Summary of Facebook Connectivity Projects

Facebook Connectivity works with partners to develop these technologies and bring them to people across the world. Since 2013, Facebook Connectivity has accelerated access to a faster internet for more than 300M people around the world. Earlier this week, during an event called Inside the Lab, our engineers shared the latest developments on some of our connectivity technologies, which aim to improve internet capacity across the world by sea, land and air:

- Subsea cables connect continents and are the backbone of the global internet. Our first-ever transatlantic subsea cable system will connect Europe to the U.S. This new cable provides 200X more internet capacity than the transatlantic cables of the 2000s. This investment builds on other recent subsea expansions, including 2Africa PEARLS which will be the longest subsea cable system in the world connecting Africa, Europe and Asia.

- To slash the time and cost required to roll out fiber-optic internet to communities, Facebook developed a robot called Bombyx that moves along power lines, wrapping them with fiber cable. Since we first unveiled Bombyx, it has become lighter, faster and more agile, and we believe it could have a radical effect on the economics of fiber deployment around the world.

- Facebook also developed Terragraph, a wireless technology that delivers internet at fiber speed over the air. This technology has already brought high-speed internet to more than 6,500 homes in Anchorage, Alaska, and deployment has also started in Perth, Australia, one of the most isolated capital cities in the world.

Bombyx wraps fiber around existing telephone wires, clearing obstacles and flipping as it needs to along its route. (Source: Facebook)

Facebook wants to bring high-speed reliable internet to more than 300M people — but the work doesn’t stop there. Connecting the next billion will require many different approaches. And as people look for more immersive experiences in new virtual spaces like the metaverse, we need to increase access to a more reliable and affordable internet for everyone. The company believes this work is fundamental for creating greater equity where everyone can benefit from the economic, education and social benefits of a digitally connected world.

“High speed, reliable Internet access that connects us to people around the world is something that’s lacking for billions of people around the world,” Mike Schroepfer, Facebook’s chief technology officer, declared during the company’s “Inside the Lab” roundtable discussion. “Business as usual will not solve it. We need radical breakthroughs to provide radical improvements – 10x faster speeds, 10x lower costs.”

Facebook and its partners are in the process of building 150,000 kilometers of subsea cables, and working on new sea-based power stations that will provide those cables with power.

“This will have a major impact on underserved regions of the world, notably in Africa, where our work is set to triple the amount of Internet bandwidth reaching the continent,” Dan Rabinovitsj, Facebook’s VP of connectivity, explained. That activity partly ties into a new segment of subsea cables called 2Africa PEARLS that will connect three continents: Africa, Europe and Asia.

(Source: Facebook)

2Africa Pearls, a new segment of subsea cable that connects Africa, Europe and Asia, will bring the total length of the 2Africa cable system to more than 45,000 kilometers, making it the longest subsea cable system ever deployed, the company said.

Cynthia Perret, Facebook’s infrastructure program manager, noted every transatlantic cable Facebook connects will contain 24 fiber pairs. “Capacity alone isn’t enough,” she said, noting that Facebook is also working on ways to configure and adapt the amount of capacity provided to each landing point. Facebook is also utilizing a model called “Atlantis” to help forecast and optimize where subsea cable routes need to be built. An integrated adaptive bandwidth system will likewise allow Facebook to shift capacities based on traffic patterns and reduce congestion and improve reliably, Perret explained.

References:

Revision of ITU-R Handbook on Global Trends in International Mobile Telecommunications (IMT)

ITU-R WP5D has initiated the development of a draft new edition of the Handbook on Global Trends in International Mobile Telecommunications (IMT). Fast development of mobile broadband worldwide urgently requires up-to-date general guidance on issues related to the deployment of IMT systems and the introduction/development of their IMT-2000, IMT-Advanced and IMT-2020 networks.

The Handbook on Global Trends in International Mobile Telecommunications (IMT) provides general information such as service requirements, application trends, system characteristics, as well as substantive information on spectrum, regulatory issues, guidelines for evolution and migration, and core network evolution. Since this Handbook was published in 2015, it requires urgent substantial updates to be a valid reference publication for the ITU membership.

Working Party 5D has invited contributions from the membership with the objective of completing the draft for consideration for approval by Working Party 5D at its 7-18 February 2022 meeting, with a deadline for contributions of 1600 hours UTC, 31 January 2022.

……………………………………………………………………………………………………………………………………………

Introduction:

This Handbook identifies International Mobile Telecommunications (IMT) and provides the general information such as service requirements, application trends, system characteristics, and substantive information on spectrum, regulatory issues, guideline for the evolution and migration, and core network evolution on IMT.

This Handbook also addresses a variety of issues related to the deployment of IMT systems.

Purpose and scope:

The purpose and scope of this Handbook is to provide general guidance to ITU Members, network operators and other relevant parties on issues related to the deployment of IMT systems to facilitate decisions on selection of options and strategies for introduction of their IMT‑2000, IMT‑Advanced and IMT-2020 networks.

The Handbook focuses on the technical, operational and spectrum related aspects of IMT systems, including information on the deployment and technical characteristics of IMT as well as the services and applications supported by IMT.

This Handbook updates previous information on IMT-2000 and IMT-Advanced. It also includes new information on IMT‑2020 from Recommendation ITU-R M.2150. In addition, the work from Report ITU-R M.2243 – Assessment of the global mobile broadband deployments and forecasts for International Mobile Telecommunications, is referenced regarding any future considerations that are identified. This Handbook has been and will continue to be a collaborative effort involving groups in the three ITU Sectors with ITU-R Working Party 5D assuming the lead, coordinating role and responsibility for developing text for the terrestrial aspects; with ITU-R Working Party 4B responsible for the satellite aspects, ITU-T Study Group 13 responsible for the core network aspects and ITU-D Q.25/2 responsible for the developing countries aspects.

Special attention has been given to needs of developing countries responding to the first part of Question ITU‑R 77/5 which decides that WP 5D should continue to study the urgent needs of developing countries for cost effective access to the global telecommunication networks.

This Handbook also includes summary of deliverables and on-going activities of WP 5D in order to provide an update for countries which are not able to attend 5D meetings.

References:

https://www.itu.int/pub/R-HDB-62

https://www.itu.int/en/publications/ITU-R/pages/publications.aspx?parent=R-HDB-62-2015&media=paper

Comcast Business Announces $28 Million Investment to Expand Fiber Broadband Network in Eastern U.S.

Comcast Business today announced a two-year $28 million project to expand its network across four Mid-Atlantic states is well underway, touting it as part of an effort to bring 1 to 100Gbps service to thousands of additional enterprises in the region.

Once completed, Comcast Business will have committed a total of more than $110 million in area network expansions since 2015, to benefit nearly 35,000 of the region’s largest companies and organizations.

The operator said that work is focused on deploying new and densifying existing fiber across parts of Delaware, Maryland, Virginia and West Virginia, as well as the District of Columbia. Approximately $13 million was already invested in the extensions in 2020, with an additional $15 million set to be spent this year to deliver service to a total of nearly 7,000 new businesses.

The network expansion delivers speeds up to 1 Gigabit per second (Gbps) for small and medium-sized businesses and up to 100 Gbps for larger enterprises and will support the ability to bring new customers online quickly with advanced services, including fast business Wi-Fi for employees and guests, cybersecurity solutions, 4G LTE backup, business TV and more. Additionally, businesses of all sizes now will have access to a comprehensive portfolio of Comcast Business products and services to help meet the day-to-day demands that require large amounts of bandwidth, linking multiple sites or branch locations or connecting offices to third-party data centers.

The latest expansion deploys new fiber optic cable or densifies existing fiber services across the following areas:

- Delaware: Georgetown, Ocean View, Rehoboth Beach and Smyrna

- Maryland: Eastern Shore, Frederick and Montgomery County

- Virginia: Ashburn, Dulles, Harrisonburg, Leesburg, Lynchburg and Richmond; planned investments include Front Royal, Tysons Corner and Warrenton

- Washington, D.C.

- West Virginia: Huntington and Martinsburg

“Comcast’s infrastructure investment in Virginia supports our business community and helps us attract new businesses to the Commonwealth,” said Brian Ball, Virginia Secretary of Commerce and Trade.

Ed Rowan, senior director of Comcast Business Sales Operations in the Beltway Region, said in a press release:

“The ability to offer both diversity of network and carrier is becoming increasingly important to help drive economic development and transformation. Connectivity is at the core of this and, more than ever, is an integral factor as businesses expand and prepare for what’s next. Our network expansions across Comcast’s Beltway Region are the latest example of the significant technology investments we’ve made to increase the availability of our multi-Gigabit Ethernet services. These investments will help foster economic development, transform our local communities, and better meet next-generation capacity needs across the region.”

Comcast’s vast and growing fiber footprint spans 29 regional networks in 39 states and includes:

- An enhanced fiber optic network, with more than 150,000 miles of fiber, that provides high- speed, high quality, and high-definition services to a number of large companies

- A support structure made up of thousands of professionals with the knowledge and experience to handle any situation

- MEF-certified carrier class Ethernet that delivers standardized, scalable, and reliable Metro Ethernet solutions – at a service and hardware level

Comcast’s nationwide fiber optic network:

References:

Telefónica Deutschland/O2 “pure 5G” with DSS, Open RAN and 5G SA

One year after the 5G launch, Telefónica Deutschland / O2 confirms their 5G network will cover over 50 percent of the German population by the end of 2022. The company is also on track to cover of over 30 percent of the population by the end of 2021. The basis for this 5G network expansion is the investment of around four billion euros until the end of 2022.

The focus of this 5G network expansion is on so-called “pure 5G” via the mid-band 3.6 GHz frequency. The 3,000th 3.6 GHz antenna just went live in the O2 5G network. Meanwhile, Telefónica Deutschland / O2 is installing around 180 of these 5G antennas in the network every week, tendency further increasing. The company is expanding 5G twice as fast overall compared to 4G and is fully on track to supply all of Germany with 5G by the end of 2025.

As with 2G, 3G and 4G, we are also bringing 5G to mass market readiness in Germany through rapid network expansion, network investments in the billions and products with the best price-performance ratio,” said CEO Markus Haas on the first anniversary of the 5G launch in the O2 network.

“Since the beginning, we have aligned the 5G roll-out with the concrete benefits for private customers and businesses. This is the most effective way for us to drive forward the urgently needed digitisation for business and consumers. Today, one year after the launch, our 5G network is already live in a hundred cities. And current international tests confirm that it is the fastest 5G network in Germany. Now we will also quickly bring the O2 5G network to the area.”

The added value of 5G for private customers in this early expansion phase, beyond the performance advantages, lies primarily in the additional network capacities provided by the new mobile communications standard. In the first half of 2021, the O2 mobile network transported 1 billion gigabytes of data, an absolute record. Cities are data traffic hotspots. The growing number of urban 5G users is increasingly shifting parts of this data traffic to the 5G network, thus relieving the 4G network. In this way, the O2 5G network also ensures a consistently good network experience for 4G users of all Telefónica Deutschland / O2 brands and partner brands.

Market penetration with 5G is visibly gaining speed. In the meantime, 5G smartphones account for more than 50 percent of all end devices sold through Telefónica Deutschland / O2 sales channels. In line with this, Telefónica Deutschland / O2 is now moving the 5G network expansion more strongly into the area. Here, too, the telecommunications company is focusing on so-called “pure 5G” via the 3.6 GHz frequency. In the future, it will provide private and business users with multiple gigabit data speeds and response times (latency) of just a few milliseconds.

This is where “pure 5G” differs from the combined 4G/5G via Dynamic Spectrum Sharing (DSS), which currently prevails in other German 5G networks [1.]. 5G shares lower frequency bands with 4G at comparable performance levels. Where it is a useful 4G extension in selected areas, the company will also use Dynamic Spectrum Sharing. In addition, it is partially rolling out 5G purely over the 700 MHz frequency to accelerate area rollout and lay the groundwork for the upcoming 5G Stand Alone in the O2 network. The first sites are already live.

Note 1. Both Vodafone Germany and Telekom Deutschland use DSS to facilitate the rollout of 5G by sharing spectrum between 4G and 5G networks: Vodafone has deployed the technology to switch 700MHz frequencies back and forth between 4G and 5G, while Telekom Deutschland is rolling out DSS as part of a 5G expansion drive and is apportioning 5MHz of its 2.1GHz resource for 4G and 5G as needed. Telefónica Deutschland, which has already said it would use DSS for deployment in rural areas, conceded it will use DSS for 4G expansion in “selected areas.” The operator also appeared to indicate that its 5G deployment over 700MHz will be only partially “pure,” in order to accelerate its network expansion.

Photo Credits: Henning Koepke / Telefónica Deutschland

Photo Credits: Henning Koepke / Telefónica Deutschland

Telefónica Deutschland / O2 is continuously increasing its 5G network expansion despite parallel major projects such as the 3G switch-off and densification of the 4G network. In addition, the company has set the course for its 5G network of the future in the last twelve months. Telefónica Deutschland / O2 was the first German network operator to bring the innovative open architecture Open RAN for the mobile access network out of the laboratory and into live operation.

The conversion to Open RAN will start before the end of this year. It will give the company greater flexibility in the choice of manufacturers and, as a primarily software-based solution, simplify and accelerate the upgrading of base stations. Telefónica Group has appointed NEC as systems integrator for open RAN trials in its four main markets – Spain, Germany, the UK and Brazil.

O2 plans to deploy Open RAN later this year

In addition, Telefónica Deutschland / O2 achieved the first frequency bundling in the 5G live network in this country via carrier aggregation, which further accelerates 5G for customers and ensures a stable high data throughput. The O2 network also recently saw the German premiere of the first voice call directly via the 5G live network. These 5G calls do not take a diversion via the 4G network and thus no longer interrupt ongoing 5G data connections. Finally, Telefónica Deutschland / O2 now operates an independent 5G core network (no explanation given for what that means?).

The company has thus created the basis for freeing the new network from its technical dependence on 4G and will provide a 5G core network for 5G Stand Alone (SA). In future, this will enable private and business customers to use even the most demanding 5G applications. Technically, the company is already in a position to roll out a nationwide 5G Stand Alone network.

As soon as 5G Stand Alone offers real added value for customers, O2 will activate the technology. For example, when enough end devices in the market support 5G SA. Telefónica Deutschland is working with Ericsson for its 5G core network, but noted that the deployment of open radio access network (RAN) technology will ensure access to a wider group of vendors.

Over the past year of 5G service, Telefónica Deutschland / O2 has started to move their 5G core network for industrial applications to the cloud. This will significantly simplify the establishment of 5G campus networks, accelerate the introduction of new industrial applications for companies and shorten the time to market for new products and applications, according to the company.

The rapid expansion of the 5G network helps Telefónica Deutschland / O2 to pursue its corporate goal of offering its customers the greenest mobile network in Germany by 2025. 5G transmits significantly more energy-efficiently than the predecessor standards. The conversion of 3G to 4G and 5G network technology alone will reduce the power consumption of the O2 network by up to 90 percent per transported byte. In addition, the company will make a significant contribution to achieving Germany’s climate targets overall. Its 5G network will pave the way for digital solutions and all-round connectivity, helping other industries to save CO2 emissions and develop sustainable business models.

References:

https://www.lightreading.com/5g/o2-germany-boasts-of-pure-5g-but-concedes-dss-need/d/d-id/772583?

T-Mobile US talks up its 5G SA network, 5G data usage, AR and robotics applications

T-Mobile US Vice President of Technology Neville Ray provided an overview of the carrier’s 5G network during his “Building 5G for All” keynote presentation at the Wireless Infrastructure Associations (WIA) Connect X event. The association represents the nation’s cell tower owners and others in the wireless industry.

Ray said T-Mobile’s 5G standalone (5G SA) network, deployed nationwide using its 600 MHz spectrum, is “the future of wireless.” He said applications like connected vehicles, industrial robotics, mixed reality, and “supercharged IoT…can all be built on this foundation. It gives us a massive opportunity to work with partners on developing advanced 5G services.”

“We are seeing incredible growth in 5G data usage,” Ray said, referring to the average data usage among customers on T-Mobile’s new Magenta Max unlimited data plan, the operator’s most expensive unlimited data plan. Ray also reiterated many of the data points on Magenta Max that T-Mobile published last month. He said that T-Mobile’s Magenta Max customers typically stream 39% more video, use 36% more data for social media and use twice as much mobile hotspot data than other T-Mobile customers. “Our customers love this plan,” Ray said.

T-Mobile’s five-year, $60 billion investment into its 5G network seems to be paying off for the telco. The effort involves building thousands of new cell towers around the country in part to allow T-Mobile to broadcast speedy 5G signals on the 2.5GHz mid-band spectrum it acquired from Sprint. T-Mobile says that over 50% of its Magenta Max customers use a 5G smartphone.

T-Mo is planning to use 5G to offer fixed wireless access (FWA) to homes and offices. T-Mobile this week said it would reduce the price of its fixed wireless service by $10 per month in a direct challenge to wired broadband ISPs.

Furthermore, Ray said T-Mobile is also working to develop new 5G businesses around augmented reality (AR) services and other advanced offerings directed at 5G-based enterprise applications and use cases. To progress that initiative, T-Mo has partnered with companies working on video-streaming drones, with Sarcos Robotics on industrial robots, and with Fisk University. The latter project involves pre-med and biology students using a 5G-enabled headset to study human cadavers.

T-Mo is also working with Taqtile and Timberline Communications Inc., giving Timberline’s field technician headsets that can support instructional AR-overlays and other relevant content, and remote support from experts. The techs, in turn, use the headsets, connected to T-Mobile’s 5G network, to perform maintenance and other work on T-Mobile’s 5G network.

“AR and VR applications are going to transform virtually every industry,” according to Senior Director of Network Technology Erin Raney. “We are so excited to see how T-Mobile’s 5G network with that low latency and high bandwidth is going to fuel these great innovations.”

In a March 2021 blog post, T-Mo’s John Saw, EVP of Advanced & Emerging Technologies wrote:

Augmented and virtual reality (AR/VR) technology is a key area of focus at T-Mobile for 5G use case development and it is applicable to so many industries from healthcare to manufacturing, agriculture and more. Enterprises today have complex machinery, a shortage of skilled workers, and customers with no patience for downtime, making sophisticated training and technical support capabilities more important than ever. With T-Mobile’s low-latency, Ultra Capacity 5G network, we are seeing businesses boost productivity and speed as technicians use augmented reality for immersive training, and then to collaborate and fix problems fast.

Taqtile, a recent graduate of the 5G Open Innovation Lab co-founded by T-Mobile, is a company doing fascinating work building AR solutions for frontline workers. Timberline Communications Inc. (TCI), a communications infrastructure company, is using Taqtile’s AR solution running on T-Mobile 5G to perform cell site upgrades and maintenance on our network. With Taqtile, TCI’s technicians use AR headsets to view virtual service checklists and troubleshoot using remote assistance. AR solutions such as this enable frontline workers to improve their skills and perform complex tasks from anywhere exploring objects such as machinery in 3D from all angles.

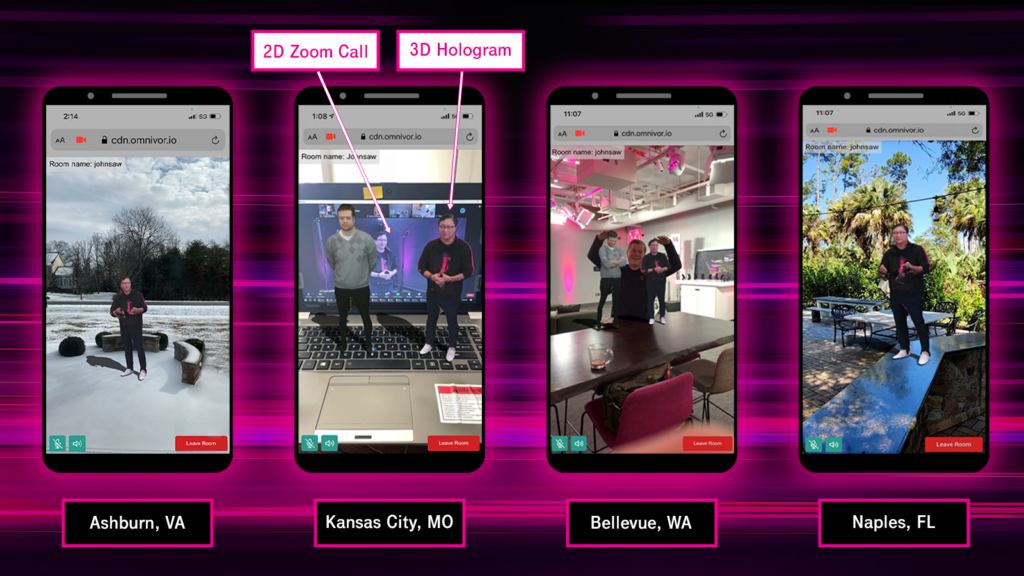

T-Mobile quarterly all-hands team meeting using holographic telepresence

…………………………………………………………………………………………………………………..

WIA recently joined the National Spectrum Consortium (NSC) to increase industry collaboration on the research and development of 5G and 5G-based technologies.

“In order to effectively address our country’s most pressing needs for wireless infrastructure, we must deliver unified solutions. WIA is looking forward to working with the Consortium to transform communications and bring next generation technology to our defense sector and communities across the U.S.,” said WIA CTO Dr. Rikin Thakker.

…………………………………………………………………………………………………………………..

References:

Frontier Communications and Ziply Fiber to raise funds for fiber optic network buildouts

Frontier Communications and Ziply Fiber have secured more funding for their respective fiber optic network building projects and network upgrades.

On October 4th, Frontier announced that it intends to offer, subject to market conditions and other factors, $1.0 billion aggregate principal amount of second lien secured notes due 2030 (the “Notes”) in a private transaction. This offering comes approximately five months after Frontier emerged from bankruptcy armed with a multi-year plan to upgrade millions of residential and business locations in its footprint. Frontier plans to deploy FTTP to about 600,000 homes this year and, more broadly, to extend FTTP to about 10 million homes by 2025.

According to Jeff Baumgartner of Light Reading, Frontier will deploy XGS-PON and is debating what to do with a remainder of its fiber and copper network. Its footprint includes rural areas that aren’t as economically attractive as the original portions of its upgrade plan. The company has discussed multiple ideas for a so-called “Wave 3” buildout that might include exploring joint ventures, securing private equity or pursuing asset swaps.

About Frontier:

Frontier offers a variety of services to residential and business customers over its fiber-optic and copper networks in 25 states, including video, high-speed Internet, advanced voice, and Frontier Secure® digital protection solutions. Frontier Business™ offers communications solutions to small, medium, and enterprise businesses.

………………………………………………………………………………………………………………………………….

Ziply Fiber, a company formed last year via the acquisition of Frontier’s operations in Washington, Oregon, Idaho and Montana, has raised $350 million in fresh funding from bond buyers.

In a prepared statement, Ziply says the new funding will support its ongoing fiber expansion. “It will ensure that we have the resources on hand to keep up the strong pace of construction we’ve set for ourselves as we head into the new year, and to continue to deliver on our goal to providing the best connected experience possible for people in the Northwest.”

At the time of its acquisition from Frontier, Ziply reported that 31% of its homes passed were fiber capable. Ziply fiber expansion goals targeted reaching 80% by 2024. The company reported passing 1.6 million locations when it was formed.

Washington state is the company’s largest market, and Montana is its smallest. Ziply employs more than 1,400 people, according to the statement about the additional funding.

The company says on its website that it is “investing $500 million to bring the best, fastest internet to our neighbors across the region.” And that was before the new $300 million funding offer.

Ziply Fiber currently serves about 500K customers across its four state footprint and has been pushing fiber deeper into its network. The company has been steadily announcing new fiber markets, adding 14 to its growing list in August 2021.

Earlier this year, Ziply Fiber announced it was moving ahead with an FTTP network upgrade that will deliver 1-Gig services to another 14 markets in Washington state and Oregon later this year. That ties into a broader commitment to deploy FTTP to 52 markets in its regions.

Like Frontier, Ziply Fiber is also starting to gear its efforts toward XGS-PON, a standard that paves the way for symmetrical 10Gbit/s services and beyond.

Ziply Fiber uses GPON today but is “fast approaching where everything will be XGS-PON,” Ziply Fiber CEO Harold Zeitz told Light Reading in a recent interview. “We are preparing all of our network for XGS. The only difference will be the ONT [optical network terminal] that goes on the home. Everything else will be XGS-ready.”

References:

VMware Cloud with Tanzu services delivers enterprise-grade kubernetes services

VMware has announced new advancements for VMware Cloud on AWS [1.], a multi-cloud computing infrastructure. The new innovations include a new portfolio of managed Kubernetes services to modernize apps on VMware Cloud. The new functions will make it simpler and safer to run enterprise apps in VMware Cloud. This new VMware initiative supports the need for customers to run their IT software in sovereign clouds, as well as technology previews that showcase the future of VMware Cloud.

Note 1. VMware Cloud on AWS is the preferred service for AWS for all vSphere-based workloads [2.]. VMware Cloud on AWS brings VMware’s enterprise-class SDDC (Software Defined Data Center) [3.] software to the AWS Cloud with optimized access to native AWS services. Powered by VMware Cloud Foundation, VMware Cloud on AWS integrates VMware’s compute, storage, and network virtualization products (VMware vSphere, VMware vSAN, and VMware NSX [4.]) along with VMware vCenter Server management, optimized to run on dedicated, elastic, bare-metal AWS infrastructure.

VMware Cloud on AWS uses NSX-T to create and manage internal SDDC (Software Defined Data Center) networks and provide endpoints for VPN connections from the customer’s on-premises network infrastructure. This subnet is used by the vCenter, NSX, and HCX appliances in the SDDC.

Note 2. vSphere is a server virtualization software application from VMware. It debuted in 2009 as the successor to the company’s flagship VMware Infrastructure solution and serves as a complete platform for implementing and managing virtual machine (VM) infrastructure on a large scale.

Note 3. A SDDC network has two notional tiers:

- Tier 0 handles north-south traffic (traffic leaving or entering the SDDC, or between the

Management and Compute gateways). - Tier 1 handles east-west traffic (traffic between routed network segments within the SDDC).

Note 4. NSX is a network virtualization and security platform that enables the virtual cloud network, a software-defined approach to networking that extends across data centers, clouds and application frameworks.

…………………………………………………………………………………………………………………………………..

The company said that together, the innovations will give VMware Cloud customers more tools to accelerate modernization of their enterprise apps, increase business agility and resiliency, and significantly reduce costs compared to existing approaches.

VMware Cloud on AWS is an integrated cloud offering jointly developed by Amazon Web Services (AWS) and VMware.

………………………………………………………………………………………………………………………………………………..

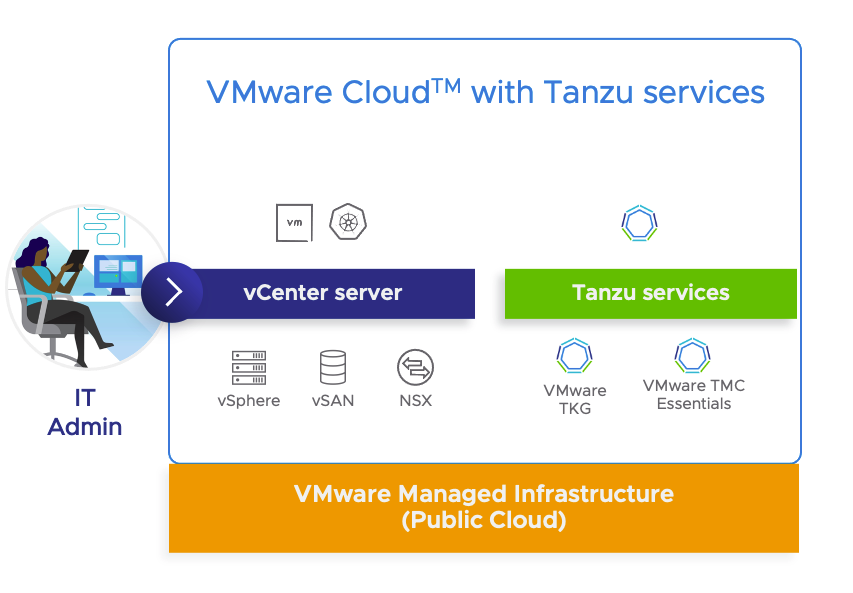

VMware Cloud with Tanzu services (see illustration below) is a new portfolio of managed Kubernetes services that will be available at no additional charge as part of VMware Cloud on AWS (see illustration above), for enterprise-grade Kubernetes on a fully managed, hybrid-cloud ready Infrastructure as a Service (IaaS) for all enterprise applications.

IT admins will be able to use the VMware vCenter interface to unify VM and container management on a common platform and provision Kubernetes clusters within minutes. Platform operators or SREs will be able to manage Kubernetes clusters consistently across clouds using Tanzu services as a multi-cloud Kubernetes management plane.

VMware Cloud with Tanzu services

Tanzu services include the following capabilities:

- Managed Tanzu Kubernetes Grid Service: ision Tanzu Kubernetes clusters within a few minutes using a simple, fast, and self-service experience in the VMware Cloud console. The underlying SDDC infrastructure and capacity required for Kubernetes workloads is fully managed by VMware. Use vCenter Server for managing Kubernetes workloads by deploying Kubernetes clusters, provisioning role-based access and allocating capacity for Developer teams. Manage multiple TKG clusters as namespaces with observability, troubleshooting and resiliency in vCenter Server.

- Built in support for Tanzu Mission Control Essentials: Attach upstream compliant Kubernetes clusters including Amazon EKS and Tanzu Kubernetes Grid clusters. Manage lifecycle for Tanzu Kubernetes Grid clusters and centralize platform operations for Kubernetes clusters using the Kubernetes management plane offered by Tanzu Mission Control. Tanzu Mission Control provides a global visibility across clusters and clouds and increases security and governance by automating operational tasks such as access and security management at scale.

Tanzu services on the VMware Cloud on AWS platform brings together the three personas working on modern applications. vSphere Administrators manage virtual machines on-premises and in the cloud and allocate resources for platform operators to deploy workloads. The operators use Tanzu Mission Control to manage and maintain clusters across environments. Developers can create code using a flexible platform for container and virtual machine-based workloads.

The managed Tanzu Kubernetes Grid Service, which is one of the Tanzu services, will enable admins to provision Tanzu Kubernetes clusters within a few minutes using a simple, fast, and self-service experience in the VMware Cloud console.

- The underlying SDDC (Software Defined Data Center) infrastructure and capacity required for Kubernetes workloads is fully managed by VMware. Use vCenter Server for managing containerized workloads by deploying Tanzu Kubernetes Grid clusters, provisioning role-based access and allocating capacity for Developer teams.

- One can manage multiple TKG clusters as namespaces with observability, troubleshooting and resiliency in vCenter Server.

……………………………………………………………………………………………………………………………….

References:

https://blogs.vmware.com/cloud/2021/10/05/introducing-vmware-cloud-with-tanzu-services/

https://blogs.vmware.com/cloud/2021/10/05/vmware-cloud-tanzu-services-a-technical-introduction/

https://docs.vmware.com/en/VMware-Cloud-on-AWS/services/vmc-on-aws-networking-security.pdf

The Sorry State of 5G SA Core Networks- Smart Communications in Phillipines

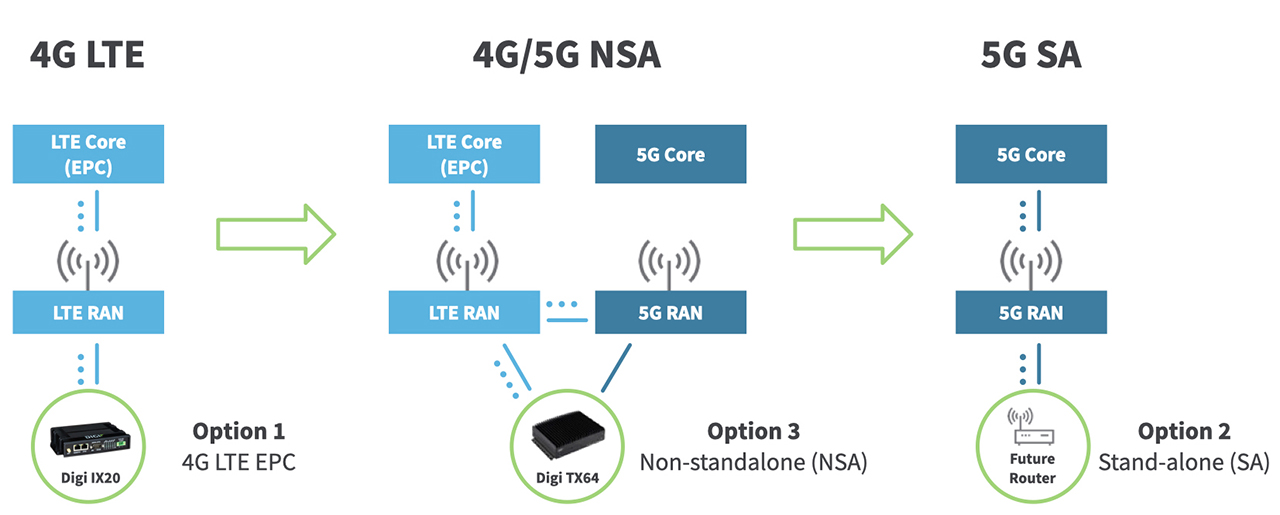

Very few 5G SA core networks of any size have been launched to date. According to the Global Mobile Suppliers Association (GSA), just 13 network operators had launched commercial public 5G SA networks as of the middle of August 2021. Some 45 other operators are planning on deploying 5G SA for public networks, and 23 operators are involved in tests or trials. That’s out of a total of 176 commercial 5G networks launched worldwide (163 of them are 5G NSA networks)!

Note that there is NO 5G core network in 5G NSA as per middle of this chart:

In the U.S., T-Mobile’s 5G SA has not provided the much touted benefits such as network slicing, automation, service chaining, network management, etc. “The light version of 5G standalone,” summed up analyst Roger Entner, founder of Recon Analytics.

For T-Mobile, the immediate incentive and upside to deploy SA 5G was making its midband 2.5GHz 5G more relevant, Entner said. As in, keeping its low band 600MHz 5G non-standalone as the pilot signal would lead to fewer phone screens lighting up with its mid band 5G, especially indoors.

“Now that 2.5GHz signal can piggyback on the 600 pilot,” he said. “With that, they get better penetration in the building with 2.5.”

Karri Kuoppamaki, SVP of radio network technology and strategy at T-Mobile, said that “the vast majority” of the carrier’s 5G customers had SA-ready SIMs, but he didn’t offer more specifics about the state of its standalone deployment. Those customers may not necessarily realize they’ve gotten anything special from SA 5G at T-Mobile, but that may not matter either, given the superiority of the carrier’s mid-band 5G.

“Standalone 5G is a means to an end,” said Craig Moffett, analyst with MoffettNathanson. “Ultimately, what matters is network capability. Being first gives T-Mobile just one more edge in network performance.” Avi Greengart, founder and lead analyst at Techsponential, concurred.

“For now, smartphone buyers should focus on finding the best combination of speed and coverage that is available in their area,” he said in an email. “That is often T-Mobile’s 5G network, but the technical underpinnings are somewhat less important to average consumers than the amount and frequency of the spectrum that T-Mobile has to deploy thanks to its acquisition of Sprint.”

………………………………………………………………………………………………………………………………………….

Smart Communications is one of the few wireless network operators in the world to have launched a 5G standalone (SA) network. The Philippines-based telco is using a separate 5G core and operating a network that is no longer anchored to 4G LTE (5G NSA). The new infrastructure supports network slicing and opens up industrial and enterprise opportunities, for example.

Smart’s 5G SA network is not yet widely available. In fact, it has been launched only in Makati – a city in the Metro Manila region and the country’s financial hub. PLDT-owned Smart said its “first batch” of 5G SA sites is fully operational. Smart noted that it has now deployed more than 4,000 non-standalone 5G sites nationwide, supported by PLDT’s 524,000 kilometer fiber network. Smart first launched 5G services in 2020.

Smart has collaborated with Ericsson, Huawei and Nokia on 5G, although it only name-checked the Swedish vendor in today’s release. For example, Smart said it has teamed up with Ericsson to develop 5G use cases at the PLDT-Smart Technolab, which currently hosts one of the 5G SA sites.

“Through the years, PLDT and Smart have been at the forefront of breakthrough innovations in the telco industry, including 5G. With the first batch of our 5G SA sites now fully operational, we are starting to see the true capabilities of 5G which will play a critical role in the advancement of massive IoT, health care and smart cities, delivering customer experience that is truly world-class” said Alfredo Panlilio, PLDT and Smart Communications president and CEO.

“Technology plays an important role in today’s society as evidently seen during the pandemic. 5G SA, as an innovation platform, will create new opportunities for enterprises and consumers that will maximize its ultra-reliable and low latency capabilities. This enables industrial automation, autonomous mobile robotics deployment, safe remote crane operations, fast response in gaming and interactive video streaming, among others. We are creating opportunities for the Filipino Enterprises to compete in the global arena,” said Mario Tamayo, head of technology at PLDT and Smart.

With the activation of the first 5G SA sites at the PLDT and Smart headquarters in Makati, Smart has upgraded its 5G facilities, enabling them to connect with the 5G core network.

With 5G SA in place, Smart said it will be able to offer Voice over New Radio (VoNR) and network slicing capabilities in the short term, as well as support new industrial and enterprise opportunities. Smart made its first successful VoNR call in July this year at the Technolab in Smart Tower in Makati City.

Smart is certainly the first to launch 5G SA in the Philippines, while rival Globe Telecom is testing the technology. Globe had 81.7 million mobile subscribers and Smart 71.7 million at the end of the second quarter. Smart and Globe still dominate the Philippines mobile market, despite a challenge from China Telecom-backed newcomer Dito Telecom.

About Smart Communications:

More than 650 global brands—including those in the most highly regulated industries and all the G15 investment banks, rely on Smart Communications to deliver meaningful customer communications across the entire lifecycle—empowering them to succeed in today’s digital-focused, customer-driven world while also simplifying processes and operating more efficiently. This is what it means to scale the conversation.

References:

https://www.lightreading.com/asia/smart-trumpets-standalone-milestone-with-5g/d/d-id/772511?

https://www.smartcommunications.com/resources/press-releases/

https://www.rcrwireless.com/20211004/5g/smart-activates-5g-sa-network-headquarters-philippines

Telcos Loss: Private 5G & MEC/5G SA Core Network – Cloud Giants Take Market Share

IDC: European smart home device shipments up 23.8% in Q2-2021

“This was the second quarter in a row in which the smart home market in Europe grew more than 20%, which is a sign of the recovery from the worst performance in the first half of 2020,” said Antonio Arantes, senior research analyst for smart home devices in Western Europe. “Amazon and Google regained the top two places in the market due to the good performance of the smart speaker and digital media adapter products.”

“In the second quarter of 2021, the total smart home device market grew by 29.1% in Central and Eastern Europe,” said Jan Prenosil, senior research analyst for smart home devices in Central and Eastern Europe (CEE). “The lighting product category recorded the largest growth in the quarter, and there were good results for the home monitoring and security category. But video entertainment is still in first place in terms of units in CEE.”

The smart home market is expected to reach more than 203 million units in 2025 in Europe — a compound annual growth rate (CAGR) of 13.5% from 2021 to 2025.

Category Highlights:

Video entertainment devices shipped 11.9 million units to Europe in the second quarter of 2021, accounting for 49.2% market share. Smart TVs had another stellar quarter, growing 18.7% year over year and reaching 70.4% of the video entertainment category.

Smart speakers grew 22.8% year over year, reaching more than 5.6 million units. Smart displays continue to see stronger growth than standard smart speakers.

Home monitoring/security, lighting, and thermostats grew 39.5% year over year. The three categories combined are expected to account for 65 million shipments in 2025.

About IDC Trackers:

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and online query tools.

Canalys 2Q-2021 smartphone rankings show big gains for Xiaomi and OPPO

Telecom, IT and cloud market research firm Canalys, said that global smartphone shipments increased by 12% in the second quarter of 2021. Samsung still maintains its position as the world’s number one with a market share of 19%. Xiaomi’s mobile phone sales surpassed Apple’s and rose to the second place in the world for the first time, with a share of 17%. Apple ranked third with 14%. OPPO and Vivo ranked fourth and fifth in the world, with a market share of 10%.

Xiaomi’s growth rate is as high as 83%, making it the top five mobile phone brand with the fastest growth rate in market share. Lei Jun, the founder and CEO of Xiaomi, sent three consecutive Weibo messages to express his congratulations to Xiaomi, and at the same time released the “Open Letter to Xiaomi Students.” Lei Jun said that Xiaomi’s becoming the second ranked global smartphone vendor is a major milestone in the history of Xiaomi’s development.

In the third quarter of 2014, Xiaomi entered the top three in the world for the first time, and then encountered huge difficulties, and soon fell out of the top five in the world. In 2020, the launch of Xiaomi Mi 10 series will fully launch the development of Xiaomi mobile phones. In the high-end journey, in the third quarter of the same year, Xiaomi returned to the third place in the world. Only two quarters later, Xiaomi was promoted to the second place in the world.

Lei Jun also said that “the second in the world” is a major victory for Xiaomi’s strategy. In August last year, Xiaomi established its core strategy for the next ten years-mobile phone X AIoT, once again clarifying the core position of the smartphone business, progressing to promote intelligent interconnection, and the AIoT business will build a smart life around the core business of mobile phones. At the same time, it has established the “three iron laws” that will never change: technology-oriented, cost-effectiveness-oriented, and making the coolest products.

About Xiaomi:

Xiaomi is an electronics company based in Beijing, China. It was founded by Lei Jun in April 2010, and in 2014, Xiaomi was the largest smartphone company in China. Today, Xiaomi is one of the top five smartphone vendors in the world.

The “MI” in their logo stands for “Mobile Internet.” It also has other meanings, including “Mission Impossible”, because Xiaomi faced many challenges that had seemed impossible to defy in our early days.

…………………………………………………………………………………………………………………………………………

Meanwhile, Canalys said that OPPO ranked first among Android smartphone manufacturers. In addition to launching 5G phones in the full price range to meet the different needs of consumers, OPPO has been actively taking the lead in applying new technologies to its latest models.

Canalys wrote that in Middle East and Africa, OPPO has climbed to fourth place in market share with a 106% year-on-year growth. The United Arab Emirates and Saudi Arabia have been at the forefront of this rise, witnessing a 196% and a 218% year-on-year growth respectively which was attributed to OPPO’s innovative product offering and strong customer service. In addition, OPPO saw a year-on-year growth of 79% in Egypt.

Ethan Xue, President of OPPO MEA said, “We are proud to see our innovative products and customer-centric approach being well received and reflected in these promising figures. Our growth in the MENA region is phenomenal and illustrates the strong customer base we have that support us and understand our brand mission, technology for mankind, kindness for the world. At OPPO, we continue to push the boundaries and our growth only serves to motivate us even more to offer our customers the best possible products at competitive prices.”

The main proponent of the brands growth is strong product launches that closely align with the evolving demands of smartphone users. Earlier this month, OPPO launched the anticipated Reno6 series, comprising of three variations, the Reno6 Pro 5G, Reno6 5G, and the Reno6 Z 5G that have all been masterfully designed for trendsetting individuals, game enthusiasts and the young at heart. From stunning design details to powerful features, the Reno6 series is already proving to be popular in the region, with a 300% pre-order increase compared to its predecessor, solidifying the demand for the technology brand in MENA.

About OPPO:

OPPO is headquartered in Dongguan, China an has been a leading global technology brand since 2004, dedicated to providing products that seamlessly combines art and innovative technology.

OPPO says they’re on a mission to building a multiple-access smart device ecosystem for the era of intelligent connectivity. The smartphone devices have simply been a gateway for OPPO to deliver a diverse portfolio of smart and frontier technologies in hardware, software and system. In 2019, OPPO launched a $7 Billion US Dollar three-year investment plan in R&D to develop core technologies furthering design through technology.

For the last 10 years, OPPO has focused on manufacturing smartphones with camera capabilities that are second to none. OPPO launched the first mobile phone, the Smile Phone, in 2008, which marked the launch of the brand’s epic journey in exploring and pioneering extraordinary technology. Over the years, OPPO has built a tradition of being number one, which became a reality through inventing the world’s first rotating camera smartphone way back in 2013, launching the world’s then thinnest smartphone in 2014, being the first to introduce 5X Zoom ‘Periscope’ camera technology and developing the first 5G commercial smartphone in Europe.

OPPO is currently ranked as the number four smartphone brand globally. OPPO brings the aesthetics of technology of global consumers through the ColorOS system Experience, and Internet service like OPPO Cloud and OPPO+.

OPPO’s business covers 40 countries with over six research institutes and five R&D centers across the world, from San Francisco to Shenzhen. OPPO also opened an International Design Centre headquartered in London, driving cutting edge technology that will shape the future not only for smartphones but for intelligent connectivity.

References:

https://min.news/en/tech/5f2410bda155bbec25c819b98c454623.html

NEW for 3Q2021 Rankings: