Author: Alan Weissberger

European Union plan for LEO satellite internet system

The European Union is considering revised plans for a low-Earth orbit (LEO) satellite internet system that would take on SpaceX/Starlink, OneWeb, Amazon Kuiper, Telesat and other LEO satellite internet players in a bid to lessen Europe’s reliance on US technology for secure connectivity, the Financial Times reports (paywall applies). The Secure Communications Initiative, as the proposed system is called, is the brainchild of Thierry Breton, the EU’s internal market commissioner, who wants the bloc to build a third satellite constellation for secure Internet access. The EU already has the Galileo system for navigation and Copernicus for Earth observation. Similar proposals have already been rejected twice, says the report, but Breton is hoping these amended plans will be able to snake their way through the EU’s notoriously slow-moving internal approvals process.

Breton told a press conference in Strasbourg on Tuesday: “This is of central importance in terms of our strategic and technical sovereignty.” He added that it would be connected to other unnamed satellite constellations to save money. Regarding obtaining the spectrum to broadcast the signals, he said: “We know where to find this frequency. It is not an issue.”

Context of the Proposal- from the Explanatory Memorandum:

The general objective of this proposal is to establish a Union secure satellite communication system (hereafter the ‘Programme’) that ensures the provision of worldwide secure, flexible and resilient satellite communication services to the Union and Member States governmental entities. Satellite communications provide ubiquitous coverage, which is complementary to terrestrial networks (ground-based in a digital communication in areas where terrestrial networks are absent (e.g. oceans, during flights, or in remote locations / islands with no cellular or broadband coverage), have been destroyed (e.g. during flooding events, or forest fires) or where local networks cannot be trusted (in crisis situations, or for diplomatic services in third countries or for sensitive governmental operations).

The signals from the new system would be encrypted and offered to Europe as well as Africa to give that continent an alternative to Chinese-built infrastructure. It would also provide a back-up in case of cyber attacks on broadband networks.

The reusable first stage of a SpaceX Falcon 9 rocket returns to land after deploying a satellite this month. The EU wants its own sovereign satellite internet system © Patrick T Fallon/AFP/Getty

References:

https://www.ft.com/content/329d7c77-b4fe-4753-910b-60a4a29eb436

Big 4 European network operators call for content platforms to fund telecom infrastructure

Several large European network operators are calling for OTT platforms and cloud giants to contribute towards the cost of the telecom infrastructure they use to deliver content to end users. In an open letter published in the Financial Times, the CEOs of Vodafone, Telefónica, Deutsche Telekom, and Orange have expressed their serious concern that content platforms should contribute towards building the connectivity infrastructure they rely on.

“The current situation is simply not sustainable. The investment burden must be shared in a more proportionate way. Today, video streaming, gaming, and social media – originated by a few digital content platforms – account for over 70 percent of all traffic running over the networks. Digital platforms are profiting from hyper scaling business models at little cost while network operators are taking on the investment required for network connectivity. At the same time, our retail market profitability has been declining.”

The CEOs note that data traffic increasing by up to 50 percent annually and claim they’re unable to make a viable return on their investments. They say it puts further infrastructure development at risk. They cite Sandvine’s Global Internet Phenomena Report, released in January 2022, stating that video streaming, gaming and social media “generated by a handful of digital content platforms” account for more than 70 percent of all traffic on the web.

Source: Sandvine

………………………………………………………………………………………………………………………………………………………………………………………

Despite being the leading providers of mobile services throughout the continent, the executives claim they are no match for the “strong market positions, asymmetric bargaining power, and the lack of a level regulatory playing field” enjoyed by tech giants.

“Consequently, we cannot make a viable return on our very significant investments, putting further infrastructure development at risk,” the CEOs added. “If we don’t fix this unbalanced situation Europe will fall behind other world regions, ultimately degrading the quality of experience for all consumers.”

They noted that South Korea is discussing a national law that would create regulatory conditions for a more equitable sharing of internet costs — in part because of the popularity of Netflix’s “Game of Squids.” Following that success, South Korean network operator SK Telecom sued Netflix over the costs it claims to have incurred from increased network traffic and maintenance work

“In the U.S., policymakers are also turning to universal services that are also funded by digital platforms,” the CEOs added.

While the joint statement did not explicitly mention net neutrality, the CEOs complained that “network operators are unable to negotiate with these mega-platforms due to their own strong market positions, asymmetric bargaining power between the parties and lack of a level regulatory playing field. Fair terms.”

The joint statement also echoes recent comments by Marc Allera, chief executive of BT’s consumer division, who noted “a complete lack of coordination on many data-intensive events.” Allera said, “Every operator’s network is suffering from stress, everyone’s internet has become more unstable than before.”

………………………………………………………………………………………………………………………………………………………

References:

https://www.ft.com/content/68f989f5-96e6-440e-90f4-2a11840d9c99

https://min.news/en/tech/c3e4e694a7c423425fbdbefa8de94c01.html

European operators want platforms to contribute towards infrastructure

https://digital-strategy.ec.europa.eu/en/policies/digital-principles

Juniper Research: Cellular IoT market expected to hit $61B by 2026

A new study from Juniper Research has found that the global value of the cellular IoT market will reach $61 billion by 2026; rising from $31 billion in 2022. It identified the growth of 5G and cellular LPWA (Low-power Wide Area) technologies as key to this 95% increase over the next four years.

