NTT & Docomo announce “6G” trials with NEC, Fujitsu, and Nokia

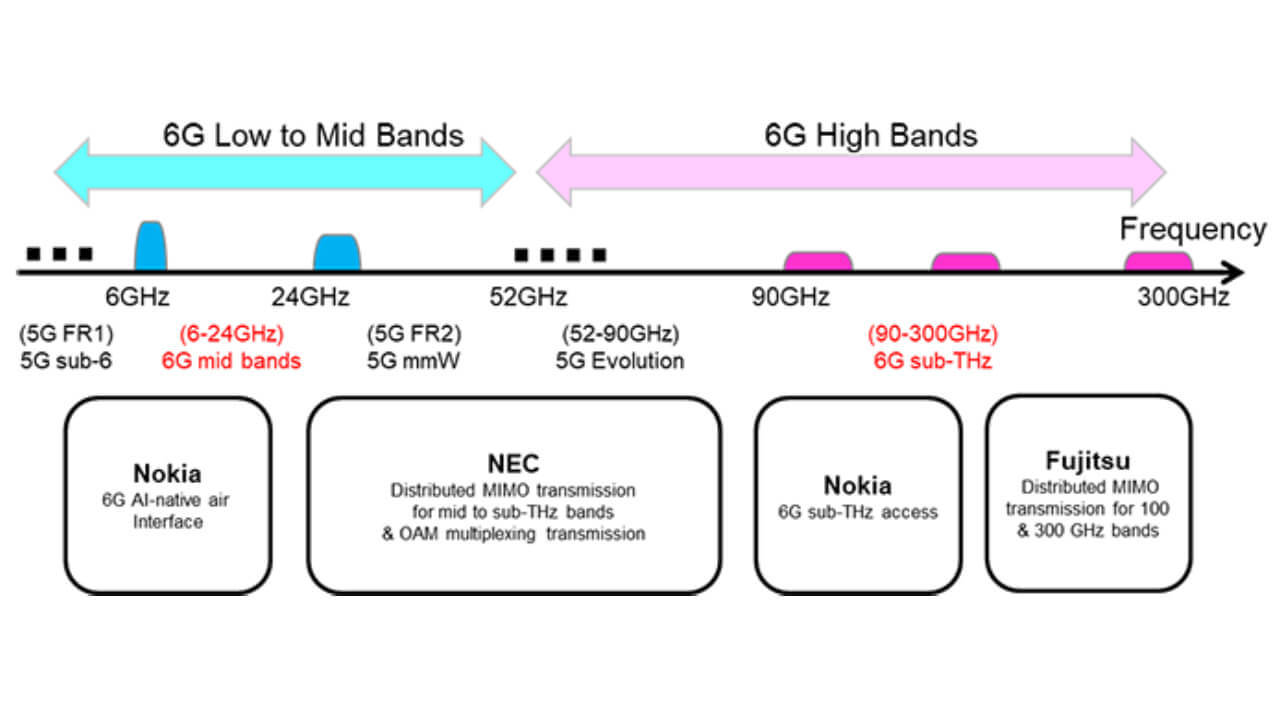

Japanese wireless network operator NTT Docomo and its parent company NTT have teamed up with mobile technology vendors Fujitsu, NEC and Nokia to conduct experimental trials of new mobile communications technologies for the targeted commercial launch of 6G services (?) by 2030.

While 6G technology is totally undefined, most industry bodies aiming for commercialization around 2030. It is already clear that the technology will be required to offer faster speeds, lower latencies, and a larger capacity than 5G wireless technology.

To achieve this, higher frequencies than those currently used for mobile services will be required, with most industry bodies suggesting that frequencies of between 100 GHz and 300 GHz will be best suited for these services.

Launching the envisioned 6G services will require verification of numerous new mobile technologies, including those needed to adopt new frequencies (not yet approved by ITU-R for use in IMT) in the millimeter and sub-terahertz (above 6 GHz) bands, in addition to bands for existing 5G services, NTT said. The trials are also expected to verify AI-based wireless transmission methods.

Docomo and NTT will launch indoor trials within the fiscal year ending in March 2023, and outdoor trials will begin in the following fiscal year. These trials are expected to verify concepts proposed so far by Docomo and NTT and will be reported in global research groups, international conferences and standardization activities related to 6G, and will serve as a foundation for more advanced technologies.

…………………………………………………………………………………………………………………………………….

Note that in April, NTT and Sky Perfect JSAT agreed to establish a joint venture company that will launch an integrated space computing network. The joint venture will build new infrastructures in space. In FY2024, the new joint venture, Space Compass, plans to launch an optical data relay service for high-speed transmission to the ground via a geostationary orbit (GEO) satellite.

Space Compass plans to use high altitude platform stations (HAPSs) to provide low-latency communication services in Japan in FY2025. HAPSs are expected to help provide communication in times of disaster, high-capacity communication for ships and aircraft, and communications services for distant islands and remote areas. NTT says mobile operators can improve their mobile networks by combining HAPSs with an increase in the number of their terrestrial base stations to expand their service coverage.

…………………………………………………………………………………………………………………………………….

Fujitsu announced that it will conduct joint trials of distributed MIMO communication technology where multiple sub-terahertz wave antennas are dispersed to simultaneously emit radio waves from multiple directions to a receiving terminal. Those joint trials will be with Docomo and NTT. Through this joint experiment, the three companies aim to develop technology that is resistant to obstruction and realizes stable high-speed wireless communication over 100 Gbps.

To achieve high-speed and large-capacity communications at sub-terahertz waves with small size and low power consumption, Fujitsu aims to develop high-frequency wireless devices utilizing compound semiconductors such as gallium nitride (GaN) and indium phosphorus (InP).

Nokia reports that its cooperation with Docomo and NTT will focus on two proof-of-concepts for emerging 6G technologies: an AI native air interface and sub-THz radio access. These aim to demonstrate a performance gain with an AI based 6G air interface compared to a conventional air interface, and to show that high-data rate beamformed access can be achieved in a high frequency band at 140 GHz, Nokia added.

Nokia has envisioned six key technologies that will be vital components of future 6G networks. Those include new spectrum technologies, AI native air interface, network as a sensor, extreme connectivity, cognitive, automated and specialized architectures, and security and trust. Among the six key technology components, the initial focus of the partnership is to demonstrate the benefits of AI-based learned waveform in the transmitter with a deep learning receiver in the mid-band, as well as to test high data rate indoor communications in the sub-THz band.

The plan is to set up environments for experiments and demonstrations in Docomo and NTT premises in Japan and Nokia premises in Stuttgart, Germany, and to start performing tests and measurements this year.

As communications technology becomes increasingly politicized, 6G targets are also beginning to be announced by national governments. Earlier this year, the Indian government announced that it would aim to deploy domestically made 6G equipment by 2030, thereby offering a major boost to the Indian economy and reducing the country’s dependence on typical telecoms equipment vendors like Nokia, Ericsson, and Huawei.

6G may only now be beginning to be defined, but the race to achieve 6G milestones has already begun.

