Month: September 2021

FT: Huawei tries to re-invent Itself: Pivot from smart phones/telecom gear to cloud services, 6G, EV’s and HiSilicon

Condensed and edited Financial Times article by Kathrin Hille in Taipei, Eleanor Olcott in London and James Kynge in Hong Kong

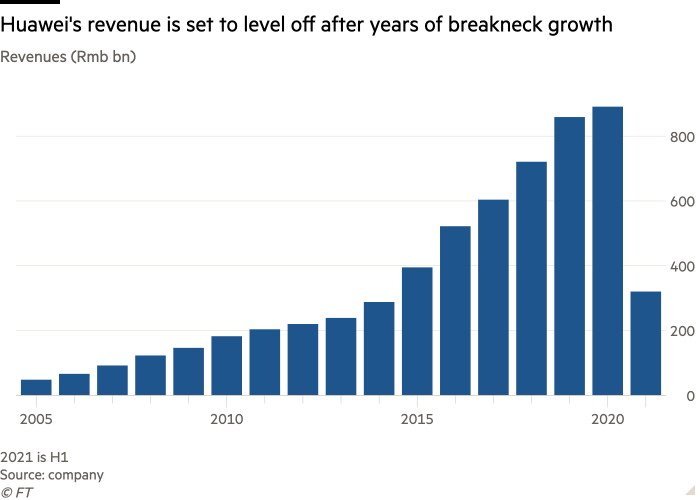

In the first half of this year, revenues at Huawei fell by almost 30 per cent compared with the same period last year, the largest ever drop. As U.S. restrictions have begun to derail Huawei’s traditional business, the group is now in a scramble to try to reinvent itself. The company is turning away from the development and sale of telecommunications network gear and smartphones into areas less dependent on foreign chip supplies — such as cloud services and software for smart cars. Huawei is also doubling down on its own research and development in an effort to escape the stranglehold of American sanctions. It is investing heavily to be a leader in the emerging 6G technology so that other companies are dependent on its patents — rather than Huawei relying on technology imports from the US. “In the current climate, the best way to describe the atmosphere within Huawei and the way we go about things, is like a huge collection of start-ups,” says Henk Koopmans, the company’s head of research and development in the UK.

At stake is not just the fate of one of China’s most prominent and successful companies, but the broader technological competition between Beijing and Washington. Chinese officials are clear that Huawei has been a vital part of the country’s network of innovation.

“Many have viewed Huawei as the only possibility for China to make a breakthrough in semiconductors and telecoms,” says a local government official in Shenzhen, the technology industry hub in southern China that is Huawei’s home. “So Huawei must survive. It is a national mission.”

The company’s smartphone sales dropped by more than 47 per cent in the first half of this year compared with the same period last year. Last week, rotating chairman Eric Xu predicted that in the full year, the company will lose up to $40bn of its $50bn smartphone business, a slide that analysts estimate will drive the share of the consumer business in Huawei’s total revenues from 42 per cent earlier this year to just over 30 per cent. “Huawei’s component bottlenecks are now starting to bite,” says Ben Stanton, a smartphone analyst at market research group Canalys. “Stockpiles are running low, and its volume will almost certainly continue to fall each quarter.” Noting that Huawei’s smartphone arm has retreated to its Chinese home market, he adds that its strength in previous overseas strongholds such as Europe “has completely evaporated.”

In the network equipment business, the decline is happening more slowly, partly because product cycles are longer. Although Huawei can no longer procure custom application-specific chips for its telecom products, it was assuring analysts that it had enough inventory to keep the infrastructure business running in the near term. In response to these losses, the first big push has been to strengthen Huawei’s software capabilities so that it is less dependent on producing hardware that it will struggle more and more to deliver without access to chip supplies.

The main software-driven business Huawei is rushing to build is cloud services. Some of the functions in a telecoms network traditionally performed by base stations can be transferred to software processes in the cloud with newer technology. Moreover, Huawei is rapidly developing new cloud services, which it offers to companies and government departments. Last week, the company announced plans to invest $100m in the next three years for small and medium-sized businesses to develop on Huawei Cloud. The company’s cloud business grew by 116% in the first quarter of this year to take a 20% share of the Chinese market (second only to Alibaba Cloud).

According to Canalys, Huawei’s cloud business grew by 116 per cent in the first quarter of this year to take a 20 per cent share of a $6bn market in China, behind Alibaba Cloud but ahead of Tencent. “Huawei Cloud’s results have been boosted by internet customers and government projects, as well as key wins in the automotive sector. It is a growing part of Huawei’s overall business,” says Matthew Ball, chief analyst at Canalys. He says that while about 90 per cent of this business is in China, Huawei Cloud has a stronger presence in Latin America and Europe, Middle East and Africa compared with Alibaba Cloud and Tencent Cloud. There are limits on Huawei’s cloud business, however.

In July, Chinese media reported that the company was considering selling a part of its server business that runs on x86 central processing units after Intel’s export license for providing Huawei with that component expired. Servers are indispensable for cloud companies because they are where the hardware data is stored and much of the computing needed for cloud services is performed. Huawei and Intel both declined to comment, but industry experts say processor supplies are a headache for Huawei.

“Selling the server business is highly likely,” says Ben Sheen, semiconductor research director for network and communication infrastructure at research firm IDC. “The CPU is a central component, and if Intel cannot ship, Huawei is in big trouble.” As in the network gear business, providers of cloud services such as Amazon Web Services or Google try to boost performance by improving their software. If Huawei can achieve the same, it will be in less urgent need to get new processor supplies. “In smartphones, your revenue share goes down very quickly if you don’t have the latest chips. In cloud, you can keep running a decent business for much longer, and maybe even expand your revenue if you invest in software differentiation,” says Jue Wang, an associate partner in the technology practice of Bain, a consulting company.

Although companies such as Intel and AMD release new CPUs every year, the majority of cloud service providers’ servers run on processors two to five years old. The cloud companies increasingly generate new revenues by investing in new AI services and tools — even if their servers run on older chips. “But eventually you will need new ones — you cannot offer cloud services without CPUs,” Wang says.

One of the fields where Huawei finds it relatively easy to pick up new business is helping to digitize industries that have been laggards in the adoption of information technology. It is offering telecom, IT and software tools to Chinese companies in sectors such as coal mining and port operations, enabling them to lower costs and enhance security. Driven by these operations, Huawei’s enterprise business revenues grew by 23 per cent last year and 18 per cent in the first half of this year.

“The enterprise business will likely continue to be a growth point for Huawei,” says Ethan Qi, an analyst at Counterpoint Research, who forecasts revenues in that segment to increase by up to 15 per cent a year in the next few years. Still, Huawei frets that this is not enough to offset the death blow the US sanctions are dealing to the smartphone business. The new industry verticals “may not even be able to compensate for those lost revenues in 10 years,” Huawei rotating Chairman Xu told reporters last week.

Huawei is making some striking bets on new areas. One of the biggest is in electric and autonomous vehicles (EV’s). Huawei made its first R&D foray into vehicles in 2014, but now the company is drastically cranking up commitment, with plans to form a 5,000-strong R&D team and investment of $1bn in the segment this year. The company says it will not build cars itself, but its engineers are clearly looking into everything short of that. “Initially, we just thought we would help the car connect, but after a while we realized that we can also help make it more intelligent,” says a Huawei official.

A vehicle released by Chinese automaker Beiqi at the Shanghai Auto Show this year featured an entire in-car electronics solution developed by Huawei. For this shift, the company is harnessing strengths built over years in its telecoms hardware business — executives say experience in designing base stations that can withstand extreme weather conditions comes in handy because temperature controls are a key requirement in electric vehicles. “They have refocused their teams in the research centers they run in Europe: In the past, those were 3G and 4G-facing, and now they are focused on [advanced driver-assistance systems],” says Jean-Christophe Eloy, chief executive and president of Yole, a French technology research and consultancy firm.

A large portion of the chips required in automotive electronics are manufactured with more mature processing technology, which does not need to be imported. “Much of that technology is available in China,” Eloy says. “Focusing on automotive therefore can also help them get away from their chip supply problem.”

But Huawei has its sights set far beyond keeping the business running in the near term: If anything, its ambition to be a tech pioneer has grown even stronger. Ren Zhengfei, founder and chief executive and Meng’s father, is letting some of Huawei’s researchers off the leash to focus on basic science and explore technology breakthroughs even without a clear understanding of its potential business applications.

“We will not demand you to put down your quill and join the troops,” Ren told R&D staff at a meeting in August. He added that the research team at HiSilicon, Huawei’s chip design unit, would be kept even though the US sanctions have robbed the Shenzhen-based operation of the chance to manufacture its advanced chips. “We allow HiSilicon to continue to scale the Himalayas,” Ren said. “The majority of us others will stay down here to grow potatoes, herd livestock and keep sending provisions to the climbers, because you can’t grow rice on Mount Everest,” Ren added.

Last year, Huawei invested Rmb141.9bn ($22bn) in R&D, almost 16 per cent of its revenue. The driver behind this focus on high-end research is the urge to become less dependent on foreign technology — while also laying the groundwork for growing intellectual property royalties.

In 5G, Huawei is one of the most significant owners of patents, forcing rival network gear makers such as Ericsson or Nokia to make certain payments to Huawei even if the Chinese company is excluded from 5G contracts in many western countries. Exhorting research staff to seek global technology leadership at the August meeting, Ren said: “We research 6G as a precaution, to seize the patent front, to make sure that when 6G one day really comes into use, we will not depend on others.” Elaborating on the potential uses of 6G for the first time, Ren said the technology might, beyond telecom’s traditional realm of connectivity, be used for sensing and detection — functions with potential for use from healthcare to surveillance. That expectation has grown out of the results of the “collection of start-ups” approach touted by Huawei’s UK research director Henk Koopmans. Ren’s encouragement for Huawei to pursue basic science is instilling what he hopes will be a start-up mentality in many of the company’s own R&D staff.

In addition, it is also tapping into a growing number of start-ups in which it invested in recent years. Engineers at the Centre for Integrated Photonics, a start-up based in Ipswich, eastern England, which Huawei acquired in 2012, recently developed a laser on a chip that can direct light into a fiber-optic cable — an alternative to established telecoms technology that sends pulses of infrared light through the cable. The researchers built the chip themselves, using Indium Phosphide technology instead of mainstream silicon-based semiconductors where US-owned tool technology gives Washington a stranglehold and which Huawei is struggling to obtain.

A circuit board on display at Huawei’s HQ. Image Credit: Bloomberg

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Koopmans says one future use of the technology could be transferring data from sensors on the skin measuring blood oxygen content in remote healthcare services. “And all this photonics activity came from a really research background where we never knew if a product would ever see the light of day. But this is how we are doing things now — reutilize our R&D capabilities in a non-monolithic way.” Ren is not short on ambition for the group’s R&D operations, but acknowledges that they might not provide short-term results.

“Some theories and papers may not be put to use until one or two hundred years after they were first published,” he told R&D staff, reminding them that the significance of Gregor Mendel’s genetics discoveries was not understood until decades later. “Your paper may even have a fate like van Gogh’s paintings — nobody showed interest in them for more than 100 years, but now they are priceless. Van Gogh starved.”

Additional reporting by Nian Liu in Beijing and Qianer Liu in Shenzhen

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.ft.com/content/9e98a0db-8d0a-4f78-90d3-25bfebcf3ac9

Huawei announces seven innovations in digital infrastructure for next decade

Vodafone, Nokia, Cisco, etc. in multi-vendor test of Broadband Network Gateway

Vodafone, together with Benu Networks, Casa Systems, Cisco and Nokia, have successfully tested a system based on a Broadband Forum specification which will make it quicker and easier to deliver faster fixed broadband services to new and existing customers across Europe.