The new study, Cellular IoT: Strategies, Opportunities & Market Forecasts 2022-2026, predicts that, LPWA solutions, such as NB-IoT and LTE-M, will be the fastest-growing cellular IoT technologies over the next four years. It anticipated that the low cost of both connectivity and hardware will drive adoption for remote monitoring in key verticals, such as agriculture, smart cities and manufacturing. In turn, LPWA connections are expected to grow 1,200% over the next four years.

The report urged operators to migrate IoT connections on legacy networks to networks that support LPWA technologies. It anticipated that demand from enterprises for low-cost monitoring technologies, enabled by LPWA networks, will increase as these legacy networks are shut off over the next four years.

Research co-author Charles Bowman commented: “Operators must educate users on the suitability of LPWA as a replacement technology for legacy networks. However, many IoT networks cannot solely rely on LPWA technologies. More comprehensive technologies, such as 5G, must underpin IoT network architectures and work in tandem with LPWA technologies to maximize the value of IoT services.”

5G to Generate $9 Billion for the IoT Market by 2026 (???):

The report predicted that 5G IoT services [1.] will generate $9 billion of revenue by 2026; rising from $800 million in 2021. This represents a growth of 1,000% over the next five years as 5G coverage expands and operators benefit from the increased number of 5G IoT connections. To capitalise on this growth, it recommended operators offer value-added services, such as network slicing and edge computing, to IoT users to maximise the value of 5G adoption.

Note 1. We believe that premium 5G-based IoT services must use the ultra-reliable low-latency communication (URLLC) 5G use case for which the 3GPP spec URLLC in the RAN has yet to be completed. Mission critical apps need ultra high reliability while real time control of IoT devices require ultra low latency. That won’t happen till the spec is complete, performance tested and implemented widely. URLLC will also required a 5G SA core network to prioritize URLLC traffic ahead of eMBB data flows.

Premium 5G URLLC services are expected to command a higher price and therefore generate proportionally more revenue per connection. However, they will likely still be in the early stages of deployment and uptake in 2026.

…………………………………………………………………………………………………………………………………

In contrast to Juniper’s bullish cellular IoT forecast, others have forecast non cellular LPWAs to be the big IoT connectivity winners.

- Ericsson predicted in a November 2020 Mobility Report that by 2026, cellular will account for 5.9 billion of the expected 26.9 billion IoT connections.

- Transforma Insights’ most recent forecast is for 19.9 billion IoT connections by 2026, with 3.2 billion of those being cellular connections. That implies the majority of LPWAs will not be cellular based, e.g. LoRA WAN, Sigfox, others.

We agree with Nick Wood’s of telecom.com who concluded, “Juniper’s forecast implies that 5G is not about to make a meaningful contribution to operators’ IoT revenues any time soon.”

References:

https://www.juniperresearch.com/press/cellular-iot-market-value-to-exceed-61b-globally

Analysts: Increased Fiber internet services may force cablecos to alter pricing & deploy FTTP

Several analysts believe the increased availability of Giga bit/sec FTTP (fiber to the premise) service offerings (with flat rates) could force cablecos to rethink their pricing strategy. For example, Jonathan Chaplin of New Street Research stated in a note to clients that cable’s promotional pricing is generally competitive with fiber offers. The problem, however, is that cable service ends up costing consumers significantly more than fiber based broadband access once those introductory rates disappear. “We have hypothesized for a couple of years that 1) Cable’s pricing strategy contributes to high churn and low NPS scores and 2) that it is unsustainable. We don’t think Cable has to cut price to remain competitive; we suspect they do have to fix the pricing model.”

Recon Analytics founder Roger Entner agreed, telling Fierce Telecom his research has shown price is the number one reason people join or leave a service provider. While consumers find promotional pricing very attractive, they’re generally unhappy when their promotions end. “So, for the cable companies, it’s both a gross addition driver and a churn driver as well,” he explained. While cable’s pricing strategy worked well when there was no competition to offer similar broadband speeds or features, that is now changing as fiber is becoming more broadly available, Entner said.

Indeed, fiber based telcos are already seizing on the opportunity to lure customers in with the promise of more simplistic pricing. For instance, AT&T used its recent launch of multi-gig fiber broadband plans as an opportunity to introduce new “straightforward” pricing which promises a flat rate with equipment and other fees included.

Speaking on an episode of Entner’s podcast, AT&T’s EVP and GM of Broadband Rick Welday stated there is “significant” demand in the market for simple pricing. “It’s obvious that consumers are done with this intro pricing where you see a fun, attractive, low rate advertised on television, you go sign up with that ISP and then 12 months later your rate jacks up considerably. Frankly, this is the model that cable has chosen. It seems to align with their video business and annual increases in carriage fees,” he said. Welday argued AT&T’s new cost model is a “game changer in terms of an ISP really obsessing over how to be transparent and upfront with the market.”

Chaplin said a shift by cable to the flat pricing model fiber players use might “weigh on gross adds initially.” However, he predicted net additions would ultimately “land in a similar place” over the course of a couple years while reduced churn would yield “lower costs and higher margins.”

Despite the potential benefits, Entner said he doesn’t expect cable to change its approach right away. “The system is still working and so you have a lot of inertia in the system. Only when cable is actually losing customers will this change,” he concluded.