References:

https://www.totaltele.com/513502/DOCOMO-and-NTT-announce-raft-of-partnerships-for-6G-trials

https://www.telecompaper.com/news/ntt-starts-6g-trials-with-fujitsu-nec-nokia–1426751

India creates 6G Technology Innovation Group without resolving crucial telecom issues

New data from IPlytics and Tech+IP Advisory LLC show regions and companies leading 5G Patent Race

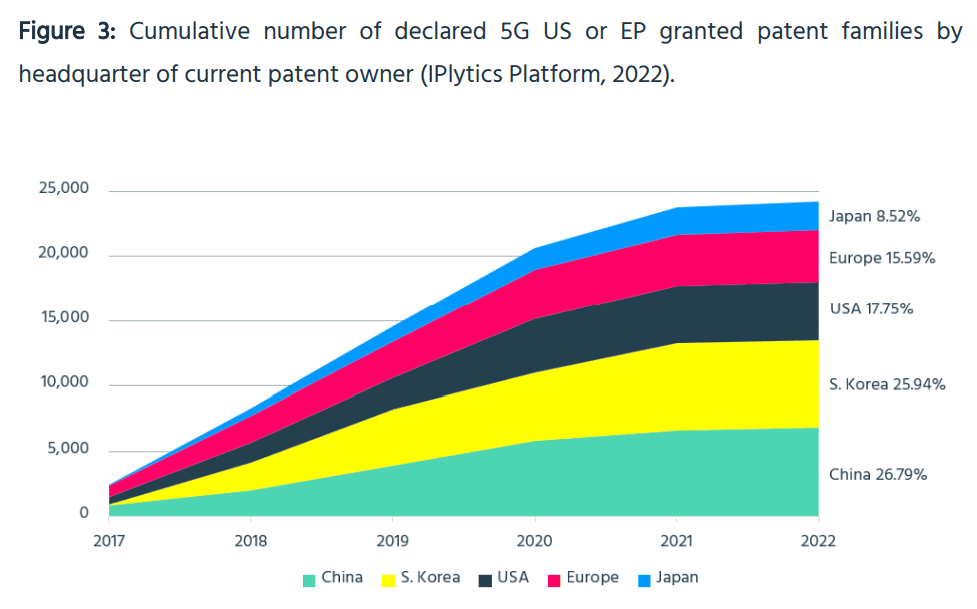

Licensing of 5G Standard Essential Patents (SEPs) [1.] promises to become a highly lucrative market, making the 5G patent race more competitive than ever before – although the latest 5G patent data shows the question of who is currently winning it remains unclear. Although it may be difficult to answer the question about who wins the 5G race, the report shows a shift in the cellular industry. While 4G technology development was mostly dominated by US and European companies, Chinese and South Korean companies have led in 5G development with the highest number of active and granted (US or European) 5G self-declared patent families.

IPlytics data shows that, of the SEP holders that have self-declared at least 10 patent families over the past decade, the number of unique patent owners has risen from 99 in 2010 to 261 in 2021 (by factor 2.6x). The uptick in the number of SEP holders is largely driven by market entrants from China, Taiwan and South Korea, which develop smartphones, network devices, computer chips or semiconductor technology. In Q1 2022, over 50,000 active and granted patent families were declared for 5G following a rapid increase in only four years. Indeed, Chinese and South Korean companies have led in 5G patent development (more below).

Note 1. SEPs is a misnomer as there is only one authentic 5G standard – ITU-R M.2150 and it is incomplete, because the URLLC specification from 3GPP does not meet the ITU-R M.2410 Performance Requirements and the companion ITU-R M.1036 IMT Frequency Arrangements (especially for mmWave spectrum) has yet to be approved. Almost all the SEPs are based on 3GPP Technical Specifications (TSs), some of which have been rubber stamped as ETSI standards.

……………………………………………………………………………………………………………………………………………………………………………………………

While current litigation in the auto industry concerns 3G and 4G SEPs, the question of how much value 5G brings to a vehicle is more difficult to answer when advanced driving systems heavily rely on 5G-enabled connectivity and increasing litigation is anticipated. But adoption of 5G in other industries is expected in the future, as the number of IoT applications that will make use of 5G is endless. One thing is certain: the majority of SEP holders will actively monetize and enforce their SEP portfolios covering 5G standards in this fast-moving, high-investment environment. However, SEP owners as well as standard implementers are faced with the challenge of managing operational and financial risks and cost exposures, while striving to maximize value. This IPlytics report takes a closer look the major 5G patent owner as well as standards developing companies.

……………………………………………………………………………………………………………………………………………………………………………………………

5G smartphone devices announced by the major licensors represent “a substantial increase in royalties over what they received for 4G”, according to an Ankura study published by IAM last year. Using IPlytics data, Ankura argues that “these rises are not explained by an increased share of patent holding.” But is patent counting enough to understand the value of 5G?

Current SEP litigation (Ericsson v Apple; Nokia v Oppo and Vivo; InterDigital v Oppo, among others) has been triggered by the present cycle of upgrading SEP licensing deals from 3G/4G to 3G/4G/5G and the questions of how much additional value 5G brings. It is undeniable that investment in 5G is larger by far compared to all earlier generations (Figure 1), when counting the number of technical standards contributions submitted by standards developers.

Licensing of 5G SEPs takes place globally, while litigation is local. The rise of so-called anti-suit injunctions shows that international courts are competing to set global FRAND (fair, reasonable and non-discriminatory) rates. Regulators (including the current EU Commission communications) in different countries compete to set rules for leadership in technology standards innovation and products alongside the related SEP licensing ecosystem, thus influencing the global technology equilibrium. In this context, a balanced framework for SEP licensing on FRAND terms is more important than ever, while competition for 5G leadership goes beyond companies as it is relevant to entire economies. This poses the question: who is leading the 5G patent race?

Although it may be difficult to answer the question about who wins the 5G race, we can observe a shift in the cellular industry. While 4G technology development was mostly dominated by US and European companies, Chinese and South Korean companies have led in 5G development with the highest number of active and granted (US or European) 5G self-declared patent families. Figure 3 shows that Chinese organizations are leading, even though the 5G patent numbers in Figure 3 only consider European or US granted patent families.

However, not all self-declared patents are essential and valid, also SEPs vary by value – with some covering core technologies of the standard and others only claiming inventions on minor improvements to the standard. One approach to identifying investment in developing 5G technology is to count the number of standards contributions. The IPlytics database enables identification of approved and agreed technical submissions to 5G standards development, ensuring that only technical contributions are counted.

Senior patent directors, licensing executives or legal counsel should bear the following in mind:

• Future technologies that enable connectivity will increasingly rely on patented technology standards, such as 5G.

• The quantity of 5G SEP declarations as well as the number of SEP owners has constantly increased. Licensees must consider royalty costs and appropriate security payments in advance.

• Patent directors and licensing executives ought not only to consider information retrieved from patent data, but also monitor and study patent declaration data, SEP claims and standards section comparisons alongside, for example, technical contributions to understand the landscape of 5G patent holders.

• The essentiality rate differs across self-declared patent portfolios. SEP determination is crucial to make accurate assumptions about 5G leadership. Further refinement and analysis are needed to identify essentiality rates.

• The essentiality rate differs across self-declared patent portfolios. SEP determination is crucial to make accurate assumptions about the 5G leadership situation. Further refinement and analysis are needed to identify essentiality rates.

……………………………………………………………………………………………………………………………………………………………………………………………

Tech + IP 4G-5G SEP Update – Comments and Key Takeaways:

While 4G SEP patent counts are flattening, and precedent is adding up, 5G SEPs are accelerating as patent filings mature and, among other things, international filings turn into issued patents. It is more important than ever to carefully assess 4G data to help guide economically rational practices in a 5G (and coming 6G ) world.

Geographic data — both on the patent side and on the market side — is particularly important in assessing SEP patent importance, and this report goes to great lengths to begin to document such data. At the same time, we posit that other data such as the technical importance (and contribution) of certain technical specifications to which described and claimed inventions relate — as compared to other technical specifications — must also be assessed just as technical contribution and degree of technical difficulty is assessed in engineering and other technical domains.

In addition, most SEP landscapes focus solely on jurisdictions where compliant products are used or sold, ignoring markets where compliant devices are made, despite the black letter law of infringement and real world licensing negotiation outcomes where royalty rates often differ based on these factors.

Despite the large number of patents potentially necessary for any 4G-5G compliant mobile handset or network and the plethora of landscapes published by 3rd parties, however, there is almost no public discussion of: what patent families are truly global (and deserving of premium FRAND rates) versus what patent families are merely regional or national (and deserving of lower FRAND rates) and how the foregoing relates to where an infringing product is made, used or sold; and what assets map to which technical specifications (“TSs”), how do the TSs rank in terms of technical contribution, and whether and why that matters.

The goal of this 4G-5G SEP report is to provide an updated set of statistics related to 4G-5G SEPs for use by the community of patent holders and implementers, and to start to delve into more sophisticated groupings and analysis of such SEPs informed both by recent court decisions and the global marketplace of licensors and licensees. The analysis proposes a method for creating family value scores that is based on real world licensing and value contexts. The methodology is applied to the 4G stack of patents because the data set is less volatile and more mature.

In 2021, approximately 24,000 new patents and applications (“Assets”) were identified to the 4G-5G standards body (ETSI) [2.] as essential to one or both of those standards. The total number of Assets declared essential to 4G-5G standards (“4G-5G SEPs”) is now approximately 200,500 (at least according to their owners). At the same time, a large number (nearly 25% of all declared families) are declared for both 4G & 5G Technical Specifications.

Note 2. ETSI is not the “4G-5G standards body.” In fact, they make contributions to ITU-R WP 5D which is the standards body for all of International Mobile Telecommunications (IMT). As per Note 1, ETSI often rubber stamps (aka “transposes”) 3GPP TS’s as ETSI standards without making any changes. ETSI is the host for 3GPP meetings and manages their website.

In 2021, ~95% of newly issued / declared Assets are related to 5G technology, strongly mirroring the evolution being seen in the market to 5G deployments. The data further shows that there are three core regions of SEPs — the US, “Core EP” and “Core Asia” countries (see the Appendix for our definitions of these regions). However, the data also indicates that many more companies are seeking and receiving SEPs in “Fast Growth” countries like India, Brazil, Indonesia and Malaysia.

Analyzing top company portfolios, we can identify different leaders in different segments of Assets and Families.

-Huawei is the leading company when analyzing overall numbers of Families that are declared to 4G-5G.

-Qualcomm’s coverage stands out when analyzing Core and Fast Growth jurisdictions.

–Samsung leads if one looks at the largest number of Families declared to both 4G & 5G Technical Specifications (TSs).

4G Stack: Out of 145 assignees that have at least one 4G Core TS Family, Samsung leads in declarations, followed by Huawei and ZTE. Together these three hold 28% of total 4G Core TS Families.

5G Stack: Huawei leads in total Family counts across all key geographic regions (Core Global, Core EP, and Core Asia) except Fast Growth regions. Samsung has the most declarations in 2021 (18% of all Assets) declared in Core EP jurisdictions (2,796). In Core Asia jurisdictions OPPO leads in regard to Assets declared in 2021 (2,129), followed by Samsung (1,818) and Vivo (751). Fast Growth “2021” analysis shows that again Samsung and Oppo have the leading positions, holding 162 and 160 Assets, respectively.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Regarding other patent research firms, Plytics and GreyB both put Huawei at the top of their 5G patent rankings. But UK law firm Bird & Bird ranked Ericsson at the top, while PA Consulting put Nokia at the top of its list. Separately, a recent study by the US Patent and Trademark Office suggested that six companies – Ericsson, Huawei, LG, Nokia, Qualcomm and Samsung – are the top 5G patent holders, with no single discernable leader.

References:

https://www.iplytics.com/wp-content/uploads/2022/06/5G-patent-race-June-2022_website.pdf

https://www.lightreading.com/5g/huawei-ranks-1-in-new-5g-patent-survey/d/d-id/777984?

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

USPTO: No clear winners in 5G patent filings; caution urged when reviewing claims of “5G dominance”

Is a new 5G Patent War in the works? Expert Opinion + Review of 5G patent studies

5G Patent Wars: Are Nokia’s 3,000 “5G” Patent Declarations Legit?

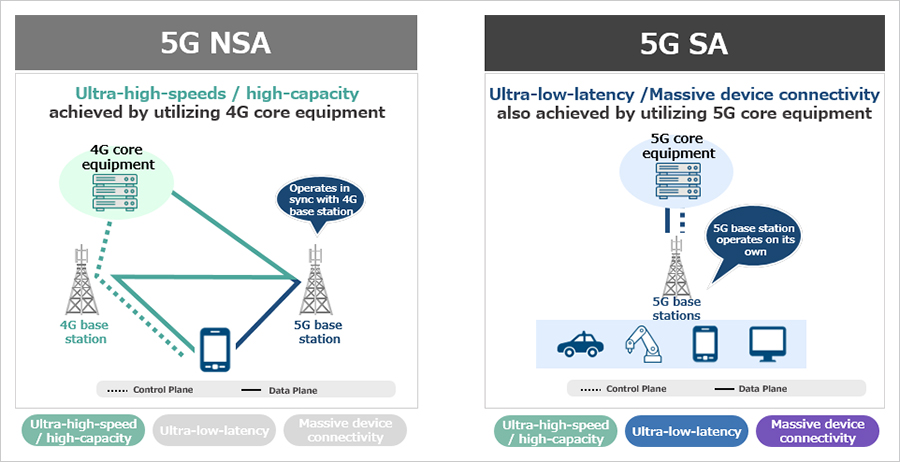

T-Mobile Launches Voice Over 5G NR using 5G SA Core Network

T-Mobile has deployed commercial Voice over 5G (VoNR, or Voice Over (5G) New Radio) service in limited areas of Portland, Oregon and Salt Lake City, Utah. The Un-carrier plans to expand VoNR to many more areas this year. Now that Standalone 5G (5G SA) is beginning to carry voice traffic with the launch of VoNR, other real 5G services, such as network slicing and security are likely to be deployed. T-Mobile customers with Samsung Galaxy S21 5G smartphones can take advantage of VoNR today in select areas.

“We don’t just have the leading 5G network in the country. T-Mobile is setting the pace for providers around the globe as we push the industry forward – now starting to roll out another critical service over 5G,” said Neville Ray, President of Technology at T-Mobile. “5G is already driving new levels of engagement, transforming how our customers use their smartphones and bringing unprecedented connectivity to areas that desperately need it. And it’s just going to get better thanks to the incredible T-Mobile team and our partners who are tirelessly innovating and advancing the capabilities of 5G every day.”

Standalone 5G removes the need for an underlying 4G LTE network and 4G core, so 5G can reach its true potential. In other words, it’s “pure 5G”, and T-Mobile was the first in the world to deliver it nationwide nearly two years ago.

The addition of VoNR takes T-Mobile’s standalone 5G network to the next level by enabling it to carry voice calls, keeping customers seamlessly connected to 5G. In the near-term, customers connected to VoNR will notice slightly faster call set-up times, meaning less delay between the time they dial a number and when the phone starts ringing. But VoNR is not just about a better calling experience. Most importantly, VoNR brings T-Mobile one step closer to truly unleashing its standalone 5G network because it enables advanced capabilities like network slicing that rely on a continuous connection to a 5G core.

“VoNR represents the next step in the 5G maturity journey-an application that exists and operates in a complete end-to-end 5G environment,” says Jason Leigh, research manager, 5G & Mobility at IDC. “Migrating to VoNR will be a key factor in developing new immersive app experiences that need to tap into the full bandwidth, latency and density benefits offered by a 5G standalone network.”

“The commercial launch of the VoNR service is another important step in T-Mobile’s successful 5G deployment,” said Fredrik Jejdling, Executive Vice President and Head of Business Area Networks at Ericsson. “It demonstrates how we as partners can introduce 5G voice based on the Ericsson solution.”

“We are proud of our partnership with T-Mobile to bring the full capabilities of 5G to customers in the United States,” said Tommi Uitto, President, Nokia Mobile Networks. “Nokia’s radio and core solutions power T-Mobile’s 5G standalone network – and this VoNR deployment is a critical step forward for the new 5G voice ecosystem.”

“At Samsung, we want to give our users the best possible 5G experience on every device – and today’s announcement represents a big step forward,” said Jude Buckley, Executive Vice President, Mobile eXperience at Samsung Electronics America. “By supporting extensive integration and testing, and working alongside an industry leader like T-Mobile, we’re bringing to life all the benefits of 5G technology with the help of our Samsung Galaxy devices.”

VoNR is available for customers in parts of Portland, Ore. and Salt Lake City with the Samsung Galaxy S21 5G and is expected to expand to more areas and more 5G smartphones this year including the Galaxy S22.

T-Mobile is the U.S. leader in 5G with the country’s largest, fastest and most reliable 5G network. The Un-carrier’s Extended Range 5G covers nearly everyone in the country – 315 million people across 1.8 million square miles. 225 million people nationwide are covered with super-fast Ultra Capacity 5G, and T-Mobile expects to cover 260 million in 2022 and 300 million next year.

………………………………………………………………………………………………………………………………………………………

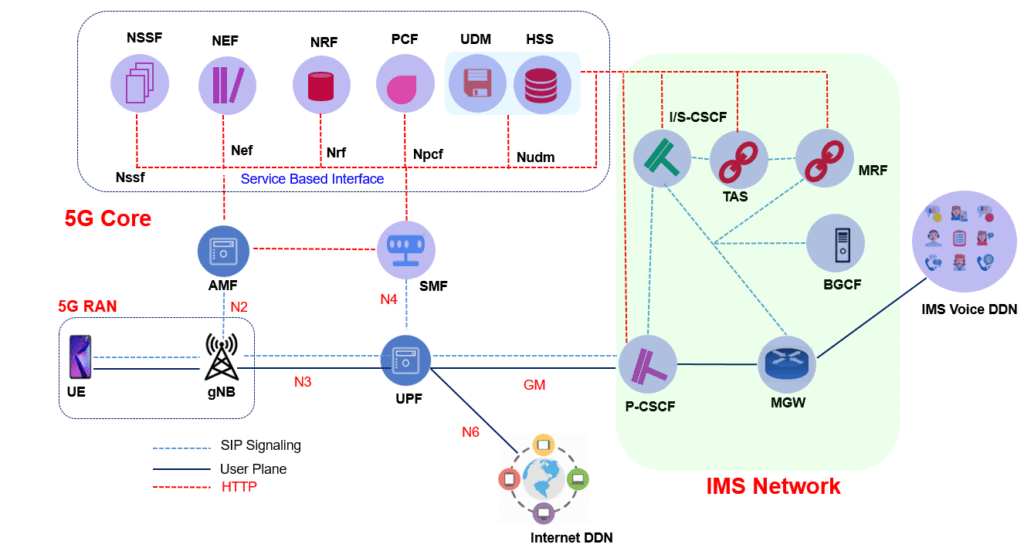

Voice Over NR Network Architecture:

Voice Over NR network Architecture is consist of 5G RAN, 5G Core and IMS network. A high level architecture is shown below. (Only major network functions are included). This network architecture supports Service based interface using HTPP protocol.

VoNR Key Pointers:

- VoNR rely upon IP Multimedia Subsystem (IMS) to manage the setup, maintenance and release or voice call connections.

- UE PDCP should support RTP and RTCP, RoHC compression and MAC layer should support DRX

- SIP is used for signaling procedures between the UE and IMS.

- VoNR uses a QoS Flow with 5QI= 5 for SIP signaling messages and QoS Flow with 5QI= 1

- QoS Flows with 5QI= 5 is non-GBR but should be treated with high priority to ensure that SIP signaling procedures are completed with minimal latency and high reliability.

- QoS Flow with 5QI= 1 is GBR. This QoS Flow is used to transfer the speech packets after connection establishment

- gNB uses RLC-AM mode DRB for SIP signaling and RLC-UM mode for Voice Traffic (RTP) DRBs

- 3GPP has recommended ‘Enhanced Voice Services’ (EVS) codecs for 5G

- EVS codec supports a range of sampling frequencies to capture a range of audio bandwidths.

- These sampling frequencies are categorized as Narrowband, Wideband, Super Wideband and Full band.

- VoNR UE provides capability information during the NAS: Registration procedure with IE ‘ UE’s Usage Setting’ indicates that the higher layers of the UE support the IMS Voice service.

- The AMF can use the UE Capability Request to get UE’s support for IMS Voice services. gNB can get UE Capability with RRC: UE Capability Enquiry and UE Capability response to the UE. The UE indicates its support for IMS voice service with following IEs

-

- ims-VoiceOverNR-FR1-r15: This field indicates whether the UE supports IMS voice over NR FR1

- ims-VoiceOverNR-FR2-r15: This field indicates whether the UE supports IMS voice over NR FR2

- within feature set support IE ims-Parameters: ims-ParametersFRX-Diff, voiceOverNR : supported

-

References:

https://www.techplayon.com/voice-over-nr-vonr-call-flow/

Samsung’s Voice over 5G NR (VoNR) Now Available on M1’s 5G SA Network

LightShed Partners on 5G, Unsustainable Wireless Growth Bubble, Revenue Opportunities

Excerpts from LightShed Partners report – The Wireless Industry’s 5G Growth Problem, MAY 31, 2022 ~ by WALTER PIECYK AND JOE GALONE (Registration required):

Wireless operators in the United States committed to invest over $200 billion into 5G (spectrum licenses, network equipment and build out costs), but does anyone care? Consumers have shown little interest in switching between service providers because of 5G. They have also been slow to upgrade to higher-priced 5G rate plans with their existing provider.

5G has not been enough to attract wireless consumers to higher priced rate plans. The major telcos have enabled 5G on all of their unlimited post-paid rate plans. Verizon withholds its “Ultra-Wideband” 5G from entry level subscribers but includes this faster speed level on the rest of their rate plans. We are skeptical faster 5G is inducing many subscribers to upgrade.

Despite the macro headwinds, we expect 1.5-3.0% growth in post-paid phone subscribers going forward. That’s not terrible, but it implies that industry net adds will fall to 6.7 million this year from 9.4 million in 2021. That is 1.9 million (22%) below consensus. Our peers may be excluding ~950k of base “cleanups” and network shutdowns in their estimates. That is odd as this is churn of subs that are allegedly paying their bills. Even if we excluded this “clean-up” our estimate would still be 1 million below consensus in 2022.

So where can wireless operators find more revenue growth?

Our outlook for industry subscriber growth is clearly not enough to generate the higher sustainable revenue growth that many investors prefer unless a wireless operator is taking material share. It’s hard to make a long-term case for notable shifts in market share in the wireless industry. Network differentiation has tightened, churn rates are at record lows. Plus, any material change to pricing would have an unwanted impact to the free cash flow of their large subscriber bases. So then what?

Wireless operators can attempt to boost revenue growth with wireless home broadband (aka Fixed Wireless Access or FWA), wholesale and IoT. But post-paid phone revenue, which represents 75% of total service revenue, is still the primary driver of growth. We estimate that in 2022, post-paid phone revenue will contribute 260 basis points of the 3.4% industry growth that we forecast. And in 2023, we expect it to contribute 220 basis points of our 3.2% expected growth. Without post-paid phone revenue growth, these companies have major growth challenges.

We are skeptical that premium services like hotspot data or better video streaming quality are incentives to move up rate plans. We invite any company to offer data on why this will offer a tailwind of upgrades over the next five years.

How much extra growth does Home Broadband offer?

We expect wireless home broadband to add an incremental $1 billion of recurring revenue per year for the wireless industry. That represents about 40 basis points of our industry revenue growth estimate of 3-4%. The impact of home broadband on growth is meaningful to T-Mobile and Verizon, contributing 100 bps and 60 bps respectively to their total wireless service revenue growth. Our wireless home broadband estimates are below the guidance of these companies, and therefore also likely below consensus – as we highlighted on our recent initiation of Charter. (Link) AT&T prefers to pursue a fiber growth strategy.

Home broadband is enabled by spectrum depth not 5G:

5G proponents would note that home broadband is a 5G application that helps to justify the $200 billion industry investment. But if that money had been plowed into spectrum and capex for LTE, we believe there would be little difference in the resulting revenue generated by home broadband. The thick spectrum blocks that operators purchased or acquired help LTE speeds and capacity in largely the same way it enables 5G. In addition, we have yet to notice perceptible differences in latency between 5G and LTE as measured (perhaps incorrectly) by the ping on speed tests. Only Dish Networks appears to be taking the capabilities of 5G down a path that is materially superior than what can be achieved with LTE and traditional network design.

References:

BT and Ericsson in partnership to provide commercial 5G private networks in the UK

BT and Ericsson have entered a new multi-million-pound joint partnership to provide commercial 5G private networks for the UK market – the first agreement of its kind. The multi-year contract will enable BT to sell 5G services to businesses and organizations in industries like manufacturing, defense, education, retail, healthcare, transport and logistics. It’s critically important to note that to be effective, a 5G private network requires a 5G Core which facilitates all the 5G features and essentials, e.g. network slicing, automation, MEC, security, etc.

The agreement comes just after BT confirmed it was investing close to £100m over the next three years to accelerate the development of customer solutions which integrate emerging technologies like 5G, IoT, Edge Compute, Cloud and AI.

5G Private Networks provide secure indoor and outdoor 5G cellular coverage, making them suitable for a range of uses – particularly in environments such as factories, education campuses and other large sites where security and ultra-low latency connectivity are important.

New innovative applications and IoT capabilities can be enabled through a private 5G network to improve productivity, optimise operations and drive cost savings, such as asset tracking, predictive maintenance, connected sensors, real-time data processing, automation and robotics.

According to a forecast from MarketResearch.com, 5G Private Networks are predicted to grow at an average rate of 40 per cent a year between 2021 and 2028, by which time the market will be worth $14bn (£10.7bn). Both BT and Ericsson believe there is significant demand from UK businesses looking to take advantage of the benefits the new technology can provide.

From MarketResearch.com:

“Key market players are strategically building partnerships with industry giants to set up a private 5G network to provide high-speed secure connectivity to their customers. For instance, in Feb 2020, Nokia Corporation deployed a private 5G network infrastructure for Lufthansa Technik for virtual inspection of engine parts remotely for its civil aviation clients. Moreover, the rising demand for enhanced bandwidth connectivity for secured enterprise applications is anticipated to fuel the adoption of private 5G services globally.”

Marc Overton, BT’s Managing Director for Division X, Enterprise, said: “This UK-first we have signed with Ericsson is a huge milestone and will play a major role in enabling businesses’ transformation, ushering in a new era of hyper-connected spaces.

“We have combined our skill and expertise at building converged fixed and mobile networks with Ericsson’s leading, sustainable and secure 5G network equipment, to offer a pioneering new proposition that will be attractive to many industries. 5G private networks will also support smart factory processes and the advancement of Industry 4.0 which can realise significant cost savings and efficiencies for manufacturers.

“Unlike a public network, a private 5G network can be configured to a specific business’s needs, as well as by individual site or location. They also provide the foundation to overlay other innovative technologies such as IoT, AI, VR and AR, opening up a multitude of possibilities.”

Katherine Ainley, CEO Ericsson UK & Ireland said: “This ground-breaking agreement with BT means we are together taking a leading role in ensuring 5G has a transformative impact for the UK. The high quality, fast and secure connectivity provided by Ericsson Private 5G can help organisations make all-important efficiency gains that can create safer, more productive, and sustainable business operations and help the country build global leaders in the industries and technologies of the future.”

Case study: BT and Ericsson have already worked together on several major projects incorporating private 5G networks, including Belfast Harbour in Northern Ireland, as they accelerate its ambition to become the world’s best regional smart port.

The partners have installed a 5G private network across 35 acres of operational port. This is helping to drive operational efficiencies and accelerate its digital transformation through optimising processes across transport, logistics, supply chain and shipping, as well as boosting productivity through the smooth-running of the Port’s operations.

Every year more than 1.75 million people and over half a million freight vehicles arrive and depart through the Port every year. While 24 million tonnes of goods are managed and carried by ferries, container ships and cargo vessels.

“With activity on that scale you need smart technology that can really make a difference. And that’s what our standalone private 5G network is enabling at the Port,” added Marc Overton.

“We’re now into phase two of the project and this includes various use cases such as teleoperation of heavy plant machinery, artificial reality (AR) for remote maintenance, as well as enhanced video AI analytics and the use of drones for surveillance and inspections.”

The partnership is also exploring how 5G and other emerging technologies such as AI, IoT and Connected Autonomous Vehicles can be used together to enhance public safety, physical security, and address climate change across the Port and other parts of Belfast City.

Mike Dawson, Corporate Services Director, Belfast Harbour Commissioners, said: “Throughout 2021 and to the end of 2022, we will have completed the implementation of both Public and Private 5G Networks. These are the foundation for several Smart and Green port initiatives, including CCTV cameras, Air Quality Monitors, Drones, MiFi units to maximise operational efficiencies and a Digital Twin. The technologies have supported our data collection on the movement of people and things through our Road Traffic Screens, Wayfinding App and a Community App for Traffic.”

BT Group is the UK’s leading provider of fixed and mobile telecommunications and related secure digital products, solutions and services. We also provide managed telecommunications, security and network and IT infrastructure services to customers across 180 countries.

BT Group consists of four customer-facing units: Consumer serves individuals and families in the UK; Enterprise and Global are our UK and international business-focused units respectively; Openreach is an independently governed, wholly owned subsidiary, which wholesales fixed access infrastructure services to its customers – over 650 communication providers across the UK.

British Telecommunications plc is a wholly-owned subsidiary of BT Group plc and encompasses virtually all businesses and assets of the BT Group. BT Group plc is listed on the London Stock Exchange.

For more information, visit www.bt.com/about

References:

https://www.marketresearch.com/Grand-View-Research-v4060/Private-5G-Network-Size-Share-14553525/

India’s 5G spectrum auctions likely to be delayed yet again; Broadband India Forum weighs in

India’s 5G rollout is already behind schedule due to repeated delays (from early 2020) in the 5G spectrum auction. It now appears that the auction will be delayed even further, resulting in even more delays in 5G rollout. The competing interests of telecom service providers (TSPs) and technology giants seeking private networks appear to have slowed the auctioning of 5G spectrum, causing the delay, according to a recent The Hindu Businessline report.

The auction was meant to take place in early June, according to India’s Telecom Minister, but there would be a delay because the Cabinet has not yet adapted the TRAI’s plan. Because issuing the notice inviting applications (NIA) and holding stakeholder meetings can take at least 45 days from the date of Cabinet approval, the auction is unlikely to take place in June.

The main reason for the delay is that various industry bodies and tech giants have requested that the captive 5G networks be allocated to them. Despite the fact that 5G private network users’ spectrum allocation has been excluded from the upcoming auction, these players have addressed the government through their representative bodies. They argue that keeping them out of the country will adversely impact the country’s efforts to digitalize its economy and make its products more competitive in the global market.

The Broadband India Forum (BIF), whose members include Amazon, Cisco, Facebook, Google, Intel, Adani, and Reliance, among others, urged the government to provide this spectrum via an administered allocation route at a nominal rate or for free. Furthermore, TRAI recommended allocating 5G spectrum to enterprises for the construction of their own private captive networks, which they day improves industry efficiency.

The BIF urged the Government to provide these spectrum through administered allocation route at some nominal rates or give it for free. “We should think of the country, the consumer…it is the benefit of the consumer, efficiency of the enterprise and finally improvement of the economy. It (spectrum) is strictly for captive usage for improvement of efficiency,” said TV Ramachandran, President at BIF.

He said not only 5G, but captive network can be set up with 4G also, which the industry body has been requesting the government to open up. For instance, airports, ports, hotels and hospitals around the world use captive network to communicate within their campuses, and that gives faster response time, too.

Telecom Regulatory Authority of India (TRAI), in its recommendations, had also said that non-telecom enterprises would be allocated a 5G spectrum for building their private networks.

For captive network, spectrum is assigned to enterprises, is utilized within a limited geographic area. Therefore, it is also referred as spectrum for localized or local use. Spectrum assigned for localised private captive networks is used in such a manner that the signals are restricted within its geographic area and do not cause interference to other outside systems.

References:

India’s 5G auction delayed again to April-May 2022 – Credibility Gap?

Tutorial: Horizontal vs. Backbone Cabling: What’s The Difference?

by Madeline Miller

Introduction:

In creating a computer network, you’re going to need physical cables in place to deliver telecommunications services where they’re needed. As a business, you need to know how to set up that cabling system to get the best results. There are two main ways this can be done: either through backbone cabling, or horizontal cabling. What does this mean, and what’s the difference between the two?

What Is Backbone Cabling?

Backbone cabling can be referred to as vertical cabling. It is usually how you’ll connect the telecommunications room to entrance facilities, equipment rooms and so on. Typically, you’ll see that the cables will run from floor to floor of your building, but they can run on the same floor and be referred to as backbone cables still.

-

Backbone cabling can be divided further into inter-building and intra-building cablings.

-

Inter-building cabling is installed between two or more different buildings, intra-building cabling is done within one building.

The wiring for backbone cabling can be coaxial, twisted pair copper, or optical fiber. These days, optical fiber is the popular choice as it’s much faster, and so lends itself better to the longer lengths that need to be used in this kind of cabling.

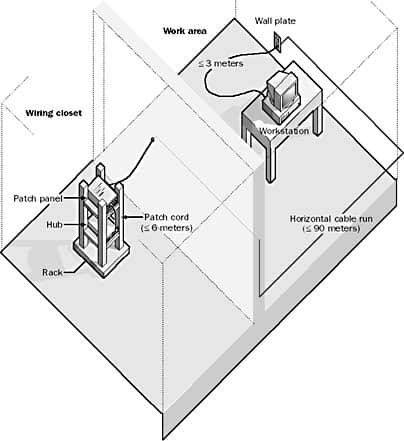

What Is Horizontal Cabling?

Next, let’s take a look at horizontal cabling. Again, this cabling extends from the telecommunications room, but this time it goes out to individual work areas. Usually, this is done in a star shape topography. As such, the system will include cabling from the telecommunications room, an optional consolidation point, mechanical terminations, and patch cords or jumpers in the TC room itself.

There are other ways that that cabling can be put into place as well. The star topography is a popular method, but connecting everything in a ring topography also works in some situations, although as everything is connected through one cable if one point goes down, everything goes down.

The Differences Between Horizontal And Backbone Cabling

So what’s the difference between these types of cabling? While they sound quite similar, you’ll see that you’ll want to pick one or the other, depending on what you’d like to connect.

The biggest difference is in the areas that they cover. Backbone cabling will usually connect entrance facilities, equipment rooms, and so on in your building. Horizontal cabling, on the other hand, will cover individual work areas and outlets on the building’s floors.

You’ll also see that backbone cabling typically runs throughout the floors of the building, or even to different buildings as needed. Horizontal cabling, as the name implies, will usually be contained to one floor, the same floor as the telecommunications room. It is possible to run horizontal cabling between floors if needed, but it’s not recommended. Even if you do run it between floors, it still remains horizontal cabling rather than backbone cabling, as it’s still serving that particular function.

The two types of cabling also have different structural requirement, as they’re installed and used in different ways. For example, backbone cabling needs to be strong enough to support its own weight as it passes between floors. It also needs to be secured properly to ensure it’s safe and meets building codes.

Finally, you’ll see that backbone and horizontal cabling both have their own fire ratings and standards that they have to adhere to. These will be fairly simple when you’re dealing with horizontal cabling, but when it comes to backbone cabling there can be different rules, depending on how the cables are installed. For example, you may need to adhere to different codes if your cables go underground. In these cases, it’s always best to talk with a cabling contractor to see what you’ll need to do.

Picking The Right Type Of Cabling For Your Project

Now you know the differences between backbone and horizontal cabling, you’ll need to decide which one is right for the project you have in mind. The biggest thing you’ll have to consider is what exactly you’re looking to connect up. If it’s workstations that you need to get online, it’s going to be horizontal cabling that you need. If you’re looking to connect up other resources, then you’re more likely going to need backbone cabling.

As with most things, what you’ll need will vary from project to project. As such, you’ll want to look into it with a cabling expert. They can recommend the right set up for you, and ensure that it’s done to code and safely, too.

Conclusions:

Now you have all the basics about what backbone and horizontal cabling systems are, and which one will be the one you need for your building and needs. Now you know this, you can start planning your cabling with a certified installer, and get everything up and running. Wishing you success!

Biography:

Madeline Miller is a writer at Academized and UK Writings. Her expertise is is in telecommunications. She also blogs for State of Writing.

References:

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

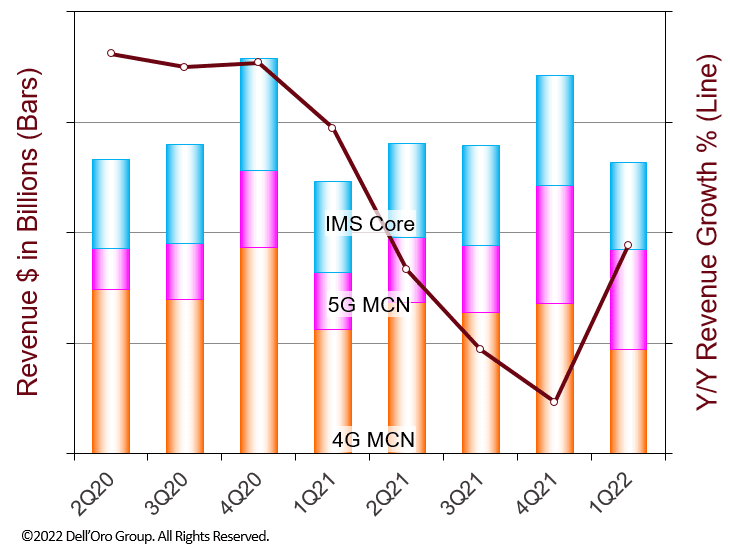

According to a recently published report from Dell’Oro Group, the total Mobile Core Network (MCN) and Multi-access Edge Computing (MEC) market revenues for 1Q 2022 rebounded to a positive year-over-year (Y/Y) growth rate after the decrease in 4Q 2021 which was the first decrease since 4Q 2017.

The MCN market growth was driven by an extremely high double-digit percentage Y/Y revenue growth rate in the 5G MCN market overcoming the Y/Y revenue declines in the 4G MCN and IMS Core markets. For the MCN market regionally, the China region had a high growth rate while the MCN market excluding China had a negative growth rate for the quarter.

“With the continued aggressive build-out of 5G Standalone (SA) networks in China, the China region in 1Q 2022 substantially increased its share of the 5G MCN market over last quarter,’ stated Dave Bolan, Research Director at Dell’Oro Group. “At the end of 1Q 2022, we have identified 25 Mobile Network Operators (MNOs) that have commercially launched 5G SA Mobile Broadband networks (MBB) with services available to consumers. The 5G Core vendors (in alphabetical order) include Cisco, Ericsson, Huawei, NEC, Nokia, Samsung, and ZTE. We have identified 150 MNOs with 5G Core contracts with the above vendors plus Mavenir. There are still more 5G Core contracts that vendors have acknowledged without revealing the associated MNOs.

“We see fewer 5G Core network launches slated for 2022 as compared to 2021 when 16 networks were launched. However, many are being readied for 2023 launches and we project mid-single-digit percentage Y/Y growth rates for the balance of 2022. One of the most anticipated and publicized 5G Core launches is Dish Wireless – the first to run 5G Core on the Public Cloud. The company is preparing to launch in many cities by mid-June 2022 to meet regulatory coverage requirements. In early May 2022, Dish had a soft launch in its first city, Las Vegas. Nokia is the primary 5G Core vendor.

“Multi-access Edge Computing deployed by MNOs has barely scratched the surface in spite of all the hype, except for the China region, which has deployed thousands of MEC nodes throughout their MNO networks, with a mix of Public MEC and Private MEC sites,” continued Bolan.

Additional highlights from the 1Q 2022 Mobile Core Network and Multi-Access Edge Computing Report:

- The top two vendors for the MCN, 4G MCN, and IMS Core markets were Huawei and Ericsson.

- The top two vendors for the 5G MCN market were Huawei and ZTE.

- Nokia and Ericsson had the highest Y/Y growth rates for the 5G MCN market coming from a low small base. However, Huawei had the highest dollar revenue gain, with a lower Y/Y growth rate coming from a larger base.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

China Telecom, ZTE jointly build spatiotemporal cognitive network for digital transformation

ZTE Corporation and the Zhejiang Branch of China Telecom have jointly built a self-adaptive spatiotemporal cognitive network based on ZTE’s Radio Composer, improving dynamic user experiences in high-capacity scenarios. Under the collaboration with intelligent user navigation, the network solution matches network resources with traffic distribution more precisely and efficiently through on-demand elastic coverage of two-layer network, adapting to user group flow in space over different time periods.

The spatiotemporal cognitive network intelligently predicts traffic distribution in the first place. According to location change of user groups in different time periods within base station coverage, the network solution, by virtue of LSTM (long short-term memory) algorithms, performs in-depth study and prediction of traffic distribution on physical grid level and analyses the traffic space distribution trend in different periods.

Based on the traffic distribution trend in both time and frequency, the spatiotemporal cognitive network implements the intelligent carrier power scaling function through power sharing, to achieve flexible coverage adjustment. Below is an example of Traffic distribution of different periods in one area over time:

When the traffic loads within coverage of the two carriers are both high, the solution balances the two carriers with the same coverage to guarantee capacity. When the traffic loads within coverage of the two carriers differentiates obviously, the solution adjusts the coverage mode. It adopts high power to cover the high-load area and decreases power in the low-load area, therefore precisely matching radio resources to ensure user experiences.

The spatiotemporal cognitive network focuses on intelligent experience collaboration and establishes AI logic grid knowledge base of base stations, in order to further balance network efficiency and user experiences.

Moving forward, the Zhejiang Branch of China Telecom and ZTE will keep innovating together to provide superb network performance and boost digital transformation.

References:

Softbank launches 5G MEC in Japan using its 5G SA core network

SoftBank announced that it has deployed a 5G Multi-access Edge Computing (MEC) site in the Kanto region of Japan. The multi-national conglomerate said it has started the nationwide deployment of MEC servers in Japan this month (May 2022). SoftBank claims its 5G MEC delivers a low-latency and secure service experience by using its 5G SA core network with compute servers at the network’s edge. The 5G MEC offering now makes it possible for customers to experience high-speed services through the deployment of applications close to user devices within the 5G SA network, which significantly reduces server access times.

SoftBank’s 5G MEC platform provides a Kubernetes-based container environment [1.] which is a de facto platform for application development. From physical infrastructure set-up to application deployment and distribution, 5G MEC sites are automated. Such features make applications on the 5G MEC platform more fault-tolerant, and they also enable faster service rollout with reduced complexity, improving a variety of industry services such as emergency notifications, in-building IoT-based network deployments, factory automation, multi-user network gaming and automated driving, among others.

Note 1. Kubernetes is a portable, extensible, open source platform for managing containerized workloads and services, that facilitates both declarative configuration and automation.

“This deployment of 5G MEC is a major milestone for SoftBank. Its compatibility with SRv6 MUP and network slicing, along with its automation of operation features, make it unique across the industry. With our partners, we’ll develop a multi-industry ecosystem to become a complete digital platform provider by harnessing the capabilities of our 5G MEC solution,” said Keiichi Makizono, SoftBank Corp. Senior Vice President and Chief Information Officer (CIO).

Source: GSMA

Source: Softbank

……………………………………………………………………………………………………………………………………………………………………………………………

Comments from partners supporting Softbank’s 5G MEC are as follows:

“SoftBank is committed to enabling the digital transformation of companies and organizations across all sectors, and we are honored to have been selected as a cloud partner in this aim. We share with SoftBank a vision where modern applications must integrate seamlessly with cloud operations to create exceptional end user experiences. We look forward to further enabling SoftBank to execute on this vision, for their cloud native customers’ use cases in and beyond 5G,” said Ankur Singla, SVP, Security & Distributed Cloud Product Group, F5. [F5 is a strategic partner for SoftBank that has worked jointly on strategic initiatives including SRv6 and 5G MEC, commented on 5G MEC].

“Corezero is excited to join SoftBank’s 5G MEC initiative. Corezero enables Logging-as-a-Service. Our flagship product FFWD is a real-time observability system built using cutting edge software to achieve true Ingest-Query-Separation, and Compute-Storage-Separation: an architecture type that best serves the modern high-volume log flows and query profiles in highly distributed cloud environments. We are looking forward to working with SoftBank to provide Logging-as-a-Service (LaaS) starting from their 5G MEC enhanced with low-cost programmability,” said Yee Soon, CEO, Corezero.

“Niantic has been working with SoftBank on promotions for our AR/location-based game titles, as well as network optimization at our live events, etc. We believe that SoftBank’s nationwide deployment of 5G MEC will open up new possibilities not only for our game titles but also for developers and creators who use Niantic Lightship ARDK, which will lead to the creation of an innovative AR experience from Japan to the world in the future,” said Setsuto Murai, President, Niantic Japan.

“Vantiq is excited to be part of SoftBank’s 5G MEC program, which is bringing significant value to the communications industry. The combination of SoftBank’s Digital Platform, which provides the necessary edge-computing infrastructure, and Vantiq’s real-time distributed processing capabilities, will help drive market innovation and disruption through the creation of mission-critical, ultra low-latency business applications,” said Marty Sprinzen, CEO, Vantiq.

“We are very excited about the Kubernetes (k8) container technology-based SoftBank 5G MEC roll out. MIXI is actively utilizing the k8-based container platform for future microservice based application development. By utilizing 5G MEC distributed all over Japan with a high affinity with mobile networking, we aim for further innovation in the sports entertainment area along with other futuristic applications,” said Junpei Yoshino, Chief General Manager, Development Operations, mixi, Inc.

“Yahoo! JAPAN is proactively trying to adopt new technologies to provide safe, secure, and comfortable services to a wide range of customers. Therefore, we are paying close attention to the expansion of SoftBank 5G MEC, which will enhance the possibility of our services by providing CSP infrastructure closer to our customers’ mobile devices with higher network reliability, significantly reduced processing speed, and ease of deployment through container infrastructure. We also expect MEC sites distributed around the world to be a powerful advantage when we, the content service providers, expand our business all over the world. We have high expectations for SoftBank to lead this important platform,” said Masahiko Kokubo, Director, EVP, Managing Corporate Officer, CTO, Yahoo Japan Corporation.

“The JCV face recognition platform is widely adopted at thousands of retail shops and entertainment venues. To provide customers with highly accurate AR experiences using spatial image recognition at commercial facilities and stadiums Real-time computing processing using SoftBank’s upcoming 5G MEC will enable us to provide our customers with increased accuracy and ultra-low latency. We are confident that, with SoftBank 5G MEC, this will fuel the creation of a metaverse platform linking online and offline,” said Andrew Schwabecher, CEO of Japan Computer Vision Corp.

“We are very much excited about SoftBank’s 5G MEC deployment which will play a vital role in realizing distributed computing necessary for advanced digital society. Using SRv6 for networking will make SoftBank’s 5G MEC even more optimal and easy to deploy at remote locations. By utilizing our regional Internet eXchanges (IX), BBIX with its valued partners will deliver the optimal network platform for the Digital Twin [2.] era,” said Hidetoshi Ikeda, Representative Director, President & CEO, BBIX, Inc.

- Note 2. Digital twin is a technology that collects information in real space via IoT, etc. and reproduces real space in cyber space based on the transmitted data.

- ……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

- Other Notes:

- In October 2021, SoftBank announced that it had started to offer 5G Standalone (SA) network services. With this new launch, SoftBank claimed to be the first carrier in Japan to offer 5G SA commercial services. At that time, the company said that the most important features of 5G SA networks are their ability to deliver network slicing and Private 5G networks, which are customized networks tailored to individual enterprise needs, and other connectivity features based on advanced technologies.

- Softbank had initially launched commercial 5G services in Japan through NSA architecture in March 2020.

- In April 2021, Softbank launched Japan’s first 5G global roaming service.

- According to Statistica, Softbank had a 20.8% share (# 3) of Japan’s mobile subscribers in 2021. NTT DoComo led with a 37% market share, while KDDI was in second place with a 27.2% market share.

- Softbank’s history is here.

References:

https://www.softbank.jp/en/corp/news/press/sbkk/2022/20220526_01/

https://www.softbank.jp/en/corp/news/press/sbkk/2021/20211019_01/