5G private networks

Dell’Oro: LTE still dominates private wireless market; will transition to 5G NR (with many new players)

Dell’Oro Group just published an updated Private Wireless market report with a 5-year forecast. According to the report, private wireless RAN revenues for the full-year of 2021 are slightly weaker than initially projected.

“The markdown is more driven by the challenges of converting these initial trials to commercial deployments than a sign that demand is subsiding,” said Stefan Pongratz, Vice President at Dell’Oro Group. “In fact, a string of indicators suggest private wireless activity is firming up not just in China but also in other regions,” continued Pongratz.

Additional highlights from the Private Wireless Advanced Research Report:

- Private wireless projections have been revised downward just slightly to factor in the reduced 2021 baseline.

- Total private wireless RAN revenues, including macro and small cells, are still projected to more than double between 2021 and 2026.

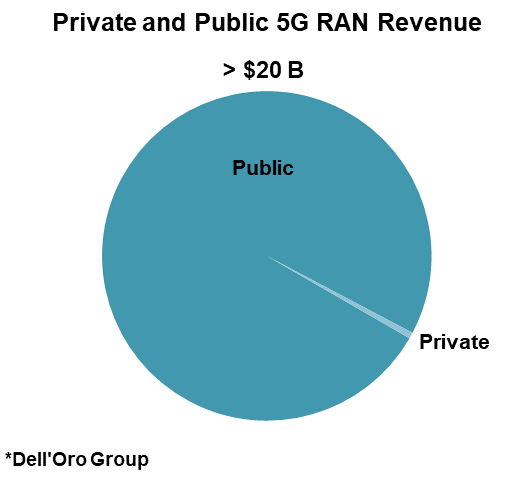

- The technology mix has not changed much with LTE dominating the private market in 2021 and 5G NR still on track to surpass LTE by the outer part of the forecast period, approaching 3 percent to 5 percent of the total 5G private plus public RAN market by 2026.

- Risks are broadly balanced. On the upside, the 5G enterprise puzzle has still not been solved. The successful launch of private 5G services by suppliers with strong enterprise channels could accelerate the private 5G market at a faster pace than expected. On the downside, 5G awareness is improving but it will take some time for enterprises to fully understand the value of private LTE/5G.

Comment & Analysis:

This author notes a bevy of new activity in the 5G private network space. It’s almost approaching a frenzy!

Yesterday, Cisco announced a “private 5G service that simplifies both 5G and IoT operations for enterprise digital transformation.” The company promised to show off the new product at the upcoming MWC trade show in Barcelona, Spain. Cisco to sell its 5G private network under an “as-a-service” model, such that enterprise customers who purchase it will only pay for what network resources they actually use. The company said that it would partner with unnamed vendors for all the necessary components, adding that it will run over midband spectrum. The company did not provide any further details. It should be noted that Cisco has never had ANY 2G/3G/4G/5G RAN products, as their wireless network portfolio has always been focused on WiFi (now for enterprise customers).

In late November 2021, Amazon unveiled its new AWS Private 5G service that will allow users to launch and manage their own private mobile network in days with automatic configuration, no per-device charges, and shared spectrum operation. AWS provides all the hardware, software, and SIMs needed for Private 5G, making it a one-stop solution that is the first of its kind. Dell’Oro Group’s VP Dave Bolan wrote in an email, “What is new about this (AWS Private 5G) announcement, is that we have a new Private Wireless Network vendor (AWS) with very deep pockets that could become a major force in this market segment.”

In addition, Mobile network operators like Deutsche Telekom, AT&T and Verizon offer private 5G networks, as do other cloud computing companies, mobile network equipment vendors like Ericsson and Nokia, system integrators like Deloitte, as well as startups like Betacom and Celona. So it’s a crowded market with suppliers each expecting a chunk of a very big pie.

I posed the seemingly contradictory finding of a less than forecast 2021 private wireless market vs the new private 5G players to Dell’Oro’s Pomengratz. In his email reply, Stefan wrote:

“If I had to summarize all our various projections I will just say that the things we know (public 5G MBB/FWA) are generally accelerating at a faster pace than expected while the things that we don’t know (private 5G/critical IoT etc.) are developing at a slower pace than expected.

And for this particular update, slower-than-expected comment was more related to revenues than activity. I agree with you that activity both when it comes to private trials and entering this space remains high.

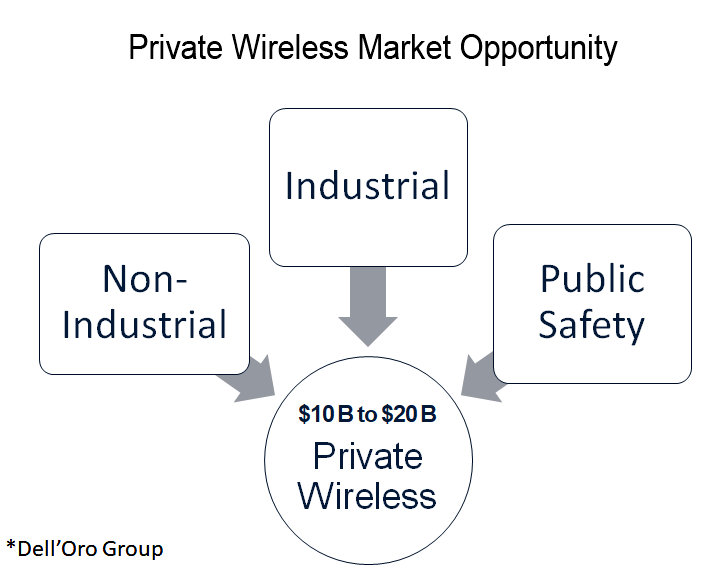

At the same time, we have talked about private cellular for a long time but the reality is that we have not yet crossed the enterprise chasm. Nevertheless, we have a very large market opportunity ($10B to $20B for just the private 4G/5G RAN) that is still up for grabs, hence the high level of interest.”

References:

Private Wireless Weaker Than Expected in 2021, According to Dell’Oro Group

https://www.cisco.com/c/en/us/products/wireless/private-5g/index.html

Deloitte to co-ordinate 5G private network field trial at the largest hospital in Latin America

Deutsche Telekom launches 5G private campus network with Ericsson; Sovereign Cloud for Germany with Google in Spring 2022

Overview:

Ericsson and Deutsche Telekom have partnered to deliver a new 5G Standalone (5G SA) private campus network offering, aimed at on-site business communications infrastructure. The new campus network offering is based on a local 5G infrastructure that is exclusively available for the customer’s digital applications. The 5G SA technology works without LTE anchors (as in 5G NSA) and offers all the technical advantages of 5G – even for particularly demanding and safety-critical use cases: fast data transmission rates, maximum network capacity and highly reliable connectivity with low latency.

With the advanced 5G SA technology, Deutsche Telekom and Ericsson support companies from a wide range of industries in developing innovative digital applications and making existing processes more efficient.

The newly offered 5G SA Campus network – powered by the Ericsson Private 5G portfolio – operates completely separated from the public mobile network: all components of the infrastructure from the antennas to the standalone core network to the network server are located on the customer’s premises. This ensures that sensitive data remains exclusively within the local campus network. The local connection of the customer infrastructure also enables particularly simple and fast processing of data via the private network. This standalone 5G architecture of “short distances” is most suitable for supporting business-critical applications that require ultra-short response times in the millisecond range. The 5G SA network operates on frequencies in the 3.7 to 3.8 GHz range that are specifically allocated to the enterprise. Thus, up to 100 MHz bandwidth is available for the exclusive use within the private campus network.

The new 5G private campus network is being launched in Germany under the name “Campus-Netz Private” – and will be offered to business customers in other European countries.

……………………………………………………………………………………………………………………………………………………………………………………..

Analysis: It is quite interesting that Deutsche Telekom chose Ericsson as it’s 5G SA Core network vendor, rather than hyper-scalers like Amazon AWS or Microsoft Azure who are building 5G SA core networks for Dish Network and AT&T respectively. Amazon also offers its own private 5G network directly to enterprise customers. So does Microsoft which offers Azure private multi-access edge compute. Earlier this year, Fierce Wireless reported that Google did NOT have a private 5G network offering, but was partnering with other companies to offer one.

……………………………………………………………………………………………………………………………………………………………………………………..

Sidebar:

Deutsche Telekom’s T-Systems has partnered with Google Cloud to build and deliver sovereign cloud services to German enterprises, healthcare firms and the public. The two companies say that the goal of this sovereign cloud is to allow customers to host their sensitive workloads while still being able to leverage all the benefits of the public cloud, such as scalability and reliability. The launch of the new Sovereign Cloud for Germany will take place ahead of schedule: Telekom’s business customer arm T-Systems and Google Cloud are launching their new sovereign cloud service in spring 2022. It will be available for all clients, initially out of the Frankfurt Google Cloud Region. Telekom and Google confirmed that they will jointly drive innovation for the cloud, closely aligned with the new German government’s digital plans which aims to build a public administration cloud based on a multi-cloud strategy and open interfaces, as well as meeting strict sovereignty and transparency requirements. To this end, the partners are setting up a Co-Innovation Center in Munich as announced in November 2021. In addition, executive briefing facilities in Munich and one in Berlin will be established for close collaboration with customers.

“Many companies in Germany state that sovereignty matters to them when choosing their Cloud provider. This is particularly important for key sectors such as public, healthcare and automotive,” Höttges said. “That’s why we’re delighted to offer a Sovereign Cloud that addresses additional European compliance requirements.”

In this new joint offering, T-Systems will manage a set of sovereignty controls and measures, including encryption and identity management. In addition, T-Systems will exercise a control function over relevant parts of the German Google Cloud infrastructure. Any physical or virtual access to facilities in Germany (such as routine maintenance and upgrades) will be under the supervision of T-Systems and Google Cloud.

……………………………………………………………………………………………………………………………………………………………………………………..

5G SA Campus Network: Full Control & Flexible Deployment:

Customers can adapt their private 5G SA network flexibly according to their own requirements as well as manage it independently: Whether for real-time communication of robots in factories or for connecting automated vehicles on company premises. Customers can prioritize data traffic within their campus network for specific applications as needed.

The mobile network is administered on site via a cloud-based network management portal by the customer’s IT staff – for example, the administration of users, 5G modules and SIM cards to access the 5G-SA campus network or to the machine control system. The closed system is characterized by its particularly high data security and reliability: Due to the redundant architecture of the local core network, the 5G SA campus network continues to function reliably even in the event of an interruption to the cloud-based management portal.

Managed service by Deutsche Telekom:

If business customers decide to deploy their own 5G SA network, Deutsche Telekom analyzes with them the critical business applications and the requirements for the private mobile network. Due to the simplified local infrastructure, the network can be built from planning to the handover to the customer within just three months. Network equipment supplier Ericsson provides the required modern 5G SA technology, while Telekom takes on the planning, deployment, operation as well as maintenance and optimization. Telekom also provides the set-up and updates so that companies can focus on their core business.

“When it comes to digitalization, industry and SMEs need a reliable partner,” says Hagen Rickmann, Managing Director Business Customers at Telekom Deutschland GmbH. “Together with Ericsson, we help business customers in every industry to increase their productivity and exploit their full potential using 5G standalone technology.”

Arun Bansal, Executive Vice President and Head of Market Area Europe & Latin America at Ericsson says: “Deutsche Telekom and Ericsson share a long-standing partnership in innovation, technology and services. Together, we offer secure, reliable and high-performance network solutions tailored to the specific business needs of our customers.”

Image Credit: Deutsche Telekom

5G Campus Network Private – Available for testing on site:

Deutsche Telekom has already been offering campus network solutions for enterprises since the beginning of 2019 and by now operates more than ten of such local networks based on 5G non-standalone technology or LTE across Germany. With the new fully private 5G SA Campus network solution, the company is expanding its business customer offering with the next development stage of 5G. The new product is being launched in Germany from now on under the name “Campus-Netz Private” – and is also offered to business customers in further European countries. For interested customers, mobile Campus 5G SA test systems are available to test their own use cases on site.

Use Cases and Industry Verticals:

There is currently a huge drive to get private 5G networks onto factory floors for manufacturing. There are some interesting examples of using IoT technology, feeding information back via high speed wireless connections, and analyzing data with machine learning/AI tools to optimize operations and do new things like predictive maintenance. Ericsson touts several industry verticals as candidates for its 5G private network offerings: Airports, Energy Utilities, Airports, Mining, Manufacturing, Ports, Offshore and Processing.

The drive towards business 5G adoptions is reflected In Ericsson’s Q4 2021 financials, in which private networks for enterprise were cited as one of the key drivers of its 41% YoY jump in profit. Evidently, Ericsson and Deutsche Telekom see a lot of potential in private 5G for industrial applications.

References:

https://www.telekom.com/en/media/media-information/archive/new-5g-standalone-campus-networks-645348

https://telecoms.com/513200/dt-and-ericsson-launch-new-5g-sa-campus-offering/

Germany and France to fund private 5G projects with ~EUR 18 million

The German and French governments are funding four 5G projects with a total of EUR 17.7 million.

- The 5G-OPERA project will create a Franco-German ecosystem for private 5G campus networks with open and virtualized hardware and software based on an open architecture. Partners for this project include Fraunhofer IIS, Fraunhofer HHI, IABG, NXP and Smart Systems Hub, among others.

- The 5G4BP project aims to implement a European set-up for sovereignty and establish open 5G networks in business parks and communities that are not yet covered by public mobile networks. The 5G networks are based on an open architecture (?). The partners in the project include Highstreet Technologies, Xelera Technologies, 6Wind, Alsatis, AW2S and Spectronite.

- Under the 5G OR project, the partners will work on developing wirelessly connected operating theatres in a private 5G network environment for minimally invasive surgery. The partners in the project are the Mannheim Hospital, Charite Hospital in Berlin, Institute Fraunhofer IPA, Karl Storz, Sectorcon, IHU Strasbourg, IRT b-com and RDS.

- Finally, under the 5G FORUM project, French and German industrial and academic parties will develop 5G wireless systems for operating theatres. Partners include RWTH Aachen University, Surgitaix, Uniklinik RWTH Aachen, AMA and Haventure. The goal of the projects is to reinforce the European ecosystem for private networks in 5G telecommunications using innovative methods.

5G private network architectures:

Under the program, the selected consortia will work on projects to make progress in 5G private networks, thus taking another big step towards digital sovereignty of 5G in Europe, said German Federal Minister for Economic Affairs and Climate Action Robert Habeck.

“I am looking forward to an intensive collaboration between France and Germany,” said Robert Habeck. “This is an important step in order to drive the economy forward with the help of state-of-the-art technologies,” he added.

“The constitution of a Franco-German sovereign ecosystem on 5G and future telecommunications network technologies will play a key role to position Europe at the forefront of innovation in 5G and its evolutions,” France’s Minister for the Economy, Finance and Recovery Bruno Le Maire said.

References:

5G Security explained: 3GPP 5G core network SBA and Security Mechanisms

by Akash Tripathi with Alan J Weissberger

Introduction:

5G networks were deployed in increasing numbers this past year. As of December 2021, GSA had identified 481 operators in 144 countries or territories that were investing in 5G, up from 412 operators at the end of 2020. Of those, a total of 189 operators in 74 countries/territories had launched one or more 3GPP-compliant 5G services, up by 40% from 135 from one year ago.

Despite 5G’s much advertised potential, there are significant security risks, especially with a “cloud native” service based architecture, which we explain in this article.

New 5G services, functions and features have posed new challenges for 5G network operators. For example, bad actors could set up “secure” wireless channels with previously issued 5G security keys.

Therefore, it’s imperative for 5G operators to address end-to-end cyber security, using an array of novel techniques and mechanisms, which have been defined by 3GPP and (to a much lesser extent) by GSMA.

5G Security Requires 5G SA Core Network:

It’s important to distinguish between 5G NSA network security (which use 4G security mechanisms and 4G core network/EPC) vs. 5G SA network security (which uses 5G core network serviced base architecture and new 5G security mechanisms as defined by 3GPP).

Samsung states in a whitepaper:

▪ With the launch of 5G Stand Alone (SA) networks, 3GPP mitigates some long-standing 4G vulnerabilities to enable much stronger security.

▪ At the same time, the way the Service Based Architecture ‘explodes’ the new 5G Core opens up potentially major new vulnerabilities. This requires a fundamentally new approach to securing the 5G Core, including comprehensive API security.

▪ Operators can communicate 5G SA’s new security features to some business users. Communication to consumers is more challenging because the benefit of new security enhancements will only come into effect incrementally over many years.

▪ Mobile network security cannot depend on 3GPP alone. Operators must apply robust cyber security hygiene and operational best practice throughout their operations.

In addition, the 5G network infrastructure must meet certain critical security requirements, such as the key exchange protocol briefly described below.

There are many other risks and challenges, such as the rising shortage of well-trained cyber security and cyber defense specialists. We will address these in this article. But first, a backgrounder….

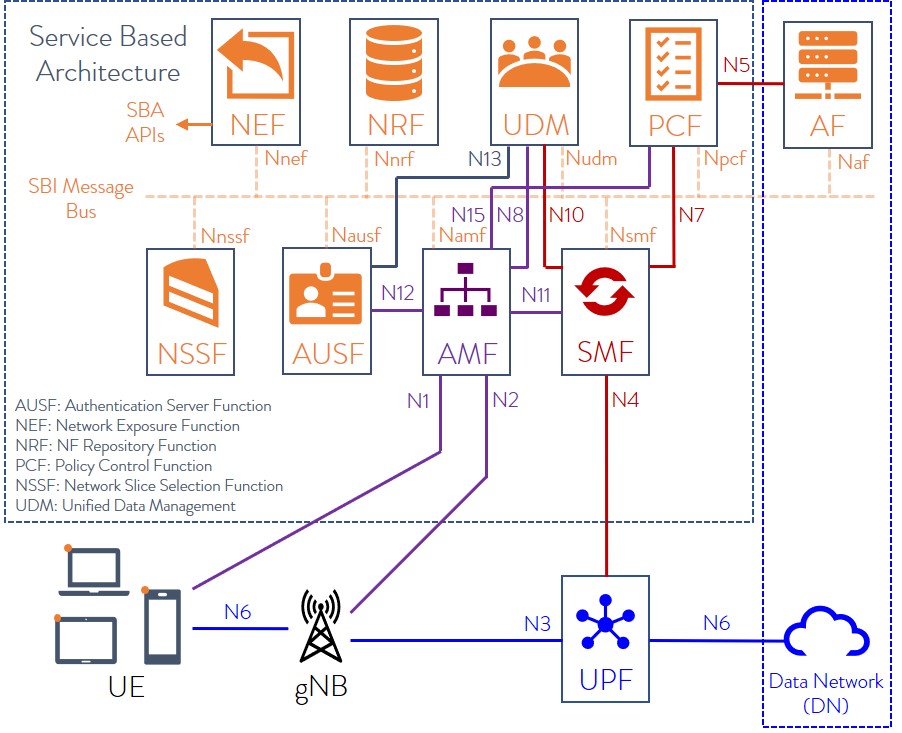

5G Core Network Service Based Architecture (SBA):

To understand 5G security specifications, one has to first the 3GPP defined 5G SA/core network architecture.

5G has brought about a paradigm shift in the architecture of mobile networks, from the classical model with point-to-point interfaces between network function to service-based interfaces (SBIs).

The 5G core network (defined by 3GPP) is a Service-Based Architecture (SBA), whereby the control plane functionality and common data repositories of a 5G network are delivered by way of a set of interconnected Network Functions (NFs), each with authorization to access each other’s services.

Network Functions are self-contained, independent and reusable. Each Network Function service exposes its functionality through a Service Based Interface (SBI), which employs a well-defined REST interface using HTTP/2. To mitigate issues around TCP head-of-line (HOL) blocking, the Quick UDP Internet Connections (QUIC) protocol may be used in the future.

Here’s an illustration of 5G core network SBA:

The 5G core network architecture (but not implementation details) is specified by 3GPP in the following Technical Specifications:

| TS 23.501 | System architecture for the 5G System (5GS) |

| TS 23.502 | Procedures for the 5G System (5GS) |

| TS 23.503 | Policy and charging control framework for the 5G System (5GS); Stage 2 |

The 5G network consists of nine network functions (NFs) responsible for registering subscribers, managing sessions and subscriber profiles, storing subscriber data, and connecting user equipment to the Internet using a base station. These technologies create a liability for attackers to carry out man-in-the-middle and DoS attacks against subscribers.

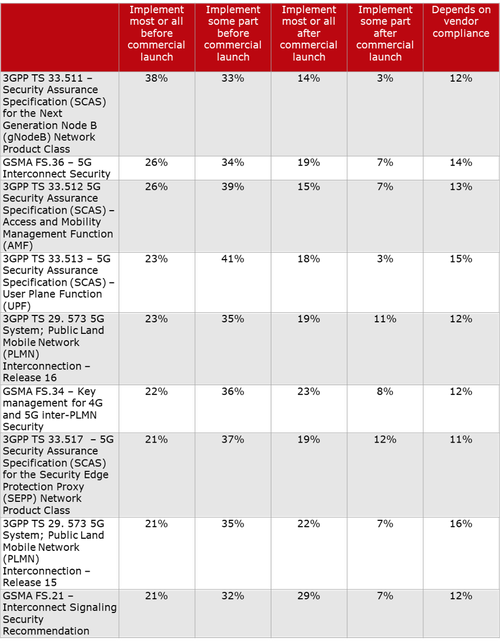

Overview of 3GPP 5G Security Technical Specifications:

The 5G security specification work are done by a 3GPP Working Group named SA3. For the 5G system security mechanisms are specified by SA3 in TS 33.501. You can see all versions of that spec here.

3GPP’s 5G security architecture is designed to integrate 4G equivalent security. In addition, the reassessment of other security threats such as attacks on radio interfaces, signaling plane, user plane, masquerading, privacy, replay, bidding down, man-in-the-middle and inter-operator security issues have also been taken in to account for 5G and will lead to further security enhancements.

Another important 3GPP Security spec is TS 33.51 Security Assurance Specification (SCAS) for the next generation Node B (gNodeB) network product class, which is part of Release 16.

It’s critically important to note that ALL 3GPP security spec features and functions are required to be supported by vendors, but the are ALL OPTIONAL for 5G service providers. That has led to inconsistent implementations of 5G security in deployed and planned 5G networks as per this chart, courtesy of Heavy Reading:

Scott Poretsky, Ericsson’s Head of Security, wrote in an email to Alan:

“The reason for the inconsistent implementation of the 5G security requirements is the language in the 3GPP specs that make it mandatory for vendor support of the security features and optional for the operator to decide to use the feature. The requirements are defined in this manner because some countries did not want these security features implemented by their national telecoms due to these security features also providing privacy. The U.S. was not one of those countries.”

………………………………………………………………………………………………..

Overview of Risks and Potential Threats to 5G Networks:

A few of the threats that 5G networks are likely to be susceptible to might include those passed over from previous generations of mobile networks, such as older and outdated protocols.

-

Interoperability with 2G-4G Networks

For inter-operability with previous versions of software or backward compatibility, 5G must still extend interoperability options with mobile gadgets adhering to the previous generation of cellular standards.

This inter-operability necessity ensures that vulnerabilities detected in the outmoded Diameter Signaling and the SS7 Interworking functions followed by 2G-4G networks can still be a cause of concern for the next-generation 5G network.

-

Issues related to data protection and privacy

There is a likely possibility of a cyber security attack such as Man-in-the-Middle (MITM) attack in a 5G network where a perpetrator can access personal data through the deployment of the International Mobile Subscriber Identity (IMSI)-catchers or cellular rogue base stations masquerading as genuine mobile network operator equipment.

-

Possibility of rerouting of sensitive data

The 5G core network SBA itself could make the 5G network vulnerable to Internet Protocol (IP) attacks such as Distributed Denial of Service (DDoS). Similarly, network hijacking, which involves redirecting confidential data through an intruder’s network, could be another form of attack.

-

Collision of Politics and Technology

Government entities can impact 5G security when it comes to the production of hardware for cellular networks. For instance, various countries have new regulations that ban the use of 5G infrastructure equipment that are procured from Chinese companies (Huawei and ZTE) citing concerns over possible surveillance by the Chinese government.

-

Network Slicing and Cyberattacks

Network slicing is a 5G SA core network function (defined by 3GPP) that can logically separate network resources. The facility empowers a cellular network operator to create multiple independent and logical (virtual) networks on a single shared access. However, despite the benefits, concerns are being raised about security risks in the form of how a perpetrator could compromise a network slice to monopolize resources for compute-intensive activities.

3GPP Public Key based Encryption Schemes:

3GPP has introduced more robust encryption algorithms. It has defined the Subscription Permanent Identifier (SUPI) and the Subscription Concealed Identifier (SUCI).

- A SUPI is a 5G globally unique Subscription Permanent Identifier (SUPI) allocated to each subscriber and defined in 3GPP specification TS 23.501.

- SUCI is a privacy preserving identifier containing the concealed SUPI.

The User Equipment (UE) generates a SUCI using a Elliptic Curve Integrated Encryption Scheme (ECIES)-based protection scheme with the public key of the Home Network that was securely provisioned to the Universal Subscriber Identity Module (USIM) during the USIM registration.

Through the implementation of SUCI, the chance of meta-data exploits that rely on the user’s identity are significantly reduced.

Zero Trust architecture:

As 5G will support a massive number of devices, Zero Trust can help private companies to authenticate and identify all connected devices and keep an eye on all the activities of those devices for any suspected transgression within the network. While it has been successfully tested for private enterprise networks, its capability for a public network like open-sourced 5G remains to be gauged.

Private 5G Networks:

A private 5G network will be a preferred mode for organizational entities that require the highest levels of security taking into account national interests, economic competitiveness, or public safety. A fully private 5G network extends an organization with absolute control over the network hardware as well as software set-up. All of those mechanisms can be proprietary as the 5G private network deployment is only within one company’s facilities (campus, building, factory floor, etc).

Future of 5G Security:

The next-generation 5G-based wireless cellular network has put the spotlight on new opportunities, challenges, and risks, which are mandatorily required as the 5G technology makes great strides.

The 5G security mechanisms will continue to evolve in 3GPP (with Release 17 and above). Many of them will be transposed to become (“rubber stamped”) ETSI standards.

Note that 3GPP has not submitted its 5G core network architecture or 5G security specifications to ITU-T which is responsible for all 5G (IMT 2020) non-radio standards.

Europe’s General Data Protection Regulation (GDPR), applicable as of May 25th, 2018 in all EU member states, harmonizes data privacy laws across Europe. It could serve as a model for network security and data protection initiatives outside the European Union.

Conclusions:

The 5G network has the possibility to enhance network and service security. While 5G comes with many built-in security controls by design, developed to enhance the protection of both individual subscribers and wireless cellular networks, there is a constant need to remain vigilant and a step ahead in terms of technological innovation to thwart possible new cyber-attacks.

An end-to-end security framework across all layers and all domains would be essential. Introducing best practices and policies around security and resilience will remain imperative to future-proof 5G networks.

References:

Strong Growth Forecast for 5G Security Market; Market Differentiator for Carriers

Report Linker: 5G Security Market to experience rapid growth through 2026

AT&T Exec: 5G Private Networks are coming soon + 5G Security Conundrum?

https://portal.3gpp.org/desktopmodules/Specifications/SpecificationDetails.aspx?specificationId=3169

5G Security Vulnerabilities detailed by Positive Technologies; ITU-T and 3GPP 5G Security specs

Author Bio:

Akash Tripathi is a Content Marketing strategist at Top Mobile Tech. He has 10+ years of experience in blogging and digital marketing. At Top Mobile Tech, he covers various how-to and tips & tricks related to iPhone and more related to technologies. For more about Akash, please refer to:

https://twitter.com/akashtripathi8

https://www.linkedin.com/in/akash-tripathi-42315959/

https://www.facebook.com/akash.tripathi.562

https://www.instagram.com/akashtripathi8/

Is 5G network slicing dead before arrival? Replaced by private 5G?

The telecom industry has been hyping 5G network slicing for several years now, asserting that carriers will be able to make money by selling “slices” of their networks to different enterprises for their exclusive use. Effectively, creating wireless virtual private networks.

Network slicing is a very complicated technology that must work across a 5G SA core, RAN, edge and transport networks. There are no standards for network slicing, which is defined in several 3GPP Technical Specifications.

From 3GPP TS 28.530:

Network slicing is a paradigm where logical networks/partitions are created, with appropriate isolation, resources and optimized topology to serve a purpose or service category (e.g. use case/traffic category, or for MNO internal reasons) or customers (logical system created “on demand”).

- network slice: Defined in 3GPP TS 23.501 v1.4.0

- network slice instance: Defined in 3GPP TS 23.501 V1.4.0

- network slice subnet: a representation of the management aspects of a set of Managed Functions and the required resources (e.g. compute, storage and networking resources).

- network slice subnet instance: an instance of Network Slice Subnet representing the management aspects of a set of Managed Function instances and the used resources (e.g. compute, storage and networking resources).

- Service Level Specification: a set of service level requirements associated with a Service Level Agreement to be satisfied by a network slice instance.

…………………………………………………………………………………………

An IEEE Techblog tutorial on network slicing is here.

………………………………………………………………………………………..

Yet despite all the pomp and circumstance, there are few if any instances of commercially available 5G SA core networks that support network slicing. Perhaps that’s because with the lack of standards there won’t be any interoperability or roaming from one 5G SA core network to another.

Meanwhile, private 5G is coming on strong, especially with Amazon’s announcement which we covered in this post:

Benefits of Private 5G Networks:

A private 5G network, also known as a local or non-public 5G network, is a local area network that provides dedicated bandwidth using 5G technology. Although the telecommunication industry is currently building the needed infrastructure and network gear to support 5G, there has not yet been a widespread rollout.

“5G deployment is still in its infancy, and we use movement from standardization bodies implementing models for Industry 4.0 or smart buildings as an indicator that the 5G private network is a foundational component for their future,” says Jon Abbott, EMEA technology director of Vertiv.

Many companies are working with service providers to use these developing networks, but some prefer the advantages that come with building their own private 5G systems.

A large component in the growth of private 5G networks is the release of an unlicensed spectrum for industry verticals. It gives businesses the option to deploy a private 5G network without having to work with an operator.

Because a private network can be designed for protection and human safety, sensor control, and security, the improved bandwidth is ideal for various use cases in multiple industries.

Benefits of a private network include:

- Reducing the company’s dependence on providers, thereby allowing full control over operating methods

- Separate data processing and storage

- Security policies can be designed and controlled within the organization, allowing companies to customize the network the way they want

- The overall high speeds, low latency, and application support of 5G

Risks of 5G:

Although there are many benefits, faster network do still come with risks. For example, the improved speed and latency can inadvertently create new avenues for cyber-criminals. As more systems go wireless, the more sources cyber criminals can attempt to hack. Furthermore, the growing adoption of 5G is increasing alongside the use of 5G-enabled devices. Because many of these devices are interconnected to various systems through the Internet of Things, the probability of a data leak increases.

Businesses need to take the proper steps to secure their systems in order to ward off cyber criminals as they attempt to take advantage of the fast speeds of 5G. When the implementation of 5G begins, organizations must have security systems, such as firewalls, VPNs, malware software, intrusion detection systems (IDS) and intrusion prevention systems (IPS), in place.

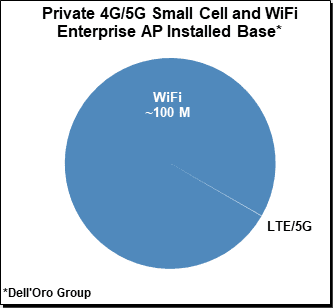

From a Dell’Oro Group report on Private Wireless Networks:

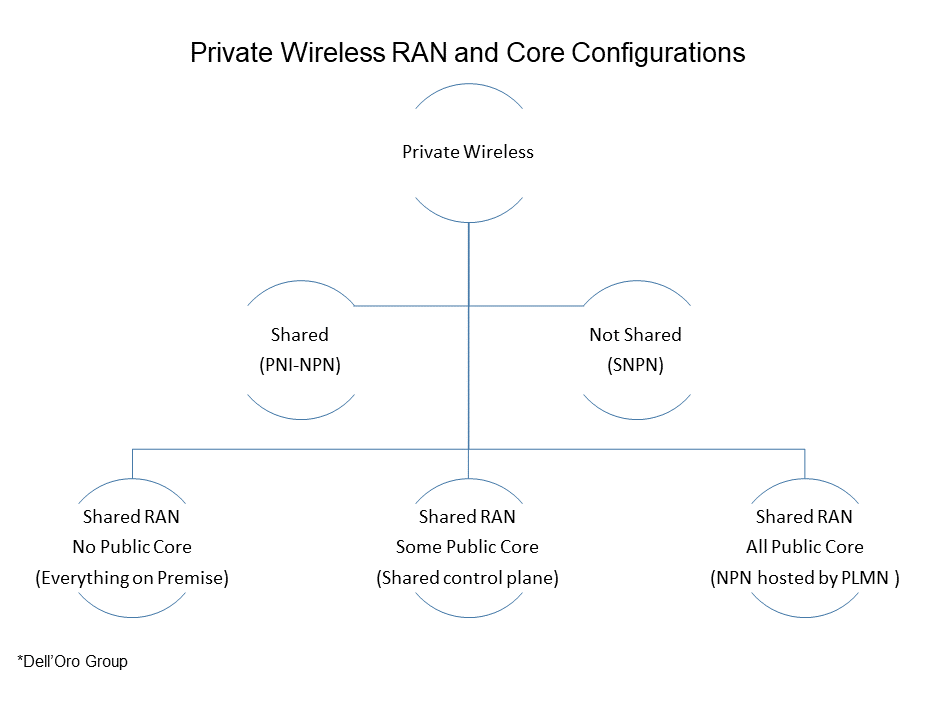

Private Wireless RAN and Core network Configurations:

There is no one-size-fits-all when it comes to private wireless. We are likely looking at hundreds of deployment options available when we consider all the possible RAN, Core, and MEC technology, architectures, business, and spectrum models. At a high level, there are two main private wireless deployment configurations, Shared (between public and private) and Not Shared:

- The shared configuration, also known as Public Network Integrated-NPN (PNI-NPN), shares resources between the private and public networks.

- Not shared, also known as Standalone NPN (SNPN), reflects dedicated on-premises RAN and core resources. No network functions are shared with the Public Land Mobile Network (PLMN).

Not surprisingly, there will be a plethora of deployment options to address the RAN domain. In addition to the shared vs. standalone configuration and LTE vs. 5G NR, private wireless RAN systems can be divided into two high-level RAN configurations: Wide-Area and Local-Area.

Dell’Oro Group continues to believe that it will take some time to realize the full vision with private wireless. Setting aside the more mature public safety market, we expect that some of these more nascent local private opportunities to support both Broadband and Critical IoT will follow Amara’s Law, meaning that there will likely be a disconnect between reality and vision both over the near and the long term.

References:

Orange installs Private 4G/5G Network at Nokia factory in Poland

Orange Poland has announced that it has been selected as the partner in the creation of a private 4G and 5G network at Nokia’s factory and R&D facility at Bydgoszcz, Poland, which includes a factory and three R&D centers. Orange said the 5G private network will benefit from various innovations and edge computing applications.

The network will cover the entire 13,000 square metre facility, providing the location’s 6,000 employees with access to faster, more reliable communications. This, in turn, will enable numerous efficiency improvements within the factory itself, including facilitating automated guided vehicles to transport products internally, drones for surveillance and monitoring, and the widespread deployment of IoT devices. The network will also allow for greater reliability when it comes to inter-facility communications, including group push-to-talk and push-to-video applications. As a private network, it will not be incorporated with Orange Polska’s wider network.

“Private 5G networks are undoubtedly the future of an effective industry. I am glad that we can boast a unique experience on the Polish market, collected during the implementation of already operating implementations of this type, which pay off in subsequent projects, such as the one with Nokia,” said Julien Ducarroz, president of Orange Polska.

“It is a solution enabling the maximum adjustment of communication to the customer’s needs, safe and increasing the efficiency of processes.”

Orange has had a busy couple of months when it comes to 5G. Last month, the company launched its first 5G Lab in Antwerp, the Netherlands, a move that further expands the operator’s presence in the city. Orange has a well-established private 5G standalone network set up in Port of Antwerp, set up back in 2020, where they have been trialling a variety of 5G use cases. At around the same time, Orange was also launching their first Open RAN lab in Paris, with CTO Michael Trabbia notably arguing that interoperable RAN tech would be central to creating a stronger European vendor ecosystem and offering the continent greater technical sovereignty. Further 5G developments are going on in Orange’s other markets too. Just yesterday, Orange Spain announced a new 5G fixed wireless access trial in Galicia, as part of Orange’s wider commitment to the Spanish government’s National 5G plan.

References:

“There’s nothing like it;” AWS CEO announces Private 5G at AWS re-Invent 2021; Dish Network’s endorsement

Amazon Web Services (AWS) CEO Adam Selipsky kicked off day 2 of AWS re-Invent 2021 today with a keynote presentation loaded with exciting announcements, status updates, and long-term vision-setting for the AWS cloud platform. AWS is now in its 15th year. It currently has 81 Availability Zones, 250+ services, 475 instance types to support virtually any workload. And it has an always-evolving library of solutions designed for highly specific use cases.

The AWS cloud stores more than 3 trillion objects, AWS offers over 200 fully-featured services, with millions of customers around the world,” the CEO said. Of those customers, Netflix, NASA and NTT DoCoMo are highlighted as some of the most innovative use cases for AWS.

“In the last 15 years, cloud has become not just another tech revolution, but a shift in how businesses actually function. There’s no business that can’t be radically disrupted. And we’re just getting started,” Selipsky added, noting that only 5-15% of spending has moved to the cloud, so there’s a big opportunity to come, with 5G and IoT becoming super important too.

“We’re going to keep innovating to keep offering the broadest suite of services,” Selipsky said.

The most import announcement for IEEE Techblog readers was a new AWS Private 5G service that will allow users to launch and manage their own private mobile network in days with automatic configuration, no per-device charges, and shared spectrum operation. AWS provides all the hardware, software, and SIMs needed for Private 5G, making it a one-stop solution that is the first of its kind.

“It’s not easy to set up a private 5G network using offerings from existing 5G providers, according to AWS CEO. “Currently, private mobile network deployments require customers to invest considerable time, money and effort to design their network for anticipated peak capacity, and procure and integrate software and hardware components from multiple vendors. Even if customers are able to get the network running, current private mobile network pricing models charge for each connected device and make it cost prohibitive for use cases that involve thousands of connected devices.”

Selipsky said AWS customers will be able to select where they want to build a mobile network and the network capacity they need. AWS will then deliver and maintain the network’s necessary small cell radio units, servers, 5G core and radio access network (RAN) software, and subscriber identity modules (SIM cards) required for a private 5G network and its connected devices.

“AWS Private 5G automates the setup and deployment of the network and scales capacity on demand to support additional devices and increased network traffic,” the company explained, noting the network will work in “shared spectrum,” likely a reference to the 3.5GHz CBRS spectrum band in the U.S. “There are no upfront fees or per-device costs with AWS Private 5G, and customers pay only for the network capacity and throughput they request.”

“It’s (AWS Private 5G) shockingly easy,” according to Selipsky – AWS sends everything you need, from hardware to software to SIM cards. Automatic configuration makes it ideal for factories and workplaces, and you can ask for as many devices to be connected as you need. He added that the company will sell the service under a pay-as-you-go model, and won’t add any per-device fees. “There’s nothing like AWS Private 5G network out there,” the CEO concluded.

“Many of our customers want to leverage the power of 5G to establish their own private networks on premises, but they tell us that the current approaches make it time-consuming, difficult, and expensive to set up and deploy private networks,” said David Brown, Vice President, EC2 at AWS in a press release. “With AWS Private 5G, we’re extending hybrid infrastructure to customers’ 5G networks to make it simple, quick, and inexpensive to set up a private 5G network. Customers can start small and scale on-demand, pay as they go, and monitor and manage their network from the AWS console.”

Dell’Oro Group’s VP Dave Bolan wrote in an email, “What is new about this announcement, is that we have a new Private Wireless Network vendor (AWS) with very deep pockets that could become a major force in this market segment.”

Immediately after Selipsky keynote speech, Dish Network’s Chief Network Officer Marc Rouanne took the re-Invent stage to tout his own company’s forthcoming 5G network. [Note that AWS is providing the 5G SA cloud native core network for Dish]. Rouanne, touted the appeal of Dish’s planned (but delayed) 5G network for enterprise customers. He said Dish is building a “network of networks” that enterprise customers will be able to adapt to their needs. He said Dish’s 5G customers will be able to customize their services based on parameters such as speed and latency, but didn’t mention that’s based on network slicing which requires the 5G SA core network that Dish has outsourced to AWS.

“Some say we are the AWS of wireless,” Rouanne said, adding that Dish’s 5G will be as flexible as the cloud computing service built by Amazon. “Dish is going to be the enabler of technology that people have not even imagined yet.”

“We’re building the first architecture that is truly optimized for the cloud. It promises tremendous advances, not just for human communications, but also for machine to machine, and of course for humans to control those machines,” he added.

We have previously expressed skepticism that Dish can be an effective telecom/IT systems integrator with no experience whatsoever in that field. We wrote:

Dish said it would use Cisco for routing, IBM for automation, Spirent for testing and Equinix for interconnections – announcements noteworthy considering Dish is mere weeks from its first market launch. The ability to automatically, virtually and in parallel test new 5G Standalone services, slices and software updates in the cloud is key to Dish Network’s network strategy and its differentiation, according to Marc Rouanne, Dish EVP and chief network officer for its wireless business. Rouanne said that the ability to rapidly test and certify network software and services has been part of Dish’s vision for its network. Dish announced more than a year ago that it would use radio management software from both Mavenir and Altiostar, when Rakuten was a major investor in Altiostar (it now owns that company).

–>So it seams that Dish Network’s 5G role will be that of a systems integrator, putting together the many outsourced parts of its 5G greenfield network. It remains to be seen what combination of vendors will supply the Open RAN portion of the 5G network and what development, if any, Dish’s engineers will do for it. And how will Dish’s 5G SA core network via AWS interface with those Open RAN vendors?

In the previously referenced press release from AWS, Stephen Bye, Chief Commercial Officer, DISH said, “Selecting AWS has enabled us to onboard and scale our 5G core network functions within the cloud. They are a key strategic partner in helping us deliver private enterprise networks to our customers. AWS’s innovative platform allows us to better serve our consumer wireless customers, while unlocking new business models for enterprise customers across a wide range of industry verticals. Our ability to support dedicated, private 5G enterprise networks allows us to give customers the scale, resilience and security needed to support a wide variety of devices and services, unlocking the potential of Industry 4.0.”

In conclusion, it looks like the AWS Private 5G network (where Amazon provides the 5G RAN and 5G core) will compete with Dish’s 5G network (where Dish provides the RAN while AWS provides the 5G SA core network) for industrial customers. In that sense, it is a win-win proposition for Amazon as AWS will be competing with AWS (hah, hah!) for the 5G SA core network. It’s also significant that these announcements strengthened the trend to use 5G for industry/factory applications rather than for consumers where there is little or no benefits.

All in all, it send a strong competitive signal to wireless telcos that they’ll be competing with cloud hyperscalers as well as network equipment and software companies in the 5G private network market.

About Amazon Web Services:

For over 15 years, Amazon Web Services has been the world’s most comprehensive and broadly adopted cloud offering. AWS has been continually expanding its services to support virtually any cloud workload, and it now has more than 200 fully featured services for compute, storage, databases, networking, analytics, machine learning and artificial intelligence (AI), Internet of Things (IoT), mobile, security, hybrid, virtual and augmented reality (VR and AR), media, and application development, deployment, and management from 81 Availability Zones (AZs) within 25 geographic regions, with announced plans for 27 more Availability Zones and nine more AWS Regions in Australia, Canada, India, Indonesia, Israel, New Zealand, Spain, Switzerland, and the United Arab Emirates. Millions of customers—including the fastest-growing startups, largest enterprises, and leading government agencies—trust AWS to power their infrastructure, become more agile, and lower costs. To learn more about AWS, visit aws.amazon.com.

References:

https://reinvent.awsevents.com/

https://press.aboutamazon.com/news-releases/news-release-details/aws-announces-aws-private-5g

https://www.techradar.com/news/live/aws-reinvent-2021-keynote-live-blog

https://www.lightreading.com/open-ran/amazon-dish-peddle-dueling-5g-products/d/d-id/773802?

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

Hyperscalers Outpace Network Operators in Private 5G

Microsoft is the most innovative private network provider globally, according to enterprises already using a private LTE and 5G network, finds a new study from Omdia.

AT&T and Deutsche Telekom are also singled out as industry pace setters, according to Omdia’s latest Private LTE and 5G Networks research which surveyed enterprises globally. Two thirds of enterprises require private network suppliers to demonstrate integration with their existing cloud platform before they will buy. Similar demands apply to enterprises’ IoT and application management platforms.

“Enterprises have needs beyond connectivity when they buy a private network,” advises Omdia principal analyst for Private Networks Pablo Tomasi. “The top two reasons enterprises invest in private networks are better security and digital transformation. They need partners that can service those needs. Telcos may lose out if they don’t step up.”

Enterprises also want these results to be achieved promptly. 55% of enterprises expect a two-year return on their private network investment, but almost a fifth of those already deployed expect ROI in only a year.

Consumption preferences are changing fast: three quarters of enterprises now planning a private network prefer a hybrid model instead of the fully dedicated private networks that dominate 70% of deployments today.

The findings are from an annual survey conducted by Omdia on enterprises using, trialling, or planning to deploy private LTE and 5G networks in six key verticals, part of the Private Networks Intelligence Service. A total of 451 respondents from seven countries participated in the survey.

Full analysis of the survey is available in Omdia’s Private LTE and 5G Network Enterprise Survey Insight – 2021 report.

………………………………………………………………………………………………………………….

What is Private Wireless?

One of the challenges with the private wireless concept is that it is not a specific technology but rather more of a broad term encompassing a wide range of technologies. Marketing departments will have some wiggle room, as the meaning of private wireless varies significantly across the ecosystem.

Some Wi-Fi suppliers, for example, believe they provide private wireless connectivity to enterprises. Smaller radio access network (RAN) suppliers without macro footprints typically associate private wireless with dedicated standalone connectivity for enterprises, while some of the more established macros RAN suppliers envision private wireless as encompassing a broader set of technologies, including both macro and small cell networks.

Suppliers focused on mission-critical and public safety networks see private LTE and NR combined with a new spectrum as an opportunity to upgrade existing private narrowband communications equipment. With the number of LoRa end nodes surpassing 0.2 B, LoRa base station suppliers believe they are dominating the private wireless IoT market.

The operators are also positioning the concept differently, with some focusing on the benefits with broader coverage, while others are capitalizing on some of the new local concepts.

While definitions or interpretations vary widely on the part of both suppliers and operators, there appears to be a greater consensus among customers.

For end-users, private wireless typically means consistent, reliable, and secure connectivity, not accessible by the public, to foster efficiency improvements. For industrial sites, private wireless typically means low latency and high reliability. It is less about the underlying technology, spectrum, or business model and more about solving the connectivity challenge. In other words, end-users don’t care what is under the hood.

From a Dell’Oro perspective, we consider private wireless as nearly synonymous with 3GPP’s vision for NPNs. According to 3GPP, NPNs are intended for the sole use of a private entity, such as an enterprise. NPNs can be deployed in a variety of configurations, utilizing both virtual and physical elements located either close to or far away from the site. NPNs might be offered as a network slice of a Public Land Mobile Network (PLMN), be hosted by a PLMN, or be deployed as completely standalone networks.

From an end-user perspective, private wireless is also a broader term, generally including not just the RAN but also transport, mobile core network (MCN), Multi-Access Edge Computing (MEC), and corresponding services.

Private Wireless RAN and Core Configurations

There is no one-size-fits-all when it comes to private wireless. We are likely looking at hundreds of deployment options available when we consider all the possible RAN, Core, and MEC technology, architectures, business, and spectrum models.

At a high level, there are two main private wireless deployment configurations, Shared (between public and private) and Not Shared:

- The shared configuration, also known as Public Network Integrated-NPN (PNI-NPN), shares the resources between the private and public networks.

- Not Shared, also known as Standalone NPN (SNPN), reflects dedicated on-premises RAN and core resources. No network functions are shared with the Public Land Mobile Network (PLMN).

Market Status

Preliminary 3Q21 estimates suggest the high-level trends remain unchanged with MBB and FWA dominating the 5G capex while private RAN revenues remain small —leading RAN vendors are reporting that private 5G revenues are still negligible relative to the overall public and private 5G RAN market.

Meanwhile, private wireless activity using both macro and local base stations is rising:

- Huawei estimates there are now around 10 K 5G B2B projects globally and the supplier is engaged in thousands of trials focusing on various 5G private use cases.

- Ericsson is currently involved in hundreds of private wireless customer engagements, including pilots with time-critical use cases.

- Even though Nokia’s enterprise business declined year-over-year in 3Q21, Nokia’s private wireless segment continued to gain momentum in the quarter–Nokia now has 380+ private wireless customers.

- ZTE has developed more than 500 cooperative partners in 15 industries, including industrial engineering, transportation, and energy. They have jointly explored 86 innovative 5G application scenarios and successfully carried out more than 60 demonstration projects worldwide supporting multiple 5G IoT use cases.

- Federated Wireless, one of the leading CBRS SAS providers, is working on hundreds of CBRS-based private wireless trials in multiple vertical domains, including warehouse logistics, agriculture, distance learning, and retail applications.

Market Opportunity and Forecast

One of the more compelling aspects with private wireless is that we are talking about new revenue streams, incremental to the existing telco capex. More importantly, the TAM is large, approaching $10–20 B when we include Non-Industrial, Industrial, and Public Safety driven applications.

At the same time, it is important to separate the TAM from the forecast. Here at the Dell’Oro Group, we continue to believe that it will take some time for enterprises to fully conceptualize the value of 5G relative to Wi-Fi. And as much as we want 5G to be as easy to deploy and manage as Wi-Fi, the reality is that we are not yet there.

Still, the uptick in the activity adds confidence the industry is moving in the right direction. And although LTE is dominating the private wireless market today, private 5G NR revenues remain on track to surpass $1 B by 2025.

ZTE and Riedel jointly build customized Private 5G as a Service campus network

ZTE announced it has collaborated with Riedel Communications to deploy a customized, private 5G-as-a-Service on a campus network. The Germany media services company plans to work with ZTE on exploring the possible network services and infrastructure for serving large-scale events.

The 5G RAN and Stand Alone (SA) architecture is based on ZTE’s large-capacity Base Band Unit, 5G pad Remote Radio Unit and i5GC (Industrial 5G Core). For industry verticals, a private 5G networks with customized functions, precise SLAs, and reduced costs can be purchased on demand, ZTE said.

“In terms of the future, 5G is a topic that offers many new opportunities. Especially for our largescale events, we need flexible and high-performance systems that enable us to set up ad-hoc infrastructures. Riedel sees ZTE as a strong partner to drive forward these topics with smart technology and the right spirit” said Lutz Rathmann, Director Managed Technology Division.

“ZTE, as one of the global leaders in 5G, truly believes that 5G is driving the development of the verticals and the digital transformation of industries. Deploying a variety of 5G applications enables the move from traditional manufacturing to intelligent manufacturing while reducing costs and increasing efficiency and quality” said Yang Lin, Managing Director of ZTE Germany Representative Office. “In the cooperation, ZTE provides a campus network with a flexible architecture, which could be easily expanded as the size of campus or separated campus. The application platform and device can be also integrated in the campus network for different use cases.”

This cooperation is the first step for Riedel and ZTE to jointly explore the value of 5G in vertical industries. With the solid network foundation of 5G, it can be foreseen that subsequent open platforms and diversified applications based on 5G will innovate further in the future.

About ZTE:

ZTE is a provider of advanced telecommunications systems, mobile devices and enterprise technology solutions for consumers, operators, businesses and public sector customers. As part of ZTE’s strategy, the company is committed to providing customers with end-to-end integrated innovations to deliver excellence and value as the telecommunications and information technology sectors converge. ZTE sells its products and services in more than 160 countries.

About Riedel:

Riedel Communications designs, manufactures, and distributes pioneering real-time video, audio, data, and communications networks for broadcast, pro audio, event, sports, theater, and security applications. The company also provides rental services for radio and intercom systems, event IT solutions, fiber backbones, and wireless signal transmission systems that scale easily for events of any size, anywhere in the world. Riedel is headquartered in Wuppertal, Germany, and employs nearly 700 people in 25 locations throughout Europe, Australia, Asia, and the Americas.

Learn more about Riedel here

References:

Deloitte to co-ordinate 5G private network field trial at the largest hospital in Latin America

The Radiology Institute (InRad) of the Hospital das Clínicas, Faculty of Medicine of the University of São Paulo in Brazil is launching their first field trial of a 5G private network. The project will be housed at InovaHC, the Innovation Center of the Hospital das Clínicas, and is coordinated by Deloitte in collaboration with Telecom Infra Project (TIP), Itaú Unibanco, NEC, Brazilian Agency for Industrial Development (ABDI), Inter-American Development Bank (BID) and the Polytechnic School of the University of São Paulo (Poli-USP).

The field trial will assess 5G data transmission capacity, response time, and the feasibility of carrying out remote examinations using the increased speed and lower latency the next-generation 5G private network provides. The proof of concept for the project, OpenCare 5G, will initially focus on the viability of conducting remote ultrasound exams using 5G connectivity with on-premise private network infrastructure.

The project will follow the TIP 5G Private Networks Solution Group framework which brings together a range of industry experts to develop, test and deploy this technology based solution to help advance healthcare for enhanced application performance. The parties involved in the OpenCare 5G tests include:

• Deloitte will coordinate the project, proposing sustainable business models for the ecosystem.

• InovaHC will contribute its research facilities and experience in attracting investors from the technology, telecommunications and pharmaceutical industries to promote academic research and foster national technology.

• Itaú Unibanco will provide its expertise in technology, as the first bank in Brazil to use Open RAN to provide a 5G connection, allocating part of its data center capacity.

• The Telecom Infra Project (TIP) 5G Private Networks Solution Group will support this use case by developing and publishing a blueprint in collaboration with NEC and Deloitte that will help scale the solution for future deployments around the world.

• NEC will act as the systems integrator of the network layer, managing the installation, configuration and commissioning of the indoor 5G network at InovaHC and Itaú Unibanco’s data center.

• The Brazilian Agency for Industrial Development (ABDI) is supporting the project to encourage the adoption of new technologies and new business models, in order to contribute to greater productivity in the industrial sector and competitiveness in the country.

• The Polytechnic School of the University of São Paulo (Poli-USP) will be responsible for the system architecture and research methodology during the implementation of the tests with an eye to the future, aware of how the technology will impact the development of new solutions.

Giovanni Guido Cerri, president of the Innovation Commission (InovaHC) at Hospital das Clínicas and president of the Board of Directors of the Institute of Radiology, said: “This project will positively impact the delivery of patient care -accelerating digitization, personalized medicine, improving access, and reducing costs. Without a doubt, it will be an impetus for new investments in health and technology development, as well as improving access and reducing inequalities. It will also contribute to improving diagnostic quality and digital health.”

Márcia Ogawa, partner and leader of the Technology, Media and Telecom Industry practice at Deloitte Brazil, said: “This project is of significant social and economic relevance. It’s fundamental for public health and the development of research and products in the area of connectivity in Brazil. The use of 5G in healthcare and this trial promotes great positive impacts, attracting investment to the country and the development of new technologies to improve the quality of patient care, expanding access to public health, and better, faster care during emergencies. We are pleased to work with several leading organizations from the technology, telecom, and banking industries, to develop this project within the Hospital das Clínicas, one of Latin America’s top teaching hospitals, which will benefit the wider Brazilian health system (Sistema Único de Saúde).”

Angelo Guerra, president of NEC Brazil said: “The InovaHC use case for mobile ultrasound provides a cutting edge opportunity to showcase NEC’s integration capabilities to develop the solution at scale for several enterprise industry verticals. NEC’s seasoned system integrator capabilities will help incubate all aspects of the solution from onboarding to deployment in addition to building a blueprint collaborating within the ecosystem of TIP’s 5G Private Networks Solution Group.”

“The 5G private network takes the evolution of networks to the next level. Businesses see the potential to reap the benefits of 5G with dedicated infrastructure for an immersive user experience. TIP, in collaboration with Deloitte, NEC, and OEMs (Original Equipment Manufacturer), is providing a platform for all partners to incubate critical Inova healthcare use cases in this field trial, expanding the community’s relevance to enterprise verticals, opening the door to more use cases,” explains Sriram Subramanian, Technical Lead of TIP’s 5G Private Networks Solution Group.

References:

https://www2.deloitte.com/us/en/insights/industry/technology/global-5g-transformation.html

https://www2.deloitte.com/us/en/insights/industry/health-care/future-of-virtual-health.html