Ericsson

BT and Ericsson wideband FDD trial over live 5G SA network in the UK

BT and Ericsson have successfully demonstrated 5G transmission using a wideband FDD (frequency division duplex) radio carrier (over 20 MHz) within a sub-3 GHz spectrum band. According to BT and Ericsson, this accomplishment is a major advancement in the progress of 5G networks, with implications that will greatly impact network capacity and performance.. The trial used existing Ericsson commercial hardware, including Baseband 6648 and Radio 4419. The software feature ‘Large Bandwidth Support Low-Band’ was activated to facilitate the testing, and Handsets powered by MediaTek Dimensity chips, specifically the MediaTek M80 Release-16 modem.

Source: BT Group

The trial was conducted on BT’s live network (EE brand name) in Bristol and Potters Bar, UK. It showcased the benefits of configuring a wide carrier bandwidth of 50 MHz (50 MHz downlink + 50 MHz uplink) within the 2.6 GHz band, along with downlink aggregation using two TDD (time division duplex) carriers in the 3.5 GHz band. This configuration led to a capacity uplift of over three times compared to a single FDD carrier. According to the joint statement, the trial also evaluated an intermediate carrier bandwidth of 30 MHz.

This result is particularly significant for the uplink in 5G Standalone (5G SA) networks. According to BT, currently, 5G SA relies on a single carrier for the uplink, but this trial demonstrates the potential to significantly boost uplink capacity using a wider carrier bandwidth. The technology partners stated that enabling 5G expansion in FDD bands is a crucial step in the rollout of EE’s 5G SA network. 5G SA is expected to offer superior experiences for consumers and businesses, meeting the increasing demand for data-driven applications like cloud gaming, virtual reality (VR), and emerging edge technologies. This achievement has the potential to enable higher capacity, improved network performance, and enhanced user experiences.

Greg McCall, Chief Networks Officer, BT Group, commented: “This breakthrough is the latest example of our commitment to maximizing the full potential of 5G for our customers. As network quality and accessibility improve, so too will innovation and the 5G services ecosystem. Demonstrating new network capabilities such as those announced today is critical to achieving this goal, and also paves the way to ensuring that 5G SA delivers new possibilities for our customers.”

Evangelia Tzifa, Chief Technology Officer, Networks & Managed Services, for Ericsson UK and Ireland said: “This is a great step forward for the deployment of 5G Standalone for EE in the UK. Ericsson innovative software capabilities such as large bandwidths for NR FDD as well as NR Carrier Aggregation enable a solid foundation for improved end user experience and network performance. This is a fundamental link for business success and the evolution to next-generation connectivity across the country.”

Dr. Ho-Chi Hwang, General Manager of Wireless Communication Systems and Partnerships at MediaTek, said: “This remarkable achievement of boosting uplink capacity is a fundamental step for the evolution from 5G Non-Standalone to 5G Standalone networks. By supporting an uplink connection in a single FDD carrier with a wider bandwidth, MediaTek Dimensity 5G chipsets already meet the surging demand for uplink data in a new era of mobile applications”.

References:

