Year: 2020

Assessment: Nokia and Samsung tout new equipment for Open RAN and Virtual RAN

For years, Huawei, Ericsson, Nokia, Samsung and ZTE supplied most of the wireless network infrastructure equipment (base stations, small cells, core network, etc) for building cellular networks and mobile operators can only pick one for each part of their network. That may change with the movement of legacy telecom equipment companies like Nokia and Samsung announcing Open RAN products.

Nokia today became the first major telecom equipment maker to commit to adding open interfaces in its products that will allow mobile operators to build networks that are not tied to a vendor. It’s Open Radio Access Network (Open RAN), aims to reduce reliance on any one vendor by making every part of a wireless 3G/4G/5G base station modular and interoperable which permits network operators to choose different suppliers for different components. The company bolded stated in its press release:

“Nokia Open RAN (O-RAN) solutions will deliver world-class performance and security to the O-RAN ecosystem.”

As part of its implementation plan, Nokia plans to deploy Open RAN interfaces in its baseband and radio units, a spokesman said. An initial set of Open RAN functionalities will become available this year, while the full suite of interfaces is expected to be available in 2021, the company said.

Nokia, unlike other Ericsson, Huawei, and other base station vendors, has participated in the development of open RAN technology and have joined the O-RAN Alliance and TIP Open RAN project.

The Finnish telecom giant (which includes what’s left of Alcatel-Lucent) promised an initial set of O-RAN functionalities this year and a “full suite” of O-RAN-defined interfaces in 2021. Nokia’s press release, made no mention of external partners/customers.

“Several operators have now committed to Open RAN, due to the enhanced flexibility that O-RAN can bring. New operators are fully committing to Open RAN and alternative hardware vendors throughout their networks, and legacy operators are using O-RAN to create opportunities for innovative new products to fit into their complex networks. This overall trend strengthens the ecosystem and allows for specialty radios to address the infinite variety of real-world applications. Nokia is the only major vendor that has fully committed to actively developing the O-RAN interfaces, ensuring that its 5G RAN solutions will support the future open ecosystem the operators are seeking,” said Joe Madden, a principal analyst at Mobile Experts.

Tommi Uitto, President of Mobile Networks at Nokia, said: “Nokia is committed to leading the open mobile future by investing in Open RAN and Cloud RAN solutions with the aim of enabling a robust telecom ecosystem with strong network performance and security. Nokia’s Cloud RAN solution leads the market and is continuing to evolve to a cloud-native architecture. We have the scale and capabilities to address the increased customer demand for this technology, underpinned by the world-class network performance and security that only Nokia can deliver.”

………………………………………………………………………………………………………………………………………..

Samsung followed Nokia’s announcement today, announcing RAN products that are fully “virtualized” baseband and radio units. The South Korean conglomerate said in its press release that it’s fully-virtualized 5G Radio Access Network (vRAN) solution will be commercially available this quarter.

“The solution provides a new option for mobile operators seeking improved efficiencies, cost savings, and management benefits from deploying a software-based 5G radio infrastructure,” according to that press release.

Samsung’s 5G vRAN consists of a virtualized Central Unit (vCU), a virtualized Distributed Unit (vDU), and a wide range of radio units to enable a smooth migration to 5G. By replacing the dedicated baseband hardware used in a traditional RAN architecture with software elements on a general-purpose computing platform, mobile operators can scale 5G capacity and performance more easily, add new features quickly, and have flexibility to support multiple architectures. Samsung’s vRAN solution operates on x86-based COTS servers, either with or without hardware accelerators depending on factors such as total bandwidth. The company said:

“When combined with Samsung’s virtualized 4G/5G Core (network), the operator will be able to implement an end-to-end software-based radio and core network running on COTS x86 servers.”

Samsung already commercialized its virtualized Central Unit (vCU) in April 2019, which operates in live networks in Japan, South Korea, and the U.S. The new 5G vRAN solution has expanded to include a virtualized baseband or Distributed Unit (vDU).

“Samsung’s 5G vRAN validates a software-based alternative to vendor-specific hardware, while offering high performance, flexibility, and stability,” said Jaeho Jeon, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “Once the solution becomes commercially available this quarter, we look forward to providing carriers with additional architectural options for building innovative and open 5G networks.”

“Samsung is a big believer in open systems,” explained Alok Shah, Samsung’s VP of strategy, marketing and business development. “It’s what our customers are asking for.”

“Now, more than ever, mobile operators recognize the need for quality-driven, flexible, scalable, and cost-efficient network architectures while planning for 5G network success,” said Peter Jarich, Head of GSMA Intelligence. “RAN virtualization will be an important tool in helping to deliver on those demands and Samsung’s continuing vRAN innovation positions it well to deliver.”

Derek Johnston, Samsung’s head of marketing and 5G business development for the Networks unit, said the company completed a final validation test performed for customers this past April. The press release said: “Samsung demonstrated its vRAN capabilities to customers in April 2020, proving the feasibility of full virtualization by operating 5G New Radio (NR) baseband functions in software running on an x86-based COTS server.”

…………………………………………………………………………………………………………………………………………………

Samsung is a RAN equipment supplier to cellular networks in Korea, U.S., and most recently Japan, where the majority of worldwide 5G subscribers are currently located. In addition, Samsung is further expanding its global footprint rapidly to new markets from Europe to Canada and New Zealand. It has recently closed contracts with Videotron and Telus in Canada, KDDI in Japan and Spark in New Zealand.

In the U.S., it is one of the suppliers for AT&T and Verizon’s 5G networks. Earlier this year the South Korean vendor received a 5G RAN contract with U.S. Cellular. Field trials of the vRAN kit will happen with North American customers in the second half of 2020, according to Johnston.

………………………………………………………………………………………………………………………………………………

Assessment, Comment and Analysis:

1. Samsung is a smaller player in the RAN market, so likely is going after greenfield or brown field carriers with its Open RAN offerings. Perhaps, U.S. rural wireless carriers will be fertile ground for the Korean giant, as many have been forced to “rip and replace” Huawei gear.

Samsung named several technology partners, including Qualcomm, HPE, Marvell and Xilinx for its base station products. Samsung, for example, has a deal with HPE to work on 5G core software and edge computing offerings, according to Mike Dano of Light Reading. For many years, we have been very skeptical about vRANs for many reasons. While it would greatly reduce the cost and OPEX of dedicated, purpose built RAN infrastructure equipment, it represents a single point of failure, an exponentially enlarged malware attack target, and lower performance, especially latency and jitter (delay variation) requirements for critical real time applications.

2. Nokia made no reference to other firms (partners or customers) in its O-RAN announcement today. In May, the company said it had joined the Open RAN Policy Coalition to help enable a comprehensive and secure approach to 5G and future network generations.

One has to wonder if Nokia is using their O-RAN/Open RAN Policy Coalition announcements as an optional check-off item for wireless carriers that will buy purpose built RAN equipment today, but want the option of going Open RAN in the future, when the smoke clears?

Much more significant is potential multi-vendor interoperability problems with Open RAN. There are two independent consortiums generating open source hardware/software specs for it (the O-RAN Alliance and TIP Open RAN project), which have some sort of undescribed relationship.

In an earlier Techblog post, we noted that two vendors from the O-RAN Alliance had to generate their own spec for an O-RAN radio and its interface to the baseband module.

I always thought that an open hardware project (e.g. O-RAN Alliance) would completely specify all hardware modules (like OCP does). In this case, radios used in 4G/5G cellular networks within an Open RAN environment. Evidently, I was wrong!

The Open RAN interoperability problem is highlighted by these two quotes in that article:

“Very few companies are participating in the current (OpenRAN) supply chain and mostly offering proprietary radio solutions lacking open interfaces that are not interoperable with other network elements. In addition, the requirement to procure products from trusted vendors in the US market is also causing operators to reconsider supplier options. OpenRAN radios provide new possibilities for operators to implement a secure, cost effective and best of breed solution as networks move to 5G and beyond.”

Parallel Wireless CEO Steve Papa commented to Light Reading that Open RAN (aka O-RAN) “will only be as good as the radios that are available,” he said. “If Ericsson and Nokia are struggling to be competitive with Huawei’s radios, we should not expect O-RAN to magically solve this problem by using the same semiconductors available to Ericsson and Nokia at present.”

Until it can demonstrate full interoperability between its own products and those made by other O-RAN suppliers, Nokia (along with every other Open RAN supplier) will find it quite difficult to sell O-RAN products.

References:

https://www.fiercewireless.com/tech/samsung-unveils-commercial-5g-vran

Non-coherent Massive MIMO for High-Mobility Communications

By Ana García Armada, PhD, Professor at Universidad Carlos III de Madrid

Introduction:

While driving on a highway in Europe (as a passenger), I tried my smartphone’s 4G-LTE connection and the best I could get was 30 Mbps downlink, 10 Mbps uplink, with latency around 50 msec. This is not bad for many of the applications we use today, but it is clearly insufficient for many low latency/low jitter mobile applications, such as autonomous driving or high-quality video while on the move.

At higher speeds, passengers of ultra-fast trains may enjoy the travel while working. Their 4G-LTE connections are often good enough to read or send emails and browse the internet. But would a train passenger be able to have a video conference call with good quality? Would we ever be able to experience virtual reality or augmented reality in such a high mobility environment?

How to achieve intelligent transport systems enabling vehicles to communicate with each other has been the subject of several papers and reports as per Reference [1]. Many telecommunications professionals are looking to 5G for a solution, but it is not at all certain that the IMT 2020 performance requirements specified in ITU-R M.2410 for low latency with high speed mobility will be met anytime soon (by either 3GPP Release 16 or IMT 2020 compliant specifications).

Editor’s Note: In ITU-R M.2410, the minimum requirements for IMT 2020 (“5G”) user plane latency are: 4 ms for eMBB (enhanced mobile broadband) and 1 ms for URLLC (ultra high reliability, ultra low latency communications).

IMT 2020 is expected to be approved by ITU-R SG D after their November 23-24,2020 meeting, which is one week after the ITU-R WP 5D approval at their November 17-19, 2020 meeting.

There are three different “5G Radios” being progressed as IMT 2020 RIT/SRIT submissions: 3GPP, DECT/ETSI, and Nufront. The TSDSI’s (India) submission adds Low Mobility Large Cell (LMLC) to 3GPP’s “5G NR.”

……………………………………………………………………………………………………………………………………….

The fundamental reason why we do not experience high data rates using 4G-LTE lies in the signal format. That did not change much with 3GPP’s “5G NR,” which is the leading candidate IMT 2020 Radio Interface Technology (RIT). Please refer to Editor’s Note above.

In coherent detection, a local carrier mixes with the received radio frequency (RF) signal to generate a product term. As a result, the received RF signal can be frequency translated and demodulated. When using coherent detection, we need to estimate the channel (frequency band). The amount of overhead strongly depends on the channel variations. That is, the faster we are moving, the higher the overhead. Therefore, the only way to obtain higher data rates in these circumstances is to increase the allocated bandwidth (e.g. with carrier aggregation [2]) for a particular connection, which is obviously a non-scalable solution.

Coherent Communications, CSI, and OFDM Explained:

A coherent receiver creates a replica of the transmitted carrier, as perfectly synchronized (using the same frequency and the same phase) as possible. Combining coherent detection with the received signal, the baseband data is recovered with additive noise being the only impairment.

However, the propagation channel usually introduces some additional negative effects that distorts the amplitude and phase of the received signal (when compared to the transmitted signal). Hence, the need to estimate the channel characteristics and remove the total distortion. In wireless communications, channel state information (CSI) refers to known channel properties of a communication link, i.e. the channel characteristics. CSI needs to be estimated at the receiver and is usually quantized and sent back to the transmitter.

Orthogonal frequency-division multiplexing (OFDM) is a method of digital signal modulation in which a single data stream is split across several separate narrowband channels at different frequencies to reduce interference and crosstalk. Modern communications systems using OFDM carefully design reference signals to be able to estimate the CSI as accurately as possible. That requires pilot signals in the composite Physical layer frame (in addition to the digital information being transmitted) in order to estimate the CSI. The frequency of those reference signals and the corresponding amount of overhead depends on the characteristics of the channel that we would like to estimate from some (hopefully) reduced number of samples.

Wireless communications were not always based on coherent detection. At the time of the initial amplitude modulation (AM) and frequency modulation (FM), the receivers obtained an estimate of the transmitted data by detecting the amplitude or frequency variations of the received signal without creating a local replica of the carrier. But their performance was very limited. Indeed, coherent receivers were a break-through to achieve high quality communications.

Other Methods of Signal Detection:

More recently, there are two popular ways of non-coherently detecting the transmitted data correctly at the receiver.

-

One way is to perform energy or frequency detection in a similar way to the initial AM and FM receivers.

-

In differential encoding, we encode the information in the phase shifts (or phase differences) of the transmitted carrier. Then, the absolute phase is not important, but just its transitions from one symbol to the other. The differential receivers are much simpler than the coherent ones, but their performance is worse since noise is increased in the detection process.

Communications systems that prioritize simple and inexpensive receivers, such as Bluetooth [3], use non-coherent receivers. Also, differential encoding is an added feature in some standards, such as Digital Audio Broadcasting (DAB). The latter was one of the first, if not the first standard, to use OFDM in wireless communications. It increases the robustness to mitigate phase distortions, caused by the propagation channel for mobile, portable or fixed receivers.

However, the vast majority of contemporary wireless communications systems use coherent detection. That is true for 4G-LTE and “5G NR.”

Combining non-coherent communications with massive MIMO:

Massive MIMO (multiple-input, multiple-output) groups together antennas at the transmitter and receiver to provide better throughput and better spectrum efficiency. When massive MIMO is used, obtaining and sharing CSI threatened to become a bottleneck, because of the large number of channels that need to be estimated because there are a very large number of antennas.

A Universidad Carlos III de Madrid research group started looking at a combination of massive MIMO with non-coherent receivers as a possible solution for good quality (user experience) high speed mobile communications. It is an interesting combination. The improvement of performance brought by the excess of antennas may counteract the fundamental performance loss of non-coherent schemes (usually a 3 dB signal-to-noise ratio loss).

Indeed, our research showed that if we take into account the overhead caused by CSI estimation in coherent schemes, we have shown several cases in which non-coherent massive MIMO performs better than its coherent counterpart. There are even cases where coherent schemes do not work at all, at least with the overheads considered by 4G-LTE and 5G (IMT 2020) standards. Yet non-coherent detection usually works well under those conditions. These latter cases are most prevalent in high-mobility environments.

Editor’s Note: In ITU-R M.2410, high speed vehicular communications (120 km/hr to 500 km/hr) is mainly envisioned for high speed trains. No “dead zones” are permitted as the “minimum” mobility interruption time is 0 ms!

When to use non-coherent massive MIMO?

Clearly in those situations where coherent schemes work well with a reasonable pilot signal overhead, we do not need to search for alternatives. However, there are other scenarios of interest where non-coherent schemes may substitute or complement the coherent ones. These are cases when the propagation channel is very frequency selective and/or very time-varying. In these situations, estimating the CSI is very costly in terms of resources that need to be used as pilots for the estimation. Alternatives that do not require channel estimation are often more efficient.

An interesting combination of non-coherent and coherent data streams is presented in reference [5], where the non-coherent stream is used at the same time to transmit data and to estimate the CSI for the coherent stream. This is an example of how coherent and non-coherent approaches are complementary and the best combination can be chosen depending on the scenario. Such a hybrid scheme is depicted in the figure below.

Figure 1. Suitability of coherent (C), non-coherent (NC) and hybrid schemes (from reference [5])

……………………………………………………………………………………………………………………………………………………….

What about Millimeter Waves and Beam Steering?

The advantage of millimeter waves (very high frequencies) is the spectrum availability and high speeds. The disadvantages are short distances and line of sight communications required.

Compensating for the overhead by adding more bandwidth, may be a viable solution. However, the high propagation loss that characterizes these millimeter wave high frequency bands creates the need for highly directive antennas. Such antennas would need to create narrow beams and then steer them towards the user’s position. This is easy when the user equipment is fixed or slowly moving, but doing it in a high speed environment is a real challenge.

Note that the beam searching and tracking systems that are proposed in today’s wireless communications standards, won’t work in high speed mobile communications when the User Endpoint (UE) has moved to the coverage of another base station at the time the steering beams are aligned! There is certainly a lot of research to be done here.

In summary, the combination of non-coherent techniques with massive MIMO does not present any additional problems when they are carried out in millimeter wave frequencies. For example, reference [6] shows how a non-coherent scheme can be combined with beamforming, provided the beamforming is performed by a beam tracking procedure. However, the problem of how to achieve fast beam alignment remains to be solved.

Concluding Remarks:

Non-coherent massive MIMO makes sense in wireless communications systems that need to have very low complexity or that need to work in scenarios with high mobility. Its advantage is that it makes possible communications in places or circumstances where the classical coherent communications fail. However, this scheme will not perform as well as coherent schemes under normal conditions.

Most probably, non-coherent massive MIMO will be used in the future as a complement to well-understood and (usually) well-performing coherent systems. This will happen when there are clear market opportunities for high mobility, high speed, low latency use cases and applications.

References:

[1] ITU report: “Setting the scene for 5G: opportunities and challenges”, 2018, https://www.itu.int/en/ITU-D/Documents/ITU_5G_REPORT-2018.pdf

[2] F. Kaltenberger et al., “Broadband wireless channel measurements for high speed trains,” 2015 IEEE International Conference on Communications (ICC), London, 2015, pp. 2620-2625, doi: 10.1109/ICC.2015.7248720.

[3] L. Lampe, R. Schober and M. Jain, “Noncoherent sequence detection receiver for Bluetooth systems,” in IEEE Journal on Selected Areas in Communications, vol. 23, no. 9, pp. 1718-1727, Sept. 2005, doi: 10.1109/JSAC.2005.853791.

[4] ETSI ETS 300 401, “Radio broadcasting systems; DAB to mobile, portable and fixed receivers,” 1997.

[5] M Lopez-Morales, K Chen Hu, A Garcia Armada, “Differential Data-aided Channel Estimation for Up-link Massive SIMO-OFDM”, IEEE Open Journal of the Communications Society -> in press.

[6] K Chen Hu, L Yong, A Garcia Armada, “Non-Coherent Massive MIMO-OFDM Down-Link based on Differential Modulation”, IEEE Trans. on Vehicular Technology -> in press.

……………………………………………………………………………………………………………………………………………………….

About Ana García Armada, PhD:

- Spanish version (updated Jan 2020)

- English version (updated Jan 2020)

- Google Scholar: link

- ResearchGate: link

- Academia.edu: link

T-Mobile shutters Sprint’s 5G network; OpenSignal 5G User Experience report highlights

As expected following the April 1st close of T-Mobile’s acquisition, Sprint’s 5G network (which uses 2.5GHz mid-band spectrum) has been deactivated while the “new T-Mobile” works to re-deploy it across its own network.

The integration of the Sprint mid-band spectrum is a key part of T-Mobile’s 5G strategy, which aims to combine low-band 600MHz spectrum for broad, nationwide 5G coverage with faster but lower-range midband (Sprint’s 2.5GHz network) and short-range mmWave networks for a balance of coverage and speed.

T-Mobile has already deployed its new 2.5GHz spectrum in New York, the first market to benefit from the wireless network operator’s spectrum in low-, mid-, and millimeter wave bands. The operator’s 2.5GHz 5G is also live in “parts” of Chicago, Houston, Los Angeles, New York, and Philadelphia.

Most existing Sprint customers won’t be able to use their current devices going forward to access 5G. Newer devices that feature Qualcomm’s X55 modem, like the Galaxy S20 5G lineup, will still be able to access the 2.5GHz 5G when they relaunch as part of the new T-Mobile’s 5G network (along with the rest of T-Mobile’s low-band and mmWave 5G spectrum). T-Mobile is offering credits for affected customers to lease a new 5G device.

“We are working to quickly re-deploy, optimize and test the 2.5 GHz spectrum before lighting it up on the T-Mobile network. In the meantime, legacy Sprint customers with compatible devices can enjoy T-Mobile’s nationwide 5G network,” a T-Mobile spokesperson said.

According to data from a new Opensignal 5G User Experience report, customers using T-Mobile’s mid-band 5G are benefitting from average download speeds of around 330Mbps. The mobile analytics company ranks T-Mobile first for 5G availability; with customers receiving a 5G signal around twice as often as AT&T and 56 times more than Verizon.

T-Mobile’s press release about the Opensignal report said customers are seeing average download speeds of 330 Mbps on its mid-band 2.5 GHz network.

From that OpenSignal report:

T-Mobile wins the 5G Availability award, as its 5G users spend 22.5% of time connected to 5G:

The time connected to a 5G service is extremely important if users are to enjoy all of 5G’s benefits. In the U.S., T-Mobile won the 5G Availability award by a large margin with Sprint and AT&T trailing with scores of 14.1% and 10.3%, respectively. Verizon users saw their extremely fast 5G service 0.4% of the time because of the limited geographical reach of the mmWave wireless technology Verizon currently relies upon for 5G and the early stage of the 5G deployment.

Sprint’s 5G users’ experience is already changing as new T-Mobile combines its network capabilities:

When we previously looked at the 5G Download Speed of Sprint’s users some time ago we saw average 5G speeds of 114.2 Mbps reflecting the mid-band 5G wireless spectrum Sprint relied upon. But following the completion of T-Mobile’s acquisition of Sprint, the new T-Mobile is starting to provide Sprint 5G users with access to old T-Mobile’s 600MHz spectrum and so average 5G speeds are now 49.5 Mbps but 5G Availability has risen from 10.3% to 14.1% of time. T-Mobile is still in the process of merging its original network with Sprint and we expect the mobile network experience of Sprint users will continue to change for some time.

………………………………………………………………………………………………………………………………………………………………………….

“Building the fastest 5G network is easy if you only cover less than 50 square miles. Opensignal’s report shows that only T-Mobile is doing the hard work to deliver BOTH 5G coverage and speed. And we’re just getting started,” said Neville Ray, President of Technology at T-Mobile.

“With the addition of Sprint, the Un-carrier’s 5G is getting bigger, better and faster every day, moving quickly on our mission to build the world’s best 5G network, one unlike any other, to people all across the country!”

T-Mobile and Sprint were finally cleared to merge on April 1st, following discussions which began in 2013.

To appease regulators, T-Mobile agreed to sell Sprint’s prepaid business, Boost Mobile, and Virgin Mobile to Dish network for $1.4 billion. The deal also included selling Sprint’s entire 800 MHz portfolio of spectrum to Dish. Those deals formally completed yesterday.

Last month, T-Mobile asked California’s Public Utilities Commission (CPUC) to ease other conditions it agreed to in order for the merger to be granted – including job creation promises following the COVID-19 pandemic, average 5G coverage and speed commitments, and to remove a “burdensome” third independent test of its network.

……………………………………………………………………………………………………………………………………………………………………

References:

T-Mobile switches off Sprint’s 5G network following $26.5 billion merger

https://www.opensignal.com/reports/2020/06/usa/mobile-network-experience-5g

ETNO, GSMA: EU should adopt “fresh approach” to support fiber & 5G investments; GSMA says 5G SA coming soon?

The European telecom network operators industry group ETNO together with the GSMA have called on the EU to make support for fiber optics communications and 5G investments part of the bloc’s economic recovery plans. In a joint statement to mark the start of the German presidency of the EU, the associations said a fresh approach is needed to ensure the focus is on closing the digital divide and that plans to alleviate that should not become bogged down in regulatory discussions.

“We encourage all institutions to take stock of the socio-economic context and shift regulatory modes from ‘business-as-usual’ to a fresh and comprehensive approach aimed at unleashing the full power of network investment, at full scale and at full pace,” the statement said.

The joint communique then delineated ways policymakers can support the investment in improved connectivity for the EU:

- Spectrum auctions are timely and conditions for spectrum assignment support network deployment. This includes taking a long-term view to spectrum prices, rather than imposing punitive fees that hamper 5G investment. Also, access and coverage obligations should not diminish the speed and scale of investment in network roll-out;

- Sharing agreements for Radio Access Network (RAN) are supported and incentivised, so that they contribute to a speedy 5G deployment;

- All fibre investment models are adequately incentivised at the national level, including co-investment and other forms of partnerships;

- Innovative infrastructure solutions, such as cloud, edge and quantum computing, are given the appropriate support;

- Future EU initiatives dramatically reduce roll-out costs for both mobile and fixed networks. This should tackle, for example, unreasonable costs for using public ground as well as complex authorization procedures for both fixed and mobile networks;

- Open and interoperable interfaces in the RAN are supported. Initiatives such as Open RAN have the potential to support Europe’s multi-vendor approach, while reducing deployment costs, further strengthening the security of the equipment and unleash more network innovation.

The most important thing is helping grow adoption of the new technologies by citizens and businesses, the statement said. This includes supporting digital skills education and training. “Finally, workers of all ages should be put in the condition to develop the necessary digital skills – both through upskilling and reskilling – to thrive in innovative and fast-paced markets.”

Demand stimulus measures can also help bring digital services to public sector organizations like schools, hospitals and local administrations. That would not only support Europe’s economic recovery, but also can contribute to the EU’s climate goals.

The GSMA and ETNO also called on the EU governments to combat the attacks against telecom infrastructure and misinformation surrounding 5G. To date they have counted over 180 arson attacks against mobile antennas in 11 countries.

Media Inquiries:

Alessandro Gropelli, ETNO – [email protected] 0032 476 9418 39

Noelle Knox, GSMA Europe – [email protected] 0032 470 45 2941

…………………………………………………………………………………………………………………………………………………………………………..

Separately, GSMA says “5G Stand Alone to Become Reality“:

“The deployment of fully virtualized networks using 5G Stand Alone Cores, thereby facilitating Edge Computing and Network Slicing, will enable enterprises and governments to reap the many benefits from high throughput, ultra-low latency and IoT to improve productivity and enhance services to their customers,” said Alex Sinclair, Chief Technology Officer, GSMA.

“5G Stand Alone Option 2 can meet various and more stringent requirements and provide optimal and differentiated solutions, thereby empowering more businesses and unlocking the potential of many services. 5G is changing our society and life,” said Liu Guiqing, Executive Vice President of China Telecom.

