RootMetrics touts 5G performance in Korea while users complain; No 5G SA in Korea!

A new report released by RootMetrics (owned by IHS Markit), shared the 5G performance results in four major South Korean cities in the first half of 2021. Three South Korean operators, KT, LG Uplus and SK Telecom, claim to have provided users with widespread access to 5G, remarkable speeds, and low latency.

According to the report, LG Uplus’s 5G network in Seoul has the fastest speed, the shortest latency, and the best coverage, providing end users with an optimal 5G experience. This is the third consecutive year that LG Uplus has maintained their position as a 5G industry leader. Of note, the report stated that LG Uplus made the most efficient use of the spectrum, despite only 80 MHz of 5G bandwidth, less than that of KT and SK Telecom, with 100 MHz each.

South Korea’s 5G availability and user speed, which are the two key components of a consumer’s 5G experience, are ahead of most of the rest of the world. RootMetrics considers LG Uplus in Seoul to be the best 5G network based on the 5G report results in four cities (see image below):

- Best 5G coverage: LG Uplus provides coverage in all scenarios, including outdoor, indoor, high-speed railway, metro, hot spots etc., with 95.2% 5G availability. That means the network is providing ubiquitous 5G access, far more than cities like New York and London city.

- Fastest 5G speed: The median speed of 5G users is 640.7 Mbps, which is much higher than in other cities with 5G access.

LG Uplus has built 5G networks with high-bandwidth massive MIMO, deployed 64TRx Massive MIMO at scale for outdoor scenarios and LampSite+distributed Massive MIMO for indoor scenarios to build “Everywhere” Massive MIMO. In addition, 5G AI+ has also been introduced. Together these technology build the strongest and most intelligent 5G network, according to RootMetrics.

The report says that the performance of the other two major operators in South Korea is also impressive. The 5G availability of the three operators has increased to over 93% and the median speed is over 461 Mbps, which means end users can access the 5G network no matter their location to enjoy the ultimate 5G experience. RootMetrics can’t help praise: South Korea is winning the global 5G race, with availability and speeds that are far, far ahead of others.

“5G is becoming the foundation of our connected communities and as important a piece of infrastructure as is water, roads, or electricity. We’ve tested performance in South Korea over many years. Our results continue to show that South Korean operators have taken a leading position in delivering the type of 5G experience that can help fuel new consumer and business activity,” said Patrick Linder, Chief Marketing Officer at RootMetrics. “As 5G continues to expand across the globe, the implementation strategies and performance seen in South Korea have set an impressive standard for other operators to follow.”

Reference:

https://rootmetrics.com/en-US/content/5g-in-south-korea-1H-2021

………………………………………………………………………………………………………………………………………………………………………

In sharp contrast to RootMetrics’ glowing praise for 5G in South Korea, many 5G customers there are extremely dissatisfied as per this Light Reading article:

Their gripe is that 5G is little better than 4G in terms of speed, while coverage is annoyingly patchy. Worst of all, they’re locked into much more expensive two-year contracts when compared to LTE tariffs.

Rather than just put up with their 5G lot, this unhappy crew is intending to take part in a collective lawsuit and seek compensation of at least KRW1 million ($890) each. South Korean law firm Joowon is spearheading the legal action.

“Considering that monthly 5G plans are around 50,000 won more expensive than 4G LTE plans, we expect around 1 million won in compensation for users subscribed to two-year plans,” explained Kim Jin-wook, a Joowon lawyer.

Kim indicated that South Korea’s “big three” had a case to answer. They initially advertised 5G download speeds as being 20 times faster than 4G LTE, when they first came out of the 5G traps in April 2019, but a government report last year apparently found that average 5G download speeds were just four times faster than 4G.

Korea Bizwire points out that the Korea National Council of Consumer Organizations, a consumer advocacy group, recommended last October that carriers pay as much as KRW350,000 ($309) in compensation to users who filed for mediation over what they saw as a mediocre 5G service.

As of January the number of 5G subscribers in South Korea was just shy of 13 million, which was less than 20% of all mobile network users in the country.

5G customer dissatisfaction is a worldwide phenomenon. In May, Reuters reported that “about 70% of (global 5G) users are dissatisfied with the apps and services bundled with their 5G plans, according to a study carried out by Ericsson ConsumerLab in 26 markets around the world.

“While early adopters are pleased with 5G network speeds, they are already expressing dissatisfaction with a lack of bundled new and innovative apps and services, which they feel were promised in the marketing pitch for 5G,” Ericsson said.

“Service providers need to offer exclusive content and services that could differentiate a 5G experience from 4G and promote a sense of novelty and exclusivity,” Ericsson said.

……………………………………………………………………………………………………………………………………………………………

Finally, none of the South Korea carriers have deployed a 5G SA/Core network, despite Samsung’s bogus claim of November 4, 2020: “Samsung and KT announced they have successfully deployed Korea’s first 5G Standalone (SA) and Non-Standalone (NSA) common core in KT’s commercial network. KT will commercially launch its SA network when 5G SA-capable devices become available in the market.”

Well, that hasn’t happened yet, so KT’s 5G SA network has yet to be deployed! The major benefits of 5G, like network slicing, automation, secure communications, new QoS model, etc. are ONLY realized via a 5G SA core network.

