Dish Network

Elon Musk: Starlink could become a global mobile carrier; 2 year timeframe for new smartphones

Yesterday, during a segment of the All-in Podcast dedicated to the SpaceX-EchoStar spectrum sales agreement [1.], Space X/Starlink boss Elon Musk was asked if this sets the industry down a path where Starlink’s end goal is to emerge as a global carrier that, effectively, would limit the role of regional carriers. “That would be one of the options,” Musk responded. Musk downplayed any threat against AT&T, Verizon and T-Mobile. The podcast section dedicated to the EchoStar agreement starts around the 16:50 mark. You can start watching at that point via this YouTube link.

Note 1. SpaceX’s $17 billion agreement with EchoStar includes $8.5 billion in stock, plus $2 billion of cash interest payments payable on EchoStar debt. Separately, AT&T’s is paying $23 billion – all in cash – for its acquisition of EchoStar’s spectrum.

Regarding the EchoStar spectrum deal, Musk said, “This is kind of a long term thing. It will allow SpaceX to deliver high bandwidth connectivity directly from the satellites to the phones.”

Musk said that deal would not seriously challenge the big three U.S. mobile carriers. He said:

“To be clear, we’re not going to put the other carriers out of business. They’re still going to be around because they own a lot of spectrum. But, yes, you should be able to have a Starlink, like you have an AT&T or T-Mobile or Verizon, or whatever. You can have an account with Starlink that works with your Starlink [satellite] antenna at home with … Wi-Fi, as well as on your phone. We’d be a comprehensive solution for high bandwidth at home and high bandwidth for direct-to-cell.”

“Could you buy Verizon?” Musk was asked. “Not out of the question. I suppose that may happen,” Musk said with a chuckle.

That idea at least “highlights the possibility that SpaceX could pursue additional spectrum,” LightShed Partners analysts Walter Piecyk and Joe Galone explained in this blog post. “We highly doubt SpaceX has any interest in the people or infrastructure of a telco, there are plenty of compelling spectrum assets in and outside of those carriers to consider.”

Getting smartphones equipped with chips to support those new frequency bands will take some time. Musk estimated that’s “probably a two-year timeframe.” LightShed Partners analysts agreed, “On devices, Elon’s two-year timeline for a Starlink phone isn’t surprising given spectrum banding, chip development, and satellite integration. He’s mused before that if phone manufacturers continued to hinder his technology that he “would make a phone as a forcing function to compete with them.”

Some analysts view MVNO agreements as Starlink’s best route to becoming a full scale mobile carrier of satellite and terrestrial wireless services.

“The most plausible business model is that Starlink partners with MNOs for them to resell the service or embed the service as part of their plans,” Lluc Palerm Serra, research director at Analysys Mason, told PCMag.

LightShed Partners agreed. Musk’s point that SpaceX isn’t out to displace the incumbent carriers “reinforced our view that securing an MVNO deal will be essential if SpaceX wants to deliver a Starlink phone directly to consumers,” LightShed’s Walter Piecyk and Joe Galone explained in this blog post.

“In parallel, we’re working on the satellites and working with the handset makers to add these frequencies to the phones,” Musk said. “And the phones will then handshake well to achieve high-bandwidth connectivity. The net effect is that you should be able to watch videos anywhere on your phone.”

AT&T CEO John Stankey addressed Starlink’s “mobile-first” possibility earlier this week at an investor conference. Starlink’s current access to spectrum, including what is coming way of EchoStar, isn’t enough to create a “robust terrestrial replacement,” he said. But he acknowledged that, with the right type of commitments, perhaps it could happen someday.

“EchoStar still owns the highly lucrative 700 and AWS-3 spectrum, in which we note that all three wireless carriers have a robust ecosystem,” TD Cowen analyst Gregory Williams wrote in a note earlier this week. “Whether EchoStar sells more [spectrum] in short order remains to be seen,” TD Cowen’s Williams wrote Monday, explaining that, with the FCC dispute resolved, it may hold onto its portfolio longer. “EchoStar is not a forced seller, now has an excellent balance sheet and liquidity, and may desire to hold onto the spectrum as long as possible for higher sale valuations at a later date,” he added.

References:

https://www.lightreading.com/5g/turning-starlink-into-a-global-carrier-one-of-the-options-musk-says

Elon Talks Starlink Phone. Disruption Looms for Telcos and Apple

Huge significance of EchoStar’s AWS-4 spectrum sale to SpaceX

U.S. BEAD overhaul to benefit Starlink/SpaceX at the expense of fiber broadband providers

Telstra selects SpaceX’s Starlink to bring Satellite-to-Mobile text messaging to its customers in Australia

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

SpaceX has majority of all satellites in orbit; Starlink achieves cash-flow breakeven

Huge significance of EchoStar’s AWS-4 spectrum sale to SpaceX

EchoStar has entered into a definitive agreement to sell its entire portfolio of prized AWS-4 [1.] and H-block spectrum licenses to SpaceX in a deal valued at approximately $19 billion. The spectrum purchase allows SpaceX to start building and deploying upgraded, laser-connected satellites that the company said will expand the cell network’s capacity by “more than 100 times.”

This deal marks EchoStar/Dish Network’s exit as a mobile network provider (goodbye multi-vendor 5G OpenRAN) which once again makes the U.S. wireless market a three-player (AT&T, Verizon, T-Mobile) affair. Despite that operational failure, the deal helps EchoStar address regulatory pressure and strengthen its financial position, especially after AT&T agreed to buy spectrum licenses from EchoStar for $23 billion.

The companies also agreed to a deal that will enable EchoStar’s Boost Mobile subscribers to access Starlink direct-to-cell (D2C) service to extend satellite service to areas without mobile network service.

