WiFi 6/IEEE 802.11ax

Research & Markets: WiFi 6E and WiFi 7 Chipset Market Report; Independent Analysis

According to Research & Markets, the WiFi 6E (IEEE 802.11ax) and WiFi 7 (IEEE 802.11be [1.]) chipset market is expanding rapidly, with projections indicating a rise from $33.65 billion in 2024 to $40.50 billion by 2025, and estimates reaching $149.65 billion by 2032. This growth reflects a notable CAGR of 20.50%, primarily driven by organizations upgrading their wireless networks in response to rising digital application use and increasing data volume.

Note 1. IEEE 802.11be standard was published July 22, 2025. The Project Approval Request (PAR) is here.

Enterprises today require scalable, secure wireless infrastructure capable of supporting diverse and demanding workloads. The latest WiFi chipsets improve network performance, facilitate secure operations, and support robust digital transformation strategies. Adopting Wi-Fi 6E and Wi-Fi 7 chipsets positions organizations to deliver secure, agile connectivity with higher speeds and lower latency.

- Application Areas: Automotive organizations implement advanced chipsets to support secure, reliable vehicle connectivity and enhance driver-assistance systems. In consumer electronics, manufacturers drive higher interactivity and seamless device experiences with updated wireless integration. Enterprises emphasize improved workforce mobility, while healthcare adopts secure, high-speed wireless for telemedicine and remote diagnostics. Industry operators deploy chipsets to enable robotics, automation, and smart manufacturing environments.

- End Users: Commercial enterprises in sectors such as hospitality, offices, and retail seek enhanced connectivity to increase operational efficiency and elevate customer engagement. Industrial segments-including utilities and manufacturing-prioritize automation and resilient communications infrastructure. Residential users focus on smart technology integration and flexible, connected home environments.

- Chipset Technologies: Integrated combo chips provide straightforward deployment for rapid delivery and compatibility, while discrete chipsets offer a tailored approach in high-volume or specialized scenarios. System-on-chip solutions bring high-density integration, maximizing energy efficiency and aligning with sustainability targets.

- Distribution Channels: Organizations maintain robust supply chains utilizing established resellers and digital platforms, ensuring prompt response to evolving logistical demands and market conditions.

- Regional Coverage: The Americas, Europe, Middle East and Africa, and Asia-Pacific each offer unique opportunities and regulatory landscapes, guiding deployment strategies and technology adoption in response to local dynamics.

- Company Profiles: The industry includes innovation-focused leaders such as Broadcom, Qualcomm, and MediaTek. These companies exhibit diverse approaches to integration and product differentiation across the competitive landscape.

Strategic Insights:

- The expanded wireless spectrum empowers businesses to scale connectivity, supporting data-rich operational environments where performance stability and capacity are critical.

- Next-generation chipset architectures enhance automation and real-time data management, particularly in healthcare and manufacturing, strengthening capabilities for time-sensitive applications.

- Collaborations between chipset vendors and device manufacturers improve compatibility, enabling tailored wireless infrastructure to address bespoke enterprise requirements.

- Maintaining a flexible supply approach-leveraging diverse distribution channels-supports organizational agility in facing evolving international trade and supply scenarios.

- Ongoing improvements in wireless security and system reliability support compliance and data protection needs for sectors operating under stringent regulatory requirements.

Market Insights:

- Surge in demand for Wi-Fi 7 chipsets optimized for multi-gigabit data throughput in dense public venues

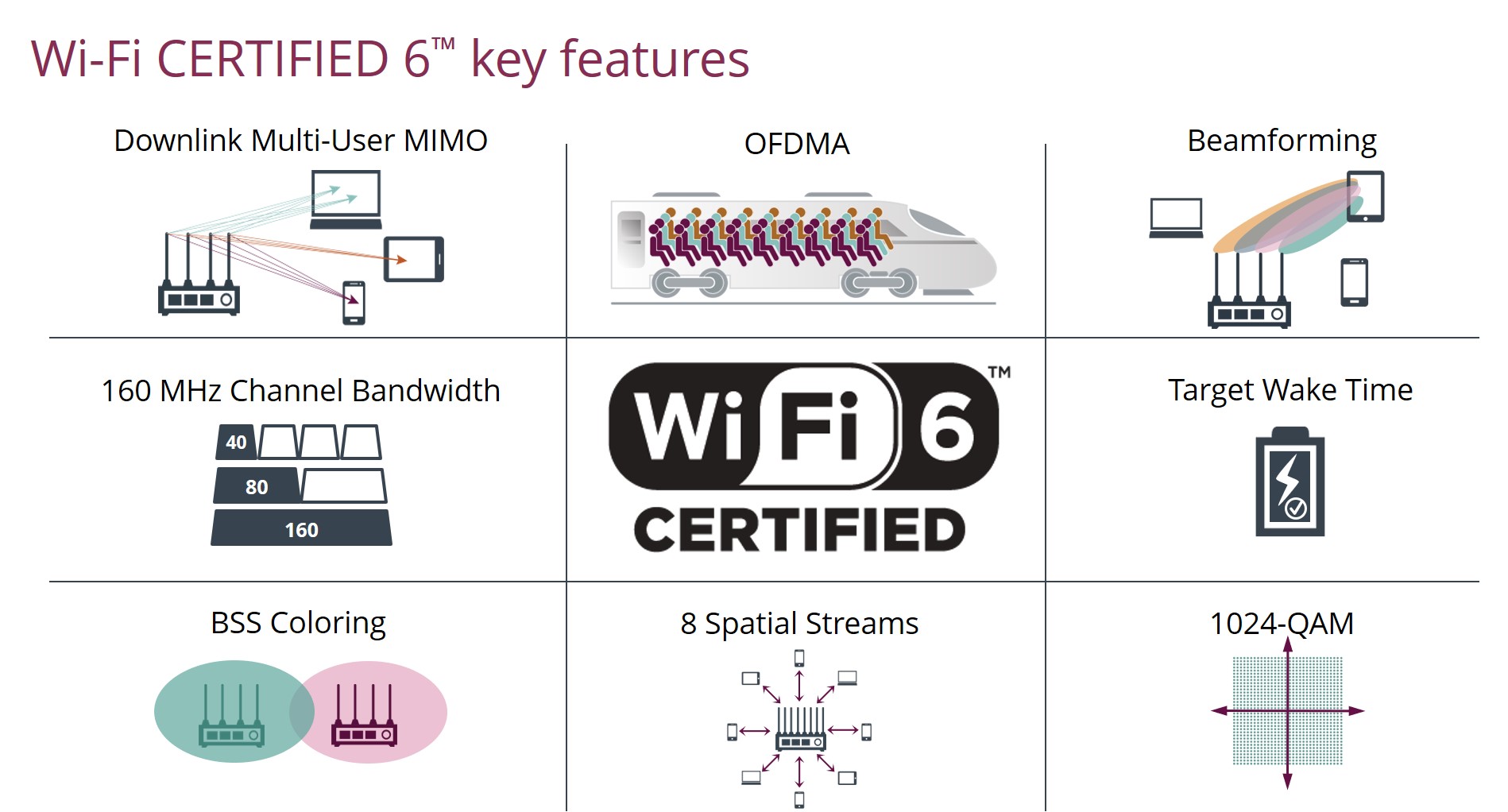

- Integration of advanced OFDMA and multi-user MIMO enhancements to support simultaneous high-bandwidth applications

- Adoption of 6 GHz spectrum by enterprise networks to enable low-latency connectivity for critical IoT devices

- Development of energy-efficient chipset architectures to extend battery life in mobile and IoT applications

- Emergence of AI-driven adaptive beamforming techniques to improve signal reliability in complex environments

- Strategic partnerships between chipset vendors and cloud providers to accelerate edge computing deployments

- Certification focus on security enhancements such as WPA3-SAE to address evolving wireless threat vectors

- Custom chipset solutions for automotive and industrial automation requiring ultra-reliable low-latency performance

For more information about this report visit: https://www.researchandmarkets.com/r/q1rlgd

…………………………………………………………………………………………………………………………………

Independent Analysis:

The top three WiFi chipset vendors are:

- Broadcom Inc.: Broadcom is generally recognized as the market leader in the Wi-Fi 6/6E and Wi-Fi 7 segment, particularly in terms of revenue share. They supply chips for a wide range of devices, from high-performance consumer routers (e.g., Netgear, Asus models) to enterprise-grade networking equipment, and are a key supplier for platform upgrades like those in flagship smartphones.

- Qualcomm Technologies, Inc.: Qualcomm is a major competitor, especially in the mobile and networking infrastructure segments. Their “FastConnect 7800” chipset has positioned them for significant growth, with Wi-Fi 6E and 7 products expected to comprise a large portion of their Wi-Fi sales in 2025. They are also a primary chip provider for many high-end routers and mesh systems.

- MediaTek Inc.: MediaTek is a strong player, particularly in the consumer electronics space and in Asia-Pacific markets. Their “Filogic 380/880” Wi-Fi 7 chipsets have seen high demand, and they have strong partnerships with major brands like TP-Link and ZTE.

Other WiFi chipset vendors include: Marvell Technology Group, Intel, Realtek Semiconductor Corporation NXP Semiconductors, Texas Instruments, and Samsung Electronics Co. The market is competitive, with these vendors heavily investing in R&D and strategic partnerships to drive the adoption of new Wi-Fi standards from IEEE 802.11 WG.

The top markets for WiFi 6E/7 chipsets are: Smartphones, PC /laptops, Access Point/WiFi routers, CPE /gateways /extenders, industry verticals (e.g. manufacturing, automotive, industrial, home appliances, gaming, augmented reality, etc).

Sources: Gemini, Perplexity AI

……………………………………………………………………………………………………………………………………………………………………..

References:

https://www.ieee802.org/11/PARs/P802_11be_PAR_Detail.pdf

Wireless Broadband Alliance Report: WiFi 7, converged Wi-Fi and 5G, AI/Cognitive networks, and OpenRoaming

WiFi 7: Backgrounder and CES 2025 Announcements

WiFi 7 and the controversy over 6 GHz unlicensed vs licensed spectrum

MediaTek to expand chipset portfolio to include WiFi7, smart homes, STBs, telematics and IoT

MediaTek Announces Filogic Connectivity Family for WiFi 6/6E

Intel and Broadcom complete first Wi-Fi 7 cross-vendor demonstration with speeds over 5 Gbps

Qualcomm FastConnect 7800 combining WiFi 7 and Bluetooth in single chip

Rethink Research: Private 5G deployment will be faster than public 5G; WiFi 6E will also be successful

WBA field trial of Low Power Indoor Wi-Fi 6E with CableLabs, Intel and Asus

Aruba Introduces Industry’s 1st Enterprise-Grade Wi-Fi 6E Access Point

Wireless Broadband Alliance Report: WiFi 7, converged Wi-Fi and 5G, AI/Cognitive networks, and OpenRoaming

The Wireless Broadband Alliance (WBA) has today released its annual industry report and survey findings. The “WBA Industry Report 2026” contains the results of its annual industry survey across the Wi-Fi, cellular and enterprise ecosystem. Among its chief findings is that 62% of respondents have grown more confident to invest in Wi-Fi over the last 12 months (18% are as confident). Wi-Fi 7 is the technology most likely to be deployed in 2026, with 38% of respondents planning deployments. Closely behind that is the impact of AI, with 32% planning to deploy AI/Cognitive networks, which can transform Wi-Fi networking, with an ability to improve the performance and reliability of networks.

Here are a few highlights:

- 60% of respondents see converged Wi-Fi and 5G as key to enterprise flexibility and that both will co-exist.

- 38% plan to roll out Wi-Fi 7 in 2025/2026, while 65% say 6 GHz availability is important or critical to their Wi-Fi business.

- 32% plan to deploy AI/Cognitive networks.

Convergence matters more:

When asked about the role of Wi-Fi in converged networks with both 5G and private enterprise implementations, responses reinforced the view that the technologies are complementary and together benefit organizations. Six in ten (60%) said combining them would give their organization greater enterprise flexibility. The same proportion expect Wi-Fi and 5G to co-exist, rather than be a binary choice for enterprise networks.

OpenRoaming momentum:

The industry survey shows OpenRoaming transitioning into a period of mainstream planning with the need for seamless onboarding and roaming between Wi-Fi and cellular networks now seen as central business drivers. 38% of respondents say they had already deployed a OpenRoaming and/or Passpoint compliant network with a further 32% wishing to deploy in 2026, and 18% in 2027.

When asked what is driving investment in OpenRoaming/Passpoint, the top three reasons given were Enablement of frictionless Wi-Fi (63%), seamless access between Wi-Fi and 5G/LTE (60%) and seamless access across different networks (40%). Each of these responses relates to network access, highlighting that this element is the most important factor for the industry.

Wi-Fi’s role in business continuity:

Respondents also gave their views on the aspects of Wi-Fi they considered most important to their business at present, and what they expected to be the most important in the future. Network security and privacy was identified as the most important area for businesses today, with 76% of all responses. Tied second position for the current most important aspect of Wi-Fi, both with 70% of responses, were end user experiences (Quality of Experience and Quality of Service), and seamless authentication to Wi-Fi.

Asked about the most important new or improved feature of Wi-Fi 6E and Wi-Fi 7, respondents rated Multi-Link Operation (MLO) as the single most important at 46%, highlighting a sharp focus on latency, resilience and spectrum efficiency in dense environments. This was followed in joint second place by OFDMA Uplink & Downlink, and Mandatory WPA3 compliance (both 33%). Multi-User MIMO Uplink took third position at 32%.

Additional key survey findings:

- 6 GHz band availability seen as ‘important’ or ‘critical’ by 65% of respondents to the future of their Wi-Fi business and rollout, underscoring the centrality of 6 GHz to future Wi-Fi strategies

- City-wide public Wi-Fi deployed by 33% of relevant respondents, with a further 39% planning deployments for 2026/2027. The top three services organizations see Public Wi-Fi underpinning were supporting city services (70%), the provision of seamless, affordable, and secure internet access to users (65%), and to provide offload to carriers (49%). City governments around the world, such as the Tokyo Metropolitan Government (TMG), are already utilizing OpenRoaming to deliver all these services

Tiago Rodrigues, President and CEO of the Wireless Broadband Alliance, said: “This year’s WBA Industry Report survey makes it clear that the Wi-Fi community has moved to building the next generation of converged connectivity and the momentum is strong: Wi-Fi 7 and AI-driven networks, which can cut costs, while improving the operational efficiency, performance and reliability of networks, are at the top of deployment plans. 6 GHz is viewed as critical spectrum, and almost half of respondents are already deploying or planning OpenRoaming networks. Respondent’s priorities of security, privacy, Quality of Experience and seamless roaming between Wi-Fi and 5G are exactly where the WBA is focused through our programs of work. In a world where connectivity is business continuity, these findings show that Wi-Fi has become essential infrastructure for enterprises, operators and cities alike.”

The WBA Industry Survey 2026 collected input from 185 participants worldwide, with diverse job roles ranging from the C-suite and business strategy to those in research & development (R&D) and product management in a wide range of sectors.

About the Wireless Broadband Alliance:

Wireless Broadband Alliance (WBA) is the global organization that connects people with the latest Wi-Fi initiatives. Founded in 2003, the vision of the WBA is to drive seamless, interoperable service experiences via Wi-Fi within the global wireless ecosystem. The WBA’s mission is to bring together global industry leaders, collaborating to accelerate the development, integration and adoption of next-generation Wi-Fi and wireless technologies to deliver business growth, through innovation, technical and standards development, and real-world deployment programs.

Key programs include NextGen Wi-Fi, OpenRoaming, 5G, 6G, IoT, Smart Cities, Testing & Interoperability and Policy & Regulatory Affairs.

www.facebook.com/WirelessBroadbandAlliance

www.linkedin.com/company/2919934/

…………………………………………………………………………………………………………

References:

https://wballiance.com/industry-report-2026/

WiFi 7: Backgrounder and CES 2025 Announcements

WiFi 7 and the controversy over 6 GHz unlicensed vs licensed spectrum

MediaTek to expand chipset portfolio to include WiFi7, smart homes, STBs, telematics and IoT

CableLabs to bring mobility to WiFi for a better user experience

AT&T to provide free WiFi and private 5G at DFW airport; will invest $10 million worth of network upgrades

Qualcomm FastConnect 7800 combining WiFi 7 and Bluetooth in single chip

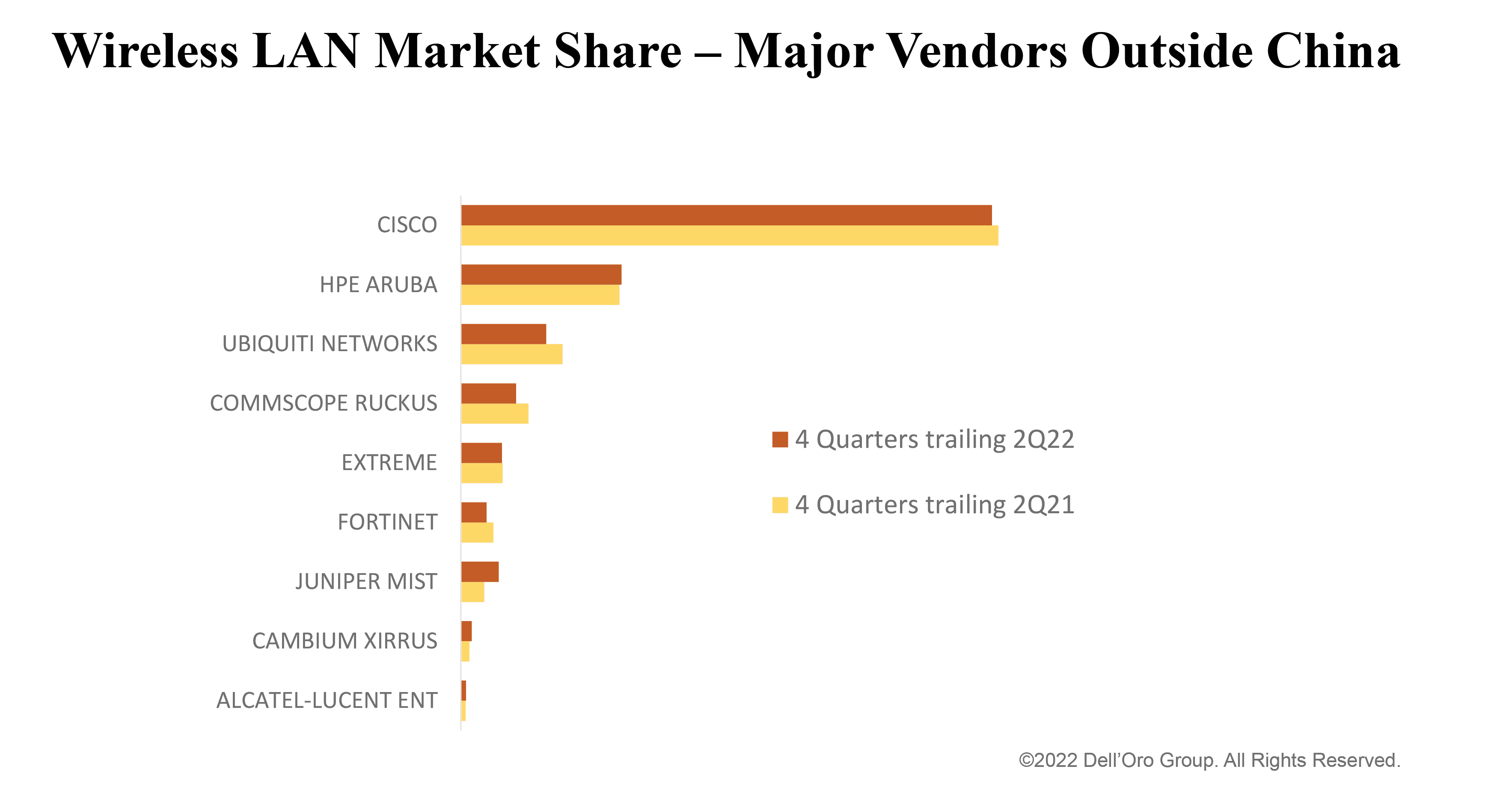

Dell’Oro Worldwide Wireless LAN market at new high in 2Q-2022; IDC reports 20.4% annual growth for enterprise segment

1. According to Dell’Oro Group’s Wireless LAN Quarterly Report, the Wireless LAN market reached a new high in the second quarter, eclipsing $2 Billion, with HPE Aruba and Juniper Mist overcoming supply constraints to contribute over two thirds of the shipment growth outside China. Enterprises saw a 10 percent increase in average prices compared to last year, boosting manufacturers’ revenues and helping to defray additional costs.

“HPE and Juniper really pulled rabbits out of their hats this quarter ̶ Aruba and Mist represent the majority of the growth in units shipped outside China,” says Siân Morgan, Wireless LAN Research Director at Dell’Oro Group. “It’s like a game of whack-a-mole for the manufacturers. They’ll get their hands on one particular access point component and then another shortage will pop up. We’re expecting shipments to be lumpy through the next few quarters.”

Cisco has promised shipments ‘en masse’ for enterprises, and all of the manufacturers are busy finding creative solutions: redesigning products, using brokerage firms, or bypassing component distributors.

“Wireless LAN solutions have also become more expensive for enterprises. It’s very rare to see such a long stretch of quarters with year-over-year price increases. It’s a combination of higher-end products being available, including the new Wi-Fi 6E technology, as well as a general move by the manufacturers to cover their escalating costs. Looking ahead we have to ask ourselves how long the market will bear these higher prices,” added Morgan.

Additional highlights from the 2Q 2022 Wireless LAN Quarterly Report:

- The Wireless LAN market saw two distinct phenomena driving the growth: one in China, and another one in the markets outside China.

- In light of the China lockdowns, the Wireless LAN market in China showed surprising strength with both Huawei and H3C pulling in strong quarters.

- Wi-Fi 6E shipments accelerated this quarter, as another half dozen vendors started shipping products supporting the new 6 GHz band. However, now in its fourth quarter of product availability, Wi-Fi 6E is lagging the adoption rate of the prior two generations of Wi-Fi.

- Revenue from public cloud-managed APs has outpaced the market. The cloud-managed AP business is still dominated by Cisco – although this quarter, Juniper grabbed an outsized market share in cloud-managed Wireless LAN.

Sian wrote in an email to this author, “It is difficult to judge changes in market share based on one or two quarters, given that supply constraints are making shipment volumes choppy. To understand how the market is unfolding it is useful to look at market share based on trailing four-quarter averages, which are shown in the chart below.

Dell’Oro note earlier this year that supply chain issues increased vendor backlogs by up to 15-times normal levels. “Many enterprises have planned network upgrades and the popular connection is Wi-Fi. The trouble is getting it. Several manufacturers announced that components from second and third-tier suppliers became the bottleneck in 1Q22,” said Tam Dell’Oro, Founder, CEO and Wireless LAN Analyst. “Supply constraints have resulted in highly volatile quarterly performance vendor-to-vendor depending on whether or not they have all the components. For example, sales may be up 20 percent in one quarter and down 20 percent the next. Another item, which could potentially cause delays, that we are keeping our eye on are the contract negotiations between the west coast dockworkers union and the Maritime Association,” added Dell’Oro.

The Dell’Oro Group Wireless LAN Quarterly Report offers complete, in-depth coverage of the Enterprise Outdoor and Indoor markets, Wireless LAN Controllers with tables containing manufacturers’ revenue, average selling prices, and unit shipments by the following wireless standards: 802.11ax (Wi-Fi 6 and 6E [6 GHz]), 802.11ac (Wi-Fi 5) Wave 1 vs. Wave 2, and historic IEEE 802.11 standards. The Enterprise market is portrayed by Public Cloud vs. Premises and Private Cloud deployments, as well as by ten Vertical markets and by Customer Size. To purchase these reports, please contact us by email at [email protected].

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

2. IDC reports that the enterprise segment of the worldwide wireless local area network (WLAN) market continued its strong growth in the second quarter of 2022 (2Q22), increasing 20.4% year over year to $2.1 billion. That’s according to the IDC report: “Worldwide Quarterly Wireless LAN Tracker.”

The 20.4% annualized growth builds on the enterprise WLAN market growing 17.1% year over year in the first quarter of 2022. In the first half of 2022, the enterprise WLAN market has grown 18.4% compared to the first half of 2021. Growth in the enterprise WLAN market continues to be driven by the latest Wi-Fi standard, known as Wi-Fi 6 or 802.11ax. Wi-Fi 6 access points (AP) made up 76.5% of the revenues in the Dependent AP segment and accounted for 62.7% of unit shipments within the segment. Wi-Fi 5 products, also known as 802.11ac, made up the remaining balance of Dependent AP sales.

The consumer segment of the WLAN market declined 3.5% year over year in 2Q22, with the quarter’s unit shipments remaining relatively flat at 0.6% growth compared to the first quarter of 2022. Adoption of Wi-Fi 6 continues in the consumer segment of the WLAN market too: In 2Q22, Wi-Fi 6 made up 33.5% of the market’s revenues.

“The enterprise WLAN market continues to grow at a rapid clip, emphasizing the importance of wireless technology in the network and digital transformation goals of organizations across the globe,” said Brandon Butler, research manager, Enterprise Networks at IDC. “The enterprise WLAN market is not immune to challenges however, with the supply chain disruptions and component shortages being notable examples. But strong demand for wireless refreshes to Wi-Fi 6 – and increasingly to Wi-Fi 6E – is buoying the market and leading to strong growth rates.”