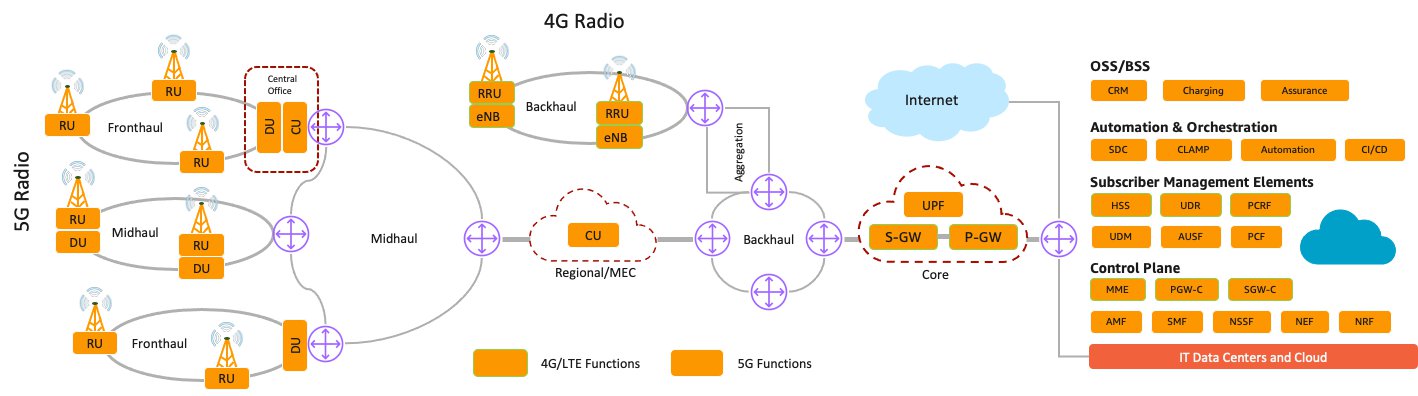

The 5G SA architecture connects the 5G Radio (base station or small cell) directly to the 5G core network, and the control signaling does not depend on the 4G network as it does in 5G NSA. The full set of 5G Phase 1 services (defined in 3GPP Release 15) are ONLY supported in 5G SA mode.

GSMA has identified 12 5G SA networks worldwide. None are in South Korea:

At least 12 operators in nine countries/territories are understood to have launched (or close to launch) public 5G SA networks:

- China Mobile, China Telecom and China Unicom have all launched 5G SA networks (China Telecom and China Unicom sharing some of the network construction). China Mobile has deployed or upgraded 400,000 base stations to support standalone services, while China Telecom announced its service launch covering more than 300 cities.

- T-Mobile in the USA has launched 5G SA nationwide using spectrum at 600 MHz.

- RAIN has launched 5G SA in parts of Cape Town in South Africa to support 5G FWA services and DIRECTV in Colombia has launched 5G SA for FWA in parts of Bogota. China Mobile Hong Kong announced the launch of 5G SA in late 2020.

- Mass Response (Spusu) has launched a limited network in Austria and is progressing with a wider regional deployment and, most recently.

- Telefonica and Vodafone have launched 5G SA networks in Germany.

- STC has announced a commercial launch in Kuwait.

- Singtel has announced its launch in Singapore (with other operators in Singapore expected to go live very soon).

- In Saudi Arabia, STC has announced that it has activated its 5G SA networks, although GSA is waiting for confirmation of availability of commercial services for customers before classifying its 5G SA networks as launched. Also, in Saudi Arabia, ITC has announced a soft launch of a 5G SA network.

- In Australia, Telstra has deployed a 5G core network and has stated it is ready to launch its 5G SA network once a sufficient range of suitable devices is available in the Australian market.

…………………………………………………………………………………………………………………………………………………………………….

Qualcomm’s designing custom CPU’s for dominance in laptop markets; CEO: “We will go big in China”

Qualcomm’s new CEO believes that by next year his company will supply CPU chips for laptop makers competing with Apple. Last year, the Cupertino, CA based company introduced laptops using a custom-designed central processor chip that boasts longer battery life. Longtime processor suppliers Intel Corp and Advanced Micro Devices have no chips as energy efficient as Apple’s.

Qualcomm Chief Executive Cristiano Amon told Reuters on Thursday he believes his company can have the best chip on the market, with help from a team of chip architects who formerly worked on the Apple chip but now work at Qualcomm. In his first interview since taking the top job at Qualcomm, Amon also said the company is also counting on revenue growth from China to power its core smartphone chip business despite political tensions.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RRPGOKG4OVID5I2WPBB3GWCY2Q.jpg)

“We will go big in China,” he said, noting that U.S. sanctions on Huawei Technologies Co Ltd (HWT.UL) give Qualcomm an opportunity to generate a lot more revenue.

Amon said a cornerstone of his strategy comes from a lesson learned in the smartphone chip market: It was not enough just to provide modem chips for phones’ wireless data connectivity. Qualcomm also needed to provide the brains to turn the phone into a computer, which it now does for most premium Android devices.

Now, as Qualcomm looks to push 5G connectivity into laptops, it is pairing modems with a powerful central processor unit, or CPU, Amon said. Instead of using computing core blueprints from longtime partner ARM Ltd, as it now does for smartphones, Qualcomm concluded it needed custom-designed chips if its customers were to rival new laptops from Apple.

As head of Qualcomm’s chip division, Amon this year led the $1.4 billion acquisition of startup, whose ex-Apple founders help design some those Apple laptop chips before leaving to form the startup. Qualcom will start selling Nuvia-based laptop chips next year.

“We needed to have the leading performance for a battery-powered device,” Amon said. “If ARM, which we’ve had a relationship with for years, eventually develops a CPU that’s better than what we can build ourselves, then we always have the option to license from ARM.”

ARM is in the midst of being purchased by Nvidia Corp for $40 billion, a merger that Qualcomm has objected to with regulators.

Amon said Qualcomm has no plans to build its own products to enter the other big market for CPUs – data centers for cloud computing companies. But it will license Nuvia’s designs to cloud computing companies that want to build their own chips, which could put it in competition with parts of ARM.

“We are more than willing to leverage the Nuvia CPU assets to partner with companies that are interested as they build their data center solutions,” Amon said.

Smartphone chips accounted for $12.8 billion of its $16.5 billion in chip revenue in its most recent fiscal year. Some of Qualcomm’s best customers, such as phone maker Xiaomi Corp are in China.

