OpenRAN

Dish Network to FCC on its “game changing” OpenRAN deployment

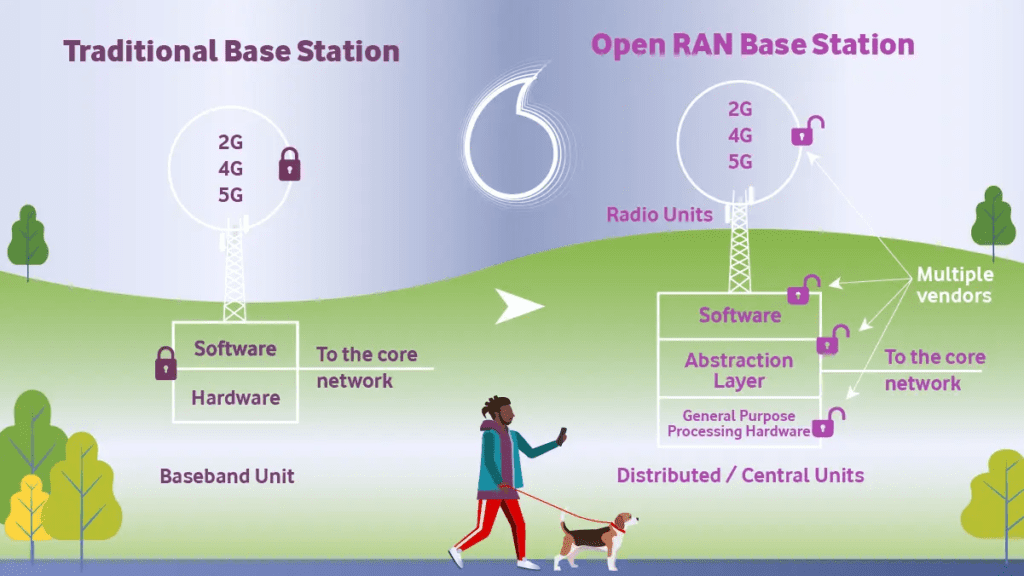

Through disaggregation of the Radio Access Network (RAN) into functional blocks/modules and defining open interfaces between those modules, OpenRAN technology promises to allow newer, smaller players to sell into the 4G/5G equipment market. The intent is to offer more choices for cellular network operators who buy most of their gear from 4 or 5 big base station vendors.

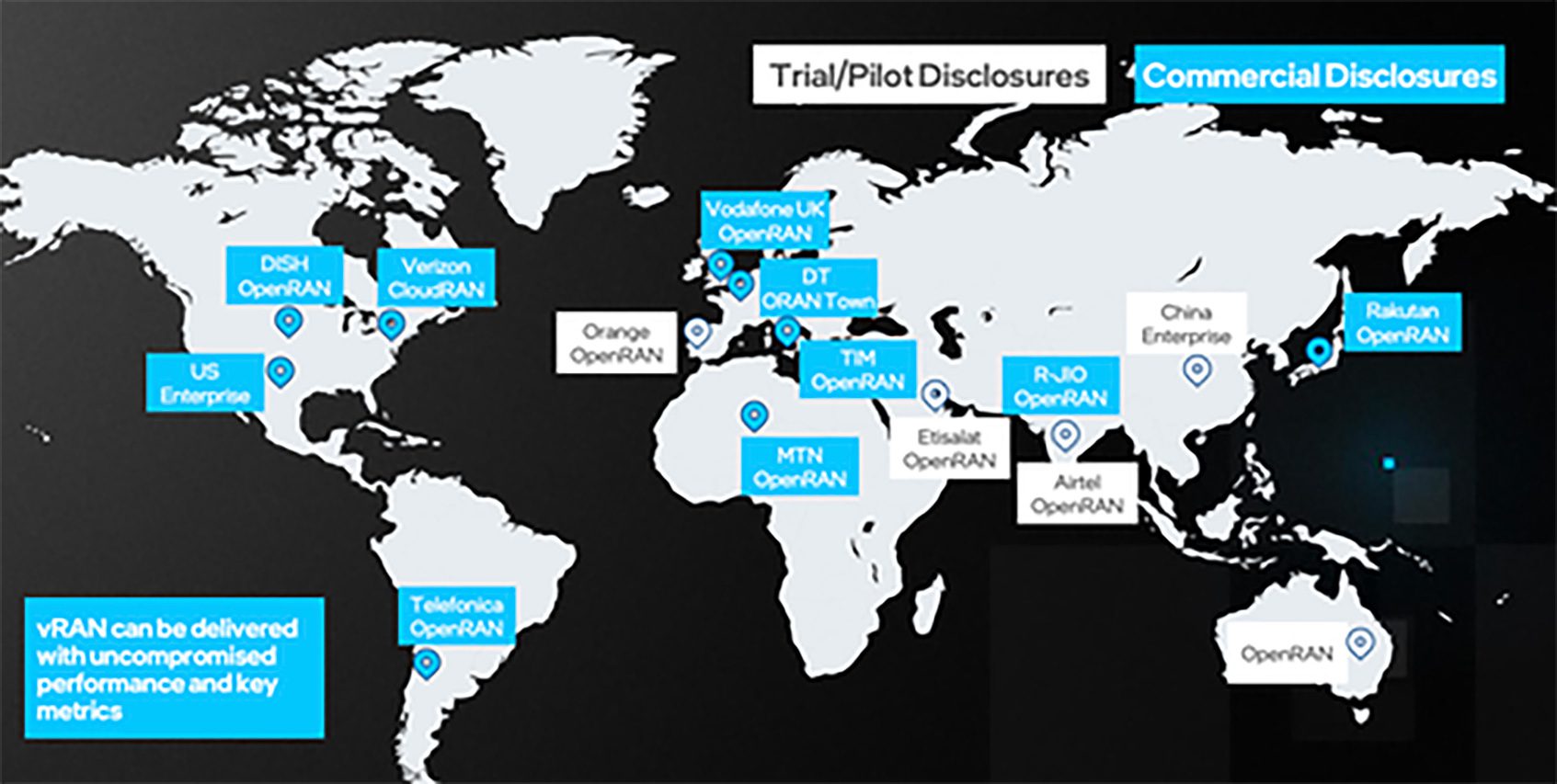

Open RAN has been endorsed by 5G upstarts like Dish Network and Rakuten in Japan, but also by five big European carriers – Deutsche Telekom, Orange, Telecom Italia (TIM), Telefónica and Vodafone – which want to build an Open RAN ecosystem in Europe. AT&T has also expressed interest in the technology. However, there remains a lot of skepticism, especially for brownfield carriers.

…………………………………………………………………………………………………………………..

On March 14th, Dish Network executives participated in a video conference with a several FCC officials to discuss the company’s plans to launch a nationwide 5G network using Open RAN technology. Present on behalf of DISH were Stephen Bye, Chief Commercial Officer; Marc Rouanne, Chief Network Officer; Jeffrey Blum, Executive Vice President, External and Legislative Affairs; Sidd Chenumolu, Vice President, Technology Development; Alison Minea, Vice President, Regulatory Affairs; William Beckwith, Director of Wireless Regulatory Affairs; Hadass Kogan, Director & Senior Counsel, Regulatory Affairs; and Michael Essington, Senior Manager, Public Policy.

According to a Dish filing, the FCC requested the meeting to learn more about how Dish plans to deploy OpenRAN, rather than traditional purpose built RAN equipment, to build their 5G cellular network.

Ahead of its June 14, 2022 buildout milestone, DISH is launching a first-of-its-kind, cloud native, virtualized O-RAN 5G network in several major metropolitan areas of the country. Because DISH is building a greenfield network, we have the flexibility to choose the best technology to enter the market. While legacy carriers built closed end-to-end networks, DISH chose O-RAN because, among other reasons, it offers lower capital and operating costs, and is more resilient, secure, and energy efficient. In cooperation with more than 30 technology partners, DISH will offer a real-world example of the benefits of O-RAN as our 5G network rolls out to customers this year.

If more American carriers see the benefits of O-RAN and are able to adopt it as their networks evolve, the United States will be a stronger competitor in the global market. O-RAN is a game changer, among reasons, because:

- O-RAN networks increase vendor diversity

- O-RAN enhances spectrum utilization and enables network slicing

- O-RAN supports national security and cybersecurity objectives

- O-RAN networks are more secure and more agileO-RAN networks are more secure and more agile

In February 2021, the FCC published an OpenRAN Notice of Inquiry, stating:

Some parties assert that open radio access networks (Open RAN) are a potential path to drive 5G innovation, with industry proponents arguing that it could provide opportunities for more secure networks, foster greater vendor diversity, allow for more flexible network architectures, lower capital and operating expenses, and lead to new services tailored to unique use cases and consumer needs; others contend that Open RAN is still in its most formative stages, and that while promising, significant work remains before the benefits of the concept can fully be realized.

This Notice of Inquiry seeks input on the status of Open RAN and virtualized network environments: where the technology is today and what steps are required to deploy Open RAN networks broadly and at scale. It also seeks comment on whether and, if so, how deployment of Open RAN-compliant networks could further the Commission’s policy goals and statutory obligations, advance legislative priorities, and benefit American consumers by making state-of-the-art wireless broadband available more quickly and to more people in more parts of the country.

The financial analysts at New Street Research, say that U.S. government legislation could pave the way for “$1.5 billion for the Public Wireless Supply Chain Innovation Fund to deploy Open RAN equipment to spur movement toward open architecture, software-based wireless technologies and funding innovative leap-ahead technologies in the US mobile broadband market.”

The analysts added, “That provision might be of particular value to Dish, which is building out its network based on that technology.”

References:

https://www.lightreading.com/open-ran/fcc-calls-on-dish-about-open-ran/d/d-id/776166?

https://www.nokia.com/about-us/newsroom/articles/open-ran-explained/

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

https://www.sdxcentral.com/articles/news/dish-missed-every-5g-commitment-it-made-in-2021/2021/12/

Dell’Oro Group: Open RAN Momentum Is Solid; RAN equipment prices to increase

by Stefan Pongratz, VP at Dell’Oro Group

Introduction:

Open RAN ended 2021 on a solid footing. Preliminary estimates suggest that total Open RAN revenues—including O-RAN and OpenRAN radios and baseband—more than doubled for the full year 2021, ending at a much higher level than had been expected going into the year. Adoption has been mixed, however. In this blog, we review three Open RAN-related topics: (1) a recap of 2021, (2) Mobile World Congress (MWC) takeaways, and (3) expectations for 2022.

2021 Recap:

Looking back to the outlook we outlined a year ago, full-year Open RAN revenues accelerated at a faster pace than we originally expected. This gap in the output ramp is primarily the result of higher prices. LTE and 5G macro volumes were fairly consistent with expectations, but the revenue per Open RAN base stations was higher than we modeled going into 2021, especially with regard to brownfield networks. Asymmetric investment patterns between the radio and the baseband also contributed to the divergence, though this is expected to normalize as deployments increase. In addition, we underestimated the 5G price points with some of the configurations in both the Japanese and US markets.

Not surprisingly, the Asia-Pacific (APAC) region dominated the Open RAN market in 2021, supported by large-scale greenfield OpenRAN and brownfield O-RAN deployments in Japan.

From a technology perspective, LTE dominated the revenue mix initially but 5G NR is now powering the majority of investments, reflecting progress both in APAC and North America.

Mobile World Congress (MWC) Barcelona 2022:

Open RAN revenues are coming in ahead of schedule, bolstering the narrative that operators want open interfaces. Meanwhile, the progress of the technology, especially with some of the non-traditional or non-top 5 RAN suppliers has perhaps not advanced at the same pace. This, taken together with the fact that the bulk of the share movements in the RAN market is confined to traditional suppliers, is resulting in some concerns about the technology gap between the traditional RAN and emerging suppliers. A preliminary assessment of Open RAN-related radio and baseband system, component, and partnership announcements at the MWC 2022 suggests this was a mixed bag, with some suppliers announcing major portfolio enhancements.

Among the announcements that most stood out is the one relating to Mavenir’s OpenBeam radio platform. After focusing initially on software and vRAN, Mavenir decided the best way to accelerate the O-RAN ecosystem is to expand its own scope to include a broad radio portfolio. The recently announced OpenBeam family includes multiple O-RAN 7.2 macro and micro radio products supporting mmWave, sub 6 GHz Massive MIMO, and sub 6 GHz Non-Massive MIMO.

NEC announced a major expansion of its O-RAN portfolio, adding 18 new O-RUs, covering both Massive MIMO and non-Massive MIMO (4T4R, 8T8R, 32T32R, 64T64R). NEC also recently announced its intention to acquire Blue Danube.

Another major announcement was Rakuten Symphony’s entry into the Massive MIMO radio market. Rakuten Symphony is working with Qualcomm, with the objective of having a commercial Massive MIMO product ready by the end of 2023.

Recent Massive MIMO announcements should help to dispel the premise that the O-RAN architecture is not ideal for wide-band sub-6 GHz Massive MIMO deployments. We are still catching up on briefings, so it is possible that we missed some updates. But for now, we believe there are six non-top 5 RAN suppliers with commercial or upcoming O-RAN Sub-6 GHz Massive MIMO GA: Airspan, Fujitsu, Mavenir, NEC, Rakuten Symphony, and Saankhya Labs.

Putting things into the appropriate perspective, we estimate that there are more than 20 suppliers with commercial or pending O-RAN radio products, most prominently: Acceleran*, Airspan, Askey*, Baicells*, Benetel*, BLiNQ*, Blue Danube, Comba, CommScope*, Corning*, Ericsson, Fairwaves, Fujitsu, JMA*, KMW, Mavenir, MTI, NEC, Nokia, Parallel Wireless, Rakuten Symphony, Saankhya Labs, Samsung, STL, and Verana Networks* (with the asterisk at the end of a name indicating small cell only).

The asymmetric progress between basic and advanced radios can be partially attributed to the power, energy, and capex tradeoffs between typical GPP architectures and highly optimized baseband using dedicated silicon. As we discussed in a recent vRAN blog, both traditional and new macro baseband component suppliers—including Marvell, Intel, Qualcomm, and Xilinx—announced new solutions and partnerships at the MWC Barcelona 2022 event, promising to close the gap. Dell and Marvell’s new open RAN accelerator card offers performance parity with traditional RAN systems, while Qualcomm and HPE have announced a new accelerator card that will allegedly reduce operator TCO by 60%.

2022 Outlook:

Encouraged by the current state of the market, we have revised our Open RAN outlook upward for 2022, to reflect the higher baseline. After more than doubling in 2021, the relative growth rates are expected to slow somewhat, as more challenging comparisons with some of the larger deployments weigh on the market. Even with the upward short-term adjustments, we are not making any changes at this time to the long-term forecast. Open RAN is still projected to approach 15% of total RAN by 2026.

In summary, although operators want greater openness in the RAN, there is still much work ahead to realize the broader Open RAN vision, including not just open interfaces but also improved supplier diversity. Recent Open RAN activities—taken together with the MWC announcements—will help to ameliorate some of these concerns about the technology readiness, though clearly not all. Nonetheless, MWC was a step in the right direction. The continued transition from PowerPoint to trials and live networks over the next year should yield a fuller picture.

Addendum:

“Following twenty years of average macro base station price declines in the 5% to 10% range, we are now modeling RAN [radio access network] prices to increase, reflecting a wide range of factors,” Stefan Pongratz, an analyst at research and consulting firm Dell’Oro Group, wrote in response to questions from Light Reading. “In addition to the changing vendor landscape and regional aspects coming into play with China’s overall share expected to decline going forward, we have also assumed there will be some COGS [cost of goods sold] inflation due to supply-demand mismatches, though the ability for everyone to pass this on [to their customers] remains limited.”

About the Author:

Stefan Pongratz joined Dell’Oro Group in 2010 and is responsible for the firm’s Mobile RAN market and Telecom Capex research programs. While at the firm, Mr. Pongratz has expanded the RAN research and authored multiple Advanced Research Reports to ensure the program is evolving to address new RAN technologies and opportunities including small cells, 5G, Open RAN, Massive MIMO, mmWave, IoT, private wireless, and CBRS. He built the Telecom Capex coverage detailing revenues and investments of over 50 carriers worldwide.

MTN and Rakuten MoU: Open RAN trials using RCP in South Africa, Nigeria and Liberia

Africa’s largest mobile network operator MTN Group and Rakuten Symphony signed a Memorandum of Understanding (MoU) to run live 4G and 5G OpenRAN Proof of Concept (PoC) trials in South Africa, Nigeria and Liberia using the Rakuten Communications Platform (RCP). The trials will start in 2022 and combine RCP OpenRAN equipment with advanced automation and autonomous network capabilities. The products are currently deployed by Rakuten Mobile in Japan and include cloud orchestration, zero-touch provisioning and automation of radio site commissioning and network integration.

The trials will enable the launch of new services more quickly, cost-effectively and seamlessly, MTN said. The mobile operator and Rakuten Symphony will be collaborating with systems integrators Accenture and Tech Mahindra to conduct the trials in the three countries.

“We are pleased to announce our partnership with Rakuten Symphony to deploy live 4G and 5G Open RAN trials across South Africa, Nigeria and Liberia. In line with our belief that everyone deserves the benefits of a modern connected life, we are committed to actively driving the rapid expansion of affordable 4G and 5G coverage across markets in Africa,” said Mazen Mroue, MTN Group Chief Technology & Information Systems Officer. “We have announced our support towards the deployment of Open RAN technology in 2021 to modernize our radio access network footprint. Through this partnership we hope to target innovation and cost efficiencies that will enable us to continue delivering an exceptional customer experience.”

The solutions, currently deployed by Rakuten Mobile in Japan, include cloud orchestration, Zero-Touch Provisioning (ZTP) and automation of radio site commissioning and network integration.

Image – left to right: Amith Maharaj, MTN Group Executive, Network Planning and Design; Tareq Amin, CEO Rakuten Symphony; Rabih Dabboussi, Chief Revenue Officer, Rakuten Symphony.

“We’re excited to take this next step in our partnership with MTN,” said Rabih Dabboussi, Chief Revenue Officer of Rakuten Symphony. “This PoC will demonstrate how one of the world’s top-tier brownfield mobile operators can utilize Rakuten Symphony’s network automation and orchestration solutions for cost-effective network transformation and timely deployment of next-generation network services to their customers across Africa.”

Rakuten Mobile made a full-scale launch of commercial services on the world’s first fully virtualized cloud-native mobile network in 2020 in Japan, and launched Rakuten Symphony in 2021 to bring its innovations to other operators. Rakuten Symphony brings together Rakuten’s telco products, services and systems under a single banner to offer 4G and 5G infrastructure and platforms to customers worldwide.

MTN has already been testing open RAN equipment in several markets and is an active member of the Telecom Infra Project. The network operator announced several other Open RAN suppliers last year which were: Altiostar, Mavenir, Parallel Wireless, Tech Mahindra and Voyage.

About the MTN Group:

Launched in 1994, the MTN Group is a leading emerging market operator with a clear vision to lead the delivery of a bold new digital world to our customers. We are inspired by our belief that everyone deserves the benefits of a modern connected life. The MTN Group is listed on the JSE Securities Exchange in South Africa under the share code ‘MTN’. Our strategy is Ambition 2025: Leading digital solutions for Africa’s progress.

About Rakuten Symphony:

Rakuten Symphony is reimagining telecom, changing supply chain norms and disrupting outmoded thinking that threatens the industry’s pursuit of rapid innovation and growth. Based on proven modern infrastructure practices, its open interface platforms make it possible to launch and operate advanced mobile services in a fraction of the time and cost of conventional approaches, with no compromise to network quality or security. Rakuten Symphony has headquarters in Japan and local presence in the United States, Singapore, India, Europe and the Middle East Africa region.

…………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://symphony.rakuten.com/newsroom/mtn-group-and-rakuten-symphony-mou

https://www.telecompaper.com/news/mtn-picks-suppliers-for-openran-roll-out-in-africa–1386900

Telefónica Germany and NEC partner to deliver 1st Open RAN with small cells in Germany

Telefónica Germany and NEC Corporation announced their successful collaboration in launching the first Open and virtual RAN architecture-based small cells in Germany. The service has initially launched in the city center of Munich to enhance the customer experience by providing increased capacity to the existing mobile network in this dense, urban area. NEC serves as the prime system integrator in the four countries of Telefónica S.A. and NEC’s program to explore ways to apply Open RAN in various geographies (urban, sub-urban, rural) and use cases. Telefónica Germany had previously said it planned to deploy pure 5G Open RAN mini-radio cells in Munich later this year.

In this German deployment, the flexibility of Open RAN is leveraged through the use of small cells to improve capacity in dense, urban areas. One of the key advantages of Open RAN over a traditional architecture is that it allows wider choice of vendor options. NEC integrated a multi-vendor architecture that includes Airspan Networks* unique Airspeed plug-and-play solution and Rakuten Symphony’s Open vRAN software for O2 / Telefónica Germany’s small cells to complement the existing multi-vendor based macro cells in its network.

The adoption of Open RAN small cells combined with macro cells will pave the way for 5G network densification. This will be especially beneficial in Germany, where multiple industries and enterprises are seeking ways to utilize cellular service functionalities in a particular area or in shared physical spaces.

Source: Telecom Infra Project

……………………………………………………………………………………………………………………………………………………

O2 / Telefónica Germany and NEC will continue their collaboration leveraging innovative Open RAN technologies, as well as automation, to validate and deploy advanced networks that efficiently deliver superior customer experiences in the 5G era, with collaboration from key partners.

“We are proud to have launched Germany’s first small cells built on innovative Open RAN technologies that help to complete the delivery of granular, high-quality connectivity in dense urban areas,” said Matthias Sauder, Director Mobile Access & Transport at O2 / Telefónica Germany. “NEC became our partner in this innovative project, with its underlying technological background and experiences of Open RAN technologies.”

“The potential of Open RAN technologies in the 5G era is infinite,” said Shigeru Okuya, Senior Vice President, NEC Corporation. “NEC is honored to be the strategic partner to O2 / Telefónica Germany, jointly leading the industry with practical and effective use cases that prove the value of Open RAN.”

………………………………………………………………………………………………………..

Germany seems to be a focal point for OpenRAN deployments. For example, greenfield operator 1 & 1 is deploying a fully-virtualized, Open RAN mobile network built by Rakuten Symphony. That partnership began in the fourth quarter of 2021.

At Mobile World Congress this week, Vodafone announced that it plans to use OpenRAN in 30 percent of its masts in Europe – which includes Germany, of course – by 2030. Last November it emerged that it is working with Nokia and network software provider Mavenir to transform Plauen in Germany into a so-called ‘OpenRAN city’ that will be a live testbed for new OpenRAN-based products.

Deutsche Telekom is also a big fan of OpenRAN. Last June it claimed Europe’s first live OpenRAN deployment in Neubrandenburg, which has been dubbed ‘O-RAN Town’. It has partnered with a broad range of suppliers, including NEC, Fujitsu, Dell, Intel, Mavenir and SuperMicro.

Last December, semiconductor/SoC start-up Picocom made headlines in the Open RAN community by releasing the “industrt’s first” 5G NR small cell SoC for Open RAN. This new product, dubbed the PC802, is described as PHY SoC for 5G NR and LTE small cell decentralized and integrated RAN architectures, including support for leading Open RAN specifications. The PC802 allows for interfacing to radio units using either the O-RAN Open Fronthaul eCPRI interface or a JESD204B high-speed serial interface. Optimized explicitly for decentralized small cells, the PC082 employs a FAPI protocol to allow communication and physical layer services to the MAC.

…………………………………………………………………………………………………………………………………………………………..

OpenRAN has been a recurring topic at this week’s Mobile World Congress in Barcelona, with Mavenir, Qualcomm, and Rakuten Symphony, etc. all making product pitches. However, it remains to be seen if Open RAN will actually be able to deliver on its promise of mix and match network modules and lower the cost of network deployment with the performance, security and reliability that network operators must provide to their customers.

…………………………………………………………………………………………………………………………………………………………..

References:

https://www.nec.com/en/press/202203/global_20220302_04.html

Mavenir at MWC 2022: Nokia and Ericsson are not serious OpenRAN vendors

Picocom PC802 SoC: 1st 5G NR/LTE small cell SoC designed for Open RAN

Mavenir at MWC 2022: Nokia and Ericsson are not serious OpenRAN vendors

Andrew Wooden of telecoms.com talked with Mavenir’s SVP of business development John Baker and CMO Stefano Cantarelli to gauge how industry is feeling towards OpenRAN. Here are a few quotes:

“Clearly the (OpenRAN) train has left the station, there’s a lot of buzz about OpenRAN – it’s back to the haves and have nots,” Baker told us. “I see a lot of interest from network operators and a lot of interest from the component suppliers. But on the other side of it, about [Nokia’s recent statement about OpenRAN] – they’re full of it. Because they’re a startup in OpenRAN themselves but are not doing anything. They’re trying to pass on a message that the OpenRAN community is confused, that there are no real OpenRAN players out there, and they’re trying to position themselves as the real OpenRAN player. Digging underneath that, we’re having to call out the Nokia’s and Ericsson’s for confusing the story and trying to keep the confusion running around the marketplace, about the status of OpenRAN.”

“Ericsson has been clear right up front that [they’re] not going to participate in OpenRAN. They name their products as Cloud RAN but you can’t mix and match, so they don’t they don’t meet the OpenRAN requirements. I stand very firm that unless you’ve got two suppliers interworked, then you haven’t got OpenRAN.” Of course, this author agrees 100%!

Regarding Nokia, Baker said: “We’ve been asking for the last two years, every month almost, we’re ready to interwork, when are you ready? And they never get there. So our view is Nokia doesn’t have anything, they’re just trying to protect an old silicon strategy. And that’s their problem. They’ve had two failed attempts, in my opinion, of their silicon strategy – first time they got it completely wrong. Second time they got it too late for the industry because software is now replacing where they are with silicon. I think at the end of the day those two logos are going to disappear in the distance.”

Cantarelli added: “I think Ericsson and Nokia are not stupid. They know OpenRAN is the future, it’s just at the beginning they didn’t think about it, and now they’re a bit late. So they’re protecting their legacy. And they’re waiting for when they’re going to be ready, so it’s purely a delaying technique.”

Some observers think OpenRAN is immediate, and of singular importance, but others don’t think it will be as disruptive as that, at least not right now. This author is in the latter camp. We’ve explained why many times why: without implementation standards there is no interoperability!

References:

Mavenir slams Nokia and Ericsson for confusing the OpenRAN story

Ericsson expresses concerns about O-RAN Alliance and Open RAN performance vs. costs

Vodafone and Mavenir create indoor OpenRAN solution for business customers

https://www.nokia.com/networks/radio-access-networks/open-ran/

Rakuten Communications Platform (RCP) defacto standard for 5G core and OpenRAN?

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

OpenRAN in 30% of Vodafone European network by 2030; Europe way behind China and South Korea in 5G deployments

Vodafone will use OpenRAN technology in 30% of its masts across Europe by 2030, said Johan Wibergh, Vodafone Group Chief Technology Officer, in a speech at Mobile World Congress (MWC) 2022 in Barcelona.

Around 30,000 Vodafone cell sites across Europe will eventually use OpenRAN, he said, with rural areas the first to benefit from the new 4G and 5G masts that use the more flexible radio technology.

When the roll-out reaches cities, the equipment from any existing 5G masts being replaced will then be reused elsewhere to reduce unnecessary wastage, he said.

Vodafone has been one of the key drivers behind the development and use of OpenRAN, building one of the first-ever live OpenRAN masts in Wales. This was followed by the construction of OpenRAN masts in Cornwall, as well as the UK’s first 5G OpenRAN site.

At MWC 2022, Vodafone announced new smartphone sustainability initiatives, as well as the trial of new Internet of Things technology to enable cars to pay automatically for their own refueling.

……………………………………………………………………………………………………………………………………………………………………………………………..

Earlier this week, Vodafone Group CEO Nick Read addressed MWC 2022 attendees in a keynote speech, highlighting the challenges and opportunities facing the mobile industry. Among them are the following:

Europe needs to be digital to remain globally competitive and maintain its leadership role in key sectors such as automotive, aerospace, defence, and agriculture. The regions that have 5G first, will be the regions that innovate fastest.

Yet, at current rates, it will take until at least the end of the decade, for Europe to match the transformational “full 5G experience” that China will already have achieved this year. If we look at 5G population coverage around the world – South Korea is over 90%, China 60%, USA 45%, and Europe under 10% – and with Africa hardly even at the starting line. Europe will only catch up if we reverse the ill-health and hyper-fragmentation of our sector. We must have local scale to close the investment gap. Otherwise, we will be the passive by-stander of the new tech order.

Local scale is needed to close the investment gap and ensure we can deploy 5G at pace. Regional scale is needed to close the digitalisation gap. The combination of local and regional scale ensures our economies and societies can enjoy the full benefits of digital innovation and industrialisation.

We have all seen the impact of global digital platforms. Platforms that change the way we conduct our daily lives. Vodafone continues to invest in regional platforms – let me just give you a few examples. In Europe we created our IoT platform which connects more than 140m devices, across 180 countries. The SIM based IoT market has tripled in the last five years, – and in the next 5 years, will hit 5bn connections. 62% of Europe’s leading automotive brands rely on Vodafone IOT. And with that scale, we are able to evolve from the “Internet of Things” to the “Economy of Things.”

References:

https://newscentre.vodafone.co.uk/news/openran-in-30-percent-of-vodafone-european-network-by-2030/

https://www.vodafone.com/news/digital-society/mwc22-new-tech-order

https://newscentre.vodafone.co.uk/press-release/switches-on-first-5g-openran-site/

Intel FlexRAN™ gets boost from AT&T; faces competition from Marvel, Qualcomm, and EdgeQ for Open RAN silicon

Dell’Oro Group estimates the RAN market is currently generating between $40 billion and $45 billion in annual revenues. The market research firm forecasts that Open RAN will account for 15% of sales in 2026. Research & Markets is more optimistic. They say the Open RAN Market will hit $32 billion in revenues by 2030 with a growth rate of 42% for the forecast period between 2022 and 2030.

As the undisputed leader of microprocessors for compute servers, it’s no surprise that most of the new Open RAN and virtual RAN (vRAN) deployments use Intel Xeon processors and FlexRAN™ software stack inside the baseband processing modules. FlexRAN™ is a vRAN reference architecture for virtualized cloud-enabled radio access networks.

The hardware for FlexRAN™ includes: Intel® Xeon® CPUs 3rd generation Intel® Xeon® Scalable processor (formerly code named Ice Lake scalable processor), Intel® Forward Error Correction Device (Intel® FEC Device), Mount Bryce (FEC accelerator), Network Interface Cards – Intel® Ethernet Controller E810 (code name Columbiaville). Intel says there are now over 100 FlexRAN™ licensees worldwide as per these charts:

Source: Intel

A short video on the FlexRAN™ reference architecture is here.

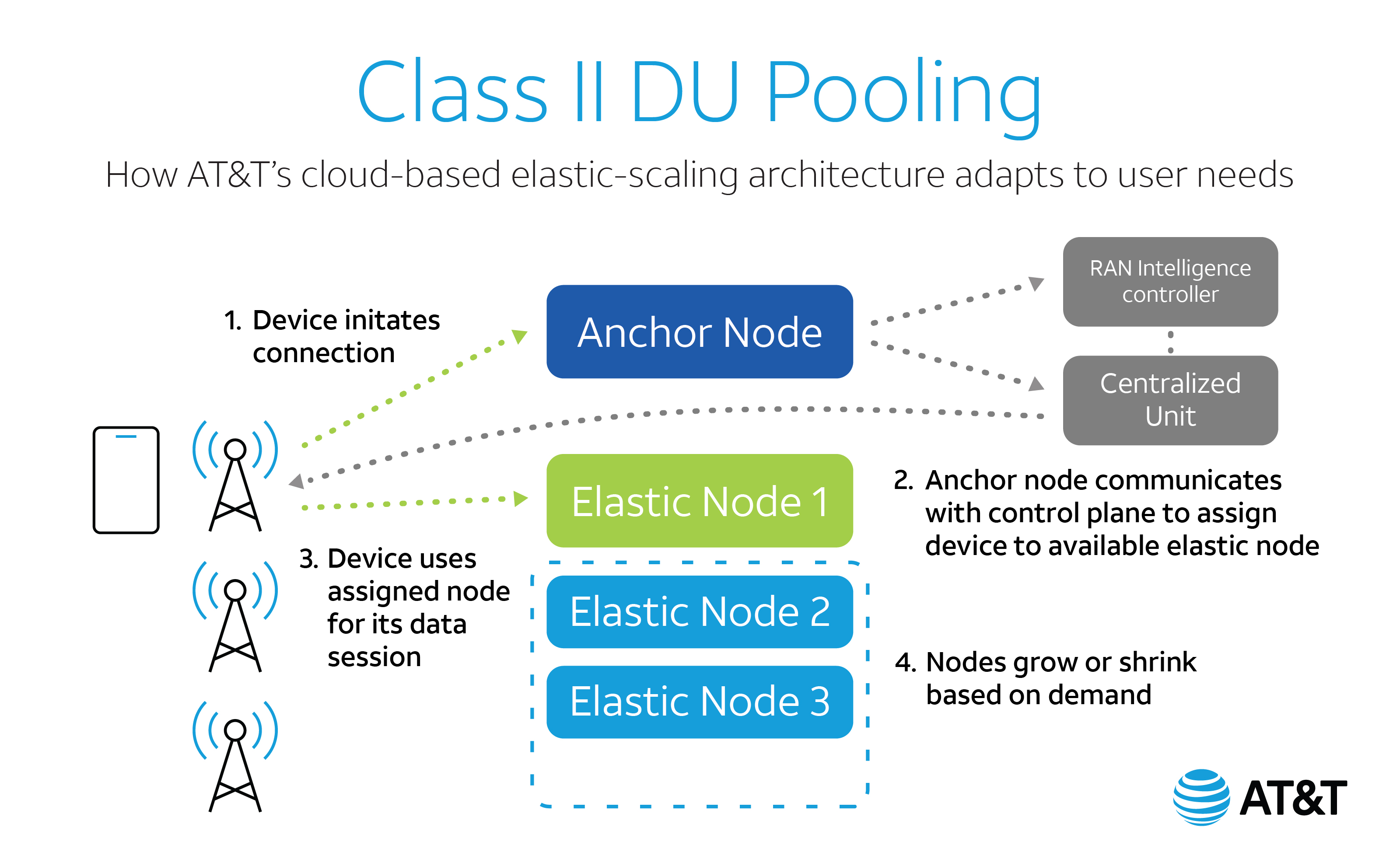

FlexRAN™ got a big boost this week from AT&T. In a February 24, 2022 blog post titled “Cloudifying 5G with an Elastic RAN,” Gordon Mansfield, AT&T VP Mobility Access & Architecture said that “AT&T and Intel had co-developed an industry-leading advanced RAN pooling technology freeing 5G radios from the limitations of dedicated base stations, while enabling more efficient, resilient, and green 5G networks. DU-pooling will eventually be usable by the entire 5G operator community to drive the telecom industry’s goals of green and efficient wireless networks forward.”

DU pooling technology was made possible by combining AT&T’s deep knowledge of Open RAN technologies as one of the co-founders of the O-RAN Alliance with Intel’s expertise in general purpose processors and software-based RAN through its FlexRAN™ software stack running on Intel 3rd generation Intel® Xeon® Scalable processors. The open standards for communications between radios and DUs that were published by O-RAN enabled its development, and the result is a technology demonstrator implemented on FlexRAN™ software.

………………………………………………………………………………………………………………………………………………………………………………..

Intel is now facing new Open RAN competition from several semiconductor companies.

Marvell has just unveiled a new accelerator card that will slot into a Dell compute server (which uses x86 processors). Based on a system called “inline” acceleration, it is designed to do baseband PHY layer processing and do it more efficiently than x86 processors. A Marvell representative claims it will boost open RAN performance and support a move “away from Intel.” Heavy Reading’s Simon Stanley (see below) was impressed. “This is a significant investment by Dell in open RAN and vRAN and a great boost for Marvell and the inline approach,” he said.

Qualcomm, which licenses RISC processors designed by UK-based ARM, has teamed up with Hewlett Packard Enterprise (HPE) on the X100 5G RAN accelerator card. Like Marvel’s offering, it also uses inline acceleration and works – by “offloading server CPUs [central processing units] from compute-intensive 5G baseband processing.”

There is also EdgeQ which is sampling a “Base Station on a Chip” which is targeted at Open RAN and private 5G markets. Three years in the making, EdgeQ has been collaborating with market-leading wireless infrastructure customers to architect a highly optimized 5G baseband, networking, compute and AI inference system-on-a-chip. By coupling a highly integrated silicon with a production-ready 5G PHY software, EdgeQ uniquely enables a frictionless operating model where customers can deploy all key functionalities and critical algorithms of the radio access network such as beamforming, channel estimation, massive MIMO and interference cancellation out of the box.

For customers looking to engineer value-adds into their 5G RAN designs, the EdgeQ PHY layer is completely programmable and extensible. Customers can leverage an extendable nFAPI interface to add their custom extensions for 5G services to target the broad variety of 5G applications spanning Industry 4.0 to campus networks and fixed wireless to telco-grade macro cells. As an industry first, the EdgeQ 5G platform holistically addresses the pain point of deploying 5G PHY and MAC software layers, but with an open framework that enables a rich ecosystem of L2/L3 software partners.

The anticipated product launches will be welcomed by network operators backing Open RAN. Several of them have held off making investments in the technology, partly out of concern about energy efficiency and performance in busy urban areas. Scott Petty, Vodafone’s chief digital officer, has complained that Open RAN vendors will not look competitive equipped with only x86 processors. “Now they need to deliver, but it will require some dedicated silicon. It won’t be Intel chips,” he told Light Reading in late 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Inline vs Lookaside Acceleration:

While Marvell and Qualcomm are promoting the “inline” acceleration concept, Intel is using an alternative form of acceleration called “lookaside,” which continues to rely heavily on the x86 processor, offloading some but not all PHY layer functions. This week, Intel announced its own product refresh based on Sapphire Rapids, the codename for its next-generation server processors.

Simon Stanley, an analyst at large for Heavy Reading (owned by Informa), said there are two key innovations. The first involves making signal-processing tweaks to the Sapphire Rapids core to speed up the performance of FlexRAN™, Intel’s baseband software stack. Speaking on a video call with reporters, Dan Rodriguez, the general manager of Intel’s network platforms group, claimed a two-fold capacity gain from the changes. “In the virtual RAN and open RAN world, the control, packet and signal processing are all done on Xeon and that is what FlexRAN enables,” he said.

The other innovation is the promise of integrated acceleration in future Sapphire Rapids processors. Sachin Katti, who works as chief technology officer for Intel’s network and edge group, said this would combine the benefits of inline acceleration with the flexibility of x86. That is preferable, he insisted, to any solution “that shoves an entire PHY layer into an inflexible hardware accelerator,” a clear knock at inline rivals such as Marvell and Qualcomm. Despite Katti’s reference to inline acceleration, Stanley does not think it is Intel’s focus. “None of this rules out an inline acceleration solution, but it does not seem to be part of the core approach,” he told Light Reading. “The key strategy is to add maximum value to Xeon Scalable processors and enable external acceleration where needed to achieve performance goals.”

Both inline and lookaside involve trade-offs. Inline’s backers have promised PHY layer software alternatives, but Intel has a major head start with FlexRAN™, which it began developing in 2010. That means lookaside may be a lot more straightforward. “The processor is in control of everything that goes on,” said Stanley during a previous conversation with Light Reading. “It is essentially the same software and makes life very easy.”

Larger network operators seemed more enthusiastic about inline during a Heavy Reading survey last year. By cutting out the processor, it would reduce latency, a measure of the delay that occurs when signals are sent over the network. That could also weaken Intel, reducing power needs and allowing companies to use less costly CPUs. “If you use inline, you probably need a less powerful processor and less expensive server platform, which is not necessarily something Intel wants to promote,” Stanley said last year.

References:

https://www.intel.com/content/www/us/en/communications/virtualizing-radio-access-network.html

EdgeQ Samples World’s 1st Software-Defined 5G Base Station-on-a-Chip

RAN growth slowed in 4Q-2021, but full year revenues rose to ~$40B – $45B; Open RAN market highlights

- Global RAN rankings did not change with Huawei, Ericsson, Nokia, ZTE, and Samsung leading the full year 2021 market.

- Ericsson, Nokia, Huawei, and Samsung lead outside of China while Huawei and ZTE continue to dominate the Chinese RAN market.

- RAN revenue shares are changing with Ericsson and Samsung gaining share outside of China.

- Huawei and Nokia’s RAN revenue shares declined outside of China.

- Relative near-term projections have been revised upward – total RAN revenues are now projected to grow 5 percent in 2022.

Open RAN Market – Highlights

- While 5G offers superior performance over 4G, both will coexist comfortably into the 2030s as the bedrock of next-generation mobile networks. There are three perspectives that help to underline this point. Firstly, unlike voice-oriented 2G and 3G (which were primarily circuit-switched networks with varying attempts to accommodate packet-switching principles), 4G is a fully packet-switched network optimized for data services. 5G builds on this packet switching capability. Therefore, 4G and 5G networks can coexist for a long while because the transition from 4G to 5G does not imply or require a paradigm shift in the philosophy of the underlying technology. 5G is expected to dominate the OPEN RAN market with $22B TAM in 2030 with a growth rate of 52% as compared to a 4G growth rate of 31% between 2022 and 2030

- Within OPEN RAN radio unit (RU), Small cells and macrocells are likely to contribute $7.5B and $2.4B TAM by 2030 respectively. It is going to be a huge growth of 46% from the current market size of $327M for such cells in the OPEN RAN market

- The sub-6GHz frequency band is going to lead the market with a 70% share for OPEN RAN although the mmWave frequency band will have a higher CAGR of 67% as compared to 37% CAGR of Sub-6GHz. Most focus has been on the 3.5 GHz range (i.e., 3.3-3.8 GHz) to support initial 5G launches, followed by mmWave awards in the 26 GHz and 28 GHz bands. In the longer term, about 6GHz of total bandwidth is expected for each country across two to three different bands

- Enterprises are adopting network technologies such as private 5G networks and small cells at a rapid rate to meet business-critical requirements. That’s why public OPEN RAN is expected to have the majority share of round ~95% as compared to the small market for the private segment

- At present, it is relatively easy for greenfield service providers to adopt 5G open RAN interfaces and architectures and it is extremely difficult for brownfield operators who have already widely deployed 4G. One of the main challenges for brownfield operators is the lack of interoperability available when using legacy RAN interfaces with an open RAN solution. Still, Mobile network operators (MNOs) throughout the world, including many brownfield networks, are now trialling and deploying Open RAN and this trend is expected to grow with time to have a larger share of brownfield deployments

- Asia Pacific is expected to dominate the OPEN RAN market with nearly 35% share in 2030. OPEN RAN market in the Asia Pacific is expected to reach USD 11.5 billion by 2030, growing at a CAGR of 34% between 2022 and 2030. Japan is going to drive this market in the Asia Pacific although China will emerge as a leader in this region by 2030. North America and Europe are expected to have a higher growth rate of more than 45% although their share will be around 31% and 26% respectively in 2030

References:

Deutsche Telekom demos end to end network slicing; plans ‘multivendor’ open RAN launch in 2023

DT and Ericsson recently demonstrated an impressive proof of concept implementation: they established connectivity with guaranteed quality of service (QoS) between Germany and Poland via 5G end-to-end network slicing. With an SD-WAN solution from Deutsche Telekom, the data connection can be flexibly controlled and managed via a customer portal. The solution ensures that different service parameters in the network can be operated across country borders. At the same time, network resources are flexibly allocated. This approach is being presented for the first time worldwide. It is particularly advantageous for global companies that operate latency-critical applications at different, international locations.

End-to-end network slicing, which requires a 5G SA core network, is a key enabler for unlocking 5G opportunities. It’s been highly touted to drive business model innovation and new use cases across various industry segments. 5G slicing will enable use cases that require specific resources and QoS levels. Globally operating enterprise are more and more seeing the need for uniform connectivity characteristics to serve their applications in different markets. Some of the latency-critical business applications that demand consistent international connectivity performance are related to broadcasting, logistics, and automotive telematics.

In this trial, the QoS connectivity was extended from Germany to Poland using a 5G slicing setup that is based on commercial grade Ericsson 5G Standalone (SA) radio and core network infrastructure and a Deutsche Telekom commercial SD-WAN solution. The home operator-controlled User Plane Function (UPF) is placed in Poland as the visited country and the entire setup is managed by an Ericsson orchestrator integrated with a Deutsche Telekom business support system via open TM Forum APIs. Combining 5G slicing and SD-WAN technology allows flexible connectivity establishment and control, while traffic breakout close to the application server in visited countries enables low latency.

…………………………………………………………………………………………………………………………………..

According to Light Reading, Deutsche Telekom (DT) has already issued a request for quotation (RFQ) to Open RAN vendors and is currently selecting partners for a commercial rollout next year. NEC – a Japanese vendor of radio units (among other things)- and Mavenir -a U.S. developer of baseband software-were mentioned as Open RAN Town participants (and likely DT RFQ respondents). “It is a multivendor setup,” said DT’s Claudia Nemat.

However, there are obstacles that Open RAN must overcome to be widely deployed. In particular, energy efficiency. Deutsche Telekom, along with most other big operators, is determined to reduce its carbon footprint and slash energy bills. Open RAN “is less energy efficient than today’s RAN technology,” Ms. Nemat said. The use of x86 general-purpose microprocessors in virtualized, open RAN deployments seems to be responsible for this inefficiency.

“If you have an ASIC [application-specific integrated circuit] for baseband processing, it is always cheaper than using a general-purpose microprocessor like an Intel processor,” said Alex Choi, Deutsche Telekom’s head of strategy and technology innovation, two years ago.

One option is to use ASICs and other chips as hardware accelerators for more efficient baseband processing. Companies including Marvell, Nvidia and Qualcomm all have products in development for sale as merchant silicon in open RAN deployments. Nemat, noted a breakthroughs with Intel.

“We achieved a reduction of electricity consumption of around minus 30%. For us, that is a big step forward for commercial deployment.”

Light Reading’s Iain Morris, provided this assessment:

Even so, a commercial open RAN deployment involving companies like NEC and Mavenir is hard to imagine. Any widespread rollout of their technologies would mean swapping out equipment recently supplied by Ericsson or Huawei (DT’s current 5G network equipment vendors), unless Deutsche Telekom plans to run two parallel networks. Either option would be costly.

Far likelier is that a 2023 deployment will be very limited. Other operators including the UK’s BT and France’s Orange have talked about using open RAN initially for small cells – designed to provide a coverage boost in specific locations.

A private network for a factory is one possible example. Outside Germany, of course, there may be a bigger short-term opportunity in Deutsche Telekom markets where 5G has not been as widely deployed.

In late June 2021, Deutsche Telekom switched on its ‘O-RAN Town’ deployment in Neubrandenburg, Germany. O-RAN Town is a multi-vendor open RAN network that will deliver open RAN based 4G and 5G services across up to 25 sites. The first sites are now deployed and integrated into the live network of Telekom Germany. This includes Europe’s first integration of massive MIMO (mMIMO) radio units using O-RAN open fronthaul interfaces to connect to the virtualized RAN software.

Ms. Nemat said at the time, “Open RAN is about increasing flexibility, choice and reinvigorating our industry to bring in innovation for the benefit our customers. Switching on our O-RAN Town including massive MIMO is a pivotal moment on our journey to drive the development of open RAN as a competitive solution for macro deployment at scale. This is just the start. We will expand O-RAN Town over time with a diverse set of supplier partners to further develop our operational experience of high-performance multi-vendor open RAN.”

……………………………………………………………………………………………………………………………………………………………………..

In November 2021, Deutsche Telekom announced it was taking the lead in a new Open lab to accelerate network disaggregation and Open RAN. The German Federal Ministry for Transport and Digital Infrastructure (BMVI) is financing the Lab with 17 million Euros and that’s to be matched by approximately a 17 million Euro investment from a consortium under the leadership of Deutsche Telekom (DT).

The lab will furthermore be supported by and working closely with OCP (Open Compute Project), ONF (Open Networking Foundation), ONAP (Open Network Automation Platform), the O-RAN Alliance and the TIP (Telecom Infra Project). Partners and supporters together form the user forum, which is open for participation by other interested companies, especially SMEs, working on applications as well as equipment and development. As an open lab it is built for collaboration within the wider telecommunications community. The i14y Lab Berlin will be the central location and core node of satellite locations such as Düsseldorf and Munich. Other highlights:

- Testing and integrating components of disaggregated networks in the lab to accelerate time to market of open network technology for the multi-vendor network of the future.

- The lab has already started operations at DT Innovation Campus Winterfeldtstraße

- Important foundation for building a European and German ecosystem of vendors and system integrators

A recent Research Nester report predicts a market size of $21 billion for O-RAN in 2028.

[Source: https://www.researchnester.com/reports/open-radio-access-network-market/2781].

References:

https://www.telekom.com/en/media/media-information/archive/telekom-at-mwc-barcelona-2022-647894

https://www.telekom.com/en/media/media-information/archive/global-5g-network-slicing-648218

KDDI claims world’s first 5G Standalone (SA) Open RAN site using Samsung vRAN and Fujitsu radio units

Japan’s KDDI is claiming to have turned on the world’s first commercial 5G Standalone (SA) Open Radio Access Network (Open RAN) site, using equipment and software from Samsung Electronics and Fujitsu. KDDI used O-RAN Alliance compliant [1.] technology, including Samsung’s 5G virtualized CU (vCU) and virtualized DU (vDU) as well as Fujitsu’s radio units (MMU: Massive MIMO Units).

Note 1. O-RAN Alliance specifications are being used for RAN module interfaces that support interoperation between different Open RAN vendors’ equipment.

The first network site went live in Kawasaki, Kanagawa today. KDDI, together with its two partners, will deploy this Open RAN network in some parts of Japan and continue its deployment and development, embracing openness and virtualization in KDDI’s commercial network. Note that both Rakuten-Japan and Dish Network/Amazon AWS have promised 5G SA Open RAN but neither company seems close to deploying it.

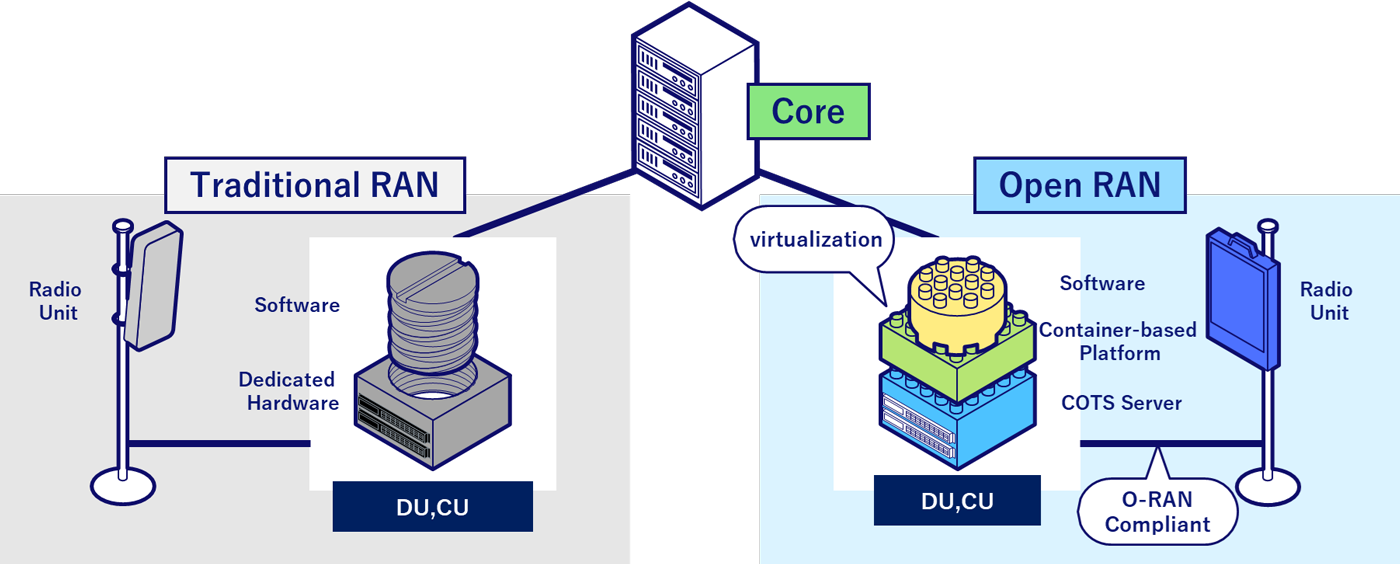

Virtualization and O-RAN technology replaces dedicated hardware with software elements that can run on commercial off-the-shelf (COTS) servers. This brings flexibility and agility to KDDI’s network, allowing the operator to offer enhanced mobile services to its users. KDDI says this architecture will deliver reliability, while accelerating deployment of Open RAN throughout Japan, including in rural areas. Meanwhile, 5G SA will deliver superior performance, higher speeds and lower latency and make possible advanced services/applications, such as network slicing, automation, service chaining and Multi-access Edge Computing (MEC).

Traditional RAN vs. Open RAN Configuration. Source: KDDI

Characteristics of this site:

This Open RAN site leverages fully-virtualized RAN software, provided by Samsung, that runs on commercial off-the-shelf (COTS) servers. Furthermore, by pursuing an open network approach between radio units and baseband unit, KDDI used Samsung’s baseband and Fujitsu’s Massive MIMO Units, which are connected with an open interface.

- Fully-virtualized 5G RAN software can be swiftly deployed using existing hardware infrastructure, which brings greater flexibility in deployment. New 5G SA technologies―such as network slicing, Multi-access Edge Computing (MEC) and others―powered by 5G vRAN, will deliver superior performance, higher speeds and lower latency, allowing KDDI users to experience a range of new next-generation services and immersive applications.

- Using an open interface between radio units and baseband unit, Open RAN not only ensures security and reliability but also enables operators to implement best-of-breed solutions from different partners and build an optimal network infrastructure for maximized performance.

- The virtualized network allows the use of general-purpose hardware (COTS servers) across the country, which will greatly increase deployment efficiencies. Additionally, by leveraging system automation, fully-virtualized RAN software can reduce deployment time, enabling swift nationwide expansion, including rural areas.

Comments from Kazuyuki Yoshimura, Chief Technology Officer, KDDI Corporation:

“Together with Samsung and Fujitsu, we are excited to successfully develop and turn on the world’s first commercial 5G SA Open RAN site powered by vRAN. Taking a big step, we look forward to continue leading network innovation and advancing our network capabilities, towards our vision of delivering cutting-edge 5G services to our customers.”

Comments from Woojune Kim, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics:

“Leveraging our industry-leading 5G capabilities, we are excited to mark another milestone with KDDI and Fujitsu. Samsung stands out for its leadership in 5G vRAN and Open RAN with wide-scale commercial deployment experiences across the globe. While KDDI and Samsung are at the forefront of network innovation, we look forward to expanding our collaboration towards 5G SA, to bring compelling 5G services to users.”

Note: Samsung released its first 5G vRAN portfolio in early 2021 following its blockbuster RAN deal with Verizon, which was the first operator to commercially deploy the new equipment. Samsung also gained a foothold in Vodafone’s plan to deploy 2,500 open RAN sites in the southwest of England and most of Wales. Samsung’s open RAN compliant vRAN hardware and software were previously deployed in 5G NSA commercial networks in Japan and Britain, but this is the first 5G SA deployment. We wonder if it is “cloud native?” Hah, hah, hah!

Comments from Shingo Mizuno, Corporate Executive Officer and Vice Head of System Platform Business (In charge of Network Business), Fujitsu Limited:

“The Open RAN-based ecosystem offers many exciting possibilities and this latest milestone with KDDI and Samsung demonstrates the innovative potential of next-generation mobile services with Massive MIMO Units. Fujitsu will continue to enhance this ecosystem, with the goal of providing advanced mobile services and contributing to the sustainable growth of our society.”

The companies will continue to strengthen virtualized and Open RAN leadership in this space, bringing additional value to customers and enterprises with 5G SA.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

Addendum: As of December 31, 2021 there were only 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

SOURCE: Dave Bolan, Dell’Oro Group.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://news.kddi.com/kddi/corporate/english/newsrelease/2022/02/18/5896.html

Samsung Electronics wins $6.6B wireless network equipment order from Verizon; Galaxy Book Flex 5G

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

_1646295038.JPG)