In a world first, the companies applied a new open architecture to the Broadband Network Gateway (BNG) – a critical component for connecting multiple users to the Internet – to enable it to work using separate software and hardware from multiple vendors. This is an important step in opening up the current single-supplier, monolithic broadband gateways to greater technological innovation from a more diverse supply chain.

Called Disaggregated BNG, the technology will change the way broadband networks are built. Using the global TR-459 standard devised by the Broadband Forum, the test allowed the core control functions of the gateway, such as authenticating a user and increasing bandwidth to support streaming services, to be separated and managed efficiently in the cloud whilst ensuring multi-vendor interoperability. Vodafone can then separately upgrade, scale and deploy new features and add more capacity, enabling greater agility and faster time to market when making enhancements across its pan-European broadband network.

Johan Wibergh, Chief Technology Officer for Vodafone, said: “We are already driving a more diverse and open mobile ecosystem with Open RAN, and now we are targeting fixed broadband. As an industry, and with government support, we owe it to people with no or slow internet access to quicken the rollout of new capabilities on fast, fixed broadband.”

Disaggregated BNG will also lower development costs for existing and new ecosystem partners and allow deeper integration with 5G.

Broadband Forum specification – multi-vendor interoperability

The test used Control and User Plane Separation technologies defined by both the Broadband Forum and the global mobile standard 3GPP, which means there will be more opportunity for converged fixed and mobile service delivery. It was conducted between test labs in Belgium (Nokia), Ireland (Casa Systems), India (Cisco) and the United States (Benu Networks).

The Broadband Forum TR-459 specification describes how a traditionally monolithic function is split into two main components – the Control Plane and the User or the Data plane. The Control Plane is the brain of the system and is responsible for managing the interactions with the customer home router, authenticating the user and determining the services and policies that should be applied. The User or Data Plane is then responsible for forwarding the users’ traffic to the correct services and enforcing any required policies such as Quality of Service (QoS).

Standardization of Control and User Plane Separation (CUPS) enables the Control Plane from one vendor to control the User Plane from a different vendor.

Partner quotes:

“We applaud Vodafone for taking a strong industry leadership role by driving standards-based interoperability between vendors,” said Ajay Manuja, CTO and VP of Engineering at Benu Networks. “Benu has specifically designed our cloud-native, disaggregated SD-Edge platform to be an open system for BNG and 5G convergence, supporting over 25 million broadband-connected homes and businesses.”

“Our goal is to simplify network transformation and make it easy for service providers to be more agile and innovative,” said Jerry Guo, CEO of Casa Systems. “Working with Vodafone, we were able to prove the interoperability and scalability of our standards-based disaggregated BNG solution that allows operators to break away from legacy infrastructures and deploy new services to their customers faster.”

“Cisco is committed to driving solutions to expand broadband penetration worldwide.” said Andy Schutz, Product Management Senior Director for Cisco. “We believe the work being done in the Broadband Forum is fundamental to these efforts, especially in the area of creating greater flexibility and choice of control and user planes from different vendors leveraging the TR-459 standard.”

“As a leading BNG vendor, Nokia is pleased to demonstrate support for a wide range of BNG deployment models including Broadband Forum’s disaggregated BNG architecture,” said Vach Kompella, VP and GM of Nokia’s IP Networks Business Division. “Nokia envisions a significant evolution in BNG architecture with the introduction of CUPS in fixed, wireless and 5G fixed wireless applications which will allow rapid feature introduction, optimal user plane placement and selection, as well as improved operations.”

……………………………………………………………………………………………………………………………

Ken Ko, managing director of Broadband Forum, told Fierce Telecom the BNG has traditionally been a “monolithic piece of equipment,” meaning operators might have to purchase a second BNG if they want to scale up or add capacity. This in turn could leave them with control plane capacity they don’t need but paid for anyway.

But with a disaggregated BNG, operators can deploy the control and user planes in a new way, centralizing the former and distributing the latter to reap myriad benefits, he said. For instance, the user plane can be deployed closer to the customer, delivering improved performance for users and giving the operator the option to scale in more flexible increments.

Additionally, by centralizing the control plane, operators not only gain scale benefits, but can also eliminate the need to set up a control plane for each individual BNG that’s rolled out. Ko pointed to improved resilience and streamlined orchestration as two other benefits of the disaggregated BNG.

For its part, Vodafone argued disaggregated BNGs would also enable “greater technological innovation from a more diverse supply chain” by lowering development costs for new and existing ecosystem players. It also highlighted the potential for deeper integration with 5G since the same control and user plane separation technology is also defined by 3GPP specifications.

Ko said the test “is a really important milestone,” adding “just the fact that we’ve got all of these players working together on this test shows that we’re getting to real deployable solutions.”

Vodafone Group

Media Relations

[email protected]

Investor Relations

[email protected]

References:

https://www.vodafone.com/news/press-release/world-first-multi-vendor-test-new-broadband-standard

https://www.fiercetelecom.com/tech/vodafone-trials-disaggregated-broadband-gateway-nokia-cisco

Samsung vRAN to power KDDI 5G network in Japan

Samsung will deploy its cloud-native, fully virtualized Radio Access Network (vRAN) in KDDI’s 5G network, following the successful completion of a 5G Standalone (SA) call using Samsung’s vRAN and another vendor’s 5G Massive MIMO radios. Among other capabilities, virtualized networks will enable 5G network slicing. Samsung and KDDI will begin trials in Q1 of 2022, and start commercial deployment in the second half of 2022.

“We are delighted to extend our collaboration with Samsung and to become the first operator in Japan to use their 5G vRAN solutions, which are currently delivering superior performance in commercial networks,” said Kazuyuki Yoshimura, Chief Technology Officer of KDDI. “We believe in the power of virtualization, and this collaboration serves as a meaningful catalyst for driving the next phase of 5G innovation, and advancing our networks to offer best-in-class 5G services.”

