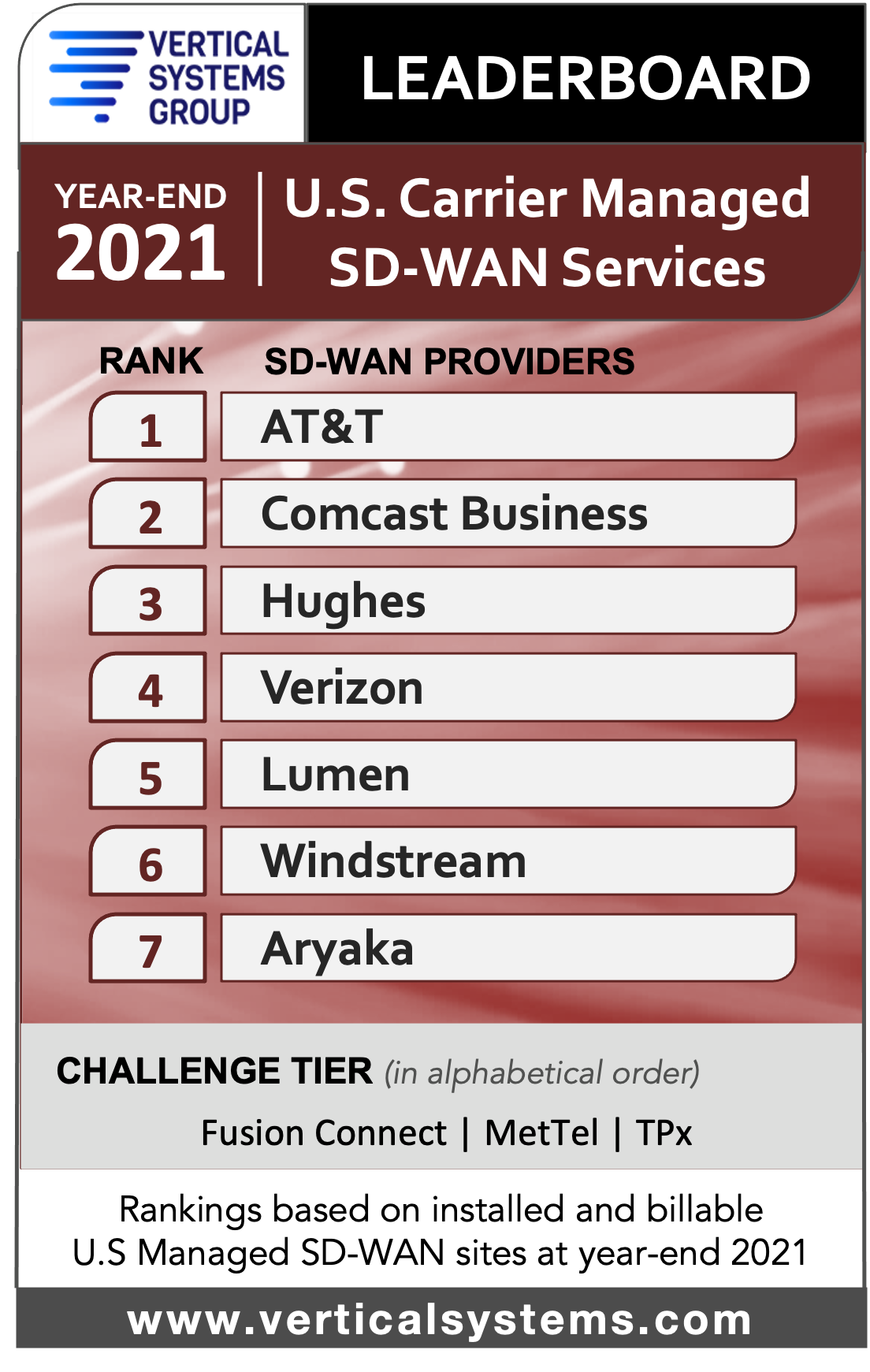

AT&T tops VSG’s U.S. Carrier Managed SD-WAN Leaderboard for 4th year

AT&T continues as the #1 U.S. Carrier Managed SD-WAN provider in 2021 for the fourth consecutive year, as per Vertical Systems Group’s annual SD-WAN Leaderboard. Seven service providers each have 2% or more of the installed and billable Carrier Managed SD-WAN customer sites in the U.S. as of December 31, 2021.

“The U.S. Managed SD-WAN services market emerged from the pandemic in 2021 with solid growth in new site installations, driven by accelerated network transformations and more flexible solutions for customers,” said Rick Malone, principal of Vertical Systems Group. “Competition is heating up as evidenced by the shake up in top provider rankings on our year-end 2021 U.S. LEADERBOARD benchmark.”

Comcast Business rose two places to the No. 2 position on the Leaderboard, bumping down Hughes and Verizon to third and fourth place, respectively. Vertical Systems Group (VSG) says that Comcast Business’s rise on the Leaderboard is due to “organic growth” plus sites added from the acquisition of Masergy.

Three companies attained a Challenge Tier citation for 2021 (in alphabetical order): Fusion Connect, MetTel and TPx. This tier includes service providers with between one percent 1% and 2% share of U.S. Carrier Managed SD-WAN sites.

Research Highlights:

- Rankings changed for five of the seven market leading providers on Vertical’s 2021 U.S. Carrier Managed SD-WAN LEADERBOARD based on latest site share results as compared to the previous year.

- AT&T retains first position overall for the fourth consecutive year.

- Comcast Business rises to second position, up from fourth in 2020 based on site share that includes organic growth plus sites added from its Masergy acquisition.

- Hughes moves to third position, from second overall in 2020. Verizon moves into fourth position, a change from third in the previous year.

- Lumen advances to rank fifth, up from sixth position. Windstream drops to sixth position from fifth in 2020. Aryaka retains seventh position and rounds out the roster of top providers for 2021.

- Additionally, TPx drops into the 2021 Challenge Tier from the Leaderboard.

- MEF 3.0 SD-WAN Service Certification has been attained by five of the 2021 U.S. LEADERBOARD companies: AT&T, Comcast Business, Verizon, Lumen and Windstream. Each of these providers also has employees with MEF SD-WAN Certified Professional training certification.

- Primary technology suppliers to the service providers ranked on the 2021 Carrier Managed SD-WAN LEADERBOARD include Cisco, Fortinet, Versa and VMware. Additionally, SD-WAN providers Aryaka and Hughes utilize internally developed technologies.

Market Players include providers selling Carrier Managed SD-WAN services in the U.S. with site share below 1%, including global network providers that manage U.S. customer sites. For 2021, the Market Player tier includes the following companies (in alphabetical order):

AireSpring, American Telesis, Arelion, Astound Business, Bigleaf, bSimplify, BT Global Services, C Spire Business, CentraCom, Cincinnati Bell, Cogent, Colt, Consolidated Communications, Cox, Crown Castle, DQE Communications, FirstLight, Frontier, Great Plains Communication, GTT, InfoStructure, Intelsat, Lightpath, Logix Fiber Networks, Meriplex, NTT, Orange Business, PCCW Global, PS Lightwave, SDN Communications, Segra, SES, SingTel, Sparklight Business, Spectrum Enterprise, Syringa, T-Mobile, T-Systems, Tata, Telefonica, Telstra, Transtelco, Unite Private Networks, Uniti, Veracity Networks, Virgin Media Business, Vodafone, Zayo and others.

Vertical’s Definition – Carrier Managed SD-WAN Service:

Vertical Systems Group defines a Carrier Managed SD-WAN Service for segment analysis and share calculations as a carrier-grade offering for business customers that is managed by a network operator. Required components and functionality for these offerings include an SDN service architecture that provides dynamic optimization of traffic flows, a purpose-built SD-WAN appliance or CPE-hosted SD-WAN VNF at each customer edge site, support for multiple active underlay connectivity services, automated failover fast enough to maintain active sessions, and centralized network orchestration with traffic and application visibility end-to-end. Security capabilities may be supplied by a managed SD-WAN service provider based on customer requirements.

Telstra to build 3 new teleports for OneWeb in Southern Hemisphere

Telstra is building and maintaining three new dedicated teleports across Australia to provide satellite gateway services for OneWeb in the Southern Hemisphere.

The first of the new teleports, located in Darwin Tivendale, is scheduled to begin installation this month with go-live planned in July. Two further sites – Charlton Toowoomba and Wangara, Perth, WA – are planned for completion later in 2022. Each facility will provide turnkey ground station support for OneWeb’s growing fleet of low-earth orbit (LEO) satellites. These facilities are being delivered as part of a 10-year deal between Telstra and OneWeb.

Telstra’s turnkey approach for OneWeb includes designing, building and activating the teleports with ground station capabilities to meet OneWeb’s requirements. Telstra will also provide 24/7 monitoring and quality assurance services at each location.

“OneWeb had exacting requirements from the outset, and we worked in close partnership with them from site selection through construction,” said Vish Vishwanathan, Vice President Wholesale & Satellite, Telstra Americas. “Teleports are complex sites involving access to secure and resilient infrastructure and on-the-ground expertise, which Telstra has provided to OneWeb throughout this project.”

A new teleport in Darwin, Australia, one of three satellite gateways built by Telstra under a 10-year deal with OneWeb to deliver global connectivity.

…………………………………………………………………………………………………………………

Telecom network providers typically own and operate significant terrestrial and subsea assets, including fiber networks, IP backbones and data centers. These resources provide the critical ground service required to support satellite operators’ growing constellations, reduce their costs of entry into new markets and minimize the need for personnel to maintain their own terrestrial infrastructures.

“Low Earth Orbit satellite technology is transforming the global connectivity landscape, not only by creating new business opportunities, but also giving more businesses, communities and governments the internet access they need for progress,” said Michele Franci, Chief of Delivery and Operations at OneWeb. “More connectivity options benefit everyone and our approach in establishing strategic partnerships with experienced providers like Telstra is core to how we deliver the OneWeb mission.”

OneWeb has 428 satellites in orbit, about two-thirds of its constellation. The satellite internet firm is providing coverage above the 50th parallel North – reaching areas that have historically been hard to connect with distributed communities and challenging terrain. This includes Alaska, Canada, and the wider Arctic Region. Earlier in March, OneWeb signed an MOU with Telstra to explore new connectivity solutions for Australia and the Asia pacific regions.

Earlier this month OneWeb and Telstra announced a memorandum of understanding to look at ways to improve digital connectivity for Telstra customers in Australia and the Asia Pacific region.

“We see lots of opportunities for our consumer, small business and enterprise customers using LEO satellite connectivity – from backhaul to back-up for resiliency, from internet of things to supporting emergency services, from home broadband to supporting agritech,” Andrew Penn, Telstra CEO said in a statement.

…………………………………………………………………………………………………………….

About Telstra:

Telstra is a leading telecommunications and technology company with a proudly Australian heritage and a longstanding, growing international business. We have been operating in the Americas for over 25 years and provide data and IP transit, internet connectivity, network application services such as unified communications and cloud, and managed services to over 500 businesses in 160 cities in the region. Our products and services are supported by one of the largest fiber optic submarine cable systems reaching Asia-Pacific and beyond, with licenses in Asia, Europe and the Americas, and access to more than 2,000 points-of-presence around the world. Through our unparalleled network reach and reliability as well as market-leading customer service and expertise, we connect businesses in the Americas to some of the world’s fastest growing economies, including China, Southeast Asia, North Asia, and Australia. For more information, please visit www.telstra.com/americas.

About OneWeb:

OneWeb is a global communications network powered from space, headquartered in London, enabling connectivity for governments, businesses, and communities. It is implementing a constellation of Low Earth Orbit satellites with a network of global gateway stations and a range of user terminals to provide an affordable, fast, high-bandwidth and low-latency communications service, connected to the IoT future and a pathway to 5G. More at http://www.oneweb.world

References:

https://spacenews.com/telstra-teleports-for-oneweb/

BT in new distribution partner agreement with OneWeb for LEO satellite connectivity

AT&T and OneWeb: Satellite Access for Business in Remote U.S. Areas

OneWeb Launches 36 LEO satellites, 254 in orbit, funding deals & UK coverage too!

Revitalized OneWeb challenges SpaceX/Starlink & Amazon/Kuiper for Broadband Satellite Service

USPTO: No clear winners in 5G patent filings; caution urged when reviewing claims of “5G dominance”

A report published in February 2022 examines which companies have filed for patents at the USPTO (US Patent and Trademark Office) in four technologies: Management of Local Wireless Resources, Multiple Use of Transmission Path, Radio Transmission Systems, and Information Error Detection or Error Correction in Transmission Systems. USPTO says that approach narrowed the focus to patent flings on technologies central to 5G innovation. The report concludes that there’s no clear lead to be seen: “The findings of the report call into question claims that any single firm or country is ‘winning’ the 5G technology race.“

Six companies topped the results, none with any notable lead. They were: Ericsson, Huawei, LG, Nokia, Qualcomm and Samsung. The report notes that while ZTE often is mentioned as a competitor to those six firms, it filed far fewer patents outside of China during the study period. The report authors did a textual analysis of the 22,000-plus patent filings studied to see if any of these competing firms stood out in particular attributes. Here, more subtle differences emerged.

Qualcomm’s patents had the most “legal breadth,” in the sense of making shorter (and therefore generally broader) claims about covered inventions; Ericsson and Nokia ranked higher for “radicalness,” meaning they cited less prior art as references; and Qualcomm and Samsung did well on “technical relevance,” or how often other patents cited their own patents or applications as prior-art references.

The USPTO report references a January 6, 2021 directive from the NTIA (National Telecommunications and Information Administration), the “National Strategy to Secure 5G Implementation Plan,” in which the NTIA sought “an informed understanding of the global competitiveness and economic vulnerabilities of United States 5G manufacturers and suppliers.”

This line from the USPTO report is significant: “Given the complexity of the results, caution is recommended when reviewing media claims of 5G dominance.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Here’s Statista’s take on leading 5G patent holders (as of February 2021):

An IEEE Techblog post from March 2021 examined claims that Huawei and Samsung were the leaders in 5G SEPs (Standard Essential Patents). Earlier related IEEE Techblog posts are listed in the References.

Even though there is no definition of 6G (while 5G standards and frequency arrangements are woefully incomplete), an April 2021 report authored by the Chinese Patent Office states that China currently holds 35% of all 6G patents worldwide. The report urged China to “utilize its technological advantage in 5G to continue staying ahead.”

–>If you believe that, I’d like to sell you a 6G smart phone!

References:

https://www.uspto.gov/sites/default/files/documents/USPTO-5G-PatentActivityReport-Feb2022.pdf

https://www.lightreading.com/5g/uspto-study-everyones-winner-in-5g-patents/d/d-id/776174?

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

Wireless Logic’s Conexa network for global IoT has £2 million revenue target in 1st year

Global IoT connectivity platform provider Wireless Logic has launched a new carrier-grade mobile network called Conexa, built to provide connectivity for companies deploying IoT devices and applications worldwide. Will this one succeed while early leader Sigfox failed (and is now in bankruptcy)?

The new cellular network will provide a single SIM for global deployments, offering a range of connectivity solutions, network control and security services for regional, national and global IoT deployments. It offers single and multi-network options, and commercial models for low and high data use.

Conexa provides a suite of connectivity solutions, network control and security services for global, national and regional deployments and is built over an ecosystem of leading mobile network operators (MNOs). It provides single or multi-network options and commercial models suited to both low and high data use according to application type.

“Mobile networks, and the infrastructure around them, were largely developed before the IoT existed, at a time when only the voice and data needs of people needed to be met,” said Oliver Tucker, Co-Founder and CEO, Wireless Logic.

“The IoT has particular requirements and for it to continue to grow, innovate and thrive, companies need a simple way to deploy and manage their solutions. That requires specific on-SIM, on-device and core network IoT services which is why Conexa is built for the IoT and aggregates the world’s best 4G, 5G and LPWAN radio networks.”

“This network has been built for enterprise businesses and those looking to roll out a global IoT deployment. Wireless Logic’s revenue target in year one is £2 million with rapid growth thereafter ahead of industry CAGR.”

Conexa is GSMA-certified and designed to meet the procurement, manufacturing, and logistics challenges that IoT companies face, providing flexible and scalable implementation, integration and day-to-day operation.

Advanced on-SIM applications, distributed networking, real time controls and cloud integration simplify deployments. Unique on-SIM control functions detect and initiate fail-over, as required, to alternative radio and core network infrastructure to protect mission critical applications.

Conexa enables robust, secure and scalable IoT solutions through:

- Global coverage with a range of local connectivity solutions in key G20 markets and beyond, compliant with permanent roaming and data sovereignty regulations

- Always-on connectivity through a dual redundant core network with automatic failover to ensure high-availability needs can be met

- Tailored connectivity solutions according to lifecycle stages, from factory to field, with advanced remote provisioning of eSIM, iSIM and multi-IMSI SIMs, which also help take cost and complexity out of procurement, manufacturing and distribution processes through single product stock keeping units

- Enhanced flexibility and resilience from on-SIM technologies and rules-based remote SIM provisioning

- Security which can be enhanced through on-SIM security applications and network protection features including IMEI locking, white or blacklisting, and private APN and VPN

- SIMPro, an industry leading management platform for SIM and device management, diagnostics and intelligence that provide insight and control of deployments.

“We designed Conexa with flexibility, scalability and usability in mind – as these are fundamental requirements for IoT managers and device manufacturers. For the IoT to continue to grow, innovate and thrive, companies need a simpler way to deploy and manage their solutions. Conexa has been designed to do just that,” Tucker added.

References:

Google’s Equiano cable system will span the west coast of Africa

First announced in 2019, the Equiano system is the third international submarine cable to be owned by Google and their fourteenth submarine cable investment in total. The Equiano cable system is expected to be ready for service by the end of this year.

It is named after Olaudah Equiano, an 18th century writer and abolitionist originally from what is now Nigeria. Enslaved as a child, Equiano purchased his freedom in 1766 and went on to play a major role in the British anti-slave trade movement of the 1780s.

The cable is set to span the West Coast of Africa, travelling from Lisbon, Portugal, down to Cape Town, South Africa, offering a myriad of branching opportunities to neighbouring African countries on the way. Branches already planned include those to Nigeria, St. Helena, Democratic Republic of the Congo, and Namibia, with many more likely to be announced later this year. Please see illustration below.

When previously announced, the system’s first African landing was expected to be at Lagos, Nigeria, but discussions between Google and the Togolese government – particularly surrounding the latter’s Togo Digital 2025 strategy, which aims to make the nation a regional digital hub – saw Togo’s capital Lome jump the queue.

Togo’s minister for digital economy and digital transformation, said her government successfully made the case to Google that it should be Togo instead.

“Togo, which was not on the list of beneficiary countries of the first cohort, was integrated after several months of negotiations and it becomes the first African country to host the cable,” said the Togolese Minister of Digital Economy and Digital Transformation, Cina Lawson.

“As Togo continues to earn its place on the regional and international stage as a digital hub and a favorable ecosystem for innovation and investment, our collaboration with Google and CSquared in successfully landing Equiano further demonstrates Togo’s commitment to enhancing public and social services for all citizens so that they can benefit economically.”

Lome is already a host to two submarine cable systems: the West Africa Cable System (WACS), which spans a similar route to Equiano but continues north to London, UK, and the shorter Maroc Telecom West Africa cable, which travels from Casablanca, Morocco, down to Libreville, Gabon.

The Equiano cable system will be maintained and operated by CSquared Woezon, a joint venture of open access wholesale broadband infrastructure company CSquared and the Société d’infrastructures numériques (SIN), a sovereign entity responsible for holding strategic assets in the telecommunications and ICT sector in Togo. The joint venture, in which CSquared holds a 56% stake, will also manage the related e-Government and Communauté Electrique du Bénin (CEB) terrestrial fibre networks in Togo.

According to Google, the cable system, which comprises 12 fiber pairs and a design capacity of 150 Tbps, should create roughly 37,000 jobs in Togo between 2022 and 2025, as well as boosting the nation’s GDP by $193 million.

References:

https://qz.com/africa/2143897/googles-equiano-cable-is-making-its-first-landing-in-togo/

UK’s Manufacturing Technology Centre (MTC) installs a standalone 5G private network from BT and Nokia

BT is participating in a UK publicly funded 5G Standalone (SA) core network testbed project with Nokia. Officially unveiled this week, the project involves installation of Nokia’s 5G SA equipment at Coventry’s Manufacturing Technology Center (MTC).

This project is part of the West Midlands 5G (WM5G) initiative, which is supported by the UK government’s 5G Test Beds and Trials funding program. It will give SMEs, corporate members, neighboring universities, and the wider industry the opportunity to explore private 5G and on-premises multi-edge computing to drive forward innovation in the region beyond the duration of the programme.

The goal is to “explore private 5G and on-premises multi-edge computing to drive forward innovation in the region beyond the duration of the program,” according to the group’s announcement.

Businesses and universities, along with “wider industry,” are given the chance to use MTC facilities to test the technology. This includes the center’s recently launched “5G-enabled demonstrator system,” which provides features such as 5G-connected robotics, computer vision and edge computing.

One use case under review is an “automated inspection process” to prove how intelligent automation and advanced connectivity could enable manufacturing sites to maximize productivity and utilization of inspection technology (while also reducing footprint and product waste).

MTC points out that traditional in-person inspections can be time consuming and prone to human error. Neither are they automatically recorded.

BT Enterprise CEO Rob Shuter told Light Reading: “It’s why 5G conversations in the enterprise space are more around deploying a private network over a manufacturing facility, a harbor, a military base etc,” he said. “I’d say we’re in the early stages of that. The technology is still maturing and customer needs are sort of emerging in a co-creation phase. I think we’ll be in that phase for most of this year, and it’ll probably be industrial scaling in ’23, ’24 and ’25.”

BT’s new Division X is spearheading the company’s efforts to sell new solutions to enterprise customers. Marc Overton, former Sierra Wireless SVP, was recently appointed Division X managing director.

Quotes:

Andy Street, Mayor of the West Midlands, said: “This innovative collaboration between WM5G and MTC will enable some of our region’s most cutting-edge businesses to power forward their pioneering work in computing and robotics alongside our dynamic universities. Given the commitment to Innovation Accelerators set out in the Levelling Up White Paper, this announcement is wonderfully timed”.

Robert Franks, Managing Director at WM5G, said: “Manufacturing is at the heart of the economy in the West Midlands, and at WM5G we are working collaboratively with our partners to ensure that public and private sector organisations can remain competitive in the global marketplace and develop cutting edge technologies to advance their capabilities.

“We are so pleased to have delivered a successful trial in partnership with nexGworx and BT at the MTC, driving forward the transformation of manufacturing productivity for the region. The learnings and outcomes from our demonstration will now be used and applied across the sector to ensure best practice is carried forward, and to accelerate the adoption of 5G technology more widely.”

Alejandra Matamoros, Technology Manager in the MTC’s Digital Engineering Group, said: “Our connected facility at the MTC will allow manufacturers of all sizes, research, and technology suppliers to explore the benefits of 5G in manufacturing. Through our enduring collaboration with nexGworx and BT we are now planning to further build on the initial capability we’ve created here at the MTC to push the boundaries of what can be achieved with the help of 5G technology.

“We hope that this project will inspire further development of innovative solutions to solve real business challenges and develop new opportunities through advanced wireless connectivity.”

https://www.lightreading.com/5g/bt-gets-into-5g-sa-testbed-with-nokia/d/d-id/776162?

Dish Network to FCC on its “game changing” OpenRAN deployment

Through disaggregation of the Radio Access Network (RAN) into functional blocks/modules and defining open interfaces between those modules, OpenRAN technology promises to allow newer, smaller players to sell into the 4G/5G equipment market. The intent is to offer more choices for cellular network operators who buy most of their gear from 4 or 5 big base station vendors.

Open RAN has been endorsed by 5G upstarts like Dish Network and Rakuten in Japan, but also by five big European carriers – Deutsche Telekom, Orange, Telecom Italia (TIM), Telefónica and Vodafone – which want to build an Open RAN ecosystem in Europe. AT&T has also expressed interest in the technology. However, there remains a lot of skepticism, especially for brownfield carriers.

…………………………………………………………………………………………………………………..

On March 14th, Dish Network executives participated in a video conference with a several FCC officials to discuss the company’s plans to launch a nationwide 5G network using Open RAN technology. Present on behalf of DISH were Stephen Bye, Chief Commercial Officer; Marc Rouanne, Chief Network Officer; Jeffrey Blum, Executive Vice President, External and Legislative Affairs; Sidd Chenumolu, Vice President, Technology Development; Alison Minea, Vice President, Regulatory Affairs; William Beckwith, Director of Wireless Regulatory Affairs; Hadass Kogan, Director & Senior Counsel, Regulatory Affairs; and Michael Essington, Senior Manager, Public Policy.

According to a Dish filing, the FCC requested the meeting to learn more about how Dish plans to deploy OpenRAN, rather than traditional purpose built RAN equipment, to build their 5G cellular network.

Ahead of its June 14, 2022 buildout milestone, DISH is launching a first-of-its-kind, cloud native, virtualized O-RAN 5G network in several major metropolitan areas of the country. Because DISH is building a greenfield network, we have the flexibility to choose the best technology to enter the market. While legacy carriers built closed end-to-end networks, DISH chose O-RAN because, among other reasons, it offers lower capital and operating costs, and is more resilient, secure, and energy efficient. In cooperation with more than 30 technology partners, DISH will offer a real-world example of the benefits of O-RAN as our 5G network rolls out to customers this year.

If more American carriers see the benefits of O-RAN and are able to adopt it as their networks evolve, the United States will be a stronger competitor in the global market. O-RAN is a game changer, among reasons, because:

- O-RAN networks increase vendor diversity

- O-RAN enhances spectrum utilization and enables network slicing

- O-RAN supports national security and cybersecurity objectives

- O-RAN networks are more secure and more agileO-RAN networks are more secure and more agile

In February 2021, the FCC published an OpenRAN Notice of Inquiry, stating:

Some parties assert that open radio access networks (Open RAN) are a potential path to drive 5G innovation, with industry proponents arguing that it could provide opportunities for more secure networks, foster greater vendor diversity, allow for more flexible network architectures, lower capital and operating expenses, and lead to new services tailored to unique use cases and consumer needs; others contend that Open RAN is still in its most formative stages, and that while promising, significant work remains before the benefits of the concept can fully be realized.

This Notice of Inquiry seeks input on the status of Open RAN and virtualized network environments: where the technology is today and what steps are required to deploy Open RAN networks broadly and at scale. It also seeks comment on whether and, if so, how deployment of Open RAN-compliant networks could further the Commission’s policy goals and statutory obligations, advance legislative priorities, and benefit American consumers by making state-of-the-art wireless broadband available more quickly and to more people in more parts of the country.

The financial analysts at New Street Research, say that U.S. government legislation could pave the way for “$1.5 billion for the Public Wireless Supply Chain Innovation Fund to deploy Open RAN equipment to spur movement toward open architecture, software-based wireless technologies and funding innovative leap-ahead technologies in the US mobile broadband market.”

The analysts added, “That provision might be of particular value to Dish, which is building out its network based on that technology.”

References:

https://www.lightreading.com/open-ran/fcc-calls-on-dish-about-open-ran/d/d-id/776166?

https://www.nokia.com/about-us/newsroom/articles/open-ran-explained/

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

https://www.sdxcentral.com/articles/news/dish-missed-every-5g-commitment-it-made-in-2021/2021/12/

New Study: Internet and Mobile Services were less affordable in 2021

Internet connectivity became less affordable worldwide in 2021, according to new data from the ITU-D and the Alliance for Affordable Internet (A4AI).

The new study shows an increase in fixed and mobile broadband costs during the pandemic. Relative prices of fixed broadband services increased to 3.5 percent of gross national income (GNI) per capita worldwide in 2021, from 2.9 percent in 2020. The relative price of mobile broadband services worldwide increased from 1.9 percent to 2 percent of GNI per capita.

It shows that many people have sacrificed other services and goods to start connected during the pandemic, with those who can staying largely connected, even at relatively higher prices. The report shows that fewer economies worldwide meet the UN Broadband Commission’s affordable cost target of 2 percent of monthly GNI per capita for entry-level broadband.

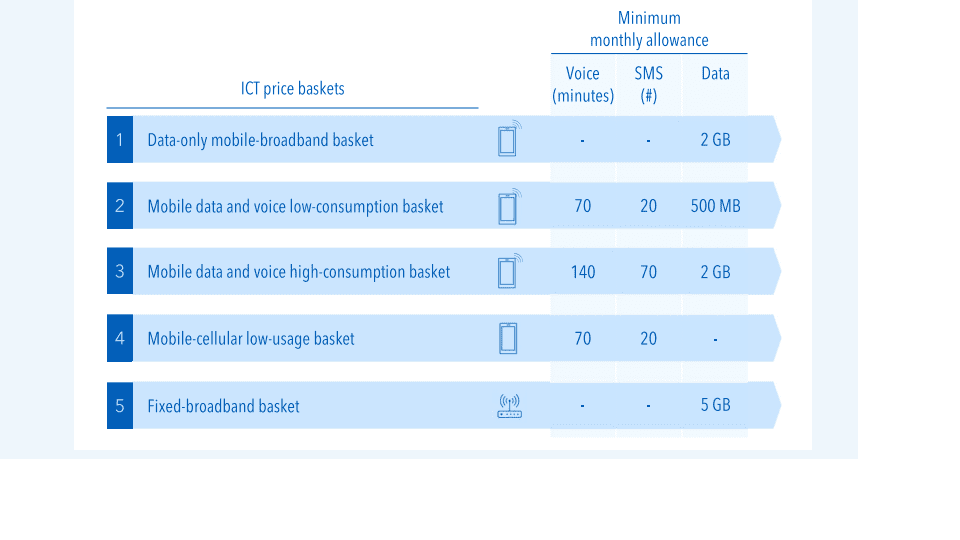

The policy brief analyzes the prices of five baskets: mobile broadband, fixed broadband, mobile data and voice low-usage, mobile data and voice high-usage and mobile cellular low usage. The figure below provides a simplified overview of the each of the five baskets used in the 2021 data collection.

https://www.itu.int/en/ITU-D/Statistics/Pages/ICTprices/default.aspx

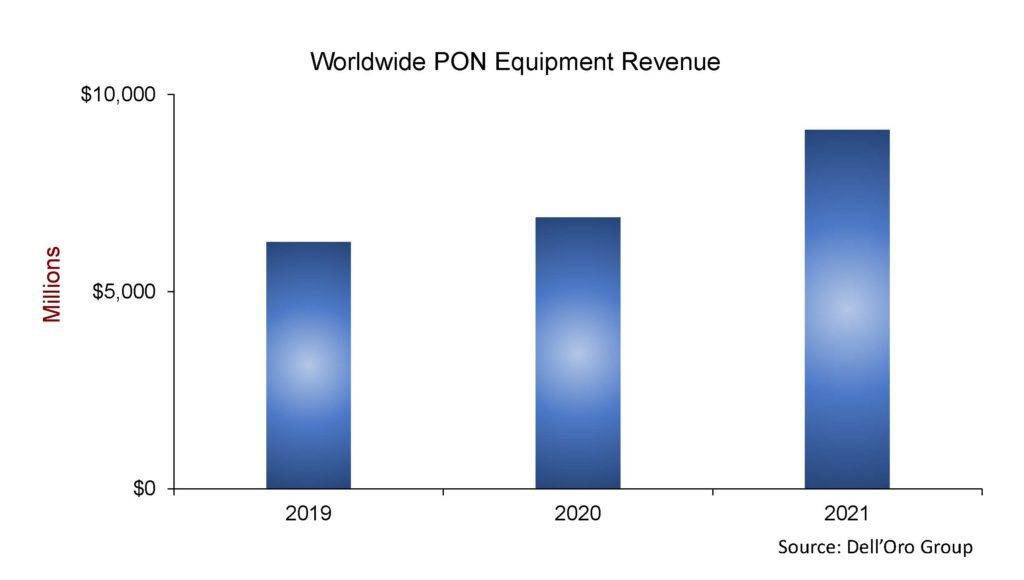

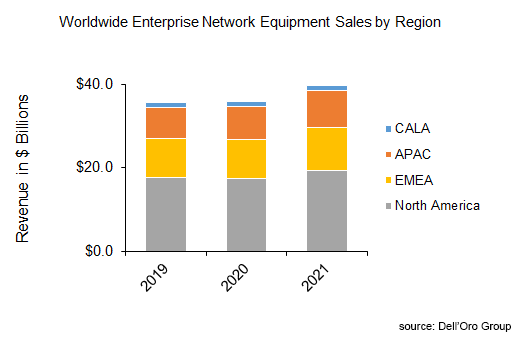

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

According to a newly published report by Dell’Oro Group, total global revenue for the Broadband Access equipment market increased to $16.3B in 2021, up 12 percent year-over-year (Y/Y). Growth came once again from spending on both PON infrastructure and fixed wireless CPE.

“2021 was a record year for PON (Passive Optical Network) equipment spending, with some of the highest growth coming from the North American market, where expansion projects and fiber overbuilds are picking up considerably,” said Jeff Heynen, Vice President, Broadband Access and Home Networking at Dell’Oro Group. “These fiber expansion projects show no signs of slowing heading into 2022.”

Additional highlights from the 4Q 2021 Broadband Access and Home Networking quarterly report:

- Total cable access concentrator revenue increased 4 percent Y/Y to just over $1B. Steady growth in Distributed Access Architecture (DAA) deployments helps offset declines in traditional CCAP licenses.

- Total PON ONT unit shipments reached a record 140 M units for the year, bucking the supply chain constraints that have dogged the cable CPE market.

………………………………………………………………………………………………………..

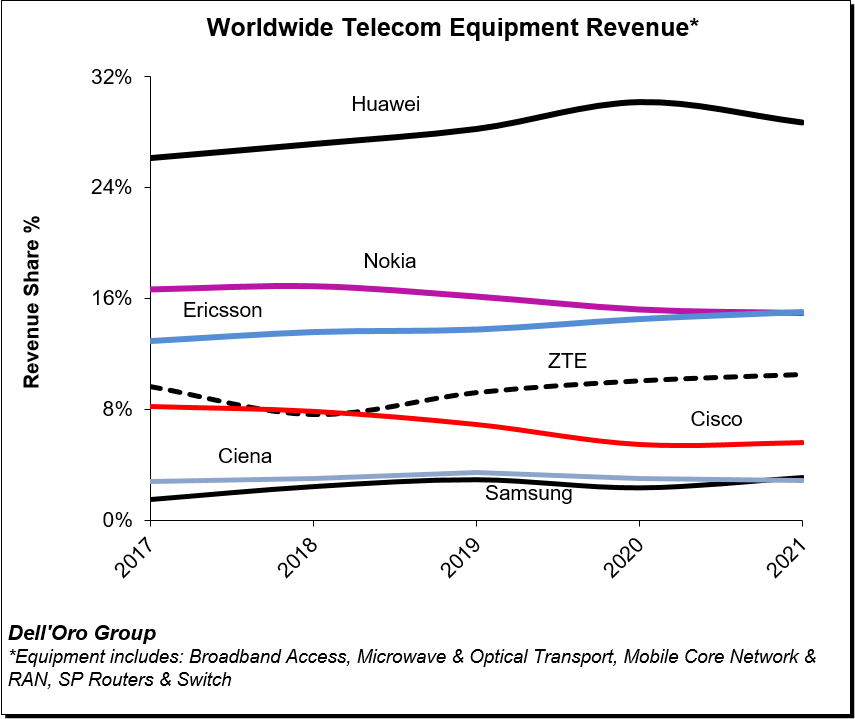

Separately, Dell’Oro just completed the 4Q2021 reports for all the Telecom Infrastructure programs covered, including Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch. The data contained in these reports suggests that total year-over-year (Y/Y) revenue growth slowed in the fourth quarter to 2%, however, this was not enough to derail full-year trends.

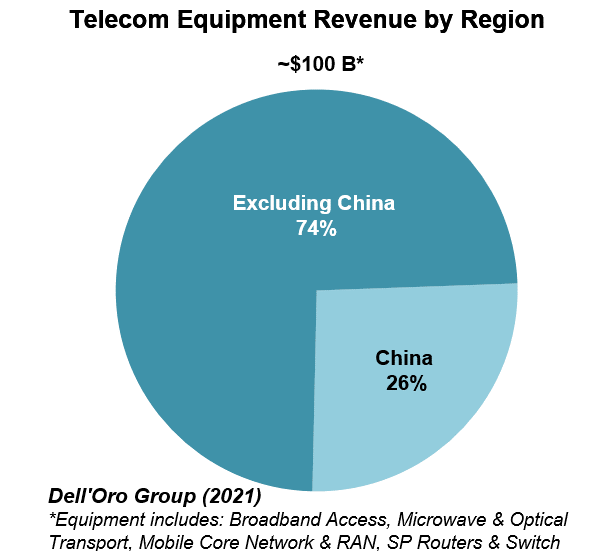

The market research firm estimates suggest the overall telecom equipment market advanced 7% in 2021, recording a fourth consecutive year of growth, underpinned by surging wireless revenues and healthy demand for wireline-related equipment spurred on by double-digit growth both in RAN and Broadband Access. Total worldwide telecom equipment revenues approached $100 B, up more than 20% since 2017.

In addition to challenging comparisons, we attribute the weaker momentum in the fourth quarter to external factors including COVID-19 restrictions and supply chain disruptions.

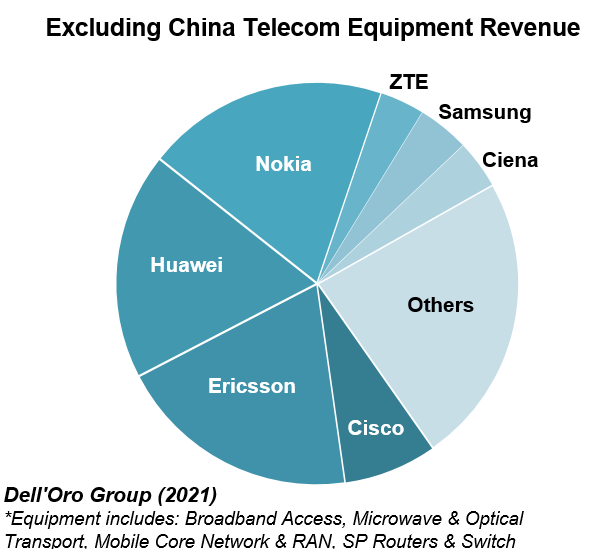

The analysis contained in these reports suggests the collective global share of the leading suppliers remained relatively stable between 2020 and 2021, with the top seven vendors comprising around 80% of the total market.

Despite U.S. sanctions, Huawei continued to lead the global market, underscoring its grip on the Chinese market, depth of its telecom portfolio, and resiliency with existing footprints. Initial readings suggest the playing field is more even outside of China, with Ericsson and Nokia essentially tied at 20% and Huawei accounting for around 18% of the market.

The relative growth rates have been revised upward for 2022 to reflect new supply chain and capex data. Still, global telecom equipment growth is expected to moderate from 7% in 2021 to 4% in 2022.

Risks are broadly balanced. In addition to the direct and indirect impact of the war in Ukraine and the broader implications across Europe and the world, the industry is still contending with COVID-19 restrictions and supply chain disruptions. At the same time, wireless capex is expected to surge in the U.S. this year.

…………………………………………………………………………………………………..

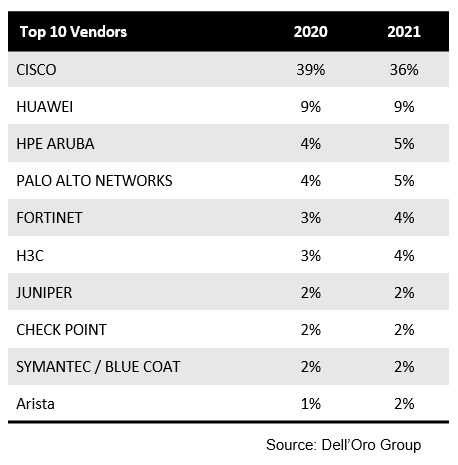

Top 10 Enterprise Network Equipment Vendors:

References:

Key Takeaways—2021 Total Enterprise Network Equipment Market

5G in India to be launched in 2023; air traffic safety a concern; 5G for agricultural monitoring to be very useful

Telecom Service Providers, informed India’s Minister of State for Communications Devusinh Chauhan on Wednesday that 5G mobile services are likely to be launched during the second half of the year 2022-23. The minister, in a written reply to Lok Sabha, also denied any impact of the 5G wave on airlines’ communication system. “The frequency band opened for International Mobile Telecommunications (IMT), including 5G Technology, in India has enough guard bands to ensure that there is no aeronautical interference. Therefore, the question of conducting study does not arise,” informed the minister.

In January, the 6,000-pilotstrong Federation of Indian Pilots wrote to Civil Aviation Minister Jyotiraditya M. Scindia and requested him to ask the Directorate General of Civil Aviation (DGCA) and the Telecom Regulatory Authority of India (TRAI ) work in tandem to develop a plan that enables the safe and efficient implementation of fifth generation (5G) mobile communications networks in the C-band. On the infrastructure required for 5G, Devusinh Chauhan said the infrastructure required for rolling out 5G services in the country is to be developed by the TSPs based on requirements and their business plan. The proposed 5G spectrum auction in the country is likely to be held before the month of August. At present, Telecom Regulatory Authority of India is expected to come out with its recommendations for the upcoming 5G auction by the end of this month. Once the Telecom Regulatory Authority of India submits its report, the department of telecommunications (DoT) will commence the process to auction the airwaves.

Separately, Dr P D Vaghela, Chairman of TRAI said that Hyderabad States will attract more investments and generate employment with a robust telecom infrastructure, which will lead to an enhanced economy.

“For the implementation of industrial automation (industry 4.0), precision agriculture, smart education, automation in healthcare, and many areas, the State governments must strive to have the best and latest telecom technology in their State such as 5G, IoT, AI, Augmented Reality, Virtual Reality, etc.,” he said. Addressing the Administrative Staff College of India’s (ASCI) online public lecture titled ‘5G: A Next-Generation Technology’, on Wednesday, he spoke on introduction to 5G and key performance indicators, use cases of 5G, role of State governments, the growth of telecom in India, and government initiatives in the broadband and telecom reforms.

In agriculture, he said that 5G was going to be helpful for monitoring along with sensor networks, precision farming, smart irrigation, climate change mitigation, livestock monitoring, and agricultural drones. Apart from being beneficial in smart mining through real-time condition monitoring, he said that in the field of online education and learning which requires high-speed data connectivity, 5G technology is capable of providing the requisite bandwidth for students and institutions. It also augments video surveillance and analytics, solid waste management, and intelligent parking in smart cities, and that the technology would create an immersive experience in video streaming, gaming and sports domain, where user/machine-generated content from smart devices could help users to share data in real time, which is likely to improve the user experience. Vaghela spoke about satellite- based communication being implemented in North- Eastern States and how it was helpful in far-flung hilly and rural areas. Observing that BharatNet project could change the scenario, he said that the last six years had seen a revolutionary change in rural areas in terms of growth of telecom and digital services.

References:

The New Indian Express newspaper