……………………………………………………………………………………………………………………………………………………………

Note 1. The AWS-4 spectrum band (2000-2020 MHz and 2180-2200 MHz) is widely considered the “golden band” for D2C services. Unlike repurposed terrestrial spectrum, the AWS-4 band was originally allocated for Mobile Satellite Service (MSS).

…………………………………………………………………………………………………………………………………………………………..

The AWS-4 spectrum acquisition transforms SpaceX from a D2C partner into an owner that controls its dedicated MSS spectrum. The deal with EchoStar will allow SpaceX to operate Starlink direct-to-cell (D2C) services on frequencies it owns, rather than relying solely on those leased from mobile carriers like T-Mobile and other mobile operators it’s working with (see References below).

Roger Entner wrote that SpaceX is now a “kingmaker.” He emailed this comment:

“With 50 MHz of dedicated spectrum, the raw bandwidth that Starlink can deliver increases by 1.5 GBbit/s. This is a substantial increase in speed to customers. The math is 30 bit/s/hz which is LTE spectral efficiency x 50 MHz = 1.5 Gbit/s. “This agreement makes Starlink an even more serious play in the D2C market as it will have first hand experience with how to utilize terrestrial spectrum. It is one thing to have this experience through a partner, this a completely different game when you own it.”

The combination of T-Mobile’s terrestrial network and Starlink’s enhanced D2C capabilities allows T-Mobile to market a service with virtually seamless connectivity that eliminates outdoor dead zones using Starlink’s spectrum.

“For the past decade, we’ve acquired spectrum and facilitated worldwide 5G spectrum standards and devices, all with the foresight that direct-to-cell connectivity via satellite would change the way the world communicates,” said Hamid Akhavan, president & CEO, EchoStar. “This transaction with SpaceX continues our legacy of putting the customer first as it allows for the combination of AWS-4 and H-block spectrum from EchoStar with the rocket launch and satellite capabilities from SpaceX to realize the direct-to-cell vision in a more innovative, economical and faster way for consumers worldwide.”

“We’re so pleased to be doing this transaction with EchoStar as it will advance our mission to end mobile dead zones around the world,” said Gwynne Shotwell, president & COO, SpaceX. “SpaceX’s first generation Starlink satellites with Direct to Cell capabilities have already connected millions of people when they needed it most – during natural disasters so they could contact emergency responders and loved ones – or when they would have previously been off the grid. In this next chapter, with exclusive spectrum, SpaceX will develop next generation Starlink Direct to Cell satellites, which will have a step change in performance and enable us to enhance coverage for customers wherever they are in the world.”

EchoStar anticipates this transaction with SpaceX along with the previously announced spectrum sale will resolve the Federal Communications Commission’s (FCC) inquiries. Closing of the proposed transaction will occur after all required regulatory approvals are received and other closing conditions are satisfied.

The EchoStar-Space X transaction is structured with a balanced mix of cash and equity plus interest payments:

-

Cash and Stock Components: SpaceX will provide up to $8.5 billion in cash and an equivalent amount in its own stock, with the valuation fixed at the time the agreement was signed. This 50/50 structure provides EchoStar with immediate liquidity to address its creditors while allowing SpaceX to preserve capital for its immense expenditures on Starship and Starlink development. A pure stock deal would have been untenable for EchoStar, which is saddled with over $26.4 billion in debt, while a pure cash deal would have strained SpaceX.

-

Debt Servicing: In a critical provision underscoring EchoStar’s dire financial state, SpaceX has also agreed to fund approximately $2 billion of EchoStar’s cash interest payments through November 2027.

-

Commercial Alliance: The deal establishes a long-term commercial partnership wherein EchoStar’s Boost Mobile subscribers will gain access to SpaceX’s next-generation Starlink D2C service. This provides a desperately needed lifeline for the struggling Boost brand. More strategically, this alliance serves as a masterful piece of regulatory maneuvering. It allows regulators to plausibly argue that they have preserved a “fourth wireless competitor,” providing the political cover necessary to approve a deal that permanently cements a three-player terrestrial market.

The move comes amid rapidly increasing U.S. mobile data usage. In 2024, Americans used a record 132 trillion megabytes of mobile data, up 35% over the prior all-time record, industry group CTIA said Monday.

About EchoStar Corporation:

EchoStar Corporation (Nasdaq: SATS) is a premier provider of technology, networking services, television entertainment and connectivity, offering consumer, enterprise, operator and government solutions worldwide under its EchoStar®, Boost Mobile®, Sling TV, DISH TV, Hughes®, HughesNet®, HughesON™, and JUPITER™ brands. In Europe, EchoStar operates under its EchoStar Mobile Limited subsidiary and in Australia, the company operates as EchoStar Global Australia. For more information, visit www.echostar.com and follow EchoStar on X (Twitter) and LinkedIn.

©2025 EchoStar, Hughes, HughesNet, DISH and Boost Mobile are registered trademarks of one or more affiliate companies of EchoStar Corp.

About SpaceX:

SpaceX designs, manufactures, and launches the world’s most advanced rockets and spacecraft. The company was founded in 2002 to revolutionize space technology, with the ultimate goal of making life multiplanetary. As the world’s leading provider of launch services, SpaceX is leveraging its deep experience with both spacecraft and on-orbit operations to deploy the world’s most advanced internet and Direct to Cell networks. Engineered to end mobile dead zones around the world, Starlink’s satellites with Direct to Cell capabilities enable ubiquitous access to texting, calling, and browsing wherever you may be on land, lakes, or coastal waters.

………………………………………………………………………………………………………………………………………………………………………………………………

References:

Mulit-vendor Open RAN stalls as Echostar/Dish shuts down it’s 5G network leaving Mavenir in the lurch

AT&T to buy spectrum Licenses from EchoStar for $23 billion

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier? (T-Mobile)

KDDI unveils AU Starlink direct-to-cell satellite service

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

Telstra selects SpaceX’s Starlink to bring Satellite-to-Mobile text messaging to its customers in Australia

Telstra partners with Starlink for home phone service and LEO satellite broadband services

One NZ launches commercial Satellite TXT service using Starlink LEO satellites

AT&T to buy spectrum licenses from EchoStar for $23 billion

Executive Summary:

Embattled EchoStar Corp, parent company of Dish Network [1.], has agreed to sell spectrum licenses to AT&T Inc. for about $23 billion in a deal that will help the company stay out of bankruptcy and fend off regulatory concerns about its airwave use. The sale will expand AT&T’s wireless network and add about 50 MHz of low-band and mid-band spectrum in an all-cash transaction, the Dallas, Texas-based telecommunications company said in a statement on Tuesday. The deal is expected to close by mid-2026, pending regulatory approval.

Note 1. Dish Network is one of only two U.S. wireless telcos that have commercially deployed 5G SA core network on Amazon’s AWS public cloud.. The EchoStar subsidiary has also deployed 5G OpenRAN.

……………………………………………………………………………………………………………………………………………………………………………………………

Key Takeaways:

- $23 billion acquisition will add an average of approximately 50 MHz of low-band and mid-band spectrum to AT&T’s holdings – covering virtually every market across the U.S. and positioning AT&T to maintain long-term leadership in advanced connectivity across 5G and fiber

- Transaction powers improved and capital-efficient long-term growth by accelerating the Company’s ability to add converged subscribers with both 5G wireless and home internet services in more places

- Leading AT&T network will enable continued EchoStar participation in wireless industry through long-term wholesale network services agreement

AT&T said the acquisition of approximately 30 MHz of mid-band spectrum and 20 MHz of low-band spectrum will strengthen the company’s ability to deliver 5G and fiber services across the US. EchoStar will operate in the US market as a hybrid mobile network operator under its Boost brand, the company said in the statement. AT&T will be its primary network partner for wireless service. AT&T has been spending heavily to expand its fiber-optic network across the country and previously said it would use cash savings from Trump’s tax and spending bill to accelerate those plans. In May, it agreed to buy the consumer fiber operations of Lumen Technologies Inc. for $5.75 billion, expanding its fast broadband service in major cities like Denver and Las Vegas. AT&T intends to finance the EchoStar deal with a combination of cash on hand and borrowings. Jefferies Financial Group Inc. advised AT&T on the EchoStar acquisition.

………………………………………………………………………………………………………………………………………………………………………………………………

Backgrounder:

Federal regulators have been pushing EchoStar to sell some of its airwaves after concerns it had failed to put valuable slices of wireless spectrum to use, Bloomberg reported in July. The FCC launched an investigation in May into whether EchoStar was meeting its obligations for its wireless and satellite spectrum rights. The company skipped bond payments and considered filing for bankruptcy, saying the probe had stymied its ability to make decisions about its 5G network. In a June meeting, first reported by Bloomberg, Trump urged EchoStar Chairman Charlie Ergen and FCC Chairman Brendan Carr to cut a deal to resolve the dispute. EchoStar shopped the assets to other would-be buyers, including Elon Musk’s Starlink, Bloomberg earlier reported.

The purchase price is $9 billion more than EchoStar paid for the spectrum and $5 billion more than the appraised value used in securitizing the assets, New Street Research’s Philip Burnett said in a research note Tuesday. While $1.5 billion shy of New Street’s valuation, he said the sale price was “nevertheless a great mark on value.”

………………………………………………………………………………………………………………………………………………………………………………………………

Quotes:

EchoStar CEO Ergen described the sale and related agreement to work with AT&T as “critical steps toward resolving the FCC’s spectrum utilization concerns.”

FCC spokesperson Katie Gorscak said “We appreciate the productive and ongoing discussions with the EchoStar team. The FCC will continue to focus on ensuring the beneficial use of scarce spectrum resources.”

………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://finance.yahoo.com/news/t-buy-echostar-spectrum-licenses-160830548.html

https://about.att.com/story/2025/echostar.html

FCC to investigate Dish Network’s compliance with federal requirements to build a nationwide 5G network

FCC approves EchoStar/Dish request to extend timeline for its 5G buildout

New FCC Chairman Carr Seen Clarifying Space Rules and Streamlining Approvals Process

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Network to FCC on its “game changing” OpenRAN deployment

DISH Wireless Awarded $50 Million NTIA Grant for 5G Open RAN Center (ORCID)

FCC to investigate Dish Network’s compliance with federal requirements to build a nationwide 5G network

In a letter to Charlie Ergen, the chairman and co-founder of network operator EchoStar, Federal Communications Commission (FCC) chairman Brendan Carr wrote that the agency’s staff would investigate the company’s compliance with requirements to build a nationwide 5G network as per the terms of its federal spectrum licenses. EchoStar owns both Dish Network and Boost Mobile’s wireless service. Dish has said its 5G network covers more than 268 million people and has met all of its regulatory requirements.

In 2019, the U.S. government set several construction milestones for Dish Network to maintain cellular licenses worth billions of dollars. The company agreed to meet specific buildout obligations in connection with a number of spectrum licenses across several different bands. In particular, the FCC agreed to relax some of EchoStar’s then-existing buildout obligations in exchange for EchoStar’s commitment to put its licensed spectrum to work deploying a nationwide 5G broadband network. EchoStar promised—among other things—that its network would cover, by June 14, 2025, at least 70% of the population within each of its licensed geographic areas for its AWS-4 and 700 MHz licenses, and at least 75% of the population within each of its licensed geographic areas for its H Block and 600 MHz licenses.

“The FCC structured the buildout obligations to prevent spectrum warehousing and to ensure that Americans would gain broader access to high-speed wireless services, including in underserved and rural areas.”

Ergen said that the company has worked collaboratively with FCC leaders since it launched its first pay-TV satellite more than 30 years ago. He added that EchoStar’s network creates American jobs and furthers a critical Trump administration priority of ensuring “the United States is at the forefront of wireless leadership and that our infrastructure is free of Chinese vendors.” Full text of his statement is below.

Ergen is reportedly working to pivot his satellite TV business from a declining pay-TV model to a “direct-to-device” business that connects smartphones from space, among other services. Carr laid out plans for the agency to seek public comment on how mobile-satellite services could use some spectrum that EchoStar currently holds. EchoStar is among a group of satellite companies that already hold licenses to provide mobile-device links, though they lack the dense network of modern satellites that Starlink has at its disposal.

SpaceX said in an April letter that EchoStar’s spectrum in the 2 Gigahertz band “remains ripe for sharing among next-generation satellite systems.” The company urged the commission to launch a new rule-making process to add new competitors to the band. EchoStar has accused SpaceX of a spectrum land grab.

Separately, Dish Network has spent years wiring thousands of cellphone towers to help Boost become a wireless operator that could rival AT&T, Verizon and T-Mobile, but the project has been slow-going. Boost’s subscriber base has shrunk in the five years since Ergen bought the brand from Sprint so it is not at all competitive with its big three U.S. cellular rivals.

Dish Network under FCC microscope, Art by Midjourney for Fierce Network

……………………………………………………………………………………………………………………………………………………………….

Charlie Ergen’s Statement in Response to FCC Letter:

“We have worked collaboratively with FCC leaders since we launched our first DBS satellite more than 30 years ago. Today, we are proud to have invested tens of billions to deploy the world’s largest 5G Open RAN network – primarily using American vendors – across 24,000 5G sites, to offer broadband service to over 268 million people nationwide. Through this deployment, which is possible thanks to scores of tower climbers, engineers, and partners, we have met or exceeded all of the commitments we have entered into with the FCC to date. And our work is not yet finished as we continue to deploy and invest in our network. Not only does our network create American jobs and a competitive alternative to incumbent wireless carriers, it also furthers another critical Trump Administration priority: deploying Open RAN to ensure the United States is at the forefront of wireless leadership and that our infrastructure is free of Chinese vendors. Thanks to our nationwide pricing model and agreements with partner carriers, Boost Mobile is available at affordable prices to Americans across the country – including in rural and hard to reach communities. Indeed, our new buildout deadlines – which are consistent with FCC practice under the past two Administrations where the Wireless Bureau granted hundreds of buildout extensions – came with additional, substantial pro-competitive commitments that EchoStar has fulfilled. As we continue to invest in and expand our terrestrial network deployment, we are also working to provide Open RAN direct-to-device satellite technology, bringing additional connectivity to all Americans in the U.S. and around the world.

EchoStar worked tirelessly to establish 3GPP NTN standard for D2D. With D2D 3GPP standards now complete, EchoStar has the global capability in terms of expertise, spectrum, and ITU priority to bring this to fruition. We are now testing new S-band services in both North America and Europe, and this year we launched a LEO satellite with several more planned in the coming months. We look forward to continuing this important work to help the Administration and FCC continue to deliver for the American people.”

References:

https://prod-i.a.dj.com/public/resources/documents/Carr-Ergen-letter.pdf

https://www.fierce-network.com/wireless/fcc-questions-echostar-about-how-its-using-5g-spectrum

https://www.tipranks.com/news/the-fly/echostar-confirms-fcc-letter-to-company-ergen-makes-statement

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Network to FCC on its “game changing” OpenRAN deployment

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

FCC approves EchoStar/Dish request to extend timeline for its 5G buildout

On September 20th, the U.S. FCC has granted EchoStar’s request to extend the deadline for portions of its 5G network buildout into 2026 in exchange for several commitments, including a low-cost offering and a pledge to accelerate build-outs in certain markets.

EchoStar’s request to the FCC was sent to the commission on September 18, 2024. The licenses subject to the requested waiver include EchoStar’s AWS-4, Lower 700MHz E Block, 600MHz, AWS-3, AWS H Block and AWS-3 licenses. Depending on the spectrum, EchoStar generally is asking to move the milestones to December 2026. EchoStar also wants final construction milestones moved from December 14, 2026, to June 14, 2028. The request seemed to make clear that its 2025 deadlines were in jeopardy even if the company could resolve its near-term debt obligations (more below).

Benefits of the FCC’s new framework include:

- Enhancing EchoStar’s Network Build. By the end of this year, EchoStar’s Boost Mobile Network will cover 80% of the U.S. population, an additional 30 million more Americans than EchoStar’s 2023 obligation to cover 70% of the population. EchoStar will also accelerate and expand its final buildout milestones in more than 500 license areas on this same timeline. Because of EchoStar’s wholesale partnerships with AT&T and T-Mobile, consumers in areas where EchoStar has not yet deployed will still be able to sign up for the industry-leading coverage EchoStar’s wireless service – Boost Mobile – offers.

- Requiring a Low-Cost Offering. EchoStar will make a low-cost wireless plan and 5G device available to consumers nationwide, regardless of whether they live in an area where EchoStar has built out its Boost Mobile Network or relies on roaming partners to provide service.

- Enabling a More Efficient Build. The targeted extensions adopted by the FCC will provide a construction timeline that more closely aligns EchoStar’s deployment with its 3.45 GHz spectrum licenses, reducing the resources necessary to install infrastructure twice at each cell site/tower. Small wireless carriers and Tribal nations will also be able to lease EchoStar spectrum licenses in extension areas where the company has not yet deployed.

Blair Levin, a policy analyst at New Street Research and a former FCC official, remarked at the speed at which the FCC approved the petition:

“We can’t think of a faster one. And it is a real tribute to the brilliant strategy and execution by the DISH public policy team,” he explained. “The speed at which the FCC acted – albeit likely with significant pre-negotiation – is an indication that the FCC leadership is willing to act quickly and decisively to increase the odds of DISH succeeding in building out a fourth national facilities-based competitor.” Levin believes a vote is “highly unlikely” if there are three Commissioners willing to push this forward.

“The Bureau has not yet issued the order but as far as we can tell, they simply approved the order. The speed at which the Bureau acted suggests to us that this was pre-negotiated, meaning that the Bureau order is unlikely to make changes,” he added noting that the FCC action could face a lawsuit, but does not expect anyone willing to spend the political capital to pursue one.

EchoStar/Dish hope to be able to offer a nationwide wireless service due to its roaming deals with AT&T and T-Mobile, but will also be able to sign up customers with competitive pricing and plans enabled by its “enhanced presence” in the accelerated buildout markets. “This pro-consumer outcome is in addition to the public interest commitments EchoStar is making in connection with its extension request,” EchoStar said in their FCC petition.

………………………………………………………………………………………………………………………………………….

EchoStar is the parent company of Dish Network which is building a 5G Open RAN based network. The goal is to establish the company as a fourth national carrier after AT&T, T-Mobile and Verizon.

EchoStar pledged to fulfill a range of commitments, including a plan to cover more than 80% of the US population with its open RAN network at the end of 2024. The company, which has MVNO partnerships with AT&T and T-Mobile, said it will also accelerate and expand its final buildout milestones in more than 500 license areas on that same timeline.

EchoStar said it’s also prepared to introduce a nationwide “affordable” 5G plan that will offer at least 30 gigabytes of data per month for no more than $25 per month for both prepaid and postpaid customers.

EchoStar also pledged to deploy 24,000 towers by June 14, 2025 – about 9,000 more than its 15,000 2023 tower obligation, and to offer to load at least 75% of new customers with compatible devices on its MVNO network in the aforementioned accelerated markets.

…………………………………………………………………………………………………………………………………………..

On Monday, EchoStar disclosed in an 8-K filing that its negotiations with certain holders of senior debt securities had concluded without reaching an agreement regarding potential transactions, including new secured notes with an extended maturity date. “The Company remains engaged with various other parties regarding possible financing transactions,” EchoStar said in the filing.

“The failure to resolve the lawsuit limits Dish’s capital raising options, but they still have options. We believe the most likely path to raising capital will be notes secured by the AWS-3 licenses,” New Street Research analyst Jonathan Chaplin said in a note about the new filing.

About EchoStar:

EchoStar Corporation (Nasdaq: SATS) is a premier provider of technology, networking services, television entertainment and connectivity, offering consumer, enterprise, operator, and government solutions worldwide under its EchoStar®, Boost Mobile®, Sling TV, DISH TV, Hughes®, HughesNet®, HughesON™ and JUPITER™ brands. In Europe, EchoStar operates under its EchoStar Mobile Limited subsidiary and in Australia, the company operates as EchoStar Global Australia. For more information, visit www.echostar.com and follow EchoStar on X (Twitter) and LinkedIn.

References:

https://www.fcc.gov/ecfs/document/1091867842711/1

https://www.lightreading.com/regulatory-politics/fcc-greenlights-echostar-s-revised-5g-buildout-plan

https://www.lightreading.com/regulatory-politics/dish-asks-fcc-for-more-time-for-5g-buildout

https://about.dish.com/2024-02-22-DISH-Expands-VoNR-Coverage-to-Over-200-Million-People

Bloomberg: Higher borrowing costs hurting indebted wireless companies; industry is 2nd largest source of distressed debt

S&P Global estimates total outstanding debt in the speculative-grade U.S. telecom and cable sector is about $275.4 billion. Most of the telecom debt issuers took advantage of historically low interest rates in 2020 and 2021 to refinance their capital structures and push out maturities until 2026 and 2027. Wireless carriers spent heavily on acquiring spectrum licenses and building out their 5G networks, which led to significant debt loads and a very low ROI. For example, AT&T’s total debt increased significantly due to the C-band auction for 5G spectrum. It jumped from $182.98 billion at the end of 2020 to $209.08 billion in March 2021. Similarly, Verizon’s total debt climbed from $151.24 billion to $180.70 billion during the same period. Large debt loads can limit a company’s ability to invest in new technologies and infrastructure.

Billionaires who built their fortunes building out wireless networks when debt cost almost nothing are seeing their wealth evaporate. For example:

- Altice founder Patrick Drahi’s wealth has dropped almost 18% to $4.4 billion this year, according to the Bloomberg Billionaires Index. Altice has been the poster child for the industry’s travails recently. Last month, Altice spokesmen told creditors of its French operations that they would have to take a hit (impairment charge) in the restructuring of the €24.3 billion debt pile.

- Rakuten Group Inc.’s Hiroshi Mikitani’s fortune has shrunk 69% since 2021 after a push into mobile increased the firm’s losses. Rakuten announced earlier this month that it was looking at combining its financial units into a single group.

- Dish Network Corp. Chairman Charles Ergen has seen his riches shrink nearly 80% in less than three years as the company tries to transition from pay-TV to wireless services. Dish has been searching for ways to address upcoming debt maturities after scrapping a debt swap earlier this year when bondholders pushed back on the deal. Private credit firms have offered financing, Bloomberg News previously reported.

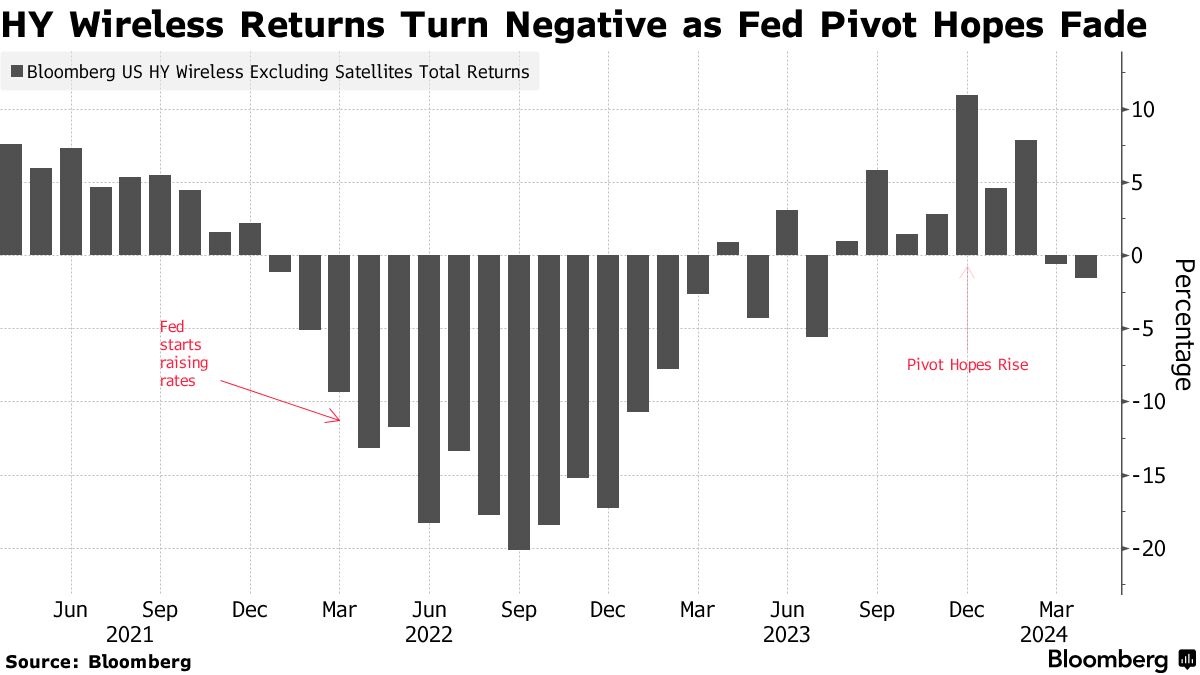

The stumbles in wireless highlight wider troubles across telecommunications, media and technology. Communications is the worst-performing junk sector in the US this year, Bloomberg Intelligence credit analyst Stephen Flynn wrote in a note this week, with several members of the index burdened with high leverage and facing large maturity walls. Annual returns from the industry’s junk bonds have turned negative this year as shown in this chart:

Wireless is the second biggest source of distressed debt globally (#1 is real estate) after the debt pile swelled to $35.3 billion, according to data compiled by Bloomberg News. That’s up more than 80% since early January! The fall in Altice bond prices sent the total level of distressed debt globally last week to the highest level since the middle of January.

Digicel, the Caribbean mobile operator founded by Irish businessman Denis O’Brien, imposed losses on bondholders and lenders earlier this year via what ratings company Moody’s described as a “distressed exchange.”

In summary, managing debt and addressing bad debt are crucial for the wireless industry to maintain financial stability and sustain growth. As interest rates fluctuate and operational challenges persist, wireless telecom companies must find effective strategies to mitigate these risks and optimize revenue assurance.

References:

https://www.bnnbloomberg.ca/telecom-tycoons-feel-pain-from-rising-mobile-woes-1.2065998

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

FT: Telecom & Technology on the Ropes: Challenging Markets & Too Much Debt

DISH Wireless Awarded $50 Million NTIA Grant for 5G Open RAN Center (ORCID)

DISH Wireless, a subsidiary of EchoStar, was awarded a historic $50 million grant from the U.S. Department of Commerce’s National Telecommunications and Information Administration (NTIA) to establish the Open RAN Center for Integration & Deployment (ORCID). ORCID will allow participants to test and validate their hardware and software solutions (RU, DU and CU) against a complete commercial-grade Open RAN network deployed by DISH.

“The Open RAN Center for Integration and Deployment (ORCID) will serve a critical role in strengthening the global Open RAN ecosystem and building the next generation of wireless networks,” said Charlie Ergen, co-founder and chairman, EchoStar. “By leveraging DISH’s experience deploying the world’s first standalone Open RAN 5G network, ORCID will be uniquely positioned to test and evaluate Open RAN interoperability, performance and security from domestic and international vendors. We appreciate NTIA’s recognition of DISH and ORCID’s role in driving Open RAN innovation and the Administration’s ongoing commitment to U.S. leadership in wireless connectivity.”

To date, this grant represents NTIA’s largest award under the Public Wireless Supply Chain Innovation Fund (Innovation Fund). ORCID will be housed in DISH’s secure Cheyenne, Wyoming campus and will be supported by consortium partners Fujitsu, Mavenir and VMware by Broadcom and technology partners Analog Devices, ARM, Cisco, Dell Technologies, Intel, JMA Wireless, NVIDIA, Qualcomm and Samsung.

NTIA Administrator Alan Davidson and Innovation Fund Director Amanda Toman will join EchoStar Co-Founder and Chairman Charlie Ergen, EchoStar CEO Hamid Akhavan, EVP and Chief Network Officer Marc Rouanne and other stakeholders to announce the grant and tour a DISH 5G Open RAN cell site later today in Las Vegas. Mr. Davidson announced the award, part of an almost $80 million allocation under the administration’s Public Wireless Supply Chain Innovation Fund, at an event staged at a Dish open RAN 5G cell site.

“Just a few firms today provide the full set of radios and computers that power mobile phones, and some of those equipment vendors pose national security risks to the US and our allies around the world,” Davidson said. “The result is that we have a wireless equipment market where costs are high, resilience is low and American companies are increasingly shut out.”

During this event, DISH will outline ORCID’s unique advantages, including that it will leverage DISH’s experience as the only operator in the United States to commercially deploy a standalone Open RAN 5G network. DISH and its industry partners have validated Open RAN technology at scale across the country; today DISH’s network covers over 246 million Americans nationwide.

At ORCID, participants will be able to test and evaluate individual or multiple network elements to ensure Open RAN interoperability, performance and security, and contribute to the development, deployment and adoption of open and interoperable standards-based radio access networks. ORCID’s “living laboratory” will drive the Open RAN ecosystem — from lab testing to commercial deployment.

Highlights of ORCID:

- ORCID will combine both lab and field testing and evaluation activities. ORCID will be able to test elements brought by any qualified vendor against DISH’s live, complete and commercial-grade Open RAN stack.

- ORCID will use DISH’s spectrum holdings, a combination of low-, mid- and high-band frequencies, enabling field testing and evaluation.

- ORCID will evaluate Open RAN elements through mixing and matching with those of other vendors, rather than validating a single vendor’s stack. DISH’s experience in a multi-vendor environment will give ORCID unique insights about the integration of Open RAN into brownfield networks.

- ORCID’s multi-tenant lab and field testing will occur in DISH’s secure Cheyenne, Wyoming facility, which is already compliant with stringent security protocols in light of its satellite functions.

About DISH Wireless:

DISH Wireless, a subsidiary of EchoStar Corporation, is changing the way the world communicates with the Boost Wireless Network. In 2020, the company became a nationwide U.S. wireless carrier through the acquisition of Boost Mobile. The company continues to innovate in wireless, building the nation’s first virtualized, Open RAN 5G broadband network, and is inclusive of the Boost Infinite, Boost Mobile and Gen Mobile wireless brands.

SOURCE: DISH Network Corporation

References:

Dish Network to FCC on its “game changing” OpenRAN deployment

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Wireless with Qualcomm Technologies and Samsung test simultaneous 5G 2x uplink and 4x downlink carrier aggregation

Justice Dept approves the “New T-Mobile” via Sprint merger; Dish Network becomes 4th U.S. wireless carrier with focus on 5G

Dish Wireless with Qualcomm Technologies and Samsung test simultaneous 5G 2x uplink and 4x downlink carrier aggregation

Dish Wireless collaborated with Qualcomm Technologies and Samsung to successfully test simultaneous 5G 2x uplink and 4x downlink carrier aggregation (CA) using FDD spectrum. DISH achieved 200 Mbps uplink peak speeds with just 35 MHz of 5G spectrum. The DISH 5G network executed 1.3 Gbps downlink peak speeds with just 75 MHz of 5G spectrum, both across FDD bands n71, n70 and n66. Boost Mobile and Boost Infinite subscribers will soon benefit with even faster download and upload speeds on America’s Smart Network™.

This test was completed in both DISH labs and the field using a mobile phone form-factor test device powered by Snapdragon® X75 5G Modem RF System from Qualcomm Technologies [1.] and Samsung’s 5G vRAN solution as well as dual- and tri-band radios across the DISH 5G network.

Note 1. Qualcomm’s Snapdragon X75is currently sampling to customers with commercial devices expected to launch later this year.

“It’s been a pleasure to work closely with DISH Wireless and support their expanding cloud-native Open RAN virtualized network as 5G services are now live across several markets, clearing the path for even lower latency and faster speeds,” said Mark Louison, executive vice president and general manager, Networks Business, Samsung Electronics America. “We are committed to pushing the boundaries to advance network capabilities to meet growing consumer demands for our customers.”

“We look forward to continued collaborative efforts with industry partners such as DISH and Samsung to enable faster 5G around the world,” said Sunil Patil, vice president, Product Management, Qualcomm Technologies, Inc. “As consumers demand increases for uplink heavy applications, carrier aggregation on FDD spectrum is crucial to bring faster upload speeds to more consumers across markets and networks.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

DISH claims its “Open RAN cloud-native 5G network is changing the way the world communicates,” but we don’t believe that is happening and we are not proponents of OpenRAN.

“The DISH 5G Open RAN network now covers over 73% of the U.S. population 5G broadband coverage and more than 100 million Americans 5G voice service – VoNR – with more markets going live each month,” said Eben Albertyn, EVP and CTO, DISH Wireless. “By successfully delivering 5G 2x uplink and 4x downlink carrier aggregation for FDD spectrum, DISH is now poised to deliver a better customer experience across our 5G standalone network. We look forward to continuing to pave the way to fully harness the power of 5G.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

According to Daryl Schoolar, analyst and director at Recon Analytics, this achievement is significant for Dish because while operators have been able to do downlink CA using multiple FDD bands, uplink CA is very new. DISH’s announcement comes just a little over a month after Qualcomm and Samsung announced that they had completed the world’s first simultaneous 5G 2x uplink and 4x downlink CA for FDD spectrum. Qualcomm and Samsung noted at the time that this development was important because it gives operators with fragmented FDD spectrum assets more flexibility and makes it possible for them to deliver faster upload and download speeds. Traditionally, uplink CA has been accomplished by combining FDD+TDD or TDD+TDD configurations.

Uplink capacity is becoming more critical as more consumers use uplink-heavy applications such as social media posting and video conferencing. Indeed, the possibility of delivering peak uplink speeds of 200 Mbps is quite a sizable increase from typical uplink speeds that are measured on wireless networks today. In Ookla’s Q3 2023 report on U.S. wireless networks, it reported that T-Mobile had the fastest median upload speed in the U.S. with speeds of just 11.31 Mbps.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

About DISH Wireless:

DISH Wireless, a subsidiary of DISH Network Corporation (NASDAQ: DISH), is changing the way the world communicates with the Boost Wireless Network. In 2020, the company became a nationwide U.S. wireless carrier through the acquisition of Boost Mobile. DISH continues to innovate in wireless, building the nation’s first virtualized, O-RAN 5G broadband network, and is inclusive of the Boost Infinite, Boost Mobile and Gen Mobile wireless brands.

For company information, go to about.dish.com

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.fiercewireless.com/wireless/dishs-technical-breakthrough-means-faster-speeds-customers

https://en.wikipedia.org/wiki/5G_NR_frequency_bands

Dish says its 5G network now covers 70% of the U.S. population

Dish Network to FCC on its “game changing” OpenRAN deployment

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish says its 5G network now covers 70% of the U.S. population

Dish Network says its 5G network is available to more than 240 million people and covers 70% of the U.S. population. That 70% threshold is what regulators demanded for it to keep valuable spectrum licenses. Dish says it has satisfied all June 14th deadlines set by the FCC, including having launched over 15,000 5G sites. Dish will continue to face 5G buildout deadlines set by federal regulators, including one in 2025 that Dish will likely need to invest billions in a rural buildout to meet. Investors have punished the stock, sending shares to near their lowest level since around 1999 amid worries that the company is struggling to stand up its wireless network without a partner.

Dish is also the first wireless service provider to launch 5G voice service – called voice over new radio (VoNR) – in the U.S. Since going live in Las Vegas last year, Dish steadily increased VoNR functionality to additional markets. Our VoNR service now covers more than 70 million people across the U.S. through both Boost Mobile and Boost Infinite. Dish plans to continue rolling out VoNR service as the network is further optimized for this next-generation voice technology.

Image Credit: Dish Networks

“As a leader in Open RAN technology, Dish is playing a major role in the transformation of America’s wireless infrastructure and the way the world communicates,” said John Swieringa, president and chief operating officer, Dish Wireless. “We have made significant progress on our network buildout, and can now focus on monetizing the network through retail and enterprise growth. With more markets across the country offering the Dish 5G network for voice, text and data services, our business can start realizing the benefits of owner economics.”

The company “can now focus on monetizing the network through retail and enterprise growth,” COO John Swieringa said in a news release, a nod to shareholder impatience with a costly project. Dish now has a month to prove it to the Federal Communications Commission with detailed documentation. Dish will file its FCC buildout report no later than July 14, 2023.

LightShed Partners analyst Walt Piecyk notes that confirmation that regulators are satisfied might soothe investors, but he doesn’t expect the FCC to comment “for the foreseeable future, if ever,” a silence that poses an “incremental hurdle for Dish to raise needed capital.”

References:

For a complete list of DISH’s wireless partners, please visit DISHWireless.com/home

Dish Network to FCC on its “game changing” OpenRAN deployment

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Network & Nokia: world’s first 5G SA core network deployed on public cloud (AWS)

Dish Network is just a month into the commercial launch of its cloud native based 5G core network, but is already planning how it will expand that architecture to take advantage of multi-cloud and hybrid cloud environments. DIsh is using Nokia’s cloud-native, 5G standalone core software which is deployed on the AWS cloud. This includes software for subscriber data management, device management, packet core, voice and data core, and integration services

During a Dish-Nokia fireside chat this Tuesday (sponsored by Nokia) on LinkedIn, Jitin Bhandari – CTO and VP, Cloud and Network Services, Nokia interviewed Sidd Chenumolu, VP of technology development and network services at Dish Wireless, provided some insight into the carrier’s current use of Amazon Web Services (AWS) public cloud resources.

Chenumolu said Dish’s 5G core was currently using three of AWS’ four public regions, was deployed in “multiple availability zones and almost all the local zones, but most were deployed with Nokia applications across AWS around the country.”

[AWS Outposts GM Joshua Burgin had previously explained to SDxCentral that Dish would be using a mixture of AWS Regions, Local Zones, and Outposts, specifically the smaller form factor AWS Outposts servers, to power its network. This includes the deployment of single 1U Outpost servers, some with an accelerator card, to run network functions in single-digit milliseconds at cell sites, he said in a phone interview.]

AWS Local Zones, which are built on Outpost racks and span 15 locations around the U.S., some of which were deployed to meet Dish’s demands, run Dish’s less latency-sensitive functions, Burgin explained. Dish’s operations and business support systems will run on AWS Regions.

“How to we deploy 5G SA core network on multi-cloud,” Sidd asked but did not answer. He then started to turn the tables and interview Jitin via a series of questions.

Chenumolu did not provide an update on Dish’s use of AWS’ Wavelength platform, which the cloud giant initially launched in partnership with Verizon to marry the network operators’ 5G networks with AWS’ edge compute service. Burgin had previously stated that support “could come down the line.”

The usual hype and back slapping/praise with glib expressions like “disintegrated disruptor, uncharted territory, automate learning with AI, cloud RAN,” etc. characterized the session.

References:

https://www.linkedin.com/video/event/urn:li:ugcPost:6945794807772438528/

https://www.sdxcentral.com/articles/news/dish-eyes-5g-multicloud-hybrid-cloud-expansion/2022/07/