Qualcomm is counting on revenue growth as its Android handset customers swoop in on former users of phones from Huawei, which was forced out of the handset market by Washington’s sanctions.

Kevin Krewell, principal analyst at TIRIAS Research, called it a “political minefield” due to rising U.S.-China tensions. But Amon said the company could do business as usual there.

“We license our technology – we don’t have to do forced joint ventures with technology transfers. Our customers in China are current with their agreements, so you see respect for American intellectual property,” he said.

Another major challenge for Amon will be hanging on to Apple as a customer. Qualcomm’s modem chips are now in all Apple iPhone 12 models after a bruising legal battle. Apple sued Qualcomm in 2017 but eventually dropped its claims and signed chip supply and patent license agreements with Qualcomm in 2019. Apple is now designing chips to displace Qualcomm’s communications chips in iPhones.

“The biggest overhang for Qualcomm’s long-term stock multiple is the worry that right now, it’s as good as it gets, because they’re shipping into all the iPhones, but someday, Apple will do those chips internally,” said Michael Walkley, a senior analyst at Canaccord Genuity Group.

Amon said that Qualcomm has decades of experience designing modem chips that will be hard for any rival to replicate and that the void in the Android market left by Huawei creates new revenue opportunities for Qualcomm.

Another challenge for Amon, a gregarious executive who is energetic onstage during keynote presentations, will be that Qualcomm is not well known to consumers in the way that Intel or Nvidia are, even in Qualcomm’s hometown.

“I flew into San Diego and got an Uber driver at the airport and told him I was going to Qualcomm. He said, ‘You mean the stadium?'” Krewell said, referring to the football arena formerly home to the San Diego Chargers.

Amon has started a new branding program for the company’s Snapdragon smartphone chips to try to change that. “We have a mature smartphone industry today. People care what’s behind the glass,” he said.

References:

https://www.reuters.com/technology/qualcomms-new-ceo-eyes-dominance-laptop-markets-2021-07-01/

China Broadcasting Network tender for 480,400 5G macro base stations & multi-band antenna products

China Broadcasting Network (CBN), China’s fourth mobile operator, has issued a tender for the radio access portion of its national 5G network via its network partner China Mobile. Previously, the two companies entered into a 5G Network Co-construction and Sharing Collaboration Agreement along with other 5G collaborations.

The CBN/China Mobile tender requests bids for 480,397 5G macro base stations in the 700 MHz band which is roughly equivalent to the number of 2.6 GHz base stations already deployed by China Mobile. Based on past big 3 (China Mobile, China Telecom, China Unicom) tender results, Huawei and ZTE are expected to win approximately 85% of the business. That would leave only 15% for Ericsson or other well known 5G base station vendor, but probably NOT Nokia which was shut out of the last China 5G contract awards.

China granted a 5G license for use of the 700 MHz frequency to CBN, the country’s fourth telecoms operator, in June 2019. The other three obtained 5G licenses for 2.6 GHz and 4.9 GHz. Founded in 2014, Beijing-based CBN is the most recently established, so lacks users and infrastructure, which is partly why it is cooperating with China Mobile on 5G.

Concurrently, a bidding announcement for the centralized procurement of multi-band (including 700MHz) antenna products was also issued. This project is a centralized bidding project. The purchased products are multi-band (including 700M) antenna products. There are three types of 6 antennas: 4+4+4 antennas (700/900/1800MHz), divided into ordinary gain and high gain; 4+4+ 4+8 antennas (700/900/1800/FA), divided into long and short models; single 4 antenna (700MHz), divided into normal gain and high gain. The procurement scale is approximately 1.74 million antennas, of which 4.448 antennas require 1.14 million antennas, and the remaining model antennas such as 444 are 600,000 antennas.

China Mobile will complete the deployment of 700MHz 400,000 stations within this year. In the first half of 2022, they plan to open 480,000 seats and fully support 5G broadcasting services. Within two years full network coverage will be achieved.

There are now nearly 100 5G mobile phones supporting the 700MHz frequency band, covering high, middle and low end consumer groups. China Mobile earlier made it clear that in 2021, it will promote the joint construction and sharing of 700MHz to achieve 700MHz commercialization. It requires: starting from March 1, 2021, terminals of 4,000 yuan and above must support 700MHz; from October 1, 2021, The newly added terminal must support 700MHz.

The tender is a milestone for the China telecom sector, marking the start of the rollout of the new entrant, who is also the first network operator not linked to the Ministry of Industry and IT. CBN said the network will be configured around video and streaming to serve its existing cable TV customer base and to provide differentiation from the incumbent telcos. The rollout will include 5G mobile broadcasting capabilities, including 3,000 transmission towers.

The 700MHz frequency band is part of the wider ultra-high frequency (UHF) band used previously for terrestrial broadcasting. The 700MHz frequency band will improve connectivity in rural areas thanks to its ability to support better coverage in open spaces. Moreover, with its wide territorial reach and good penetration in buildings, the 700MHz band will help service providers meet the rising consumer demand for audiovisual content and other broadband services over wireless networks.

Li Shuang, Deputy Director of Department of Technology Development, CBN, said: “CBN always extensively cooperates with domestic and international industry partners with innovation-driven, open and win-win concepts in mind, promoting continuous maturation of the global industry chain of 5G 700MHz network and committed to building a high-quality nationwide 5G network in China. The successful test by Ericsson based on the 3GPP 5G specifications contributed by CBN, including the 700MHz technology standard and n28 band terminal enhancements standard, has improved the 700MHz network capability efficiently, which is of great significance to the innovation of low-band 5G networks in various scenarios.”

…………………………………………………………………………………………………………………………………………………………………………….

CBN and China Mobile are reportedly promising to deploy 400,000 base stations this year.

Robert Clark of Light Reading wrote, “That seems unlikely – it took the incumbent operators nearly two years to reach that mark – but it seems certain that CBN will offer its first commercial services late this year or early 2022. The bid documents state that the tender is fully funded, a positive sign for the cash-strapped CBN.

As Rakuten in Japan is learning, it is not easy to compete against big legacy players each with a large installed base and deep marketing channels. Even in the capital markets, CBN may find itself competing again with its industry rivals.”

References:

http://www.cctime.com/html/2021-6-30/1579416.htm

https://www.lightreading.com/asia/cbn-issues-massive-5g-base-station-tender/d/d-id/770623?

LF Networking 5G Super Blue Print project gets 7 new members

Overview:

LF Networking (LFN), which facilitates collaboration and operational excellence across open source networking projects, today announced seven new member organizations and one associate member have joined the community to collaborate on the 5G Super Blue Print initiative.

The 5G Super Blueprint project covers RAN, Edge, and Core and enables solutions for enterprises and verticals, large institutional organizations, and more. While Networking provides platforms and building blocks across the networking industry that enable rapid interoperability, deployment, and adoption. Participation in this nexus for 5G innovation and integration is open to anyone.

The new members are:

AQSACOM, a leader in Cyber Intelligence software solutions for communications service providers (CSPs) and law enforcement agencies (LEAs);

Radtronics, which provides secure and powerful private wireless network for Maximum Productivity with new applications and services, through Outcome based and cost efficient solutions enabled by strong innovation;

Turnuium, which enables channel partners to connect people, data, and applications through its turnkey multi-carrier managed SD-WAN;

SEMPRE, which secures 5G for critical infrastructure by moving compute to the edge and leveraging military-grade technology—the only HEMP-hardened 5G gNODEB with Edge; and

Wavelabs, a new-age technology company for the Digital, Cognitive & Industry 4.0 Era have joined LFN at the Silver level. New Associate members include: the Oman government’s Ministry of Transportation, Communications & Information Technology;

ICE Group’s (state telecommunications and energy operator of Costa Rica)

ANTTEC (ICE Group’s main union of technicians and engineers); and

High School Technology Services, which offers coding and technology training to students and adults, have joined as Associate members.

“As the center platform for enabling open source 5G building blocks, collaboration and integration is more important than ever for LFN, amplified by our recent developer event in early June,” said Arpit Joshipura, general manager, Networking, Edge and IoT, the Linux Foundation. “This impressive roster of new members across intelligence, government, enterprise and more are welcome additions to the LFN community. We look forward to continued collaboration that enables rapid interoperability, deployment, and adoption of 5G across the ecosystem.”

Leveraging the convergence of major initiatives in the 5G space, and building on a long-running 5G Cloud Native Network demo work stream, LF Networking is leading a community-driven integration and proof of concept involving multiple open source initiatives in order to show end-to-end use cases demonstrating implementation architectures for end users.

In April, the Linux Foundation and the World Bank launched an online course: 5G and Emerging Technologies for Public Service Delivery & Digital Economy Operations – Fundamentals of 5G Networks: Implications for Practitioners. The course is now available on the World Bank’s Open Learning Campus here. Aimed at decision makers and development practitioners, the course provides an introduction to open source and the critical role it plays in today’s networks.

ONE Summit:

Learn more about the 5G Super Blue Print during the Open Networking & Edge (ONE) Summit, the ONE event for end to end connectivity solutions powered by open source and enables the collaborative development necessary to shape the future of networking and edge computing. Taking place October 11-12, 2021 in Los Angeles, Calif., Registration will open soon.

New Member Support:

“With the dramatic growth of Private Wireless LTE and 5G networks over the coming years, the Open Source community will play a transformational role, which is the reason we’re joining the Linux Foundation Networking,” said Peter Lejon, co-founder of RADTONICS AB. “5G technology will have a huge impact on our future, driving positive changes for all of us. With enterprise and regional operators procuring solutions direct from the solutions providers, initiatives like 5G Super Blueprint and Magma Packet Core will be instrumental in serving a rapidly developing market that will include the next billion users on their journey of capturing value through digitalization. We believe that through Open Source and by working together, we can further accelerate the current pace of innovation and development. Change will never be this slow again,” added Lejon.

Marcus Owenby, SEMPRE’s Global CTO, affirmed “SEMPRE’s support for 5G Super Blueprint will enable enterprise and government organizations to leverage open source technology, while also securing 5G using military-grade technology purpose-built to protect critical infrastructure.”

“Wavelabs.ai is an ardent proponent of the ‘OPEN X’ network vision. We work with the entire ecosystems of clients & partners as an engaged, committed, and collaborative partner to realize 5G open and disaggregated ‘White Box’ network as a reality” said Mansoor Khan, CEO of Wavelabs. “LF Networking open-source 5G initiatives address major opportunities today and tomorrow. We believe this partnership will strengthen Wavelabs mission in accelerating the Journey to Future Connectivity by offering the unique blend of next-generation Digital, Cognitive, and Network technology services and solutions”

Resources

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

AT&T will run its 5G SA Core network on Microsoft’s Azure public cloud computing platform. Microsoft AZURE, which is the second largest cloud computing provider by revenue behind rival Amazon Web Services, has been building out specific cloud computing offering to attract carriers. AT&T is Microsoft’s first major deal in the 5G SA Core network space.

The two giant companies said that Microsoft will purchase software and intellectual property developed by AT&T to help build out its offerings for carriers. The companies did not disclose the terms of the deals, but said that Microsoft will make job offers to several hundred AT&T Network Cloud engineers.

Microsoft will use AT&T’s software and IP to grow its telecom flagship offering, Azure for Operators. Microsoft is acquiring AT&T’s carrier-grade Network Cloud platform technology, which AT&T’s 5G core network (when completed) will run on.

The companies disclosed a few key details about their new deal, but did not provide any firm numbers or any financial arrangements/guidance:

- Microsoft will “assume responsibility for both software development and deployment of AT&T’s Network Cloud immediately,” according to the companies, and will transition AT&T’s existing network cloud operations into Azure over the next three years. Eventually, all of AT&T’s mobile network traffic will run over Microsoft’s Azure.

- The effort will start with AT&T’s 5G core, but will eventually include virtually all of the company’s network operations, including its 4G core.

- Microsoft will be the company to certify all of AT&T’s software-powered network operations for inclusion in the AT&T network. That will include software from other vendors. AT&T has not yet named its 5G core network vendors.

- Microsoft will acquire AT&T’s Network Cloud technology – including its AT&T engineering and lifecycle management software – and its cloud-network operations team. The companies did not disclose exactly how many AT&T employees that transaction might cover, but an AT&T official suggested it will be in the “low hundreds.” Microsoft will then incorporate AT&T’s intellectual property into its Azure for Operators offering, which is for sale to other 5G network operators.

- Microsoft and AT&T did not provide the logistics of their deal, including exactly how many Azure computing locations might be necessary to power AT&T’s network. It’s an important issue considering AT&T’s cellular network spans an estimated 70,000 cell towers across the country, and the operation of the radios on top of those towers might eventually be handled by programs running inside of Microsoft’s cloud. A top Microsoft executive involved in the deal told Light Reading that Microsoft’s Azure software will be installed into some of AT&T’s existing computing locations. Several of those compute server locations are staffed by AT&T technicians.

- AT&T said the company plans to continue to run its network workloads inside of its own data centers and facilities. However, AT&T added that the deal today is focused on AT&T’s 5G core network and that the companies might explore additional elements of the network such as Open Radio Access Network (O-RAN) technology over the course of the agreement.

…………………………………………………………………………………………………………………………………………………

Sidebar: 5G SA Core networks to run on cloud service provider platforms:

- In late April, Dish Network made a similar deal to have Amazon run its 5G core network on AWS.

- In late May, Telefónica said it had validated AWS Outposts as option for 5G SA core deployment in Brazil.

- Earlier this week, TIM said it was building its 5G SA Core network on “Google’s cloud solutions” (whatever that means?)

Do you think the cloud service providers will essentially take over the implementation, operations, and maintenance of 5G SA Core networks, especially since they will likely all be “cloud native.” Please post a comment in the box below this article to express your opinion and why. Thanks!

………………………………………………………………………………………………………………………………………………………………………

“This deal is not exclusive, so I fully expect Azure will try to assert itself as the telecom cloud provider for many carriers around the world,” said Roger Entner of Recon Analytics LLC.

“It’s the first time a Tier One operator has trusted their existing consumer subscriber base to hyper-scaler technology,” Microsoft’s Shawn Hakl, VP of the company’s 5G strategy, told Light Reading. Before joining Microsoft in 2020, Hakl was a longtime Verizon executive.

The deal follows a $2 billion agreement in 2019 in which AT&T said it would start using Microsoft’s cloud for software development and other tasks. At that time, AT&T said it would continue to run its core networking functions in its own private data centers.

Andre Fuetsch, AT&T’s chief technology officer, said that shifting to a public cloud vendor will let AT&T take advantage of a larger ecosystem of software developers who are working on technologies such as wringing more use out of pricey 5G spectrum or creating new features for users. “That’s what we at AT&T want to do, and we think working with Microsoft gives us that advantage,” Fuetsch told Reuters in an interview.

“AT&T has one of the world’s most powerful global backbone networks serving hundreds of millions of subscribers. Our Network Cloud team has proved that running a network in the cloud drives speed, security, cost improvements and innovation. Microsoft’s decision to acquire these assets is a testament to AT&T’s leadership in network virtualization, culture of innovation, and realization of a telco-grade cloud stack,” said Andre Fuetsch, executive vice president and chief technology officer, AT&T. “The next step is making this capability accessible to operators around the world and ensuring it has the resources behind it to continue to evolve and improve. And do it securely. Microsoft’s cloud expertise and global reach make them the perfect fit for this next phase.”

Microsoft intends to use the newly acquired technology – plus the experience gained helping AT&T run the network – to build out a product it calls Azure for Operators, which it will use to pursue 5G core network business from telecommunications companies in the 60 regions of the world where it operates.

https://azure.microsoft.com/en-us/industries/telecommunications/

https://about.att.com/story/2021/att_microsoft_azure.html

https://www.reuters.com/business/media-telecom/att-run-core-5g-network-microsofts-cloud-2021-06-30/

https://www.lightreading.com/the-core/atandt-to-offload-5g-into-microsofts-cloud/d/d-id/770600?

Project Marconi: Machine Learning-based RAN application to boost 5G spectrum capacity

At MWC today Intel and Capgemini Engineering unveiled the industry’s first Machine Learning-based RAN application to boost 5G spectrum capacity. Capgemini says their solution gives mobile network operators a significant advantage to monetize 5G services faster. Entitled “Project Marconi,” it conforms to O-RAN (Open Radio Access Network) guidelines to maximize spectrum efficiency. The solution intelligently boosts subscriber quality of experience (QoE) with real-time predictive analytics.

Project Marconi is the industry’s first Artificial Intelligence / Machine Learning (AI/ML) based radio network application for 5G Medium Access Control (MAC) scheduler. Optimized with Intel AI Software and 3rd Gen Intel Xeon Scalable processors.

Network providers globally have invested heavily in spectrum and are looking for solutions to develop and gain 5G services faster. According to the Global Mobile Suppliers Association, the total value of spectrum auctions reached over $27 billion in 2020.

Capgemini’s application (running on Intel Architecture) increases the amount of traffic each cell can handle. It allows operators to serve more subscribers and deliver an outstanding experience, while launching new Industry 4.0 services such as enhanced Mobile Broadband (eMBB) and Ultra Reliable Low Latency Communications (URLLC) use cases.

Walid Negm, Chief Research and Innovation Officer at Capgemini Engineering said: “Our teams worked closely with Intel to create a truly innovative solution that can really move the needle for operators. We gathered and utilized over one terabyte of data and conducted countless test runs with NetAnticipate5G to fine-tune the predictive analytics to meet diverse operator requirements. In short, machine learning can be deployed for intelligent decision-making on the RAN without any additional hardware requirement. This makes it cost efficient in the short run and future proof in the long run as we move into Cloud Native RAN implementations.”

Cristina Rodriguez, VP of Wireless Access Network Division at Intel said: “Our 3rd Gen Intel Xeon Scalable processors with built-in AI acceleration provide high performance for deep learning on the Net Anticipate 5G platform. Together, our collaboration delivered ultra-fast inference data to enhance the Open-Source ML libraries resulting in an intelligent RAN that can predict and quickly react to subscriber coverage requirements while reducing TCO.”

Capgemini deployed its NetAnticipate5G and RATIO O-RAN platform to introduce advanced AI/ML techniques. The AI powered predictive analytical solution forecasts and assigns the appropriate MCS (modulation and coding scheme) values for signal transmission through forecasting of the user signal quality and mobility patterns accurately. In this way, the RAN can intelligently schedule MAC resources to achieve up to 40% more accurate MCS prediction and yield to 15% better spectrum efficiency in the case studies and testing. As a result, it delivers faster data speeds, better and more consistent QoE to subscribers and robust coverage for use cases that rely on low latency connectivity such as robotics-based manufacturing and V2X (vehicle-to-everything).

Project Marconi will be demonstrated live at Intel virtual booth and O-RAN virtual booth during MWC 2021.

More information can be found on Capgemeni’s website.

…………………………………………………………………………………………………………………………………………………………………..

Last week, Capgemini Research Institute released a report titled, “Accelerating the 5G Industrial Revolution: State of 5G and edge in industrial operations” stating that industrial 5G adoption is still at the ideation and planning stages, with only 30% of industrial organizations having moved to the pilot stage or beyond. This means there is a huge window of opportunity for telcos and those industrial organizations that are yet to make a move.

Signaling a paradigm shift, 40% of industrial organizations surveyed expect to roll out 5G at scale at a single site within two years, and the experience of early adopters could persuade others to make the move. 5G trials and early implementations are delivering strong business benefits, with 60% of early adopters saying that 5G has helped to realize higher operational efficiency, while 43% saying they have experienced increased flexibility.

The study also found that industrial organizations are optimistic that 5G will drive revenues by enabling the introduction of new products, services, and business models. In fact, 51% of industrial organizations plan to leverage 5G to offer new products, and 60% plan to offer new services enabled by 5G.

Furthermore, industrial organizations are aware of the role of edge computing in their 5G initiatives and view it as essential to realizing the full potential of 5G. 64% of organizations plan to adopt 5G-based edge computing services within three years, driven by the increased performance, reliability, data security and privacy it offers. More than a third of industrial organizations across sectors surveyed prefer to deploy private 5G networks, with interest in private 5G networks led by the semiconductor and high-tech sector (50%), followed by aerospace and defense (46%).

“Industrial 5G is a key catalyst in unlocking the potential of intelligent industry and accelerating data-driven digital transformation,” comments Fotis Karonis, Group Leader of 5G and Edge Computing at Capgemini. “Enterprises need to take advantage of the benefits of 5G by engaging with the ecosystem to tap into the shared expertise and co-create innovative, sustainable solutions for tomorrow. An element of iteration is required, but organizations should seek to leverage the 5G ecosystem to jointly test solutions and progress with full-scale 5G adoption, fine-tuning the approach as the ecosystem evolves.”

……………………………………………………………………………………………………………………………………………..

About Capgemini:

Capgemini is a global leader in partnering with companies to transform and manage their business by harnessing the power of technology. The Group is guided everyday by its purpose of unleashing human energy through technology for an inclusive and sustainable future. It is a responsible and diverse organization of 270,000 team members in nearly 50 countries. With its strong 50 year heritage and deep industry expertise, Capgemini is trusted by its clients to address the entire breadth of their business needs, from strategy and design to operations, fueled by the fast evolving and innovative world of cloud, data, AI, connectivity, software, digital engineering and platforms. The Group reported in 2020 global revenues of €16 billion.

References:

https://capgemini-engineering.com/uk/en/industries/communications/marconi-project/

https://www.dropbox.com/sh/i6j3jmvro58tv9q/AAC2UGWH1FvozJcVXElcbGnwa?dl=0

Orange to launch Europe’s 1st 5G Stand Alone (SA) end-to-end cloud network

Orange announced the official launch of a new research project starting in July, describing it as Europe’s first fully cloud-native 5G standalone network. Running over a two-year period, the experimental network in Lannion (Britanny) will reach further locations in 2022 and be tested by several hundred end-users. It will explore the benefit of a ‘zero-touch’ approach, relying on software-enabled automation and artificial intelligence to minimize human intervention in its operations.

Editor’s Note: Orange’s announcement comes just two days after TIM (previously known as Telecom Italia) said they were launching Europe’s first 5G SA Cloud Network. Both the TIM and Orange 5G SA networks are experimental tests rather than actual 5G SA commercial deployments.

………………………………………………………………………………………………………………………………………….

Orange’s experimental network will be a 100% software-enabled network, be data and AI-driven, fully automated and cloud-native. Crucially, it will also encompass Open RAN technology – underlining its commitment to this technology. By implementing and operating this network it will enable Orange to better understand how these technologies co-exist and their impact on the network lifecycle.

Furthermore, it will enable Orange to better understand the customer experience benefits of a fully cloudified network as well as the full potential of AI and Data. It will also enable Orange to determine the future skills needed – a key strand of its Engage2025 strategy to ‘co-create a future-facing’ company, as well as the environmental benefits – another key pillar of its strategy.

Built on a single Kubernetes-based infrastructure (containers), the network will combine elements from several partners, including the 5G Open RAN software developed by Mavenir. Orange has also selected Casa Systems (cloud 5G SA core network), Hewlett Packard Enterprise (cloud 5G SA subscriber data management), Dell Technologies (servers supporting RAN centralized unit, distributed unit and core) and Xiaomi (devices) as partners in the project.

Network and service management will be automated using orchestration open source tools from GitLab and ONAP. The scope of the forthcoming trials also covers OSS and BSS integration aspects.

The new network sees the setting up of Open RAN and 5G core functions on a single Kubernetes-based infrastructure fully managed by Orange and deploying a fully automated core. From July, the network will start using and testing O-RAN radio equipment, CNF’s (Containerized Network Functions) on a cloud infrastructure, network data collection and AI automation. The experimental network will also host Information System OSS (Operations Support System – network inventory management and network operations), BSS (Business Support System – CRM and billing) as well as scaling Orange’s ambition using AI to secure and optimize the network and predict its behavior. In 2022, the network will expand to further locations to increase the number of users and to test vertical use-cases leveraging dynamic network slicing.

Michaël Trabbia, Chief Technology and Innovation Officer, Orange, commented: “Our ambition is to prepare Orange for the operator of the future by building more resilient and auto-adaptive networks that offer best in class quality of service in each situation. This experimental network represents an important milestone on our way to implement and deploy Open RAN and AI technologies to prepare on-demand connectivity and zero touch operator capabilities.”

References:

https://techblog.comsoc.org/tag/5g-cloud-native-core-network/

GSMA Mobile Economy 2021: 5G has momentum, 4G has peaked, global mobile subscriber growth slowing

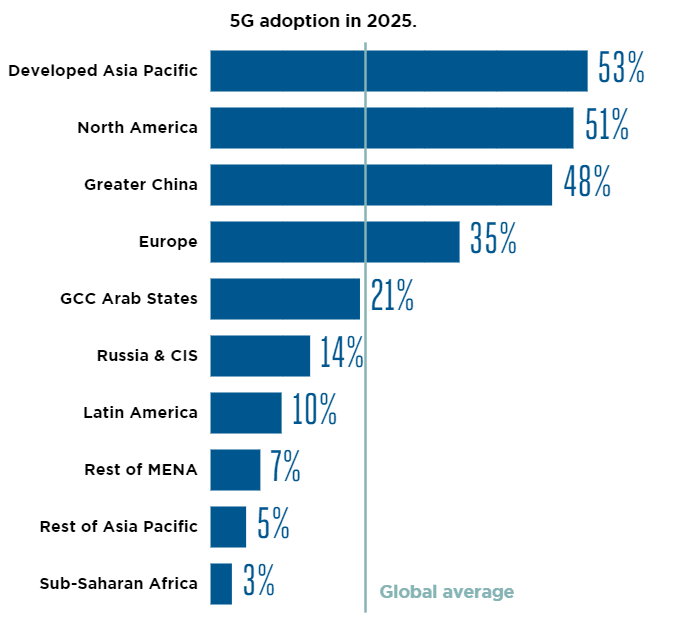

The launch of commercial 5G services in Latin America and Sub-Saharan Africa over the last year means that 5G technology is now available in every region of the world. The pandemic has had little impact on 5G momentum; in some instances, it has even resulted in operators speeding up their network rollouts, with governments and operators looking to boost capacity at a time of increased demand. By the end of 2025, 5G will account for just over a fifth of total mobile connections and more than two in five people around the world will live within reach of a 5G network. In leading 5G markets, such as China, South Korea and the U.S.

4G – LTE has peaked and, in some cases, begun to decline. In many other countries, particularly in developing regions, 4G still has significant headroom for growth. Much of the growth in 4G will come from existing 4G – LTE infrastructure, as 5G will account for 80% of total capex over the next five years. Globally, 4G adoption will peak at just under 60% by 2023 as 5G begins to gain traction in new markets.

Subscriber growth is slowing, but mobile’s contribution to the global economy remains significant. By the end of 2020, 5.2 billion people subscribed to mobile services, representing 67% of the global population. Adding new subscribers is increasingly difficult, as markets are becoming saturated and the economics of reaching rural populations are becoming more difficult to justify in a challenging financial climate for mobile operators. That said, there will be nearly half a billion new subscribers by 2025, taking the total number of subscribers to 5.7 billion (70% of the global population). Large under-penetrated markets in Asia and Sub-Saharan Africa will account for the majority of new subscribers. In 2020, mobile technologies and services generated $4.4 trillion of economic value added (5.1% of GDP) globally. This figure will grow by $480 billion by 2025 to nearly $5 trillion as countries increasingly benefit from the improvements in productivity and efficiency brought about by the increased take-up of mobile services. 5G is expected to benefit all economic sectors of the global economy during this period, with services and manufacturing seeing the most impact.

At the end of 2020, 67% of the world’s population had a mobile network subscription of some sort. This means 5.2 billion people, generating $4.4 trillion of world GDP through mobile technologies and services. This also means adding new subscribers is increasingly difficult, with markets getting saturated. Plus a challenging financial climate for mobile operators is making them less tempted to invest to reach untapped rural populations.

There will be a half billion new subscribers between now and 2025. Most of them – nearly two thirds – will be in large, under-reached markets in Asia and sub-Saharan Africa. Not to mention a billion more mobile Internet subscribers. Mobile Internet users, now 51% of the world’s population at 4.0 billion, will reach 60% or 5 billion by 2025, the GSMA forecasts.

We will quickly get smarter, too – smartphones will make up 81% of mobile connections in 2025, up from 68% in 2020. End point devices will also get smarter, and fast. There will be 24.0 billion Internet of Things (IoT) connections in 2025, up by 85% from 13.0 billion in 2020. Still, COVID is stretching out replacement cycles – from 2.25 years on average, up to three years or more. With many consumers pinched in the pocket, there’s a pivot to lower-cost handsets, with average retail prices for 5G handsets falling more than a third since 2019.

References:

https://www.gsma.com/mobileeconomy/wp-content/uploads/2021/06/GSMA_MobileEconomy2021.pdf

TIM with Google and Ericsson will launch first ‘5G Cloud Network’ in Italy

Gruppo TIM, along with its Noovle subsidiary, has started creating the first ‘5G Cloud Network’ in Italy. The solution will lead to faster deployment of the 5G digital applications through the automation of industrial processes and the implementation of services in real time, thanks to EDGE Computing, based on specific requirements. The project will use TIM’s Telco Cloud infrastructure, Google’s Cloud solutions and Ericsson’s 5G Core network and Automation technologies.

Editor’s Notes:

- TIM did not disclose any implementation details, e.g. containers (with or without kubernetes) or virtual machines, type of cloud service and configuration, APIs, etc.

- The 5G core network, as defined by three 3GPP specifications, utilizes cloud-aligned, service-based architecture (SBA) that spans across all 5G functions and interactions including authentication, security, session management and aggregation of traffic from end devices. The implementation method, e.g. containers, virtual machines/network functions, etc are not specified.

- ITU-T has no serious work underway for 5G Core network, even though they are supposed to be responsible for all 5G/IMT 2020 non-radio recommendations/standards.

- TIM also did not disclose availability date(s) for their 5G Core network, locations in Italy that can access it, or 5G endpoint devices (e.g. smartphones, tablets, etc) compatible with it.

……………………………………………………………………………………………………………………………………………………………………………..

At the start of March 2020, TIM and Google announced a new partnership covering cloud and edge computing services, building on an MoU they signed back in November 2019. In line with the rapidly expanding cloud market, TIM said at the time that it would aim to generate €1 billion from cloud services by 2024.

In early 2021, TIM acquired 100% of cloud specialist Noovle, intending for the unit to ultimately operate TIM’s 17 Italian data centers. Since its launch, Milan based Noovle has been working on innovative technological solutions to improve services across various areas, such as the provision of virtual IT infrastructures, remote working, customer experience and Artificial Intelligence.

TIM says their 5G cloud solution offers businesses – e.g. those in the automotive and transportation sector – integrated innovative solutions capable of improving the efficiency of logistics and production processes, acting in collaboration with software developers. The ‘5G Cloud Network’ will be available close to companies’ premises, based on the customer’s specific requirements, in order to ensure the lowest latency possible. It also optimizes the network service implementation time and related costs.

TIM says their 5G Cloud Network is in full compliance with data protection and in line with the strictest sector standards (not disclosed how this is done and there are no sector standards for 5G data protection/security). Earlier this month, Italy created a national agency responsible for fighting cyber attacks, as it presses ahead with plans to create a unified cloud infrastructure to increase security for public administration data storage. According to Reuters, the new Italian cyber-security agency unifies under the prime minister’s authority many aspects of digital security which are currently dispersed among several ministers and state bodies.

Companies that intend to adopt 5G services and connectivity will be able to use the ultrabroadband radio network (RAN) in conjunction with the ‘5G Cloud Network’ without needing to build the physical infrastructure of the core network at their logistics or production sites.

References:

https://www.gruppotim.it/en/press-archive/market/2021/PR-TIM-Cloud-Network-5G-28giugno2021.html

Nokia and Vodafone Turkey trial 1st Asia-Europe Terabit IP link

Nokia today announced it has successfully completed a trial with Vodafone Turkey, linking Asia and Europe IP traffic in the first intercontinental, single 1T (terabit) clear-channel IP interface.

A milestone in Vodafone Turkey’s ongoing efforts to modernize its IP architecture, this trial comes at a particularly critical time as changing internet patterns from consumers, home workers and businesses continue to push the capacity limits of operators’ networks.

Changing internet traffic patterns from consumers, home workers and businesses are pushing the capacity limits of operators’ networks. As they look to combine gigabit capable fixed and wireless access technologies, the IP networks that carry this broadband traffic need to scale to keep up.

Through Nokia’s 7950 XRS routers powered by Nokia’s FP4 chipset, Vodafone Turkey can now scale up the capacity of its IP network by ten times, enabling the support of next-generation applications and access technologies, simplified operational complexity and cost overhead, SDN control automation, and more.

The trial is part of an ongoing modernization effort to transform Vodafone Turkey’s IP network. Nokia is delivering a multi-access mobile transport architecture that will enable the operator to evolve its transport infrastructure in a changing industry. Nokia’s 7250 IXR interconnect router and FP4-based 7750 Service Router portfolios have already been deployed for the delivery of high capacity, low latency 5G services to Vodafone Turkey’s customers. Nokia’s platforms support the features and protocols that will enable SDN control automation and optimization of applications and use cases.

Thibaud Rerolle, CTO, at Vodafone Turkey, said: “As we ramp up our delivery of new services, we are committed to providing the best possible quality of experience to our customers. We continue to rely on Nokia to evolve our IP network with industry-leading router innovation and technology to address our needs today and for next generation services.”

Vach Kompella, Head of IP Networks Division, Nokia, said: “Today’s IP networks are expected to handle hundreds of new applications and services for millions of users. The 1T trial builds upon Nokia’s advanced routing technology and platforms to future-proof Vodafone Turkey’s IP network, which serves one of the world’s largest intercontinental markets. Together we have successfully validated Nokia’s FP4 based 1T clear channel interface across Asia and Europe.”

Resources:

- Web page: Nokia FP4 network processor

- Web page: Nokia 7950 Extensible Routing System (XRS)

- Web page: Nokia 7250 interconnect routers

- Web page: Nokia 7750 Service Routers

Reference: