Author: Alan Weissberger

US Ignite Pilot Program for 5G Living Lab at Marine Corps Air Station Miramar in San Diego, CA

- The 1st project will use the Verizon 5G network through a Cooperative Research and Development Agreement (CRADA) to offload data from an automated package-delivery shuttle.

- The 2nd project will track the development of four finalist applications selected in a recent 5G pitch competition, culminating in a demonstration event for U.S. Marine Corps and Department of Defense officials.

“Military bases, like smart cities, are a crucial testing ground for new sensor-driven technologies, particularly as we upgrade the nation’s wireless networks to 5G,” said Nick Maynard, Chief Operating Officer for US Ignite. “We have an opportunity at Miramar not only to experiment with systems to improve overall safety and efficiency on base, but also to help develop a framework of best practices that will serve smart bases and smart communities across the country.”

MCAS Miramar is part of the first wave of military bases deploying 5G networks. Through a partnership with Verizon, the base is fast tracking deployment of 5G and 4G small cells to supplement 4G LTE macro cells already in place. The upgraded wireless network serves as the foundation for the 5G Living Lab at Miramar, making it possible to experiment with digitally connected infrastructure to improve operational resiliency.

“We can create a smarter, more connected military base by working collaboratively across the public and private sector, which is why our partnerships with US Ignite and Verizon are so critical,” said Lieutenant Colonel Brandon Newell, NavalX SoCal Tech Bridge Director and 5G Living Lab Lead. “Through the 5G Living Lab at Miramar, we expect to develop technologies that benefit: military operations, the private sector forging new business models around 5G services, and the public we serve.”

“Since Verizon and Miramar announced the first-ever 5G Ultra Wideband deployment on a military base last July, the NIWC Pacific team has created a true testbed for innovation,” said Andrés Irlando, Senior Vice President and President, Public Sector and Verizon Connect at Verizon. “Leaders across the Department of Defense understand the mission-critical role 5G plays in unlocking innovation for the military, and this new pilot program will accelerate the research to help bring it all to life.”

US Ignite has begun work on both of the initial pilot projects for the MCAS Miramar 5G Living Lab. Team members are designing a route map and finalizing operational details for package delivery service on base using an Olli automated shuttle. Finalists from the recent 5G pitch competition – hosted by the National Security Innovation Network (NSIN) in partnership with NavalX SoCal Tech Bridge and NIWC Pacific – are working on prototype demonstrations of their 5G applications as part of a process facilitated by US Ignite to present the new technology at multiple stages of development to military officials.

Additional pilot projects are planned for 2021, including an effort to connect solar cells on base to the local 5G network. US Ignite will also partner with the University of California San Diego for future data analysis work related to transportation and energy projects.

NIWC Pacific contracted with US Ignite to run the 5G Living Lab pilot program located at MCAS Miramar based on proven technical and project management capabilities. US Ignite has demonstrated its experience through efforts that include: leading a broad portfolio of connected communities in testing applications and services powered by advanced networks; overseeing the development and deployment of multiple city-scale wireless testbeds; and implementing new automated vehicle technology at the United States Army installation at Fort Carson, Colorado.

About US Ignite:

US Ignite is a high-tech nonprofit with a mission to accelerate the smart community movement. We work to guide communities into the connected future, create a path for private sector growth, and advance technology research that’s at the heart of smarter development. For more information, visit www.us-ignite.org.

Media Contact: Sarah Archer-Days, +1 646-596-6103, [email protected], www.us-ignite.org

Cignal AI: Network Operator Spending on Optical and Packet Transport Gear in North America

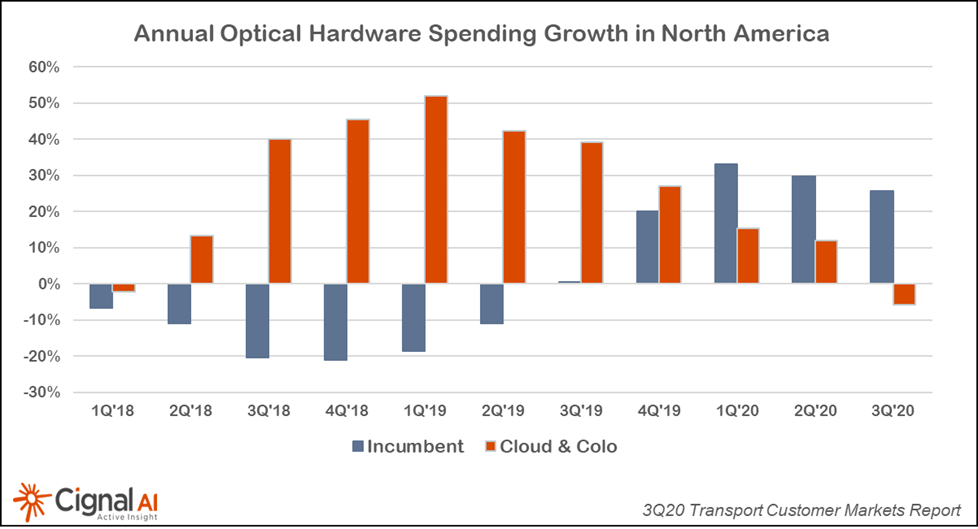

Expenditures by North American cloud and colocation operators on optical and packet transport equipment declined 20 percent year over year in the third quarter of 2020 (3Q20), while incumbent operator spending increased 2 percent, according to the 3Q20 Transport Customer Markets Report from market research firm Cignal AI. It’s quite important that incumbent operator spending grew while cloud and colocation operator spending declined during 2020.

“Equipment suppliers to cloud operators report that sales in the third quarter were depressed because service providers absorbed capacity on networks that were built during the first half of 2020,” said Scott Wilkinson, lead analyst at Cignal AI. “Both incumbent and cloud operators, especially in North America, spent significantly more of their annual budget than typical in the first half of the year.”

| More Key Findings from the 3Q20 Transport Customer Markets Report |

- After uncharacteristically strong growth in 2Q20, sales to cloud and colocation operators in Asia Pacific (APAC) rose dramatically again in the third quarter

- Despite a year-over-year decline in sales, Ciena maintained its worldwide market share leadership in sales to cloud and colocation operators in 3Q20

- The fourth quarter is expected to be challenging for sales outside APAC, with traditional telco and cloud and colocation purchases anticipated to wane worldwide

| About the Transport Customer Markets Report |

| The Cignal AI Transport Customer Markets Report tracks global optical and packet transport equipment spending by end-customer market type, including incumbent, wholesale, cloud and colocation, cable MSO and broadband, enterprise and government network operators. The report includes historical market share and market size and five-year market size forecasts. Vendors examined: Adtran, ADVA, Alaxala, Ciena, Cisco, Ekinops, Ericsson, Fiberhome, Fujitsu, Fujitsu NC, Huawei, Infinera, Juniper Networks, Mitsubishi Electric, NEC, Nokia, Padtec, RAD, Tejas Networks, Ribbon Communications, Telco Systems, Xtera and ZTE. |

| About Cignal AI |

Cignal AI provides active and insightful market research for the networking component and equipment market and its end customers. Our work blends expertise from various disciplines to create a uniquely informed perspective on the evolution of networking communications.

…………………………………………………………………………………………………………………………………………………………………………………….. Some of the Optical Transport Equipment vendors are: Ciena, Cisco, ADVA Optical networking, Aliathon Technology, ECI Telecom, Ericsson, Fujitsu, Alcatel-Lucent, Furukawa Electric / OFS Russia, Huawei Technologies, Micron Optics

|

Telegeography: Strong international bandwidth demand in LatAm; Global Internet traffic and bandwidth increased in 2020

TeleGeography’s latest research on Latin America shows that international bandwidth demand is strong in the region. With an ongoing surge in new submarine cable deployments, content providers are expanding their geographic reach as both owners and anchor customers of new cable systems.

The market research firm reported in August that the average international internet traffic increased 48% in 2020 while internet bandwidth was up 35%, the biggest increase since 2013. In its annual report on submarine networks and capacity, TeleGeography said the global Internet “bent but – for the most part – did not break” during the COVID-19 pandemic. However, the market research firm wrote that the spike in bandwidth and traffic growth in 2020 is probably a one-time event and a return to typical rates of growth is likely when the pandemic restrictions end.

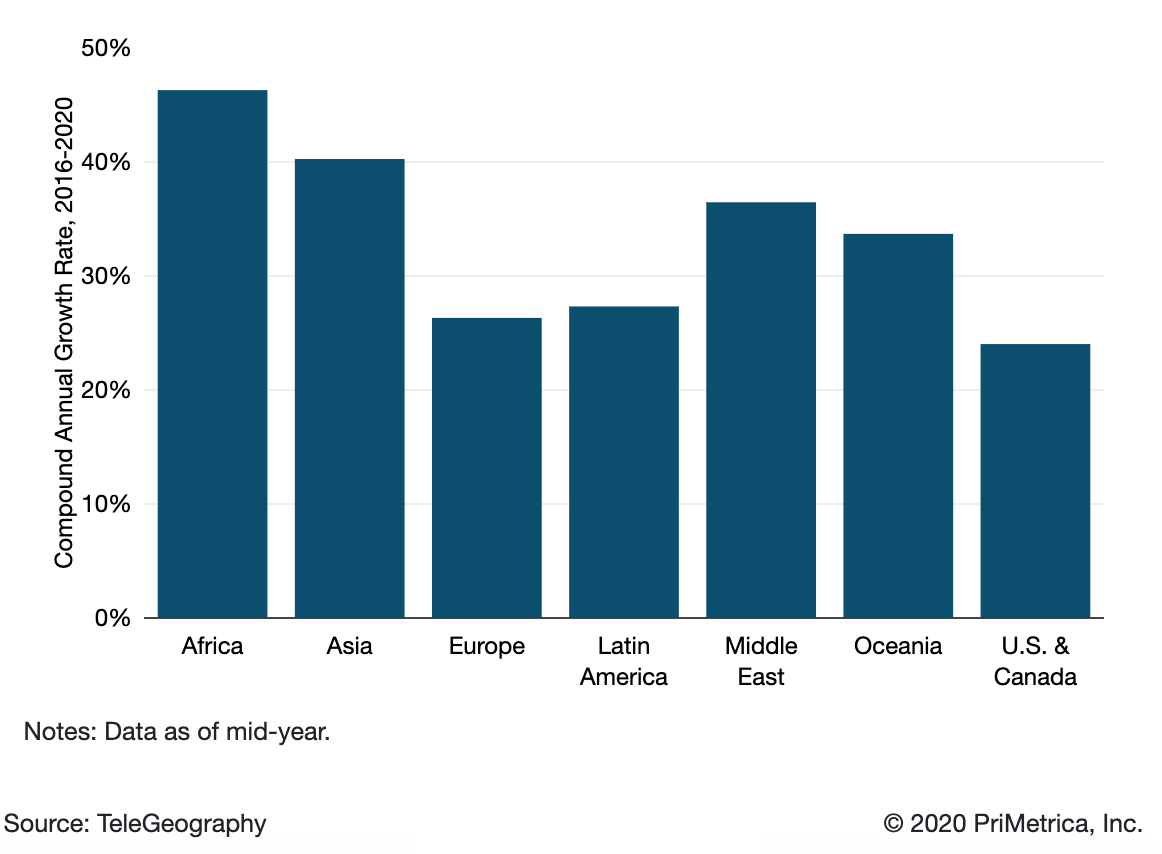

International Internet Bandwidth Growth by Region:

International internet traffic growth largely mirrors that of internet capacity. However, traffic and capacity growth seldom move in perfect tandem. (Network operators will often add capacity in anticipation of traffic growth.). Average and peak international internet traffic increased at a compound annual rate of 30% between 2016 and 2020, comparable to the 29% compound annual growth rate in bandwidth.

Based on discussions with network operators worldwide, TeleGeography believes the trends of recent years will continue. While international Internet bandwidth and traffic growth had been gradually slowing prior to 2020, growth remains brisk. Africa has experienced the most rapid growth in international bandwidth, growing at a compound annual rate of 47% from 2016-2020, with Asia just behind at 40%.

What won’t change is the role of U.S. web giants Google, Microsoft, Facebook and Amazon. They have become far and away the dominant users of international bandwidth, accounting for 64% of all used capacity in 2019. Across six of the world’s seven regions, they added capacity at a compound annual rate of above 70% between 2015 and 2019, compared to a rate of less than 45% for others. Their rapid expansion into subsea capacity has caused a major shift in the global wholesale market, TeleGeography says.

That presence “drives scale to establish new submarine cable systems and lower overall unit costs.” The OTT firms have become a key part of the subsea cable business model. Many of the big cables, invested in by both telcos and Internet players, now rely on the initial capital injection from the Internet content players. This means a share of network capacity or fiber pairs can be allocated to the largest consumers to cover initial costs, with the remaining shares sold as managed wholesale bandwidth.

TeleGeography states that both content players and telcos are trying to cope with massive growth in demand, driven by new applications and greater penetration into emerging markets. “The sheer growth in supply will drive lower unit costs for bandwidth,” it says. “In the face of unrelenting price erosion, the challenge for wholesale operators is to carve out profitable niches where demand trumps competition.” Prices vary enormously even though they are falling sharply. London and Singapore prices have declined 25% since 2017, yet Singapore tariffs are much higher; a 10 GigE port costs roughly three times as much, for example. Thanks to capacity upgrades, the prices for 10 GigE ports in São Paulo and Sydney fell 38% and 22% compounded annually over the past three years. TeleGeography warns that while the unit cost savings from the large cable investments are an incentive to investment for operators, they don’t want to be left with too much excess bandwidth. “It’s often a race to offload wholesale capacity before a new generation of lower-cost supply emerges.”

TeleGeography predicts $8.1 billion worth of new cables will be launched between 2020 and 2022 with the biggest share, $2.3 billion, invested in the trans-Pacific route. But the research firm cautions that the pandemic could disrupt supply. “Temporary cable factory closures combined with delays in permitting and marine installation could hamper the deployment of many planned cables.”

References:

https://blog.telegeography.com/internet-traffic-and-capacity-in-covid-adjusted-terms

https://www2.telegeography.com/covid19-state-of-the-network

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

5G Network Slicing Tutorial:

While there is no ITU-T recommendation to implement 5G network slicing, 3GPP Network Slicing requirements are included in 3GPP TS 22.261, Service requirements for the 5G system Stage 1, for Release 15 and updated for Release 16. As defined by 3GPP, Network slicing allows the 5G network operator to provide customized networks with different QoS capabilities.

A Network Slice is a logical (virtual) network customized to serve a defined business purpose or customer, consisting of an end-to-end composition of all the varied network resources required to satisfy the specific performance and economic needs of that particular service class or customer application. The ideas in play in developing and progressing the ‘slice’ concept draw on a progression of similar but simpler parallels in preceding network architectures including IP/Ethernet networking services (VLANs, IP VPNs, VPLS, etc.), and broaden the scope to include a wide range of access and core network functions from end-to-end and from the top to the bottom of the networking stack. Network slicing offers a conceptual way of viewing and realizing service provider networks by building logical networks on top of a common and shared infrastructure layer. Network slices are created, changed and removed by management and orchestration functions, which must be considerably enhanced to support this level of multi-domain end-to-end virtualization.

Here are a few use cases for 5G network slicing, which will likely to lead to different phases of adoption:

• Network Slicing can be used for operational purposes by a single network operator, to differentiate characteristics and resources for different broad

classes of services

• Network slicing can be used by a service provider seeking to establish a virtual service provider network over the infrastructure of a physical network operator

• Network slicing can allow individual end customers (enterprises) to be able to customize a virtual network for their operations and consume these network resources in a more dynamic way similar to today’s cloud services (i.e. dynamically varying scale, or for temporary needs).

• Network slicing can allow for “traffic splitting” across networks (5G, 4G, and WiFi via hybrid fiber-coax).

………………………………………………………………………………………………………………………………………………………………………………………………..

Ericsson launches 5G RAN Slicing to spur 5G business growth:

- New software solution enables communications service providers to deliver innovative 5G use cases to consumers and enterprises with guaranteed performance

- Built on Ericsson radio expertise and a scalable and flexible architecture, the new solution supports customized business models and growth requirements of advanced use cases

- Ericsson 5G RAN Slicing strengthens end-to-end network slicing capabilities needed to deliver different services over a common infrastructure

Network slicing supports multiple logical networks for different service types over one common infrastructure. It is a key enabler for unlocking 5G revenue opportunities such as enhanced video, in-car connectivity and extended reality, Ericsson said.

Ericsson said what makes its product distinct is that it boosts end-to-end management and orchestration support for fast and efficient service delivery. This gives service providers the differentiation and guaranteed performance needed to monetize 5G investments. Ericsson’s network slicing platform is already in use in the consumer segment and for enterprise applications such as video-assisted remote operations, AR/VR, sports event streaming, cloud gaming, smart city, and applications for Industry 4.0 and public safety. Customers working with the system include KDDI and Swisscom.

An Ericsson report estimates USD 712 billion in an addressable consumer market for service providers by 2030. The addressable market for network slicing alone in the enterprise segment is projected at USD 300 billion by 2025 (GSMA data). As 5G scales up, service providers are looking to maximize returns on their investments by targeting innovative and high revenue-generating use cases such as cloud gaming, smart factories, and smart healthcare.

Toshikazu Yokai, Executive Officer, Chief Director of Mobile Technology, at KDDI, says: “End-to-end slicing is key to monetizing 5G investment and RAN slicing will help make that happen. Across different slices in our mobile networks, RAN slicing will deliver the quality assurance and latency required by our customers.”

Mark Düsener, Head of Mobile and Mass Market Communication at Swisscom, says: “We’re gearing up for the next stage of 5G where we expect to apply end-to-end network slicing, and RAN slicing is key to guaranteed performance. With efficient sharing of network resources across different slices, we will be able to provide communications for diverse 5G applications such as public safety or mobile private networks.”

Sue Rudd, Director, Networks and Service Platforms, Strategy Analytics, says: “Ericsson is the first vendor to offer a fully end-to-end solution with RAN slicing based on dynamic radio resource partitioning in under 1 millisecond using embedded radio control mechanisms to assure Quality of Service, Over the Air, in real time. This truly end-to-end approach integrates radio optimization with policy-controlled network orchestration to deliver inherently secure virtualized private RAN slicing without the loss of the 30 – 40 percent spectrum capacity due to ‘hard slicing’. Ericsson’s real-time dynamic RAN slicing bridges the ‘RAN gap’ to make e2e slicing profitable.”

About Ericsson 5G RAN Slicing:

The Ericsson 5G RAN Slicing solution offers a unique, multi-dimensional service differentiation handling that allows for the effective use of dynamic radio resource partitioning, slice-aware quality of service (QoS) enforcement, and slice orchestration functionality for service-level agreement (SLA) fulfilment. Built on Ericsson radio expertise and a flexible and scalable slicing architecture, the solution dynamically shares radio resources at 1 millisecond scheduling for best spectrum efficiency. This enables service providers to offer a variety of use cases with increased flexibility and versatility. It ensures end-to-end network slice management and orchestration support for fast service delivery and supports business models for virtual, hybrid and dedicated private networks. The solution can also power use cases for mission-critical and time-critical communication services.

References:

https://techblog.comsoc.org/2018/05/18/ieee-comsoc-papers-on-network-slicing-and-5g/

https://www.ericsson.com/en/network-slicing

https://www.telecompaper.com/news/ericsson-releases-5g-ran-slicing-software–1369987

Join an Ericsson live broadcast session: February 4, 2021 at, 3pm CET on LinkedIn, Facebook, Twitter, or YouTube

LG U+ first to deploy 600G backbone network in Korea with Ciena’s ROADM equipment

South Korea network operator LG U+ today announced it is the first carrier in South Korea to deploy 600Gb/sec on a single wavelength for long haul, using Ciena’s WaveLogic 5 technology. LG U+ made this upgrade to support remote experiences.

The company will establish a ROADM (Re-configurable Optical Add-Drop Multiplexer) backbone network to strengthen the competitiveness of business. LG U+’s newly constructed and dedicated nationwide ROADM backbone network will satisfy the needs of customers and preemptively respond to increased traffic following the introduction of the remote era. For this network transformation, LG U+ has selected Ciena’s WaveLogic 5 Extreme and WaveLogic Ai coherent optical solutions.

Sung-cheol Koo who’s in charge of LG U+’s wired business said, “Amid the expansion of cloud services such as telecommuting, video conferencing and remote classes, we are building a new backbone network that can accommodate the needs of various corporate customers. With a flexible and stable transmission network, we expect that companies can provide a higher level of service.”

LG U+ also applied the Optical Time Domain Reflectometer (OTDR) technology, which measures the loss of optical lines, disconnection points, and distances across the entire section of the new backbone network. By intuitively monitoring the condition of the line in real time, it is possible to shorten the response time in case of a failure.

With rapidly increasing traffic, Ciena will enable LG U+ to transmit single-carrier 600G wavelengths over the new flexible grid backbone that has six times the network capacity compared to the existing network. The new backbone network will provide enhanced availability through low-latency, multiple route diversity and direct connections between large cities without the need for regeneration.

LG U+ is in the process of implementing a major capacity upgrade, including multi-terabits of additional capacity, to accommodate large-capacity customers and enable stable traffic management. By applying OTDR (Optical Time Domain Reflectometer) technology to all sections of the backbone network, real-time and intuitive line condition monitoring is possible to shorten troubleshooting time and enable smooth network management and operations.

In addition, Ciena’s 6500 ROADM equipment can reliably configure DR (Disaster Recovery) line services to public government, financial institutions and compute centers of large enterprises through third party interworking certification. LG U+ can also provide a dedicated line service with enhanced security through optical transport encryption.

In addition, Ciena’s 6500 ROADM equipment can reliably configure DR (Disaster Recovery) line services to public government, financial institutions and compute centers of large enterprises through third party interworking certification. LG U+ can also provide a dedicated line service with enhanced security through optical transport encryption.

LGU+ will be using Ciena’s Manage, Control and Plan (MCP) SDN controller to be able to automate service delivery via next-generation OPEN APIs to improve customer experience and increase operational efficiencies.

References:

https://www.ciena.com/about/newsroom/press-releases/lg-u-builds-new-nationwide-backbone-network.html

Starlink Internet could be a game changer with 100 megabytes per second download speed

Elon Musk’s Space Exploration Technologies Corp (Space X) has launched more than 1,000 satellites for its Starlink internet service and is signing up early customers in the U.S., U.K. and Canada. SpaceX has told investors that Starlink is angling for a piece of a $1 trillion market made up of in-flight internet, maritime services, demand in China and India — and rural customers such as Brian Rendel. He became a Starlink tester in November after struggling for years with sluggish internet speeds at his 160-acre farm overlooking Lake Superior in Michigan’s Upper Peninsula. After he paid about $500 for the equipment, FedEx arrived with a flat dish and antenna. For $99 a month, Rendel is now getting speeds of 100 megabytes per second for downloads and 15 to 20 for uploads — far faster, he says, than his previous internet provider.

“This is a game changer,” said Rendel, a mental health counselor, who can now easily watch movies and hold meetings with clients over Zoom. “It makes me feel like I’m part of civilization again.”

For months, SpaceX has been launching Starlink satellites on its Falcon 9 rockets in batches of 60 at a time, and the 17th Starlink launch was on Jan. 20. There are now roughly 960 functioning satellites in orbit, heralding an age of mega-constellations that have prompted worries about visual pollution for astronomers.

But the Starlink array in low-Earth orbit, closer to the planet than traditional satellites, is enough to enable SpaceX to roll out service along a wide swath of North America and the U.K. As SpaceX sends up more satellites, the coverage area will grow, expanding the potential customer base — and revenue stream — beyond the initial stages of today.

“The big deal is that people are happy with the service and the economics of Starlink versus other alternatives,” said Luigi Peluso, managing director with Alvarez & Marsal, who follows the aerospace and defense industries. “SpaceX has demonstrated the viability of their solution.”

Last year, SpaceX Chief Operating Officer Gwynne Shotwell said that Starlink is a business that SpaceX– one of the most richly valued venture-backed companies in the U.S. — is likely to spin out and take public. That dangles the possibility of another Musk enterprise offering shares after last year’s sensational stock-market gains by Tesla Inc.

Starlink will face plenty of competition. While fiber optic cable is widely considered too expensive to lay down in remote regions and many rural locations, cellular connectivity is expected to make big advances with 5G and then 6G. Meanwhile, a number of innovative attempts to extend cellular to unserved areas are being developed by other well-heeled companies such as Facebook Inc.

“There will always be early Starlink adopters who think that anything from Elon Musk is cool,” said John Byrne, a telecom analyst at GlobalData. “But it’s hard to see the satellite trajectory keeping pace with the improvements coming with cellular.”

SpaceX, based in Hawthorne, California, is primarily known for launching rockets for global satellite operators, the U.S. military, and NASA. Last year, SpaceX made history by becoming the first private company to fly astronauts to the International Space Station. Maintaining strong service while growing the customer base is something SpaceX has never tried before.

“Like any network, Starlink is going to enjoy rave reviews while it is underutilized,” said industry analyst Jim Patterson. “However, it will be challenged with the same congestion issues as their peers as they grow their base.”

Then again, SpaceX says the service will improve as it builds out more infrastructure.

“As we launch more satellites, install more ground stations and improve our networking software, data speed, latency and uptime will all improve dramatically,” Kate Tice, a senior engineer at SpaceX, said in a livestream of a Starlink mission in November.

Starlink is gearing up for a big 2021, hiring software engineers, customer support managers, a director of sales, and a country launch manager. The fan fervor that made Tesla cars such a hit with consumers and retail investors extends to Starlink. Facebook groups, Reddit threads and Twitter are filled with reports from early customers sharing images of their download speeds. You Tube has videos of people “unboxing” their Starlink dish and going through the initial set-up.

Ross Youngblood lives in Oregon and works remotely as an engineer for a tech company in San Jose. He owns a Tesla Model X and follows All Things Musk pretty closely. He got Starlink before Thanksgiving.

“I just plugged it all in and it started to work,” said Youngblood. “It’s going to be very disruptive, and I don’t think enough people are paying attention.”

Many other customers are waiting in the wings. In December, the Federal Communications Commission awarded SpaceX $885.5 million in subsidies as part of a wider effort to bring broadband to over 10 million Americans in rural areas. SpaceX will focus on 35 states, including Alabama, Idaho, Montana and Washington.

“We can’t continue to throw money at aging infrastructure,” said Russ Elliot, director of the Washington State Broadband Office. “With Starlink, you can be anywhere. The cost to build in deep rural or costly areas is now less of an issue with this technology as an option.”

Early in the coronavirus pandemic, Elliot connected SpaceX with members of the Hoh Tribe in far western Washington. The Native American community had struggled for years to bring high-speed internet to their remote reservation, which spans about 1,000 acres and has 23 homes. Kids struggled to access remote learning, and internet connections were so slow that downloading homework could take all day.

“SpaceX came up and just catapulted us into the 21st century,” said Melvinjohn Ashue, a member of the Hoh Tribe, in a short video produced by the Washington State Department of Commerce. In a phone interview with the Economic Times of India, Ashue said that the first thing he did once he connected to Starlink was download a long movie: Jurassic Park. Now most of the reservation’s households have Starlink, making it possible for families to access not just online schooling but tele-health appointments and online meetings.

“Internet access is a utility. It’s no longer a luxury,” said Maria Lopez, the tribal vice chairwoman. Lopez said that Starlink was easy to hook up. The scariest part was climbing up a ladder to set up the dish on her roof. “Every now and then it will glitch,” she said. “But it quickly reboots itself,” Ms. Lopez added.

References:

After 9 years Alphabet pulls the plug on Loon; Another Google X “moonshot” bites the dust!

After nine years as the high-flyer of the Google X lab, Alphabet is ending Loon, which was one of the company’s high-profile, cutting-edge efforts. Loon aimed at providing Internet access to rural and remote areas, creating wireless networks with up to 1 Mbit/second speeds using high-altitude balloons at altitudes between 18 and 25 km (11 and 16 miles). As for so many of Google X labs “moonshots,” it was difficult to turn Loon into a business.

“The road to commercial viability has proven much longer and riskier than hoped. So we’ve made the difficult decision to close down Loon,” Astro Teller, who heads Google X, wrote in a blog post. Alphabet said it expected to wind down operations in “the coming months” with the hope of finding other positions for Loon employees at Alphabet.

Sadly, despite the team’s groundbreaking technical achievements over the last 9 years — doing many things previously thought impossible, like precisely navigating balloons in the stratosphere, creating a mesh network in the sky, or developing balloons that can withstand the harsh conditions of the stratosphere for more than a year — the road to commercial viability has proven much longer and riskier than hoped. So we’ve made the difficult decision to close down Loon. In the coming months, we’ll begin winding down operations and it will no longer be an Other Bet within Alphabet.

From the farmers in New Zealand who let us attach a balloon communications hub to their house in 2013, to our partners who made it possible to deliver essential connectivity to people following natural disasters in Puerto Rico and Peru, to our first commercial partners in Kenya, to the diverse organizations working tirelessly to find new ways to deliver connectivity from the stratosphere — thank you deeply. Loon wouldn’t have been possible without a community of innovators and risk-takers who are as passionate as we are about connecting the unconnected. And we hope we have reason to work together again before long.

The idea behind Loon was to bring cellular connectivity to remote parts of the world where building a traditional mobile network would be too difficult and too costly. Alphabet promoted the technology as a potentially promising way to bring internet connectivity to not just the “next billion” consumers but the “last billion.”

The giant helium balloons, made from sheets of polyethylene, are the size of tennis courts. They were powered by solar panels and navigated by flight control software that used artificial intelligence to drift efficiently in the stratosphere. While up in the air, they act as “floating cell towers,” transmitting internet signals to ground stations and personal devices.

Credit…Loon LLC, via Associated Press

………………………………………………………………………………………………………………………………………………………………………………………

Google started working on Loon in 2011 and launched the project with a public test in 2013. Loon became a stand-alone subsidiary in 2018, a few years after Google became a holding company called Alphabet. In April 2019, it accepted a $125 million investment from a SoftBank unit called HAPSMobile to advance the use of “high-altitude vehicles” to deliver internet connectivity.

Last year, Google announced the first commercial deployment of the Loon technology with Telkom Kenya to provide a 4G LTE network connection to a nearly 31,000-square-mile area across central and western Kenya, including the capital, Nairobi. Before then, the balloons had been used only in emergency situations, such as after Hurricane Maria knocked out Puerto Rico’s cellular network. In closing down this pilot service in Kenya, Loom said it would pledge $10 million to Kenyan non-profits and businesses offering “connectivity, internet, entrepreneurship, and education.”

Loon was starting to run out of money and had turned to Alphabet to keep its business solvent while it sought another investor in the project, according to a November report in The Information.

The decision to shut down Loon is another signal of Alphabet’s recent austerity toward its ambitious and costly technology projects. Under Ruth Porat, Alphabet’s chief financial officer since 2015, the company has kept a close watch over the finances of its so-called Other Bets, fledgling business ventures aimed at diversifying from its core advertising business.

Alphabet has aggressively pushed its “Other Moonshot Bets” like Waymo and Verily, a life sciences unit, to accept outside investors and branch out on their own. Projects that failed to secure outside investment or show enough financial promise have been discarded, such as Makani, a project to produce wind energy kites that Alphabet shut down last year.

That austerity has been a notable change from a time when units like X, which had been a favored vanity project of Google’s co-founders Larry Page and Sergey Brin, had autonomy to spend freely to pursue ambitious technology projects even if the financial outlook remained unclear.

……………………………………………………………………………………………………………………………………………………………………….

Facebook’s efforts have likewise stumbled, with Mark Zuckerberg’s company deciding in 2018 to ground Aquila, its gigantic, solar-powered drone designed to deliver Internet by laser. “Surprisingly, it’s just not practical,” drolly commented Techcrunch. Instead, it is efforts to beam the net from satellites that seem to be meeting with higher-flying fortunes.

Starlink, the satellite network being built by Elon Musk’s SpaceX, appears to be making fast progress – with 800 satellites, including 60 launched in November.

Its launch of services in the rural UK this month is bad news for OneWeb – which only just emerged from bankruptcy in November with new owners, the UK Government and Bharti Global. Analysts, though, think neither will provide too much of a threat to established Internet providers in urban are

For all that was innovative about its technology, Loon never turned a profit, and the company was tight-lipped about precisely how many users it ever had. It was never a matter of providing free Internet to the masses, but instead, of amplifying the reach of existing telecoms companies to rural populations, via the balloon network. Once connected, clients paid for the Internet, just like anybody else. It just seems there were not enough of them who did.

Its technical advances concerned a type of ballet, using its software system to predict how weather events could move its balloons, then adapting the balloons’ height in accord with wind currents to manipulate their position. The balloons usually lasted a few hundred days, after which they were directed to a landing zone – though the landings weren’t always as accurate as its engineers would have hoped.

References:

https://blog.x.company/loons-final-flight-e9d699123a96

https://medium.com/loon-for-all/loon-draft-c3fcebc11f3f

https://www.lightreading.com/services/google-pops-loon-balloon/d/d-id/766855?

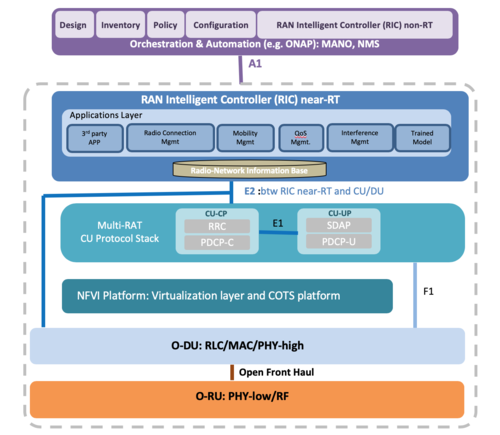

Analysis: Telefonica, Vodafone, Orange, DT commit to Open RAN

Four of Europe’s biggest network operators have signed a Memorandum of Understanding (MoU) to express their individual commitment to the implementation and deployment of Open Radio Access Network (Open RAN) as the technology of choice for future mobile networks across Europe. In a statement, Telefonica, Deutsche Telekom, Orange and Vodafone pledged to back Open RAN systems that take advantage of new open virtualized architectures, software and hardware with a view to enhancing the flexibility, efficiency and security of European networks in the 5G era.

The four operators committed to working together with existing and new ecosystem partners, industry bodies like the O-RAN Alliance and the Telecom Infra Project (TIP), as well as European policy makers, to ensure Open RAN quickly reaches competitive parity with traditional RAN solutions. “This initiative is an important milestone towards a diverse, reinvigorated supplier ecosystem and the availability of carrier-grade Open RAN technology for a timely commercial deployment in Europe,” they said in a joint statement.

The MNOs added that the introduction of Open RAN, virtualisation and automation would pave the way for a fundamental change in the way operators manage networks and deliver services, allowing them to add or shift capacity more quickly for end users, automatically resolve network incidents or provide enterprise level services on-demand for industry 4.0.

The four operators also expressed the hope that the European Commission and national governments will agree to play an important role in fostering and developing the Open RAN ecosystem by funding early deployments, research and development, open test lab facilities as well as incentivising supply chain diversity by lowering barriers to entry for small suppliers and startups.

The MoU comes a few days after Telefonica announced plans to use open RAN technology at around 1,000 of its mobile sites in Germany. Vodafone made a similar commitment at around 2,600 of its masts and rooftops in the UK at the end of last year.

Without orders from numerous large operators, open RAN producers have struggled to increase volumes and generate the necessary economies of scale.

“This is like putting the band back together,” says Gabriel Brown, a principal analyst with Heavy Reading, a sister company to Light Reading. “The European operators are saying if we co-operate then we can have a meaningful influence and impact on the way open RAN develops.”

Operators are drawn to open RAN because it would allow them to mix and match vendors, using radio software from one vendor in tandem with general-purpose equipment developed by another. Traditional radio access networks typically force operators to buy all their components from the same supplier.

While today’s statement is light on details of firm commitments, Vodafone has already promised to use open RAN technology at around 2,600 of its mobile sites in the UK, while Telefónica this week said it would do the same at roughly 1,000 sites in Germany.

Deutsche Telekom, Germany’s telecom incumbent, has had less to say about rollout targets, although in December it revealed plans to build an “O-RAN town” in Neubrandenburg this year. “This will be a small-scale commercial deployment, which will encompass up to 150 cells, and will bring open RAN into a real 4G/5G network environment,” said a Deutsche Telekom spokesperson by email.

That leaves France’s Orange, which has now made a jaw-dropping commitment: Starting in 2025, it will buy only open RAN equipment when upgrading its European networks.

“From 2025, our intention is that all new equipment deployed by Orange in Europe should be based on open RAN,” says Arnaud Vamparys, Orange’s senior vice president of radio networks. “This is a good time to send a clear message.”

His expectation is that over this timeframe open RAN will reach “parity” with traditional RAN for deployment in a macro network. That would mean resolving some of the performance shortcomings that have mainly restricted open RAN to rural and less demanding conditions.

“2025 sounds about right,” says Brown. “The integrated systems are really setting a very high bar and open RAN is behind on features and performance right now.”

Brown told Light Reading he was encouraged by some of the recent open RAN activity in the semiconductor industry, citing baseband advances by Marvell and radio innovation by Xilinx. But he says it is too early to say open RAN will definitely be a mainstream success by the mid-2020s. “Can this be the best way to build a radio access network? If it isn’t, it is probably not going to succeed.”

“We continue to work to unlock the value of these European programs because clearly there are industry-leading initiatives of some of the manufacturing being brought back to Europe, especially on open RAN,” said Markus Haas, Telefónica Deutschland’s CEO, when asked during an analyst call this week if the telecom sector could be a beneficiary of Europe’s COVID-19 recovery fund.

“There is high interest so that the overall industry, the vendor landscape, might change or might be empowered by additional funds in order to progress and accelerate open RAN.”

While Ericsson and Nokia say they are now investing in open RAN technology, Vodafone looks determined to use alternative players for its 2,600-site rollout. Supplier diversification has topped the agenda for other service providers, as well.

“We want Europe to play a role in that evolution and it has to unite a bit to achieve this goal,” says Orange’s Vamparys. “There are lots of US and Japanese companies pushing strongly for the acceleration of open RAN. If we don’t communicate and help other companies, it could create an unbalanced situation.”

SOURCE: ORAN Alliance

Telefónica Deutschland named Altiostar, KMW, NEC and Supermicro as potential open RAN partners in a presentation it gave this week, while Deutsche Telekom has been in talks with Dell, Fujitsu, Mavenir, Nokia and NEC.

Vodafone has already carried out open RAN trials with Mavenir and Parallel Wireless.

The region’s biggest gap is probably in silicon, says Heavy Reading’s Brown. Most of the high-profile chipmakers developing open RAN technology, including Marvell and Xilinx, are based in the US.

Arm, a UK-based firm whose processor designs are used in many of the world’s smartphones, is a member of the O-RAN Alliance, the group responsible for open RAN specifications. But it is also currently the target of a $40 billion takeover move by Nvidia, a US semiconductor maker.

In the meantime, any plan to use part of the European recovery fund to support open RAN could meet with political resistance given the healthy state of the telecom sector compared with other industries, including airlines, hospitality, retail and tourism.

John Strand, the CEO of advisory firm Strand Consult, lashed out at the suggestion that open RAN could benefit from Europe’s COVID-19 stimulus package.

“Do these companies need subsidies? Is Telefónica in such a bad position that it needs public funding?” he told Light Reading. “We are living in a time when numbers of companies are in deep financial crisis because of COVID-19 and telecom operators, which definitely haven’t been hit, are asking for subsidies.”

Market forecasters now think open RAN will account for about one tenth of the overall market for radio access network products by the mid-2020s:

- Omdia expects industry revenues to increase from just $70 million in 2019 to about $3.2 billion in 2024, giving it a 9.4% share of the 4G and 5G market.

- Dell’Oro, another analyst firm, is in broad agreement: Last year, it predicted operators would spend somewhere north of $3 billion on open RAN products in 2024.

……………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecompaper.com/news/telefonica-vodafone-orange-dt-sign-open-ran-mou–1369273

Viavi Solutions and Mavenir collaborate to validate new SD, cloud-native RAN infrastructure

VIAVI Solutions Inc today announced that Mavenir, an upstart provider of end-to-end cloud-native network software for mobile operators, is collaborating with VIAVI for lab validation of radio access solutions in the U.S. VIAVI’s lab test platform, in use by almost every base station manufacturer in the world, provides scalable test systems for validating network performance as experienced by end users, across multiple cells and different radio access technologies.

The year 2020 marked a significant inflection point for mobile networks around the globe. With 229 million subscribers as of December 2020, 5G became the fastest growing mobile technology in history. New MNOs (like Dish Network) were granted licenses to establish greenfield networks to take advantage of this demand. Meanwhile, #1 base station maker Huawei was restricted from supplying infrastructure in markets around the globe. These trends have driven an expansion of the supply chain for mobile network solutions.

VIAVI tools are able to measure the complete performance of the network over multiple interfaces including O-RAN and RF through to the packet core. Capable of emulating one to many thousands of UEs, the platforms create a sophisticated and precise test environment, including comprehensive feature interactions, simulated RF and mobility, accurate replications of real-world user behavior profiles, together with mobility across the radio access network.

“Mavenir is proud to be a leading vendor to mobile operators around the globe, offering software-defined infrastructure that can adapt to evolving requirements for both brownfield and greenfield networks, large-scale to startup networks,” said Ramnik Kamo, EVP Quality, Systems and People, Mavenir. “VIAVI has been a highly collaborative partner with our two companies’ engineering teams working together to prove a new technology against very tight customer timescales.”

“As vendors across the industry develop open, cloud-native and disaggregated architectures, testing against user expectations of service quality will be critical to accelerate adoption at scale,” said Luiz Cesar Oliveira, Vice President, Americas, VIAVI. “We are excited to help Mavenir optimize their advanced radio access solutions based on our unique experience supporting over 200 service providers and virtually every network equipment manufacturer worldwide.”

About VIAVI

VIAVI (NASDAQ: VIAV) is a global provider of network test, monitoring and assurance solutions for communications service providers, enterprises, network equipment manufacturers, government and avionics. We help these customers harness the power of instruments, automation, intelligence and virtualization to Command the network. VIAVI is also a leader in light management solutions for 3D sensing, anti-counterfeiting, consumer electronics, industrial, automotive, and defense applications. Learn more about VIAVI at www.viavisolutions.com. Follow us on VIAVI Perspectives, LinkedIn, Twitter, YouTube and Facebook.

………………………………………………………………………………………………………………………………………………………………….

References:

Deutsche Telekom’s T-Labs enters research partnership to progress quantum technologies

Deutsche Telekom said it is taking part in the Platform and Ecosystem for Quantum-Assisted Artificial Intelligence project to conduct research into quantum technologies, under the leadership of research and development unit T-Labs. Deutsche Telekom will carry out research activities and tests for potential use cases of quantum technologies, particularly for network operators. A consortium of 15 partners and 33 associated partners are taking part the research projects, funded by the German Federal Ministry of the Economy.

T-Labs will provide specific use cases from the field of telecommunications, including the optimization of communication networks, Industry 4.0 applications or AI-clustering problems for customer segments. Quantum algorithms can provides solutions to the complexity and size of applications. Quantum computers could be used for Deutsche Telekom’s operational business.

Quantum algorithms for telecommunication providers

Quantum computers promise an exponential increase in processing speed for selected problem classes. For example, in combinatorial optimization problems or the training of AI models (AI: artificial intelligence). In communication science, Shor’s algorithm is usually considered the “killer application” of quantum computing. This is because quantum computers can use it to attack today’s security infrastructures.

In the PlanQK project, T-Labs provides some specific use cases from the field of telecommunications. These include the optimization of communication networks, Industry 4.0 applications or AI-clustering problems for customer segments. These applications have a high level of complexity and, if the problem exceeds a critical size, can only be calculated classically with great difficulty. Here, quantum algorithms promise the solution. With growing size, quality and processing speed, quantum computers could find their way into Telekom’s operational business.

The path to a standardized quantum app store

However, the goal is not only to evaluate and demonstrate the applicability of current quantum technology for use at Telekom. The PlanQK project also seeks to prevent the risk of any one company achieving a dominant market position and setting de facto industry standards. This project is targeted at ensuring the development and establishment of a vendor-independent platform and associated ecosystem for quantum-assisted artificial intelligence. Users could then, for example, compile solutions for their company or commission them via the cloud or a quantum app store.

About Deutsche Telekom: Deutsche Telekom at a glance

About T-Systems: T-Systems company profile

References:

New ITU-T SG13 Recommendations related to IMT 2020 and Quantum Key Distribution