Ericsson to acquire Vonage to create a global VoIP network and communication platform

Ericsson has agreed to buy VoIP network operator Vonage for $21 per share, for a total of $6.2 billion. The board of directors at Vonage approved the deal, which will enable Ericsson to expand its enterprise operations globally and build on its integration of Cradlepoint in September 2020.

Vonage reported revenues for the 12 months to end September of $1.4 billion, with an adjusted EBITDA margin of 14% and free cash flow of $109 million. The merger price represents a premium of 28% to Vonage’s closing share price on 19 November and 34% to the volume-weighted average share price for the three months to 19 November.

Vonage’s presence in the Communication Platform as a Service (CPaaS) segment will provide Ericsson with access to a complementary and high-growth segment, the company said. The combination will also accelerate enterprise digitization and the development of advanced APIs made possible by 5G. Over the longer term, Ericsson intends to deliver services to the full ecosystem, including telecom operators, developers, and businesses, by creating a global platform for open network innovation, built on Ericsson and Vonage’s complementary solutions.

The cloud-based Vonage Communications Platform (VCP) serves over 120,000 customers and more than one million registered developers globally. The API (Application Programming Interface) platform within VCP allows developers to embed high quality communications – including messaging, voice and video – into applications and products, without back-end infrastructure or interfaces. Vonage also provides Unified Communications as a Service (UCaaS) and Contact Center as a Service (CCaaS) solutions as part of the Vonage Communications Platform.

VCP accounts for approximately 80% of Vonage’s current revenues and delivered revenue growth in excess of 20% in the three-year period to 2020, with adjusted EBITDA margins moving from -19% in 2018 to break-even in the 12-month period to 30 September 2021. Vonage’s management team projects annual growth of over 20% for VCP in the coming years.

Börje Ekholm, President and CEO of Ericsson, says: “The core of our strategy is to build leading mobile networks through technology leadership. This provides the foundation to build an enterprise business. The acquisition of Vonage is the next step in delivering on that strategic priority. Vonage gives us a platform to help our customers monetize the investments in the network, benefitting developers and businesses. Imagine putting the power and capabilities of 5G, the biggest global innovation platform, at the fingertips of developers. Then back it with Vonage’s advanced capabilities, in a world of 8 billion connected devices. Today we are making that possible.”

“Today Network APIs are an established market for messaging, voice and video, but with a significant potential to capitalize on new 4G and 5G capabilities. Vonage’s strong developer ecosystem will get access to 4G and 5G network APIs, exposed in a simple and globally unified way. This will allow them to develop new innovative global offerings. Communication Service Providers will be able to better monetize their investments in network infrastructure by creating new API driven revenues. Finally, businesses will benefit from the 5G performance, impacting operational performance, and share in new value coming from applications on top of the network.”

Rory Read, CEO of Vonage, says: “Ericsson and Vonage have a shared ambition to accelerate our long-term growth strategy. The convergence of the internet, mobility, the cloud and powerful 5G networks are forming the digital transformation and intelligent communications wave, which is driving a secular change in the way businesses operate. The combination of our two companies offers exciting opportunities for customers, partners, developers and team members to capture this next wave.”

“We believe joining Ericsson is in the best interests of our shareholders and is a testament to Vonage’s leadership position in business cloud communications, our innovative product portfolio, and outstanding team.”

References:

CEO and CFO presentation (pdf)

Two webcasts on November 22, 2021:

9:10 AM CET: Replay

3:30 PM CET: Replay

GSA: 5G Market Snapshot – 5G networks, 5G devices, 5G SA status

By end October 2021, GSA had identified 469 operators in 140 countries/territories were investing in 5G, including trials, acquisition of licenses, planning, network deployment and launches. (This number excludes nearly 200 additional companies awarded spectrum in the US CBRS PAL auction, which could potentially be used for 5G).

- Of those, a total of 182 operators in 73 countries/territories had launched one or more 3GPP-compliant 5G services

- 173 operators in 69 countries/territories had launched 5G mobile services

- 65 operators in 36 countries/territories had launched 3GPP-compliant 5G FWA services (36% of those with launched 5G services)

- Five operators had announced soft launches of their 5G networks that are not counted in the above launch figures.

- 97 operators are identified as investing in 5G standalone (including those evaluating/testing, piloting, planning, deploying as well as those that have launched 5G SA networks).

- GSA has catalogued 20 operators as having deployed/launched 5G SA in public networks

As for 5G endpoint devices:

The number of announced 5G devices continues to rise and has now reached 1115, an increase of 18.9% in the last quarter. Of these devices, 67.7% are understood to be commercially available. The number of commercial 5G devices has grown by 24.2% over the last three months passing 750 for the first time, to reach a total of 755 devices understood to be commercially available.

By end-October 2021, GSA had identified:

- twenty-two announced form factors.

- one hundred and sixty-five vendors who had announced available or forthcoming 5G devices.

- one thousand, one hundred and fifteen announced devices (including regional variants, but excluding operator-branded devices that are essentially re-badged versions of other phones), including 755 that are understood to be commercially available:

- five hundred and fifty phones (up 27 from September), at least 491 of which are now commercially available (up 32 in a month).

- one hundred and ninety FWA CPE devices (indoor and outdoor), at least of which 90 are now commercially available.

- one hundred and fifty-six modules.

- seventy-one industrial/enterprise routers/gateways/modems.

- forty-eight battery operated hotspots.

- twenty-five tablets.

- twenty laptops (notebooks).

- eleven in-vehicle routers/modems/hotspots.

- eight USB terminals/dongles/modems.

- thirty-six other devices (including drones, head-mounted displays, robots, TVs, cameras, femtocells/small cells, repeaters, vehicle OBUs, a snap-on dongle/adapter, a switch, a vending machine and an encoder).

- six hundred and twenty-seven announced devices with declared support for 5G standalone in sub-6 GHz bands, 434 of which are commercially available.

Not all devices are available immediately and specification details remain limited for some devices.

We can expect the availability of devices to continue to improve and for more information about announced devices to emerge as they reach the market. Based on vendors’ previous statements and recent rates of device release, we might expect to see the number of commercial devices surpassing the 820 mark by the end of Q4 2021. GSA will be tracking and reporting regularly on these 5G device launch announcements. Its GAMBoD database contains key details about device form factors, features and support for spectrum bands. Summary statistics are released in this regular monthly publication.

More information on 5G SA networks:

Operators are increasingly experimenting with and deploying 5G standalone (SA) networks. With a totally new, cloud-based, virtualized, microservices-based core infrastructure, some of the anticipated benefits of introducing 5G SA technologies include faster connection times (lower latency), support for massive numbers of devices, programmable systems enabling faster and more agile creation of services and network slices, with improved support for SLA management within those slices, and the advent of voice-over new radio (VoNR). Introduction of 5G SA is expected to facilitate simplification of architectures, improve security and reduce costs. 5G SA is expected to enable customization and open up new service and revenue opportunities tailored to enterprise, industrial and government customers.

GSA is tracking the emergence of the 5G SA system, including the availability of chipsets and devices for customers, plus the testing and then deployment of 5G SA networks by public mobile network operators as well as private network operators. This paper is the latest in an ongoing series of papers summarising market trends, drawing on the data collected in GSA’s various databases covering chipsets, devices, spectrum and networks.

Investment in 5G SA by public and private network operators

5G SA networks can be deployed in a variety of scenarios: as an overlay for a public 5G non-SA (NSA) network, as a greenfield 5G deployment for a public network operator without a separate LTE network, or as a private network deployment for an enterprise, utility, education, government or any other organization requiring its own private campus network.

GSA has identified 94 operators in 48 countries/territories worldwide that have been investing in public 5G SA networks (in the form of trials, planned or actual deployments). This equates to just over 20% of the 469 operators known to be investing in 5G licenses, trials or deployments of any type.

At least 19 operators in 15 countries/territories are now understood to have launched public 5G SA networks. A further four have deployed 5G SA technology but not yet launched services, or have only soft-launched them. In addition to these, at least 25 have been catalogued as deploying or piloting 5G standalone, 28 as planning to deploy the technology and 18 as being involved in evaluations/tests/trials.

A recent survey of European and North American mobile operators by Heavy Reading and EXFO (published October 2021) revealed that 49% of them plan to deploy 5G SA within a year and that a further 39% plan to deploy 5G SA within one or two years. Meanwhile, vendors are reporting the deployment of 5G core SA networks that are not announced publicly. So the active deployments and launches catalogued by GSA so far will be the first of many.

In addition to the investment in 5G SA for public mobile networks mentioned above, a number of organizations are testing, piloting or deploying 5G SA technologies for private networks. GSA has developed a new database tracking private mobile network licenses, trials and deployments. It has collated information about 626 organizations known to be deploying LTE or 5G private mobile networks, or known to have been granted a license suitable for the deployment of a private LTE or 5G network so far. Of those, 151 are known to be using 5G networks (excluding those labelled as 5G-ready) for private mobile network pilots or deployments. Of those, 27 (nearly 18% of them) are known to be working with 5G SA already, including manufacturers, academic organizations, commercial research institutes, construction, communications/IT services, rail and aviation organizations.

……………………………………………………………………………………………………………………………………

Addendum:

Despite the above 5G status report, many believe that 5G has been a failure. For example, Half-Baked Business Models…… from SDxCentral.

References:

https://gsacom.com/technology/5g/

https://www.sdxcentral.com/articles/news/half-baked-business-models-hamper-5gs-potential/2021/11/

Orange and Nokia demo 600Gb/sec transmission over a 914 km optical network; Nokia 25G PON

Nokia and Orange announced the completion of a network trial using the Nokia PSE-Vs, its fifth generation super coherent optics. With this field trial, Orange has successfully validated a planned upgrade of its long-haul backbone networks to support new high-bandwidth 400 Gb/sec services, and the ability to scale fiber capacity up to 600Gb/sec. This represents an increase in spectral efficiency by 50% compared to prior technologies on its long distance optical network.

The trial was performed in real-world conditions using Nokia PSE-Vs super coherent optics in production-ready optical transport hardware, just 16 months after the lab prototype trial done on Orange’s live network. Orange and Nokia demonstrated error-free performance at a data rate of 600Gb/sec over a 914 km network between Paris and Biarritz, under challenging live network conditions. The fiber network consisted of 13 spans of Orange’s existing network, through multiple cascaded reconfigurable optical add/drop multiplexers (ROADM), using 100GHz WDM spectrum channels.

Jean-Luc Vuillemin, Vice President of International Networks and Services at Orange, said: “With the booming market bandwidth requirement and need for scalability and flexibility, it is important that Orange continues to support an ever-greater network scale and new high-bandwidth services across our terrestrial and subsea global footprint.

Validating super coherent optics with Nokia represents an important enabler for future-proof networks which will bring spectral efficiency and operational deployment flexibility to our customer solutions. Furthermore this technology will allow for power savings by nearly 50%, which is key to our objective of developing greener networks for our customers. ”

James Watt, Head of Optical Networks Division, Nokia, said: “We are delighted to work with Orange in continued support of their network upgrade plans. With the introduction of the PSE-Vs super coherent capabilities across our entire 1830 portfolio, Nokia enables spectrally-efficient transport at 600Gb/sec over real-world long haul networks, and 400Gbps services over ultra long haul networks spanning multiple 1000’s of kilometers.”

Nokia 1830 Photonic Service Interconnect (PSE)

The Nokia PSE-V

The Nokia PSE-V is the industry’s most advanced family of digital coherent optics (DCO), powering the next generation of Nokia high-performance, high-capacity transponders, packet-optical switches, disaggregated compact modular and subsea terminal platforms. The PSE-V Super Coherent DSP (PSE-Vs) implements the industry’s only 2nd generation probabilistic constellation shaping (PCS) with continuous baud rate adjustment, and supports higher wavelength capacities over longer distances – including support for 400G over any distance – over spectrally efficient 100GHz WDM channels while further reducing network costs and power consumption per bit.

Further resources:

• Web page: Nokia 1830 Photonic Service Interconnect (PSI)

• Web page: Nokia Photonic Service Engine (PSE) Coherent DSPs

• Web page: 400G Everywhere

……………………………………………………………………………………………………………………..

Earlier this week, Nokia and Bell Canada announced the first successful test of 25G PON fiber broadband technology in North America at Bell’s Advanced Technical Lab in Montréal, Québec.

The trial validates that current GPON and XGS-PON broadband technology and future 25G PON can work seamlessly together on the same fiber hardware, which is being deployed throughout the network today. 25G PON delivers huge symmetrical bandwidth capacity that will support new use cases such as premium enterprise service and 5G transport. Nokia’s 25G PON solution utilizes the world’s first implementation of 25G PON technology and includes Lightspan and ISAM access nodes, 25G/10G optical cards and fiber modems.

For the past decade, Bell has been rolling out fiber Internet service to homes and businesses across the country, a key component in the company’s focus on connecting Canadians in urban and rural areas alike with next-generation broadband networks. With this successful trial, Bell can be confident that its network will absorb the increased capacity of future technologies and connect Canadians for generations to come.

Stephen Howe, EVP & Chief Technology Officer, Bell, said:

“As part of Bell’s purpose to advance how Canadians connect with each other and the world, we embrace next-generation technologies such as 25G PON to ensure we remain at the forefront of broadband innovation. Our successful work with Nokia to deliver the first 25G PON trial in North America will help ensure we maximize the Bell fiber advantage for our customers in the years to come.”

Jeffrey Maddox, President of Nokia Canada, said: “Nokia innovations powered the fiber networks and the connectivity lifeline that carried Canadian homes and businesses through the pandemic. 25G PON innovations will drive the next generation of advances in our connected home experience.”

Bell and Nokia have closely collaborated over the years on many industry breakthroughs, such as the first Canadian trial of 5G mobile technology in 2016. Bell continues to work with Nokia to build and expand its 5G network across Canada.

References:

TIM Brasil, Ericsson, Qualcomm, Motorola test 5G SA for power distribution in LatAm

TIM Brasil has been carrying out a 5G Standalone (SA) pilot in Sao Paulo since August 2nd. It’s in partnership with energy distribution company Enel, reports Telesintese. The 5G SA tests in an electric substation in the neighborhood of Vila Olímpia are being conducted in the 3.5 GHz band and use Ericsson AIR 6449, AIR3227, and AIR 6488 antennas. Qualcomm provided a 5G Fixed Wireless Access (FWA) gen 2 CPE with Snapdragon X62 5G Modem, while Motorola provided Edge, Moto G 5G and Moto G100 smartphones.

Sensors installed by Enel in the substation allow remote control of the structure and identify in real time if there are faults or maintenance needs. According to the companies, this is the first pilot to use 5G in electrical distribution in Latin America.

Photo Credit: Telesintese

As Leonardo Capdeville explained to Tele.Síntese , the 5G worked as a backhaul link for Qualcomm’s CPE, which radiated the WiFi signal through the power substation. Sensors installed by Enel in the substation allow remote control of the structure and identify in real time if there are failures or maintenance needs.

Another application tested is related to the field team. Enel technicians use smartphones connected directly to 5G. These feature augmented reality programs that allow instant access to substation data and detail how to perform maintenance just by pointing the camera at the equipment.

This was the first pilot to use 5G in electrical distribution in Latin America, according to the companies.

Currently, Enel uses systems that connect via 3G to its control centers. Such a connection is much slower, and results in response times in the seconds.

With 5G, observe Fernando Andrade, responsible for the Engineering and Construction area at the distributor, the response time is between 1 to 5 milliseconds, opening the way for a more intense use of the concept of “self healing” networks, that is, networks that establish routes for energy as problems in one of them are identified.

PROJECT WILL BE BIGGER WHEN 3.5 GHZ SIGNAL IS RELEASED:

According to the executives, the project should evolve. Enel liked the result, noted gains in efficiency and speed in handling incidents. In the city of São Paulo there are 120 power substations that could be connected, but the executive goes further: “We started with the substation because it is a relatively controlled environment, but it is possible to spread the technology to the equipment throughout the network ”, he observed.

Andrade envisions the use of 5G for commanding drones, capturing and analyzing images. It even suggests that, in the future, garbage trucks bring cameras and sensors that analyze energy networks, freeing inspectors for other tasks.

Capdeville, from TIM, points out that the current test is based on a provisional license from Anatel, but that the antenna installed in Vila Olímpia must remain and be used to serve the 5G consumer in general as soon as the 3.5 GHz spectrum is released in the city – the operator was one of the buyers of the track in the auction held by the regulatory agency at the beginning of the month .

The 5G network pilot is part of Enel’s Urban Futurability project, which will transform Vila Olímpia into a digital and sustainable neighborhood with an investment of R$125 million from the Research and Development program of the National Electric Energy Agency (Aneel).

TIM and Enel, both companies with Italian origins, already have a partnership for research and development of products and in different areas. Enel is one of the companies hired by TIM to supply energy from renewable sources. In this case, the built-in solar power plants distributor in Bahia serves the tele consumer units.

In addition, Enel X, the energy company’s innovation arm, has a contract with TIM to develop solutions for smart cities – such as smart grid applications.

References:

https://www.telecompaper.com/news/tim-brasil-launches-5g-standalone-tests-with-enel–1404882

Ericsson expresses concerns about O-RAN Alliance and Open RAN performance vs. costs

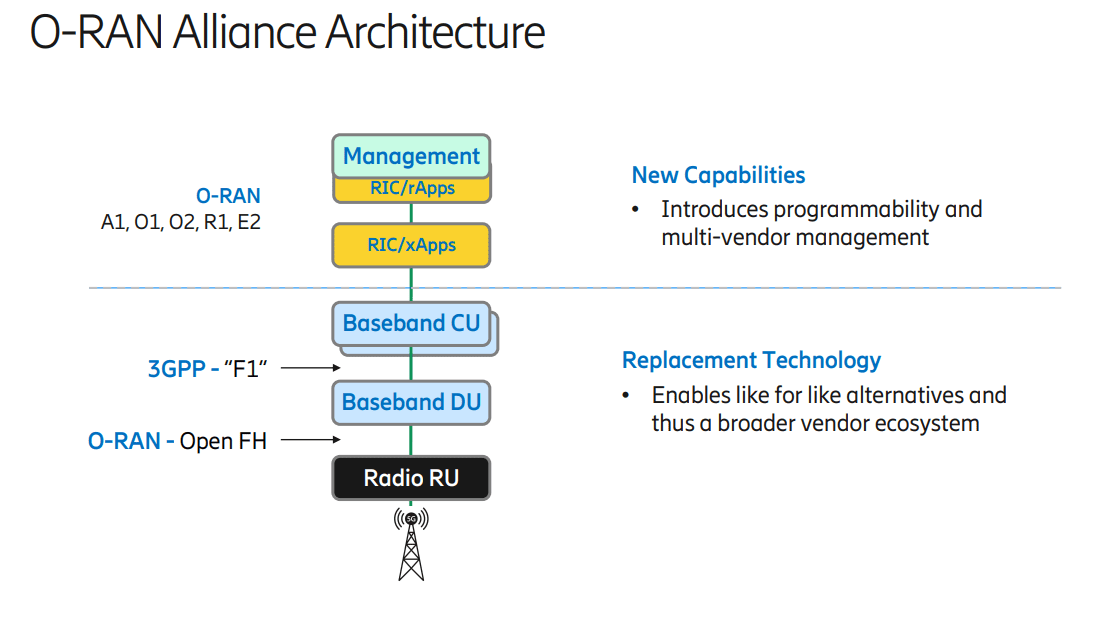

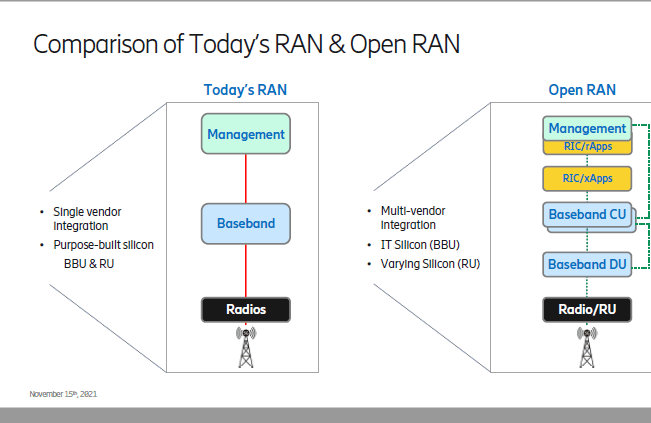

In a letter to the FCC, Jared M. Carlson, Ericsson’s Vice President, Government Affairs and Public Policy expressed his company’s concern with the O-RAN Alliance. In particular, an August report of the European Commission could not determine whether the O-RAN Alliance was complying with various WTO criteria, including transparency and open procedures, and also noted a concern that any one of the five founding members could effectively veto any proposed specification.

Some O-RAN Alliance specifications are proceeding slowly, according to Ericsson. One reason why can be explained simply by the resources devoted to the group. For example, O-RAN front-haul meetings (a more mature O-RAN specification) sees about 60 members attending, with only about ten members actively contributing. In contrast, in a typical 3GPP RAN Plenary, there are approximately 600 members delivering 1000 contributions per quarter.

The lack of completed O-RAN specifications means that any such deployments require individual vendors to come to mutual agreements—a far cry from the “plug-and-play” vision of a complete set of Open RAN network interface standards. Light Reading referred to that months ago as another form of “vendor lock-in.”

Mike Murphy, CTO, Ericsson North America told the FCC that Ericsson has dedicated a number of resources to making O-RAN Alliance specifications successful, delivering about 1000 of 7000 total specifications,” the company told the FCC, citing Murphy’s presentation. “Indeed, without Ericsson’s contributions to the O-RAN Alliance, the timeline for more fully developed standards would likely be even further out in the future.”

Regarding security, Mr. Murphy noted that, again, Ericsson is one the top three contributors to the O-RAN Alliance Security working group. Yet there are no security specifications from the O-RAN Alliance Security group—there is only a set of requirements. He also noted that the performance of Open RAN does not compare to (vendor specific, purpose built) integrated RAN. Even if the so called 40% cost saving estimates were true on a per-unit cost basis, the two different types of RAN equipment would not deliver the same level of performance.

Furthermore, Ericsson’s own estimates have indicated that Open RAN is more expensive than integrated RAN given the need for more equipment to accomplish what purpose-built solutions can deliver and increased systems integration costs. That’s quite shocking considering that many upstarts (e.g. Rakuten, Inland Cellular, etc) have stated Open RAN is cheaper. For example, “Open RAN will allow for cost savings over proprietary architectures,” Open RAN vendor Mavenir declared in its own recent meeting with FCC officials. The company said open RAN equipment can reduce network providers’ operating expenses by 40% and total cost of ownership by 36%.

Ericsson isn’t the only 5G company cautioning the FCC on Open RAN. Nokia – another major 5G equipment vendor – made similar arguments in a recent presentation to the FCC. “While there are some vendors that only offer open RAN architecture and/or limited RAN products, Nokia is able to provide a choice of classical or open RAN depending on the desires of our customers,” Nokia explained. “To date, the vast majority of service providers have chosen classical RAN solutions, deferring investment in open RAN until further commercial maturity has been demonstrated.”

Nokia also took issue with the notion that open RAN equipment is dramatically cheaper than traditional, classic RAN equipment. “The draft cost catalog also demonstrates that there are not cost savings being offered through open RAN equipment estimates compared to integrated RAN estimates,” Nokia wrote to the FCC in April following the release of the agency’s initial, draft pricing catalogue.

Many telecom professionals, like John Strand, argue that open RAN is not yet mature. They contend that government mandates that would require the use of the technology – in a furtherance of geopolitical goals – would be misguided. “The US has clearly demonstrated that open and intense competition, not government mandates, is the most effective way to mobilize the telecom industry to enable unprecedented innovation and value creation,” Ericsson told the FCC. “The US led the world in 4G and the ‘app economy’ not by insisting on any particular network standard, but by creating an open, predictable and attractive investment climate for all industry stakeholders and allowing operators to select the best technology based on their needs.”

Mr. Murphy concluded that the Commission and the U.S. government more generally should continue to “keep their eyes on the prize.” Notably, ensuring that the U.S. continues to smooth the way for 5G deployments will continue to pay dividends for the U.S. economy, with over $500 Billion added to the U.S. economy from 5G-enabled business, is the critical job of the day. The key step the Commission can take is to continue to foster the deployment of 5G.

References:

https://ecfsapi.fcc.gov/file/1117953022367/Ericsson%20Open%20RAN%20ex%20parte%20Nov%2017%20FINAL.pdf

https://ecfsapi.fcc.gov/file/1117953022367/Ericsson%20O-RAN%20Update%20FINAL.pdf

https://www.lightreading.com/open-ran/ericsson-actually-open-ran-is-more-expensive/d/d-id/773617?

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

Addendum -Tuesday 23 November 2021:

German study warns of security risks in Open RAN standards

Open Radio Access Networks (Open RAN) based on the standards of the O-RAN Alliance carry significant security risks in their current form, according to a study commissioned by Germany’s Federal Office for Information Security (BSI). The analysis was carried out by the Barkhausen Institute, an independent research institution, in cooperation with the group Advancing Individual Networks in Dresden and the company Secunet Security Networks.

The implementation of Open RAN standards by the O-RAN Alliance is based on the 5G-RAN specifications developed by the 3GPP. Using a best / worst case scenarios analysis, the German study demonstrated that the Open RAN standards have not yet been sufficiently specified in terms of ‘security by design’, and in some cases carry security risks. The BSI called for the study’s findings to be taken into account in the further development of the Open RAN ecosystem, in order to support the rapid growth of the market with security from the start.

The open RAN project is supported by all three mobile operators in Germany – Deutsche Telekom, Vodafone and Telefonica – as well as the 1&1, which is building a fourth network in the country. The German government also recently awarded EUR 32 million in subsidies to support further development of the open RAN technology.

https://www.telecompaper.com/news/german-study-warns-of-security-risks-in-open-ran-standards–1405252

China plans to triple the number of 5G base stations by end of 2025

China’s Ministry of Industry and Information Technology (MIIT) plans to more than triple the number of 5G base stations over the next four years, targeting a total of 3.64 million by end-2025, local newspaper China Daily reported.

China aims to have about 3.64 million 5G base stations by the end of 2025. That’s 26 5G base stations for every 10,000 people. In comparison, there were only five 5G base stations for every 10,000 people in China in 2020.

Xie Cun, director of MIIT, said the overall goal proposed in a five-year plan for the information and communication industry is to basically build a high-speed, ubiquitous, smart, green, safe and reliable new digital infrastructure by 2025.

The plan also proposed that the penetration rate of 5G users in China will increase from 15 percent in 2020 to 56 percent in 2021, and by then, 80 percent of China’s administrative villages will have 5G signal accessibility.

Xie said that China so far has already built more than 1.15 million 5G base stations, accounting for more than 70 percent of the global total, and 5G network coverage has been achieved in urban areas of all prefecture-level cities, 97 percent of counties and 40 percent of rural towns across the country.

The 5G mobile subscriber accounts in China, numbering some 450 million, make up over 80 percent of the global total, Xie added.

The five-year plan also forecast that by the end of 2025, the information and communication industry will maintain an annual growth rate of about 10 percent to reach a total revenue of 4.3 trillion yuan ($674.2 billion) in 2025. The plan also forecast that the cumulative investment in telecom infrastructure will increase from 2.5 trillion yuan in 2020 to 3.7 trillion yuan in 2025.

Widening the industrial use of 5G will also be a key focus for China. Xie said 5G has already been used in 22 industries. The application of 5G in industrial manufacturing, mining and ports is relatively mature, where 5G has been expanded from production assistance to core businesses such as equipment control and quality control. Meanwhile, a number of 5G-powered applications have also emerged in industries such as medical care, education and entertainment.

“In the next step, we will work with other parties to focus on promoting 5G applications in 15 industries that target information consumption, real economy and people’s livelihood services,” Xie said.

Wang Zhiqin, deputy head of the China Academy of Information and Communications Technology, a government think tank, said China is likely to achieve several breakthroughs in 5G technological evolution, network construction and applications by 2025.

“By the end of the 14th Five-Year Plan period (2021-25), China will have built the world’s largest and most extensive stand-alone 5G network and basically achieve full network coverage in urban and rural areas,” Wang said.

Ding Yun, president of Huawei Technologies carrier business group, said:

“5G is no longer for early adopters. It is improving our daily lives. This year is the first year with large-scale 5G industry applications. Operators will need new capabilities in network planning, deployment, maintenance, optimization and operations, in order to achieve zero to one, and replicate success from one to many.”

……………………………………………………………………………………………………………………………..

Technicians check a 5G base station in Tongling, Anhui province, China

[Photo by Guo Shining/For China Daily]

Chinese operators recorded a net gain of 43.88 million 5G subscribers in September, according to the carriers’ latest available figures.

China Mobile, the world’s largest operator in terms of subscribers, added a total of 27.08 million 5G subscribers in September. The state owned #1 carrier said it ended last month with 331.22 million 5G subscribers, compared to 113.59 million 5G customers in September 2020. China Mobile has added a total of 166.22 million subscribers in the 5G segment since the beginning of the year.

Rival operator China Unicom said it added a total of 7.88 million 5G subscribers during last month. During the first nine months of the year, the carrier added a total of 66.11 million 5G subscribers. The telco ended September with 136.94 million 5G subscribers. China Unicom started to provide 5G statistics earlier this year.

China Telecom added 8.92 million 5G subscribers in September to take its total 5G subscribers base to 155.54 million. During the January-September period, the telco added a total of 69.04 million 5G subscribers.

Leichtman Research Group: U.S. broadband growth returns to pre-pandemic levels in Q3-2021

Leichtman Research Group, Inc. (LRG) found that the largest cable and wireline phone providers in the U.S. – representing about 96% of the market – acquired about 630,000 net additional broadband Internet subscribers in 3Q 2021, compared to a pro forma gain of about 1,525,000 subscribers in 3Q 2020, about 615,000 in 3Q 2019, and about 600,000 in 3Q 2018.

These top broadband providers now account for about 107.9 million subscribers, with top cable companies having about 75.2 million broadband subscribers, and top wireline phone companies having about 32.7 million subscribers.

Findings for the 3rd /quarter include:

- Overall, broadband additions in 3Q 2021 were 41% of those in 3Q 2020

- The top cable companies added about 590,000 subscribers in 3Q 2021 – 45% of the net additions for the top cable companies in 3Q 2020

- The top wireline phone companies added about 40,000 total broadband subscribers in 3Q 2021 – compared to about 200,000 net adds in 3Q 2020. Telcos had about 475,000 net adds via fiber in 3Q 2021, and about 435,000 non-fiber net losses

“Broadband additions returned to pre-pandemic levels in the third quarter of 2021,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “The top broadband providers added significantly fewer subscribers than in last year’s third quarter, but had a similar number of net adds as in 3Q 2019 and 3Q 2018.”

| Broadband Providers/ | Subscribers at end of 3Q 2021// | Net Adds in 3Q 2021/ |

| Cable Companies | ||

| Comcast | 31,688,000 | 300,000 |

| Charter | 29,899,000 | 265,000 |

| Cox* | 5,510,000 | 25,000 |

| Altice | 4,388,100 | (13,200) |

| Mediacom | 1,466,000 | (2,000) |

| Cable One | 1,030,000 | 13,000 |

| Atlantic Broadband^ | 717,000 | 3,000 |

| WOW (WideOpenWest)^ | 509,500 | 1,600 |

| Total Top Cable | 75,207,600 | 592,400 |

| Wireline Phone Companies | ||

| AT&T | 15,510,000 | 29,000 |

| Verizon^^ | 7,337,000 | 74,000 |

| CenturyLink/Lumen | 4,589,000 | (77,000) |

| Frontier | 2,789,000 | (9,000) |

| Windstream | 1,147,000 | 15,200 |

| TDS | 522,800 | 9,200 |

| Cincinnati Bell* | 439,000 | 1,200 |

| Consolidated | 390,661 | (2,819) |

| Total Top Telco | 32,724,461 | 39,781 |

References:

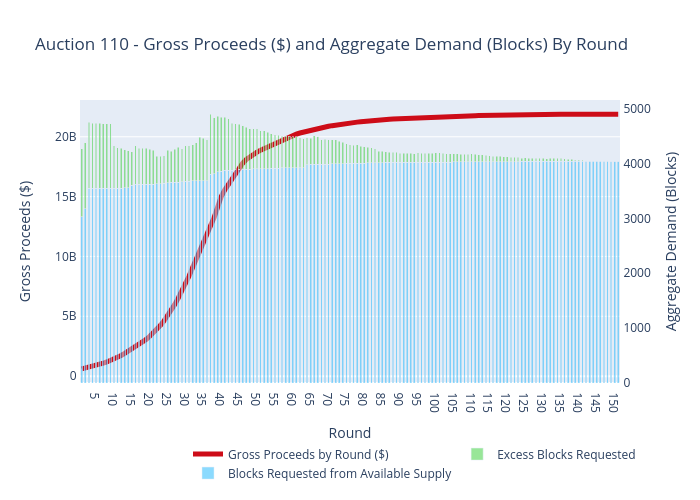

FCC Auction 110 for mid-band 5G spectrum gets $21.9B in winning bids

The latest FCC auction (#110) of mid-band spectrum for 5G ended Tuesday with a total of $21.9 billion in winning bids. That total is roughly in line with pre-auction estimates.

Auction 110 offered 100 megahertz of mid-band spectrum in the 3.45–3.55 GHz band (the 3.45 GHz Service) for flexible use, including 5G wireless. The 100 megahertz of spectrum available in Auction 110 will be licensed on an unpaired basis divided into ten 10-megahertz blocks in partial economic areas (PEAs) located in the contiguous 48 states and the District of Columbia (PEAs 1–41, 43–211, 213–263, 265–297, 299–359, and 361–411). These 10-megahertz blocks are designated as A through J.

The clock phase concluded on November 16, 2021. The FCC will release a public notice within the next few business days announcing details about the assignment phase, including the date and time when bidding in the assignment phase will begin.

See the Auction 110 website for more information.

Highlights:

- Qualified Bidders (Clock Phase)= 33

- Licenses Won=4041

- FCC Held Licenses=19

- Total Licenses=4060

- Gross Proceeds as of Clock Phase=$21,888,007,794

Next up is the auction’s “assignment” phase, wherein winning bidders can select the specific frequencies they want to use. After that phase is over, the FCC will announce the identities of the winning bidders. That might not happen until December or January.

Major participants in the auction included AT&T, Verizon, T-Mobile, Dish Network, Grain Management and Columbia Capital.

The spectrum in this auction is ideal for 5G. Mid-band spectrum is in high demand because it is widely viewed as providing the optimum mix of speed and coverage for 5G. Licenses in Auction 110 sold for an average of $0.666 per MHz per person (MHz pop) in the coverage area, according to Sasha Javid, chief operating officer for BitPath, who has been doing a detailed daily analysis of auction results.

Auction 110 winners will pay less per MHz pop in comparison with what Auction 107 (C-band) winners paid but more than Auction 105 CBRS band winners paid, according to Javid. Those other two auctions also included mid-band spectrum and the C-band auction was record breaking.

Javid notes that the CBRS licenses were subject to power restraints, making them less valuable. He didn’t offer an opinion on why Auction 110 licenses were less costly than Auction 107 licenses (on a MHz-pop basis), but perhaps the disparity is related to license size.

Winning bidders will need to purchase new radio equipment from base station/kit makers Ericsson, Nokia, and Samsung (but not Huawei or ZTE which are banned in the U.S.) to put their spectrum licenses into 5 commercial service.

Unlike past spectrum auctions, cable companies including Comcast and Charter did not participate in the auction. Based on Dish Network’s recent fundraising, the company appears poised to potentially account for as much as a fourth of the auction’s total.

Broadly, the FCC’s 110 auction of spectrum licenses between 3.45GHz and 3.55GHz can be considered a success. The auction started October 5, and bidding crossed the critical $14.8 billion reserve price October 20. That was a necessary milestone considering that reserve price is the cost to move existing, incumbent military users out of the band.

The auction was worth around $0.70 per MHz-POP. The per MHz-POP calculation is applied to most spectrum transactions and reflects the number of people covered compared with the amount of spectrum available, though it can be affected by a wide variety of factors.

In comparison, the recent CBRS auction of mid-band spectrum drew winning bids of just $0.215 per MHz-POP, whereas the massive C-band auction generated winning bids of $0.945 per MHz-POP, a figure that does not account for additional clearing costs.

This FCC auction is the agency’s third-biggest spectrum auction ever. As noted by Next TV, only the $45 billion AWS-3 auction in 2015 and the $81 billion C-band auction earlier this year generated more in winning bids. The auction earlier this month passed the FCC’s broadcast incentive auction of 600MHz licenses, which ended with $19.8 billion in winning bids in 2017.

The value of the spectrum licenses in this auction could rise if interference with aircraft concerns continue to drag on the C-band. However, CTIA President and CEO, Meredith Attwell Baker in response to the bulletin maintained that 5G using C-band won’t cause interference and that timely deployments are key for 5G leadership. “5G networks using C-band spectrum operate safely and without causing harmful interference to aviation equipment.

References:

https://www.fcc.gov/auction/110

https://auctiondata.fcc.gov/public/projects/auction110

https://www.fcc.gov/auction/110/factsheet

https://sashajavid.com/FCC_Auction110.php

FCC Pockets Close to $22B in Auction 110 of 3.45 GHz Band Spectrum

The case for and against AI in telecommunications; record quarter for AI venture funding and M&A deals

Many pundits believe that telcos will need AI driven solutions. Some of the benefits: enable telcos to configure new offers and products in hours and days, fail fast/ learn fast when 5G applications don’t gain market traction, service customers more effectively and radically simplify their operations.

An AI-powered “decisioning engine” might help telcos take the correct action during every interaction in real time with customers, suppliers, and partners.

Proponents say that with AI-driven capabilities in place, telcos can:

Grow revenue through upsell and cross-sell of services: Telecom Providers (aka telcos or network operators) can increase average revenue per user (ARPU) by anticipating customer needs using real-time context, so they can make the right offer on the right channel when it is needed.

Accelerate subscriber growth: Net subscriber additions are critical to success. Key telecom industry partners can build customer interest in preferred channels, guide prospects to find the right bundle, and delight them with a flawless omni-channel experience.

Proactive digital customer service: By combining AI-driven decisioning with end-to-end automation, telcos can deliver proactive, personalized service across channels. This might give customers and agents a guided, intuitive experience that delivers the best outcomes for everyone seamlessly.

Resolve billing enquiries: To avoid costly calls to service centers and keep customers happy, telcos need to stay one step ahead. AI driven capabilities such as real-time monitoring and pattern detection can enable them to sense a potential billing issue, then send a proactive notification to the customer.

Guided service setup: In order to make a great first impression and reduce calls to the service center, AI can drive a self-serve guided setup for services like internet connectivity to make customers’ experience easy and frictionless. Step-by step visual instructions can help to get set up successfully, and troubleshooting tips allow customers to easily navigate challenges along the way.

Intelligent automation: To increase network capacity, efficiently deploy new 5G and fiber networks, or simplify order fulfillment, telecoms providers can use AI in combination with robotics and end-to-end automation to streamline and digitize complex operations, keeping margins high and bringing value to customers fast. With intelligent automation and robotics, telecoms can:

Orchestrate, automate, and deliver customer orders: With a better connection between front and back offices, partners, and customers across all channels, telcos can optimize operations, reduce costs and boost customer satisfaction.

Build and deploy new networks faster: Telecoms providers can accelerate fiber and 5G mobile network rollout with intelligent automation. Case management, robotics, and low-code development capabilities can help them build out critical infrastructure more efficiently and faster at lower cost.

Automatically resolve network outages and events: Telcos can provide end-to-end visibility of complex processes and analyze live data related to business rules, costs, and other criteria. The most effective delivery methods, equipment, vendors, or contractors can be selected to address and resolve problems.

……………………………………………………………………………………………………………………………………………………

However, the AI cheerleaders never talk about the shortcomings of cyclically ultra hyped AI technology. We call attention to the cover story on this month’s IEEE Spectrum (the flagship publication of IEEE). “Why is AI so Dumb?” Here’s an excerpt:

AI has suffered numerous, sometimes deadly, failures. And the increasing ubiquity of AI means that failures can affect not just individuals but millions of people. Increasingly, the AI community is cataloging these failures with an eye toward monitoring the risks they may pose.

“There tends to be very little information for users to understand how these systems work and what it means to them,” says Charlie Pownall, founder of the AI, Algorithmic and Automation Incident & Controversy Repository.

“I think this directly impacts trust and confidence in these systems. There are lots of possible reasons why organizations are reluctant to get into the nitty-gritty of what exactly happened in an AI incident or controversy, not the least being potential legal exposure, but if looked at through the lens of trustworthiness, it’s in their best interest to do so.”

Part of the problem is that the neural network technology that drives many AI systems can break down in ways that remain a mystery to researchers.

“It’s unpredictable which problems artificial intelligence will be good at, because we don’t understand intelligence itself very well,” says computer scientist Dan Hendrycks at the University of California, Berkeley.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………….

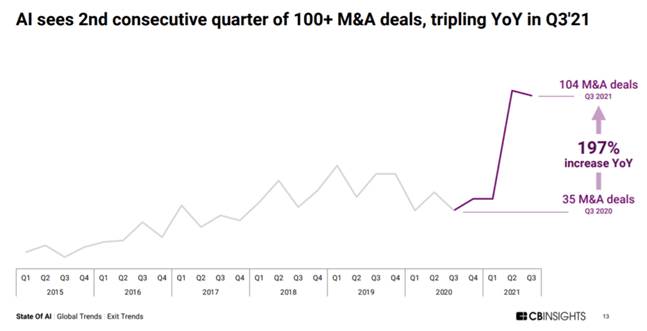

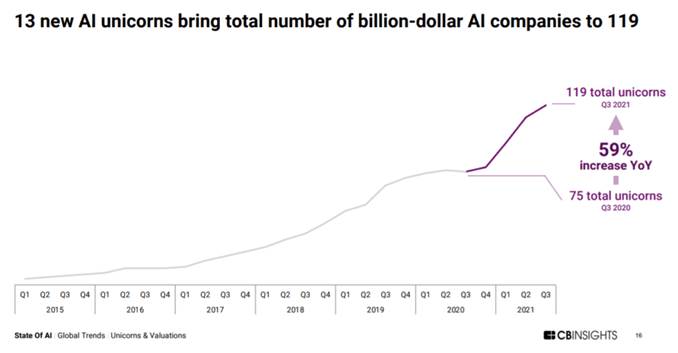

CB Insights: What you need to know about AI venture in Q3-2021:

- New record: $17.9B in global funding for AI startups across 841 deals in Q3-2021. This marks an 8% increase in funding and 43% increase in deals QoQ.

- At $50B, 2021 YTD funding has already surpassed 2020 levels by 55%. 75% Growth in megarounds YTD.

- The number of $100M+ mega-rounds has reached a record-high 138 in 2021 YTD.

- There were 45+ mega-deals in each of the first 3 quarters in 2021 — the highest quarterly numbers ever.

- 100+ AI acquisitions. Quarterly M&A deals have surpassed 100 for 2 consecutive quarters, putting total M&A exits at a record 253 in 2021 YTD.

- Annual IPOs and SPACs are also up this year. In Q3-2021, there were 3 SPACs and 8 IPOs.

- The largest M&A deal of Q3-2021 was PayPal’s acquisition of buy now, pay later startup Paidy for $2.7B — 370% bigger than the next largest deal. Paidy uses machine learning to determine consumer creditworthiness and underwrite transactions instantly.

- 43% QoQ increase in median US deal size. In Q3-2021, global markets saw strong QoQ growth in the median size of funding rounds: 43% in the US, 64% in Asia, and 67% in Europe.

- Across regions, median deal size was $7M, while average deal size reached a record $33M.

References:

https://telecoms.com/opinion/how-is-ai-reshaping-telecoms/

https://spectrum.ieee.org/files/11920/10_Spectrum_2021.pdf

https://www.cbinsights.com/research/report/ai-trends-q3-2021/

CableLabs Evolved MVNO Architectures for Converged Wireless Deployments

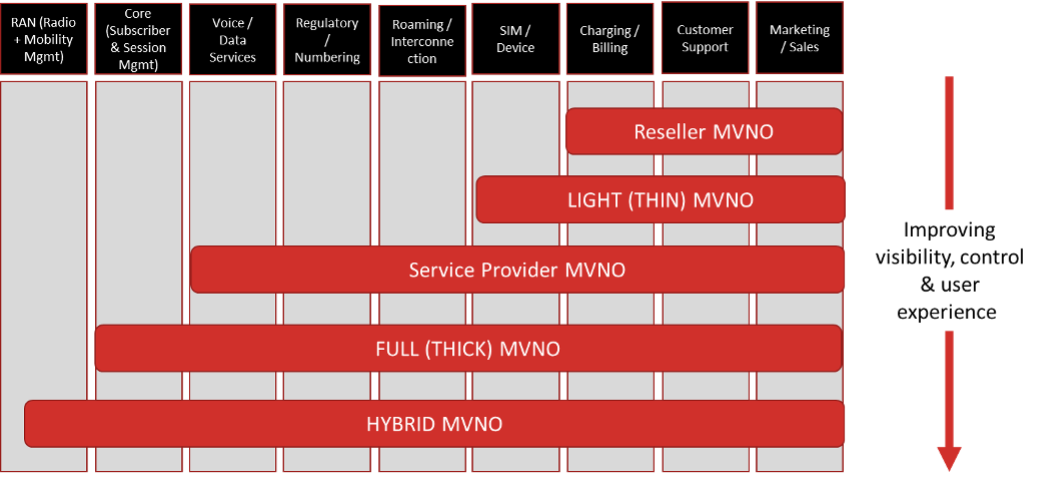

CableLabs and its members (cablecos/MSOs) initiated a technical working group to create an evolved architectural blueprint for mobile virtual network operators (MVNOs). The working group’s aim is to explore new converged architectures that will benefit CableLabs members’ wireless deployments while highlighting the benefits, impacts to existing deployments and features needed to be supported by both mobile network operator (MNO) and MVNO networks.

As cable operators in the US and abroad enter the mobile game or look to enhance their existing mobile services through MVNO partnerships, the working group’s intention is to “create an evolved architectural blueprint for mobile virtual network operators (MVNOs),” Omkar Dharmadhikari, wireless architect at CableLabs, explained this week in a blog post.

Many traditional broadband services providers—also known as multiple system operators (MSOs)—might not own mobile infrastructure but have (or are in the process of negotiating) MVNO arrangements with MNOs. These kinds of arrangements allow them to bundle fixed and mobile broadband services into a single service package. Traditionally, most MSOs adopt a reseller-type “Wi-Fi first” MVNO, where the MVNO doesn’t own any mobile network infrastructure and resells the services leveraging MNO infrastructure.

Source: CableLabs

The MVNO models vary based on the amount of mobile network infrastructure that the MVNO owns and the degree of control over the management of different aspects of MVNO subscriptions and their service offerings. One common aspect of all traditional MVNO models is leveraging the radio access network (RAN) of a partner MNO.

With the advent of 5G and the availability of shared spectrum, many MSOs are actively evaluating offload opportunities for enhancing MVNO economics and are contemplating deploying their own mobile radio infrastructure in specific geographic areas (in addition to their substantial Wi-Fi footprint).

Such MSOs now have to contend with three disparate sets of wireless infrastructures:

- the MSO’s community Wi-Fi network,

- the MNO’s 4G/5G network, and

- the MSO’s own 4G/5G network.

This creates a new type of MVNO model called hybrid-MVNO (H-MVNO) that enables MVNOs to offload their subscribers’ traffic from the MNO network—not just to their Wi-Fi networks but also to the MVNO-owned mobile network when inside the coverage footprint of their wireless network(s).

Maximizing data offload via the H-MVNOs’ own wireless assets—thus ensuring a consistent user experience and enforcing uniform and personalized policies as users move in and out of coverage of these three networks—will require the deployment of new converged network architecture and related capabilities.

While CableLabs working group’s focus on the hybrid MVNO challenge is new, several cable operators, including a group in North America, are already pursuing that initiative.

Comcast and Charter Communications have MVNO deals with Verizon, operate their own metro and in-home Wi-Fi networks, and have secured CBRS licenses in areas where mobile traffic is anticipated to be heaviest. Charter plans to launch a field trial involving “thousands” of CBRS small cells in one market in early 2022, and use that as a blueprint of sorts for deployments in additional markets.

Canada’s Cogeco plans to enter the wireless business in Canada via a proposed H-MVNO framework. Tied into that plan, Cogeco secured 38 spectrum licenses in the 3500MHz band at auction, and says it now has spectrum licenses to cover about 91% of its broadband footprint.

H-MVNOs intend to offload as much traffic as possible to help offset the costs of going to their mobile network operator partners. But they’ll also need a new converged network architecture and related capabilities to ensure a consistent user experience and the enforcement of uniform and personalized policies as customers move in and out of these different networks, Dharmadhikari explained.

The new CableLabs working group is exploring H-MVNO architectures that use dual-SIM and single-SIM approaches.

Unlike architectures with dual SIMs, single-SIM devices allow the H-MVNO network to enable seamless low-latency mobility for data applications across the MNO and H-MVNO networks. An ideal architecture for offering mobile services with single-SIM device usage is to combine the roaming architecture and a mobility interface, both of which are standardized in 3GPP.

However, due to the targeted nature of H-MVNO mobile deployments, the signaling load can increase on MNO mobility management core network elements, as the H-MVNO subscribers move in and out of H-MVNO network coverage.

To overcome this problem, CableLabs evaluated new MVNO architectures that make use of dedicated network elements within the MNO domain to serve H-MVNO subscriber traffic, thereby isolating it from the MNO subscriber traffic and eliminating the increase in signaling load on core network elements that serve MNO subscribers.

In addition, CableLabs evaluated voice handling in scenarios where H-MVNOs don’t want to deploy their own voice platforms. One option is to offer voice via a third-party voice service provider; another is to enable additional interfaces between the MNO and the H-MVNO network to leverage the MNO’s voice platform.

If you have any further questions, please feel free to reach out to the MVNO Interconnect Technical WG Lead, Omkar Dharmadhikari ([email protected]).

References:

https://www.lightreading.com/cable-tech/cablelabs-sizes-up-hybrid-mvno-architectures-/d/d-id/773484?