OpenRAN

India’s Success in 5G Standards; IIT Hyderabad & WiSig Networks Initiatives

by Prof. Kiran Kuchi, PhD & Dean of Research at Indian Institute of Technology Hyderabad (IITH) -edited by Alan J Weissberger, ScD EE

The development of 5G happens through a global forum called the 3rd Generation Partnership Project (3GPP). It’s a partnership between seven global Standards Development Organizations (SDOs) of which Telecommunications Standards Development Society, India (TSDSI) is a member. 3GPP kickstarted the 5G project in 2016 where we made substantial contributions to three successive releases of 5G specifications to date. IITH primarily led the efforts with significant support from CEWiT, IITM, and other Indian corporations (Tejas Networks and Reliance Jio are our major industry partners) with well over 300 technical documents submitted to date.

These sustained efforts led to the incorporation of several innovations introduced into the global 5G standards. One significant contribution that stands out is the introduction of a new transmit waveform, the only new waveform that is adopted in 5G, which is a generational change.

Both 4G and 5G adopted a waveform technology called OFDM (Orthogonal Frequency Division Multiplexing) that is quite suitable for the downlink transmission (that is the link between a base station (BS) and user equipment (UE)) but not so well suitable for the reverse link (that is the link between UE and BS). The limitations of OFDM owes to low-power efficiency (of about 10%). Prof Kuchi has designed a new waveform called “pi/2 BPSK with spectrum shaping” that provides close to 100% power efficiency and yet retains all the other advantages offered by OFDM.

This new transmit waveform allows the power amplifier in the UE to operate near its saturation level thus delivering a 3-4fold increase in the transmission power, and a hardware cost similar to that of OFDM. The overall gain in the cell range compared to OFDM will be at least twofold, hence this became a driver behind the design of the large cell 5G concept.

This indigenous waveform technology is developed for over a decade and is covered by a family of patents developed by IITH and CEWiT. There are well over 100 patents filed by IITH and WiSig to date. These patents will likely become the backbone of our indigenous 5G ecosystem. India’s 5G at ITU There are two parallel tracks that India took during the 5G development. The first effort is the aforementioned contributions to the 3GPP-based 5G standard, and our second noteworthy contribution is through TSDSI and the ITU (International Telecommunication Union). The second effort is led by IITM on the ITU front with significant backing and support from IITH, CEWiT (and Indian Industry such as Tejas networks, Reliance Jio).

ITU is a United Nations body that specifies requirements and radio standards for 5G known generically as IMT 2020. ITU-R WP5D had adopted India’s proposed Low-Mobility-Large-Cell (LMLC) use case as a mandatory 5G requirement in 2017. This requirement was adopted by ITU-R WP5D mainly as a result of sustained effort by the Indian entities through the Department of Telecommunications (DoT) to address the unique Indian rural broadband deployment scenario. Several countries supported this use case as they saw a similar need in their jurisdictions as well. TSDSI took this opportunity to develop the so-called LMLC based 5G technology that is a modification of 3GPP-based 5G specification.

This indigenously developed standard designated as 5Gi will deliver ultra-fast, low-latency mobile internet and next-generation IoT services in both cellular and mm-wave spectral bands that are common to all 5G candidate standards and adds “pi/2 BPSK with spectrum shaping waveform” as a mandatory technological enhancement that can provide broadband connectivity to rural users using ultra-long range cell sites.

This enhancement will ensure that 100% of India’s villages are covered from towers located at panchayat villages, whereas nearly a third of such villages would be out of coverage otherwise. Both 5G and 5Gi are fully compatible and interoperable systems that are being leveraged for the upcoming deployments in India. Adoption of the LMLC based 5G standards in India will enable India to leap forward in the 5G space, with key innovations introduced by Indian entities accepted as part of global wireless standards for the first time. The nation stands to gain enormously both in achieving the required 5G penetration in rural and urban areas as well as in nurturing the nascent Indian R&D ecosystem to make a global impact. The current national efforts are aligned with the national digital communication policy that promotes innovation, equipment design, and manufacturing out of India for the world market.

MeitY has been funding our wireless research for the past 10 years and these efforts have led to the development of larger wireless programs. More recently, the DoT (India Dept of Telecom) has sanctioned the “Indigenous 5G Testbed” program with a project outlay of 224 crores to IITH, IITM, CEWiT, IITK, IITB, IISc, and SAMEER.

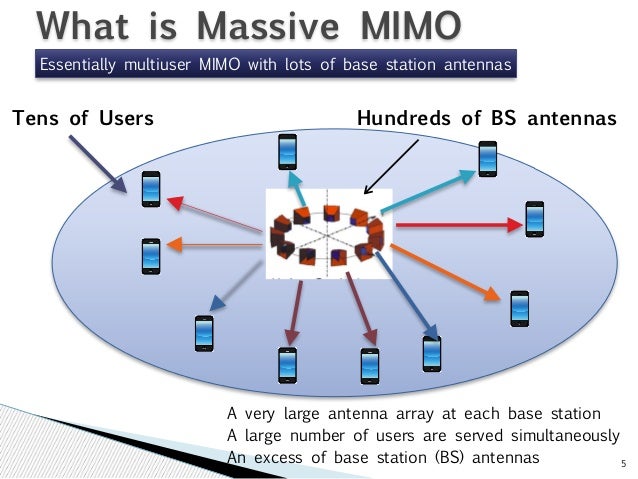

This 3-year program, already close to completion, started yielding results in the form of prototype base stations, CPE/UE and NB-IoT chipsets. IITH stands out with major contributions to key 5G technologies such as cloud RAN base station with massive MIMO capability and cellular NB-IoT chipset for connecting sensors and meters to the internet. We are gearing towards full-fledged demonstration and field trials.

