How fast is 5G really? OpenSignal and Reviews.org provide answers

Most IEEE Techblog readers know that 5G speeds are dependent on the spectrum used, with mmWave providing by far the fastest bit rates.

- Millimeter wave spectrum, championed by Verizon, is available in very large block widths, and can therefore deliver very high speeds. But coverage (propagation) is very poor.

- Low frequency spectrum offers very good coverage, but poor speeds.

- The sweet spot for 5G is therefore mid-band spectrum*, which offers the most compelling blend of coverage and capacity/speed.

* According to telecom research analyst Craig Moffett, not all mid-band spectrum is the same. The propagation differences between T-Mobile’s 2.5 GHz spectrum and the 3.7 to 4.2 GHz C-Band spectrum that will be auctioned off in a matter of weeks (and which is likely to be the cornerstone of Verizon’s future mid-band deployments) are dramatic. For a given cell site, the area covered in open space by T-Mobile’s 2.5 GHz will likely be 10x greater than that covered by a cell site in the C-Band.

OpenSignal examined 5G download speeds in five U.S. cities and found that Verizon is crushing it compared to the other big wireless carriers, so far. But some, including T-Mobile’s President of Technology Neville Ray, have questioned the wisdom of leading a 5G strategy with mmWave deployments. Verizon’s early lead with the high-band spectrum could begin to vanish as the other two carriers’ 5G deployments mature.

In each of the five cities, the average 5G download speed was over three times faster using Verizon than on either AT&T or T-Mobile. But OpenSignal notes that most of these measurements were taken before Verizon’s launch of its Nationwide 5G, which includes the use of lower frequency bands. As Verizon adds more lower frequency spectrum into the mix, its lead on speed will likely decline.

OpenSignal’s lead analyst Ian Fogg said the variation in mmWave download speeds depends on how each carrier has deployed. Verizon has deployed very densely in some urban areas while the other two carriers have deployed less densely. One of the big downsides to mmWave is its limited propagation. Fogg said, “If you’re on the edge of the range of the signal, you may get more error correction,” among other factors that will slow the speed.

OpenSignal also reported on mmWave upload speeds, which are drastically lower than mmWave download speeds.

Since cellular networks are asymmetric, upload speeds are always much slower. “If you are sending information from a large antenna on a cell site, it’s easy to transmit down to a small phone,” said Fogg. “But when the phone is transmitting back, you have a small battery device that’s transmitting in the other direction.”

But since upload is used for such things as sharing photos and videos, consumers are going to want faster and faster upload speeds. Fogg noted that the cameras of smartphones get improved in each new generation, becoming more capable of high-resolution images that result in larger file sizes.

Aside from 5G being used to improve mobile broadband, the technology also promises to earn its return on investment for business use cases. One of those use cases will be fixed wireless access (FWA) deployments. In that case, the upload constraints could be mitigated by the types of devices deployed. Fogg noted that for FWA “you don’t have a battery constraint in the same way.” He said, “You’ll probably have a smaller antenna than you would on a cell tower. There’s still an asymmetry dynamic, but not quite the same.”

There are three notable 5G developments:

- Verizon nationwide 5G. After October 13, Verizon started its nationwide 5G rollout using dynamic spectrum sharing (DSS) to allow Verizon to offer 5G on lower frequency spectrum bands that are also available for use simultaneously for Verizon’s 4G users. The use of lower frequency bands will change the nature of Verizon’s 5G service compared with the exclusively mmWave service used beforehand, likely increasing 5G Availability but lowering average 5G Download Speeds.

- T-Mobile’s mid-band 5G extension. Similar to Verizon, T-Mobile is also altering the mix of 5G spectrum it uses for its 5G service. In the last quarter of 2020, T-Mobile is aiming to greatly expand the reach of its 2.5GHz mid-band 5G service to many more cities which should enable faster speeds. The company claims its mid-band coverage will increase from 30 million to 100 million people by the end of 2020. It is also looking to extend the reach of its standalone 5G technology which should help T-Mobile to improve its 5G Availability as well.

- The arrival of the 5G iPhone. All iPhone 12 models support both 5G and mmWave 5G in the U.S. and their arrival should accelerate 5G adoption. The first units arrived in customers’ hands on October 23. Apple’s smartphones are a key part of the U.S. wireless market. AT&T in particular was the first carrier to market the iPhone and it continues to have a strong iPhone share. This launch means all major smartphone makers offer 5G models. It also means that the U.S. wireless customers who prefer Apple — approximately half of U.S. mobile users — now have a 5G option that the carriers can market.

…………………………………………………………………………………………………………………………………………………………………………………………………………..

To help consumers understand the difference between current 4G internet speeds and 5G internet speeds, Reviews.org crunched the numbers to put these speeds into perspective:

What this illustrates is that the jump from 4G to 5G is not a minor boost, according to Joe Hanlan of Reviews.org. A decade ago it seemed impossible to imagine watching TV and movies on our phones, and now it is something that lots of people do every day. New 5G networks will open up our gadgets to a range of new possibilities, and while it is hard to imagine exactly the kinds of things we’ll be doing in a decade from now, our 5G future makes it possible.

To compare flight durations to mobile network speeds, REVIEWS.org sourced average download speeds from 4G and 5G networks from Opensignal. The research firm then converted the difference in speeds between networks to a non-stop flight from Perth to London (17:20 duration).

References:

https://www.opensignal.com/2020/11/24/understanding-5g-availability-in-us-cities

https://www.fiercewireless.com/5g/verizon-s-5g-mmwave-crushing-it-but-for-how-long

5G speeds: here’s how much faster new internet speeds will be

Millimeter Wave Market Projected to reach 7.38B by 2027; 37% CAGR

The global telecom millimeter wave technology market size is projected to reach USD 7.38 billion by 2027, registering a CAGR of 37.01%.

Millimeter Waves (MMW) can transmit a large amount of data efficiently, operating in the electromagnetic spectrum of 30 GHz to 300 GHz. Millimeter waves are also known as Extremely High-Frequency (EHF) waves owing to its operational frequency spectrum. The property of transmitting a large amount of data has made the technology popular across the telecommunication application.