“NTT DOCOMO has been actively promoting virtualisation of our core network; we believe that this virtualisation technology is already mature and that our operational know-how will be our advantage. In the future we expect to build dedicated networks, optimised for consumer use cases, such as AR /VR and gaming,” said Hiroyuki Oto, General Manager of Core Network Development Department, NTT DOCOMO, Inc.

The latest version of the 5G SA guidelines ‘5G Implementation Guidelines: SA Option 2 will be released 30th June at 17:00 Beijing time during Thrive China, a new virtual event from the GSMA.

NOTE that those GSMA guidelines come before 3GPP Release 16 5G Architecture (including 5G Core) spec 23.501 is finalized/frozen at 3GPP’s July 2020 meeting. It seems there will be many versions of 5G core networks:

Alex Quach, VP of Intel’s Data Platforms Group: “The way different service providers implement their 5G core is going to vary. Every service provider has unique circumstances. The transition to a new 5G core is going to be different for every operator.”

Asked if SK Telecom has now completed its 5G Standalone core network, the South Korean carrier was vague in an email reply to FierceWireless. “To commercialize standalone 5G service in Korea, we are currently making diverse R&D efforts including conducting tests in both lab and commercial environment. Our latest achievements include the world’s first standalone (SA) 5G data session on our multi-vendor commercial 5G network.

fiercewireless.com/operators/sk-t

……………………………………………………………………………………………………………………………………………………………………………..

GSMA also states that:

Mobile connections, including cellular IoT as of 1 July 2020 =8,805,024,140 (not the 20B Ericsson and others predicted for 2020)

……………………………………………………………………………………………………………………………………………………………………..

References:

https://etno.eu/news/all-news/8-news/678-joint-statement-telecoms-eu-recovery.html

https://etno.eu/news/all-news.html

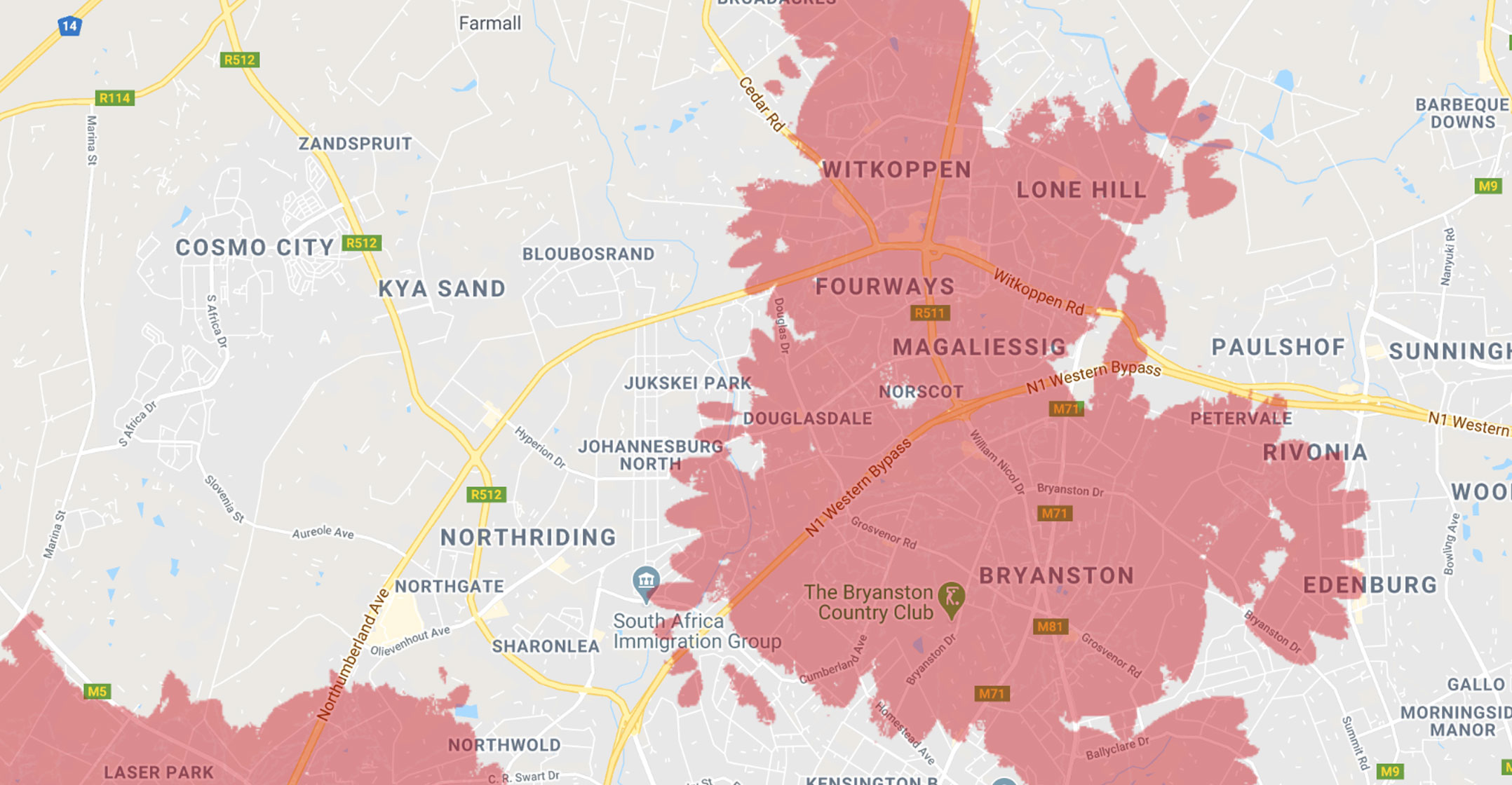

MTN 5G launch at 100 sites in South Africa using multiple frequency bands and DSS

MTN South Africa has officially launched its 5G network, a first for its 21 operations across Africa and the Middle East. The 5G network covers areas of Johannesburg and Cape Town, as well as Bloemfontein and Port Elizabeth. The operator used various spectrum bands, including temporary spectrum assigned by communications regulator Icasa during the Covid-19 state of disaster, to launch the network. See video interviews in References, directly below this article.

The launch comes after the South African government’s allocation of temporary spectrum and extensive 5G trials and testing. One of the key innovations driving the broad roll-out by MTN has been the adoption of Dynamic Spectrum Sharing (DSS) to overcome the lack of dedicated 5G spectrum.

“Our 5G strategy has been years in the making and we are confident that we have built a strong foundation to grow and support our 5G ecosystem…,” said chief technology and information officer Giovanni Chiarelli.

“One of the key innovations driving the broad roll-out by MTN has been a strategic approach to dynamic spectrum sharing, as these deployments overcome the challenges of lack of dedicated 5G spectrum,” he added.

MTN will deliver 5G connectivity on the 3.5 GHz band at 58 sites including Johannesburg, Cape Town and Bloemfontein, as well as use the 2,100 MHz and 1,800 MHz bands at 35 sites. The operator is re-farming some 4G spectrum to allow it to run 4G and 5G services at the same time, in the same band. This allows for easier migration of network technology from LTE to 5G and allows the company to deploy 5G using existing spectrum assets in the absence of additional high demand spectrum. MTN deployed 5G sites on the 2,100 MHz band in Johannesburg and Port Elizabeth.

In addition, it will use the 700 MHz band (which analog TV broadcasters are still using) at five sites for extensive coverage in small towns, including Port Alfred, Hopetown, Virginia Queenstown and Tsantsabane.

The South African operator will also deploy 5G in the 28 GHz frequency at three sites in Hatfield (Pretoria), Edenvale and Durban.MTN was the first in the southern hemisphere to demonstrate AAA game streaming over its 5G network.

MTN South Africa 5G Coverage map, courtesy of Tech Central.

In a partnership with Emerge Gaming, MTN demonstrated GameGloud on 5G streamed to a Huawei P40 Pro phone.nch comes on the back of government’s allocation of temporary spectrum and extensive 5G trials and testing. One of the key innovations driving the broad roll-out by MTN has been the adoption of Dynamic Spectrum Sharing to overcome the lack of dedicated 5G spectrum.

“We are extremely encouraged by the release of the temporary spectrum by Icasa. Our call to the regulator and government is to release permanent 4G and 5G spectrum as a matter of urgency so that we can fuel the digital revolution our nation needs to bridge the digital divide that currently deepens the gap between the ‘haves’ and the ‘have-nots’,” said MTN South Africa CEO Godfrey Motsa.

……………………………………………………………………………………………………………………………………………..

References:

https://www.telecompaper.com/news/mtn-launches-first-5g-network-at-100-sites-in-south-africa–1344595

https://techcentral.co.za/mtn-5g-launch-everything-you-need-to-know/99224/

https://techcentral.co.za/this-is-where-you-can-get-mtn-5g-coverage/99203/

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

Market research firm GreyB cooperated with Amplified, which develops software for intellectual property research, to publish a “preliminary” report named ‘Who Owns Core 5G Patents? – A Detailed Analysis of 5G Standard Essential Patents (SEP)s.’ The stated aim of the project is ‘to bring greater transparency to the landscape of 5G standard essential patents.’

The caveat is that the data used for the study in this report is from March 2019 and its taken from the ETSI website, rather than ITU-R WP5D–IMT 2020 website. Note that 3GPP members declare IPR not to 3GPP (which is not a legal entity but is a collaborative activity between several SDOs), but to their regional standard bodies for which they are participating. Many of the 3GPP members are also ETSI members, so they declare their IPR to ETSI.

For info on 3GPP IPR handling: https://www.3gpp.org/about-3gpp/legal-matters

………………………………………………………………………………………………………………………………………………..

From the report authors:

The report is the first of a series of collaborations between Amplified and GreyB that aim to bring greater transparency to the landscape of 5G standard essential patents. The data is large, opaque, and highly technical. Our focus will be on making the data involved more accessible and understandable. The issues are nuanced and complicated. We hope that this report and the following reports enable the many stakeholders involved to have more effective discussions and make better decisions.

Patents, which help protect the rights of the innovators who contribute to building the standard, may be declared as potentially essential and relevant to the standard. These are known as SEPs. Declaration does not require verification. Verifying that a patent is essential to a particular standard is a complex task

requiring significant time from experts in the field.

Importance of Standards:

Standards benefit businesses, policy makers, and society in general.

• They promote innovation in the market through rewarding R&D

• Help to commercialize the technology and bring products to market faster

• Ensure and define interoperability and interchangeability which gives manufacturers and consumers more choice

• Encourage improvement and competition in the market

• Help protect consumer safety

They balance cooperation and competition among innovative companies such that the net benefit is greater than the sum of their individual parts.

Manufacturers who implement standardized technology get an even playing field – a blueprint from which they can all build from at a predictable cost. This encourages more companies to participate in a market and innovate around the core technology.

Standards provide the ground rules for different devices, systems and processes to work together. Interoperable and interchangeable products gives consumers more choice and that encourages market pressure towards better, safer, and cheaper products.

Finally, standards provide policymakers with well-documented baselines and rules for implementation which helps them to understand the implications of new technology and take action to protect consumer, business, societal interests

……………………………………………………………………………………………………………………….

5G Patent Leaders:

The strong conclusion of the report is that Huawei is the 5G SEP leader, and not just by a little bit. As you can see in the chart below, Huawei accounts for 19% of core (used in 5G standards/3GPP specs) patents, followed by the two Korean tech giants, which are surprisingly ahead of Huawei’s main rivals in this case.

GreyB originally got in touch with Telecoms.com after reading an article there titled: 5G patent chest-beating is an unhelpful distraction. The purpose of the research is an attempt to cut through the noise created by various competing claims and get to the heart of the matter.

“5G is going to be next disruptive technology,” report co-author Muzammil Hassan of GreyB, told Telecoms.com. “And going by all the fuss around, it is important to know where each of the top contributors of 5G technology stand in terms of quality of innovation. Some may want to switch gears and file better inventions.”

One other metric GreyB was keen to flag up was ‘essentiality ratio,’ which seeks to illustrate the proportion of filed patents that make it into the core standard. Once more, in the chart below, Huawei comes top, but it should be noted that the ratio is derived from only those patents analyzed.

As a proportion of all declared patents Huawei is among the lowest at 13%, compared to the leader Nokia with 20%. Ericsson has the lowest ranks of all by this metric with 11%. The Sweden based company is also the lowest in SEPs with only 9%.

Problems and pitfalls:

Reviewing historical work done in this field we’ve identified the following pitfalls which we seek to avoid:

• Extrapolating conclusions done from a small sample size

• Using proxies from 4G and projecting those onto 5G

• Taking declared numbers at face-value

• Implicitly framing all patents as equal by focusing on patent quantity only without accounting for quality

The complex nature of patent data analysis simply makes it impossible to address these issues completely so unfortunately it may be impossible to avoid all of these in entirety. However, it is our goal to create a reliable report and therefore we believe it is critical to acknowledge and account for them transparently and to the best of our ability. Our methodology is detailed in the appendix and we invite corrections, additions, criticism, and contributions.

Patent Source and Study Methodology:

The data covered was all patents from the ETSI website 5G declaration list March 2019 version. This covers any patent or patent application declared to the ETSI 5G standard. Essentiality evaluation involves significant time and effort so there is a lag between release date of our report and data covered. We’ll issue updates as we continue to analyze the data.

• All patents declared to relevant 5G specifications and projects were selected resulting in 63,985 individual patent documents (granted patents, published patent applications, and non-public patent applications)

• ~500 Non-public patent documents, unavailable for inspection, were removed

• The remaining ~63,500 patent documents were grouped into 12,002 patent families.

• 6,402 of the 12,002 patent families with a granted patent having live legal status as of 31st December 2019 were kept, the rest were removed

• We determined our understanding of each of the 6,402 patent families by reading the claims and related embodiments from these granted patents and checked the correspondence history and documentation at the patent office to understand each patent.

• We determined essentiality for each patent family as a Core SEP or not by checking any specifications declared to be relevant by the patent holder to the SEP and compared the specific sections of these to compare overlap of the patent claims with those sections. If partial or no overlap was found, we then broadened our comparison to the wider group of all other specifications to repeat this process.

………………………………………………………………………………………………..

References:

2021: Who Owns Core 5G Patents? – A Detailed Analysis of 5G SEPs

5G Patent Wars: Are Nokia’s 3,000 “5G” Patent Declarations Legit?

Strategy Analytics: Huawei 1st among top 5 contributors to 3GPP 5G specs

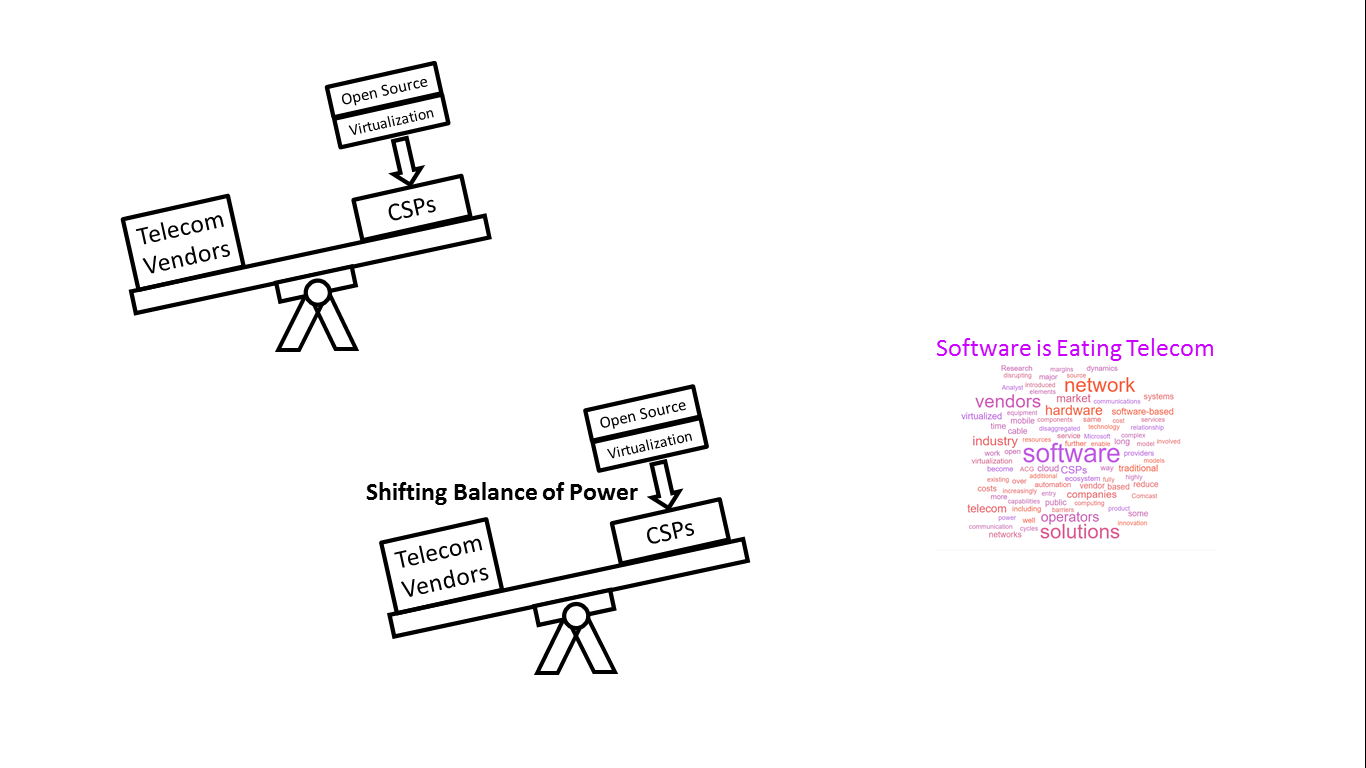

Opinion: How virtualization and open source are upending the entire telecom industry

Article below written by Liliane Offredo-Zreik and Dr. Mark H Mortensen of ACG Research

[Note that the IEEE Techblog content manager (since April 2009) does not agree with the theme of this article. We believe that the only really big customers of virtualization and open source hardware/software are the largest tier 1 telcos (like AT&T, Telefonica, etc) and the big cloud companies (like Amazon, Google, Microsoft, Facebook, Alibaba, Tencent, etc).

