Network Equipment

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

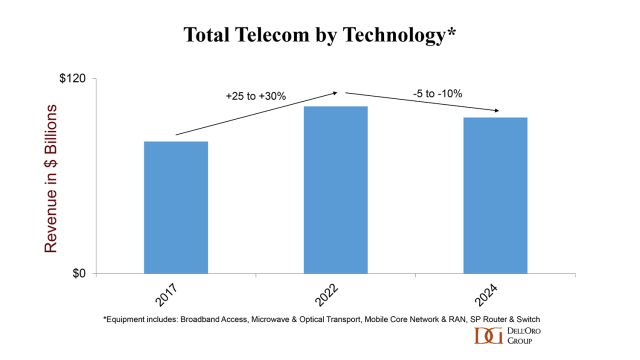

Preliminary Dell’Oro Group data found that worldwide telecom equipment revenues across the six telecom programs tracked – Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch – declined 5% year-over-year (YoY) for the full year 2023, performing worse than expected. First and foremost, challenging comparisons in some of the advanced 5G markets with higher 5G population coverage taken together with the slow transition towards 5G SA helped to partially explain steep declines in wireless-based investments. This capex deceleration was not confined to the RAN and MCN segments. Following a couple of years of robust PON investments, operators were able to curtail their home broadband capex as well. This reduction was more than enough to offset positive developments with optical transport and Service Provider routers.

The North America telecom equipment market declined faster than expected. Initial readings show that the aggregate telecom equipment market dropped by roughly a fifth in the North America region, underpinned by weak activity in both RAN and Broadband Access. On the bright side, regional dynamics were more favorable outside of the US. Our assessment is that worldwide revenues excluding North America advanced in 2023, as positive developments in the Asia Pacific region were mostly sufficient to offset weaker growth across Europe.

Also contributing to the regional and technology trends is the disruption caused by Covid hoarding and the supply chain crisis. Although this inventory correction was not felt everywhere and varied across the telecom segments, it was more notable in the RAN this past year.

Renewed concerns about macroeconomic conditions, Forex, and higher borrowing costs are also weighing down prospects for growth. The gains in the USD against the Yuan and the Yen are impacting USD-based equipment revenue estimates in China and Japan.

………………………………………………………………………………………………………………………………………………………………………………………………

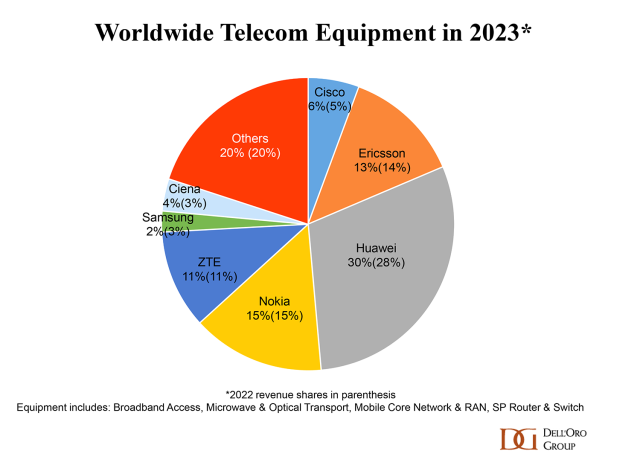

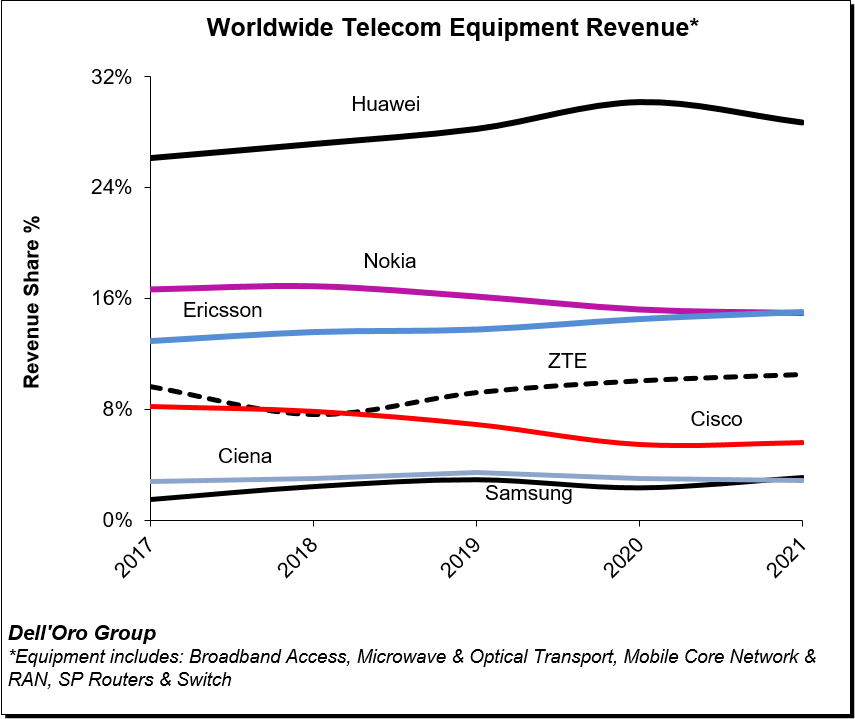

Dell’Oro says that Huawei maintained its lead as the top global telecom equipment company by revenue in 2023, despite efforts by the U.S. government and other countries to limit its addressable market and access to Android and the latest chips and semiconductor technology from TSMC. In fact, Dell’Oro’s assessment is that Huawei’s lead widened in 2023, in part because its limited exposure to the North America region was a benefit in 2023 on a relative basis.

Supplier rankings were mostly unchanged. However, vendor revenue shares shifted slightly in 2023. Still, the overall concentration has not changed – the top seven suppliers accounted for around 80% of the overall market.

Market conditions are expected to remain challenging in 2024, though the decline is projected to be less severe than in 2023. The analyst team is collectively forecasting global telecom equipment revenues to contract 0 to -5% in 2024. Risks are broadly balanced. In addition to currency fluctuations, economic uncertainty, and inventory normalization, there are multiple regions/technology segments that are operating in a non-steady state.

References:

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Executive Summary:

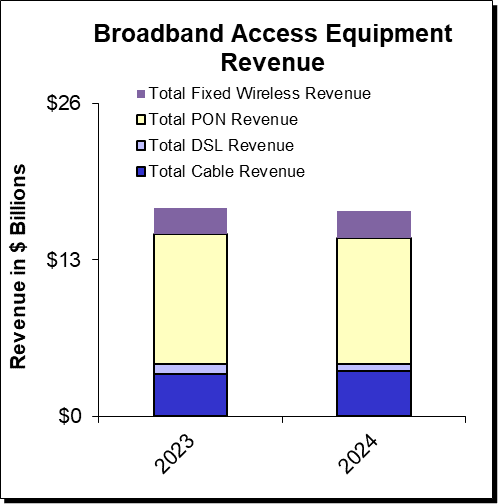

Operator spending on broadband network equipment will remain sluggish well into 2024, forecasts Dell’Oro’s Jeff Heynen. “Inventory Correction, Inventory Realignment,” or whatever term you prefer to call the root cause of 2023’s broadband spending slowdown will likely persist well into 2024, he wrote. Without the benefit of fourth quarter numbers, total spending on broadband equipment in 2023 is expected to show a decline of around 10%. Early projections for 2024 indicate an additional 5% year-over-year decrease, as the lagging impact of interest rate increases to curb inflation will be felt more acutely. This additional 5% decrease would put total spending to around $16.5 B—roughly equal to 2021 spending levels.

The expected declines in 2023 and 2024 follow three straight years of white-hot growth in broadband network and service investments from 2020 to 2022. During this period, year-over-year growth rates reached 9%, 15%, and 17%, respectively. Similar periods of growth from 2003-2006 and 2010-2014 were both followed by two subsequent years of reduced spending, as operators—particularly in China—shifted their capital expenditure focus from broadband to mobile RAN.

However, there are signs of a return to growth in 2025 as money from BEAD and other broadband subsidy programs trickle down to broadband equipment suppliers. Well before that, pockets of growth in fixed wireless CPE, cable DAA equipment and CPE, and continued spending on PON equipment by tier 2 and tier 3 operators should make the broadband market one in which the headlines might communicate malaise, but a peek under the hood shows clear signs of resilience powering an inevitable return to growth.

Cable Operators Travel Different Paths to Fend off Fixed Wireless and Fiber:

Just like last year, in the minds of cable consumers, cable operators find themselves stuck battling against the perception that they are the provider with inferior copper technology that can’t be flexible when it comes to offering plans that meet a consumer’s budget, like fixed wireless currently can. As a result of this situation, larger cable operators are seeing increased broadband subscriber churn and quarters of net subscriber losses.

Comcast is pushing hard to counter those perceptions and is already offering its X-Class Internet tiers, which offer symmetrical speeds of 2 Gbps in Atlanta, Colorado Springs, and Philadelphia. Additional cities are expected to roll out these service tiers in 2024. Comcast’s use of full-duplex DOCSIS 4.0 (FDX), including brand new CPE using Broadcom’s D4.0 silicon in a two-box configuration. Later this year, we expect to see a combined gateway that also incorporates Wi-Fi 7, as Comcast looks to battle back against FTTH providers by providing the most advanced residential gateway to customers.

Meanwhile, in 2024, Charter’s Remote PHY and vCMTS rollouts will kick into high gear. (At the time of this publication, we are awaiting fourth quarter earnings from both Harmonic and Vecima, the announced RPD partners for Charter’s buildout to determine how much equipment the operator purchased in advance of this significant deployment.) For Charter, which is employing Extended Spectrum DOCSIS 4.0, 2024 will also bring much wider availability of 1.8 GHz amplifiers and taps, as well as a choice of CPE with dedicated silicon for ESD, as well as silicon that combines both FDX and ESD variants.

Charter will likely also announce additional vendors for its upgrade efforts, as the operator has been public about its desire for a multi-vendor environment.

Cox will also begin rolling out 1.8 GHz amplifiers this year but, like Charter, will likely run those at 1.2 GHz until taps and CPE become more widely available.

Meanwhile, for those operators that weren’t part of the initial DOCSIS 4.0 Joint Development Agreement (JDA) with Broadcom (and for some of those who were), DOCSIS 3.1 Plus is quickly becoming an important stopgap measure to help increase throughput within the existing DOCSIS 3.1 framework by leveraging additional OFDM channels. Operators can either use existing integrated CCAP chassis (with either legacy line cards supporting 3 OFDM blocks or newer cards supporting 4 OFDM blocks) or vCMTS platforms. This can be combined with either DOCSIS 4.0 modems or modems designed specifically for D3.1 Plus deployments, which won’t require the additional gain amplifier (and cost) needed for full DOCSIS 4.0.

While it remains to be seen which type of CPE operators deploying DOCSIS 3.1 Plus will move forward with, the fact that there is significant interest in the technology means that there will now be additional operators who will likely move on from DOCSIS 4.0 and instead buy themselves time with DOCSIS 3.1 Plus before moving forward with fiber overbuilds. The biggest question here is just how many operators will do so.

As Light Reading previously reported, Broadcom and MaxLinear are working on new D3.1 chipsets that can beef up downstream capacity and speed through the support of additional OFDM (orthogonal frequency-division multiplexing) channels. Some operators are likewise exploring the deployment of new D4.0 modems on their D3.1 networks to achieve similar capacity gains.

That approach could extend the life of DOCSIS 3.1 networks, delay D4.0 upgrades or become an interim step before a future leap to fiber-to-the-premises. But it’s still not clear how many operators will pursue this path.

Heynen expects to see additional FTTH deployments—both greenfield and overbuild—by cable operators around the world. Whether using Remote OLT platforms or more traditional OLT platforms, cable operators will take advantage of work being done at CabeLabs to standardize the integration of ITU-T PON recommendations into existing DOCSIS management frameworks. This will make it far easier for MSOs (aka Cablecos) to deploy XGS-PON, as well as 25GS-PON and, potentially 50G- and 100G-PON.

XGS-PON to Dominate Fiber Spend This Year:

The PON equipment market will be the most dynamic this year, with tier 1 operators besides of BT OpenReach and Deutsche Telekom, all continuing to better align their inventories with anticipated subscriber growth, as well as reduced homes passed goals. For larger tier 1s, the short-term reduction in homes passed goals will ultimately give way to a renewed construction phase beginning in 2025 that should propel the overall PON market through the end of the decade.

But while the tier 1s slow, there will be no slowing the continued efforts by tier 2 and tier 3 operators in both North America and Europe to both upgrade and expand their fiber networks. In fact, the same dynamic that played out in North America in 2023 will likely repeat in 2024, as tier 2, tier 3, utilities, municipalities, and co-ops all continue their buildouts.

The technology beneficiary will be XGS-PON, which already surpassed 2.5 Gbps GPON revenue back in 2022, but will more than double it in 2024. And in markets where operators are beginning to see cable operators deliver symmetric 2 Gbps services, there is a strong chance they will also sprinkle in some 25GS-PON to comfortably deliver symmetric 5-10 Gbps services.

Meanwhile in China, which is expected to show a marked decline in new OLT port shipments in 2023, will likely see another decline until 50G-PON rollouts begin in earnest later this decade. On the flip side, ONT unit shipments in China are expected to increase as FTTR (Fiber to the Room) deployments expand, delivering 2-3 ONTs per home as opposed to the traditional architecture of using a single ONT to terminate fiber.

Wi-Fi 7 Progress Will Accelerate:

With the Wi-Fi Alliance recently announcing the opening of certification testing for Wi-Fi 7 products, don’t be surprised to see dozens of Wi-Fi 7 residential routers and broadband CPE models being deployed by operators by the end of this year. Early gateway models, though pricey, have already been introduced to the market and will become much more widely available this Spring, and then well before the Holiday season. As of our July 2023 forecast, we expect over 2.5 million residential Wi-Fi routers and broadband gateways to ship in 2024, though we are undoubtedly increasing this forecast based on the certification testing opening up.

Operators can’t wait to deploy Wi-Fi 7 products to help differentiate themselves in increasingly crowded broadband markets and to eliminate much of the confusion in the market with the coexistence of Wi-Fi 6 and Wi-Fi 6E.

References:

2024 Outlook: Broadband Market Faces Challenge Amidst Lower Spending from 2023

https://www.lightreading.com/broadband/broadband-equipment-spending-to-dip-again-in-2024-dell-oro

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

MTN Consulting: Top Telco Network Infrastructure (equipment) vendors + revenue growth changes favor cloud service providers

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro: Worldwide Telecom Equipment Market Growth +3% in 2022; MTN: +2% Network Infrastructure Growth in 2022

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

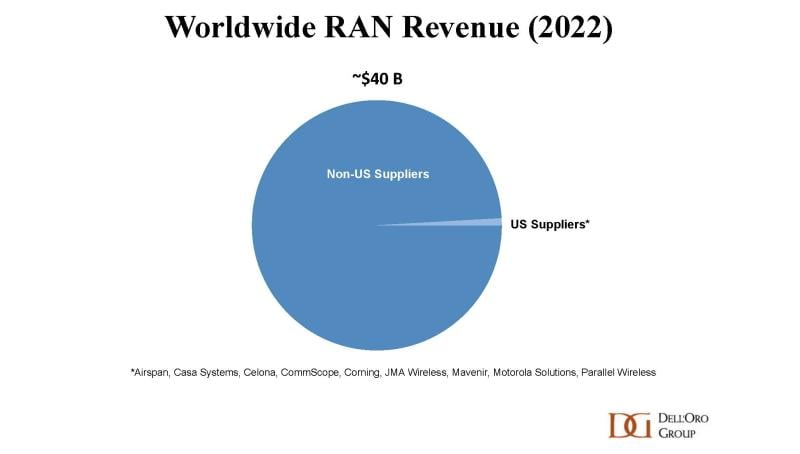

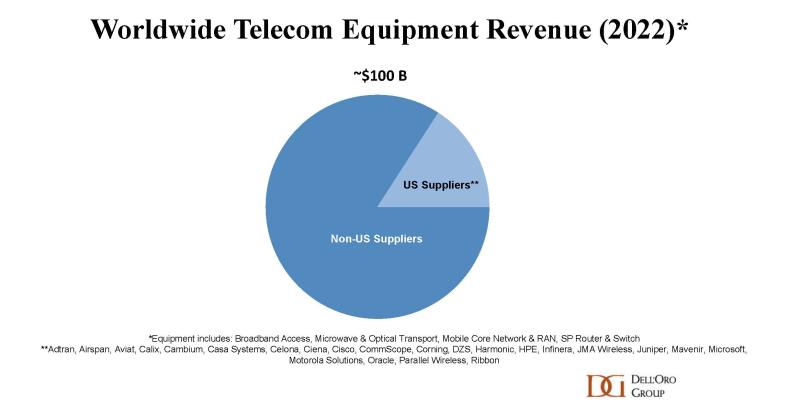

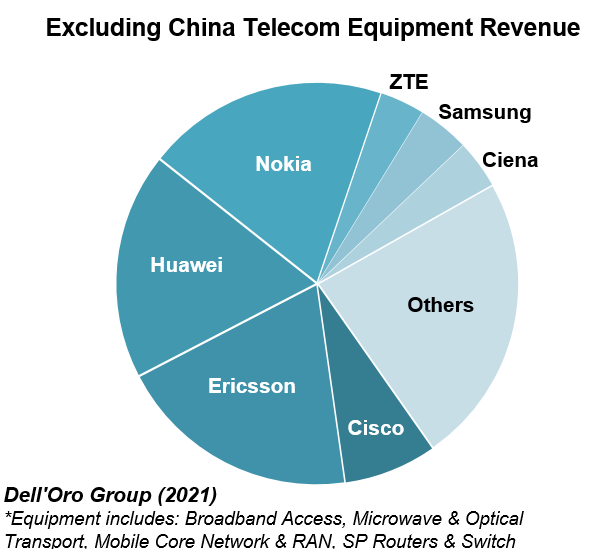

According to Stefan Pongratz of Dell’Oro, U.S. suppliers collectively accounted for around 16% of the global telecom equipment market in 2022, underpinned by strong presence in broadband access, optical transport and Service Provider Routers. Not surprisingly, this global view is masking the progress to some degree. If we exclude China, we estimate that the 20+ American suppliers comprise ~20% of the broader telecom equipment market.

U.S. suppliers appear to be struggling more in the RAN market. Per Dell’Oro’s 4Q22 RAN report, the American-based vendors still accounted for less than 1% of the global RAN market in 2022. Even if China is removed, the aggregate revenue share remains in the same range.

…………………………………………………………………………………………………………………………………………………………………….

Editor’s Note: The big 5 have dominated the global RAN market for over 15 years. Huawei, Ericsson, Nokia, ZTE, and Samsung together have about 95% of the global RAN market. Pongratz expects global RAN revenues to decline at a low-single-digit rate for 2023, with a surge in spending from India-based operators to fuel their 5G plans offset by dropping demand in China, Europe, and North America.

“After four years of extraordinary growth that catapulted the RAN market to record levels in 2021, the RAN market is now entering a new phase,” Pongratz wrote. “Even with 5G still increasing at a healthy pace, comparisons are more challenging and the implication for the broader RAN market is that growth is decelerating.”

…………………………………………………………………………………………………………………………………………………………………….

Dell’Oro estimates that the collective RAN revenues for the U.S. suppliers had an increased of 60% in 2022 relative to 2020, in part because of the improved entry points with Open RAN. U.S. network equipment vendors are fairly optimistic about the growth prospects:

- Mavenir is targeting 30%+ growth in 2023. While the mobile core network continues to drive the lion’s share of its revenue mix, Mavenir’s 10,000+ macro-site brownfield pipeline is expected to play a pivotal role in reaching this $1 billion group revenue target for FY23.

- Celona is working with 100+ customers and has seen a 300%+ increase in the number of connected devices across its 5G installed base. The vendor is now targeting to more than double its revenues this fiscal year.

- JMA has not shared any growth objectives for its wireless business. Even so, the vendor has announced multiple DoD wins and believes its all-American team is well positioned to support advanced private 5G networks for the U.S. government.

- Verana Networks is set to work on a trial with Verizon later this year.

- Dell is planning to enter the vRAN market over the next year, allegedly.

- Airspan’s equipment and software revenue growth slowed in 2022. Still, trial activity is on the rise and Airspan remains hopeful that its 400+ private network wins will soon have a more meaningful impact on the topline.

At the same time, it is early days in this process of re-shaping the RAN. And even if global market concentration as measured by the Herfindahl-Hirschman Index (HHI) is actually trending in the right direction, vendors with smaller footprints are still trying to figure out the best near-term and long-term approaches to improve their respective RAN positions – some think that open RAN can be an entry point for brownfield macro opportunities while others believe the likelihood of winning is greater in greenfield settings (public or private).

Open RAN might help to open the door, but this movement does not change the fact that RAN remains a scale game and double-digit RAN revenue shares are still required to maintain competitive portfolios.

Currently, this vendor asymmetry between RAN and the broader telecom equipment market then also implies that the U.S. suppliers are actually doing rather well beyond the wireless scope. In fact, if we remove the RAN from the picture, we estimate that the U.S. vendors accounted for around a fourth of the global non-RAN telecom equipment market. Better yet, if we take it one step further and also strip out China, the data shows that the American team comprised around one third of the non-RAN telco equipment market excluding China.

Dell’Oro’s assessment is that the U.S. suppliers hold a strong position in the non-RAN telecom equipment market. When it comes to RAN, however, the data shows that the American-based suppliers are moving in the right direction, especially in private wireless. But the overall progress has been slow, and it is still a long road ahead before we can establish that the U.S. suppliers are back at full speed in the broader public plus private 5G RAN business

…………………………………………………………………………………………………………………………………………………………

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm’s Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

References:

https://www.fiercewireless.com/wireless/what-state-us-ran-and-non-ran-suppliers-pongratz

Dell’Oro: Worldwide Telecom Equipment Market Growth +3% in 2022; MTN: +2% Network Infrastructure Growth in 2022

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Dell’Oro: 5G RAN growing; total RAN growth is slowing over next 5 years

Dell’Oro: RAN Market Disappoints in 2Q-2022

Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

MTN Consulting on Telco Network Infrastructure: Cisco, Samsung, and ZTE benefit (but only slightly)

By Matt Walker

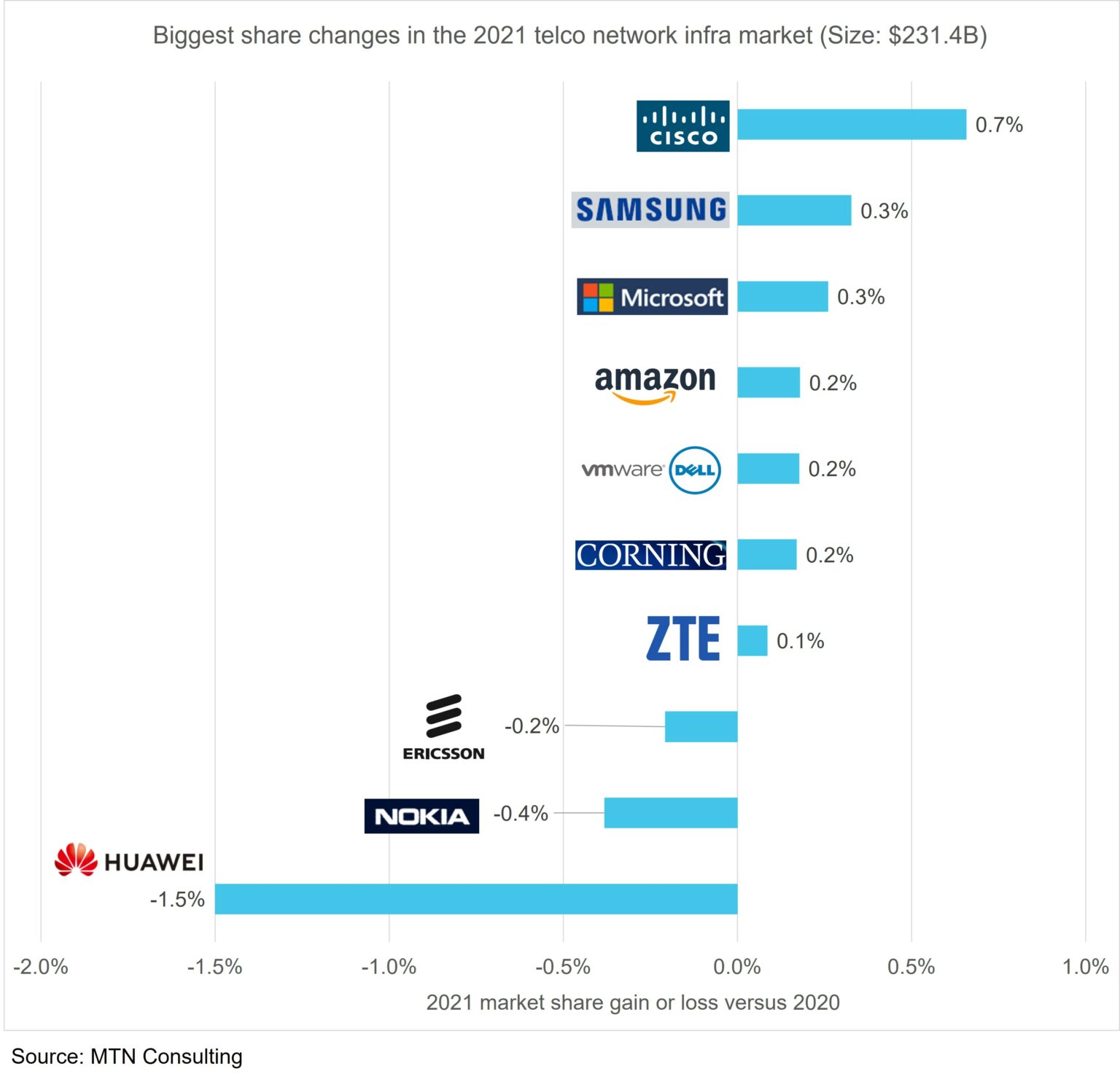

Cisco, Samsung, and ZTE benefit most from Huawei bans in 2021 in the telco Network Infrastructure market. (However, the market share gains were miniscule= <1% for each network equipment vendor).

Introduction:

2021 results for the 100+ vendors selling into the telco market are just about finalized. Contrasting 2021 telco network infrastructure (NI) market share with 2020, we note the following NI Equipment Vendor Market Share Changes:

Cisco clearly came out on top, gaining 0.7% share in a market worth $231.4 billion (B). Cisco was helped both by a telco shift in 5G spending towards core networks, and Huawei’s entity list troubles.

Samsung’s share growth of 0.3% was due to a big win with Verizon and a growing telco interest in seeking RAN alternatives beyond Ericsson and Nokia. ZTE, which has escaped the US entity list to date, also picked up some unexpected 5G wins but its growth is more broad-based due to optical, fixed broadband, and emerging market 4G LTE business.

Dell (including VMWare), Microsoft, and Amazon also picked up share as telcos have begun investing in 5G core and cloud technologies. Their growth has little to do with Huawei, and more due to telcos’ ongoing changes to network architecture and service deployment patterns. Corning was an unexpected winner in 2021, gaining 0.2% share on the back of fiber-rich wireless deployments and government support for rural fiber builds.

On the flip side, both Nokia and Ericsson lost share in the overall telco NI market in 2021. Their RAN revenues benefited from Huawei’s troubles in 2020 but telco spending has since shifted towards product areas with more non-Huawei competition. Both vendors are attempting to diversify beyond the telco market, with Nokia so far having more success; its non-telco revenues grew 12% in 2021.

Huawei’s share of telco NI declined to 18.9% in 2021, down from a bit over 20% in both 2019 and 2020. The US Commerce Department’s entity list restrictions were issued in May 2019 but hit the hardest in late 2020 and 2021, after Huawei’s inventory stockpiles began running out.

Huawei’s messaging on its recent fall is muddled. During its annual report webcast yesterday, it cited three factors behind its 2021 revenue decline: supply continuity challenges, a drop in Chinese 5G construction, and COVID. In MTN Consulting’s opinion, supply continuity was the main factor. A related factor were the many government-imposed restrictions on using Huawei gear around the world, especially in Europe where 5G spending was strong in 2021. The other two factors cited by Huawei’s CFO, however, are misleading. Chinese telco network spending, overall, was relatively strong in 2021: total capex for the big three telcos was $52.8B, up 8% from 2020. Without this rise, Huawei’s 2021 results would have been worse. As for COVID, few other vendors cite the pandemic as a factor restraining 2021 telco spend. More vendors cite the opposite: 2021 spending was strong in part because telcos were forced to delay many projects during COVID’s early spread.

To date, Huawei’s troubles have impacted RAN markets the most, but in 2022 and 2023 will begin spreading more clearly to IP infrastructure, optical, microwave, fixed broadband, and other areas. A number of vendors are eager to pursue new opportunities as this happens, including Adtran/ADVA, Ciena, Cisco, CommScope, DZS, and Infinera. The CEO of Infinera, in fact, said on its 4Q21 earnings call that “it was a nice taste, a nice appetizer in 2021, but…we said all along that we would see the design wins and RFPs really scaling and we thought that we’d see revenues from that really beginning to take hold as we got into 2023.”

To date, Huawei has been unable to fully adapt to the supply chain restrictions put in place in 2019. It remains the global #1 in telco NI, however, due to dominance in China and a huge installed base across the globe. The company is investing heavily in carrier services & software, Huawei Cloud and new product areas. One certainty is that it won’t simply fade away, despite the current decline.

……………………………………………………………………………………………….

Editor’s Note:

In contrast, Dell’Oro estimates suggest the overall telecom equipment market advanced 7% in 2021, recording a fourth consecutive year of growth, underpinned by surging wireless revenues and healthy demand for wireline-related equipment spurred on by double-digit growth both in RAN and Broadband Access. Total worldwide telecom equipment revenues approached $100 B, up more than 20% since 2017.

Initial readings suggest the playing field is more even outside of China, with Ericsson and Nokia essentially tied at 20% and Huawei accounting for around 18% of the market.

References:

Cisco, Samsung, and ZTE benefit most from Huawei bans in 2021 telco NI market

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

Nokia Deploys 1st Liquid Cooled Base Station in Helsinki, Finland

Nokia, Elisa and Efore have commercially deployed has announced a proof of concept (PoC) deployment of a liquid cooled base station system in an apartment building in Helsinki, Finland. The Nokia designed PoC liquid cooled base station was done in collaboration with network operator Elisa and power systems supplier Efore.

Nokia Bell Labs developed the base station, while Efore developed the liquid-cooled power system and Elisa handled deployment.

Analysis from Finland’s VTT Technical Research Centre indicates that the deployment reduced CO2 emissions by up to 80% and energy operating expenses by up to 30%.

Minna Kröger, Director, Corporate responsibility from Elisa, said: “We have set science-based targets to reduce our emissions in our effort to become an environmental leader, and we are committed to providing customers the services that enable them to act in a sustainable way. We are excited to leverage the extensive expertise of Nokia and Nokia Bell Labs for this important deployment.”

“Nokia and Nokia Bell Labs have conducted extensive research and testing to explore the possibilities of using a liquid-cooled base station in an operator’s network,” said Pekka Sunström, head of the Elisa customer team at Nokia.

“This first commercial deployment will enable us to understand the real-world benefits for customers such as Elisa as they transition toward 5G, and how the system can be implemented on a wider scale to help reduce the environmental impact of information and communications technology,” he added.

Vlad Grigore, Chief Technology Officer of Efore, said: “We are dedicated to providing efficient and reliable power supply solutions tailored to our customer’s needs. The power system pilot with MHE (Modular High Efficiency) rectifiers adapted for liquid cooling helps reduce energy consumption and emissions, with a positive impact on environment. We are enthusiastic about this development that continues our long tradition of close cooperation with Nokia.”

Additional Information:

Reference:

Data Center, Cloud & Campus Networking Equipment + Cisco Beats

by Patrick Seitz of IBD (edited by Alan J Weissberger)

AI and machine learning have crept into the computer networking gear business as hardware vendors look to add more smarts to their routers and switches to help customers better manage data traffic and solve problems.

Cisco, Arista, Netgear and Extreme build a range of wired and wireless network switches and routers for moving data.

“The overall business is pretty healthy,” IDC analyst Rohit Mehra told Investor’s Business Daily.

Spending on Ethernet switches alone is expected to rise 3% to $26.3 billion this year, he said.

Business campus and enterprise deployments are the largest subsegment, accounting for 57% of Ethernet switch spending in 2016, the most recent year for which research firm IDC has full-year data. Data centers accounted for the remaining 43% of spending.

Cisco is by far the largest name in the industry, with a market capitalization of over $200 billion. At a fraction of that size, Arista is next in line, with a market cap near $20 billion.

While Cisco has a full portfolio of networking products across customer segments, Arista Networks is focused today on data center customers.

On Wednesday, investment bank Goldman Sachs initiated coverage of Cisco and Arista with buy ratings and Juniper at neutral. The report noted that enterprise spending intentions for networking gear are at their highest levels since 2007.

“Almost two-thirds of respondents indicated that they expect to increase networking spend in 2018, with only 6% expecting a decrease,” Goldman analyst Rod Hall said in the report.

Arista Networks Targets High-Speed Cloud Data Centers:

Arista has high exposure to the hyperscale data center side of the market, which is expected to accelerate slightly to 29% capital-expenditure growth this year, Hall said.

“We are modeling for revenue upside (at Arista) from consensus, as cloud capex looks set to accelerate again in 2018,” he said. “Arista has established itself as the dominant vendor of high-speed data center networking solutions, with nearly 25% share of 100G data center switches.”

Other Network Equipment Vendors:

Juniper Networks has been hurt by large data-center customers buying more commodity networking hardware from so-called white-box vendors, analysts say.

Commodity networking hardware from ODMs/white box vendors uses merchant silicon from semiconductor firms such as Broadcom, Cavium, and Mellanox Technologies rather than purpose-built chips called application-specific integrated circuits (ASICs) from traditional network gear makers like Cisco and Juniper.

Networking gear vendors have avoided the commoditization price trap partly by placing greater emphasis on software and services.

Because of surging data traffic, network administrators need more tools to help them solve bottlenecks, security issues and other concerns.

Cisco (see Update below) has been a laggard in providing predictive analytics and high-level network monitoring and management capabilities, which created opportunities for a host of companies to step in and fill the gap.

But in late January, Cisco announced initiatives to provide more automation and network management capabilities to its product offerings. It introduced tools designed to help information technology teams become more proactive rather than reactive to problems.

Cisco said IT workers today spend 43% of their time troubleshooting. Software innovations should make IT operations more automated, proactive and agile, the company says.

“There’s more of a realization at Cisco that network monitoring, analytics and visibility is key to delivering automation,” IDC’s Mehra said. “If you don’t build automation into your network systems, you’re not going to be there as the market for IoT (Internet of Things) explodes and as cloud continues to gain more affinity in the enterprise.”

Mergers and acquisitions could play a role in the networking gear space this year, especially with cash-rich Cisco. Cisco could make a meaningful acquisition in 2018, Barclays analyst Mark Moskowitz said in a Jan. 17th report.

“We think CEO Chuck Robbins could make a larger, synergistic acquisition (i.e., north of $5 billion to $7 billion) – something that bolsters the company’s cloud, software, security or services presence on day one,” he said.

On Feb. 2nd, Cisco completed its acquisition of BroadSoft for $1.9 billion. BroadSoft adds cloud calling and contact center solutions to Cisco’s calling, meetings, messaging, customer care, hardware endpoints and services portfolio.

Meanwhile, Arista has been a thorn in the side of Cisco’s core networking business, but could become a bigger threat, Moskowitz said.

“If Arista is able to penetrate the enterprise vertical and also gain traction with its routing foray, the headline and fundamental risks (for Cisco) could start to become more meaningful,” he said.

RELATED:

Netgear Plans IPO For Fast-Growing Arlo Security-Camera Business

Juniper Offers Earnings Beat, Buyback — But Outlook Falls Short

Will Resurgent Cisco Slow Down Arista Networks In Cloud Computing?

…………………………………………………………………………………………………………………

Update – Cisco Fiscal 2nd Quarter Earnings Report:

Cisco today (February 14, 2018) reported a fiscal second-quarter loss of $8.78 billion, or $1.78 a share, compared with net income of $2.35 billion, or 47 cents a share, in the year-ago period. Adjusted earnings, excluding $11.1 billion in charges from the U.S. tax overhaul, were 63 cents a share. Of the 26 analysts surveyed by FactSet, Cisco on average was expected to post adjusted earnings of 59 cents a share; the company had forecast 58 cents to 60 cents a share.

Revenue rose 2.6% to $11.89 billion from $11.58 billion in the year-ago period, breaking a streak of six straight quarters of year-over-year revenue declines. Wall Street had expected revenue of $11.81 billion, according to 23 analysts polled by FactSet. Cisco had predicted revenue of $11.7 billion to $11.93 billion.

- Product revenue, which makes up 73% of the top line, increased 2.6%.

- Services revenue rose 2.9% to $3.18 billion, while analysts had expected a 0.9% rise to $3.13 billion. Security revenue, on the other hand, rose 6% to $558 million, while Wall Street had expected a 10% gain to $582.8 million.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Repatriation of overseas cash, mostly to pay for share buybacks and dividends:

Cisco said it would repatriate $67 billion of its foreign cash holdings to the U.S. this quarter, in one of the largest repatriation plans yet revealed. The company plans to spend much of the newly repatriated cash on share buybacks and dividends, it said Wednesday while reporting earnings, amounting to about $44 billion over the next two years. At the end of the quarter, Cisco had $73.7 billion of cash and equivalents, with the vast majority held outside the U.S. Under the new tax law, the company will be able to access its money at a significantly lower rate than was previously required.

Critics of the U.S. tax law have said increases in share repurchases and dividends show money saved from the law is going to shareholders instead of being invested in new U.S. jobs, infrastructure, research and development, and related areas.

The focus on stock buybacks and an increased dividend suggests Cisco isn’t likely to use the cash on a major acquisition, said RBC Capital Markets analyst Mitch Steves (that contradicts the IBD story above). Instead, he expects Cisco to focus on smaller deals, perhaps in a range of $1 billion to $10 billion.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Since taking the helm of Cisco, Chief Executive Chuck Robbins has focused on subscriptions, common in the software industry but more difficult for a hardware company. That kind of transition can have a negative effect on revenue in the short term, as less of the sale is recognized up front with the rest deferred to later quarters, which Cisco has seen in the past couple of years.

Cisco introduced a new switching family called the Catalyst 9000, a software-centric switch that is delivered as a service with subscription fees and long-term contracts, last June. While previously, a sale of a switch — Cisco’s biggest business — would have been recognized in full up front, Chief Financial Officer Kelly Kramer explained that a healthy portion of that sale is now considered to be for software support and recognized over the length of the contract.

“Of total product revenue, 13% of product revenue is recurring,” Kramer said; at the beginning of Cisco’s fiscal 2015, recurring revenue was about 6% of total revenue, she said.

“The Catalyst 9000 is our fastest ramping product in our history,” Robbins crowed on a conference call.

Kramer largely echoed Robbins’s positive tone in a later interview, while avoiding any grand pronouncements. When asked whether the company’s transition was at an inflection point, she said, ‘I am always hesitant to call any inflection, but I am not surprised about the improvement. Overall, we feel very, very good about our portfolio, this is where we have been focused for a long time.”

Robbins has focused on software as a path, making big-money acquisitions like AppDynamics and BroadSoft, and analysts were curious in Wednesday’s conference call about what may be next for the acquisitive company. Company executives said they plan to bring back all of Cisco’s cash that is outside the U.S. by the end of this quarter under the new tax laws that are now taking hold.

After recognizing an $11.1 billion charge largely from repatriation in Wednesday’s report, Cisco will have many billions of dollars to play with, even after adding $25 billion to its stock-repurchase authorization and increasing its dividend 14% Wednesday.

“We are seeing the benefits of the strategy we started executing on 10 quarters ago,” Kramer said. “We are seeing the benefits as we shift the business model and you are seeing it translate through fantastic financials.

https://investor.cisco.com/investor-relations/news-and-events/events-and-presentations/default.aspx

https://seekingalpha.com/article/4146882-cisco-systems-csco-q2-2018-results-earnings-call-transcript

https://investor.cisco.com/investor-relations/financial-information/Financial-Results/default.aspx

https://www.wsj.com/articles/cisco-returns-to-growth-after-two-year-sales-slump-1518645580