BT, Ericsson Wideband FDD Trial Showcase Breakthrough 5G SA Performance

Ericsson and O2 Telefónica demo Europe’s 1st Cloud RAN 5G mmWave FWA use case

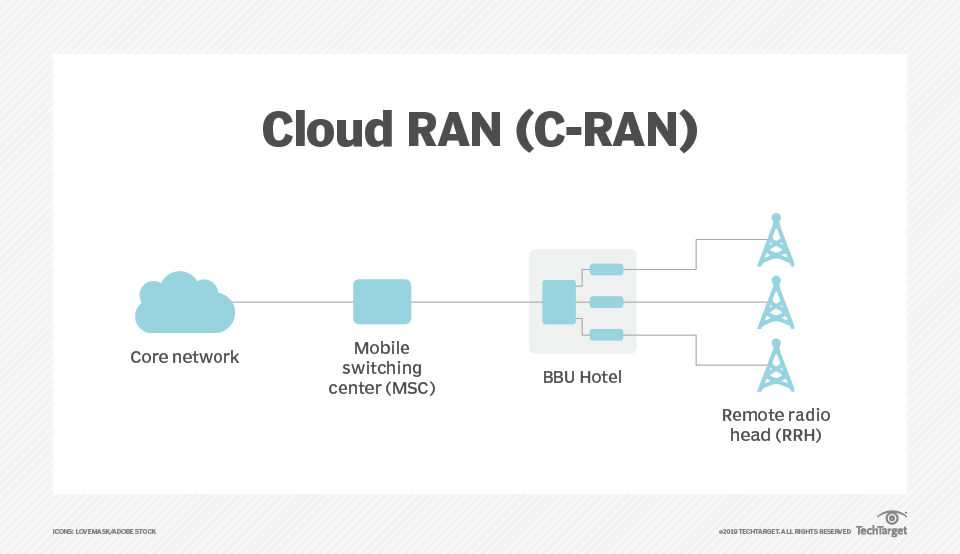

Ericsson and O2 Telefónica say they have conducted the first demonstration of 5G Cloud RAN (Radio Access Network) [1.] technology in Europe. The Proof of Concept (PoC) deployment at O2 Telefónica’s Wayra innovation hub in Munich utilized a centralized control unit (CU) and harnessed the power of mmWave frequency to achieve an impressive end-to-end speed of more than 4 Gbit/s. The companies validated the use of Cloud RAN for fixed wireless access (FWA), as well as enterprise and industrial use cases.

One FWA case is “Data Shower,” a new concept in the automotive industry that enables the efficient deployment of software updates to vehicles in production lines by using mmWave technology for high-bandwidth transfer.

Note 1. A cloud radio access network (Cloud RAN) is a centralized, cloud computing-based architecture for radio access networks. It enables large-scale deployment, collaborative radio technology support and real-time virtualization capabilities.

Ericsson Cloud RAN is a cloud-native software solution handling compute functionality in the RAN. Cloud RAN is a viable option for communications service providers to have increased flexibility, faster delivery of services, and greater scalability in networks. Ericsson Cloud RAN is enhanced with support for 5G mid-band and with Cloud RAN for high performance in combined footprint. More information is below.

…………………………………………………………………………………………………………………

By implementing Ericsson’s cloud-native software solution for 5G Cloud RAN, O2 Telefónica in Germany will experience significant gains in flexibility, service delivery and improved network operations. This initiative also sets the stage for other communication service providers (CSPs) to leverage network automation and RAN programmability, thereby enhancing their overall network flexibility, scalability, and simplification.

Daniel Leimbach, Head of Customer Unit Western Europe at Ericsson, says: “The partnership between Ericsson and O2 Telefónica demonstrates our commitment to achieving significant breakthroughs on our path to build the networks of the future. It is a first for both companies in Europe and shows the potential of Cloud RAN for high performance use cases. It builds upon our work with the cloud-native 5G core we have deployed in O2 Telefónica Germany, enabling a full end-to-end cloud native network. We are very proud to be doing this together with O2 Telefónica.”

Mallik Rao, Chief Technology & Information Officer of O2 Telefónica, says: ” O2 Telefónica is a pioneer in deploying new network technologies such as Cloud RAN. With the introduction of a cloud-based, standardized architecture, we are able to respond quickly to customer needs, introduce new products and services even more flexibly and scale our O2 network better. With Cloud RAN, we combine the benefits of open interfaces with the expertise and product quality of European network equipment supplier Ericsson, whose technology we already use for our high-performance 5G core network.”

Cloud-native deployment plays a pivotal role in the transformation of the telecommunications industry, and the integration of cloud-native architecture into the radio access network (RAN) presents an exceptional opportunity to foster innovation and enhance network efficiency. By virtualizing the RAN and adopting a cloud-native, standardized architecture, O2 Telefónica will gain the ability to respond rapidly to customer needs, introduce new products and services with greater flexibility and agility, and realize benefits such as faster service delivery, improved scalability and enhanced cost efficiency.

Ericsson’s commitment to advancing telecommunications networks is underscored by this collaboration and builds upon the company’s successful Cloud RAN deployments with other leading CSPs in North America and Australia.

The incorporation of Cloud RAN extends the foundation of the ongoing network cloudification efforts by Ericsson and O2 Telefónica in Germany.

Technology overview: Benefits:

Ericsson 5G Cloud RAN, a cloud-native software solution, effectively handles compute functionality in the RAN, offering a range of benefits for CSPs, including the advantage of implementing common operational systems and practices, simplifying deployment and life cycle management of resources for enhanced efficiency. By centralizing processing and management functions, Cloud RAN transforms traditional network architecture to improve resource allocation, scalability and network management. This innovation empowers mobile network operators to dynamically allocate resources, optimizing performance and ensuring a seamless user experience.

Millimeter Wave (mmWave) frequency operates in the high-frequency range, typically above 24 gigahertz (GHz). This spectrum offers immense bandwidth potential, enabling data transfer at unprecedented speeds. By leveraging mmWave, telecommunications companies can deliver ultra-fast internet connections, supporting a wide range of applications such as 5G networks, virtual reality, augmented reality, and high-definition video streaming. With its ability to transmit vast amounts of data over short distances, mmWave frequency paves the way for the realization of futuristic technologies that demand low latency and exceptional performance.

References:

https://www.ericsson.com/en/ran/cloud

https://www.techtarget.com/searchnetworking/definition/cloud-radio-access-network-C-RAN

Ericsson’s new antenna helps accelerate Vodafone 5G roll-out

Vodafone is rolling out Ericsson’s new compact antenna to bring greater 5G capacity, coverage and performance to locations across the U.K. The Ericsson AIR 3218 combines a radio unit and antenna in a single unit. It can also transmit mobile data over all of the frequencies that Vodafone currently uses in the U.K., without needing additional antenna units, as was the case for previous models.

The combined multiband, Massive MIMO design makes it easier for the operator to add more capacity to a mast without increasing its footprint. It’s also easier to mount on rooftops, towers, walls and poles.

“5G is the UK’s digital future, but we should never underestimate how difficult it is to deliver a future-proofed network at scale across the length and breadth of the UK. Working in partnership with Ericsson, we are constantly exploring new ways to accelerate this transformation, and this is another example of where innovation is delivered through collaboration,” said Ker Anderson, head of Radio and Performance at Vodafone UK, in a statement.

Ericsson noted that the Interleaved AIR 3218 is powered by the latest Ericsson Silicon technology. It also uses beam-through technology where an arbitrary active antenna can be placed behind the passive antenna, reducing the overall footprint in terms of size, weight and wind load.

So far, they’ve calculated a 30% reduction in site acquisition and build time based on results from the first five sites where deployment has already been completed. The AIR 3218 is expected to be deployed across 50 sites within the Vodafone UK network in 2023.

References:

https://www.vodafone.co.uk/newscentre/news/new-ericsson-antenna-helps-accelerate-vfuk-5g-rollout/

Orange Business tests new 5G hybrid network service in France

Orange Business said that it has carried out tests of a new 5G service called “Mobile Private Network hybrid“at its office in Arcueil (Ile-de-France region). The telco claims the hybrid private network has several applications and is able to connect industrial equipment, tablets and autonomous vehicles, among other end points. It cited the example of ports as an area particularly suitable for hybrid network deployments.

Orange said it is “actively investing in the construction” of hybrid 5G networks in France. Its two units have been “constantly innovating to continue to develop services and use [cases],” the company added.

The new 5G service has been tested with a router from Ericsson owned Cradlepoint which is connected to both networks simultaneously and assigns data flows to the appropriate network based on predefined use cases and the application being used. The Cradlepoint router supports 5G SA and network slicing technology for business premises, with a hardened version available for industrial settings.

The test project hosted two use cases in two network slices, running on a laptop (“behind the router”): transmission of a video feed to the cloud on the public network to support a remote assistance use case, and an edge-based supervision application for an industrial process where all the data circulated on the private network. “The separation of data flows is complete from the application on the terminal to the core network.”

(Source: l_martinez / Alamy Stock Photo)

The network is operated by Orange in full and does not require the use of multiple SIM cards. Companies can use the solution for both critical and non-critical applications, with data flows isolated from the application on the terminal all the way to the core, and service quality adapted to each application. The company says it relies on local break-out technology, which allows for local routing of data flows, to offer stable low latencies. Orange also says the private network guarantees performance and offers higher data security than the public network.

Orange is one of few European operators that have started rolling out 5G SA networks, it has not yet officially launched one in France. In March, it announced it would start offering 5G SA in a handful of Spanish cities later this year. The telco will rely on Ericsson’s core technology, which will also be used in Belgium, Luxembourg and Poland.

References:

Orange intros managed hybrid-private 5G service for French enterprises

Orange Spain & Ericsson to build 5G Infrastructure for 3 High-Speed Rail Lines

In a statement, Orange highlighted it had won two of the three lots tendered by the transport infrastructure entity ADIF. It claimed its proposals for the lots received “the highest score” and its bids topped those from Vodafone.

In partnership with Ericsson, which is also supplying kit for Vodafone’s deployment, Orange will provide and maintain 5G infrastructure across the high speed rail corridors.

Announcing the award of its contracts, ADIF said it was part of attempts to “promote the digitisation and efficiency of the railway system” with the entity committing €117.3 million to deployment of 5G on the network and within its assets.

Alongside advantages for passengers, the organisation hailed 5G as a “critical catalyst in the digitisation of the economy in the coming years”.

Within the rail industry, it pointed to use cases including advanced logistics; real-time traffic management; automated vehicles; predictive maintenance; and improved surveillance in stations and on trains.

Orange says it is the first operator to launch 5G+, a network that consumes 90 percent less energy. Some of the notable sustainability initiatives undertaken by Orange include:

- 100% Green Energy Consumption: Since 2014, Orange has exclusively relied on green energy sources to power its operations, reinforcing their dedication to environmental responsibility.

- Device Recycling and Repair Program: Orange has implemented an ambitious program focused on recycling and repairing devices at their points of sale. By extending the lifespan of devices, they actively contribute to reducing electronic waste.

- Eco-Guidelines for Sustainable Practices: Orange has established eco-guidelines to encourage sustainable actions in their day-to-day operations. These guidelines serve as a roadmap, guiding employees in adopting environmentally friendly practices, even in the smallest gestures.

The ongoing efforts of Orange to promote sustainability demonstrate their commitment to mitigating their environmental impact. By integrating green energy, recycling and repair programs, and fostering sustainable practices, Orange is leading by example in its pursuit of a more sustainable future.

…………………………………………………………………………………………………………………………………………..

Separately, Orange Belgium has completed its acquisition of a controlling stake in telco operator, VOO SA. The closing of this deal will give Orange Belgium a 75% stake minus 1 share in VOO SA, with the remaining 25% plus one share retained by Nethys.

This transaction values VOO at an enterprise value of €1.8 billion for 100% of the capital. Orange Belgium will finance this transaction through an intra-Group loan.

Xavier Pichon, CEO of Orange Belgium, comments: “For decades, we developed our telecom skills and pioneering spirit to challenge the market, but as from today, we have the industrial power, tech means and commercial scale to accelerate and Lead the Future of the Belgian telco market in the interest of all consumers, employees and society in general.”

References:

Orange Launches 5G+ Network With Reduced Energy Consumption in Spain

Ericsson and MediaTek set new 5G uplink speed record using Uplink Carrier Aggregation

Ericsson and MediaTek have set a new 5G uplink speed record of 440 Mbps in low-band and mid-band spectrum using Uplink Carrier Aggregation. That uplink speed was achieved in an Ericsson lab. The test was performed with Ericsson’s Radio Access Network (RAN) Compute Baseband 6648 and a mobile device using a MediaTek Dimensity 9200 flagship 5G smartphone chipset.

More precisely, the combination used was 50MHz FDD n1 and 100MHz TDD n77. By aggregating these two bands, communications service providers can considerably increase their uplink speeds, resulting in better network performance and user experience. The fast uplink speed brings better, smoother experiences for the likes of video conference users, streamers, and their audience with more frames per second and higher image resolution. The 440 Mbps 5G upload speed achieved in the lab compares to an average of 26.78 Mbps outdoors and 22.98 Mbps indoors, as per a Cellsmart survey.

Sibel Tombaz, Head of Product Line 5G RAN, Ericsson, said: ”Super-fast uplink speeds make a big difference in the user experience. From lag-free live streaming, video conferencing and AR/VR apps, to more immersive gaming and extended reality (XR) technologies. The 440 Mbps upload speed achieved by Ericsson and MediaTek will help make that difference. We are also continuously designing innovative solutions for optimizing 5G networks so our customers can make the best use of their spectrum assets.”

Service providers are seeking innovative ways of boosting capacity while using existing spectrum efficiently to meet growing demands for wireless data and applications. This is where carrier aggregation comes in, optimizing the service provider’s spectrum assets to bring to users better coverage, increased capacity, and higher data speeds.

HC Hwang, General Manager of Wireless Communication System and Partnership at MediaTek, said: “The successful result of combining Ericsson’s state-of-the-art 5G Baseband and MediaTek’s flagship smartphone chip has achieved another 5G industry milestone, and paves the way for superior mobile experiences to benefit users every day.” Uplink speed is becoming more crucial with the expected uptake of

gaming, XR, and video-based apps. For example, as AR devices gain popularity with larger augmentation objects, rendering becomes more demanding. This increases the demand on networks to deliver higher throughput and lower latency.

Uplink speed is becoming more crucial with the expected uptake of gaming, XR, and video-based apps. For example, as AR devices gain popularity with larger augmentation objects, rendering becomes more demanding. This increases the demand on networks to deliver higher throughput and lower latency.

Earlier this year, AT&T boasted that it had completed what was believed to be the first 5G standalone (SA) uplink 2-carrier aggregation data connection in the U.S.

The connection was made at its Redmond, Washington, lab, where they achieved upload speeds of over 120 Mbps with a combination of 850 MHz and 3.7 GHz spectrum.

In May, T-Mobile reported reaching uplink speeds over 200 Mbps in a 5G data call using uplink CA; in that case, they used T-Mobile’s live commercial 5G SA network as opposed to a lab environment. T-Mobile used 2.5 GHz and 1.9 GHz bands.

References:

https://www.fiercewireless.com/tech/ericsson-mediatek-claim-upload-speed-record-440-mbps

CELLSMART: 5G upload speeds are insufficient for industrial/enterprise applications

Cellsmart: 5G download performance improves but upload performance lags

Swisscom, Ericsson and AWS collaborate on 5G SA Core for hybrid clouds

Swiss network operator Swisscom have announced a proof-of-concept (PoC) collaboration with Ericsson 5G SA Core running on AWS. The objective is to explore hybrid cloud use cases with AWS, beginning with 5G core applications. The plan is for more applications to then gradually be added as the trial continues. With each cloud strategy (private, public, hybrid, multi) bringing its own drivers and challenges the idea here seems to be enabling the operator to take advantage of the specific characteristics of both hybrid and public cloud.

The PoC reconfirms Swisscom and Ericsson’s view of the potential hybrid cloud has as a complement to existing private cloud infrastructure. Both Swisscom and Ericsson are on a common journey with AWS to explore how use cases can benefit telecom operators.

The PoC will examine use cases that take advantage of the particular characteristics of hybrid and public cloud. In particular, the flexibility and elasticity it can offer to customers which can mean deployment efficiencies for use cases where capacity is not constantly needed. An example of this could be when maintenance activities are undertaken in Swisscom’s private cloud, or when there are traffic peaks, AWS can be used to offload and complement the private cloud.

Swisscom had already been collaborating with AWS on migrating its 5G infrastructure towards standalone 5G. In addition, it has also used the hyperscaler’s public cloud platform for its IT environments. Telco concerns linger [1.] around the use of public cloud in telecoms infrastructure (especially the core networks) for some operators, hybrid cloud is seemingly gaining momentum as a transitional approach.

Note 1. Telco concerns over public cloud:

- In a recent survey by Telecoms.com more than four in five industry respondents feared security concerns over running telco applications in the public cloud, including 37% who find it hard to make the business case for public cloud as private cloud remains vital in addressing security issues. This also means that any efficiency gains are offset by the IT environment and the network running over two cloud types.

- Many in the industry also fear vendor lock-in and lack of orchestration from public cloud providers. Around a third of industry experts from the same survey find it a compelling reason not to embrace and move workloads to the public cloud unless applications can run on all versions of public cloud and are portable among cloud vendors.

- There’s also a lack of interoperability and interconnectedness with public clouds. The services of different public cloud vendors are indeed not interconnected nor interoperable for the same types of workloads. This concern is one of the drivers to avoid public cloud, according to some network operators.

–>PLEASE SEE THE COMMENT ON THIS TOPIC IN THE BOX BELOW THE ARTICLE.

Quotes:

Mark Düsener, Executive Vice President Mobile Network & Services at Swisscom, says: “By bringing the Ericsson 5G Core onto AWS we will substantially change the way our networks will be built and operated. The elasticity of the cloud in combination with a new magnitude in automatization will support us in delivering even better quality more efficiently over time. In order to shape this new concept, we as Swisscom believe strategic and deep partnerships like the ones we have with Ericsson and AWS are the key for success.”

Monica Zethzon, Head of Solution Area Core Networks, Ericsson says: “5G innovation requires deep collaboration to create the foundations necessary for new and evolving use cases. This Proof-of-Concept project with Swisscom and AWS is about opening up the routes to innovation by using hybrid cloud’s flexible combination of private and public cloud resources. It demonstrates that through partnership, we can deliver a hybrid cloud solution which meets strict telecoms industry requirements and security while making best use of HCP agility and cloud economy of scale.”

Fabio Cerone, General Manager AWS Telco EMEA at AWS, says: “With this move, Swisscom is opening the door to cloud native networks, delivering full automation and elasticity at scale, with the ability to innovate faster and make 5G impactful to their customers. We are committed to working closely with partners, such as Ericsson, to explore new use cases and strategies that best support the needs of customers like Swisscom.”

“How to deploy software in different cloud environments – at a high level, it is hard making that work in practice,” said Per Narvinger, the head of Ericsson’s cloud software and services unit. “You have hyperscalers with their offering and groups trying to standardize and people trying to do it their own way. There needs to be harmonization of what is wanted.”

https://telecoms.com/520337/swisscom-ericson-and-aws-collaborate-on-hybrid-cloud-poc-on-5g-core/

https://telecoms.com/520055/telcos-and-the-public-cloud-drivers-and-challenges/

AWS Telco Network Builder: managed network automation service to deploy, run, and scale telco networks on AWS

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Ericsson to lay off 8,500 employees as part of cost cutting plan

After warning in January that profit margins at its RAN business would worsen, telecom equipment maker Ericsson will lay off 8,500 employees globally as part of its plan to cut costs, according to a memo sent to employees and seen by Reuters.

“The way headcount reductions will be managed will differ depending on local country practice,” Chief Executive Borje Ekholm wrote in the memo. “In several countries the headcount reductions have already been communicated this week,” he said. “It is our obligation to take this cost out to remain competitive,” Ekholm said in the memo. “Our biggest enemy right now may be complacency.”

While technology companies such as Microsoft, Meta and Alphabet have laid off thousands of employees citing economic conditions, Ericsson’s move would be the largest layoff to hit the telecoms industry.

On Monday, the company, which employs more than 105,000 worldwide, announced plans to cut about 1,400 jobs in Sweden. While Ericsson did not disclose which geography would be most affected, analysts had predicted that North America would likely be most affected and growing markets such as India the least.

The company said in December it would cut costs by 9 billion crowns ($880 million) by the end of 2023 as demand slows.

“Our aim is to manage the process in every country with fairness, respect, professionalism and in line with local labor legislation,” Ericsson said in a statement.

“We are also working on our service delivery, supply, real estate and IT. We have already started to implement and accelerate various initiatives to help us reach” the cost-cutting goal, Ericsson said.

Many telecom companies had beefed up their inventories during the height of the pandemic which is now leading to slowing orders for telecom equipment makers like Ericsson and Nokia.

References:

https://www.reuters.com/business/media-telecom/ericsson-lay-off-8500-employees-memo-2023-02-24/

https://apnews.com/article/technology-stockholm-covid-business-07bda439ac93836817a00d0d54892d0a

Ericsson Mobility Report: 5G monetization depends on network performance

High Tech Layoffs Explained: The End of the Free Money Party

Ericsson Mobility Report: 5G monetization depends on network performance

A special Ericsson Mobility Report – called the Business Review edition – addresses monetization opportunities as they relate to 5G. Flattening revenues have been a challenge for service providers in all parts of the world, often impacting network investment decisions as part of their business growth strategies, known as ‘monetization’ in the industry.

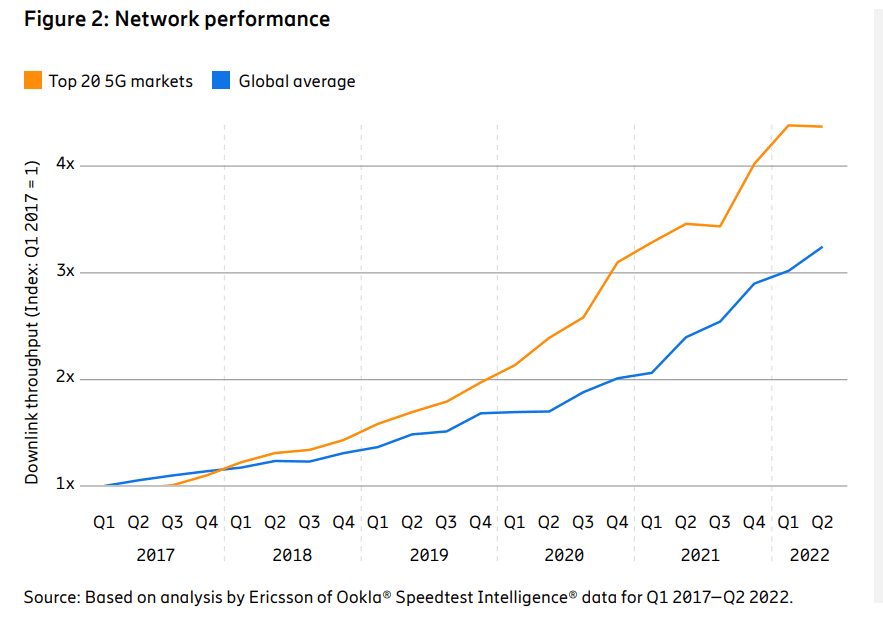

The report highlights a positive revenue growth trend since the beginning of 2020 in the top 20* 5G markets – accounting for about 85 percent of all 5G subscriptions globally – that correlates with increasing 5G subscription penetration in these markets.

The report finds:

- Tiered pricing models are key for service providers, both for effectively addressing the individual needs of each customer and for continuing to drive long-term revenue growth.

- The top 20 5G markets have seen a significant network performance boost following the introduction of 5G services.

- After a period of slow or no growth, wireless service revenue curves are again pointing upwards in these leading markets. This correlate with 5G subscription penetration growth.

- In the top 20 5G markets, the average downlink throughput has increased by 4.3 times over the past 5 years. This is 32 percent more than other markets on a global level, showing the positive impact 5G has had on network performance and user experience. The most significant network performance improvement in the top 20 5G markets was in 2020, following the introduction of 5G NSA network services.

- In the top 20 5G markets, the median downlink throughput of 5G is 5.8 times higher than the throughput of 4G (187 Mbps vs. 32 Mbps) in Q3 2022. This performance boost is what service providers could offer to consumers as an immediate benefit of upgrading to 5G.

Fredrik Jejdling, Executive Vice President and Head of Networks, Ericsson, says: “Meeting our customers’ challenges is at the heart of our R&D efforts and every resulting product we develop. The link between 5G uptake and revenue growth in the top 20 5G markets underlines that not only is 5G a game changer, but that early adopters benefit. What is particularly encouraging about this is that while 5G is still at a relatively early phase, it is growing fast with proven early use cases and a clear path to medium and long-term use cases.”

As expected, Enhanced Mobile Broadband (eMBB) is the main early use case for 5G, driven by increasing geographical coverage and differentiated offerings. More than one billion 5G subscriptions are currently active across some 230 live commercial networks globally. 5G eMBB offers the fastest revenue opportunities for 5G, as it is an extension of service providers’ existing business, relying on the same business models and processes. Even in the top 20 5G markets, about 80 percent of consumers have yet to move to 5G subscriptions – one pointer to the potential for revenue growth.

As highlighted in the November 2022 Ericsson Mobility Report, Fixed Wireless Access (FWA) is the second biggest early 5G use case, particularly in regions with unserved or underserved broadband markets. FWA offers attractive revenue growth potential for CSPs as it largely utilizes mobile broadband assets. FWA connections are forecast to top 300 million within six years.

Beyond consumer subscribers, there are growing opportunities in enterprise and public sector applications across the world. Ericsson sas that 5G enables significant value for enterprises, with private 5G networks and wireless wide area networks being deployed for enterprise and industrial use.

Upgrading existing 4G sites to 5G has the potential to realize increases of 10 times in capacity and reduce energy consumption by more than 30 percent, offering the possibility of growing revenue and lowering costs, while addressing sustainability.

Jejdling adds: “Revenue growth and sustainability are recurring themes in my discussions with customers. In this special Ericsson Mobility Report edition, we have explored how service providers are tapping 5G opportunities. We see initial signs of revenue growth in advanced 5G markets with extensive coverage build-out and differentiated service offerings. An equally crucial aspect of 5G is that it brings cost advantages and helps service providers handle the data growth needed to drive future revenue. This can make 5G the growth catalyst that the market has been waiting for.”

Read the full Ericsson Mobility Report Business Review Edition report here.

*Note: The markets categorized as the Top 20 5G markets in the report are: Australia, Bahrain, China, Denmark, Finland, Hong Kong, Ireland, Japan, Kuwait, Monaco, Norway, Qatar, Saudi Arabia, Singapore, South Korea, Switzerland, Taiwan, the UAE, the UK and the US.

They were selected on the basis of 5G subscription penetration. These markets represent 85 percent of all 5G subscriptions globally – with each market having 5G penetration above 15 percent.

Related links:

Ericsson Mobility Report site

Ericsson 5G

Ericsson 4G and 5G Fixed Wireless Access

Breaking the energy curve

5G the next wave – what does consumers want

Ericsson & Mobily enhance network performance through Artificial Intelligence (AI)

Ericsson has developed an AI system for automated network management which has now been included in Saudi Arabia operator Mobily’s wireless network. The companies have successfully deployed the ‘Ericsson AI-based network solution’ into Mobily’s network in Saudi Arabia in order to enable some ‘enhanced and smart end-user experiences.’

This AI system will provide 5G network diagnostics, root cause analysis and recommendations for ‘superior user experiences.’ The network diagnostics capabilities within the cognitive software suite provides ‘proactive network optimization’, allowing the operator to identify and resolve network anomalies and providing reliable connectivity, we are told.

Ericsson’s AI-based network solution delivers comprehensive Machine Learning (ML) based 5G network diagnostics, root cause analysis and recommendations for superior user experiences. The smart, automated network diagnostics capabilities of Ericsson’s cognitive software suite results in proactive network optimization, supporting Mobily, the leading digital partner of the international technical conference LEAP 23, in identifying and resolving network anomalies and constantly providing reliable connectivity.

Ericsson is so excited by the product in fact that it says it ‘redefines the very nature of network operations,’ alongside the presence of Big Data and ‘ever-expanding and more accessible computing power.’

“From people in remote locations to large gatherings, individuals often expect uninterrupted and quality connectivity,” said Alaa Malki, Chief Technology Officer from Mobily. “Ericsson’s Artificial Intelligence (AI)-based solution enables our customers to enjoy superior and uninterrupted 5G connectivity to stay connected with loved ones or to document key moments anytime, anywhere. Our partnership with Ericsson has once more reinforced our commitment to Unlock Possibilities during times that matter most, and we look forward to carrying our mission forward. I want to thank Ericsson for its support which allowed us to use this data-driven concept to make all kinds of changes and optimizations within short timeframes.”

Ekow Nelson, Vice President at Ericsson Middle East and Africa said: “For numerous years, our partnership with Mobily has provided customers with assured and superior connectivity to stream live experiences and benefit from a multitude of services even in the most challenging environments. Our success relied on Ericsson’s Artificial Intelligence-based network solution built with Machine Learning models that learn from the live network using the multiple sources of data to deliver near real-time improvements, thus avoiding interruptions during critical and peak times.”

How AI interacts and disrupts different industries looks likely to be an increasingly prominent issue in the years to come, for all sorts of reasons. In an interview with Telecoms.com recently, Beerud Sheth – CEO of conversational AI firm Gupshup said, “Like almost any industry, telcos will also have to figure out how they see this disruption… it creates opportunities and threats. And I think you have to lean into the opportunities, and maybe mitigate the threats a little bit. It changes a lot of things, it changes consumer expectations, it changes what people expect and what they want to do and can do, and they have to keep pace with all of it. So, there’s a lot of work for telco executives.”

References:

Ericsson, Mobily successfully enhance network performance through Artificial Intelligence

Ericsson warns profit margins at RAN business set to worsen