Huawei

Mobile Experts: Ericsson #1 in RAN market; Huawei falls to #3

According to a new report from analyst firm Mobile Experts, Ericsson leapt into the #1 position in the RAN market for 2021. Ericsson (see Table 1. at bottom of this article), which achieved a 26.9% share of a market that grew by about 3% in value to be worth in the region of $45 billion last year.

Sanctions hit Huawei very hard as the Chinese tech giant dropped to third place in the RAN market in terms of the value of sales with a 20.4% market share. Huawei had a shortfall of roughly $4B last year due to the company’s inability to produce high-capacity TDD base stations. That was because of U.S. Government sanctions on the critical components needed. As a result, Huawei achieved much lower dollar value than their western competitors.

Nokia (21.9% market share) placed third while ZTE achieved fourth place (14.5%) ahead of Samsung (8% market share).

“Our approach to forecasting is deeply analytical, using data from more than 100 sources, rather than simply the inputs of five OEMs. Our approach works. This analyst team has been creating some of the most accurate, detailed forecasting on the market for over a decade,” commented Chief Analyst of Mobile Experts, Joe Madden. “We have developed relationships with suppliers, operators, and vendors that give us data for a three-pronged approach to triangulation on mobile infrastructure revenue.”

Mobile Experts’ models show the RAN market growing at a CAGR (Cumulative Annualized Growth Rate) of 3%, with -1% growth in macro base stations and 25%-35% growth in millimeter wave and software segments. The analyst firm, known for their unmatched accuracy, leverage over a decade of ear-to-ground experience in this market to present this detailed market forecast that presents last year’s findings concisely and completely as well as presenting what’s next for the RAN market and its players.

“Overall, the RAN market is looking up. After 30 years of boom-and-bust cycles, the market is currently reaching a peak with 5G deployment in its active mode this year. In coming years, we see new revenue coming in from private enterprises to offset the natural drop in CSP sales; specifically, the private LTE/5G market will grow by 19%, accounting for more than $4 billion in 2026. As a result, the total RAN market will remain near its 5G peak for a few years, with the possibility for growth in the longer term,” commented Chief Analyst Joe Madden.

Total Year Review for 2021 – Global RAN Revenue:

This pre-earnings report offers a comprehensive overview of the RAN market with Mobile Experts’ signature accuracy and detailed breakdowns. This quarter’s report includes revenue estimates for the top 25 vendors in the RAN market for 2021. This is the first of a series of quarterly updates, and it is available today for instant download with purchase at www.mobile-experts.net.

For more about this research and buy the report, click here.

About Mobile Experts Inc.:

Mobile Experts provides insightful market analysis for the mobile infrastructure and mobile handset markets. Our analysts are true Experts, who remain focused on topics where each analyst has 25 years of experience or more. Research topics center on technology introduction for radio frequency (RF) and communications innovation. Recent publications include: RAN Revenue, Cellular V2X, Fixed Mobile Convergence, Edge Computing, In-Building Wireless, CIoT, URLLC, Macro Base Station Transceivers, Small Cells, VRAN, and Private LTE.

……………………………………………………………………………………………..

Table 1: Ericsson’s headline figures (Swedish Krona-SEK billions)

| 2021 | 2020 | Change | |

| Net sales | 232.3 | 232.4 | 0% |

| Gross income | 100.7 | 93.7 | 7% |

| Gross margin | 43.4% | 40.3% | – |

| Research and development expenses | -42.1 | -39.7 | – |

| Selling and administrative expenses | -27.0 | -26.7 | – |

| Impairment losses on trade receivables | 0.0 | 0.1 | -134% |

| Other operating income and expenses | 0.4 | 0.7 | -45% |

| Share in earnings of JV and associated companies | -0.3 | -0.3 | – |

| EBIT | 31.8 | 27.8 | 14% |

| – of which networks | 37.3 | 30.9 | 21% |

| – of which digital services | -3.6 | -2.2 | – |

| – of which managed services | 1.5 | 1.6 | -6% |

| – of which emerging business and other | -3.4 | -2.4 | – |

| EBIT margin | 13.7% | 12.0% | – |

| Financial income and expenses, net | -2.5 | -0.6 | – |

| Income tax | -6.3 | -9.6 | 30% |

| Net income | -0.5 | -1.3 | – |

| Source: Ericsson | |||

“5G smart hospital” launched in Thailand; Joint Innovation Lab to incubate 5G applications

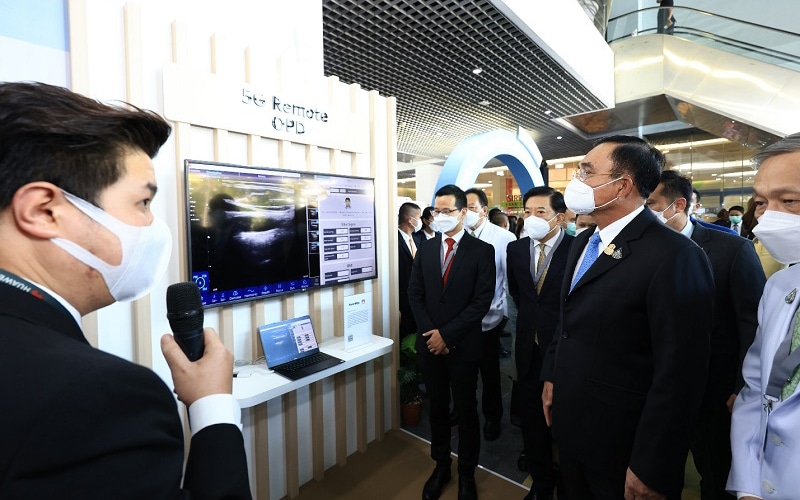

The Office of The National Broadcasting and Telecommunications Commission (NBTC) in Thailand, Siriraj Hospital, and Huawei jointly launched the “Siriraj World Class 5G Smart Hospital” on Sunday, December 10th. This is the first and largest 5G smart hospital project in the ASEAN region. It will deliver a more efficient and convenient experience to patients by introducing technologies such as 5G, cloud, and artificial intelligence. Meanwhile, Siriraj Hospital and Huawei will establish a Joint Innovation Lab to incubate over 30 innovative 5G applications that will be promoted nationwide from 2022.

General Prayut Chan-o-cha, Prime Minister, addressed the national policy on 5G and digital economy. “Thailand understands the importance of technology, and today is an important first step in the utilization of digital technologies and 5G in the medical field. We are thankful for the long-lasting friendship and collaboration between Thailand and China. We admire Siriraj Hospital and Mahidol University, and would like to thank Huawei, NBTC, and all other partners. We hope the project will act as a blueprint for all smart hospitals in Thailand going forward.”

Han Zhiqiang, Ambassador of the People’s Republic of China in Thailand, emphasized that China will leverage technology to help Thailand fight the pandemic. “China and Thailand’s 5G cooperation has become a model in the region, helping Thailand become the first country in Southeast Asia to launch 5G commercial use. China will continue to support Huawei and other Chinese companies in advancing Smart Hospitals and bringing better lives for Thai and Chinese people.”

Prof. Dr. Prasit Watanapa, MD, Dean of Faculty of Medicine, Siriraj Hospital Mahidol University, and Colonel Natee Sukonrat, Ph.D., Vice-Chairman of NBTC emphasized that with the “smart hospitals” model, people in remote areas will have better opportunities to access advanced health care services.

Abel Deng, CEO of Huawei Thailand, said, “Huawei has collaborated with Siriraj Hospital to transform it into a world class 5G Smart Hospital, and introduced the Innovation Lab at Srisavarindira Building as part of its 5G infrastructure project for Siriraj Hospital last year. This signifies a model for upgrading Thailand’s public health industry in the future and contributes to Siriraj’s transition to becoming a smart hospital, in line with Huawei’s mission to Grow in Thailand, Contribute to Thailand.”

Thailand’s Prime Minister Prayut Chan-o-cha touring the Siriraj hospital. Image courtesy of Huawei Technologies

……………………………………………………………………………………………………………………………………………………………………………………………………..

This cross-sector collaboration will enhance and upgrade the services of Siriraj Hospital to progress it to become a smart medical center using digital technologies based on 5G, AI, big data infrastructure, and cloud edge processing for the purpose of patient tracking, disease diagnosis by AI on cloud, data storage and analysis, and allocation of resources.

Since the beginning of the pandemic, Siriraj Hospital and Huawei have established long-term cooperation in 5G technology development and application. In June 2020, Siriraj Hospital cooperated with Huawei Thailand to launch 5G self-driving vehicles for contactless delivery of medical supplies.

Siriraj Hospital and Huawei signed a five-year MoU in December 2020 to accelerate the use of 5G and cloud technologies. In June, 5G unmanned vehicles were introduced for contactless medical supplies delivery. Last year, Siriraj received the CommunicAsia “Most Innovative 5G Trial in Asia Pacific Region” award.

References:

https://www.huawei.com/us/news/2021/12/smart-hospital-thailand-5g-siriraj

https://www.itnews.asia/news/thailand-launches-first-5g-smart-hospital-in-asean-574247#

Thailand partners with Huawei to launch ASEAN’s first 5G smart hospital

Huawei Execs: ICT Industry Initiatives for 5G and Green 5G Networks for a Low-Carbon Future

Huawei’s rotating chairman Ken Hu kicked off the 12th annual Global Mobile Broadband Forum (MBBF) in Dubai with a call for the ICT industry to work together on the next stage of 5G development. He outlined the specific areas where the industry needs to improve. The MBBF is hosted by Huawei, together with its industry partners in the GSMA and the SAMENA Telecommunications Council. This forum gathers mobile network operators, vertical industry leaders, and ecosystem partners from around the world to discuss how to maximize the potential of 5G and push the mobile industry forward..

Speaking on the current state of 5G development and new opportunities moving forward, Hu noted, “In just five years of commercial deployment, 5G has provided a considerable upgrade in mobile experience for consumers, and it’s already starting to empower different industries around the globe. Progress was much faster than we expected, especially in terms of the subscriber base, network coverage, and the sheer number of 5G terminals on the market.”

On the device side, he said lowering barriers to headset adoption is critical to reaching a tipping point in virtual reality, one of the key technologies in the Extended Reality repertoire of AR, VR, and MR. “To reach [this tipping point], we have to make improvements to both headsets and content. For headsets, people want devices that are smaller, lighter, and more affordable.” To enrich the content ecosystem, Hu called on the industry to provide cloud platforms and tools that simplify content development, which is notoriously difficult and expensive.

Telecom operators need to enhance their networks and develop new capabilities to get ready for 5GtoB [THAT WILL REQUIRE A UNIFIED 5G SA CORE NETWORK). A strong end-to-end network is key to 5G applications for industrial use, so operators need to keep making improvements to network capabilities such as uplink, positioning, and sensing. As industrial scenarios are much more complex than consumer scenarios, O&M can be a real challenge. In response, Huawei is developing autonomous networks that bring intelligence to all aspects of 5G networks, from planning and construction to maintenance and optimization.

Digital transformation also requires different roles. In addition to providing connectivity, operators can also serve as cloud service providers, systems integrators, and more, and develop the requisite capabilities. To drive broader adoption of 5G in industries, developing industry-specific telecoms standards is also important. In China, operators, together with their industry partners, have begun working on standards for applying 5G in industries like coal mining, steel, and electric power, and this has helped to fuel greater adoption within these sectors.

“Beyond technology,” said Hu, “these are some of the intangible strengths that won’t provide immediate profit, but will be key to long-term competitiveness in the 5GtoB market.”

The ICT industry needs to get ready to go green. According to the World Economic Forum, by 2030, digital technology can help reduce global carbon emissions by at least 15%. “On one hand,” said Hu, “we have a great opportunity to help all industries cut emissions and improve power efficiency with digital technology. On the other hand, we have to recognize that our industry has a growing carbon footprint, and we have to take steps to improve that. Right now Huawei is using new materials and algorithms to lower the power consumption of our products, and we’re remodeling sites, and optimizing power management in our data centers for greater efficiency.”

“We have seen so many changes in the past two years – with the pandemic, technology, business and the economy. Moving forward, as the world begins to recover, we need to recognize the opportunities in front of us and get ready for them. Get our technology ready, get our businesses ready, and get our capabilities ready,” Hu concluded.

Also at the MBBF, Ryan Ding, Huawei’s Executive Director and President of the Carrier Business Group, gave a keynote speech entitled “Green 5G Networks for a Low-Carbon Future.” In his speech, Ding said that 5G has become a new engine for the growth of the mobile industry, and that to adapt to the rapid growth of data traffic, the whole industry will need to keep pursuing innovations in power supply, distribution, use, and management, and build greener 5G networks with higher performance and lower energy consumption.

According to Ding, in countries where 5G is developing faster, operators who have invested heavily in 5G have seen remarkable returns, but he stressed that operators will realize business value only when the 5G user penetration rate is high enough. When the 5G user penetration rate reaches a threshold of 20%, Ding said, rapid development of 5G will follow. In countries such as China, South Korea, and Kuwait, operators were quick to provide continuous nationwide coverage, giving users a consistent experience. They also offer flexible service packages, which delivers a win-win result for both users and themselves. In addition, these operators are providing a gigabit experience—a tangible improvement over 4G—to accelerate user migration and network evolution. In these countries, the 5G user penetration rate has exceeded the 20% threshold, triggering a positive cycle of user growth, business returns, and network construction.

High-quality 5G networks will drive the rapid growth of mobile data traffic. It is estimated that the average data traffic per user per month will reach 600 GB by 2030. If the energy efficiency of existing networks remains unchanged, the energy consumption of wireless networks will increase by more than tenfold. Ding said that to cut the ICT industry’s greenhouse gas emissions by 45%, operators will need to pursue ongoing innovations in power supply, distribution, use, and management to build greener 5G networks with higher performance and lower energy consumption.

Ding said Huawei has already deployed low-carbon site solutions in more than 100 countries, including Saudi Arabia, Greece, Pakistan, and Switzerland, helping operators reduce carbon dioxide emissions by 40 million tons. As a player in the communications industry, Huawei will continue to put green development at the center of everything it does and develop innovative solutions to build greener 5G networks with operators worldwide.

References:

https://www.huawei.com/en/news/2021/10/mbbf2021-huawei-ken-hu

https://www.huawei.com/en/news/2021/10/mbbf2021-huawei-ryan-ding-green-5g

FT: Huawei tries to re-invent Itself: Pivot from smart phones/telecom gear to cloud services, 6G, EV’s and HiSilicon

Condensed and edited Financial Times article by Kathrin Hille in Taipei, Eleanor Olcott in London and James Kynge in Hong Kong

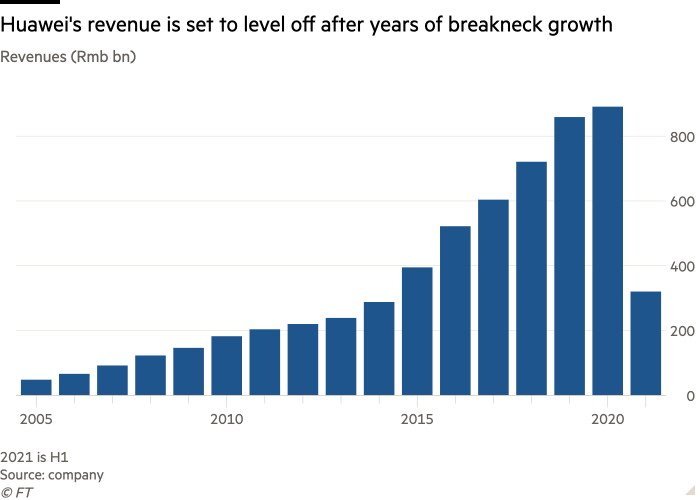

In the first half of this year, revenues at Huawei fell by almost 30 per cent compared with the same period last year, the largest ever drop. As U.S. restrictions have begun to derail Huawei’s traditional business, the group is now in a scramble to try to reinvent itself. The company is turning away from the development and sale of telecommunications network gear and smartphones into areas less dependent on foreign chip supplies — such as cloud services and software for smart cars. Huawei is also doubling down on its own research and development in an effort to escape the stranglehold of American sanctions. It is investing heavily to be a leader in the emerging 6G technology so that other companies are dependent on its patents — rather than Huawei relying on technology imports from the US. “In the current climate, the best way to describe the atmosphere within Huawei and the way we go about things, is like a huge collection of start-ups,” says Henk Koopmans, the company’s head of research and development in the UK.

At stake is not just the fate of one of China’s most prominent and successful companies, but the broader technological competition between Beijing and Washington. Chinese officials are clear that Huawei has been a vital part of the country’s network of innovation.

“Many have viewed Huawei as the only possibility for China to make a breakthrough in semiconductors and telecoms,” says a local government official in Shenzhen, the technology industry hub in southern China that is Huawei’s home. “So Huawei must survive. It is a national mission.”

The company’s smartphone sales dropped by more than 47 per cent in the first half of this year compared with the same period last year. Last week, rotating chairman Eric Xu predicted that in the full year, the company will lose up to $40bn of its $50bn smartphone business, a slide that analysts estimate will drive the share of the consumer business in Huawei’s total revenues from 42 per cent earlier this year to just over 30 per cent. “Huawei’s component bottlenecks are now starting to bite,” says Ben Stanton, a smartphone analyst at market research group Canalys. “Stockpiles are running low, and its volume will almost certainly continue to fall each quarter.” Noting that Huawei’s smartphone arm has retreated to its Chinese home market, he adds that its strength in previous overseas strongholds such as Europe “has completely evaporated.”

In the network equipment business, the decline is happening more slowly, partly because product cycles are longer. Although Huawei can no longer procure custom application-specific chips for its telecom products, it was assuring analysts that it had enough inventory to keep the infrastructure business running in the near term. In response to these losses, the first big push has been to strengthen Huawei’s software capabilities so that it is less dependent on producing hardware that it will struggle more and more to deliver without access to chip supplies.

The main software-driven business Huawei is rushing to build is cloud services. Some of the functions in a telecoms network traditionally performed by base stations can be transferred to software processes in the cloud with newer technology. Moreover, Huawei is rapidly developing new cloud services, which it offers to companies and government departments. Last week, the company announced plans to invest $100m in the next three years for small and medium-sized businesses to develop on Huawei Cloud. The company’s cloud business grew by 116% in the first quarter of this year to take a 20% share of the Chinese market (second only to Alibaba Cloud).

According to Canalys, Huawei’s cloud business grew by 116 per cent in the first quarter of this year to take a 20 per cent share of a $6bn market in China, behind Alibaba Cloud but ahead of Tencent. “Huawei Cloud’s results have been boosted by internet customers and government projects, as well as key wins in the automotive sector. It is a growing part of Huawei’s overall business,” says Matthew Ball, chief analyst at Canalys. He says that while about 90 per cent of this business is in China, Huawei Cloud has a stronger presence in Latin America and Europe, Middle East and Africa compared with Alibaba Cloud and Tencent Cloud. There are limits on Huawei’s cloud business, however.

In July, Chinese media reported that the company was considering selling a part of its server business that runs on x86 central processing units after Intel’s export license for providing Huawei with that component expired. Servers are indispensable for cloud companies because they are where the hardware data is stored and much of the computing needed for cloud services is performed. Huawei and Intel both declined to comment, but industry experts say processor supplies are a headache for Huawei.

“Selling the server business is highly likely,” says Ben Sheen, semiconductor research director for network and communication infrastructure at research firm IDC. “The CPU is a central component, and if Intel cannot ship, Huawei is in big trouble.” As in the network gear business, providers of cloud services such as Amazon Web Services or Google try to boost performance by improving their software. If Huawei can achieve the same, it will be in less urgent need to get new processor supplies. “In smartphones, your revenue share goes down very quickly if you don’t have the latest chips. In cloud, you can keep running a decent business for much longer, and maybe even expand your revenue if you invest in software differentiation,” says Jue Wang, an associate partner in the technology practice of Bain, a consulting company.

Although companies such as Intel and AMD release new CPUs every year, the majority of cloud service providers’ servers run on processors two to five years old. The cloud companies increasingly generate new revenues by investing in new AI services and tools — even if their servers run on older chips. “But eventually you will need new ones — you cannot offer cloud services without CPUs,” Wang says.

One of the fields where Huawei finds it relatively easy to pick up new business is helping to digitize industries that have been laggards in the adoption of information technology. It is offering telecom, IT and software tools to Chinese companies in sectors such as coal mining and port operations, enabling them to lower costs and enhance security. Driven by these operations, Huawei’s enterprise business revenues grew by 23 per cent last year and 18 per cent in the first half of this year.

“The enterprise business will likely continue to be a growth point for Huawei,” says Ethan Qi, an analyst at Counterpoint Research, who forecasts revenues in that segment to increase by up to 15 per cent a year in the next few years. Still, Huawei frets that this is not enough to offset the death blow the US sanctions are dealing to the smartphone business. The new industry verticals “may not even be able to compensate for those lost revenues in 10 years,” Huawei rotating Chairman Xu told reporters last week.

Huawei is making some striking bets on new areas. One of the biggest is in electric and autonomous vehicles (EV’s). Huawei made its first R&D foray into vehicles in 2014, but now the company is drastically cranking up commitment, with plans to form a 5,000-strong R&D team and investment of $1bn in the segment this year. The company says it will not build cars itself, but its engineers are clearly looking into everything short of that. “Initially, we just thought we would help the car connect, but after a while we realized that we can also help make it more intelligent,” says a Huawei official.

A vehicle released by Chinese automaker Beiqi at the Shanghai Auto Show this year featured an entire in-car electronics solution developed by Huawei. For this shift, the company is harnessing strengths built over years in its telecoms hardware business — executives say experience in designing base stations that can withstand extreme weather conditions comes in handy because temperature controls are a key requirement in electric vehicles. “They have refocused their teams in the research centers they run in Europe: In the past, those were 3G and 4G-facing, and now they are focused on [advanced driver-assistance systems],” says Jean-Christophe Eloy, chief executive and president of Yole, a French technology research and consultancy firm.

A large portion of the chips required in automotive electronics are manufactured with more mature processing technology, which does not need to be imported. “Much of that technology is available in China,” Eloy says. “Focusing on automotive therefore can also help them get away from their chip supply problem.”

But Huawei has its sights set far beyond keeping the business running in the near term: If anything, its ambition to be a tech pioneer has grown even stronger. Ren Zhengfei, founder and chief executive and Meng’s father, is letting some of Huawei’s researchers off the leash to focus on basic science and explore technology breakthroughs even without a clear understanding of its potential business applications.

“We will not demand you to put down your quill and join the troops,” Ren told R&D staff at a meeting in August. He added that the research team at HiSilicon, Huawei’s chip design unit, would be kept even though the US sanctions have robbed the Shenzhen-based operation of the chance to manufacture its advanced chips. “We allow HiSilicon to continue to scale the Himalayas,” Ren said. “The majority of us others will stay down here to grow potatoes, herd livestock and keep sending provisions to the climbers, because you can’t grow rice on Mount Everest,” Ren added.

Last year, Huawei invested Rmb141.9bn ($22bn) in R&D, almost 16 per cent of its revenue. The driver behind this focus on high-end research is the urge to become less dependent on foreign technology — while also laying the groundwork for growing intellectual property royalties.

In 5G, Huawei is one of the most significant owners of patents, forcing rival network gear makers such as Ericsson or Nokia to make certain payments to Huawei even if the Chinese company is excluded from 5G contracts in many western countries. Exhorting research staff to seek global technology leadership at the August meeting, Ren said: “We research 6G as a precaution, to seize the patent front, to make sure that when 6G one day really comes into use, we will not depend on others.” Elaborating on the potential uses of 6G for the first time, Ren said the technology might, beyond telecom’s traditional realm of connectivity, be used for sensing and detection — functions with potential for use from healthcare to surveillance. That expectation has grown out of the results of the “collection of start-ups” approach touted by Huawei’s UK research director Henk Koopmans. Ren’s encouragement for Huawei to pursue basic science is instilling what he hopes will be a start-up mentality in many of the company’s own R&D staff.

In addition, it is also tapping into a growing number of start-ups in which it invested in recent years. Engineers at the Centre for Integrated Photonics, a start-up based in Ipswich, eastern England, which Huawei acquired in 2012, recently developed a laser on a chip that can direct light into a fiber-optic cable — an alternative to established telecoms technology that sends pulses of infrared light through the cable. The researchers built the chip themselves, using Indium Phosphide technology instead of mainstream silicon-based semiconductors where US-owned tool technology gives Washington a stranglehold and which Huawei is struggling to obtain.

A circuit board on display at Huawei’s HQ. Image Credit: Bloomberg

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Koopmans says one future use of the technology could be transferring data from sensors on the skin measuring blood oxygen content in remote healthcare services. “And all this photonics activity came from a really research background where we never knew if a product would ever see the light of day. But this is how we are doing things now — reutilize our R&D capabilities in a non-monolithic way.” Ren is not short on ambition for the group’s R&D operations, but acknowledges that they might not provide short-term results.

“Some theories and papers may not be put to use until one or two hundred years after they were first published,” he told R&D staff, reminding them that the significance of Gregor Mendel’s genetics discoveries was not understood until decades later. “Your paper may even have a fate like van Gogh’s paintings — nobody showed interest in them for more than 100 years, but now they are priceless. Van Gogh starved.”

Additional reporting by Nian Liu in Beijing and Qianer Liu in Shenzhen

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.ft.com/content/9e98a0db-8d0a-4f78-90d3-25bfebcf3ac9

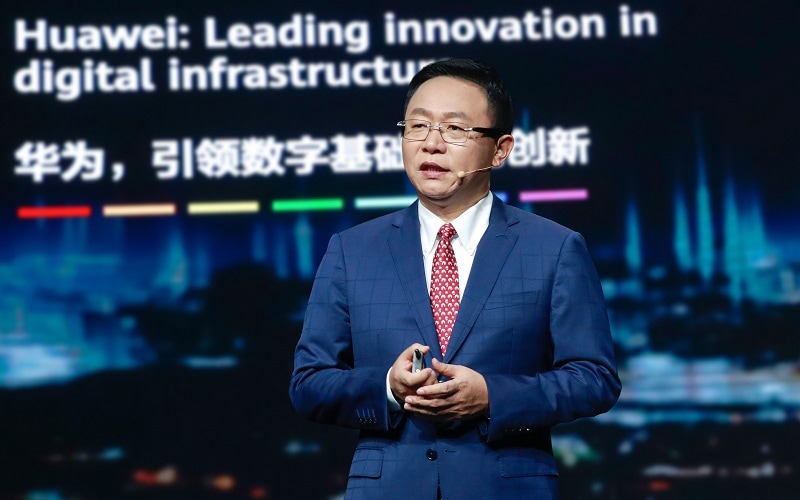

Huawei announces seven innovations in digital infrastructure for next decade

Huawei announces seven innovations in digital infrastructure for next decade

On Friday at HUAWEI CONNECT 2021, Huawei unveiled “breakthrough” innovations in several different domains, providing a first look at its comprehensive digital infrastructure range. Several of these innovations are completely new and have never been seen before outside of Huawei’s labs. The release highlighted how these products and solutions are set to shape digital infrastructure for the next decade. Huawei is one of the world’s leading creators of digital infrastructure, and is dedicated to building a fully connected, intelligent world.

During the event, Huawei Executive Director and President of ICT Products & Solutions David Wang delivered a keynote speech titled Leading Innovation in Digital Infrastructure. In the speech, he noted, “Infrastructure has been vital to every stage of human development. The intelligent world is fast approaching and digital infrastructure is the key to building this intelligent world. The world now faces unprecedented challenges and so Huawei will remain customer-centric and committed to innovation. We are dedicated to breakthroughs to serve major application scenarios such as digital offices, smart manufacturing, wide area network (WAN), and data centers, and accelerate the development of the global digital infrastructure.”

David Wang unveils seven innovations in digital infrastructure at HUAWEI CONNECT 2021

David Wang unveils seven innovations in digital infrastructure at HUAWEI CONNECT 2021

…………………………………………………………………………………………………………………………

Wang explained how digital infrastructure of the future would need to be hyper secure, reliable, and deterministic, and need more efficient data circulation and computing power as the world dives into digital. This speech started with the ideas Wang introduced two days ago at the release event for Huawei’s Intelligent World 2030 report. The report itself finds that, by 2030, global connections will top 200 billion; monthly data per cellular user will grow 40 times to 600 gigabytes; worldwide general computing volume will grow 10 times over; and data generated will increase by 23 times, reaching one yottabyte for the first time. All of this creates a picture of new challenges and opportunities for the digital infrastructure sector over the next 10 years.

The main focus of his speech were seven specific innovations Huawei has launched or is about to launch onto the market.

1. Digital meeting rooms: Powered by intelligent “Office Twins” and bridging the world with ubiquitous gigabit and seamless collaboration

The newest “Office Twins” from Huawei are the AirEngine 6761 and IdeaHub. AirEngine 6761 are the industry’s highest-performance Wi-Fi 6E product that delivers an experience-centric, all-wireless network for businesses, with instant and secure user access, interaction latency down to 10 milliseconds, and ultra-fast file transfer at 1,000 Mbps. As part of the next generation of smart office tools, the 6-in-1 design of IdeaHub allows it to function as a projector, whiteboard, computer, conference endpoint, speaker, and microphone, enabling “frictionless collaboration” across different locations.

2. Huawei OptiXsense: Accelerating pipeline inspection

The Huawei OptiXsense EF3000 is the company’s first product under the OpiXsense family, and is currently the most accurate optical sensor of the industry. Coming packed with Huawei’s leading optical technologies, the OptiXsense uses a unique optical digital signal processor (oDSP) and a new vibration ripple analysis engine for automatic incident identification. The OptiXsense achieves 97% accuracy, compared with the industry average of 60%–80%. It is designed to streamline oil and gas pipeline inspections, and will ultimately enable intelligent, unmanned pipeline inspections. Going forward, OptiXsense products will also support other domains, monitoring temperature, stress, and water quality.

3. The industry’s first deterministic IP network solution: Making lights-out digital factories a reality

Industrial control systems demand extremely low levels of network latency and jitter. Conventional IP networks cannot deliver these standards, but today Huawei unveiled the industry’s first deterministic IP network solution, providing end-to-end guaranteed network performance to support industrial controls. This solution uses CloudEngine S6730-H-V2 switches and NetEngine 8000 M8 routers. Huawei’s innovations in IP system engineering and algorithms deliver microsecond-level single-hop latency and keep jitter within 30 microseconds from end to end, regardless of the number of hops. The solution supports multi-hop networking of tens of thousands of nodes, so it can deliver deterministic IP network performance for a workshop, a factory, or even multiple factories. It can even support centralized remote control of production lines located thousands of kilometers away.

4. H-OTN: Leading a revolution in secure production networks

H-OTN, the industry’s first converged optical device that supports hard pipe technologies, introduces an innovative Point-to-Multipoint (P2MP) OTN architecture for access networks. For the first time, Huawei enables an end-to-end hard pipe, from the access network to WAN, using a redefined product architecture and converged protocols. This not only guarantees 100% security, but also reduces latency by at least 60%. Huawei H-OTN will provide highly reliable communications networks, with ultra-low latency and simplified O&M, to support digital transformation across industries such as electric power and transportation.

5. An industry-leading IP network solution: Enabling cross-region computing resource scheduling

Huawei’s newest IP network solution delivers industry-leading performance to help customers build vast, unified networks for cross-region computing. This solution combines Huawei’s CloudEngine 16800 data center switches and NetEngine 8000 F8 WAN routers. Thanks to intelligent & lossless algorithm 2.0 and intelligent cloud graph algorithm, this Huawei solution is able to construct ultra-large data center networks connecting up to 270,000 servers, three times larger than the industry average. It guarantees 0 packet loss on Ethernet and lowers latency by 25%. This solution also features intelligent routing by cloud service type and cloud-network resource factor, improving transmission efficiency by 30%.

6. OceanStor Pacific: Ushering in an era of High Performance Data Analytics (HPDA)

OceanStor Pacific is the industry’s first distributed storage for HPDA, representing huge breakthroughs in technical architecture, including data flows adaptive to large and small I/O, converged indexing for unstructured data, ultra-high-density hardware, and EC algorithms. With this solution, a single storage unit can make data analytics 30% more efficient by supporting hybrid workloads across high-performance computing (HPC), big data analytics, and AI computing, breaking through the performance, protocol, and capacity barriers that typically limit HPDA. OceanStor Pacific has already been deployed in oilfields, and is set to accelerate the digital transformation of oil and gas exploration and create digital basins and oilfields.

7. Huawei CC Solution: Building the industry’s first public diversified computing service platform

Huawei’s CC Solution helps customers roll out public platforms that provide diversified computing power. It is designed with three scenarios in mind: AI computing centers, high performance computing centers, and integrated big data centers. The solution has four advantages over traditional solutions: diversified computing, rapid rollout, efficient utilization, and on-demand service. This solution is already in use in multiple projects, powering industry clusters with computing clusters and supporting the digital transformation of countless industries.

As Wang closed out the day’s events, he stressed that the future of digital infrastructure will need a thriving software ecosystem in addition to new and innovative hardware. He promised that Huawei continues its “dive into digital” and will continue working with partners, developers, and open source organizations from around the world to build a diverse software ecosystem that is shared and open.

Wang concluded by saying, “Each and every R&D employee at Huawei lives and breathes innovation. No matter what comes our way, innovation will remain constant. To sum up, our innovation in digital infrastructure centers on: breakthroughs in basic theories and algorithms; technology spillover; technical architecture; product architecture; industry pace; industry direction; and industry creation… Huawei will remain committed to innovation in digital infrastructure, create value for customers and partners on an ongoing basis, and work relentlessly to build a fully connected, intelligent world.”

Huawei hosts HUAWEI CONNECT 2021 online from September 23 to October 31. The theme of this year’s event is Dive into Digital. We’re going to dive deep into the practical application of technologies like cloud, AI, and 5G in all industries, and how they can make organizations of all shapes and sizes more efficient, more versatile, and ultimately more resilient as we move towards economic recovery.

References:

https://www.huawei.com/us/news/2021/9/huawei-connect-2021-david-wang-seven-innovations

HUAWEI CLOUD launches partner programs in LatAm and Caribbean

HUAWEI CLOUD [1.] announced today that it will launch partner programs in Latin America and the Caribbean, such as the Spark Program, which provides a fund of $10 million for startup innovation, and the Huawei Mobile Services (HMS) Ecosystem Program, which provides a fund of $10 million to enable app developers and partners to improve cloud experience.

Note 1. HUAWEI CLOUD provides a powerful computing platform and easy-to-use development platform to support Huawei’s full-stack, all-scenario AI strategy.

………………………………………………………………………………………………………………………………

From August 25 to September 3, HUAWEI CLOUD is celebrating its second anniversary in Latin America with a series of activities. HUAWEI CLOUD and its customers and partners will share experiences in digital transformation and intelligent upgrade.

The event includes a series of releases, covering distributed cloud, cloud native, big data, AI, and video service. The following cloud services are launched for the first time in Latin America: Intelligent EdgeCloud (IEC), Intelligent EdgeFabric (IEF), KYON (Keep Your Own Network), FunctionGraph 2.0, Multi-Cloud Container Platform (MCP), Application Service Mesh (ASM), Container Guard Service (CGS), GaussDB database, ModelArts Pro (AI development platform for enterprises), and Cloud-native Video Service. These powerful offerings help Latin American customers simplify connections, deployment, data analysis, AI adoption, and service rollout, facilitating their digital transformation.

Four Initiatives to Accelerate Digital Transformation and Intelligent Upgrade:

“Cloud is the core of the ICT industry and a key driving force for industry digitalization,” said Mr. Zhang Ping‘an, Senior Vice President of Huawei, CEO of Huawei Cloud BU, and President of Huawei Consumer Cloud Service. “HUAWEI CLOUD values the strategy of building a global presence within local reach. Latin America is one of the most important emerging markets for cloud computing. HUAWEI CLOUD has been investing heavily in this market and has achieved rapid growth,” Mr. Zhang Ping‘an continued. “Going forward, we will strengthen our support for the digital transformation and intelligent upgrade of our customers in Latin America through four initiatives: continuous tech innovation, joint outreach by HUAWEI CLOUD & Huawei Mobile Services, Global + Local services, and high-quality business ecosystems. We invite more partners to join. Together, we will build a robust digital ecosystem around the world and lay the cloud foundation for an intelligent world.”

Continuous tech innovation: Drawing on Huawei’s rock-solid foundation built by 80,000 R&D engineers and an annual investment of 15 billion US dollars into R&D, HUAWEI CLOUD continues to innovate in cloud native, AI, and big data, delivering global cloud services with compelling elasticity, performance, and consistency.

Joint outreach by HUAWEI CLOUD & Huawei Mobile Services (HMS): This cloud-cloud synergy initiative enables deep collaboration between HUAWEI CLOUD and Huawei Consumer Cloud for media, audio-visual, finance, industrial interconnection, and medical education. The synergy aims to deliver consistent technologies and experience for developers and partners via unified accounts, development platforms, and application distribution and operation.

Global + Local services: HUAWEI CLOUD has built 45 availability zones (AZs) in 23 regions around the world. Over the past year, HUAWEI CLOUD has continuously invested in Latin America, bringing the second region online in Mexico and adding two new AZs in Brazil and Chile. As of today, HUAWEI CLOUD operates three core regions in Chile, Brazil, and Mexico, and two country-level regions in Argentina and Peru, with eight AZs in total. HUAWEI CLOUD has the largest number of nodes in Latin America and the Caribbean. The unrelenting resource investment helps provide customers with stable, efficient, and low-latency cloud service experience.

High-quality business ecosystem: HUAWEI CLOUD has more than 20,000 partners, including consulting, SaaS, and software partners. In the process of global deployment, HUAWEI CLOUD has focused on building a multi-dimensional global ecosystem and complementing the advantages of different regions to create maximum value for customers. In the future, HUAWEI CLOUD will engage with more partners in Latin America and bring the experience in other regions of the world to create shared success for all.

Continuous Investment in Latin America and Increased Support for Partners

“We position our company not only as a provider of leading cloud infrastructure and services, but also a long-term business partner in Latin America, as well as a responsible corporate citizen,” said Fernando Liu, President of Latin America Cloud Business Dept, Huawei. “As a cloud service provider with the largest number of nodes and the fastest growth in Latin America, HUAWEI CLOUD will continue to invest more in Latin America with more local nodes, new solutions, and partner support. We are dedicated to bringing the latest technology to Latin America.”

Fernando Liu also stressed HUAWEI CLOUD’s belief in a co-created ecosystem of shared success, as HUAWEI CLOUD works with partners to take digital transformation and intelligent upgrade to new heights in Latin America. At the two-year anniversary, HUAWEI CLOUD is launching a series of support initiatives for HMS partners, SaaS partners, and start-ups.

- Spark Program: A fund of USD10 million to encourage and support innovation by start-ups in Latin America.

- HMS Ecosystem Program: A fund of USD10 million to enable developers and partners to launch applications on Huawei AppGallery. The program also helps them better experience device-cloud synergy based on the HUAWEI CLOUD platform.

- Service Partner Program: Provides additional incentives for consulting partners who pass the Service Capability Certification (SCC).

- SaaS Partner Program and Marketplace Program: Focused technical and commercial policies to support technical partners and help them develop solutions based on HUAWEI CLOUD. The Marketplace Program supports the partners throughout the sales cycle, helping them achieve greater business success.

Since 2019, HUAWEI CLOUD has worked with more than 1000 consulting partners and 200 technical partners in Latin America, covering 14 Latin American countries, propelling Latin America towards digital transformation and intelligent upgrade in logistics, manufacturing, transportation, retail, education, and telecommunications.

References:

Huawei investment subsidiary buys 40 companies in 3 years to reconstruct semiconductor supply chain

According to financial magazine Caijing (Chinese), Huawei has been building an independent and controllable silicon industrial capability in the last two years as it attempts to rebuild its supply chain. Investments cover virtually every part of the semiconductor industry, including IC design, electronic design automation (EDA) software, packaging and testing, and materials.

On June 23rd, Tianyancha, an enterprise information query platform, revealed that Shenzhen Hubble Investment Partnership (Limited Partnership), a subsidiary of Huawei Technologies Co., Ltd [1.], became a shareholder of Qiangyi Semiconductor (Suzhou) Co., Ltd. The registered capital of the latter increased from 65.943 million yuan to 73.165 million yuan. This is the first company in mainland China that has the ability to independently design vertical probe cards and has achieved mass production of MEMS probe cards.

The probe card is the core component of the chip test link, accounting for 70% of the total cost of the entire test fixture. As a test interface, the probe card will test the bare chip and screen out defective products. For a long time, the semiconductor test probe market has been monopolized by foreign manufacturers.

Note 1. Shenzhen Hubble Investment Partnership (Limited Partnership), which was established in April this year and is an investment institution controlled by Huawei Investment Holdings Co., Ltd., which is the same as Hubble Technology Investment Co., Ltd., which was established in April 2019.

…………………………………………………………………………………………………………………………………………………………………………………

Hubble Technology Investment Co., Ltd., which has been established for three years, has made faster and more detailed investments. In May, it invested in Shenzhen Yunyinggu Technology. On June 23 and 24, it successively invested in Qiangyi Semiconductor and Chongqing Xinjing Special Glass. There are 37 companies in its investment portfolio, of which 34 are related to semiconductors, involving chip design, EDA, testing, packaging, materials and equipment All links.

Before the establishment of Hubble Investment in 2019, Huawei had always followed the long-term principle of not investing in any company. Hubble’s mission is closely linked to the production of Huawei chips via wholly-owned subsidiary HiSilicon. Huawei CEO Ren Zhengfei had insisted the company would not invest in or partner with suppliers in order to ensure it was free to choose the best technologies.

In 2019, after Huawei was sanctioned by the U.S. government, the chips designed by HiSilicon could not find a foundry company (e.g. TMSC, Samsung, etc) that would make those chips for them. Those U.S. sanctions have changed Ren’s stance on investments/acquisitions. So Hubble Investment’s mission was directed at Huawei’s survival needs.

According to market research firm Strategy Analytics report, in the first quarter of 2021, the global smartphone processor market grew by 21% year-on-year, and Huawei HiSilicon’s smartphone processor shipments dropped by 88% compared to the same period last year. The sharp decline in data also indicates the urgency of self-help to make HiSilicon designed chips.

As tech blogger Kevin Xu pointed out: “Habo is a way to find and invest in the best companies in China who can be suppliers and partners, and groom them to be world class quality. That’s why Huawei gives them its business — there’s no better training than serving a real (and big) customer.”

Huawei’s executive director and CEO of consumer business, Yu Chengdong, once admitted that it was a mistake to only choose the field of chip research and development and ignore the asset-heavy chip manufacturing field.

The investment focus has shifted several times as it has built out its prospective supply chain partners, Caijing says. In late 2019 and the first half of 2020, its targets were materials and opto-electronic chip firms. In the latter part of 2020 and early 2021, it shifted to EDA software. In recent months it has targeted advanced equipment. In early June it invested 82 million yuan (US$12.7 million) in Beijing RSLaser Opto-Electronics Technology Co, specialist in light source systems for lithography machines.

Caijing confirmed with many people familiar with the matter that Huawei will build its first wafer fab in Wuhan. It will need a series of related materials, equipment, software, etc., which cannot be researched by Huawei alone. This means that Hubble’s investment in the semiconductor industry chain in the past three years will play an important role, and this will also be a crucial step for Huawei to achieve self-help in the supply chain.

Most of the companies invested by Hubble are in the early stages, and their scale is still far from the leading companies in the industry. Huawei tends to grow together with a company. Therefore, even some technologies that have not yet been commercialized in large quantities will receive investment from Huawei. This is for the controllable layout of Huawei’s industrial chain.

Although the information released to the outside world is extremely limited, many sources indicate that Hubble is closely connected with Huawei’s overall strategic plan. Bai Yi, the chairman and general manager of Hubble Investment, is also the president of Huawei’s Global Financial Risk Control Center and formerly vice president of Huawei’s strategy department.

A Huawei employee revealed to a reporter from Caijing that Hubble’s personnel are simple, “only a few dozen people”, but some of them also belong to Huawei’s strategic department in terms of administrative planning. For a long time before this, the decision-making power of Hubble’s foreign investment was not in the hands of the investment company itself, but was determined by the business department related to the invested company.

A semiconductor investor told a reporter from Caijing that sometimes they will look at projects with Hubble Investment. In many projects, Huawei’s procurement VP will directly participate in investment negotiations. At the same time, some of the invested companies are also Huawei’s upstream suppliers. . Some companies have business cooperation with Huawei, but Hubble has only deepened business cooperation.

The most obvious manifestation of the in-depth business cooperation is the order. In addition to investment, Huawei will also support the invested companies in order.

Take analog chip manufacturer Si Ruipu as an example. In the prospectus disclosed, customer A is the number one customer of Si Ruipu, which accounts for 57.13% of the operating income of the company. According to some related information, it is speculated that this customer A is Huawei. According to the prospectus, Si Ruipu established a cooperative relationship with Huawei in 2016 and obtained the certification of Huawei as a qualified supplier in 2017. In 2019, Hubble Investment, a subsidiary of Huawei, through private placement, became a shareholder of Seripul, and furthered the cooperation, and Huawei became the number one customer of Siripul.

Another example is Can Qin Technology. In 2019, Can Qin Technology became Huawei’s strategic core supplier and the largest supplier of Huawei’s 5G base station filters. Its orders from Huawei accounted for 91.34% of its operating income. In 2020, Hubble Investment will invest in Canqin Technology through equity transfer, with a shareholding ratio of 4.58%.

For small and medium-sized start-ups, the most worrying thing before is that no manufacturers are willing to use the product. Obtaining Huawei’s orders means stable sales revenue and strong ecological support, and it also gives these companies the opportunity for iterative trial and error. Many semiconductor companies in the United States have gradually developed by relying on powerful semiconductor manufacturers.

As previously noted, Huawei was not receptive to domestic suppliers in the early days. In addition to its strong style, Huawei did not give many domestic companies opportunities in the early years of the company. Their suppliers will still be the world’s first-class manufacturers. Today, the situation is quite different, but it gives tech companies in mainland China a rare opportunity.

In addition to orders, if some companies say that products or technologies may not be developed until next year, Huawei will also say that as long as the company can produce products in the future, Huawei promises to use it. This is a strong driving force for China’s independent semiconductor industry chain.

Once Huawei’s wafer fab is completed, its IDM model will go through, and a closed loop of the ecological industry chain will be realized. Now, Huawei is hiring talents in chip manufacturing and equipment. At the same time, Huawei is also paying attention to some domestic material companies, such as photoresist, silicon wafer, gas and other companies, which will serve for the construction of fabs in 2 to 3 years.

Becoming a supplier of Huawei is not an easy task. Huawei has very high requirements on suppliers. Accepting Huawei’s orders is a very energy-consuming task. At the same time, invested companies may also face the choice of giving up other customers. If there is a problem with Huawei, a major customer, the company’s operations will also be strained.

Today, Huawei is planning to build its own wafer fab and adopt the IDM model. If completed, Huawei’s semiconductor ecosystem will gradually form a closed loop. Huawei also hopes that the companies it invests in will be used for its production lines in the next 3 to 5 years.

References:

https://mp.weixin.qq.com/s/16JJ4h5JXckwoowvLe4gYw

Reports: Huawei wins 5G contracts with Vodafone-Italy and Malaysia

Reuters reports that Vodafone’s Italian division has secured conditional approval from Rome to use equipment made by China’s Huawei in its 5G radio access network, two sources close to the matter said.

Italy can block or impose tough conditions on deals involving non EU vendors under “golden powers,” which have been used three times since 2012 to block foreign interest in industries deemed to be of strategic importance.

The government of national unity led by Prime Minister Mario Draghi authorized the deal between Vodafone and Huawei on May 20, one of the two sources told Reuters, asking not to be named due to the sensitivity of the matter.

As in similar deals, the government imposed a set of prescriptions including restrictions on remote intervention by Huawei to fix technical glitches and an extremely high security threshold, the source added. Vodafone and Huawei declined to comment.

The United States has lobbied Italy and other European allies to avoid using Huawei equipment in their next generation telecoms networks and to closely scrutinize rival ZTE, saying the companies could pose a security risk. Huawei and ZTE strongly deny the allegations.

In the last 12 months, Italy has adopted a tougher stance on Huawei, while not banning it entirely from 5G infrastructure.

Under previous Prime Minister Giuseppe Conte, Rome prevented telecoms group Fastweb in October from signing a deal with Huawei to supply equipment for its 5G core network, where highly sensitive data is processed.

……………………………………………………………………………………………………………………………………..

In Malaysia a former deputy minister of international trade and industry, Kian Ming Ong, told Sydney Morning Herald it hadn’t seen any proof of vulnerabilities in Huawei’s network equipment. He said the government was likely to select Huawei as prime supplier to its national wholesale 5G network.

Huawei would be selected by a specially formed 5G government agency as the majority provider for Malaysia’s so-called single wholesale network. Fellow Chinese company ZTE and Scandinavian heavyweights Ericsson and Nokia are among seven other potential vendors who have been asked to bid for the deal.

In a Nikeii Asia op-ed Huawei’s Vincent Peng wrote:

Huawei is caught in a rivalry between two great powers. Although U.S.-China relations may not thaw any time soon, it seems clear that the current administration is taking a more multilateral approach to the world than its predecessor did.

This gives us hope that there may eventually be a change in how the U.S. government chooses to treat Huawei and other global technology companies headquartered outside of the United States.

To register for Huawei’s Finance Summit 2021:

https://e.huawei.com/topic/2021-event-fsi-summit/en-ap/index.html

…………………………………………………………………………………………………………………………………………..

References:

https://asia.nikkei.com/Opinion/Huawei-to-Joe-Biden-Let-s-talk

https://e.huawei.com/topic/2021-event-fsi-summit/en-ap/index.html

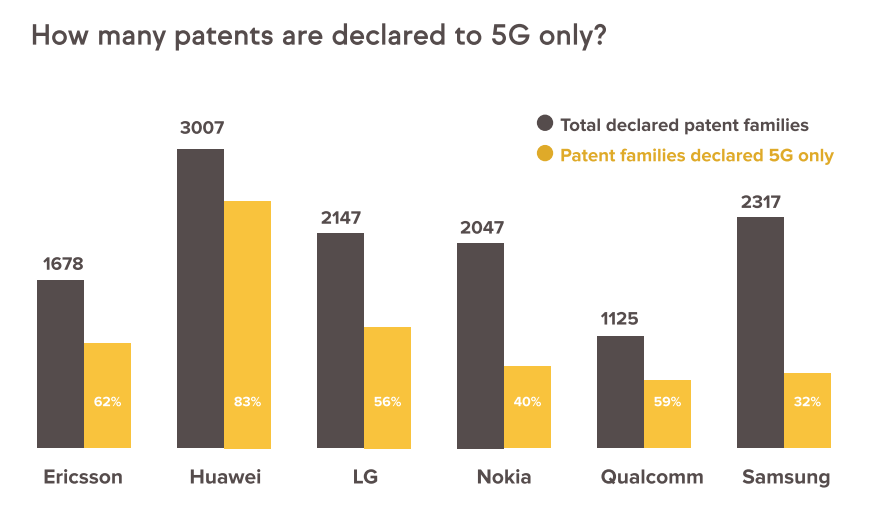

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

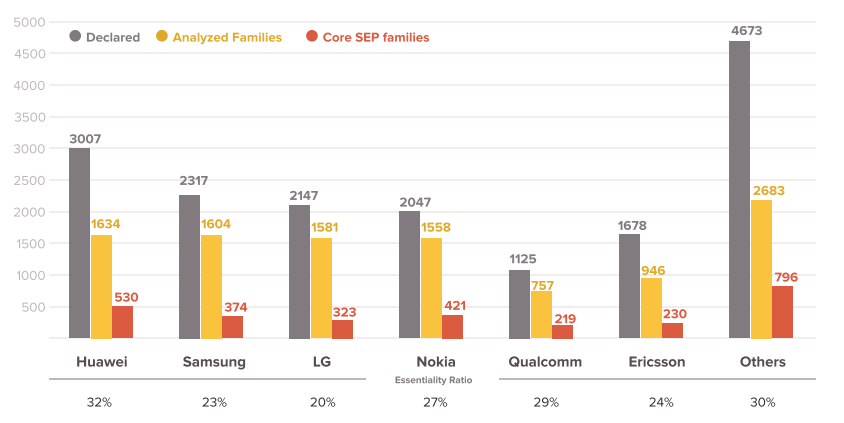

A new report, jointly released by IP consulting and analysis companies, Amplified and GreyB, disclosed that the top 6 companies (Huawei, Samsung, LG, Nokia, Ericsson, Qualcomm) account for 64.9% in 18,887 declared patent families. In granted 10,763 declared patent families, 2,893 families have been identified as core SEPs where top 6 companies account for 72.5%.

Huawei was first with 530 patent families and a ratio 18.3%. Nokia and Samsung were ranked No. 2 and No. 3 with 14.6% and 12.9%. respectively.

The report is an update of the previous report “Exploration of 5G Standards and Preliminary Findings on Essentiality” released on May 26, 2020.

………………………………………………………………………………………………………………………………

Separately, Samsung Electronics Co., Ltd. announced on March 10th that it has ranked first in 5G Standard Essential Patent (SEP)¹ shares according to a patent essentiality study conducted by IPlytics2, a Berlin-based market intelligence firm comprised of economists, scientists and engineers. The findings were published in IPlytics’ recent report: “Who is leading the 5G patent race? A patent landscape analysis on declared SEPs and standards contributions.”

Samsung also ranked second in two other categories: share of 5G granted3 and active patent4 families5, and share of 5G granted and active patent families with at least one of them granted by the EPO (European Patent Office) or USPTO (United States Patent and Trademark Office).

Last year, Samsung also led in 5G patents as a result of its research and development of 5G standards and technologies.

the top 10 companies own more than 80% of all granted 5G patent families, while the top 20 own more than 93% of all 5G granted patent families. These numbers confirm that there are only a few major large 5G patent owners, but looking at overall 5G declarations, the IPlytics Platform database identified more than 100 independent companies, which have declared ownership of at least one 5G patent.

The 5G patent family statistics presented in Table 1 are not based on verified SEP families. Neither ETSI nor the declaring companies have published independent assessments of the essentiality or validity of the declared 5G patents. Thus, the 5G patent families presented are only potentially essential. Many well-known SEP studies estimate that between 20% and 30% of all declared patents are essential. However, the essentiality rate differs across patent portfolios. To better understand the essentiality rate across portfolios, IPlytics created a data set of 1,000 5G-declared patent families (EPO/USPTO granted), which independent experts have mapped to 5G specifications. Here, the experts mapped the patents for six hours in a first check and then EPO/USPTO patent attorneys double-checked the mapping for a further three hours.

Table 1. Top 5G patent declaring companies (with >1% share)

| Current Assignee | 5G families | 5G granted and active families | 5G EPO/USPTO granted and active families | 5G EPO/USPTO granted and active families not declared to other generations |

| Huawei (CN) | 15.39% | 15.38% | 13.96% | 17.57% |

| Qualcomm (US) | 11.24% | 12.91% | 14.93% | 16.36% |

| ZTE (CN) | 9.81% | 5.64% | 3.44% | 2.54% |

| Samsung Electronics (KR) | 9.67% | 13.28% | 15.10% | 14.72% |

| Nokia (FN) | 9.01% | 13.23% | 15.29% | 11.85% |

| LG Electronics (KR) | 7.01% | 8.7% | 10.3% | 11.48% |

| Ericsson (SE) | 4.35% | 4.59% | 5.25% | 3.79% |

| Sharp (JP) | 3.65% | 4.62% | 4.66% | 5.50% |

| Oppo (CN) | 3.47% | 0.95% | 0.64% | 1% |

| CATT Datang Mobile (CN) | 3.44% | 0.85% | 0.46% | 0.68% |

| Apple (US) | 3.21% | 1.46% | 1.66% | 2.15% |

| NTT Docomo (JP) | 3.18% | 1.98% | 2.25% | 1.9% |

Source: IPlytics

………………………………………………………………………………………………………………………………..

Superscript Notes:

[1] “A patent that protects technology essential to a standard”, European Commission report – “Setting out the EU approach to Standard Essential Patents”, p1, November 2017.

[2] “IPlytics derived the “essential rate” by creating a random data set of 1,000 5G-declared patent families (EPO/USPTO granted) and mapping it to 5G specifications.” . Available : https://www.iam-media.com/who-leading-the-5g-patent-race-patent-landscape-analysis-declared-seps-and-standards-contributions

[3] “a patent that is granted by at least one of patent offices”, IPlytics report – “who is leading the 5G patent race”, p5, November 2019.

[4] “in active status, which means it has not lapsed, been revoked or expired”, IPlytics report – “who is leading the 5G patent race”, p3, November 2019.

[5] “a collection of patent applications covering the same or similar technical content”, . Available: https://www.epo.org/searching-for-patents/helpful-resources/first-time-here/patent-families.html

…………………………………………………………………………………………………………………………………………….

References:

https://www.amplified.ai/news/

https://www.greyb.com/5g-patents/

https://news.samsung.com/us/samsung-extends-leadership-5g-patents/

Huawei and China Mobile test 5G indoor Massive MIMO

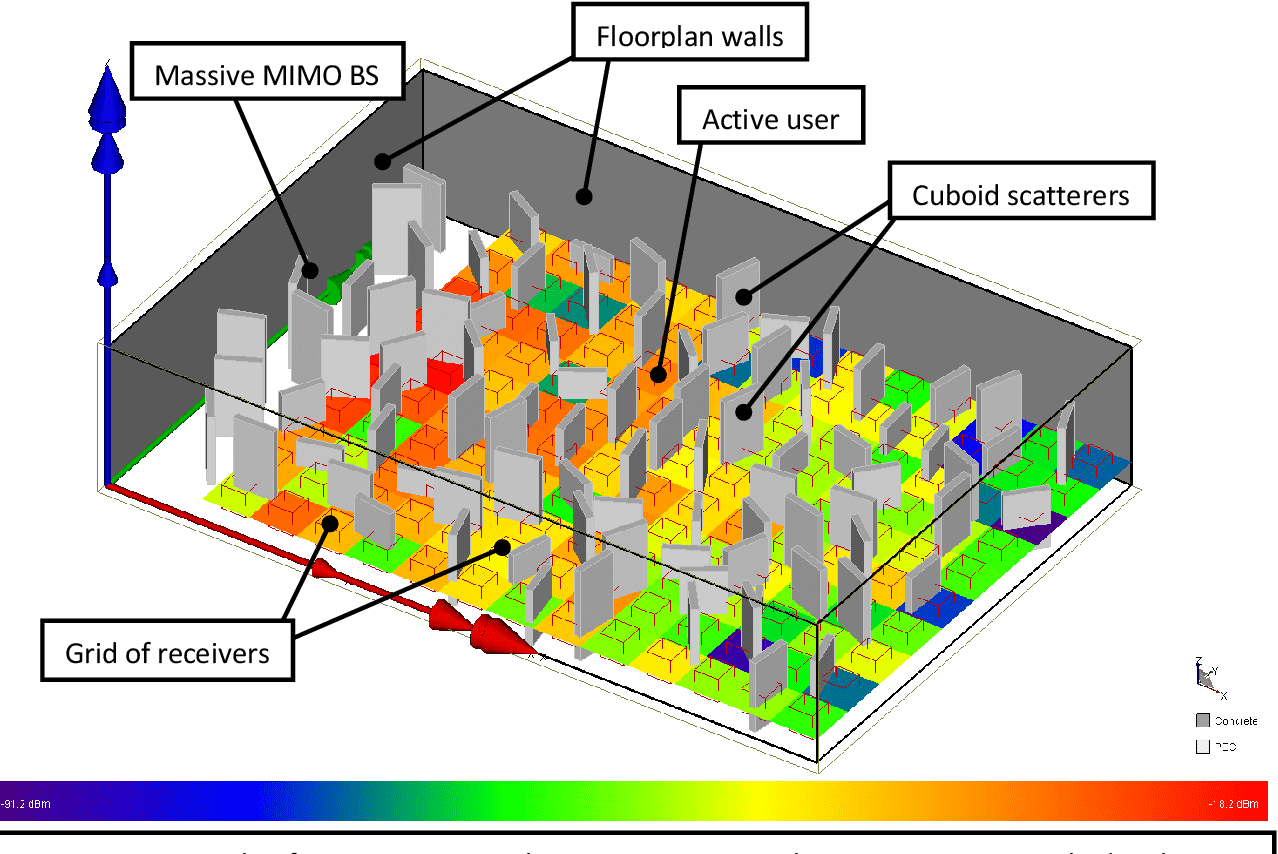

The pilot was conducted using LampSite, Huawei’s 5G digital indoor network product, based on the 2.6 GHz inter-frequency networking (80 MHz + 80 MHz). Distributed Massive MIMO was enabled in multiple 5G indoor cells to provide the large capacity needed to support 5GtoB (5G to Business) services and meet their high requirements for uplink experience. The peak uplink experience was quadrupled compared with traditional 4T4R cells.

Indoor distributed Massive MIMO introduces Massive MIMO for macro base stations to indoor networks. It is an innovative approach by Huawei to continuously increase the capacity of indoor 5G networks. The technology supports up to 64T64R channels and pools beamforming, MU-MIMO, and other technologies to ensure high capacity in the uplink and consistent user-perceived data speeds. Such a high level of performance makes it perfectly for smart production in which service terminals are frequently relocated for flexible production. Adding another competitive edge to empower 5G to transform industries.

The pilot is of great significance to indoor 5G, providing carriers with a new option to ensure premium uplink experience for emerging industrial services, such as video transfer and AGV operations, and expand 5G to factories, ports, power grids, airports, transportation, security, and many other industrial markets.

Huawei will continue to work with China Mobile Guangdong in innovating 5G to improve 5G performance, build competitive 5G networks, and lead the development of 5G to Business customers.

Huawei will continue to work with China Mobile Guangdong in innovating 5G to improve 5G performance, build competitive 5G networks, and lead the development of 5G to Business customers.