WiFi 6E

Research & Markets: WiFi 6E and WiFi 7 Chipset Market Report; Independent Analysis

According to Research & Markets, the WiFi 6E (IEEE 802.11ax) and WiFi 7 (IEEE 802.11be [1.]) chipset market is expanding rapidly, with projections indicating a rise from $33.65 billion in 2024 to $40.50 billion by 2025, and estimates reaching $149.65 billion by 2032. This growth reflects a notable CAGR of 20.50%, primarily driven by organizations upgrading their wireless networks in response to rising digital application use and increasing data volume.

Note 1. IEEE 802.11be standard was published July 22, 2025. The Project Approval Request (PAR) is here.

Enterprises today require scalable, secure wireless infrastructure capable of supporting diverse and demanding workloads. The latest WiFi chipsets improve network performance, facilitate secure operations, and support robust digital transformation strategies. Adopting Wi-Fi 6E and Wi-Fi 7 chipsets positions organizations to deliver secure, agile connectivity with higher speeds and lower latency.

- Application Areas: Automotive organizations implement advanced chipsets to support secure, reliable vehicle connectivity and enhance driver-assistance systems. In consumer electronics, manufacturers drive higher interactivity and seamless device experiences with updated wireless integration. Enterprises emphasize improved workforce mobility, while healthcare adopts secure, high-speed wireless for telemedicine and remote diagnostics. Industry operators deploy chipsets to enable robotics, automation, and smart manufacturing environments.

- End Users: Commercial enterprises in sectors such as hospitality, offices, and retail seek enhanced connectivity to increase operational efficiency and elevate customer engagement. Industrial segments-including utilities and manufacturing-prioritize automation and resilient communications infrastructure. Residential users focus on smart technology integration and flexible, connected home environments.

- Chipset Technologies: Integrated combo chips provide straightforward deployment for rapid delivery and compatibility, while discrete chipsets offer a tailored approach in high-volume or specialized scenarios. System-on-chip solutions bring high-density integration, maximizing energy efficiency and aligning with sustainability targets.

- Distribution Channels: Organizations maintain robust supply chains utilizing established resellers and digital platforms, ensuring prompt response to evolving logistical demands and market conditions.

- Regional Coverage: The Americas, Europe, Middle East and Africa, and Asia-Pacific each offer unique opportunities and regulatory landscapes, guiding deployment strategies and technology adoption in response to local dynamics.

- Company Profiles: The industry includes innovation-focused leaders such as Broadcom, Qualcomm, and MediaTek. These companies exhibit diverse approaches to integration and product differentiation across the competitive landscape.

Strategic Insights:

- The expanded wireless spectrum empowers businesses to scale connectivity, supporting data-rich operational environments where performance stability and capacity are critical.

- Next-generation chipset architectures enhance automation and real-time data management, particularly in healthcare and manufacturing, strengthening capabilities for time-sensitive applications.

- Collaborations between chipset vendors and device manufacturers improve compatibility, enabling tailored wireless infrastructure to address bespoke enterprise requirements.

- Maintaining a flexible supply approach-leveraging diverse distribution channels-supports organizational agility in facing evolving international trade and supply scenarios.

- Ongoing improvements in wireless security and system reliability support compliance and data protection needs for sectors operating under stringent regulatory requirements.

Market Insights:

- Surge in demand for Wi-Fi 7 chipsets optimized for multi-gigabit data throughput in dense public venues

- Integration of advanced OFDMA and multi-user MIMO enhancements to support simultaneous high-bandwidth applications

- Adoption of 6 GHz spectrum by enterprise networks to enable low-latency connectivity for critical IoT devices

- Development of energy-efficient chipset architectures to extend battery life in mobile and IoT applications

- Emergence of AI-driven adaptive beamforming techniques to improve signal reliability in complex environments

- Strategic partnerships between chipset vendors and cloud providers to accelerate edge computing deployments

- Certification focus on security enhancements such as WPA3-SAE to address evolving wireless threat vectors

- Custom chipset solutions for automotive and industrial automation requiring ultra-reliable low-latency performance

For more information about this report visit: https://www.researchandmarkets.com/r/q1rlgd

…………………………………………………………………………………………………………………………………

Independent Analysis:

The top three WiFi chipset vendors are:

- Broadcom Inc.: Broadcom is generally recognized as the market leader in the Wi-Fi 6/6E and Wi-Fi 7 segment, particularly in terms of revenue share. They supply chips for a wide range of devices, from high-performance consumer routers (e.g., Netgear, Asus models) to enterprise-grade networking equipment, and are a key supplier for platform upgrades like those in flagship smartphones.

- Qualcomm Technologies, Inc.: Qualcomm is a major competitor, especially in the mobile and networking infrastructure segments. Their “FastConnect 7800” chipset has positioned them for significant growth, with Wi-Fi 6E and 7 products expected to comprise a large portion of their Wi-Fi sales in 2025. They are also a primary chip provider for many high-end routers and mesh systems.

- MediaTek Inc.: MediaTek is a strong player, particularly in the consumer electronics space and in Asia-Pacific markets. Their “Filogic 380/880” Wi-Fi 7 chipsets have seen high demand, and they have strong partnerships with major brands like TP-Link and ZTE.

Other WiFi chipset vendors include: Marvell Technology Group, Intel, Realtek Semiconductor Corporation NXP Semiconductors, Texas Instruments, and Samsung Electronics Co. The market is competitive, with these vendors heavily investing in R&D and strategic partnerships to drive the adoption of new Wi-Fi standards from IEEE 802.11 WG.

The top markets for WiFi 6E/7 chipsets are: Smartphones, PC /laptops, Access Point/WiFi routers, CPE /gateways /extenders, industry verticals (e.g. manufacturing, automotive, industrial, home appliances, gaming, augmented reality, etc).

Sources: Gemini, Perplexity AI

……………………………………………………………………………………………………………………………………………………………………..

References:

https://www.ieee802.org/11/PARs/P802_11be_PAR_Detail.pdf

Wireless Broadband Alliance Report: WiFi 7, converged Wi-Fi and 5G, AI/Cognitive networks, and OpenRoaming

WiFi 7: Backgrounder and CES 2025 Announcements

WiFi 7 and the controversy over 6 GHz unlicensed vs licensed spectrum

MediaTek to expand chipset portfolio to include WiFi7, smart homes, STBs, telematics and IoT

MediaTek Announces Filogic Connectivity Family for WiFi 6/6E

Intel and Broadcom complete first Wi-Fi 7 cross-vendor demonstration with speeds over 5 Gbps

Qualcomm FastConnect 7800 combining WiFi 7 and Bluetooth in single chip

Rethink Research: Private 5G deployment will be faster than public 5G; WiFi 6E will also be successful

WBA field trial of Low Power Indoor Wi-Fi 6E with CableLabs, Intel and Asus

Aruba Introduces Industry’s 1st Enterprise-Grade Wi-Fi 6E Access Point

Wireless Broadband Alliance Report: WiFi 7, converged Wi-Fi and 5G, AI/Cognitive networks, and OpenRoaming

The Wireless Broadband Alliance (WBA) has today released its annual industry report and survey findings. The “WBA Industry Report 2026” contains the results of its annual industry survey across the Wi-Fi, cellular and enterprise ecosystem. Among its chief findings is that 62% of respondents have grown more confident to invest in Wi-Fi over the last 12 months (18% are as confident). Wi-Fi 7 is the technology most likely to be deployed in 2026, with 38% of respondents planning deployments. Closely behind that is the impact of AI, with 32% planning to deploy AI/Cognitive networks, which can transform Wi-Fi networking, with an ability to improve the performance and reliability of networks.

Here are a few highlights:

- 60% of respondents see converged Wi-Fi and 5G as key to enterprise flexibility and that both will co-exist.

- 38% plan to roll out Wi-Fi 7 in 2025/2026, while 65% say 6 GHz availability is important or critical to their Wi-Fi business.

- 32% plan to deploy AI/Cognitive networks.

Convergence matters more:

When asked about the role of Wi-Fi in converged networks with both 5G and private enterprise implementations, responses reinforced the view that the technologies are complementary and together benefit organizations. Six in ten (60%) said combining them would give their organization greater enterprise flexibility. The same proportion expect Wi-Fi and 5G to co-exist, rather than be a binary choice for enterprise networks.

OpenRoaming momentum:

The industry survey shows OpenRoaming transitioning into a period of mainstream planning with the need for seamless onboarding and roaming between Wi-Fi and cellular networks now seen as central business drivers. 38% of respondents say they had already deployed a OpenRoaming and/or Passpoint compliant network with a further 32% wishing to deploy in 2026, and 18% in 2027.

When asked what is driving investment in OpenRoaming/Passpoint, the top three reasons given were Enablement of frictionless Wi-Fi (63%), seamless access between Wi-Fi and 5G/LTE (60%) and seamless access across different networks (40%). Each of these responses relates to network access, highlighting that this element is the most important factor for the industry.

Wi-Fi’s role in business continuity:

Respondents also gave their views on the aspects of Wi-Fi they considered most important to their business at present, and what they expected to be the most important in the future. Network security and privacy was identified as the most important area for businesses today, with 76% of all responses. Tied second position for the current most important aspect of Wi-Fi, both with 70% of responses, were end user experiences (Quality of Experience and Quality of Service), and seamless authentication to Wi-Fi.

Asked about the most important new or improved feature of Wi-Fi 6E and Wi-Fi 7, respondents rated Multi-Link Operation (MLO) as the single most important at 46%, highlighting a sharp focus on latency, resilience and spectrum efficiency in dense environments. This was followed in joint second place by OFDMA Uplink & Downlink, and Mandatory WPA3 compliance (both 33%). Multi-User MIMO Uplink took third position at 32%.

Additional key survey findings:

- 6 GHz band availability seen as ‘important’ or ‘critical’ by 65% of respondents to the future of their Wi-Fi business and rollout, underscoring the centrality of 6 GHz to future Wi-Fi strategies

- City-wide public Wi-Fi deployed by 33% of relevant respondents, with a further 39% planning deployments for 2026/2027. The top three services organizations see Public Wi-Fi underpinning were supporting city services (70%), the provision of seamless, affordable, and secure internet access to users (65%), and to provide offload to carriers (49%). City governments around the world, such as the Tokyo Metropolitan Government (TMG), are already utilizing OpenRoaming to deliver all these services

Tiago Rodrigues, President and CEO of the Wireless Broadband Alliance, said: “This year’s WBA Industry Report survey makes it clear that the Wi-Fi community has moved to building the next generation of converged connectivity and the momentum is strong: Wi-Fi 7 and AI-driven networks, which can cut costs, while improving the operational efficiency, performance and reliability of networks, are at the top of deployment plans. 6 GHz is viewed as critical spectrum, and almost half of respondents are already deploying or planning OpenRoaming networks. Respondent’s priorities of security, privacy, Quality of Experience and seamless roaming between Wi-Fi and 5G are exactly where the WBA is focused through our programs of work. In a world where connectivity is business continuity, these findings show that Wi-Fi has become essential infrastructure for enterprises, operators and cities alike.”

The WBA Industry Survey 2026 collected input from 185 participants worldwide, with diverse job roles ranging from the C-suite and business strategy to those in research & development (R&D) and product management in a wide range of sectors.

About the Wireless Broadband Alliance:

Wireless Broadband Alliance (WBA) is the global organization that connects people with the latest Wi-Fi initiatives. Founded in 2003, the vision of the WBA is to drive seamless, interoperable service experiences via Wi-Fi within the global wireless ecosystem. The WBA’s mission is to bring together global industry leaders, collaborating to accelerate the development, integration and adoption of next-generation Wi-Fi and wireless technologies to deliver business growth, through innovation, technical and standards development, and real-world deployment programs.

Key programs include NextGen Wi-Fi, OpenRoaming, 5G, 6G, IoT, Smart Cities, Testing & Interoperability and Policy & Regulatory Affairs.

www.facebook.com/WirelessBroadbandAlliance

www.linkedin.com/company/2919934/

…………………………………………………………………………………………………………

References:

https://wballiance.com/industry-report-2026/

WiFi 7: Backgrounder and CES 2025 Announcements

WiFi 7 and the controversy over 6 GHz unlicensed vs licensed spectrum

MediaTek to expand chipset portfolio to include WiFi7, smart homes, STBs, telematics and IoT

CableLabs to bring mobility to WiFi for a better user experience

AT&T to provide free WiFi and private 5G at DFW airport; will invest $10 million worth of network upgrades

Qualcomm FastConnect 7800 combining WiFi 7 and Bluetooth in single chip

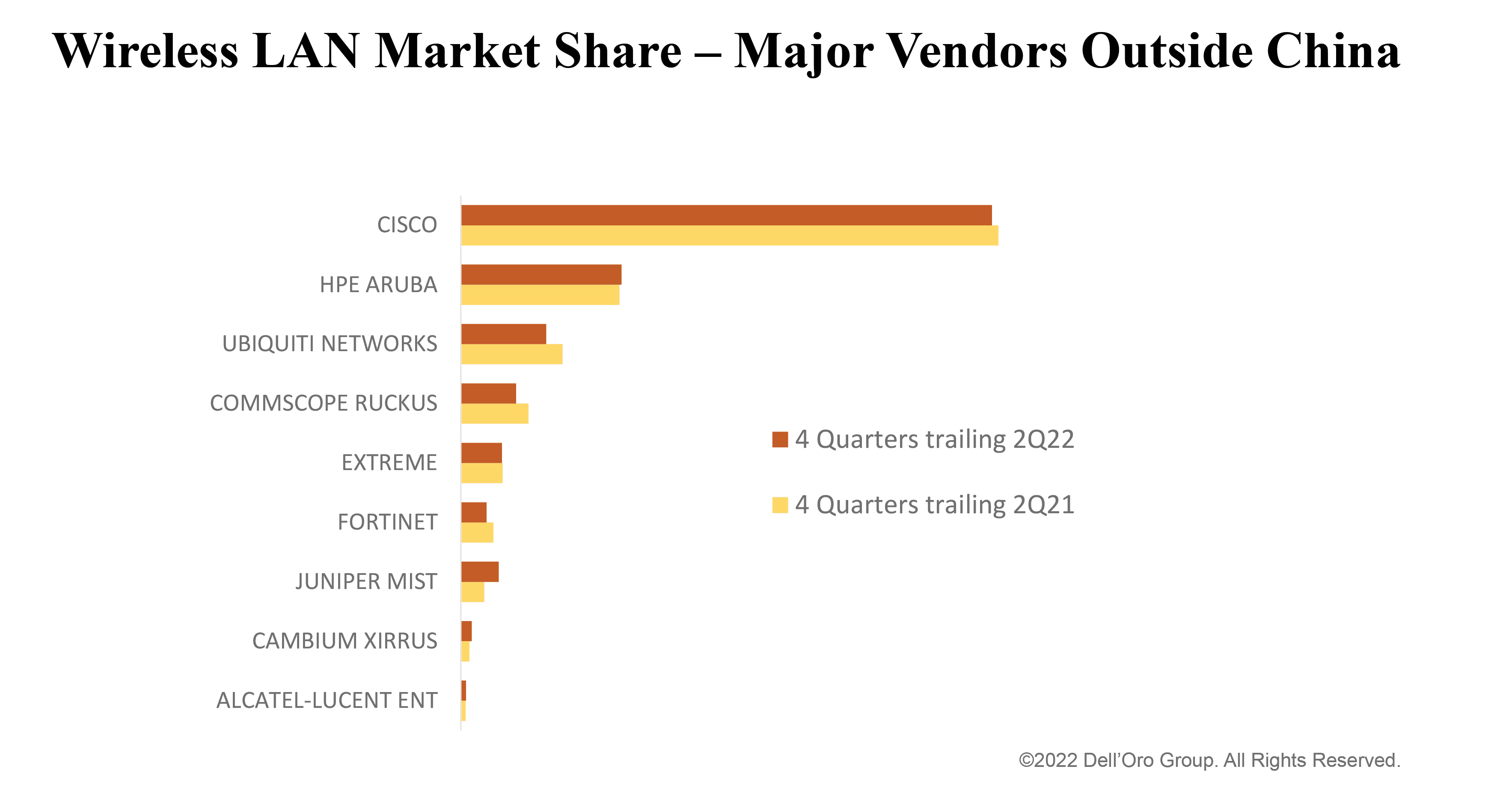

Dell’Oro Worldwide Wireless LAN market at new high in 2Q-2022; IDC reports 20.4% annual growth for enterprise segment

1. According to Dell’Oro Group’s Wireless LAN Quarterly Report, the Wireless LAN market reached a new high in the second quarter, eclipsing $2 Billion, with HPE Aruba and Juniper Mist overcoming supply constraints to contribute over two thirds of the shipment growth outside China. Enterprises saw a 10 percent increase in average prices compared to last year, boosting manufacturers’ revenues and helping to defray additional costs.

“HPE and Juniper really pulled rabbits out of their hats this quarter ̶ Aruba and Mist represent the majority of the growth in units shipped outside China,” says Siân Morgan, Wireless LAN Research Director at Dell’Oro Group. “It’s like a game of whack-a-mole for the manufacturers. They’ll get their hands on one particular access point component and then another shortage will pop up. We’re expecting shipments to be lumpy through the next few quarters.”

Cisco has promised shipments ‘en masse’ for enterprises, and all of the manufacturers are busy finding creative solutions: redesigning products, using brokerage firms, or bypassing component distributors.

“Wireless LAN solutions have also become more expensive for enterprises. It’s very rare to see such a long stretch of quarters with year-over-year price increases. It’s a combination of higher-end products being available, including the new Wi-Fi 6E technology, as well as a general move by the manufacturers to cover their escalating costs. Looking ahead we have to ask ourselves how long the market will bear these higher prices,” added Morgan.

Additional highlights from the 2Q 2022 Wireless LAN Quarterly Report:

- The Wireless LAN market saw two distinct phenomena driving the growth: one in China, and another one in the markets outside China.

- In light of the China lockdowns, the Wireless LAN market in China showed surprising strength with both Huawei and H3C pulling in strong quarters.

- Wi-Fi 6E shipments accelerated this quarter, as another half dozen vendors started shipping products supporting the new 6 GHz band. However, now in its fourth quarter of product availability, Wi-Fi 6E is lagging the adoption rate of the prior two generations of Wi-Fi.

- Revenue from public cloud-managed APs has outpaced the market. The cloud-managed AP business is still dominated by Cisco – although this quarter, Juniper grabbed an outsized market share in cloud-managed Wireless LAN.

Sian wrote in an email to this author, “It is difficult to judge changes in market share based on one or two quarters, given that supply constraints are making shipment volumes choppy. To understand how the market is unfolding it is useful to look at market share based on trailing four-quarter averages, which are shown in the chart below.

Dell’Oro note earlier this year that supply chain issues increased vendor backlogs by up to 15-times normal levels. “Many enterprises have planned network upgrades and the popular connection is Wi-Fi. The trouble is getting it. Several manufacturers announced that components from second and third-tier suppliers became the bottleneck in 1Q22,” said Tam Dell’Oro, Founder, CEO and Wireless LAN Analyst. “Supply constraints have resulted in highly volatile quarterly performance vendor-to-vendor depending on whether or not they have all the components. For example, sales may be up 20 percent in one quarter and down 20 percent the next. Another item, which could potentially cause delays, that we are keeping our eye on are the contract negotiations between the west coast dockworkers union and the Maritime Association,” added Dell’Oro.

The Dell’Oro Group Wireless LAN Quarterly Report offers complete, in-depth coverage of the Enterprise Outdoor and Indoor markets, Wireless LAN Controllers with tables containing manufacturers’ revenue, average selling prices, and unit shipments by the following wireless standards: 802.11ax (Wi-Fi 6 and 6E [6 GHz]), 802.11ac (Wi-Fi 5) Wave 1 vs. Wave 2, and historic IEEE 802.11 standards. The Enterprise market is portrayed by Public Cloud vs. Premises and Private Cloud deployments, as well as by ten Vertical markets and by Customer Size. To purchase these reports, please contact us by email at [email protected].

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

2. IDC reports that the enterprise segment of the worldwide wireless local area network (WLAN) market continued its strong growth in the second quarter of 2022 (2Q22), increasing 20.4% year over year to $2.1 billion. That’s according to the IDC report: “Worldwide Quarterly Wireless LAN Tracker.”

The 20.4% annualized growth builds on the enterprise WLAN market growing 17.1% year over year in the first quarter of 2022. In the first half of 2022, the enterprise WLAN market has grown 18.4% compared to the first half of 2021. Growth in the enterprise WLAN market continues to be driven by the latest Wi-Fi standard, known as Wi-Fi 6 or 802.11ax. Wi-Fi 6 access points (AP) made up 76.5% of the revenues in the Dependent AP segment and accounted for 62.7% of unit shipments within the segment. Wi-Fi 5 products, also known as 802.11ac, made up the remaining balance of Dependent AP sales.

The consumer segment of the WLAN market declined 3.5% year over year in 2Q22, with the quarter’s unit shipments remaining relatively flat at 0.6% growth compared to the first quarter of 2022. Adoption of Wi-Fi 6 continues in the consumer segment of the WLAN market too: In 2Q22, Wi-Fi 6 made up 33.5% of the market’s revenues.

“The enterprise WLAN market continues to grow at a rapid clip, emphasizing the importance of wireless technology in the network and digital transformation goals of organizations across the globe,” said Brandon Butler, research manager, Enterprise Networks at IDC. “The enterprise WLAN market is not immune to challenges however, with the supply chain disruptions and component shortages being notable examples. But strong demand for wireless refreshes to Wi-Fi 6 – and increasingly to Wi-Fi 6E – is buoying the market and leading to strong growth rates.”

The enterprise WLAN market had mixed results across the globe. In the United States, the market increased 15.7% annually, while in Latin America the market grew 47.7% from a year earlier. In Canada the market declined 1.6%. In Western Europe, the market increased 45.4%, but in Central and Eastern Europe, the market declined 20.6%. Within Central and Eastern Europe, Russia’s market declined 73.2% as the Russia-Ukraine war rages on. In the Middle East & Africa, the market rose 23.2%. In the Asia/Pacific region, excluding Japan and China, the market rose 26.5%, while in the People’s Republic of China the market increased 8.7% year over year. In Japan the market rose 6.2%.

Vendor highlights (note that Juniper Mist is NOT mentioned by IDC as a leading wireless LAN vendor):

- Cisco’s enterprise WLAN revenues increased 19.3% year over year in 2Q22 to $792.0 million, giving the company market share of 37.7%, compared to market share of 41.5% in the previous quarter, 1Q22.

- HPE-Aruba revenues rose 48.6% year over year in 2Q22, giving the company market share of 14.9%, down from 16.5% in the first quarter.

- Ubiquiti enterprise WLAN revenues increased 10.5% year over year in 2Q22, giving the company 7.9% market share in the quarter, up from 7.1% in 1Q22.

- Huawei enterprise WLAN revenues rose 20.0% year over year in 2Q22, giving the company 8.5% market share, up from 4.6% market share in the previous quarter.

- H3C revenues increased 16.4% year over year in 2Q22, giving the company market share of 4.6%, up from 4.3% in 1Q22.

The IDC Worldwide Quarterly Wireless LAN Tracker provides total market size and vendor share data in an easy-to-use Excel Pivot Table format. The geographic coverage includes nine major regions (USA, Canada, Latin America, People’s Republic of China, Asia/Pacific (excluding Japan & China), Japan, Western Europe, Central and Eastern Europe, and Middle East and Africa) and 60 countries. The WLAN market is further segmented by product class, product type, product, standard, and location. Measurement for the WLAN market is provided in vendor revenue, value, and unit shipments.

About IDC Trackers:

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

References:

HPE Aruba and Juniper Mist Navigate Component Shortages to Gain Share, According to Dell’Oro Group

https://www.idc.com/getdoc.jsp?containerId=prUS49663322

https://www.idc.com/getdoc.jsp?containerId=IDC_P23464

Globe Telecom and Linksys deploy dual band mesh WiFi 6 system

Philippines network operator Globe Telecom has partnered with Linksys, a provider of home and business WiFi services, to provide Globe At Home subscribers with Linksys’ Atlas Pro 6 Dual-Band Mesh WiFi 6 system.

All Globe At Home subscribers can now pre-order the Linksys WiFi 6 Mesh device. Powered by Velop Intelligent Mesh, this dual-band WiFi 6 router is designed to allow more than 30 devices to connect across three bedrooms. It is best recommended for subscribers to Globe At Home’s Unli Fiber Up 70 Mbps plan and up, the operator added.

Globe customers can take up the Linksys Atlas Pro 6 (MX5502 – two units) for PHP 1,099 per month or for a one-time payment of PHP 19,995. For a limited time only, every pre-order will come with a bonus Samsung SmartThings camera worth PHP 5,500, Globe said.

“As a company whose mission is to give Filipinos the tools they need to keep winning in life despite all the challenges we face, we are always on the lookout for emerging technologies that can help us do just this,” says Barbie Dapul, Vice President for Marketing of Globe At Home. “From our improved unli, fiber internet plans to Globe Streamwatch 2-in-1 Entertainment Box, and now the Linksys Atlas Pro 6 WiFi Mesh, all of our efforts are geared towards turning Filipino houses into powerhouses; homes that are capable of enriching familial bonds and at the same time, fulfilling dreams.”

The Linksys Atlas Pro 6 makes so much sense especially in the post-pandemic setting with the internet becoming more central in people’s lives and the home becoming a central venue for work, school, gaming, and family entertainment. The WiFi 6 competency is designed to deliver gigabit WiFi speeds to every corner of the home, including balconies and outdoor areas, offering the best home mesh WiFi coverage to date.

“With more people working from home, and attending school online, home networks are becoming increasingly constrained, especially when used for video or other streaming applications,” said Kingsley Chan, Business Development Director, Linksys. “The new Linksys Atlas Pro 6 is designed to address this and provides all of the heavy WiFi lifting at a reasonable price.”

Access to 160 MHz unleashes the true power of WiFi 6 technology—the least-congested channels on the 5 GHz band offer incredibly fast connectivity. Faster peak data rates allow work-from-home, online learning, streaming, and gaming devices to operate simultaneously without diminished bandwidth. Meanwhile, advanced security and parental controls all add to the essentiality of this upgrade to any home.

Additional Features and Benefits

- 4X Faster Speed than WiFi 5, Powerful WiFi 6 Mesh Coverage: WiFi 6 sends and receives multiple streams of data simultaneously, providing up to 4X more WiFi capacity to handle more mobile, streaming, gaming, and smart home devices.

- Increased WiFi Range by 50%: Expands WIFI coverage up and lessens dead spots.

- Ultra-Low Latency: Faster WiFi performance for lag-free online gaming and HD streaming to any device, providing 4X more speed compared to WiFi 5.

- Easy set-up and WIFI controls with Linksys app let you access your network from anywhere, and view or prioritize which connected devices are using the most WiFi.

References:

https://www.globe.com.ph/about-us/newsroom/consumer/better-wider-wifi-globe-at-home-linksys.html

For more information, please visit shop.globe.com.ph/linksys-atlas-pro6-pre-order. You can also download the Globe At Home app and follow Globe At Home on Facebook.

https://www.linksys.com/us/velop/

WBA field trial of Low Power Indoor Wi-Fi 6E with CableLabs, Intel and Asus

The Wireless Broadband Alliance (WBA) today announced results from a new field trial using technology from CableLabs®, Intel, and Asus. The purpose was to highlight the benefits of using Low Power Indoor Wi-Fi 6E for a wide variety of demanding residential applications, including video collaboration for telecommuting, multiplayer gaming, augmented and virtual reality, streaming video and more.

Since the 6 GHz band is higher frequency range than 2.4 GHz or 5 GHz typically used for Wi-Fi, signals have more of a challenge with obstruction the trial took place in a 3,600-square-foot, two-story home with a basement and the drywall, wood and other building materials typically found in a suburban residence. The Wi-Fi 6E enabled laptops with Intel® Wi-Fi 6E AX210 wireless cards were placed in various locations throughout the home and tests were conducted using a Wi-Fi 6E enabled access point from Asus.

The trial featured a range of tests on the downlink and uplink comparing throughput achieved on the 5 GHz and 6 GHz bands for wide channels (80 MHz and 160 MHz). CableLabs and Intel also analyzed the Wi-Fi 6E performance compared to Wi-Fi 6 on the 5 GHz band in the presence of overlapping neighbouring access points.

The trial’s key results include 1.7 TCP Gbps downlink and 1.2 TCP Gbps uplink speeds when using 160 MHz channels on Wi-Fi 6E in locations close to the access point. The larger channel bandwidth and the associated increase in total EIRP transmit power based on the channel bandwidth helped maximize both coverage and speed throughout the home.

These results clearly demonstrate the real-world benefits of using Wi-Fi 6E enabled devices over 6 GHz rather than 5 GHz. It is important to note that although Wi-Fi 6 devices perform better than Wi-Fi 5 devices over 5 GHz, next-level user experiences are possible with Wi-Fi 6E and the additional bandwidth available in the 6 GHz spectrum.

Tiago Rodrigues, CEO of the Wireless Broadband Alliance, said: “This field trial by CableLabs and Intel shows how Wi-Fi 6E and 6 GHz spectrum maximize coverage, capacity, throughput and the user experience in one of the most demanding real-world environments: people’s homes. Between HD and 4K streaming video, multiplayer gaming, dozens of smart home devices and videoconferencing for remote work, today’s home Wi-Fi networks are the foundation for how people live, work and play. This trial highlights that Wi-Fi 6E is more than capable of shouldering that load, especially when paired with 6 GHz spectrum.”

Lili Hervieu, Lead Architect of Wireless Access Technology at CableLabs, said: “CableLabs has been a proponent of making the 6 GHz band available for unlicensed use, and we were honored to conduct the Wi-Fi 6E trial in one of our employee’s homes for a truly real-world experience. The results confirmed the benefit of Wi-Fi 6E for increased capacity and data rate that will support the growing demand we are seeing for a large variety of applications and for new emerging technologies.”

Eric A. McLaughlin, VP Client Computing Group, GM Wireless Solutions Group, Intel Corporation, said: “Intel’s mission is to enable great PC experiences with industry leading platform capabilities like Wi-fi 6E. The wireless trial, in collaboration with CableLabs and the Wireless Broadband Alliance, helps demonstrate the versatility of Wi-fi 6E on Intel platforms. The speed, latency, and reliability improvements enabled by the new 6 GHz spectrum, with larger channels and freedom from legacy Wi-Fi interference, will help dramatically enhance user communication, entertainment, and productivity.”

About the Wireless Broadband Alliance:

Wireless Broadband Alliance (WBA) is the global organization that connects people with the latest Wi-Fi initiatives. Founded in 2003, the vision of the Wireless Broadband Alliance (WBA) is to drive seamless, interoperable service experiences via Wi-Fi within the global wireless ecosystem. WBA’s mission is to enable collaboration between service providers, technology companies, cities, regulators and organizations to achieve that vision. WBA’s membership is comprised of major operators, identity providers and leading technology companies across the Wi-Fi ecosystem with the shared vision.

WBA undertakes programs and activities to address business and technical issues, as well as opportunities, for member companies. WBA work areas include standards development, industry guidelines, trials, certification and advocacy. Its key programs include NextGen Wi-Fi, OpenRoaming, 5G, IoT, Testing & Interoperability and Policy & Regulatory Affairs, with member-led Work Groups dedicated to resolving standards and technical issues to promote end-to-end services and accelerate business opportunities.

The WBA Board includes Airties, AT&T, Boingo Wireless, Broadcom, BT, Cisco Systems, Comcast, Deutsche Telekom AG, GlobalReach Technology, Google, Intel, Reliance Jio, SK Telecom and Viasat. For the complete list of current WBA members, click here.

MediaTek Announces Filogic Connectivity Family for WiFi 6/6E

Taiwan based MediaTek (one of only two 5G merchant silicon vendors) unveiled its new Filogic connectivity chip sets with the introduction of the Filogic 830 Wi-Fi 6/6E system-on-chip (SoC) and Filogic 630 Wi-Fi 6E network interface card (NIC) products. MediaTek said its new Filogic series of Wi-Fi 6/6E chipsets provide reliable connectivity, high computation functionalities and a rich set of features in highly integrated, power-efficient designs.

MediaTek Filogic Wi-Fi 6/6E products are certified by the Wi-Fi Alliance and deliver unbeatable performance in a wide range of applications.

- Home, business or enterprise router and repeater devices

- Service provider broadband equipment or retail devices

- Wi-Fi Alliance EasyMeshTM certified

- Home automation bridges and IoT

- Consumer devices and applications such as laptops, TVs, IP cameras, wireless storage, audio and more

MediaTek Filogic 830

Filogic 830 packs a wide variety of features into a compact, ultra-low power 12nm SoC, allowing customers to design differentiated solutions for routers, access points and mesh systems. The SoC integrates four Arm Cortex-A53 processors operating at up to 2GHz per core for up to +18,000 DMIPs processing power, dual 4×4 Wi-Fi 6/6E for up to 6Gbps connectivity, two 2.5 Gigabit Ethernet interfaces and a host of peripheral interfaces. Filogic 830’s built-in hardware acceleration engines for Wi-Fi offloading and networking enable faster and more reliable connectivity. In addition, the chipset also supports MediaTek FastPath™ technology for low latency applications such as gaming and AR/VR.

MediaTek Filogic 630

Filogic 630 is a Wi-Fi 6/6E NIC solution that supports dual-band, dual-concurrent 2×2 2.4GHz and 3×3 5GHz or 6GHz for up to 3Gbps. The chipset supports a unique 3T3R 5/6GHz system with internal front-end modules (FEMs) which provide equivalent or better range than competing 2T2R solutions with external FEMs. This highly integrated design helps lower bill of materials (BOM) cost, while allowing for sleeker designs with its small RF frontend area. Filogic’s 630’s third antenna enables superior transmit beamforming capability as well as diversity gains. Filogic 630 supports interfaces such as PCIe, which allows it to be combined with Filogic 830 for tri-band connectivity solutions for broadband gateways, enterprise access points and retail routers with even higher speeds and bandwidth capacity.

“The MediaTek Filogic series ushers in a new era of smart Wi-Fi solutions with extreme speeds, low latency and superb power efficiency for seamless, always connected experiences,” said Alan Hsu, Corporate Vice President & General Manager, Intelligent Connectivity at MediaTek. “These new chipsets provide best-in-class features with highly integrated designs for the next generation of premium broadband, enterprise and retail Wi-Fi solutions.”

MediaTek has the broadest Wi-Fi portfolio and is the No. 1 Wi-Fi supplier across broadband, retail routers, consumer electronics devices and gaming. MediaTek’s Wi-Fi portfolio powers hundreds of millions of devices every year. Over the years, MediaTek has worked closely with the Wi-Fi Alliance to ensure MediaTek’s connectivity portfolio supports the latest Wi-Fi features. In January 2021, MediaTek was selected to be on the test bed for Wi-Fi 6E, the latest certification from Wi-Fi Alliance® for Wi-Fi CERTIFIED 6™ devices with 6GHz support.

Wi-Fi 6E offers a number of advantages over previous Wi-Fi generations, including lower latency and additional capacity and speed. Devices using Wi-Fi 6 connections in 6GHz are designed to make use of wide 160 MHz channels and uncongested bandwidth in 6GHz to deliver multi-gigabit, low latency Wi-

About MediaTek Inc.

MediaTek Incorporated (TWSE: 2454) is a global fabless semiconductor company that enables nearly 2 billion connected devices a year. We are a market leader in developing innovative systems-on-chip (SoC) for mobile device, home entertainment, connectivity and IoT products. Our dedication to innovation has positioned us as a driving market force in several key technology areas, including highly power-efficient mobile technologies, automotive solutions and a broad range of advanced multimedia products such as smartphones, tablets, digital televisions, 5G, Voice Assistant Devices (VAD) and wearables. MediaTek empowers and inspires people to expand their horizons and achieve their goals through smart technology, more easily and efficiently than ever before. We work with the brands you love to make great technology accessible to everyone, and it drives everything we do. Visit www.mediatek.com for more information.

References:

https://www.mediatek.com/products/connectivity-and-networking/mediatek-filogic-wifi-6

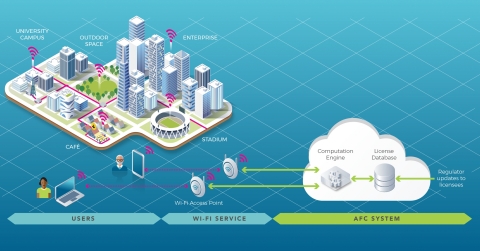

Broadcom, Cisco and Facebook Launch TIP Group for open source software on 6 GHz Wi-Fi

The purpose of this new TIP project group is to develop a common reference open source software for an AFC system. The AFC will be used by unlicensed devices in the newly available 6 GHz band to operate outdoor and increased range indoor while ensuring incumbent services are protected.

The US, EU, Canada, and Brazil, among others, have approved or are finalizing the approval of 6 GHz unlicensed spectrum use, opening up a huge bandwidth for Wi-Fi services.

By 2025, the Wi-Fi Alliance estimates that the 6 GHz Wi-Fi will deliver USD 527.5 billion in incremental economic benefits to the global economy [1]. Standard outdoor power operations will be a key part of the value proposition of 6 GHz Wi-Fi and is critical for enabling more affordable wireless broadband for consumer access.

The FCC is the first regulator to enable its use under an AFC, ISED Canada authorized standard power with AFC in May 2021, with others expected to follow. The AFC will enhance Wi-Fi to provide a consistent wireless broadband user experience in stadiums, homes, enterprises, schools, and hospitals.

“The 6 GHz Wi-Fi momentum is unmistakable. In the year following the historic FCC ruling to open up the band for unlicensed access, we already have an entire ecosystem of Wi-Fi 6E devices delivering gigabit speeds indoors. As we work towards closing the digital divide and further realizing the value of the 6 GHz band, AFC-enabled standard power Wi-Fi operation becomes critical. As Wi-Fi 7 comes along, AFC will turbocharge the user experience by enabling over 60 times more power for reliable, low latency, and multi-gigabit wireless broadband both indoors and outdoors. With this vision in mind, Broadcom is excited to join hands with Cisco and Facebook to create the TIP Open AFC Software Group aimed at enabling a cost effective and scalable AFC system,” said Vijay Nagarajan, Vice President of Marketing, Wireless Communications & Connectivity Division, Broadcom.

“The creation of the TIP Open AFC Software Group represents the immense momentum behind unlicensed spectrum and the potential it holds to deliver innovation,” said Rakesh Thaker, VP of Wireless Engineering, Cisco. “Many of the applications and use cases we’re just beginning to dream up with the introduction of Wi-Fi 6 and the 6 GHz spectrum will rely on standard power, greater range and reliability. This software group will play an important role in ensuring those applications can become reality, while also protecting important incumbent services. We’re thrilled to join Broadcom and Facebook on this effort, and to share a vision with TIP of providing high-quality, reliable connectivity for all.”

Facebook developed a proof of concept Open AFC system, which will protect 6 GHz incumbent operations and enable faster adoption of standard power operations in the 6 GHz band. This prototype system will be contributed to the TIP community through today’s launch of the Open AFC Software Group, with the goal of enabling the proliferation of standard power devices in the United States to start, with other markets to follow.

Broadcom and Cisco have committed to driving the industry forward in developing Open AFC to ensure that the code continues to be developed to meet the needs of the industry and regulators, such that an AFC operator could take the code and build upon it for rapid certification.

The vast majority of Wi-Fi use is indoors, but there are situations where people will want to use Wi-Fi outdoors. The use of AFC provides the flexibility for outdoor deployments in open air stadiums and similar venues.

“Bringing AFC technology to the TIP Open AFC Software Group is a huge milestone for the unlicensed spectrum community,” said Dan Rabinovitsj, vice president for Facebook Connectivity. “We are excited to see the contributions and innovations by Open AFC and we look forward to celebrating the widespread adoption of the 6 GHz band, which will rapidly accelerate the performance and bandwidth of Wi-Fi networks around the world”.

David Hutton, Chief Engineer of TIP, said: “The industry is coming together to support 6 GHz for unlicensed use for Wi-Fi and TIP will be providing the forum to contribute to make this happen, supporting regulatory efforts by ensuring that AFC systems are developed under a common code base that is available to all industry stakeholders.”

Closing Comment:

We wonder why this new WiFi 6GHz group is in TIP rather than the WiFi Alliance. From the WiFi Alliance Certified 6:

“Wi-Fi Alliance is leading the development of specifications and test plans that can help ensure that standard power Wi-Fi devices operate in 6 GHz spectrum under favorable conditions, avoiding interference with incumbent devices.”

In this author’s opinion, there are way too many alliances/ fora/ consortiums that produce specifications that are to be used with existing standards. In this case (IEEE 802.11ax) there is potential overlap amongst amongst groups, which leads to inconsistent implementations that inhibit interoperability.

References:

Rethink Research: Private 5G deployment will be faster than public 5G; WiFi 6E will also be successful

Introduction:

RAN Research, a division of Rethink Technology Research, says in a new report that private 5G network deployments will surge over the next few years faster than public 5G, reaching a peak in 2027 when they will generate $19.3 billion in equipment sales, before subsiding after that as saturation approaches.

There will be a similar boom in deployment of enterprise WiFi networks around the WiFi 6E standard (IEEE 802.11ax endpoints that are capable of operating at 6 GHz, as well as in the 2.4 GHz and 5 GHz spectra already used by Wi-Fi 6). They will offer greater capacity and performance than the current WiFi generation (IEEE 802.11ac, 802.11n, etc).

WiFi growth will be confined largely to North America and Europe, and will peak earlier in 2024, after which an increasing number of sites will swing to 5G for more demanding use cases.

Private 5G networks will generate annual revenues of US$19.3 billion worldwide in 2027, up from $1.5 billion this year, according to a new report written by Rethink analyst Caroline Gabriel. Growth will be at its fastest in the 2022-2025 period, peaking in 2027 and then declining towards the end of the decade as market saturation approaches, she notes.

By 2028 there will be 26.6 million private 5G networks deployed globally, a significant increase on the 1.1 million expected to be rolled out this year.

Image Courtesy of Qualcomm

These are key findings of the latest report, “Private Networks Driving Opportunities in 5G and WiFi” from RAN Research, the wireless forecasting arm of Rethink Technology Research. The forecast drills down into regions and vertical industry sectors, identifying manufacturing as a major driver for private enterprise 5G in line with the industry 4.0 revolution, but with strong growth across the board. Healthcare, transportation, energy and government stand out as other industry vertical where deployments of private 5G and WiFi 6E will flourish.

Executive Summary:

Private 5G networks are on the verge of rapid take off to generate a surge in annual revenues for network equipment from $1.5 billion in 2021 to $19.3 billion in 2027. Growth will be fastest in most markets from 2022 to 2025 before tailing off and declining towards the end of the period after 2027 as saturation approaches.

By 2028 there will be 26.6 million private 5G networks deployed around the world, up from 1.1 million in 2021. This growth will occur in all regions but will be most striking in the four countries leading the private 5G field now, the U.S., Germany, China and Japan. Of these four, China stands out for facing stronger regulatory resistance to private 5G where roll out is dominated by the three great stateowned monopolies, China Mobile, China Telecom and China Unicom. But strong upsurge from enterprises, including government agencies as well as manufacturers, looks like opening up the country ’ enterprise 5G field to rapid growth.

Image Courtesy of Qualcomm

Private wireless networks will be deployed at a faster rate than 5G as a whole in most markets, as mobile networks combined with edge compute become capable of meeting more use cases and enabling new applications in manufacturing process, UAVs, remote healthcare, advanced transportation and others.

WiFi 6E is on course for a similar growth trajectory as private 5G, tailing off later in the forecast period. It is true though that only the next generation WiFi 7 that will start being deployed after 2024 will close the gap on 5G in peak performance, capacity and low latency. Our forecast numbers for WiFi 6E also include early deployments of WiFi 7 without making any distinction. Certainly, until that 7th generation comes along, WiFi will lack the deterministic behavior required for the most demanding ultra low latency real time applications, such as control of UAVs. In these scenarios 5G will be preferred but WiFi will continue to coexist for applications where best effort performance is adequate. This will include some of those use cases touted for 5G under the eMBB category concerned mostly with high capacity, although WiFi 6E itself still has to justify investment in the upgrade from WiFi 5. 5G will emerge in some cases as an immediate alternative to WiFi 6E. There are also common factors affecting both private 5G and WiFi 6E roll out, such as chip shortages and other continuing impacts of the global Covid19 pandemic. All these will impede deployments in the short and medium term, with both service providers and their equipment suppliers reporting a slowdown resulting from changed working practices during the pandemic and disruptions within the supply chain.

For some enterprises where blanket indoor coverage is established there will be more concerted migration from WiFi to cellular for private wireless communications. But unless such 5G coverage is almost ubiquitous, users will continue with WiFi and indeed penetration will increase around new best effort use cases.

Copyright © 2021 Rethink Research, All rights reserved.

………………………………………………………………………………………………

References:

https://rethinkresearch.biz/reports-category/ran-research/

China to drive private 5G network growth despite regulatory headwind– research

Aruba Introduces Industry’s 1st Enterprise-Grade Wi-Fi 6E Access Point

HPE subsidiary Aruba today announced the first commercially available, enterprise-grade Wi-Fi 6E [1.] solution set – the 630 Series of campus access points (APs), starting with the AP-635.

Note 1. Wi-Fi 6E refers to IEEE 802.11ax (Wi-Fi 6) products that support 6GHz wireless spectrum. Wi-Fi 6E enables faster speeds and lower latencies than Wi-Fi 6 and earlier iterations of WiFi (IEEE 802.11). WiFi 6 products are starting to appear in routers [2.] and silicon. Cisco has been selling a WiFi AP for enterprises since 2019.

Note 2. List of best WiFi 6 routers:

- Asus RT-AX86U. The best Wi-Fi 6 router overall. …

- Netgear Nighthawk RAXE500. The Wi-Fi 6e speed demon. …

- Netgear Orbi with Wi-Fi 6 (RBK852) Best Wi-Fi 6 mesh router. …

- Netgear Nighthawk XR1000. …

- Eero Pro 6. …

- Netgear Nighthawk AX8 (RAX80) …

- TP-Link Deco X20. …

- Linksys Max Stream MR9600

In April 2020, the Federal Communications Commission (FCC) allocated 1,200 megahertz of spectrum in the 6 GHz band for unlicensed WiFi use. That was the largest swath of spectrum approved for WiFi since 1989. Opening the 6 GHz band more than doubles the amount of RF spectrum available for Wi-Fi use, allowing for less congested airwaves, broader channels, and higher-speed connections and enabling a range of innovations across industries. Since the FCC decision to open the 6 GHz band, 39 additional countries that are home to over 1.3 billion people have opened the 6 GHz unlicensed band for Wi-Fi 6E. (Source: Wi-Fi Alliance)

The industry’s first enterprise-grade Wi-Fi 6E solution, the new Aruba 630 Series delivers greater performance, lower latency, and faster data rates to support high-bandwidth applications and use cases. The new Aruba 630 Series APs will be available in calendar third quarter 2021.

Currently, as organizations increase their use of bandwidth-hungry video, cope with increasing numbers of client and IoT devices connecting to their networks, and speed up their transition to cloud, the demand for Wi-Fi continues to rise. As a result, wireless networks are becoming oversubscribed, throttling application performance. This frustrates all network users by negatively impacting the user experience, reduces productivity, puts digital initiatives at risk, and stifles innovation.

“The Aruba 630 Series campus access points are the first enterprise-grade WiFi 6E access points to be introduced by any of the main enterprise networking providers,” Gayle Levin, marketing manager at Aruba, wrote in response to questions. “We’re seeing the most interest from large public venues, such as airports, stadiums, and lecture halls, as well as healthy interest from health care and higher education,” she added.

“With connectivity demands growing exponentially, Wi-Fi 6E can take advantage of up to seven, super wide 160 MHz channels and uncongested bandwidth in the 6 GHz band to deliver unprecedented multi-gigabit and low latency connectivity,” said Kevin Robinson, SVP of Marketing at Wi-Fi Alliance. “Wi-Fi 6E will spur enhanced innovations and exciting new services. Wi-Fi Alliance is pleased to see longtime member Aruba bringing Wi-Fi 6E solutions to market that will help organizations better support critical activities like videoconferencing, telemedicine, and distance learning.”

According to leading market intelligence research firm 650 Group, Wi-Fi 6E will see rapid adoption in the next couple of years, with over 350M devices entering the market in 2022 that support 6 GHz. 650 Group expects over 200% unit growth of Wi-Fi 6E enterprise APs in 2022.

The new Aruba Wi-Fi 6E solutions are part of Aruba ESP (Edge Services Platform), the industry’s first AI-powered, cloud-native platform designed to unify, automate, and secure the Edge. Able to predict and resolve problems at the network edge before they happen, Aruba ESP’s foundation is built on AIOps, Zero trust network security, and a unified campus to branch infrastructure to deliver an automated, all-in-one platform that continuously analyzes data across domains, tracks SLAs, identifies anomalies, and self-optimizes, while seeing and securing unknown devices on the network.

With Aruba’s new Wi-Fi 6E offerings, organizations can take advantage of the increased capacity, wider channels in 6 GHz, and significantly reduced signal interference with 3.9 Gbps maximum aggregate throughput to support high bandwidth, low latency services and applications such as high definition video, next-generation unified communications, augmented reality/virtual reality (AR/VR), IoT, and cloud. Additionally, with a new ultra tri-band filtering capability, which minimizes interference between the 5 GHz and 6 GHz bands, organizations can truly maximize use of the new spectrum.

“As we progress in our digital transformation, we are continually adding an increasing number of IoT devices to our network and transitioning to Wi-Fi as our primary network connection rather than Ethernet. We are being asked to support an expanded array of mission-critical, high bandwidth applications that support research as well as hyflex learning and entertainment, like streaming video, video communications, and AR/VR for our students, professors, and staff,” said Mike Ferguson, network manager and enterprise architect at Chapman University.

“With Aruba’s Wi-Fi 6E APs, we’re confident that we’ll be able to not just support our short-term needs, but we’ll have room to grow as well, which will keep all of our users happy, increase our competitiveness, and allow us to extend the lifecycle of this network deployment by 50%,” he added.

Aruba 630 Series Access Point Key Features:

- Comprehensive tri-band coverage across 2.4 GHz, 5 GHz, and 6 GHz with 3.9 Gbps maximum aggregate data rate and ultra-triband filtering to minimize interference

- Up to seven 160 MHz channels in 6 GHz to better support low-latency, high bandwidth applications like high-definition video and AR/VR

- Operates on existing IEEE 802.3at standards for PoE power so there is no need to rip and replace existing power supplies

- Advanced security with WPA3 and Enhanced Open to better protect passwords and data

- Flexible failover with two HPE Smart Rate Ethernet ports for 1-2.5 Gbps, offering true hitless failover from one port to another for both data and power

- Application assurance to guarantee stringent application performance for latency sensitive and high bandwidth uses by dynamically allocating and adjusting radio resources

- Cloud, controller, or controllerless operation modes to address campus, branch, and remote deployments

“Consumer appetite for ubiquitous wireless connectivity is limitless, whether at home or traveling the world,” said Mike Kuehn, president at Astronics CSC. “As a leading global provider of advanced technologies for the aerospace and defense industries – including some of the largest major airlines in the world – Aruba’s new Wi-Fi 6E AP gives us the ability to offer compelling and unique solutions that deliver a new, enhanced and more secure wireless experience to our customers.”

“Aruba has two decades of leadership in Wi-Fi innovations, backed by an unwavering commitment to providing our customers with the reliable, fast, high capacity, and secure connectivity they need to pursue and exceed their organizational objectives,” said Chuck Lukaszewski, vice president and wireless chief technology officer at Aruba.

“Since 2016 we have helped lead the advocacy effort that has led to the 6 GHz band being opened all over the world. As such, we are extremely proud to be the first vendor to bring enterprise-grade Wi-Fi 6E solutions to market so our customers can take advantage of the huge increase in capacity that 6 GHz delivers,” he added.

Aruba is also framing the new WiFi 6E access points as “an important element of Aruba’s Edge Services Platform (ESP)” because the equipment will sit at the edge of the network, Levin added. “By virtue of their position and role within the network, access points are vital in collecting edge data from client devices and IoT that feeds back into Aruba ESP.”

The vendor entered the edge services market with the cloud-native platform last year to target campuses, data centers, branches, and remote workers, but it only works with Aruba’s access points, switches, and SD-WAN gateways.

…………………………………………………………………………………………………………………………………….

References:

https://www.businesswire.com/news/home/20210525005243/en/

https://www.sdxcentral.com/articles/news/aruba-claims-first-enterprise-wifi-6e-aps/2021/05/

https://www.tomsguide.com/news/wi-fi-6e-explained

North Carolina School District deploys WiFi 6 from Cambium Networks; WiFi 6 vs 6E Explained

FCC to open up 6 GHz band for unlicensed use – boon for WiFi 6 (IEEE 802.11ax)