belgium

https://www.proximus.com/news/2022/20220629-fiber-rollout.html

FTTH Council Europe: 197 million homes passed in 2026 in EU27+UK

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

The city of Amarillo, TX has selected AT&T to install fiber-to-the-premises (FTTP) networks, covering more than 22,000 customer locations. The project will cost about $24 million (with $2 million coming from the city). The network, which will be built out over three years, still requires final approval by Amarillo and a final contract between AT&T and the city.

AT&T already has access to public rights of way in Amarillo with its legacy infrastructure and will work closely with the city on permitting activities required for the fiber build-out.

[Amarillo residents and businesses also served by Altice USA’s Suddenlink Communications.]

AT&T is taking the public/private partnership route here. The telco inked a similar $39.6 million agreement (with about $10 million coming from public funds) last year with Vanderburgh County, Indiana, to build fiber to about 20,000 locations in the rural, southern tip of the state. AT&T also has a $33 million fiber project underway to connect about 20,000 locations in Oldham County, Kentucky.

As noted in an earlier IEEE Techblog post, AT&T’s FTTP buildout/upgrade plan is targeting 30 million locations by 2025. AT&T added 289,000 FTTP subs in Q1 2022, ending the period with a grand total of 6.28 million, and enough to offset a quarterly loss of 284,000 non-fiber subs (including U-verse Internet customers).

“What we’re doing here in Amarillo that’s different is that this is an urban core,” said Jeff Luong, president, broadband access and adoption initiatives for AT&T. “The city of Amarillo identified a specific area that they believe is challenging from a connectivity perspective in their urban core,” he added.

“The area that the city wanted to address is actually the city core. It’s actually an area they feel is underserved,” he said. “We are expanding access, we are providing a very affordable free solution when partnered with ACP [Affordable Connectivity Program] and then we’ll be actively engaging in adoption, digital literacy and other type of activities to ensure that people have access, they can afford it and that they understand how to use the service.”

“We’re working with the public sector to identify areas that are more challenging to build on our own from a private sector perspective and creating these type of public/private partnerships where we, AT&T, will invest our own capital. But the public sector would also contribute a share of the cost to expand fiber connectivity to these locations,” Luong said.

AT&T today delivers services in the area via other technologies, including legacy copper networks. The new fiber overlay, based on XGS-PON, will be capable of delivering symmetrical speeds of 5 Gbit/s, replicating a new mix of multi-gigabit services that AT&T has launched in its other FTTP markets.

AT&T already has access to public rights of way in Amarillo with its legacy infrastructure and will work closely with the city on permitting activities required for the fiber build.

About AT&T in Texas:

AT&T customers and FirstNet® subscribers in Texas got a big boost in wireless connectivity and fiber access last year. In 2021, AT&T completed nearly 1,000 wireless network enhancements in Texas, including adding nearly 200 new macro sites. AT&T also made fiber available in more than 300,00 new locations in Texas in 2021. These network improvements will enhance the state’s broadband coverage and help give residents, businesses and first responders faster, more reliable service.

From 2018 to 2020, we expanded coverage and improved connectivity in more communities by investing more than $7.7 billion in our wireless and wireline networks in Texas. This investment boosts reliability, coverage, speed and overall performance for residents and their businesses.

And in Amarillo, we expanded coverage and improved connectivity by investing more than $60 million in our wireless and wireline networks from 2018-2020.

References:

https://www.att.com/local/fiber/texas/amarillo

https://about.att.com/story/2022/amarillo-broadband-access.html

AT&T CEO John Stankey: 30M or more locations could be passed by AT&T fiber

“Fiber is Foundational” as AT&T achieves 37% subscriber penetration rate across its fiber footprint

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?

AT&T CFO sees inflation as main threat, but profits and margins to expand in 2nd half 2022

Clearwave Fiber to build all fiber Internet access network in Kansas

Clearwave Fiber (not to be confused with the now defunct Clearwire WiMAX network provider) will begin building a state-of-the art, all-fiber Internet access network in Lansing, KS. This latest expansion marks the company’s first network presence in Kansas and underscores its goal to bring the most advanced and fastest Internet available to more than 500,000 homes and businesses across the United States by 2027. Clearwave Fiber is scheduled to begin construction of the all fiber network in Kansas this month.

Clearwave Fiber’s Vice President of Kansas, Stormy Supiran, stressed the importance of the company’s investment to consumers and the broader local community.

“We are committed to providing underserved communities with the high-speed connectivity that is essential for families, businesses, and local economies; without these essential services, many of the communities we are targeting may struggle to survive,” said Supiran. “We are excited to extend services to Lansing, and we look forward to becoming long-term partners to the community.”

Featuring gigabit download and upload speeds, Clearwave Fiber will bring ten times more speed to consumer doorsteps at a time when fast, reliable Internet is becoming increasingly critical to modern households. “More and more, we see households where multiple bandwidth-intensive activities occur simultaneously and many consumers’ Internet connections just aren’t up to the task,” said Clearwave Fiber’s Midwest President, Byron Cantrall. “The Clearwave Fiber network solves that problem.”

In March Clearwave acquired the assets of RG Fiber, a fiber network provider near Kansas City, Kansas. This was Clearwave’s first entry into Kansas. At the time, the company said that it planned to expand RG Fiber’s network and bring more fiber services to other communities in Kansas that do not currently have access to fiber.

For many consumers, Internet touches every facet of daily life. Remote work, telehealth, and virtual learning all require robust, reliable connections. A 2021 study by Deloitte indicated that 55% of U.S. households include one or more remote workers, and 43% include at least one household member attending virtual classes.