- One of the big problems with network virtualization is that you have a single point of failure (the server running virtual network functions) and also a much larger attack surface for cyber attacks.

- The biggest obstacles to using open source hardware and software are systems integration, multi-vendor interoperability and compatibility and tech support, especially related to failure isolation and recovery. Other issues with deploying open source include performance (vs purpose built hardware/firmware/software) and OPEX associated with integrating and maintaining hardware/software from multiple vendors.

However, we like to present different views and provide balanced coverage of telecom tech topics like open networking and open source hardware/software. So please enjoy the below article and comment in the Comment box below it.]

………………………………………………………………………………………………………………………………………………..

Posted by: Anasia D’mello. Article written by Liliane Offredo-Zreik and Dr. Mark H Mortensen of ACG Research.

Until recently, network technology vendors to communication service providers (CSPs) had a well-established competitive market position with brand loyalty, long-standing customer relationships, and well entrenched proprietary solutions. However, an inexorable move to software-based (virtualised) solutions, combined with the increasing prevalence of open-source resources, is disrupting the market dynamics and will have profound implications for the industry structure.

Traditionally, telecom network technology vendors supplied bespoke solutions, typically consisting of hardware racks populated with purpose-built circuit boards that performed highly specialised tasks, complemented by highly customised software, with complex back office systems to manage these systems and the applications that run on them. These solutions were supplemented by extensive professional services resources, and typically involved regular software upgrades, and, less frequently hardware ones.

This, combined with the long cycles involved in introducing new solutions, or in upgrading existing ones due to long testing cycles, created a relatively closed ecosystem with high barriers to entry and high switching costs. It also drove costs up, as it increased the bargaining power of suppliers; it limited the number of competitors and stifled innovation because younger companies with fewer resources found it difficult to penetrate the ecosystem.

The disruptive nature of virtualization

The inexorable migration to software-based, virtualized solutions is disrupting this ecosystem, with profound long-term consequences. Increasingly, telecom operators are introducing virtualized software solutions in their operating environments. Their long-term goal is of a fully software-driven ecosystem with software-only network elements running on commodity off-the-shelf servers (COTS) or open source hardware, hosted in local offices, in distributed data centres or in a cloud-compute environment.

The software-based systems are not less complex, and the incumbent vendors are rushing to either port their existing solutions on COTS or redeveloping parts of those systems to become software based. It also allows new software vendors to enter the market without the long design, manufacturing, and logistics supply chains of traditional hardware.

At the same time, the CSP traditional development/deployment paradigm, which was largely based on the waterfall model and involved protracted cycles, is slowly making way to an agile framework, based on the Continuous Integration/Continuous Deployment model where incremental changes are introduced on an on-going basis, enabled by a microservices-based, modularised architecture.

This paradigm allows minimally viable products to be introduced and then rapidly enhanced, reducing the entrenched foothold of existing suppliers and opening the way for new entrants, further transforming the market dynamics.

By reducing the barriers to entry, virtualization is adding new vendors and new delivery mechanisms that bypass the traditional supply chains: New virtual network software companies, public cloud companies, and the network operators themselves.

- New virtual network software companies: New software-centric companies have entered the market over the last several years. Examples include Affirmed Networks, Altiostar and Parallel Wireless that offer a software-based mobile core solution, Etiya that provides a nearly fully virtualised mobile solution (running on an AWS public cloud infrastructure), and Metaswitch that offers a wide range of mobile and fixed network software-based network technologies. Other traditional software vendors to operators, such as HPE, are also entering the virtualised network equipment market.

- Public cloud companies: Cloud providers are increasingly tapping into the convergence of cloud and communication networks. Recently, Microsoft bought Affirmed Networks, which offers fully virtualized, cloud-native mobile network solutions for telecom operators. This acquisition will enable Microsoft to become a major telecom vendor in the mobile and nascent private 5G markets. In days past, communication service providers (CSP) used to build their own data centres, but virtualisation technologies enable cloud providers, such as Microsoft, to offer the same capabilities, mostly as services, on their public computing and storage infrastructure at much lower initial cost and with more flexibility.

- DIY: Some CSPs are hiring software developers in droves and are beginning to develop their own solutions. Not only that, but some operators are also transforming themselves into vendors, offering their solutions to their peer operators. A case in point is Comcast Corp. The company’s mantra has become “software eats the world.” Its newly opened Comcast Technology Center serves as “the dedicated home for our company’s growing workforce of more than 4,000 technologists, engineers and software architects.” Comcast has developed its Xfinity X1 entertainment service in-house; it is also syndicating it to cable operators, including Cox and Shaw and Rogers of Canada. At the same time, the company has developed a software-defined platform (ActiveCore) to power its business services, and it is not unfathomable that it would look to syndicate it at some point in the future.

Others CSPs are expanding their software capabilities for internal, and external, use. Reliance Jio’s parent company, Reliance Industries, bought Radisys, a US-based provider of open telecom solutions, while AT&T’s expansion of its software capabilities is well-known in the industry.

The role of open-source collaboration

Most operators do not have the capacity nor the ability to undertake massive development efforts, particularly because some of the solutions they need are highly complex. However, open-source hardware and software and disaggregated network elements go a long way to alleviate the need to undertake end to end developments.

Recent disaggregated network element (DNE) projects, some including open-source hardware and software, have been created by CSPs throughout the various telecom equipment domains, from radio backhaul to the core networks, optical access and transport equipment, and edge computing environments, among many others. DNEs are essentially public open source Lego-like building blocks that run on standard computing and storage hardware or programmable ASICs that standardise designs and that can be used to create solutions. They enable CSPs to select the best combination of commoditised hardware and specialised software components. DNEs are designed to reduce vendor lock-ins and further lower the barriers to entry for new vendors, increasing competition in sales and support.

The operator–vendor new relationship framework

New engagement models are emerging. The traditional supplier/customer relationship is making way to a cooperative engagement model, where the operator and the vendor work hand in hand on developing solutions. Furthermore, unlike traditional models where the vendor is paid upfront and is further compensated for on-going support, new frameworks are emerging where the vendor is compensated based on the success of the operator. One such arrangement was the Infinite Broadband Unlocked that Cisco introduced in 2018 where it charged cable operators based on broadband consumption over their networks, rather than upfront licenses. Such arrangements are facilitated by software-based solutions and are likely to become more prevalent over time, further disrupting market dynamics.

Toward the future

The commoditisation of the hardware components of the network will reduce the vendors’ margins and potentially reduce overall CSPs’ costs. However, the CSPs will have to bear the additional costs of testing multivendor arrangements, configuring, and managing the larger number of network components, as well as securing the entire network.

These additional costs will eat into the potential savings and are expected to require a hefty dose of automation. Such automation will come from vendors, systems integrators, as well as from additional open-source initiatives such as the ONAP program, the open-source version of the AT&T ECOMP home-grown system that seeks to provide real-time, policy-driven software automation of AT&T’s network management functions.

It is too early in the game to scope the full impact of this unfolding transformation. It is likely that it will increase the speed of innovation and improve the cost structure for operators. At the same time, intense competition may reduce vendors’ margins, decreasing their ability to invest in R&D. However, an increasingly symbiotic relationship between operators and vendors will improve industry dynamics, overall, as it will lead to better targeted solutions, more cost efficiency and improved customer experience.

Conclusion

Technological changes and industry realignment are enabling CSPs to gain greater market control and to reap larger efficiencies by replacing monolithic hardware and software solutions from major vendors with disaggregated networking elements with open-source software on commoditised, standardised hardware, and by adopting co-development models. This will reduce the pricing power of major vendors and compress their margins but may lead to greater innovation in the industry.

The authors are Liliane Offredo-Zreik and Dr. Mark H Mortensen of ACG Research.

Liliane Offredo-Zreik

Dr. Mark H Mortensen

About the authors

Liliane Offredo-Zreik ([email protected] @offredo) is a principal analyst with ACG Research. Her areas of coverage include the cable industry, SD-WAN, and communications service provider digital transformation. Prior to her analyst work, she held senior roles in major telecom and cable companies, including Verizon and Time Warner Cable (now Charter) as well as with industry vendors and has been an industry advisor in areas including marketing, strategy, product development and M&A due diligence.

Dr. Mark H Mortensen ([email protected] @DrMarkHM) is an acknowledged industry expert in communications software for the TMT sector, with over 40 years of experience in OSS and BSS specifications, network operations, software architecture, product marketing, and sales enablement. His work has spanned the gamut of technical work at Bell Labs, strategic product evolution at Telcordia, CMO positions at several software vendors, and as a research director at Analysys Mason. He is currently the Communications Software Principal Analyst at ACG Research focusing on network and business automation.

……………………………………………………………………………………………………………………………………………….

Futurium: 2020 SD-WAN market set to accelerate

Despite no standards for multi-vendor operator (UNI) or network-to-network (NNI), Futurium projects continued growth in SD-WAN through at least the next 3-5 years. Enterprises and service providers alike are interested in deploying SD-WAN technology in services to deliver cloud-based orchestration and automation of networking and security.

Based on a survey of 100 end users as well as dozens of interviews with professionals in the IT and networking markets, Futurium forecasts the SD-WAN tools and software market will increase to $4.6 billion by 2023 as enterprises increasingly move their IT and networking services to a cloud infrastructure.

In the nearer term, Futuriom’s founder and principal analyst, Scott Raynovich, expects a market growth rate of 34% CAGR to hit $2 billion this year and reach $2.85 billion in 2021 as more enterprises demand “agile, high-performance, and secure connections to cloud applications.”

Cloud-delivered SD-WAN, a growing technology domain that enables enterprises and organizations to set up and manage secure WAN connections using cloud software deployment and management approaches, is gaining and increasing role to speed up and secure cloud connectivity. Enterprises are buying SD-WAN to reduce the complexity in configuring branch-office devices, routing schemes, and network addresses. With SD-WAN, many of these functions can be abstracted into the cloud and managed by the service provider or an enterprise manager using a cloud interface, rather than using proprietary networking equipment.

The report was sponsored by Aryaka Networks, Citrix Systems, Fortinet, Nuage Networks, Silver Peak, Versa Networks, and VMware (VeloCloud).

Report highlights:

- Momentum in the SD-WAN market continues. Despite a slight slowdown in the 1H due to pandemic-related supply chain and sales challenges, the market is likely to accelerate in 2H 2020 and into 2021 as the features of SD-WAN serve growing cloud demand.

- Futuriom expects the SD-WAN tools and software market to accelerate to a growth rate of 34% CAGR to reach $2.0 billion in 2020, $2.85 billion in 2021, and $4.6 billion by 2023. The acceleration will be spurred by demand for more agile, high-performance, and secure connections to cloud applications.

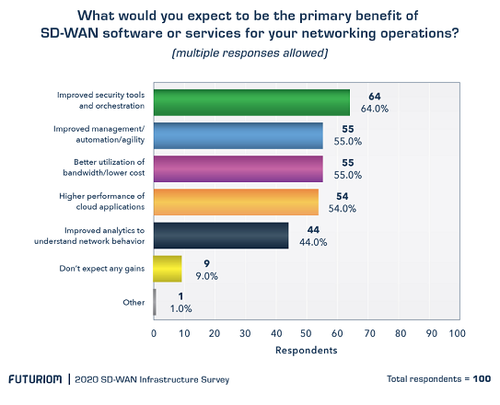

- The top four benefits of SD-WAN adoption include improved security, better management/agility, bandwidth optimization/cost savings, and faster cloud applications performance. These benefits were picked in our Futuriom 2020 SD-WAN Infrastructure Survey of 100 enterprise end users, which also indicated broadening use cases and adoption in the market.

- Awareness of SD-WAN is growing as the market matures. In the Futuriom 2020 survey, 92% of respondents said they are evaluating SD-WAN services and/or software.

- The Work from Home (WFH) trend is giving the SD-WAN market a boost. SD-WAN integrates virtual private networking (VPN) functionality for both remote workers and enterprises branches, which is a key feature demand.

- As predicted in 2019, M&A and consolidation has continued and is likely to continue. The acquisition leaves fewer players on the dance floor. Aryaka, Cato Networks, FatPipe, Silver Peak, and Versa Networks are all strong candidates for M&A or IPO. (Last year, CloudGenix was on this list – Palo Alto Networks announced earlier this year that it’s acquiring the startup.)

- Companies featured in this report: Adaptiv Networks, Aryaka Networks, Bigleaf Networks, Cisco Systems (Viptela), Cato Networks, Citrix Systems, CloudGenix (Palo Alto Networks), HPE, FatPipe Networks, Fortinet, Juniper Networks, Nuage Networks (Nokia), Riverbed, Silver Peak, Versa Networks, VMware (VeloCloud).

……………………………………………………………………………………………………………………………………………………….

In April, Omdia released similar predictions for the SD-WAN market, reporting that SD-WAN revenue reached $2 billion in 2019, up from $1.1 billion in 2018. Omdia predicts SD-WAN revenue will hit $4.8 billion in 2024.

While the COVID-19 pandemic slowed SD-WAN market momentum in the first half of 2020, Raynovich forecasts a pickup in the market in the second half of 2020 and into 2021 as more enterprise employees are working from home and require secure, remote access services.

“Enterprises aren’t going to pay for people to have MPLS in their home, it’s too expensive. SD-WAN is serving its role as a quick, secure VPN for work-from-home situations. That’s a driver of growth,” Raynovich told Light Reading. SD-WAN is continuing to reduce dependence on MPLS and is becoming “one of the go-to solutions to work from home where there is no alternative,” he said.

IT and networking professionals cited “improved security tools and orchestration” (64%) as the top benefit of utilizing SD-WAN in their networks, according to a Futuriom survey of 100 networking and cybersecurity professionals. About 55% of respondents also cited improved management/automation/agility; better utilization of bandwidth/lower cost; and higher performance of cloud applications as the primary benefits of SD-WAN. As network security is a top priority for enterprises, the majority of SD-WAN vendors have added cloud security and next-generation firewall products from security suppliers such as Check Point, Zscaler and Palo Alto, according to the report.

…………………………………………………………………………………………………………………………………………………..

Separately,

Market Research Inc has recently published a new market assessment report titled “Global SD-WAN Market – Growth, Future Scenarios, and Competitive Analysis, 2019 – 2025”. The market study provides an extensive understanding of the present-day and forthcoming stages of the industry market based on factors such as major sought-after events, research ingenuities, management stratagems, market drivers, challenges and visions and all-encompassing industry subdivision and regional distribution.

A key utilization of SD-WAN is to enable organizations to fabricate higher-execution WANs utilizing lower-cost and economically accessible Internet get to, empowering organizations to mostly or entirely supplant progressively costly private WAN association innovations, for example, MPLS. The global market is forecasted to expand rapidly at a compound annual growth rate (CAGR) of +35%.

Request a Sample of this Report and Analysis of Key Players at https://www.marketresearchinc.com/request-sample.php?id=15951

……………………………………………………………………………………………………………………………………………………….

References:

https://www.lightreading.com/sd-wan/sd-wan-market-to-exceed-$4b-by-2023—report/d/d-id/761907?

New T-Mobile no longer the “uncarrier”: layoffs, network outage, challenge integrating Sprint network

T-Mobile US Inc. is cutting jobs faster than initially planned after its April merger with rival Sprint Corp. created a company with about 80,000 employees. Before regulators signed off on T-Mobile’s $26 billion merger with Sprint, executives like former CEO John Legere said that the merger would create many new jobs from “day one.” With the ink barely dry on the deal, it’s abundantly clear that is NOT happening.

T-Mobile said in a securities filing late Wednesday that it expects to spend about $300 million more than initially projected on merger-related costs, primarily on severance expenses, to accelerate expected cost benefits from the deal. The company now expects merger costs before taxes to total $800 million to $900 million during the June-ended quarter. The “new T-Mo” didn’t detail the number of jobs being cut. T-Mobile ended 2019 with 53,000 workers. Sprint last reported 28,500 employees in early 2019.

T-Mobile Chief Executive Mike Sievert said Tuesday the company seeks to hire workers in 5,000 new positions like retail and engineering over the next 12 months. “As part of this process, some employees who hold similar positions are being asked to consider a career change inside the company, and others will be supported in their efforts to find a new position outside the company,” Mr. Sievert said.

The savings estimates T-Mobile provided investors suggest several thousand jobs are being eliminated, according to Jonathan Chaplin, a telecom analyst for New Street Research. Those cuts don’t include stores run by third-party dealers, some of which will switch to other brands, he added. “They will be cutting redundant positions, but adding other positions as they invest for growth,” Mr. Chaplin said.

T-Mobile last year told lawmakers that the then-proposed merger of the two wireless giants would yield more jobs at the combined company by 2024 than each business would employ on its own.

…………………………………………………………………………………………………………………………………………………

Back Story:

Last month, T-Mobile laid off an estimated 6,000 employees from its Metro prepaid division, layoffs that had everything to do with the merger, and nothing to do with the COVID-19 crisis. And on June 15th, hundreds of Sprint employees were unceremoniously fired as part of a six minute conference call during which nobody was allowed to ask questions:

“In a conference call on Monday lasting under six minutes, T-Mobile vice president James Kirby told hundreds of Sprint employees that their services were no longer needed. He declined to answer his employees’ questions, citing the “personal” nature of employee feedback, and ended the call.”

On June 19th, Tech Dirt’s Karl Bode wrote:

This was all ridiculously predictable. There’s 40 years of documented US telecom history showing that the elimination of a major competitor reduces competition and raises prices (oh hi, Comcast). Global markets (Canada, Ireland) have also made this clear. Such deals almost universally result in thousands of layoffs as redundant retail, support, and management positions are culled. It’s why similar deals of this type (AT&T’s 2011 acquisition of T-Mobile, T-Mobile’s 2014 acquisition of Sprint) were blocked. This isn’t a debate topic. It’s not a murky subject. Telecom consolidation routinely ends badly for employees and customers.

Economists made all of these points to the DOJ and FCC, but they were unceremoniously ignored. First by an FCC that couldn’t bother to even read its own staff analysis before rubber stamping the a merger it helped cook up behind closed doors, then by a DOJ whose “antitrust” boss personally escorted the deal to fruition while ignoring all criticism.

If you go back and look at some of ex-CEO John Legere’s blog posts from a few months ago (which I’m sure won’t be around much longer), the CEO repeatedly promised that the merger would be “job positive” from “day one”:

“So, let me be really clear on this increasingly important topic. This merger is all about creating new, high-quality, high-paying jobs, and the New T-Mobile will be jobs-positive from Day One and every day thereafter. That’s not just a promise. That’s not just a commitment. It’s a fact. To achieve what we’re setting out to do – become the supercharged Un-carrier that delivers new value, ignites competition and delivers nationwide real 5G for All – the New T-Mobile will provide an amazing and compelling set of services for consumers.”

Legere was so breathlessly offended by statements to the contrary, he tried to insist that union officials were lying — before reminding everybody he testified under oath about the deal’s looming job explosion:

“We also keep seeing the opposition try to use projected layoff numbers from an analyst’s projections that were based on a completely different deal at a completely different point in time to discredit this merger. It’s SO bad that the head of the Communications Workers Association (CWA) was bold enough to refer to those completely unrelated numbers in a CONGRESSIONAL HEARING. I guess if the real numbers don’t tell the story you want, you can just make up new ones? It’s actually offensive. At the hearings, I raised my right hand and swore under oath to tell the TRUTH… and the truth is that the New T-Mobile will CREATE JOBS.”

…………………………………………………………………………………………………………………………………………………

Network Outage:

T-Mobile network suffered a nationwide service failure on Monday. Federal regulators said they would investigate the incident, which led to intermittent voice and data coverage for about 12 hours. Company chief technology officer Neville Ray later said the problems stemmed from a supplier’s fiber optic circuit going down. But what happened to automated failure detection and recovery/restoral?

Cellphone carriers’ network backbones usually have several fallback routes should one path get severed. Mr. Ray said that “redundancy failed us and resulted in an overload situation that was then compounded by other factors.” The company said its Sprint customers weren’t affected and vowed to put new safeguards in place.

………………………………………………………………………………………………………………………………………………

Integrating Sprint’s 3G and 5G networks:

The “new T-Mo” also faces the challenge of integrating Sprint’s 3G CDMA network with its own 3G GSM network. Also the two former carriers were designing different 5G NSA networks, albeit both using 3GPP Release 15 “5G NR” for the data plane.

T-Mobile has had difficulty integrating Sprint’s customers and network assets and building out a faster 5G network throughout the country, The Wall Street Journal reported in May.

Despite pandemic-related challenges, T-Mobile has begun the process of integrating Sprint into the new stand-alone company and tapping into the trove of airwaves it acquired as part of the deal. Many of T-Mobile’s current executives remain in charge, though some Sprint leaders including technology chief John Saw hold key posts in the combined company.

………………………………………………………………………………………………………………………………………………..

Separately, AT&T has outlined plans to cut more than 3,400 jobs in the coming weeks, according to the Communications Workers of America, which represents a large share of the telecom and media giant’s 244,000 employees. Those cuts exclude hundreds of other positions potentially eliminated through store closures.

AT&T said it will make “targeted, but sizable reductions in our workforce across executives, managers and union-represented employees” as it overhauls its employee base. The carrier also is closing more stores to cater to online shoppers, a shift the company said it accelerated in response to the coronavirus crisis.

“Reducing our workforce is a difficult decision that we don’t take lightly,” AT&T said in a statement.

In light of the tens of thousands of AT&T layoffs the last few years, does anyone seriously believe that statement?

…………………………………………………………………………………………………………………………………………….

References:

https://www.wsj.com/articles/t-mobile-and-at-t-are-cutting-thousands-of-jobs-11592501203

https://www.wsj.com/articles/t-mobile-to-feel-coronavirus-pain-through-2020-11588799462

Ericsson: U.K. Telecom Rules May Hinder Country’s 5G Opportunity

Bloomberg reports that the U.K. risks missing the benefits of fifth-generation (5G) wireless networks, because of policies that could lead to an expensive and inefficient roll-out, according to Swedish telecommunications equipment giant Ericsson AB.

“Decisive action is needed — uncertainty is not good for business and it could delay the roll-out of the U.K.’s 5G network, putting the country’s long-term competitiveness at risk. The U.K. was late in adopting 4G and largely missed the economic opportunity that came with it. There is a real possibility of history repeating itself.” said Arun Bansal, head of the wireless equipment supplier’s European and Latin American operations.

Bansal identified several concerns with U.K. policy. He said there’s a risk the airwaves (frequency spectrum) owned by different carriers could be fragmented and inefficient. International cooperation is required so the same frequency bands are used within the country.

NOTE: It is the job of ITU-R WP5D to update ITU-R M.1036 Frequency arrangements for implementation of the terrestrial component of International Mobile Telecommunications (IMT) in the bands identified for IMT in the Radio Regulations. WP 5D gets spectrum recommendations inputs from WRC 19 meeting outputs from last Fall. A new version of M.1036 must be completed before IMT 2020 (5G) RIT/SRIT specs are approved.

The telecom regulator in each country is then responsible for assigning frequencies to each IMT service, e.g. 4G and 5G within their country. The U.K. telecom regulator is OFCOM. In the U.S. it’s the FCC.

………………………………………………………………………………………………………………………………………..

Bansal also noted the country’s required planning approvals are slowing engineers’ work and making it more expensive, Bloomberg reported He urged the government could do a better job at supporting 5G as a potential replacement for landline broadband, the report said.

Britain’s government rejected the criticisms and said reforms have made network deployment cheaper and easier.

In a statement, the U.K. Department for Digital, Culture, Media & Sport told Bloomberg that the country’s campaign to roll out gigabit-capable broadband nationwide “is technology neutral, and we would be happy to meet with the supplier to discuss the role of 5G.”

Ericsson has been positioning itself to supply British carriers with billions of pounds’ worth of 5G equipment. With U.K. officials now looking to curtail the role of its Chinese rival Huawei Technologies Co. amid growing tensions with Beijing, that potential opportunity has grown — as long as Ericsson can show it’s able to match Huawei’s technological edge.

Bansal didn’t mention Huawei by name. However, he denied claims that Ericsson was technologically behind any other player, and said it’s ready for whatever approach Britain chooses. “We ship enough 5G-ready radios to cover the greater London area every single day,” he said.

……………………………………………………………………………………………………………………………………………………….

Bansal’s allegations comes one week after O2, the London-based telecommunications services provider owned by Telefónica, selected Ericsson to deploy its 5G across the UK and upgrade the existing 2G/3G/4G sites as part of a major network modernization program.

In April, BT said it would use Ericsson equipment for the core of its 5G network. Ericsson would provide a “cloud native, containerized” core for 4G, non-standalone 5G, and eventually 5G standalone services, which will become a converged IP network.

NOTE that there are no standards or specifications for such a core network. The only 5G core spec we know of is 3GPP Release 16 specification TS.23501 5G Systems Architecture-V16.4.0 (27 March, 2020) which does not specify how to build a cloud native containerized core network.

“The containerization of core network functions will enable BT to benefit from greater industry innovation in many areas, including automation, orchestration, network resilience, security, and faster upgrade techniques,” Ericsson said at that time. “This means increasing overall network availability for customers and services while being cost-effective.”

……………………………………………………………………………………………………………………………..

Last month, PYMTS reported COVID-19 has prompted Ericsson to update its forecast for worldwide 5G subscriptions to 2.8 billion by 2025 from 2.6 billion, the company said in a webinar.

“We’re witnessing transformative changes just in the last two months,” Patrik Cerwall, Ericsson’s head of strategic marketing, said in the “Unboxed Office” event that was broadcast live on Periscope.

Amy McCune, Ericsson North America’s vice president and chief operations officer, told PYMNTS in May that shifts in lifestyle, work and healthcare are accelerating the demand for the next generation of wireless communications technologies.

……………………………………………………………………………………………………………………………………

References:

Ericsson Says UK Telecom Rules Are Slowing 5G Installs And Driving Up Costs