With its latest 5G vRAN technology, Samsung brings a range of improvements to KDDI’s network. By replacing dedicated baseband hardware with software elements, vRAN offers more deployment flexibility, greater scalability and improved resource efficiency in network operation. With its cloud-native, container-based architecture, Samsung’s vRAN also simplifies end-to-end network management through automation, allowing operators to quickly introduce new services with minimal impact on deployment.

“With commercially-proven performance and reliability, our vRAN is an attractive technology option for operators — from both the deployment and operational perspectives,” said Woojune Kim, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics.

“We are excited to mark another milestone with KDDI, following previous network collaborations that include the commercialization of 5G in 2020, and the rollout of 700MHz 5G in 2021. We look forward to our ongoing work with KDDI to bring new 5G innovations to their customers.”

Virtualized networks will play a key role in supporting KDDI’s pursuit of new 5G use cases and next-generation capabilities. Last year, Samsung and KDDI demonstrated how 5G end-to-end network slicing could play a key role for mobile operators by enabling the creation of multiple virtual networks within a single physical network infrastructure.

Samsung has been at the forefront of vRAN leadership around the world, unveiling its fully virtualized 5G RAN in 2020, followed by successful commercialization with a Tier 1 operator in the U.S. In June 2021, the company was selected by a major European operator to bring vRAN to the U.K.

Samsung recently demonstrated its vRAN capability to support Massive MIMO radios on mid-band, reaching multi-gigabit speeds. The company also teamed with a Tier 1 U.S. operator to complete an end-to-end 5G vRAN trial over C-Band in a live network environment, demonstrating vRAN performance equal to that of traditional hardware-based equipment.

References:

https://news.samsung.com/global/samsung-and-kddi-to-bring-5g-vran-to-japan

Quortus: IT Decision Makers Very Interested in Private Cellular Networks

New research commissioned by LTE and 5G network solutions provider Quortus indicates that enterprise IT decision makers are becoming increasingly interested in private networks as an answer to productivity and efficiency woes caused by poor connectivity. Almost two-thirds (63%) of US and European enterprises have suffered reduced productivity and efficiency due to weak and unreliable public network connectivity.

Private cellular networks are 3GPP-based cellular networks offering a combination of low-power wide-area (LPWA), broadband LTE and even “massive” scale, ultra-reliable 5G connectivity for exclusive use by private parties. Deployed and managed separately of public cellular networks, they offer improved security, reliability and control.

The research, which surveyed 260 IT decision makers from the U.S., U.K., Germany and France, found that nearly two thirds (63%) of respondents said that weak and unreliable connectivity results in reduced productivity and efficiency at their enterprise. Further, a staggering 91% of them believe such limitations are directly tied to the limitations of macro public networks.

The research concluded that a fifth of enterprises do not believe the quality of their existing connectivity will support their future digital ambitions. Many enterprise IT leaders are looking for alternative options. 97% of them are ready to invest more money to ensure better connectivity.

The survey findings, published in an exclusive report ‘Build, don’t buy: the road to private networks‘ highlight the perceived inadequacies of public fixed and mobile networks:

- 91% of enterprise respondents believe the limitations of their existing connectivity is squarely tied to the limitations of macro public networks

- The major limitations of public networks frustrating enterprises include weak security, restricted network speeds and limited available network capacity limiting innovation

- 97% of organizations are ready to invest more money to ensure better connectivity, and almost half (47%) would increase current budgets by 10% if it reduced existing fears and limitations and helped drive operational efficiency

- A fifth of enterprises do not believe the quality of their existing connectivity will support the achievement of their future digital ambitions

“Enterprises, until recently, have had to rely on public macro networks for broadband connectivity,” said Neil Dunham, VP of sales at Quortus. “Our study reveals significant levels of frustration with the inherent limitations of macro networks. Too often global enterprises are finding that the quality of connectivity they receive is decided by an enterprise’s location, relative to network sites and the number of users relying on them.”

Dunham continues: “This burgeoning excitement towards private networks is seeing enterprises consider their options when it comes to build, design, and deployment. The key areas of motivation amongst enterprise IT decision makers include a willingness to benefit from specialist vertical knowledge and expertise, not being limited by a public operator’s footprint or service capability and need for bespoke requirements now and in the future. Only private networks can offer a truly bespoke connectivity solution to guarantee appropriate levels of performance, reliability, security and control for all global enterprises.”

Quortus also explored how those enterprises already working on establishing private networks at their facilities are doing so or intend to do, finding that 23% of enterprises surveyed currently operate their own network, while third (33%) would prefer to build their own network with the help of specialist partners, rather than buy it directly from a public operator.

Some of the major findings include a mission to build and not buy

The Quortus study revealed that many global enterprises are taking the safeguarding of high-quality connectivity into their own hands by building and operating private cellular networks.

- Almost a quarter (23%) of enterprises surveyed currently operate their own network

- A third (33%) would prefer to build their own network with the help of specialist partners, rather than buy it directly from a public operator

- The top perceived enterprise benefits of private networks include greater security, increased performance and tighter network control.

Reports from industry organization Global mobile Suppliers Association (GSA) supports Quortus’ research. The GSA in August said it is tracking at least 370 companies around the world that have been or are investing in private mobile networks, with 5G deployments beginning to gain momentum. The data suggests that manufacturing is an early adopter of local area private mobile networks, with 79 identified companies holding suitable licenses or involved in known pilots or deployments of LANs or probable LANs. Mining follows second, with ports also actively trialing/deploying local area private mobile networks.

“Our study reveals significant levels of frustration with the inherent limitations of macro networks. Too often global enterprises are finding that the quality of connectivity they receive is decided by an enterprise’s location, relative to network sites, and the number of users relying on them.”

“As this study shows, strong and reliable connectivity is a significant enabler to greater operational efficiency, enhanced service innovation and better productivity. It is therefore no surprise that enterprises are evaluating their future needs so closely and evaluating alternative means of supply.”

About Quortus:

Quortus is a pioneering UK company that is changing the mobile communications world using the best IT principles to create innovative mobile communication software that is easy to deploy, manage and scale. The company has created a software defined core network technology platform and a suite of products that covers 3GPP 4G, 3G and GSM standards, in addition to taking the lead with emerging technologies such as 5G, Mobile Edge Computing (MEC), Private LTE and cellular core network virtualization.

References:

Majority of global enterprises suffer reduced productivity and efficiency due to poor connectivity

Quortus research indicates ‘burgeoning excitement’ for private networks

Quortus Partners with TLC Solutions for Private 5G Network Radio Solution

Gartner’s 2021 Magic Quadrant for WAN Edge Infrastructure

Gartner’s 2021 Magic Quadrant for WAN Edge Infrastructure [1.] notes that spending on WAN edge equipment will grow by 2.6% per year through 2025. This is the result of the robust growth of SD-WAN (18.0% CAGR) and the decline of traditional branch office routers (-16.5% CAGR). The past several years have seen a large-scale shift from traditional MPLS-based customer edge routers to SD-WAN technology, according to the report.

Note 1. WAN edge infrastructure enables network connectivity from distributed enterprise locations to access resources in both private and public data centers as well as cloud (as a service). It is typically procured by senior networking leaders within an infrastructure and operations (I&O) organization. This market has evolved from traditional branch routers (often called “customer edge routers” in a Multiprotocol Label Switching [MPLS] implementation), and is undergoing dramatic change, driven by the needs of digital business transformation and the demands of line-of-business managers. The market for branch office wide-area network functionality is shifting from dedicated routing, security and WAN optimization appliances to feature-rich SD-WAN and vCPE platforms. WAN edge infrastructure now incorporates a widening set of network functions, including secure routers, firewalls, SD-WAN, WAN path control and WAN optimization, along with traditional routing functionality.

The increased sales of WAN edge technology in general has been driven by SD-WAN equipment designed to support work-from-home and in-office environments are slightly dampened by the fact that sales of traditional branch office routers are sharply down as a consequence, Gartner stated in its report.

The number of vendors Gartner has designated as Leaders in WAN-edge infrastructure since 2019 has increased as more are judged to have the requisite “completeness of vision” and “ability to execute”. Just two companies were rated “leaders” in 2019, compared to six in 2020 and 2021. The same six companies were ranked as leaders in the past two reports—Fortinet, VMware, Versa, Palo Alto Networks, Cisco and Silver Peak—although the Silver Peak was bought out last year by HPE/Aruba last year and has inherited the company’s spot in the new report. Gartner noted that edge network leaders offer versatile products with rich features, and broad name recognition.

SASE architecture is also on the rise, according to Gartner, who predicted that more than 70% of SD-WAN customers would implement SASE by 2024, up 10% from last year’s estimate. The ability to deliver a competitive SASE service affected this year’s ratings, making up a part of vendors’ innovation” score. If a vendor’s offerings include the types of network security features that would qualify its WAN edge products as SASE, the innovation score are slightly higher.

“We see network and security decisions being made at the same time and more often with the same solution,” the latest report said. “This is largely driven by the move to distribute internet access to support cloud applications and change the security perimeter.”

Gartner says Fortinet is a leader in this Magic Quadrant. Its offering is the FortiGate Secure SD-WAN product, which includes physical, virtual appliances and cloud-based services managed with FortiManager orchestrator. Fortinet is based in Sunnyvale, California, U.S., and Gartner estimates that it has more than 34,000 WAN edge customers with more than 10,000 SD-WAN customers. FortiOS v.7.0 combines ZTNA to its broad WAN and network security functionalities to deliver a capable SASE offering. It has a wide global presence, addressing customers across multiple verticals and sizes. We expect the vendor to continue investing in SASE, artificial intelligence for IT operations (AIOps) and 5G functionality.

VMware is a Leader in this Magic Quadrant. Its offering is branded as VMware SD-WAN, and is part of VMware SASE. The offering includes edge appliances (hardware and software), gateways — VMware points of presence (POPs) offering various services — and an orchestrator and its Edge Network Intelligence. VMware provides additional optional security via VMware Cloud Web Security and VMware Secure Access. Based in California, U.S., it has more than 14,000 SD-WAN customers. The vendor operates globally and addresses customers of all sizes, and in all verticals. Gartner expects the vendor to continue investments in this market, including enhancing options for remote workers and building out its SASE offering.

Cisco is also a leader in this Magic Quadrant. It has two branded offerings: Cisco SD-WAN powered by Viptela and Cisco SD-WAN powered by Meraki. Both include hardware and software appliances, and associated orchestration and management. Cisco also provides optional additional security via the Cisco Umbrella Security Internet Gateway (SIG) platform. Cisco is based in California, U.S., and has more than 40,000 WAN edge customers. The vendor operates globally and addresses customers of all sizes, in all verticals. We expect the vendor to continue to invest in this market, particularly in the areas of improved self-healing capabilities, new consumption-based pricing models and integrated security to enable a single-vendor SASE offering.

References:

https://www.gartner.com/reviews/market/wan-edge-infrastructure

https://www.gartner.com/en/documents/4005922

Ericsson IoT Accelerator Cloud Connect to connect cellular IoT devices to AWS

Ericsson has launched IoT Accelerator Cloud Connect to make it easier for enterprises using Ericsson’s IoT Accelerator platform to cellular devices to connect to the Amazon Web Services (AWS) server securely. According to Ericsson, Cloud Connect shifts the complex encryption required for secure IoT connectivity away from the device and onto the edge of the cellular network.

With an estimated five billion cellular IoT devices to be in use by the end of 2026, according to the Ericsson Mobility Report (June 2021), enterprises are increasingly outsourcing IoT device authentication and data management to public cloud providers such as AWS.

Enterprises on Ericsson IoT Accelerator-managing cellular devices such as sensors, meters, or tracking devices now have a much simpler way to connect to the already secure AWS server through Ericsson’s IoT Accelerator Cloud Connect, which moves complex encryption from the device to the edge of the cellular network.

Quotes from companies across multiple industry sectors:

Steve Dunn, CEO and Co-Founder at Digital Keys, a smart IoT security company, says: “Our cellular connected smartlocks with digital keys application are used for banks, hotels, universities, office buildings, shared labs, and apartments. Every smartlock has a SIM card that needs to connect to the cellular networks and the AWS cloud securely. It was a smooth process with Ericsson’s IoT Accelerator Cloud Connect.”

Communication service providers (CSPs) play a crucial role in the IoT ecosystem, providing global cellular connectivity using Ericsson IoT Accelerator. With more than 35 global CSPs already on Ericsson’s IoT Accelerator, enterprises of any size can manage the connectivity of their devices worldwide. It is now even easier to connect to AWS IoT Core.

Cristoff Martin, Chief Marketing Officer, Telenor Connexion, says: “This capability, integrated with our IoT Cloud service also developed together with AWS, will allow even more efficient development and operation of new connected solutions taking benefit of network technologies like Narrowband-IoT and the superior security capabilities of mobile networks in general.”

Jan Willem Smeenk, Chief Architect at SODAQ, a leading company in solar-powered asset tracking that specializes in scalable and efficient IoT hardware and software to empower businesses, says: “It is costly and complicated to connect our smart asset trackers securely, but with Ericsson as a key partner, we were able to order SIM cards from the operator on IoT Accelerator, insert them into our device with no additional encryption or certificate management required. Then, using Ericsson’s IoT Accelerator Cloud Connect, the device is authorized and automatically provisioned to the target AWS destination. It was simple and can serve our customers of any scale and size.”

Connecting to AWS IoT Core requires each connected device to use Transport Layer Security (TLS) encryption for all communications. With Cloud Connect, the IoT Accelerator service offers a plug-and-play alternative. In this, enterprises benefit from simple activation of devices that tunnel to the edge of the cellular infrastructure before automatically self-provisioning to AWS and securely connecting via Cloud Connect generated encryption and keys.

Rauno Jokelainen, Chief Technology Officer at UROS Group, a leading company in digital water services, says: “We see high value with the use of Cloud Connect in the UROS Sense Liquid Quality as a Service solution to provide real-time water quality detection to the municipalities and enterprises around the world in an easily deployable manner. With this solution, we can bring the peace of mind to the CIOs of the municipalities that their water networks are monitored in a secure manner.”

With Ericsson’s IoT Accelerator Cloud Connect, devices with unencrypted yet privately secured communications over cellular network leveraging Message Queuing Telemetry Transport (MQTT) or narrowband User Data Protocols (UDP) – such as Constrained Application Protocol (CoAP) – can connect seamlessly to AWS IoT Core, resulting in significantly lower power and data consumption.

Initial results show that Ericsson’s IoT Accelerator Cloud Connect enables low-powered devices to reduce mobile data by up to 95 percent and extend battery life by up to 50 percent by removing the need to run public end-to-end internet encryption.

Michael MacKenzie, General Manager, AWS IoT Connectivity & Control, says: “As enterprises connect more IoT devices to the public cloud, they want an easy and secure way to ingest IoT device data to AWS. Simple solutions like Ericsson’s IoT Accelerator Cloud Connect give enterprises flexibility by leveraging AWS IoT to easily manage and authorize devices, use zero touch provisioning, and ensure data is encrypted and secure.”

Kyle Okamoto, General Manager IoT, Ericsson, says: “Ericsson’s IoT Accelerator Cloud Connect removes barriers for enterprises to connect their IoT devices to numerous public clouds and to optimize the IoT data management infrastructure offered by providers like AWS. This means a faster time to market for enterprise devices and products. We are excited to offer this service to our IoT Accelerator community of over 7,000 enterprises globally.”

RELATED LINKS:

……………………………………………………………………………………………………………

Separately, Ericsson is cutting hundreds of jobs in China after losing market share during the recent awards of 5G contracts, according to Light Reading.

“Layoffs will happen by the end of this year as Ericsson merges three separate customer units in China into one. Until now, it has maintained a unit for each of China’s big mobile operators – China Mobile, China Telecom and China Unicom – but the restructuring will create a single mainland China customer unit catering to them all.”

Ericsson’s recent loss of market share has left it with a lower volume of 5G business to serve. Its move is aimed at rebalancing sales and costs so that it remains competitive on price.

Employees in China were briefed on the plans at an internal company meeting earlier today, where Chris Houghton, Ericsson’s head of market area for northeast Asia, said: “I sincerely regret that we now need to make changes to our great team, in order to reflect Ericsson’s changing market share position in China. We are committed to China and delivering value to our customers with our leading technology and solutions.”

The restructuring comes weeks after China Mobile gave Ericsson just 2% of the 700MHz bid on top of its existing share in 2.6GHz. This phase-two allocation in 5G is down from about 11% last year.

Ericsson has also picked up only a 3% share of the phase-two 5G work for China Telecom and China Unicom, which have joined forces to build a 5G network.

References:

https://www.ericsson.com/en/news/2021/9/ericsson-iot-cloud-connect-connects-iot-devices-to-aws

ITU-R Report in Progress: Use of IMT (likely 5G and 6G) above 100 GHz (even >800 GHz)

Introduction:

In July 2015, ITU-R published Report M-2376: Technical feasibility of IMT in bands above 6 GHz Since then, there has been academic and industry research and development ongoing related to suitability of mobile broadband systems in frequency bands above 100GHz. As a result, a new ITU-R Report ITU-R M.[IMT.ABOVE 100 GHz] was started at the August 2021 meeting of ITU-R WP5D (#38) to study the technical feasibility of IMT in bands above 100 GHz. That report will be a complement to the previous studies documented in Report M-2376.

Discussion:

Compared with the 3GPP 5G NR FR2 frequency band (24250 MHz – 52600 MHz), the terahertz frequency band above 100 GHz can provide a larger usable bandwidth, but it also suffers from greater path loss/signal attenuation. Fortunately, it is possible to overcome certain path attenuation by improving the directivity and gain of the antenna and using beamforming technology to increase the coverage of the cell. IMT technologies adopted for bands above 100 GHz can be used in indoor/outdoor hotspot environments, integrated sensing and communication and ultra-short-range environments to provide ultra-high data rate services.

Some possible use cases for IMT above 100 GHZ are:

Indoor hotspot in an large meeting room – small cell base stations operating at bands above 100 GHz may solve the needs of applications with extremely high data rates, such as Holographic displays. Considering the large path attenuation of bands above 100GHz, high-gain directional antennas or large-scale antenna arrays that can provide higher gains could be used to flexibly establish wireless fronthaul /backhaul links with outdoor base stations or core networks.

Integrated sensing and communication – A typical use case is the use of sensing technology to assist communication, such as using sensing technology to predict the user’s trajectory to assist the base station in beam tracking of the user, or using sensing technology to sense the user’s location for rapid beamforming. Using bands above 100 GHz can achieve better imaging and achieve higher positioning accuracy.

Secure Imaging and Infrared Thermal Cameras are other potential use cases depicted below:

In preparation for a contribution on this topic for the October 2021 WP5D meeting, the Republic of China conducted channel measurement campaigns in indoor scenarios at 140 GHz and 220 GHz. The measured indoor scenarios include a meeting room, and office area, and hallway in office room. Pathloss models for the investigated bands were derived based on the channel measurement campaigns conducted in a meeting room and an office room and presented in their contribution.

Reference 4. notes recent regulatory and standard body rulings that are anticipating wireless products and services above 100 GHz and illustrates the viability of wireless cognition, hyper-accurate position location, sensing, and imaging. It also presents approaches and results that show how long distance mobile communications will be supported to above 800 GHz since the antenna gains are able to overcome air-induced attenuation, and present methods that reduce the computational complexity and simplify the signal processing used in adaptive antenna arrays, by exploiting the Special Theory of Relativity to create a cone of silence in over-sampled antenna arrays that improve performance for digital phased array antennas.

References:

- W. Tong, P. Zhu, “6G: The Next Horizon, From Connected People and Things to Connected Intelligence”, Cambridge University Press, 2021.

- 5GCM, “5G channel model for bands up to 100 GHz,” Tech. Rep., Sep. 2016, Available online at http://www.5gworkshops.com/5GCM.html.

- 3GPP TR 38.901, “Study on channel model for frequencies from 0.5 to 100 GHz,” v. 16.1.0, Dec. 2019. [4]. ITU-R M.2412, “Guidelines for evaluation of radio interface technologies for IMT-2020,” Sep. 2017.

- Wireless Communications and Applications Above 100 GHz: Opportunities and Challenges for 6G and Beyond. IEEE Xplore

Orange España: commercial deployment of 10 Gbps fiber in 5 cities

Orange’s new 10Gbps fiber access will be at Love Total Plus and Love Total Plus 4 rates for residential customers, and at Love Empresa 3 and 5 rates for freelancers and small businesses. Adopting this speed will mean an increase of 10 euros /month on the price of the same.

In the 10Gbps offered by Digi, only 8Gbps was obtained, and it is expected that in the case of Orange it might be similar. It remains to be seen, what actual performance it offers.

References:

Orange launches 10Gbps symmetric fiber for individuals and companies, first in five major cities

Canada’s TeraGo to Complete 5G Core Network for 5G FWA and private 5G network applications

Canadian network operator TeraGo said it is on track to complete its planned 5G core network expansion projects for this year, as the company prepares to deploy 5G fixed wireless access services to its existing customer base and 5G private networking applications for new customers.

TeraGo plans to achieve its goal using the capital raised earlier this year to increase capacity and throughput in its core network and to its wireless hub sites. This initiative is necessary to provide the network bandwidth that 5G fixed wireless access and private networks will require.

5G private networking applications are expected to take advantage of the security, high speed, and low latency that TeraGo’s licensed mmWave spectrum offers (not that 5G mmWave frequencies have yet to be agreed on in the still uncompleted revision 6 to ITU-R M.1036).

TeraGo 5G: TeraGo has Canada’s largest nationwide millimeter wave spectrum holdings, including the 7 largest cities in the country. Throughout 2021 and beyond, TeraGo will continue to invest in 5G technology trials and proof of concepts to explore how 5G Fixed Wireless solutions can be brought to market and solve real-world problems for our customers.

KEY FEATURES:

- Largest mmWave spectrum holder in Canada, including the 7 largest cites in the country

- Edge Computing (requires 5G SA Core network)

- Industrial IoT Applications (can use 5G NSA or 5G SA Core network)

SOURCE: TeraGo

………………………………………………………………………………………………………………………………..

To enable these new applications, TeraGo is expanding its overall network capacity this year by five to six times its pre-expansion levels. Nokia supplies TeraGo with 5G network equipment with customer premises gear from Askey Computer and Inseego.

“We continue to diligently work through our network upgrade plan, which includes over 50 projects that we expect to complete by year-end,” said Matthew Gerber, Chief Executive Officer (CEO) at TeraGo.

“Some of these projects include things like new fiber optic connections to our hub sites and core network link upgrades to 100 Gbps. We have completed over 40 of these projects to date and are currently on track to achieve our project objectives by the end of the calendar year. We will continue to target installing some of our first customer pilot installations over the next couple of months and remain confident in our ability to establish TeraGo as one of the first operators to launch commercial mmWave 5G fixed wireless and private networking services in Canada.”

About TeraGo:

TeraGo owns a national spectrum portfolio of exclusive 24 GHz and 38 GHz wide-area spectrum licenses including 2,120 MHz of spectrum across Canada’s 6 largest cities. TeraGo provides businesses across Canada with cloud, colocation and connectivity services. TeraGo manages over 3,000 cloud workloads, operates five data centers in the Greater Toronto Area, the Greater Vancouver Area, and Kelowna, and owns and manages its own IP network.

TeraGo offers a managed SD-WAN service as described in this blog post.

The Company serves business customers in major markets across Canada including Toronto, Montreal, Calgary, Edmonton, Vancouver, Ottawa and Winnipeg.

For more information about TeraGo, please visit www.terago.ca.

References:

https://terago.ca/what-is-managed-sd-wan-and-why-you-need-it/

http://www.apofc.com/news/show.php?itemid=359

Open Networking Foundation spins off Ananki to deliver open source-based Software Defined Private 5G as per Industry 4.0 requirements

Ananki plans to deliver software defined private 5G that is purpose built for the Industry 4.0 revolution, encompasng M2M mobile networks, IoT, and related communication initiatives.

- Private 5G is the key to empowering the machine-to-application communications necessary to complete this vision, according to the ONF.

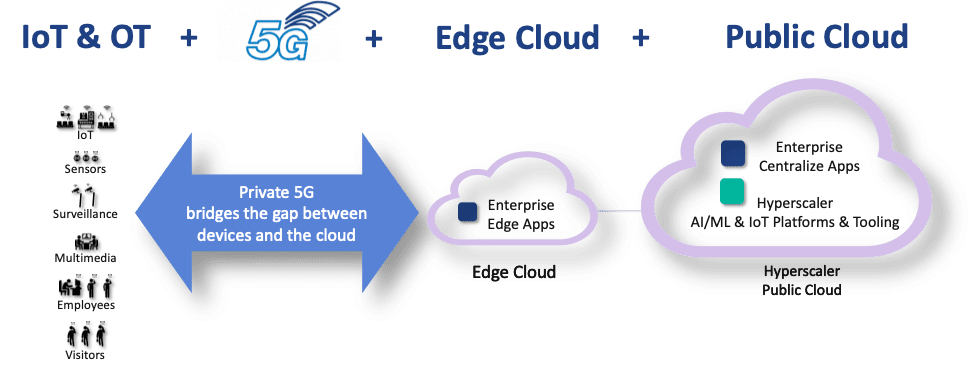

- Industry 4.0 is a combination of intelligent devices, edge cloud and cloud-based AI/ML which is intended to enable software-based optimization and innovation.

Ananki’s Software-Defined Private 5G+ was said to deliver:

● Optimized 5G+ Experience – Software-defined, automated, AI powered, application optimized connectivity, with enhanced security enabled by a programmable data plane.

● Cloud First – pre-integrated with hyperscaler cloud and edge, delivering private 5G as a SaaS service, creating a continuously improving experience running on any multi-cloud platform.

● Industry 4.0 Ready – Empowering developers to build transformative IoT, IIoT and OT solutions with rich APIs.

Ananki’s technological foundation leverages ONF’s open source Aether™, SD-RAN™, SD-Fabric™ and SD-Core™ projects, and melds them together into a commercial offering that is delivered as a SaaS, making private 5G as easy to consume as wifi for enterprises. ONF also incorporates developer APIs to accelerate the creation of more powerful digital transformation solutions. This open platform is hardened and optimized for industrial applications, and introduces developer APIs to empower the creation of more powerful digital transformation solutions.

Other Highlights:

— Ananki delivers slice/device level SLA assurance for mission critical applications.

— Proactively identify network bottlenecks before they impact your application performance.

— Define application priority once and let Ananki (Self healing/optimizing/organizing network) deliver optimal application performance.

— CI/CD lets you dynamically upgrade your service to handle evolving application requirements and security threats.

— Telco grade security and resilience to Enterprise operational networks with AI/Ops fault and detection.

Ananki’s Inception:

When ONF’s Aether was selected for the $30M Pronto Project, DARPA encouraged ONF to commercialize the platform in order to advance the impact of the project’s secure 5G research. To date, ONF has operationalized and deployed Aether at 15 locations operating as a cloud managed service.

To accelerate Aether’s adoption, the ONF board voted unanimously to create a new separate venture backed commercial entity to provide an enhanced, hardened solution so vendors and partners can easily incorporate private 5G into the solutions they then build and deliver to enterprises.

Ananki, has been structured as a Public Benefit Corporation to support and promote open source. Furthermore, Ananki shares common executives with the ONF, ensuring that a consistent vision and mission keeps the two entities well aligned.

Quotes:

Andre Fuetsch, ONF Board Chair and AT&T CTO:

“ONF continues to innovate in ways that magnify the power of open systems and open source across our industry. The ONF board recognizes that the lack of support for open source initiatives from commercial companies remains an inhibiting factor for scaled adoption. To meet this challenge, we have agreed to spin out Ananki as an independent company to pursue commercialization of Aether with a view that this will help accelerate the adoption and impact of open source.”

Guru Parulkar, Executive Director ONF and CEO of Ananki:

“Ananki is broadening the impact of the ONF’s work, and will help ONF’s Aether become much more broadly adopted. By providing a commercially supported option for consuming Aether, many more organizations will be able to easily and economically leverage the benefits of Private 5G for building Industry 4.0 solutions. And in turn, Ananki is committed to contributing back to the ONF open source, helping to advance the Aether platform and broaden the ONF community.”

About Ananki:

Ananki delivers a commercially supported Software-Defined Private 5G as-a-service to help facilitate enterprise digital transformation. As a Public Benefit Corporation, Ananki synergistically builds on Open Networking Foundation (ONF) open source software platforms, and in turn contributes focus, funding, developers and contributions to the ONF projects. With Ananki, companies can now choose a commercially supported option when consuming ONF open source.

About the Open Networking Foundation:

The Open Networking Foundation (ONF) is an operator-led consortium spearheading disruptive network transformation. Now the recognized leader for open source solutions for operators, the ONF first launched in 2011 as the standard bearer for Software-Defined Networking (SDN). Led by its operator partners AT&T, China Unicom, Deutsche Telekom, Google, NTT Group and Türk Telekom, the ONF is driving vast transformation across the operator space. For further information visit http://www.opennetworking.org

For more information, please visit ananki.io and/or register to attend a live keynote on September 28th as part of the Private 5G for Industry 4.0 Spotlight event.

References: