Ericsson

Huawei and Ericsson renew global patent cross-licensing agreement

The top two global RAN equipment makers, Huawei and Ericsson, have announced the renewal of a multi-year global patent cross-licensing agreement, which enables each to use the other’s standardized (3GPP, ITU, IEEE, and IETF standards for 3G, 4G, and 5G cellular technologies) and patented technologies. The patent sharing agreement includes network infrastructure, as well as endpoint devices.

“We are delighted to reach a long-term global cross-licensing agreement with Ericsson,” said Alan Fan, Head of Huawei’s Intellectual Property Department. “As major contributors of standard essential patents (SEPs) for mobile communication, the companies recognize the value of each other’s intellectual property, and this agreement creates a stronger patent environment. It demonstrates the commitment both parties have forged that intellectual property should be properly respected and protected.”

“Both companies are major contributors to mobile communication standards and recognize the value of each other’s intellectual property. This agreement demonstrates the commitment of both parties that intellectual property should be respected and rewarded, and that leading technological innovations should be shared across the industry. A balanced approach to licensing ensures that the interests of both patent holders and implementers are served fairly, driving healthy, sustainable industry development for the benefit of consumers and enterprises everywhere.”

Over the past 20 years, Huawei has been a major contributor to mainstream ICT standards, including those for cellular, Wi-Fi, and multimedia codecs. In 2022, Huawei topped the European Patent Office’s applicant ranking for number of patent applications filed, with 4,505 applications.

“Our commitment to sharing leading technological innovations will drive healthy, sustainable industry development and provide consumers with more robust products and services,” added Fan.

Huawei is both a holder and implementer of SEPs and seeks to take a balanced approach to licensing. Through the signing of this agreement, it is both giving and receiving access to key technologies. Fan said, “This agreement is the result of intensive discussions that ensured the interests of both patent holders and implementers are served fairly.”

Christina Petersson, Ericsson’s chief IP officer said, “This agreement demonstrates the commitment of both parties that intellectual property should be respected and rewarded, and that leading technological innovations should be shared across the industry. A balanced approach to licensing ensures that the interests of both patent holders and implementers are served fairly.”

The last time the two companies extended a cross-licensing agreement was in 2016. Over the past few years, both companies have actively contributed to developing key mobile standards.

Earlier this year, the European Patent Office published the EPO Patent Index 2022: with 4,505 patents filed, Huawei was the top contributor, while Ericsson came in fifth with 1,827. Currently, according to the Financial Times, Huawei owns 20% of global patents which makes it the world’s largest 5G patent owner. Ericsson says they’ve been granted 60,000 patents.

Both Huawei and Ericsson are part of the Avanci patent pool, although the Chinese company is a recent addition following Avanci’s launch of a 5G vehicular programme earlier this month, which it says will “simplify the licensing of the cellular technologies used in next generation connected vehicles.”

Other Avanci patent licencees include Samsung, Philips, Panasonic and ZTE.

However, while Huawei and Ericsson have not engaged in active patent litigation, towards the end of last year Huawei demonstrated an intention to be more litigious over its patent portfolio. This included filing lawsuits against car manufacturer Stellantis over mobile phone patents, as well as launching a series of lawsuits over Wi-Fi 6 patents against Amazon, Netgear and AVM.

Around the same time, in the midst of a US FRAND trial, Ericsson and Apple signed a global patent licence agreement. This ended one of the largest disputes over implementation patents and SEPs in recent years, which spanned the US, Germany, the Netherlands, Belgium, the UK, Colombia and Brazil.

References:

Nikkei Asia: Huawei demands royalties from Japanese companies

Chinese companies’ patents awarded in the U.S. increased ~10% while U.S. patent grants declined ~7% in 2021

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

Ericsson and Vodafone enable Irish rugby team to use Private 5G SA network for 2023 Rugby World Cup

Ericsson and Vodafone Ireland have partnered to install a cutting-edge 5G Standalone Mobile Private Network (MPN) solution for the Irish rugby team to supply fast and reliable in-play data analysis ahead of the 2023 Rugby World Cup in September.