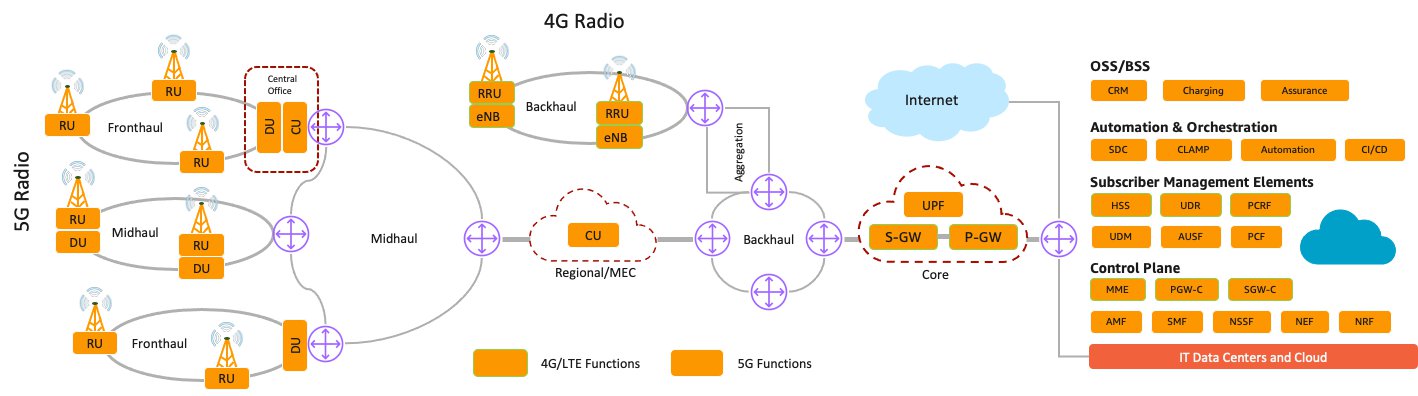

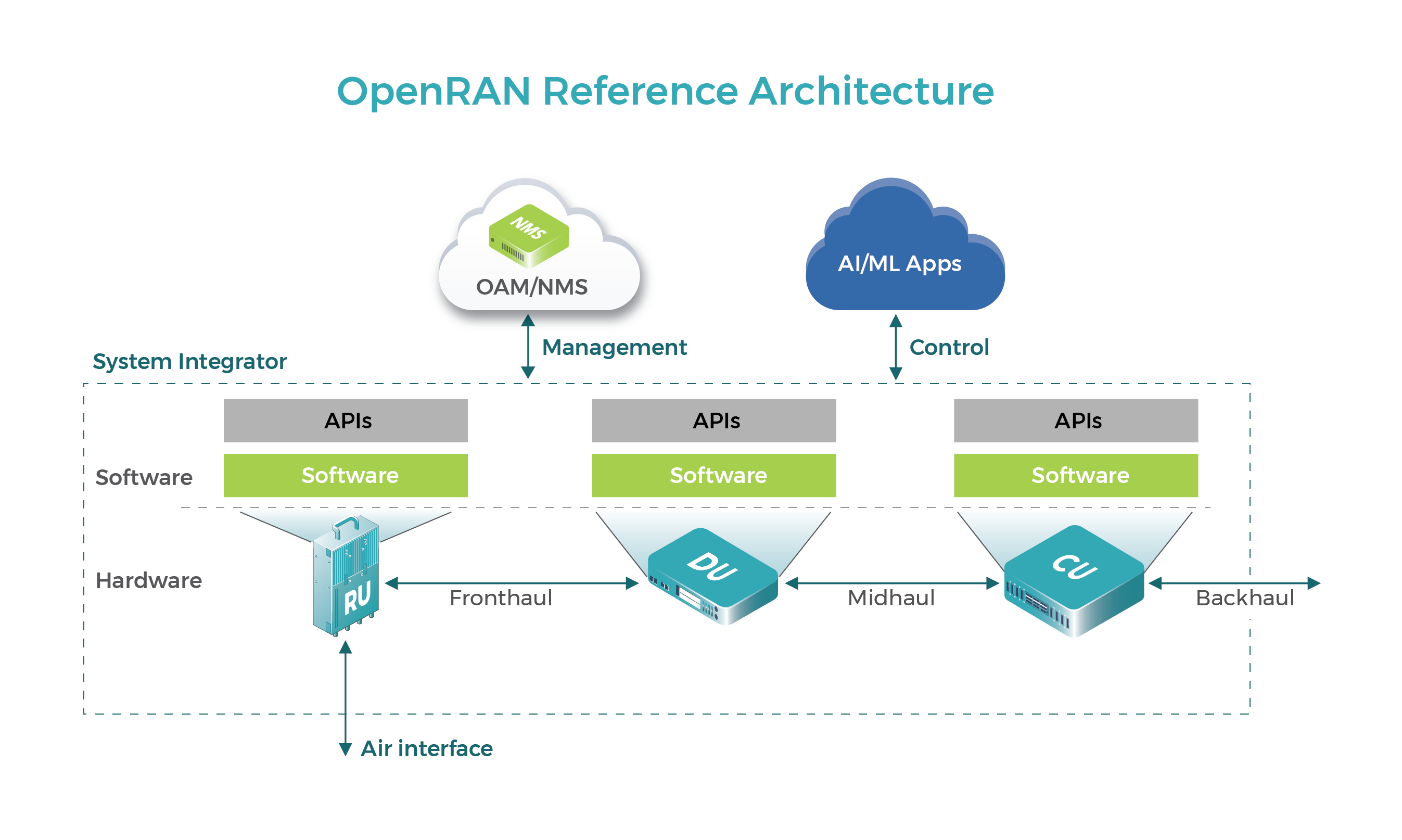

An upcoming player in the 5G space WiSig Networks (WiSig) is a 5G start-up incubated at the IITH tech incubator (i-tic foundation). WiSig has developed a 5G radio access network (5G-RAN) based on an emerging technology called O-RAN (Open-Radio-Access Network), that is being touted as the next major disruptor in the 5G landscape. This technology allows rapid deployment of low-cost, software upgradable 5G base stations in significantly higher volumes and larger densities than the current 4G network.

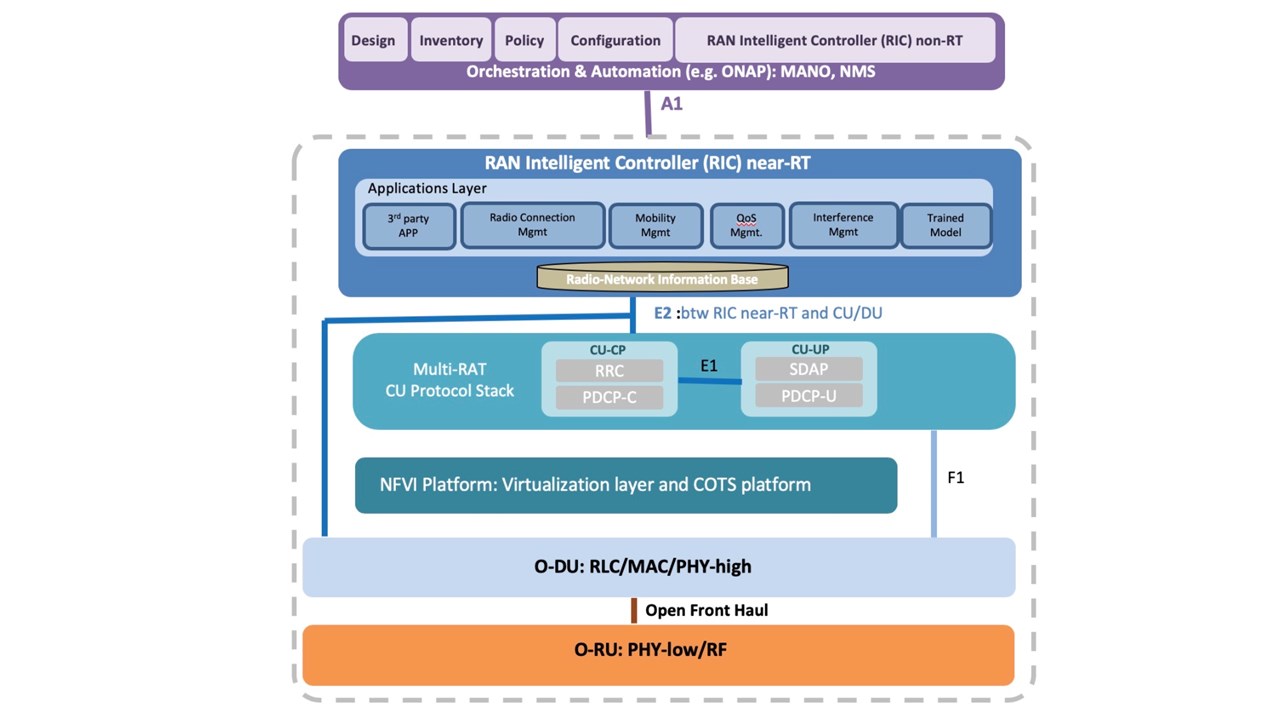

O-RAN is a disaggregated 4G/5G base station based on open interfaces and general purpose hardware. It is being defined by the O-RAN alliance, TIP Open RAN project and ONF SD-RAN v1.0 Software Platform for Open RAN.

Some operators have initiated the deployment of O-RAN based software-defined network and virtualization networks that enable self-organization, low operational cost and ease of introduction of new features and service upgrades. New 5G use cases can be introduced rapidly on the fly using software upgrades as opposed to costly and time-consuming hardware development cycles. WiSig has created commercial grade IP in this space and is well on track to carry out one of India’s first O-RAN compliant demonstrations of a software defined 5G massive MIMO base station. Overall, WiSig is well on its path to deliver 5G RAN intellectual property components to the global 5G supply chain.

LMLC based 5G technology is a modification of 3GPP-based 5G New Radio (NR) specification. This indigenously developed LMLC ITU-R standard, designated as 5Gi, will deliver ultra-fast, low-latency mobile internet and next-generation IoT services in both cellular and mm-wave spectral bands that are common to all 5G candidate standards and adds “pi/2 BPSK with spectrum shaping waveform” as a mandatory technological enhancement that can provide broadband connectivity to rural users using ultra-long range cell sites.

In contrast to high-speed mobile broadband, a vast number of IoT applications requires few bits to be exchanged with the internet intermittently. The key considerations of these kind of IoT devices are that they are ultra-low-cost and have a long battery life – up to 10 years. Narrowband IoT (NB-IoT) (Belongs to the 5G family of technologies is well suited for this purpose and is quietly emerging as a killer application for lowbit rate IoT applications. IITH and WiSig joined hands in commercializing a NB-IoT SoC (System on a Chip) that was successfully taped out in Q1 2021.

The chip is named “Koala” after an animal indigenous to Australia that sleeps about 20 hours a day – typical behavior of the NB-IoT modem.

Given that this is the first time a standards compliant cellular modem is designed in India and that both the software and hardware that goes into the chip is developed indigenously, this chip should preferably be leveraged to serve the security needs of critical national IoT infrastructure.

In summary, the investments made by Meity and DoT on 5G research have started to bear fruit in delivering the basic technological components and sub-systems required to build 5G. The time is ripe for the Government to nurture domestic design and manufacturing of 5G equipment. The country has enough talent and the technological depth required to support a domestic 5G ecosystem. With the right kind of policy support, then India is likely to see a 5G/IoT domestic manufacturing revolution within this decade. IITH will continue to play a pivotal role in shaping the 5G ecosystem not only in India but globally as well.

About Kiran Kumar Kuchi, PhD:

Kiran is a Professor Department of Electrical Engineering IIT-Hyderabad (IITH) and Dean of Research. He also started WiSig Networks that has been incubated at IITH. He received PhD and MS degrees in Electrical Engineering from the University of Texas at Arlington, TX. His current projects include: Cloud radio, Heterogeneous networks (HeNets), Next generation wireless test-bed development.

References:

https://pcr.iith.ac.in/Kiriith-Issue-6,April,20215GandNext-GenCommunicationTechnologies.pdf

5 European telcos publish Open RAN Technical Priorities Document

Five major European network operators have issued a white paper outlining their technical requirements for the open, disaggregated radio access network products they want to deploy in significant deployments starting next year.

The telco quintet – Deutsche Telekom, Orange, Telefónica, TIM (Telecom Italia) and Vodafone – signed the Memorandum of Understanding (MoU) on The Implementation of Open RAN Based Networks In Europe earlier this year and have now set out their technical stall so that the vendor community has some guidance with which to work.

The ‘Technical Priorities Document’ provides a set of “technical requirements that the signatories of the Open RAN MoU consider priorities for Open RAN architecture. It serves as a guidance to the RAN supplier industry on where to focus to accelerate market deployments in Europe, focusing on commercial product availability in the short term, as well as solution development in the medium term. In terms of timeframe, the operators wish to ensure the readiness of Open RAN solutions for large scale network roll-out from 2022 onwards. Macro deployment is identified as the primary target for the operators.”

The telco quintet say they are not seeking to develop new specifications or standards in this process, but simply identify their preferences in terms of technology and architecture that are based primarily on the specifications being developed by the O-RAN Alliance.

There are many requirements, particularly around the IT requirements underpinning the Open Cloud architecture that needs to support containerized cloud native functions (CNFs). You can read the full document here.

Opinion:

How many Open RAN technical requirements and spec writing consortiums/alliances are necessary? We already have O-RAN Alliance, TIP Open RAN Project, Open RAN Policy Committee, and slew of company alliances. That is NOT the way specifications are created as there are surely overlaps, duplications and gaps in one or more of these entities requirements documents. This will surely result in mass confusion and slow the market for Open RAN equipment.

The way to proceed, IMHO, is to have the operators work through the O-RAN Alliance to state which of their requirements are mandatory and which are optional. This is what PTT’s did from 1976-1996 within CCITT to standardize X.21, X.25, ISDN, Frame Relay, and ATM. They did likewise from 1998-2000 to standardize ADSL and VDSL within ITU-T.

……………………………………………………………………………………………………………………………………………….

The Open RAN Requirements document highlights multiple interfaces that need specific attention by technology developers. For example, adherence to an Open F1 interface for the centralized unit/distributed unit (CU/DU) split, as well as Open X2/Xn interfaces for connectivity between base stations – but stresses the importance of open fronthaul, described as “the prime interface to be supported in a fully interoperable manner, without compromising network performance, especially for Massive-MIMO.” The O-RAN Alliance 7.2x interface the preference of the five operators, though they note there is the need to “further investigate UL [uplink] enhancements for the 7.2x split in order to improve performance and robustness particularly in mobility scenarios.”

The paper also stresses that focus should be on 4G/5G in the 3.4-3.8 GHz bands as well as legacy FDD (frequency division duplex) bands. The operators believe that mmWave bands are more specific to certain markets and so not as important initially for this set of operators. As for interoperability with legacy mobile networks, the paper notes that “the operators are interested in inter-operability between 2G/3G baseband units and RUs, based on proprietary interfaces, since no open interface has been specified successfully. This applies mainly to hybrid Radio Units supporting 2G/3G/4G/5G, but also for legacy 2G/3G only RUs already deployed.”

In addition, the operators need to be sure that the Open RAN technology they deploy will enable RAN sharing: “While MORAN [multi-operator RAN] with shared O-RU only and MOCN [multi-operator core network] support is unanimously requested, both shared infra and dedicated infra per operator is relevant, depending on whether the infra is deployed on the same site or deployed autonomously by each operator in their target location (e.g. in their own cloud). Efficient RAN sharing management is required to allow sufficient independence between operators to manage their own CNFs on a shared infra, while avoiding any potential conflicts.”

References:

Strand Consult: The 10 Parameters of Open RAN; AT&T memo to FCC

Strand Consult is attempting to determine if, when, and how Open RAN (TIP project) and O-RAN (Alliance) will replace conventional RAN on a 1:1 basis without compromising the network quality, security, energy efficiency, and other important factors. Mobile operators have little ability to raise price, so operators must compete on network quality, coverage, and other factors. Here are few things to keep in mind.

In general, mobile ARPU is falling. In many countries, operators are trying to shift the focus away from price by competing on innovation and quality. For example, US mobile operators compete on the quality and coverage of their 4G and 5G networks. Mobile operators are focused on rolling out technology quickly, maintaining customer satisfaction, and ensuring quality of experience and other key performance indicators (KPIs). Chief technology officers, network managers, and other technical staff are laser focused on these KPIs and are loath to make changes to which would negatively impact these indicators.

In general, Strand Consult observes that what public affairs officials say about OpenRAN differs significantly from what network managers say.

Strand Consult’s 10 parameters to evaluate OpenRAN:

Strand Consult’s investigation has been guided by 10 parameters or questions to determine the value of OpenRAN. Here is what we’ve learned.

- Whether OpenRAN is a technical standard. The O-RAN Alliance is a private organization that develops technical specifications for OpenRAN. It should not be confused with the OpenRAN Policy Coalition which is a public affairs organization. The O-RAN Alliance is not a standards development organization (SDO), but rather an industrial collaboration that builds solutions on top of 3GPP specifications. While industrial cooperation is important, there can be no mobile networks the 3rd Generation Partnership Project (3GPP), an umbrella term for many standards organizations which develop protocols for mobile telecommunications and define the technological inputs for cellular networks. Companies like Rakuten develop their own corporate and proprietary concepts for OpenRAN. These concepts that do not necessarily follow a particular standard (3GPP) or O-RAN Alliance specification.

- Whether OpenRAN can replace Chinese equipment. Some mobile operators have suggested that OpenRAN is the way to avoid Huawei and ZTE in mobile networks. However other Chinese companies are deeply involved with OpenRAN technical specifications, product roadmap, and strategy. One founding member of the O-RAN Alliance is China Mobile, a state-owned company and the world’s largest mobile operator with 950 million subscribers and 450,000 employees. The O-RAN Alliance has more than 40 Chinese member companies, many of which government-owned and military aligned (See Strand Consult’s research note 44 Chinese companies have joined the OpenRAN effort, a strategy to reduce Huawei’s presence in 5G). The Chinese members of 0-RAN Alliance outnumber the Europeans. China Mobile’s Chih-Lin has veto power over the organization. China Mobile leads or co lead 8 of the 9 O-RAN Alliance’s working groups either as chairman or vice-chairman.

- OpenRAN and 5G innovation. OpenRAN proponents claim it will have a revolutionary impact on 5G, however reports suggest that large scale deployment of OpenRAN won’t happen until 2025. This means that OpenRAN cannot replace existing RAN on a 1:1 basis today. The 5G networks rolled out today use the standards from 3GPP Release 15 with increased functionality forthcoming in Releases 16 and 17 within two years. There are more than 144 3GPP-5G commercial networks deployed but only one proprietary OpenRAN 5G network (Rakuten). If OpenRAN is to increase 5G innovation, it must evolve faster than 5G itself. Presently it is not on par with the 5G standards defined years ago. It is difficult to see how OpenRAN can catch up when the significant resources already supporting the 3GPP standards timeline.

- OpenRAN and 5G deployment. Today mobile operators are rolling out 5G at a faster than 4G and even fast than 3G. In practical terms, 5G networks already built in 2019 and 2020 and those to be built in 2021 and 2022 already have the standards roadmap in place. If OpenRAN can’t catch up by 2025, operators have only two choices, delay 5G until 2025 (when 6G will start to take root) or replace their 5G equipment in 4 to 5 years. OpenRAN may be too little, too late for 5G operators.

- OpenRAN and vendor diversity. OpenRAN proponents claim that it will create more competition in the network equipment market. The 5G network equipment vendor market has many vendors and segments. Omdia details more than a dozen full-service providers with additional providers in segments for antennas, basebands, remote radios, small cells, macro cells, phase shifters and so on. This idea that there are not many vendors for 5G equipment was likely created by Huawei to deter the security reviews and subsequent restrictions imposed on the military-aligned company. If anything, the restrictions on Huawei have helped to open the door to new equipment vendors which could not compete because of Huawei’s predatory pricing and anti-competitive tactics. For example, Samsung has quickly gained market share and is supply 5G rollouts in the US, Australia, and other countries.

- OpenRAN and network equipment cost. OpenRAN proponents suggest that it can lower the cost of network equipment. The cost competitiveness of OpenRAN versus RAN is not yet known. It may be that some OpenRAN providers can offer equipment more cheaply on some parameters, but the cost advantage may not be significant when considering all the costs such as supply, availability, energy consumption, security, warranty, network integration, equipment matching, new contracts and service level agreements etc. However, operators frequently reduce their number of vendors so that they can enjoy lower unit costs with volume purchasing, the company BUYIN is a great case. For an operator’s perspective, check out the comments from Neil McRae, Managing Director and Chief Architect at BT (Scroll to minute 51 minute in the video). McRae explains that when he took his job, he inherited a network portfolio with 50 vendors. He subsequently reduced it to 4 vendors and saved £1 billion in 3 years. He observed that too many vendors not only increased cost, it increased complexity. He is wary of notions of “open architectures” which require managing portfolios of 5-50 vendors. He noted that vendor reduction increased shareholder value and that he would pursue the same strategy again.

- OpenRAN and security. OpenRAN proponents suggest that OpenRAN technology and the “unbundling” of 5G hardware and software is the means reduce reliance on Huawei and hence greater security. However, it is not clear how trading one known insecure Chinese vendor for 50 unknown Chinese vendors is the path to greater security. The issue of backdoors is omnipresent on all Chinese hardware given the country’s disposition and associated intelligence and surveillance policies. Moreover, it is not clear how security is improved when network owners must vet not one, but multiple new OpenRAN vendors. The time and cost to perform this review would seem to be multiplied by the number of vendors the operators takes on.

- OpenRAN and energy efficiency. Energy efficiency is an increasingly important issue for mobile operators which expect to compete on carbon reduction strategies. Naturally if OpenRAN could offer a greener solution, that would be an advantage. However, it is reported that many OpenRAN installation use the Intel X86 processor, which is less efficient than specialized RAN chips. If anything, energy consumption could increase if signals must traverse a multitude of mix and match components instead of a single end-to-end system designed with energy efficiency in mind. To reduce energy, Apple developed tits own processer as an alternative to Intel X86.

- OpenRAN and Rakuten. The media has promoted a supposed Rakuten success story with OpenRAN success. However, Rakuten is not offering open-source tools, but rather proprietary OpenRAN solution. It offers this through a freemium model in which free service is offered for a period, and operators pay down the line. Some companies have success with freemium and loss leader models, but typically they need scale.

- OpenRAN and the indigenous movement. OpenRAN has been promoted as a way to support domestic innovation like India or Brazil or what Germany’s Economic Minister calls for European-only actors in 5G. Curiously many of these calls are coupled with operator strategies to keep Huawei equipment in place because OpenRAN will not be ready for some years. Policymakers have also pursued subsidies and other financial incentives to support local OpenRAN startups which may design the equipment in their respective country but manufacture it in China. Unfortunately, production in China and with Chinese partners could compromise security, as the Supermicro case demonstrates.

Conclusion

The many problems that OpenRAN is purported to solve is impressive. In fact, I have to go back to 3G in 2000 to find the level of hype observed today with OpenRAN. Indeed, the Huawei problem is so serious that people are desperate for a solution. However, in the enthusiasm for the OpenRAN solution, too many want to look past the inconvenient reality that China is shaping much of the Open RAN future particularly through the O-RAN Alliance.

It is important to develop secure alternatives to Huawei, but this is not a reason to oversell OpenRAN. While it may be commendable to pursue the goals proffered by OpenRAN proponents, the actual impact of OpenRAN must be measured by real world facts and experience.

The questions remain how OpenRAN will affect the CAPEX and OPEX mobile operators in the short, medium and long term and whether operators will buy OpenRAN as a serious 1:1 alternative to standard RAN in Paris, London, Berlin, Madrid, New York, Sao Paulo and Copenhagen. It seems that OpenRAN is falling short of expectations.

Separately, AT&T told the FCC it plans to begin adding open RAN-compliant equipment into its network “within the next year.”

That puts AT&T on roughly the same timeframe as Verizon. Verizon’s SVP Adam Koeppe told Light Reading earlier this year that the operator’s 5G hardware vendors – Ericsson, Samsung and Nokia – will begin supplying open RAN-compliant equipment starting later this year. And he expects that the bulk of their equipment shipments to Verizon will comply with open RAN specifications by next year. AT&T told the FCC it expects to implement similar changes into its own network.

“The challenge for an operator shifting to any open network architecture, including but not limited to O-RAN, will be maintaining network reliability, integrity and performance for customers during the transition,” the operator wrote in a filing. “For our part, AT&T serves multiple customer groups, with varied and often complex, service requirements. As we introduce O-RAN into our network, our goal will be maintaining the same high level of performance at scale. We are actively working in this direction.”

References:

https://www.lightreading.com/open-ran/atandt-to-launch-open-ran-by-next-year/d/d-id/769199?

AT&T to FCC: Promoting the Deployment of 5G Open Radio ) Access Networks – GN Docket No. 21-63

https://ecfsapi.fcc.gov/file/1042871504579/AT%26T%20Comments%20to%20FCC%20NOI%20(04.28.21).pdf

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

On its Q1-2021 earnings call, Dish Network Chairman and Co-founder Charlie Ergen did not provide any specifics regarding Dish’s deal with Amazon/AWS or its overall plan to build a nationwide 5G Open RAN, “cloud native” core network. Are you a bit tired of cliché’s like this:

“We’re building a Netflix in a Blockbuster world.” All Netflix did was put video on the cloud. Instead of going to a physical store, you put it in the cloud. Right. All the business plans in the world, all the numbers, all the thought if they just did something simple they put it in the cloud and the technology was they were a little ahead of the technology but the technology got there. All we’re doing is taking all those towers that you see as you drive down the highway, we basically put them in the cloud. And so instead of driving to physical store and rent a movie, you’re going to get all your data and information and automation everything from the cloud. And so it’s a dramatic paradigm shift in the way network is built and it should and it’s an advantage over legacy carriers who have 30-year-old architecture.” Of course, that’s incorrect as almost all 5G carriers plan to build a 5G cloud native core network.

Dish is planning to build the world’s first standalone, cloud-based 5G Open Radio Access Network (O-RAN), starting with the launch of a 5G wireless network for enterprise customers in Las Vegas, NV later this year.

Dish says it will leverage AWS’s architecture and services to deploy a cloud-native 5G network that includes O-RAN—the antennas and base stations that link phones and other wireless devices to the network. Also existing in the cloud will be the 5G core, which includes all the computer and software that manages the network traffic. AWS will also power Dish’s operation and business support systems.

“Amazon has made massive investments over the years in compute storage transport and edge, [and] we’ll be sitting on top of that and as we tightly integrate telco into their infra, then we can expose APIs to their development community, which we think makes and enables third-party products and services to have network connectivity, as well as enterprise applications,” said Tom Cullen, executive VP of corporate development for Dish, explaining some of the technical details of the arrangement during Thursday’s earnings call.

Ergen reiterated Dish’s plan to spend up to $10 billion on its overall 5G network and provided milestone date for completion of the first phase of the 5G build-out.

“All of that $10 billion isn’t spent by June of 2023, which is our major milestone,” Ergen said, pointing to the company’s agreement with the U.S. government to cover at least 70% of the population with 5G no later than June 14, 2023. However, Ergen has an escape hatch:

“The agreement we have [with the FCC] recognizes that [there could be] supply chain issues outside of our control, and that the timelines could be adjusted. But we don’t look at it that way internally. There is always unforeseen circumstances, and this one might be particularly acute. But we’re not going to let anything stop us. We’re focused on meeting our timelines, and regardless of what the challenges are. And we’ll have to reevaluate that from time to time, but we’re focused right now on Las Vegas and we’re focused on the 20% build-out by June of next year.”

“We’re not going to let anything stop us, he added. The $10 billion “does take us through the complete (5G) buildout.”

On the 5G cloud native aspect, Ergen said:

“Yes, we anticipated a cloud native network from the beginning, he said. “So the $10 billion total build-out cost that we announced a couple of years ago–I think people are probably still skeptical … But you can see where we’re headed. Most of your models will probably take a lot of capex off the board when you understand the architecture, and we’re not going to go through all the architecture in this call, but it’s certainly has a material impact on capex.”

Dish said last week it plans to run all of its network computing functions inside the public AWS cloud – a plan that represents a dramatic break from the way most 5G networks around the world run today. Many analysts think that’s a huge cyber-security risk as the attack surface is much greater in a virtual, cloud based network.

Marc Rouanne — Executive Vice President and Chief Network Officer:

“Yeah, the way to think of our cloud native network is a network of networks, that’s the way it’s architected. So when a customer comes to us, it’s easy for us to offer one sub network, which we can call it private network and there are techniques behind that like slicing, like automation, like software defined, so I’m not going to go into the techniques, but natively the way to think of it is really this network of networks. Right. And then, as Stephen, you’ve seen that you plan this to the postpaid customers and telling you how they would shake lose sub networks.”

“Absolutely, yeah. No, I think we’ve talked to a number of customers across multiple verticals in different industry segments and is an increasing appetite in demand for the kind of network that we’re building, which is really to enable them to have more security, more control and also more visibility into the data that’s coming off the devices, so that they can control their business more effectively. So we’re seeing a terrific demand. And the network architecture, we’re putting in place actually enables and unlocks that opportunity for those enterprise customers and it’s again not restricted to any specific vertical.

We’re touching a lot of different companies and a lot of different vertical segments across the country and the other aspect of the opportunity that we see for ourselves is that while we build out a nationwide network, we are in the process of working with customers and prospective customers on private networks that are not limited by the geography of our national footprint. So we can deploy those within their environments to support their business operations as well. So the demand we’re seeing is terrific and we’re already engaged with a number of customers today.”

Ergen chimed in again:

“The cloud infrastructure as it existed a couple of years ago, really didn’t handle telco very well, there has been a lot of R&D and investment that they’ve had to make to transform their network into something that where a telco can operate in the cloud, because it’s a little bit different than their traditional IT infrastructure. And then today they are, they were best in class room for what we needed and whether it be their APIs and the documentation and discipline and vendor at the — community that supports them and their — the developers and then of course obviously reach into the enterprise business. So it was — so that’s the first and foremost.

And then the second thing I think is, is the company committed? I’m not going to put words in Amazon’s mouth, I’ll let them talk to their commitment, but they’ve done a lot of work for us to help us without knowing where they have the deal or not and very appreciative that it. I think it’s helpful that Andy will become the CEO because he’s owned this project from the start and he can — he will be able to move all the pieces within Amazon to focus on this. And so I think at the end of the day, I think we’re going to be their largest customer in cloud and I think they’re going to — they may be the largest customer in our network. I mean, but we have to build a network and prove it, and they have to build and prove it. I think that all other carriers around the world will, including the United States will look at Amazon as a real leader here because we’re just doing something different.”

Stephen Bye — Executive Vice President, Chief Commercial Officer

“Yeah. So just in terms of what the Las Vegas build looks like. I think there are several attributes that are really important to what we’re doing to build on Charlie’s comment. One is we are building a cloud native infrastructure. We are using an Open Radio Access architecture. But it’s also a 5G native network. We’re not trying to put 5G on top of 2G, 3G and 4G, the infrastructure that we’re deploying is optimized for 5G and the way we’ve designed the network from an RF perspective and a deployment perspective is to take advantage of the 5G architecture as well as the 5G platform. And so, what does that look like?

It’s basically a new network, it’s new infrastructure, it’s designed using all of the spectrum bands that we have and the RF is optimized to take advantage of that. So we’re on a path to launching that in the third quarter, but it’s one of a number of markets we have coming on. We just have announced those markets through the end of the year, but it’s the first, obviously a number that we have in flight today and we’ve got activity going on across the country to actually build out this network. So it will be the first one that people can touch and feel and get the experience, but it is really a 5G native network and we’ve proven that O-RAN from a technology perspective can work compared to that at the end of last year. Now we are in the execution phase, now we’re in the deployment phase and so you know Vegas will have to be the first one that it will be a fully deployed market that people will be able to touch and feel and experience.”

Bye added that the 5G build-out will be done in phases but the network is designed to support all customers across all segments.

5G Network End-to-End Architecture. Image courtesy of AWS.

……………………………………………………………………………………………………………………………

In a note to clients, analyst Craig Moffett said that Dish was purchasing services from AWS rather than Amazon investing in Dish’s 5G network:

“It was a purchase agreement, albeit one freighted with lots of rather fuzzy jargon, and nothing more. Notably, Verizon already has its own relationship with AWS, and theirs does call for AWS to co-market Verizon services to AWS’s enterprise customers. By contrast, the Dish agreement calls only for Dish to market AWS services to Dish’s customers, not the other way around. Objectively, it is Verizon, not Dish, that has the more strategic relationship.

Amazon isn’t likely to market a service to its customers unless they are highly confident that its quality is first rate and that its staying power is assured. Perhaps Dish will get there. But it won’t be clear that they have arrived at that point until their network is successfully serving customers… without the safety net of the T-Mobile MVNO agreement. That’s not until 2027. That feels to us like a long time to wait.”

Regarding Dish Network’s new business model, Craig said “It is now fair to say that Dish’s core business is wireless rather than satellite TV. Not by revenues, of course; the wireless business is today but the modest reseller stub of what once was Boost (Mobile). But certainly by valuation….What does matter, however, is the extent to which the satellite TV business can serve as a source of funds for financing the wireless business.”

………………………………………………………………………………………………………………………………………

References:

https://d1.awsstatic.com/whitepapers/5g-network-evolution-with-aws.pdf

https://docs.aws.amazon.com/whitepapers/latest/cicd_for_5g_networks_on_aws/5g-networks-on-aws.html

Telecom Italia to be first Open RAN network operator in Italy

Telecom Italia (TIM) is among the first operators in Europe and the only one in Italy to launch the Open RAN deployment program to innovate 4G and 5G radio access networks.

The initiative is covered by the signing of a Memorandum of Understanding (MoU) last February with the main European operators to promote Open RAN technology with the aim of speeding up the implementation of new generation mobile networks, in particular 5G, Cloud and Edge Computing.

TIM said it signed up to the MoU to commit to the development of innovative mobile network systems that use open virtualized architecture to facilitate increasingly agile, flexible, secure and functional 5G services.

The first city in Italy to adopt this open network model is Faenza. Through collaboration with JMA Wireless – a leader in mobile coverage and the development of Open RAN software – TIM will use a solution that decouples or disaggregates the components (hardware and software) of the radio access network.

The radio node on the 4G network has been built by combining JMA’s software baseband with the radio units provided by Microelectronics Technology (MTI). Going forward, this venture will also extend to 5G solutions.

The deployment of Open RAN solutions in an open environment, in line with the objectives of TIM’s 2021-2023 ‘Beyond Connectivity’ plan, will unite the potential of the cloud and Artificial Intelligence with the evolution of the mobile network. Moreover, it will enable operators to further strengthen security standards, improve network performances and optimize costs in order to provide ever more advanced digital services such as those linked to the new solutions for Industry 4.0, the smart city and autonomous driving.

TIM is a member of the European Open RAN alliance launched earlier this year by Deutsche Telekom, Orange, Telefonica and Vodafone to work together on developing and implementing open RANs for mobile. TIM said that the initiative will provide strong impetus to the introduction of the broadband mobile network’s new functionalities, in particular the 5G ones, promoting an increasingly widespread deployment and improving its management.

That consortium may be in competition with the 5G Open RAN Ecosystem, which includes the following companies: Dell Technologies Japan, Fujitsu, Intel, Mavenir, NEC, NTT Data, Nvidia, Qualcomm Technologies, Red Hat, VMware, Wind River and Xilinx.

Of course there is also the O-RAN Alliance and the TIP Open RAN project group. Yet no standards body (like ITU, ETSI, IEEE, etc) is involved and neither is 3GPP which is the main spec writing body for cellular networks.

…………………………………………………………………………………….

References:

https://www.gruppotim.it/en/press-archive/corporate/2021/CS-TIM-ORAN-Faenza-26-aprile2021-EN.html

Analysis: Telefonica, Vodafone, Orange, DT commit to Open RAN

Another Open RAN Consortium: 5G Open RAN Ecosystem led by NTT Docomo

https://www.gruppotim.it/en/press-archive/corporate/2021/PR-TIM-ORAN-en.html

Mavenir and Xilinx Collaborate on Massive MIMO for Open RAN

Mavenir, an upstart end-to-end cloud-native network software provider and Xilinx, a leader in adaptive computing, announced today the companies are collaborating to bring to market a unified 4G/5G O-RAN massive MIMO (mMIMO) portfolio to enable Open RAN deployments. The first mMIMO 64TRX joint solution is expected to be available in Q4 2021.

Working together, the two companies have successfully completed end-to-end integration of a first-generation mMIMO solution using Open RAN principles. Held at the Mavenir Lab in Bangalore, India, the integration covered multiple deployment scenarios and was evaluated by six CSPs, all leading global operators. Mavenir delivered the Virtualized RAN (vRAN) support for mMIMO, including Core Network, CU and DU, with Xilinx providing the Category B O-RAN Radio Unit.

“This integration demonstrates an efficient Open RAN massive MIMO solution to achieve diversification of the telecommunications supply chain,” says Pardeep Kohli, President and CEO, Mavenir. “This is an important milestone in the delivery of open and interoperable interfaces enabling the deployment of mMIMO in high density, high mobile traffic metro areas.”

“We were early proponents of Open RAN technology along with Mavenir and actively led in standards development in the industry through many field trials around the world,” said Liam Madden, executive vice president and general manager, Wired and Wireless Group at Xilinx. “With the investment we have done on our market-leading wireless radio technology and massive MIMO R&D, we are excited to collaborate with Mavenir to bring our collective technology and radio system expertise together that will accelerate the deployment of market leading 5G O-RAN massive MIMO radio solutions.”

With history of leadership success in various 4G and 5G network deployments worldwide, the companies are jointly developing the next generation of mMIMO products which will bring the world’s first O-RAN compliant 64TRX mMIMO products that support up to 400MHz instantaneous bandwidth in a compact form factor. Mavenir’s vRAN software supports Multi-User MIMO with up to 16 layers, advanced receiver algorithms, full digital beamforming – all running on Mavenir’s open and flexible cloud-native platform, as well as on other cloud platforms.

These products will leverage Xilinx’s technology platform including RFSoC DFE and Versal AI for advanced beamforming, delivering a fully integrated hardware and software O-RAN compliant mMIMO solution.

The wireless industry’s focus is squarely set on massive MIMO as mid-band spectrum 5G deployments continue, particularly following the record high mid-band 5G spectrum auction that concluded in the U.S. earlier this year. Massive MIMO is especially important in mid-band 5G networks because it allows operators to densify network coverage, increase capacity and coverage, and reduce the need for incremental outdoor sites, all of which translates to less labor and lower costs.

Mavenir and Xilinx have not yet disclosed the specifications for the equipment, but claim the equipment at the top of the portfolio will feature a 64-antenna array for transmitting and receiving signals and support up to 400 megahertz of bandwidth. The initial supply of radios will support C-band spectrum in the U.S., and the companies plan to later support mid-band spectrum for 5G deployments in Europe, the Middle East, and India.

The vendors are coming together to prove that “open RAN massive MIMO radios are a reality, and we will deliver that to the market. Our first open RAN massive MIMO radio will be labs ready by early Q4 and field-trial ready by the end of the year,” said Gilles Garcia, a senior director at Xilinx.

“5G Open RAN has significant momentum in the market with ABI Research forecasting network vendor spending to reach $10 billion by 2026-27 and then surpass traditional RAN at $30 billion by 2030,” said Dimitris Mavrakis, senior research director of 5G at ABI Research.

“As Mavenir and Xilinx continue to work together to accelerate O-RAN-based massive MIMO adoption, their solutions will be well-timed to serve this high-growth market with the higher spectral efficiency, performance, power efficiency and cost needed as 5G demand intensifies.”

Altiostar and Rakuten Mobile Demonstrate Success for Open RAN Network in Japan

Rakuten Mobile and Altiostar have announced a number of performance and scalability achievements for the Rakuten Mobile 4G and 5G Open RAN deployments in Japan. That network, built on Altiostar’s cloud-native Open vRAN software, was said to achieve superior levels of automation and performance.

Rakuten Mobile launched its 4G network in April 2020. The wireless network operator ended January 2021 with more than 11,000 base stations that cover 74.9 percent of the population. Rakuten Mobile plans to expand its network coverage to 96 percent of Japan’s population coverage by summer this year. That’s about five years ahead of its own schedule! The network has achieved both high performance (number one in upload speed in market at 16.8Mbps, per OpenSignal), despite having only 1/6th of the spectrum holdings of competing operators in market.

In September 2020, five months after the initial launch, Rakuten Mobile launched a commercial-scale, cloud-native 5G network, using Altiostar’s Open vRAN service. As baseband functions are deployed as VNFs (virtual network functions), Rakuten Mobile automated various operational tasks such as new cell site integration (auto-commissioning), as well as fault detection and automated recovery from failures (self-healing). Due to the automation of its network, Rakuten Mobile reports it can provide a new 5G cell site in four minutes and a 4G site in eight minutes.

The 5G network, using advanced massive MIMO and millimeter wave (mmWave) radios, covers both sub-6 GHz and mmWave frequency bands. Altiostar worked with Qualcomm Technologies, Airspan, and Rakuten Mobile on innovation in mmWave radios based on Qualcomm 5G RAN platforms. Altiostar partnered with NEC and Rakuten Mobile to introduce to the 5G network the sub-6 GHz massive MIMO radios, which were validated as compliant with O-RAN specifications during an O-RAN Alliance Plugfest held this past September in India.

The 5G network has demonstrated impressive performance for end users, with throughput of 1.77 Gbps. This compares favorably to data from a Ookla, which detailed speed test results for Japan in Q3 2020, where the fastest 10% of users realized an average download speed of 719.42 Mbps.

Image Credit: Altiostar

“Rakuten has been a disruptor in the mobile space and our 4G and 5G Open vRAN deployments reflect this strategy,” said Tareq Amin, Representative Director, Executive Vice President and Chief Technology Officer at Rakuten Mobile. “The performance and stability of the 5G network shows that a cloud-native framework and web-scale architecture can compete with a traditional RAN approach and provide new levels of automation to the network. We will continue to drive the transformation of the mobile industry with a rich and diverse ecosystem with companies including Altiostar, Qualcomm Technologies and NEC.”

“Rakuten has been at the forefront of the Open vRAN movement since it began. The industry is closely watching its every step, and it has been able to demonstrate a high-quality experience for their customers,” said Stéphane Teral, Chief Analyst, LightCounting. “This is validated by the performance metrics of their 5G network and I am excited to see the next steps they take as the network goes national.”

“This is a significant milestone for the Rakuten Mobile and Altiostar partnership towards commercial realization of a high performing, cloud-native 5G RAN architecture,” said Ashraf Dahod, CEO of Altiostar. “The Altiostar container-based solution allows Rakuten Mobile to quickly provision new sites and turn up service for a customer in record time. By leveraging the power of an Open virtualized RAN, Rakuten can transform its network and its business to provide a robust service for the consumer that exceeds that of a traditional operator.”

Altiostar has partnered with Rakuten Mobile to design and deploy its Open vRAN. Rakuten Mobile has standardized on the Altiostar Open vRAN software for all types of deployment models from small cells to macro to massive MIMO, across 4G and 5G radio access technologies.

About Altiostar

Altiostar provides 4G and 5G open virtualized RAN (Open vRAN) software that supports open interfaces and virtualizes the radio access baseband functions to build a disaggregated multi-vendor, web-scale, cloud-based mobile network. Operators can add intelligence, quickly adapt the network for different services and automate operations to rapidly scale the network and reduce Total Cost of Ownership (TCO). Altiostar collaborates with a growing ecosystem of partners to support a diverse Open RAN supply chain.

The company was selected by Dish last June to deliver its cloud-native O-RAN compliant solution for DISH’s nationwide 5G network buildout, the first of its kind in the U.S. The Altiostar solution will provide openness, modularity, agility and scalability to DISH, enabling faster deployment of new 5G services for consumers and businesses.

The Altiostar Open vRAN solution has been deployed globally, including the world’s first cloud-native commercial-scale mobile network with Rakuten Mobile in Japan. For more information, visit www.altiostar.com

About Rakuten Mobile

Rakuten Mobile, Inc. is a Rakuten Group company responsible for mobile communications, including mobile network operator (MNO) and mobile virtual network operator (MVNO) businesses, as well as ICT and energy. Through continuous innovation and the deployment of advanced technology, Rakuten Mobile aims to redefine expectations in the mobile communications industry in order to provide appealing and convenient services that respond to diverse customer needs.

Qualcomm 5G RAN Platform is a product of Qualcomm Technologies, Inc. and/or its subsidiaries.

Qualcomm is a trademark or registered trademark of Qualcomm Incorporated.

SOURCE: Altiostar

……………………………………………………………………………………………………………………………………………

References:

References:

NTT DOCOMO selects Samsung for 5G and O-RAN network solutions

Samsung Electronics announced on Monday that it has been selected as a 5G network solutions provider for NTT DOCOMO, the leading mobile operator in Japan with 82 million customers. Samsung will support DOCOMO (now wholly owned by NTT Corp.) with its innovative 5G technology, including O-RAN-compliant solutions, to bring enriched 5G services to users, advance digital transformation for businesses, and improve society at large.

As part of its ongoing strategy to deliver an advanced network and provide customers an array of enhanced mobile services, DOCOMO leverages leading edge-technologies in its 5G network.

“As a leading mobile operator, our goal is to provide our customers the best possible services for creating innovative, fun and exciting experiences and finding solutions to social issues,” said Sadayuki Abeta, General Manager of the Radio Access Network Development Department at NTT DOCOMO. “We are excited to collaborate with Samsung for the next phase of 5G Open RAN and accelerate the expansion of our ‘Lightning Speed 5G’ coverage in the nation.”

“We are pleased to be part of DOCOMO’s 5G networks and look forward to continued collaboration in advancing 5G innovation for their customers,” said Satoshi Iwao, Vice President and Head of Network Division at Samsung Electronics Japan. “Our goal is to leverage Samsung’s technical leadership to bring the best network solutions to mobile operators around the world, so they can deliver the next generation of transformative 5G services and electrifying user experiences.”

“The agreement between NTT DOCOMO and Samsung is significant,” said Stefan Pongratz, Vice President at Dell’Oro. “NTT DOCOMO has a history of being at the forefront with new and innovative technologies and this announcement cements Samsung’s position as a major 5G RAN supplier.”

Samsung says they have pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios, and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing connectivity to hundreds of millions of users around the world.

This is the latest in a series of recent contract awarded to Samsung. The company scored its biggest win when it received a $6.6 billion 5G contract from Verizon, replacing Nokia. It got a contract from Canada’s SaskTel earlier this month and is also in talks with European telecom operators to gain a foothold on the continent.

It is supplying 5G RAN to New Zealand’s Spark and last week announced it will be the sole 4G/5G core and RAN supplier to Sasktel. Samsung also supplies 5G RAN and core equipment to SK Telecom and KT in its home market.

NTT DoCoMo already has a broad slate of 5G vendors. Fujitsu supplies RAN equipment, NEC core and edge, Nokia baseband and Ericsson (a major supplier to rival KDDI) supplies RAN optimization. Six weeks after DoCoMo, a founding member of the O-RAN Alliance, unveiled its “5G Open RAN Ecosystem” aimed at “accelerating open RAN introduction to operators” worldwide. Members include NEC, Fujitsu, Mavenir, Intel and Qualcomm which are DoCoMo’s own team of preferred open RAN solution vendors.

………………………………………………………………………………………………………………………………………

References:

https://news.samsung.com/global/samsung-collaborates-with-ntt-docomo-on-5g

https://www.lightreading.com/asia/samsung-networks-lands-docomo-for-5g-open-ran/d/d-id/768255?

FCC Notice of Inquiry to discuss Open and Virtualized RANs (vs Vendor Lock-in 2.0)

The Federal Communications Commission (FCC) today adopted a Notice of Inquiry to start a formal discussion on the opportunities and potential challenges presented by open and virtualized radio access networks (RANs), and how the FCC might leverage these concepts to support network security and 5G leadership.

The FCC seeks comment on the current status of development and deployment, whether and how the FCC might foster the success of these technologies, and how to support competitiveness and new entrant access to this emerging market.

The Open Radio Access Networks (Open RAN) concept promotes the use of open interface

specifications (not standards as the FCC incorrectly stated) in the portion of the telecommunications network that connects wireless devices—like mobile phones—to the core of the network.

This can be implemented in vendor-neutral hardware and software-defined technology based on open interfaces and standards. In addition, Open RAN allows disaggregation of the radio access network, which can enable the use of interchangeable technologies that promote network security and public safety. The FCC is seeking input from academics, industry, and the public on what steps are required to deploy Open RAN networks broadly and at scale.

The Notice of Inquiry (NOI) seeks comment on the current status of Open RAN development and deployment in networks in the U.S. and abroad. It asks about the role of established large manufacturers and new entrants in setting standards for this new network architecture. It seeks input on what steps should be taken by the FCC, federal partners, industry, academia, and others to accelerate the timeline for Open RAN standards development. Further, it seeks comment on any challenges or other considerations related to the deployment, integration, and testing of systems based on Open RAN specifications. The NOI also requests comment on the costs and benefits associated with Open RAN development and deployment.

The FCC’s Technological Advisory Committee, a group of industry representatives that provides technical advice to the Commission, recently recommended that the Commission encourage the development of the Open RAN ecosystem by supporting Open RAN innovation, standardization, testing, and security and reliability. The Commission also hosted a Forum on 5G Open Radio Access Networks in September 2020.

This Notice of Inquiry seeks input on the status of Open RAN and virtualized network environments: where the technology is today and what steps are required to deploy Open RAN networks broadly and at scale. It also seeks comment on whether and, if so, how deployment of Open RAN-compliant networks could further the Commission’s policy goals and statutory obligations, advance legislative priorities, and benefit American consumers by making state-of-the-art wireless broadband available more quickly and to more people in more parts of the country.

What the Notice of Inquiry Would Do:

- Describe the relationship of recent government action to Open RAN development, including through Commission and other U.S. government action, legislative developments, and international activity.

- Seek comment on the current status of Open RAN development and deployment domestically and internationally.

- Seek comment on potential public interest benefits in promoting Open RAN development and deployment, including increased competition, network vendor diversity, affordability for consumers, network security and public safety, and other potential benefits.

- Seek comment on additional considerations regarding Open RAN development and deployment, including potential software vulnerabilities or risks posed by a virtualized operating environment. o Seek comment on barriers to Open RAN development and deployment and whether and what Commission efforts could be undertaken to promote Open RAN development and deployment.

- Seek comment on how the Commission can collaborate with and/or leverage ongoing Open RAN research and development activities in academia and other federal agencies.

- Discuss and seek comment on the costs and benefits of Open RAN deployment.

Diagram courtesy of TIP Open RAN Project

……………………………………………………………………………………………………………………….

Author Notes:

It’s important to note that there is no Open RAN work ongoing within SDOs like ITU-R, ITU-T, ETSI or IEEE. Nor is there any Open RAN activity within 3GPP. Instead, there are three consortia/forums that are working on Open RAN specifications and market awareness. They are: O-RAN Alliance, TIP Open RAN project and GSMA which will surely be the marketing arm for this technology.

In addition, there are several consortiums in the U.S., Europe, and Asia that are trying to promote Open RAN technology.

In the U.S., the Open RAN Policy Coalition “represents a group of companies formed to promote policies that will advance the adoption of open and interoperable solutions in the Radio Access Network (RAN) as a means to create innovation, spur competition and expand the supply chain for advanced wireless technologies including 5G.”

“Coalition members believe that by standardizing or “opening” the protocols and interfaces between the various subcomponents (radios, hardware and software) in the RAN, we move to an environment where networks can be deployed with a more modular design without being dependent upon a single vendor.”

The above statement is quite strange, considering that 1) There is NO ongoing standardization work on Open RAN (consortiums produce specs but NOT standards) and 2) An “open” network should not exclude vendors (e.g. Huawei, ZTE) or cause vendor lock-in.

However, it seems vendor lock-in is how Open RAN technology is being deployed today with various vendors and operators banding together to offer Open RAN technology solutions. Some examples of that include:

- Rakuten-NEC “RCS” which has been endorsed by Telefonica and supposedly sold to 15 network operators.

- Mavenir, a U.S. based software developer, has teamed up with MTI, a Taiwanese maker of radio units.

- Parallel Wireless, a Mavenir rival, has a similar partnership with China’s Comba.

- NTT DoCoMo’s open RAN ecosystem includes some prominent names in the IT and telecom sectors, such as Dell, Fujitsu, Intel, Mavenir, NEC, Nvidia, Qualcomm, Red Hat, VMware, Wind River and Xilinx.

- Telefonica, Deutsche Telekom, Orange and Vodafone pledged in a MoU to back Open RAN systems that take advantage of new open virtualized architectures, software and hardware with a view to enhancing the flexibility, efficiency and security of European networks in the 5G era.

Light Reading’s Iain Morris coined the term “Vendor Lock-in 2.0.” He says that Open RAN deployment is all about trading one form of vendor lock-in for another, as depicted in this illustration, courtesy of Light Reading:

Market research firm Omdia’s view is that “preferred partnerships” will take shape between software developers and hardware manufacturers. Its latest forecast is that open and “virtualized” radio access network products will account for roughly 9% of the total market by the end of 2024, up from just 1% in 2020.

However, rather than encouraging new RAN companies, Omdia believes the big five – Huawei, Ericsson, Nokia, ZTE and Samsung – will “probably seize the majority” of this business. The challengers, it says, simply “cannot achieve the same economies of scale as the incumbents.”

………………………………………………………………………………………………………………………………………………..

References:

https://www.fcc.gov/document/fcc-seeks-comment-open-radio-access-networks

https://docs.fcc.gov/public/attachments/DOC-370266A1.pdf

https://techblog.comsoc.org/2021/01/20/analysis-telefonica-vodafone-orange-dt-commit-to-open-ran/

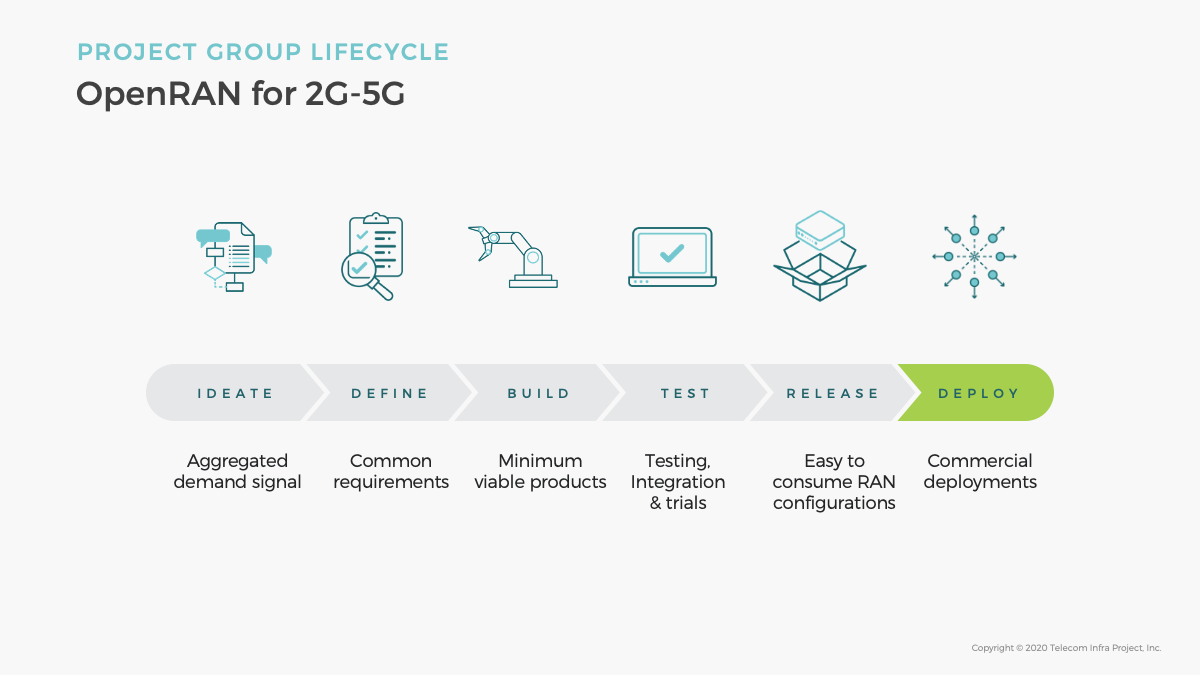

TIP OpenRAN project: New 5G Private Networks and ROMA subgroups

The Telecom Infra Project (TIP), one of several industry consortiums creating specifications for open radio access networks (Open RAN), recently announced a new 5G Private Networks subgroup.

Editor’s Note:

We don’t know whether the TIP OpenRAN project or the O-RAN Alliance has (and will have) more industry influence and impact. In addition, there are many splinter partnerships forming; many of them led by Rakuten Mobile. What’s mind boggling is that none of the groups have liaison agreements with either ITU-R WP5D (responsible for all IMT standards, including 4G and 5G) or 3GPP (the prime spec writing organization for mobile networks).

……………………………………………………………………………………

5G Private Networks contribute to improve the quality of experience for 5G connectivity, including better coverage and capacity through on-premise radio equipment, the ability to support low latency and high bandwidth service requirements through edge compute & routing of private traffic, and the potential to support the increasing demand for privacy and localized data analytics.

For network operators, 5G Private Networks also create the opportunity to implement new network management and operational models, enabling full automation of the operation of the enterprise network while improving end customer application experience.

However, to fully capture the benefits of 5G Private Networks, a different approach is required, because traditional network architectures, focused on large scale deployments and operations don’t have the right economics or the operational flexibility to efficiently deliver on the emerging needs of enterprise customers.

The 5G Private Networks Solution Group will develop a new approach to manage and operate 5G Private Networks, based on a cloud-native architecture, and making use of a new class of software management tools, based on the paradigms currently used for the cloud, but adapted to deliver the requirements of a telecom network environment. Telefónica will test the solution in their local TIP Community Lab in Madrid and then move to field trials in Málaga (Spain).

Juan Carlos Garcia, SVP Technology Innovation & Ecosystem, Telefónica, and TIP Board Director said: “This new solution group will enable operators to address the exciting opportunities that 5G is creating in the enterprise segment, both through valuable features for our customers and more efficient network operations. The TIP community is the perfect environment for this innovation, as it will allow us to leverage multiple current project groups (Open Core Networks, OpenRAN) to deliver an end-to-end Minimum Viable Product that we will then test in Telefonica’s TIP Community Lab.”

In particular, the new Solutions Group will leverage previous work contributed to TIP’s OpenRAN Project Group, on a first version of a CI/CD platform that applies traditional IT methodologies to automate integration, testing and deployment of OpenRAN software.

Ihab Tarazi, CTO and SVP, Networking and Solutions, Dell Technologies and TIP Board Director, said: “For open networks to deliver their benefits, the telecom industry needs an abstraction layer that helps integrate different components into end-to-end solutions. New software management tools based on the ones currently used for the cloud can address this need, and this Solution Group is a timely initiative for the industry to collaborate on making this happen.”

Caroline Chan, VP and GM Network Business Incubation Division, Intel and TIP Board Director, said: “Through the recently launched solution groups, TIP is expanding its scope to include the validation of interoperability between different elements across the whole network, and insights and recommendations about how to operate them. The new 5G Private Networks Solution Group is a strong example of this approach. With dedicated local private high-performance network connectivity as a key emerging deployment model for 5G and edge buildout, this group can help foster important ecosystem collaboration.”

As a result, this new solution group will help drive:

- Improved network economics, through the use of commoditized hardware and open source software, and more efficient and flexible network operations and automation, enabled by the adoption of cloud-native technologies.

- Dedicated local high-performance 5G connectivity and edge computing infrastructure, appealing to multiple B2B & B2B2C verticals.

- Better network security and performance.

Telefónica is one of the five European telcos that announced that they will work together on open RANs for mobile networks. The others are Deutsche Telekom, Orange, TIM and Vodafone. A memorandum of understanding (MOU) for that grouping commits the five to the O-RAN Alliance, which has 27 network operator members from AT&T to Vodafone, and to “other industry initiatives, such as the Telecom Infra Project, that contribute to the development of open RAN and that aim to create a healthy and competitive open RAN ecosystem and advance R&D efforts.”

……………………………………………………………………………………………………………….

Separately, the charter of the new OpenRAN Orchestration and Management Automation (ROMA) subgroup was approved by the OpenRAN PG. ROMA focuses on aggregating and harmonizing mobile network operators requirements on Open RAN orchestration and lifecycle management automation, fostering ecosystem partners to develop products and solutions that meet ROMA requirements.

The goal of ROMA is to:

· Develop a common set of use cases for OpenRAN lifecycle management automation and orchestration that are agreed across multiple MNO and OpenRAN ecosystem members

· Develop Technical Requirements on products and solutions that support the identified use cases, including interfaces and data models

· Facilitate product and solution development through lab testing, field trials, participating TIP Plugfest and badging on TIP exchange etc.

· Support large scale OpenRAN deployment with lifecycle management automation, including Continuous Integration and Continuous Deployment (CI/CD) frameworks and tool sets.

It will bring better coverage and capacity through on-premise radio equipment, says TIP, and the ability to support low latency and high bandwidth service requirements through edge compute and routing of private traffic, and the potential to support the increasing demand for privacy and localized data analytics.

……………………………………………………………………

About the Telecom Infra Project:

The Telecom Infra Project (TIP) is a global community of companies and organizations that are driving infrastructure solutions to advance global connectivity. Half of the world’s population is still not connected to the internet, and for those who are, connectivity is often insufficient. This limits access to the multitude of consumer and commercial benefits provided by the internet, thereby impacting GDP growth globally. However, a lack of flexibility in the current solutions – exacerbated by a limited choice in technology providers – makes it challenging for operators to efficiently build and upgrade networks.

Founded in 2016, TIP is a community of diverse participants that includes hundreds of companies – from service providers and technology partners, to systems integrators and other connectivity stakeholders. We are working together to develop, test and deploy open, disaggregated, and standards-based solutions that deliver the high-quality connectivity that the world needs – now and in the decades to come.

Find out more: www.telecominfraproject.com

References:

Learn more and join the new 5G Private Networks Solution Group here.

https://telecominfraproject.com/tip-launches-5g-private-networks-solution-group/