Cable One formed the Clearwave Fiber joint venture in January. Its JV partners include a trio of private equity firms: GTCR, Stephens Capital Partners and the Pritzker Organization. At the time, Cable One said that the new entity would target deployments of fiber to residential and business customers within and adjacent to its existing markets.

For more information, visit clearwave.com/home.

Clearwave Fiber is an Internet service provider based in Savannah, GA that operates a more than 2,000 route-mile fiber network serving cities across the Midwest and Southeast regions of the United States. Delivering advanced telecommunications solutions with an emphasis on exceptional customer care and community engagement, they provide fiber to business, enterprise, and residential customers in more than 90 municipalities in Illinois and Kansas. It is a joint venture formed by operator Cable One.

References:

https://www.fiercetelecom.com/broadband/clearwave-fiber-will-expand-fiber-footprint-kansas

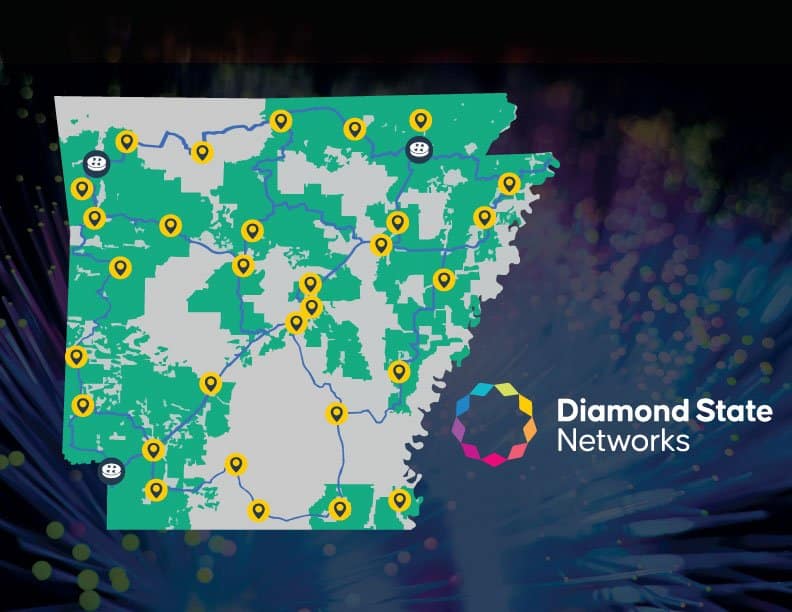

Diamond State Networks to invest more than $1.66 billion in fiber infrastructure in Arkansas

A new consortium in Arkansas is leading the way forward for electric cooperatives in the rural U.S. can increase bandwidth and save costs by collaborating on fiber broadband delivery.

Diamond State Networks (DSN) is a collective of 13 electric co-ops from across the state of Arkansas which are joining forces to deliver wholesale fiber broadband. All in, the cooperative networks’ 50,000 miles of fiber will cover 64% of Arkansas and reach 1.25 million rural Arkansans. The goal for DSN is to serve 600,000 residences and businesses in Arkansas in the next few years, with over 250,000 locations already deployed. Here’s a network coverage map:

The 13 member cooperatives in DSN include: OzarksGo, Clay County Connect, Farmers Electric Cooperative, Petit Jean Fiber, Enlightened by Woodruff Electric, NEXT Powered by NAEC, Wave Rural Connect, Arkansas Fiber Network (AFN), Four States Fiber Internet, empower (delivered by Craighead Electric), MCEC Fiber, South Central Connect and Connect2First.

Doug Maglothin, DSN’s director of operations, says his company expects to add “a couple more cooperatives” to that list. (The state of Arkansas has 17 electric co-ops, served by a central entity called the Arkansas Electric Cooperative Corporation.)

The collective of co-ops that form DSN are at different phases of their service delivery journey. Some, like Farmers Electric, are in the early planning stages. OzarksGo – the subsidiary of Ozarks Electric Cooperative – is furthest along and nearing 40,000 subscribers. Indeed, Maglothin referred to Ozarks Electric CEO Mitchell Johnson as the “visionary” for DSN, who saw the need for the state’s electric co-ops to get involved with broadband delivery in 2015 and 2016.

But as electric co-ops began entering the space in 2017 and 2018, “pretty quickly, you find out how difficult and expensive it can be to buy connectivity to the global Internet,” said Maglothin. It was “from that necessity” that the plan for DSN was born.

While the consolidated electric cooperative model is unique for the broadband space, other states and communities are deploying broadband as collectives or partners. That includes Utopia Fiber’s municipal, open access fiber delivery network in Utah as well as California’s planned open-access statewide middle-mile network. And this week, a group of rural telcos and an electric cooperative in Indiana announced plans to launch HoosierNet, a “multi-year, multi-million-dollar” statewide fiber network.

Maglothin said DSN is collaborating with other states looking for a similar solution and that Diamond State has “kind of become a beacon for cooperative middle mile,” as it offers a model that allows electric co-ops to control their costs.

“The more bandwidth you grow, the more content you collect, the more powerful your voice is in negotiating pricing to get to these big anchor points for your network,” said Maglothin. “So we feel like there’s a potential future for cooperative companies working together like this where we become one of the largest bandwidth aggregators probably in the country.”

The 13 member co-ops are investing more than $1.66 billion in fiber infrastructure for DSN. According to Maglothin, less than 20% of that funding is from federal and state grants. But he expects that DSN will be eligible for Broadband Equity, Access, and Deployment (BEAD) and Middle Mile grant funding, federal programs worth $42.45 billion and $1 billion, respectively.

According to Broadband.Money, a platform connecting local providers and networks with funding opportunities, Arkansas is estimated to receive $1.4 to $1.6 billion for broadband through the Infrastructure Investment and Jobs Act (IIJA). But those numbers are still to be determined by federal broadband mapping data that officials say will be released later this year.

Notably, while existing FCC broadband data is widely understood to undercount the digital divide in the US, a recent presentation by the Broadband Development Group at the Arkansas Rural Connect Broadband Forum revealed that the state’s broadband gap may now be smaller than the FCC’s count shows. While federal data puts Arkansas’ digital divide at 250,000 households or 21% of the population, BDG’s analysis brought that to 209,000 households (17%).

Maglothin attributes this increase in broadband access to the work electric co-ops have done in recent years. “It’s because of the rapid onset of cooperative fiber being pushed out,” he said.

For this reason, and with more funding coming down through the BEAD program, Maglothin thinks that Arkansas can go from being among the lowest-ranked states in the US for connectivity to the highest.

References:

https://www.diamondstatenetworks.com/

https://www.broadbandworldnews.com/document.asp?doc_id=778063&

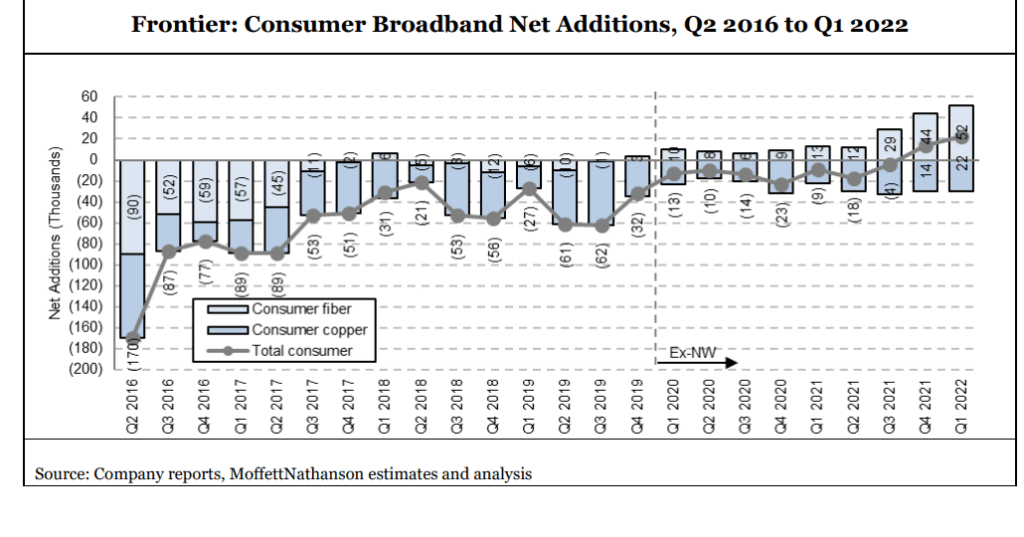

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

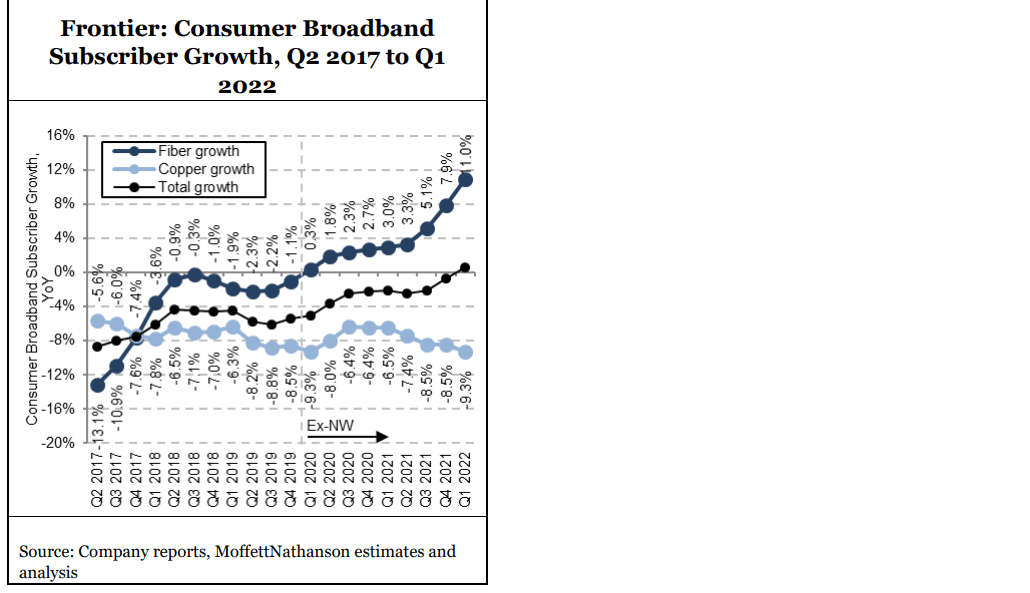

Frontier Communications added a record 54,000 fiber broadband customers in the first quarter of 2022, a 20% gain over the previous record set in Q4 2021 and somewhat higher than expectations coming in to the quarter. These fiber customer adds are coming from both new and existing fiber markets. Frontier’s data continues to track nicely: 22% penetration at the 12-month mark for its 2020 cohort and 18% for its larger 2021 cohort, and 44% at the 24-month mark for its (admittedly small and probably not broadly representative) 2020 cohort. Base market penetration was up 50 basis points in the quarter and 90 basis points over the past two quarters.

Frontier’s aggressive fiber network buildout and a record low churn of 1.19%, enabled the telco to offset copper losses and add 20,000 net broadband subs for Q1 2021. That’s a record nearly two times higher than that set in the prior quarter. Frontier ended the quarter with 1.38 million residential fiber broadband subs, up 11% YoY.

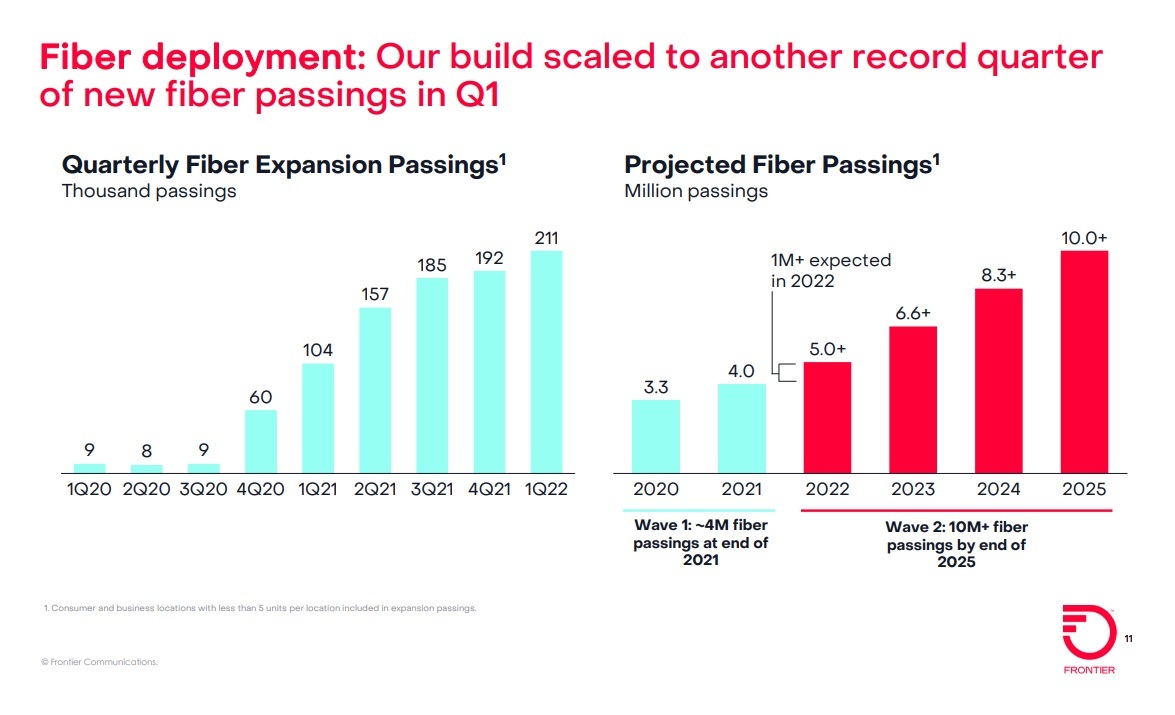

Frontier plans to expand its fiber-to-the-premises (FTTP) footprint to 10 million locations by 2025 – a figure that includes the company’s “Wave 1” and “Wave 2” builds. Frontier built fiber out to another 211,000 locations in the first quarter of 2022, and says it’s on track to add more than 1 million FTTP locations for all of 2022, and another 1.6 million in 2023.

Frontier passed another 211K locations with fiber in the quarter, up from the ~190K level of the prior two quarters, a nice accomplishment in light of the disruptions associated with Omicron early in the quarter (100K of the 211K passings were achieved in March alone). Management continues to expect to add at least 1M fiber locations in 2022, and it seems on track to meet or exceed that target.

“Positive net adds is the new normal,” Nick Jeffery, Frontier’s president and CEO, declared on Friday’s earnings call. The CEO continued:

“We gained momentum in business and wholesale, reaching a key inflection point in SMB and we made progress improving our employee engagement. And last week, we unveiled our new Frontier brand. A year ago, we said we will take a long and hard look at our brand and its future and after a thorough data-driven evaluation I am delighted with the results. Our new brand is modern, more relevant, more tech-oriented, and reflects our commitment to relentlessly being better in our business and for our customers. We also gained customers in our mature fiber market, what we refer to as our base fiber footprint. In our base fiber footprint, penetration increased 50 basis points sequentially to 42.4%. And our base fiber footprint serves as a target for where we expect to drive penetration in our expansion fiber footprint and we expect to steadily grow penetration to at least 45% over time.

In our expansion fiber footprint, we are also making excellent progress. At the 12-month mark, our 2021 build cohort reached penetration of 18%, consistent with our target range of 15% to 20%. And at the 24-month mark, our 2020 build cohort reached penetration of 44%, significantly outperforming our target range of 25% to 30%. As larger builds are pulled into our 2020 cohort throughout the year, we continue to expect penetration of 25% to 30% at the 24-month mark.”

Indeed, Frontier’s operations and service levels have improved dramatically over the past two years. Our colleague Nick Del Deo at MoffettNathanson wrote in a research note to clients:

By some measures, Frontier is now operating at as high a level as key competitor Charter in the California market. And this is having an effect on its customer perceptions and market traction. Its American Consumer Satisfaction Index scores are slowly moving up, while its net promoter score has surged, especially where it has rolled out FTTH. Churn has fallen, as have customer care call volumes.

Frontier’s post-emergence management team has taken a data-driven approach to running the business and making key decisions. Put simply, the choice to refresh the company’s font and logo rather than totally rebrand is further evidence that changes to the business are working.”

To reiterate, 1Q-2022 fiber penetration rates rose to 42.45% in the company’s base fiber footprint. Frontier expects to reach penetration rates of at least 45% over time.

In the expansion areas, Frontier realized a penetration rate of 12% at the 12-month mark in its 2021 fiber build cohort – within its target range of 15%-20%. In the 2020 FTTP build cohort, Frontier is seeing a 44% penetration rate at the 24-month mark, outperforming its target range of 25%-30%.

Source: Frontier Communications Q1 2022 earnings presentation

CEO Jeffery said Frontier’s fiber-powered services are taking share from incumbent cable operators, but didn’t elaborate on how much damage Frontier is inflicting. He also acknowledged that fixed wireless access (FWA) could present an attractive option in rural areas where fiber isn’t present. Jeffery also believes fiber represents “a fundamentally different proposition” over FWA, given current data usage trends. In March, the average Frontier fiber subscriber consumed about 900 gigabytes of data, up 30% from pre-pandemic levels, with a portion consistently consuming more than 1 terabyte per month.

Significantly, Frontier gained new customers in areas where fiber is being built out. “This is critical because we know our future is fiber and fiber customers are the ones that will drive our growth in the years to come,” said Jeffery, a former Vodafone UK exec who took the helm of Frontier in March 2021.

For the full 2022 year, Frontier is targeting adjusted EBIDTA of $2 billion to $2.15 billion, and capital expenditures in the range of $2.4 billion to $2.5 billion, the same as guidance issued last quarter. This implies $2,003M for the remainder of the year at the midpoint. Management continues to target FTTH builds in 2022 of at least 1,000K vs. 638K built in 2021.

References:

https://s1.q4cdn.com/144417568/files/doc_financials/2022/q1/Frontier-First-Quarter-2022-Results.pdf

Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth

Altice USA recently disclosed a plan to overbuild its hybrid fiber-coaxial (HFC) network to blanket 6.5 million locations with fiber by 2025. The NYC based cableco/MSO operates the Optimum and Suddenlink brands, which it plans to rebrand under the Altice USA name.

During a New Street Research investor conference, Altice USA EVP of corporate finance and development Nick Brown said the decision to make that move was a “no brainer” for the company, but acknowledged that it’s in a slightly different position than fellow cable giants Comcast and Charter Communications. Brown stated Altice USA’s own experience and that of its sister companies in Europe gave it better insight into what the transition to fiber would look like in terms of costs and returns, leaving it unafraid to take the leap. But it also already faces “a lot of fiber-based competition relative to others,” especially from Verizon Fios in its legacy Cablevision footprint in the eastern part of the country.

Altice has already upgraded its head ends and backbone rings with fiber. Since DOCSIS would require it to push fiber deeper and deeper into the network anyway, Brown said it made sense to go all-in to pull forward the benefits full fiber has to offer. “The FTTH end-to-end glass network that we’re deploying here in the U.S. for us is pretty much the end state, the logical end state, of a coax upgrade anyway,” Brown argued.

Brown said the move to fiber will allow Altice USA to save in the “low hundreds of millions” of dollars in operating expenses and “materially” reduce its capital expenditures over time. It’s also expected to help Altice more effectively compete by allowing it to offer a better product, reduce churn and improve network reliability. He also pointed out it’ll make future network upgrades easier. Today, it has around half a million active components in its coax network, nearly all of which need to be touched for a DOCSIS upgrade. But with fiber “the equivalent is about 1,000 to 2,000 pieces of equipment that you would need to upgrade to go to next generations of fiber technology as we’re doing this year as we’re moving to XGS-PON,” he said, noting its current fiber footprint of more than 1 million locations was originally built with GPON technology.

“I think it’s just a lot more scalable, a lot more future-proof in our mind, and a lot more cost effective to move to future broadband technologies,” Brown concluded.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

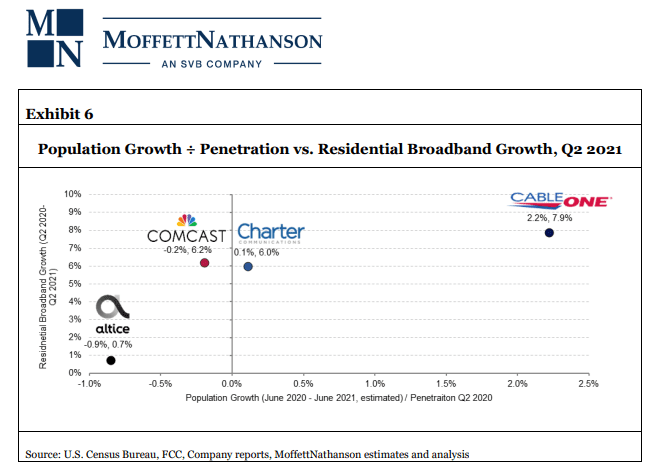

To determine which operators might have been most negatively affected by low population growth (and therefore likely low household growth) from July 2020 to July 2021, and which might have been net beneficiaries of the fastest growth, analysts at MoffettNathanson aggregated the population by county in each cable operator’s footprint using FCC Form 477 data as of Q4 2020. Using those totals, we calculated a weighted average population growth for each operator’s total footprint based on the county-level annual estimates published by the Census Bureau. The weighted-average population growth implies a meaningful headwind to Altice USA (at -0.4% growth), and a significant tailwind to Cable One (at 0.7% growth).

Craig concluded: “Again, there’s a lot more at work in broadband subscriber growth rates than just population (new household formation) growth or starting penetration. Different operators have different demographics. They face different overlaps with fiber, and some will face more FWA than others. They have different pricing strategies.”

References:

https://www.fiercetelecom.com/telecom/altice-usa-exec-fiber-logical-end-state-coax

“Fiber is Foundational” as AT&T achieves 37% subscriber penetration rate across its fiber footprint

During its annual Analyst & Investor day virtual presentations today, AT&T said that Fiber is Foundational for the company’s growth. It is the critical asset in making AT&T the most pervasive and scaled broadband network provider. According to the company, that fiber foundation includes: Multi-gig capable speeds, Symmetric and low latency connectivity, Sustainable, and Enabling critical technologies.

“To us, fiber is foundational to our entire network. Wherever fiber goes, wireless follows,” Jeff McElfresh, CEO of AT&T Communications, said. McElfresh is confident that AT&T has the heft and deals in place to execute on the plan in the face of supply chain constraints and increasing demand and costs for labor.

“We are a very large fiber overbuilder,” he said. “We’ve got scale and we’ve done it before. That scale translates to things like supply chain agreements that are long in tenure and have really good protections for both us and our suppliers.”

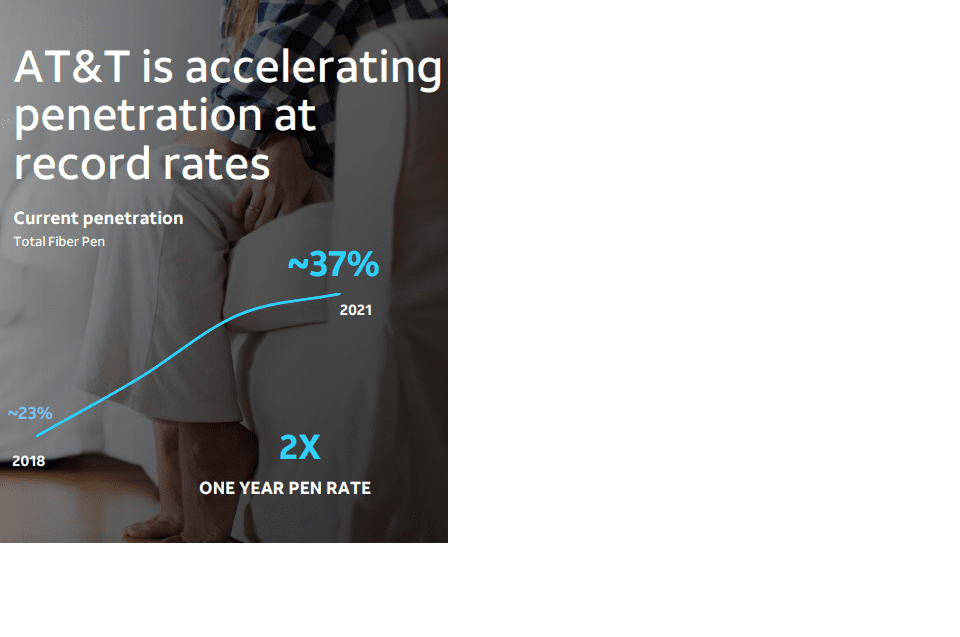

Furthermore, AT&T experienced 37% service penetrations across its entire fiber footprint, including new-build areas, last year.

In markets such as New Orleans, Miami and Louisville, where AT&T is now building FTTP rapidly, penetrations are “well north of 30% after only 12 months of fiber deployment,” Jenifer Robertson, AT&T’s EVP and GM, mobility, said during AT&T’s annual analyst and investor day.

About two-thirds of AT&T’s fiber adds are new to AT&T, Robertson added. With a nod toward service bundling, AT&T is also seeing a 50% boost in wireless market share in its fiber footprint.

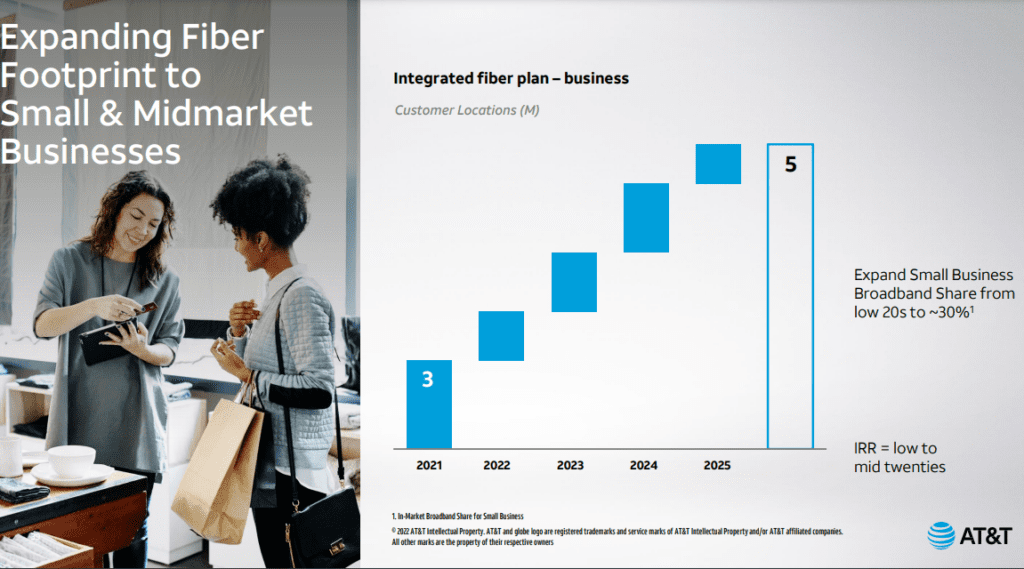

AT&T is targeting small and medium businesses with its FTTP deployments. That’s depicted in this graphic:

AT&T built about 2.6 million new fiber locations in 2021. The company reiterated a plan to build out a footprint of 30 million-plus locations (25 million residential, 4 million small businesses and 1 million enterprise locations) by 2025. It will build in the range of 3.5 million to 4 million locations per year in the coming years to hit that mark. AT&T also expects to spend $3 billion to $4 billion per year to fulfill its fiber buildout mission.

