Analysts: Combined ADTRAN & ADVA will be a “niche player”

ADTRAN is positioning its acquisition of ADVA as building a complementary combination of assets that can better capitalize on what it sees as an unprecedented investment cycle in fiber. However, analysts argue that the new combined company would still be just a “niche player” in the market.

On Monday, ADTRAN wrote in an email to this author (and many others):

ADTRAN has entered into a business combination agreement with ADVA, a Germany-based global leader in business ethernet, metro WDM, Data Center Interconnect and network synchronization solutions, to combine our two companies.We believe our combination will create many opportunities to better serve end-to-end fiber networking solutions spanning metro edge, aggregation, access and subscriber connectivity. Additionally, we anticipate that by utilizing our collective world-class R&D teams, we will be better positioned to accelerate innovation and offer differentiated solutions.Going forward, it will be business as usual and all existing customer, partner and supplier relationships will remain intact. Until we receive all required regulatory approvals and close the transaction, ADVA and ADTRAN will continue to operate as separate companies. As we integrate the two companies, we will be focused on the best ways to offer our enhanced value proposition and partner with you.

Highlights of the Deal:

- Combination expands product offering and strengthens position as a global fiber networking innovation leader with combined revenue of $1.2B

- Highly complementary businesses create a global, scaled end-to-end provider to better serve customers with differentiated fiber networking solutions, spanning metro edge, aggregation, access and subscriber connectivity

- Creates a stronger and more-profitable company, poised to benefit from the unprecedented investment cycle in fiber, an expanded market opportunity and increased scale

- Meaningful value creation with over $50 million in annual run-rate cost synergies

- All-stock transaction with ADTRAN shareholders to own approximately 54% and ADVA shareholders to own approximately 46% of the combined company, assuming a tender of 100% of ADVA shares

- Combined company to be dual-listed on the NASDAQ and Frankfurt Stock Exchange

The two vendors produced a combined $1.2 billion in revenues last year. However, ADTRAN’s presentation in support of the deal showed that market heavyweights Nokia, Ciena, and smaller player Infinera had much higher revenues over that same time period.

The two vendors produced a combined $1.2 billion in revenues last year. However, ADTRAN’s presentation in support of the deal showed that market heavyweights Nokia, Ciena, and smaller player Infinera had much higher revenues over that same time period.

“It’s not going to reshape the optical networking industry,” John Lively, principal analyst at LightCounting, told SDxCentral about the deal. “ADTRAN and ADVA are going to improve their position in combination, [but] don’t really threaten the large players.”

Companies that are potentially threatened by this deal are smaller competitors such as Infinera ($1.4 billion in 2020 revenues) and Calix ($500 million in 2020 revenues), Lively noted.

“The challenges pressured by the global pandemic have clearly shown that fiber connectivity has become an essential foundation for the modern digital economy,” ADTRAN Chairman and CEO Thomas Stanton explained to investors about the deal. “This transformation will significantly increase the scale of the combined businesses, enhancing our ability to serve as a trusted supplier to our customers and worldwide.”

Stanton added that “our combination will make us one of the largest western suppliers for the markets we serve. Our greater size will increase cross-selling opportunities to existing customers, accelerating our combined growth, and allowing us to further penetrate our target markets.”

Although ADTRAN will remain a mid-tier player after the deal closes, LightCounting’s Lively and Dell’Oro Group VP Jimmy Yu both think in general, “it’s a good move.”

Yu noted that industry mergers can destroy value if too many products and workforces overlap. But in this case, ADTRAN and ADVA are from adjacent markets of fixed access and optical layer, and both sides will help each other grow the product line, so “it seems like a complementary combined company that’s going to come out of this,” he added.

Jimmy had this general comment on optical network trends:

“Disaggregated DWDM systems outperformed the broader market, demonstrating the growing adoption of this platform type. Really what we see is that this type of platform architecture, where transponder units are independent of the line systems, is being more widely embraced beyond the Internet content providers. Also, it is no longer just for metro applications. Recently, the highest growth rates have been from long-haul applications,”

Lively noted that there is almost no overlap in the product line, and “for the networks, the two companies logically fit together [as] ADTRAN makes access to equipment and ADVA makes the gear that connects the access equipment to the core.”

“So if you are a smaller service provider, and you want to upgrade to 10 Gb/s internet service for your customers, you could potentially buy everything you need from the new ADTRAN, from the passive optical networking, all the way through to connect to the core,” he said.

Yu also mentioned that the deal will help increase the scale and diversity in products as ADTRAN will be able to offer access and a backhaul solution, especially in tier-two and tier-three markets where most service providers want to work with one solution company instead of multiple vendors.

“2022 should be positive for sales,” argued the analysts at WestPark Capital in a note to investors earlier this month, following the release of Adtran’s second quarter results.

The WestPark Capital analysts pointed out that ADTRAN stands to gain ground in part from government broadband funding, as well as moves by some American and European network operators away from China’s Huawei.

The Raymond James analysts concurred on the Huawei opportunity. “We believe that the Huawei backlash outside of China presents among the largest opportunities,” they wrote on Monday.

The combined company will maintain ADTRAN’s global headquarters in Huntsville, Alabama. It will maintain ADVA’s headquarters in Munich, Germany, as its European base. Currently, ADTRAN has a geographical revenue split of 74% in the Americas, 21% in Europe, the Middle East, and Africa, and 5% in Asia Pacific, while ADVA is split 62% in EMEA, 29% in the Americas, and 9% in Asia Pacific, according to Stanton.

The deal expands ADVA’s presence in North America and ADTRAN’s ability to reach the European market more effectively, Lively said. One of the drivers for this combination is “we see our customers making significant capital investments to transition their supply chains to trusted vendors with our roots in the U.S. and Germany, our company will be viewed favorably by customers who increasingly specify Western vendors,” Stanton explained.

“It’s kind of a race to build out their digital infrastructure to make the country competitive,” which presents a real opportunity for the new ADTRAN and also its competitors, Lively added.