The MMW technology industry is prominently dependent on the applications in various verticals where it is used extensively. Major application areas include telecommunication, military and defense, security services, and medical and healthcare. Evolution of 5G technology is likely to occur over the coming years on account of recent developments and continuous research and progress in the telecom industry.

Millimeter waves are anticipated to play a vital role in the development of 5G technology on account of the technology’s demand for higher-bandwidth. The 5G technology is predicted to emerge in the coming years and the market is likely to witness its adoption significantly. Eventually, the demand for MMW technology is expected to boost, in turn, propelling the overall MMW technology market, particularly across the telecom industry.

Increased government funding and initiatives coupled with intensive R&D carried out from the military and private sectors are leading towards the improvement of the MMW technology. In addition, the E-band frequency segment having extensive application in the telecommunication sector is estimated to generate the highest revenue. The E-band frequency segment is projected to keep on dominating in the telecom industry owing to the growing telecom applications. Therefore, the overall telecom millimeter wave technology market is poised to witness significant growth worldwide over the forecast period at a notable pace.

Telecom Millimeter Wave Technology Market Report Highlights:

- North America accounted for the largest market share in the telecom MMW technology market owing to the technology’s early and greater adoption rate

- U.S. being the highest revenue generating country in 2019 in North America, the regional market is predicted to exhibit steady growth over the forecast period

- E-band frequency segment is anticipated to grow rapidly over the estimated duration owing to its extensive adoption in the telecom applications

- The telecom industry in the Asia Pacific is poised to expand substantially over the coming years, and the E-band frequency segment is likely to witness lucrative opportunity in the regional telecom industry

- Besides, growing urbanization in the Asia Pacific region and competition amongst the telecom service providers to offer superior quality of internet and other related services in order to enlarge customer base is another factor expected to drive the telecom MMW technology market

- Online streaming of high-quality videos, online gaming, and other entertainment stuff which demand high bandwidth and consume heavy data are again likely to fuel the overall demand for MMW technology in the telecom sector globally.

Millimeter wave (mmWave) communication systems have attracted significant interest regarding meeting the capacity requirements of the future 5G network. The mmWave systems have frequency ranges in between 30 and 300 GHz where a total of around 250 GHz bandwidths are available. Although the available bandwidth of mmWave frequencies is promising, the propagation characteristics are significantly different from microwave frequency bands in terms of path loss, diffraction and blockage, rain attenuation, atmospheric absorption, and foliage loss behaviors. In general, the overall loss of mmWave systems is significantly larger than that of microwave systems for a point-to-point link.

Fortunately, the small wavelengths of mmWave frequencies enable large numbers of antenna elements to be deployed in the same form factor thereby providing high spatial processing gains that can theoretically compensate for at least the isotropic path loss. Nevertheless, as mmWave systems are equipped with several antennas, a number of computation and implementation challenges arise to maintain the anticipated performance gain of mmWave systems. Toward this end, this chapter discusses key enabling techniques of the mmWave based 5G network from the link level perspective. The link level performance of the mmWave wireless system depends on a number of factors, including the transmission scheme (i.e., whether we employ beamforming, multiplexing, or both), the approach to identifying the channel, how to design the transmitted signal waveform structure and access strategies.

References:

https://www.sciencedirect.com/topics/engineering/millimeter-wave

G20 Global Smart Cities Alliance/WEF: 36 cities to develop policy roadmap

The World Economic Forum (WEF), the International Organization for Public-Private Cooperation, has selected 36 cities across 22 countries to create a new worldwide policy roadmap for smart cities developed by the G20 Global Smart Cities Alliance.

Established in June 2019, the G20 Global Smart Cities Alliance on Technology Governance unites municipal, regional and national governments, private-sector partners and cities’ residents around a shared set of principles for the responsible and ethical use of smart city technologies. The Alliance establishes and advances global policy norms to help accelerate best practices, mitigate potential risks, and foster greater openness and public trust. The WEF serves as secretariat for the Alliance.

The selected 36 cities will adopt policies for privacy protection, accountability for cyber security, improved broadband coverage, increased openness of city data, and improved accessibility for elderly/disabled people to digital city services. These 26 cities include Belfast, Leeds and London in the UK; Barcelona and Bilbao in Spain; Toronto in Canada; Moscow, Russia; Melbourne and Newcastle in Australia; Milan, Italy; Apeldoorn in the Netherlands; and Bengaluru, Faridabad and Hyderabad in India.

“This roadmap is not about theoretical ideas and pipe dreams, it is built on practical, real-world policies from leading cities around the globe,” said Jeff Merritt, Head of the Internet of Things and Urban Transformation, World Economic Forum. “City governments are on the frontline of a global crisis and need to be able to act quickly and decisively to curtail this pandemic and set course for their economic recovery. Technology is an essential tool in this fight but governments cannot risk falling into the usual traps related to privacy, security and vendor lock-in. That’s where the G20 Global Smart Cities Alliance can help.”

“This initiative originated in Japan last year from our Centre for the Fourth Industrial Revolution, a fact I’m very proud of,” said Koichi Akaishi, Vice Minister for Science, Technology and Innovation for the Cabinet Office of the Government of Japan. “I hope to see more cities participating in the Alliance following the model set by these first pioneer cities.”

Leaders of organizations participating in this program had the following comments:

Miguel Eiras Antunes, Global Smart Cities Leader, Deloitte Global, said “The transformation from a traditional city to a ‘smart city’ does not just happen overnight. Success depends on the quality of the decisions that are made and the way those decisions are executed. Deloitte is committed to working closely together with the G20 Global Smart Cities Alliance on Technology Governance to co-design policy frameworks that will empower governments to accelerate smart cities initiatives for sustainable developments.”

“Being a pioneer city in the G20 Global Smart Cities Alliance is an excellent opportunity for us to promote the innovative work that is taking place in Leeds right now, but also facilitates the opening of doors where we can learn from other leading cities around the world and implement best practice in our city,” said Stephen Blackburn, Head of Smart Cities, Leeds.

London’s Chief Digital Officer, Theo Blackwell, said “We need to work together to realize the potential of data to solve city challenges by putting it in the hands of those who can make a difference. But we also need to do it in a way that is safe, ethical and responsible. London is proud to join this global initiative as a pioneer city to promote the adoption of ethical smart city policies.”

Will Cavendish, Digital Services Leader at Arup said “COVID-19 has driven a step-change in the use of digital services in cities, and many of these changes will only accelerate beyond the pandemic. The policies developed by the G20 Smart Cities Alliance will be fundamental in ensuring that the enabling digital connectivity and data infrastructures, along with the rapidly-emerging technology-enabled services, are deployed in an inclusive, transparent and mutually beneficial manner.”

“Technology and knowledge are two strategic assets to build inclusive, data-driven, and sustainable smart cities capable of tackling new and emerging challenges,” said Roberta Cocco, Deputy Mayor for Digital Transformation and Services to Citizens, Milan. “That is why Milan is joining the G20 Global Smart City Alliance, as this initiative will allow us to share best practices with innovative cities around the world. Today more than ever, in fact, we need to collaborate with each other to identify the most effective tools to face global threats like COVID-19. It is only by joining our forces that we can beat this common enemy that is threatening the health, the economy, and the future of our citizens.”

Dr. Julia Glidden, Corporate Vice President, Worldwide Public Sector, Microsoft Corporation, said “Accessibility and privacy policies are critical to making cities more inclusive and transparent. Microsoft congratulates the Forum and G20 for creating model policies that aid cities in serving all citizens.”

“We will adopt a transparent and participatory philosophy of local governance in the city of Istanbul,” said Ekrem İmamoğlu, Mayor of Istanbul. “Our aim is to empathize with all segments of society, and value the participation of everyone, ensuring that the majority of the people are represented – not the few.”

Gilvan Maximo, Secretary of Science, Technology and Innovation, Brazil, said “The G20 Global Smart Cities Alliance will provide us with a global partnership to accelerate the adoption of technologies in a responsible manner and for the benefit of the citizen, debating complex issues and seeking joint solutions. Therefore, Brasilia is eager to participate in this joint work.”

“This opportunity to collaborate as a G20 Global Smart Cities Alliance pioneer city on a new roadmap for safely adopting new technology is very welcome indeed as we work to develop a Belfast Smart District and to weave digital innovation into every part of our economy,” said Alderman Frank McCoubrey, Lord Mayor of Belfast. “We’ll be exploiting new technologies and data to tackle city challenges in areas such as health and mobility to improve our citizens’ quality of life – and we must ensure this is done ethically and in a way that prioritizes transparency, privacy, equity and inclusion. Being part of the G20 Global Smart Cities Alliance on Technology Governance means that each of the partner cities will benefit from expert, tailored insights and policy tools and this collaborative approach will allow us all to make progress in how we govern technology more swiftly and effectively, for the benefit of all our citizens.”

Dr. Frank Mentrup, Mayor of Karlsruhe, said “The G20 Global Smart Cities Alliance offers a unique opportunity to develop common ethical standards, foster digital sovereignty and therefore create and build a new resilient ‘trust infrastructure for cities and citizens’, as trust is going to become one of the most important and most vulnerable resources of our future.”

We believe that technology is a key enabler that can transform our cities in to smart cities leading to delivery of improved services to citizens and businesses”, said K.T. Rama Rao, Minister of Municipal Administration and Urban Development, Industries and Information Technology, Electronics and Communication, Government of Telangana, India. “We are keen to collaborate with G20 cities in formulating policy frameworks to improve quality of life of our citizens using emerging technologies.”

“Transforming our cities into smart cities is a great tool to improve people’s life quality,” said Horacio Rodriguez Larreta, Mayor of Buenos Aires. “That is why we are committed to continue incorporating technology, developing innovative public policies, and to work together with the G20 cities to build a modern and efficient state that makes life easier for everyone who lives, works, studies or visits us in Buenos Aires.”

“The pandemic presents an opportunity to reshape our future, with renewed digital rights and tools that should allow access for all and people-centred government. Local and regional governments will need to lead this shift to ensure the application of technology promotes human rights through equitable public service provision; putting our communities and planet first,” said Emilia Saiz, Secretary General of the United Cities and Local Governments. “The G20 Smart Cities Alliance is an important mechanism to help facilitate this transformation, bringing together a critical network of partners to collectively address and mitigate future crises”

……………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://globalsmartcitiesalliance.org/

Highlights of AT&T CFO and CTO remarks at Morgan Stanley Investor Conference

Network quality driven by significant investments in 5G and fiber:

AT&T believes that its recent and anticipated network investments will bolster its network foundation to compete as the need for high-quality connectivity only continues to increase. At a Morgan Stanley European Investor Conference, AT&T CFO John Stephens indicated that AT&T’s integrated fiber strategy is expected to improve the company’s connectivity offering for both consumer and enterprise markets and enhance its 5G network quality in a cost-efficient manner.

COVID-19 Impact:

AT&T CTO Andre Fuetsch said: “Obviously what happened was everyone basically started working, started schooling from home, and all of a sudden we had to readjust our lives to work from home, learn from home, and all of a sudden we had to adapt very quickly to that. Within our homes, we had to have these different personas that we normally don’t do — whether it’s doing your day job, performing that duty, helping your children get online so they can do their schooling, and then all the other things in life. That was a blurring, in a way, of these sort of enterprise and consumer segments coming together.”

“All of this technology is great, but at the end of it, we are humans and anything we can do to help facilitate [and] build better, stronger human connections” will benefit society at large, Fuetsch added. “This year we’re really getting pushed and challenged to do that. I really think this type of technology is just going to make things better.”

Artificial Intelligence (AI) Improves Operations:

Some of these technologies, like Artificial Intelligence (AI), are already helping AT&T improve its operations, especially among its field technicians, he said, noting that AT&T’s entire routing and scheduling program relies heavily on AI.

“Any given day we have 35,000 network technicians driving around in trucks installing, and repairing, and maintaining our network. It’s essentially a very complex logistics algorithm and, as you can imagine with a company of our scale, just a single percentage improvement in efficiencies can lead to big, big dollars,” Fuetsch said.

AT&T is also trialing the use of drones with computer vision analytics to help improve inspections of its roughly 70,000 cell sites. When those drones take flight, they are scanning towers, looking for excessive heat dissipation, corrosion, loose cables, and bird nests, among other signs that indicate a required repair.

“All of this is getting fed back into a neural network, which is basically AI based,” and that program identifies the repair checklist, the technician and skill sets required, and the parts needed to remedy the problem, Fuetsch said.

AT&T’s experiences here and elsewhere gives him confidence that “the camera is still and will be the killer app” for the foreseeable future. However, the use of cameras is undergoing dramatic changes, he said.

“We carry about 400 petabytes a day across our network. About 50% of that traffic we carry is video traffic. Most of that is going out in a sort of downstream way. The future is going to be about upstream,” Fuetsch said.

Use of Video Cameras:

Fuetsch envisions new applications that “can help better manage our lives through a simple video camera” with the aid of video analytics and sensing. These advancements are occurring not just despite the scourge of COVID-19, but rather because of it in some ways as well, he said.

“This pandemic has really created some new norms here. I think the good news for operators is connectivity is so important and so relevant for everything we do. As we go into 2021, certainly with hopefully a light at the end of the tunnel here in terms of the pandemic with the latest news we’re hearing about vaccines, I’m actually very optimistic.”

“As we go into 2021, certainly with hopefully a light at the end of the tunnel here in terms of the pandemic with the latest news we’re hearing about vaccines, I’m actually very optimistic,” Fuetsch added.

References:

https://about.att.com/story/2020/john_stephens_update.html

Dell’Oro and Cignal AI: Optical Transport Equipment Market Grows in 3Q 2020

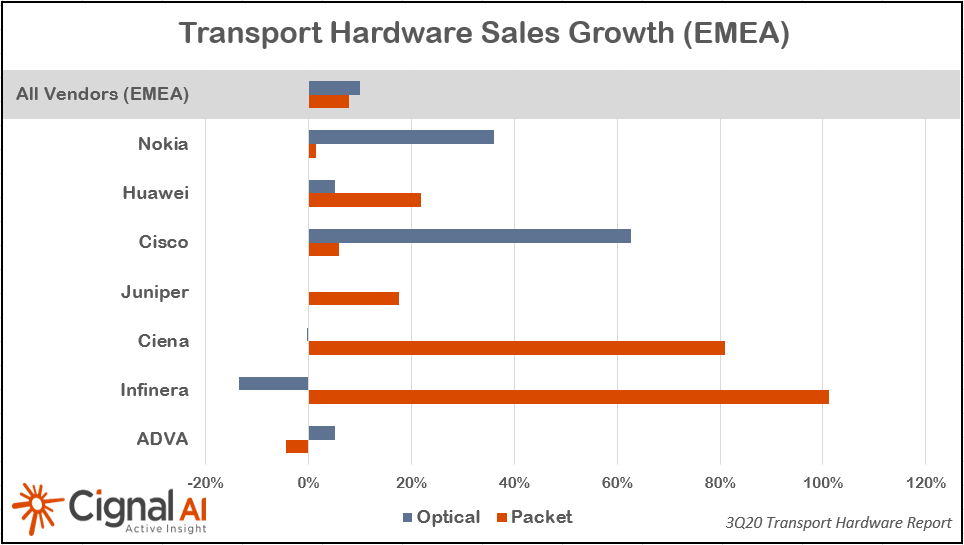

According to a recently published report from Dell’Oro Group, the optical transport equipment revenue increased 9 percent year-over-year in 3Q 2020 reaching $3.8 billion. The market growth was largely attributed to higher demand in Asia Pacific.

“Sales slowed in North America following a strong first half of the year,” said Jimmy Yu, Vice President at Dell’Oro Group. “Whether it was due to network demand caused by people working and studying from home or new projects at the beginning of the year, the demand for optical equipment in the region rose 11 percent in the first half of 2020. But I think there was enough concern surrounding the longevity of the pandemic that service providers grew cautious and refrained from overextending their capital. As a result, optical revenue in North America declined 7 percent in the third quarter,” continued Yu.

Growth in Asia Pacific more than offset the lower revenue in North America and Latin America. Optical revenue grew 22 percent year-over-year in Asia Pacific, driven largely by higher deployments in China and Japan. Also, with lockdown restrictions easing, some regions such as Middle East and Africa (MEA), significantly rebounded in the quarter following a sharp decline in 1H 2020. Sales in China, Japan, and MEA each grew over 25 percent.

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com

…………………………………………………………………………………………………………………………………………………………………………………………………………..

|

|||

|

|||

|

|||

|

|||

About the Transport Hardware Report

About Cignal AI

|

Dell’Oro: RAN growth accelerates due to “torrid pace” of 5G NR in 3Q2020

Dell’Oro has upgraded its near-term outlook for the RAN market to reflect stronger-than-expected activity in China, Europe and North America. The market researcher now expects the market to approach USD 70-80 billion over the combined 2020 and 2021 period.

The improved outlook in Dell’Oro’s Q3 RAN market report indicates continued positive momentum. The upswing begun in the second half of 2018 extended into the third quarter, with surging demand for 5G propelling the RAN market to robust year-over-year growth, the researcher said. It estimates that the overall 2G to 5G RAN market advanced 10-20 percent year-on-year in the third quarter, meaning annual growth in eight out of the last nine quarters.

“While we correctly identified that the RAN market would appear disconnected from the underlying economy throughout this year, we also underestimated the pace and the magnitude of these 5G rollouts,” said Stefan Pongratz, analyst with the Dell’Oro Group. “This shift from 4G to 5G, including low-band-and mid-band 5G NR, continued to accelerate at a torrid pace in the quarter, underpinned by stronger-than-expected 5G activity in multiple regions.”

Additional highlights from the 3Q20 RAN report:

- RAN revenue shares were impacted to some degree by the state of the 5G rollouts in China and North America, resulting in share gains for both Huawei and ZTE over the 1Q20-3Q20 period.

- The near-term outlook remains favorable for both macro and small cells, with combined 2020 and 2021 2G-4G and 5G base station shipments projected to eclipse 10 M units.

- We have adjusted the near-term RAN market outlook upward, to reflect stronger than expected activity in China, Europe, and North America, with total RAN projected to approach $70 B to $80 B for the combined 2020 and 2021 period.

Editor’s Note: The RAN market today is almost entirely provided by a handful of vendors making cellular base stations and small cells. Those are: Huawei, Ericsson, Nokia, Samsung, ZTE, and Fujitsu. In the future, there is a movement to both Open RAN and Cloud RAN which would disrupt the current deployments with disaggregated hardware and open software. We are very skeptical of those two over hyped industry initiatives.

Radio Access Network illustration from Resource Gate

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ revenue, transceivers or RF carrier shipments, macro cell and small cell BTS shipments for 5G NR Millimeter Wave, 5G NR Sub 6 GHz, LTE, and WCDMA/GSM. The report tracks the RAN market by region and includes market data for Massive MIMO. The report also includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com

References:

Surging Demand for 5G Accelerates RAN Growth, According to Dell’Oro Group

Nokia, Elisa and Qualcomm achieve 5G speed record of 8 Gbps in Helsinki, Finland

Elisa, Nokia and Qualcomm Technologies announced that they reached a record 5G speed of 8 Gbps on a commercial 5G network in Finland, serving two 5G mmWave devices. The lightning fast speed was showcased at Elisa’s flagship store in Helsinki. The service is expected to be deployed in 2021.

The speed was achieved using Nokia 5G mmWave technology and Qualcomm Technologies’ 5G smartphone form factor test devices on Elisa’s commercial 5G network. The 5G base station used two Nokia AirScale radios, each using 800 MHz of commercial millimeter wave 5G spectrum at 26 GHz. They provided connectivity to two 5G smartphone form factor test devices run by a Qualcomm Snapdragon X55 5G Modem-RF System with Qualcomm QTM525 mmWave antenna modules. Each device reached 4 Gbps peak speeds from the base station.

The fast 5G bit rate will support new low-latency, high-bandwidth services such as rapid video and game downloads, as well as mission-critical or virtual reality (VR) and augmented reality (AR) applications. It will enable remotely controlled devices for industrial needs and VR/AR large stadium concert broadcasts. It will allow enhanced fixed wireless access connectivity, too, as an alternative to fiber optic broadband.

Sami Komulainen, Executive Vice President, Production at Elisa, said: “This is an important development and another step in our efforts to bring the fastest speeds and best 5G experiences to our customers. Elisa was the first in Finland and amongst the first in the world to deploy 5G. Reaching 8Gbps is a natural step in our 5G development and we want to explore the possibilities 5G offers and push the technology further to benefit our customers.”

Tommi Uitto, President of Mobile Networks at Nokia, commented: “We are proud to work with our partners on this important and significant achievement that will deliver incredible 5G experiences to people and businesses in Finland. This is another milestone in the development of 5G services and demonstrates the capacity of our commercially deployed 5G solutions.”

Enrico Salvatori, Senior Vice President and President, Qualcomm Europe/MEA, said: “We are incredibly proud of this collaboration on this landmark event, which represents a significant milestone for 5G mmWave. Qualcomm Technologies’ research and development efforts to drive the next generation of wireless connectivity, along with our work with Elisa and Nokia, has made this milestone a commercial reality. The throughputs achieved today show the true potential for mmWave deployments and we are excited to continue collaborating with industry leaders to make 5G mmWave a commercial reality.”

Resources:

- Webpage: Elisa

- Webpage: Nokia AirScale

- Webpage: Qualcomm

About Elisa:

Elisa is a pioneer in telecommunications and digital services. We serve approximately 2.8 million consumer, corporate and public administration organisation customers, and have over 6.3 million subscriptions in our extensive network. Cooperation with Vodafone and Tele2, among others, enables globally competitive services. Our core markets are Finland and Estonia, and we also provide digital services for international markets. Elisa’s shares are listed on the Nasdaq Helsinki. In 2019, our revenue was EUR 1.84 billion euros, and we employed 4,900 people. As a responsible Finnish market leader, our operations are guided by continuous improvement. We will be a carbon neutral company from 2020 onwards. Further information on www.elisa.com, Facebook (@elisasuomi) and Twitter (@ElisaOyj)

About Nokia:

We create the technology to connect the world. Only Nokia offers a comprehensive portfolio of network equipment, software, services and licensing opportunities across the globe. With our commitment to innovation, driven by the award-winning Nokia Bell Labs, we are a leader in the development and deployment of 5G networks.

Our communications service provider customers support more than 6.4 billion subscriptions with our radio networks, and our enterprise customers have deployed over 1,300 industrial networks worldwide. Adhering to the highest ethical standards, we transform how people live, work and communicate. For our latest updates, please visit us online www.nokia.com and follow us on Twitter @nokia.

Media Inquiries: Email: [email protected]

About Qualcomm:

Qualcomm is the world’s leading wireless technology innovator and the driving force behind the development, launch, and expansion of 5G. When we connected the phone to the internet, the mobile revolution was born. Today, our foundational technologies enable the mobile ecosystem and are found in every 3G, 4G and 5G smartphone. We bring the benefits of mobile to new industries, including automotive, the internet of things, and computing, and are leading the way to a world where everything and everyone can communicate and interact seamlessly.

Qualcomm Incorporated includes our licensing business, QTL, and the vast majority of our patent portfolio. Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of our engineering, research and development functions, and substantially all of our products and services businesses, including our QCT semiconductor business.

References:

SoC start-up EdgeQ comes out of stealth mode with 5G/AI silicon for 5G private networks/IIoT

System on a Chip (SoC) start-up EdgeQ (Cupertino, CA) announced its launch from stealth with $51 million in total funding, including $38.5 million in a Series A round. Backed by investors Threshold Ventures (formerly DFJ), Fusion Fund, Yahoo! co-founder Jerry Yang (AME Cloud Ventures) and an unannounced strategic customer, EdgeQ will address the 5G infrastructure market with products aimed at delivering 5G connectivity with AI computing.

The company counts experience in cellular modem development from Qualcomm, Intel and Broadcom on its team. It sees a limited number of players in the market, focused especially on smartphones, leaving room for new providers targeting edge devices and infrastructure.

EdgeQ said it will deliver a converged 5G and AI silicon platform that is open and software programmable for both devices and edge infrastructure. By introducing open programmability to the baseband, EdgeQ wants to provides a new software-driven development model for OEMs and operators, supporting existing cellular protocols such as 4G and 5G as well as the next generation of networks.

EdgeQ’s AI-5G SoC is aimed at emerging 5G private networks that are viewed as the backbone of industrial Internet of Things and other data-driven enterprise deployments. Along with manufacturing, the AI chip maker said Tuesday (Nov. 17) it is targeting the automotive, construction, energy and telecommunications sectors.

“We are rapidly evolving from a smartphone economy to a constellation of intelligent edge devices,” said Vinay Ravuri, CEO and founder of EdgeQ. “This will cause massive disruption to the current paradigm, where existing fixed-function approaches are inadequate to meet the scale, speed, and breadth of new end connections.”

“We provide an open platform converging 5G plus AI, which abstracts much of the complexities for our customers working on 5G deployment—from supporting multiple chipsets, different software stacks, board design, cost, power, and latencies in transferring data in between, not to mention, potential security hazards. Though we are not ready to disclose the hardware details, our 5G chip architecture uniquely lends itself to AI in a way without needing an extra AI accelerator hardware, saving both power and cost to the end customer.”

The combination of 5G connectivity, AI hardware and a “software-friendly” design is intended to enable an “open and programmable platform that is adaptable, configurable and economical for 5G-based applications,” added Ravuri, a former Qualcomm vice president for product management.

Ravuri said Qualcomm’s 5G SoC design (targeted at 5G endpoints) was closed while EdgeQ’s was open. “Their chip technology does not support 5G connectivity and AI computing, making it inadequate for enterprise-grade 5G infrastructure, which needs robust computing capabilities in addition to 5G,” he said. “We can bring the best of breed here—the cellular, but also offer to the market what they’re really looking for, which is an open ecosystem where they are able to innovate and add/develop features on this chipset that they can’t do otherwise. That is what we see as a big departure from the existing Qualcomm offerings.”

The software-defined SoC is aimed at replacing existing wireless and legacy networks with edge components that can be used to divide and partition 5G spectrum for emerging private wireless networks. The networking equivalent of private clouds, those high-bandwidth connections are being promoted as “industrial-strength” platforms that could be used to link sensors, massive amounts of raw data and AI-enabled manufacturing platforms in real time.

Yang and other early investors assert that EdgeQ’s programmable silicon moves beyond custom AI chip designs with limited use cases. “This technology will disrupt the market for silicon and democratize access to 5G for the first time,” said Yang.

Industry analysts note that AI and 5G technologies are advancing in tandem as new automation and edge use cases emerge. Among the operational efficiencies provided by AI-powered 5G networks is “predictive remediation,” in which potential outages can be identified before networks crash. “We are getting there with the help of AI,” said Will Townsend, an analyst with Moor Insights & Strategy.

Other analysts have predicted emerging AI systems on a chip. The adoption of 5G “may someday lead to convergence of the radio spectra for these disparate radio channels and convergence of network interfaces down to single chips that are agile at maintaining seamless connections across multiple radio access technologies,” James Kobielus, research director at Futurum Research, wrote last year.

References:

https://www.fiercetelecom.com/telecom/5g-and-ai-soc-vendor-edgeq-out-starter-blocks-51m-funding

China Telecom launches 5G standalone cloud native network with Tianyi Cloud

China Telecom claims it has launched what it says is the world’s largest 5G standalone (SA) network. Executives announced the start of commercial 5G SA operations during a company virtual conference last week and said their 5G SA network is currently supported by 30 devices, with 100 expected by year-end.

China Telecom’s 5G SA end-to-end capability testing with Tencent and Huawei was completed in September. Earlier in the week, China Telecom said it will offer 5G SA services to over 300 cities in China at a press event held with Qualcomm at Guangzhou, China.

Like all the other telcos on the path to 5G SA (only T-Mobile US has deployed it), China Telecom’s is said to be 5G SA is a cloud native network called the “Tianyi Cloud.” Company leaders said it’s 5G SA cloud network can guarantee “five-nines reliability,” secure network slicing and latency of below 5ms. In particular:

With the popularization of cloud computing, hybrid multi-cloud has become the new normal for cloud migration. It is just necessary to realize high-speed network interconnection and unified management between multi- clouds. The full-stack hybrid cloud launched by Tianyi Cloud realizes the same technical architecture of the underlying cloud platform and has no cloud capabilities. It extends and covers the deployment of three scenarios: edge, private cloud, and industry cloud. At the same time, it provides first-line multi-cloud capabilities, a dedicated line connects multiple mainstream public cloud service providers at the same time, and high-speed interconnection between public and private clouds can also be realized. In addition, it is worth mentioning that Tianyi Cloud’s full-stack hybrid cloud has been adapted to national production and production at the chip, hardware, and operating system levels, and has the ability to provide national production and service services.

The new generation of cloud-native database developed by Tianyi Cloud completely independently developed and technically tackled key problems. It successfully realized the de-IOE of China Telecom’s core IT system database. Telecom users and billion-level terminal equipment access. Through continuous upgrading and evolution, Tianyi Cloud’s new generation of cloud-native database has reached financial-level data security and high reliability, and has continuously broken through the limits of scale and performance, while being compatible with a complete database ecological chain, so as to meet customers’ diverse data service needs.

Also, China Telecom officially launched the “Cloud Terminal” plan at the event. Tianyi Cloud, as the base of the cloud terminal strategy, has independently created a cloud computer through computing in the cloud, data in the cloud, application in the cloud, security in the cloud, and imagination in the end mode. And cloud mobile phone products.

President and COO Li Zhengmao said the arrival of the 5G era provided the opportunity and the technical ability for the integration of cloud and the network.

In terms of 5G cloud integration, Hu Zhiqiang said:

“In the 5G era, cloud-network integration has entered a new realm. Cloud-network integration is the goal that Tianyi Cloud pursues.” On the one hand, Tianyi Cloud launched an intelligent edge video cloud to break through the bottleneck of ultra-high-definition real-time encoding technology. At the same time, it has real-time scheduling capabilities of millions of video streams. On the other hand, 5G is a cloud-based network. Tianyi Cloud provides 99.999% reliability guarantee and exclusive slice data security, achieving a comprehensive TCO reduction of more than 90%, and a delay of less than 5ms.”

A white paper presented at last week’s event describes China Telecom’s cloud-network integration as driven by open sharing, open network capabilities, multi-network access 5G and SD-WAN support. The China Telecom paper said the company was a hybrid multi-cloud strategy, integrating Alibaba Cloud, Tencent Cloud, Huawei Cloud, AWS, Azure and others into its aggregation platform.

In conclusion, Hu Zhiqiang said: “China Telecom Tianyi Cloud will continue to strengthen technological innovation, strengthen open cooperation, and accelerate the construction of a digital China and a smart society, and make greater contributions with partners.”

………………………………………………………………………………………………………………………………………………………………………………………………….

References:

http://www.c114.com.cn/news/117/a1143514.html

https://www.lightreading.com/asia/china-telecom-gets-cracking-on-5g-standalone/d/d-id/765464?

China says it has deployed 700,000 5G base stations this year; Huawei’s forecast

Bank of America: OpenRAN primer with global 5G implications

Written by Multiple Bank of America Research Analysts

Introduction:

OpenRAN turns base stations using proprietary hardware into software running on common off-the-shelf hardware. Tal Liani views this trend as a continuation of ongoing forces in the broader IT and hardware markets – a shift to virtualized hardware, merchant silicon and general software disruption of proprietary hardware markets.

With 78% of the cellular base station/ RAN market controlled by Huawei, Ericsson and Nokia, OpenRAN represents an opportunity for software-only vendors like Altiostar, Parallel Wireless and Mavenir to offer traditional as well as new carriers such as Rakuten and DISH the technology to build cost effective networks with no legacy equipment consideration. OpenRAN is ideally deployed in a virtualized or cloud-based architecture, offering a high degree of automation as well as enabling vendor mixing/matching to reduce costs of innovation and increase efficiencies.

$35bn RAN market set for new competition, disruption:

Radio Access Networks (RANs) represent the largest category of hardware technology, estimated at just under $35bn in 2020. The market is highly concentrated, with 78% controlled by Huawei, Ericsson, and Nokia. OpenRAN is disrupting the market, enabling vendor mixing and matching, greater competition, and introducing new entrants via standardization, separation of software and hardware, and by turning certain elements into independent applications.

Early days for OpenRAN, likely limited impact in near-term:

OpenRAN is still in its early days, representing ~1% of the total RAN market in 2020 and ~6% projected by 2024. These estimates are preliminary though, and like any other disruptive technology, deployments could gain momentum as they are adopted by key carriers. To date, the biggest OpenRAN advocates are new carriers, like Rakuten and DISH, which are utilizing the technology to build cost effective networks having no legacy equipment considerations. Tier-1 carriers are taking a more measured approach with legacy architectures/vendors still offering better economics. Yet, at the same time, most leading carriers are testing OpenRAN and some already deploy it on a small scale. For example, Verizon‘s 5G upgrade is partially done with Ericsson‘s proprietary approach and partially with Samsung‘s OpenRAN solution. We also see interest from European carriers, with OpenRAN providing an efficient way to replace Huawei equipment.

Importance of semis, commodity hardware on the rise:

On the vendor side, OpenRAN represents new opportunities for software-only vendors like Altiostar, Parallel Wireless, and Mavenir, hardware providers like Fujitsu and leading semi vendors like Intel and Qualcomm. Nokia and Ericsson partially support OpenRAN, given its disruptive nature, focusing instead on proprietary software-based solutions, like virtualized (vRAN) or Cloud RAN. However, as momentum grows, we expect all leading vendors to support OpenRAN, similar to trends seen in Switching and Routing. We expect the legacy Radio vendors to offset the negative implications of OpenRAN via a growing focus on software, applications and expansion into adjacent markets.

Open Radio Access Networks, or OpenRAN, is an emerging trend that is set to shake up the roughly $40bn 4G/5G infrastructure market. We view this trend as a continuation of ongoing forces in the broader IT and Telecom Hardware markets, such as the shift to virtualized software, whitebox hardware, merchant silicon, and general software disruption of the proprietary hardware markets. We have witnessed similar efforts to open and standardize other networking markets such as Ethernet Switching and IP Routing, however, the complexity, performance demands, and tight vendor controls in the Mobile Infrastructure market have left the Radio Access Networks proprietary thus far. 5G deployments represent an entry point and a catalyst for OpenRAN, and our deep dive aims to explore the potential opportunities and disruption across vendors and sectors that service the RAN market.

Our note is organized into 5 main sections: 1) drivers of OpenRAN deployments vs the challenges, 2) introduction to the Radio Access Market, which describes the technical components, leading vendors, and market dynamics of the traditional RAN market, 3) an OpenRAN 101 section that outlines the architectural changes, new vendors, and growth forecasts, 4) the impact of OpenRAN, and opportunities related to adjacent areas of technology, such as semiconductors, and lastly 5) OpenRAN traction by geographic region.

Ultimately, we see three key takeaways for investors: 1) we flag that OpenRAN and Virtualized/Cloud RAN are separate trends that are coming together to form the attractiveness of Open and Virtualized RAN (vRAN), 2) it remains early for OpenRAN, which is expected to represent less than 1% of RAN spending in 2020 and grow to only 6% of the total market by 2024, and 3) OpenRAN creates opportunities for legacy and new vendors, in our view. We quantify the disruptive potential on page 33, and compare the OpenRAN phenomenon to what happened in the virtualized Evolved Pack Core (EPC) market. We also view OpenRAN as an enabling technology for global carriers to replace Huawei in certain areas, either through growing share of Nokia and Ericsson, or via the introduction of new vendors.

|

Figure 1: OpenRAN vs Virtual RAN and evolution to Open vRAN |

|

|

|

Source: BofA Global Research, Omdia |

A key benefit of OpenRAN is new innovation in the radio access market, with newer software companies such as Altiostar pushing incumbent vendors to begin disaggregating their software from hardware and support industry groups dedicated to developing OpenRAN technology, such as the O-RAN Alliance. OpenRAN itself also encourages innovation via its open interfaces, and the enablement of third party vendors to add new solutions. OpenRAN is ideally deployed in a virtualized and cloud-based architecture, offering a high degree of automation, increasing efficiencies and reducing costs. Currently, OpenRAN development is supported by a wide range of semiconductor, hardware, testing, systems integration, and software companies, helping foster innovation in each domain and cooperation toward a more ‘hyperscale-like‘ network. As we have seen in other areas of cloud networking and technology, open ecosystems often foster greater innovation.

|

Figure 2: Comparison of Traditional RAN versus OpenRAN |

|

|

| Source: World Wide Technology |

Less vendor lock-in to create more competition:

Another key driver for OpenRAN interest is the ability to avoid vendor lock-in. Following years of vendor consolidation in the Mobile Infrastructure market, there are only four leading equipment provider choices: Huawei, Nokia, Ericsson, and ZTE to a lesser extent. On top of limited choice, it is notoriously difficult to switch vendors, requiring expensive and labor-intensive equipment swaps from the radio head to the baseband data center infrastructure. In some cases, the equipment swap cost burden falls on the carrier and in some cases vendors provide such services as part of the sales/services strategies. Ultimately, the lack of choice and difficulty in switching vendors create a market rife with equipment vendor lock-in.

Swapping out Huawei represents a major catalyst:

As the market has consolidated, political pressures versus Chinese vendors‘ role in 5G (see note on Huawei pressure and risk) further limit vendor choice to only 2-3 firms in some regions. Therefore, global pushback against Huawei/ZTE may be one of the largest drivers of OpenRAN adoption, pulling forward the timing of operator decisions on RAN architectures. Huawei has gained significant share in the $38bn market over the last seven years, now representing 34% of the total market, and government support for removing the vendor from networks has grown in recent months. The UK government recently instituted a policy banning UK carriers from buying new Huawei equipment beginning in 2021, and all Huawei equipment must be removed from UK networks by 2027. Other regions of Europe such as Belgium, Poland, and Sweden have also recently shied away from Huawei.

Importantly, replacing Huawei brings large costs, both from losing Huawei as a competitor (Huawei known for its attractive price/performance) and equipment swaps. As a result, the US government is beginning to take steps to help developing countries within Africa and the Middle East fund the costly replacement of Huawei/traditional equipment. Specifically, the US Agency for International Development is spearheading the effort, while the US State Department continues to pressure US allies to displace Huawei and ZTE equipment from their networks. In our view, the replacement of Chinese RAN technology could open up a $35bn market to both incumbent and new vendors, and the replacement of network vendors‘ architectures offers an attractive opportunity for carries to re-architect the Access network utilizing modernization and virtualization, which are both drivers for OpenRAN. The US government has also explored investing in OpenRAN technologies to help US software/hardware/semi vendors play more of a role in cellular networks.

Open RAN Cost Savings:

Opening the interfaces between the baseband unit (BBU) and remote radio unit (RRU) helps increase competition, lowers the switching costs, and likely saves carrier capex to some degree. However, we believe the real benefits related to the OpenRAN vision come to fruition when the architecture becomes virtualized or cloud OpenRAN (often referred to as Open vRAN). In Open vRAN, carriers first save on equipment capex as the baseband unit software runs on commodity off the shelf (COTS) hardware (i.e., x86 servers) rather than proprietary integrated hardware. Software can be purchased from new vendors and the equipment can be provided by vendors such as Quanta Computer. High degree of competition for the RRU component and the hardware commoditization for the BBU component could result in potential capex savings of 40-50%. Installation and integration services can also potentially be brought in house or outsourced to a longer list of competitors, adding RAN installation savings that are typically part of capex (see Exhibit 3).

The second area of carrier total cost of ownership (TCO) savings is related to the maintenance and operating expense. By copying the efficient cloud models of hyperscalers and centralizing/standardizing the foundation of the RAN, carriers stand to run more efficient data center operations. The software-defined approach also adds to network agility and automation. Through better agility and automation, carriers save on the management, maintenance, and upgrades for the network. Early reports suggest potential 31% operating expense savings as a result (see Exhibit 4).

|

|

|

OpenRAN Industry groups:

1. Telecom Infra Project (TIP):

TIP was formed in February 2016, with Facebook playing a central role. Major vendor Nokia is also part of the group. Japanese members include NTT, KDDI, SoftBank, Rakuten Mobile, NEC and Fujitsu. TIP‘s goal is to create mobile networks using open and disaggregated solutions. The scope of the group‘s work extends from OpenRAN to include the backhaul portion of the network, core network architecture and other areas.

TIP and O-RAN Alliance announced a liaison agreement in February 2020. Under the agreement, the groups will share information, reference respective specifications and collaborate on testing.

2. O-RAN Alliance:

O-RAN Alliance was formed in February 2018 through a merger between x-RAN Forum and C-RAN Alliance. Japanese members include NTT DoCoMo, KDDI, SoftBank, Fujitsu and NEC. In May 2020, O-RAN Alliance and GSMA, an industry body representing MNOs, agreed to collaborate on opening up 5G networks.

Major vendors Ericsson and Nokia are also part of the O-RAN Alliance. However, they appear to be taking a slightly different stance on OpenRAN. In February 2019, some members of O-RAN Alliance announced new open fronthaul specifications and related testing. Nokia is mentioned in the announcement, but Ericsson is absent. Nokia believes open standards are a viable option for RU-DU, but is doubtful about the effectiveness for the CU-DU interface.

The O-RAN Alliance is focused on efforts to standardize technologies. NTT DoCoMo is expected to play a key role in the standardization process. In September 2019, DoCoMo announced it had achieved interoperability with equipment from different vendors in a 4G/5G demo project. Vendors in the demo were Nokia, Fujitsu and NEC. As widely reported, Fujitsu has teamed up with Ericsson and NEC is collaborating with Samsung in OpenRAN technology.