In tandem with the aggressive fiber buildout, AT&T expects broadband revenue to grow by 6% or more in 2022, and in the mid-to-high single-digit range in 2023. Total annual capital expenses are poised to hit $24 billion in 2022 and 2023, up from $20.1 billion in 2021.

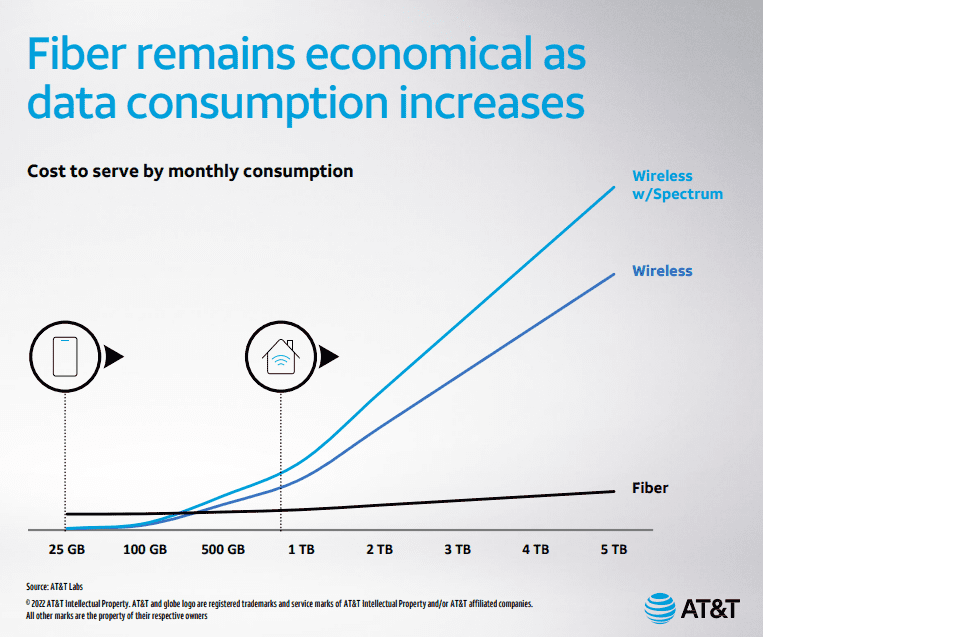

McElfresh outlined the data growth the company expects in coming years that will take advantage of fiber-level speeds. While consumer data consumption has reached the neighborhood of 0.9 terabytes (TB) today, the company expects that to climb to 4.6 TB by 2025. AT&T expects to see big gains in its small- and medium-sized (SMB) and enterprise segments. It also anticipated that the average number of devices connected to the home network will triple, to about 40, by 2025.

“We’re not attempting to serve terabytes of monthly consumption over wireless,” McElfresh said, implying such high data consumption would be via fiber.

Commenting on future networking trends, AT&T CEO John Stankey said:

We conservatively project a 5x data increase on our network over 5 years. A couple of examples. The evolution of social interaction, gaming and experiential alternate realities will consume huge amounts of real-time, low latency 2-way data.

Dramatically improving collaboration tools will enable more effective distributed work environments that will take traffic off of corporate lands and onto robust distributed WANs. Improved health care outcomes and lower cost to address an aging population will rely on access, telemetry and observation to address the challenge of rising cost curves and the list goes on. Some worry and ask, will we get paid for this new rule? History has shown us that sound policy will, in fact, provide returns and solutions.

In the lab, software and hardware will mature rapidly and efficiently. As has been the case since the advent of compute, distributed networking will be running to keep pace. We exit the pandemic with a credible real-world testimony to the value of reliable and pervasive connectivity.

In order to meet the bandwidth and latency needs of broadband applications “nothing is going to top fiber,” he added, noting that AT&T is making a “longer term bet” with its fiber buildout plan.

Separately, U.S. fiber investment forecast from RVA LLC calls for service providers to spend $125 billion over the next five years, exceeding the total amount that has been invested in fiber since providers first began deploying it.

………………………………………………………………………………………………………….

References:

https://video.ibm.com/recorded/131492715

AT&T CEO John Stankey: 30M or more locations could be passed by AT&T fiber

Fiber Investment Forecast to Surpass $125 Billion Over Next Five Years

MoffettNathanson: Robust broadband and FWA growth, but are we witnessing a fiber bubble?

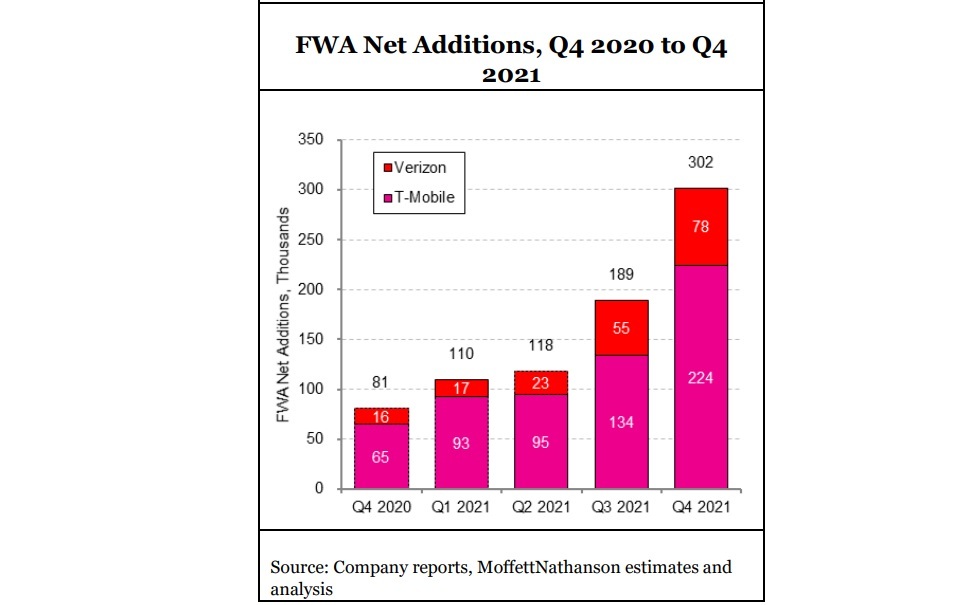

According to a new comprehensive, market research report from MoffettNathanson (written by our colleague Craig Moffett), Q4 2021 broadband growth, at +3.3%, “remains relatively robust,” and above pre-pandemic levels of about +2.8%.

Meanwhile, the U.S. fixed wireless access (FWA market) captured ~ 38% share of broadband industry net adds in the fourth quarter of 2021. Approximately half of Verizon’s FWA customers are coming from commercial accounts, T-Mobile has indicated that about half its FWA customers are coming from former cable Internet subscribers. FWA’s strong Q4 showing left cable’s flow share at just 66%, about the same as cable’s share of installed US broadband households. “In other words, Cable likely neither gained nor lost share during the quarter, and instead merely treaded water,” Moffett noted. FWA “has gone from low-level background noise to suddenly a major force, with Verizon and T-Mobile alone capturing more than 300K FWA subscribers in the fourth quarter,” Craig noted. However, he isn’t sure that wireless network operators will allocate enough total bandwidth capacity for FWA to fully scale.

In 2020, a year that witnessed a surge in broadband subs as millions worked and schooled from home, the growth rate spiked to 5%. Here’s a snapshot of the broadband subscriber metrics per sector for Q4 2021:

Table 1:

| Sector | Q4 2021 Gain/Loss | Q4 2020 Gain/Loss | Year-on-Year Growth % | Total |

| Cable | +464,000 | +899,000 | +3.8% | 79.43 million |

| Telco | -26,000 | +21,000 | -0.4% | 33.51 million |

| FWA* | +302,000 | +81,000 | +463.9% | 869,000 |

| Satellite | -35,000 | -35,000 | -6.6% | 1.66 million |

| Total Wireline | +437,000 | +920,000 | +2.8% | 112.95 million |

| Total Broadband | +704,000 | +966,000 | +3.3% | 115.48 million |

| * Verizon and T-Mobile only (Source: MoffettNathanson) |

||||

U.S. broadband ended 2021 with a penetration of 84% among all occupied households. According to US Census Bureau data, new household formation, a vital growth driver for broadband, added just 104,000 to the occupied housing stock in Q4 2021, versus +427,000 in the year-ago period. Moffett said the “inescapable conclusion” is that growth rates will continue to slow, and that over time virtually all growth will have to stem from new household formation.

Factoring in competition and other elements impacting the broadband market, MoffettNathanson also adjusted its subscriber forecasts for several cable operators and telcos out to 2026. Here’s how those adjustments, which do not include any potential incremental growth from participation in government subsidy programs, look like for 2022:

- Comcast: Adding 948,000 subs, versus prior forecast of +1.25 million

- Charter: Adding 958,000 subs, versus prior forecast of +1.22 million

- Cable One: Adding 39,000, versus prior forecast of +48,000

- Verizon: Adding 241,000, versus prior forecast of +302,000

- AT&T: Adding 136,000, versus prior forecast of +60,000

Are we witnessing a fiber bubble?

“The market’s embrace of long-dated fiber projects rests on four critical assumptions. First, that the cost-per-home to deploy fiber will remain low. Second, that fiber’s eventual penetration rates will be high. Third, that these penetration gains can be achieved even at relatively high ARPUs. And fourth, that the capital to fund these projects remains cheap and plentiful.

None of these assumptions are clear cut. For example, there is an obvious risk that all the jostling for fiber deployment labor and equipment will push labor and construction costs higher. More pointedly, we think there is a sorely underappreciated risk that the pool of attractive deployment geographies – sufficiently dense communities, preferably with aerial infrastructure – will be exhausted long before promised buildouts have been completed.

Revenue assumptions, too, demand scrutiny. Cable operators are increasingly relying on bundled discounts of broadband-plus-wireless to protect their market share. What if the strategy works, even a little bit? And curiously, the market’s infatuation with fiber overbuilds comes at a time when cable investors are growing increasingly cautious about the impact of fixed wireless. Won’t fixed wireless dent the prospects of new overbuilds just as much (or more) as those of the incumbents.”

Moffet estimates that about 30% of the U.S. population has been overbuilt by fiber over the past 20 years, and that the number is poised to rise as high as 60% over the next five years. But the big question is whether there’s enough labor and equipment to support this magnitude of expansion. “Our skepticism about the prospects for all of the fiber plans currently on the drawing board is not born of doubt that there is enough labor to build it all so much as it is that the cost of building will be driven higher by excess demand,” Moffett explained. “There are already widespread reports of labor shortages and attendant higher labor costs,” he added.

“The outlook for broadband growth for all the companies in our coverage, particularly the cable operators, is more uncertain than at any time in memory. IMarket share trends are also more uncertain that they have been in the past. Cable continues to take share from the telcos, but fixed wireless, as a new entrant, is now taking share from all players. Share shifts between the TelCos and cable operators are suppressed by low move rates, likely due in part to supply chain disruptions in the housing market. This is likely dampening cable growth rates. In at least some markets, returns will likely be well below the cost of capital,” Moffett forecasts.

References:

U.S. Broadband: Are We Witnessing a Fiber Bubble? MoffetNathanson research note (clients and accredited journalists)