Synergy Research: Growth in Hyperscale and Enterprise IT Infrastructure Spending; Telcos Remain in the Doldrums

Hyperscale cloud companies are spending more and more money on Capex IT infrastructure compared with the largest telecommunication companies as overall IT infrastructure spending in 2022 reached $700 billion. In 2022, hyperscale operators spent roughly $200 billion on Capex IT infrastructure such as network switches and data center hardware and software, representing a 9 percent increase annually and led by Amazon, Google and Microsoft, according to new data from IT market research firm Synergy Research Group.

Comparatively, telecom spending on IT infrastructure by companies like Verizon, AT&T and China Mobile dropped 4 percent in 2022 to approximately $290 billion, Synergy Research Group reported.

Hyperscale operator share of total spending has continued to rise steadily over the last few years, as continued growth in cloud and other digital services drive ever-higher spending levels. Telco spending remains heavily crimped by lack of meaningful growth in their revenue streams. Enterprise spending has also bounced back in the last two years after a soft spell in 2019 and 2020. The main drivers in the enterprise have been the continued long-term growth of hosted and cloud collaboration solutions, increased spending on network security, and a post-pandemic bounce back for both enterprise data centers and switches. In some segments, higher ASPs have also contributed, as cost increases due to supply chain issues are passed on to the customers of tech vendors.

Telcos remain locked in a low-to-no-growth world and their Capex reflects that. For hyperscale operators, the boom in cloud services and continued growth in other digital services is driving ongoing growth in spending. Telecom companies’ share of Capex IT infrastructure spending was 42 percent in 2022, down from 58 percent share in 2016. The largest telco spenders on technology infrastructure last year were China Mobile, Deutsche Telekom, Verizon, AT&T, NTT and China Telecom.

In 2022, hyperscale operators accounted for 29 percent share of the total Capex infrastructure spending market, up significantly from 13 percent share in 2016. Some of the biggest spenders in 2022 were Amazon, Apple, Google, Microsoft and Alibaba.

Overall spending by both fixed and mobile telco operators has been relatively flat over the past eight years, with annual spending levels for infrastructure hovering around $290 billion each year. Synergy market data covers total capital expenditure for telco and hyperscale operators mostly around networking and data center hardware and software.

The final market segment covered in Synergy’s new data is enterprise spending on IT infrastructure, which grew 9 percent year over year in 2022 to roughly $210 billion. The enterprise spend accounted for 29 percent of the total Capex infrastructure market in 2022.

“Enterprise spending has also bounced back a bit in the last two years after a soft spell in 2019 and 2020,” said Dinsdale. ince 2016, enterprise IT spending has grown by an average of over 6 percent annually. Synergy said to make the market data numbers more comparable, enterprise spending covers data center hardware and software, networking and collaboration tools. It excludes enterprise spending on communication and IT services, devices and business software.

“There has also been something of a post-pandemic bounce back for both enterprise data centers and switches, the former being helped by higher costs due to supply chain issues that are being passed on in the form of higher ASPs [average selling price],” said Dinsdale. “For equipment and software vendors, the good news is that overall IT infrastructure spending will continue to grow steadily over the next five years,” he added.

…………………………………………………………………………………………………………………………………………………………………………………………………..

About Synergy Research Group:

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database SIA ™, which enables easy access to complex data sets. Synergy’s Competitive Matrix ™ and CustomView ™ take this research capability one step further, enabling our clients to receive on-going quantitative market research that matches their internal, executive view of the market segments they compete in.

Synergy Research Group helps marketing and strategic decision makers around the world via its syndicated market research programs and custom consulting projects. For nearly two decades, Synergy has been a trusted source for quantitative research and market intelligence.

To speak to an analyst or to find out how to receive a copy of a Synergy report, please contact [email protected] or 775-852-3330 extension 101.

…………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.crn.com/news/cloud/cloud-provider-spend-on-it-capex-climbs-as-telecom-falls

Synergy Research: public cloud service and infrastructure market hit $126B in 1Q-2022

Synergy Research: Microsoft and Amazon (AWS) Dominate IT Vendor Revenue & Growth; Popularity of Multi-cloud in 2021

Synergy Research: Hyperscale Operator Capex at New Record in Q3-2020

Synergy Research: Strong demand for Colocation with Equinix, Digital Realty and NTT top providers

AT&T Highlights: 5G mid-band spectrum, AT&T Fiber, Gigapower joint venture with BlackRock/disaggregation traffic milestone

On AT&T’s earnings call this week, CEO John Stankey provided these highlights:

- AT&T network teams have also consistently outpaced our mid-band 5G spectrum rollout objective. In fact, we now reach 150 million mid-band 5G POPs, more than double our initial 2022 year-end target. Our goal remains to deploy our spectrum efficiently and in a manner that supports traffic growth. In the markets where we have broadly deployed mid-band 5G, 25% of our traffic in these areas already takes advantage of our mid-band spectrum.

- We also expect to continue our 5G expansion, reaching more than 200 million people with mid-band 5G by the end of 2023.

- AT&T had more than 1.2 million AT&T Fiber net adds last year. The fifth straight year we’ve totaled more than 1 million AT&T Fiber net adds. And after 2.9 million AT&T Fiber net adds over the last 2.5 years, we’ve now reached an inflection point where our fiber subscribers outnumber are non-fiber DSL subscribers. The financial benefits of our fiber focus are also becoming increasingly apparent as full year fiber revenue growth of nearly 29% has led to sustainable revenue and profit growth in our Consumer Wireline business. As we scale our fiber footprint, we also expect to drive margin expansion.

- AT&T has the nation’s largest and fastest-growing fiber Internet, and we expect continued healthy subscriber growth as we grow our fiber footprint. As we keep expanding our subscriber base will drive efficiencies in everything we do. AT&T considers fiber a multiyear opportunity that will transform the way consumers’ and businesses’ growing connectivity needs are met in the ensuing decade and beyond.

- AT&T Fiber will be passing 30 million-plus consumer and business locations within our existing wireline footprint by the end of 2025. We finished last year with approximately 24 million fiber locations passed, including businesses, of which more than 22 million locations are sellable, which we define as our ability to serve. We remain on track to reach our target of 30 million plus passed locations by the end of 2025. The simple math would suggest 2 million to 2.5 million consumer and business locations passed annually moving forward. As we previously shared, build targets will vary quarter-to-quarter in any given year based on how the market is evolving.

- AT&T’s Gigapower joint venture announcement with a BlackRock infrastructure fund has not yet closed, we’re very excited about the expected benefit. Through this endeavor, Gigapower plans to use a best-in-class operating team to deploy fiber to an initial 1.5 million locations, and I would expect that number to grow over time. This innovative risk-sharing collaboration will allow us to prove out the viability of a different investment thesis that expanding our fiber reach not only benefits our fiber business, but also our mobile penetration rates. But what makes me most enthusiastic about this endeavor is that we believe Gigapower provides us long-term financial flexibility and strategic optionality and what we believe is the definitive access technology for decades to come, all while sustaining near-term financial and shareholder commitments.

- AT&T sees huge opportunities to connect people who previously did not have access to best-in-class technologies through broadband stimulus and Broadband Equity, Access, and Deployment (BEAD) funding. As I shared before, we truly believe that connectivity is a bridge to possibility in helping close the digital divide by focusing on access to affordable high-speed Internet is a top priority of AT&T. The intent of these government programs is to provide the necessary funding and support to allow both AT&T and the broader service provider community that means to invest alongside the government at the levels needed to achieve the end state of a better connected America.

- Our commitment to fiber is at the core of our strategy. In footprint, we’re on track to deliver our 30 million plus location commitment and we’re building the strategic and financial capabilities to take advantage of further opportunities as they emerge.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

AT&T’s open disaggregated core routing platform was carrying 52% of the network operators traffic at the end of 2022, according to Mike Satterlee, VP of AT&T’s Network Core Infrastructure Services in an interview with SDxCentral. Satterlee described this platform as the carrier’s “common” or “core backbone,” which supports about 594 petabytes of data traffic per day. This core backbone is a multi-part architecture spanning from AT&T’s nationwide network switch and cloud provider connections to its consumer- and enterprise-facing broadband and mobility services.

AT&T’s core platform uses Broadcom’s Jericho2 hardware design and Ramon switching chips, the carrier’s distributed disaggregated chassis (DCC) white box router architecture, and Israel based DriveNets Network Cloud (DNOS) software. It’s fed by AT&T’s edge router platform that sits in regional connection points. It uses the Broadcom silicon, Cisco software platform, and hardware from UfiSpace.

Satterlee said AT&T is running a nearly identical architecture in its core and edge environments, though the edge system runs Cisco’s disaggregates software. Cisco and DriveNets have been active parts of AT&T’s disaggregation process, though DriveNets’ earlier push provided it with more maturity compared to Cisco.

“DriveNets really came in as a disruptor in the space,” Satterlee said. “They don’t sell hardware platforms. They are a software-based company and they were really the first to do this right.”

AT&T began running some of its network backbone on DriveNets core routing software beginning in September 2020. The vendor at that time said it expected to be supporting all of AT&T’s traffic through its system by the end of 2022.

“It’s completely open in the sense that either vendor software could run in either places of the network,” Satterlee explained, adding that this was very helpful during the COVID-19 pandemic. “By having a common platform it’s just a matter of switching out the [network operating system] so we were able to very quickly redirect equipment for different use cases within AT&T and it was just a simple software change controlled by SDN.”

AT&T is targeting 65% of its traffic running on the disaggregated architecture by the end of this year. This will be important to support AT&T’s fiber and 5G push, which was enhanced late last year through a deal the carrier struck with BlackRock to expand its fiber footprint.

John Gibbons, assistant VP for AT&T’s Network Infrastructure Services, added that this also paves the way for the carrier to roll out 800-gigabit support for its backbone. “We don’t have to swap out the core router to get to 800-gig,” Gibbons said. “We can actually add to the current chassis. … We can add the new box to start growing it out from there. That’s the flexibility. It’s like the building-block model.

“Pretty much everything we spoke about supports our two biggest initiatives, which is growing the AT&T fiber broadband as well as 5G, and it’s all the underpinnings of those services,” Gibbons said.

References:

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T Deploys Dis-Aggregated Core Router White Box with DriveNets Network Cloud software

Dell’Oro: Optical Transport market to hit $17B by 2027; Lumen Technologies 400G wavelength market

According to a recent forecast report by Dell’Oro Group, the Optical Transport equipment demand is forecast to increase at a 3 percent compounded annual growth rate (CAGR) for the next five years, reaching $17 billion by 2027. The cumulative revenue during that five year period is expected to be $81 billion.

“We expect annual growth rates to fluctuate in the near term before stabilizing to a more typical 3 percent growth rate,” said Jimmy Yu, Vice President at Dell’Oro Group. “There is still a large amount of market uncertainty this year due to the economic backdrop—economists are predicting a high chance of a recession in North America and Europe. However, at the same time, most optical systems equipment manufacturers are reporting record levels of order backlog entering the year, and we expect that most of this backlog could convert to revenue when component supply improves this year,” added Yu.

Additional highlights from the Optical Transport 5-Year January 2023 Forecast Report:

- Optical Transport market expected to increase in 2023 due to improving component supply.

- WDM Metro market growth rates in next five years are projected to be lower than historic averages due to the growing use of IP-over-DWDM.

- DWDM Long Haul market is forecast to grow at a five-year CAGR of 5 percent.

- Coherent wavelength shipments on WDM systems forecast to grow at 11 percent CAGR, reaching 1.2 million annual shipments by 2027.

- Installation of 400 Gbps wavelengths expected to dominate for most of forecast period.

About the Report

The Dell’Oro Group Optical Transport 5-Year Forecast Report offers a complete overview of the Optical Transport industry with tables covering manufacturers’ revenue, average selling prices, unit shipments, wavelength shipments (by speed up to 1.2+ Tbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers, optical switch, Disaggregated WDM, DCI, and ZR Optics.

……………………………………………………………………………………………………………………………………………………

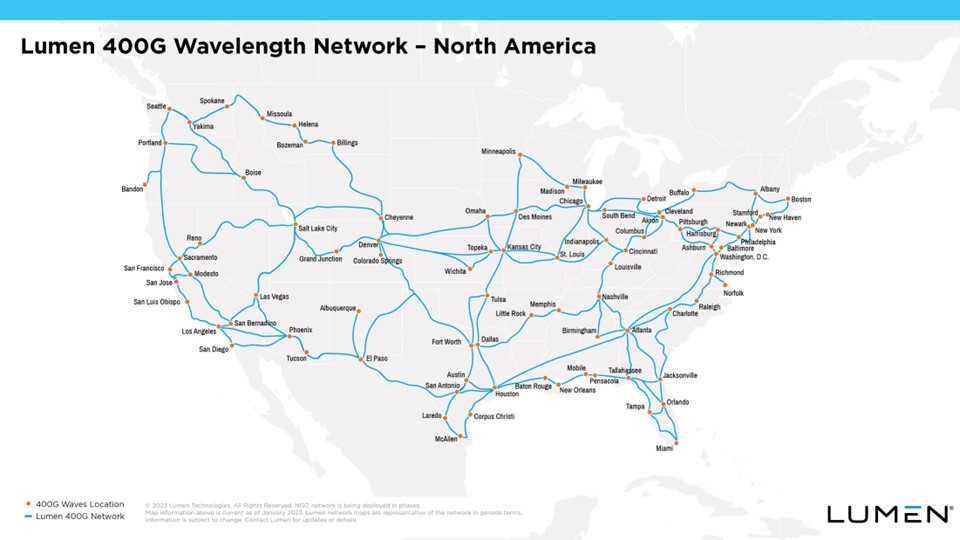

Separately, Lumen Technologies is expanding its 400G wavelength network across North America. Lumen said it has now deployed the network in 70 markets. More than 240 data centers have access to Lumen’s 400G Wavelength Services, and the network has over 800 Tbit/s of capacity.

Lumen said it plans to continue its intercity 400G expansion this year, pushing the network “deeper into the metro edge.” The company noted that wavelength services will assist customers in moving workloads to the cloud, and provide private, dedicated connections.

Enterprise customers can also examine network options, plan out their wavelengths and get cost estimates with Lumen’s Topology Viewer.

References:

https://www.prnewswire.com/news-releases/lumen-kicks-up-its-400g-offering-across-the-us-301730126.html

High Tech Layoffs Explained: The End of the Free Money Party

Thanks to the Federal Reserve Board’s “free money party” (aka Quantitative Easing/QE and Zero Interest Rate Policy/ZIRP) from 2009-March 2022, investors desperate for returns sent their money to Silicon Valley, which pumped it into a wide range of start-ups that might not have received any funding in other times. Extreme valuations of both public and private companies made it easy to issue stock or take on loans to expand aggressively or to offer sweet deals to potential customers that quickly boosted market share.

“The whole tech industry of the last 15 years was built by cheap money,” said Sam Abuelsamid, principal analyst with Guidehouse Insights. “Now they’re getting hit by a new reality, and they will pay the price.”

Cheap money funded many of the tech acquisitions that were a substitute for internal growth. Two years ago, as the pandemic raged and many office workers were confined to their homes, Salesforce bought the office communications tool Slack for $28 billion, a sum that some analysts thought was way too high. Salesforce borrowed $10 billion to do that deal. This month, Salesforce said it’s laying off 8,000 employees, about 10% of its staff, many of them from Slack.

More than 46,000 workers in U.S.-based tech companies have been laid off in mass job cuts so far in 2023, according to a Crunchbase News tally. Last year, more than 107,000 jobs were slashed from public and private tech companies Here are just a few:

- Amazon is laying off 18,000 office workers and shuttering operations that are not financially viable. More below.

- Google parent Alphabet is cutting 12,000 jobs.

- Microsoft, which has been riding high on cloud revenues for years, is eliminating 10,000 jobs.

- Cisco plans to cut 5% of workforce – approximately 4,100 people will lose their jobs.

- Facebook parent Meta announced in November that it plans to eliminate 13% of its staff, which amounts to more than 11,000 employees.

- Shortly after closing his $44 billion purchase of Twitter in late October, new owner Elon Musk cut around 3,700 Twitter employees.

- IBM said today it would eliminate about 1.5% of its global workforce, which amounts to a “ballpark” figure of 3,900 job cuts.

The easy money era (which started shortly after the Lehman Brothers bankruptcy in September 2008) had been well established when Amazon decided it had mastered e-commerce enough to take on the physical world. Its plans to expand into bookstores was a rumor for years and finally happened in 2015. The media went wild. According to one well-circulated story, the retailer planned to open as many as 400 bookstores. Instead, the eRetail and cloud computing leader closed 68 stores last March, including not only bookstores but also pop-ups and so-called four-star stores. It continues to operate its Whole Foods grocery subsidiary, which has 500 U.S. locations, and other food stores. Amazon said in a statement that it was “committed to building great, long-term physical retail experiences and technologies.”

“High rates are painful for almost everyone, but they are particularly painful for Silicon Valley,” said Kairong Xiao, an associate professor of finance at Columbia Business School. “I expect more layoffs and investment cuts unless the Fed reverses its tightening.”

Addendum (Feb 26, 2023):

Ericsson will lay off 8,500 employees globally as part of its plan to cut costs, according to a memo sent to employees and seen by Reuters. “The way headcount reductions will be managed will differ depending on local country practice,” Chief Executive Borje Ekholm wrote in the memo. “In several countries the headcount reductions have already been communicated this week,” he said. “It is our obligation to take this cost out to remain competitive,” Ekholm said in the memo. “Our biggest enemy right now may be complacency.”

Ericsson to lay off 8,500 employees as part of cost cutting plan

References:

https://news.crunchbase.com/startups/tech-layoffs/

The Rise of New Tech Companies – Fiendbear Unicorns, FANGs, and the Nifty Nine

Update on 5G Stand-Alone (SA) Core Networks

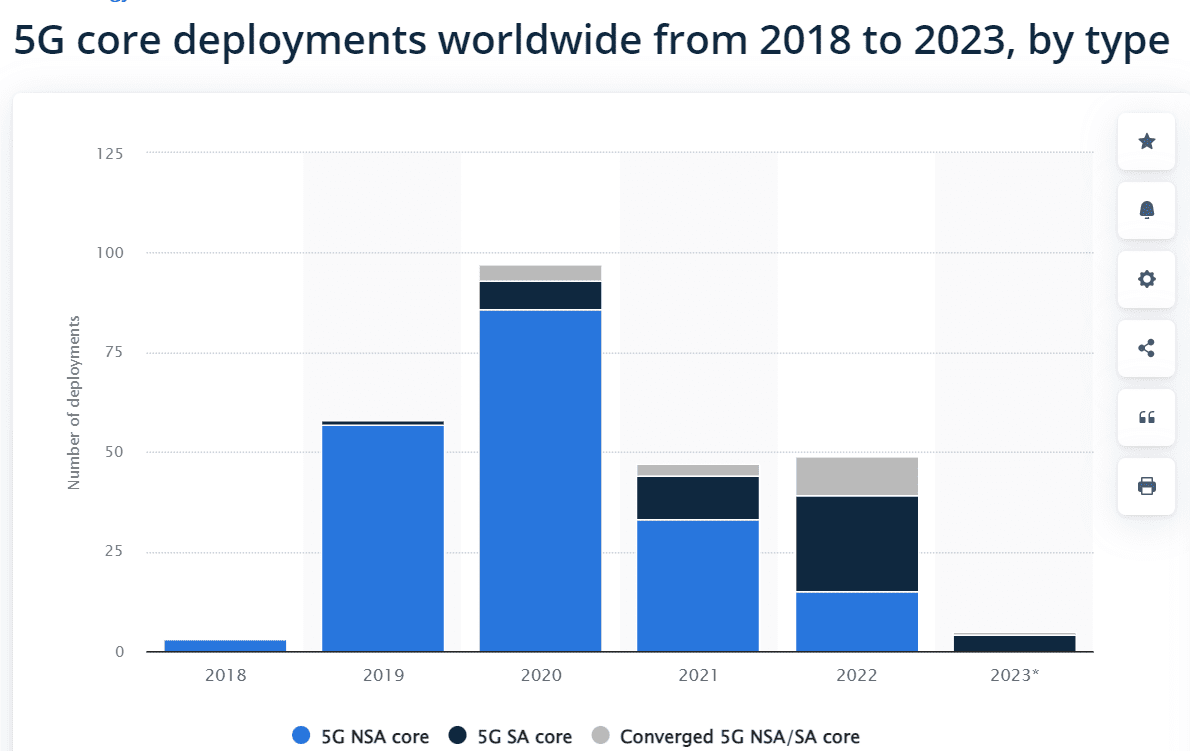

Statista:

The type of 5G cores currently deployed remains dominated with about 75% of non-standalone (NSA) cores, or cores using the preexisting 4G network infrastructure. However, 5G standalone (SA) cores, which require more up-front costs and development yet may provide faster and more scalable connection, are forecast to outstrip NSAs and consist of 24 of the 49 5G core launches in 2022. All but one of the 5G launches announced for 2023 are standalone.

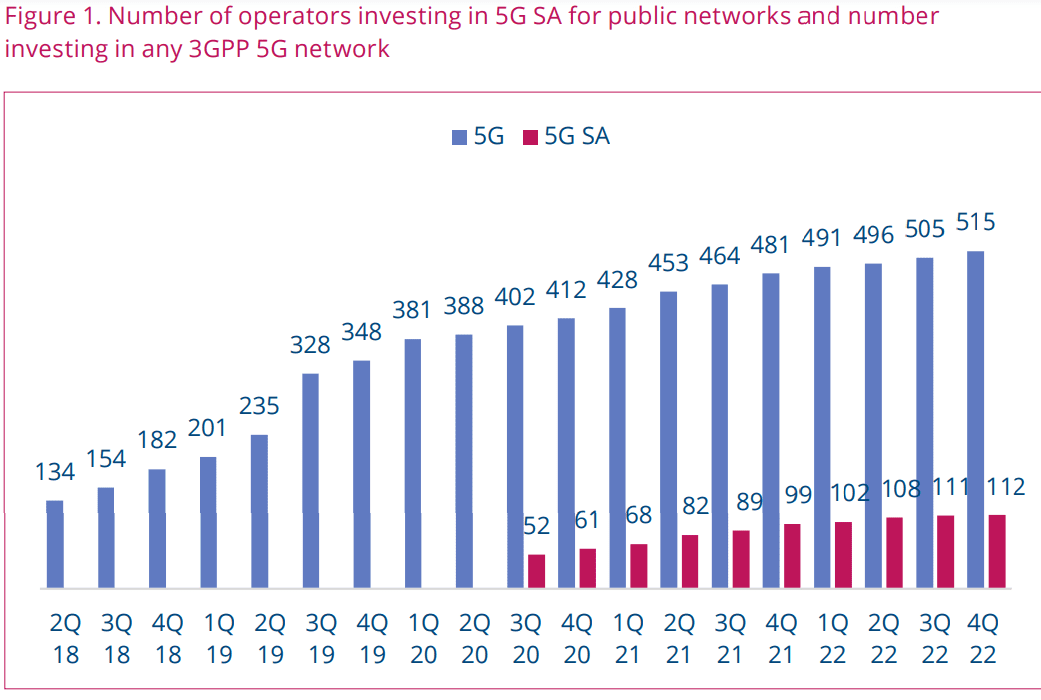

GSA:

Network Operators are increasingly experimenting with and deploying 5G standalone (SA) networks. With a totally new, cloud-based, virtualized, microservices-based core infrastructure, some of the anticipated benefits of introducing 5G SA technologies include faster connection times (lower latency), support for massive numbers of devices, programmable systems enabling faster and more-agile creation of services and network slices, with improved support for management of service-level agreements within those slices, and the advent of voice over New Radio (VoNR) technology. The introduction of 5G SA is expected to facilitate simplification of architectures, improve security and reduce costs.

The 5G SA technology is expected to enable customisation and open up new service and revenue opportunities tailored to enterprise, industrial and government customers.

GSA is tracking the emergence of the 5G SA system, including the availability of chipsets and devices for customers, plus the testing and deployment of 5G SA networks by public mobile network operators as well as private network operators. This report is the latest in an ongoing series summarizing market trends, drawing on data collected in GSA’s various databases covering chipsets, devices, spectrum and networks.

GSA has identified 112 operators in 52 countries and territories worldwide that have been investing in public 5G SA networks in the form of trials, planned or actual deployments . This equates to almost 21.7% of the 515 operators known to be investing in 5G licences, trials or deployments of any type.

At least 32 operators in 21 countries and territories are now understood to have launched public 5G SA networks, two of which have only soft-launched their 5G SA networks. In addition to these, 21 operators have been catalogued as deploying or piloting 5G SA for public networks, and 31 as planning to deploy the technology, showing that launches of 5G SA look set to continue apace. GSA has also recorded 19 operators as being involved in evaluations, tests or trials of 5G SA.

As of the last update in December 2022, GSA had collated information about 955 organisations known to be deploying LTE or 5G private mobile networks.

Countries and territories with operators identified as investing in public 5G SA networks have been granted a licence suitable for the deployment of a private LTE or 5G network so far. Of those, 391 are known to be using 5G networks (excluding those labelled as 5G-ready) for private mobile network pilots or deployments. Of those, 41 (slightly more than 10% of them) are known to be working with 5G SA already. They include manufacturers, academic organizations, commercial research institutes, construction, communications and IT services, rail and aviation organizations.

Dell’Oro Group:

At the close of 2022, we identified 39 mobile network operators that have commercially launched 5G SA eMMB networks.

References:

https://www.statista.com/statistics/1330511/5g-core-deployments-worldwide-by-type/

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

https://www.3gpp.org/technologies/5g-system-overview

https://www.ericsson.com/en/core-network/5g-core

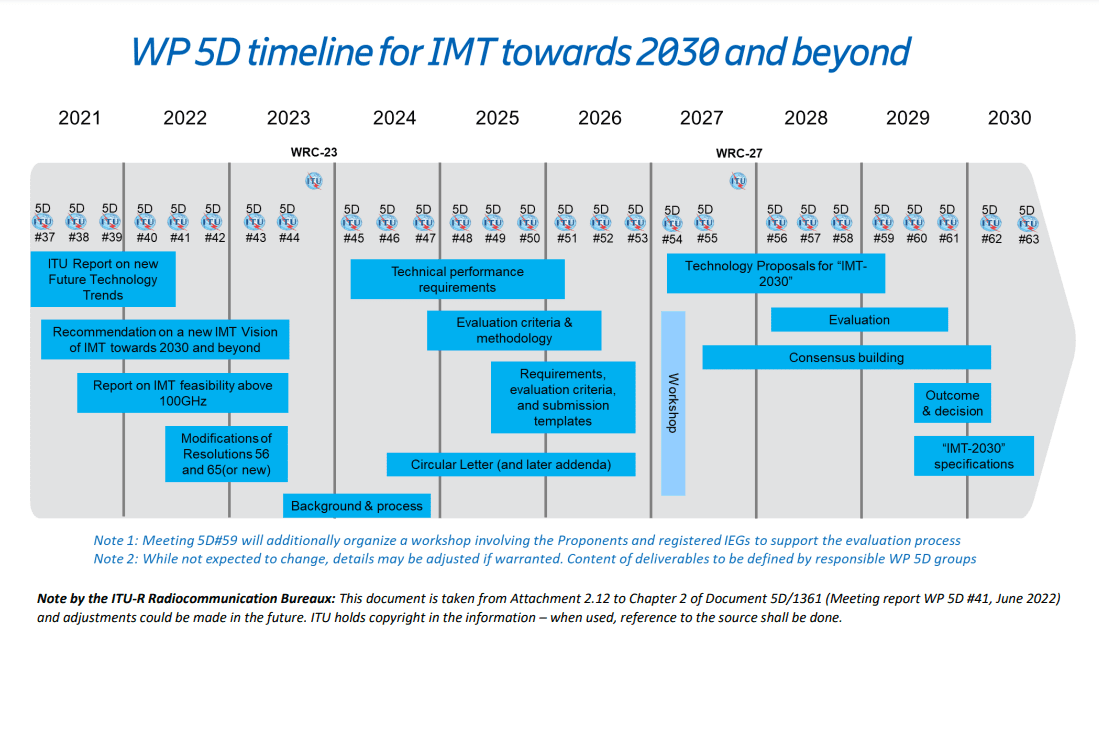

ITU-R WP5D: Studies on technical feasibility of IMT in bands above 100 GHz

The development of IMT for 2030 and beyond is expected to enable new use cases and applications with extremely high data rate and low latency, which will benefit from large contiguous bandwidth spectrum resource with around tens of GHz. This suggests the need to consider spectrum in higher frequency ranges above 92 GHz as a complementary of the lower bands.

Report ITU-R M.[IMT.ABOVE 100 GHz] investigates technical feasibility of IMT in bands above 92 GHz including propagation characteristics, potential new enabling IMT technologies, which could be appropriate for operation in these bands, and relevant deployment scenarios.

The Report describes a series of propagation measurement activities carried out by academia and industry aiming at investigating the propagation characteristics in these bands under several different environments (such as outdoor urban and indoor office). It also includes a summary of the measurement activities collected for these bands, noting that bands of interest are more concentrated in 100, 140-160, 220-240, and around 300 GHz. Characteristics of IMT technologies in bands above 92 GHz, including coverage, link budget, mobility, impact of bandwidth and needed capabilities to support new use cases, have been presented in this Report.

To overcome major challenges of operating in bands above 92 GHz such as limited transmission power, the obstructed propagation environment due to high propagation losses and blockage, it describes enabling antenna and semiconductor technologies, material technologies including reconfigurable intelligent surfaces and MIMO and beamforming technologies as potential solutions.

Given the large bandwidth and high attenuation characteristics of bands above 92 GHz, some typical use cases are also envisaged in this Report, such as indoor/outdoor hot spots, integrated sensing and communication, super-sidelink, flexible wireless backhaul and fronthaul.

