Verizon’s 2Q-2022 weak subscriber growth results in lower forecasts

Highlights of Verizon’s 2Q-2022 Earnings Report:

Total Broadband:

- Total broadband net additions of 268,000, including 256,000 fixed wireless net additions. Total broadband net additions increased 39,000 from first-quarter 2022, and fixed wireless net additions increased 62,000 from first-quarter 2022.

- 36,000 Fios Internet net additions.

Total Wireless:

- Total wireless service revenue of $18.4 billion, a 9.1 percent increase year over year.

- Total retail postpaid churn of 1.03 percent, and retail postpaid phone churn of 0.81 percent.

- Postpaid phone net additions of 12,000.

………………………………………………………………………………………………………………………………………..

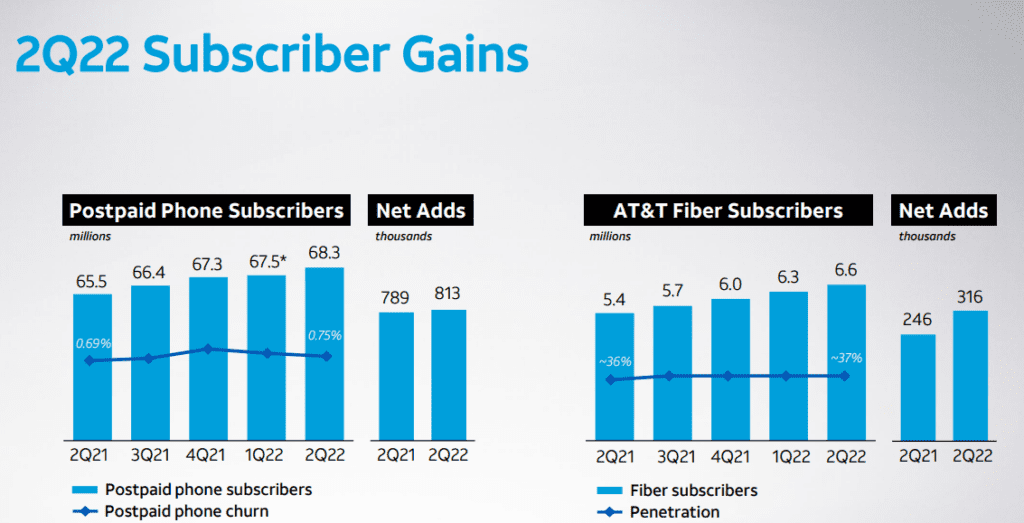

Verizon gained 12,000 postpaid wireless connections in the second quarter, a sign of relatively weak growth in its core customer base. Rival AT&T Inc. reported a net gain of 813,000 equivalent connections over the same span. Investors tend to track subscribers on postpaid mobile plans, which charge customers for monthly service after it is rendered, to measure wireless-company growth.

The weaker-than-expected customer additions prompted executives to raise rates for some midprice plans in June. The company also raised the monthly cost of some metered-data plans by $6 to $12 and boosted some consumer-plan fees. It added another monthly “economic adjustment charge” of up to $2.20 per line for business plans.

In the June quarter, Verizon’s net income decreased to $5.2 billion, down from $5.8 billion from the same period one year ago. On a per-share basis, its profit slipped to $1.24 from $1.40 a year earlier. Operating revenue was roughly flat from the previous year at $33.79 billion.

The company added 268,000 total broadband users in the second quarter, up 39,000 from the previous quarter. Verizon’s consumer segment struggled in the quarter, losing 215,000 postpaid phone subscribers due to an increase in churn and year-over-year decline in gross phone additions. Consumer operating income for the quarter fell 4.6% year over year to $7.2 billion.

Verizon’s business segment reported 430,000 wireless retail postpaid net additions, including 227,000 postpaid phone adds. Still, operating income for the segment was down 21.1% on an annual basis as wireless revenue declined.

Verizon said it expects wireless-service revenue growth of 8.5% to 9.5% in 2022, down from its earlier forecast of a 9% to 10% increase. The company also predicted its adjusted earnings would be flat to negative instead of growing this year.

In contrast, AT&T raised its wireless service revenue target, a sign it could be claiming some business from its rival. But its results also reflected some strain in consumers’ budgets. The company on Thursday lowered its free cash-flow target for 2022 due to costly smartphone promotions and customers taking slightly longer to pay their bills.

Verizon CFO Matt Ellis told analysts Friday that the company hadn’t seen “any noticeable change in the payment patterns from customers,” crediting the carrier’s “high-quality customer base.”

“We believe Verizon is currently between a rock and a hard place,” wrote CFRA Research analyst Keith Snyder. “On the one side you have AT&T, which is being extremely aggressive with promotions, and on the other, you have T-Mobile, who has a vastly superior 5G network currently.”

References:

https://www.verizon.com/about/news/verizon-reports-2q-and-first-half-2022-results

https://www.barrons.com/articles/verizon-earnings-guidance-51658490741

U.S. wireless carrier groups ask FCC for much larger 5G subsidies

U.S. rural wireless carriers want increased funding for 5G in the areas they serve. The FCC is planning to allocate $9 billion in the next few years to help finance the construction of 5G networks in rural parts of the U.S. However, rural carriers want more. A lot more.

“For many carriers, upgrading to 5G in remote areas will not generate new revenues from existing customers, and likely will not attract many new ones,” wrote the Coalition of Rural Wireless Carriers in a recent filing to the FCC. “Accordingly, the commission should include in any proceeding it opens a proposal to develop a mechanism for providing support for operations and maintenance, to ensure that facilities in remote areas remain operational and that carriers have an opportunity to upgrade them.”

The Coalition of Rural Wireless Carriers membership is comprised of Bristol Bay Cellular Partnership; Carolina West Wireless, Inc.; Cellular Network Partnership, a Limited Partnership, d/b/a Pioneer Cellular; Cellular South Licenses, LLC d/b/a C Spire; East Kentucky Network, LLC, dba Appalachian Wireless; NE Colorado Cellular, Inc. d/b/a Viaero Wireless; Nex-Tech Wireless, LLC; Smith Bagley, Inc.; Union Telephone Company dba Union Wireless; United States Cellular Corporation; and United Wireless Communications, Inc.. A number of these operators have already embarked on 5G deployments.

The Coalition asked the FCC to recommend that Congress update the universal service contribution mechanism, as per this statement in their FCC filing:

“It its upcoming report, the FCC should recommend that Congress enact urgently needed revisions to the universal service contribution mechanism. While the Coalition agrees that the Commission likely has authority to assess broadband under the current classification of broadband service, use of that authority is certain to be challenged in court, delaying a final resolution of the matter for years to come. Congress is best positioned to update the contribution mechanism, including addressing the issue of whether edge providers should contribute to universal service.”

“It is clear that consumers view access to wireless connectivity as vital. Unfortunately, many parts of the United States, especially rural America, are at risk of being left behind,” wrote the Competitive Carriers Association (CCA) [1.] in its filing to the FCC. The CCA represents many of the nation’s smaller wireless network operators. The group argued that more FCC funding is needed to address what it calls the “5G gap.”

Note 1. CCA was founded in 1992 by nine rural and regional wireless carriers as a carrier centric organization. Since its founding, CCA has grown to become the nation’s leading association for competitive wireless providers serving all areas of the United States. CCA is committed to being the premier advocacy organization for competitive wireless carriers and stakeholders. CCA will use advocacy, leadership, education, and networking opportunities to help competitive carriers grow and thrive in the wireless industry.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Both the CCA and the Coalition of Rural Wireless Carriers pointed to a recent 5G network buildout model released by financial analysis firm CostQuest. That firm’s report found that $36 billion is needed to support ubiquitous 5G connectivity in the US – far more than the $9 billion the FCC set aside in 2020 for its 5G Fund.

“Establishing the 5G Fund further secures United States leadership in 5G and will close the digital divide and bring economic opportunities to rural America,” the agency argued at the time.

However, FCC officials have said that they plan to wait to allocate the 5G Fund until after the agency finishes developing updated maps that show where broadband is available in the US – and where it is not. The Coalition wrote in their FCC Filing:

“With respect to the 5G Fund, we urged the Commission to rectify the prior Commission’s premature decision to adopt a rule providing that areas currently receiving unsubsidized 4G LTE service are ineligible for inclusion in the 5G Fund auction. Under the current rule, a rural area that has unsubsidized service at, for example, 5/1, 6/1, or 7/1 Mbps (downstream/upstream bit rates) will be ineligible for universal service investment for a decade. To say to rural citizens that their current service — which is well below typical 5G standards — is what they can expect to receive until the mid-2030s, directly contradicts Section 254(b)(3) of the Act which requires the Commission to develop policies that make rural service quality reasonably comparable to that in urban areas.”

The FCC is aware of this conundrum. “For too long, our broadband maps have been a patchwork with information gaps that impeded the ability of policymakers to assure that critical funding efforts could be precisely targeted to deploying broadband facilities to consumers and communities most in need,” according to FCC Chairwoman Jessica Rosenworcel.

“We asked the commission to report to Congress that it intends to open a proceeding to develop a record on whether the size of the 5G Fund should be substantially increased to accelerate and sustain mobile broadband investment. We also asked the commission to consider in such a proceeding whether it should develop a middle-mile fiber funding program to increase fiber connectivity to cell towers located in remote areas,” the Coalition of Rural Wireless Carriers concluded.

References:

https://www.fcc.gov/ecfs/search/search-filings/filing/10719203442014

https://www.fcc.gov/ecfs/search/search-filings/filing/106302599815573

https://irp.cdn-website.com/cd1ed710/files/uploaded/CostQuest%20National%205G%20Model.pdf

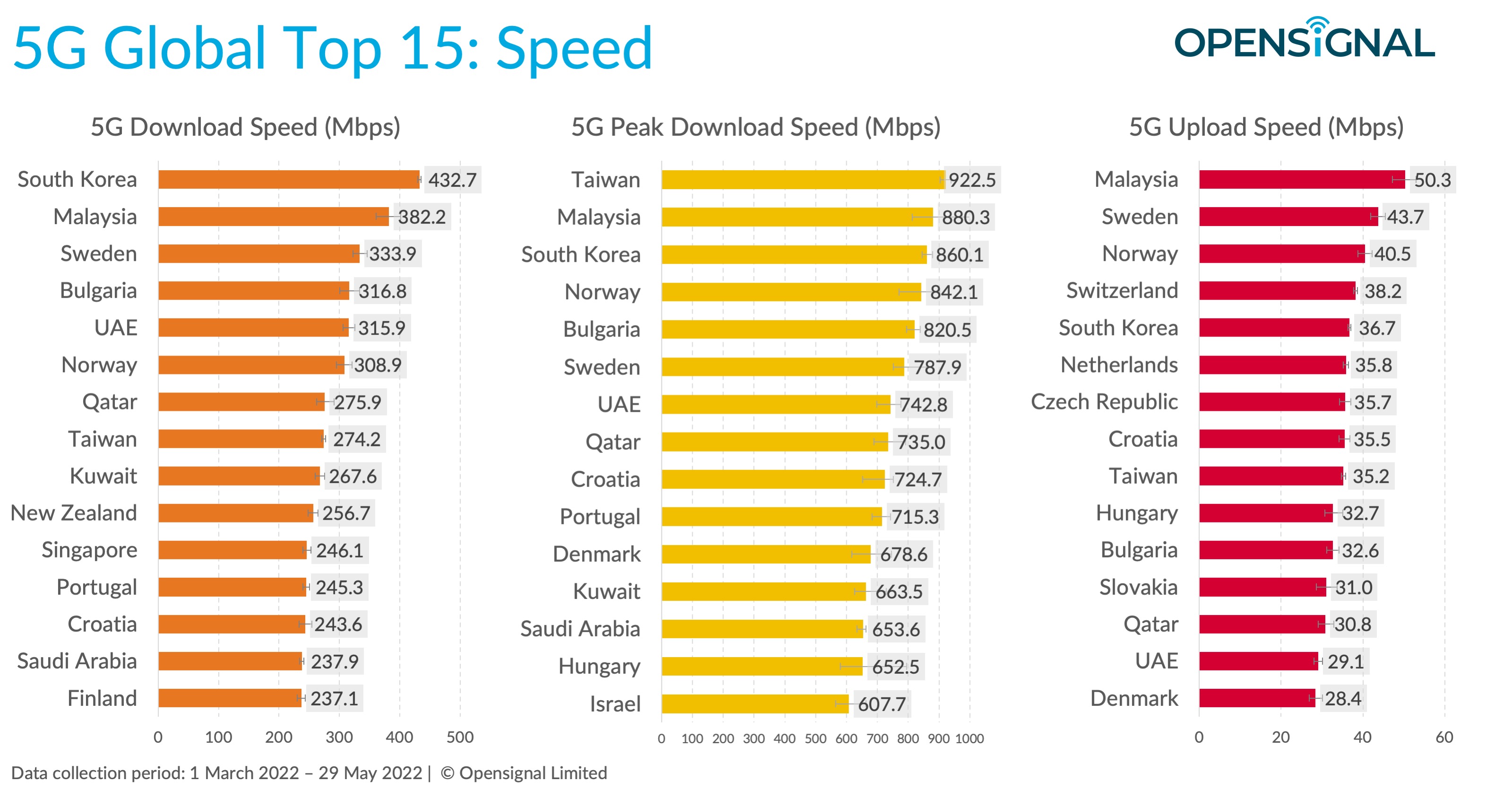

Opensignal: South Korea leads in 5G download speed; Philippines posts highest improvement in 5G video experience

Among the 15 markets with 5G improvements ranked by Opensignal, South Korea’s 432.7 Mbps was first, followed by Malaysia’s 382.2 Mbps and Sweden’s 333.9 Mbps (see table below). The Philippines maintains the second lowest 5G speed of 138.6 Mbps, only ahead of Thailand’s 122.7 Mbps. Malaysia led all markets on the ratio of download speed improvement with its 5G about 26 times faster than its 4G, but Opensignal said there are only a few subscribers in the country and 5G speed could decline when adoption increases.

The Philippines has recorded the highest improvement in 5G video experience in the world as telco giants continue to invest heavily in network expansion to enhance internet speed. Opensignal said the country topped all markets worldwide in terms of improvement in mobile video streaming experience using 5G.

“The Philippines continues to see a tremendous uplift with the shift from 4G to 5G by topping the 5G Video Experience uplift category with a 79 percent increase in its score,” Opensignal said.

The Philippines bested the 73 percent boost in 5G video experience in Malaysia, 64 percent in Chile and Thailand and 61 percent in Indonesia.

5G usage for video would continue to increase due to the superiority of its streaming quality when compared to 4G. “With Opensignal’s new video streaming tests including higher resolutions that are more suited to a 5G world, we see greater difference in video streaming experience using 5G compared with 4G. The uplift with 5G is now considerably higher,” Opensignal said.

According to Opensignal, the Philippines ranked third on the difference in internet speed between the two technologies, with 5G here nearly nine times faster than 4G. “Excluding Malaysia, Chile continues to top the 5G download speed uplift table, followed by the Philippines with the same position as in the last benchmark comparison,” Opensignal said.

In the Philippines, Smart Communications and Globe Telecom offer 5G to subscribers, leaving behind telco newcomer Dito Telecommunity in the competition.

For the year, Smart’s parent PLDT Inc. is spending P85 billion for its capital expenditures to be used for the firm’s increased commitment in 5G roll out.

Meanwhile, Globe installed 380 new 5G sites in the first quarter as part of efforts to hook up as many users to 5G as possible.

References:

https://www.opensignal.com/reports/2022/04/philippines/mobile-network-experience

https://www.opensignal.com/2022/06/22/benchmarking-the-global-5g-experience-june-2022

AT&T added 813K mobile postpaid subscribers & >300K net fiber subs during 2Q-2022

AT&T remains committed to investing in its network operations, including a focus on its 5G and fiber-optic related assets. AT&T gained 813,000 mobile postpaid subscribers during the quarter that ended in June, more than doubling analyst predictions and raising its wireless revenue forecast for 2022.

AT&T posted flat results for its now dominate communications segment, which includes its 5G wireless, wireline, and fiber operations. Segment revenues increased 2% year over year to $28.7 billion. However, increased costs and a loss of wireline customers dropped segment operating income by 2.1% to $7.2 billion.

AT&T CEO John Stankey said on today’s earnings call:

“In Fiber, we continue to invest in building out a premium network, drive a great build velocity and deliver on our stated expectations for accelerated customer growth through improved penetration rates. We’re finding success in serving more customers in new and existing markets with what we believe is the best wired Internet offering available. This is evidenced by our more than 300,000 second quarter AT&T Fiber net adds, marking our 10th straight quarter with more than 200,000 Fiber net adds.

The strength and value of the AT&T Fiber experience is enabling us to increase share in our Fiber footprint and convert more IP broadband Internet subscribers to Fiber subscribers. Ultimately, our Fiber strategy is a sustainable and long-term technology play that will support key macro trends.

We expect to see a continuation of favorable ARPU trends as we expand the availability of what we believe is a best-in-class network with a multi-decade lifespan. So I’m very pleased with the strong customer growth we’re seeing.

Our success only reinforces the improved value proposition we’re providing, and we expect our investment in top-tier technology to translate into strong resiliency for our services for years to come.

Over the last eight quarters, we’ve achieved an industry-best six million postpaid phone net adds while adding nearly 2.3 million AT&T Fiber customers, increasing our Fiber subscriber base by more than 50%. I’m also very proud with the progress our teams have made in rapidly expanding our 5G and fiber footprints.

I’m pleased to say that we’ve achieved our target of covering 70 million mid-band POPs 2 quarters ahead of our year-end target, and are now on track to approach 100 million mid-band POPs by the end of this year.”

……………………………………………………………………………………………………………………………………………..

AT&T reduced its free cash flow expectations (FCF), saying that customers were paying bills later than usual due to economic stress. AT&T said it now expects 2022 free cash flow of $14 billion. About $1 billion of the difference was tied to the “timing of customer collections.”

The gloomier FCF outlook overshadowed second-quarter results that topped estimates for profit and wireless subscriber growth.

…………………………………………………………………………………………………………………………………

AT&T CFO Pascal Desroches told investors that AT&T was bracing for a delay in consumers paying their bills due to surging recession concerns. He explained that “it’s taking about two more days than last year to collect customer receivables,” which resulted in a $1 billion impact in Q2, and that AT&T had around $130 million in higher bad debt expense.

“While bad debt is now slightly higher than pre-pandemic levels, it is being offset by better than expected customer revenue growth,” Desroches said, citing recent price increases.

Desroches also warned that AT&T was cutting its full-year free-cash-flow guidance from $16 billion down to $14 billion due to ongoing economic and recession uncertainty. That cut looked modest next to the carrier only posting $4 billion in free cash flow for the first half of the year, which was well below expectations.

The executive explained that AT&T had front-loaded its $24 billion in full-year capex due to its mid-band 5G and fiber deployments. This will lessen second-half spend needs, though AT&T remains committed to spending another $24 billion on capex in 2023.

“It underscores the importance of transitioning to our own operating connectivity services as well as rolling 5G and fiber integrated solutions,” Desroches said of its capex push. “In fact, our connectivity services revenue growth continues to accelerate as we are up nearly 15% year over year. Both areas, business 5G and fiber, continue to perform well.”

AT&T has previously stated that its ability to tie together its 5G and fiber networks allow it to better support enterprise SD-WAN, secure access service edge (SASE), and security needs. The carrier has struck a number of deals with vendors like Cisco, Fortinet, and Palo Alto Networks to power these SD-WAN, SASE, and security initiatives.

“As people migrate away from VPN and we have a more dense fiber base, we’re selling more fundamental underlying transport, frankly, at higher speeds and therefore higher connection values in that segment of the market, and that’s where our future is,” added AT&T CEO John Stankey on the Q2 call.

Analyst Craig Moffett Comments:

To be sure, AT&T’s results in Mobility haven’t been bad. They’ve walked a tightrope of heavy promotions in return for good-enough subscriber growth, and, up to now. On the back

of those passably good results in Mobility, the company has (arguably) provided at least some degree of confidence that they can sustain their new, lowered, dividend.

Meanwhile, they’ve promised faster capital spending on fiber deployment in their Consumer Wireline segment, something they have promised will result in at least positive longer-term growth in a segment that accounts for about 10% of revenues. (They’ve largely been silent about their much larger Business Wireline segment, which is shrinking badly and still getting worse).

AT&T’s consolidated growth prospects rest entirely on their Mobility segment. Their Business Wireline segment, which represents nearly 20% of revenues, is shrinking by high single digits, while their Consumer Wireline segment is at best marginally better than flat. Their Mobility segment has maintained modest service revenue growth through a mix of relatively rapid subscriber growth, offset by shrinking ARPU. Mobility is AT&T’s largest and most important business, accounting for two-thirds of consolidated pro forma revenues.

Subscriber growth trends remain very strong:

• AT&T added 1.06M post-paid subscribers, much better than the Street consensus expectation of 804K, in line with last year’s 1.16M.

• Better still, they added 813K post-paid phone subscribers on an as-reported basis, and with migrations (for comparability to the reporting of the other carriers), would have been a still-impressive 793K. Reported post-paid phone net additions were much better than consensus of 562K, and better than last year’s 789K.

• Pre-paid net additions of 231K also beat Street consensus of 131K, but were down from last year’s 297K gain.

We won’t know the industry’s growth rate until everyone else has reported, but it seems clear that AT&T is gaining unit market share. At their heart of their subscriber gain story is low churn. AT&T’s “best deals for all” promotion continues to keep churn very low.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

According to Seeking Alpha, six analysts rate AT&T stock (“T”) a Strong Buy, while seven have a Buy rating on the stock. 15 analyst rate “T” as a Hold, while there are 0 Sell recommendations.

References:

https://investors.att.com/financial-reports/quarterly-earnings/2022

Oracle and Microsoft Enhance Interoperability of their Cloud Platforms (facilitating multi-cloud)

At Microsoft Inspire, an online event for Microsoft partners, Oracle and Microsoft announced a deeper interoperability of their cloud platforms which will permit customers to more easily run projects across their two cloud platforms. The new service connects Oracle’s database service directly to the Azure cloud, eliminating custom work that previously would have been required.

With the general availability of Oracle Database Service for Microsoft Azure, Microsoft Azure customers can easily provision, access, and monitor enterprise-grade Oracle Database services in Oracle Cloud Infrastructure (OCI) with a familiar experience. Users can migrate or build new applications on Azure and then connect to high-performance and high-availability managed Oracle Database services such as Autonomous Database running on OCI.

Years ago, many cloud providers tried to lock customers into a single platform, but that is no longer feasible as the cloud has become more central to operations. Customers typically use multiple clouds, and cloud platform providers such as Microsoft and Oracle are adapting to that multi-cloud environment. About two-thirds of enterprise-level companies use multiple clouds (AKA multi-cloud), according to a May 2021 report by Boston Consulting Group.

Since 2019, when Oracle and Microsoft partnered to deliver the Oracle Interconnect for Microsoft Azure, hundreds of organizations have used the secure and private interconnections in 11 global regions.

Microsoft and Oracle are extending this collaboration to further simplify the multicloud experience with Oracle Database Service for Microsoft Azure. Many joint customers, including some of the world’s largest corporations such as AT&T, Marriott International, Veritas and SGS, want to choose the best services across cloud providers to optimize performance, scalability, and the ability to accelerate their business modernization efforts. The Oracle Database Service for Microsoft Azure builds upon the core capabilities of the Oracle Interconnect for Azure and enables customers to more easily integrate workloads on Microsoft Azure with Oracle Database services on OCI. Customers are not charged for using the Oracle Database Service for Microsoft Azure or for the underlying network interconnection, data egress, or data ingress between Azure and OCI. Customers will pay only for the other Azure or Oracle services they consume, such as Azure Synapse or Oracle Autonomous Database.

“Over the last couple years we have had a lot of success with Oracle Interconnect for Microsoft Azure. And we also got a lot of customer feedback. And one of the things that customers (said) was, ‘Hey, it’s great you are working together, but we really would like a more integrated experience,’” said Clay Magouyrk, executive vice president, Oracle Cloud Infrastructure.

“Microsoft and Oracle have a long history of working together to support the needs of our joint customers, and this partnership is an example of how we offer customer choice and flexibility as they digitally transform with cloud technology. Oracle’s decision to select Microsoft as its preferred partner deepens the relationship between our two companies and provides customers with the assurance of working with two industry leaders,” said Corey Sanders, corporate vice president, Microsoft Cloud for Industry and Global Expansion. “The ability to benefit from both clouds, and the flexibility, is a real win for customers,” Sanders added.

“There’s a well-known myth that you can’t run real applications across two clouds. We can now dispel that myth as we give Oracle and Microsoft customers the ability to easily test and demonstrate the value of combining Oracle databases with Azure applications. There is no need for deep skills on either of our platforms or complex configurations—anyone can use the Azure Portal to harness the power of our two clouds together,” said Clay Magouyrk, executive vice president, Oracle Cloud Infrastructure.

“Multi-cloud takes on a whole new meaning with the launch of the Oracle Database Service for Microsoft Azure. This service, designed to provide intuitive, simple access to the Exadata Database Service and Autonomous Database to Azure users in a transparent manner, responds to the critical need of Azure and Oracle customers to apply the benefits of the latest in Oracle Database technology to their Azure workloads. This combined and interactive connection of services across public clouds sets the stage for what a multi-cloud experience should be, and is a bold statement about where the future of cloud is heading. It should deliver huge benefits for customers, developers, and the cloud services landscape overall,” said Carl Olofson, research vice president, Data Management Software, IDC.

With the new Oracle Database Service for Microsoft Azure, in just a few clicks users can connect their Azure subscriptions to their OCI tenancy. The service automatically configures everything required to link the two cloud environments and federates Azure Active Directory identities, making it easy for Azure customers to use the service. It also provides a familiar dashboard for Oracle Database Services on OCI using Azure terminology and monitoring with Azure Application Insights.

“Many of our mission-critical workloads are running Oracle databases on-premises at massive scale. As we move these workloads to the cloud, Oracle Database Service for Azure enables us to modernize these Oracle databases to services such as Autonomous Database in OCI while leveraging Microsoft Azure for the application tier,” said Jeremy Legg, chief technology officer, AT&T. Watch the video.

“Multi-cloud architectures enable us to choose the best cloud provider for each workload based on capabilities, performance, and price. The OCI and Azure partnership integrates the capabilities of two major cloud providers, including the Oracle Database services in OCI and Azure’s application development capabilities,” said Naveen Manga, chief technology officer, Marriott International. Watch the video.

“Oracle Database Service for Microsoft Azure has simplified the use of a multicloud environment for data analytics. We were able to easily ingest large volumes of data hosted by Oracle Exadata Database Service on OCI to Azure Data Factory where we are using Azure Synapse for analysis,” said Jane Zhu, senior vice president and chief information officer, Corporate Operations, Veritas.

“Oracle Database Service for Microsoft Azure simplifies our multi-cloud approach. We’re going to be able to leverage the best of Oracle databases in Azure, and we are going to be able to keep our infrastructure in Azure. This is a great opportunity to have the best of the two worlds that eases our migration to the cloud and improves the skills of our people in IT,” said David Plaza, chief information officer, SGS. Watch the video.

References:

https://www.oracle.com/bd/news/announcement/oracle-database-service-for-microsoft-azure-2022-07-20/

https://www.spiceworks.com/tech/cloud/articles/multi-cloud-vs-hybrid-cloud/

Microsoft unveils Azure Space Partner Community to shape the future of space technologies and services

Microsoft is expanding its relationships with space companies through the Azure Space Partner Community, an initiative unveiled July 19 at the Microsoft Inspire 2022 conference.

The Azure Space Partner Community enables Microsoft’s partners to deliver the most comprehensive and innovative offerings to joint customers, helping to shape the future of space technologies and services. The space industry is rapidly advancing and we believe in the power of bringing together this community in an ecosystem.

This ecosystem is enabled with opportunities such as co-engineering, go-to-market scaling and support, alongside many other benefits designed to empower our partners. We are excited to rapidly innovate and advance the industry with our inaugural cohort of partners, and we look forward to welcoming new partners in the days to come.

“By launching the Azure Space Partner Community, we can enable our partners to deliver the most comprehensive and innovative offerings to our joint customers, and help shape the future of space technologies and services,” Stephen Kitay, Microsoft Azure Space senior director, told SpaceNews. “This is an ecosystem of space partners with exclusive access to technical support and scaling solutions.”

Microsoft’s inaugural cohort of space-related partners are Airbus, Amergint, Ball Aerospace, blackshark.ai, Esri, Hewlett Packard Enterprise, iDirect, Intelsat, Kratos, KSAT, Loft Orbital, Nokia, Omnispace, Orbital Insight, SES, SkyWatch, SpaceX, Thales Alenia Space, US Electrodynamics, Viasat and Xplore.

Image Credit: Microsoft

……………………………………………………………………………………………………………………………..

“We look forward to welcoming new partners in the days to come,” Kitay said.

Microsoft has played a growing role in the space sector since announcing plans in 2020 to help customers move data directly from satellites into the Azure cloud for processing and storage.

“We’ve increasingly seen an opportunity for this community to benefit from Microsoft engineering and go-to-market resources,” Kitay said.

Azure Space Community partners will have access to Microsoft sales and engineering specialists, go-to-market scale and support, and guidance related to marketing and community involvement. In addition, Azure Space Partners will be eligible for incentives like Azure credits, sponsored accounts and volume discounts.

By establishing the Azure Space Community, Microsoft is “creating more of a structure” to clearly convey the benefits of membership and enable the tech giant to “efficiently onboard” new partners, Kitay said.

Through the Azure Space Partner Community (which falls under the broader Microsoft Partner Program), Microsoft also is acknowledging the growing importance of the space sector.

“It is absolutely representative of the value and importance that Microsoft is placing on this industry and our excitement about growing alongside these partners,” Kitay said. “Space is a big data domain, where massive amounts of data are either moving through space with connectivity solutions or being collected from space and transmitted to the Earth. The need to process that, understand it and then connect it with customers is vitally important.

……………………………………………………………………………………………………………………………………

Program Details and Deliverables:

Image Credit: Microsoft

Co-innovation and engineering:

The Azure Space Partner Community will have direct access to Microsoft engineering and specialist resources to turn our partnership vision into reality, including:

- Participation in Azure Space training to learn about and onboard the latest Azure Space technologies.

- Collaboration and innovation with our engineering and sales specialist teams for customer proof of concepts to demonstrate the value of our partnership.

- Access to quarterly Azure Space NDA roadmap reviews and newsletters, and ability to directly influence the produce roadmap.

- Partner highlighting in reference architectures and training materials.

- Priority access to early adopter and private preview programs.

Go-to-market scale and support:

Our Azure Space Partner Community will be able to increase their go-to-market opportunities by participating in the following opportunities:

- Microsoft first party product integration or add-ins, such as in Teams, Power BI, or productivity tools.

- White glove onboarding to the Microsoft Cloud Partner Program, to become a cloud solution provider or managed solution provider via direct or indirect channels.

- Support onboarding to the Azure Marketplace as an indirect or transactable offer, with access to a broad set of Azure sellers and customers.

- Joint go-to-market coordination with a regular cadence of customer pipeline reviews.

Marketing and community involvement:

Azure Space provides a unique opportunity for our partners to expand their marketing through public outreach via our marketing channels, such as:

- Opportunities to be showcased in Microsoft customer presentations and sales training.

- Participation in space and spectrum focused Microsoft events – such as BUILD, Inspire or sales readiness.

- Joint public relations and marketing opportunities, such as press releases, blogs, and speaking events at conferences.

Product offering incentives:

The Space Partner Community will also have special access to our premier incentives offered for Azure Space product offerings:

- Azure credits, sponsored accounts, and volume discounts in return for Microsoft Azure Consumption Commitment.

- Enterprise Agreement Programs, such as Licensed Service Providers (LSPs) and Azure Online Services Government (AOSG), with rebates based on resell criteria.

- FastTrack dedicated modernization and migration architecture support for qualified opportunities.

- Many other Microsoft Partner Network benefits, such as credits for gold competencies and partner marketing benefits via co-sell programs.

References:

https://www.microsoft.com/azure/partners/news/article/announcing-the-azure-space-partner-community

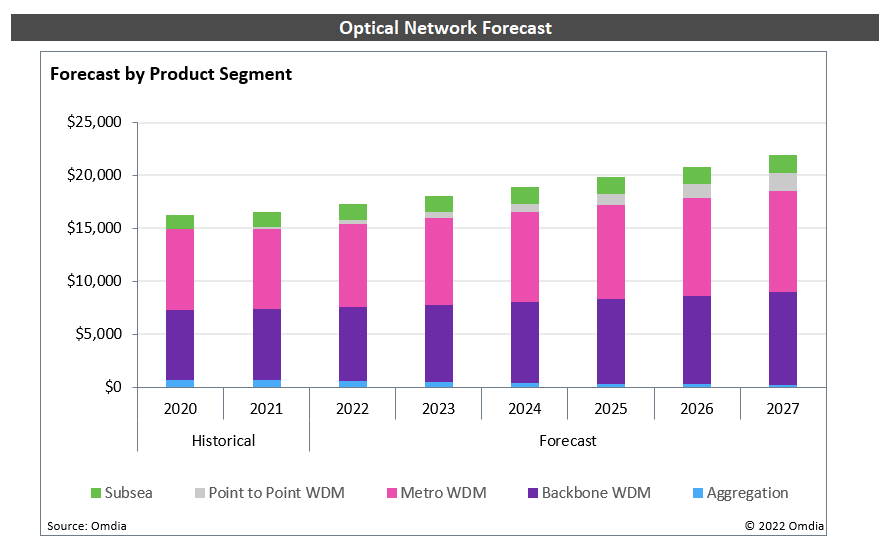

Dell’Oro: DWDM equipment market to exceed $17 billion by 2026

Demand for optical transport DWDM equipment is forecast to exceed $17 billion by 2026, according to a new Dell’Oro Group report.

The $17 billion in revenue for dense wavelength-division multiplexing (DWDM) equipment represents the bulk of revenue for the total optical transport equipment market. Dell’Oro forecasts the total market to grow at a 3% compound annual growth rate (CAGR) to $18 billion by 2026 as a result of sales of DWDM systems delivering wavelength speeds over 200 Gbit/s.

“Although there is a ton of market turbulence, we do not see demand for DWDM equipment letting up,” said Jimmy Yu, Vice President at Dell’Oro Group. “In fact, the biggest issue is that demand seems to be growing faster than supply. Hence, even if a mild recession were to occur, we think the worst case scenario is that demand will align with supply sooner.

“Hence, we are projecting continuous growth for DWDM system revenues. The only difference over the next five years, compared to previous years, is that we are expecting more growth from DWDM Long Haul since IPoDWDM should lower the use of WDM Metro systems in data center interconnect,” added Yu.

Dell’Oro predicts that DWDM long-haul revenue will grow at a five-year CAGR of 5%. Over the same period, the research group forecasts that metro WDM revenue will grow at a CAGR of 3%.

Additional highlights from the Optical Transport 5-Year July 2022 Forecast Report:

- DWDM Long Haul revenue is forecasted to grow at a five-year compounded annual growth rate (CAGR) of 5 percent.

- WDM Metro revenue is forecasted to grow at a five-year CAGR of 3 percent.

- Capacity shipments each year are projected to grow at an average annual rate of 30+ percent.

- Spectral efficiency is expected to improve at an average annual rate of 9 percent.

Dell’Oro forecasts that DWDM long-haul system sales will grow faster than wavelength division multiplexing (WDM) metro system sales over this five-year period. While the DWDM market is experiencing quite a bit of “market turbulence,” demand is not expected to decrease, said Jimmy Yu, VP at Dell’Oro Group, in a statement.

Capacity shipments each year are projected to grow at an average annual rate of over 30%, according to Dell’Oro. The group also predicts that spectral efficiency will improve at an average annual rate of 9%.

Overall, the optical transport equipment market grew 2% year-over-year in Q1, largely from increased market growth in the Americas, according to another recent report by Dell’Oro. The war in Ukraine, COVID lockdowns, supply chain constraints and inflation all contributed to a decline in the optical transport equipment market in Europe, the Asia-Pacific and China.

…………………………………………………………………………………………………………………………………….

Researchers at Omdia are also bullish about growth in the optical network market, which they project will exceed $20 billion by 2027. Analysts at Omdia forecast that the metro WDM market will exceed $9 billion by 2026.

References:

Optical Transport DWDM Equipment Market to Surpass $17 Billion by 2026, According to Dell’Oro Group

Verizon boost 5G Ultra Wideband capacity and availability with C-band spectrum

Highlights:

- Verizon has started deploying with 100 MHz of C-band spectrum in many markets across the US – a significant increase from the 60 MHz it has deployed in 5G markets to date.

- In the recent trial, using 100 MHz of C-band spectrum, engineers were able to reach 1.4 Gbps peak download speeds near active cell sites and 500 Mbps further away from the towers.

- As more spectrum is cleared in the coming months and years, customers ultimately will have access to between 140-200 MHZ across the nation.

Verizon said it started deploying nearly double the amount of C-band spectrum on its 5G network in order to boost capacity. A recent trial with 100 MHz carriers of the C band delivered peak download speeds of 1.4 Gbps near active cell sites and 500 Mbps further away from the towers.

Since it started the roll-out of the C band earlier this year, Verizon has been using blocks of 60 MHz. After recent successful trials of 100 MHz carriers, Verizon has started deploying the larger capacity in many markets across the US, the company announced. In addition to higher speeds and greater capacity for mobile customers, the extra spectrum is expected to support more 5G home broadband and business internet services for customers.

“This increase from using 60MHz to 100 MHz of C-band – which we will ultimately have available in many markets across the US – allows us to support more network traffic, deliver even better performance to our customers and add new products and services on top of the mobile and fixed wireless access solutions we provide today,” said Kyle Malady, EVP and President, Global Networks and Technology. “Reaching new levels of innovation and digital transformation in our society requires a fundamental transformation of the networks our world runs on. The continued evolution of our network is paving the way for this tremendous growth.”

In the recent trial, using 100 MHz of C-band spectrum, engineers were able to reach 1.4 Gbps peak download speeds near active cell sites and 500 Mbps further away from the towers. This additional spectrum is being made available to customers in certain markets several months earlier than projected due to agreements with satellite providers to clear C-Band spectrum (which was originally scheduled to be cleared in December 2023). With the start of commercial deployment with 100 MHz of C-band, customers now have access to more spectrum than ever before. And there is still much runway ahead. As more spectrum is cleared in the coming months and years, customers ultimately will have access to between 140-200 MHz of C Band spectrum across the nation.

This additional spectrum is being made available to customers in certain markets several months earlier than projected due to agreements with satellite providers to clear the C-band spectrum. It was originally scheduled to be cleared only in December 2023. As more spectrum is cleared in the coming months and years, customers ultimately will have access to between 140-200 MHz of C Band spectrum across the nation.

References:

https://www.telecompaper.com/news/verizon-boost-5g-capacity-with-extra-c-band-spectrum–1431401

https://www.verizon.com/about/news/verizon-provide-5g-ultra-wideband-service-more-cities-year

Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

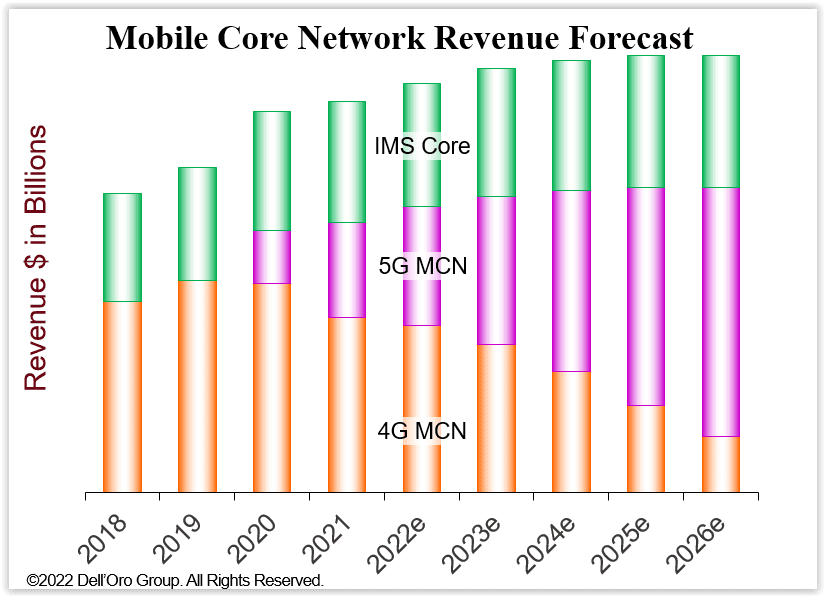

According to a newly published Dell’Oro Group report, Mobile Core Network (MCN) market growth will be decreasing. Worldwide MCN 5-year growth is now forecasted at a 2% compounded annual growth rate (CAGR), compared to our January 2022 forecast of 3% CAGR.

“The July 2022 forecast is more conservative than the January 2022 forecast due to industry headwinds, including supply chain challenges, higher inflation, an impending recession, Mobile Network Operators’ (MNO) challenges to increase revenues, and regional political conflicts,” said Dave Bolan, Research Director at Dell’Oro Group. “As a result, we reduced the 2022 to 2026 cumulative revenue forecast by 6 percent, decreasing revenues by $3.2 B. The July 2022 cumulative revenue forecast (2022-2026) is now $50.3 B resulting in a 2 percent CAGR.

“We are tracking the number of 5G Standalone (5G SA) MBB networks that have been launched commercially by MNOs. In the first half of 2022, only three new 5G SA networks were launched, KDDI in Japan, DISH Wireless in the US, and China Broadnet in China bringing the total deployed around the world to 27 MNO 5G SA MBB networks,” Bolan added.

Additional highlights from the MCN 5-Year July 2022 Forecast report:

- Year-over-year (Y/Y) MCN revenue growth rates for each year in the forecast are positive but will decrease each year; by 2026, Y/Y revenues will be essentially flat.

- MCN market CAGR forecast by industry segments we expect 5G MCN to be 21 percent, 4G MCN -20 percent, IMS Core 2 percent, and the User Plane Function (UPF) required for Multi-access Edge Computing (MEC) 67 percent.

- The North America and China regions are expected to have the lowest CAGRs, while Europe, Middle East, and Africa (EMEA), and Asia Pacific without China regions are expected to have the highest CAGRs.

Dell’Oro Group’s Mobile Core Network & Multi-Access Edge Computing 5-Year January Forecast Report offers a complete overview of the market for Wireless Packet Core including MEC for the User Plane Function, Policy, Subscriber Data Management, and IMS Core with historical data, where applicable, to the present. The report provides a comprehensive overview of market trends by network function implementation (Non-NFV and NFV), covering revenue, licenses, average selling price, and regional forecasts for various network functions. To learn more about this report, please contact us at [email protected]

………………………………………………………………………………………………………………………………………………

In a related Dell’Oro “Private Wireless Advanced Research Report,” Stefan Pongranz states that private wireless radio access network (RAN) shipments and revenues are coming in below expectations, resulting in another decreased forecast.

“We have not made any changes to the potential market calculations and still estimate private wireless is a massive opportunity,” said Stefan Pongratz, Vice President at Dell’Oro Group. “At the same time, the message we have communicated for some time still holds – we still envision the enterprise and industrial play is a long game. This taken together with the fact that the standalone LTE/5G market is developing at a slower pace than previously expected forms the basis for the near-term downgrade,” continued Pongratz.

Additional highlights from the Private Wireless Advanced Research Report:

- Private wireless projections have been revised downward to reflect weaker than expected progress with private wireless LTE and 5G small cells.

- Total private wireless RAN revenues, including macro and small cells, are projected to roughly double between 2022 and 2026.

- Standalone private LTE/5G is now expected to account for a low single-digit share of the total RAN market by 2026.

Dell’Oro Group’s Private Wireless Advanced Research Report with a 5-year forecast includes projections for Private Wireless RAN by RF Output Power, technology, spectrum, and region. To purchase this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, enterprise networks, data center infrastructure, and network security markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

Industry Headwinds to Decrease Mobile Core Network Market Growth, According to Dell’Oro Group

Private Wireless Forecast Adjusted Downward, According to Dell’Oro Group

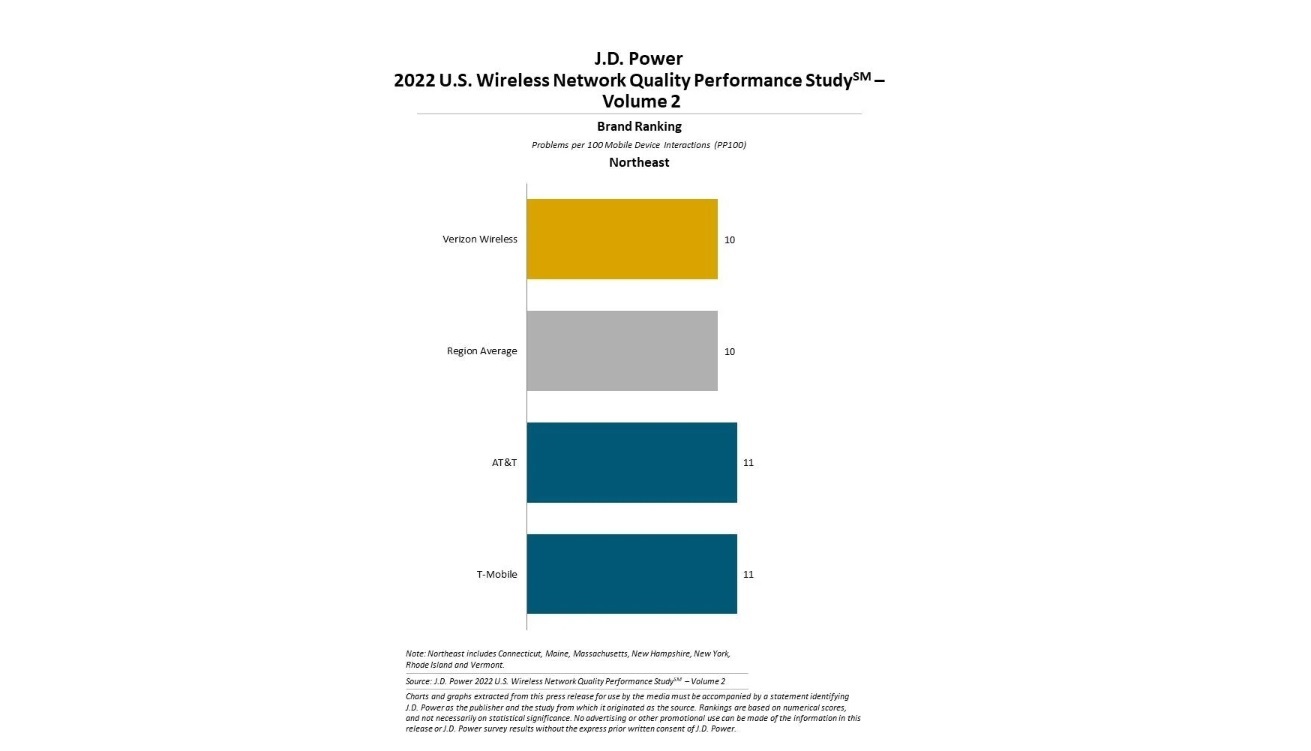

JD Power: US cellular network quality declines – users cite slow or failure to load content

US cellular network quality has recently declined, according to a new study released this week by J.D. Power. That metric comes as as more devices were loaded onto their respective networks and used for streaming and other types of data-hungry applications. The most common reported problem is slow or failure to load content.

“An uptick in wireless and device usage was bound to catch up to network quality,” said Ian Greenblatt, managing director at J.D. Power. “Wireless customers are increasingly adept in data usage and streaming, meaning they’re less inspired and more aware of problems. While the number of problems is significantly lower when 5G is available, the most influential problems on network quality ratings continue to be streaming audio and video quality, low loading times and calls not going through.”

Verizon Wireless ranks highest in five regions evaluated in the study, achieving the fewest network quality problems per 100 connections (PP100) in call quality; messaging quality; and data quality in the Mid-Atlantic, North Central, Northeast, Southeast and West regions.

AT&T ranks highest or is tied in all factors in the Southwest region with a score of 11 PP100, achieving the fewest network quality problems in call quality in the region.

The 2022 U.S. Wireless Network Quality Performance Study—Volume 2 is based on responses from 34,174 wireless customers. Carrier performance is examined in six regions: Mid-Atlantic, North Central, Northeast, Southeast, Southwest and West. In addition to evaluating the network quality experienced by customers with wireless phones, the study also measures the network performance of tablets and mobile broadband devices. The study was fielded from January through June 2022.

By region, here’s how the network quality numbers compared:

- Mid Atlantic: regional average in V2 is 10; regional average in V1 was 9.

- North Central: regional average in V2 is 10; regional average in V1 was 9.

- Northeast: regional average in V2 is 10; regional average in V1 was 9.

- Southeast: regional average in V2 is 11; regional average in V1 was 10.

- Southwest: regional average in V2 is 12; regional average in V1 was 11.

- West: regional average in V2 is 11; regional average in V1 was 9.

For more information about the U.S. Wireless Network Quality Performance Study, visit

https://www.jdpower.com/business/resource/jd-power-wireless-network-quality-performance-study.

About J.D. Power:

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world’s leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

References:

Media Relations Contacts:

Geno Effler, J.D. Power; West Coast; 714-621-6224; [email protected]

John Roderick; East Coast; 631-584-2200; [email protected]