MEC

Moody’s skeptical on 5G monetization; Heavy Reading: hyperscalers role in MEC and telecom infrastructure

In a recent “Top of Mind” series report, Moody’s said, “The adoption of 5G is gaining momentum. Yet we question how fast companies can roll out 5G and the ability to generate revenue from applications based on 5G technology.”

“We do not expect material revenue increases in the global telecom sector from 5G in the 2022-2025 period. This is because 5G will mainly evolve around enhanced mobile broadband, which will be broadly similar to 4G.”

Wireless network operators have invested heavily in 5G spectrum, network infrastructure upgrades and the credit rating and financial research firm concludes global carriers’ capex will continue to rise through 2025. That’s despite more tepid carrier capex forecasts from Dell’Oro Group and others.

“Global capex growth is expected to moderate from 9 percent in 2021 to 3 percent in 2022, before tapering off in 2023 and 2024,” wrote Stefan Pongratz of Dell’Oro.

Wireless carriers’ capex as a share of revenue leveled off at 16% globally in 2019 and 2020, inched up to 17% in 2021, and is expected to hit 18% for the next four years, according to Moody’s.

Wireless telcos have cumulatively spent $200 billion globally on 5G spectrum to date, according to Moody’s, and GSMA predicts operators will invest about $510 billion on 5G-related infrastructure and services from 2022 to 2025.

…………………………………………………………………………………………………………………..

On the income side of the ledger, wireless carriers have experienced a prolonged period of flat to declining revenue. Rising costs and flat revenue portends a rough four-year stretch for operators, and there’s little to suggest that dynamic will change by 2026. One analyst said the only real revenue generator for wireless telcos in the last few years has been selling their cell towers!

The largely unmet promise of 5G, with no real “killer apps,” follows previous disappointments for carriers in the 3G and 4G time periods. Indeed, they did not make any money of mobile apps, cloud computing/storage, interactive gaming, edge computing or really any value added services.

“This phase carries the greatest uncertainty about companies’ capital spending. As a result, we remain cautious when projecting revenue growth derived from 5G until there is clarity on the business case, especially given the lessons of limited monetization of 4G and 3G,” Moody’s analysts wrote.

Specialized services for enterprises continue to be the most compelling use cases for 5G, and additional IoT applications could drive incremental revenue gains after 2025 but those are unlikely to justify carriers’ significant 5G investments, the financial research firm said.

While ultra low latency might be important (assuming 3GPP release 16 “URLLC in the RAN” spec is completed, performance tested and deployed), the resulting “almost immediate network response time is only relevant in specialized use cases, Indeed, it has become apparent that the most compelling use cases for 5G revolve around businesses rather than residential consumers,” the Moody’s analysts wrote.

“The wide array of potential applications — such as autonomous vehicles, robotics, and smart homes — places different demands on networks in terms of speed and latency, in contrast to previous generations that focused on one major advance, such as broadband mobile video with 4G or web browsing with 3G,” the analysts wrote.

………………………………………………………………………………………………………………..

Moody’s missed a very crucial point related to 5G revenues: that the hyperscalers (Amazon, Microsoft, Google) will get an increasing share of 5G SA core network services and MEC revenues. That’s because of the partnerships wireless carriers have made with the big cloud service providers.

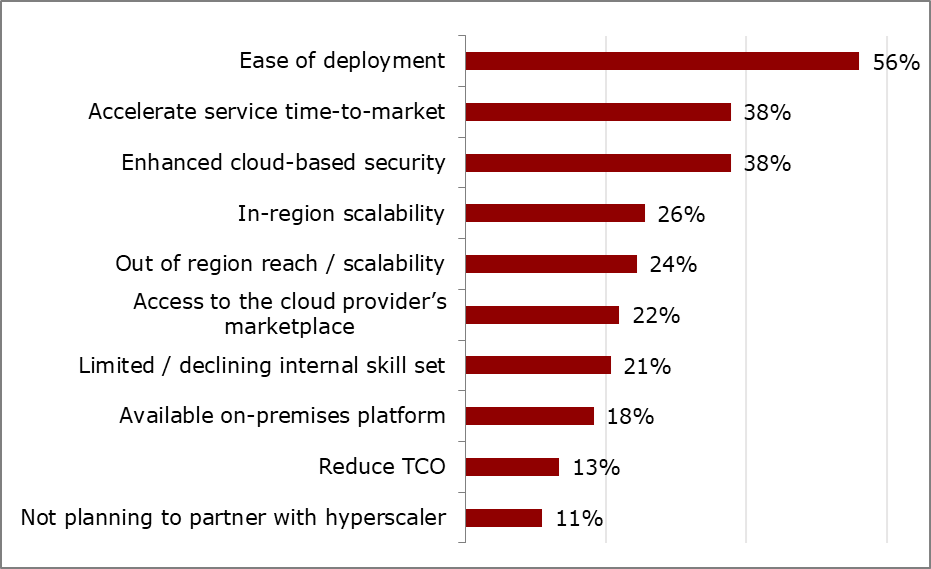

Heavy Reading noted that in a recent blog post. Heavy Reading conducted a survey in collaboration with Accedian, Kontron and Red Hat. The survey questioned 82 communications service providers (CSPs) that have launched edge computing solutions or are planning to do so within 24 months. One of the objectives of the survey was to examine the go-to-market strategies of the CSP and the role the hyperscalers have assumed in those strategies.

Hyperscalers have introduced dedicated edge products and embedded their software stack into operator infrastructure, including Internet of Things (IoT) devices and network gateways. They have introduced products dedicated to the telco market, such as Wavelength from Amazon Web Services (AWS), Azure Edge Zones from Microsoft and Anthos for Telecom from Google Cloud. According to Heavy Reading’s survey results, their efforts have paid off, as CSPs have unquestionably decided to partner with hyperscalers in their multi-access edge computing (MEC) services.

Q: Why do you plan to partner with a hyperscaler to deliver your edge computing? Select up to three. (n=82)

Source: Heavy Reading

…………………………………………………………………………………………………………..

Heavy Reading’s most recent edge computing survey determined that the pivot to improved customer experience is the key goal of edge network deployments and that CSPs must clear new paths to achieve this goal. They must do so by:

- Leaning into automation, particularly in overall lifecycle management.

- Building in comprehensive security protections from the design phase forward.

- Enhancing performance control through automation and AI. CSPs’ growing collaborations with hyperscalers are key to achieving these goals and improving ease of deployment, accelerating time-to-market and enhancing cloud-based security.

Heavy Reading’s survey results show that carriers have committed to edge computing and are progressing rapidly with implementations. The deployment of edge computing brings with it issues of scale and complexity. CSPs are most concerned with overall network performance and security. In fact, those companies that have already deployed the edge have a heightened concern about these issues. They are looking for help from their traditional vendor and integrator partners, from their network monitoring and assurance tools and from the hyperscalers.

References:

Omdia: Regulatory activity to impact telecom in 2022; Global 5G status

According to market research dynamo Omdia, 2022 will be rife with regulatory activity that will impact the telecommunications market for years to come.

“As technology evolves, regulation will become more important than ever in the TMT industry,” said Sarah McBride, senior analyst for regulation at Omdia.

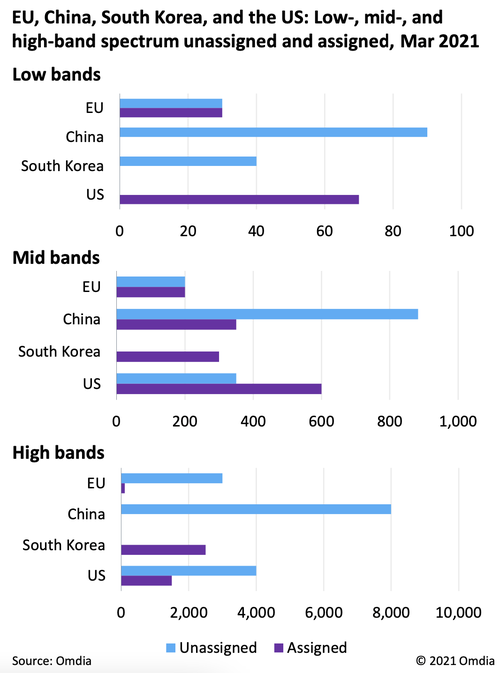

Omdia identified several trends it says will be “at the heart of regulatory activity” next year, including spectrum licensing, fiber networks, the digital divide and 6G (even though 5G spectrum has not been standardized by ITU-R in a revision to M.1036).

Regarding the digital divide (between the broadband haves and have nots), Omdia says “governments should learn from the pandemic and recognize the need for these broadband services to be affordable to all.”

The Omdia analysts say that governments must define a “comprehensive national digital strategy that includes providing state-aid tools to improve broadband availability and affordability.”

Such a strategy should go beyond deployment to “ensure citizens can use connectivity transformatively to bring about innovation and growth.” Doing so will encourage more deployment and investment, writes Omdia.

However, to avoid too much government intervention, Omdia also stresses the need for cooperation by service providers.

“Experience shows that market-led development, not a reliance on government intervention, is the most effective model for effective allocation of resources. However, economic viability is lower in some rural and sparsely populated areas than in populous areas,” Omdia said. The firm recommends that network operators collaborate by sharing infrastructure to reduce deployment costs and create shared wireless networks to “remove the need for regulators to set ambitious coverage obligations as part of spectrum licenses or universal service obligations.”

According to Omdia’s tracker for 5G networks, more than 150 5G networks have been launched around the world to date, which the research firm says will continue to drive demand for more spectrum.

“5G will profoundly affect society because of its ultrafast speeds, low latency, and high reliability, which enable digital transformation and support new use cases,” writes Omdia.

Regulators need to effectively manage spectrum allocation, “allowing access to the right amount of internationally harmonized spectrum (e.g., 700MHz, 3.6GHz, and 26GHz bands in the EU) in a timely manner to keep costs down.”

As operators continue to build out their 5G networks, Omdia tells policymakers it’s important to plan ahead on 6G standards, given the role these networks will play in the digital economy and the danger posed by a lack of cohesion.

Specifically, the firm warns against further splintering the telecom and Internet ecosystem, or what it calls “the splinternet.”

“It is especially important that regulators and policymakers prepare for future network generations by ensuring agreement is reached on 6G standards. A fragmentation of standards must be avoided to prevent any further separation of the telecoms and internet ecosystem, a ‘splinternet’,” writes Omdia.

Acknowledging that plans for 6G are in their infancy, Omdia further tells policymakers to begin identifying appropriate spectrum bands, though it notes that such plans “will need to be balanced with the need to release spectrum for 5G.”

Part of the rush to deploy high-speed internet everywhere includes a migration to fiber, whether through new builds or upgrades of existing cable networks. Omdia says that as network operators migrate to fiber, regulators should focus on promoting competition, pricing strategies and raising awareness amongst consumers about fiber access.

The firm further states that regulators should include fiber access in wholesale obligations, “once sufficient fiber coverage is reached.”

It’s important for network operators to collaborate with regulators on network upgrade plans and give wholesale customers advance warning to avoid disruption.

“Operators need to give their wholesale customers a sufficient notice period when withdrawing copper networks. This includes providing formal notifications that outline the timeframes involved, the replacement products on offer, and the new price terms,” writes Omdia.

……………………………………………………………………………………………..

In a separate report titled, 2022 Trends to Watch: Global 5G, Omdia says that 5G network rollouts are still in the early stages, especially in developing regions.

“But there are compelling reasons for telcos to commit to 5G so they can differentiate around an improved network experience, as well as realize network efficiencies and lower operating costs. Moreover, 5G’s enhancements over 4G – most noticeably speed and latency – will come to be appreciated by consumers more next year as an increasing number of data-intensive services and applications become popular in the mass market,” the research firm said.

“A surprise to many next year may be the rapid emergence of satellite to augment telcos’ terrestrial network coverage,” Omdia observed.

“A key driver for hybrid satellite-cellular deployments is the need for ubiquitous high-speed data coverage, something which telcos can greatly benefit from if their rivals’ 5G network coverage remains patchy.”

Major telcos including BT, Deutsche Telekom, Telecom Italia and Verizon signed significant deals with satellite internet providers in 2021 to offer a hybrid approach to targeted residential, enterprise and industrial markets.

Omdia believes that the likely success of these satellite internet initiatives could jump-start a flurry of new activity in this area in 2022.

“Although most end users aren’t rushing to buy 5G, the quality of their network experience in terms of reliability, speed, and coverage is increasingly important to them. As such, 5G offers telcos a better opportunity than 4G to differentiate, especially for ones that can claim they offer the best-in-market network experience,” Omdia said.

Omdia thinks that partnership strategies will be even more important for telco 5G success in 2022.

“How good telcos are at partnering, whether for content, service, or technology development, will increasingly define how successful they are in consumer, enterprise, and industrial markets. Because of its enhanced capabilities over 4G, 5G enables telcos to offer much more, and they will have to partner effectively to capitalize on this.”

“Except for 5G MEC (really ?), the ecosystem and markets for advanced 5G technologies are still in their infancy. However, 5G front-runners are already launching them, placing them in a strong position to gain a first-mover advantage when the market is ready to adopt them,” Omdia said.

References:

https://www.broadbandworldnews.com/document.asp?doc_id=774240&

https://techblog.comsoc.org/2021/12/18/etsi-mec-standard-explained-part-ii/

ETSI MEC Standard Explained – Part II

by Dario Sabella, Intel, ETSI MEC Chair

Introduction:

This is Part II of a two part article series on MEC. Part I may be accessed here.

Access to Local and Central Data Networks (DN):

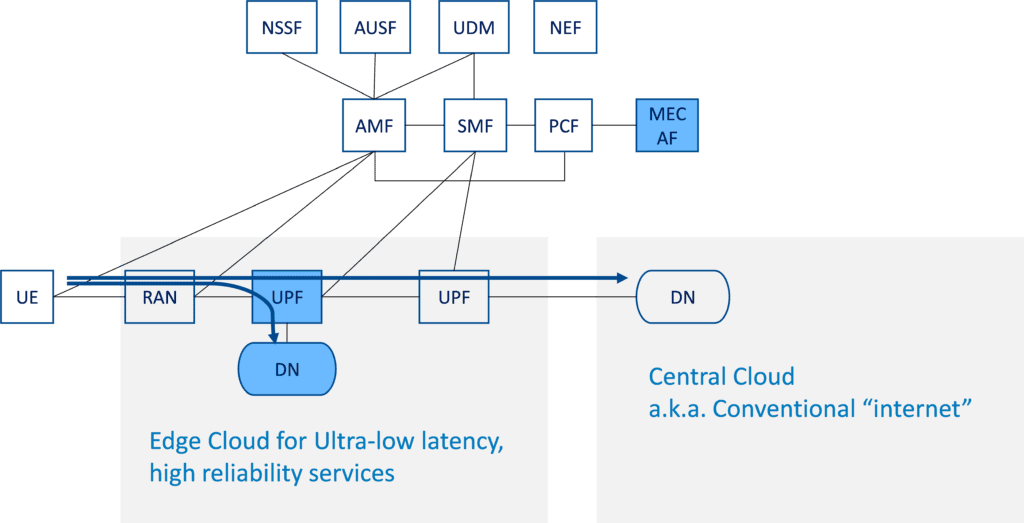

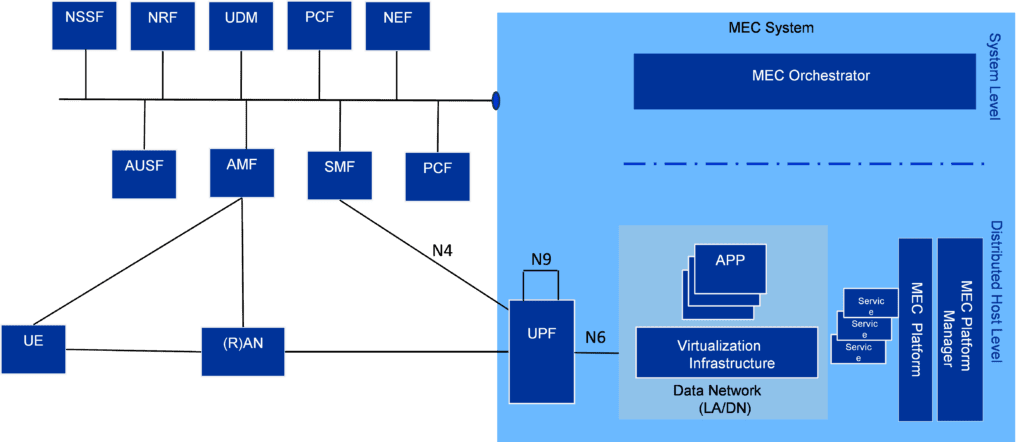

Figure 5. below illustrates an example of how concurrent access to local and central DN (Data Networks) works. In this scenario, the same UP session allows the UE to obtain content from both the local server and central server (service continuity is enabled by IP address anchoring at the centralized UPF, with no impact on UE by using Uplink Classifier -ULCL).

Figure 5. Concurrent access to local and central Data Networks (DN)

In this context it is assumed that MEC is deployed on the N6 reference point, i.e. in a data network external to the 5G system. This is enabled by flexibility in locating the UPF. The distributed MEC host can accommodate, apart from MEC apps, a message broker as a MEC platform service, and another MEC platform service to steer traffic to local accelerators. Logically MEC hosts are deployed in the edge or central data network and it is the User Plane Function (UPF) that takes care of steering the user plane traffic towards the targeted MEC applications in the data network.

The locations of the data networks and the UPF are a choice of the network operator who may choose to place the physical computing resources based on technical and business parameters (such as available site facilities, supported applications and their requirements, measured or estimated user load etc). The MEC management system, orchestrating the operation of MEC hosts and applications, may decide dynamically where to deploy the MEC applications.

In terms of physical deployment of MEC hosts, there are multiple options available based on various operational, performance or security related requirements (for more details, see the ETSI paper “MEC in 5G networks” [6] and the more recent study on “MEC 5G integration” [7]).

Moving forward with 5G (3GPP Release 17 onwards):

Given the increase of 5G adoption, and the progressive migration of network operators towards 5G SA (Stand Alone) networks this above MEC deployment is naturally becoming a long-term option considering the evolution of the networks. A major joint opportunity for MEC 5G integration, is on one hand for MEC to benefit from the edge computing enablers of the 5G system specification, and for 3GPP ecosystem to benefit from the MEC system and its APIs as a set of complementary capabilities to enable applications and services environm5 ents in the very edge of mobile networks. IN this perspective, also in the view of more mature 5G deployments, ETSI MEC is aligning with 3GPP SA6, defining from Rel.17 an EDGEAPP architecture (ref. 3GPP TS 23.558).

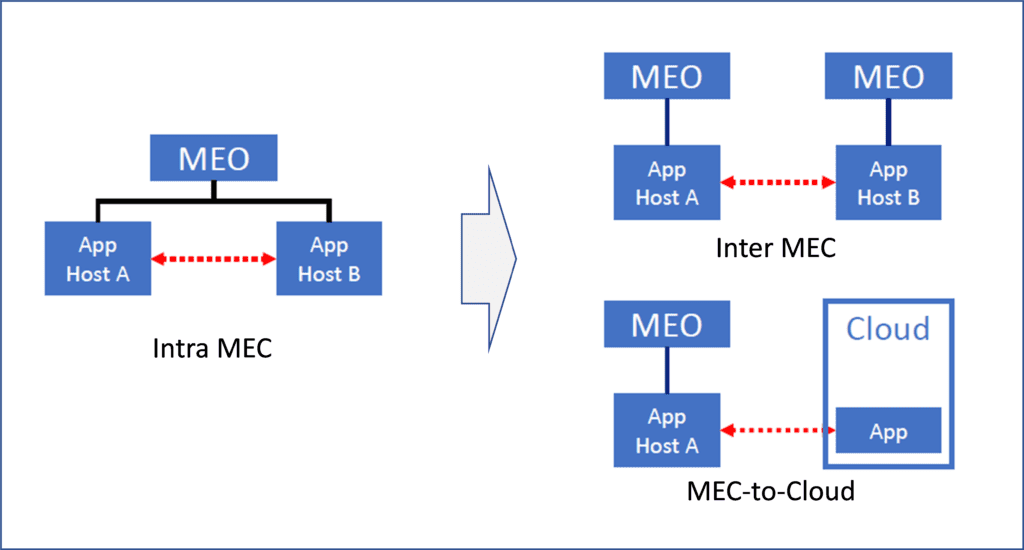

In this perspective, an ETSI white paper [3] provides some first information on this ongoing alignment, which is introducing a Synergized Mobile Edge Cloud architecture supported by 3GPP and ETSI ISG MEC specifications. This is an ongoing alignment, also in the view of future Rel.18 networks, and with respect to MEC federation and the related expansion (for MEC Phase 3 specifications) from intra-MEC communication to inter-MEC and MEC-Cloud coordination (as depicted in Figure 6). A very first study in this field has been published by ETSI MEC with the ETS GR 035 report [8].

Figure 6. MEC Phase 3: Expansion from intra-MEC to inter-MEC and MEC-Cloud

The MEC 035 study on “Inter-MEC systems and MEC-Cloud systems” was a major effort in ETSI MEC, mainly driven by the need of operators to form federated MEC environments. For example, to achieve V2X (vehicle to X) service continuity in multi-operator scenarios, to enable edge resource sharing among the federating members, and in general offer edge computing infrastructure as an asset to provide global services benefiting of better performance and low latency environments. Many use cases in MEC 035 are in need of MEC federation. Many are also based on the ETSI MEC requirements in MEC 002 (e.g. use cases like “V2X multi-stakeholder scenario” and “Multi-player immersive AR game,” among others).

This work carefully aligns with a GSMA publication introducing requirements for their “Operator Platform” concept. [The GSMA Operator Platform defines a common platform exposing operator services/capabilities to customers/developers in the 5G-era in a connect once, connect to many models. The first phase of the platform focuses on Edge which will be expanded in future phases with other capabilities such as connectivity, slicing and IPComms.] In this scenario, multiple operators will federate their edge computing infrastructure to give application providers access to a global edge cloud which may then run innovative, distributed and low latency services through a set of common APIs.

Currently ETSI MEC is working on the related normative work to enable and support this concept of MEC Federation, by defining a suitable MEC architecture variant in MEC GS 003, updating other impacted MEC specifications in Phase 3, and by introducing proper “MEC Federation Enablement APIs” (MEC GS 040) [9].

Enablement of MEC Deployment and Ecosystem Development:

MEC adoption is critical for the ecosystem. In this perspective, ETSI ISG MEC has established a WG DECODE dedicated to MEC Deployment and Ecosystem engagement activities. As a part of that (but not limited to it!) MEC is publishing and maintaining a MEC Wiki page (mecwiki.etsi.org), including links to several examples of MEC adoption from the ecosystem:

- MEC Ecosystem, with 3rd party MEC Applications and Solutions

- Proof of Concepts (PoCs), with a list and description of past and ongoing PoCs, including the ISG MEC PoC Topics and PoC Framework (and Information about process, criteria, templates….)

- MEC Deployment Trials (MDTs), with a list and description of past and ongoing MDTs (and the MDT Framework, clarifying how to participate)

Additionally, the MEC Wiki also includes: information on MEC Hackathons, MEC Sandbox, OpenAPI publications for ETSI MEC ISG API specifications, and outreach activities (e.g. MEC Tech Series of video and podcasts).

Summary and Conclusions:

- MEC (Multi-access Edge Computing) “offers to application developers and content providers cloud-computing capabilities and an IT service environment at the edge of the network” (see Ref 1. below).

- The nature of the ETSI MEC Standard (as emphasized by the term “Multi-access” in the MEC acronym) is access agnostic and can be applicable to any kind of deployment, from Wi-Fi to fixed networks.

- MEC is also serving multiple use cases and providing an open and flexible standard, in support of multiple deployment options, especially for 5G networks.

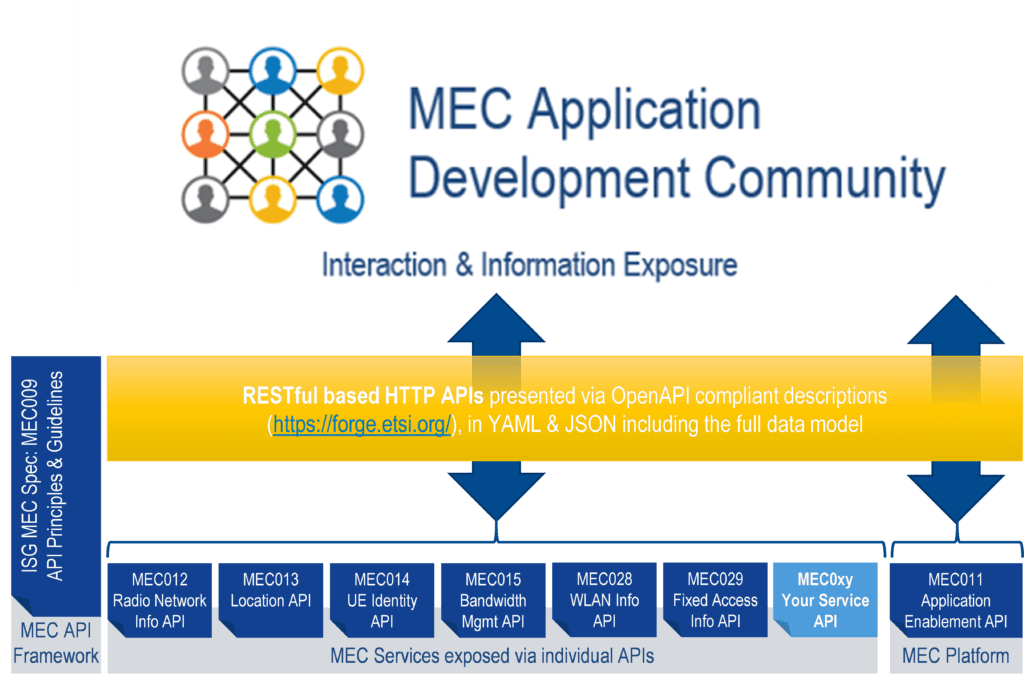

- MEC is focused on Applications at the Edge, and the specified MEC service APIs include meaningful information exposed to application developers at the network edge, ranging from RNI (Radio Network Information) API (MEC 012), WLAN API (MEC 029), Fixed Access API (MEC 028), Location API (MEC 013), Traffic Management APIs (MEC015) and many others. Additionally, new APIs (compliant with the basic MEC API principles) can be added, without the need for ETSI standardization.

- The ongoing ETSI MEC work in alignment with 3GPP includes aspects related to MEC 5G Integration and future evolution, including the standardization work on MEC Federation. Also, carefully aligning the MEC work with requirements from GSMA OPG (Operator Platform Group).

Finally, since MEC adoption is critical for the IT ecosystem, ETSI ISG MEC has established a WG dedicated to MEC Deployment and Ecosystem engagement activities.

There is also a dedicated MEC Wiki page (mecwiki.etsi.org) which provides several examples of MEC adoption from the ecosystem (PoCs, trials, MEC implementations). It also includes information on MEC Hackathons, MEC Sandbox, OpenAPI publications for ETSI MEC ISG API specifications, and outreach activities (e.g. MEC Tech Series of video and podcasts).

………………………………………………………………………………………….

Previous References (from Part I):

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

[1] ETSI MEC website, https://www.etsi.org/technologies/multi-access-edge-computing

[2] ETSI GS MEC 003 V2.1.1 (2019-01): “Multi-access Edge Computing (MEC); Framework and Reference Architecture”, https://www.etsi.org/deliver/etsi_gs/mec/001_099/003/02.01.01_60/gs_mec003v020101p.pdf

[3] ETSI White Paper #36, “Harmonizing standards for edge computing – A synergized architecture leveraging ETSI ISG MEC and 3GPP specifications”, First Edition, July 2020, https://www.etsi.org/images/files/ETSIWhitePapers/ETSI_wp36_Harmonizing-standards-for-edge-computing.pdf

[4] ETSI GS MEC 009 V3.1.1 (2021-06), “Multi-access Edge Computing (MEC); General principles, patterns and common aspects of MEC Service APIs”, https://www.etsi.org/deliver/etsi_gs/MEC/001_099/009/03.01.01_60/gs_MEC009v030101p.pdf

[5] ETSI White Paper No. 24, “MEC Deployments in 4G and Evolution Towards 5G”, February 2018, https://www.etsi.org/images/files/ETSIWhitePapers/etsi_wp24_MEC_deployment_in_4G_5G_FINAL.pdf

[6] ETSI White Paper No. 28, “MEC in 5G network”, June 2018, https://www.etsi.org/images/files/ETSIWhitePapers/etsi_wp28_mec_in_5G_FINAL.pdf

[7] ETSI GR MEC 031 V2.1.1 (2020-10), “Multi-access Edge Computing (MEC); MEC 5G Integration”, https://www.etsi.org/deliver/etsi_gr/MEC/001_099/031/02.01.01_60/gr_MEC031v020101p.pdf

[8] ETSI GR MEC 035 V3.1.1 (2021-06), “Multi-access Edge Computing (MEC); Study on Inter-MEC systems and MEC-Cloud systems coordination”, https://www.etsi.org/deliver/etsi_gr/MEC/001_099/035/03.01.01_60/gr_mec035v030101p.pdf

[9] ETSI DGS/MEC-0040FederationAPI’ Work Item, “Multi-access Edge Computing (MEC); Federation enablement APIs”, https://portal.etsi.org/webapp/WorkProgram/Report_WorkItem.asp?WKI_ID=63022

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Additional References:

https://mecwiki.etsi.org/index.php?title=Main_Page

https://www.gsma.com/futurenetworks/5g-operator-platform/

https://techblog.comsoc.org/2021/05/19/o2-uk-and-microsoft-to-test-mec-in-a-private-5g-network/

https://techblog.comsoc.org/2021/07/06/att-and-google-cloud-expand-5g-and-edge-collaboration/

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

by Dario Sabella, Intel, ETSI MEC Chair, with Alan J Weissberger

Introduction (by Alan J Weissberger):

According to Research & Markets, the global Multi-access Edge Computing (MEC) market size is anticipated to reach $23.36 billion by 2028, producing a CAGR of 42.6%. Reduced Total Cost of Ownership (TCO) due to integration of MEC in network systems as compared to legacy systems and subsequent ability to generate faster Return on Investment (RoI) is further expected to encourage smaller retail chains to leverage MEC technology.

Multi-access Edge Computing Market Highlights (from Research & Markets):

- The software segment is anticipated to be the fastest-growing segment owing to emerging demand among service providers to use software that can be deployed for various applications without making changes to existing 3GPP hardware infrastructure specifications.

- The energy and utilities segment is expected to witness the fastest growth rate over the forecast period owing to increasing demand among companies to quickly access insights and analyze data generated from remote locations

- The Asia Pacific region is expected to emerge as the fastest-growing regional market due to strong support from the government to encourage advanced network infrastructure

A few important MEC applications/ use cases include:

- Streaming video and pay TV: Increasing number of users adopting the Over the Top (OTT) video delivery model is expected to promote telecom companies and mobile networks to upgrade their existing infrastructure to cache video/audio content closer to the user. Using the multi-access edge computing (MEC) architecture system brings backend functionality closer to the user network, which is expected to aid Multichannel Video Programming Distributors (MVPD) to meet their customers’ demands. Users pay subscription fees for a specified duration of time to access the content offered by the MVPD.