Juniper to integrate RAN Intelligent Controller with Intel’s FlexRAN platform for Open RAN

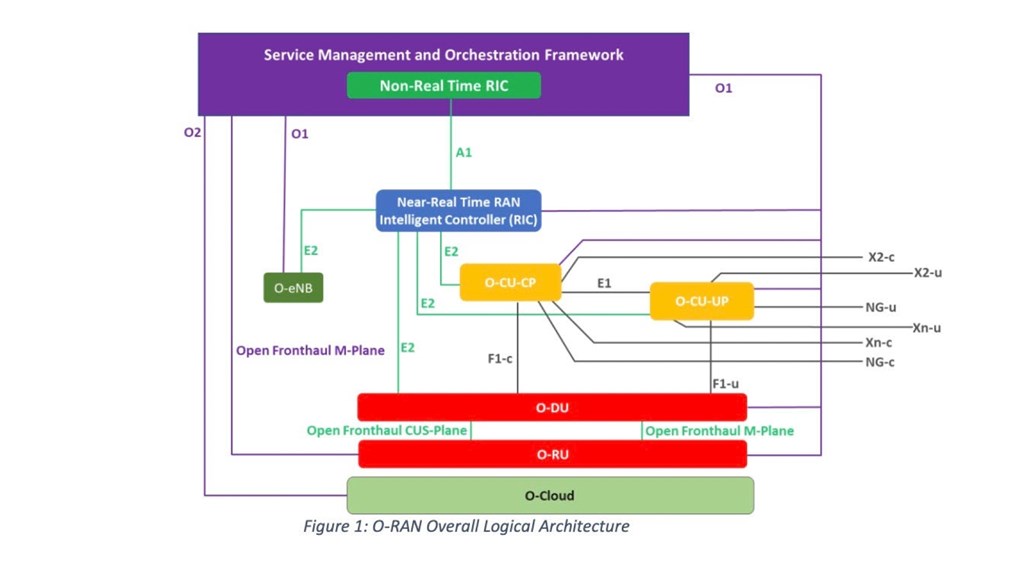

Juniper Networks today announced plans to integrate its radio access network (RAN) intelligent controller (RIC) with Intel’s FlexRAN platform for Open RAN development.

This joint initiative between two companies is part of Juniper’s continuing efforts to bring openness and innovation to a traditionally closed-off part of the network, providing a faster route-to-market for service providers and enterprises to deliver 5G, edge computing and AI. Juniper views open RAN as an opportunistic endeavor and claims it’s currently testing the RIC integration in labs and trials with some tier-one operators. Juniper’s RIC takes direction from the O-RAN Alliance and adheres to open interfaces and APIs, but the specialized features it adds on top are proprietary.

Juniper has made major investments to lead the shift to Open RAN, beginning with the exclusive IP licensing agreement with Netsia (a subsidiary of Turk Telekom Group), and continuing with significant involvement in the O-RAN Alliance. Juniper is heavily engaged in expanding integrations with key partners and is part of the innovation team building joint customer solutions in Intel’s 5G Lab.

Spending on Radio Access Networks (RAN) is a significant amount of service providers’ CapEx, primarily due to limited vendor choice and closed architectures which lead to lock-in. Juniper recognizes that the RAN is a domain that demands openness and best-of-breed innovation to ensure the best experience for network operators and their customers, and is determined to lead the industry toward that vision.

Juniper’s collaboration with Intel includes the following:

- Juniper RAN Intelligent Controller (RIC) and Intel FlexRAN platform are pre-integrated and pre-validated to enhance usability of a full ORAN-compliant Intelligent RAN system

- Collaborative R&D work with Intel Labs for RIC platform-specific apps to improve customer experience, maximize ROI and drive rapid ORAN ecosystem innovation

- Joint customer testbeds with Intel to validate performance-improving implementation and speed of time-to-market

Juniper is an active member of the O-RAN Alliance, contributing to six working groups and serving as chair and co-chair of the slicing and use-case task groups, respectively. Juniper is also an editor of RIC specifications within the alliance.

Quotes:

“Juniper has always been committed to open infrastructures, which is why we are excited to support the work that Intel has undertaken with their FlexRAN ecosystem. By collaborating with Intel, we are able to deliver cloud-native routing, automation, intelligence and assurance solutions and services that are optimized for our customers’ needs, speeding time-to-market and enabling them to monetize faster.”

– Constantine Polychronopoulos, VP of 5G and Telco Cloud at Juniper Networks

“RIC is like the brain for open RAN, and we also call it essentially the operating system of the RAN,” said Jai Thattil, director of strategic technology marketing at Juniper Networks. Juniper intends to differentiate its RIC from others by pre-integrating and validating the technology so operators can adopt it as part of a more comprehensive offering combined with other services. “Juniper is kind of in a unique position, compared to a lot of other vendors” because of its experience in 5G transport, network cores, service management and orchestration, according to Thattil.

“The virtualization of the RAN continues to gain momentum across the industry as operators take advantage of cloud economics and the delivery of new services. This collaboration with Juniper and the validation of FlexRAN and RIC solutions will assist service providers to overcome integration challenges and accelerate time-to-market for future deployments.”

– Caroline Chan, VP Intel Corporation, GM of Network Business Incubator Division

O-RAN Alliance Threatened:

The O-RAN Alliance is in a crisis because of U.S. sanctions against Chinese vendors in the group has troubled Nokia and Ericsson. In particular, the recent addition to the American “entity list” of three Chinese members of the Alliance. Kindroid, a semiconductor company, Phytium, a supercomputing company, and Inspur, a compute server vendor, have been accused of working with the Chinese military, and have joined 260 other Chinese companies, including, Huawei, on the entity list.

A few days after Nokia decided to suspend its technical activity with the O-RAN Alliance, in fear of American punishment over its engagement at the forum with companies recently put on the American “entity list,” Ericsson expressed similar concerns.

It should not be a surprise that, given O-RAN Alliance’s legacy (born out of a merger of the American-led xRAN Forum and the Chinese-led C-RAN Alliance), there are a strong Chinese contingency. According to Strand Consult, by the end of 2020, 44 of the 200 odd Alliance members are companies from China. Also of concern is this post by Mr. Strand, What NTIA won’t tell the FCC about OpenRAN.

………………………………………………………………………………………………………….

References:

https://www.sdxcentral.com/articles/news/juniper-nudges-open-ran-ric-into-intel-flexran/2021/09/

Additional Resources:

Media Relations:

Lori Langona

Juniper Networks

+1 (831) 818-8758

[email protected]

IDC: Global Smartphone Shipments +7.4% in 2021, led by Emerging Markets

IDC forecasts that global smartphone shipments are set to increase by 7.4% this year, marking a return to growth after the Covid-19 pandemic hit the industry in 2020, according to new analyst figures. IDC estimates worldwide smartphone shipments at 1.37 billion units in 2021, which represents “minimal growth” compared with pre-pandemic 2019. Its data for 2019 shows shipments of 1.372 billion, then a 5.9% decline to 1.29 billion the following year. Making comparisons with 2019 (pre-COVID) gives a more accurate picture of the state of the market.

The 7.4% growth can be attributed to a healthy 13.8% growth from iOS devices combined with 6.2% growth from Android. Although COVID-19 drastically impacted 2020 shipments, 2021 shipments have managed to display minimal growth compared to 2019 (pre-pandemic) volumes, giving us a more accurate view of the state of the market. The world’s largest markets – China, the United States, and Western Europe – will still be down from 2019, but growing markets such as India, Japan, the Middle East, and Africa are fueling the recovery.

“The smartphone market was better prepared from a supply chain perspective heading into 2020 given almost all regions were expecting to grow and vendors were preparing accordingly,” said Ryan Reith, group vice president with IDC’s Mobility and Consumer Device Trackers. “2020 was a bust due to the pandemic but all of the top brands continued forward with their production plans with the main difference that the timeline was pushed out. Therefore, we are at a point where inventory levels are much healthier than PCs and some other adjacent markets and we are seeing the resilience of consumer demand in recent quarterly results.”

5G shipments continue to be a primary driver of 2021 growth as both vendors and channels focus on 5G devices that carry a significantly higher average selling price (ASP) than older 4G devices. The ASP of a 5G smartphone will reach $634 in 2021, which is flat from $632 in 2020. However, 4G devices continue to witness a massive price decline as the ASP drops to $206, representing a nearly 30% decline from last year ($277). As a result, the total 5G shipment volume will grow to 570 million units, up 123.4% from last year.

China will continue to lead the smartphone market with 47.1% of the 5G global market share, followed by the USA at 16%, India at 6.1%, and Japan at 4.1%. By the end of 2022, 5G units are expected to make up more than half of all smartphone shipments with a 54.1% share.

“Despite the ongoing issues surrounding the pandemic and the Delta variant, consumers are continuing to upgrade to more premium smartphones this year,” said Anthony Scarsella, research director, Mobile Phones at IDC. “Premium smartphones (priced at $1000+) continued to grow in the second quarter as the segment displayed 116% growth from last year. Moreover, ASPs across the entire market climbed 9% as buyer preferences trend towards more costly 5G models than entry-level devices.”

Closing Comment: We don’t share IDC’s enthusiastic forecast for 5G smartphones, because they do not support any new features, applications or use cases without a 5G SA core network. As 95% of deployed 5G networks are NSA (requiring a 4G anchor/core network), 5G smartphones that use 5G NSA networks are only a little faster [1.] than 4G-LTE phones with no noticeable improvement in latency. Also, there’s no roaming, so users must fall back to 4G-LTE when outside of their 5G carrier serving area. Mobile subscribers will soon realize that and stop buying 5G smartphones.

Note 1. PC magazine has tested smartphones on 5G networks from AT&T, T-Mobile, and Verizon. Their report Fastest Mobile Networks 2021 found that T-Mobile’s new mid-band 5G network is the only U.S. nationwide 5G that’s markedly faster than 4G

…………………………………………………………………………………………………………………………………….

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

For more information about IDC’s Worldwide Quarterly Mobile Phone Tracker, please contact Kathy Nagamine at 650-350-6423 or [email protected].

References:

https://www.idc.com/getdoc.jsp?containerId=prUS48194821

https://www.idc.com/tracker/showproductinfo.jsp?containerId=IDC_P8397

https://www.pcmag.com/news/fastest-mobile-networks-2021

https://techblog.comsoc.org/2021/08/22/juniper-research-5g-smartphone-trends/

Verizon starts private 5G mobile edge services with Microsoft Azure cloud

Verizon announced the availability of an on-premises, private edge compute service with Microsoft Azure, building on their collaboration formed last year. Verizon 5G Edge with Microsoft Azure Stack Edge is a cloud computing platform that brings compute and storage services to the edge of the network at the customer premises. This should provide enterprises with increased efficiencies, higher levels of security, and the low lag and high bandwidth needed for applications involving computer vision, augmented and virtual reality, and machine learning, Verizon said. Here are the highlights:

- Through its relationship with Microsoft, Verizon is now offering businesses an on-premises, private edge compute solution that enables the ultra-low latency needed to deploy real-time enterprise applications.

- Solution leverages Verizon 5G Edge with Microsoft Azure Stack Edge to bring compute and storage services to the edge of the network at the customer premises, providing increased efficiencies, higher levels of security, and the low lag and high bandwidth needed for applications involving computer vision, augmented and virtual reality, and machine learning.

- Ice Mobility has used Verizon 5G Edge with Microsoft Azure to help with computer vision-assisted product packing to improve on-site quality assurance. The company is now exploring additional 5G Edge applications that provide tangible, material automation enhancements to its business, such as near real-time activity-based costing.

Some of the applications possible with the on-site 5G and edge computing include in-shop information processing in near real time to help retailers manage inventory, or factory data processing and analytics to minimize downtime and gain visibility across manufacturing processes.

Logistics company Ice Mobility has used Verizon 5G Edge with Azure Stack Edge to help with computer vision-assisted product packing to improve on-site quality assurance. The company is exploring additional 5G applications that leverage initial computer vision and 5G edge investments to provide automation enhancements, such as near real-time activity-based costing. This would allow the company to assign overhead and indirect costs to specific customer accounts, pick and pack lines, and warehouse activities to enhance efficiencies and improve competitiveness.

“This announcement aligns with IDC’s view that an on-premises, private 5G edge compute deployment model will spur the growth of compelling 4th generation industrial use cases,” said Ghassan Abdo, Research VP at IDC. “This partnership is a positive development as it leverages the technology and communications leadership of both companies.”

“Our partnership with Microsoft brings 5G Edge to enterprises, dropping latency at the edge, helping critical, performance-impacting applications respond more quickly and efficiently,” said Sampath Sowmyanarayan, Chief Revenue Officer of Verizon Business. “5G is ushering in next-generation business applications, from core connectivity to real-time edge compute and new applications and solutions that take advantage of AI transforming nearly every industry.”

“Business innovation demands powerful technology solutions and central to this is the intersection between the network and edge” said Yousef Khalidi, corporate vice president Azure for Operators at Microsoft. “Through our partnership with Verizon, we are providing customers with powerful compute and storage service capabilities at the edge of customers’ networks, enabling robust application experiences with increased security.”

Verizon offers a similar service with Amazon Web Services (AWS which provides private multi-access edge computing (Private MEC) for enterprises. Private MEC integrates edge computing infrastructure with private networks deployed on or near the customer’s premises.

……………………………………………………………………………………………………………………………………..

References:

https://www.verizon.com/about/node/921923

Watch this video to learn more about how Ice Mobility is using Verizon 5G Edge. Learn more information about Verizon 5G Edge and Verizon’s 5G technology

Amazon AWS and Verizon Business Expand 5G Collaboration with Private MEC Solution

India lagging in 5G unless spectrum prices decrease & 5Gi standard debate is settled

Bloomberg says India risks lagging in the rollout of the 5G wireless networks unless the government makes airwaves cheaper in an upcoming spectrum auction, a local telecom industry body said, citing the financial stress in the sector.

“The reserve prices are fixed so high that almost 50-60% of the spectrum may go unsold,” S.P. Kochhar, director general of Cellular Operators Association of India (COAI), said in an interview August 27th. “It is not viable because we are not passing on the extra price to the consumer as we continue to bleed. We have to reduce our cash outflow and one of the major things money goes into is auctions.”

Proceeds from the 5G airwaves auction, likely early next year, is an important source of revenue for the Indian Exchequer (UK term for Treasury Dept.) especially as the Narendra Modi-led government looks to spur India’s pandemic-hit economy. Too high a reserve price for spectrum risks putting off wireless network operators whose financial health has been battered by a brutal tariff war after the entry of billionaire Mukesh Ambani’s Reliance Jio Infocomm Ltd. in 2016. Most operators since have quit, gone bankrupt or merged.

Lowering the base price for auctioned spectrum and other government levies have been a longstanding industry demand. The local telecom industry is paying about 32% of its total revenue as levies and taxes and that’s “too high,” said Kochhar. “It’s the highest in the world.”

India’s government has set the reserve price for 5G airwaves at 4.92 billion rupees ($67.2 million) per megahertz of spectrum in 3,300 to 3,600 Mhz bands which are most suitable for the new technology. Kochhar expects the auction to happen in January or February 2022.

High reserve prices have hindered spectrum sales in some categories in the past. The 700 megahertz band, which is suitable for 5G technology, didn’t receive any bids in the March auction.

…………………………………………………………………………………………………………………………………………..

Sidebar: TSDSI’s 5Gi standard (included in ITU-R M.2150 recommendation/IMT 2020.specs)

Another important aspect of 5G in India deployments has been the deliberation on the development of specific 5G India standards (5Gi or LMLC). While the Telecommunications Standards Development Society of India (TSDSI) has been keen on pushing telcos to undertake trials based on 5Gi, a homegrown standard with a Large Cell Low Mobility enhancement for wider coverage in rural areas, the Cellular Operators Association of India (COAI) has argued for the implementation of the global 3GPP specification (5G NR in Release 15 & 16) for 5G in India. They remain convinced that 5Gi could lead to interoperability issues. This ongoing debate is further delaying the 5G launch in India.

Source: The Economic Times

……………………………………………………………………………………………………………………………………..

India remains a relative latecomer in the 5G space compared to some countries, including China and South Korea, which already have 5G networks in place.

If the government can “somehow have the right price point for spectrum,” it would boost the growth of 5G network traffic as well as the devices, Bharti Airtel Ltd. Chairman Sunil Mittal said in an investor call Monday. “We need to invest in fiber backhaul now.”

The market leader Jio and Bharti Airtel, India’s no. 2 operator, have been conducting 5G trials in preparation for a nationwide roll out once the airwaves are sold.

Debt-laden Vodafone Idea Ltd. — the only other private sector wireless operator left in India — has been posting losses for several quarters and is struggling to stay afloat. Bharti and Vodafone Idea also have to come up with billions of rupees in back dues to the government after India’s top court rejected their petitions seeking relief.

“At this point, the payouts in telecom are so excessive that even survival is becoming a problem,” said Kochhar. That strongly implies there will be only two 5G network operators in India- Jio and Bharti!

………………………………………………………………………………………………………………………

BSNL is aiming to upgrade the 4G network to 5G non-standalone (NSA) by 2022 (pending 5G spectrum to be purchased at the long delayed auction) and to 5G standalone (SA) by 2023. What about that? Almost every country has already deployed 5G NSA while operators are slowly evolving to 5G SA using different software technologies in the absence of any standard or implementation spec.

Light Reading says BSNL is unlikely to meet to this timeline, with shortlisted 4G network vendors still conducting tests. It is likely to be another year before BSNL can roll out a 4G network, while private-sector companies are gearing up for a 5G launch in the coming year.

References:

Singtel discloses new 5G SA uses cases for enterprises and residents in Singapore

At its ‘Powering Up Singapore With 5G’ event, Singtel (the leading network operator in Singapore) revealed a number of 5G Standalone (SA) use cases, according to a press release. The new use cases span a variety of sectors from entertainment to mobility and bring to life the benefits of 5G by redefining live, work and play experiences with blazing fast speeds and near-instantaneous response times.

Singtel said it continues to expand its 5G network, which now covers over two-thirds of Singapore, adding sites in densely populated areas like Choa Chu Kang, Punggol, Sembawang and Tampines. In addition, it has expanded its 5G indoor coverage to more major shopping malls island-wide such as Funan, West Mall, Tampines Mall, Northpoint City and Waterway Point.

Minister for Communications and Information Mrs Josephine Teo highlighted the role of 5G, “Mobile networks and data exchanges are key building blocks for the digital infrastructure. 5G, which promises to be ultra-fast and supports near-zero latency, can change the way we live and work in profound ways, and become essential for the digital developments of the future. Building a digital future is certainly about the hardware, software, systems and standards. It is equally about the people and skills. For that, the Government will continue to invest in reskilling and upskilling our people so that they can achieve not just digital literacy but digital mastery. This way, everyone can benefit from the infrastructure.”

Yuen Kuan Moon, CEO of Singtel said: “With the maturing of 5G technology, we’re excited to unlock the benefits of a 5G-enabled reality for consumers and enterprises. Its potential to transform business models and deliver enhanced products and services on a scale like never before, will spur Singapore’s digital economy as the country moves into post-COVID recovery. As part of our strategic reset to focus on 5G, we are accelerating our roll-out and the creation of new services.”

Ookla® recently declared Singtel the ‘Fastest 5G mobile operator in Singapore’ in H1 2021 for clocking in the highest median mobile network speed.

Singtel said the arrival of 5G has proved timely against a backdrop of accelerated digital adoption as a result of safe distancing and remote working. With more people using digital channels to go about their lives, there has been a corresponding increase in demand for fast and reliable connectivity. This is reflected in a recent Singtel survey, in which majority of consumers indicated that 5G-enabled services such as augmented reality books and virtual reality entertainment events appeal to them.

The new use cases powered by Singtel’s 5G SA network include:

- 5G-powered Remote Racing: Partnering with Formula Square to deliver an immersive, lag-free experience racing remote-controlled cars powered by 5G at Southside, Sentosa;

- 4K Live Streaming: Working with S.E.A. Aquarium to bring Singapore’s first underwater 5G livestream of the S.E.A. Aquarium to UNBOXED, Singtel’s unmanned pop-up retail store, where visitors can immerse themselves in the aquatic wonders of the aquarium, viewing manta rays, sharks and shoals of fishes in vivid 4K resolution;

- Enhancing the Arts and Culture Experience: Collaborating with the National Gallery Singapore and Esplanade – Theatres on the Bay to deliver cultural and art experiences over 5G, from the Singtel Special Exhibition Gallery and the Singtel Waterfront Theatre when it opens officially next year. This will enable more people with opportunities to get up close and personal with local artists and performers amid prevailing safe distancing measures;

- Co-creating the future of hybrid work: Teaming up with Samsung and Zoom to introduce a Productivity Data Pass plan offering data-free usage of Zoom, enabling customers to connect to family and colleagues seamlessly and lag-free. This, coupled with Samsung devices such as DeX, will enable customers to set up virtual workstations easily.

Singtel has also signed a Memorandum of Understanding (MoU) with Ericsson and global industry partners to collaborate on the development and deployment of advanced 5G enterprise solutions in Singapore. The agreement will allow companies to leverage Ericsson’s technology expertise and Singtel’s 5G network, test facilities and capabilities to innovate solutions and scale them up for global deployment.

Singtel launched its 5G SA network in May, via a partnership with South Korea’s Samsung. The 5G SA sites run on 3.5 GHz spectrum. Singtel had initially launched its 5G Non-Standalone (NSA) network in September of 2020, using spectrum in the 3.5 GHz frequency as well as existing 2.1 GHz spectrum.

As part of its 5G SA deployment, Singtel has already deployed over 1,000 5G sites across Singapore in strategic locations such as Orchard Road, the Central Business District, Marina Bay, Harbourfront and Sentosa, as well as major residential areas including Sengkang, Punggol, Pasir Ris, Jurong East and Woodlands.

Singtel also demonstrated at the event how 5G is empowering industries and businesses with greater productivity and operational efficiency. Key to this is multi-access edge computing (MEC), an infrastructure that maximizes 5G’s low latency, high bandwidth benefits and enables functions like real-time computing, data storage, data analytics and AI services at the edge. MEC supports massive and faster connectivity of devices, bringing to life more mission critical enterprise applications than before, such as real-time asset tracking and automated quality inspection in factories and smart city planning.

During the event, Guest of Honor Mrs Josephine Teo, Minister of Communications and Information and IMDA’s Chief Executive Mr Lew Chuen Hong were ‘teleported’ into the venue via Singtel’s 5G network, in which their high-resolution likeness were beamed from a separate location. The network’s ultra-low latency meant that Minister Teo and Mr Lew could ‘interact’ seamlessly with Mr Yuen on stage.

Singtel aims to intensify its 5G SA deployment across the island in the coming months as handset manufacturers progressively roll out 5G SA software updates for existing 5G handsets and launch more 5G SA-compatible models in Singapore later this year.

References:

https://www.singtel.com/personal/products-services/mobile/5g#5g1

https://www.rcrwireless.com/20210830/5g/singtel-unveils-new-use-cases-5g-sa-technology-singapore

Singtel starts limited deployment of 5G SA; only 1 5G SA endpoint device; state of 5G SA?

LightCounting: Wireless Infrastructure Market to Grow at 5% in 2021; 8% in 2Q-2021

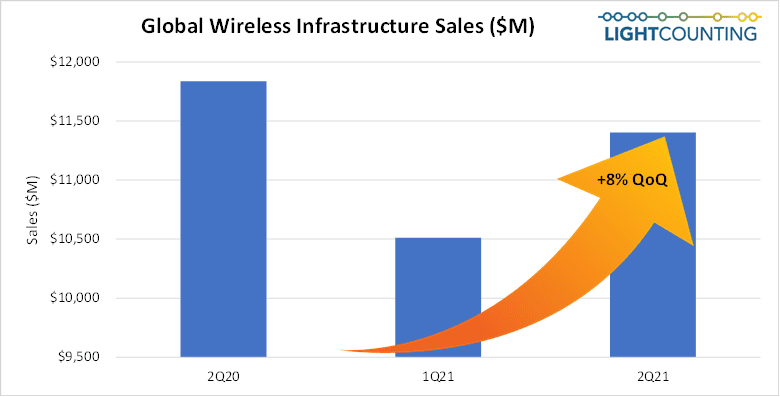

LightCounting says the 2nd quarter of 2021 was robust for the wireless infrastructure market, as a second quarter typically is, but below 2Q20 that was revved up by China’s 5G catch-up after a massive COVID-19 lockdown. The 5G rollout momentum seen in North America, and Northeast Asia reported in 2H-2020 and 1Q-2021 continued in 2Q-2021 and was augmented by strong activity in Europe, and 4G expansion in India.

As a result, the global wireless infrastructure market grew sequentially, driven by RAN, open vRAN—again mostly fueled by Rakuten Mobile’s 5G network buildout, and 5G and 4G core network elements.

“2Q21 was somewhat reminiscent of the golden GSM era and I could not find anyone malcontent as sales of all 4G and 5G network nodes performed magnificently. Regarding the vendors’ market shares, the gradual rise of Ericsson and Nokia was most immediately induced by the fall of Huawei.” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

LightCounting once again had to increase their North American forecast to reflect a strong start in C-band activity and Ericsson’s 5-year $8B 5G contract with Verizon and decrease their Asia Pacific’s 5G forecast due to uncertainties in China and India. As a result, the global wireless infrastructure market’s growth stayed intact at 5% over 2020.

In the long run, factoring in the strong North American 5G activity which is expected to last until 2025 our model’s market peak has moved by a year to 2023. Our service-provider 20-year wireless infrastructure footprint pattern analysis points to a 2020-2026 CAGR of 1% characterized by low single-digit growth through 2023, followed by a 1% decline in 2024, flatness in 2025, and a 4% drop in 2026. This lumpy pattern reflects the differences in regional and national agendas.

About the report:

2Q21 Wireless Infrastructure Market Size, Share, and Forecast report analyzes the wireless infrastructure market worldwide and covers 2G, 3G, 4G and 5G radio access network (RAN) and core network nodes. It presents historical data from 2016 to 2020, quarterly market size and vendor market shares, and a detailed market forecast through 2026 for 2G/3G/4G/5G RAN, including open vRAN, and core networks (EPC, vEPC, and 5GC), in over 10 product categories for each region (North America, Europe, Middle East Africa, Asia Pacific, Caribbean Latin America). The historical data accounts for the sales of more than 30 wireless infrastructure vendors, including vendors that shared confidential sales data with LightCounting. The market forecast is based on a model correlating wireless infrastructure vendor sales with 20 years of service provider network rollout pattern analysis and upgrade and expansion plans.

More information on the report is available at:

https://www.lightcounting.com/report/august-2021-wireless-infrastructure-2q21-116

Dell’Oro: 5G Fixed Wireless Access (FWA) deployments to be driven by lower cost CPE

by Jeff Heynen, Dell’Oro Group

Introduction:

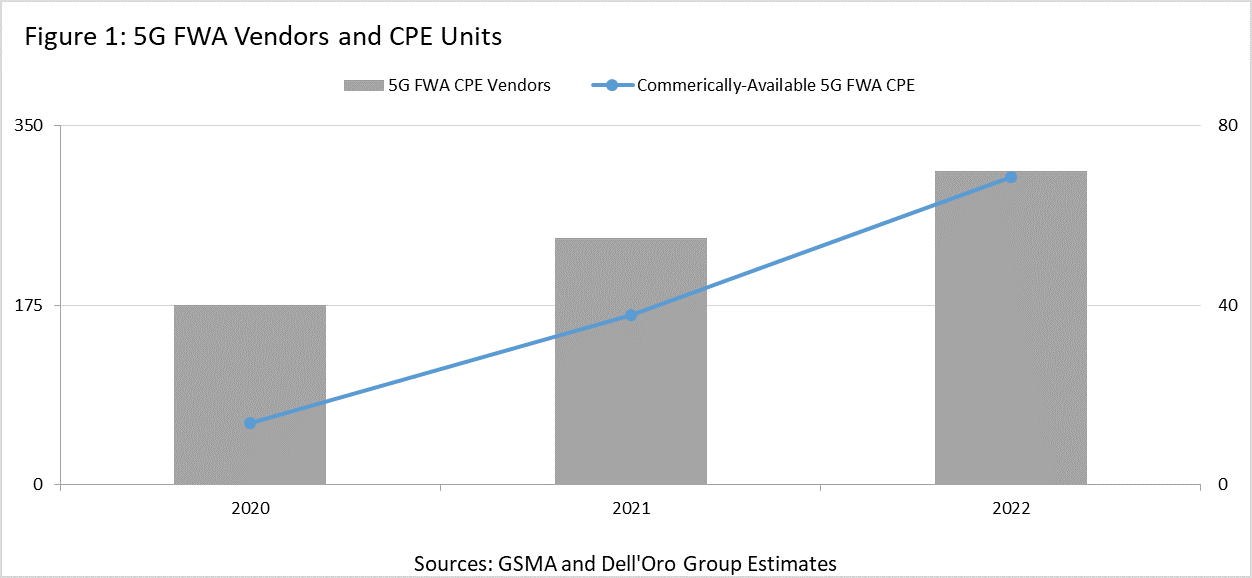

The global demand for broadband service has resulted in an acceleration of interest among fixed and mobile operators alike to either expand their existing LTE or point-to-multipoint fixed wireless access (FWA) offerings or roll out early 5G FWA services to a growing base of current and potential subscribers. In both mature and emerging markets, there has been a tremendous increase in the number of RFPs for equipment and software to support large-scale 5G fixed wireless service deployments. Clearly, service providers are looking to strike while the iron is hot, securing subscribers who need broadband now, while also taking advantage of growing government subsidization of broadband service rollouts.

The vendor ecosystem supporting 5G fixed wireless has naturally increased, particularly in the area of dedicated CPE. According to the GSA (Global mobile Suppliers Association), there are currently over 130 FWA CPE devices (both indoor and outdoor) that have been announced by a growing list of vendors, which now numbers above 50. Over 50 of these dedicated CPE are now commercially available, which is up from 15 commercially-available units just one year ago. By the end of 2021, we expect that the number of commercially-available devices will exceed 100 and will double in 2022. The number of vendors producing or planning to produce 5G FWA CPE already exceeds the number of suppliers of 4G FWA CPE.

The increase in available units, which corresponds with the perceived addressable market of 5G network deployments and subscriber uptake, combined with the rapid uptake of 5G-capable smartphones will help to push the cost of both indoor and outdoor 5G FWA units down to levels that satisfy the business case requirements of operators globally. In particular, operators in emerging markets where ARPU levels are typically low, cost-reduced CPE are an absolutely critical requirement to ensuring a faster ROI.

The larger the addressable market, the more willing component suppliers will be to forward-price to capture a larger share of that growing market. The resulting price reductions in components begets wider availability of finished CPE. It becomes an iterative cycle that benefits the entire supply chain and the network operators as end purchasers.

Quick Ramp of 5G FWA Devices Expected:

At the end of 2020, we estimate that there are nearly 60M fixed wireless subscribers globally. A large percentage of these subscribers use 4G LTE networks, though there are also subscribers using 3G networks, proprietary point-to-multipoint services, as well as some using early 5G technologies, including sub-6Ghz and millimeter wave. We estimate that the 5G subscribers are around 1 million currently. However, we expect that those subscriber numbers are set to double in 2021, as operators such as T-Mobile (USA), AT&T, Verizon, Bell Canada, Saudi Telecom, Rain (South Africa), Swisscom, Deutsche Telekom, Optus, and others introduce or expand 5G FWA services this year.

With those operator commitments already in place, we estimate that the total number of 5G FWA devices shipping to operators this year will easily exceed 3 million units and could push 4 million units. The vast majority of these units will be to support sub-6Ghz service offerings, though we also expect to see millimeter wave units, as some operators use a combination of those technologies to provide both extensive coverage and fiber-like speeds in areas where the competition from fixed broadband providers is more intense. Overall, however, we expect volumes first from sub-6GHz units this year and into next year, followed by increasing volumes of millimeter wave units beginning in the latter part of 2022 and into 2023.

We also anticipate that the vast majority of 5G FWA deployments will rely on indoor gateways that combine a 5G modem with a WiFi 6 access point for signal distribution within the home. Many of these gateways will also be mesh-capable and will be paired with satellite units to blanket homes with WiFi coverage and to eliminate dead spots within the home.

There will be situations where outdoor units will be required, particularly in the case of millimeter wave deployments which require line of sight because of the high-frequency ranges being used. But even in the case of sub-6Ghz 5G FWA deployments, outdoor units will be required when homes or apartments have very thick-paned windows or are located in LEED (Leadership in Energy and Environmental Design) buildings.

With this growing clarity around deployment models and device types, we expect that the costs of 5G FWA CPE will decline throughout this year and next, providing a catalyst for much larger, global deployments of the service through 2022 and beyond. We believe that the average cost for an indoor 5G FWA CPE will decline from around $475 in 2020 to around $180 by the end of 2023 (Figure 2).

5G chipsets will see the biggest price declines, helped in large part by increasing volumes of 5G smartphones, but also by a growing ecosystem of 5G modems, gateways, tablets, cars, and other products reliant on 5G networks for WAN connectivity. Currently, 5G SoCs are roughly 4x the cost of 4G SoCs. But we have seen this played out before in the early stages of 4G network and device rollouts when the cost of chips dropped quickly as device volumes increased.

Similarly, the cost of WiFi 6 chips remains about 15-20% higher than WiFi 5 units. While WiFi 6 will be the primary technology for mature, highly competitive markets, WiFi 5 will remain an important option for very price-sensitive markets, particularly those in developing countries and in rural markets where competition comes from lower-cost services. But as enterprise and higher-end residential gateways are built with WiFi 6 technology, the cost of those chips will decline significantly over the next couple of years.

Beyond these two major components, manufacturing costs will also decline as equipment and contract manufacturers increase volumes based on initial board and hardware designs. FWA gateway designs, like higher-end residential WiFi access point designs, are well-understood at this point. However, with any new product spin, there is a learning curve for the manufacturers. Though the cost of producing the first few thousand units is high, the costs quickly decrease as the manufacturing process becomes clearly defined and as new iterations of the devices incorporate lower-cost components.

There are two critical components for the steady reduction in cost for 5G FWA CPE: Increased orders and volumes from service providers, along with the cooperation among providers of 4G CPE devices and 5G units to understand how to bring down the costs as quickly as possible. This cooperation will be necessary to stimulate interest among service providers, who can then drive the volumes necessary to improve the overall economics of delivering 5G fixed wireless services.

5G FWA Will Build on 4G Deployments:

Though the deployment of FWA services using 4G LTE networks has been moderately successful around the world, 5G will dramatically boost the addressable market of subscribers, as well as the service’s ability to reasonably compete with most fixed broadband technologies. 5G can comfortably deliver downstream speeds that compare favorably with VDSL and DOCSIS 3.0 services while easily beating previous generations of both fixed technologies. More importantly, C-band and millimeter wave technologies promise to be comparable with DOCSIS 3.1 and fiber services, thereby expanding the addressable market of subscribers even further.

Mobile operators around the world who have previously been unable to compete with fixed broadband providers, as well as fixed broadband providers looking to expand the reach of their services more quickly, are all enthusiastic about the opportunity in front of them with FWA. Their growing commitment to the service, as well as a rapidly expanding vendor ecosystem for customer devices, will help to quickly reduce the cost of those devices, thereby ensuring a faster ROI for service providers and a willingness to expand their reach even further.

HUAWEI CLOUD launches partner programs in LatAm and Caribbean

HUAWEI CLOUD [1.] announced today that it will launch partner programs in Latin America and the Caribbean, such as the Spark Program, which provides a fund of $10 million for startup innovation, and the Huawei Mobile Services (HMS) Ecosystem Program, which provides a fund of $10 million to enable app developers and partners to improve cloud experience.

Note 1. HUAWEI CLOUD provides a powerful computing platform and easy-to-use development platform to support Huawei’s full-stack, all-scenario AI strategy.

………………………………………………………………………………………………………………………………

From August 25 to September 3, HUAWEI CLOUD is celebrating its second anniversary in Latin America with a series of activities. HUAWEI CLOUD and its customers and partners will share experiences in digital transformation and intelligent upgrade.

The event includes a series of releases, covering distributed cloud, cloud native, big data, AI, and video service. The following cloud services are launched for the first time in Latin America: Intelligent EdgeCloud (IEC), Intelligent EdgeFabric (IEF), KYON (Keep Your Own Network), FunctionGraph 2.0, Multi-Cloud Container Platform (MCP), Application Service Mesh (ASM), Container Guard Service (CGS), GaussDB database, ModelArts Pro (AI development platform for enterprises), and Cloud-native Video Service. These powerful offerings help Latin American customers simplify connections, deployment, data analysis, AI adoption, and service rollout, facilitating their digital transformation.

Four Initiatives to Accelerate Digital Transformation and Intelligent Upgrade:

“Cloud is the core of the ICT industry and a key driving force for industry digitalization,” said Mr. Zhang Ping‘an, Senior Vice President of Huawei, CEO of Huawei Cloud BU, and President of Huawei Consumer Cloud Service. “HUAWEI CLOUD values the strategy of building a global presence within local reach. Latin America is one of the most important emerging markets for cloud computing. HUAWEI CLOUD has been investing heavily in this market and has achieved rapid growth,” Mr. Zhang Ping‘an continued. “Going forward, we will strengthen our support for the digital transformation and intelligent upgrade of our customers in Latin America through four initiatives: continuous tech innovation, joint outreach by HUAWEI CLOUD & Huawei Mobile Services, Global + Local services, and high-quality business ecosystems. We invite more partners to join. Together, we will build a robust digital ecosystem around the world and lay the cloud foundation for an intelligent world.”

Continuous tech innovation: Drawing on Huawei’s rock-solid foundation built by 80,000 R&D engineers and an annual investment of 15 billion US dollars into R&D, HUAWEI CLOUD continues to innovate in cloud native, AI, and big data, delivering global cloud services with compelling elasticity, performance, and consistency.

Joint outreach by HUAWEI CLOUD & Huawei Mobile Services (HMS): This cloud-cloud synergy initiative enables deep collaboration between HUAWEI CLOUD and Huawei Consumer Cloud for media, audio-visual, finance, industrial interconnection, and medical education. The synergy aims to deliver consistent technologies and experience for developers and partners via unified accounts, development platforms, and application distribution and operation.

Global + Local services: HUAWEI CLOUD has built 45 availability zones (AZs) in 23 regions around the world. Over the past year, HUAWEI CLOUD has continuously invested in Latin America, bringing the second region online in Mexico and adding two new AZs in Brazil and Chile. As of today, HUAWEI CLOUD operates three core regions in Chile, Brazil, and Mexico, and two country-level regions in Argentina and Peru, with eight AZs in total. HUAWEI CLOUD has the largest number of nodes in Latin America and the Caribbean. The unrelenting resource investment helps provide customers with stable, efficient, and low-latency cloud service experience.

High-quality business ecosystem: HUAWEI CLOUD has more than 20,000 partners, including consulting, SaaS, and software partners. In the process of global deployment, HUAWEI CLOUD has focused on building a multi-dimensional global ecosystem and complementing the advantages of different regions to create maximum value for customers. In the future, HUAWEI CLOUD will engage with more partners in Latin America and bring the experience in other regions of the world to create shared success for all.

Continuous Investment in Latin America and Increased Support for Partners

“We position our company not only as a provider of leading cloud infrastructure and services, but also a long-term business partner in Latin America, as well as a responsible corporate citizen,” said Fernando Liu, President of Latin America Cloud Business Dept, Huawei. “As a cloud service provider with the largest number of nodes and the fastest growth in Latin America, HUAWEI CLOUD will continue to invest more in Latin America with more local nodes, new solutions, and partner support. We are dedicated to bringing the latest technology to Latin America.”

Fernando Liu also stressed HUAWEI CLOUD’s belief in a co-created ecosystem of shared success, as HUAWEI CLOUD works with partners to take digital transformation and intelligent upgrade to new heights in Latin America. At the two-year anniversary, HUAWEI CLOUD is launching a series of support initiatives for HMS partners, SaaS partners, and start-ups.

- Spark Program: A fund of USD10 million to encourage and support innovation by start-ups in Latin America.

- HMS Ecosystem Program: A fund of USD10 million to enable developers and partners to launch applications on Huawei AppGallery. The program also helps them better experience device-cloud synergy based on the HUAWEI CLOUD platform.

- Service Partner Program: Provides additional incentives for consulting partners who pass the Service Capability Certification (SCC).

- SaaS Partner Program and Marketplace Program: Focused technical and commercial policies to support technical partners and help them develop solutions based on HUAWEI CLOUD. The Marketplace Program supports the partners throughout the sales cycle, helping them achieve greater business success.

Since 2019, HUAWEI CLOUD has worked with more than 1000 consulting partners and 200 technical partners in Latin America, covering 14 Latin American countries, propelling Latin America towards digital transformation and intelligent upgrade in logistics, manufacturing, transportation, retail, education, and telecommunications.

References:

Asia Pacific’s 5G network targets 90% coverage in Taiwan; Chunghwa Telecom leads 5G market

The Taipei Times reports that Asia Pacific Telecom Co. said it expects its 5G network to cover 90 percent of Taiwan’s population by the end of this year, as its 5G base station number reaches 9,500 units by sharing infrastructure with Far EasTone Telecommunications Co.

Through a co-build and co-share infrastructure model, Asia Pacific currently provides 5G services through 7,500 base stations utilizing the 3.5-gigahertz spectrum owned by Far EasTone, the company said.

“Asia Pacific has obtained a new opportunity to thrive, thanks to the new telecommunications regulation that allows telecoms to co-share and co-build 5G networks,” company chairman Lu Fang- ming told a media briefing following the company’s annual shareholders’ meeting in Taipei.

Asia Pacific Telecom Co chairman Lu Fang-ming speaks to reporters during a media briefing following the company’s annual shareholders’ meeting in Taipei’s Neihu District yesterday. Photo credit: Lisa Wang, Taipei Times

………………………………………………………………………………………………………………………………………….

A subsidiary of Hon Hai Precision Industry Co, Asia Pacific Telecom said it has seen a rebound in subscriber numbers after rolling out its 5G services in October last year, shaking off the adverse impact from a major price war in 2019.

The company saw a 172 percent jump in average revenue per user from 5G subscribers compared with its 4G users.

The company plans to upgrade 20 percent of its mobile subscribers — or about 400,000 users — to its new 5G services by the end of this year, despite a delayed regulatory approval, company president Huang Nan-ren told reporters.

The Fair Trade Commission approved the 5G infrastructure co-sharing proposal early this month.

The National Communications Commission yesterday gave the green light for Far EasTone to invest NT$5 billion (US$179 million) for an 11.58 percent stake in Asia Pacific, which would it give one seat on the latter’s board.

Asia Pacific said it expects its earnings before interest, taxes, depreciation and amortization to further improve, extending a positive trend over the past two years. It hopes to be profitable in three to five years.

…………………………………………………………………………………………………………………………………………

Taiwan as a whole is expected to reach a 5G penetration rate of nearly 30% by the end of this year, local news site Digitimes reported, citing industry sources.

According to the Digitimes report, Chunghwa Telecom (CHT) currently leads the Taiwanese 5G market, with nearly 1 million subscribers. The operator is expected to reach 2 million 5G customers by the end of the year.

The carrier currently operates a total of 8,000 5G base stations, with plans to expand this figure to 10,000 by the end of the year, according to the sources.

The operator was the first telco in Taiwan to receive a license for 5G services from the National Communications Commission (NCC). Chunghwa Telecom launched commercial 5G services in Taiwan based on the non-standalone (NSA) 5G architecture.

Far EasTone Telecommunications (FET) has already secured over 800,000 5G subscribers and expects 5G service users to account for 30% of its total mobile services by the end of 2021. The company has already deployed over 7,000 5G base stations, with its coverage reaching 75% of the total population in Taiwan.

Taiwan Mobile currently has 800,000 subscribers in the 5G segment and aims to increase its 5G penetration rate to 30% by the end of the year, according to the report. Taiwan Mobile had partnered with Nokia to launch its 5G network. The telco had acquired 60 megahertz of spectrum in the 3.5 GHz band and 200 megahertz of the 28 GHz frequency.

Digitimes also said that handset vendors will find it difficult to sustain the competitiveness of their 4G models while putting sales focus on 5G smartphones. If they want to achieve good business performance during the 4G to 5G transition period they must continue to sell 4G smartphones till 5G coverage in Taiwan increases.

References:

https://taipeitimes.com/News/biz/archives/2021/08/26/2003763222

https://www.rcrwireless.com/20210826/5g/apt-5g-coverage-reach-90-taiwan-population-end-2021