The radio wave propagation assessment, measurements, technology development and prototyping described in the Report indicate that utilizing the bands above 92 GHz is feasible for studied IMT deployment scenarios, and could be considered for the development of IMT for 2030 and beyond.

This ITU-R report is expected to be completed and approved in 2023.

References:

ITU-R Report in Progress: Use of IMT (likely 5G and 6G) above 100 GHz (even >800 GHz)

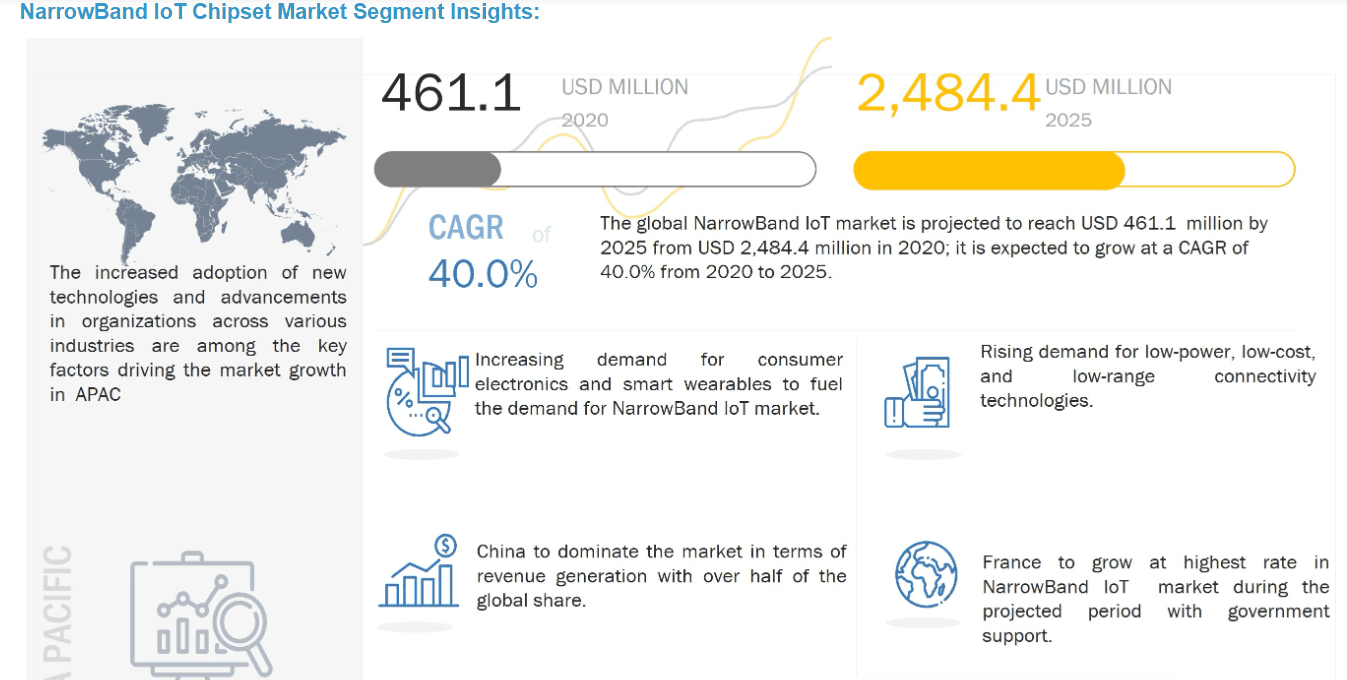

Research & Markets: Global Narrowband IoT (NB-IoT) Chipset Market Expected to Reach $7.7B by 2028

Executive Summary:

The “Global Narrowband IoT (NB-IoT) Chipset Market Size, Share & Industry Trends Analysis Report By Application, By Deployment, By Offering (Hardware (Processor, Memory, and Power Management Unit) and Software), By Vertical, By Regional Outlook and Forecast, 2022 – 2028” report has been published by ResearchAndMarkets.com.

The Global Narrowband IoT (NB-IoT) Chipset Market size is expected to reach $7.7 billion by 2028, rising at a market growth of 51.6% CAGR during the forecast period. A Narrowband IoT (NB-IoT) chipset is used in many machines, electronic gadgets, and physical items.

Due to numerous advantages of the technology, including low power consumption for user devices, high system capacity, and improved spectrum efficiency enabling deep coverage of an area, the narrowband IoT chipset market is expanding at a rapid rate. A wide variety of new Internet of Things (IoT) devices and services are made possible by the standards-based low power wide area (LPWA) technology known as narrowband Internet of Things (NB-IoT).

In deep coverage, NB-IoT dramatically increases spectrum efficiency, system capacity, and user device power consumption. A variety of use cases can accommodate a battery life of more than 10 years. The technologies utilized to transport data nowadays range widely. Each has distinct advantages and disadvantages, and the appropriate technology is selected based on the specific circumstances.

The most discussed in recent years and one that will be widely used in future years across multiple industries is NB-IoT (Narrowband Internet of Things). A lot of devices can communicate data using the NB-IoT technology even in areas without coverage from a typical mobile network. A more reliable data transport is ensured by the use of a licensed frequency band where there is no interruption from other devices. A network that can span over big regions while using less energy is an LPWAN, and this is what the NB-IoT is.

COVID-19 Impact Analysis:

As lockdowns were imposed all over the world and the continuity of operations for the majority of industries is significantly compromised, the COVID-19 pandemic is having a significant impact on global supply chains and logistics. Several nations have halted all imports as a result of the COVID-19 pandemic out of concern for further viral spread.

The pandemic is anticipated to cause a decrease in the availability of connectivity devices, which is expected to cause the rate of growth of the NB-IoT chipset market to be slower than anticipated. Moreover, the market for smart street lighting has been impacted by the expansion of COVID-19, which has also had an impact on investments in smart cities and infrastructure projects for roads and highways.

Market Growth Factors:

Increasing Adoption of IoT Along With Better Battery Life for Other Connected Devices:

Battery life is a major aspect in the world of IoT devices as well as other connected devices today. Smartphone makers are continuously striving to improve their devices’ massive battery life because modern smartphones are so different from their models from only a few years ago.

Technologies are evolving and becoming more advanced and sophisticated every year. The market for connected devices is expanding, particularly in the industrial sector, as M2M communications become more prevalent. In addition, connectivity has been made possible by market trends, like IoT in practically every sector, encompassing healthcare, consumer electronics, or retail.

Lesser Initial and Maintenance Costs Along With Increasing Reliability:

Companies is expected to not make significant investments in new technology if it does not improve their bottom line in the long run. That is actually how it should be because a business is fundamentally a living entity that is trying to survive in a hostile market where cost is a very significant factor for the growth and revenue of any business.

With the rapidly expanding information infrastructure and the world’s economy being so interconnected, this is more relevant than ever. NB-IoT and similar technologies use a fairly straightforward waveform, which uses less power. But it’s not only about power savings. As NB-IoT becomes more and more popular, making NB-IoT chips will become more and more affordable.

Market Restraining Factors:

Incompatibility with High Data Speeds Along With the Availability of Alternatives Across The Market

Compared to LTE-M, NB-IoT is less suitable for situations where very low network latency is required. In situations where near-real-time data could be necessary, where LTE-M is a better fit, it will therefore be less common. In the transition to 5G, both NB-IoT and LTE-M play a role in enabling use cases that demand speed and are frequently crucial.

Not all of this depends on the communication standard that is selected. For fixed or mobile devices, NB IoT was created as a pure data transfer method. It cannot seamlessly switch between cells and cannot serve applications that need low latency.

Media Contact:

Research and Markets

Laura Wood, Senior Manager

[email protected]

Reference:

………………………………………………………………………………………………………………..

Companies making NB-IoT Chip Sets:

Huawei, Qualcomm, Nordic Semiconductor, Samsung, Mediatek, Intel, among others

https://www.marketsandmarkets.com/Market-Reports/narrowband-iot-market-59565925.html

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

Samsung Electronics and KDDI announced the successful demonstration of Service Level Agreements (SLA) assurance network slicing in a field trial conducted in Tokyo, Japan. For the first time in the industry, the companies proved their capabilities to generate multiple network slices using a RAN Intelligent Controller (RIC) on a live commercial 5G Standalone (SA) network. The RIC, provided by Samsung in this field trial, is a software-based component of the Open RAN architecture that optimizes the radio resources of the RAN to improve the overall network quality.

Network slicing (which requires a 5G SA core network) enables multiple virtual networks to be created within a single physical network infrastructure, where each slice is dedicated for a specific application or service — serving different purposes. For instance, 5G SA network operators can create a low latency slice for automated vehicles, an IoT slice for smart factories and a high bandwidth slice for live video streaming — all within the same network. This means that a single 5G SA network can support a broad mix of use cases simultaneously, accelerating the delivery of new services and meeting the tailored demands of various enterprises and consumers.

“Network slicing will help us activate a wide range of services that require high performance and low latency, benefitting both consumers and businesses,” said Toshikazu Yokai, Managing Executive Officer, General Manager of Mobile Network Technical Development Division at KDDI. “Working with Samsung, we continue to deliver the most innovative technologies to enhance customer experiences.”

Through this field trial conducted in Q4 of 2022, KDDI and Samsung proved their capabilities of SLA assurance to generate multiple network slices that meet SLA requirements, guaranteeing specific performance parameters — such as low latency and high throughput — for each application. Samsung also proved the technical feasibility of multiple user equipment (UE)-based network slices with quality assurance using the RIC, which performs advanced control of RAN as defined by the O-RAN Alliance.

“Network slicing will open up countless opportunities, by allowing KDDI to offer tailor-made, high-performance connectivity, along with new capabilities and services, to its customers,” Junehee Lee, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics. “This demonstration is another meaningful step forward in our efforts to advance technological innovation and enrich network services. We’re excited to have accomplished this together with KDDI and look forward to continued collaboration.”

For more than a decade, the two companies have been working together, hitting major 5G networks milestones that include: KDDI’s selection of Samsung as a 5G network solutions provider, end-to-end 5G network slicing demonstration in the lab, 5G network rollout on 700MHz and the deployment of 5G vRAN on KDDI’s commercial network.

Samsung has pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.

References:

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Deutsche Telekom demos end to end network slicing; plans ‘multivendor’ open RAN launch in 2023

Is 5G network slicing dead before arrival? Replaced by private 5G?

Telefonica in 800 Gbps trial and network slicing pilot test

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

Ericsson warns profit margins at RAN business set to worsen

Ericsson on Friday reported lower than expected 4th-quarter core earnings as sales of 5G equipment slowed in high-margin markets such as the United States, sending the Swedish company’s shares to their lowest since 2018.

Ericsson is the latest tech company to show the impact of customers tightening belts amid concerns about a global economic slowdown. Others have been cutting staff, including Microsoft (10,000) and Google parent Alphabet (12,000) which have announced thousands of job cuts this week while Amazon had announce 10,000 layoffs several weeks ago.

Ericsson has already announced plans to cut costs by 9 billion crowns ($880 million) by the end of 2023.

Chief Financial Officer Carl Mellander told Reuters that would involve reducing consultants, real estate and also employee headcount. “It’s different from geography to geography, some are starting now, and we’ll take it unit by unit, considering the labour laws of different countries,” Mellander said, referring to the cuts.

Mellander declined to say if the job cuts would be similar to 2017 when Ericsson laid off thousands of employees and focused on research to return the company to profitability.

Last week, the company said it would book a 2.3 billion Swedish crown ($220 million) provision for an expected fine from U.S. authorities for breach of a settlement reached in 2019.

Ericsson’s net sales rose in the fourth quarter, but margins, net income and core earnings fell. Its gross margin for the fourth quarter of 2022 fell to 41.4% from 43.2%.

Ericsson said it expected a fall in margin in its Networks business to persist through the first half of 2023, but the effect of cost savings to emerge in the second quarter.

JPMorgan analysts said given the fall in margins and higher investments, they would expect 2023 earnings to decline by a double digit percentage.

Inge Heydorn, partner and fund manager at investment firm GP Bullhound, said: “The fourth quarter shows once again that the U.S. has a big impact on Ericsson’s margins.”

With U.S. customers such as Verizon tightening their purse strings, Ericsson is hoping newer markets such as India can provide some growth. Its South East Asia, Oceania and India market was the only one to grow in the quarter, rising 21%, accounting for 13% of the company’s business.

The company’s fourth-quarter adjusted operating earnings, excluding restructuring charges, fell to 9.3 billion Swedish crowns from 12.8 billion a year earlier. That was short of the 11.22 billion expected by analysts, Refinitiv Eikon data showed. Net sales rose 21% to 86 billion crowns, beating estimates of 84.2 billion.

A settlement of a patent deal with Apple (AAPL.O) last month resulted in revenue of 6 billion crowns, but Ericsson also took 4 billion crowns in charges, including a provision for a potential fine from U.S. regulators and divestments.

However, there was some good news.

- Ericsson said it expects significant patent revenue growth over the coming 18-24 months.

- Ericsson, outside China, remains the company to beat in 5G. Its share of the market for radio access networks (RANs) appears to have increased several years in a row – from 33% in 2017 to 39% now.

- Ericsson is healthily profitable, which could not be said when CEO Ekholm took charge in 2017.

- Boosted by recent takeover activity and a major licensing deal with Apple, its headline sales for the final quarter of 2022 were up 21%, to 86 billion Swedish kronor (US$8.4 billion), compared with the same period a year before.

However, Ericsson has experienced one of its biggest profit slumps since the first half of Ekholm’s tenure. Hurt by higher costs and SEK4 billion ($390 million) worth of one-off charges – relating to US fines, write-downs and divestiture – its net income dropped by 39%, to SEK6.2 billion ($600 billion). Worse, all the various profit margins thinned, with Ericsson’s closely monitored EBIT (earnings before interest and tax) margin shrinking to just 9.1%, from 16.1% a year earlier. And the outlook is frosty.

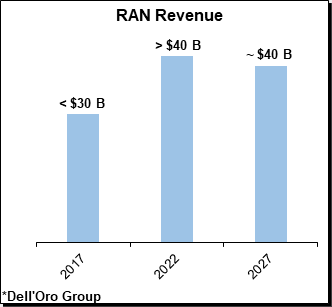

The mini-boom in 5G spending appears to be over – temporarily, at least. Last year, the market for RAN products, where Ericsson now generates about 70% of its revenues, grew by around 5%, according to data from Dell’Oro, a market research firm that Ericsson uses. This year, RAN market sales are expected to fall by 1%. And in North America, responsible for nearly 30% of Ericsson’s overall revenues, Dell’Oro predicts they will drop by a worrying 7%.

After investing heavily in network rollouts during the last couple of years, many operators are cutting their expenditure amid signs of an economic downturn, and reducing the equipment stockpiles they built up when supplies were tight. “We expect operators to adjust inventory levels as the supply situation eases and we plan for these trends to continue during the first half of 2023,” said Ekholm on Ericsson’s earnings call today.

“The first half is really where we’ll see the sizeable inventory adjustments,” said Ekholm, answering questions asked by analysts. “Operators can sweat assets for a couple of quarters but it cannot be done much more [than that] because of the traffic growth underneath. That is the way to model it.” Ericsson’s expectation is that total mobile data traffic worldwide will grow by a factor of five between 2022 and 2028.

Given the market slowdown, turbulence of the last year and seemingly endless difficulties at smaller units, it is easy to forget that Ericsson remains a solid and successful business. But it has become more reliant on RAN sales under Ekholm – generating more than 70% of its revenues in that market last year, compared with just 47% in 2016. Ekholm clearly restored Ericsson’s reputation as a RAN provider. Amid the slowdown in that sector (zero growth forecast by Dell’Oro through 2027), his big challenge now is to prove it can thrive elsewhere.

Andrew Gardiner, analyst at Citi, said the announcements demonstrated the “significant challenges” the company faced this year. “We view Ericsson’s outlook as one of fundamentals deteriorating in the next quarter or two, as it aims to improve in the second half and beyond,” he added.

References:

https://www.reuters.com/technology/ericsson-quarterly-earnings-miss-expectations-2023-01-20/

https://www.ft.com/content/dd5cb329-f5bd-4b78-bde1-ca7510daaa7a

Dell’Oro: 5G RAN growing; total RAN growth is slowing over next 5 years

According to a newly published forecast report by Dell’Oro Group, after four years of extraordinary growth that propelled the radio access network (RAN) market to reach new record levels, the RAN market is now transitioning from the expansion phase to the next phase in this 5G journey with more challenging comparisons and slower growth.

“It is still early days in the 5G journey but at the same time, the coverage and capacity phases that have shaped the capex cycles with previous technology generations still hold,” said Stefan Pongratz Vice President and analyst with the Dell’Oro Group. “Still, even with the expected changes in capital intensities as the operators reach their initial 5G coverage targets, the plethora of 5G frequencies taken together with the upside from FWA and eventually private 5G, will curb the peak-to-trough decline relative to 2G-4G,” continued Pongratz.

Editor’s Note: In December, Ericsson said it expects the RAN market to be flat with 5G build-out still in its early days.

Additional highlights from the Mobile RAN 5-Year January 2023 Forecast Report:

- Global RAN is projected to grow at a zero percent CAGR outside of China by 2027. See chart below.

- The less advanced MBB regions are expected to grow while RAN investments in both China and North America are expected to decline at mid-single digit CAGRs over the forecast period.

- 5G RAN is expected to grow another 25 percent to 30 percent by 2027, though this will barely be enough to offset steep declines in LTE.

- mmWave projections have been revised downward over the near term and upward in the outer part of the forecast to reflect the potential upside with higher EIRP solutions.

- Small cell RAN revenue growth has been outpacing macros for some time now and these trends are expected to extend throughout the forecast period, with small cell RAN revenues growing more than 20 percent by 2027.

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the Mobile RAN industry by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue and unit shipments for 5GNR, 5G NR Sub 6 GHz, 5G NR mmW and LTE pico, micro, and macro base stations. The report also covers Open RAN, Virtualized RAN, small cells, and Massive MIMO. To purchase this report, please contact by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com

References:

5G RAN is Growing but Total RAN Growth is Slowing over Next Five Years, According to Dell’Oro Group

\