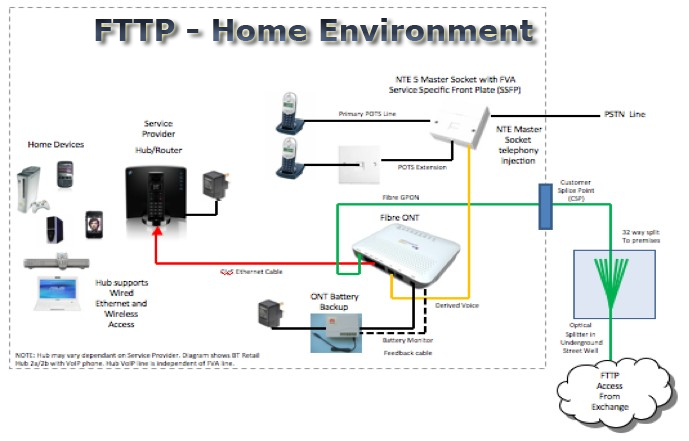

Source: https://kitz.co.uk/adsl/fttp.htm

In addition, cablecos are planning FTTP deployments in the near future. I’ve heard that directly from an anonymous Comcast executive who told me to look out for their upcoming 10G bit/sec service.

We previously reported that a Cable One joint venture (JV) with three private equity firms is seeking to speed its expansion of fiber based Internet access to underserved markets. Clearwave Fiber is a newly formed joint venture that holds Clearwave Communications and certain fiber assets of Hargray Communications. Cravath is representing Cable One in connection with the transaction. With the formation of the JV, Clearwave Fiber intends to invest heavily in bringing Fiber-to-the-Premise (“FTTP”) service to residential and business customers across its existing footprint and near-adjacent areas.

Meanwhile, CableLabs has developed technologies that fall under the platform’s key tenets including capacity, security and speed. Increasing the number of bits per second that are delivered to subscribers can improve download and upload speed, a primary objective for the 10G platform. As data demands increase, many operators are considering increasing capacity on the existing optical access network.

To help operators better meet that demand, CableLabs recently published its first set of specifications for a new device, called the Coherent Termination Device, that enables operators to take advantage of coherent optics technologies in fiber-limited access networks.

References:

https://www.fiercetelecom.com/broadband/analysts-fiber-could-force-cable-overhaul-its-pricing-model

https://www.fiercetelecom.com/operators/at-t-puts-cable-companies-notice-fiber-plan

https://kitz.co.uk/adsl/fttp.htm

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

10-Gbps last-mile internet could become a reality within the decade from Futurology

WideOpenWest picks Seminole County, FL as its 1st greenfield area for FTTP deployments

MetroNet’s FTTP buildout in Florida; Merger with Vexus Fiber

Cable One joint venture to expand fiber based internet access via FTTP

Vodafone-Oracle latest deal between 5G telco and “cloud native” service provider

UK network operator Vodafone has signed a deal with enterprise software maker Oracle to implement its cloud native network policy management platform into its 5G core network. This is consistent with the trend of cloud service providers (like Amazon, Microsoft and Google) to ink contracts with wireless network operators for their cloud native 5G SA core network, thus taking over all the intelligent functions, features and services that 5G can (theoretically) provide. In general, alliances between cloud giants and wireless telcos are increasing at a rapid rate.

The cloud platform is based on the ability to dynamically prioritize low-latency applications to edge data networks, while optimizing network policies based on data analytics. With Oracle’s cloud native network policy management solution as part of its 5G core, Vodafone says they will be able to make more intelligent policy decisions and quickly test and deploy new services.

“Moving to ‘cloud native’ is a culture shift as much as it is a technology shift for a telecom company like Vodafone,” said Andrea Dona, chief network officer, Vodafone UK. “Our partners must demonstrate flexibility and agility, as well as aligning to our vision of how technology will augment and support tomorrow’s digital society,” she added.

Converged policy management is comprised of the 5G Core Policy Control Function (PCF) and the Policy and Charging Rules Function (PCRF). The solution helps to dynamically prioritizes low-latency applications to edge data networks, while continuously optimizing network policies based on data analytics. For example, based on the data, the solution can help Vodafone customers get the network offering that best suits their needs, be it connecting smart devices, utilizing live streaming, or enabling AR/VR gaming. As such, Vodafone can provide a seamless experience across 4G and 5G networks while simultaneously delivering a smooth integration of new 5G services. The solution will be deployed by Oracle Communications consulting.

“5G undoubtedly opens the door for endless new ways to engage with our world, but intelligent policy management is the entryway to capitalize on these opportunities,” said Andrew Morawski, senior vice president and general manager, Oracle Communications, Networks. “Our 5G and cloud capabilities are helping Vodafone to build a future-proof network that is automated, easier to scale, simpler to operate, and more cost-effective.”

Aligned with the Cloud Native Computing Foundation (CNCF) [1.], Oracle’s cloud native 5G core control plane features network functions, including the policy control, that help operators automate and scale to meet the expected growth in 5G subscribers and connected devices. Learn more about how Oracle is powering the future of 5G.