- Deployment of MEC technology is expected to enable retail and on line stores to improve the performance of in-store systems and reduce data processing time, thus ensuring faster resolving of customer grievances. Furthermore, adoption of this technology is expected to reduce the load on external macro sites, thus offering a seamless in-store experience for users.

- Increasing number of IoT devices and the emerging need to gain access to real-time analysis of data generated by them is expected to drive MEC market growth. Leveraging this technology in IoT can facilitate reduced pressure on cloud networks and result in lower energy consumption, which is expected to offer significant growth opportunities to the market.

- Multi-access edge computing is expected to enhance manufacturing practices and thus facilitate the advent of connected cars ecosystem. Connected cars are equipped with computing systems, wireless devices, and sensing, which have to work together in a coordinated fashion, thus facilitating the need to adopt MEC.

- 5G MEC technology can be used to exchange critical operational and safety information to enhance efficiency, safety, and enhance value-added services such as smart parking and car finder.

Previously referred to as Mobile Edge Computing, MEC raises a lot of questions. For example:

- Can MEC be used with wireline and fixed access networks?

- Is 5G Stand Alone (SA) core network with separate control, data, and management planes required for MEC to be effective?

- Finally, why should MEC (and multi-cloud) matter to infrastructure owners and application developers?

Dario Sabella, Intel, ETSI MEC Chair, answers those questions and provides more context and color in his two part article.

………………………………………………………………………………………………..

ETSI MEC Standard Explained, by Dario Sabella, Intel, ETSI MEC Chair

ETSI MEC – Foundation for Edge Computing:

MEC (Multi-access Edge Computing) “offers to application developers and content providers cloud-computing capabilities and an IT service environment at the edge of the network” [1].

The MEC ISG (Industry Specification Group) was established by ETSI to create an open standard for edge computing, allowing multiple implementations and ensuring interoperability across a diverse ecosystem of stakeholders: from mobile operators, application developers, Over the Top (OTT) players, Independent Software Vendors (ISVs), telecom equipment vendors, IT platform vendors, system integrators, and technology providers; all of these parties are interested in delivering services based on Multi-access Edge Computing concepts.

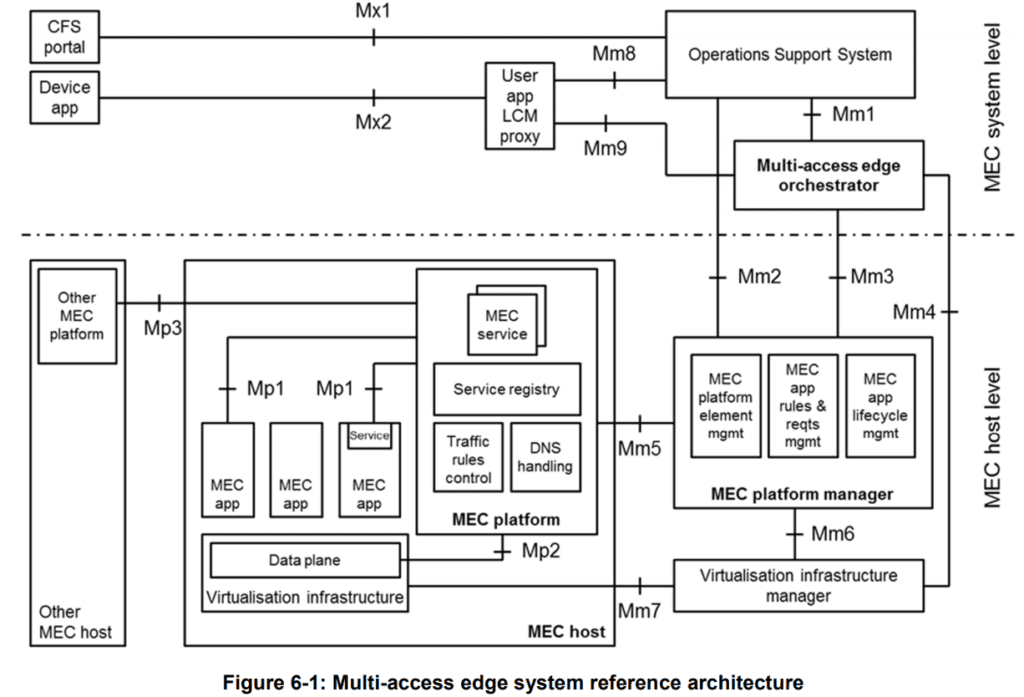

The work of the MEC initiative (see the architecture in Figure 1. above) aims to unite the telco and IT-cloud worlds, providing IT and cloud-computing capabilities at the edge: operators can open their network edge to authorized third parties, allowing them to flexibly and rapidly deploy innovative applications and services towards mobile subscribers, enterprises and vertical segments (e.g. automotive).

Author’s Note:

From a deployment point of view, a natural question is “where exactly is the edge?” In this perspective, the ETSI MEC architecture supports all possible options, ranging from customer premises, 1st wireless base station/small cell, 1st network compute point of presence, internet resident data center/compute server or edge of the core network. The MEC standard is flexible, and the actual and specific MEC deployment is really an implementation choice from the infrastructure owners.

Additionally, the MEC architecture (shown in Figure 2 and defined in the MEC 003 specification [2]) has been designed in such a way that a number of different deployment options of MEC systems are possible:

- The MEC 003 specification includes also a MEC in NFV (Network Functions Virtualization) variant, which is a MEC architecture that instantiates MEC applications and NFV virtualized network functions on the same virtualization infrastructure, and to reuse ETSI NFV MANO components to fulfil a part of the MEC management and orchestration tasks. This MEC deployment in NFV (Network Functions Virtualization) is also coherent with the progressive virtualization of networks.

- In that perspective, MEC deployment in 5G networks is a main scenario of applicability (note that the MEC standard is aligned with 3GPP specifications [3]).

- On the other hand, the nature of the ETSI MEC Standard (as emphasized by the term “Multi-access” in the MEC acronym) is access agnostic and can be applicable to any kind of deployment, from Wi-Fi to fixed networks.

- A major effort of the MEC standardization work is dedicated to publishing relevant and industry-driven exemplary specifications of MEC service APIs, that are using RESTful principles, thus exposed to application developers in a universally recognized language.

The ETSI MEC initiative is focused on Applications at the Edge, and the specified MEC APIs (see above Figure 2.) include meaningful information exposed to application developers at the network edge, ranging from RNI (Radio Network Information) API (MEC 012), WLAN API (MEC 029), Fixed Access API (MEC 028), Location API (MEC 013), Traffic Management APIs (MEC015) and many others.

Additionally, new APIs (compliant with the basic MEC API principles [4]) can be added, without the need of being standardized in ETSI.

In this perspective, MEC truly provides a new ecosystem and value chain, by opening up the market to third parties, and allowing not only operators and cloud providers but any authorized software developers that can flexibly and rapidly deploy innovative applications and services towards mobile subscribers, enterprises and vertical segments.

MEC in 4G (and 5G NSA) Deployments:

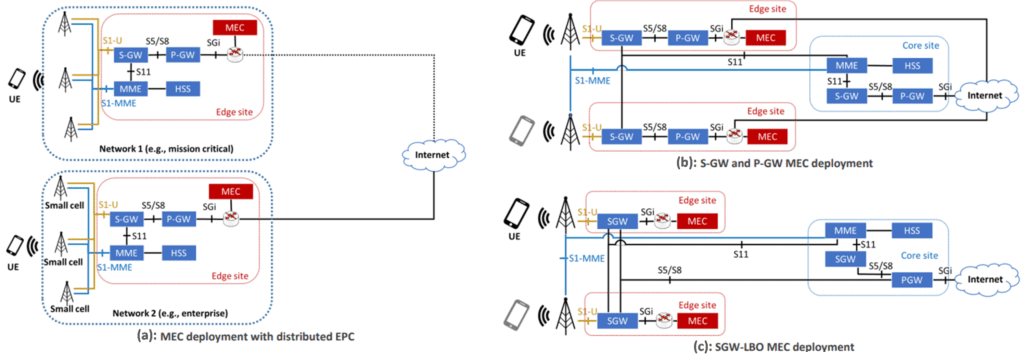

ETSI has already clarified how MEC can be deployed in 4G networks, given its access-agnostic nature [5], with many approaches:

From “bump in the wire” (where the MEC sits on the S1 interface of the 4G system architecture), to “distributed 4G-Evolved Packet Core” (EPC -where the MEC data plane sits on the SGi interface), to “distributed S/PGW” (where the control plane functions such as the MME and HSS are located at the operator’s core site) and “distributed SGW with Local Breakout” (SGW-LBO) -where the MEC system and the distributed SGW are co-located at the network’s edge.

Figure 3. MEC deployment options with distributed EPC (a), distributed S/PGW (b) and SGW-LBO (c)

Depending on the selected solution, MEC Handover is executed in different ways:

In the “bump in the wire approach,” mobility is not natively supported. Instead, in the EPC MEC, SGW + PGW MEC, and CUPS MEC, the MEC handover is supported using 3GPP specified S1 Handover with SGW relocation by maintaining the original PGW as anchor.

The same considerations apply for the SGW-LBO MEC deployment. In the latter case, the target SGW enforces the same policy towards the local MEC application.

Finally, the solutions that include an EPC gateway, such as EPC MEC, SGW+PGW MEC, SGW-LBO MEC, and CUPS MEC are compliant with LI (Lawful Interception) requirements.

This last aspect is also very relevant for MEC adoption, since public telecommunications network and service providers are legally required to make available to law enforcement authorities information from their retained data which is necessary for the authorities to be able to monitor telecommunications traffic as part of criminal investigations.

In that perspective, MEC deployment options are also chosen by infrastructure owners in the view of their compliance to Lawful Interception requirements.

Distributed SGW with Local Breakout (SGW-LBO):

A mainstream for the adoption of MEC is given by the progressive introduction of 5G networks.

Among the various 5G deployment options, local breakout at the SGWs (Figure 3c above) is a solution for MEC that originated from operators’ desire to have a greater control on the granularity of the traffic that needs to be steered. This principle was dictated by the need to have the users able to reach both the MEC applications and the operator’s core site application in a selective manner over the same APN.

The traffic steering uses the SGi – Local Break Out interface which supports traffic separation and allows the same level of security as the network operator expects from a 3GPP-compliant solution.

This solution allows the operator to specify traffic filters similar to the uplink classifiers in 5G, which are used for traffic steering. The local breakout architecture also supports MEC host mobility, extension to the edge of CDN, push applications that requires paging and ultra-low latency use cases.

The SGW selection process performed by MMEs is according to the 3GPP specifications and based on the geographical location of UEs (Tracking Areas) as provisioned in the operator’s DNS.

The SGW-LBO offers the possibility to steer traffic based on any operator-chosen combination of the policy sets, such as APN and user identifier, packet’s 5-tuple, and other IP level parameters including IP version and DSCP marking.

Integrated MEC deployment in 5G networks (3GPP Release 15 and later):

Edge computing has been identified as one of the key technologies required to support low latency together with mission critical and future IoT services. This was considered in the initial 3GPP requirements, and the 5G system was designed from the beginning to provide efficient and flexible support for edge computing to enable superior performance and quality of experience.

In that perspective, the design approach taken by 3GPP allows the mapping of MEC onto Application Functions (AF) that can use the services and information offered by other 3GPP network functions based on the configured policies.

In addition, a number of enabling functionalities were defined to provide flexible support for different deployments of MEC and to support MEC in case of user mobility events. The new 5G architecture (and MEC deployment as AF) is depicted in the Figure 4 below.

Figure 4. – MEC as an AF (Application Function) in 5G system architecture

In this deployment scenario, MEC as an AF (Application Function) can request the 5GC (5G Core network) to select a local UPF (User Plane Function) near the target RAN node. Then use the local UPF for PDU sessions of the target UE(s) and to control the traffic forwarding from the local UPF so that the UL traffic matching with the traffic filters received from MEC (AF) is diverted towards MEC hosts while other traffic is sent to the Central Cloud.

In case of UE mobility, the 5GC can re-select a new local UPF more suitable to handle application traffic identified by MEC (AF) and notify the AF about the new serving UPF.

In summary, MEC as an AF can provide the following services with a 5GC:

- Traffic filters identifying MEC applications deployed locally on MEC hosts in Edge Cloud

- Target UEs (one UE identified by its IP/MAC address, a group of UE, any UE)

- Information about forwarding the identified traffic further e.g. references to tunnels toward MEC hosts

………………………………………………………………………………………………………………………………………………………………………………………….

Part II. of this two part article will illustrate and explain concurrent access to local and central Data Networks. The enablement of MEC deployments and ecosystem development will also be presented.

Importantly, Part II will explain how MEC is evolving to the next phase of 5G– 3GPP Release 17. In particular, ETSI MEC is aligning with 3GPP SA6 which is defining an EDGEAPP architecture (ref. 3GPP TS 23.558).

Part II will also explain how MEC is evolving to multi-cloud support in alignment with GSMA OPG requirements for the MEC Federation work.

ETSI MEC Standard Explained – Part II

…………………………………………………………………………………………………………………………………………………………………………………………..

References:

1. Introduction:

https://www.accenture.com/_acnmedia/PDF-128/Accenute-MEC-for-Pervasive-Networks-PoV.pdf

PowerPoint Presentation (etsi.org)

2. Main body of this article (Part I and II):

[1] ETSI MEC website, https://www.etsi.org/technologies/multi-access-edge-computing

[2] ETSI GS MEC 003 V2.1.1 (2019-01): “Multi-access Edge Computing (MEC); Framework and Reference Architecture”, https://www.etsi.org/deliver/etsi_gs/mec/001_099/003/02.01.01_60/gs_mec003v020101p.pdf

[3] ETSI White Paper #36, “Harmonizing standards for edge computing – A synergized architecture leveraging ETSI ISG MEC and 3GPP specifications”, First Edition, July 2020, https://www.etsi.org/images/files/ETSIWhitePapers/ETSI_wp36_Harmonizing-standards-for-edge-computing.pdf

[4] ETSI GS MEC 009 V3.1.1 (2021-06), “Multi-access Edge Computing (MEC); General principles, patterns and common aspects of MEC Service APIs”, https://www.etsi.org/deliver/etsi_gs/MEC/001_099/009/03.01.01_60/gs_MEC009v030101p.pdf

[5] ETSI White Paper No. 24, “MEC Deployments in 4G and Evolution Towards 5G”, February 2018, https://www.etsi.org/images/files/ETSIWhitePapers/etsi_wp24_MEC_deployment_in_4G_5G_FINAL.pdf

[6] ETSI White Paper No. 28, “MEC in 5G network”, June 2018, https://www.etsi.org/images/files/ETSIWhitePapers/etsi_wp28_mec_in_5G_FINAL.pdf

[7] ETSI GR MEC 031 V2.1.1 (2020-10), “Multi-access Edge Computing (MEC); MEC 5G Integration”, https://www.etsi.org/deliver/etsi_gr/MEC/001_099/031/02.01.01_60/gr_MEC031v020101p.pdf

[8] ETSI GR MEC 035 V3.1.1 (2021-06), “Multi-access Edge Computing (MEC); Study on Inter-MEC systems and MEC-Cloud systems coordination”, https://www.etsi.org/deliver/etsi_gr/MEC/001_099/035/03.01.01_60/gr_mec035v030101p.pdf

[9] ETSI DGS/MEC-0040FederationAPI’ Work Item, “Multi-access Edge Computing (MEC); Federation enablement APIs”, https://portal.etsi.org/webapp/WorkProgram/Report_WorkItem.asp?WKI_ID=63022

IDC: Global Managed Edge Services Market forecast ~$2.8B in 2025

According to IDC, Managed Edge Services [1.] will deliver worldwide revenues of about $445.3 million this year – a 43.5% increase over 2020. In addition, the IT market research firm forecasts that managed services revenues will hit nearly $2.8 billion in 2025. Over the 2021-2025 forecast period, the compound annual growth rate (CAGR) for managed edge services is expected to be 55.1%.

Note 1. Managed Edge Services seems to be a misnomer or at least a redundant term. That’s because all Multi-Access Edge Compute (MEC) services will be managed by a service provider (telco, cloud, or CDN) or network equipment vendor/managed services provider for on-premises edge computing.

“Managed edge services represent an emerging market opportunity that promises to provide a wide variety of low-latency services with the potential to enhance customer experience, drive operational efficiencies, and improve performance. It is a highly contested marketplace among key providers including communications SPs, hyper-scalers, CDN providers, and managed SPs with strategic partnerships and alliances forming to establish early commercial success and leadership,” said Ghassan Abdo, research VP, Worldwide Telecommunications at IDC.

“At the same time, service providers are keenly aware of the potential impact of the edge on their current market position and are watching closely for unforeseen competition from adjacent markets and new disruptors. Technology vendors including network equipment providers (NEPs) and software, datacenter, and networking vendors are vying to shape this market and play a significant role in delivering innovative edge services. Technical challenges abound including interoperability, open interfaces, and varying standards. The potential, however, is there to positively transform industries and user experiences,” he added.

IDC has identified three primary deployment models for managed edge services.

- On-premises deployment: This represents managed edge use cases where the edge compute infrastructure is deployed at the enterprises’ premises, also referred to as private deployment. This deployment model is intended to address the need for extra low latency and is applicable to industrial use cases, healthcare, and AR/VR applications.

- Service provider edge deployment: This represents managed edge services provided by edge compute deployed at the provider edge, both fixed and mobile. IDC expects this deployment model to spur development of a wide range of vertical use cases.

- CDN edge deployment: This represents managed edge services provided by edge compute deployed at the CDN POPs or edge locations. These use cases will enhance content delivery with personalized, high-fidelity, and interactive rich media customer experience.

IDC projects the on-premises edge to be the fastest growing segment with a five-year CAGR of 74.5%. The service provider edge will be the second-fastest growing segment with a CAGR of 59.2%, which will enable it to become the largest market segment by 2022. The CDN edge segment is expected to have a five-year CAGR of 41.9%.

The IDC report, Worldwide Managed Edge Services Forecast, 2021–2025 (IDC report #US47308121), provides a worldwide forecast for managed edge services covering 2021–2025. The forecast quantifies the revenue opportunities for service providers (SPs) that offer managed edge services on a monthly recurring revenue contractual arrangement. Service providers, in this context, comprise communications SPs, content delivery network (CDN) providers, public cloud providers or hyper-scalers, and managed service providers. This is the first forecast provided by IDC on this new and developing market.

For more information, contact:

Michael Shirer [email protected] or 508-935-4200

………………………………………………………………………………………………………………………………………

June was a busy month for managed edged compute deals:

- Vodafone outsourced its European MEC infrastructure to Amazon Web Services (AWS);

- Ericsson and Google agreed to collaborate on edge compute solutions for mutual benefit; and

- AT&T sold its Network Cloud technology to Microsoft which will also provide Azure (public cloud) based 5G SA/core network for AT&T.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS48179321

https://telecoms.com/511025/managed-edge-services-revenue-expected-to-hit-2-8-billion-by-2025/

Dell’Oro: MEC Investments to grow at 140% CAGR from 2020 to 2025

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

O2 UK and Microsoft to test MEC in a Private 5G Network

UK mobile network operator O2 (Telefónica UK) has partnered with Microsoft to test the benefits of on-premise Mobile Edge Computing (MEC) within a Private 5G network, with a focus on low latency and security.

The MEC Proof of Concept (PoC) involves technology running on Microsoft Azure, which will be the first Azure deployment using a UK Private 5G network. It is designed to support secure data management, with all confidential data staying on premises at all times.

Image credit: Microsoft Azure for Operators

O2 (Telefónica UK) will provide Secure 5G Network capabilities and various Industry 4.0 applications. The computing service will be delivered via Azure Private Edge Zones, bringing compute, intelligence and storage to the edge where data is created. O2 and Microsoft will also support start-ups in developing new 5G solutions through the ‘Microsoft for Startups’ program.

O2 recently announced it had launched a Private 5G Network initiative with Leonardo, a global high technology company in the Aerospace, Defence & Security sector. This trial with Microsoft will be similar, however will involve MEC to broaden the use cases and benefits.

Jo Bertram, MD of Business at O2, said, “We’re incredibly proud of our track record of supporting business partners with innovative network solutions. This particular trial with the Microsoft Azure platform will provide secure and superfast capabilities that will maximise productivity and efficiency, as well as peace of mind. We pride ourselves on having a secure 5G network and being champions of coverage and reliability, as recognised in industry awards.”

Yousef Khalidi, corporate vice president, Azure for Operators at Microsoft, said: “Through our collaboration with O2, we will enable enterprises to leverage 5G to unlock new scenarios that accelerate digital transformation within their own private, on-premises environments. Combining Azure technology with O2 services is critical to bringing MEC to the enterprise edge, and we look forward to seeing customers leverage this platform to drive innovation across a broad range of information and operational technology applications.”

Key Deliverables:

- O2 partners with Microsoft to trial the benefits of on premise Mobile Edge Computing (MEC) within a Private 5G Network, focusing on security and low latency

- The Proof of Concept (PoC) aims to pave the way for secure data management, enabling confidential information to stay on premises at all times

- Technology will be run via the Microsoft Azure platform, its first deployment utilizing a UK Private 5G Network

References:

https://azure.microsoft.com/en-us/industries/telecommunications/

Amazon AWS and Verizon Business Expand 5G Collaboration with Private MEC Solution

AWS and Verizon Business have expanded their 5G collaboration to provide private multi-access edge computing (Private MEC) for enterprises. Private MEC integrates edge computing infrastructure with private networks deployed on or near the customer’s premises. AWS and Verizon have integrated Verizon’s 5G Edge MEC platform with AWS Outposts [1.], a fully managed service that offers the same AWS Infrastructure, AWS services, APIs, and tools to virtually any data center, colocation space, or on-premises facility for a consistent, hybrid experience.

Note 1. Outposts is AWS’ on-premises option that involves data center equipment being installed at an enterprise facility. It uses AWS infrastructure, services, APIs, and tools to support a hybrid cloud service. Verizon is offering several form factor options of Outposts, include 1U and 2U deployments.

AWS initially launched Outposts in late 2019. “Instead of building this funky bridge between two things,” on-premises data centers and the cloud, Outposts brings native AWS services into on-premises data centers while “seamlessly connecting to AWS’s broad array of services in the cloud,” AWS CEO Andy Jassy explained at the time.

Outposts is similar to competing offers like Microsoft’s Azure Arc, Google’s Anthos, and IBM’s Cloud Satellite. AWS last month also struck a deal with Nokia to combine Outposts with the telecom vendor’s RAN and edge equipment to target the enterprise space.

………………………………………………………………………………………………………………………………………

Verizon Business customers will be able to tap into the combination to deploy a fully managed private mobile edge compute network within their on-premises environment that can handle low-latency applications like intelligent logistics, robotics, and factory automation.

MEC deployment across different enterprise networks. Source: ETSI

…………………………………………………………………………………………………………………………………….

According to Amazon, cloud migrations are often inhibited by residency or privacy constraints that prevent data from leaving the premises, strict compute latency requirements, or the need for cloud infrastructure to connect directly to onsite equipment. Similarly, many workloads involve huge volume of data, making transfers to the cloud infeasible due to limited available network bandwidth and timing constraints.

Furthermore, enterprise applications commonly depend on local wired or Wi-Fi networks to transport data locally. While wired networks can provide acceptable performance, they are expensive to upgrade, reroute, and extend. On the other hand, enterprise Wi-Fi offers simplicity and cost-effectiveness, but offers less manageability and suffers from coverage, capacity, reliability, security, and handoff issues.

The Private MEC solution deployed on AWS Outposts addresses these challenges by providing a secure, dedicated cloud computing platform and reliable on-premises wireless networking based on 5G, all using a single infrastructure deployment. The private 5G network offers better performance, control, reliability, and density than existing options. Combined with the AWS services brought by AWS Outposts, we are enabling Enterprise customers to deploy low latency, high-performance applications on their premises, leveraging both the benefits of 5G and the cloud, locally. By leveraging Private MEC enterprises can host workloads in emerging areas such as Industry 4.0; for example, Private MEC and private 5G can facilitate deeper integration between IT and operational technology (OT) systems in manufacturing facilities.

Private MEC also supports many use cases beyond the factory. Events and venues, such as sports, concerts, and theme parks can use Private MEC to provide enhanced experiences with AR/VR, live information overlays, multi-camera, multiple angle views, and personalized instant replays. Healthcare providers use Private MEC for real-time diagnostics over 5G for rapid access to radiological scans on-site and local processing of sensitive patient data. Schools and universities can benefit from Private MEC by servicing students in rural areas without adequate broadband coverage to run applications like virtual desktops. We are excited about the innovations that Private MEC solutions can unlock across industries, and continue to work with customers to power their innovation with edge computing.

……………………………………………………………………………………………………………………………………………

Amazon AWS is also working with Corning Incorporated, a leading materials science and advanced manufacturing innovator, and Verizon to deploy a Private MEC solution on AWS Outposts at the Corning factory in Hickory, North Carolina. Corning uses AWS Outposts to run computer vision software from Gestalt Robotics that provides autonomous navigation and advanced environmental sensing. Corning recently installed an AWS Outposts rack that places the power of the AWS cloud within the four walls of its optical cable plant in Hickory, North Carolina.

The AWS capabilities that Outposts delivers, combined with the ultra-low latency, high throughput of the private 5G network, provide a powerful platform upon which Corning will innovate with applications never before possible, such as real-time analysis of large volumes of high-resolution video streams from across the factory and integration of high-data-rate automation systems. In factory environments like this, Amazon EC2 instances with GPU acceleration provide the necessary computing power to run Computer Vision (CV) and AI/ML workloads efficiently, enabling real-time control of Autonomous Mobile Robots (AMRs) that roam the factory floors.

The software running on the Private MEC service can guide the AMRs safely and speedily through a factory, avoiding people and obstacles while ferrying their payloads from point to point. The Private 5G network enables reliable, low-latency transmission of rich sensor data (lidar, vibration, temperature, audio) from these AMRs and other industrial devices located throughout the factory. Importantly, this enables operators to observe a live stream of video in near real-time and intervene when necessary.

The same computer vision technology used by the AMRs for navigation and safety can also be used to detect and inventory raw material and finished goods in a factory. Mobile video streams from the AMRs can be combined with feeds from cameras installed in the factory and onsite sensor inputs and RFIDs for accurate counting and tracking. In addition, integration with Manufacturing Execution Systems (MES) running on Outposts enables real-time monitoring, automation, and optimization, as raw material is turned into the final product.

This opens up possibilities such as performing predictive maintenance and servicing of onsite machinery without the need to ship massive amounts of sensor data over network links into the cloud. Private MEC solutions like this enable factories to become even smarter and leverage the power of innovation that AWS brings to the cloud, while simplifying the deployment and management of on-premise networking with the latest 5G technologies.

References:

https://aws.amazon.com/outposts/

https://www.sdxcentral.com/articles/news/verizon-adds-aws-outposts-to-5g-edge-plan/2021/04/

https://www.etsi.org/images/files/ETSITechnologyLeaflets/MultiAccessEdgeComputing.pdf

SK Telecom and AWS launch 5G edge cloud service and collaborate on other projects

South Korea’s #1 wireless network operator SK Telecom (SKT) has launched a 5G edge cloud service in partnership with Amazon Web Services (AWS). ‘SKT 5GX Edge’ uses AWS Wavelength at the edge of SKT’s 5G network. SKT said that SKT 5GX Edge will enable customers to develop mobile applications that require ultra-low latency.

With SKT 5GX Edge, applications are connected to ‘AWS Wavelength Zones’, which are located at the edge of SK Telecom’s 5G network, making it unnecessary for application traffic to hop through regional aggregation sites and the public internet.

SKT 5GX Edge with AWS Wavelength is expected to enable SK Telecom’s enterprise customers and developers to build innovative services in areas including machine learning, IoT, video games and streaming using the AWS services, APIs, and tools they already use.

SK Telecom and AWS started operating the first AWS Wavelength Zone in South Korea in the central city of Daejeon (140 kilometers south of Seoul) earlier this month. They plan to expand the SKT 5GX Edge infrastructure to other parts of the country, including Seoul in 2021.

SK Telecom has been cooperating with AWS since February of this year to deploy AWS Wavelength Zones on SK Telecom’s 5G network and worked with 20 enterprise customers to test the service.

SKT and AWS are actively cooperating in the area of non-face-to-face services as demand grows due to the pandemic. The two companies have been working with video conferencing solution provider Gooroomee to build an environment where two-way video conferencing and remote education services are provided without delay, and have realized a service with a latency of less than 100 milliseconds for multiple simultaneous sessions.

“With AWS Wavelength on SKT’s 5G network, customers in South Korea can develop applications that take advantage of ultra-low latencies to address use cases like machine learning inference at the edge, smart cities and smart factories, and autonomous vehicles – all while using the same familiar AWS services, API, and tools to deploy them to 5G networks worldwide,” said Matt Garman, Vice President of Sales and Marketing, AWS.

“In collaboration with AWS, SK Telecom has successfully integrated private 5G and edge cloud. By leveraging this new technology, we will lead the efforts to create and expand innovative business models in game, media services, logistics, and manufacturing industries,” said Ryu Young-sang, President of MNO at SK Telecom.

………………………………………………………………………………………………………………………………

SK Telecom and AWS also report that they have been working to improve operational stability of autonomous robots and efficiency in remote monitoring and control. Together with Woowa Brothers, the operator of food delivery app ‘Baedal Minjok,’ the two companies have completed tests of applying the 5G MEC service to outdoor food delivery robot Dilly Drive. Meanwhile, work continues with local robotics company Robotis to test run autonomous robots in the 5G cloud environment.

SK Telecom and AWS have also signed an agreement with Shinsegae I&C and Maxst to build an AR navigation and guidance system in the Coex Starfield shopping mall in Seoul. They are also working on potential use of the 5G cloud service with Deep Fine, an AR glass solution developer, and Dabeeo, a spatial recognition service provider. With the National IT Industry Promotion Agency (NIPA), SK Telecom has launched an open lab to develop realistic contents optimized for the 5G network and to support the growth of the related ecosystem.

Collaboration is also ongoing with Looxid Labs, a provider of real-time analysis for eye-gaze tracking and brain wave data, to develop services on the 5G MEC for a senior citizen center in Busan.

SK Telecom and AWS are also cooperating in the area of non-face-to-face services as demand grows due to the COVID-19 pandemic. The two companies have been working with video conferencing services provider Gooroomee to develop an environment where 2-way video conferencing and remote education services are provided without delay, and claim they have achieved a service with a latency of less than 100 milliseconds for multiple simultaneous sessions.

………………………………………………………………………………………………………………………………………………

References:

https://www.sktelecom.com/en/press/press_detail.do?page.page=1&idx=1494&page.type=all&page.keyword=

https://www.telecompaper.com/news/sk-telecom-launches-5gx-edge-cloud-service-with-aws–1366915