Month: August 2020

Extended-range 5G NR data call over mmWave completed; Ericsson & Qualcomm test 5G SA Carrier Aggregation

Qualcomm Technologies, Casa Systems and Ericsson announced that the companies successfully completed what they call the world’s first extended-range 5G NR data call over mmWave. The extended range data call was completed in Regional Victoria, Australia on 20 June, achieving a farthest-ever connection of 3.8 kilometers (km).

This so called “breakthrough” from Qualcomm Technologies, Casa Systems and Ericsson provides global network operators and ISPs with the reach and performance to offer fixed broadband wireless as a “last mile” access technology. Of course, line of sight communications (i.e. no trees, walls or other blockages permitted). With the increased range demonstrated for mmWave, that technology may be suitable for fixed wireless access (FWA) as well as for 5G mobile service in suburban or even rural areas that won’t require as many small cells or high density cell towers.

Network operators will have the potential to use their existing mobile network assets to deliver fixed wireless services and expand their service with ease to new areas, from urban to rural, while delivering 5G’s multi-gigabit speeds and ultra-low latency to a wider customer base within their coverage footprint. In addition, this milestone will proliferate the roll-out of FWA customer-premises equipment (CPE) devices to areas that are often too difficult to reach with traditional broadband, including rural and suburban areas, empowering more customers across the globe to access superior connectivity at fiber optic-like speeds.

The extended-range data call was achieved by applying extended-range software to commercial Ericsson hardware – including Air5121 and Baseband 6630 – and a 5G CPE device powered by the Qualcomm Snapdragon X55 5G Modem-RF System with the Qualcomm QTM527 mmWave antenna module.

“With the introduction of the Qualcomm QTM527 mmWave antenna module as part of the Snapdragon X55 5G Modem-RF System, we are empowering operators and OEMs to offer high-performance, extended-range multi-gigabit 5G broadband to their customers – which is both flexible and cost-effective, as they can leverage existing 5G network infrastructure,” said Gautam Sheoran, senior director, product management, Qualcomm Technologies, Inc. “With this major milestone being the first step in utilizing mmWave for an extended-range 5G data transfer, our collaboration with Casa Systems and Ericsson is paving the way to implement fixed broadband services for broad coverage in urban, suburban and rural environments.”

“As operators look to close the digital divide and expand broadband services throughout rural, suburban and urban communities, the technology in this data connection underscores the critical role mmWave will play in the global proliferation of 5G networks,” said Steve Collins, senior vice president, access devices, Casa Systems. “This collaboration with Qualcomm Technologies and Ericsson is an industry milestone that makes it possible for operators to offer multi-gigabit broadband services wirelessly as a new broadband alternative solution using mmWave spectrum, and we look forward to delivering innovative CPE devices that further empowers the global broadband delivery ecosystem.”

“Ericsson has a long history of working with extended range across generations of mobile technologies, pioneering with 3G, then 4G and now with 5G. By collaborating with leading industry partners like Qualcomm Technologies and Casa Systems, we are able to ensure that everyone can access the transformative benefits of 5G connectivity. This achievement will open up opportunities for communications service providers around the world and how they can use mmWave spectrum for long-range use cases,” said Per Narvinger, head of product area networks, Ericsson.

…………………………………………………………………………………………………………………………………………………………………………………..

5G SA Carrier Aggregation from Qualcomm & Ericsson:

Today’s announcement comes just three days after Qualcomm and Ericsson announced that they completed interoperability tests for 5G standalone (SA) carrier aggregation. Carrier aggregation allows operators to use multiple sub-6 GHz spectrum channels simultaneously to transfer data between base stations and a 5G mobile device.

The test was completed at Ericsson’s labs in Beijing, China. The connection reached 2.5 Gb/s peak speeds by aggregating 100 MHz and 60 MHz within the 2.5 GHz (n41) TDD band in a 70% downlink configuration and using 4×4 multiple-input multiple-output (MIMO) technology. In Sweden, the two companies established a successful 5G SA carrier aggregation data call by combining 20 MHz in the 600 MHz (n71) FDD band with 100 MHz of spectrum in the 2.5 GHz (n41) TDD band.

Implementation of 5G carrier aggregation delivers enhanced network capacity along with improved 5G speeds and reliability in challenging wireless conditions, allowing consumers to experience smoother video streaming and enjoy faster downloads. This key 5G capability is expected to be widely deployed by operators around the world in 2021, according to Ericsson.

…………………………………………………………………………………………………………………………………………………………………………………..

About Qualcomm

Qualcomm is the world’s leading wireless technology innovator and the driving force behind the development, launch, and expansion of 5G. When we connected the phone to the internet, the mobile revolution was born. Today, our foundational technologies enable the mobile ecosystem and are found in every 3G, 4G and 5G smartphone. We bring the benefits of mobile to new industries, including automotive, the internet of things, and computing, and are leading the way to a world where everything and everyone can communicate and interact seamlessly.

Qualcomm Incorporated includes our licensing business, QTL, and the vast majority of our patent portfolio. Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, operates, along with its subsidiaries, substantially all of our engineering, research and development functions, and substantially all of our products and services businesses, including our QCT semiconductor business.

About Casa Systems, Inc.

Casa Systems, Inc. is delivering physical, virtual and cloud-native 5G infrastructure and customer premise networking for high-speed data and multi-service communications networks. Our core and edge convergence technology enables public and private networks for both communications service providers and enterprises. Casa Systems’ products deliver higher performance, improved network flexibility and scalability, increased operational efficiency and lower total cost of ownership (TCO). Commercially deployed in more than 70 countries, Casa serves over 475 Tier 1 and regional service providers worldwide. For more information, visit http://www.casa-systems.com.

About Ericsson

Ericsson enables communications service providers to capture the full value of connectivity. The company’s portfolio spans Networks, Digital Services, Managed Services, and Emerging Business and is designed to help our customers go digital, increase efficiency and find new revenue streams. Ericsson’s investments in innovation have delivered the benefits of telephony and mobile broadband to billions of people around the world. The Ericsson stock is listed on Nasdaq Stockholm and on Nasdaq New York. www.ericsson.com

References:

https://www.ericsson.com/en/news/2020/8/5g-carrier-aggregation

ITU-T SG13 FG on “Machine Learning (ML) for Future Networks including 5G” completes mission; 10 technical specs approved

Introduction:

ITU-T Study Group 13 Focus Group on Machine Learning for Future Networks including 5G (FG ML5G) has accomplished its mission. The FG ML5G was active from January 2018 until July 2020.

During its lifetime, FG ML5G delivered ten technical specifications.. Four of those specifications have already been approved by ITU-T SG13 and published by ITU-T. Six further technical specifications are being considered by ITU-T SG13. These ten technical specifications are publicly available free of charge. Please refer to ITU-T FG ML5G webpage to download the documents. [All ITU-T Focus Group publications are available for download at ITU-T Focus Group webpage]

Deliverables processed by ITU-T SG13 and published by ITU-T are:

Y.Sup55: ITU-T Y.3170-series – Machine learning in future networks including IMT-2020: use cases

This Supplement describes use cases of machine learning in future networks including IMT-2020. For each use case description, along with the benefits of the use case, the most relevant possible requirements related to the use case are provided. Classification of the use cases into categories is also provided.

ITU-T Y.3172: Architectural framework for machine learning in future networks including IMT-2020

ITU-T Y.3172 specifies an architectural framework for machine learning (ML) in future networks including IMT-2020. A set of architectural requirements and specific architectural components needed to satisfy these requirements are presented. These components include, but are not limited to, an ML pipeline as well as ML management and orchestration functionalities. The integration of such components into future networks including IMT-2020 and guidelines for applying this architectural framework in a variety of technology-specific underlying networks are also described.

ITU-T Y.3173: Framework for evaluating intelligence levels of future networks including IMT-2020

ITU-T Y.3173 specifies a framework for evaluating the intelligence of future networks including IMT-2020 and a method for evaluating the intelligence levels of future networks including IMT-2020 is introduced. An architectural view for evaluating network intelligence levels is also described according to the architectural framework specified in Recommendation ITU-T Y.3172.

In addition, the relationship between the framework described in this Recommendation and corresponding work in other standards or industry bodies, as well as the application of the method for evaluating network intelligence levels on several representative use cases are also provided.

ITU-T Y.3174: Framework for data handling to enable machine learning in future networks including IMT-2020

ITU-T Y.3174 describes a framework for data handling to enable machine learning in future networks including International Mobile Telecommunications (IMT)-2020. The requirements for data collection and processing mechanisms in various usage scenarios for machine learning in future networks including IMT-2020 are identified along with the requirements for applying machine learning output in the machine learning underlay network. Based on this, a generic framework for data handling and examples of its realization on specific underlying networks are described.

…………………………………………………………………………………………………………………………………………………………………………………..

This document is at an advanced stage in ITU-T SG13:

Draft Recommendation ITU-T Y.3176: “ML marketplace integration in future networks including IMT-2020”

This document is a draft Recommendation under study by Q20 of SG13. This draft Recommendation provides the architecture for integration of ML marketplace in future networks including IMT-2020. The scope of this draft Recommendation includes: – Challenges and motivations for ML marketplace integration – High level requirements of ML marketplace integration – Architecture for integration of ML marketplace in networks.

The July 2020 ITU-T SG13 meeting started the approval process for this draft new Recommendation, which is largely based on the output of the FG ML5G.

…………………………………………………………………………………………………………………………………………………………………………………..

Deliverables which FG ML5G submitted to ITU-T SG13 for consideration:FG ML5G specification:

“Requirements, architecture and design for machine learning function orchestrator”

This technical specification discusses the requirements for machine learning function orchestrator (MLFO). These requirements are derived from the use cases for machine learning in future networks including IMT-2020. Based on these requirements, an architecture and design for the machine learning function orchestrator is described.

FG ML5G specification: “Serving framework for ML models in future networks including IMT-2020”

This specification describes a serving framework for ML models in future networks including IMT-2020. The specification includes requirements and architecture components for such a framework.

FG ML5G specification: “Machine Learning Sandbox for future networks including IMT-2020: requirements and architecture framework”

Use cases for integrating machine learning (ML) to future networks including IMT-2020 has been documented in Supplement 55 and an architecture framework for this integration was specified in ITU-T Y.3172. However, network stakeholders are apprehensive about using ML-driven approaches directly in live networking systems because it can lead to unexpected situations that can degrade KPIs. This is mostly due to the apparent complexity of ML mechanisms (e.g., deep learning), the incompleteness of the available training data, the uncertainty produced by exploration-exploitation approaches (e.g., reinforcement learning), etc. In the face of such impediments, the ML Sandbox emerges as a potential solution that allows mobile network operators (MNOs) for improving the degree of confidence in ML solutions before their application to the network infrastructure. This technical specification deals with the requirements, architecture, and implementation examples for ML Sandbox in future networks including IMT-2020.

FG ML5G specification: “Machine learning based end-to-end network slice management and orchestration”

This document proposes the framework and requirements of machine learning based end-to-end network slice management and orchestration in multi-domain environments.

FG ML5G specification: “Vertical-assisted Network Slicing Based on a Cognitive Framework”

This technical specification proposes a new framework that enables vertical QoE-aware network slice management empowered by machine learning technologies.

…………………………………………………………………………………………………………………………………………………………………………

Conclusions:

The activities of the FG ML5G were concluded and its mandate was accomplished. SG13 closed the FG ML5G while recognizing the FG ML5G chairman Prof. Dr. Slawomir Stanczak (Frauenhofer HHI, Germany) and his management team, active contributors and all the FG members.

|

Contact: |

Leo Lehmann |

Tel: 41 58460 5752 |

……………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.itu.int/en/ITU-T/focusgroups/ml5g/Pages/default.aspx

Nokia & Omdia: 5G could bring up to $3.3 trillion to Latin America by 2035- vs 13% of mobile subs in 2025?

Executive Summary:

5G services could bring up to $3.3 trillion to Latin America by 2035, according to a new study by Nokia and research firm Omdia. The study, titled ‘Why 5G in Latin America?’ notes the uncertainty around the ongoing Covid-19 pandemic – yet alongside the projected $3.3 trillion in economic and social value promised by 5G, a $9 trillion improvement in productivity is also predicted.

We question what this optimistic forecast is based on since we haven’t been able to identify any real 5G use cases with current and near future 5G deployments.

Latin American operators have been relatively silent, apart from some trials, a deployment in Uruguay, and recent soft launches using DSS in Brazil.

This caution is understandable considering the late adoption of 4G. Omdia estimates that 4G in Latin America is about 52% of lines and 3G about a third (as of year-end 2019). Even 2G remains important at 13%, and it will not disappear until well after 2024.

To ignore the potential of 5G is to miss a considerable opportunity or leave it to one’s competitors, according to Omdia. This report shows the opportunity in the mass market, as a fixed broadband substitute, and in the enterprise market. The mass-market opportunity is based on the immersive technologies powered by 5G that will take our digital experiences to the next level and beyond.

The enterprise opportunity is less familiar because it has not been as important a play in 3G and 4G as Omdia believes it will be in 5G. All Latin American enterprises must explore digital transformation to remain competitive in the rapidly evolving global economy. Latin American governments must transform themselves and, more importantly, encourage digital transformation in their economies to improve productivity and return the region to real growth in income per capita.

5G is not an option but an imperative, and this report discusses what service providers and policy makers must do to get ready. There is a brief overview in the Appendix for those who would like to understand more about 5G technology.

The pandemic can be seen as a major opportunity point for digitisation of essential sectors, such as healthcare and emergency services, manufacturing, and the supply chain. Yet a major roadblock remains; a gap between the haves and have-nots for broadband penetration and connectivity.

This is similar to the reports from the Asia Cloud Computing Association (ACCA) regarding the Asia Pacific region; countries such as China and India score poorly because of the disparity between the rich and poor regions. Brazil, another BRIC region, is therefore set to be a major beneficiary according to the report; $1.22tn of 5G economic impact and an increase in productivity of just over $3 trillion.

The report outlines recommendations for service providers, particularly with regard to upgrading 4G to make it 5G-ready. Policy makers, meanwhile, are encouraged to finish allocating 4G spectrum to enable a ‘clear spectrum policy roadmap and an infrastructure policy which both encourages and facilitates the private sector to invest in 5G.’

“Latin American countries must diversify their sources of income and jobs into higher value-added activities,” said Wally Swain, principal consultant for Omdia Latin America. “Activities including mining and manufacturing must become more productive and 5G will play an important role on this.”

It is too early to be definitive about how COVID-19 will change behaviors and the patterns of 5G adoption in Latin America. But it seems clear that increased demand for broadband can only help the 5G business case, especially in FWA for homes and businesses. Because of the pandemic, there is a clear need for digitalization of essential sectors such as healthcare, emergency services, manufacturing, and supply chain.

The need for better-quality emergency communications will encourage the deployment of network slices, a key feature of the coming versions of 5G. In the future of what is often called Industry 4.0, a large part of the new value creation will be around the ability for humans to remotely see, understand, manage, operate, fix, and generally interact with all manner of physical systems and machines, and that will be possible with 5G.

Conclusions:

It is too early to be definitive about how COVID-19 will change behaviors and the patterns of 5G adoption in Latin America. But it seems clear that increased demand for broadband can only help the 5G business case, especially in FWA for homes and businesses. Because of the pandemic, there is a clear need for digitalization of essential sectors such as healthcare, emergency services, manufacturing, and supply chain.

The need for better-quality emergency communications will encourage the deployment of network slices, a key feature of the coming versions of 5G. In the future of what is often called Industry 4.0, a large part of the new value creation will be around the ability for humans to remotely see, understand, manage, operate, fix, and generally interact with all manner of physical systems and machines, and that will be possible with 5G.

You can read the full Omdia report here (name and email address required)

………………………………………………………………………………………………………………………………………………………………………………………

According to Ebanx Labs, 5G will represent 13% of mobile connections in Latin America in 2025, according to the Ericsson Mobility Report. The survey indicates the first 5G network deployments are expected during 2020 in the region, with Argentina, Brazil, Chile, Colombia and Mexico to be the pioneer countries.

Photo Credit: Shutterstock

References:

5G could bring up to $3.3 trillion to Latin America by 2035, says Nokia and Omdia

ZTE reports strong 1st Half 2020 financials; 5G Flexhaul; Automatic Antenna Pattern Control Trial with China Mobile

ZTE reported strong first half financial results, with operating revenues up 5.8 percent from the year before to RMB 47.20 billion and net profit increasing 26.3 percent to RMB 1.86 billion. Net profit after extraordinary items increased 47.4 percent to RMB 0.9 billion. The operating cash flow grew over 61 percent to RMB 2.04 billion while spend on research and development (R&D) advanced to RMB 6.64 billion.

In the first half of 2020, the company strengthened its cash flow and sales revenue collection management. Its net cash flow from operating activities for H1 2020 is approximately RMB2.04 billion, about 61.1% year-on-year growth. With great commitment to 5G R&D investment, the company’s R&D spending increased to RMB6.64 billion in H1 2020, covering 14.1% of operating revenue.

In light of the coronavirus pandemic and its impact, ZTE decided to push its R&D initiatives and to take advantage of the mega shift brought on by its own ongoing digital transformation. The company also focused on customer service, helping to achieve a steady growth of business.

ZTE put its in-house new-generation core chipsets for access, bearer and fixed-networks into large-scale commercial deployments, further improving the performance, integration and energy efficiency ratio of its chipsets. The company is also focusing on strengthening its algorithm processes, new materials and new technologies in general, as it helps build 5G commercial networks and works towards becoming the “ultimate” cloud company.

In terms of operator network business, ZTE, underpinned by the rapid 5G rollouts in China, achieved revenue of RMB34.97 billion, a year-on-year growth of 7.7%. (Note that ZTE and Huawei were recently banned from the UK’s 5G rollouts). In 1st half o 2020, the company continuously strengthened the landscape of global network infrastructure.

Proactively taking advantages of new infrastructure construction and new services, ZTE further explored market growth opportunities, with the revenue of ZTE’s government and enterprise business reaching RMB4.82 billion, a year-on-year growth of 2.5%. The company further explored high-value overseas markets while promoting healthy operations during the period.

In its consumer business, ZTE has continuously strengthened its 5G terminal (mostly smartphones) agreements with over 30 wireless network operators around the world, with a focus on China’s “open market.”

Moving forward, ZTE says it will continuously strengthen the research and development, operate steadily and proactively address the risks and challenges in the global markets, thereby achieving the quality growth. Meanwhile, the company will seize the opportunities of new infrastructure and network technology innovations to expand its market shares, accelerate the digital transformation, and improve the organizational efficiency, so as to become an ultimate cloud company.

The company recently announced its 5G Flexhaul solution, which adopts a minimal forwarding plane architecture and a cloud-native control plane to provide 5G fronthaul, midhaul, and traditional backhaul, flexibly meeting the differentiated needs of 5G multi-scenarios and the ultimate performance challenges of 5G services. Based on a full range of self-developed and the industry’s only “3-in-1” highly integrated 5G bearer chip, combined with the pioneering FlexE Channel technology, ZTE’s 5G Flexhaul solution not only provides ultra-large bandwidth capabilities, but also supports massive connections for different services Provide differentiated SLA guarantee and network slicing capabilities to provide customers with a flexible, scalable, and operable 5G bearer network.

……………………………………………………………………………………………………………………………………………………………………………………..

ZTE’s announced financial report comes one day after the company said that it has completed the trial of Automatic Antenna Pattern Control (AAPC) self-optimization solution in Guangzhou, China along with the Guangzhou branch of China Mobile.

By means of the seamless integration between the AI technology and the network structure optimization, this solution can greatly simplify the optimization and O&M of the 5G Massive MIMO network, thereby effectively improving the efficiency and reducing the costs.

The trial result shows that the network coverage rate has increased by nearly 12%, and the signal strength has increased about 4-to-5 dB while the signal-to-noise ratio has increased nearly 1-to-2 dB and the download rate has risen by about 10%.

The solution is based on ZTE’s intelligent AAPC optimization tool, employing the AI algorithm and the network management platform to quickly search and lock the optimal antenna parameters in complex scenarios. According to the MR (measurement report) data, the solution can accurately evaluate the quality of the network coverage.

In addition, the solution has adopted an AI model to achieve the iterative optimization, and the optimal matching between scenarios and antenna parameters, so as to create an end-to-end operational solution of self-configuration and self-evaluation.

Moving forward, ZTE and China Mobile will further explore various complex scenarios, and develop a larger-scale AI self-optimization system, expecting to accelerate the transformation and upgrade of intelligent networks.

About ZTE:

ZTE is a provider of advanced telecommunications systems, mobile devices and enterprise technology solutions to consumers, operators, companies and public sector customers. The company has been committed to providing customers with integrated end-to-end innovations to deliver excellence and value as the telecommunications and information technology sectors converge. Listed in the stock exchanges of Hong Kong and Shenzhen, ZTE sells its products and services in more than 160 countries.

References:

https://www.zte.com.cn/global/about/news/20200828e1.html

https://www.zte.com.cn/global/about/news/20200827e1.html

https://www.zte.com.cn/china/solutions/201905201708/201905201738/5G_Flexhaul

ZTE facilitates 4G and 5G co-evolution with a comprehensive set of solutions

Cignal AI: COVID-19 Continued to Pressure Optical Network Supply Chain in Q2-2020

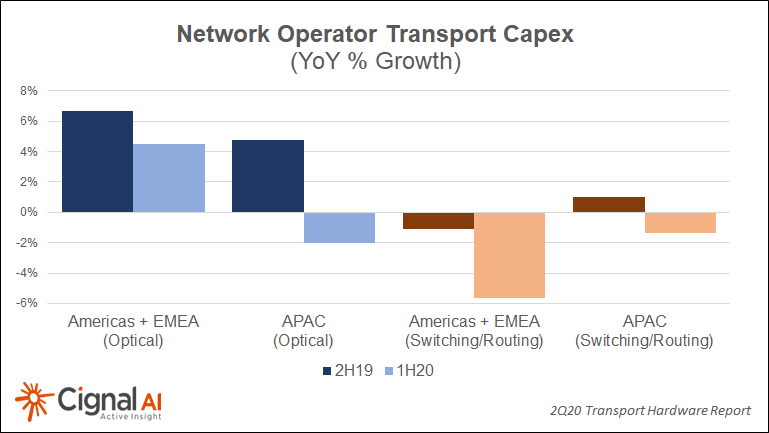

Delayed order fulfillment due to COVID supply chain impact earlier this year was expected to spur sales growth in 2Q20, but instead the results were mixed, according to the most recent Transport Hardware Report from research firm Cignal AI. Forecasted growth in Q2 from sales pushed out from Q1 did not materialize, and network operators indicated that annual CapEx would not increase (see chart below). As a result, spending on optical and switching/routing equipment will be flat to down in the second half of the year.

“COVID operational issues slowed deliveries and revenue recognition in the second quarter, although optical hardware sales increased in NA and EMEA due to high demand for inventory,” stated Cignal AI Lead Analyst Scott Wilkinson. “Growth is not expected to continue in the second half as carriers have pulled forward annual CapEx spending and networks are now able to cope with COVID-related surges.”

Some regions did shine in 2Q20. North American optical sales were up sharply YoY in both metro and long haul WDM, though the second half of the year is expected to be flat or down. Japan’s extraordinary growth in optical sales expanded to packet sales this quarter, with sales to both market segments up substantially YoY.

Additional 2Q20 Transport Hardware Report Findings:

- In addition to COVID woes, RoAPAC continues to suffer from the CapEx limitations in India, and optical sales declined -20% for the quarter while packet sales also declined.

- China has overcome its COVID related issues and returned to optical and packet spending growth this quarter, with increasing growth forecasted for Q3.

- EMEA optical spending increased YoY but was weighed down by weak Nokia sales. Nokia predicts that Q3 sales increases will offset Q2 declines.

Real-Time Market Data:

Cignal AI’s Transport Hardware Dashboardis available to clients of the Transport Hardware Report and provides up-to-date market data, including individual vendors’ results as they are released. Users can manipulate variables online and see information in a variety of useful ways, as well as download Excel files with up-to-date snapshots of market reporting.

Contact: sales@@cignal.ai

References:

https://cignal.ai/2020/08/transport-hardware-misses-expected-bounce-back-in-2q20/

Addendum:

According to Industry Research, the global Optical Transport Network (OTN) Equipment (optical transport and switching) market is projected to reach USD 20360 million by 2026, from USD 15810 million in 2020, at a CAGR of 4.3% during 2021-2026.

The Optical Transport Network (OTN) Equipment market is segmented into the following categories:

- Mobile Backhaul Solutions

- Triple Play Solutions

- Business Services Solution

- Industry and Public Sector

- Others

With respect to data rates, the Optical Transport Network (OTN) Equipment market is segmented into three categories:

- < 10G

- 10G-100G

- 100-400G

https://www.industryresearch.co/global-optical-transport-network-otn-equipment-market-16157288

COVID-19 Challenges faced by Telcos and Impact on the Telecom Sector

by Raj Vignesh, Digital Marketing Lead, Megron Tech, Swindon, United Kingdom

(edited by Alan J Weissberger)

Introduction:

The emergence of the novel coronavirus (COVID-19) has brought a series of “black swan” events to the entire telecom industry. People and businesses are shifting to digital means to manage their work loads, which has led to an unexpected surge in fixed AND mobile network traffic and access demands. TELECOM NETWORK OPERATORS HAVE HAD TO address this UNPRECEDENTED situation to fulfill the INCREASED networking REQUIREMENTS of their customers.

We discuss the strategies being crafted by telco leaders during this crisis; like increasing network bandwidth, leveraging digital technologies, use of 5G to support their customers and facilitating business continuity.

Further, we IDENTIFY opportunity areas for the telecom operators/service providers that have emerged in the wake of this coronavirus pandemic. Customer complaints raised during the lockdown due to poor mobile network signal reception and slow internet speeds are important concerns that the service providers need to CAREFULLY EXAMINE AND REVIEW.

IN RESPONSE TO THE PANDEMIC, TELCOS are building customized service offerings for their customers. THEIR AIM IS TO enable seamless interaction WITH USERS and to move forward with their business processes WHILE ALSO REALIZING a positive return on their investments.

Disruption in telecom industry due to the rise in COVID-19

The COVID-19 wave has smashed every industry. The telecommunications industry has been largely disrupted, as it is the core of communications required for medical, government and private sector business functions to operate seamlessly.

For example, reliable, high-speed Internet access is key to ensuring that hospitals and medical institutions have access to global information networks and resources necessary to fight the virus. Broadband connectivity is also now absolutely crucial for educational institutions and businesses to continue to provide essential services. The unprecedented global health emergency is taxing networks and platforms to the limit, with some operators and platforms reporting demand spikes as high as 800%.

The sudden disruption of normal business operations caused by the coronavirus has forced companies to drive their businesses remotely. That shift has spiked the demand for better network connectivity and improved internet coverage, especially in remote or rural areas.

As a result, the telecom industry (wireline and wireless) is trying to deliver better Internet infrastructure to their customers.

What are the key areas being impacted by this deadly outbreak?

The coronavirus pandemic has brought in some dramatic changes into the world, with network connectivity acting as a key for business continuity. How COVID-19 has impacted the telecoms industry is discussed below:

-

Ensuring resilient connectivity 24/7: Wireless Telecom operators are allocating spectrum resources to provide round the clock Internet connections to mobile subscribers. Due to increased data traffic, Internet download speeds have dropped, making the quality of video streaming poor.

-

Cloud computing increases amidst the lockdown: As businesses are proceeding with their work remotely, demand for video conferencing services and SaaS applications is continuously rising. Businesses are keen to adopt this new cloud-based model of working as they realize increased productivity with less investment in office space. Therefore, companies gain business benefits over the long-term.

-

Payments with pin and chip are the new normal: Following the social distancing norm, people nowadays prefer to do payments digitally i.e. via UPI apps, credit/debit cards or Internet banking. Due to COVID-19, the rise in digital payments is expected to reach 67% as per research conducted by Bain & Company.

-

Security to combat vulnerabilities: Cloud resources are accessed online and ease in restrictions is increasing the risk of cyber attacks. Cyber security engineers need to act on developing strategies to strengthen remote connectivity with proper authorization procedures. Mobile customer transactions need enhanced security with mobile-intelligence based approaches to prevent fraudulent transactions.

How are telcos responding to this critical situation?

-

Increase in network transport capacity – The COVID-19 lockdown weariness brought in demands for mobile broadband as most of the people are forced to stay home. Many telcos have eased their 3G/4G/5G network speed to facilitate users with proper Internet connections to stay connected with their loved ones, or can work remotely without any disruption while having business meetings with colleagues, clients and other stakeholders of the company.

-

Enhancement in 5G technology – This is the right time for mobile network operators (MNOs) to build and deploy 5G networks to wide geographical area including towns and villages. Many have done so already using 3GPP Release 15 “5G New Radio” for the Data plane along with a LTE core network (this is known as “5G Non Stand Alone” or “5G NSA”).

-

Comprehend each customer segment’s value and tailor solutions accordingly – Telcos are partnering with technology companies to understand customer behavior using technologies like AI/ML and data analytics. With deeper insights gained (e.g. geographies, customer interests, demographics, etc), telcos are adjusting their service offerings to customer segments to satisfy their demands in the current and post-COVID-world.

-

The Federal Communications Commission (FCC) launched its Keep Americans Connected initiative to help ensure that Americans don’t lose critical telecommunications services they depend on. Broadband wireline and wireless service providers that have signed the pledge have agreed not to terminate service if a customer can’t afford to pay bills due to the pandemic, to waive late fees resulting from economic hardship, and to expand the availability of their Wi-Fi hotspots. The FCC has also made additional wireless spectrum available to providers, warned people of COVID-19 related scams, and is expanding robocall protections for hospitals.

-

Selected U.S. and UK telco initiatives to help customers:

-

Verizon has been assisting its client base to transition from teleworking to remote working capabilities, with a pledge to not overcharge them in this crisis. Starting July 1st, customers who signed up for the Pledge to maintain their wireless service will automatically be enrolled in the company’s Stay Connected repayment program to provide options to stay connected.

-

AT&T suspended data caps for broadband customers to support the employees forced to do work from home during pandemic. Moreover, internet data is being offered to limited-income households at $10/month and businesses with 50% rebate on the current AT&T World Connect Advantage package.

-

T-Mobile has teams working 24/7 to ensure it continues to perform for all its customers, even under times of anticipated heavier traffic due to the pandemic lockdowns. Customers can make appointments through the store locator page on T-Mobile.com for curbside fulfilment on device and accessory orders.

-

Vodafone has increased network capacity to deal with new spikes in Internet traffic which it says has increased 50% since lockdowns were put in place. Customers accessing government-supported healthcare websites and educational resources will be able to do so without worry about data consumption charges.

-

Virgin Media’s postpaid customers have been offered unlimited minutes to landlines and other mobile numbers, as well as a 10 GB data boost for the month at no extra cost. For broadband, any data caps on legacy products will be lifted.

-

Comcast* subscribers interacted with customer service digitally via Xfinity Assistant, which is Comcast’s cross-channel, virtual customer service tool. Xfinity Assistant answers customers’ questions around the clock without them needing to stop what they’re doing to call customer service reps. Comcast said Xfinity Assistant is helping its customers about 400,000 times every day, compared to before COVID-19 when it averaged about 60,000 interactions a day. Comcast said Xfinity Assistant was proof that customers want to use digital tools and applications.

-

* Comcast is one of the largest retail Internet Service Provider (ISP) in the U.S. via its Xfinity brand. Xfinity also offers pay TV and cellular service as a MVNO for Verizon. The company also offers business network services, including broadband Internet through Comcast Business.

………………………………………………………………………………………………………………………………………………………………………………………………………………

Editor’s Note: Short-Term Commercial Initiatives by Network Operators (SOURCE: ITU-D):

Additional data: Many mobile network operators (MNOs) are offering to provide customers with additional data as businesses and schools across the world transition to working remotely, due to the spread of the COVID-19 virus.

Going digital in terms of recharges, etc: Facilitate prepaid mobile recharges being made online rather through physical scratch cards etc to improve connectivity during any lockdowns.

Free access to online learning resources: In order to support distance learning and home-schooling during school closures, access to remote leaning opportunities and educational

platforms has been made available at no cost by a number of operators.

Facilitating mobile money transactions: Banks and telecommunications companies are encouraging consumers to avoid cash payment in favour of digital transactions to avoid the

spread of the coronavirus.

Increasing Broadband Speeds: Operators are upgrading Internet speeds – including transmission and backhaul capacity – to better accommodate the unprecedented number of people working and learning from home which has been up to a 70 percent in certain country markets.

Free access to health/government information: MNOs are providing free access to information contained in government and social welfare sites, as well as to websites containing health

information relevant to coronavirus crisis.

Providing other free services: MNOs have also commenced a variety of other initiatives for their customers, at no extra cost. These include free access to networks and waiving overcharge fees.

………………………………………………………………………………………………………………………………………………………………………………………………………………

Other Opportunities for Telco Service Providers:

-

Resolution of customer queries through a virtualized support solution: Dealing with customers in this pandemic is becoming tricky and telecom operators are investing heavily to minimize customer churn in order to retain their customers. They are offering virtual support services to customers to keep them engaged and solve their issues more quickly.

-

Customer QoE measurement needs to be enhanced: Telecom operators need to assess QoE monitoring with network coverage and speed, voice failures, via enabling customer services team online without visiting the customer site. Cell tower monitoring is a critical activity that needs to be undertaken in order to measure network performance and deliver increased throughput, clear voice calls amid crisis.

-

Building partnerships with edge application providers for better Internet connectivity: Applications with low latency like gaming, video conferencing applications require computing to be placed at edge near the end-user to give better user experience with enhanced network connection. Telcos can collaborate with cloud application providers in order to meet the requirements of users working from home in this time of coronavirus outbreak.

Conclusions:

Telcos are continuously adapting to the changes caused due to COVID-19 crisis. Being the sole distributor of Internet infrastructure to other industry verticals, telecom operators have made several amendments in their operations and offerings to serve their customers in a better way. Though the coronavirus pandemic brought in several challenges, initiatives taken by the telcos is surely going to retain their business partnerships and customers for the long-term. That should lead to an increase in telco revenues during the COVID-19 pandemic and thereafter when life returns to normal.

…………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.bain.com/insights/the-covid-19-tipping-point-for-digital-payments/

https://telecoms.com/opinion/telcos-have-a-huge-role-to-play-in-navigating-the-covid-19-pandemic/

https://www.bain.com/insights/covid-19-how-telcos-can-reset-their-customer-strategy/

https://www.datacenterknowledge.com/networks/covid-19-five-recommendations-telco-it-leaders

https://www.weforum.org/agenda/2020/03/coronavirus-and-corporate-social-innovation/

https://www.insidetelecom.com/covid-19-impacts-on-the-telecoms-industry/

Analysis of Open Network Foundation new 5G SD-RAN™ Project

Executive Summary:

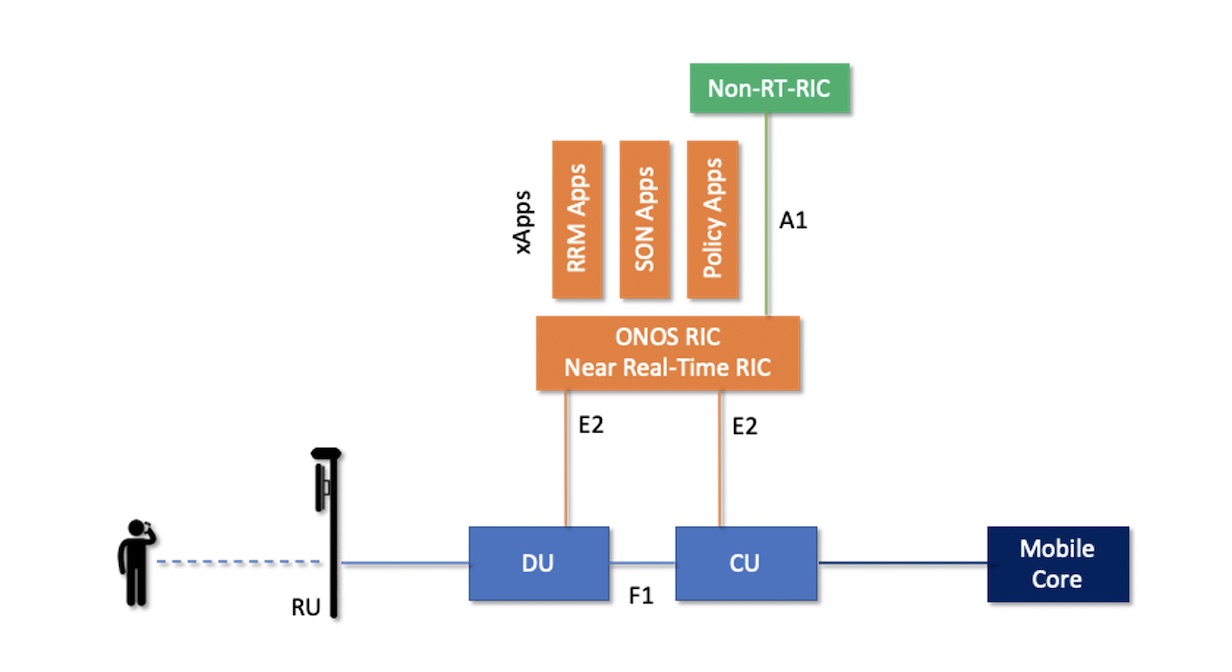

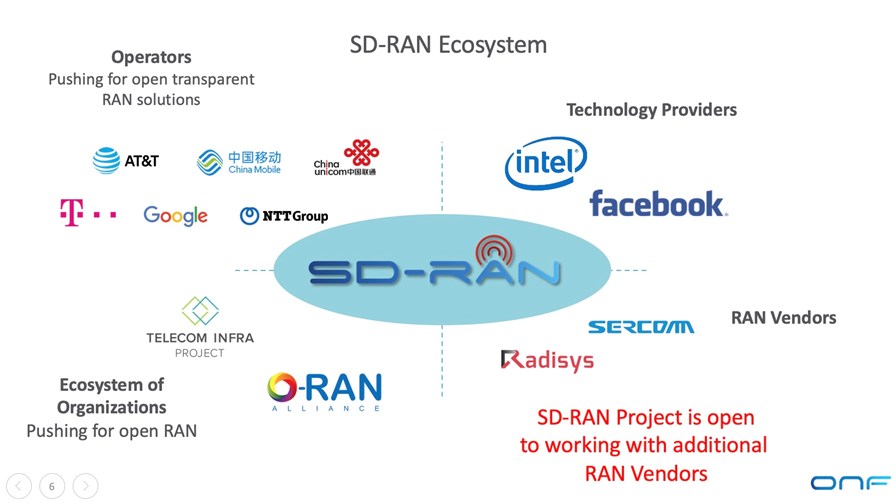

In a move that will help promote multi-vendor interoperability, the Open Networking Foundation (ONF) today announced the formation of the SD-RAN project (Software Defined Radio Access Network) to pursue the creation of open source software platforms and multi-vendor solutions for mobile 4G and 5G RAN deployments. Initially, the project will focus on building an open source Near Real-Time RAN Intelligent Controller (nRT-RIC) compatible with the O-RAN architecture.

The new SD-RAN project is backed by a consortium of leading operators and aligned technology companies and organizations that together are committed to creating a truly open RAN ecosystem. Founding members include AT&T, China Mobile, China Unicom, Deutsche Telekom, Facebook, Google, Intel, NTT, Radisys and Sercomm. All the project members will be actively contributing, and this includes the operators contributing use cases and trialing the results, according to the ONF. However, the larger cellular base station vendors that are ONF members, Nokia, Samsung, ZTE, Fujitsu, NEC were silent on their participation in this SD-RAN project.

There may be some confusion caused by ONF’s SD-RAN project as it is the third Open RAN consortium. The O-RAN Alliance and TIP Open RAN project are working on open source hardware and open interfaces for disaggregated RAN equipment, like a 4G/5G combo base station.

In a brief video chat yesterday, Timon Sloane, VP of Ecosystem and Marketing for ONF told me that this new ONF SD-RAN project would be in close contact with the other two Open RAN consortiums and distinguished itself from them by producing OPEN SOURCE SOFTWARE for disaggregated RAN equipment—something he said the O-RAN Alliance and TIP Open RAN project were NOT doing.

That should go a long way in dispelling that confusion, but it nonetheless presents a challenge on how three consortiums can effectively work together to produce meaningful open source software code (ONF) and hardware (O-RAN Alliance and TIP) specifications with joint compliance testing to ensure multi-vendor interoperability.

Sloane told Matt Kapko of SDXCentral: “The operators really are pushing for separation of hardware and software and for enabling new innovations to come in in software without it being tightly coupled to the hardware that they purchase. And xApps are where the functionality of the RAN is to be housed, and so in order to do this in a meaningful way you have to be able to do meaningful functions in these xApps,” Sloane said.

However, no mention was made in the ONF press release of a liaison with either 3GPP or ITU-R WP5D which are producing the standards and specs for 5G and have already done so for 4G-LTE. Neither of the aforementioned O-RAN consortiums have liaisons with those entities either.

There are other complications with Open RAN (independent of SD-RAN), such as U.S. government’s attempt to cripple Huawei and other China telecom equipment vendors, need for a parallel wireless infrastructure, legacy vs greenfield carriers. These are addressed in Comment and Analysis section below.

µONOS-RIC:

Central to the project is the development of an open source near-real time RIC called µONOS-RIC (pronounced “micro-ONOS-RIC”).

µONOS is a microservices-based SDN controller created by the refactoring and enhancement of ONOS, the leading SDN controller for operators in production tier-1 networks worldwide. µONOS-RIC is built on µONOS, and hence features a cloud-native design supporting active-active clustering for scalability, performance and high availability along with the real-time capabilities needed for intelligent RAN control.

µONOS-RIC is designed to control an array of multi-vendor open RAN equipment consistent with the O-RAN ALLIANCE architecture. In particular, the O-RAN ALLIANCE E2 interface is used to interface between µONOS-RIC and vendor supplied RAN RU/DU/CU RAN components.

xApps running on top of the µONOS-RIC are responsible for functionality that traditionally has been implemented in vendor-proprietary implementations. A primary goal of the SD-RAN project (and, not coincidentally, for the operators who founded the O-RAN consortium) is to enable an external intelligent controller to control the RAN so that operators have both visibility and control over their RAN networks, thus giving operators ownership and control over how spectrum is utilized and optimized along with the tools to deliver an optimal experience for users and applications.

……………………………………………………………………………………………………………………………………………………………………………………………………

Relationship to O-RAN Alliance, O-RAN Software Community and TIP:

The participating members of the SD-RAN project plan to implement, prototype and trial an advanced architecture that enables intelligent RIC xApps to control a broad spectrum of SON and RRM functionality that historically has been implemented as vendor-proprietary features on bespoke base station equipment and platforms. SD-RAN’s focus and goals are complementary to various efforts across the industry, including work taking place within the O-RAN ALLIANCE, the O-RAN Software Community and the TIP OpenRAN Project Group.

SD-RAN will follow O-RAN specifications as they are developed and will also make use of components of existing open source to facilitate interoperability. As the project pioneers new functionality, all extensions and learnings that come from building the system will be contributed back to O-RAN ALLIANCE, with the intent that these extensions can inform and advance the O-RAN specifications.

The SD-RAN work inside the ONF community will take place in parallel with work being contributed to the O-RAN Software Community. The intent is for interoperable implementations to come out of both efforts, so that a mix of open source and vendor proprietary components can be demonstrated and ultimately deployed.

Timing and Availability:

The SD-RAN project already has a working skeleton prototype of the µONOS-RIC controller above a RAN emulation platform through the E2 interface. This implementation is demonstrating handover and load balancing at scale, supporting over 100 base stations and 100,000 user devices with less than 50ms handover latency (less than 10ms latency for 99% of all handovers).

The SD-RAN community is advancing towards a field trial by early 2021, working with RAN vendors to integrate carrier-grade RU/DU/CU components while in parallel implementing xApps to demonstrate SON and RRM functionality. Interested parties are encouraged to contact ONF for additional information.

Quotes Supporting the SD-RAN Project:

“AT&T strongly supports the development of specifications and components that can help drive openness and innovation in the RAN ecosystem. The O-RAN ALLIANCE’s specifications are enabling the ecosystem, with a range of companies and organizations creating both open source and proprietary implementations that are bringing the open specifications to life. The ONF SD-RAN project, along with the O-RAN OSC, will expand the ecosystem with an nRT-RIC that can support xApps and help demonstrate their interoperability. This project will help accelerate the transition to an open RAN future.”

Andre Fuetsch, President and Chief Technology Officer, AT&T Labs

“China Mobile co-founded O-RAN in order to promote both the opening of the RAN ecosystem for multi-vendor solutions and the realization of RAN with native intelligence for performance and cost improvement. An open nRT-RIC with support for open xApps that go beyond policy-based control and SON to also enhance Radio Resource Management (RRM) will make it possible for operators to optimize resource utilization and application performance. We are excited to see the development of an open nRT-RIC and xApps in the SD-RAN project led by ONF, and expect this work to help advance the state-of-art for open and intelligent RAN.”

Dr. Chih-Lin I, Chief Scientist, Wireless Technologies, China Mobile

“China Unicom has been a long-term partner with ONF. We continue to see the benefits of the ONF’s work and the impact it has on our industry. The SD-RAN project is now applying the ONF’s proven strategy for disaggregating and creating open source implementations to the 5G RAN space in order to foster innovation and ecosystem transformation. We are excited by this work, and are committed to trialing a solution as it becomes available.”

Dr. Xiongyan Tang, Network Technology Research Institute, China Unicom

“Deutsche Telekom is a huge believer in applying disaggregation and open source principles for our next-generation networks. DT has ONF’s mobile core platform (OMEC) in production and we are taking ONF’s broadband access (SEBA/VOLTHA) platform to production towards the end of 2020. This journey has shown us the tremendous value that is created when we can build solutions based on interoperable multi-vendor components intermixed with open source components. ONF’s SD-RAN project is leveraging these same principles to help accelerate innovation in the RAN domain, and we are excited to be an active collaborator in this journey.”

Dr. Alex Jinsung Choi, SVP Strategy & Technology Innovation, Deutsche Telekom

“Connectivity is an integral part of Facebook’s focus to bring people closer together. We work closely with partners to develop programs and technologies that make connectivity more affordable and accessible. Through our collaboration with ONF on their SD-RAN project, we look forward to engaging with the community to improve connectivity experiences for many people around the world.”

Aaron Bernstein, Facebook’s Director of Connectivity Ecosystem Programs

“Google is an advocate for SDN, disaggregation and open source, and we are excited to see these principles now being applied to the RAN domain. ONF’s SD-RAN project’s ambition to create an open source RIC can help invigorate innovation across the mobile domain.”

Ankur Jain, Distinguished Engineer, Google

“Intel is an active participant of the ONF’s SD-RAN project to advance the development of open RAN implementations on high volume servers. ONF has been leading the industry with advanced open source implementations in the areas of disaggregated Mobile Core, e.g. the Open Mobile Evolved Core (OMEC), and we look forward to continuing to innovate by applying proven principles of disaggregation, open source and AI/ML to the next stepping stone in this journey – the RAN. SD-RAN will be optimized to leverage powerful performance, AI/ML, and security enhancements, which are essential for 5G and available in Intel® Xeon® Scalable Processors, network adapters and switching technologies, including Data-Plane Development Kit (DPDK) and Intel® Software Guard Extensions (Intel SGX).”

Pranav Mehta, Vice President of Systems and Software Research, Intel Labs

“NTT sees great value in transforming the RAN domain in order to foster innovation and multi-vendor interoperability. We are excited to be part of the SD-RAN ecosystem, and look forward to working with the community to develop open source components that can be intermixed with vendor proprietary elements using standard O-RAN interfaces.”

Dai Kashiwa, Evangelist, Director of NTT Communications

“Radisys is excited to be a founding member of the SD-RAN project, and we are committed to integrating our RAN software implementation (CU & DU) with O-RAN interfaces to the µONOS-RIC controller and xApps being developed by the SD-RAN project community. This effort has the potential to accelerate the adoption of O-RAN based RIC implementation and xApps, and we are committed to working with this community to advance the open RAN agenda.”

Arun Bhikshesvaran, CEO, Radisys

“As a leading manufacturer of small cell RAN equipment and an avid supporter of the open RAN movement, Sercomm is excited to collaborate with the SD-RAN community to open E2 interfaces and migrate some of our near-real-time functionalities from the RAN equipment into xApps running the μONOS-RIC controller. This is a nascent yet dynamic area full of potential, and we are committed to working with the SD-RAN ecosystem to build solutions ready for trials and deployment.”

Ben Lin, CTO and Co-Founder, Sercomm

“TIP’s OpenRAN solutions are an important element of our work to accelerate innovation across all elements of the network including Access, Transport, Core and Services. We are excited about the collaboration between our RIA subgroup and ONF’s SD-RAN project to accelerate RAN disaggregation and adoption of open interfaces. Through this collaboration we will enable the OpenRAN ecosystem to leverage the strengths of data science and AI/ML technologies to set new industry benchmarks on performance, efficiency and total cost of ownership.”

Attilio Zani, Executive Director for Telecom Infra Project (TIP)

…………………………………………………………………………………………………………………………………………………………………………………………………

Comment and Analysis of Open RAN Market:

Disclaimer: Like all IEEE Techblog posts, opinions, comment and analysis are ALWAYS by the authors and do NOT EVER represent an opinion or position by IEEE or the IEEE Communications Society. This should be obvious to all in the 11 1/2 years of this author’s contribution to the IEEE Techblog and its predecessor- ComSoc Community blogs.

…………………………………………………………………………………………………………………………………………………………………………

Besides NOT having a liaison with either 3GPP or ITU-R, the following Open RAN issues may limit its market potential. These are NOT specific to the ONF SD-RAN project, but generic to Open RAN deployments.

- U.S. officials promoting Open RAN as a way to decrease the dominance of Huawei, the world’s biggest vendor of mobile equipment by market share and also to thwart the rise of other vendors like ZTE and China Information and Communication Technology Group (CICT) which recently won a small part of s China Mobile contract. Obviously, China’s government will fight back and NOT allow any version of Open RAN to be deployed in China (likely to be the world’s biggest 5G market by far)! That despite China Mobile and China Unicom’s expressed interest in Open RAN (see Quotes above). Remember, that the three big China carriers (China Mobile, China Telecom, China Unicom) are all state owned.

- Dual infrastructure: If a legacy wireless carrier deploys Open RAN, existing wireless infrastructure equipment (base stations, small cells, cell tower equipment, backhaul, etc) must remain in place to support its customers. Open RAN gear (with new fronthaul and backhaul) won’t have wide coverage area for many years. Therefore, current customers can’t simply be switched over from legacy wireless infrastructure to Open RAN gear. That means that a separate separate and distinct WIRELESS INFRASTRUCTURE NETWORK must be built and physically installed for Open RAN gear. Yet no one seems to talk or write about that! Why not?

- Open RAN is really only for greenfield carriers with NO EMBEDDED WIRELESS INFRASTRUCTURE. Rakuten and Dish Network are two such carriers ideally suited to Open RAN. That despite a lot of noise from AT&T and Deutsche Telekom about Open RAN trials. All the supporting quotes from legacy carriers are indicative of their interest in open source software AND hardware: to break the stranglehold the huge wireless equipment vendors have on cellular infrastructure and its relatively high costs of their proprietary network equipment and element management systems.

- Open RAN should definitely lower initial deployment costs (CAPEX), but may result in INCREASED maintenance cost (OPEX) due to the difficulty of ensuring multi-vendor interoperability, systems integration and MOST IMPORTANTLY tech support with fault detection and rapid restoration of service.

Conclusions:

Considering all of the above, one may conclude that traditional cellular infrastructure, based on vendor specific equipment and proprietary interfaces, will remain in place for many years to come. As a result, Open RAN becomes a decent market for greenfield carriers and a small market (trial or pilot networks) for legacy carriers, which become brownfield carriers after Open RAN is commercially available to provide their cellular services.

Given a smaller than commonly believed market for Open RAN, this author believes the SD-RAN project is a very good idea. That’s because it will make open source software available for Open RAN equipment, something that neither the O-RAN Alliance of TIP Open RAN project are doing. Of course, having more vendors producing Open RAN white boxes and software does add to the systems integration and tech support that only large (tier 1) telcos (like AT&T, Deutsche Telekom, NTT and cloud companies (like Google, Facebook, Microsoft) have the staff to support.

In a follow up phone conversation today, Timon Sloane told me that network operators want a fully functional and powerful RAN Intelligent Controller (RIC) to gain visibility and control over their RANs, but that has yet to be realized. To date, such controllers have been proprietary, rather than open source software.

The ONF µONOS-RIC is a key software module to realize that vision, Timon said. It is very much like a (near) real time operating system for an Open RAN. If successful, it will go a long way to promote multi-vendor interoperability for Open RAN deployments. Success and good luck ONF!

………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.prnewswire.com/news-releases/onf-announces-new-5g-sd-ran-project-301117481.html

https://www.sdxcentral.com/articles/news/onf-picks-up-where-o-ran-alliance-falls-short/2020/08/

At long last, commercial 400GE is real via Windstream -Evergreen long haul optical circuit

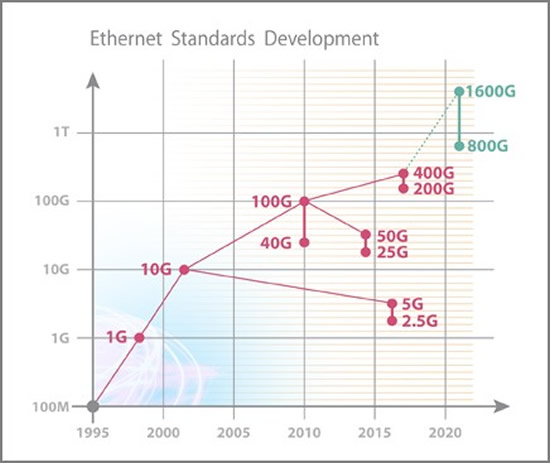

IEEE 802.3‘s “400 Gb/s Ethernet Study Group” started working on the 400 Gbit/s generation standard in March 2013. Results from the study group were published and approved on March 27, 2014. IEEE officially ratified its 802.3bs standard for 200G and 400G over Single Mode Fiber (SMF) and Multi Mode Fiber (MMF) on December 6, 2017.

Below are charts of recent IEEE 802.3 Ethernet standards development and the various option for 400GE over SMF or MMF:

| Name | Medium | Tx Fibers | Lanes | Reach | Encoding |

|---|---|---|---|---|---|

| 400GBASE-SR16 | MMF | 16 | 16 x 25 Gbps | 70 m (OM3)100 m (OM4) | NRZ |

| 400GBASE-DR4 | SMF | 4 | 4 x 100 Gbps | 500 m | PAM4 |

| 400GBASE-FR8 | SMF | 1 | 8 x 50 Gbps (WDM) | 2 km | PAM4 |

| 400GBASE-LR8 | SMF | 1 | 8 x 50 Gbps (WDM) | 10 km | PAM4 |

| 200GBASE-DR4 | SMF | 4 | 4 x 50 Gbps | 500 m | PAM4 |

| 200GBASE-FR4 | SMF | 1 | 4 x 50 Gbps (WDM) | 2 km | PAM4 |

| 200GBASE-LR4 | SMF | 1 | 4 x 50 Gbps (WDM) | 10 km | PAM4 |

Source: IEEE 802.3

……………………………………………………………………………………………………………………………………….

There’s been much talk about 400GE since then with continued promised of “deployment this year,” primarily for Data Center Interconnect (DCI), Internet Data Exchange, and wholesale fiber service providers. Now, it’s finally real!

Windstream Wholesale has begun deploying long haul 400 Gigabit Ethernet (400GE) to link the regional teleco’s fiber network with Everstream’s Chicago-to-Cleveland route. For this deployment, Windstream used Infinera’s Groove (GX) Series compact modular platforms and Juniper’s PTX Series transport routers. Windstream provided the 400G Wavelength Service using Infinera’s coherent wavelength technology.

The two primary customer segments for 400GE have been data center operators looking to interconnect two or more data centers, or service providers that want to build metro rings consisting of 400G lines on which they then would lease capacity to data center operators or enterprises through a data center interconnection (DCI) as-a-service offering.

“So this is not just an experiment,” said Buddy Bayer, chief network officer at Windstream. “This is a real world revenue generating circuit for us. We have a lot of peers in this industry that we talk to quite a bit, and there’s a lot of experimentation and lot of discussion going on around about 400 Gig. But this is the first one that we’ve really heard about where it’s a real circuit with real revenue behind it.”

Source: Windstream Wholesale

…………………………………………………………………………………………………………………………………………………………………………………

Bayer credited the work done in Windstream’s Little Rock lab earlier this year with Infinera for being able to boot up the commercial 400GbE connection with Everstream. In April, Windstream Holdings and Infinera paired 400GE with client-side services with commercially available 400GE-LR8 QSFP-DD compact pluggable interfaces. The trial used Infinera’s commercially available 2x 600G Wavelength muxponder on its Groove (GX) G30 Compact Modular Platform with the CHM-2T sled, which enabled the customer-facing 400GE service to be transmitted using a single-carrier 600G wavelength. Windstream has been aggressive about working with vendors such as Infinera and Ciena in its labs in order to provision 400G services.

“With the LR8, you now you have the optical reach for the long haul. So going from seeing it in the lab environment to now getting it onto our network live with a real customer is pretty exciting. This kind of put us in the driver’s seat from our consumers’ perspective,” Bayer said. “We get to take all their questions and all their needs and put them right inside of those labs and trials and create solutions around them,” he added.

The introduction of Windstream’s 400 GbE Wavelength Service helps Everstream meet the relentless growing bandwidth demands from enterprises and provide the flexibility to support a wide variety of business-class services. The partnership enables Everstream to leverage the national footprint of Windstream’s advanced fiber-optic network and augment its high-demand route between Chicago and Cleveland. Windstream’s Wavelength Service product offering includes routes across its nationwide fiber network from 10GbE to 400GbE.

“Everstream is committed to continually enhancing our business-only network and expanding our partnerships to deliver a customer experience that is unmatched for even the most demanding enterprise requirements,” said Everstream President and CEO Brett Lindsey. “As our customers continue to scale, they need access to high-bandwidth, agile network solutions. This opportunity with Windstream enables us to consistently lead the market in providing the services that businesses demand with the reliability they need.”

“Windstream is committed to tapping into the latest technological innovation, enabling us to offer customers the benefits of ultra-efficient, high-capacity transport solutions across our network,” said Joe Scattareggia, executive vice president, Windstream Wholesale. “By partnering with Windstream Wholesale, regional service providers like Everstream have access to advanced national connectivity solutions to support the increasing bandwidth and capacity demands of their customers.”

…………………………………………………………………………………………………………………………………………………………………………………………………

Cisco and Juniper have produced commercially available 400G for routers, but the optical network transport side has been slower on the uptake, according to Jimmy Yu, vice president and analyst for the optical transport market at Dell’Oro Group.

“So the fact that Everstream is going to be the first announced paying customer really speaks to the fact that they (Windstream) have gone full throttle on getting this not only up, but getting it running and getting a customer,” Yu said. “It does seem like they are kind of hitting the market first among service providers.”

Yu also pointed to Windstream’s work with Ciena for the build-out of Windstream’s new nationwide optical network, which is slated for turn up in the third quarter of this year.

Bayer and Yu expect 400G long-haul deployments will ramp up around the middle of next year after a few smaller launches near the end of this year. Bayer said the cost model for deploying 400G needs to come down for wide-scale adoption.

“I think the typical cost curve hasn’t kicked in yet,” Bayer said. “It’s supply and demand. As soon as there’s a demand on the 400G side, we’re going to see the cost come way down. You’re going to see cost models where it’s cheaper to turn up one 400 Gig as it is for turning up two 100 Gigs. We’re not there yet.

“The router blades are in the same supply and demand curves that the transport optics are in.”

Both Bayer and Yu said ZR pluggable optics, which will be for the longer spans of up to up to 120 kilometers, would start to become more widely available next year. Using ZR and ZR Plus pluggable optics allows service providers to eliminate transponders in the their WDM wavelength-division multiplexing) networks.

“IR8 is absolutely a good technology and it gave us the reach that we needed for 400 Gig, but ZR optics is another level of performance at a lower cost point,” Bayer said. “ZR is a lot lower cost point that’s going to be more appealing. I think that’s when you start to really see 400 Gig take off because now you can take that pluggable and put it in a router or transport gear. I think that’ll really kind of stir the nest for demand for 400G.

Yu said that while ZR is standards-based ZR Plus is not. ZR Plus could span up to 1,000 kilometers but may not fit on a switch or router.

“One of the advantages of ZR is everyone wants to put the pluggable on an Ethernet switch or router instead of on an optical system,” Yu said. “It’s not clear to me if ZR Plus can be put on a router or just go on an optical system but now it’s going to be more pluggable,” Yu added.

400G ZR and the longer-distance 400G ZR Plus will bring interoperability, and with that, potentially lower cost to 400G deployments as companies deploying 400G have more options to mix and match different vendors.

“ZR Plus will probably be generally available mid next year,” Bayer said. “ZR Plus is a lot lower cost point and that’s going to be more appealing. It’s not available to us yet, but as soon as it is we’re right in the labs and environments with it. We’re ready to go.”

References:

Everstream Partners with Windstream to Bring 400GbE Services to Market

https://www.fiercetelecom.com/telecom/windstream-powers-up-live-400gbe-service-everstream

Chile Government Officials: 5G will NOT close the Digital Divide; Improved Fiber Coverage Needed

5G technology “is not a tool for closing the digital divide and the big problem is fixed internet,” according to Chile’s telecommunications undersecretary Pamela Gidi. Business daily Diario Financiero reported the minister’s comments in response to criticism about the country’s forthcoming 5G frequency auction. Consumer rights body Conadecus and network operator Entel complained that the tender conditions failed to require licensees to provide coverage in rural areas, claiming that the 700MHz band above all would be ideal for boosting coverage in underserved areas.

However, Gidi said the digital divide should be closed with improved fiber-optic infrastructure coverage, given that only a quarter of Chileans with a fixed broadband connection currently connect via fiber. “This is where the greatest gap is and we have to work on both supply and demand,” she said, adding that areas where people can afford fiber aren’t covered while areas where people can’t afford it are. According to Subtel data, 54% of Chileans have fixed broadband home access.

Pamela Gidi participating in Chile’s Senate Telecommunications Commission tele-meeting.

The undersecretary revealed that telecommunications regulator Subtel is currently discussing the possibility of enacting a universal service bill and even introducing subsidies to boost internet demand.

Fernando Saiz, an executive at Telefonica Moviles Chile said that “5G is not a panacea. It is a super important technology for industrial uses, robotic processes and applications like the Internet of Things (IoT). It is useful for businesses and entrepreneurs, but not so much for people.”

–>THIS STATEMENT ALIGNS WITH THE AUTHOR’S VIEW THAT 5G ENHANCED MOBILE BROADBAND (eMBB) WILL NOT BE THE “KILLER APP” FOR 5G OR EVEN NEEDED FOR MOST PEOPLE!

Chile started its 5G auction earlier this week, releasing the details for a tender of a total 1,800 MHz in the 700 MHz, AWS (1,800 and 2,100 MHz), 3.5 GHz and 26 GHz bands with a view to creating at least four 5G operators.

Juan Pablo Letelier, the President of the Commission, criticized the 5G auction, noting that “this wireless technology only exacerbates the digital gaps since only a few people will be able to afford to access it.”

From Ana Garcia Armada: Technology consultant Roberto Gurovich said 5G does not say anything new. Essentially, 5G will increase the capacity of mobile networks and may provide broadband services to people and places where wireline fixed access does not reach. Now and in the near future, 5G will be used for enhanced mobile broadband. Later, 5G will be used for IoT and URLLC. Chile is ready for the implementation of 5G now. but with the pandemic it is not the best moment since they need to reinforce 4G and even 3G to provide for the increased mobile data traffic that is being demanded.

……………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.telecompaper.com/news/5g-not-a-tool-to-bridge-digital-divide-chile-minister–1351137

https://www.df.cl/noticias/empresas/telecom-tecnologia/pregunta-al-experto-que-implicara-la-llegada-de-la-red-5g-a-chile-para/2020-08-21/130047.html (interview in Spanish with Roberto Gurovich on what 5G means for the people of Chile)

Ericsson deploys 25,000 base stations in Russia; 100 5G deployment agreements top Huawei & Nokia

Sebastian Tolstoy, Head of Ericsson in Russia, said:

“Our development enables Tele2’s subscribers the opportunity to use mobile internet services in high quality. As all our network equipment in Russia supports an upgrade to 5G technologies through remote software installation, operators in Russia are able to launch new services as soon as they get the appropriate licenses.

Ericsson’s 5G Innovation Hub in Moscow gives Russian service providers the opportunity to test innovations on live 5G and IoT networks. The Ericsson Academy, our training center co-located at the Innovation Hub, trains more than 1,000 specialists from Russian service providers and students each year.”

The pace of deployment from Ericsson is truly impressive, especially in the context of the ongoing pandemic. If the current pace is maintained, the five-year deal will be completed in two years.

Aleksey Telkov, CTO of Tele2 Russia, comments:

“In the Moscow region, from the very start, we installed 5G-ready base stations. We deployed a pilot 5G network in the center of Russia’s capital, and together with Ericsson, we are carrying out a large-scale network modernization across the country.

This allows us to say that Tele2 is technologically ready for 5G.”

The 5G Zone uses the 28 GHz band in non-Standalone (NSA) mode and the frequency band for anchor LTE band is Band 7 (2600MHz). 5G pocket routers supporting 28 GHz were used as end-user devices for mobile broadband services with ultra-high speeds.

Ericsson and Tele2’s 5G Zone was used to demonstrate the opportunities 5G presents, including immersive VR entertainment, smart buildings, and other consumer and industrial use cases.

………………………………………………………………………………………………………………………………………………………………………………………………………………..

Ericsson announced it had 100 telco 5G agreements following the announcement of a 5G deal with Telekom Slovenije yesterday. That’s a lot of progress made in a relatively short time. Just under a year ago, Ericsson had publicly announced 24 5G contracts with equipment live in 15 networks. As of today, 58 contracts have been publicly announced and Ericsson’s gear is being used in 56 live 5G networks.

Börje Ekholm, President and CEO, Ericsson, said:

“Our customers’ needs have been central to the development and evolution of Ericsson’s 5G technology across our portfolio from the very beginning. We are proud that this commitment has resulted in 100 unique communications service providers globally selecting our technology to drive their 5G success ambitions.

We continue to put our customers center stage to help them deliver the benefits of 5G to their subscribers, industry, society and countries as a critical national infrastructure.”

Ericsson has been able to capitalize on the uncertainty surrounding Huawei’s future in many Western countries due to security concerns. Even prior to the UK’s decision to ban Huawei’s equipment, many operators in Britain were moving away from the Chinese vendor. India is now moving in that same direction.

In April, Howard Watson, BT’s chief technology and information officer, said:

“Having evaluated different 5G core vendors, we have selected Ericsson as the best option on the basis of both lab performance and future roadmap. We are looking forward to working together as we build out our converged 4G and 5G core network across the UK.”

For comparison, Nokia says it has 85 commercial 5G deals and equipment live in 33 5G networks. In February 2020, Huawei aid it had secured more than 90 commercial 5G contracts worldwide, an increase of nearly 30 from last year despite the relentless pressure from U.S. authorities and being banned in the UK.

………………………………………………………………………………………………………………………………………………………………………………………………..

References:

Ericsson deploys 25,000 base stations in Russia to support Tele2’s 5G rollout

https://asia.nikkei.com/Business/China-tech/Huawei-claims-over-90-contracts-for-5G-leading-Ericsson