Previously the team relied on standard WiFi across stadiums and training facilities both at home and away. Now giving instant feedback on team plays and tactics, the 5G Standalone MPN solution and artificial intelligence technology ensures faster download and upload speeds and lower latency, which can be utilised for real-time performance analysis and decisions on the pitch.

Using this reliable connectivity, up to eight high-resolution video streams are captured by multiple cameras and a 5G connected drone and then analysed in real-time to collate data on team performance. The technology helps to improve the communication between management, coaches and players and maximises the time on pitch where the smallest tweak to a running line or defensive position, can have a significant impact on the weekend’s game.

Vodafone Ireland and Ericsson have worked closely with the IRFU and their Head of Analytics and Innovation, Vinny Hammond and his analysis team of John Buckley, Alan Walsh and Jack Hannon. This collaboration has led to a clear understanding of the specific performance outcomes sought by such an elite sports team and has supported the design and installation of the Ericsson Private 5G solution, which now enables the management team, coaches and players to feel the real benefit of instant feedback to enhance the ability to make decisions quikcly.

The new solution has been tested at the Irish team’s High Performance Centre and will be brought to France in a bespoke 5G connected van for the World Cup in September.

Vodafone Ireland Network Director, Sheila Kavanagh says: “At Vodafone, we are so proud of our support for the Irish Rugby team, so we’re delighted to bring further value through the delivery of this cutting-edge technology solution. Performance analysis has experienced massive changes in the past couple of decades. What started with pen and paper-based methods for collecting notational data has evolved to using cutting-edge computer-based technologies and artificial intelligence to collect ever increasing amounts of real-time information. Distilling and delivering this data back to the team at top speed requires a reliable, secure and scalable connectivity solution.”

“This 5G MPN, drone and additional technology will support Vinny Hammond and his analytics team to quickly breakdown and organise unstructured data and present it back in a clear manner to other coaching staff and management – helping them understand the performance of the plays and overall team, without delay. It’s fantastic to see it in use in the HPC, but we’re also really excited to support the team with 5G connectivity throughout their time at the World Cup in France with our fully kitted Connected Van. Our 5G MPN technology is a demonstration of how technology and connectivity innovation can enhance the business of sport and the performance of teams, bringing added layers of data and analysis to coaches, management, and their players.”

IRFU Head of Analytics and Innovation, Vinny Hammond says: “So much of our roles revolve around moving large quantities of data so we can analyse performance to understand what is working and what is not. Vodafone’s 5G MPN stretches the boundaries of what we can do in terms of how quickly we can analyse multiple high-resolution cameras and drone footage which ultimately informs our strategic decision making. The work John and Alan have done on this project in conjunction with Vodafone and Ericson has enabled us to push new boundaries at this years RWC. Being on our own 5G network also gives us that level of security and reliability that we really need, and we’ll have the added benefit of that connectivity with our 5G Connected Van, linking back to our High Performance centre, to reduce reliance on third party connectivity.”

John Griffin, Head of Ericsson Ireland, says: “5G is the ultimate platform of future innovation and our successful partnership with Vodafone continues to ensure new organisations like the IRFU can benefit from the low latency, high bandwidth, and secure connectivity of a 5G standalone private network. Our global leadership in 5G technology and accelerated software availability mean the IRFU will be one step ahead of their competitors on and off the field, giving them the best chance of success at an elite level of performance and revolutionizing the future of a key function within the sports industry.”

References:

https://www.ericsson.com/en/news/3/2023/ericsson-and-vodafone-help-irish-rugby-team-adopt-5g-technology-to-get-fast-in-play-data-analysis

BT and Ericsson wideband FDD trial over live 5G SA network in the UK

BT and Ericsson have successfully demonstrated 5G transmission using a wideband FDD (frequency division duplex) radio carrier (over 20 MHz) within a sub-3 GHz spectrum band. According to BT and Ericsson, this accomplishment is a major advancement in the progress of 5G networks, with implications that will greatly impact network capacity and performance.. The trial used existing Ericsson commercial hardware, including Baseband 6648 and Radio 4419. The software feature ‘Large Bandwidth Support Low-Band’ was activated to facilitate the testing, and Handsets powered by MediaTek Dimensity chips, specifically the MediaTek M80 Release-16 modem.

