Optical Network Equipment Market

Cignal AI: Strong 4Q-2017 Optical Equipment Growth in Asia, EMEA led by Metro WDM Gear

Cignal AI’s quarterly optical hardware report was published last week and includes results for almost all vendors in 4Q2017. Global spending on optical network equipment surged due to larger than usual seasonal growth in China and EMEA combined with continued elevated spending in rest of APAC (RoAPAC) = APAC x Japan and China. However, North America and CALA regions each suffered a double digit decline. Here are Cignal AI’s YoY % change from 4Q2016 to 4Q2017:

Key takeaways for the 4th quarter of 2017:

- China – When compared to 4Q2016’s weak spending, 4Q2017’s Chinese spending was massive, with year-over-year revenue increasing 40 percent (see chart above) and reaching record quarterly levels. We expect further discussion with Chinese vendors to provide greater insight on what drove this surge.

- EMEA – Carriers maxed out capex at the end of the year and spent 21 percent more YoY. Beneficiaries of this spending were Huawei and Nokia, while Infinera also reported significant EMEA revenue from a large North American cloud/colo vendor. Vendors believe that 2018 will be better and they expect incumbent operators to spend more.

- Japan – Spending was up 13 percent YoY for the quarter. NEC and Fujitsu accounted for 80 percent of all optical equipment sold in the region in 2014, but by 2017 it has dropped to 65 percent, as vendors such as Huawei, Ciena, and Infinera made inroads in this market. Western vendors are encouraged, and now consider Japan an area of potential expansion.

- RoAPAC – Nokia and Ciena had record revenue in RoAPAC during 4Q2017. Ciena’s revenue exceeded $100 million in the region, while Nokia’s nearly matched that of Huawei. Spending in India remained high, though Cignal AI is monitoring for the impact of the upcoming merger between Jio and Reliance.

- North America – 4Q17 spending continued to slip on a YoY basis for the fifth consecutive quarter with all customer market segments spending at lower levels. Spending by cloud and colo operators has not returned to earlier levels. Multiple vendors also cited continued weakness at Level3/CenturyLink and AT&T, particularly on long-haul WDM equipment. We think AT&T’s spending will be depressed until the end of 2018 as the company prepares its new disaggregated hardware deployment strategy. Component vendors note that shipments used in metro WDM networks such as Verizon’s are trending up for next year.

“One of the biggest surprises in 2017 was massive spending growth in China. Despite slumping purchases from component manufacturers, Chinese optical vendors Huawei and ZTE reported record levels of revenue. A strong component sales rebound should be expected if this divergence was a result of excess inventory,” said Andrew Schmitt, lead analyst for Cignal AI.

Huawei, Nokia, Ciena, Cisco, and Infinera did very well in the EMEA region, according to the Cignal AI report. Huawei, ZTE, Nokia and Ciena all enjoyed a strong quarter overall, thanks in large part to the popularity of their Metro WDM systems and submarine line (undersea cable) terminal equipment (SLTE).

Additional highlights of results for the full year can be found in Cignal AI’s press release.

TABLE OF CONTENTS

…………………………………………………………………………………………………………………………………….

Separately, Research and Markets has published “Optical Networking Opportunities in 5G Wireless Networks: 2017-2026” report. According to a press release:

5G will create considerable new opportunities for the optical networking industry going forward in the 5G infrastructure; both backhaul and fronthaul. However, while optical links have been widely used in the mobile telephony industry for many years, revenue generation from optical networking in the 5G space will require carefully thought through strategies by the optical networking industry as a whole.

5G is poised to dramatically increase the use of fiber optics in some parts of the network, while actually reducing the use of fiber in others:

- There is a vision of 5G as a converged fiber-wireless network in which short-haul, but very high bandwidth wireless connections will support high data rates, but with fiber almost everywhere else. 5G as it is currently evolving seems more willing than previous generation to make fiber optic deployments a central part of the network and any general standards that emerge. This makes 5G potentially a huge opportunity for the fiber optics industry – including the makers of modules and components as well as the fiber/cable manufacturers themselves.

- The main beneficiary of the shift towards fiber in the 5G infrastructure will ultimately be NG-PON2. But for now this is really only being championed by one company; Verizon. XGS-PON will provide an interim solution, but the question is for how long?

- On the other hand, 5G, with its high data rates, seems to imply fiber could present a significant challenge to long-held assumptions about the need for fiber-to-the-premises. This suggests that some of the fiber optic opportunities that have been baked into the product/market strategies of many optical networking firms may turn out to be wrong. A faceoff between 5G and NG-PON as service platforms seem likely in the long run.

5G deployment is currently at an early stage. There is no formal standard yet for 5G and there are many different visions of what 5G will ultimately look like. In particular, fiber opportunities will be impacted by the implementation of new approaches using C-RAN architectures and next-generations interfaces that move beyond CPRI. Fiber opportunities in the 5G infrastructure will also depend on the shifting boundaries between fronthaul and backhaul. The votes are still out on what type of 5G network will ultimately evolve and this will impact the size and growth of the 5G network’s need for fiber optics market accordingly.

In this highly uncertain environment, this report is designed to provide guidance to the optical networking industry and where and how 5G backhaul and fronthaul will present new opportunities over the coming decade.

Included in this report are:

-

An assessment of how current visions of 5G networks vary in terms of their impact on optical network products and fiber optics demand. How will optical links help to support the necessary bandwidth and latency for 5G networks? And what will the concept of an integrated wireless/fiber network mean in practice?

-

An analysis of the type of optical networking products that 5G will require. In this analysis we cover modules (by MSA, data rate, etc.), components and the types of fiber that would be used in an integrated wireless/fiber network. The report is particularly focused on the role of PONs – especially XGS-PON and NG-PON2 – in providing 5G infrastructure. It also examines how interfaces between fiber and base stations/hubs will evolve in the 5G network

-

A granular market ten-year market forecast of fiber optics-related opportunities flowing from 5G deployment. The forecast is provided in both unit shipment and market value terms. It is also broken out by type of transceiver product, cable type, data rate, network segment, country/region, etc.

-

Discussions and assessments of how leading firms in the module and component space are preparing for 5G deployment and what this says about who the fiber optics-related winners and losers will be

-

A discussion of how the deployment of 5G networks as residential broadband platforms will impede the planned use of fiber in the access network. In particular, the report will take a look at how optical networking firms can readjust their marketing strategies to new product and customer types as the 5G revolution takes hold.

Media Contact:

Laura Wood, Senior Manager

[email protected]

IHS Markit: Telecom Revenue +1.1%; CAPEX -1.8% in 2017

Despite unabated exponential growth in network usage, global telecom revenue is on track to grow just 1.1 percent in 2017 over the prior year, according to a new report [1] by business information provider IHS Markit.

Global economic growth prospects, meanwhile, are looking up. IHS Markit macroeconomic indicators point to moderate global economic growth of 3.2 percent for 2017, up from 2.5 percent in 2016, and world real gross domestic product (GDP) is projected to increase 3.2 percent in 2018 and 3.1 percent in 2019.

“Although the telecom sector has been resilient, revenue growth in developed and developing economies has slowed dramatically due to saturation and fierce competition,” said Stéphane Téral, executive director of research and analysis and advisor at IHS Markit. “At this point, every region is showing revenue growth in the low single digits when not declining, and there is no direct positive correlation between slow economic expansion and anemic telecom revenue growth or decline as seen year after year in Europe, for instance.”

China alone is tamping down global telecom capex in 2017:

IHS Markit forecasts a 1.8 percent year-over-year decline in global telecom capital expenditures (capex) in 2017, mainly a result of a 13 percent year-over-year falloff in Chinese telecom capex. Asia Pacific outspends every other region in the world on telecom equipment.

“Call it precision investment, strategically focused investment or tactical investment, but all three of China’s service providers — China Mobile, China Unicom and China Telecom — scaled back their 2017 spending plans, and the end result is another double-digit drop in China’s telecom capex bucket, with mobile infrastructure hit the hardest,” Téral said. “Bringing down capital intensity to reasonable levels of 15 to 20 percent is the chief goal of these operators.”

The virtualization trend:

A transformation is underway in service provider networks, epitomized by software-defined networking (SDN) and network functions virtualization (NFV), which involve the automation of processes such as customer interaction, as well as the addition of more telemetry and analytics with feedback loops into network operations, operations and business support systems, and service assurance.

“Many service providers have deployed new architectural options — including content delivery networks, distributed broadband network gateways, distributed mini data centers in smart central offices, and video optimization,” said Michael Howard, executive director of research and analysis for carrier networks at IHS Markit. “Nearly all operators are madly learning how to use SDN and NFV, and the growing deployments today bring us to declare 2017 as The Year of SDN and NFV.”

Data is the new oil, and AI is the engine:

Big data is becoming more manageable, and operators are leveraging subscriber and network intelligence to support the automation and optimization of their networks using SDN, NFV and initial forays into using analytics, including artificial intelligence (AI) and machine learning (ML).

“Forward-thinking operators are experimenting with how to use anonymized subscriber data and analytics to create targeted services and broker this information to third parties such as retailers and internet content providers like Google,” Téral said. “No matter their size, market or current level of digitization, service providers need to rethink their roles in the new age of information and reset the strategies needed to capitalize on this opportunity.”

……………………………………………………………………………………………….

Note 1. The Telecom Trends & Drivers Market Report is published twice annually by IHS-Markit to provide analysis of global and regional market trends and conditions affecting service providers, subscribers, and the global economy. These roughly 40- page reports assess the state of the telecom industry, telling the story of what’s going on now and what we expect in the near and long term, illustrated with charts, graphs, tables, and written analysis. These critical analysis reports are a foundation piece for all market forecasts.

The reports include top takeaways on the economic health of the global telecom/datacom space; regional and global trends, drivers, and analysis for the service provider network sector in the context of the overall economy; financial analysis of the world’s top 10 service providers (revenue growth, capital intensities, free cash flow, debt level); regional enterprise and carrier spending trends; top-level service provider and subscriber forecasts; macroeconomic drivers; and key economic statistics (e.g., unemployment, OECD indicators, GDP growth). The reports are informed by all of IHS Technology research, from market share and forecasts to surveys with telecom service providers and small, medium, and large businesses.

……………………………………………………………………………………………………………….

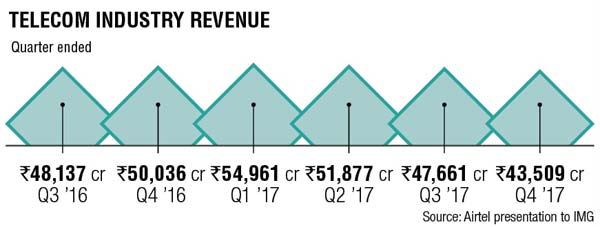

The chart below from Bharti Airtel (India’s largest telecom company) shows that telecom industry revenue has declined in 2017 Q2, Q3, and Q4 with only Q1 showing positive growth.

…………………………………………………………………………………………………………………..

Optical Network Equipment Vendors:

In a service provider survey report on Optical Networking and equipment vendors, IHS-Markit found Ciena, Huawei and Nokia as the three most popular optical networking equipment vendors. The report also highlighted Data Center Interconnection (DCI) is a huge growth opportunity.

IHS-Markit predicts DCI will be a significant driver for the optical equipment market, surging from 19 percent of overall equipment sales at mid-2017 to nearly 30 percent by 2021.

Ciena was deemed the top DCI vendor by 39 percent of those surveyed by IHS-Markit. Cisco, Coriant, and Infinera each garnered 36 percent of the votes.Last year Ciena reportedly won a DCI deal from rival ADVA Optical, which had a negative impact on ADVA’s operational results.

Ciena also topped the list of top (optical) transport software-defined networking (SDN) vendors, with 46 percent of those surveyed citing the company as a leader in the segment. Adams noted that while this market was still in its early days, Ciena’s continued integration of its Blue Planet software platform with its optical equipment products was driving differentiation in the market.

Cisco attracted the second most votes in terms of transport SDN leadership, followed by Nokia and Infinera.

LightCounting’s 3Q 2017 Optical Market Update + China’s Optical Network Comeback?

I. Light Counting’s 3Q2017 Market Update:

In its newly released “December 2017 Quarterly Market Update” LightCounting LLC states that demand for optical communications technology in 3Q 2017 followed what has been a year-long trend: Telecom/network service provider spending declined year-on-year while data center operators increased their investments in fiber optic infrastructure.

The decline in telecom optical network spending hit the optical components segment hardest, but was negative for vendors selling to telcos which can be seen from the chart below:

In 3Q 2017, data center use of optical communications technology was considerably more than that of telecom/network service providers.

Source: LightCounting LLC

…………………………………………………………………………………………………………..

Chinese carriers (see companion piece below) followed through on their announced plans to trim spending. LightCounting reports that China Telecom will continue to cut capex in 2018. Elsewhere in the world, only Orange looks like it will spend more this year than last among LightCounting’s list of top 15 telecom service providers.

Upticks in 100G DWDM transponders and WSS module sales paled in comparison to the declines experienced in the FTTx and wireless front haul markets, both sequentially and annually (see “Demand for FTTx, wireless optics declines from 2016: LightCounting”).

LightCounting says that check-ins with semiconductor vendors such as Analog Devices, Qualcomm, and Xilinx revealed increased activity in wireless/cellular communications, including 4.5G and 5G projects. This information leads the market research firm to expect initial commercial deployments of next generation wireless technologies in 2018, which in turn should boost the demand for optical front haul technology.

Optical vendors with exposure to the data center and internet content provider markets fared better than long haul/DWDM vendors. For example, Alibaba, Facebook, and Google increased their infrastructure spends by 142%, 62% and 39%, respectively, leading to overall spending records in the space during the quarter. Facebook plans to double capex in 2018, leading to hopes that data center optical spending growth is sustainable.

Optical transceiver vendors benefited during the quarter, which Applied Optoelectronics seeing a 27% increase in revenues and Innolight a 94% boom versus 3Q16. Shipments of PSM4 and CWDM4 100GbE modules set records during the quarter. However, 100GBASE-LR4 QSFP28 optical transceiver demand in the third quarter of 2017 proved softer than LightCounting expected.

…………………………………………………………………………………………………………….

LightCounting LLC says:

Our analysis is based on confidential sales data provided by leading suppliers and offers a unique port-based view of the industry.

References:

https://www.lightcounting.com/News_121317.cfm

https://www.futuremarketinsights.com/reports/optical-networking-market

…………………………………………………………………………………..

II. China’s Optical Market Comeback (via Barron’s on-line), by Tiernan Ray

China’s optical fiber market is coming back, but slowly, according to a note this morning from Rosenblatt Securities analyst Jun Zhang, who follows shares of laser vendor Oclaro, Acacia Communications, Applied Optoelectronics, and other vendors.

“Demand in China is stabilizing and slightly improving,” writes Zhang, “but we do not see a broad acceleration in China’s recovery yet.

“Chinese vendors recently concluded 2018 component and module procure- ments. Therefore, optical module and component suppliers should have base- line procurement contracts from Chinese vendors for 2018.”

The tricky part, indicates Zhang, is that Chinese buyers of components are increasingly coming up with their own internal components, which is going to dent some of the demand:

Instead of over promising volume to suppliers, we believe Chinese vendors offered baseline procurement volume estimates for 2018. Additionally, we believe these current procurement forecasts do not include any upside from initial 5G deployments in 2H18. However, line and client side module procurements from Chinese vendors are all down YoY due to internal sourcing. Therefore, due to conservative forecasts and increasing competition in the module market, most optical suppliers will likely continue to speak conservatively on China demand.

Zhang goes through what to expect, and it’s quite a mixed bag for various different vendors:

As we expected, ZTE is attempting to increase its internal sourcing for line side CFP2 DCO modules in 2018. Therefore, Acacia’s business could be negatively impacted in 2018 by ZTE. On the other hand, we believe there’s a chance Acacia can qualify at Huawei for DSP in 2018, but we see no signs yet. Intel’s CWDM4 has been qualified at Facebook and could have a sizeable market share, similar to the share size we expect InnoLight to also have at Facebook in 2018. However, Applied Optoelectronics shares are down significantly at Facebook in 2018 likely putting its CQ4 guidance at risk […]

NeoPhotonics could be up YoY, Lumentum flat YoY, Oclaro down slightly YoY, and Acacia down YoY. We also estimate Huawei and ZTE’s 100G ports to grow to 150K and 35K from 130K and 45K, respectively, in 2018. FiberHome recently saw a large share gain at China Unicom and we expect it to double its 100G port shipments in 2018 from a small basis.

Cignal AI & Del’Oro: Optical Network Equipment Market Decline Continues

Executive Summary & Overview:

Does anyone remember the fiber optic build out boom of the late 1990’s to early 2001? And the subsequent bust, which the industry still has not recovered from!

Fast forward to today, where we hear more and more about huge fiber demand from mega cloud service providers/Internet companies for intra and inter Data Center Connections. And the huge amount of fiber backhaul for small cells and cell towers.

Yet two respected market research firms- Cignal AI and Del’Oro Group– both say that optical network transport equipment revenue declined yet again.

Cignal AI said: “global spending on optical network equipment dropped for a third consecutive quarter, led by a larger than normal seasonal decline in China and weakening trends in EMEA.” However, Cignal AI (Andrew Schmitt) stated that “North American spending increased again quarter-over-quarter, with positive results reported by most vendors. Spending on Metro WDM continues to grow at the expense of LH WDM.”

Del’Oro Group reported in a press release: “revenues for Optical Transport equipment in North America continued to decline in the third quarter of 2017.”

“Optical Transport equipment purchases in North America was about 10 percent lower in the first nine months of 2017,” said Jimmy Yu, Vice President at Dell’Oro Group. “This has been one of the more challenging years for optical equipment manufacturers selling into North America. However, a few vendors in the region performed really well considering the tough market environment. For the first nine months of the year, Ciena was able to hold revenues steady, Cisco was able to grow revenues 14 percent, and Fujitsu experienced only a slight revenue decline,” Mr. Yu added.

–>Please see Editor’s Notes below for additional optical network equipment market insight and vendor perspective.

…………………………………………………………………………………………………………

Cignal AI Report Summary:

- North American spending increased again quarter-over-quarter, with positive results reported by most vendors. Spending on Metro WDM continues to grow at the expense of LH WDM.

- EMEA revenue fell sharply though this was the result of weakness at larger vendors – smaller vendors performed better. As in North America, LH WDM bore the brunt of the decline.

- Last quarter was the weakest YoY revenue growth recorded in China in over 4 years as momentum from 2Q17 spending failed to continue into the third quarter. Spending trends in the region remain difficult to predict.

- Revenue in the rest of Asia (RoAPAC) easedfollowing breakout results in India during 2Q17 though spending remains at historically high levels.

- Quarterly coherent 100G+ port shipments broke 100k units for the first time on a global basis. 100G+ Port shipments in China were flat QoQ and are substantially up YoY.

Cignal AI’s October 29, 2017 Optical Customer Markets Report discovered an unexpected weakness in 2017 optical transport equipment spending from cloud and co-location (colo) operators (see Cignal AI Reports Unexpected Drop in Cloud and Colo Spending). This surprising trend was then further supported by public comments later made by Juniper and Applied Optoelectronics.

Contact Info:

Cignal AI – 225 Franklin Street FL26 Boston, MA – 02110 – (617) 326-3996

Email: [email protected]

…………………………………………………………………………………………………………

Editor’s Notes:

1.One prominent Optical Transport Network Equipment vendor evidently feels the effect of the market slowdown. On November 8, 2017, Infinera reported a GAAP net loss for the quarter of $(37.2) million, or $(0.25) per share, compared to a net loss of $(42.8) million, or $(0.29) per share, in the second quarter of 2017, and net loss of $(11.2) million, or $(0.08) per share, in the third quarter of 2016.

Infinera also announced it is implementing a plan to restructure its worldwide operations in order to reduce its expenses and establish a more cost-efficient structure that better aligns its operations with its long-term strategies. As part of this restructuring plan, Infinera will reduce headcount, rationalize certain products and programs, and close a remote R&D facility.

2. Astonishingly, there’s an India based optical network equipment vendor on the rise. Successful homegrown Indian telecom vendors are hard to come by. That makes Bengaluru-based Tejas Networks something of an anomaly. Started 17 years ago (in 2000), Tejas is one of India’s few hardware producers.

Tejas Networks India Ltd. has made a name for itself in the optical networking market, especially within India, which looks poised for a boom in this sector (mainly due to fiber backhaul of 4G and 5G mobile data traffic). Nearly two thirds of its sales come from India, with the rest earned overseas.

“We are growing at 35% year-on-year and we hope to grow by at least 20% over the next two to three years,” says Sanjay Nayak, the CEO and managing director of Tejas, during an interview with Light Reading. “Overseas, we mainly target south-east Asian, Latin America and African markets.” Telcos in these markets have similar concerns to those in India, explains Nayak, making it easy for Tejas to address their demands.

“R&D is in our DNA and we believe that unless you come up with a differentiated product the market will not take you seriously,” says Nayak. “We have a huge advantage as an Indian player … [which] allows us to provide the product at a lesser price.”

Nayak believes that the experience of developing solutions for the problems faced by Indian telcos has helped the company to address overseas markets as well.

“Our products do very well for networks evolving from TDM to packet, which is a key concern of the Indian telcos,” he explains. “We realized that the US-based service providers were facing a similar problem of cross connect, which we were able to resolve. So, as we say, you can address any market if you are able to handle the Indian market.”

Read more at: http://www.communicationstoday.co.in/daily-news/17152-india-s-tejas-eyes-bigger-slice-of-optical-market

3. The long haul optical transport market is dominated by OTN (Optical Transport Network) equipment (which this editor worked on from 2000 to 2002 as a consultant to Ciena, NEC, and other optical network equipment and chip companies).

The OTN wraps client payloads (video, image, data, voice, etc) into containers or “wrappers” that are transported across wide area fiber optic networks. That helps maintain native payload structure and management information. OTN offers key benefits such as reduction in transport cost and optimal utilization of the optical spectrum.

OTN technology includes both WDM and DWDM. The service segment includes network maintenance and support services and network design & optimization services. On the basis of component, the market is divided into optical switch and optical transport. Based on end user, it is classified into government and enterprises.

According to Allied Market Research, OTN equipment market leaders include: Adtran, Inc., ADVA Optical Networking, Advanced Micro Devices Inc., Fujitsu, Huawei Technologies., ZTE Corporation., Belkin Corporation., Ciena Corporation., Coriant, and Allied Telesyn.

Above illustration courtesy of Allied Market Research

………………………………………………………………………………………………..

Note that Cisco offers OTN capability on their Network Convergence System (NCS) 4000 – 400 Gbps Universal line card. Despite that and other OTN capable gear, Cisco is not covered in the above mentioned Allied Market Research OTN report.

………………………………………………………………………………………………………………….

Global Switching & Router Market Report:

Separately, Synergy Research Group said in a press release that:

Worldwide switching and router revenues were well over $11 billion in Q3 and were $44 billion for last four quarters, representing 3% growth on a rolling annualized basis. Ethernet switching is the largest of the three segments accounting for almost 60% of the total and it is also the segment that has by far the highest growth rate, propelled by aggressive growth in the deployment of 100 GbE and 25 GbE switches.

In Q3 North America remained the biggest region accounting for over 41% of worldwide revenues, followed by APAC, EMEA and Latin America. The APAC region has been the fastest growing and this was again the case in Q3, with growth being driven in large part by spending in China, which benefited Huawei in particular.

Cisco’s share of the total worldwide switching and router market was 51%, with shares in the individual segments ranging from 63% for enterprise routers to 38% for service provider routers. Cisco is followed by Huawei, Juniper, Nokia and HPE. Their overall switching and router market shares were in the 4-10% range in Q3. There is then a reasonably long tail of other vendors, with Arista and H3C being the most prominent challengers.

![S&R Q317[1]](http://www.globenewswire.com/news-release/2017/11/27/1206112/0/en/photos/494670/0/494670.jpg?lastModified=11%2F27%2F2017%2004%3A20%3A07&size=3)

“The big picture is that total switching and router revenues are still growing and Cisco continues to control half of the market,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “Some view SDN and NFV as existential threats to Cisco’s core business, with own-design networking gear from the hyperscale cloud providers posing another big challenge. While these are genuine issues which erode growth opportunities for networking hardware vendors, there are few signs that these are substantially impacting Cisco’s competitive market position in the short term.”

Contact Info:

To speak to a Synergy analyst or to find out more about how to access Synergy’s market data, please contact Heather Gallo @ [email protected] or at 775-852-3330 extension 101.

IHS-Markit: 15% Drop in Global Optical Network Equipment Sales; Cisco and VMware are SD-WAN market leaders

- Optical Network Equipment Market:

IHS-Markit reports that the optical network equipment market slumped 3% in the third quarter from the same period last year. Huawei was #1 in optical network sales, followed by Ciena, which ranked first in North America where Huawei isn’t permitted to sell its gear.

Highlights:

- In the third quarter of 2017 (Q3 2017), the global optical equipment market declined 15 percent quarter over quarter and 3 percent year over year as North America, Latin America and EMEA (Europe, the Middle East and Africa) experienced significant reductions in spending; the Asia Pacific region was up 2 percent on a year-over-year basis

- The metro wavelength-division multiplexing (WDM) segment was down slightly in Q3 2017 from the prior quarter but increased 3 percent from a year ago; long-haul WDM declined 9 percent year over year

- Huawei remained the worldwide optical equipment market leader in Q3 2017; Ciena was the number-two optical equipment vendor by revenue globally and maintained its number-one position in North America

IHS-Markit analysis:

The worldwide optical equipment market declined 15 percent sequentially and 3 percent year over year in Q3 2017 as soft growth in the Asia Pacific region was not sufficient to offset the declines in EMEA, North America and Latin America.

Recent performance in some corners of the optical components market has many in the industry looking to the market in China and questioning whether it can sustain the high investment levels seen over the past 18 months. While China was indeed down sharply sequentially as is typical for the quarter, it did manage to stay in growth territory on a year-over-year basis. Recent bid activity in China indicates that further significant investments in backbone and provincial networks are still ahead.

In Q3 2017, the WDM equipment segment declined 15 percent from the prior quarter and was down 2 percent from a year ago. The metro WDM segment fell slightly quarter over quarter, but increased 3 percent year over year, supporting our view that this will be the main growth vector for the market moving forward. The long-haul segment sank 23 percent quarter over quarter and was down 9 percent year over year. Subsea revenue also declined both sequentially and on a year-over-year basis in Q3 2017.

Huawei remained the optical equipment market leader in Q3 2017 despite a significant seasonal drop in revenue both sequentially and year over year. Tepid spending in Western Europe was responsible for a large part of Huawei’s overall decline in the quarter. Ciena moved back up to the number-two position worldwide for Q3 2017. The company continues to be the dominant optical equipment vendor in North America, and it also made notable progress outside its home market in Q3 2017 with strong year-over-year gains in EMEA, Latin America and Asia Pacific.

Analyst Quotes:

“The metro WDM segment fell slightly quarter over quarter, but increased 3% year over year, supporting our view that this will be the main growth vector for the market moving forward,” report author Heidi Adams said.

“Huawei remained the optical equipment market leader in Q3 2017 despite a significant seasonal drop in revenue both sequentially and year over year,” Adams said. “Tepid spending in Western Europe was responsible for a large part of Huawei’s overall decline in the quarter.”

Ciena “continues to be the dominant optical equipment vendor in North America, and it also made notable progress outside its home market in Q3 2017 with strong year-over-year gains in EMEA, Latin America and Asia Pacific,” Adams added.

Optical report synopsis:

The IHS Markit optical network hardware report tracks the global market for metro and long-haul WDM and Synchronous Optical Networking (SONET)/Synchronous Digital Hierarchy (SDH) equipment, Ethernet optical ports, SONET/SDH ports and WDM ports. The report provides market size, market share, forecasts through 2021, analysis and trends.

References:

https://technology.ihs.com/597065/optical-network-hardware-market-cools-off-in-q3-2017

…………………………………………………………………….

Related article:

Optical Networks Booming in India

…………………………………………………………………………………………………………………………………………………..

2. SD-WAN Market:

IHS Markit offered a much more bullish assessment for software-defined (SD) WAN vendors.

Consolidation and acquisitions are well underway in the software-defined wide area network (SD-WAN) market as vendors race to include SD-WAN technology in their offerings. Following Cisco’s acquisition of Viptela, VMware carried out its own acquisition of VeloCloud, the SD-WAN revenue leader in the first half of 2017, for an undisclosed amount.

“VMware and Cisco have acquired the two SD-WAN market share leaders, making the SD-WAN market a two-horse race for the number-one spot,” said Cliff Grossner, PhD and senior research director/advisor for cloud and data center markets at IHS Markit. “And we could see even more consolidation as vendors set out to add SD‑WAN to their capability sets, especially since the technology is key to supporting connectivity in the multi-clouds that enterprises are building.”

According to the IHS Markit Data Center and Enterprise SDN Hardware and Software Biannual Market Tracker, SD-WAN is currently a small market, totaling just $137 million worldwide in the first half of 2017 (H1 2017). However, global SD-WAN hardware and software revenue is forecast to reach $3.3 billion by 2021 as service providers partner with SD-WAN vendors to deploy overlay solutions — and as virtual network function (VNF)–based solutions become more closely integrated with carrier operations support systems (OSS) and business support systems (BSS).

“Currently, the majority of SD-WAN revenue is from appliances, with early deployments focused on rolling out devices at branch offices,” Grossner said. “Moving forward, we expect a larger portion of SD-WAN revenue to come from control and management software as users increasingly adopt application visibility and analytics services.”

More highlights from the IHS Markit data center and enterprise SDN report:

- Globally, data center and enterprise software-defined networking (SDN) revenue for in-use SDN-capable Ethernet switches, SDN controllers and SD-WAN increased 5.4 percent in H1 2017 from H2 2016, to $1.93 billion

- Based on in-use SDN revenue, Cisco was the number-one market share leader in the SDN market in H1 2017, followed by Arista, White Box, VMware and Hewlett Packard Enterprise

- Looking at the individual SDN categories in H1 2017, White Box was the front runner in bare metal switch revenue, VMware led the SDN controller market segment, Dell held 45 percent of branded bare metal switch revenue and Hewlett Packard Enterprise had the largest share of total SDN-capable (in-use and not-in-use) branded Ethernet switch ports

Reference:

Highlights of 2017 Telecom Infrastructure Project (TIP) Summit

Executive Summary:

The Telecom Infra Project (TIP) is gaining a lot of awareness and market traction, judging by last week’s very well attended TIP Summit at the Santa Clara Convention Center. The number of telecom network operators presented was very impressive, especially considering that none were from the U.S. with the exception of AT&T, which presented on behalf of the Open Compute Project (OCP) Networking Group. It was announced at the summit that the OCP Networking group had formed an alliance with TIP.

The network operators that presented or were panelists included representatives from: Deutsche Telekom AG, Telefonica, BT, MTN Group (Africa), Bharti Airtel LTD (India), Reliance Jio (India), Vodafone, Turkcell (Turkey), Orange, SK Telecom, TIM Brasil, etc. Telecom Italia, NTT, and others were present too. Cable Labs – the R&D arm of the MSOs/cablecos – was represented in a panel where they announced a new TIP Community Lab (details below).

Facebook co-founded TIP along with Intel, Nokia, Deutsche Telekom, and SK Telecom at the 2016 Mobile World Congress event. Like the OCP (also started by Facebook), its mission is to dis-aggregate network hardware into modules and define open source software building blocks. As its name implies, TIP’s focus is telecom infrastructure specific in its work to develop and deploy new networking technologies. TIP members include more than 500 companies, including telcos, Internet companies, vendors, consulting firms and system integrators. Membership seems to have grown exponentially in the last year.

During his opening keynote speech, Axel Clauberg, VP of technology and innovation at Deutsche Telekom and chairman of the TIP Board of Directors, announced that three more operators had joined the TIP Board: BT, Telefonica, and Vodafone.

“TIP is truly operator-focused,” Clauberg said. “It’s called Telecom Infrastructure Project, and I really count on the operators to continue contributing to TIP and to take us to new heights.” That includes testing and deploying the new software and hardware contributed to TIP, he added.

“My big goal for next year is to get into the deployment stage,” Clauberg said. “We are working on deployable technology. [In 2018] I want to be measured on whether we are successfully entering that stage.”

Jay Parikh, head of engineering and infrastructure at Facebook, echoed that TIP’s end goal is deployments, whether it is developing new technologies, or supporting the ecosystem that will allow them to scale.

“It is still very early. Those of you who have been in the telco industry for a long time know that it does not move lightning fast. But we’re going to try and change that,” Parikh said.

…………………………………………………………………………………………………………………….

TIP divides its work into three areas — access, backhaul, and core & management — and each of the project groups falls under one of those three areas. Several new project groups were announced at the summit:

- Artificial Intelligence and applied Machine Learning (AI/ML): will focus on using machine learning and automation to help carriers keep pace with the growth in network size, traffic volume, and service complexity. It will also work to accelerate deployment of new over-the-top services, autonomous vehicles, drones, and augmented reality/virtual reality.

- End-to-End Network Slicing (E2E-NS): aims to create multiple networks that share the same physical infrastructure. That would allow operators to dedicate a portion of their network to a certain functionality and should make it easier for them to deploy 5G-enabled applications.

- openRAN: will develop RAN technologies based on General Purpose Processing Platforms (GPPP) and disaggregated software.

The other projects/working groups are the following:

- Edge Computing: This group is addressing system integration requirements with innovative, cost-effective and efficient end-to-end solutions that serve rural and urban regions in optimal and profitable ways.

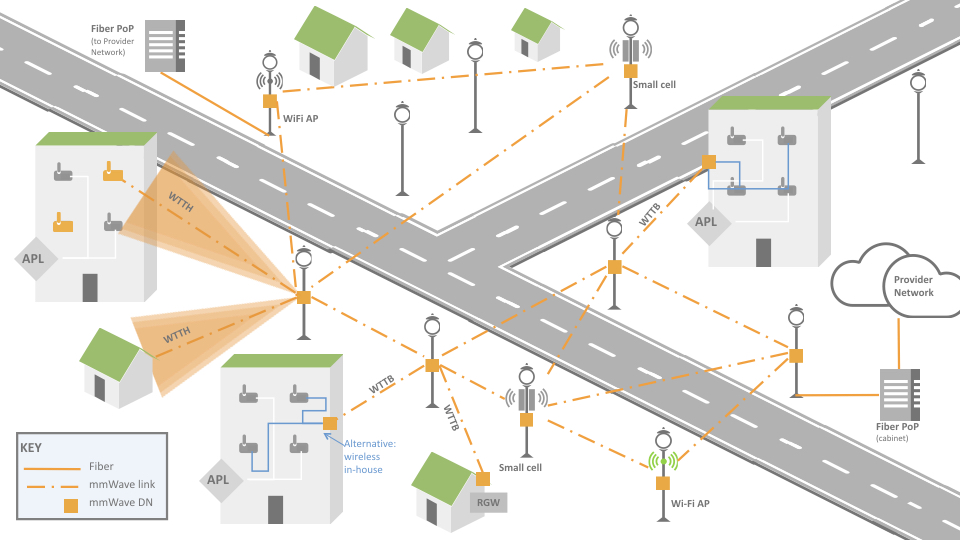

- This group is pioneering a 60GHz wireless networking system to deliver gigabits of capacity in dense, urban environments more quickly, easily and at a lower cost than deploying fiber. A contribution was made to IEEE 802.11ay task force this year on use cases for mmW backhaul.

Above illustration courtesy of TIP mmW Networks Group

- Open Optical Packet Transport: This project group will define Dense Wavelength Division Multiplexing (DWDM) open packet transport architecture that triggers new innovation and avoids implementation lock-ins. Open DWDM systems include open line system & control, transponder & network management and packet-switch and router technologies.

- The Working Group is focused on enabling carriers to more efficiently deliver new services and applications by using mobile edge computing (MEC) to turn the RAN network edge (mobile, fixed, licensed and unlicensed spectrum) into an open media and service hub.

- The project is pioneering a virtualized RAN (VRAN) solution comprised of low-cost remote radio units that can be managed and dynamically reconfigured by a centralized infrastructure over non-ideal transport.

- project group will develop an open RAN architecture by defining open interfaces between internal components and focusing on the lab activity with various companies for multi-vendor interoperability. The goal is to broaden the mobile ecosystem of related technology companies to drive a faster pace of innovation.

A complete description, with pointers/hyperlinks to respective project/work group charters is in the TIP Company Member Application here.

TEACs – Innovation Centers for TIP:

Also of note was the announcement of several new TEACs – TIP Ecosystem Acceleration Centers, where start-ups and investors can work together with incumbent network operators to progress their respective agendas for telecom infrastructure.

The TIP website comments on the mission of the TEACs:

“By bringing together the key actors – established operators, cutting-edge startups, and global & local investors – TEACs establish the necessary foundation to foster collaboration, accelerate trials, and bring deployable infrastructure solutions to the telecom industry.”

TEACs are located in London (BT), Paris (Orange), and Seoul (SK Telecom). .

TIP Community Labs:

TIP Community Labs are physical spaces that enable collaboration between member companies in a TIP project group to develop telecom infrastructure solutions. While the labs are dedicated to TIP projects and host TIP project teams, the space and basic equipment are sponsored by individual TIP member companies hosting the space. The labs are located in: Seoul, South Korea (sponsored by SK Telecom); Bonn, Germany (sponsored by Deutsche Telekom); Menlo Park, California, USA (sponsored by Facebook). Coming Soon Rio de Janiero, Brazil – to be sponsored by TIM Brasil. At this summit, Cable Labs announced it will soon open a TIP Community Lab in Louisville, CO.

…………………………………………………………………………………………………………………………..

Selected Quotes:

AT&T’s Tom Anschutz (a very respected colleague) said during his November 9th – 1pm keynote presentation:

“Network functions need to be disaggregated and ‘cloudified.’ We need to decompose monolithic, vertically integrated systems into building blocks; create abstraction layers that hide complexity. Design code and hardware as independent modules that don’t bring down the entire IT system/telecom network if they fail.”

Other noteworthy quotes:

“We’re going to build these use-case demonstrations,” said Mansoor Hanif, director of converged networks and innovation at BT. “If you’re going to do something as difficult and complex as network slicing, you might as well do it right.”

“This is the opening of a system that runs radio as a software on top of general purpose processes and interworks with independent radio,” said Santiago Tenorio, head of networks at Vodafone Group. The project will work to reduce the costs associated with building mobile networks and make it easier for smaller vendors to enter the market. “By opening the system will we get a lower cost base? Definitely yes,” absolutely yes,” Tenorio added.

“Opening up closed, black-box systems enables innovation at every level, so that customers can meet the challenges facing their networks faster and more efficiently,” said Josh Leslie, CEO of Cumulus Networks. “We’re excited to work with the TIP community to bring open systems to networks beyond the data center.” [See reference press release from Cumulus below].

“Open approaches are key to achieving TIP’s mission of disaggregating the traditional network deployment approach,” said Hans-Juergen Schmidtke, Co-Chair of the TIP Open Optical Packet Transport project group. “Our collaboration with Cumulus Networks to enable Cumulus Linux on Voyager (open packet DWDM architecture framework and white box transponder design) is an important contribution that will help accelerate the ecosystem’s adoption of Voyager.”

……………………………………………………………………………………………………………………………

Closing Comments: Request for Reader Inputs!

- What’s really interesting is that there are no U.S. telco members of TIP. Bell Canada is the only North American telecom carrier among its 500 members. Equinix and Cable Labs are the only quasi- network operator members in the U.S.

- Rather than write a voluminous report which few would read, we invite readers to contact the author or post a comment on areas of interest after reviewing the 2017 TIPS Summit agenda.

References:

https://www.devex.com/news/telecom-industry-tries-new-tactics-to-connect-the-unconnected-91492

TC3 Update on CORD (Central Office Re-architected as a Data center)

Introduction:

Timon Sloane of the Open Networking Foundation (ONF) provided an update on project CORD on November 1st at the Telecom Council’s Carrier Connections (TC3) summit in Mt View, CA. The session was titled:

Spotlight on CORD: Transforming Operator Networks and Business Models

After the presentation, Sandhya Narayan of Verizon and Tom Tofigh of AT&T came up to the stage to answer a few audience member questions (there was no real panel session).

The basic premise of CORD is to re-architect a telco/MSO central office to have the same or similar architecture of a cloud resident data center. Not only the central office, but also remote networking equipment in the field (like an Optical Line Termination unit or OLT) are decomposed and disaggregated such that all but the most primitive functions are executed by open source software running on a compute server. The only hardware is the Physical layer transmission system which could be optical fiber, copper, or cellular/mobile.

Author’s Note: Mr. Sloane didn’t mention that ONF became involved in project CORD when it merged with ON.Labs earlier this year. At that time, the ONOS and CORD open source projects became ONF priorities. The Linux Foundation still lists CORD as one of their open source projects, but it appears the heavy lifting is being done by the new ONF as per this press release.

………………………………………………………………………………………………………………

Backgrounder:

A reference implementation of CORD combines commodity servers, white-box switches, and disaggregated access technologies with open source software to provide an extensible service delivery platform. This gives network operators (telcos and MSOs) the means to configure, control, and extend CORD to meet their operational and business objectives. The reference implementation is sufficiently complete to support field trials.

Illustration above is from the OpenCord website

……………………………………………………………………………………………………………………….

Highlights of Timon Sloane’s CORD Presentation at TC3:

- ONF has transformed over the last year to be a network operator led consortium.

- SDN, Open Flow, ONOS, and CORD are all important ONF projects.

- “70% of world wide network operators are planning to deploy CORD,” according to IHS-Markit senior analyst Michael Howard (who was in the audience- see his question to Verizon below).

- 80% of carrier spending is in the network edge (which includes the line terminating equipment and central office accessed).

- The central office (CO) is the most important network infrastructure for service providers (AKA telcos, carriers and network operators, MSO or cablecos, etc).

- The CO is the service provider’s gateway to customers.

- End to end user experience is controlled by the ingress and egress COs (local and remote) accessed.

- Transforming the outdated CO is a great opportunity for service providers. The challenge is to turn the CO into a cloud like data center.

- CORD mission is the enable the “edge cloud.” –>Note that mission differs from the OpenCord website which states:

“Our mission is to bring datacenter economies and cloud agility to service providers for their residential, enterprise, and mobile customers using an open reference implementation of CORD with an active participation of the community. The reference implementation of CORD will be built from commodity servers, white-box switches, disaggregated access technologies (e.g., vOLT, vBBU, vDOCSIS), and open source software (e.g., OpenStack, ONOS, XOS).”

- A CORD like CO infrastructure is built using commodity hardware, open source software, and white boxes (e.g. switch/routers and compute servers).

- The agility of a cloud service provider depends on software platforms that enable rapid creation of new services- in a “cloud-like” way. Network service providers need to adopt this same model.

- White boxes provide subscriber connections with control functions virtualized in cloud resident compute servers.

- A PON Optical Line Termination Unit (OLT) was the first candidate chosen for CORD. It’s at the “leaf of the cloud,” according to Timon.

- 3 markets for CORD are: Mobile (M-), Enterprise (E-), and Residential (R-). There is also the Multi-Service edge which is a new concept.

- CORD is projected to be a $300B market (source not stated).

- CORD provides opportunities for: application vendors (VNFs, network services, edge services, mobile edge computing, etc), white box suppliers (compute servers, switches, and storage), systems integrators (educate, design, deploy, support customers, etc).

- CORD Build Event was held November 7-9, 2017 in San Jose, CA. It explored CORD’s mission, market traction, use cases, and technical overview as per this schedule.

Service Providers active in CORD project:

- AT&T: R-Cord (PON and g.fast), Multi-service edge-CORD, vOLTHA (Virtual OLT Hardware Abstraction)

- Verizon: M-Cord

- Sprint: M-Cord

- Comcast: R-Cord

- Century Link: R-Cord

- Google: Multi-access CORD

Author’s Note: NTT (Japan) and Telefonica (Spain) have deployed CORD and presented their use cases at the CORD Build event. Deutsche Telekom, China Unicom, and Turk Telecom are active in the ONF and may have plans to deploy CORD?

……………………………………………………………

Q&A Session:

- This author questioned the partitioning of CORD tasks and responsibility between ONF and Linux Foundation. No clear answer was given. Perhaps in a follow up comment?

- AT&T is bringing use cases into ONF for reference platform deployments.

- CORD is a reference architecture with systems integrators needed to put the pieces together (commodity hardware, white boxes, open source software modules).

- Michael Howard asked Verizon to provide commercial deployment status- number, location, use cases, etc. Verizon said they can’t talk about commercial deployments at this time.

- Biggest challenge for CORD: Dis-aggregating purpose built, vendor specific hardware that exist in COs today. Many COs are router/switch centric, but they have to be opened up if CORD is to gain market traction.

- Future tasks for project CORD include: virtualized Radio Access Network (RAN), open radio (perhaps “new radio” from 3GPP release 15?), systems integration, and inclusion of micro-services (which were discussed at the very next TC3 session).

Addendum from Marc Cohn, formerly with the Linux Foundation:

Here’s an attempt to clarify the CORD project responsibilities:

- CORD is an open reference architecture. In that sense, CORD is similar to the ETSI NFV Architectural Framework, ONF SDN Architecture, and MEF LifeCycle Services Orchestration (LSO) reference architectures.

- As it is a reference architecture, it is not an implementation, and is maintained by the Open Networking Foundation (ONF), which merged with ON.LAB towards the end of 2016.

- OpenCORD is a Linux Foundation project announced in the summer of 2016. It is focused on an open source implementation of the CORD architecture. OpenCord was derived from the work undertaken by ON.LAB, prior to the merger with ONF in 2016.

- For technical details, visit the OpenCORD Wiki

- Part of the confusion is that if one visits the Linux Foundation projects page, CORD is listed, but the link is to the OpenCord website.

CignalAI: Cloud/Colo Spending Unexpectedly Drops in 1st Half 2017

by Andrew Schmitt, CignalAI

|

|

|

Top Optical Network Equipment Vendors: Data Center Interconnect & Overall Market

Executive Summary:

Market research firms Dell’Oro and Heavy Reading disagree on who are the top optical network equipment vendors, especially for data center interconnect (DCI). Obviously, the mega cloud computing/Internet service providers (Google, Amazon, Baidu, Facebook, etc) together account for the overwhelming market for DCI equipment purchased. None of them disclose who their DWDM vendors are. It’s well known that most of those mega cloud/Internet players design their own IT equipment (e.g. compute servers, Ethernet switches, Routers, etc), but they don’t design or build DWDM transport gear.

Dell’Oro Group DCI Market Analysis:

Ciena, Cisco and Infinera together command 85% of the disaggregated wavelength-division multiplexing field for DCI optical network equipment market segment, Dell’Oro Group estimates.

……………………………………………………………………………………………………..

–>This is a big surprise to this author as neither Nokia (via Alcatel-Lucent), Huawei (#1 overall optical network vendor) or ZTE are top tier according to Dell’Oro. See two graphs below (“Other Voices” section), courtesy of Heavy Reading and IHS-Markit.

……………………………………………………………………………………………………..

Dell’Oro Group estimated that disaggregated WDM systems reached an annualized revenue run rate of $400 million, growing 225% year-over-year. This is partly because these systems are finding utility in the booming DCI market segment.

Jimmy Yu, VP at Dell’Oro Group, said that while the disaggregation concept is not new, service provider adoption in the data center segment is.

“In most—if not all—purchases, we found that these new systems were being employed in DCI across both metro and long haul spans,” Yu said in a press release. “So far, the largest consumers have been internet content providers that appreciate the platform for its simplicity, capacity, and power savings.”

Yu added that “based on second quarter results, where disaggregated WDM systems represented nearly one-third of the optical DCI equipment purchases made, we have to say that Disaggregated WDM systems are truly hitting the sweet spot for DCI.”

As wireline operators look to diversify their revenue mix, the DCI market has a compelling growth path driven by the consumption and distribution of various data forms over the public internet and private networks.

Outside of DCI, the overall WDM market, which consists of WDM Metro and DWDM Long Haul, grew only 2% year-over-year in the second quarter, says Dell’Oro. The research firm noted that growth was driven by strength in the Asia Pacific region, especially China and India.

The share of 100G WDM wavelength shipments going to DCI was 14% in the quarter, according to Dell’Oro.

About the Report:

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 40 Gbps, 100 Gbps, and >100 Gbps). The report tracks DWDM long haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, and data center interconnect (metro and long haul). To purchase this report, call Matt Dear at +1.650.622.9400 x223 or email [email protected].

………………………………………………………………………………………………………………

Other Voices on Optical Network Equipment Market:

1. Cignal AI:

Huawei and ZTE saw record shipments of 100-Gbps coherent ports in China during the second quarter of 2017 as well as strong sales in general throughout the region, reports Cignal AI. So what accounts for sour grapes from optical component houses? Inventory corrections at Chinese systems vendors, particularly Huawei, according to the market research firm.

“Demand for optical hardware in China is not slowing down, and equipment vendors are universally providing positive guidance for North America during the second half of the year,” said Andrew Schmitt, lead analyst for Cignal AI. “Operators around the world are shifting spending from long-haul to metro WDM, though this shift is materializing into gains for only a few vendors.”

Optical revenue in China is up 13 percent for the first half of 2017 as compared to the same period in 2016. The weak demand reported by component makers is a result of an ongoing inventory correction (primarily at Huawei), rather than a signal of weak end market demand.

2. IHS-Markit:

Huawei ranked first overall in combined market presence and market leadership in the recent Optical Network Hardware Vendor Scorecard released by IHS Markit. Huawei received this assessment for its comprehensive performance on multiple benchmarks including reputation for innovation, market share momentum, and global market share.

There are over a dozen vendors around the globe that make and sell optical network equipment. The 10 vendors profiled in this Scorecard–ADVA, Ciena, Cisco, Coriant, ECI, Fujitsu, Huawei, Infinera, Nokia, and ZTE–were selected because they are the top revenue producers of optical hardware.

The Scorecard used concrete data and metrics, including market share, financials and direct feedback from buyers on innovation, product reliability, service and support to evaluate 2016 market performance and future momentum of the top 10 optical network equipment vendors.

IHS Markit optical network hardware vendor scorecard (Source: IHS Markit Optical Network Hardware Vendor Scorecard)

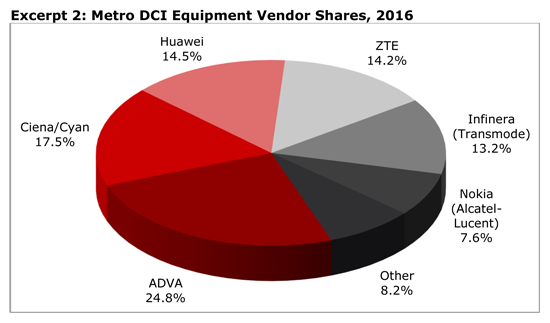

3. Heavy Reading:

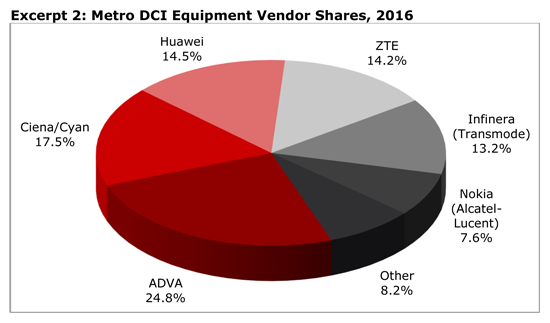

Market share estimates are based on DCI revenue contribution by Heavy Reading’s definition (not disclosed in the teaser briefing). Most vendors do not currently break out from their broader metro WDM revenue the portion accounted for by metro DCI deployments. A few companies did provide Heavy Reading with some general guidance on their revenue from metro DCI. The pie chart figure below shows Heavy Reading’s metro DCI equipment vendor share estimates for 2016.

Note that Adva has the top vendor market share and Cisco is not represented in the figure.

Source: Heavy Reading

References:

https://cignal.ai/2017/08/2q17-optical-hardware-results/

http://www.huawei.com/en/news/2017/8/Huawei-Optical-Network-IHS-Leader

http://www.heavyreading.com/details.asp?sku_id=3503&skuitem_itemid=1728

Top Optical Network Equipment Vendors: Data Center Interconnect & Overall Market

Executive Summary:

Market research firms Dell’Oro and Heavy Reading disagree on who are the top optical network equipment vendors, especially for data center interconnect (DCI). Obviously, the mega cloud computing/Internet service providers (Google, Amazon, Baidu, Facebook, etc) together account for the overwhelming market for DCI equipment purchased. None of them disclose who their DWDM vendors are. It’s well known that most of those mega cloud/Internet players design their own IT equipment (e.g. compute servers, Ethernet switches, Routers, etc), but they don’t design or build DWDM transport gear.

Dell’Oro Group DCI Market Analysis:

Ciena, Cisco and Infinera together command 85% of the disaggregated wavelength-division multiplexing field for DCI optical network equipment market segment, Dell’Oro Group estimates.

……………………………………………………………………………………………………..

–>This is a big surprise to this author as neither Nokia (via Alcatel-Lucent), Huawei (#1 overall optical network vendor) or ZTE are top tier according to Dell’Oro. See two graphs below (“Other Voices” section), courtesy of Heavy Reading and IHS-Markit.

……………………………………………………………………………………………………..

Dell’Oro Group estimated that disaggregated WDM systems reached an annualized revenue run rate of $400 million, growing 225% year-over-year. This is partly because these systems are finding utility in the booming DCI market segment.

Jimmy Yu, VP at Dell’Oro Group, said that while the disaggregation concept is not new, service provider adoption in the data center segment is.

“In most—if not all—purchases, we found that these new systems were being employed in DCI across both metro and long haul spans,” Yu said in a press release. “So far, the largest consumers have been internet content providers that appreciate the platform for its simplicity, capacity, and power savings.”

Yu added that “based on second quarter results, where disaggregated WDM systems represented nearly one-third of the optical DCI equipment purchases made, we have to say that Disaggregated WDM systems are truly hitting the sweet spot for DCI.”

As wireline operators look to diversify their revenue mix, the DCI market has a compelling growth path driven by the consumption and distribution of various data forms over the public internet and private networks.

Outside of DCI, the overall WDM market, which consists of WDM Metro and DWDM Long Haul, grew only 2% year-over-year in the second quarter, says Dell’Oro. The research firm noted that growth was driven by strength in the Asia Pacific region, especially China and India.

The share of 100G WDM wavelength shipments going to DCI was 14% in the quarter, according to Dell’Oro.

About the Report:

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 40 Gbps, 100 Gbps, and >100 Gbps). The report tracks DWDM long haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, and data center interconnect (metro and long haul). To purchase this report, call Matt Dear at +1.650.622.9400 x223 or email [email protected].

………………………………………………………………………………………………………………

Other Voices on Optical Network Equipment Market:

1. Cignal AI:

Huawei and ZTE saw record shipments of 100-Gbps coherent ports in China during the second quarter of 2017 as well as strong sales in general throughout the region, reports Cignal AI. So what accounts for sour grapes from optical component houses? Inventory corrections at Chinese systems vendors, particularly Huawei, according to the market research firm.

“Demand for optical hardware in China is not slowing down, and equipment vendors are universally providing positive guidance for North America during the second half of the year,” said Andrew Schmitt, lead analyst for Cignal AI. “Operators around the world are shifting spending from long-haul to metro WDM, though this shift is materializing into gains for only a few vendors.”

Optical revenue in China is up 13 percent for the first half of 2017 as compared to the same period in 2016. The weak demand reported by component makers is a result of an ongoing inventory correction (primarily at Huawei), rather than a signal of weak end market demand.

2. IHS-Markit:

Huawei ranked first overall in combined market presence and market leadership in the recent Optical Network Hardware Vendor Scorecard released by IHS Markit. Huawei received this assessment for its comprehensive performance on multiple benchmarks including reputation for innovation, market share momentum, and global market share.

There are over a dozen vendors around the globe that make and sell optical network equipment. The 10 vendors profiled in this Scorecard–ADVA, Ciena, Cisco, Coriant, ECI, Fujitsu, Huawei, Infinera, Nokia, and ZTE–were selected because they are the top revenue producers of optical hardware.

The Scorecard used concrete data and metrics, including market share, financials and direct feedback from buyers on innovation, product reliability, service and support to evaluate 2016 market performance and future momentum of the top 10 optical network equipment vendors.

IHS Markit optical network hardware vendor scorecard (Source: IHS Markit Optical Network Hardware Vendor Scorecard)

3. Heavy Reading:

Market share estimates are based on DCI revenue contribution by Heavy Reading’s definition (not disclosed in the teaser briefing). Most vendors do not currently break out from their broader metro WDM revenue the portion accounted for by metro DCI deployments. A few companies did provide Heavy Reading with some general guidance on their revenue from metro DCI. The pie chart figure below shows Heavy Reading’s metro DCI equipment vendor share estimates for 2016.

Note that Adva has the top vendor market share and Cisco is not represented in the figure.

Source: Heavy Reading

References:

https://cignal.ai/2017/08/2q17-optical-hardware-results/

http://www.huawei.com/en/news/2017/8/Huawei-Optical-Network-IHS-Leader

http://www.heavyreading.com/details.asp?sku_id=3503&skuitem_itemid=1728