Juniper CEO: Cloud and AI-driven strategy: #1 in Cloud WAN routing

“Ultimately cloud is not just a market segment. When people think cloud, they think AWS, Azure and Google. Certainly, these are companies that have built their entire businesses around cloud-service delivery models but I view cloud as a way of life for every customer across every vertical. CIOs of enterprises wake up in the morning and wonder how they are going to protect their companies from disruption that’s happening outside of their four walls and do so while they don’t really have unlimited budgets and most of their employees are stuck in just keeping the lights on. Up to 80, 90% of the IT of an enterprise company are just keeping status quo running. That’s not a recipe for success,” said Juniper CEO Rami Rahim.

Expansion into Cloud Majors is a priority as it’s seen as the growth driver of enterprise digitalization:

– Accelerated enterprise shift of workloads into public clouds

– Direct Cloud connectivity drives growth in MX edge routers

– Two-sided business opportunity: Cloud + Enterprise WAN

Growth driver of 400G core upgrades

– Comprehensive 400G fixed & modular platform portfolio

– Investment in custom, high-performance Triton silicon for 400Gb/sec

• >100 customers for 400Gb/sec WAN solutions

Speaking at the JP Morgan 49th Annual Global Technology, Media and Communications conference today, Rahim said that the company’s enterprise business has never been as strong as it is today and he attributes much of that strength to the company’s AI-driven enterprise strategy.

“AI-driven enterprise is not just a marketing slogan,” Rahim said. “There is technical substance. We have an AI engine that drives the solutions that we are offering customers today,” he added.

Much of the company’s AI-driven enterprise strategy is a result of its 2019 acquisition of Mist Systems, which had an AI-powered wireless platform that Juniper then used to enhance its own networking solutions.

“We’ve been taking share [from competitors] in the face of meaningful headwinds,” Rahim said. “I expect once those headwinds lessen as we emerge from Covid, we will see even more improved dynamics.”

Juniper said that it plans to extend that AI-driven focus to other areas of its business, such as SD-WAN. Juniper purchased 128 Technology last October for $450 million and is in the process of combining 128 Technology and Mist’s AI capabilities into its SD-WAN solution.

Rahim said that he believes Juniper’s IP routing and transport business will see the most opportunity because the move to 5G will mean more traffic from the radio access network (RAN) to the transport network and the cloud.

Security is also a potential area of growth from 5G investments. Rahim said that future 5G networks are going to be more prone to threats, and service providers will need to invest in more high-end security.

He also said that Juniper projects that its service provider business will grow close to 2% for the full year with the revenue increasing 17% year over year.

On the supply chain front, Juniper executives warned during the company’s first quarter earnings report last month that it could be negatively impacted by the ongoing semiconductor shortage. Those shortages are still a concern, the company said, noting that it will continue to need extended lead times for products through the rest of the year.

Cloud Service Providers Increase Telecom Revenue; Telcos Move to Cloud Native

MTN Consulting publishes quarterly vendor share in the telecom vertical, covering more than 100 suppliers of hardware, software and services. Many of them are starting to call out the cloud service providers as among their key competitors. VMware is an obvious one. It notes that “providers of public cloud infrastructure and SaaS-based offerings, such as Amazon AWS, Google GCP, Oracle Cloud and Microsoft Azure” are direct competitors.

Nearly a decade ago, as cloud services began gaining popularity, many telcos hoped to be direct beneficiaries on the revenue side. The cloud market went a much different direction, though, with large internet-based providers proving to have the global scale and deep pockets able to develop the market effectively. From 2011-2020 webscale operators invested over $700 billion in capex, a big portion of it devoted to building out their cloud infrastructure.

Amazon Web Services (AWS) made the earliest strides in telecom, in 2015 (with Verizon), but Azure and GCP were serious about the market by 2017.

By 2020, cloud service providers had made significant progress in the telecom sector. The figure below, courtesy of MTN Consulting, provides an estimate of cloud revenues in the telecom vertical for the three top U.S. based cloud service providers as well as China-based Alibaba and Tencent.

Here is how cloud computing helps telecom operators thrive and provide better services:

- Ensure high scalability: telcos who have made their journey to the cloud can easily scale up for today and scale back down once the demand for telecommunication services returns to its normal.

- Guarantee resilience: cloud computing helps telecom companies quickly recover from stressful situations such as sporadic high loads, hacker attacks, hardware failures, etc. It is based on a well-architected approach that allows the self-healing of a system in time. Anomaly detection, automation, and adaptiveness are the key concepts of it.

- Offer quick disaster recovery: anything from a power outage at a data center to a security breach may cause data loss. If you have backups of databases stored in the cloud, you can quickly restore all the data.

- Improve time-to-market: with cloud computing, telecom companies can deliver their products and services faster, because they no longer have to procure individual pieces of hardware for each function in the network. They can now develop network functions from the outset as software and run them on servers hosted in a cloud environment.

- Cut expenses: in terms of cost economics, cloud reduces the operating expense of a company setting up and managing its own data center. This includes various costs associated with hardware, software, servers, energy bills, IT experts, etc. With cloud infrastructure, a telecom company simply pays only for services it uses.

- Enhance customer experience: cloud computing helps telecom operators minimize latency, strengthen security, provide automated customer support, predict customer preferences, and offer new omnichannel digital experiences.

- Enable network automation: cloud helps automate today’s manual processes regarding designing and testing new network components; deploying, orchestrating, and monitoring networks. This becomes possible thanks to continuous integration, continuous testing, and continuous deployment. Modern networks are able to analyze their performance and respond to issues in real-time that only boosts customer satisfaction.

- Make use of data: telecom companies process huge volumes of customer data. And cloud enables operators to drive valuable insights from this data with the help of data science and data analytics. As a result, telcos can use these insights to further improve their operations. For example, during the pandemic, telecom operators provide data to monitor how people and crowds are spreading the virus.

- Generate new revenue streams: telecom operators can monetize their physical infrastructures by partnering with cloud service providers. Until recently, operators and hyperscalers were seen as competitors. But partnerships between telecommunications companies and cloud providers will only support further market growth. Telcos can offer their infrastructures to cloud providers to help them get closer to customers at the edge by launching platform solutions dedicated to telecoms infrastructure and integrate directly with 5G networks.

- The latest of such solutions include: Wavelength from AWS, Azure Edge Zones from Microsoft and Anthos for Telecom from Google Cloud.

Several new telco-cloud collaboration announcements in the last few weeks:

- Telefonica signed a collaboration agreement with Microsoft for Azure Private Edge Zone, combining private 5G connections from Telefonica with Azure edge computing capabilities on the customer premise. (May 11)

- Vodafone expanded on existing work with Google Cloud to create a six-year partnership to jointly build a new integrated data platform to help Vodafone “more quickly offer its customers new, personalized products and services across multiple markets” (May 3)

- Dish Network, a greenfield open RAN-based operator in the U.S., agreed to build its 5G core network on AWS: Local Zones to support low latency, Outposts to extend capabilities to customer premises, Graviton2-based instances for compute workloads, and EKS to run containerized workloads. (April 21)

- Google Cloud and AT&T announced a collaboration to help enterprises take advantage of Google Cloud’s technologies and capabilities using AT&T network connectivity at the edge, including 5G. Additionally, AT&T and Google Cloud intend to deliver a portfolio of 5G edge computing solutions that bring together AT&T’s network, Google Cloud’s leading technologies, and edge computing to help enterprises address real business challenges.

The cloud service providers are leaving no stone unturned in their efforts to go after business in the telecom vertical. Moreover, they are also partnering with the traditional vendors to the telecom vertical to develop joint offerings. Nokia announced three such deals last quarter, one each with AWS, Azure and GCP. There are many other examples. NEC and AWS teamed up in 2019 on a mobile core solution, for instance, and Amdocs has collaborations in place with each of the big three. Just last month Amdocs won a digital transformation deal at Singapore’s M1 which leverages their Azure relationship.

Matt Walker, founder and Chief Analyst of MTN Consulting LLC wrote in a Fierce Telecom article: “Whether the cloud players are competitors, partners, suppliers or all of those, they’re going to continue to reshape telecom’s landscape for years to come.”

…………………………………………………………………………………………………………………………………….

Telco’s Move from Virtual Network Functions (VNFs) to Cloud Native Core Networks:

With VNFs, many network operators (e.g. AT&T) have automated portions of their infrastructures. But to satisfy new performance demands and meet the needs of modern customers, telcos are now migrating to fully cloud-native infrastructures.

Cloud-native network functions (CNFs) are a new way of providing a required network functionality using containers.

CNFs are dynamic, flexible, and easily scaled, making them a favored solution in the transition to 5G. While a VM with its own operating system may consume several gigabytes of storage space, a container might only be tens of megabytes in size. Therefore, a single server can host more containers than VMs, significantly boosting data-center efficiency while reducing equipment, maintenance, power, and other costs.

In the near future, it is expected that many of the deployments on the road to 5G will consist of a mix of CNFs and VNFs as we are now at the transition stage of moving to fully cloud-native architectures.

Image courtesy of N-iX (a Ukraine and Poland based provider of software development outsourcing and professional services)

Here are some suggestions to facilitate telco’s move to cloud native core networks from N-iX:

- Decide on the cloud strategy: choose the best deployment model: public, private, or hybrid clouds, select the most suitable approach: single cloud or multi-cloud, settle on the cloud provider (s).

- Create a clear migration plan: it should include your goals, costs estimates, timelines, services and technology to use, etc.

- Choose a VNF migration strategy: define which network functions need to remain as VMs and which can be re-architected as cloud-native microservices.

- Assess and prioritize your apps, processes, and operations: understand app dependencies; categorize your apps into mission-critical applications, business-critical applications, customer-facing applications, and other non-critical apps; define operations that can be automated; simplify processes so that they consist of fewer steps.

- Adopt microservices architecture: transform your monolith architecture into a number of loosely coupled microservices to be able to quickly develop, test, and deploy new features and fixes without impacting other components of the application.

- Make use of containers: Containers make it easy to move applications between environments while retaining full functionality. They also make it possible to build and run scalable applications across public, private, and hybrid clouds.

- Leverage edge computing: edge computing is among the top telecom trends. Telcos should make use of edge networks to reduce latency and improve network performance by bringing workloads closer to the users who need to access them. As opposed to the content delivery network (CDN), which is considered to be the predecessor of edge computing and only stores cached data, edge networks, by contrast, can accommodate a wider array of functionality (they can store and process data in real-time) and device types.

Nokia is a strong supporter of Cloud Native. Here’s what they say:

For 5G, service providers need more from cloud. Cloud must be re-architected to cloud-native so that they can get breakthrough business agility in rapidly onboarding new apps and deploying & operating new services.

The scale of 5G brings many more devices and a very diverse mix of services, there’s no way legacy operations can keep up, they need much more automation, especially for slicing. 5G brings new performance demands, so the cloud needs to move towards the edge, for the sake of low-latency, localized reliability, and traffic steering; for that CSP need cloud-native’s efficiency.

………………………………………………………………………………………………………………………………………..

References:

https://www.n-ix.com/cloud-computing-telecom/

https://www.nokia.com/networks/portfolio/cloud-native-solutions/

Heavy Reading: “The Journey to Cloud Native” – Will it be a long one?

x-China Mobile Chairman: 5G phones have no new features, new 5G devices urgently needed

The 2021 Sohu Technology 5G&AI Summit was held in Beijing on May 17. Wang Jianzhou, former chairman of China Mobile and senior consultant at GSMA shared his views on 5G in his speech.

Wang Jianzhou believes that the current 5G industry applications have achieved many results, such as smart control, smart logistics, smart security, telemedicine, etc., but the perception of the consumer market is not strong.

“There is no ready-made experience for 5G consumer-level applications to learn from. Every year at the Barcelona Communications Exhibition, I am most concerned about what applications are there, but they are all industrial applications.” Wang Jianzhou said.

In addition to chips and antenna modules, 5G mobile phones don’t really have any new features. Indeed, compared with the overwhelming hype, the perception of 5G on the consumer side is not strong. Major mobile phone manufacturers are looking forward to using 5G to boost mobile phone sales, but with the limited application of 5G consumption scenarios and expensive packages, it is unknown whether 5G can stimulate significant smartphone upgrades.

Despite the huge scale of China’s 5G efforts, with 819,000 base stations deployed and 285 million package subscribers signed up, industry leaders are worried about the lack of innovative services and rising energy costs. Wang said only “massive consumer-level applications” could take full advantage of the coverage and huge capacity of 5G networks. He said that while many industrial use cases had already become a reality, new consumer 5G applications were rare.

“I think the tipping point of 5G consumer-level applications is likely to be the device,” he said.

“They are not yet ideal 5G mobile phones. Consumers need 5G mobile devices with new functions,” he said, citing the impact of browser-enabled phones, led by the iPhone, that drove the explosion of 3.5G and 4G mobile Internet.

“Except for a faster video download speed, I didn’t find any other use for 5G. The 5G package is so expensive, and the first thing a 5G phone is to turn off 5G. So what’s the use of 5G? But it only increases power consumption.”

A repeat complaint of China’s “5G package” customers is: “I got a 5G package upgrade, I have a 4G mobile phone, and I don’t have a 5G network, so I got lonely.” That’s according to China’s Weibo microblogging website.

Indeed, global smartphone sales have recently decreased:

- According to Gartner, global smartphone sales fell by 20.2% and 20.4% year-on-year, in the quarter and second quarter of 2020, respectively.

- According to the latest data from IDC, global smartphone shipments fell 1.3% year-on-year in the third quarter of this year.

- According to a report from the China Academy of Information and Communications Technology, the cumulative shipments of 5G mobile phones from January to September last year were 108 million, and the total number of new models on the market was 167, accounting for 47.7% and 46.5%, respectively. Whether it is shipments or models, it accounts for less than half.

Wang Jianzhou made several suggestions for 5G consumer-level applications:

First, pay attention to consumer-level IoT applications. “Consumers will pay more attention to entertainment, such as cloud gaming. In addition, if we can combine AR, VR and the Internet of Things, we can create many new consumer-level applications.”

Second, extend the functions of mobile phones. “The explosion of 3G applications is the popularization of smart phones. The tipping point of 5G consumer-level applications is likely to be terminals. Except for 5G chips and 5G antenna modules, current 5G mobile phones do not see new functions, which is not ideal. The state of 5G mobile phone.”

“I think the functions of 5G mobile phones should extend from communication, social networking, browsing, shopping, payment, navigation, verification, entertainment to the Internet of Things and artificial intelligence, and make mobile phones a controller that connects everything. This extension is actually becoming a reality. Nowadays, some mobile phones have been equipped with laser rangefinders, so that the mobile phones have the function of measuring distance, which can produce some new applications.”

Third, focus on wearable devices. “5G’s application flashpoint is also likely to be wearable devices. The combination with 5G smartphones will produce many new functions. For example, camera and laser systems are installed in glasses and helmets and connected to 5G mobile phones for processing.” Wang Jianzhou said.

5G’s outlook was clouded by “a serious shortage” of both low-end and middle-range spectrum, Wang said. “It is essential to establish multi-band coordinated 5G networks as soon as possible.”

He also said operators should be further encouraged to expand network co-construction and sharing.

Network sharing and rollout had already become a trend, he noted, with China Unicom and China Telecom saving billions of dollars from their shared 5G project.

Jianzhou also called on the industry to drive down energy consumption by adding network intelligence. The huge power consumption and high operating costs of 5G networks meant it was necessary to further improve 5G network efficiency and to implement intelligent networks.

References:

https://min.news/en/economy/339e0871cb5dccd09cf1f411dcf0e226.html

Has MPLS networking reached its end as enterprises move to the cloud?

by Amir Khan (edited by Alan J Weissberger)

MPLS networking has been a staple feature of service providers for over 20 years, and it’s a technology that remains widely in use. But there is every indication that MPLS is nearing the end of its usefulness as an effective enterprise WAN solution.

Enterprise networking is moving to the cloud, and connectivity is required that fits the bill, mirroring cloud’s ease of deployment and able to adapt to business needs at cloud speed.

Will carriers and service providers keep relying on MPLS to the bitter end? Or will they take a proactive approach by assisting their enterprise customers with a migration journey to a future of networking built in the cloud and designed for the cloud era? If they act now, and make the right strategic partnerships, service providers can take credit for leading this migration in an orderly, secure and planned manner, empowering their customers to operate ‘at the speed of business.’

It is certainly clear that service providers must avoid the trap made by previous generations who failed to move fast enough away from legacy revenue streams, such as voice. The evolutionary pace of cloud is much more rapid than any previous transitional phase, meaning telcos have minimal time to decide on a strategy. Acting now to adopt a cloud-native approach could be the difference between being a disruptor and one of the disrupted. The tipping point is at hand.

Why might MPLS networking no longer be appropriate for contemporary enterprise customers? For that, we need to consider the recent past from the viewpoint of the enterprise. MPLS was designed for connecting sites to sites, and sites to data centers, globally.

As a CIO, you had to call your MPLS service provider and they provisioned a connection for you. This typically took weeks, if not months. How long would depend on what capacity the service provider had available in the region where you needed the connectivity. The cost for the bandwidth in question would be quite high too, compared to basic Internet service. The SLAs are good with MPLS, compared to Internet, but there’s a price to be paid for that.

As enterprises started to become more and more reliant on cloud services, the dynamics began to change. The task of a WAN has moved on from just connecting campuses and data centers. Cloud has created new traffic patterns, with enterprises now running many workloads in many different clouds. You can’t optimize that kind of complexity with MPLS, because it’s too rigid.

What’s needed instead is an approach that is designed from the ground up for the modern needs, one that lives in the cloud. That means more than just an on-ramp that connects to the edge of the cloud. It’s about cloud-native technology, available as a service, able to seamlessly interconnect multiple clouds but also reach beyond cloud boundaries into enterprise on-premise locations.

Service providers need to realize that unless they can come up with an offer based around these principles, one that takes their enterprise customers beyond MPLS, then somebody else will do it instead.

Cloud networking is a solution that the customer will eventually be drawn to, with or without the service provider. By moving now to meet this need, the service provider can prove that they are a trusted partner, looking beyond the short term, offering something beyond the familiar. Service providers don’t have the luxury now of sitting around deciding. Those that do will lose over time, and get left so far behind they will no longer be able to compete.

Service providers already know that existing revenue streams are declining as cloud takes over. But it’s not just about adding a new product line to their portfolio. They must take a hard look at their own business models, transforming themselves away from what’s safe and traditional and embracing something much more radical.

They must review internal processes and cultures, preparing themselves not just for a new technology but for a whole new market. The way they approach the customer has to be right. Being cloud-relevant, for example, is about offering services on a global scale. Even small businesses have people working for them across the globe now. Customers will expect not just a global footprint, but one with security and full visibility baked in.

If service providers can reengineer their business for the new age of cloud then they will gain agility, free themselves to explore new revenue opportunities and look forward to continued relevance.

About Amir Khan:

Amir is a computer networking visionary who founded and led Viptela’s market-leading, cloud-first, Software-Defined Wide Area Networking (SD-WAN) business before its acquisition by Cisco.

As prescient as he was in identifying the $8B opportunity for SD-WAN, Amir recognized that the network hampered the cloud journey and founded Alkira in 2018 with CTO Atif Khan to reinvent networking for the cloud era. Amir’s vision is to deliver the Cloud Network as-a-Service (CNaaS).

Alkira has delivered the industry’s first Network Cloud, a global unified cloud network infrastructure delivered as-a-service with 1) connectivity for hybrid and multi-cloud networks 2) integrated network and security services, and 3) end-to-end operational visibility and governance. Alkira CSX, is an on-demand, as-a-service, point and click, unified CNaaS that enables cloud architects to design, build, and deploy a global multi-cloud network in minutes. Alkira enables enterprises to implement 50% less firewall capacity, and reduce TCO by up to 40%. Before Viptela, Amir held leadership roles at Cisco, Juniper, and Nortel. He holds 4 patents. Amir earned an MS in Electrical Engineering from the University of Colorado at Boulder, and a BS in Electrical Engineering from the University of Mississippi.

References:

SiFi Networks is building 10G b/sec open access fiber networks in the U.S.

SiFi Networks is a privately owned, U.S. based company that builds and operates competitive fiber networks which service providers use to deliver first class service to their customers; internet, TV, phone and more. The company was founded in 2013 and operates using a wholesale model focused on getting carriers onboard as tenants. It is now offering 10 Gb/sec fiber access networks to U.S. operators, hoping to entice them to adopt a more European infrastructure model and sign on as tenants to its wholesale fiber network rather than building out the last mile themselves.

SiFi Networks is delivering open access fiber networks right across the US called FiberCities®, called so because fiber passes every single home and business in the city and Smart City access points are put in place as standard, developing a future proofed city for generations to come.

The company is a big advocate of dig once and only once, therefore removing costs and disruption that could be associated with future connectivity, and by operating the network independently of any end service provision it removes the requirement for others to go to the expense and disruption of building separate networks.

Earlier this month, the city of Salem, MA, signed a contract attracting over $35 million of private investment to create a citywide, fully fiber-based broadband network. The project will be privately funded by SiFi Networks, with no taxpayer subsidy. With projects like this, the company hopes to transform the U.S. broadband model by operating citywide networks that can be used by multiple service providers, mobile carriers and even the municipality itself.

SiFi president Scott Bradshaw told Fierce Telecom that SiFi has build commitments in place covering 13 cities across seven states. This will eventually yield a projected footprint of “well over” 40 million feet of fiber covering more than half a million homes and businesses, he said.

CEO Ben Bawtree-Jobson added it expects to announce several additional projects in the coming months. The CEO noted its open access network model is fairly revolutionary in the U.S. “It’s very much commonplace in other countries, in particular in Europe, but in the U.S. having last mile infrastructure that’s independently operated, that isn’t under the control of the service provider is a new model,” Bawtree-Jobson said.

Jeff Heynen, VP of broadband access and home networking at analyst firm Dell’Oro Group, explained in an email to Fierce this is primarily due to the “the legislative influence of the big telco and cable operators.” He said major incumbents like Verizon and AT&T “were able to successfully lobby legislators that they should own their networks and equipment because they bear the heavy cost of the initial deployment.” In states like North Carolina, these players even convinced lawmakers to “block the roll out of municipal fiber networks because they were argued to be unnecessary.”

While a handful of open fiber networks have sprung up in cities across the country, Heynen said, “The influence of the big carriers on legislation (local, state, and national) has limited their advance over the years.”

Bawtree-Jobson noted reactions to its offer have varied, with smaller ISPs “happy to get onto networks, share infrastructure and gain access to customers” without having to spend massive amounts in capex and opex. Incumbent local exchange carriers (ILECs) are a tougher nut to crack, he said.

Bolstering its pitch, though, is SiFi’s plan to roll out 10 Gbps capabilities from day one. Bawtree-Jobson said the idea is to be “ahead of the game in terms of philosophy, thinking, concept. Ahead of the game in terms of network architecture. Ahead of the game in terms of network capability and speed as well.”

SiFi is planning to use micro-trenching for its fiber rollouts, which is expected to help accelerate its deployments. Bawtree-Jobson said depending on the size of the project, its city deployments are expected to take anywhere from two to five years to complete.

References:

https://sifinetworks.com/corporate/

https://www.fiercetelecom.com/telecom/sifi-networks-aims-to-bring-european-fiber-model-to-us

O2 UK and Microsoft to test MEC in a Private 5G Network

UK mobile network operator O2 (Telefónica UK) has partnered with Microsoft to test the benefits of on-premise Mobile Edge Computing (MEC) within a Private 5G network, with a focus on low latency and security.

The MEC Proof of Concept (PoC) involves technology running on Microsoft Azure, which will be the first Azure deployment using a UK Private 5G network. It is designed to support secure data management, with all confidential data staying on premises at all times.

Image credit: Microsoft Azure for Operators

O2 (Telefónica UK) will provide Secure 5G Network capabilities and various Industry 4.0 applications. The computing service will be delivered via Azure Private Edge Zones, bringing compute, intelligence and storage to the edge where data is created. O2 and Microsoft will also support start-ups in developing new 5G solutions through the ‘Microsoft for Startups’ program.

O2 recently announced it had launched a Private 5G Network initiative with Leonardo, a global high technology company in the Aerospace, Defence & Security sector. This trial with Microsoft will be similar, however will involve MEC to broaden the use cases and benefits.

Jo Bertram, MD of Business at O2, said, “We’re incredibly proud of our track record of supporting business partners with innovative network solutions. This particular trial with the Microsoft Azure platform will provide secure and superfast capabilities that will maximise productivity and efficiency, as well as peace of mind. We pride ourselves on having a secure 5G network and being champions of coverage and reliability, as recognised in industry awards.”

Yousef Khalidi, corporate vice president, Azure for Operators at Microsoft, said: “Through our collaboration with O2, we will enable enterprises to leverage 5G to unlock new scenarios that accelerate digital transformation within their own private, on-premises environments. Combining Azure technology with O2 services is critical to bringing MEC to the enterprise edge, and we look forward to seeing customers leverage this platform to drive innovation across a broad range of information and operational technology applications.”

Key Deliverables:

- O2 partners with Microsoft to trial the benefits of on premise Mobile Edge Computing (MEC) within a Private 5G Network, focusing on security and low latency

- The Proof of Concept (PoC) aims to pave the way for secure data management, enabling confidential information to stay on premises at all times

- Technology will be run via the Microsoft Azure platform, its first deployment utilizing a UK Private 5G Network

References:

https://azure.microsoft.com/en-us/industries/telecommunications/

GMSA vs ITU-R, FCC & U.S. Tech Companies on use of 6GHz band: Licensed 5G or Unlicensed WiFi?

Introduction:

There’s a huge disagreement on the use of the 6 GHz band for wireless communications. GSMA strongly says it’s needed for 5G, ITU-R WRC-23 only has it on their agenda for world region 1, the FCC has opened up that band for unlicensed operation, while a group of big tech companies say 6 GHz unlicensed WiFi is an economic winner and have asked the FCC for additional communications capabilities.

GSMA Position – Licensed 6 GHz for 5G:

In a May 17th GSMA blog post, the GSMA trade group warns that the 6GHz band is urgently needed for licensed (terrestrial) 5G operations, but that governments are diverging [1.] in their plans for same. “The global future of 5G is at risk says GSMA in the first sentence of their post.

“The 6 GHz band is essential not only for mobile network operators to provide enhanced affordable connectivity for greater social inclusion, but also to deliver the data speeds and capacity needed for smart cities, transport, and factories. It is estimated that 5G networks need 2 GHz of mid-band spectrum over the next decade to deliver on its full potential. [reference 1]”

Note 1. Different Approaches for the 6 GHz band

China will use the entire 1200 MHz in the 6 GHz band for 5G. Europe has split the band, with the upper part considered for 5G, but a new 500 MHz tranche available for Wi-Fi. Africa and parts of the Middle East are taking a similar approach.

At the other extreme, the U.S. and much of Latin America have declared that none of this valuable resource will be made avail able for 5G, but rather will be offered to Wi-Fi and other unlicensed band technologies. Also see the section Worldwide Status of Unlicensed 6 GHz below for more on this controversial topic.

……………………………………………………………………………………………………………………………………………

“5G has the potential to boost the world’s GDP by $2.2 trillion,” said John Giusti, Chief Regulatory Officer for the GSMA. “But there is a clear threat to this growth if sufficient 6 GHz spectrum is not made available for 5G. Clarity and certainty are essential to fostering the massive, long-term investments in this critical infrastructure.”

GSMA opines that 5G is accelerating the digital transformation of all industries and sectors, unleashing new waves of innovation that will benefit billions. This technology is crucial for the environment and climate goals as connectivity replaces carbon. In order to reach all users, however, industries will require the extra capacity that the 6 GHz band offers.

The GSMA calls on governments to:

- Make at least 6,425-7,125 MHz available for licensed 5G;

- Ensure backhaul services are protected; and

- Depending on countries’ needs, incumbent use and fiber footprint, the bottom half of the 6 GHz range at 5,925-6,425 MHz could be opened on a license-exempt basis with technology neutral rules.

The GSMA also published a statement with Ericsson, Huawei, Nokia and ZTE that further details the importance of the 6 GHz band for the future of 5G. That document states, “Extending the bandwidth of 5G through the harmonization of 6 GHz spectrum will provide more bandwidth and improve network performance. On top of this, the broad, contiguous channels offered by the 6 GHz range will reduce the need for network densification and make next-generation connectivity more affordable for all.

About GSMA:

The GSMA represents the interests of mobile operators worldwide, uniting more than 750 operators with almost 400 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces the industry-leading MWC events held annually in Barcelona, Los Angeles, and Shanghai, as well as the Thrive Series of regional conferences. The GSMA continues to work with partners that share its commitment to sustainable development and economic growth. Click here to find out more.

For more information, please visit the GSMA corporate website at www.gsma.com. Follow the GSMA on Twitter: @GSMA.

Media Contact: [email protected]

……………………………………………………………………………………………………………………………………………..

ITU-R (WRC-2023) and FCC Positions:

1. GSMA says the World Radiocommunication Conference in 2023 (WRC-23) will provide the opportunity to harmonize the 6 GHz band across large parts of the world and help develop the ecosystem. That is not entirely correct as their related work item 1.2 only covers 6 GHz IMT for region 1, which comprises Europe, Africa, the former Soviet Union, Mongolia, and the Middle East west of the Persian Gulf, including Iraq.

2. The FCC voted last year to allocate the entire 6 GHz band for unlicensed operations, including Wi-Fi. Commercial Wi-Fi devices working in the 6 GHz band have already begun hitting the market.

The FCC’s vote represented a setback to some players like Ericsson, Verizon and T-Mobile that had urged the Commission to set aside some or all of the 6GHz band for licensed uses, including 5G.

In it’s latest WRC-23 related document, the FCC made no move to reverse their decision on unlicensed 6 GHz. More importantly, they have not requested a broadening of the 6 GHz band for 5G to include the U.S. or any other world region besides region 1. According to that FCC document:

WRC-23 agenda item 1.2 will consider the possibility of identifying IMT in the frequency bands 3 600-3 800 MHz and 3 300-3 400 MHz (Region 2); 3 300-3 400 MHz (amend footnote in Region 1); 7 025-7 125 MHz (globally); 6 425-7 025 MHz (Region 1); 10 000-10 500 MHz (Region 2).

Sharing and compatibility studies will need to be conducted, with a view to ensuring the protection of existing services to which the frequency band is allocated on a primary basis, without imposing additional regulatory or technical constraints on those services, and also, as appropriate, protection of services in adjacent bands.

……………………………………………………………………………………………………………………………………….

Tech Companies Meet with FCC on Unlicensed Use of the 6 GHz band:

Mike Dano, Editorial Director, 5G & Mobile Strategies at Light Reading said that representatives from Apple, Broadcom Facebook, Google, Qualcomm (the #1 supplier of 5G silicon) and two attorney’s from Wiltshire & Grannis LLP met (via video conference) with the legal advisor to FCC Commisioner Carr on May 13th to discuss the “Unlicensed Use of the 6 GHz Band.”

The 5 big tech companies collectively supported the FCC’s 6 GHz decision noting that the FCC unlicensed 6 GHz order adopted carefully considered rules that will protect incumbents while permitting innovation in fixed unlicensed equipment and operations.

The next step is to meet consumers’ expectation for mobility and portability through the pending FCC Public Notice and Further Notice of Proposed Rulemaking (FNPRM) for expanded use of the 6 GHz band in the U.S. They recommend the following additional capabilities:

- Client-to-client communications (which would allow devices to talk directly to each other).

- Very Low Power operations (which would allow low-power communications without Automatic Frequency Coordination technology).

- Mobile operations (which would permit mobile connections using Automatic Frequency Coordination technology for services such as mass transit connectivity).

The companies said that WiFi has been “an economic powerhouse.” In particular:

• Wi-Fi is projected to contribute nearly $1 trillion to the U.S. economy in 2021

• $3.3 trillion contributed globally in 2021

• That contribution will grow to $1.58 trillion by 2025 in the U.S.

• $4.9 trillion global contribution by 2025

• Wi-Fi 6 and 6 GHz devices are significant contributors to this expected growth

Unlicensed bands (NOT 5G) are the workhorses of the wireless economy:

- Unlicensed bands carry half of all internet traffic in the U.S., a figure that is growing each year

- LTE offload to unlicensed will increase with 5G, from 54% of traffic in 2017 to 59% by 2022

- Unlicensed is the on-ramp to broadband for American homes, enterprise wireless, rural

communities, schools, healthcare facilities, and more - Unlicensed spectrum is also the backbone for new IoT networks

- Key economic sectors—manufacturing, logistics, and research—depend on Wi-Fi for business

processes and internal connections - Quotient and Qualcomm studies have demonstrated an enormous unlicensed

spectrum shortfall in the mid-band - The 6 GHz band is central to addressing this pressing need

Worldwide Status of Unlicensed 6 GHz:

Of the top 20 economies in the world, fully half have opened, or are in the process of opening the 6 GHz band to unlicensed use—the U.S., Japan, Germany, UK, France, Canada, South Korea, Brazil, Mexico, and Saudi Arabia. In Europe, the CEPT decision opening 6 GHz is expected to become European law in March 2021 and will shortly be followed by country-specific implementations.

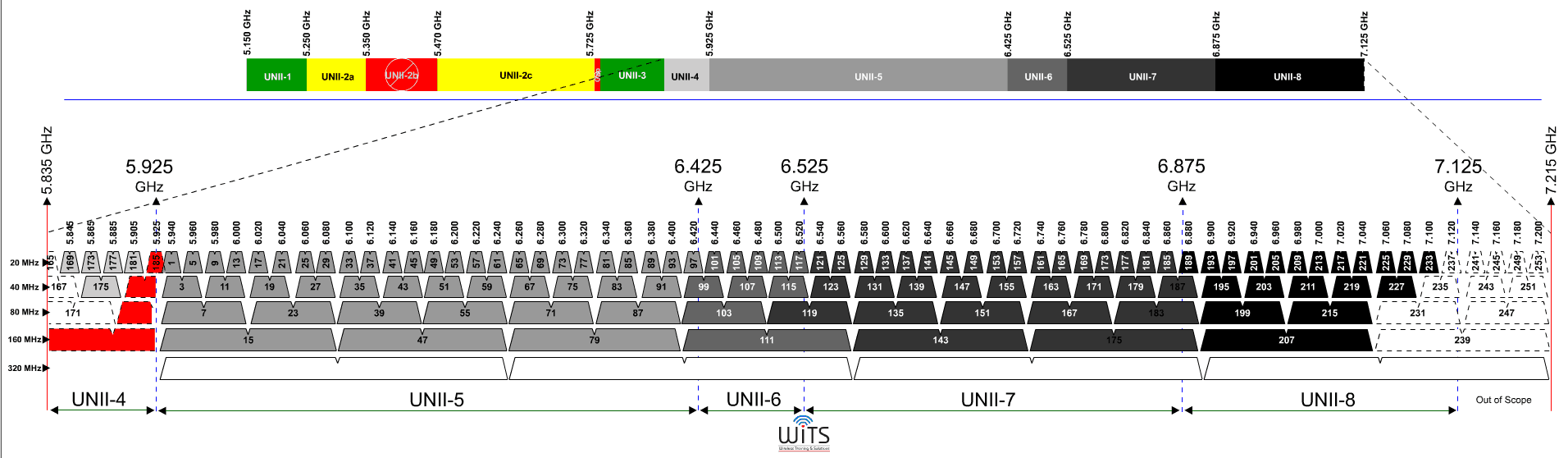

Proposed 6 GHz Channel Map for Unlicensed WiFi:

Image Credit: Wireless Training Solutions

………………………………………………………………………………………………………………………………………

References:

https://www.gsma.com/newsroom/press-release/gsma-calls-on-governments-to-license-6-ghz-to-power-5g/

https://www.gsma.com/spectrum/wp-content/uploads/2021/05/6-GHz-Capacity-to-Power-Innovation.pdf

https://www.lightreading.com/5g/gsma-5g-is-at-risk-if-6ghz-remains-unlicensed/d/d-id/769600?

https://ecfsapi.fcc.gov/file/1051767219870/6%20GHz%20Thumann%20Ex%20Parte%20(May%2013%202021).pdf

https://www.coleago.com/app/uploads/2021/01/Demand-for-IMT-spectrum-Coleago-14-Dec-2020.pdf

Strong Growth Forecast for 5G Security Market; Market Differentiator for Carriers

Some key findings from ResearchAndMarkets.com’s “5G Security Market by Technology, Solution, Category, Software, Services, and Industry Vertical Support 2021 – 2026” new report:

- The overall global 5G security market will reach $9.2 billion by 2026 [1.]

- The fastest-growing segment will be communications security at 49.2% CAGR

- North America [2.] will be the leading region projected to reach $4.1 billion by 2026

- Integrated 5G security and blockchain solutions will reach $183.1 million by 2026

- AI-based solutions for edge computing infrastructure will reach $253.2 million by 2026

- Distributed denial of service (DDoS) protection for 5G networks will reach $583 million by 2026

- Major drivers for carrier 5G security include 5G core network implementation and support of private wireless networks

- Leading carriers will transform 5G security from a cost of doing business into a major market differentiator for business customers

Note 1. In February 2021 report, Markets and Markets said that 5G security market size is projected to grow from $580 million in 2020 to $5.226 billion by 2026, at a compound annual growth rate (CAGR) of 44.3%. The market research firm believes the major drivers for the 5G security market include rising security concerns in the 5G networks, increasing ransomware attacks on IoT devices, rising attacks on critical infrastructure, and increasing IoT connections paved way for mMTC with enhanced security requirement.

The “cloud native mode” of 5G core/SA deployment is expected to exhibit a higher CAGR during the forecast period. By deploying 5G security solutions and services on the cloud, organizations can avoid spending on hardware, software, storage, and technical staff.

The cloud deployment type is often used for both private and public clouds and may vary from case to case, depending on the requirement of the client.

Additionally, organizations can scale up or down, depending on their use of cloud-based 5G security services. The cloud deployment segment has witnessed strong demand in the early phase of the 5G standalone network. It offers a wide range of benefits, such as scalability, accessibility, flexibility, and cost-effectiveness.

Note 2. Markets and Markets expects the APAC region to hold the largest market share during the forecast period. China, Australia, and Japan are the prime APAC countries that have started several 5G-related activities; which would provide growth opportunities for 5G security vendors in the region.

Asian telecom service providers, vendors, and government firms are determined to take the lead in 5G R&D. The infrastructural growth in APAC, especially in Japan, South Korea, Australia, Singapore, China, and India, and the increasing deployment of 4G and 5G networks present huge opportunities for the implementation of the 5G security solutions.

……………………………………………………………………………………………………………………………………………

The ResearchAndMarkets.com report evaluates the 5G threat landscape as well as technologies and solutions to secure networks, platforms, devices, data, and applications [3.]. The report also assesses the 5G security market outlook and potential for many solutions, services, and support. It also evaluates the impact of security functions across various technologies including Mobile Edge Computing (MEC), IoT networks, and mobility infrastructure. The report includes market forecasts for all major technologies, industry verticals, solutions, and service types from 2021 to 2026.

The 5G security market must be robust as solutions need to be deployed on multiple levels including devices, air interface equipment, cloud RAN infrastructure, mobile backhaul facilities, and more.

Note 3. There’s likely to be an increasing adoption of 5G security solutions by carriers. It will be used for identity management, differentiated security protection, privacy protection and growing demand for data protection worldwide. 5G security technology offers various benefits such as diversified system level protection of IT-aware infrastructure, security as service, and rapid detection and response.

The growing demand for a security monitoring and threat analysis to help the business to protect the integrity of systems and data is expected to create a huge opportunity for the global 5G Security market.

In addition, the need for E2E security for vertical industries from protection to detection and increasing importance of a unified security view across enterprise, are anticipated to drive the 5G Security market growth.

Reference: https://www.futuremarketinsights.com/reports/5g-security-market

![]()

……………………………………………………………………………………………………………………………………..

Among other areas, the 3GPP Security architecture and procedures for 5G System (Specification #: 33.501) specifies requirements for E1 and f1 interfaces as well as requirements for an overall secure environment. The organization specified many areas necessary for 5G security including subscription authentication, UE authorization, access and serving network authorization and more. Other areas include user and signaling data integrity to ensure seamlessness and interoperability between network elements.

Note that there are no ITU-T recommendations on 5G/IMT 2020 security.

One of the import areas emerging with 5G security that is a greater concern than ever before is data security and private. Much more so than LTE, 5G networks must be concerned with the confidentiality and integrity of user and signaling data. The 5G gNB must support encryption as per security policies for various potential vulnerability areas such as user data in transit as well as signaling for radio resource control. Access control is equally important as well as ensuring that serving networks are authorized by home networks.

5G mobile network operators need to expedite implementation of a more integrated 5G security approach, one of the primary areas of focus will be support of 5G-based private wireless networks for enterprise and industrial customers. While today’s private networks take a more old-school approach to security, more security-minded enterprise, industrial and government sector customers will realize greater cybersecurity through interconnection and managed services with leading carrier 5G security solutions.

Leading carriers will transform 5G security from a cost of doing business into a major market differentiator for business customers including direct to enterprise/industrial/government customers and via hybrid models involving neutral hosts and/or direct interconnect with private wireless networks. The challenging task for mobile network operators is to simultaneously convince business customers that they are more secure with them than without them, while not causing alarm about security holes that existed prior to implementation of 5G security solutions.

For more information about this report please visit: https://www.researchandmarkets.com/r/vqa21q

………………………………………………………………………………………………………………………………………….

In a recent IEEE Future Networks presentation titled, Security Considerations for Evolving RAN Architectures, Scott Poretsky and Jason Boswell of Ericsson wrote about “the trust stack in 5G Cloud RAN.” Here’s what they said (emphasis added):

Network security is built upon a trust stack of trusted hardware, trusted software, trusted deployment, trusted applications, and trusted operations. Cloud deployments have an expanded attack surface due to decoupling of the software from the hardware, multiple organizations sharing the same hardware, a third-party organization managing the cloud infrastructure, and use of open source software components.

The chain of trust between these disparate components is not standardized and is implementation dependent, making it challenging to determine the level of risk, such as defined by the NIST Risk Management Framework (RMF). In a cloud environment an external attacker could gain access to a compromised container and from there escalate privilege to gain access to services and infrastructure. Likewise, an attacker that gains access to a service can use it as platform to gain access to containers and infrastructure.

Reference:

https://www.ericsson.com/en/reports-and-papers/white-papers/security-in-5g-ran-and-core-deployments

………………………………………………………………………………………………………………………………

India’s Success in 5G Standards; IIT Hyderabad & WiSig Networks Initiatives

by Prof. Kiran Kuchi, PhD & Dean of Research at Indian Institute of Technology Hyderabad (IITH) -edited by Alan J Weissberger, ScD EE

The development of 5G happens through a global forum called the 3rd Generation Partnership Project (3GPP). It’s a partnership between seven global Standards Development Organizations (SDOs) of which Telecommunications Standards Development Society, India (TSDSI) is a member. 3GPP kickstarted the 5G project in 2016 where we made substantial contributions to three successive releases of 5G specifications to date. IITH primarily led the efforts with significant support from CEWiT, IITM, and other Indian corporations (Tejas Networks and Reliance Jio are our major industry partners) with well over 300 technical documents submitted to date.

These sustained efforts led to the incorporation of several innovations introduced into the global 5G standards. One significant contribution that stands out is the introduction of a new transmit waveform, the only new waveform that is adopted in 5G, which is a generational change.

Both 4G and 5G adopted a waveform technology called OFDM (Orthogonal Frequency Division Multiplexing) that is quite suitable for the downlink transmission (that is the link between a base station (BS) and user equipment (UE)) but not so well suitable for the reverse link (that is the link between UE and BS). The limitations of OFDM owes to low-power efficiency (of about 10%). Prof Kuchi has designed a new waveform called “pi/2 BPSK with spectrum shaping” that provides close to 100% power efficiency and yet retains all the other advantages offered by OFDM.

This new transmit waveform allows the power amplifier in the UE to operate near its saturation level thus delivering a 3-4fold increase in the transmission power, and a hardware cost similar to that of OFDM. The overall gain in the cell range compared to OFDM will be at least twofold, hence this became a driver behind the design of the large cell 5G concept.

This indigenous waveform technology is developed for over a decade and is covered by a family of patents developed by IITH and CEWiT. There are well over 100 patents filed by IITH and WiSig to date. These patents will likely become the backbone of our indigenous 5G ecosystem. India’s 5G at ITU There are two parallel tracks that India took during the 5G development. The first effort is the aforementioned contributions to the 3GPP-based 5G standard, and our second noteworthy contribution is through TSDSI and the ITU (International Telecommunication Union). The second effort is led by IITM on the ITU front with significant backing and support from IITH, CEWiT (and Indian Industry such as Tejas networks, Reliance Jio).

ITU is a United Nations body that specifies requirements and radio standards for 5G known generically as IMT 2020. ITU-R WP5D had adopted India’s proposed Low-Mobility-Large-Cell (LMLC) use case as a mandatory 5G requirement in 2017. This requirement was adopted by ITU-R WP5D mainly as a result of sustained effort by the Indian entities through the Department of Telecommunications (DoT) to address the unique Indian rural broadband deployment scenario. Several countries supported this use case as they saw a similar need in their jurisdictions as well. TSDSI took this opportunity to develop the so-called LMLC based 5G technology that is a modification of 3GPP-based 5G specification.

This indigenously developed standard designated as 5Gi will deliver ultra-fast, low-latency mobile internet and next-generation IoT services in both cellular and mm-wave spectral bands that are common to all 5G candidate standards and adds “pi/2 BPSK with spectrum shaping waveform” as a mandatory technological enhancement that can provide broadband connectivity to rural users using ultra-long range cell sites.

This enhancement will ensure that 100% of India’s villages are covered from towers located at panchayat villages, whereas nearly a third of such villages would be out of coverage otherwise. Both 5G and 5Gi are fully compatible and interoperable systems that are being leveraged for the upcoming deployments in India. Adoption of the LMLC based 5G standards in India will enable India to leap forward in the 5G space, with key innovations introduced by Indian entities accepted as part of global wireless standards for the first time. The nation stands to gain enormously both in achieving the required 5G penetration in rural and urban areas as well as in nurturing the nascent Indian R&D ecosystem to make a global impact. The current national efforts are aligned with the national digital communication policy that promotes innovation, equipment design, and manufacturing out of India for the world market.

MeitY has been funding our wireless research for the past 10 years and these efforts have led to the development of larger wireless programs. More recently, the DoT (India Dept of Telecom) has sanctioned the “Indigenous 5G Testbed” program with a project outlay of 224 crores to IITH, IITM, CEWiT, IITK, IITB, IISc, and SAMEER.

This 3-year program, already close to completion, started yielding results in the form of prototype base stations, CPE/UE and NB-IoT chipsets. IITH stands out with major contributions to key 5G technologies such as cloud RAN base station with massive MIMO capability and cellular NB-IoT chipset for connecting sensors and meters to the internet. We are gearing towards full-fledged demonstration and field trials.

An upcoming player in the 5G space WiSig Networks (WiSig) is a 5G start-up incubated at the IITH tech incubator (i-tic foundation). WiSig has developed a 5G radio access network (5G-RAN) based on an emerging technology called O-RAN (Open-Radio-Access Network), that is being touted as the next major disruptor in the 5G landscape. This technology allows rapid deployment of low-cost, software upgradable 5G base stations in significantly higher volumes and larger densities than the current 4G network.

O-RAN is a disaggregated 4G/5G base station based on open interfaces and general purpose hardware. It is being defined by the O-RAN alliance, TIP Open RAN project and ONF SD-RAN v1.0 Software Platform for Open RAN.

Some operators have initiated the deployment of O-RAN based software-defined network and virtualization networks that enable self-organization, low operational cost and ease of introduction of new features and service upgrades. New 5G use cases can be introduced rapidly on the fly using software upgrades as opposed to costly and time-consuming hardware development cycles. WiSig has created commercial grade IP in this space and is well on track to carry out one of India’s first O-RAN compliant demonstrations of a software defined 5G massive MIMO base station. Overall, WiSig is well on its path to deliver 5G RAN intellectual property components to the global 5G supply chain.

LMLC based 5G technology is a modification of 3GPP-based 5G New Radio (NR) specification. This indigenously developed LMLC ITU-R standard, designated as 5Gi, will deliver ultra-fast, low-latency mobile internet and next-generation IoT services in both cellular and mm-wave spectral bands that are common to all 5G candidate standards and adds “pi/2 BPSK with spectrum shaping waveform” as a mandatory technological enhancement that can provide broadband connectivity to rural users using ultra-long range cell sites.

In contrast to high-speed mobile broadband, a vast number of IoT applications requires few bits to be exchanged with the internet intermittently. The key considerations of these kind of IoT devices are that they are ultra-low-cost and have a long battery life – up to 10 years. Narrowband IoT (NB-IoT) (Belongs to the 5G family of technologies is well suited for this purpose and is quietly emerging as a killer application for lowbit rate IoT applications. IITH and WiSig joined hands in commercializing a NB-IoT SoC (System on a Chip) that was successfully taped out in Q1 2021.

The chip is named “Koala” after an animal indigenous to Australia that sleeps about 20 hours a day – typical behavior of the NB-IoT modem.

Given that this is the first time a standards compliant cellular modem is designed in India and that both the software and hardware that goes into the chip is developed indigenously, this chip should preferably be leveraged to serve the security needs of critical national IoT infrastructure.

In summary, the investments made by Meity and DoT on 5G research have started to bear fruit in delivering the basic technological components and sub-systems required to build 5G. The time is ripe for the Government to nurture domestic design and manufacturing of 5G equipment. The country has enough talent and the technological depth required to support a domestic 5G ecosystem. With the right kind of policy support, then India is likely to see a 5G/IoT domestic manufacturing revolution within this decade. IITH will continue to play a pivotal role in shaping the 5G ecosystem not only in India but globally as well.

About Kiran Kumar Kuchi, PhD:

Kiran is a Professor Department of Electrical Engineering IIT-Hyderabad (IITH) and Dean of Research. He also started WiSig Networks that has been incubated at IITH. He received PhD and MS degrees in Electrical Engineering from the University of Texas at Arlington, TX. His current projects include: Cloud radio, Heterogeneous networks (HeNets), Next generation wireless test-bed development.

References:

https://pcr.iith.ac.in/Kiriith-Issue-6,April,20215GandNext-GenCommunicationTechnologies.pdf

AT&T to spin off Warner Media group and combine it with Discovery Inc.

With great fanfare, AT&T thundered its way into the media business three years ago with grand visions of streaming video to millions of its customers’ cellphones, etc. Now the telecom and media giant implicitly admits its mistake: AT&T has agreed to spin off its Warner Media group and merge it with a rival content provider, Discovery Inc., the companies announced today.

[We hinted that this might happen in a recent article titled, “Verizon Explores Sale of Media Assets; Wake up Call for AT&T?” We also chronicled AT&T’s spin off of their TV business in the article titled: Analysis: AT&T spins off Pay TV business…. Finally, we voiced our objection to the June 2018 AT&T-Time Warner deal in Analysis & Huge Implications of AT&T – Time Warner Merger.]

The transaction will combine HBO, Warner Bros. studios, CNN and several other cable networks with a host of reality-based cable channels from Discovery, including Oprah Winfrey’s OWN, HGTV, The Food Network and Animal Planet.

The new company will join together two of the largest media businesses in the country. AT&T’s Warner Media group includes the sports-heavy cable networks TNT and TBS. In addition to Discovery’s strong lineup of reality-based cable channels, the company has a large international sports business.

The new company will be bigger than Netflix or NBC Universal. Together, WarnerMedia and Discovery generated more than $41 billion in sales last year, with an operating profit topping $10 billion. Such a sum would have put the new company ahead of Netflix and NBCUniversal and behind the Walt Disney Company as the second-largest media company in the United States.

Under the terms of the agreement, which is structured as an all-stock, Reverse Morris Trust transaction, AT&T would receive $43 billion (subject to adjustment) in a combination of cash, debt securities, and WarnerMedia’s retention of certain debt, and AT&T’s shareholders would receive stock representing 71% of the new company; Discovery shareholders would own 29% of the new company. The Boards of Directors of both AT&T and Discovery have approved the transaction.

As part of the deal, AT&T will be able to shed some of its debt and get some cash and bonds that altogether would amount to $43 billion. AT&T shareholders will own 71 percent of the new business, with Discovery investors owning the rest.

The new company will be run by David Zaslav, 60, a media veteran and the longtime chief executive of Discovery, casting into doubt the future (yet again) of the top ranks of WarnerMedia. Jason Kilar, 50, who was hired to run AT&T’s media group only last year, could lose his job.

“Jason is a fantastic talent,” Mr. Zaslav said on a call with reporters following the announcement. He also praised other executives within WarnerMedia, including Toby Emmerich, the head of the film division, Casey Bloys, who runs HBO, and Jeff Zucker, the leader of CNN. Mr. Zucker and Mr. Zaslav are also longtime golfing buddies.

Mr. Zaslav said he would be looking for ways to “get the best people to stay,” but he didn’t elaborate on his plan for the new company’s management team.

John Stankey, the head of AT&T, who appeared alongside Mr. Zaslav in the news conference via Zoom, said “Jason remains the C.E.O. of WarnerMedia.” He added: “David’s got decisions he’s got to make across a broad cross section of how he wants to organize the business and who will be in what roles moving forward during this transition period.”

The companies said they expected the deal, which must be approved by Discovery shareholders and regulators, to be finalized in the middle of next year. The companies anticipate they will cut annual costs by $3 billion as a result of the transaction. AT&T will also cut its dividend (more below).

The deal highlights the need for even large media companies to get bigger. Traditional entertainment firms are struggling to maintain their grip on viewers as the likes of Facebook, YouTube and TikTok

continue to draw big audiences. Consolidation appears to be the quickest way to buy more eyeballs — the deal could set off another round of media mergers. ViacomCBS, the smallest of the major entertainment conglomerates, is often seen as a possible target.

To compete with Netflix and Disney, both AT&T and Discovery have invested heavily in streaming. AT&T has spent billions building HBO Max, which now has about 20 million customers. Discovery has 15 million global streaming subscribers, most of them for its Discovery+ app.

The new company expects to generate $52 billion in sales and $14 billion in pretax profit by 2023. Streaming will be a big driver of that growth and is estimated to bring in $15 billion in revenue.

Our analyst colleague Craig Moffett wrote in a note to clients:

This deal makes strategic sense for each side. Discovery’s linear networks are helped by the inclusion of CNN for news and by the inclusion of TV rights to the NBA, NFL, MLB and NCAA Basketball for sports. By our math, the new company will instantly become the largest home of linear impressions, sourcing 28% of the 2020 U.S. viewing time and 24% of U.S. national advertising. Better still, it will be under-monetized, as it will generate only 20% of national affiliate fees. While we rightly worry about the long-term health of TBS and TNT, we would assume that Discovery will move key Turner sports and news content to Discovery+, to make it a broader and more attractive offering which will help

their ability to grow those more valuable impressions. Internationally, Discovery’s linear and SVOD offerings will be strengthened by the inclusion of CNN and Cartoon Network into their offerings. Simply put, Discovery+ becomes a more relevant service for a wider group of people in the world.For WarnerMedia, they benefit from having a more natural destination for Turner’s product in a DTC world. We have noted time and time again that TNT and TBS were poorly positioned, and appeared to have no clear path forward to a DTC world. We have similarly lamented that HBO Max, while immensely attractive to U.S. audiences, were not nearly so well positioned outside the U.S. Discovery’s international footprint and focus creates both an accelerator and greater scope for HBO Max’s international rollout.

The new company will now be able to have unified conversations with the same set of global distribution partners – Roku, Amazon, Apple, wireless operators, broadband services – with greater strength and urgency. We assume that both brands Discovery+ and HBO Max will maintain separate identities but will be offered in a bundle a la Disney. In short order, the new company will be able to join the upper tier of global SVOD/AVOD players: Netflix, Disney and Amazon.

For AT&T, while the timing was surprising, the action was not. The market was never going apply a Disney-like multiple (say, by using on 2024 revenue multiple for HBO Max) that would give AT&T full sum-of-the-parts credit for the potential value of HBO Max. Moreover, AT&T’s balance sheet allowed neither the aggressive investment required for HBO Max nor the 5G wireless push (nor, for that matter, for the consumer fiber business). Ultimately, they had no choice. The die was cast even before the ink was dry on their initial acquisition.

Not at all unexpected, AT&T said its 52-cent-a-share dividend would be cut if its merger of Warner Media and Discovery is approved. AT&T’s dividend’s health had been in question given a debt load that was exacerbated by the company’s 2018 acquisition of the WarnerMedia assets, which include TNT, CNN, HBO, and the Warner Bros. movie studio. As of March 31st, long-term debt totaled about $160.7 billion, up from $153.8 billion at the end of 2020.

In an interview with CNBC Monday morning, AT&T CEO John Stankey said “there’s been some overhang on our equity that’s been driven by the balance sheet dynamic,” notably debt. The deal will allow AT&T to “accelerate our deleveraging of the business,” he added

References:

https://about.att.com/story/2021/warnermedia_discovery.html

https://www.nytimes.com/2021/05/17/business/att-discovery-merger.html

Verizon Explores Sale of Media Assets; Wake up Call for AT&T?

Analysis: AT&T spins off Pay TV business; C-Band $23.4B spend weakens balance sheet