Source: BT Group

The trial was conducted on BT’s live network (EE brand name) in Bristol and Potters Bar, UK. It showcased the benefits of configuring a wide carrier bandwidth of 50 MHz (50 MHz downlink + 50 MHz uplink) within the 2.6 GHz band, along with downlink aggregation using two TDD (time division duplex) carriers in the 3.5 GHz band. This configuration led to a capacity uplift of over three times compared to a single FDD carrier. According to the joint statement, the trial also evaluated an intermediate carrier bandwidth of 30 MHz.

This result is particularly significant for the uplink in 5G Standalone (5G SA) networks. According to BT, currently, 5G SA relies on a single carrier for the uplink, but this trial demonstrates the potential to significantly boost uplink capacity using a wider carrier bandwidth. The technology partners stated that enabling 5G expansion in FDD bands is a crucial step in the rollout of EE’s 5G SA network. 5G SA is expected to offer superior experiences for consumers and businesses, meeting the increasing demand for data-driven applications like cloud gaming, virtual reality (VR), and emerging edge technologies. This achievement has the potential to enable higher capacity, improved network performance, and enhanced user experiences.

Greg McCall, Chief Networks Officer, BT Group, commented: “This breakthrough is the latest example of our commitment to maximizing the full potential of 5G for our customers. As network quality and accessibility improve, so too will innovation and the 5G services ecosystem. Demonstrating new network capabilities such as those announced today is critical to achieving this goal, and also paves the way to ensuring that 5G SA delivers new possibilities for our customers.”

Evangelia Tzifa, Chief Technology Officer, Networks & Managed Services, for Ericsson UK and Ireland said: “This is a great step forward for the deployment of 5G Standalone for EE in the UK. Ericsson innovative software capabilities such as large bandwidths for NR FDD as well as NR Carrier Aggregation enable a solid foundation for improved end user experience and network performance. This is a fundamental link for business success and the evolution to next-generation connectivity across the country.”

Dr. Ho-Chi Hwang, General Manager of Wireless Communication Systems and Partnerships at MediaTek, said: “This remarkable achievement of boosting uplink capacity is a fundamental step for the evolution from 5G Non-Standalone to 5G Standalone networks. By supporting an uplink connection in a single FDD carrier with a wider bandwidth, MediaTek Dimensity 5G chipsets already meet the surging demand for uplink data in a new era of mobile applications”.

References:

BT, Ericsson Wideband FDD Trial Showcase Breakthrough 5G SA Performance

Ericsson and O2 Telefónica demo Europe’s 1st Cloud RAN 5G mmWave FWA use case

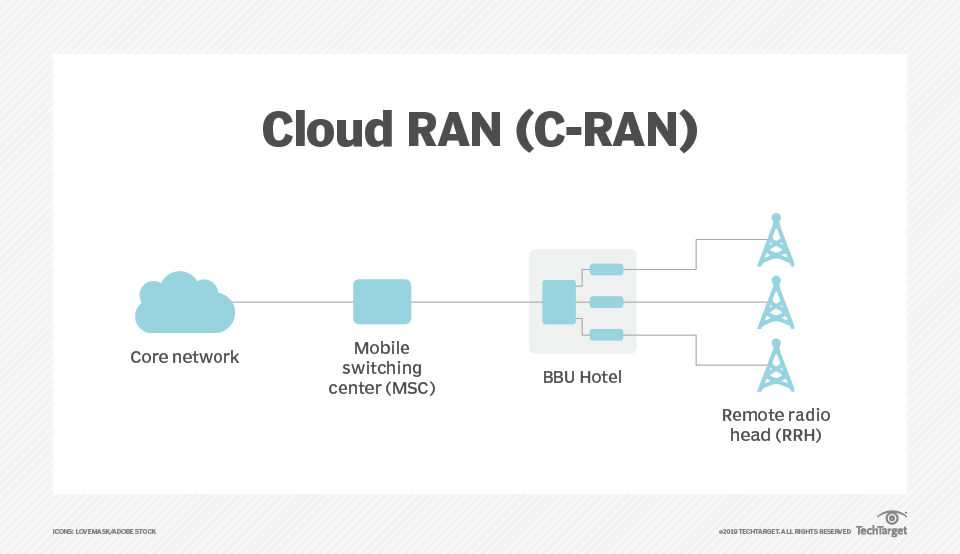

Ericsson and O2 Telefónica say they have conducted the first demonstration of 5G Cloud RAN (Radio Access Network) [1.] technology in Europe. The Proof of Concept (PoC) deployment at O2 Telefónica’s Wayra innovation hub in Munich utilized a centralized control unit (CU) and harnessed the power of mmWave frequency to achieve an impressive end-to-end speed of more than 4 Gbit/s. The companies validated the use of Cloud RAN for fixed wireless access (FWA), as well as enterprise and industrial use cases.

One FWA case is “Data Shower,” a new concept in the automotive industry that enables the efficient deployment of software updates to vehicles in production lines by using mmWave technology for high-bandwidth transfer.

Note 1. A cloud radio access network (Cloud RAN) is a centralized, cloud computing-based architecture for radio access networks. It enables large-scale deployment, collaborative radio technology support and real-time virtualization capabilities.

Ericsson Cloud RAN is a cloud-native software solution handling compute functionality in the RAN. Cloud RAN is a viable option for communications service providers to have increased flexibility, faster delivery of services, and greater scalability in networks. Ericsson Cloud RAN is enhanced with support for 5G mid-band and with Cloud RAN for high performance in combined footprint. More information is below.

…………………………………………………………………………………………………………………

By implementing Ericsson’s cloud-native software solution for 5G Cloud RAN, O2 Telefónica in Germany will experience significant gains in flexibility, service delivery and improved network operations. This initiative also sets the stage for other communication service providers (CSPs) to leverage network automation and RAN programmability, thereby enhancing their overall network flexibility, scalability, and simplification.

Daniel Leimbach, Head of Customer Unit Western Europe at Ericsson, says: “The partnership between Ericsson and O2 Telefónica demonstrates our commitment to achieving significant breakthroughs on our path to build the networks of the future. It is a first for both companies in Europe and shows the potential of Cloud RAN for high performance use cases. It builds upon our work with the cloud-native 5G core we have deployed in O2 Telefónica Germany, enabling a full end-to-end cloud native network. We are very proud to be doing this together with O2 Telefónica.”

Mallik Rao, Chief Technology & Information Officer of O2 Telefónica, says: ” O2 Telefónica is a pioneer in deploying new network technologies such as Cloud RAN. With the introduction of a cloud-based, standardized architecture, we are able to respond quickly to customer needs, introduce new products and services even more flexibly and scale our O2 network better. With Cloud RAN, we combine the benefits of open interfaces with the expertise and product quality of European network equipment supplier Ericsson, whose technology we already use for our high-performance 5G core network.”

Cloud-native deployment plays a pivotal role in the transformation of the telecommunications industry, and the integration of cloud-native architecture into the radio access network (RAN) presents an exceptional opportunity to foster innovation and enhance network efficiency. By virtualizing the RAN and adopting a cloud-native, standardized architecture, O2 Telefónica will gain the ability to respond rapidly to customer needs, introduce new products and services with greater flexibility and agility, and realize benefits such as faster service delivery, improved scalability and enhanced cost efficiency.

Ericsson’s commitment to advancing telecommunications networks is underscored by this collaboration and builds upon the company’s successful Cloud RAN deployments with other leading CSPs in North America and Australia.

The incorporation of Cloud RAN extends the foundation of the ongoing network cloudification efforts by Ericsson and O2 Telefónica in Germany.

Technology overview: Benefits:

Ericsson 5G Cloud RAN, a cloud-native software solution, effectively handles compute functionality in the RAN, offering a range of benefits for CSPs, including the advantage of implementing common operational systems and practices, simplifying deployment and life cycle management of resources for enhanced efficiency. By centralizing processing and management functions, Cloud RAN transforms traditional network architecture to improve resource allocation, scalability and network management. This innovation empowers mobile network operators to dynamically allocate resources, optimizing performance and ensuring a seamless user experience.

Millimeter Wave (mmWave) frequency operates in the high-frequency range, typically above 24 gigahertz (GHz). This spectrum offers immense bandwidth potential, enabling data transfer at unprecedented speeds. By leveraging mmWave, telecommunications companies can deliver ultra-fast internet connections, supporting a wide range of applications such as 5G networks, virtual reality, augmented reality, and high-definition video streaming. With its ability to transmit vast amounts of data over short distances, mmWave frequency paves the way for the realization of futuristic technologies that demand low latency and exceptional performance.

References:

https://www.ericsson.com/en/ran/cloud

https://www.techtarget.com/searchnetworking/definition/cloud-radio-access-network-C-RAN

Ericsson’s new antenna helps accelerate Vodafone 5G roll-out

Vodafone is rolling out Ericsson’s new compact antenna to bring greater 5G capacity, coverage and performance to locations across the U.K. The Ericsson AIR 3218 combines a radio unit and antenna in a single unit. It can also transmit mobile data over all of the frequencies that Vodafone currently uses in the U.K., without needing additional antenna units, as was the case for previous models.

The combined multiband, Massive MIMO design makes it easier for the operator to add more capacity to a mast without increasing its footprint. It’s also easier to mount on rooftops, towers, walls and poles.

“5G is the UK’s digital future, but we should never underestimate how difficult it is to deliver a future-proofed network at scale across the length and breadth of the UK. Working in partnership with Ericsson, we are constantly exploring new ways to accelerate this transformation, and this is another example of where innovation is delivered through collaboration,” said Ker Anderson, head of Radio and Performance at Vodafone UK, in a statement.

Ericsson noted that the Interleaved AIR 3218 is powered by the latest Ericsson Silicon technology. It also uses beam-through technology where an arbitrary active antenna can be placed behind the passive antenna, reducing the overall footprint in terms of size, weight and wind load.

So far, they’ve calculated a 30% reduction in site acquisition and build time based on results from the first five sites where deployment has already been completed. The AIR 3218 is expected to be deployed across 50 sites within the Vodafone UK network in 2023.

References:

https://www.vodafone.co.uk/newscentre/news/new-ericsson-antenna-helps-accelerate-vfuk-5g-rollout/

Orange Business tests new 5G hybrid network service in France

Orange Business said that it has carried out tests of a new 5G service called “Mobile Private Network hybrid“at its office in Arcueil (Ile-de-France region). The telco claims the hybrid private network has several applications and is able to connect industrial equipment, tablets and autonomous vehicles, among other end points. It cited the example of ports as an area particularly suitable for hybrid network deployments.

Orange said it is “actively investing in the construction” of hybrid 5G networks in France. Its two units have been “constantly innovating to continue to develop services and use [cases],” the company added.

The new 5G service has been tested with a router from Ericsson owned Cradlepoint which is connected to both networks simultaneously and assigns data flows to the appropriate network based on predefined use cases and the application being used. The Cradlepoint router supports 5G SA and network slicing technology for business premises, with a hardened version available for industrial settings.

The test project hosted two use cases in two network slices, running on a laptop (“behind the router”): transmission of a video feed to the cloud on the public network to support a remote assistance use case, and an edge-based supervision application for an industrial process where all the data circulated on the private network. “The separation of data flows is complete from the application on the terminal to the core network.”

(Source: l_martinez / Alamy Stock Photo)

The network is operated by Orange in full and does not require the use of multiple SIM cards. Companies can use the solution for both critical and non-critical applications, with data flows isolated from the application on the terminal all the way to the core, and service quality adapted to each application. The company says it relies on local break-out technology, which allows for local routing of data flows, to offer stable low latencies. Orange also says the private network guarantees performance and offers higher data security than the public network.

Orange is one of few European operators that have started rolling out 5G SA networks, it has not yet officially launched one in France. In March, it announced it would start offering 5G SA in a handful of Spanish cities later this year. The telco will rely on Ericsson’s core technology, which will also be used in Belgium, Luxembourg and Poland.

References:

Orange intros managed hybrid-private 5G service for French enterprises

Orange Spain & Ericsson to build 5G Infrastructure for 3 High-Speed Rail Lines

In a statement, Orange highlighted it had won two of the three lots tendered by the transport infrastructure entity ADIF. It claimed its proposals for the lots received “the highest score” and its bids topped those from Vodafone.

In partnership with Ericsson, which is also supplying kit for Vodafone’s deployment, Orange will provide and maintain 5G infrastructure across the high speed rail corridors.

Announcing the award of its contracts, ADIF said it was part of attempts to “promote the digitisation and efficiency of the railway system” with the entity committing €117.3 million to deployment of 5G on the network and within its assets.

Alongside advantages for passengers, the organisation hailed 5G as a “critical catalyst in the digitisation of the economy in the coming years”.

Within the rail industry, it pointed to use cases including advanced logistics; real-time traffic management; automated vehicles; predictive maintenance; and improved surveillance in stations and on trains.

Orange says it is the first operator to launch 5G+, a network that consumes 90 percent less energy. Some of the notable sustainability initiatives undertaken by Orange include:

- 100% Green Energy Consumption: Since 2014, Orange has exclusively relied on green energy sources to power its operations, reinforcing their dedication to environmental responsibility.

- Device Recycling and Repair Program: Orange has implemented an ambitious program focused on recycling and repairing devices at their points of sale. By extending the lifespan of devices, they actively contribute to reducing electronic waste.

- Eco-Guidelines for Sustainable Practices: Orange has established eco-guidelines to encourage sustainable actions in their day-to-day operations. These guidelines serve as a roadmap, guiding employees in adopting environmentally friendly practices, even in the smallest gestures.

The ongoing efforts of Orange to promote sustainability demonstrate their commitment to mitigating their environmental impact. By integrating green energy, recycling and repair programs, and fostering sustainable practices, Orange is leading by example in its pursuit of a more sustainable future.

…………………………………………………………………………………………………………………………………………..

Separately, Orange Belgium has completed its acquisition of a controlling stake in telco operator, VOO SA. The closing of this deal will give Orange Belgium a 75% stake minus 1 share in VOO SA, with the remaining 25% plus one share retained by Nethys.

This transaction values VOO at an enterprise value of €1.8 billion for 100% of the capital. Orange Belgium will finance this transaction through an intra-Group loan.

Xavier Pichon, CEO of Orange Belgium, comments: “For decades, we developed our telecom skills and pioneering spirit to challenge the market, but as from today, we have the industrial power, tech means and commercial scale to accelerate and Lead the Future of the Belgian telco market in the interest of all consumers, employees and society in general.”

References:

Orange Launches 5G+ Network With Reduced Energy Consumption in Spain

Ericsson and MediaTek set new 5G uplink speed record using Uplink Carrier Aggregation

Ericsson and MediaTek have set a new 5G uplink speed record of 440 Mbps in low-band and mid-band spectrum using Uplink Carrier Aggregation. That uplink speed was achieved in an Ericsson lab. The test was performed with Ericsson’s Radio Access Network (RAN) Compute Baseband 6648 and a mobile device using a MediaTek Dimensity 9200 flagship 5G smartphone chipset.

More precisely, the combination used was 50MHz FDD n1 and 100MHz TDD n77. By aggregating these two bands, communications service providers can considerably increase their uplink speeds, resulting in better network performance and user experience. The fast uplink speed brings better, smoother experiences for the likes of video conference users, streamers, and their audience with more frames per second and higher image resolution. The 440 Mbps 5G upload speed achieved in the lab compares to an average of 26.78 Mbps outdoors and 22.98 Mbps indoors, as per a Cellsmart survey.

Sibel Tombaz, Head of Product Line 5G RAN, Ericsson, said: ”Super-fast uplink speeds make a big difference in the user experience. From lag-free live streaming, video conferencing and AR/VR apps, to more immersive gaming and extended reality (XR) technologies. The 440 Mbps upload speed achieved by Ericsson and MediaTek will help make that difference. We are also continuously designing innovative solutions for optimizing 5G networks so our customers can make the best use of their spectrum assets.”

Service providers are seeking innovative ways of boosting capacity while using existing spectrum efficiently to meet growing demands for wireless data and applications. This is where carrier aggregation comes in, optimizing the service provider’s spectrum assets to bring to users better coverage, increased capacity, and higher data speeds.

HC Hwang, General Manager of Wireless Communication System and Partnership at MediaTek, said: “The successful result of combining Ericsson’s state-of-the-art 5G Baseband and MediaTek’s flagship smartphone chip has achieved another 5G industry milestone, and paves the way for superior mobile experiences to benefit users every day.” Uplink speed is becoming more crucial with the expected uptake of

gaming, XR, and video-based apps. For example, as AR devices gain popularity with larger augmentation objects, rendering becomes more demanding. This increases the demand on networks to deliver higher throughput and lower latency.

Uplink speed is becoming more crucial with the expected uptake of gaming, XR, and video-based apps. For example, as AR devices gain popularity with larger augmentation objects, rendering becomes more demanding. This increases the demand on networks to deliver higher throughput and lower latency.

Earlier this year, AT&T boasted that it had completed what was believed to be the first 5G standalone (SA) uplink 2-carrier aggregation data connection in the U.S.

The connection was made at its Redmond, Washington, lab, where they achieved upload speeds of over 120 Mbps with a combination of 850 MHz and 3.7 GHz spectrum.

In May, T-Mobile reported reaching uplink speeds over 200 Mbps in a 5G data call using uplink CA; in that case, they used T-Mobile’s live commercial 5G SA network as opposed to a lab environment. T-Mobile used 2.5 GHz and 1.9 GHz bands.

References:

https://www.fiercewireless.com/tech/ericsson-mediatek-claim-upload-speed-record-440-mbps

CELLSMART: 5G upload speeds are insufficient for industrial/enterprise applications

Cellsmart: 5G download performance improves but upload performance lags

Swisscom, Ericsson and AWS collaborate on 5G SA Core for hybrid clouds

Swiss network operator Swisscom have announced a proof-of-concept (PoC) collaboration with Ericsson 5G SA Core running on AWS. The objective is to explore hybrid cloud use cases with AWS, beginning with 5G core applications. The plan is for more applications to then gradually be added as the trial continues. With each cloud strategy (private, public, hybrid, multi) bringing its own drivers and challenges the idea here seems to be enabling the operator to take advantage of the specific characteristics of both hybrid and public cloud.

The PoC reconfirms Swisscom and Ericsson’s view of the potential hybrid cloud has as a complement to existing private cloud infrastructure. Both Swisscom and Ericsson are on a common journey with AWS to explore how use cases can benefit telecom operators.

The PoC will examine use cases that take advantage of the particular characteristics of hybrid and public cloud. In particular, the flexibility and elasticity it can offer to customers which can mean deployment efficiencies for use cases where capacity is not constantly needed. An example of this could be when maintenance activities are undertaken in Swisscom’s private cloud, or when there are traffic peaks, AWS can be used to offload and complement the private cloud.

Swisscom had already been collaborating with AWS on migrating its 5G infrastructure towards standalone 5G. In addition, it has also used the hyperscaler’s public cloud platform for its IT environments. Telco concerns linger [1.] around the use of public cloud in telecoms infrastructure (especially the core networks) for some operators, hybrid cloud is seemingly gaining momentum as a transitional approach.

Note 1. Telco concerns over public cloud:

- In a recent survey by Telecoms.com more than four in five industry respondents feared security concerns over running telco applications in the public cloud, including 37% who find it hard to make the business case for public cloud as private cloud remains vital in addressing security issues. This also means that any efficiency gains are offset by the IT environment and the network running over two cloud types.

- Many in the industry also fear vendor lock-in and lack of orchestration from public cloud providers. Around a third of industry experts from the same survey find it a compelling reason not to embrace and move workloads to the public cloud unless applications can run on all versions of public cloud and are portable among cloud vendors.

- There’s also a lack of interoperability and interconnectedness with public clouds. The services of different public cloud vendors are indeed not interconnected nor interoperable for the same types of workloads. This concern is one of the drivers to avoid public cloud, according to some network operators.

–>PLEASE SEE THE COMMENT ON THIS TOPIC IN THE BOX BELOW THE ARTICLE.

Quotes:

Mark Düsener, Executive Vice President Mobile Network & Services at Swisscom, says: “By bringing the Ericsson 5G Core onto AWS we will substantially change the way our networks will be built and operated. The elasticity of the cloud in combination with a new magnitude in automatization will support us in delivering even better quality more efficiently over time. In order to shape this new concept, we as Swisscom believe strategic and deep partnerships like the ones we have with Ericsson and AWS are the key for success.”

Monica Zethzon, Head of Solution Area Core Networks, Ericsson says: “5G innovation requires deep collaboration to create the foundations necessary for new and evolving use cases. This Proof-of-Concept project with Swisscom and AWS is about opening up the routes to innovation by using hybrid cloud’s flexible combination of private and public cloud resources. It demonstrates that through partnership, we can deliver a hybrid cloud solution which meets strict telecoms industry requirements and security while making best use of HCP agility and cloud economy of scale.”

Fabio Cerone, General Manager AWS Telco EMEA at AWS, says: “With this move, Swisscom is opening the door to cloud native networks, delivering full automation and elasticity at scale, with the ability to innovate faster and make 5G impactful to their customers. We are committed to working closely with partners, such as Ericsson, to explore new use cases and strategies that best support the needs of customers like Swisscom.”

“How to deploy software in different cloud environments – at a high level, it is hard making that work in practice,” said Per Narvinger, the head of Ericsson’s cloud software and services unit. “You have hyperscalers with their offering and groups trying to standardize and people trying to do it their own way. There needs to be harmonization of what is wanted.”

https://telecoms.com/520337/swisscom-ericson-and-aws-collaborate-on-hybrid-cloud-poc-on-5g-core/

https://telecoms.com/520055/telcos-and-the-public-cloud-drivers-and-challenges/

AWS Telco Network Builder: managed network automation service to deploy, run, and scale telco networks on AWS

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Ericsson to lay off 8,500 employees as part of cost cutting plan

After warning in January that profit margins at its RAN business would worsen, telecom equipment maker Ericsson will lay off 8,500 employees globally as part of its plan to cut costs, according to a memo sent to employees and seen by Reuters.

“The way headcount reductions will be managed will differ depending on local country practice,” Chief Executive Borje Ekholm wrote in the memo. “In several countries the headcount reductions have already been communicated this week,” he said. “It is our obligation to take this cost out to remain competitive,” Ekholm said in the memo. “Our biggest enemy right now may be complacency.”

While technology companies such as Microsoft, Meta and Alphabet have laid off thousands of employees citing economic conditions, Ericsson’s move would be the largest layoff to hit the telecoms industry.

On Monday, the company, which employs more than 105,000 worldwide, announced plans to cut about 1,400 jobs in Sweden. While Ericsson did not disclose which geography would be most affected, analysts had predicted that North America would likely be most affected and growing markets such as India the least.

The company said in December it would cut costs by 9 billion crowns ($880 million) by the end of 2023 as demand slows.

“Our aim is to manage the process in every country with fairness, respect, professionalism and in line with local labor legislation,” Ericsson said in a statement.

“We are also working on our service delivery, supply, real estate and IT. We have already started to implement and accelerate various initiatives to help us reach” the cost-cutting goal, Ericsson said.

Many telecom companies had beefed up their inventories during the height of the pandemic which is now leading to slowing orders for telecom equipment makers like Ericsson and Nokia.

References:

https://www.reuters.com/business/media-telecom/ericsson-lay-off-8500-employees-memo-2023-02-24/

https://apnews.com/article/technology-stockholm-covid-business-07bda439ac93836817a00d0d54892d0a

Ericsson Mobility Report: 5G monetization depends on network performance

High Tech Layoffs Explained: The End of the Free Money Party