The enterprise WLAN market had mixed results across the globe. In the United States, the market increased 15.7% annually, while in Latin America the market grew 47.7% from a year earlier. In Canada the market declined 1.6%. In Western Europe, the market increased 45.4%, but in Central and Eastern Europe, the market declined 20.6%. Within Central and Eastern Europe, Russia’s market declined 73.2% as the Russia-Ukraine war rages on. In the Middle East & Africa, the market rose 23.2%. In the Asia/Pacific region, excluding Japan and China, the market rose 26.5%, while in the People’s Republic of China the market increased 8.7% year over year. In Japan the market rose 6.2%.

Vendor highlights (note that Juniper Mist is NOT mentioned by IDC as a leading wireless LAN vendor):

- Cisco’s enterprise WLAN revenues increased 19.3% year over year in 2Q22 to $792.0 million, giving the company market share of 37.7%, compared to market share of 41.5% in the previous quarter, 1Q22.

- HPE-Aruba revenues rose 48.6% year over year in 2Q22, giving the company market share of 14.9%, down from 16.5% in the first quarter.

- Ubiquiti enterprise WLAN revenues increased 10.5% year over year in 2Q22, giving the company 7.9% market share in the quarter, up from 7.1% in 1Q22.

- Huawei enterprise WLAN revenues rose 20.0% year over year in 2Q22, giving the company 8.5% market share, up from 4.6% market share in the previous quarter.

- H3C revenues increased 16.4% year over year in 2Q22, giving the company market share of 4.6%, up from 4.3% in 1Q22.

The IDC Worldwide Quarterly Wireless LAN Tracker provides total market size and vendor share data in an easy-to-use Excel Pivot Table format. The geographic coverage includes nine major regions (USA, Canada, Latin America, People’s Republic of China, Asia/Pacific (excluding Japan & China), Japan, Western Europe, Central and Eastern Europe, and Middle East and Africa) and 60 countries. The WLAN market is further segmented by product class, product type, product, standard, and location. Measurement for the WLAN market is provided in vendor revenue, value, and unit shipments.

About IDC Trackers:

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

References:

HPE Aruba and Juniper Mist Navigate Component Shortages to Gain Share, According to Dell’Oro Group

https://www.idc.com/getdoc.jsp?containerId=prUS49663322

https://www.idc.com/getdoc.jsp?containerId=IDC_P23464

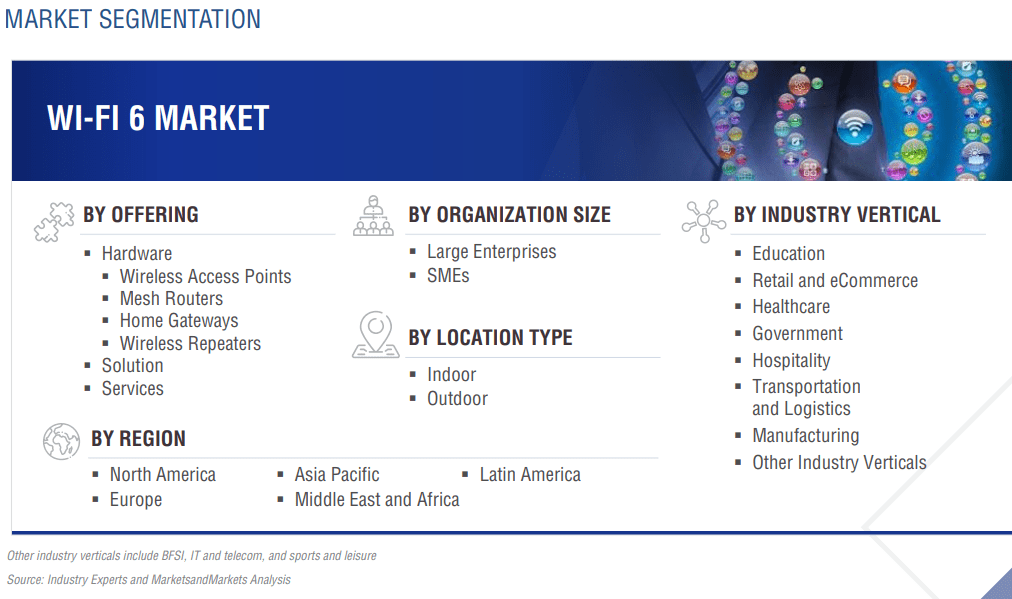

Global Wi-Fi 6 market forecast to grow from $11.5B in 2022 to $26.2B by 2027; CAGR=17.9%

According to a new research report “Wi-Fi 6 Market Global Forecast to 2027,” published by MarketsandMarkets™, the global Wi-Fi 6 market size is expected to grow from $11.5 billion in 2022 to $26.2 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 17.9% during the forecast period.

……………………………………………………………………………………………………………………………………

Editor’s Note:

Wi-Fi 6 is an acronym for the IEEE 802.11ax standard. Prior to the release of Wi-Fi 6, Wi-Fi standards were identified by version numbers ranging from 802.11b to 802.11ac.

…………………………………………………………………………………………………………………….

The managed services Wi-Fi 6 market segment is expected to grow at a higher CAGR than enterprise or consumer Wi-Fi 6 during the forecast period. Managed Service Providers (MSPs) offer are third–party IT service providers that remotely manage the IT infrastructure and systems of clients for backup and recovery of business–critical data. These service providers carry out 24/7 remote monitoring of Wi–Fi 6 networks for their commercial clients. Enterprises opt for managed services to overcome the challenges of budget constraints and technical expertise as managed service providers have skilled human resources, infrastructure, and industry certifications. They offer services to monitor and manage hardware devices and manage the availability and the performance of networks. They also ensure smooth operations and security of networks. The growth of the Wi–Fi 6 market is being driven by the increasing reliance by businesses on the use of IT to improve business productivity, coupled with a continuing rise in demand for specialized MSPs and cloud–based managed Wi–Fi 6 services.

Asia Pacific (APAC) region to record the highest growing region in the Wi-Fi 6 Market. Important countries include Australia, Japan, Singapore, India, China, and New Zealand. The region is expected to witness the fast-paced adoption of Wi-Fi 6 software. The Asia Pacific region is estimated to be the fastest-growing Wi-Fi 6 Market owing to the rise in the adoption of new technologies, high investments for digital transformation, the rapid expansion of domestic enterprises, extensive development of infrastructures, and increasing GDP of various countries. Rapidly growing economies, such as China, Japan, Singapore, and India, are implementing Wi-Fi 6 solutions across multiple business processes to provide effective solutions.

Key and innovative vendors in the Wi-Fi 6 market are:

Cisco Systems (US), Intel Corporation (US), Huawei Technologies (China), NETGEAR (US), Juniper Networks (US), Broadcom (US), Qualcomm Inc. (US), Extreme Networks (US), Ubiquiti Networks (US), Fortinet Inc. (US), Aruba Networks (US), NXP Semiconductors (Netherlands), AT&T (US), Cambium Networks (US), D-Link Corporation (China), Alcatel-Lucent (US), TP-Link (China), MediaTek (China), Telstra (Australia), Murata (Japan), Sterlite Technologies Limited (India), Celeno (Israel), H3C (China), Senscomm Semiconductor (China), XUNISON (Ireland), Redway Networks (UK), VSORA (France), NEWRACOM (US), WILUS Group (South Korea), Federated Wireless (US).

References:

MediaTek Announces Filogic Connectivity Family for WiFi 6/6E

Taiwan based MediaTek (one of only two 5G merchant silicon vendors) unveiled its new Filogic connectivity chip sets with the introduction of the Filogic 830 Wi-Fi 6/6E system-on-chip (SoC) and Filogic 630 Wi-Fi 6E network interface card (NIC) products. MediaTek said its new Filogic series of Wi-Fi 6/6E chipsets provide reliable connectivity, high computation functionalities and a rich set of features in highly integrated, power-efficient designs.

MediaTek Filogic Wi-Fi 6/6E products are certified by the Wi-Fi Alliance and deliver unbeatable performance in a wide range of applications.

- Home, business or enterprise router and repeater devices

- Service provider broadband equipment or retail devices

- Wi-Fi Alliance EasyMeshTM certified

- Home automation bridges and IoT

- Consumer devices and applications such as laptops, TVs, IP cameras, wireless storage, audio and more

MediaTek Filogic 830

Filogic 830 packs a wide variety of features into a compact, ultra-low power 12nm SoC, allowing customers to design differentiated solutions for routers, access points and mesh systems. The SoC integrates four Arm Cortex-A53 processors operating at up to 2GHz per core for up to +18,000 DMIPs processing power, dual 4×4 Wi-Fi 6/6E for up to 6Gbps connectivity, two 2.5 Gigabit Ethernet interfaces and a host of peripheral interfaces. Filogic 830’s built-in hardware acceleration engines for Wi-Fi offloading and networking enable faster and more reliable connectivity. In addition, the chipset also supports MediaTek FastPath™ technology for low latency applications such as gaming and AR/VR.

MediaTek Filogic 630

Filogic 630 is a Wi-Fi 6/6E NIC solution that supports dual-band, dual-concurrent 2×2 2.4GHz and 3×3 5GHz or 6GHz for up to 3Gbps. The chipset supports a unique 3T3R 5/6GHz system with internal front-end modules (FEMs) which provide equivalent or better range than competing 2T2R solutions with external FEMs. This highly integrated design helps lower bill of materials (BOM) cost, while allowing for sleeker designs with its small RF frontend area. Filogic’s 630’s third antenna enables superior transmit beamforming capability as well as diversity gains. Filogic 630 supports interfaces such as PCIe, which allows it to be combined with Filogic 830 for tri-band connectivity solutions for broadband gateways, enterprise access points and retail routers with even higher speeds and bandwidth capacity.

“The MediaTek Filogic series ushers in a new era of smart Wi-Fi solutions with extreme speeds, low latency and superb power efficiency for seamless, always connected experiences,” said Alan Hsu, Corporate Vice President & General Manager, Intelligent Connectivity at MediaTek. “These new chipsets provide best-in-class features with highly integrated designs for the next generation of premium broadband, enterprise and retail Wi-Fi solutions.”

MediaTek has the broadest Wi-Fi portfolio and is the No. 1 Wi-Fi supplier across broadband, retail routers, consumer electronics devices and gaming. MediaTek’s Wi-Fi portfolio powers hundreds of millions of devices every year. Over the years, MediaTek has worked closely with the Wi-Fi Alliance to ensure MediaTek’s connectivity portfolio supports the latest Wi-Fi features. In January 2021, MediaTek was selected to be on the test bed for Wi-Fi 6E, the latest certification from Wi-Fi Alliance® for Wi-Fi CERTIFIED 6™ devices with 6GHz support.

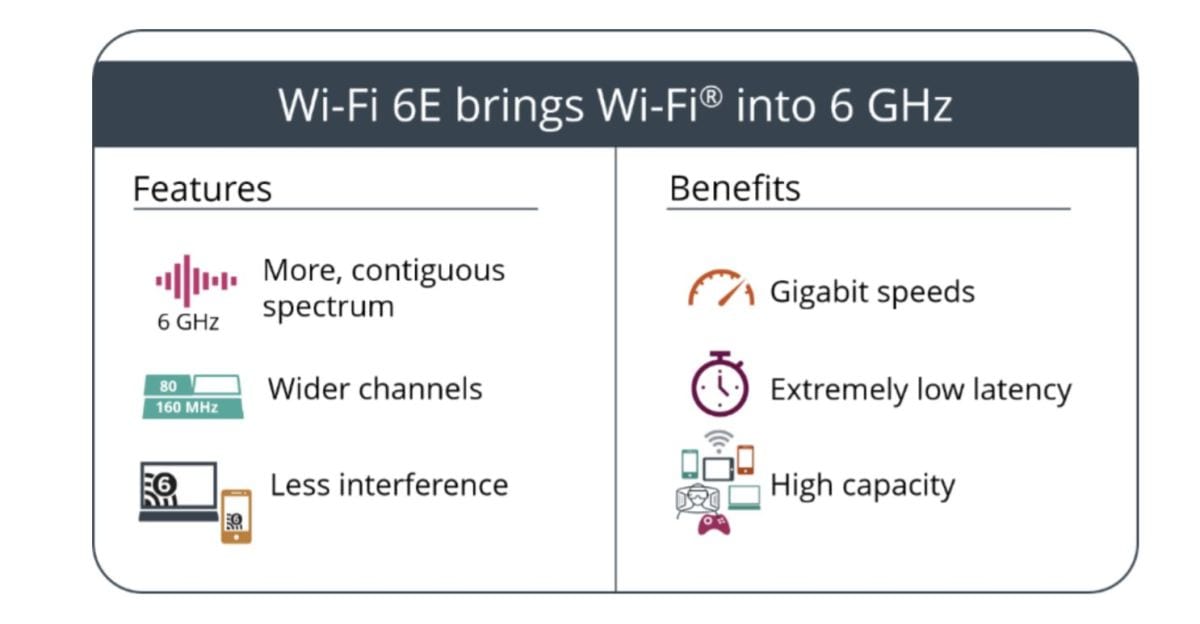

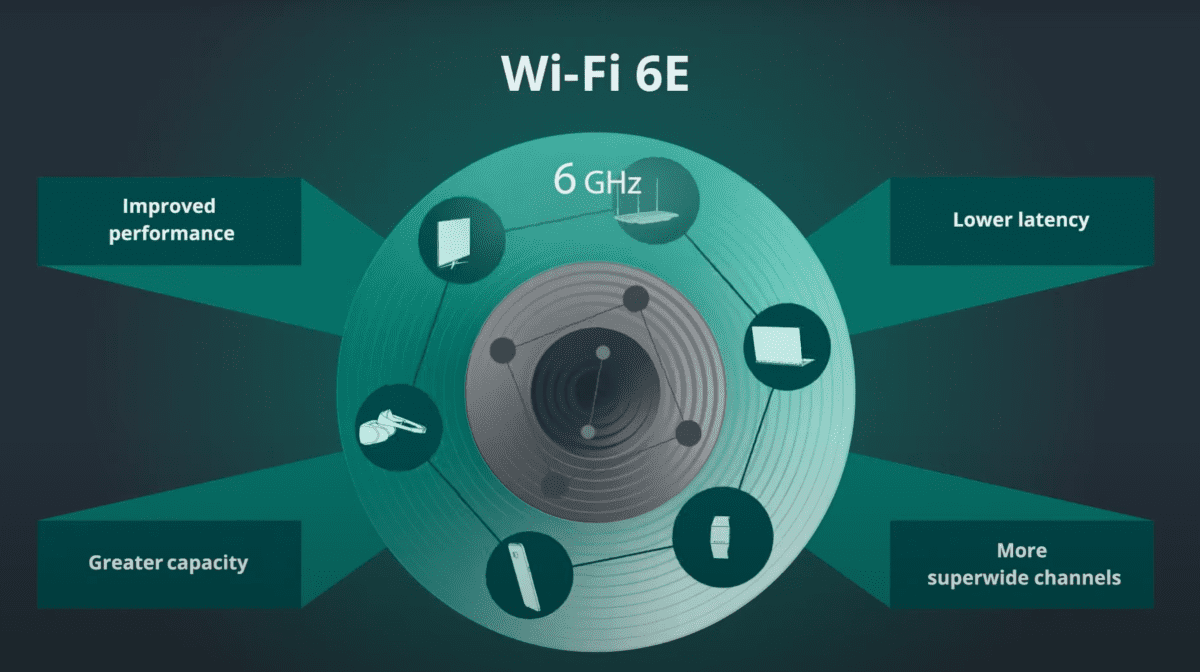

Wi-Fi 6E offers a number of advantages over previous Wi-Fi generations, including lower latency and additional capacity and speed. Devices using Wi-Fi 6 connections in 6GHz are designed to make use of wide 160 MHz channels and uncongested bandwidth in 6GHz to deliver multi-gigabit, low latency Wi-

About MediaTek Inc.

MediaTek Incorporated (TWSE: 2454) is a global fabless semiconductor company that enables nearly 2 billion connected devices a year. We are a market leader in developing innovative systems-on-chip (SoC) for mobile device, home entertainment, connectivity and IoT products. Our dedication to innovation has positioned us as a driving market force in several key technology areas, including highly power-efficient mobile technologies, automotive solutions and a broad range of advanced multimedia products such as smartphones, tablets, digital televisions, 5G, Voice Assistant Devices (VAD) and wearables. MediaTek empowers and inspires people to expand their horizons and achieve their goals through smart technology, more easily and efficiently than ever before. We work with the brands you love to make great technology accessible to everyone, and it drives everything we do. Visit www.mediatek.com for more information.

References:

https://www.mediatek.com/products/connectivity-and-networking/mediatek-filogic-wifi-6

Broadcom, Cisco and Facebook Launch TIP Group for open source software on 6 GHz Wi-Fi

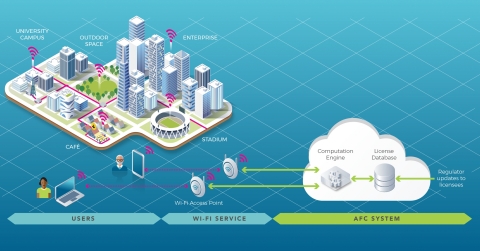

The purpose of this new TIP project group is to develop a common reference open source software for an AFC system. The AFC will be used by unlicensed devices in the newly available 6 GHz band to operate outdoor and increased range indoor while ensuring incumbent services are protected.

The US, EU, Canada, and Brazil, among others, have approved or are finalizing the approval of 6 GHz unlicensed spectrum use, opening up a huge bandwidth for Wi-Fi services.

By 2025, the Wi-Fi Alliance estimates that the 6 GHz Wi-Fi will deliver USD 527.5 billion in incremental economic benefits to the global economy [1]. Standard outdoor power operations will be a key part of the value proposition of 6 GHz Wi-Fi and is critical for enabling more affordable wireless broadband for consumer access.

The FCC is the first regulator to enable its use under an AFC, ISED Canada authorized standard power with AFC in May 2021, with others expected to follow. The AFC will enhance Wi-Fi to provide a consistent wireless broadband user experience in stadiums, homes, enterprises, schools, and hospitals.

“The 6 GHz Wi-Fi momentum is unmistakable. In the year following the historic FCC ruling to open up the band for unlicensed access, we already have an entire ecosystem of Wi-Fi 6E devices delivering gigabit speeds indoors. As we work towards closing the digital divide and further realizing the value of the 6 GHz band, AFC-enabled standard power Wi-Fi operation becomes critical. As Wi-Fi 7 comes along, AFC will turbocharge the user experience by enabling over 60 times more power for reliable, low latency, and multi-gigabit wireless broadband both indoors and outdoors. With this vision in mind, Broadcom is excited to join hands with Cisco and Facebook to create the TIP Open AFC Software Group aimed at enabling a cost effective and scalable AFC system,” said Vijay Nagarajan, Vice President of Marketing, Wireless Communications & Connectivity Division, Broadcom.

“The creation of the TIP Open AFC Software Group represents the immense momentum behind unlicensed spectrum and the potential it holds to deliver innovation,” said Rakesh Thaker, VP of Wireless Engineering, Cisco. “Many of the applications and use cases we’re just beginning to dream up with the introduction of Wi-Fi 6 and the 6 GHz spectrum will rely on standard power, greater range and reliability. This software group will play an important role in ensuring those applications can become reality, while also protecting important incumbent services. We’re thrilled to join Broadcom and Facebook on this effort, and to share a vision with TIP of providing high-quality, reliable connectivity for all.”

Facebook developed a proof of concept Open AFC system, which will protect 6 GHz incumbent operations and enable faster adoption of standard power operations in the 6 GHz band. This prototype system will be contributed to the TIP community through today’s launch of the Open AFC Software Group, with the goal of enabling the proliferation of standard power devices in the United States to start, with other markets to follow.

Broadcom and Cisco have committed to driving the industry forward in developing Open AFC to ensure that the code continues to be developed to meet the needs of the industry and regulators, such that an AFC operator could take the code and build upon it for rapid certification.

The vast majority of Wi-Fi use is indoors, but there are situations where people will want to use Wi-Fi outdoors. The use of AFC provides the flexibility for outdoor deployments in open air stadiums and similar venues.

“Bringing AFC technology to the TIP Open AFC Software Group is a huge milestone for the unlicensed spectrum community,” said Dan Rabinovitsj, vice president for Facebook Connectivity. “We are excited to see the contributions and innovations by Open AFC and we look forward to celebrating the widespread adoption of the 6 GHz band, which will rapidly accelerate the performance and bandwidth of Wi-Fi networks around the world”.

David Hutton, Chief Engineer of TIP, said: “The industry is coming together to support 6 GHz for unlicensed use for Wi-Fi and TIP will be providing the forum to contribute to make this happen, supporting regulatory efforts by ensuring that AFC systems are developed under a common code base that is available to all industry stakeholders.”

Closing Comment:

We wonder why this new WiFi 6GHz group is in TIP rather than the WiFi Alliance. From the WiFi Alliance Certified 6:

“Wi-Fi Alliance is leading the development of specifications and test plans that can help ensure that standard power Wi-Fi devices operate in 6 GHz spectrum under favorable conditions, avoiding interference with incumbent devices.”

In this author’s opinion, there are way too many alliances/ fora/ consortiums that produce specifications that are to be used with existing standards. In this case (IEEE 802.11ax) there is potential overlap amongst amongst groups, which leads to inconsistent implementations that inhibit interoperability.

References:

Aruba Introduces Industry’s 1st Enterprise-Grade Wi-Fi 6E Access Point

HPE subsidiary Aruba today announced the first commercially available, enterprise-grade Wi-Fi 6E [1.] solution set – the 630 Series of campus access points (APs), starting with the AP-635.

Note 1. Wi-Fi 6E refers to IEEE 802.11ax (Wi-Fi 6) products that support 6GHz wireless spectrum. Wi-Fi 6E enables faster speeds and lower latencies than Wi-Fi 6 and earlier iterations of WiFi (IEEE 802.11). WiFi 6 products are starting to appear in routers [2.] and silicon. Cisco has been selling a WiFi AP for enterprises since 2019.

Note 2. List of best WiFi 6 routers:

- Asus RT-AX86U. The best Wi-Fi 6 router overall. …

- Netgear Nighthawk RAXE500. The Wi-Fi 6e speed demon. …

- Netgear Orbi with Wi-Fi 6 (RBK852) Best Wi-Fi 6 mesh router. …

- Netgear Nighthawk XR1000. …

- Eero Pro 6. …

- Netgear Nighthawk AX8 (RAX80) …

- TP-Link Deco X20. …

- Linksys Max Stream MR9600

In April 2020, the Federal Communications Commission (FCC) allocated 1,200 megahertz of spectrum in the 6 GHz band for unlicensed WiFi use. That was the largest swath of spectrum approved for WiFi since 1989. Opening the 6 GHz band more than doubles the amount of RF spectrum available for Wi-Fi use, allowing for less congested airwaves, broader channels, and higher-speed connections and enabling a range of innovations across industries. Since the FCC decision to open the 6 GHz band, 39 additional countries that are home to over 1.3 billion people have opened the 6 GHz unlicensed band for Wi-Fi 6E. (Source: Wi-Fi Alliance)

The industry’s first enterprise-grade Wi-Fi 6E solution, the new Aruba 630 Series delivers greater performance, lower latency, and faster data rates to support high-bandwidth applications and use cases. The new Aruba 630 Series APs will be available in calendar third quarter 2021.

Currently, as organizations increase their use of bandwidth-hungry video, cope with increasing numbers of client and IoT devices connecting to their networks, and speed up their transition to cloud, the demand for Wi-Fi continues to rise. As a result, wireless networks are becoming oversubscribed, throttling application performance. This frustrates all network users by negatively impacting the user experience, reduces productivity, puts digital initiatives at risk, and stifles innovation.

“The Aruba 630 Series campus access points are the first enterprise-grade WiFi 6E access points to be introduced by any of the main enterprise networking providers,” Gayle Levin, marketing manager at Aruba, wrote in response to questions. “We’re seeing the most interest from large public venues, such as airports, stadiums, and lecture halls, as well as healthy interest from health care and higher education,” she added.

“With connectivity demands growing exponentially, Wi-Fi 6E can take advantage of up to seven, super wide 160 MHz channels and uncongested bandwidth in the 6 GHz band to deliver unprecedented multi-gigabit and low latency connectivity,” said Kevin Robinson, SVP of Marketing at Wi-Fi Alliance. “Wi-Fi 6E will spur enhanced innovations and exciting new services. Wi-Fi Alliance is pleased to see longtime member Aruba bringing Wi-Fi 6E solutions to market that will help organizations better support critical activities like videoconferencing, telemedicine, and distance learning.”

According to leading market intelligence research firm 650 Group, Wi-Fi 6E will see rapid adoption in the next couple of years, with over 350M devices entering the market in 2022 that support 6 GHz. 650 Group expects over 200% unit growth of Wi-Fi 6E enterprise APs in 2022.

The new Aruba Wi-Fi 6E solutions are part of Aruba ESP (Edge Services Platform), the industry’s first AI-powered, cloud-native platform designed to unify, automate, and secure the Edge. Able to predict and resolve problems at the network edge before they happen, Aruba ESP’s foundation is built on AIOps, Zero trust network security, and a unified campus to branch infrastructure to deliver an automated, all-in-one platform that continuously analyzes data across domains, tracks SLAs, identifies anomalies, and self-optimizes, while seeing and securing unknown devices on the network.

With Aruba’s new Wi-Fi 6E offerings, organizations can take advantage of the increased capacity, wider channels in 6 GHz, and significantly reduced signal interference with 3.9 Gbps maximum aggregate throughput to support high bandwidth, low latency services and applications such as high definition video, next-generation unified communications, augmented reality/virtual reality (AR/VR), IoT, and cloud. Additionally, with a new ultra tri-band filtering capability, which minimizes interference between the 5 GHz and 6 GHz bands, organizations can truly maximize use of the new spectrum.

“As we progress in our digital transformation, we are continually adding an increasing number of IoT devices to our network and transitioning to Wi-Fi as our primary network connection rather than Ethernet. We are being asked to support an expanded array of mission-critical, high bandwidth applications that support research as well as hyflex learning and entertainment, like streaming video, video communications, and AR/VR for our students, professors, and staff,” said Mike Ferguson, network manager and enterprise architect at Chapman University.

“With Aruba’s Wi-Fi 6E APs, we’re confident that we’ll be able to not just support our short-term needs, but we’ll have room to grow as well, which will keep all of our users happy, increase our competitiveness, and allow us to extend the lifecycle of this network deployment by 50%,” he added.

Aruba 630 Series Access Point Key Features:

- Comprehensive tri-band coverage across 2.4 GHz, 5 GHz, and 6 GHz with 3.9 Gbps maximum aggregate data rate and ultra-triband filtering to minimize interference

- Up to seven 160 MHz channels in 6 GHz to better support low-latency, high bandwidth applications like high-definition video and AR/VR

- Operates on existing IEEE 802.3at standards for PoE power so there is no need to rip and replace existing power supplies

- Advanced security with WPA3 and Enhanced Open to better protect passwords and data

- Flexible failover with two HPE Smart Rate Ethernet ports for 1-2.5 Gbps, offering true hitless failover from one port to another for both data and power

- Application assurance to guarantee stringent application performance for latency sensitive and high bandwidth uses by dynamically allocating and adjusting radio resources

- Cloud, controller, or controllerless operation modes to address campus, branch, and remote deployments

“Consumer appetite for ubiquitous wireless connectivity is limitless, whether at home or traveling the world,” said Mike Kuehn, president at Astronics CSC. “As a leading global provider of advanced technologies for the aerospace and defense industries – including some of the largest major airlines in the world – Aruba’s new Wi-Fi 6E AP gives us the ability to offer compelling and unique solutions that deliver a new, enhanced and more secure wireless experience to our customers.”

“Aruba has two decades of leadership in Wi-Fi innovations, backed by an unwavering commitment to providing our customers with the reliable, fast, high capacity, and secure connectivity they need to pursue and exceed their organizational objectives,” said Chuck Lukaszewski, vice president and wireless chief technology officer at Aruba.

“Since 2016 we have helped lead the advocacy effort that has led to the 6 GHz band being opened all over the world. As such, we are extremely proud to be the first vendor to bring enterprise-grade Wi-Fi 6E solutions to market so our customers can take advantage of the huge increase in capacity that 6 GHz delivers,” he added.

Aruba is also framing the new WiFi 6E access points as “an important element of Aruba’s Edge Services Platform (ESP)” because the equipment will sit at the edge of the network, Levin added. “By virtue of their position and role within the network, access points are vital in collecting edge data from client devices and IoT that feeds back into Aruba ESP.”

The vendor entered the edge services market with the cloud-native platform last year to target campuses, data centers, branches, and remote workers, but it only works with Aruba’s access points, switches, and SD-WAN gateways.

…………………………………………………………………………………………………………………………………….

References:

https://www.businesswire.com/news/home/20210525005243/en/

https://www.sdxcentral.com/articles/news/aruba-claims-first-enterprise-wifi-6e-aps/2021/05/

https://www.tomsguide.com/news/wi-fi-6e-explained

North Carolina School District deploys WiFi 6 from Cambium Networks; WiFi 6 vs 6E Explained

FCC to open up 6 GHz band for unlicensed use – boon for WiFi 6 (IEEE 802.11ax)

North Carolina School District deploys WiFi 6 from Cambium Networks; WiFi 6 vs 6E Explained

Cambium Networks a leading global provider of wireless networking solutions, today announced its multi-year agreement with the school district of Burke County, N.C., with the addition of Wi-Fi 6 access points to provide multi-gigabit speeds in classrooms.

Using E-Rate funding for education, Burke County will upgrade its network to the latest Wi-Fi 6 technology to improve learning for students. The project, which began in late 2020, is delivering 1,500 multi-gigabit high-density access points to the district’s 27 schools and 12,000 students. This will allow students to simultaneously use Zoom and view streaming videos in the classroom using the latest XV3-8 access points, as well as XMS cloud management that seamlessly integrates with Google G-Suite and other embedded education systems.

“When the technology works, the students win, and so does our community. That is especially important as we navigate the pandemic and students return in March,” said Dr. Melanie Honeycutt, CIO of the Burke County School District. “Cambium is our solution for great performance at an affordable price for high density classrooms, and just in time as COVID accelerated our 1:1 laptop program and the increased use of streaming video.”

Cambium’s Wi-Fi 6 and XMS end-to-end cloud-management solutions provide multi-gigabit Wi-Fi access at a proven low total cost of ownership. With easy integration to existing systems, planning, provisioning, installation and centralized cloud management, Cambium’s solutions can be rapidly deployed to deliver end-to-end multi-gigabit wireless speeds.

“We love to work with visionary and discerning customers,” said Atul Bhatnagar, president and CEO, Cambium Networks. “Dr. Honeycutt and Burke County understand that this is the time to address the digital divide. They have done so in a way that gives students what they require for excellence in education.”

……………………………………………………………………………………..

What is WiFi 6 and 6E?

The IEEE 802.11ax standard was dubbed Wi-Fi 6 by the WiFi Alliance. At the time of publication, it was limited by U.S. law to a wireless spectrum that only covered the 2.4GHz and 5GHz bands.

In a 2.4GHz band, there are three non-overlapping channels—and that bandwidth is shared by all users. If too many end point WiFi devices compete for bandwidth on the same wireless channel, then some of those signals will be dropped.

In April of 2020, the Federal Communications Commission (FCC) voted unanimously to open up the 6GHz band for unlicensed use. With that policy change, significantly more airwaves are open that WiFi routers can use. The WiFi Alliance named versions of IEEE 802.11ax that operate at or above 6GHZ as WiFi 6E.

Images Courtesy of WiFi Alliance

…………………………………………………………………………………….

The opening of the 6GHz band is essentially quadruples the amount of airwaves (14 additional 80MHz channels, and seven additional 160MHz channels) available for WiFi routers and smart WiFi devices. That means less signal interference.

Wi-Fi Alliance® is introducing new terminology to distinguish forthcoming Wi-Fi 6 devices that are capable of 6 GHz operation, an important portion of unlicensed spectrum that may soon be made available by regulators around the world. Wi-Fi 6E brings a common industry name for Wi-Fi® users to identify devices that will offer the features and capabilities of Wi-Fi 6 – including higher performance, lower latency, and faster data rates – extended into the 6 GHz band. Wi-Fi 6E devices are expected to become available quickly following 6 GHz regulatory approvals, utilizing this additional spectrum capacity to deliver continuous Wi-Fi innovation and valuable contributions to consumers, businesses and economies.

So, what’s the difference?

Early-adopter devices using Wi-Fi 6 (such as the first batch of Wi-Fi 6 routers) are limited to the 2.4GHz and 5GHz spectrum, while Wi-Fi 6E-compliant devices will have access to all those much richer 6GHz airwaves.

References:

https://www.wi-fi.org/news-events/newsroom/wi-fi-certified-6-delivers-new-wi-fi-era

https://www.wi-fi.org/news-events/newsroom/wi-fi-alliance-brings-wi-fi-6-into-6-ghz

Work from Home Reality Impacts Market for New Networking Technologies

SOURCE: Bigleaf Networks

Introduction:

Hype around next generation wireless standards (e.g. WiFi6/IEEE 802.11ax, 5G: ITU-R IMT 2020.SPECS/3GPP Release 16) has become a distraction, according to Bigleaf Networks founder and CEO, Joel Mulkey. Marketers are promoting these new technologies which sacrifice reliability to push faster speeds that are mostly useless in the new work from home era.

Mulkey and Bigleaf Vice President of Product, Jonathan Petkevich, looked into the reality behind the marketing hype around 5G and WiFi 6, as well as other networking trends such as satellite networks and artificial intelligence, in a wide-ranging panel discussion hosted for the company’s customers, partners, and agents.

As IT leaders look to regain their footing in 2021, many tech conversations that were trending at the beginning of 2020 picked up where they left off, while other trends emerged. Below are selected highlights from Mulkey and Petkevich’s conversation:

The Work From Home Reality:

“If you look at some of the Stay-At-Home mandates that have happened over the course of 2020, we estimate that about 85 million people are working from home, and that’s a big shift towards where we were at the start of 2020,” said Mulkey. “Starting at about the mid-March timeframe, 88% of organizations asked employees or required employees to work from home. About 57% of the US workforce started to work from home on a regular basis. So that was a big shift towards most people working in the office, with a few people working remotely in regional or local areas. And a lot of organizations have been talking about how they’re switching to a more long-term remote work-from-home strategy.”

Adapting to this new work from home reality meant frantically moving technology to the cloud. Part of that shift meant IT and network infrastructure teams needed to revamp their networks to support the connection reliability and application performance required in this kind of new normal.

“You need to have a healthy path between the device you’re using and the cloud server, otherwise you’re not going to have a usable experience,” said Mulkey. “One of the things we’re seeing companies running into is a sudden realization that quality of connectivity is really important.”

The Danger of WiFi 6:

According to Gartner, WiFi (IEEE 802.11) is the primary high performance network technology that companies will use through 2024. Today, roughly 96% of organizations use some form of wireless technology with many of those companies looking to move to faster versions of those networking capabilities in the next couple of years. Mulkey and Petkevich say the hype is hurting companies.

“Ensuring that you have technology that’s built on the latest standards makes sense,” said Petkevich. “I don’t know that 5G or WiFi 6 are drastically changing how a business operates day-to-day. There’s a little bit of over-hype around the speed and performance and some of the promise that’s with both of these.”

“WiFi 6 is a bit misplaced in our industry’s priorities and 5G is a marketing mess,” said Mulkey. “WiFi 6 is good for really dense, high bandwidth needs. So if you have an office with 1,000 people in a small area or you’re trying to provide WiFi offload in a stadium, WiFi 6 has technologies that will help you out. But if you’re a normal person and you’ve got a house with a couple of kids and you need to make sure your WiFi doesn’t drop-out when you’re on Zoom calls, I don’t see WiFi 6 moving the needle there. In fact, I think it’s harmful. The WiFi industry has become so focused on a story of faster, faster, faster, that the pace of innovation comes at the sacrifice of reliability. What you really need is stable WiFi connectivity that doesn’t drop out, that deals really well with roaming, that has some more intelligence to the quality of connectivity rather than prioritizing speed.”

5G Hype and Rural America:

“Now, 5G is interesting because there’s some really promising stuff there,” continued Mulkey. “Imagine if you didn’t even need WiFi, you just had always-on connectivity from all your devices at say, 100 megabits a second. That was the vision cast for it. The problem is, it’s almost all hype. What you need for the really high speeds is millimeter wave connectivity, which is really only going to be available in dense urban areas. So the folks that absolutely need good 5G today in rural areas or suburban areas without good landline connectivity, are probably not gonna get that millimeter wave behavior, surely not in rural areas.”

“We really have most of the benefits, if not all of them, with 4G today, so the evolution from a 4G to 5G in these longer distance connections is minimal to nothing,” added Mulkey. “It’s just a marketing term slapped on 4G. Now, 4G has gotten better since your phone first said 4G on it, but you’re not going to magically be able to stream 3D Star Wars style holograms because your phone has a 5G icon on it. That may come some day, but it won’t be 2021.”

Satellites:

Those who have the toughest time with WAN internet connectivity are those in rural areas or suburban areas that have been abandoned by the telecom and cable operators. An area Mulkey and Petkevich see low Earth orbit satellite networks moving beyond hype.

“The issue with traditional satellites is latency,” said Petkevich. “Starlink fixes that. So it’ll be interesting to see that play out in 2021.”

Artificial Intelligence in the Network:

44% of IT decision-makers believe that AI and machine learning can help companies optimize their network performance, and more than 50% identify AI as a priority investment needed to deliver their ideal network and make things work for them.

“There are two main ways that AI is in use today. You have a consumer-facing flavor — Siri on my iPhone, or the way that Google can find me images of apples; and then you have the hidden AI that nobody knows about — the instantaneous response of a Google search, where they’ve built smart technology that would fall under the definitions of AI to make sure that your request for Google gets to the right server from the right path and gets back to you as efficiently and effectively as possible,” said Mulkey. “Those technologies are available today. The challenge is they’re not available to the everyday person. This is an area where we, ourselves, have dedicated people and resources to figure out, ‘How can we make our network behave in an autonomous manner far better than it could if there were just people controlling it?'”

“There’s a kind of a misconception that when we talk about AI, the first thought is all the wonderful movies that have come out over the years,” quipped Petkevich. “Where we are today is there’s a lot of innovation going on to make this more tangible and more practical for businesses to use on the smaller scale, and not reserve it for the large enterprises of the world, and make it more generally available. This is definitely an area where a technology is moving beyond its hype.”

About Bigleaf Networks:

Bigleaf Networks is the intelligent networking service that optimizes Internet and Cloud performance by dynamically choosing the best connection based on real-time usage and diagnostics. Inspired by the natural architecture of leaves, the Bigleaf Cloud-first SD-WAN platform leverages redundant connections for optimal traffic re-routing, failover and load-balancing. The company is dedicated to providing a better Internet experience and ensuring peace of mind with simple implementation, friendly support and powerful technology. Founded in 2012, Bigleaf Networks is investor-backed, with service across North America.

Bigleaf combines a simple on-site installation, intelligent hands-off operations, and redundancy at every level to turn commodity broadband connections into a worry-free, Enterprise-grade connection to your applications.

…………………………………………………………………………………………………………………………………………………………………………………………..

References:

Linksys and Qualcomm Launch the First 5G and Wi-Fi 6 Mobile Hotspot in Korea and Hong Kong

Linksys, the connected home division within the Belkin International and Foxconn Interconnect Technology (FIT) entity (formerly owned by Cisco Systems), has introduced the first 5G and Wi-Fi 6 Mobile Hotspot in Korea with Korea Telecom (KT), the largest Korean mobile carrier and in Hong Kong with CSL. The Linksys 5G Mobile Hotspot is powered by the Qualcomm® Snapdragon™ X55 5G Modem-RF System and Qualcomm® FastConnect™ 6800 mobile connectivity system.

The Linksys 5G Mobile Hotspot harnesses 5G and Wi-Fi 6 for blazing fast and seamless connectivity. The device is the world’s thinnest and lightest 5G mobile hotspot and includes a USB-C port with Qualcomm® Quick Charge™ Technology, ensuring devices are powered up and optimally connected at home or on-the-go.

The Linksys 5G Mobile Hotspot enables a fast and stable network by utilizing the latest Wi-Fi 6 standard and dual-band Wi-Fi (802.11ax) technologies. With USB tethering that supports large-capacity LTE high-speed data, users can stay connected regardless of what environment or situation they are in.

“Mobile hotspots are essential to use fast, seamless wireless networks in a variety of environments, enabling increased connectivity, mobility and productivity across many use cases,” said L.C. Wu, chief operating officer, Connected Home Division (Linksys, Wemo, Phyn), Belkin International. “Linksys is excited to launch the first 5G mobile hotspot supporting 5G and Wi-Fi 6 in Korea with KT and Hong Kong with CSL. We will continue to rollout new innovative 5G devices around the world, and expect many consumers will enjoy a fast and stable mobile life with our products.”

Additional specs include:

- The thinnest and lightest 5G mobile hotspot in the market – 15.5mm thickness and 185g weight

- Connects up to 16 devices

- 4000mAh battery capacity allows all-day usage

Linksys 5G (BKE-500) 5G/WiFi 6 mobile hotspot: Image Credit: Linksys

The Linksys Mobile Hotspot will deliver 5G supersonic speeds to 15+ devices, all day, and on the go. The ultra-thin and lightweight design and all-day battery life is a match made in tech heaven.

- Portable 5G supersonic speed and bandwidth

- WiFi 6 speeds up to 1.8 Gbps (AX1800), Handles 15+ Devices

- Ultra-thin design for maximum convenience

- All-Day Battery capacity to keep you connected at all times*

- Powered by leading edge 5G technology by Qualcomm®

- Quick charging through USB-C, QC3.0 certified

- Future-ready with the latest IPv6 internet protocol

………………………………………………………………………………………………………………………………………………………………………………………….

About Linksys

The Linksys brand has pioneered wireless connectivity since its inception in 1988, being the first router brand to ship 100 million units worldwide. Recognized for its award-winning Velop Intelligent Mesh™ Technology and integrated Linksys Aware WiFi motion sensing software, Linksys enables a connected lifestyle with simplified home and business control, enhanced security and seamless Internet access through innovative features and a growing application and partner ecosystem. Linksys products are sold in more than 60 countries and can be found in major retailers around the world.

About Belkin International

In 2018, Foxconn Interconnect Technology merged with Belkin International (Belkin®, Linksys®, Wemo®, Phyn®) to create a global consumer electronics leader. Today, this group leads in connecting people with technologies at home, at work and on the go within the accessories (“Connected Things” – Belkin brand) and the smart home (“Connected Home” – Linksys, Wemo and Phyn brands) markets.

Qualcomm Snapdragon, Qualcomm FastConnect and Qualcomm Quick Charge are products iof Qualcomm Technologies, Inc. and/or its subsidiaries.

……………………………………………………………………………………………………………………………………………………………………………………

References: