Month: December 2020

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

Annual spending on LTE and 5G NR RAN (Radio Access Network) infrastructure operating in unlicensed spectrum will reach $1.3 Billion by 2023, says SNS Telecom & IT in a new report. That’s despite competition from non-3GPP wireless technologies and the ongoing economic impact of the COVID-19 pandemic.

Over the past decade, the operation of 3GPP-based cellular networks in unlicensed spectrum has gone from being a perennial talking point to what is now a key element of mobile network densification strategies. Mobile operators across the globe are increasingly rolling out LTE RAN (Radio Access Network) infrastructure operating in unlicensed spectrum – primarily the globally harmonized 5 GHz band – to expand network capacity and deliver higher data rates, particularly in dense urban environments. These implementations are largely based on LAA (Licensed Assisted Access) technology which aggregates unlicensed channels with anchors in licensed spectrum to maintain seamless and reliable connectivity.

However, the practical applicability of unlicensed spectrum is not limited to the capacity enhancement of traditional mobile operator networks. Technical and regulatory initiatives such as MulteFire, CBRS (Citizens Broadband Radio Service) and sXGP (Shared Extended Global Platform) make it possible for enterprises, vertical industries, third-party neutral hosts and other new entrants to build and operate their own independent cellular networks solely in unlicensed spectrum without requiring an anchor carrier in licensed spectrum. Furthermore, in conjunction with the availability of new license-exempt frequencies such as the recently opened 6 GHz band from 5925 MHz to 7125 MHz, the introduction of 5G NR-U in 3GPP’s Release 16 specifications paves the way for 5G NR deployments in unlicensed spectrum for both licensed assisted and standalone modes of operation. Given 5G’s inherent support for reliability and time-sensitive networking, NR-U is particularly well suited to meet industrial IoT requirements for the automation and digitization of environments such as factories, warehouses, ports and mining sites.

Despite the economic slowdown due to the COVID-19 pandemic, competition from non-3GPP wireless technologies and other challenges, SNS Telecom & IT estimates that global investments in LTE and 5G NR-ready RAN infrastructure operating in unlicensed spectrum will reach nearly $500 Million by the end of 2020. The market is further expected to grow at a CAGR of approximately 40% between 2020 and 2023, eventually accounting for $1.3 Billion by 2023.

The “LTE & 5G NR in Unlicensed Spectrum: 2020 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents a detailed assessment of the market for LTE and 5G NR in unlicensed spectrum including the value chain, market drivers, barriers to uptake, enabling technologies, key trends, future roadmap, business models, use cases, application scenarios, standardization, spectrum availability/allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also provides global and regional forecasts for unlicensed LTE and 5G NR RAN infrastructure from 2020 till 2030. The forecasts cover two air interface technologies, two modes of operation, two cell type categories, seven frequency band ranges, seven use cases and five regional markets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report.

The key findings of the report include:

-

Despite the economic slowdown due to the COVID-19 pandemic, competition from non-3GPP wireless technologies and other challenges, SNS Telecom & IT estimates that global investments in LTE and 5G NR-ready RAN infrastructure operating in unlicensed spectrum will reach nearly $500 Million by the end of 2020. The market is further expected to grow at a CAGR of approximately 40% between 2020 and 2023, eventually accounting for $1.3 Billion by 2023.

-

As part of their network densification efforts, mobile operators across the globe are increasingly employing the use of LAA technology to aggregate licensed spectrum assets with unlicensed frequencies – primarily the globally harmonized 5 GHz band – in order to deliver higher data rates and alleviate capacity constraints across the most congested parts of their networks.

-

With the possibility to leverage the 3.5 GHz CBRS band on a GAA (General Authorized Access) basis in the United States and the availability of Japan’s license-exempt 1.9 GHz sXGP band, independent cellular networks that can operate solely in unlicensed spectrum – without requiring an anchor carrier in licensed spectrum – are beginning to emerge as well. In addition, it is worth noting that a limited number of custom-built, standalone LTE networks operating in the unlicensed 2.4 GHz and 5 GHz bands are operational in certain national markets, predominantly for industrial IoT applications.

-

In the coming years, with the commercial maturity of 5G NR-U technology, we also anticipate to see 5G NR deployments in unlicensed spectrum for both licensed assisted and standalone modes of operation – using the 3.5 GHz CBRS, 5 GHz, 6 GHz and higher frequency bands up to 71 GHz.

The report will be of value to current and future potential investors into the unlicensed spectrum LTE and 5G network market, as well as LTE/5G equipment suppliers, mobile operators, MVNOs, fixed-line service providers, neutral hosts, private network operators, vertical domain specialists and other ecosystem players who wish to broaden their knowledge of the ecosystem.

For further information concerning the SNS Telecom & IT publication “LTE & 5G in Unlicensed Spectrum: 2020 – 2030 – Opportunities, Challenges, Strategies & Forecasts” please visit: https://www.snstelecom.com/unlicensed

For a sample please contact: [email protected]

https://www.snstelecom.com/Unlicensed-LTE-5G-a-1-3-Billion-opportunity

……………………………………………………………………………………………………………………………..

Editor’s Notes:

1. LTE in unlicensed spectrum (LTE-Unlicensed, LTE-U) is a proposed extension of the Long-Term Evolution (LTE) wireless standard intended to allow cellular network operators to offload some of their data traffic by accessing the unlicensed 5 GHz frequency band.

LTE-Unlicensed is a proposal, originally developed by Qualcomm, for the use of the 4G LTE radio communications technology in unlicensed spectrum, such as the 5 GHz band used by 802.11a and 802.11ac compliant Wi-Fi equipment. It would serve as an alternative to carrier-owned Wi-Fi hotspots. Currently, there are a number of variants of LTE operation in the unlicensed band, namely LTE-U, License Assisted Access (LAA), and MulteFire.

Proponents of LTE-U argue that the use of LTE in unlicensed bands produces better spectrum efficiency than WiFi, leading to higher data rates and capacity. With carrier aggregation, end users should experience better performance as service quality is ensured if unlicensed band becomes unstable due to interference.

For more info: https://www.leverege.com/blogpost/unlicensed-lte-lte-u-vs-laa-vs-lwa-vs-multefire

2. 5G NR in Unlicensed band

5G NR-U is the first global cellular standard with both license-assisted and standalone use of unlicensed spectrum.

3GPP Release 16 begins with 5G NR-U in the 5 GHz unlicensed band. With new unlicensed 6 GHz spectrum now being available in the US and coming soon to other countries, the 5G NR-U standard is gearing up to support this band next, followed by the 60 GHz millimeter wave band which is being developed as part of Release 17.

For more information: https://www.qualcomm.com/invention/5g/5g-unlicensed-shared-spectrum

……………………………………………………………………………………………………………………………………………..

Reliance Jio may deploy 5G SA while Bharti Airtel to trial both 5G NSA and SA

Reliance Jio may launch its much touted 5G services using the next generation 5G standalone (GSMA Option 2) architecture for its network, Business Standard reported.

The telco may skip the current non-standalone 5G. The NSA 5G architecture enables operators to leverage their existing investments in their 4G LTE networks and reduce capital costs. Mukesh Ambani recently said that Jio intends to roll-out 5G services in India in the second half of 2021.

Image Credit: Reliance Jio

Conversely, Sunil Mittal of Bharti Airtel said that 5G will take 2-3 years to reach mass scale in India’s market. Nonetheless, Airtel recently applied for both NSA and SA 5G trials to test its network architecture.

“Even though the majority of countries are offering 5G using NSA, SA is also being used for 5G services. Airtel feels it’s a good time to test its network using both modes,” a person familiar with the development told ETTelecom.

Airtel is planning to do Standalone 5G trials in Karnataka and Kolkata using Nokia and Ericsson 5G gear, respectively. In both circles, ZTE and Huawei currently power the Sunil Mittal-led telco’s 4G network.

Non-standalone (NSA) and standalone (SA) are two 5G tracks that communication service providers can opt for when transitioning from 4G to the next-generation mobile technology. In NSA, the existing 4G LTE network is used for everything except the 5G data plane, which is usually based on 3GPP Release 15 version of 5G NR. 5G NSA enables operators to leverage their existing investments in their 4G LTE networks and reduce capital costs, but it can’t support new 5G features such as network slicing.

Reliance Jio, Bharti Airtel, Vodafone Idea, and BSNL recently submitted a list of “preferred vendors” which includes European and American companies for 5G field trials with the telecom department (DoT).

Jio had submitted fresh applications for 5G trials with Samsung, Nokia, Ericsson, and for its own 5G technology. The largest Indian telco recently submitted an application trial of its own 5G technology in South Mumbai and Navi Mumbai areas, while it intends to do trials with Samsung in other areas like Bandra Kurla complex, Kamothe Navi Mumbai, and Solapur with Maharashtra.

Jio intends to 5G trials with Nokia in Pune and Ahmednagar, and with Ericsson in Delhi areas like Chandani chowk and Shashtri Nagar and in Dabwali in Haryana.

References:

Ambani: Reliance Jio to deploy 5G network in second half of 2021

Singtel and Ericsson 5G NR SA and dual mode 5G core network

Ericsson and Singapore communications service provider Singtel, are accelerating their 5G partnership in Singapore through the deployment of high-end 5G technology enabled by 5G New Radio (NR) Standalone (SA) and dual-mode 5G core network products and solutions, including real-time rating and policy control.

The energy-efficient, end-to-end 5G network will operate on Singtel’s 3.5GHz and 28GHz spectrum bands, spanning outdoor and indoor 5G coverage. Millimeter wave (mmWave) connectivity will also be deployed in hotspots across the city state.

Ericsson’s radio and core solutions will ensure that residents, enterprises, industry and government authorities in Singapore – renowned the world over as early technology adapters and hi-tech innovators – are among the first in the world to benefit from the highest performance that 5G can offer.

5G-enabled application use cases could include cloud gaming, immersive virtual reality/augmented reality, robot-human collaboration in real-time, autonomous transport, remote healthcare, precision smart manufacturing and smart-nation connectivity.

The 5G contract award takes the partnership between Ericsson and Singtel to new levels, as Industry 4.0 gathers pace globally. Singapore was recently named world’s most competitive economy for the second successive year in the latest IMD World Competitiveness Ranking.

Image Credit: Singtel

Mark Chong, Group Chief Technology Officer, Singtel, says: “As the leading telco in Singapore, Singtel is committed to building a secure, resilient, world-class 5G network that will serve as the backbone of Singapore’s digital economy. We are pleased to be working with Ericsson, leveraging on its industry-leading 5G capabilities and to deliver innovative applications and transformative customer experiences for our consumers and enterprise customers.”

Martin Wiktorin, Head of Ericsson Singapore, Brunei and Philippines, says: “Singtel is determined to play a leading role in keeping Singapore at the cutting edge of technology innovation and to ensure that the whole nation benefits from 5G. To do so they need the best 5G technology on the market. At Ericsson, our global leadership is evidenced by our extensive deployment experience with 75 live 5G networks worldwide. As a long-standing partner, we are equally determined to work alongside Singtel to ensure its subscribers and business customers enjoy the best experiences and opportunities that 5G has to offer.”

Earlier this month, Singtel said it was using 28 GHz mmWave spectrum, in addition to the 3.5 GHz and 2.1 GHz bands, to boost its 5G deployment in Singapore.

Singtel has switched on mmWave in several locations across the island, including Orchard Road, the Padang area and Marina Bay Sands Expo. Singtel also reports it has achieved 5G speeds of 3.2Gbps at its pop-up store dubbed Unboxed.

Singtel’s 5G network will take advantage of mmWave through a combination of the latest cellular technologies including massive MIMO, carrier aggregation and beam-forming solutions. Singtel customers with 5G plans can expect to experience mobile speeds of up to 3 Gbps speeds when mmWave-enabled handsets arrive in Singapore next year, the carrier said.

The largest telco inSingapore had initially launched its 5G non-standalone (NSA) network in September, using spectrum in the 3.5 GHz frequency as well as existing 2.1 GHz spectrum. Singtel was officially awarded a 5G license issued by Singapore’s Infocomm Media Development Authority (IMDA) in June 2020.

Singtel and Ericsson will deploy 5G SA networks beginning in January 2021 and will be required to provide coverage for at least half of Singapore by the end of 2022, scaling up to nationwide coverage by the end of 2025.

Related links:

Ericsson 5G

Ericsson 5G Core

Ericsson Radio System

Ericsson 5G New Radio (NR)deployment solutions

References:

44 Chinese companies have joined the O-RAN Alliance

by John Strand, Strand Consult (edited by Alan J Weissberger)

In 2019, the world’s mobile network operators earned just over $1 trillion and spent $30 billion on Radio Access Network (RAN) equipment, which was some 3 percent of revenue. To reduce cost, mobile operators leverage the pool of network equipment vendors, for example by developing new interfaces in network equipment to lower barriers to entry, under the industry term OpenRAN or “Open Radio Access Network.”

OpenRAN is not a standard, but a collection of technological features purported to allow different vendors to supply 5G networks with “standardized open interfaces” specified by the O-RAN ALLIANCE.

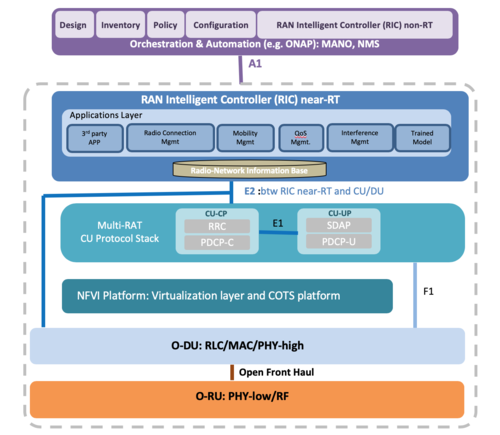

Source: O-RAN Alliance

……………………………………………………………………………………………………………………….

O-RAN only addresses internal RAN components. The wireless telecom industry still relies on 3GPP, the 3rd Generation Partnership Project, to build an end-to-end mobile cellular network and to connect end-user devices.

OpenRAN has become a hot topic in tech policy as an antidote to Huawei network equipment in mobile networks, but dozens of Chinese companies have joined the O-RAN ALLIANCE and are poised to drive OpenRAN standards and manufacturing

Chinese technological threats extend beyond Huawei

As the practices and relationships between Huawei and the Chinese government have been revealed, many nation state leaders have demanded the removal of Huawei equipment from communications networks. Huawei itself has not succeeded to demonstrate that it is an employee- owned company free from Chinese government control. China’s practice of civil military fusion means that all economic inputs can be commandeered for military purposes. Its de facto information policy asserts sovereignty over the internet and can thus enjoin any Chinese firm or subject to participate in surveillance and espionage. This means that restricting Huawei alone is not sufficient to secure 5G; the presence of any Chinese product in the network poses a security risk. Now that the Huawei brand name is toxic, many non-Chinese firms see an opportunity to enter the 5G network equipment market, but it is not clear whether and to what degree they will use Chinese standards, components, and manufacturing.

The O-RAN ALLIANCE was established in 2018 by Deutsche Telekom, NTT DOCOMO, Orange, AT&T, and China Mobile and has grown to 237 mobile operators and network equipment providers. The US has 82 O-RAN Alliance members; China, 44 (3 from Hong Kong); Taiwan, 20; Japan, 14; United Kingdom, 10; India, 10; and Germany, 7. Notably the 44 Chinese member companies exert significant control on the technical specifications and supply chain of OpenRAN 5G products and services. The conundrum of engagement with restricted Chinese entities does not end there. Citing security concerns, the Federal Communications Commission rejected a US operating license to China Mobile and may revoke approvals for China Telecom for its failure to demonstrate that it is not influenced the Chinese government. Other O-RAN ALLIANCE members include Inspur, Lenovo, Tsinghua, and ZTE, companies the US government restricts for security reasons given their ties to the Chinese government and/or military. The O-RAN ALLIANCE did not return a request for comment.

Some mobile operators cite OpenRAN to avoid ripping and replacing Huawei equipment

While many mobile operators are taking precautions to protect their customers by removing Huawei equipment, Vodafone, Telefonica, and Deutsche Telekom have resisted. They posit the promise of OpenRAN (with the O-RAN ALLIANCE specification) to justify a delay of rip and replace efforts, knowing that OpenRAN products will not be available for some years. Thus, these three operators can extend the life of Huawei in their 5G networks with the promise of using so called “open” equipment built with Chinese government standards. Separately the cost to rip and replace Huawei in European networks is minimal, about $7 per European mobile subscriber. The mobile operators which have switched out Huawei equipment have not experience increased cost or delay to the rollout of 5G.

Local politicians jump on the OpenRAN bandwagon thinking it has no Chinese connection

With the manufacturing base decimated in the countries they represent, many policymakers have looked to OpenRAN to get back into the network equipment game. Presumably OpenRAN would provide some high-end software jobs, though manufacturing is likely to be dominated by established Chinese entities. A US House bill would offer a whopping $750 million for OpenRAN development, though the location of manufacturing is not conditioned. Similar bills have been offered in UK, Japan, India, Germany, and Brazil. However commendable the notion of OpenRAN may be from a technical perspective, it appears that China has already outwitted Western leaders. China can afford to lose the Huawei battle if it wins the war on standardizing and building billions of “open”, “interoperable”, and “vendor neutral” devices. As long China influences the O-RAN specifications and manufacturing, it does not care whose brand is used.

Policymakers in the US and EU have today a lot of focus on communications network equipment from Chinese vendors. In 2019 and 2020 Strand Consult published many research notes and reports to help telecom companies navigate a complex world. We focused heavily on the problem of Chinese equipment in telecommunications networks. While the media has largely focused on Huawei, the discussion should be broadened to the many companies that are owned or affiliated with the Chinese government including but not limited to TikTok, Lexmark, Lenovo, TCL, and so on. Although some of our customers disagree with our views, Strand Consult’s job is to publish what is actually happening and how policy decisions may affect their business in the future.

Here are some of Strand Consult’s research.

44 Chinese companies have joined the OpenRAN effort, a strategy to reduce Huawei’s presence in 5G

https://www.o-ran.org/membership

…………………………………………………………………………………………………………………..

Open RAN first surfaced nearly three years ago at Mobile World Congress 2018. It promised a new set of interfaces that would allow service providers to mix and match vendors at the same mobile site, instead of buying all products from the same supplier. Operators hoped it would inject competition into a market dominated by Ericsson, Huawei and Nokia.

Since then, geopolitics has propelled it to the very top of the telecom agenda. Non-Chinese policymakers have latched onto open RAN as an alternative to Huawei, a Chinese vendor that governments are banning and operators are ditching because of its suspected links to an increasingly authoritarian Chinese state.

Avoiding Chinese equipment makers is one thing. Skirting Chinese technology expertise is not so easy. Already, there is concern that China, through Huawei and ZTE, has too much influence in the 3GPP, the group that develops the 5G standard. Further worsening of relations between Western democracies and China could prompt a future break-up of international standards-setting bodies, according to several experts.

Chinese influence:

These circumstances leave open RAN in an awkward situation. Anyone listening to the Open RAN Policy Coalition might think the technology was born in the USA and has never set foot in China. The O-RAN Alliance shows otherwise. Its most prominent Chinese members include ZTE, an equipment vendor that was on a US trade blacklist until it hawked up billions in fines. Also named are China Mobile and China Telecom, two state-backed operators that turned up on a Pentagon blacklist in June.

China Mobile is a busy member of the group, says a source who requested anonymity. That is hardly surprising as it was arguably the main force in the C-RAN Alliance, a Chinese group whose merger with the largely American xRAN Forum created the O-RAN Alliance in 2018. Today, the Chinese operator is a very active contributor to specifications, according to Light Reading’s source. ZTE has been similarly engaged, said sources within the company at the start of the year.

None of this will be very palatable to US politicians determined to block China’s influence. Yet any break-up of the O-RAN Alliance into C-RAN Alliance and xRAN Forum camps would be a major setback for open RAN. It would complicate development and threaten new disputes over intellectual property.

Right now, the issue of technology patents means the O-RAN Alliance faces a potential dilemma about involving Huawei. The group’s interfaces build heavily on specifications developed outside the O-RAN Alliance by Ericsson, Nokia, NEC and Huawei. The Nordic and Japanese vendors have all now joined the club, agreeing to license their patents on fair, reasonable and non-discriminatory (FRAND) terms. But Huawei has not. There is concern it could attempt to thwart open RAN by arguing its patents have been infringed.

While addressing that risk, its membership of the O-RAN Alliance would create other problems. For one thing, China’s biggest slab of tech R&D muscle would – paradoxically – have gained entry to the design room of the technology touted as a Huawei substitute. US policymakers able to live with China Mobile and China Telecom might balk at the involvement of telecom public enemy number one.

It would also make all three big telecom equipment vendors a part of the specifications group. That would increase the likelihood that Ericsson, Huawei and Nokia become the main suppliers of open RAN products, frustrating efforts to nurture competitors. There are already doubts that smaller rivals will be able to land much open RAN work. Appledore Research, an analyst firm, reckons open RAN will generate $11.1 billion in revenues in 2026. As much as $8 billion will go to the incumbents, it predicts.

Ever wary of open RAN, Huawei signaled its growing interest in the technology in July, when Victor Zhang, its vice president, was being grilled by UK politicians. “We are watching open RAN as one of the choices,” he told a parliamentary committee. “Once it has comparable performance to single RAN, we believe Huawei will be one of the best suppliers of open RAN as well.” Outside China, an open RAN ecosystem that makes space for Huawei could fast lose its appeal.

https://www.lightreading.com/open-ran/chinas-role-in-open-ran-is-looming-problem/d/d-id/766204?

5G Security Vulnerabilities detailed by Positive Technologies; ITU-T and 3GPP 5G Security specs

Introduction:

Mobile network operators are mostly running 5G non-standalone networks (NSA), which are based on 4G LTE infrastructure. Positive Technologies said these 5G NSA networks are at risk of attack because of long-standing vulnerabilities in the Diameter and GTP protocols, which were reported on by Positive Technologies earlier this year.

“… true 5G security must go beyond the features built into standalone architecture,” said Pavel Novikov, head of the Positive Technologies’ telecom security research team. “Cost efficiencies can be gained by building a hybrid network that supports both 4G LTE and 5G which will enable a future-proofed next generation network in the longer term,” he added.

What will be the 5G security issues/vulnerabilities when mobile network operators move to deploy 5G stand alone networks with a 5G core (rather than 4G EPC used in 5G NSA)?

Background:

Cellular network operators are gradually migrating to 5G standalone infrastructure [T-Mobile US has deployed 5G SA]. but this also has security considerations of its own. Gartner expects 5G investment to exceed LTE/4G in 2022 and that communications service providers will gradually add 5G standalone capabilities to their non-standalone 5G networks.

Source: Positive Technologies’ Standalone 5G core security research

………………………………………………………………………………………………………………………

Discussion:

Vulnerabilities and threats for subscribers and mobile network operators stem from the use of new standalone 5G network cores. The vulnerabilities in protocols HTTP/2 and PFCP, used by standalone 5G networks, include the theft of subscriber profile data, impersonation attacks and faking subscriber authentication.

The stack of 5G technologies potentially leaves the door open to attacks on subscribers and the operator’s network. Such attacks can be performed from the international roaming network, the operator’s network, or partner networks that provide access to services.

For example, the Packet Forwarding Control Protocol (PFCP) that is used to make subscriber connections has several potential vulnerabilities such as denial of service, cutting subscriber access to the internet and redirecting traffic to an attacker, allowing them to downlink the data of a subscriber. Correct configuration of the architecture as highlighted in Positive Technologies GTP protocol research can stop these types of attacks.

The HTTP/2 protocol, which is responsible for vital network functions (NFs) that register and store profiles on 5G networks, also contains several vulnerabilities. Using these vulnerabilities, attackers could obtain the NF profile and impersonate any network service using details such as authentication status, current location, and subscriber settings for network access. Attackers can also delete NF profiles potentially causing financial losses and damaging subscriber trust.

In these cases, subscribers will be unable to take action against threats that lurk on the network, so operators need to have sufficient visibility to safeguard against these attacks.

Dmitry Kurbatov, CTO at Positive Technologies commented: “There is a risk that attackers will take advantage of standalone 5G networks while they are being established and operators are getting to grips with potential vulnerabilities. Therefore, security considerations must be addressed by operators from the offset. Subscriber attacks can be both financially and reputationally damaging – especially when vendors are in high competition to launch their 5G networks. With such a diverse surface of attack, robust core network security architecture is by far the safest way to protect users.

“5G standalone network security issues will be much further reaching when it comes to CNI, IoT and connected cities – putting critical infrastructure such as hospitals, transport and utilities at risk. In order to achieve full visibility over traffic and messaging, operators need to perform regular security audits to detect errors in the configuration of network core components to protect themselves and their subscribers,”

Jimmy Jones, telecoms cybersecurity expert at Positive Technologies, said 5G users will need to increase their lines of communication with mobile operators, analysts and customers as 5G presents new threats and attack surfaces.

“They’re going to need to start speaking to the mobile operators as much as possible, because the mobile operators can secure things and will do everything to secure things. They just need to know what they’re securing,” Jones added.

[This author has spoken at length with Jimmy Jones and can attest to his vast knowledge and experience in cellular network security/vulnerabilities]

Jimmy Jones, Positive Technologies Network Security Expert

Positive Technologies has published a new report titled “5G standalone core security assessment,” which details the vulnerabilities of those networks.

The report focuses on the SA (Standalone) mode of 5G network deployment. “The implementation is based on Rel 15 3GPP with the OpenAPI Specification providing detailed descriptions of each interface,” the researchers explain.

Again, almost all deployed 5G networks are based on NSA which depend on a “4G LTE anchor for all non radio functions, including the 4G EPC (Evolved Packet Core) technology. The 5G core network architecture (but not implementation details) is specified by 3GPP and includes the following Technical Specifications:

| TS 23.501 | System architecture for the 5G System (5GS) |

| TS 23.502 | Procedures for the 5G System (5GS) |

| TS 23.503 | Policy and charging control framework for the 5G System (5GS); Stage 2 |

The 5G mobile network consists of nine network functions (NFs) responsible for registering subscribers, managing sessions and subscriber profiles, storing subscriber data, and connecting user equipment to the Internet using a base station. These technologies create a liability for attackers to carry out man-in-the-middle and DoS attacks against subscribers.

One of the main issues in the system architecture is the interface responsible for session management, known as SMF (Session Management Function). SMF is possible due to a protocol known as PFCP (Packet Forwarding Protocol):

To manage subscriber connections, three procedures are available in the PFCP protocol (Session Establishment, Modification, and Deletion), which establish, modify, and delete GTP-U tunnels on the N3 interface between the UPF and gNB. […] We will focus on the N4 interface. Testing of this interface revealed potential attack scenarios against an established subscriber session.

Other problems Positive Technologies discovered are based on subscriber authentication vulnerabilities. The researchers demonstrated that “subscriber authentication becomes insecure if the NRF does not perform authentication and authori-zation of 5G core network functions.”

In conclusion, this report only covers “a few examples” of how vulnerabilities in G5 can be exploited. “Just as with previous-generation networks, attackers still can penetrate operator networks by means of the international roaming network or partner networks. Therefore, it is vital to ensure comprehensive protection of 5G networks,” the report concludes.

For more information on vulnerabilities of standalone 5G networks, please download the Positive Technologies report here –after filling out a form. …………………………………………………………………………………………………………………..

Editor’s Note: 5G Security Standards (?) and Specifications

Most 5G “professionals” don’t realize that there are no standards for 5G security– either in the radio access network (RAN) or the core network. As ITU is the official standards body for 5G (e.g. IMT 2020.SPECS for the RAN) you’d think the work would be done there. There is some high level 5G security work being done in ITU-T SG 17/Q6, but the corresponding ITU recommendations won’t be completed till late 2021- 2o22 timeframe.

The real work on 5G security is being done by 3GPP with technical specification (TS) 33.501 Security architecture and procedures for 5G system being the foundation 5G security document. That 3GPP spec was first published in Release 16, but the latest version dated 16 December 2020 is targeted at Release 17. You can see all versions of that spec here.

3GPP’s 5G security architecture is designed to integrate 4G equivalent security. In addition, the reassessment of other security threats such as attacks on radio interfaces, signaling plane, user plane, masquerading, privacy, replay, bidding down, man-in-the-middle and inter-operator security issues have also been taken in to account for 5G and will lead to further security enhancements.

Another important 3GPP Security spec is TS 33.51 Security Assurance Specification (SCAS) for the next generation Node B (gNodeB) network product class, which is part of Release 16. The latest version is dated Sept 25, 2020.

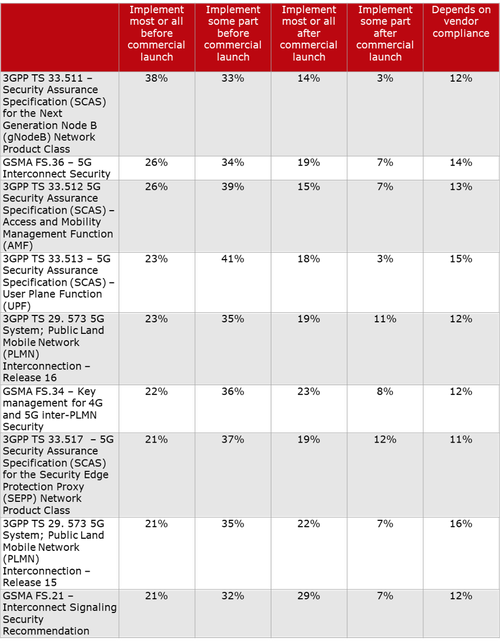

Here’s a chart on 3GPP and GSMA specs on 5G Security, courtesy of Heavy Reading:

Question to 5G network operators: When do you plan to implement the following 5G security specifications? Source: Heavy Reading

“While 3GPP TS 33.511 had the greatest level of commitment to implementing before commercial launch (38% + 33%), the support for all nine specifications in the list is strong enough to confirm each one is relevant on some level for ensuring the security of 5G networks,” according to Heavy Readings’ Jim Hodges.

………………………………………………………………………………………………………………………

References:

https://sensorstechforum.com/new-5g-vulnerabilities-dos-mitm-attacks/

https://www.ericsson.com/en/blog/2020/6/security-standards-role-in-5g

https://www.itu.int/ITU-T/workprog/wp_search.aspx?&isn_sg=3935&isn_wp=6682&isn_qu=4216&details=0

https://www.3gpp.org/news-events/1975-sec_5g

https://portal.3gpp.org/desktopmodules/Specifications/SpecificationDetails.aspx?specificationId=3169

https://www.3gpp.org/ftp//Specs/archive/33_series/33.501/

https://portal.3gpp.org/desktopmodules/Specifications/SpecificationDetails.aspx?specificationId=3444

Nokia to do “whatever it takes to lead in 5G” despite flat margins in its mobile network business next year

Nokia today said it expects operating margins at its mobile networks business will be flat in 2021 in an update on strategy to streamline the Finland headquartered company into four business groups.

The immediate focus of the mobile networks business will be on executing its turnaround, Nokia said. It expects the business to deliver a comparable operating margin of about 0% in 2021 and significant improvement over the longer term, Nokia added.

Nokia announced a new strategy in October under which the company will have four business groups and CEO Pekka Lundmark said Nokia would “do whatever it takes” to take the lead in 5G.

Pekka Lundmark Photographer: Roni Rekomaa/Bloomberg

…………………………………………………………………………………………………

“We are putting in a significant technology investment in this new strategy switch… we are willing to sacrifice short-term profitability, to make sure that we really get into technology leadership,” Lundmark said in a video interview.

“We are now putting so much money in R&D that we are sacrificing a little bit of the short-term profitability to get to where we want to be in the long term. Still, we are only taking contracts that make commercial sense.”

“We have to remember that 5G is going to be a 10-year cycle and we are still in the very early stages of that cycle.”

The company had earlier cut its 2020 operating margin forecast to 9% from 9.5% and for 2021 forecast operating margin of 7-10% for the entire company. Operating margins at its Network Infrastructure business, which includes optical and fixed networks, would be in the high single digit range in 2021.

Lundmark, who took over as CEO in August, is driving a reorganization at the telecommunications gear maker as the roll out of 5G networks gathers speed. The company said its overall outlook for next year is unchanged and it expects a margin, excluding some items such as restructuring costs, for the entire business of 7% to 10% in 2021.

The break-even margin implies that the “Mobile Networks’ present status seems worse than feared,” analyst Daniel Djurberg at Svenska Handelsbanken AB wrote, even as Nokia seeks “a significant improvement over the longer term” for the unit. Djurberg said he had expected a low single-digit margin.

……………………………………………………………………………………………..

Lundmark took over the top job in Nokia in August after product missteps by the company saw it lag Swedish rival Ericsson and Chinese group Huawei in the race to win deals to sell 5G network equipment.

Several senior executives have also left company as it is moving to a new operating model to be implemented on January 1st.

Lundmark said Nokia will now have 11 members in the new leadership team from 17 earlier and there were still two unannounced names who will leave the company.

Nokia has been losing out on contracts for carriers’ 5G build outs, including a big contract to provide 5G technology to Verizon earlier this year which was won by Samsung Electronics Co.

…………………………………………………………………………………………..

References:

Nokia sees flat margins at 5G networks business in 2021 | Reuters

Nokia (NOK1V.FH) to Sacrifice Network Margins for 5G Growth in New Strategy – Bloomberg

Taiwan has over 1M 5G subscribers since July 2020 5G service launch

Taiwan officially entered the 5G era in July of this year. In less than half a year, the total number of 5G subscribers in Taiwan has broken the 1 million mark. Chunghwa Power, FarEasy, and Taiwan Mobile each have about 300,000 5G users while Taiwan Star has exceeded 100,000. Asia Pacific Telecom also has 5G subscribers in Taiwan.

Chunghwa Power was originally scheduled to reach 300,000 5G users by the end of the year. Chunghwa Chairman Xie Jimao said recently that he had reached the standard ahead of schedule and was “cautiously optimistic” about the results of rushing out of 500,000 by the end of the year. He hopes to reach one million in June next year.

Regarding the construction of 5G base stations, Xie Jimao said that the total number of 5G base stations in Taiwan’s telecommunications companies has exceeded 10,000, and Chunghwa Power’s progress has exceeded 4,000 units. The investment in 5G next year will accelerate the increase. Next year, the mobile investment is estimated to exceed NT$ 10 billion ($355 million) . Chunghwa expects more than 50% of 4G users will be converted to 5G within three years.

Jing Qi, the general manager of FarEasy Telecom, said recently that since the launch of 5G in Taiwan in July, telecommunications companies have been actively building. FarEasy will follow the lead of Chunghwa Telecom. The number of 5G users has exceeded 300,000, which is equivalent to reaching the end of the year goal ahead of schedule.

–>Both Chunghwa and FarEasy are aiming to achieve 1 million 5G subs by the second half of 2021.

Taiwan Mobile General Manager Lin Zhichen said that Taiwan’s 5G users have exceeded 300,000, and the user upgrade speed is faster than expected. It is estimated that the 5G user penetration rate is expected to reach 15% to 20% by the end of next year.

Taiwan Star today announced the launch of the “Double 12 Limited” offer. Zhu Xiaoxing, senior deputy general manager of the Taiwan Star Marketing Division, also stated that the current total number of 5G users has exceeded the 100,000 mark, of which 62% are new customers and 38% are Old customers have upgraded or renewed their original contracts. It is expected that this double 12 will drive the overall 5G bidding performance to grow by 20%.

Asia-Pacific Telecom launched 5G services in late October this year, with a goal of 5G penetration rate reaching 10% to 12% within one year, and it will turn losses into profits in 3 to 5 years.

Taiwan 5G network industrial illustration, huge cellular tower or mast on digital background with the Taiwan flag top left – 3D Illustration

……………………………………………………………………………………………………………………………………….

Taiwan Mobile has already decided on a 75% hike in 5G spending to around NT$14 billion ($486.8 million). Chunghwa has also sketched out its growing 5G collaboration with Taiwan’s chip and hardware firms, which see opportunities in 5G mmWave equipment.

The telco has set up a 5G Open Lab with network gear from both Ericsson and Nokia, where local players such as chip firm MediaTek, notebook supplier Acer, handset-maker HTC and ODMs Inventec and Wistron Neweb can develop and test their new kit. The lab will take advantage of Chunghwa Telecom’s continuous bandwidth of 600MHz in the 28GHz mm Wave band.

Ivan Lin, president of Chunghwa Telecom Research Institute, said Chunghwa believed the mm Wave band provided a better development environment for high-throughput, low-latency applications such as AR/VR live video, HD video and smart surveillance.

Additionally, Chunghwa is running smart factory field trials for mmWave enterprise networks and is supporting AI and unmanned vehicle applications and AR-based remote collaboration.

References:

https://money.udn.com/money/story/5612/5081901

https://www.lightreading.com/asia/taiwan-hits-1m-5g-subs-after-five-months/d/d-id/766153?

Fastweb to launch 5G in 4 Italian cities and boost FTTH speeds to 2.5 Gbps

Italian network operator Fastweb plans to activate 5G in an initial four cities before the end of the year (it is the fifth mobile operator in Italy).

Separately, Fastweb will increase the top speed of its existing FTTH service to 2.5 Gbps in the coming months. The company already leads Italy’s fixed gigabit market with a 36.5 percent share of FTTH subscribers having download speeds of 1 Gbps speeds. It now intends to upgrade its proprietary network in 30 large cities so that it can hike top speeds from 1 Gbps to 2.5 Gbps at no additional cost in around 4 million homes, covering 15 percent of Italy’s population, starting in February 2021.

These two announcements follow the launch of Fastweb’s ‘UltraFWA’ service in partnership with Linkem to offer speeds of 1Mbps in 3 localities in the south of the country. Linkem said the 5G FWA service is now available in Modugno, Grottaglie and Avellino. Those are the first 3 of the 50 localities the network operator aims to connect by the end of this year, rising to 500 by the end of next year. part of a commitment to bridge the digital divide in “historically disadvantaged” areas of southern Italy.

Fastweb said it will continue to bridge the digital divide in small and medium-sized Italian towns with its new 5G FWA (Fixed Wireless Access) service. ‘UltraFWA’ will offer speeds of up to 1Gbps in a total of 50 localities by the end of this year, rising to 500 by the end of next year and around 2,000 by 2024 for a total coverage of 8 million homes in ‘grey’ areas and 4 million in ‘white’ areas.

The increased performance and coverage are part of Fastweb’s new multi-year commitment to citizens, institutions and companies called ‘NeXXt Generation 2025’. The plan to connect millions of families throughout the country is based on the three pillars of technological leadership, transparency and social responsibility, with the operator also confirming plans to activate its 5G service in an initial four cities on 27 December. Fastweb 5G will switch on in Milan, Bologna, Rome and Naples and then gradually extend to other cities to reach 90 percent of the population by 2025.

The company added that it will be the only operator to make 5G technology available to both new and existing customers at no additional cost and with no constraints whatsoever. Fastweb last year signed an ambitious decade-long network sharing deal with WindTre to jointly roll out 5G infrastructure on a national scale, having previously acquired a 200MHz frequency block in the 26 GHz band in Italy’s 5G spectrum auction in October 2018, swiftly followed by 40 MHz of spectrum in the 3.5 GHz band from Tiscali.

References:

T-Mobile US CEO talks up Sprint merger & 5G leadership in U.S.

T-Mobile has begun shuttering Sprint’s network in a few locations following its acquisition, but doesn’t expect to really start until 2021-to-2022.

Talking with a fireplace in the background during a UBS Global TMT Virtual Conference on December 8th, T-Mobile CEO Mike Sievert said in response to a question about when Sprint’s network will shut down: “We’ve already done some on an isolated basis.”

T-Mobile has boasted of $6 billion in savings through its Sprint merger which has resulted in a single “master brand.”

We can go into an area, and as we get capacity on the destination T-Mobile network, we can migrate traffic off the Sprint network on to that destination network without having to touch those rate plans or billing relationships at all. We might move the brand relationship from Sprint to T-Mobile in advance of that or we might wait until later.

T-Mobile acquired Sprint for $26 billion earlier this year. Industry observers have been awaiting news on the company’s plans to shutter the old network as the “New T-Mobile” rolls out—which promises 14 times more capacity in six years than standalone T-Mobile has today. Sievert went on to say most of the shutdowns won’t happen until 2022 when at least most of Sprint’s legacy customers should have transitioned over to T-Mobile’s network.

This isn’t T-Mobile’s first acquisition and network shut down. In 2012, T-Mobile acquired MetroPC’s regional network and then dismantled it. It’s a fairly standard practice which Sprint did in 2016. After acquiring Clearwire, Sprint shut down the WiMax network it so highly promoted as the first real 4G.

Author’s Note:

T-Mobile’s 3G network is based on GSM while Sprint uses CDMA. Running two competing 3G networks simultaneously doesn’t help the bottom line. Both telcos support 4G LTE which is the ONLY 4G network since no carrier deployed WiMax Advanced.

…………………………………………………………………………………………………………………

Sievert summed up the Sprint network integration with this statement:

It’s really important that we use our capacity to migrate Sprint mobile customers over, right? So, we’re going to be — while we’re revenue-farming spectrum and building the destination network that’s our priority. So, you’ll see us go at pace for the first couple of years on broadband because the bigger prize for our shareholders is synergy attainment.

…………………………………………………………………………………………………………………….

Sievert said:

“What we’ve got at the dawn of the 5G era is the ability to lead all through this era with a superior product and a superior value simultaneously, something no company has ever been positioned to do. And obviously, they see that and they feel that they need to act. Now, they’ll try and convince you that what they’re doing is economic. By the way, it’s nothing too extraordinary, nor surprising.”

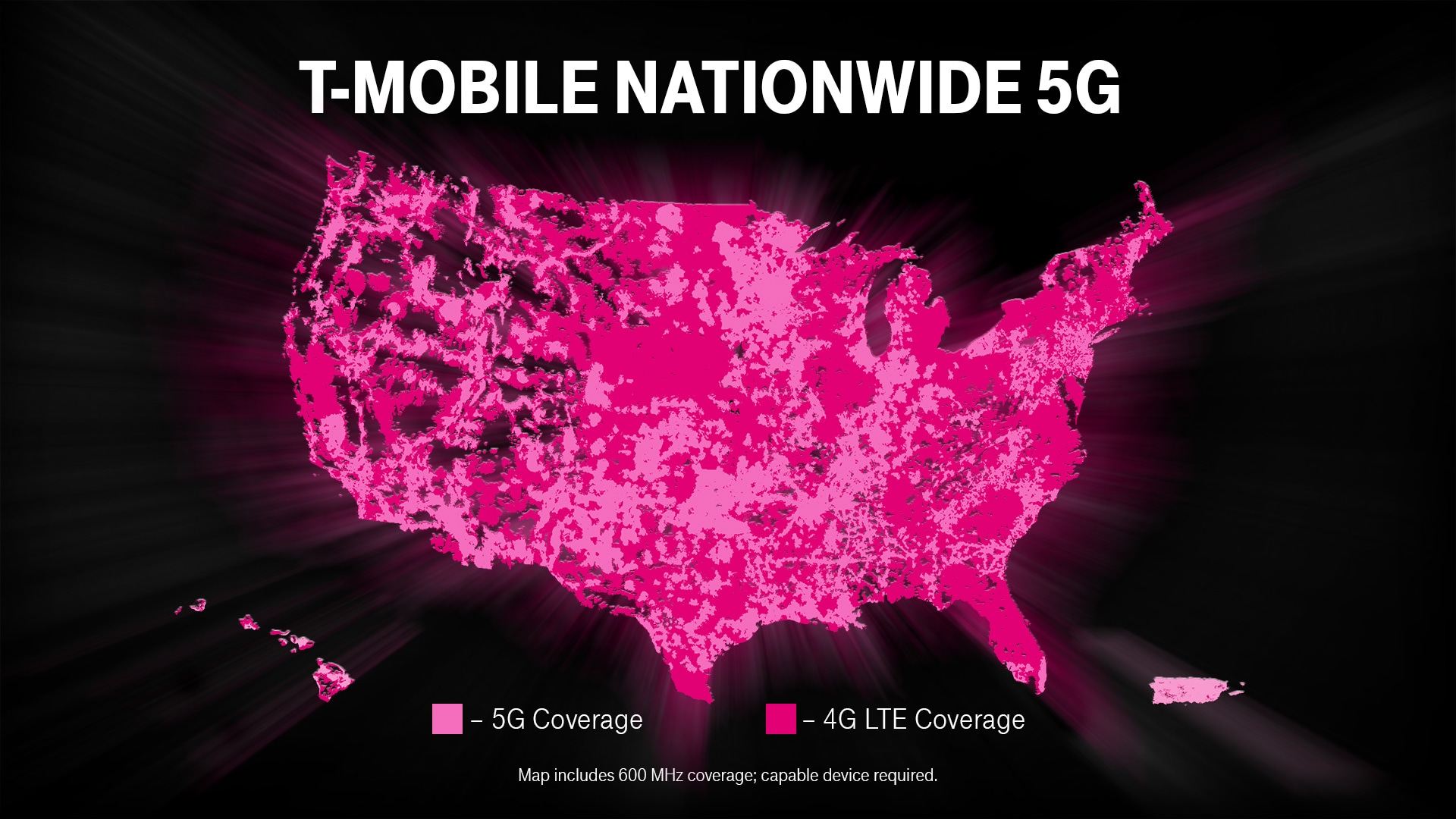

With respect to use of 600MHz for 5G is 2 or 3 times faster than 4G-LTE. Sievert said:

As of the last quarterly announcement, we were reaching about 270 million people with 600 megahertz Extended Range 5G. And that’s 5G even more on 4G LTE. These are dedicated lanes, and to your point, increasing dedicated lanes, because during this farming process and transition process, we’re actually leasing additional 600 megahertz spectrum from a variety of parties.

And what that allows us to do is to open up really wide dedicated Extended Range 5G lanes, so different than what you’re seeing from our competitors with DSS instead. They don’t have those dedicated lanes. And so they’re having to divide up their LTE spectrum into both technologies. It doesn’t get you much.

Our dedicated Extended Range 600 megahertz 5G is two times faster, in some cases, three times faster than LTE. So it’s a really nice pickup and experience for customers, but importantly, also gives us the capacity that we need to move quickly on migration. And that’s obviously the bigger payday for us and for customers. So those are the numbers.

About 1.4 million square miles as of the last quarterly announcement. That’s about three times what Verizon has, about double what AT&T had around that time. And again, we announced that we weren’t stopping there. We’re moving very quickly for the year-end time period. Next time we talk to you shortly after the New Year, we’ll have covered significantly more than those numbers. And so terrific progress there.

Most of the phones are compatible with 600 on the LTE front. Right now, close to 6 million on the 5G front and rapidly growing, because as you know, some of the most popular ones have only very recently been launched. And again this is something — this level of device compatibility is not something we had in prior mergers. And, boy, is it great to see, because we’re able — again, it’s a thing that’s allowing us to move quickly.

The company will add its newly-acquired midband 2.5GHz spectrum to its existing low band 600MHz 5G network. Sievert comments were very strong and “game changing”:

We’re tracking really nicely, to be at 100 million 5G covered people by the end of this year, certainly, by the next time we talk to you. That’s incredible.

The other guys are bumping around, like a Verizon with Ultra Wideband, maybe 2, 3, 4 million. And they’re talking about a lot of new cities, but little parts of cities and towns. You know their strategy. I predict they’re going to have a wholesale change in their strategy over at Verizon. They’re going to discover that they need to have a mid-band-centric 5G approach.

This is the way that you get very-very high ultra capacity 5G experiences to people by the millions and tens of millions. Our signal reaches miles, not meters. And so, that’s really important for the everyday experience. And people are going to see — across these tens of millions of people, they’re going to see an experience that’s not a little bit better than 4G LTE, but a transformation. So 7, 8, 9, 10 times faster, 300, 400 megabits per second, peak speeds over 1 gigabit. And this isn’t just a little smattering of certain street corners and when the leaves aren’t out. This is across vast swaths of the country.

So that’s really game changing. And it’s probably the place where we lead the most. And it’s going to be what millions of people see. It’s going to be FOMO, it’s going to be bragging rights. And everybody is going to be able to see this difference that T-Mobile is able to give you across massive swaths of the country.

100 million as we exit this year into the first part of 2021 and then 200 million as we exit next year. And so, this is game-changing. And it was a huge part of why we worked so hard to get this merger done, because we knew how it would benefit tens of millions of people and by extension, benefit our business.

……………………………………………………………………………………………………………………………

T-Mobile CTO Ray Neville has said is “really going to deliver an incredible 5G experience.”

Neville said in May that T-Mobile’s plan is to grow the company’s ~65,000 towers to 85,000 macro cell sites by building 15,000 new cell towers and decommissioning unnecessary, overlapping Sprint cell sites. T-Mobile says that it’s been adding 2.5GHz transmission radios to its existing towers at the rate of roughly 1,000 per month.

The company claims to be the first wireless telco to deploy a 5G Stand Alone (SA)/ 5G core network.

Sievert’s 5G boasting hit a peak with this statement:

In 5G, that’s our opportunity. We’re starting out way ahead and we intend to lead for the entire era. And not just be the best 5G network in terms of speed and capacity but to be the best network. And this – we’re a pure-play wireless company. And we know that in order to win, we have to have the best and the leading network in this country. And we have to become famous for it, which frankly is even harder because brands are stubborn. Brands are powerful.

That helps us on some fronts because simultaneous to being the best network in this country we’re the best value. And consumers and businesses already give us credit for that. We can’t lose that. We build behind it and lead through the entirety of the 5G era on network.

And then the third leg of the stool is experiences. Our company believes in delivering the best experiences. We have the highest Net Promoter Scores in the history of this industry. We’ve won five years in a row on J.D. Power for both consumers and businesses. Customers love us because we hire the best people and we have a culture of treating customers with respect and love. And so when you have the best value, the best network and the best experiences, that’s a winning formula. And we intend to lead with that formula through the entire 5G decade.

With respect to the legacy wireless competition, especially AT&T, Sievert said:

I don’t think we’ve caught AT&T on revenues yet. So, we surpassed them on customers. It’s always hard to tell what these comparisons. Our competitors can always provide the same exact transparency that we do.

But we think we’re right behind them on revenues. And so there’s a few differences between our model and the others. One is we have a denser network grid which is going to convey some of that advantage that I talked about that’s so important for growth. So, we intend to be a share taker and a grower through the time period and there’s always some cost to near-term margins to that very small.

We also intend to continue being the best value and there’s a small cost to that on margins. But both of those accrue to terminal value and growth rates and enterprise value-creation potential. And so there are things that are deliberate and we’re proud of and plan to keep.

Beyond that there aren’t that big of differences. And so you’ll see synergy attainment close the gap. And there will be differences as I just said, but between synergies and cost transformation of bringing these companies together, you’ll see that margin gap start to close. And we’ll talk more about it when we lay out more of our plans. But everything we talked about in 2018 when we announced this merger in terms of long-term potential, we still see. And in fact in some cases we see it unfolding better than we had anticipated back in 2018.

On the enterprise (business) market, Sievert said:

One of our biggest growth engines right now is enterprise. And we’re very focused not just on the here and now, but what enterprises want two and three and four years from now. And again, we’ve got this big network capacity, including the spectrum that backs up the network. And ultimately that gives us tools to be able to work with enterprises around the kinds of solutions that they may want in the future for dedicated networks, very low-latency, high-capacity dedicated networks with advanced dedicated spectrum capabilities. And there’s really exciting opportunities there.

Some of them are more two and three years out before they contribute in a very big way. But they’re real. And ultimately we’re so well positioned for that part of the market. Right now what we’re doing is selling our macro capabilities. And enterprises unlike consumers, where we have a bit of a brand deficit, we’ve got to overcome on network, meaning we’re not famous yet, as the best network in the space.

Enterprises don’t care about any of that, because they check out 100 phones and test them for a few weeks and then they come back and pick us. And so that’s a tailwind on our business. You’re seeing it in our present performance. In Q3, we had an all-time record on enterprise sales and you’re going to see it continue. It’s something that we’re really, really focused on a big growth engine for the company. 90-plus percent of the customers out there are with somebody else.

References:

https://event.webcasts.com/viewer/event.jsp?ei=1402861&tp_key=ad09ead741

Revitalized OneWeb challenges SpaceX/Starlink & Amazon/Kuiper for Broadband Satellite Service

Space X and Amazon now have company in what may become a satellite broadband “space war.” A long distance race involving three of the world’s richest men has just begun!

India tycoon Sunil Mital’s Bharti Airtel plans to invest $2 billion for a 50% stake in the once bankrupt low-Earth orbit satellite constellation company OneWeb and says that company will be offering global broadband services within 18 months in Alaska and the UK.

”By May-June of 2022, which is less than 18 months, OneWeb’s constellation will cover the entire globe, every square inch of this world,” the founder and chairman of Bharti Enterprises said Wednesday at a conference hosted by the United Nations’ International Telecommunication Union and Saudi Arabian communication regulator CITC.

OneWeb says it will resume launches of its satellites with a Soyuz launch scheduled for Dec. 17 from the Vostochny Cosmodrome. Credit: GK Launch Services

Elon Musk’s SpaceX rockets have launched over 500 satellites for the Starlink constellation since OneWeb went into bankruptcy in March. Starlink is now testing broadband internet service with potential customers. Unlike OneWeb, Starlink’s service isn’t set to cover the extreme north and south of the planet for now, offering its rival a potential niche serving governments, shipping and aviation in remote regions.

“We welcome competition,” Mittal said. “We fight like hell in the marketplace.” Later generations of OneWeb satellites could provide global positioning capabilities, he added.

OneWeb has put 74 of an initial 648 planned satellites in orbit so far, and plans to resume launches this month. It’s not yet secured all the funding it needs to complete the constellation. Mittal estimated the overall cost at between $5.5 billion and $7 billion and said the remaining shortfall is between $2 billion and $2.5 billion — with half of that to be covered by Bharti and the British government. As for raising further capital with other investors, he said: “I don’t see that to be an issue.”

“There are still too many places where broadband access is unreliable or where it doesn’t exist at all. Kuiper will change that. Our $10 billion investment will create jobs and infrastructure around the United States that will help us close this gap,” Amazon senior vice president Dave Limp said in a statement.

Amazon has not outlined a timeline for Kuiper and the FCC said the company has not finished the satellites’ design.

References:

https://spacenews.com/oneweb-emerges-from-chapter-11-with-new-ceo/