FTTP

STELLAR Broadband offers 10 Gigabit Symmetrical Fiber Internet Access in Hudsonville, Michigan

STELLAR Broadband, a fiber internet and technology service provider, will provide leading edge technologies and Internet connectivity up to 10Gbps to Elmwood Lake Apartments in Hudsonville, Michigan.

Elmwood Lake Apartments is a suburban haven of elevated comfort, where sweet serenity meets desirable convenience. From cozy interiors and relaxing leisure spaces to an idyllic setting next to private Elmwood Lake, the welcoming apartments in Hudsonville, MI, are ready to deliver a heightened living experience.

“With STELLAR Broadband, residents of Elmwood Lake Apartments will enjoy the fastest and most reliable internet service available. STELLAR Broadband’s fiber optic network provides symmetrical speeds of up to 10Gbps so residents can stream, game, and work from home without any lag or buffering,” said Richard Laing, president of STELLAR Broadband.

“Bosgraaf Homes has been building homes in West Michigan for four generations. Over the years, we’ve seen the industry change dramatically thanks to advances in technology. Construction methods have evolved, and the amenities that homeowners expect have grown more sophisticated. We’re grateful for our partnership with STELLAR Broadband, a company that has been at the forefront of the industry for 22 years. Their experience and leadership have helped us make the transition into multi-family housing,” said Mike Bosgraaf, president of Bosgraaf Homes.

The first in the U.S. to bring 10Gbps Internet to the apartment in student housing, STELLAR today serves over 149 communities totaling over 10,000 residents with a wide range of technology solutions, from managed Wi-Fi, TV, and access control to security.

“DTN is excited to partner with Bosgraaf Homes and STELLAR Broadband to provide Elmwood Lake residents with a unique and enjoyable experience. Bosgraaf is building beautiful homes that will be easy to lease, and STELLAR will provide residents and our office with the best possible internet service,” said Dayle Braden, DTN property manager.

“We’ve seen and have been on the forefront of technology evolving from a desired amenity to a necessity. We are proud to partner with Bosgraaf to provide the high-quality technology that their residents expect and deserve,” Laing stated.

About Spartan Net Co, dba STELLAR Broadband:

STELLAR Broadband is the largest residential fiber internet service provider in Michigan, servicing over 149 communities with multi-Gigabit fiber internet. STELLAR provides technology design and installation services for the full portfolio of technologies for multi-tenant developments, including network design, structured wiring, consulting, door entry and access control, engineered Wi-Fi, security, voice, television services, and various Internet of Things solutions. To learn more, visit: www.stellarbb.com

References:

No Surprise: AT&T tops leaderboard of commercial fiber lit buildings for 7th year!

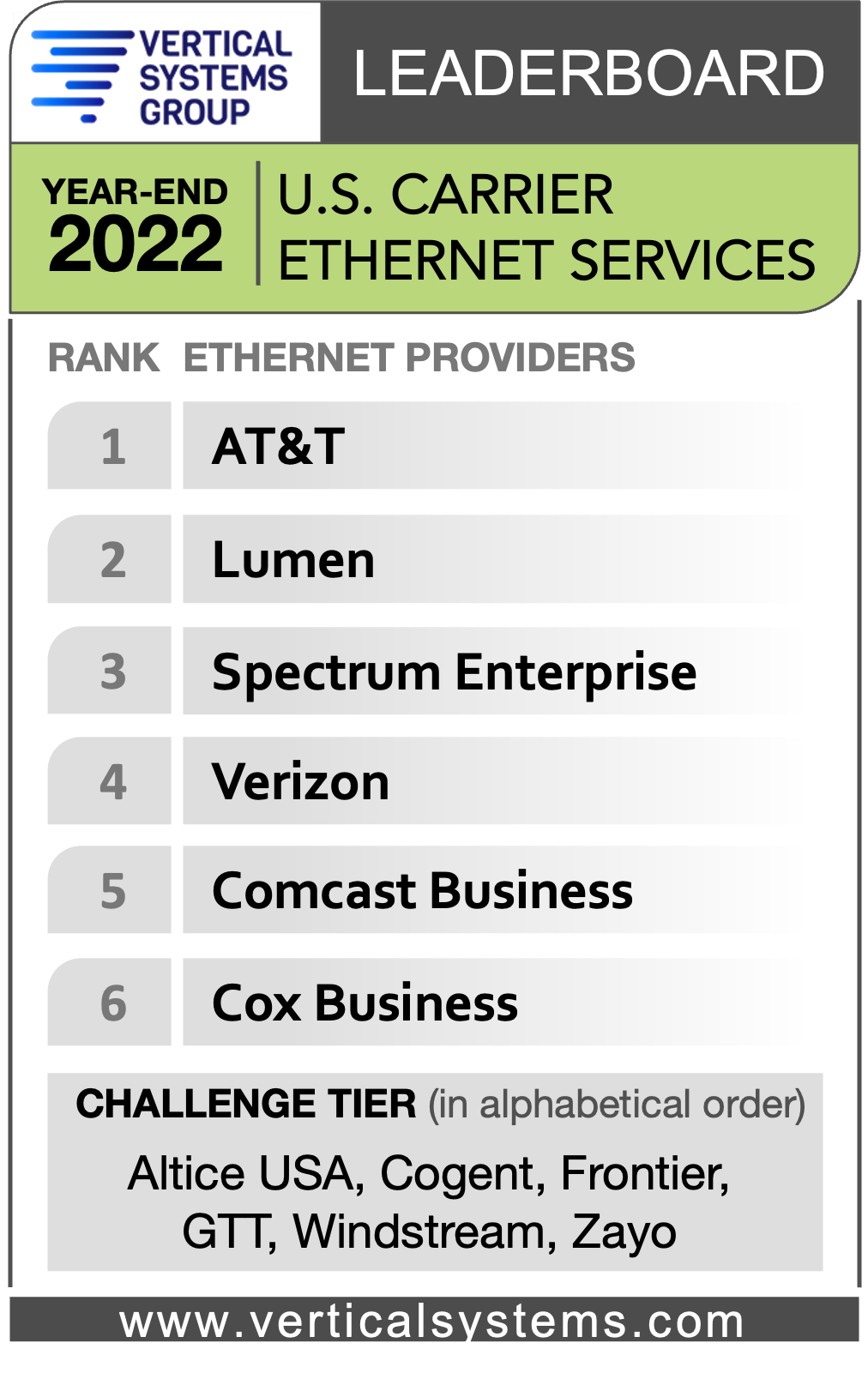

Once again, AT&T ranked #1 in the U.S. Fiber Lit Buildings Leaderboard fromVertical Systems Group (VSG) for a seventh consecutive year. The fiber focused U.S. carrier retained the top spot with the highest number of fiber lit buildings across its footprint in 2022. But there’s a whole lot more AT&T #1 rankings that the carrier has not gotten proper credit for achieving:

- AT&T also holds the #1 ranking in VSG 2022 U.S. Carrier Ethernet LEADERBOARD.

- AT&T ranked #1 for the fifth consecutive year in VSG’s year end 2022 U.S. managed carrier SD-WAN leaderboard.

–>Please see the images below, courtesy of VSG.

Major mobile operators like AT&T and Verizon are actively installing new fiber for their 5G network backhaul, which facilitates new fiber connectivity to nearby commercial sites. T-Mobile no longer has any fiber assets from their Sprint acquisition. They were sold to Cogent along with all other wireline assets in a deal that closed May 1, 2023.

Verizon, Spectrum Enterprise, Lumen, Comcast Business, Cox Business, Zayo, Crown Castle, Frontier, Brightspeed, Breezeline and Optimum followed. Those retail and wholesale fiber providers qualified for the leaderboard with 15,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2022.

-

“Fiber installations at U.S. commercial sites increased in 2022, driven by escalating requirements for gigabit-speed connectivity to support cloud-based services, data centers, 5G rollouts, and other applications,” said Rosemary Cochran, principal of Vertical Systems Group. “New fiber investments in the U.S. will continue to be impacted by pending federal programs and funding initiatives. Opportunities in the commercial segment include monetizing the millions of small buildings underserved.”

U.S. Fiber Lit Buildings LEADERBOARD Highlights:

- The 2022 LEADERBOARD roster increases to twelve commercial fiber providers, up from eleven in 2021.

- AT&T retains the #1 rank on the 2022 U.S. Fiber Lit Buildings LEADERBOARD for the seventh consecutive year.

- Rankings for the top six companies on the 2022 LEADERBOARD are unchanged from 2021, which includes AT&T, Verizon, Spectrum Enterprise, Lumen, Comcast Business, and Cox Business.

- The next six LEADERBOARD provider rankings change as compared to the previous year. Zayo advances to rank seventh ahead of Crown Castle, which dips to eighth. Frontier moves up to ninth position from tenth. Brightspeed debuts in tenth position with fiber assets acquired from Lumen. Breezeline (formerly Atlantic Broadband) falls to eleventh position from ninth. Optimum (Altice USA brand) drops from eleventh to the twelfth and final position.

- The number of 2022 Challenge Tier citations expands from eight to nine with the addition of Ritter Communications.

Market Players include all other fiber providers with fewer than 5,000 U.S. commercial fiber lit buildings. The 2022 Market Players tier covers more than two hundred metro, regional and other fiber providers, including the following companies (in alphabetical order): 11:11 Systems, ACD, Alaska Communications, American Telesis, Armstrong Business Solutions, Astound Business, C Spire, Centracom, Cogent, Conterra, DFN, DQE Communications, Everstream, ExteNet Systems, Fatbeam, FiberLight, First Digital, Flo Networks, Fusion Connect, Google Fiber, GTT, Horizon, Hunter Communications, Logix Fiber Networks, LS Networks, Mediacom Business, MetroNet Business, Midco, Pilot Fiber, PS Lightwave, Shentel Business, Silver Star Telecom, Sonic Business, Sparklight Business, Syringa, T-Mobile, TDS Telecom, TPx, U.S. Signal, Vast Networks, WOW!Business, Ziply Fiber and others.

For this analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

……………………………………………………………………………………………………………………………………..

References:

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

https://www.verticalsystems.com/2023/02/15/2022-u-s-ethernet-leaderboard/

AT&T tops VSG’s U.S. Carrier Managed SD-WAN Leaderboard for 4th year

VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020

Shentel joins Frontier and Altice USA with 5-gig broadband service

Shenandoah Telecommunications (Shentel) became the latest wireline network operator to roll out a symmetrical 5 Gbps internet tier, making it available to all 147,000 passings where it currently offers Glo Fiber service. Over 147,000 homes across Virginia, West Virginia, Maryland and Pennsylvania will have access to the fastest fiber speeds available in these markets.

The average U.S. household now has approximately 20 connected devices, and that number is expected to continue to grow. In addition, with more consumers working remotely long-term, video conferencing is here to stay. Multi-gig speeds are designed for these growing demands and will provide more bandwidth to run a multitude of connected devices at once.

“Adding 5 Gig internet service to our multi-gig product portfolio allows Glo Fiber to meet the demands of our customers and communities. 5 Gig is a premium residential service designed to connect multiple devices at their fastest possible speeds over a reliable, 100% fiber optic network,” said Ed McKay, Shentel Chief Operating Officer.

As of the end of Q4 2022, Glo Fiber was live in 17 markets across four states, including Maryland, Pennsylvania, Virginia and West Virginia. Jeff Manning, Shentel’s VP of Product and Network Strategy, said that by the end of 2023, Glo Fiber and the new 5-gig offering will be available to just under 250,000 passings across 23 markets.

“It feels like the right time to launch,” Manning said. “When you look at the number of devices in homes, the average is well over 20 devices in every home now. So, 5-gig service gives you the capability to ensure every device in the home is fully supported with the capacity it needs.”

The regional network operator already offers 600 Mbps, 1.2 Gbps and 2.4 Gbps service tiers at price points ranging from $65 to $135. The new 5-gig tier will cost $285 per month and require customers to bring their own router.

Manning said the reason it is asking 5-gig customers to bring their own router is because that will enable them to select a device with the level of performance they need. That and there aren’t routers on the market yet which are fully capable of delivering 5 gigs over Wi-Fi. When that changes, he said, Shentel will look at options to package routers with the 5-gig plan.

As a leading broadband internet provider in the Mid-Atlantic region, Glo Fiber takes great pride in several key differentiators compared to their competitors:

- Fiber-to-the-home technology with exceptional reliability

- Symmetrical download and upload speeds

- Easy, straight-forward pricing

- Prompt local customer service

Frontier has 125,000 fiber passings in West Virginia and recently announced plans to build another 100,000 there this year. It also provides fiber service in parts of Pennsylvania, including near Harrisburg and Lancaster, areas Shentel is eyeing for its expansion.

Altice also offers its Optimum fiber service in parts of Pennsylvania, including the areas west of Carlisle, which are similarly situated in the general area of a market Shentel is targeting. AT&T and Google Fiber offer 5-gig service tiers as well but don’t appear to operate within Shentel’s footprint. Frontier’s 5-gig service currently runs $164.99 per month while Altice’s costs $180 per month.

Watkins said the majority of Glo Fiber customers today are landing in its 1-gig and 2-gig buckets, though only around 10% fall into the latter. Thus, it’s not expecting huge take rates for the 5-gig product. Instead of mass market appeal, he said it’s designed to cater to select segments of the population with high bandwidth needs.

About Glo Fiber:

Glo Fiber (Glo) provides next-generation fiber-to-the-home (FTTH) multi-gigabit broadband internet access, live streaming TV, and digital home phone service powered by Shentel (Nasdaq: SHEN). Glo provides the fastest available service to residents leveraging XGS-PON, a state-of-the-art technology capable of symmetrical internet speeds up to 10 Gbps. To learn more about Glo Fiber, please visit www.glofiber.com or 1-800-IWANTGLO (1-877-492-6845).

About Shenandoah Telecommunications:

Shenandoah Telecommunications Company (Shentel) provides broadband services through its high speed, state-of-the-art fiber-optic and cable networks to customers in the Mid-Atlantic United States. The Company’s services include: broadband internet, video, and voice; fiber optic Ethernet, wavelength and leasing; and tower colocation leasing. The Company owns an extensive regional network with over 8,300 route miles of fiber and over 220 macro cellular towers. For more information, please visit www.shentel.com.

References:

https://www.fiercetelecom.com/broadband/shentel-targets-power-users-5-gig-broadband-plan

Shentel plots launch of fiber in 6 greenfield markets in 2023

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Google Fiber offers 8 Gig symmetric service in Mesa, AZ; Chandler, AZ next in line

Google Fiber is using its service launch in the Westwood neighborhood of Mesa, Arizona, market to also serve as the initial launch point for its new symmetrical 8 Gbit/s broadband service. Residential customers in Mesa can sign up for Google Fiber’s 8 Gig service for $150 per month. 8 Gig offers symmetrical uploads and downloads of up to 8 Gbps with a wired connection, along with a Wi-Fi 6 router (which allows for up to 800 mbps over Wi-Fi) and up to two mesh extenders.

The 8-Gig tier, now Google Fiber’s fastest, sells for $150 per month and comes with a Wi-Fi 6 router and two Wi-Fi mesh extenders. There are three other symmetrical broadband service tiers:

- 1-Gig: $70 per month

- 2-Gig: $100 per month

- 5-Gig: $125 per month

Google Fiber’s debut in the Westwood neighborhood of Mesa arrives about eight months after the city council there approved the buildout. Mesa, the first city in Arizona to get service from Google Fiber, is also being served by primary incumbent providers Cox Communications and Lumen.

Amid the revamp of its network expansion strategy, Google Fiber expects to start construction later this year in Chandler, Arizona, Ashley Church, GM for Google Fiber’s west region, said in a blog post.

As announced last fall, Google Fiber is also in the process of launching new 5-Gig and 8-Gig tiers in additional markets in 2023. Its new 5-Gig service is already available in several Google Fiber markets, including Kansas City, West Des Moines, Iowa, and all the cities it provides service to in Utah.

Google Fiber will start construction later this year in Chandler, AZ. As new segments are completed, we’ll offer service in those neighborhoods. Residents who want to keep up on the construction process or service availability in their area can sign up here. Google Fiber has also conducted lab tests in Kansas City that produced downstream speeds of 20.2 Gbps.

.jpg)

Here’s an updated snapshot of where Google Fiber currently provides or plans to provide via FTTP or fixed-wireless Webpass services:

Table 1:

| Market | FTTP or Webpass |

| Atlanta, Georgia | FTTP |

| Austin, Texas | FTTP |

| Chandler, Arizona | FTTP |

| Charlotte, North Carolina | FTTP |

| Chicago, Illinois | Webpass |

| Council Bluffs, Iowa | FTTP |

| Denver, Colorado | Webpass |

| Des Moines, Iowa | FTTP |

| Huntersville, North Carolina | FTTP |

| Huntsville, Alabama | FTTP |

| Idaho | FTTP* |

| Kansas City, Kansas and Missouri | FTTP |

| Lakewood, Colorado | FTTP |

| Miami, Florida | Webpass |

| Nevada | FTTP* |

| Nashville, Tennessee | FTTP |

| Oakland, California | Webpass |

| Omaha, Nebraska | FTTP |

| Orange County, California | FTTP |

| Provo, Utah | FTTP |

| Salt Lake City, Utah | FTTP |

| San Antonio, Texas | FTTP |

| San Diego, California | Webpass |

| San Francisco, California | Webpass |

| Seattle, Washington | Webpass |

| *Google Fiber FTTP deployments coming to cities yet to be announced. (Source: Google Fiber and Light Reading research) |

|

References:

https://fiber.googleblog.com/2023/03/mesa-here-we-come-and-superfast-too.html

Ziply® Fiber agrees to acquire Ptera as U.S. fiber buildouts slow

Ziply® Fiber [1.] has announced an agreement to acquire Ptera, Inc, a fiber internet and fixed wireless internet service provider (WISP) serving four counties across Eastern Washington and Northern Idaho. The acquisition, Ziply’s fourth since June 2022, is scheduled to close later this year, pending regulatory approvals. Financial terms of the buyout were not disclosed.

Note 1. Ziply was created in May 2020 after Frontier Communications sold its operations and assets in Washington, Oregon, Idaho and Montana to WaveDivision Capital in partnership with Searchlight Capital Partners for $1.35 billion. Ziply won just over $57 million in Rural Digital Opportunity Fund (RDOF) support to build fiber to more than 21,000 locations. It has also been working with state and local broadband officials on additional opportunities and plans to participate in the Broadband Equity, Access, and Deployment (BEAD) Program.

Image Credit: Ziply® Fiber

……………………………………………………………………………………………………………………

Founded in 2001 and headquartered in Liberty Lake, WA, Ptera serves more than 4,000 customers in the cities of Airway Heights, Cheney, Liberty Lake, Medical Lake, Otis Orchards and more. All Ptera employees will join the Ziply Fiber team as part of the acquisition.

“Both Ptera and Ziply Fiber were born here in the Northwest, and both of our companies have been focused on a similar mission to connect communities that have been underserved when it comes to reliable, high-speed internet,” said Harold Zeitz, CEO of Ziply Fiber. “We look forward to having the Ptera employees join the Ziply Fiber team and continue the work underway to expand their fiber network to reach more addresses in the region.”

Zeitz told Fierce Wireless the deal will not only help fill in a gap in its fiber map, but will also give it fixed wireless access expertise which may help it secure more customers in the future. Zeitz said, “We’re not going to build fiber generally where there is fiber. So, rather than skip those areas that we think fit what we ultimately want as our network, it makes sense ultimately to join forces rather than skip an area or build over fiber.”

Zeitz told Fierce Wireless on Friday that it now serves fiber to approximately 800,000 locations – and remains on track to hit its goal to deploy fiber to 80% to 85% of its territory. But for the 15% to 20% of locations that fall outside its economic threshold for building fiber, Zeitz said it will either use grants to help fund its build or just use fixed wireless. Its recent acquisitions “give us an opportunity to have teams that are experienced with that.”

“There’s definitely a part of the footprint that’s just too expensive to get to but they deserve better internet, so fixed wireless is a good alternative for that cross section of the population,” he said. “We may build fiber where there is fixed wireless [today] but we’ll likely have some fixed wireless and we may extend the fixed wireless. We’re in the process of thinking through how we would do that.”

Steven Wilson, CEO of Ptera, said, “Ptera has been a family-owned business for more than 20 years, and I’m very proud of the work our team has done to earn the trust and support of our customers across the Inland Northwest. I’m excited about this next chapter for the company and our future together with Ziply Fiber.”

Current Ptera customers will not see any immediate changes to their service or working relationships. Once the acquisition officially closes (which can take months), customers will benefit from expanded customer service capabilities and access to new products such as SD-WAN and improved network management capabilities.

……………………………………………………………………………………………………………………………

Meanwhile, the fiber buildout boom shows signs of slowing due to inflationary pressures for labor and equipment with a higher interest rates (i.e. cost of capital). In a new report to MoffettNathanson clients, Craig Moffett found that incremental telco fiber passings in 2022 were about 500,000, roughly 8% below year-ago expectations. Meanwhile, combined guidance for 2023 has dipped by 3.1 million, or 40%, he added, noting that this doesn’t include the build activities of private companies such as Windstream, Brightspeed, Ziply Fiber and Cincinnati Bell (altafiber).

AT&T has reduced the pace of future fiber buildouts to 2 million to 2.5 million per year, down from the prior suggested run-rate of 3.5 million to 4 million. That doesn’t include the AT&T-BlackRock joint venture initially targeting the buildout of 1.5 million fiber locations outside AT&T’s current footprint.

Lumen’s build also dropped about 33% from its year-ago guidance amid a broader company “reset”. Frontier Communications’ expected 2023 build has been cut back by about 300,000 passings, though its target to build fiber to 10 million locations by 2025 hasn’t changed.

Altice USA has also reduced its original fiber upgrade plans, putting more emphasis on DOCSIS upgrades in rural footprint.

Moffett doesn’t see any near-term relief as more government funds are released to support rural builds. “We expect labor cost pressures, in particular, to worsen,” he wrote. “We are inching ever closer to the allocation of rural subsidy BEAD [Broadband Equity, Access, and Deployment] funds to states, and then to individual grantees. Those projects will introduce an enormous new source of demand for labor (and for crews from contract builders such as Dycom).”

……………………………………………………………………………………………………………………………….

About Ziply Fiber:

Ziply Fiber is local in the Northwest, headquartered in Kirkland, Washington, and has major offices in Everett, Washington; Beaverton, Oregon; and Hayden, Idaho. Most of Ziply Fiber’s executive team, which consists of former executives from AT&T, CenturyLink, and Wave Broadband, either grew up in the Northwest or have spent the better part of 30 years living here. That local ownership and market familiarity is an important part of the company mindset and culture. Ziply Fiber’s primary service offerings are Fiber Internet and phone for residential customers, Business Fiber Internet and Ziply Voice services for small businesses, and a variety of Internet, networking, and voice solutions for enterprise customers. The company also continues to support Ziply Internet (DSL) customers and its TV customers in Washington and Oregon.

Ziply Fiber has committed to invest hundreds of millions of dollars to build an advanced, 100-percent fiber network to both suburban and rural communities across the Northwest that have been underserved when it comes to internet access. The company has been actively building fiber across the Northwest since June 2020 and has plans to build and deploy new fiber-optic cables, local hubs, new offices, and new hardware to run the network as part of hundreds of additional projects across its 250,000-square-mile footprint.

A full listing of products and services can be found at ziplyfiber.com.

About Ptera:

Ptera, a Liberty Lake, WA based telecommunications corporation, was founded in 2001 as a family-owned business. Today, Ptera is a pioneering wireless internet service provider operating a network with coverage in four counties across Eastern Washington and Northern Idaho. Ptera also offers hosted voice over IP phone solutions serving customers across the country. The company’s service has no data caps on fiber internet and the lowest latency in town, even lower than DSL or cable providers. Ptera’s VoIP service offers crystal clear digital phone calls over an Internet connection utilizing your current handset or Cisco office phone.

For more, visit ptera.com.

References:

https://www.fiercetelecom.com/telecom/ziply-buys-ptera-fiber-expansion-rolls-mulls-fwa-strategy

https://www.lightreading.com/broadband/spotlight-turns-to-arpu-in-us-broadband-battle/d/d-id/783742?

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

Frontier Communications Parent, Inc. (“Frontier”) reported impressive 4th quarter and full-year 2022 results today. The fiber facilities based carrier added a record 76,000 fiber subs in the last quarter, more than two times what it added in the year-ago quarter. The bulk of those fiber subscriber gains are coming from cable competitors, execs said.

Frontier ended 2022 with 1.7 million fiber customers, a figure that represents the majority of its total base of 2.8 million broadband subs. Frontier also built out a record 381,000 new fiber locations in Q4, ending 2022 with 5.2 million fiber locations. That gets Frontier past the halfway point toward a goal of building fiber-to-the-premises to 10 million locations by 2025.

Total revenues were down year-over-year, but consumer fiber revenues rose 7.7% to $436 million versus the prior year period, offsetting declines in video. Consumer fiber broadband revenues surged 15.5%, to $283 million.

“We ended the year strong with another quarter of record operational results. We now have the fiber engine we need to power our growing digital infrastructure business. This is how we advance our purpose of Building Gigabit America,” said Nick Jeffery, President and Chief Executive Officer of Frontier.

“This year, we will accelerate our fiber build and give customers more reasons to choose the un-cable provider. The team is fired up and ready to return to growth in 2023.”

Frontier expects to accelerate its fiber build to 1.3 million homes in 2023 – about 20% faster than its 2022 pace – and end the year with 6.5 million fiber locations. Frontier is also exploring fiber builds beyond its initial goal of 10 million. The company has identified 1 million to 2 million copper locations where it can upgrade to fiber cost-effectively. There’s another 3 million to 4 million locations in its footprint that remain financially unattractive but could get over the hump with government subsidies or partnerships.

Even with its faster build pace, Frontier expects 2023 capital expenditures to reach $2.8 billion, essentially flat versus 2022’s $2.74 billion. Frontier anticipates its fiber buildout costs will stay in its envelope of $900 to $1,000 per location passed.

Frontier believes it’s set to grow its average revenue per user (ARPU) by 2% to 3% in 2023. Tied in, it’s updating its pricing and looking to upsell customers to higher speeds (more than half of new subs are choosing speeds of 1-Gig or more) while also reducing its reliance on perks such as gift cards.

Source: Frontier Q4 2022 earnings presentation

……………………………………………………………………………………………………………………………………………………………………

On the wholesale side, Frontier has fiber tower deals with AT&T, Verizon and T-Mobile and recently inked an expanded deal with AT&T to connect it to Frontier’s central offices. Company President and CEO Nick Jeffery suggested that the same model could apply to the likes of Amazon, Microsoft and other cloud companies that are distributing data and could make use of cache locations where data is being consumed.

But that handwork with wireless network operators has yet to drive Frontier toward deals that could enable it to add mobile services to the bundle, and follow the path being taken by major cable operators such as Comcast and Charter Communications.

Jeffery reiterated a position that Frontier is keeping close watch on potential MVNO partnerships but that no such agreement is imminent. Such a deal could be a “distraction of our capital,” he said.

“For the moment, we don’t see the need to launch with an MVNO and bundle with our core broadband offer,” Jeffery explained. “We think it’s something we could spin up relatively quickly and efficiently if we needed to.”

Full-Year 2022 Highlights:

- Built fiber to 1.2 million locations, bringing total fiber passings to 5.2 million by the end of 2022 – more than halfway to our target of 10 million fiber locations.

- Added a record 250,000 fiber broadband customer net additions, resulting in fiber broadband customer growth of 17.5% from 2021.

- Revenue of $5.79 billion, net income of $441 million, and Adjusted EBITDA of $2.08 billion.

- Capital expenditures of $2.74 billion, including $1.52 billion of non-subsidy-related build capital expenditures and $0.06 billion of subsidy-related build capital expenditures.

- Surpassed our $250 million gross annualized cost savings target more than one year ahead of plan and raised our target to $400 million by the end of 2024.

4th-Quarter 2022 Highlights:

- Built fiber to a record 381,000 locations

- Added a record 76,000 fiber broadband customers

- Revenue of $1.44 billion, net income of $155 million, and Adjusted EBITDA of $528 million

- Capital expenditures of $878 million, including $517 million of non-subsidy-related build capital expenditures and $33 million of subsidy-related build capital expenditures

- Net cash from operations of $360 million, driven by strong operating performance and increased focus on working capital management

- Achieved annualized run-rate cost savings of $336 million

4th-Quarter 2022 Consolidated Financial Results:

- Frontier reported revenue for the quarter ended December 31, 2022, of $1.44 billion, a 6.9% decline compared with the quarter ended December 31, 2021, as growth in consumer, business and wholesale fiber was more than offset by declines in copper and subsidy.

- Revenue growth was negatively impacted by the expiration of CAF II funding at the end of the fourth quarter of 2021.

- Excluding subsidy-related revenue, revenue for the quarter ended December 31, 2022, declined 2.5% compared with the quarter ended December 31, 2021, an improvement in the year-over-year rate of decline reported for the quarter ended September 30, 2022.

- Fourth-quarter 2022 operating income was $136 million and net income was $155 million.

- Capital expenditures were $878 million, an increase from $559 million in the fourth quarter of 2021, as fiber expansion initiatives accelerated.

4th-Quarter 2022 Consumer Results:

- Consumer revenue of $764 million declined 2.3% from the fourth quarter of 2021, as strong growth in fiber broadband was more than offset by declines in legacy video and voice.

- Consumer fiber revenue of $436 million increased 7.7% over the fourth quarter of 2021, as growth in consumer broadband, voice, and other more than offset declines in video.

- Consumer fiber broadband revenue of $283 million increased 15.5% over the fourth quarter of 2021, driven by growth in fiber broadband customers.

- Consumer fiber broadband customer net additions of 73,000 resulted in consumer fiber broadband customer growth of 17.9% from the fourth quarter of 2021.

- Consumer fiber broadband customer churn of 1.32% was flat with the fourth quarter of 2021.

- Consumer fiber broadband ARPU of $61.20 declined 1.6% from the fourth quarter of 2021, as price increases and speed upgrades were more than offset by the autopay and gift-card incentives introduced in the third quarter of 2021.

- Excluding the impact of gift-card incentives, consumer fiber broadband ARPU increased 0.9% over the fourth quarter of 2021.

4th-Quarter 2022 Business and Wholesale Results:

- Business and wholesale revenue of $659 million declined 2.6% from the fourth quarter of 2021, as growth in our fiber footprint was more than offset by declines in our copper footprint.

- Business and wholesale fiber revenue of $285 million increased 5.5% over the fourth quarter of 2021, driven by growth in both business and wholesale.

- Business fiber broadband customer churn of 1.33% increased from 1.23% in the fourth quarter of 2021.

- Business fiber broadband ARPU of $107.68 increased 0.8% from the fourth quarter of 2021.

…………………………………………………………………………………………………………………………………………………..

Separately, Frontier introduced its Fiber Innovation Labs yesterday – National Innovation Day – designed for inventing and testing new patents, technologies and processes that will advance its fiber-optic network. Improving the customer experience and driving efficiencies are key to accelerating Frontier’s fiber-first strategy. Frontier’s labs serve as a testing ground to find new technologies and procedures to advance the way it delivers blazing-fast fiber internet to consumers and businesses across the country.

“The work we are doing in our Fiber Innovation Labs will change the way we serve our customers and will ultimately change the industry,” said Veronica Bloodworth, Frontier’s Chief Network Officer. “We have the best team in the business – they live and breathe innovation. They have been awarded several patents and are in the process of bringing those new inventions to life to deliver the best ‘un-cable’ internet experience to our customers. Be prepared to be amazed.”

As part of Frontier’s Fiber Innovation Labs, the company has launched its first-ever outside plant facility in Lewisville, Texas. The facility is designed as a miniature suburban neighborhood that mimics the real-life experiences of its techs serving customers every day. It features roads, sidewalks, a state-of-the-art central office, a small house and a reconstructed manhole system. It also simulates weather elements and temperature changes. Here, the Frontier team can test and learn new methods in real-world environments to install and maintain its fiber-optic network.

References:

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

\

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier Communications previewed its Q4 2022 results today, revealing it gained 75,000 new fiber customers and had 8,000 total broadband net additions.

- Strong customer growth in Q4 led Frontier to finish 2022 with 17% more fiber broadband customers than it had at the end of 2021.

- For the fifth consecutive quarter, fiber broadband customer additions outpaced copper broadband customer losses, resulting in 8,000 total broadband customer net additions in the fourth quarter of 2022.

During a Citi investor conference presentation following the announcement, CFO Scott Beasley said growth spanned both new and existing markets and resulted in part from gains made against cable competitors. “We continue to outpace our cable competitors, gaining share in nearly every geography we operate in. Our new position as the ‘un-cable’ provider is taking hold. We are bringing customers a superior product and it is paying off in record broadband customer growth.”

According to Beasley, the vast majority of its net additions are customers who are new to Frontier rather than those converting from a legacy DSL service. That means most either moved into or within the operator’s territory during the quarter or switched from cable. “We had success against every competitor in every geography,” the CFO stated. Asked whether cable’s recent efforts to woo consumers with fixed-mobile bundles presented a challenge, Beasley said Frontier hasn’t yet “seen much of an impact from their converged offerings.”

Frontier doesn’t appear to be concerned about advances from fixed wireless access (FWA) rivals either. New Street Research noted Frontier’s net add announcement implied it lost 67,000 copper subscribers, which was significantly higher than the 56,000 the analyst firm had expected. However, Beasley said fixed wireless has had “very little impact” on its fiber gross additions.

Regarding its DSL based services, Beasley said “we haven’t seen any significant impact from fixed wireless (FWA)” in terms of churn but acknowledged FWA is “nibbling around the edges” where new movers only have the choice between Frontier’s DSL or a fixed wireless product.

Beasley added despite macroeconomic challenges and a recessionary environment, Frontier hasn’t seen any slowdown in bill payments or tier step-downs from customers. In fact, as it works to achieve a goal of 3% to 4% year-on-year average revenue per user (ARPU) growth by the end of 2023, he said it will actually look to encourage customer plan step-ups. Beasley noted uptake of its gigabit plans currently stands around 15% among Frontier’s base and around 45% for new customers, leaving plenty of room for movement. The company will also implement “normal base price increases to reflect higher input costs” and use gift card promotions to retain and gain other subscribers, he said.

Media Contact:

Chrissy Murray

VP, Corporate Communications

+1 504-952-4225

[email protected]

References:

https://investor.frontier.com/news/news-details/2023/Frontier-Adds-Record-Fiber-Broadband-Customers-in-Q4-2022/default.aspx

https://investor.frontier.com/events-and-presentations/events/event-details/2023/Citi-Communications-Media–Entertainment-Conference/default.aspx

https://www.fiercetelecom.com/broadband/frontier-bags-75k-fiber-subs-q4-2022-eyes-arpu-gains-23

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications Accelerates Fiber Build Out -10 Million locations passed by 2025

Frontier Communications and Ziply Fiber to raise funds for fiber optic network buildouts

ITU-T: 25 years of increasing fixed-broadband speeds over copper and fiber optic networks

by ITU News

The ITU Telecommunications standardization (ITU-T) working groups on broadband access over metallic conductors (Q4/15) and optical systems for fiber access networks (Q2/15), established in 1997 (25 years ago), laid the foundations for fixed broadband and have since then facilitated the meteoric rise in access speeds. Both groups are part of ITU-T Study Group 15, which looks at networks, technologies and infrastructures for transport, access and home.

DSL: ITU-T Q4/15 was formed to make DSL globally scalable:

“What followed was a 25-year journey of dedicated engineers fighting physics for ever-higher broadband speeds, through several generations of ITU-standardized DSL technology,” says Q4/15 Rapporteur Frank Van der Putten (a strong colleague of this author from 1996-2002 when both of us worked on ADSL and VDSL standards in T1E1.4 and the ADSL Forum).

Building on prior work by Alliance for Telecommunications Industry Solutions (ATIS) committee T1E1.4 and European Telecommunications Standards Institute (ETSI) working group TM6, the DSL technologies standardized by ITU now connect over 600 million homes and businesses to the Internet.

“DSL changed the world by enabling mass-market broadband,” Van der Putten says.

DSL enabled rapid broadband deployment at low cost because it used the existing telephone wires to the home.

“Championed at first by an impassioned few, continually provoking debates among Q4/15 experts, it has been an intellectual catalyst for the advancement of communications technology,” he adds. “We are proud to have played a part in that.”

While ADSL (asymmetric DSL), as defined by ITU in 1999, could deliver 8 megabits per second (Mbit/s), it was followed by ADSL2plus in 2003 at 24 Mbit/s and the very high speed VDSL2 at 70 Mbit/s. With the introduction of vectoring, VDSL2 reached 100 Mbit/s by 2010 and 300 Mbit/s by 2014.

In 2014, G.fast raised the bar to 1 Gbit/s, doubling this to 2 Gbit/s in 2016. Its successor standard, MGfast, achieves an aggregate bit rate up to 8 gigabits per second (Gbit/s) in Full Duplex mode and 4 Gbit/s in Time Division Duplexing mode.

The architecture standards for DSL, G.fast and MGfast were defined by the Broadband Forum (once known as the ASDL forum), which also plays a key part in promoting interoperability.

Van der Putten explains: “Both technologies intend to meet service providers’ need for a complement to the fibre-to-the-home technologies in scenarios where G.fast or MGfast prove the more cost-efficient strategy.”

The continual upgrading of ITU’s standards has also sparked huge upward revisions in forecasts for the life left in traditional telephone wiring.

Future directions for Q4/15 work include G.fast-based backhaul, MGfast at aggregate data rates of 10 Gbit/s, and ultra-low latency transmission optimized for 5G wireless back/mid-haul, he says.

…………………………………………………………………………………………………………………………………………………………………………………………………………

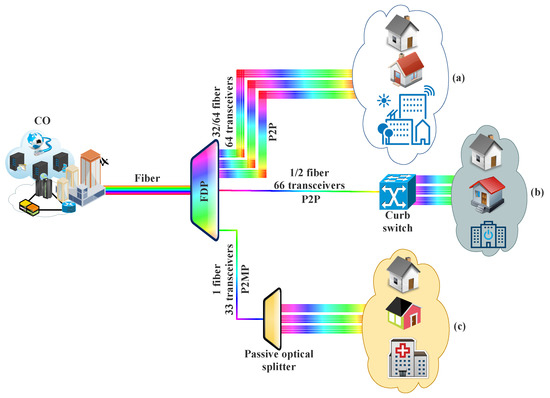

Cost-efficient fiber access – PON and FTTH:

ITU-T Q2/15 paved the way for passive optical network (PON) technologies as a highly cost-efficient means of enabling FTTH. Optical access networks now serve over a billion users worldwide, mostly based on PON. Q2/15 works closely with Full Service Access Network (FSAN), which collects system requirements from operators to determine common requirements for ITU standards.

“The result has been systems ideally suited for a large group of networks and applications,” says Q2/15 Rapporteur Frank Effenberger.

“The first widely deployed system, G-PON [Gigabit PON], is found almost everywhere now,” he adds.

Q2/15 has developed seven generations of PON systems. The first, pi-PON, operated at 50 Mbit/s. This was followed by A-PON (155 Mbit/s), B-PON (622 Mbit/s), G-PON (2.5 Gbit/s), XG(S)-PON (10 Gbit/s), and NG-PON2 (4 x 10 Gbit/s).

To provide the basis for interoperability, ITU standards specify the control system for PON systems. Q2/15 has also developed a range of implementer’s guides and works closely with FSAN, ATIS, and the Broadband Forum to foster common designs and interoperability.

From 10 to 50 Gbit/s PONs:

Demand for higher capacity keeps growing fast. Optical access solutions also support 5G wireless communications and innovation for smart cities and factories.

“What we are seeing is a gradual evolution from G-PON to XG-PON [a 10G, or 10 Gbit/s, network] and XGS-PON [a 10G symmetric network], which is now being deployed at scale in many countries,” says Effenberger.

The latest generation of ITU-standardized PON, known as “Higher Speed PON”, provides for speeds of 50 Gbit/s per wavelength, up from the 10 Gbit/s of its predecessors. Market demand for Higher Speed PON is expected to begin in 2024.

“Given the large size and cost of the fixed access network, upgrades generally come once per decade,” says Effenberger.

Higher Speed PON includes both single-channel 50 Gbit/s systems to succeed XG(S)-PON and multi-channel 50 Gbit/s systems to succeed today’s NG-PON2 – a 40G PON that operates at 10Gbit/s per wavelength.

Although Higher Speed PON offers a five-fold capacity increase over its predecessors, it has been designed to work with the same fibre plant as G-PON, XG(S)-PON and NG-PON2.

“A successful technology requires a coincidence of both technical feasibility and strong global market demand,” notes Effenberger. “We strongly believe that 50G PON will provide the right capacity, at the right price, and at the right time.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

All-fiber future at Gbit/s speeds:

Q2/15 aims to continue delivering higher-capacity PON solutions, such as a multi-wavelength version of Higher Speed PON, and speeds even higher than 50 Gbit/s on a single wavelength. But passive networks cannot handle all foreseen demand.

“Certain applications will require more dedicated and higher-capacity solutions than PON,” says Effenberger, highlighting the motivations behind Q2/15’s development of various point-to-point bidirectional optics with speeds of 1 Gbit/s, 10 Gbit/s, 25 Gbit/s, and 50 Gbit/s.

Q2/15 continues to study 100 Gbit/s transmission and point-to-point wavelength connections over a shared optical distribution network based on wavelength division multiplexing. “These are likely to find use in wireless fronthaul applications, given their exacting latency requirements,” says Effenberger.

References:

MoffettNathanson: ROI will be disappointing for new fiber deployments; FWA best for rural markets

From two recent research reports to clients, MoffettNathanson chief analyst Craig Moffett wrote:

There is no question that there will be a great deal of new fiber deployed in the U.S. But we expect it will be considerably less than current worst-case scenarios for two reasons.

- There simply isn’t sufficient labor availability for all operators to meet the projections they’ve set forth (this issue will be significantly exacerbated by the upcoming rural Broadband Equity, Access, and Deployment (BEAD) program, which will introduce a dramatic new source of labor demand).

- The expected return from fiber overbuilds will be disappointing, in our view, both because deployment costs (including the cost of capital) have risen sharply, and because expected densities of available markets are falling sharply.

We are skeptical about the returns that will be generated by fiber builds, as costs are rising and densities are falling. The spiraling costs of fiber deployment also make it likely that there will be upward, not downward, pressure on broadband ARPU in competitive markets, as overbuilders scramble to cost-justify not only their existing projects, but, perhaps more importantly, the projects on which they have not yet broken ground (and which, without a more generous ARPU assumption, can no longer be return-justified). Craig had argued earlier this year that the fiber buildout bubble may pop.

Wireless operators have an enormous cost advantage in offering fixed wireless access (FWA) service on preexisting network facilities; the marginal cost of offering FWA is zero if it is simply using excess capacity. The capacity available for such a strategy is relatively limited, making the strategic leverage of FWA relatively limited as well. Cable operators have a smaller, but still significant, cost advantage in offering wireless services that can offload at least some of their traffic onto existing infrastructure. And unlike wireless operators offering FWA, their capacity to do so is unlimited.

Almost no telecom investor with whom we have spoken views FWA as an important part of the story for the companies that actually offer it. Investors seem to have already come to the view (for the wireless operators, at least) that FWA is at best a costly sideline in rural markets. Longer term, the bigger threat to cable broadband is likely fiber rather than fixed wireless, Moffett said. But even with that, the analyst seems to be less concerned that cable operators will overspend on fiber or that overbuilders will present more competition.

The convergence arguments for fiber to the home (FTTH) are arguably even weaker. As we’ve pointed out often, AT&T’s wireline footprint covers but 45% or so of the U.S. (by population), and of that, just a third is wired for fiber. In total, then, AT&T can deliver a bundled solution to just 15% or so of the population. In our view, a strategy (bundling) that “works” in 15% of the country isn’t a strategy.

We certainly aren’t convinced that the U.S. market will be fundamentally shaped by convergence. But if it is, the cable operators, not the telcos, are positioned to benefit.

References:

MoffettNathanson: Fiber Bubble May Pop; AT&T is by far the largest (fiber) overbuilder in U.S.

ETSI Telemetry Standard for Optical Access Networks to enhance FTTP QoE

As the scale and services offered through the Optical Access Networks increase, it is crucial to maintain network good operation and performance. To achieve this, the Optical Access Network monitoring can be improved when compared to existing traditional methods via automated real-time data collection. Telemetry enables this and transmits data from the optical line terminal (OLT) – i.e., the device at the endpoint of a passive optical network – in real-time to provide information to the data collection platform.

With the new ETSI specification ETSI GS F5G-011 defining Telemetry Framework and Requirements for Access Networks, service providers and operators benefit from the advantages of real-time monitoring with scale, speed and automation using telemetry. The data retrieved by telemetry, together with analytics and AI, will ultimately offer end users an optimized quality of experience (QoE) for their fiber to the home (FTTH) network, unlocking the potential of the fifth generation of fixed networks (F5G). Note that F5G is based on fiber access- not wireless/cellular access.

Today, the Access Network deployment is based on a traditional data pulling methods, such as Simple Network Management Protocol (SNMP), syslog and Command-Line Interface (CLI) to pull data from the OLT to monitor Optical Access Network and troubleshoot any issues. The interface uses proprietary management information bases (MIBs) from different OLT equipment vendors, making automation a difficult task. Each request to pull data is therefore resource intensive and impacts the performance of the OLT, adding complexity because there is more than one pull request per OLT. The pulling method does not efficiently scale.

With the flexibility of telemetry, which uses the push method to continuously stream data from the OLT, the data of interest can be selected from the OLT and transmitted it in a structured format to a data collection platform for monitoring, AI-based analytics and visualization.

Telemetry introduces finer granular data points and more frequent data streaming in the Optical Access Network. It enables better performance monitoring and therefore better control over large Access Networks. Telemetry data can assist in the prediction of network problems and take preventative actions without impacting the performance of the OLT. The operators can gain better visibility and insight into the network. They can also enhance the network operational performance by using data analytics.

“Telemetry technology opens the door to big data and machine learning methods application in the Access Network and brings a clear benefit to end users,” outlines Luca Pesando, Chair of the ETSI F5G group which developed this standard. “In the Group Specification, we also showcase examples of implementation of the telemetry system as we recommend it, already at the stage of Proof of Concept so that operators can leverage the potential of this new telemetry architecture,” he adds.

Requirements of F5G QoE (from ETSI GS F5G 005 V1.1.1 (2022-03):

- The F5G network shall support telemetry.

- The F5G network shall support the capability of telemetry to frequently send measured data.

- The F5G network shall support the capability of telemetry to export fine grained statistics.

- The F5G network telemetry interface shall support per-slice QoS measurement data.

- The F5G network shall support end-to-end QoE assessment in the CPN, Access Network, Aggregation Network, and Core Network.

- The F5G network shall support AI-based QoE assessment based on measured network or application performance data.

- The F5G CPN shall provide a mechanism to improve QoE in the customer premises network (residential, enterprise, verticals).

- The F5G service and underlay plane shall support network-layer QoS measurement mechanisms to support QoE assessment and management.

- The F5G service and underlay plane shall support application-layer QoS measurement mechanisms to support QoE assessment and management.

The ETSI F5G Industry Specification Group is working on 10 other specifications and will soon release F5G PON (Passive Optical Networks) for industrial applications and an F5G security architecture. If you’re interested, feel free to join us and contact [email protected]

About ETSI:

ETSI provides members with an open and inclusive environment to support the development, ratification, and testing of globally applicable standards for ICT systems and services across all sectors of industry and society. We are a non-profit body, with more than 900 member organizations worldwide, drawn from over 60 countries and five continents. The members comprise a diversified pool of large and small private companies, research entities, academia, government, and public organizations. ETSI is officially recognized by the EU as a European Standardization Organization (ESO). For more information, please visit us at https://www.etsi.org/

Press contact:

Claire Boyer

Tel.: +33 (0)6 87 60 84 40

Email: [email protected]

References:

ETSI – New ETSI Telemetry Standard Improves Automation for better End-User Quality of Experience

https://www.etsi.org/deliver/etsi_gs/F5G/001_099/005/01.01.01_60/gs_F5G005v010101p.pdf