Note 1. Cloud Native Computing Foundation (CNCF) serves as the vendor-neutral home for many of the fastest-growing open source projects, including Kubernetes, Prometheus, and Envoy. CNCF) hosts critical components of the global technology infrastructure. CNCF brings together the world’s top developers, end users, and vendors and runs the largest open source developer conferences. CNCF is part of the nonprofit Linux Foundation.

Oracle also has similar relationships with Italian carrier TIM, Indian carrier Bharti Airtel, and other international telecommunications companies. The company currently has 37 cloud computing regions in 20 countries. It is trying to compete with Amazon AWS, Microsoft Azure, and Google Cloud in the cloud infrastructure and platform as a service markets, along with its telecom cloud ambitions.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Just last week Oracle struck a global cloud deal with Spanish telecoms group Telefónica, where the two firms will jointly offer platform-as-a-service (PaaS) and applications to enterprises and public sector organizations. As cloud computing continues to become more embedded in the telecoms sector, and the wider world besides, we can expect to see many more partnerships of this type in the future.

Telefónica will also become the host partner for the Oracle Cloud Madrid Region. It is Oracle’s first cloud region in Spain, and will offer enterprises and public sector bodies there a secure and reliable connection to its range of services. It will also help businesses address their in-country data residency and compliance requirements, Oracle said.

“With Oracle Cloud Infrastructure, we are complementing Telefónica’s robust cloud services offering with a cloud platform that has seen strong growth over the last year as customers all over the world use it to run their most mission-critical workloads,” said Albert Triola, country leader, Oracle Spain.

Source: Gartner

………………………………………………………………………………………………………………………….

References:

https://telecoms.com/513455/vodafone-recruits-oracle-cloud-platform-to-bolster-5g-core/

https://www.oracle.com/industries/communications/

Why are alliances between operators and cloud giants multiplying?

Oracle and Telefónica Tech Partner to Offer Global Cloud Services

Telegeography: Legacy MPLS networking declines; Direct Internet Access surges

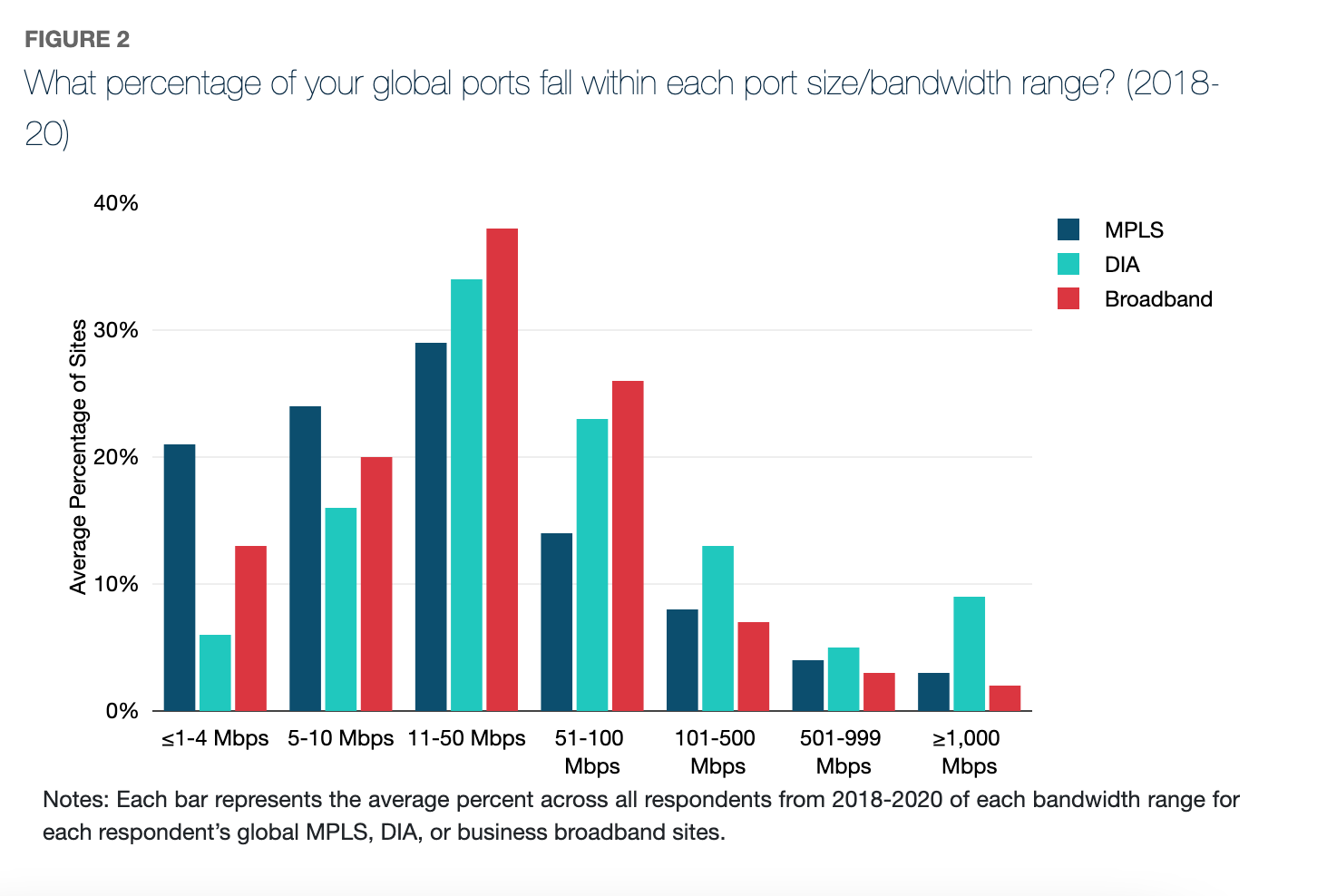

TeleGeography, a global telecommunications market research and consulting firm, has released its 2021 WAN Manager Survey, revealing that Direct Internet Access (DIA) is gaining ground on MPLS, with 42% of average sites running the product in 2021.

At the same time, survey responses show a clear downtrend in MPLS use, from a dominant high of 82% of sites running the product in 2018 down to 46% in 2021. It marks the first time this figure has dropped below half of average sites. This shift to DIA reflects the plans of many WAN managers to reduce their reliance on MPLS in their networks.

Key Findings:

• For the first time, MPLS usage dipped below half of average sites—46% of sites were running MPLS in 2021.

• DIA is hot on the heels of MPLS, with 42% of average sites running the product in 2021.

• MPLS usage at average WAN sites has declined by 5% compounded annually over four years, while DIA and broadband usage has climbed by 3% and 1.5% each year across the same time period.

• WAN managers want more bandwidth. Across MPLS, DIA, and broadband, the percentage of large port sizes being procured is growing, while port sizes 50 Mbps and under are declining 1-3% compounded annually.

• The most common strategy for backing up MPLS is using an alternative connectivity service like DIA or broadband.

• Zero Trust Security adoption is on the rise, growing from just 8% of respondents in 2019 to 35% in 2021, and the knowledge gap is narrowing.

• Multi-factor authentication (MFA) and single sign on (SSO) are the top ZTS features implemented.

• Increased remote work is the top factor driving companies towards ZTS solutions.

• Top network infrastructure security vendors in hardware–Palo Alto, Cisco, and Fortinet–also lead in the software-based security vertical.

TeleGeography’s WAN Manager Survey features analysis based on the experiences of WAN managers from 185 companies with a median revenue of $10 billion USD. The 2021 focuses on IT managers whose day-to-day role covers designing, sourcing, and managing U.S. national, regional, and global corporate wide area computer networks. It also includes 60 new responses across various industries.

TeleGeography’s report highlights how the extension of COVID-related remote work has accelerated many ongoing WAN trends like migration to the cloud, SD-WAN adoption, and incorporation of alternative access technologies into the underlay. To that effect, the team found that DIA and business broadband usage have been on the rise, with DIA experiencing a four-year CAGR increase of 3% and broadband logging an increase of 1.5%.

“Through our survey, we can see that enterprise companies are embracing hybrid networks more and more. MPLS usage in our respondents’ WAN has been declining steadily, and in 2021 we saw a near-equal ratio of MPLS and DIA in the average network. Given these rates, we’ll have an eye on DIA usage to perhaps overtake MPLS in future surveys,” said Elizabeth Thorne, Senior Analyst at TeleGeography.

TeleGeography’s new survey also reveals WAN managers’ views on zero trust security (ZTS) and secure access service edge (SASE) adoption. ZTS adoption is on the rise, growing from just 8% of respondents in 2019 to 35% in 2021, a significant increase in just two years.

Telegeography asked WAN managers how far along they were in implementing ZTS (Zero Trust Security) or SASE (Secure Access Service Edge) security policies on their network. Here are the results:

• Implementation of one or more elements of ZTS/SASE on at least some of the respondent’s network jumped from just 8% in 2019 to 35% in 2021, a significant increase in just two years.

• There’s been a narrowing of the knowledge gap. Just 8% of respondents were unfamiliar with ZTS in 2021, compared to one in five in 2019.

• Overall we saw a shift down the deployment pipeline, with reductions in the percentage of respondents who either had not started, or were just beginning their implementation journey.

• In 2021 we introduced the option “Waiting on SD-WAN,” as in past interviews many respondents indicated that their adoption of zero trust policies was incumbent on their SD-WAN deployment. That is reflected in the results, as it was the second most common–28%–stage respondents were in.

Other findings:

- Fixed Wireless Access (FWA) represents a small percent of average WAN sites, often used as backups or temporary connectivity.

- Satellite had the lowest reported average usage, and has maintained its reputation as an expensive connectivity option of last resort.

…………………………………………………………………………………………………………………..

End Quote:

“Enterprise networking is evolving, in part due to an increase in remote working. Network managers are facing the challenge of accommodating a remote-friendly, work-from-anywhere environment and many will likely be moving toward internet-first networks and further away from MPLS in the coming years,” said Greg Bryan, Senior Manager at TeleGeography.

References:

https://www2.telegeography.com/download-the-wan-manager-survey-executive-summary

Lumen Technologies Fiber Build Out Plans Questioned by Analysts

Lumen Technologies is one of a large and growing number of telecom companies counting on a broad expansion of its fiber network. The Fiber Broadband Association (FBA) recently reported that the fiber industry is entering its “largest investment cycle ever” thanks to the efforts of companies like AT&T, Verizon and Lumen.

Lumen hopes to build its fiber network to 12 million new locations over the coming years. But it won’t be easy, according to Lumen CEO Jeff Storey.

“Supply chains are stressed, and we continue working very closely with our diverse and valued suppliers to mitigate risk as we execute on our growth objectives,” Storey said this week during his company’s quarterly conference call, according to a Seeking Alpha transcript. Others have issued similar warnings.

“I don’t want to overstate the issue, but it’s something that we are really paying attention to and working with vendors. We are starting to see some companies hold off on taking new orders. And as we see that, then we are working to put in our mitigation plans to make sure it’s factored into our build plan. But it is an issue that I will highlight as a real one that we have to mitigate.”

Lumen Technologies reported fourth-quarter results and 2022 expectations that generally fell below the forecasts of some financial analysts.

“Lumen’s 2022 guidance will fuel concerns that the company will have no choice but to eventually let leverage rise to inappropriate levels, dial back on investment, cut the dividend, or choose some combination thereof,” wrote the financial analysts at MoffettNathanson. “In particular, 2022 EBITDA [earnings before interest, taxes, depreciation, and amortization] guidance was noticeably below expectations at a time when capex will be elevated.”

“Results at this stage don’t give investors confidence in the company’s ability to earn an adequate return,” wrote the financial analysts at New Street Research.

Lumen and other fiber providers like Frontier Communications and AT&T are moving forward with their fiber buildout plans. Some, like AT&T and Frontier, are reporting big gains in the number of their new fiber customers. But others, like Lumen, are not.

“The past few quarters have been relatively weak for broadband net additions for Lumen, even for its higher-speed fiber offering,” MoffettNathanson said of Lumen’s consumer broadband business. “This quarter’s broadband net adds were at the low end of what the company has reported over the past few years and were shy of consensus estimates.”

The financial analysts at Evercore wrote that Lumen’s business segment drives three-quarters of the company’s revenue, and that too remains stressed. “The jury remains very much out on the company’s prospects in this sector,” they wrote, noting that sales in the company’s business segment declined slightly in the fourth quarter when compared with the third quarter of last year.

New Street analysts say a key metric for Lumen will be the percentage of customers in a given area who opt to purchase its new fiber optic access. If Lumen gets 40% of potential customers to sign up, the company likely will generate profits. “At 30%, the company would likely destroy value,” they warned.

Lumen CEO Storey stated that the company has already managed to get an average of around 29% of customers in its new fiber markets to sign up for its service. And that, he said, is with relatively little marketing.

He expects that number to be above 40% in the months and years to come. “If you look at the quality of the product that we have, we have a very effective competitive product and even with the limited marketing, we are doubling our penetration rates in our traditional copper areas,” Storey said.

New findings from the financial analysts at Cowen are supportive of Lumen’s fiber optic build out plans. The Cowen analysts recently conducted a nationwide survey of more than 1,000 respondents and found that fiber-to-the-home (FTTH) “take rates” reached 56% among those surveyed.

“Take rate, or more specifically, market penetration, is a key driver of the FTTH business case,” they wrote. “We have previously noted that a penetration rate of 30-35% is the typical minimum break-even threshold when underwriting FTTH projects. When there is one broadband competitor, fiber penetration can approach high-50s and even 60% penetration levels in mature markets.”

Lumen CMO Shaun Andrews said: “One of the things that really differentiates us right now is our focus on fiber as part of the core infrastructure to an edge experience versus a distraction with 5G or content. And being able to look an enterprise in the eye and say ‘Not only do we have these capabilities, but we will build the fiber to you where you are.’ That resonates with customers, and I think that’s a differentiator.”

…………………………………………………………………………………………………………………………

Last month, Lumen reported that they secured a massive $1.2 billion contract with the U.S. Department of Agriculture (USDA), setting it up to give one of the biggest government agency networks a major makeover.

Under the contract, Lumen will “completely transform” the USDA’s network covering 9,500 locations across the country. It will provide a range of services, including SD-WAN, managed trusted internet protocol, zero-trust networking, edge computing, remote access, virtual private networking, cloud connectivity, unified communications and collaboration, contact center, voice-over-internet protocol, ethernet transport, optical wavelength, and equipment and engineering.

References:

https://www.lightreading.com/opticalip/analysts-fret-over-lumens-fiber-plans/d/d-id/775229?

https://www.fiercetelecom.com/telecom/lumen-reels-12b-contract-overhaul-usdas-legacy-network

Lumen’s big fiber roll-out push from 2.5M to 12M locations passed in the next few years

Lumen Technologies to empower customers to set up the wavelength subnetworks

CenturyLink rebrands as LUMEN for large enterprise customers; adds Quantum Fiber

ZTE using TSMC’s 7-nm process to build custom chips for its 5G base stations

ZTE is on a roll! China’s #2 telecom firm said in its annual report that it gained market share in China last year for servers, core networks and storage solutions — the three areas where Huawei is a key player. Revenues grew at a double-digit percentage rate last year, rising inside and outside China and across all three business units – carrier (networks), enterprise (business) and consumer (gadgets).

With TSMC’s business booming, Nikkei Asia believes that ZTE is quietly building a technological edge in the base station market for fifth-generation (5G) cellular connectivity. These base stations are used by telecommunications carriers to meet consumer demands, and the publication believes that ZTE has designed its equipment to be based on the 7-nanometer (nm) process node.

The company [ZTE] has been utilizing some of TSMC’s most advanced chip production technology — the so-called 7-nm tech — to build processors for its 5G base stations. Sources said it also uses the Taiwanese chipmaker’s advanced chip packaging technology, which uses stacking technology to arrange chips with different functions into one package.

Nikkei Asia also said that Huawei’s inability to conduct business with TSMC due to American sanctions has left the field wide open for ZTE. The company is targeting double-digit growth for its server and base station segment, and it is also interested in TSMC’s leading-edge chip node, which is the company’s 5nm process.

However, while ZTE might not be sanctioned to procure the latest chip technologies from TSMC, the company still can not sell its 5G base stations to several Western companies. This has resulted in it focusing its efforts mostly on China, as the U.S. will rely on small cell 5G Open RAN platform developed by Qualcomm Incorporated on the 4nm node.

Source: Jordi Boixareu/Alamy Live News

“ZTE has turned quite aggressive in pursuing its chip capability in the past few years. Although the volume is still small, it is showing impressive progress,” said one unnamed source.

TSMC, as well as ZTE, seems to be on a very solid growth track. On the back of another robust set of quarterly financials Q4 FY21 and a strong balance sheet, the world’s #1 chip making firm announced a massive capex budget hike to increase manufacturing capacity in “advanced process technologies,” including 2nm, 3nm, 5nm and 7nm.

TSMC also sells products built on the 4nm, which is a design extension of the company’s 5nm process families. Different process technologies marketed under the 4nm branding are expected to commence production from the second half of this year to the first half of 2023.

References:

https://wccftech.com/tsmc-reveals-36-revenue-growth-as-chinas-zte-reportedly-using-7nm-for-5g/

https://www.lightreading.com/asia/zte-has-designs-on-chips-with-tsmc/d/d-id/775180?

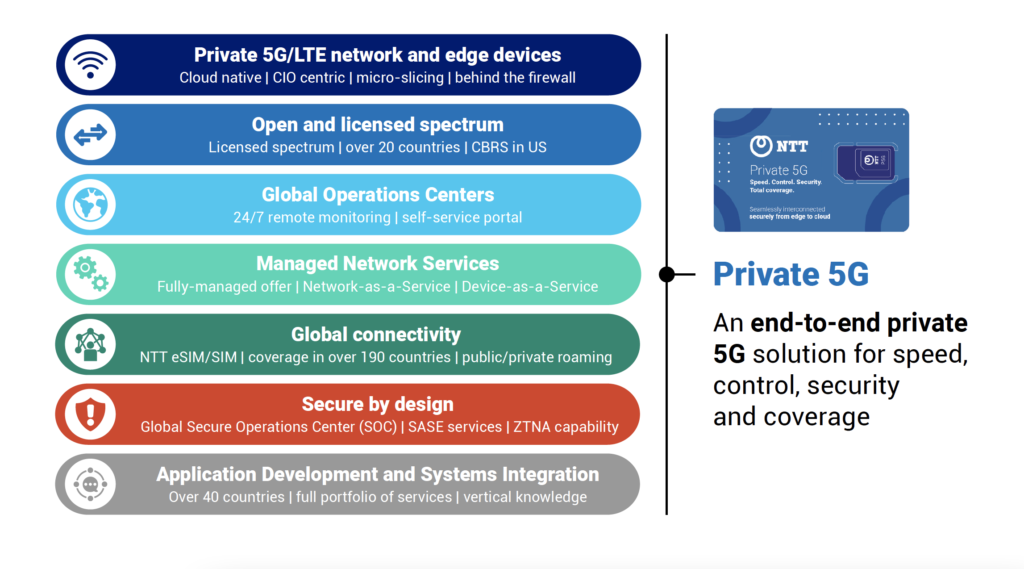

NTT: Biggest challenges to effectively integrate private 5G into existing infrastructure and applications?

by Shahid Ahmed of NTT

Introduction:

For most countries, the public 5G networks are expected to enable users to experience a whole new level of connectivity. Enterprises are wanting to make the most of the network as well. While the public 5G networks do offer enterprise solutions and services, a private 5G network might just be the better option for them.

Why should enterprises consider a private 5G network?

Shahid Ahmed, Group EVP, New Ventures and Innovation at NTT Ltd.

…………………………………………………………………………………………………………………………….

As enterprises continue supporting wider digitization, the demands on secure and reliable connectivity solutions are increasing. NTT recently partnered with the Economist Impact and interviewed over 200 CIOs globally, and our findings show they expect to benefit from the improved data control, privacy, and security as the most anticipated outcomes of implementing private 5G networks followed closely by improving workforce productivity through automation.

Advanced connectivity is an essential element for industrial automation applications in manufacturing facilities, Automotive, Hospitals, and Warehousing Facilities. Hence, private 5G networks provide a single network for mission-critical operational technology (OT) using micro-slicing to support manufacturing workflow automation, autonomous guided robots, and machine vision AI applications.

For most industrial applications, the cost of ownership for private 5G wireless is better than alternative technologies operating in an unlicensed spectrum. The TCO of private 5G wireless networks is lower (when compared to WiFi) because these networks provide wider (especially outdoor) coverage requiring far fewer access points which means less overall infrastructure to install and manage.

What are the biggest challenges when it comes to effectively integrating private 5G into existing infrastructure and applications?

Through NTT’s recently conducted CIO survey alongside secondary research, our findings revealed that the most common (44%) barrier to deploying private 5G networks is integrating the technology with legacy systems and networks. The complexity surrounding the deployment and management of private 5G networks was also cited as another significant barrier by 37% of respondents given that 5G technology is still in the early stages of its adoption lifecycle. Employees lacking the technical skills and expertise to manage 5G networks was the third most common barrier facing 30% of firms.

In view of these challenges, organizations could consider outsourcing their private 5G deployment to a managed service provider who will have the expertise when it comes to implementing private 5G networks. This is likely to be the most common approach to private 5G adoption, preferred by 38% of survey respondents. Buying a private 5G network ‘as-a-service’ can accelerate the adoption process and offer a better end-user experience and return on investment for companies.

Additionally, it is important to integrate the private 5G network into business operational workflows. For example, in cases such as safety and maintenance, these business processes and employee and machine workflows must be directly integrated into the network.

Source – NTT

………………………………………………………………………………………………………………………

How is NTT helping enterprises with their private 5G adoption? Are there any use case examples to share?

We have a range of commercial out of the box use cases and device solutions available; for example, autonomous guided robots, machine vision worker safety PPE detection, machine vision AI smart factory and smart building solutions, group communication Push to Talk (PTT), AR/VR connected workforce, and automate manufacturing workflow solutions. These are just some examples of use cases NTT has curated internally or together with our partners.

NTT’s private 5G (P5G) fully managed Network as a Service (NaaS) solution is ideally suited for enterprises in need of better security, data management, and privacy supporting their wider enterprise digitization initiatives. NTT further provides system design and integration services to integrate the network existing systems and application and network management upon completion of the network. The solution is pre-integrated with leading network suppliers, offering clients the flexibility to seamlessly work with any industry-certified applications.

When it comes to cybersecurity, will private 5G enable enterprises to have better visibility and control over their network?

Security is the main draw for enterprises when it comes to private 5G adoption. This was also one of the key findings from the Economist Impact survey with 83% of executives citing it as the number one reason why they wanted to build a private 5G network.

Private 5G enabled networks are built around Zero Trust (ZTNA) principles leveraging SIM-based (multi-factor) authentication and authorization, enhanced end-user data encryption, enhanced authentication, and data encryption between network sub-components and network slicing.

Together, these enhancements provide end-to-end security and strict access control, through device authentication and protecting sensitive data with network isolation. It enables true granular micro[1]slicing capabilities where traffic within the facilities and warehouses can be segmented according to enterprise IT/OT SLA needs.

Lastly, the 5G network has been making headlines in the US over concerns it can affect aircraft radar. Should businesses be concerned if a private 5G network might affect other machinery in their plants?

With regards to concerns relating to 5G networks affecting aircraft radar, discussion among wireless carriers as well as the airline industry and regulators are still ongoing, and it is too early to speculate on the way forward.

Private 5G networks in the US are different than Public 5G. Additionally, most private networks in the US will leverage the CBRS band which is an FCC-approved and shared band, much further removed from the frequencies used for aviation altimeters systems while operating at much lower power than public 5G networks.

Similarly, the risks of deploying private 5G to an organization’s machinery is unlikely – and because the networks are custom, the individual network can be configured properly so there is ZERO RISK. Companies may benefit from leveraging a managed service provider who will be able to manage the infrastructure, implementation process, and any ongoing operational risks.

References:

https://techwireasia.com/2022/02/enabling-more-enterprise-use-cases-with-private-5g-networks/

América Móvil: 5G deployment 1H-2022; pay-TV service in Mexico under discussion by IFT

América Móvil will begin this year the deployment of its 5G network in Mexico and all the countries in the Latin American region where it operates, with the exception of Colombia, said Daniel Hajj, CEO of the company.

The company, owned by magnate Carlos Slim, will invest around eight billion dollars this year, said the executive in a conference call with analysts. América Móvil expects to have 5G connectivity ready in 90 percent of its markets.

Hajj pointed out that although there is no specific date for the launch of the 5G network, he expects it to take place during the first half of this year. “I don’t have a specific date, but all over the year we’re working on a launch. I hope we can do it in the first semester of this year,” said Hajj said about 5G on a call with investors.

America Movil operates in at least 10 markets, mainly in Latin America.

The company on Tuesday reported that its fourth-quarter net profit more than tripled from the year-ago period, boosted by its sale of its TracFone wireless unit to Verizon Communications Inc. It posted a net profit of 135.6 billion pesos ($6.6 billion), compared with 37.3 billion pesos a year earlier.

The CEO also referred to the company’s plans to offer pay-TV service in Mexico, a request that is under discussion at Mexico’s telecom regulator- the Federal Telecommunications Institute (IFT).

At the end of January, the Plenary of the IFT reversed a project that denied the concession of a pay TV channel to Claro TV, a subsidiary of América Móvil, which postponed the decision on the request made by Carlos Slim‘s company more than three years ago.

However, Hajj said that they expect to have positive news on the matter and assured that the request before the regulator complies with all the regulations in force, in addition to the fact that it would benefit consumers.

“It is clear that competition would be good for consumers and the sector, and we believe that Claro and América Móvil is a clear alternative, so that will have to be determined by the IFT, and we expect positive news on that front,” a company executive said.

References: