Month: January 2022

FCC Auction 110 rakes in $22.5 billion in gross proceeds for 3.45 GHz Service

The results of the FCC’s 3.45 GHz auction were announced today. On January 4, 2022, bidding in Auction 110—the auction of new flexible-use licenses in the 3.45–3.55 GHz band—concluded following the close of bidding in the assignment phase.1 Auction 110 raised a total of $22,418,284,236 in net bids and $22,513,601,811 in gross bids, with 23 bidders winning a total of 4,041 licenses.

With $22.5 billion in gross proceeds, Auction 110 was the third highest grossing auction in the FCC’s history.

The 3.45 GHz action makes available 100 megahertz of mid-band spectrum for commercial use across the contiguous United States. Licensees can use it for fixed or mobile uses.

Here are the big winners:

- AT&T: $9.1B

- Dish: $7.3B

- T-Mobile: $2.9B

AT&T won 1,624 licenses in the 3.45 GHz auction, and Dish, bidding under the name Weminuche LLC, won 1,232 licenses. US Cellular acquired 380 licenses, followed by Cherry Wireless LCC with 319. T-Mobile acquired 199 licenses. Meanwhile, Verizon bid =ZERO.

The remainder went to a relatively familiar list of private equity investors, including Grain Capital, Columbia Capital, and Charlie Townsend’s Bluewater Wireless. Here’s the complete list of bidders:

| Bidder | Bidding entity | Winning bids | Licenses won |

| AT&T | AT&T Auction Holdings, LLC | $9 billion | 1,624 |

| Dish Network | Weminuche L.L.C. | $7.3 billion | 1,232 |

| T-Mobile | T-Mobile License LLC | $2.9 billion | 199 |

| Columbia Capital | Three Forty-Five Spectrum, LLC | $1.4 billion | 18 |

| Uscellular | United States Cellular Corporation | $580 million | 380 |

| Whitewater Wireless II, L.P. | $428 million | 14 | |

| Grain Management | NewLevel III, L.P. 0 | $376 million | 8 |

| Moise Advisory | Cherry Wireless, LLC | $211 million | 319 |

| N Squared Wireless, LLC | $101.8 million | 55 | |

| Skylake Wireless II, LLC | $39 million | 57 | |

| Blue Ridge Wireless LLC | $8.9 million | 39 | |

| Agri-Valley Communications | Agri-Valley Communications | $8 million | 7 |

| LICT | LICT Wireless Broadband Company, LLC | $7.7 million | 24 |

| Viaero | NE Colorado Cellular, Inc. | $6.7 million | 18 |

| Nsight | Nsight Spectrum, LLC | $4.7 million | 6 |

| East Kentucky Network | East Kentucky Network, LLC | $4.4 million | 2 |

| Carolina West Wireless | Carolina West Wireless, Inc. | $3.8 million | 11 |

| PVT | PVT Networks, Inc. | $2 million | 6 |

| Chat Mobility | RSA 1 Limited Partnership | $1.7 million | 1 |

| Raptor Wireless LLC | $845,700 | 6 | |

| Horry Telephone | Horry Telephone | $88,060 | 12 |

| PocketiNet | PocketiNet Communications | $59,501 | 1 |

| Jones, Anthony L | $1,575 | 2 | |

| Bidder identity included where available. Source: FCC | |||

The results were pretty much as expected- Dish spent more than expected, and AT&T a bit less, but in rank order and in magnitude, the numbers were relatively close to expectations.

Credit: Getty Images

The “mid-band spectrum” that was auctioned off is considered crucial for mobile operators’ deployment of next generation of wireless service such as 5G, which promises to deliver much faster wireless service and a more responsive network. Mid-band spectrum provides more-balanced coverage and capacity due to its ability to cover a several-mile radius with 5G, despite needing more cell sites than lower-tiered spectrum bands. Its ability to connect more devices and offer real-time feedback is expected to spark a sea change in how we live and work, ushering in new advances like self-driving cars and advanced augmented reality experiences.

“Today’s 3.45 GHz auction results demonstrate that the Commission’s pivot to mid-band spectrum for 5G was the right move,” said FCC Chairwoman Jessica Rosenworcel. “I am pleased to see that this auction also is creating opportunities for a wider variety of competitors, including small businesses and rural service providers. This is a direct result of the Commission’s efforts to structure this auction with diversity and competition front of mind.”

Craig Moffett wrote in a note to clients shortly after the auction results were announced by the FCC:

“After the almost $100B spent on the C-Band auction [1.], these numbers might sound almost quaint. Still, AT&T’s $9B translates to nearly a quarter turn of additional leverage. And for Dish Network, it is roughly two years of EBITDA, or two full turns. As always, spending money on spectrum is only the beginning. Now starts the spending on putting the new spectrum to work. The carriers did not pay up for this spectrum to allow it to languish in a fallow state, and the Towers will be natural beneficiaries of the deployment process over the coming years. Carrier plans for the C-Band suggest that spectrum will ultimately be deployed in a fairly broad-based manner, rather than just in more densely populated areas of the country, and a similar result seems likely for this spectrum, given its broadly similar propagation attributes.”

Note 1. The C-band auction broke records with its $81.2 billion in gross proceeds.

Analysts at New Street Research thought T-Mobile was going to win more spectrum than it did. They were predicting T-Mobile to spend in the range of $6.6 billion and Dish to spend about $5 billion. The FCC is planning for even more auctions in the future.

References:

https://www.fcc.gov/document/fcc-announces-winning-bidders-345-ghz-service-auction

https://www.fcc.gov/auction/110

FCC Auction 110 for mid-band 5G spectrum gets $21.9B in winning bids

https://www.cnet.com/tech/mobile/at-t-and-dish-big-winners-in-latest-5g-auction/

https://www.fiercewireless.com/wireless/att-dish-top-list-fccs-345-ghz-auction-winners

Chinese companies’ patents awarded in the U.S. increased ~10% while U.S. patent grants declined ~7% in 2021

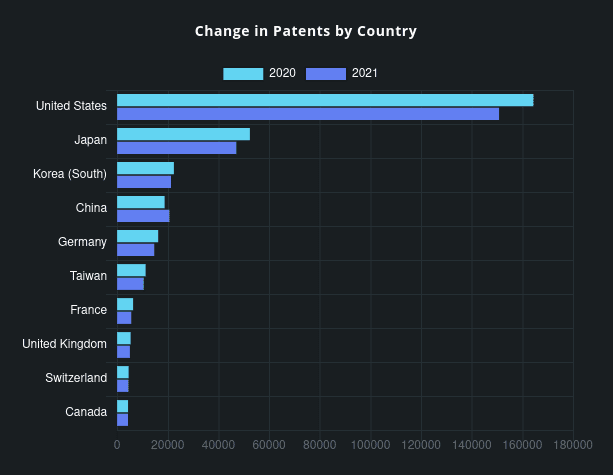

Chinese companies’ patents granted in the United States surged last year, even as total patent awards in the U.S. trended downward, according to a renowned U.S. patent service provider. Data from IFI Claims (more below) showed that Chinese companies’ patents earned in the U.S. increased ~10% to 20,679 in 2021, up from 18,792 in 2020.

The progress came as total U.S. patent grants declined about 7% from 2020 to 327,329 awards last year, the most precipitous drop in the past decade, said IFI Claims.

Several Chinese companies are now among the Top 50 in U.S. patent rankings, including world’s #1 chip maker Taiwan Semiconductor Manufacturing Co (TSMC) at No 4, telecom giant Huawei at No 5, display maker BOE at No 11, tech heavyweight Oppo at No 49, while China’s Advanced New Technologies was ranked #43. Oppo was granted 719 patents in the U.S. last year, marking a surge of 33% year-on-year.

When it comes to total global patents held, China possesses 29% of the global 250 patent families – collections of patent applications covering the same or similar technical content – compared to the U.S. (24%) and Japan (19%), said IFI Claims.

A deeper analysis shows that the U.S. and Japanese portfolios are stronger and more mature. Nevertheless, it is clear that China has stimulated a research and development culture that is serious about intellectual property, said Mike Baycroft, CEO of IFI Claims Patent Services in a statement (see below).

The progress comes as Chinese companies increasingly strengthen their R&D push. Huawei, for instance, invested 141.9 billion yuan ($22.3 billion) in R&D in 2020, accounting for about 15.9% of its revenue.

Jason Ding, head of the intellectual property department at Huawei, said earlier that the company has become one of the world’s largest patent holders through investment in innovation.

Oppo is also beefing up its R&D push. Chen Mingyong, CEO of Oppo, said earlier that the company aims to be a tech pioneer by increasing R&D spending.

“We’ve been working hard for many years to ramp up our products,” Chen said. So far, Oppo has filed for patents in more than 40 countries and regions around the world as it accelerates efforts to expand its global business. As of Dec 31, 2021, Oppo had filed 75,000 patent applications globally, and its global number of authorized patents exceeds 34,000, the company said.

For more information, email: [email protected]

…………………………………………………………………………………………………………………………….

IFI Claims Patent Services – China Surges, as Others Decline:

In a year that saw U.S. patent grants decrease anywhere from 8 to 12% among worldwide corporations, China-based companies stood out with an increase of 10 percent, going from 18,792 awards in 2020 to 20,679 during the past year. A total of four Chinese companies are now in the U.S. Top 50 including Huawei at #5, BOE at #11, Advanced New Technologies at #43, and Guangdong Oppo at #49. US company grants were down commensurate with the worldwide total decline, 8%.

“Last year saw the steepest decline in patent grants in the past decade. There could be many reasons for this – and clearly some are pandemic-related – but what we’re seeing is that corporations are still innovating at an impressive clip despite a challenging environment, particularly U.S. and Asia-based entities,” said Mike Baycroft, CEO of IFI CLAIMS Patent Services.

Consistent with the overall decline in U.S. patent activity from 2020 to 2021, all regions except China had a negative growth rate Year over Year (2021 vs 2020). That is depicted on this chart:

Source: IFI Claims Patent Services

………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://mobile.chinadaily.net.cn/cn/html5/2022-01/14/content_013_61e07f4ced500fb050170922.htm

IPS Expands Long Haul Submarine Data Transmission Capacity with Ribbon’s 100 Gigabit Ethernet (100GbE) services

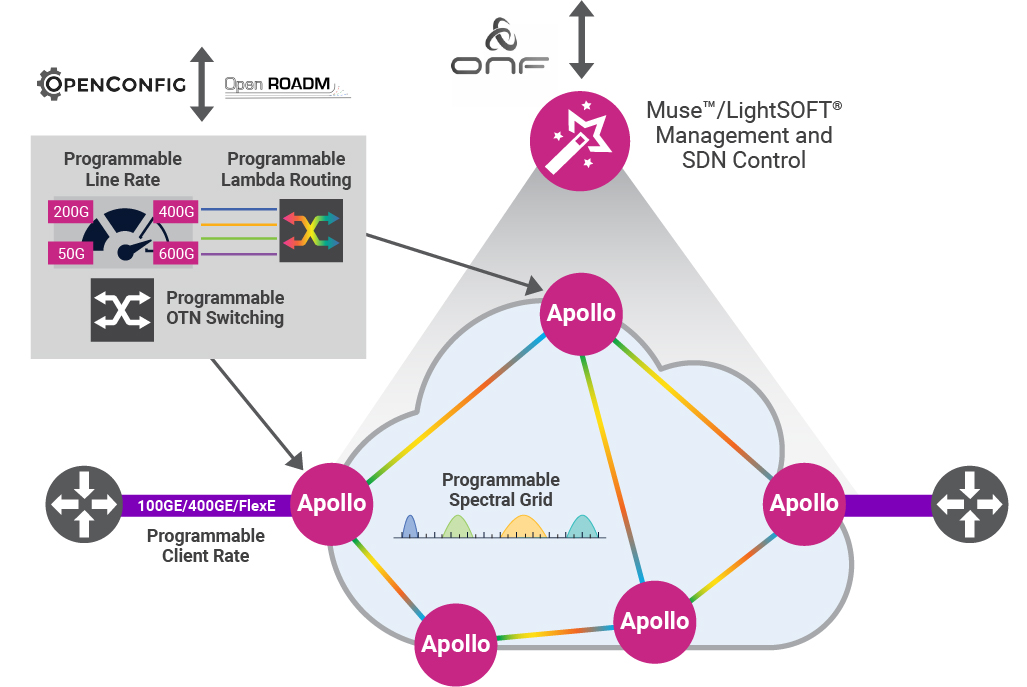

Ribbon Communications Inc, a global provider of real time communications software and IP Optical networking solutions to service providers, enterprises, and critical infrastructure sectors, today announced that Tokyo based IPS (a leading provider of international connectivity services for communications service providers), is using Ribbon’s Apollo Optical Networking solution to power 100 Gigabit Ethernet (100GbE) services delivered over both terrestrial and undersea cables from Manilla to Hong Kong and Singapore.

“Our ability to seamlessly deliver connectivity services to our customers over long distances is key to the success of our business,” said Koji Miyashita, President and CEO, IPS. “Ribbon’s Optical transport technology allowed us to maximize our available capacity and transmit world-class communications applications via our submarine services under the South China Sea.”

“Submarine applications must deliver extensive capacity and carry the highest level of communications services on each channel in order to realize cost efficiencies,” said Mickey Wilf, General Manager APAC and MEA Regions for Ribbon. “Our Apollo solution enables IPS to maximize capacity by leveraging dual wavelengths with programmable baud rate and modulation, in conjunction with flex grid technology.”

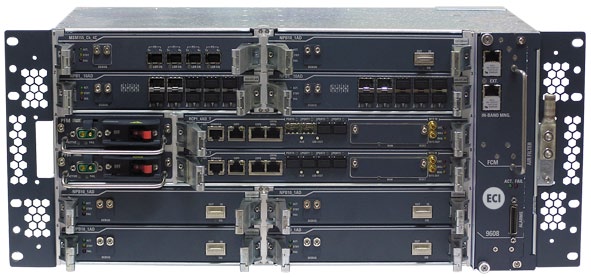

The solution deployed by IPS leverages Apollo’s high-performance programmable TM800 muxponder cards on Apollo 9600 series platforms to provide optimized long haul undersea connectivity for 100GbE services.

| 9504D | 9603 | 9608 | 9608D | 9624 | ||||

| Size | 1RU | 2RU | 5RU | 5RU | 15RU | |||

| Line Capacity | 1.6T | 2.4T | 6.4T | 6.4T | 19.2T | |||

| Photonics | CDC-F ROADMs, Fixed and Dynamic Amplifiers | |||||||

| Datasheet | Apollo 9504D | Apollo 9603 | Apollo 9608 | Apollo 9608D | Apollo 9624 | |||

| Image | Data Center |

|

|

Data Center |

|

|||

About IPS:

IPS Inc. operates as a Carriers-of Carrier in the Philippines providing network services for local and international telecom companies, contact centers and data centers. It has international telecommunication lines connecting Manila with Hong Kong, Singapore, and many other countries. IPS is listed on the Tokyo Stock Exchange.For more information visit ipsism.co.jp/en/.

About Ribbon:

Ribbon Communications (Nasdaq: RBBN) delivers communications software, IP and optical networking solutions to service providers, enterprises and critical infrastructure sectors globally. We engage deeply with our customers, helping them modernize their networks for improved competitive positioning and business outcomes in today’s smart, always-on and data-hungry world. Our innovative, end-to-end solutions portfolio delivers unparalleled scale, performance, and agility, including core to edge software-centric solutions, cloud-native offers, leading-edge security and analytics tools, along with IP and optical networking solutions for 5G. To learn more about Ribbon visit rbbn.com.

References:

https://ribboncommunications.com/products/service-provider-products/apollo-optical-systems

CTIA Announces 5G Security Test Bed for Commercial 5G Networks

CTIA today announced the launch of its 5G Security Test Bed (STB), a security testing and validation initiative dedicated to commercial 5G networks. CTIA created the STB in partnership with organizations across wireless, tech, and academia to test 5G security recommendations across real-world conditions using commercial-grade equipment and facilities.

The 5G Security Test Bed’s founding members—AT&T, Ericsson, T-Mobile, UScellular, MITRE, and the University of Maryland (UMD)—contribute invaluable industry expertise that strengthens the STB’s ability to enhance the wireless security ecosystem and ensure strong protections on 5G networks.

There are no ITU standards for 5G security, which requires a 5G SA Core network. Rather, there are 3GPP 5G Security technical specifications (TS 23.501 – 23.503) with ALL features required to be implemented by vendors, but none of them mandatory for 5G network operators. IEEE Techblog articles and tutorials for 5G security are here.

The STB was created to build on 5G security (presumably from the referenced 3GPP technical specs), testing use cases, making recommendations, and further bolstering 5G’s security to benefit consumers, enterprises, and government.

Governed by industry leaders, guided by government priorities, and managed by CTIA, the test-bed is the latest in a series of steps the industry has taken to make 5G the most secure network ever. Its founding members developed the initiative through their participation in CTIA’s Cybersecurity Working Group, which convenes the world’s leading telecom and tech companies to assess and address the present and future of cybersecurity.

The STB primarily focuses on verifying the Federal Communications Commission’s (FCC) Communications Security Reliability and Interoperability Council (CSRIC) VII recommendations for 5G networks. The FCC announced the working group members of the council last month. There are six CSRIC VIII working groups:

-Working Group 1 is centered on 5G signalling protocols security and is co-chaired by Brian Daly of AT&T and Travis Russell of Oracle.

-Working Group 2 focuses on promoting the security, reliability, and interoperability of Open RAN equipment. It is co-chaired by Mike Barnes of Mavenir and George Woodward of the Rural Wireless Association.

-Working Group 3 focuses on using virtualization to promote security and reliability in 5G, co-chaired by Micaela Giuhat of Microsoft and John Roese of Dell

-Working Group 4 is centered on 911 service over Wi-Fi and is co-chaired by Mary Boyd of Intrado and Mark Reddish of APCO.

-Working Group 5’s area of focus is on managing software and cloud services supply chain security for communications infrastructure; the group is chaired by Rittwik Jana of VMWare.

-Working Group 6 will work on issues surrounding the use of mobile device applications and firmware for wireless emergency alerts. It is co-chaired by Farrokh Khatibi of Qualcomm and Francisco Sanchez of Harris County, Texas’ OHSEM.

The STB will also serve as a valuable industry resource for CSRIC VIII, focused on 5G security, which launched in June, and includes CTIA SVP and CTO Tom Sawanobori among its members.

“This initiative will complement and bolster the FCC’s 5G security efforts, validate its recommendations, and demonstrate 5G security features, with cross-industry groups working collaboratively to test use cases and products on an actual 5G network using real-world hardware and software,” said Sawanobori.

The test bed’s first configuration, built with Ericsson equipment, mirrors the initial setup for most 5G networks—a 5G radio access network is connected to a 4G core to create a 5G non-standalone (NSA) network. In 2022, the STB’s configuration will shift to a 5G standalone (SA) network using a 5G core, which will enable testing of 5G SA use cases.

The STB is located at a secure lab facility at the University of Maryland, leveraging personnel with extensive experience in wireless security. The wireless core network is hosted in Northern Virginia by MITRE, a not-for-profit research and development company.

The 5G Security Test Bed’s evaluations and recommendations cover issue areas that will help transform cities, government, and industries. Applications include autonomous vehicles, immersive augmented reality and virtual reality, automated factory operations, private 5G networks for enterprises, and much more.

5G STB Member Quotes:

“We are excited to have a network dedicated to testing security, which is paramount for the success of 5G. This effort builds on the work underway in standards setting bodies, such as 3GPP, and will enable the industry to demonstrate 5G security in a real-word setting for consumers, enterprise businesses and government.” — Chris Boyer, VP, Global Security and Technology Policy, AT&T

“Ericsson has worked closely with operators to provide the latest equipment to expand secure 5G networks and devices across the nation. We are pleased to play a major role in this next critical step in ensuring robust 5G security for all users. Critical Infrastructure, in particular, must have secure and resilient communication end to end, while maintaining the trust and integrity of its supply chain. Ericsson is proud to be such a trusted supplier, as we provide much of that next-gen equipment from our 5G Smart Factory in Lewisville, TX and services from across the U.S.” —Jason Boswell, VP and Head of End-to-End Security, Ericsson North America

“5G is the most secure generation of wireless networks to date, and we are dedicated to enhancing those protections even further. We’re thrilled that the 5G Security Test Bed will provide an environment to assess potential threats to 5G security raised by security researchers.” — Drew Morin, Director, Federal Cyber Security Technology and Engineering Programs, T-Mobile

“The work being done by this collaborative group to evaluate and validate assumptions is important for protecting the integrity and security of 5G data. We’re looking forward to contributing to the security of 5G for consumers, business and government, now and as the technology continues to evolve.” — Narothum Saxena, Vice President of Technology Strategy & Architecture, UScellular

“Securing 5G networks is whole-of-nation problem with significant implications for our economic and national security that requires collaboration across industry and government. Ensuring the next generation of wireless networks is secure and reflective of democratic values will provide an invaluable foundation for further innovation.” — Charles Clancy, Senior Vice President, General Manager, and Chief Futurist, MITRE Labs

“At UMD, we pride ourselves on training the next generation of engineering leaders and conducting research that advances network and device performance and security. This industry collaboration greatly enhances our ability to meet those objectives.” — Wayne Phoel, Ph.D., Visiting Research Engineer, Institute for Systems Research, University of Maryland

Additional information about the 5G Security Test Bed and how to participate is available at www.5GSecurityTestBed.com.

About CTIA:

CTIA® (www.ctia.org) represents the U.S. wireless communications industry and the companies throughout the mobile ecosystem that enable Americans to lead a 21st century connected life. The association’s members include wireless carriers, device manufacturers, suppliers as well as apps and content companies. CTIA vigorously advocates at all levels of government for policies that foster continued wireless innovation and investment. The association also coordinates the industry’s voluntary best practices, hosts educational events that promote the wireless industry and co-produces the industry’s leading wireless tradeshow. CTIA was founded in 1984 and is based in Washington, D.C.

References:

https://techblog.comsoc.org/category/5g-security/

Will 2022 be the year for 5G Fixed Wireless Access (FWA) or a conundrum for telcos?

Lightshed Partners says absolutely! “This is the year for 5G Wireless Home Broadband,” as it emerges as a viable competitor to cable based Internet access.

The market research firm believes that the recent deployment of large blocks of spectrum by wireless operators will enable them to offer viable home broadband service to a notable segment of the market.

T-Mobile is already adding more than 200k home broadband subs per quarter, and Verizon is about to unleash rate plans that drop as low as $25/month. Verizon is also layering additional commission opportunities for their sales group. The vast majority of cell phone upgrades in the U.S. are still done in a cellular operator’s store. That provides wireless network operators with a familiar opportunity to sell home broadband and they are incenting their salesforce to do so.

Fixed wireless access (FWA) services into homes and offices, have approximately 7 million users around the U.S. The new efforts by Verizon and T-Mobile appear poised to push the technology into the cable industry’s core domain.

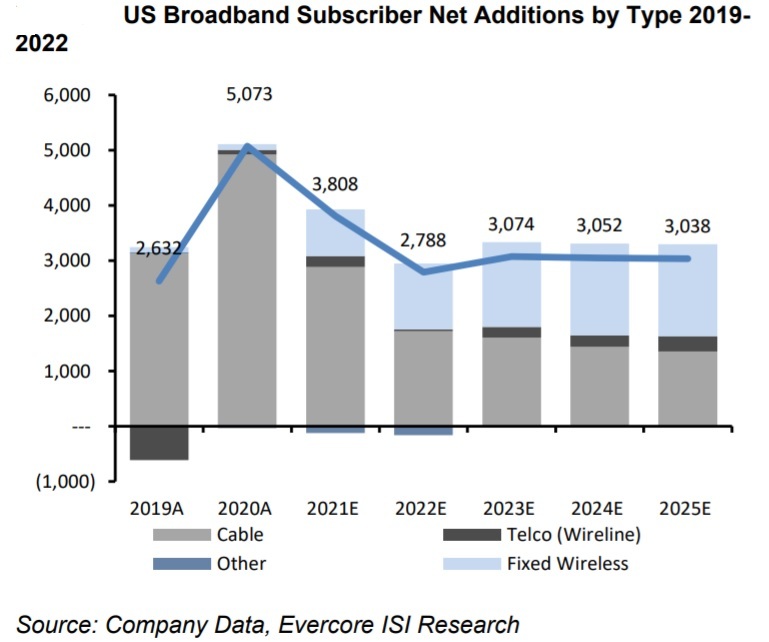

“We forecast that Verizon and T-Mobile will add 1.8 million wireless home broadband customers in 2022, more than doubling the 750,000 added in 2021,” the LightShed analysts forecast. “To put that growth in context, Comcast, Charter and Altice combined added 2.4 million broadband subscribers in 2021 and 2.7 million in 2019. Investors expect these three cable companies to add more than 2 million broadband subs in 2022, but even that reduced level of growth from recent years may prove to be too aggressive.”

5G fixed wireless access (FWA) services could serve 8.4 million rural households—nearly half the rural homes in the U.S.—with a “future-proof”, rapidly deployable, and cost-effective high-speed broadband option, according to a new Accenture study commissioned by CTIA, the wireless industry association.

Other analysts agree. “Fixed wireless probably cost Comcast and Charter, in aggregate, about 180,000 subscribers in the second half of 2021,” wrote the financial analysts at Sanford C. Bernstein & Co. in a recent note to investors.

“The great risk seems to lie in late 2022 and 2023. As Verizon, T-Mobile and AT&T deploy initial and subsequent blocks of C-band spectrum and as T-Mobile expands its 2.5GHz coverage to the last 1/3rd of US households, the availability of fixed wireless should expand,” Bernstein analysts wrote.

The financial analysts at Evercore predict that FWA services will gain a growing share of U.S. broadband new subscribe additions. Light Reading’s Mike Dano wrote the reasons are as follows:

- Verizon and T-Mobile are in the midst of deploying significant amounts of new spectrum into their networks. The addition of C-band spectrum (for Verizon) and 2.5GHz spectrum (for T-Mobile) will give them far more network capacity. And that’s important considering the average Internet household chews through almost 500 GB per month, according to OpenVault. The average smartphone user, meanwhile, consumes just 12 GB per month, according to Ericsson.

- Verizon and T-Mobile have finally shifted their FWA offerings from the test phase into the deployment phase. Although Verizon has been discussing FWA services for years, it finally started reporting actual customer numbers late last year (it ended the third quarter of 2021 with a total of 150,000 customers). Similarly, T-Mobile first outlined its FWA strategy in 2018, but officially launched its 5G FWA service in April – the company ended 2021 with 646,000 in-home Internet customers, well above its goal of 500,000. And both companies have recently cut FWA prices.

- The cable industry appears to be in the early stages of what MoffettNathanson analyst firm described as the “great deceleration.” According to the principal analyst Craig Moffett, this cable industry slowdown stems from such factors as a decrease in the rate of new household formation, increased competition from fiber providers – and FWA. He described the situation as a “concerning issue for cable investors, particularly if it appears that this is just a taste of what lies ahead.”

However, Craig is not convinced that FWA from telcos will mount a serious threat to cablecos Internet, partly because of capacity challenges operators will face as they bring subscribers onto the platform. They also wonder if it makes sense for mobile operators to get too aggressive with FWA, considering the much higher value on a per-gigabit basis they get from their respective mobile bases.

MoffettNathanson does acknowledge that both Verizon and T-Mobile have ramped up their focus on FWA even as AT&T takes a more cautious, targeted approach. Last week at an investor conference, AT&T CEO John Stankey said:

I believe that having some fixed high bandwidth infrastructure is going to be essential to being an effective networking company moving forward… Is fixed wireless going to be the best way to get a lot of bandwidth out to less densely populated rural areas? Yes, it probably will be. So is there a segment of the market where fixed wireless will apply and be effective? Sure, it will, and we’ll be in a position to have the right product to address those places.

But I don’t want to just simply say, well, that is the single solution that’s going to deal with what I would call the 70% of the business community, the 70% of the consumer population that are going to be pretty intensive users in some location, indeed, to have fixed infrastructure to support that over the long haul, given all the innovation that’s going to come……I see an opportunity for us to be very targeted and very disciplined around what we do (in FWA) and what used to be I hate using the term but traditional out of region markets, where good fiber deployment that supplements the strength of our wireless network.

Moffett wrote in a note to clients today:

There’s been a sea change in the rhetoric about fixed wireless broadband. We’re admittedly still struggling to understand it.

Until recently, Verizon and T-Mobile had, by turns, swung between aggressiveness and reticence. Investors will recall that in 2018, Verizon made bold claims about millimeter wave-based FWA. T-Mobile was rather skeptical at the time, not just about mmWave but even about FWA-over-mid-band. By 2019, Verizon had pulled in their horns, just as T-Mobile was first committing to bring FWA to rural Americans in a bid to sell their Sprint merger to regulators. At the start of last year, when all three of Verizon, AT&T, and T-Mobile held analyst days, T-Mobile upped the ante, forecasting 7-8M FWA customers by 2025. But Verizon was by then more cautious, committing only to a paltry $1B in revenue by 2024 (equating to perhaps 1.7M customers) and warning that their participation would be back end loaded. And AT&T was more cautious still, arguing that the capacity utilization implications made FWA unattractive.

Now, for the first time, Verizon and T-Mobile are pounding the table at the same time. What has changed? And what does it mean for the many plans for fiber overbuilds?

First, it’s important to consider the network capacity implications of fixed wireless. Most investors understand that the burden of serving homes with a wired broadband replacement is far greater than that of serving individual phones for mobility. But investors will also understand that network utilization isn’t uniform across all cell sites; there are cell sites with more excess capacity and there are cell sites with less.

The challenge for operators is to ensure that their FWA subscriptions fit as neatly as possible into the cell sites, or sectors of cell sites, with the most available capacity (a cell site will typically be divided into three sectors, each covering a 120 degree arc).

No operator wants to risk their high-value mobile service experience for the benefit of a few incremental low-value fixed subscriptions (as we’ll see shortly, the revenue per bit from a mobile customer is 30 to 50x higher than that for fixed).

Still, both T-Mobile and Verizon see FWA as promising. T-Mobile expects to have between 7 million to 8 million FWA subs by 2025, and views an addressable market of about 30 million homes that are suitable from a signal quality and capacity standpoint. T-Mobile has already noted that their 664K FWA customers include a mix of customers from relatively rural areas with limited or no wired broadband availability and those from suburbia who were previously cable subscribers.

Verizon, meanwhile, is committing to about $1 billion in FWA revenues by 2024, which MoffettNathanson equates to roughly 1.7 million customers (Verizon ended Q3 2021 with about 150,000 FWA subscribers).

Craig questions whether there’s enough bandwidth to go around to fulfill subscriber targets, and if getting aggressive with FWA makes business sense. He indicates that 5G telcos are getting desperate to find revenues after spending billions of dollars for licensed spectrum and 5G RAN buildouts.

With tens of billions of dollars of investment in spectrum already sunk, and with tens of billions more to come for network densification, one might imagine that carriers are desperate to find a more tangible revenue opportunity than one that depends on beating Amazon AWS at what is essentially just a next iteration of cloud services.

And when all is said and done, Craig is as puzzled as this author:

As we said at the outset… we’re struggling to understand. We’re struggling to understand why Verizon and T-Mobile suddenly see this (FWA) relatively low value use of network resources as attractive. We’re struggling to understand how, after an initial burst of growth, they will sustain that growth as sectors “fill up.” We’re struggling to understand why they have set such ambitious targets so publicly. And we’re struggling to understand why cable investors have come to expect that deployments of FWA and fiber should be treated as independent, or additive, risks. It doesn’t seem, to us, that it all adds up.

Opinion: We think an undisclosed reason for telco interest in FWA is that 5G mobile offers few, if any advantages over 4G and there is no roaming. Therefore, the 5G enhanced mobile broadband use case will continue to fail to gain market traction. 5G FWA can work well with a proprietary telco/cloud native 5G SA core network which could be shared by both 5G mobile and FWA subscribers (perhaps using the over hyped “network slicing”). So even though FWA was NOT an ITU IMT 2020 use case, it still has a lot of room to grow into a revenue generating service for wireless telcos.

References:

MoffettNathanson research note (only available to the firm’s clients)

Complete and Comprehensive Highlights of AT&T CEO’s Remarks at Citi Conference

Georgia Tech harvests 5G network power for wireless device charging

The dense focus of 5G creates a significant amount of power, much of which goes unused, so the project created an antenna system that can harvest it. In essence, the Georgia Tech discovery helps funnel 5G waves to devices, so they don’t have to rely on batteries, said Aline Eid, senior researcher in the Athena lab, which studies technologies for electromagnetic, wireless, and other applications. In the future, electricity providers could even offer power on demand “over the air,” Tentzeris said. “5G is going to be everywhere, especially in urban areas,” he added.

Because 5G networks are specifically built for high-bandwidth connection, the U.S. Federal Communications Commission (FCC) has authorized them to focus power much more densely than 4G networks. That means the high-frequency network will have a great deal of unused power that—unless “harvested”—will be wasted, he said.

That harvested energy could fuel the many battery-powered devices around us, like the sensors that help make up the IoT and that monitor conditions in homes, cities, autonomous cars, and even—via wearable electronics—inside our bodies.

“There’s been a lot of discussion of biomonitoring,” Tentzeris said. “In a wearable configuration, for monitoring glucose or blood pressure or sleep, you could have systems literally working for years and without the need for a battery charge.” The energy could be used for sensors in rugged environments where batteries aren’t an option, he added.

Power-as-a-service may well be a way for the telecom industry to supply electricity in the same way that many software makers today provide access to their applications in the cloud rather than through downloadable software, he added. Doing away with batteries will be a boon to the environment, Eid said.

“By 2025 you’ll be surrounded by billions of devices. That is the promise of IoT,” she said. “Billions of devices means billions of batteries being continuously replaced and continuously discarded at a huge cost to our environment, while there is power all around us.”

In order for a world without batteries to come to pass, researchers needed to find a way to tap into the 5G network. The Georgia Tech researchers believe they’ve found a way to do that.

Like its predecessors, the 5G networks service areas are divided into small geographical areas called cells. An antenna in each cell sends out radio waves that connect all the 5G wireless devices in that cell to the internet and to cellphones.

“People have attempted to do energy harvesting at high frequencies like 24 or 35 gigahertz before,” Eid said. But the antennas used only worked if they had line of sight to the base station.

Now, she and her colleagues developed a small, flexible Rotman-lens-based rectifying antenna (rectenna) system, capable, for the first time, of millimeter-wave harvesting in the 28-GHz band.

But to harvest enough power to supply low-power devices at long ranges requires antennas with large apertures. The problem with the larger antennas required to harvest 5G power is they have a narrowing field of view, which hinders operation from a 5G base station. In other words, the larger antennas cannot get a line of sight onto the 5G base stations, which exist in many more locations than those for 28G bands.

The Georgia Tech researchers created a system with a wide angle of coverage, which solves the problem of only being able to look from one direction, said Jimmy Hester, senior lab advisor.

“With this innovation, we can have a large antenna, which works at higher frequencies and can receive power from any direction. It’s direction-agnostic, which makes it a lot more practical,” he said.

The key to seeing in many directions is the researchers’ optical lens as an intermediate component between the receiving antennas and the rectifiers.

Operating just like an optical lens, their Rotman lens can see six fields of view at the same time. The Rotman lens is key for beam-forming networks and is frequently used in radar surveillance systems to see targets in multiple directions without physically moving the antenna system, Tentzeris said.

For their 5G device, they’ve devised a way to print the antennas and to tune the shape of the lens, which results in a structure with one angle of curvature on the beam-port side and another on the antenna side. This enables the antenna to map a set of selected radiation directions to an associated set of beam-ports; to “see” in six directions, he added.

Prototype of mm-Wave Energy Harvester. Image Credit: Georgia Tech

Incorporating 3-D printing into their technology, the researchers printed the palm-sized wave harvesters on many types of everyday flexible and rigid substrates. Providing 3D and inkjet printing options will make the system more affordable and accessible to a broad range of users, platforms, frequencies, and applications, Hester said.

For instance, the harvester on a wearable device would ensure it has the energy to keep counting your steps. In demonstrations, Georgia Tech’s technology achieved a 21-fold increase in harvested power compared with another harvesting device, Eid said.

“With this innovation, we can have a large antenna, which works at higher frequencies and can receive power from any direction. It’s direction-agnostic, which makes it a lot more practical,” noted Jimmy Hester, senior lab advisor and the CTO and co-founder of Atheraxon, a Georgia Tech spinoff developing 5G radio-frequency identification (RFID) technology.

“I’ve been working on energy harvesting conventionally for at least six years, and for most of this time it didn’t seem like there was a key to make energy harvesting work in the real world, because of FCC limits on power emission and focalization,” Hester said. “With the advent of 5G networks, this could actually work and we’ve demonstrated it. That’s extremely exciting — we could get rid of batteries.”

This work was supported by the Air Force Research Laboratory and the National Science Foundation (NSF) – Emerging Frontiers in Research and Innovation program. The work was performed in part at the Georgia Tech Institute for Electronics and Nanotechnology, a member of the National Nanotechnology Coordinated Infrastructure (NNCI), which is supported by the NSF (Grant ECCS-1542174).

References:

https://www.asme.org/topics-resources/content/harnessing-5g-excess-energy-could-end-battery-power

https://rh.gatech.edu/news/645735/leveraging-5g-network-wirelessly-power-iot-devices

A. Eid, et al., “5G as a wireless power grid.” (Scientific Reports, 2021) https://doi.org/10.1038/s41598-020-79500-x

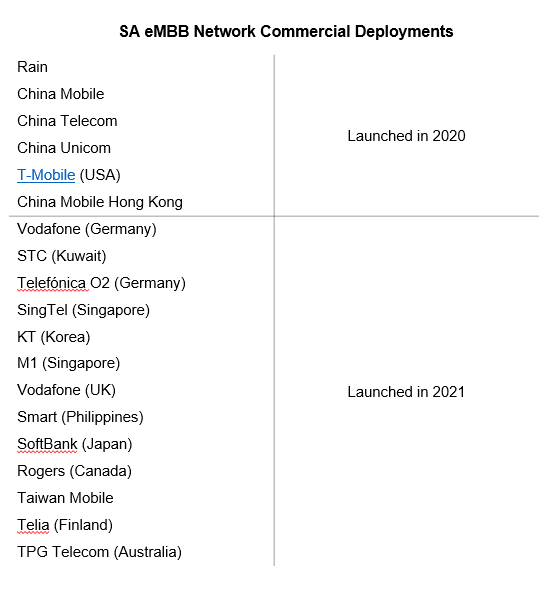

GSA: 200 global operators offer 5G services; only 20 (Dell’Oro says 13) have deployed 5G SA core network

200 global network operators in 78 countries are offering 5G mobile and/or fixed wireless services at the end of 2021, according to the GSA. 487 operators in 145 countries are investing in 5G, including trials and spectrum license acquisitions, up from 412 operators at the end of 2020.

Notably, only 187 of the operators offering 5G services provide 5G mobile services, in 72 countries. The others are delivering 5G fixed-wireless access (even though it’s not an IMT 2020 use case). In total, 83 operators in 45 countries/territories have launched 3GPP-compliant 5G fixed-wireless access services.

Only 99 operators in 50 countries are investing already in 5G standalone (SA) core network, which includes those planning/testing and launched 5G SA networks).

GSA has catalogued just 20 operators in 16 countries with 5G standalone deployed/launched in public networks.

13 January 2022 update from Dave Bolan of Dell’Oro Group:

We count 13 CSPs that commercially deployed 5G SA networks for enhanced Mobile Broadband (eMBB) in 2021, and they were nowhere close to the aggressiveness in breadth and depth of the buildouts that we saw by the Chinese Service Providers in 2020, or for that matter in 2021. We thought all three CSPs in Korea would have launched by now, but so far only KT has launched.

And we expected AT&T and Verizon in the U.S., and the CSPs in Switzerland to have launched 5G SA in 2021. In spite of these disappointments, the projected growth rate for 2021 is 61% Y/Y for 2021 and lowering to 18% Y/Y for 2022 due to the expected decline in growth rate by the Chinese CSPs.

The 5G device market is growing much more quickly. The GSA counted 1,257 announced devices at year-end, up nearly 125 percent from 2020. Around half (614) are 5G phones, up more than 120 percent from 278 at the end of 2020.

In total, 857 of the devices are commercially available, up more than 155% from the 335 on the market at the end of 2020. GSA has identified 614 announced 5G phones, up more than 120% from 278 at the end of 2020.

References:

https://gsacom.com/technology/5g/

GSA: 5G Market Snapshot – 5G networks, 5G devices, 5G SA status

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

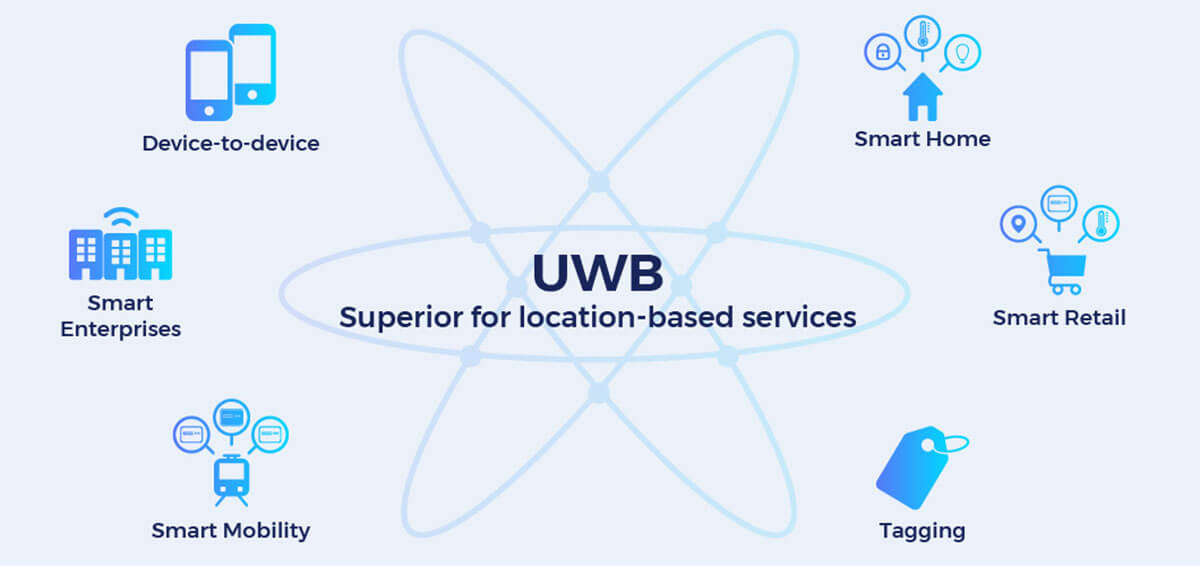

IEEE 802.15. 3 Ultra Wideband (UWB) technology, consumer applications and use cases

Ultra Wideband (or UWB) is a fast, secure and low power radio technology used to determine location with precise accuracy unmatched by any other wireless technology. While similar to Bluetooth, it is more precise, reliable and effective.

UWB was standardized by IEEE 802.15 Working Group in June, 2020 as per:

IEEE 802.15.4z-2020 – IEEE Standard for Low-Rate Wireless Networks–Amendment 1: Enhanced Ultra Wideband (UWB) Physical Layers (PHYs) and Associated Ranging Techniques

This amendment enhances the UWB PHYs with additional coding options and improvements to increase the integrity and accuracy of ranging measurements. It also enhances the MAC to support control of time-of-flight ranging procedures and exchange ranging related information between the participating ranging devices.

Figure 1. Ranging time structure for beacon-enabled ranging

Figure 2. Distance commitment principle and RF integration window ………………………………………………………………………………………………………………………..

The UWB frequency range is between 3.1 and 10.6 GHz. UWB can determine the relative position of other devices in the line of sight up to 200 meters. While short range is a drawback for many applications, it’s not an issue when you have two UWB devices in close proximity of each other.

UWB’s low-power signals cause little interference with other radio transmissions and can effectively measure distance with an accuracy up to 10 cm (3.9 inches). Decawave’s UWB chip promises accuracy even up to 2 cm (0.78 inches) in indoor environments. To compare Wi-Fi and Bluetooth accuracy is only up to 1 meter (39 inches) provided there are no obstructions.

………………………………………………………………………………………………………………….

In 2002 the Federal Communications Commission (FCC) authorized the unlicensed use of UWB. As a result, UWB was used in military radars and was even briefly used as a remote heart monitoring system. However, the cost of implementation was relatively high and performance lower than expected, which limited the use of UWB in consumer products. Today, ultra-wideband chips are cheap and small enough to put them inside other devices like smartphones.

UWB applications enable a lot of new services for consumers and enterprises like accurate indoor location and positioning, providing context aware information and precise analytics in real time. One of them is digital car keys, as explained in a new whitepaper from the Car Connectivity Consortium (CCC).

UWB-compatible chips have the acuity to determine the location of an object to within a centimeter, says Daniel Knobloch, a wireless engineer at BMW and president of the Car Connectivity Consortium. That group has incorporated UWB into its standard, finalized in May of 2021, for opening and starting a car with any smartphone.

CCC’s Digital Key is a standardized technology that enables mobile devices to store, authenticate, and share digital keys for vehicles in a secure, privacy-preserving way that works everywhere. Backed by backed by Apple, Google, BMW, Volkswagen and others, Digital Key is designed to let anyone with a late-model smartphone or Apple Watch unlock and start their cars simply by walking up to them. It could make it easy for us to control any connected light, lock, speaker or other smart-home gadget simply by pointing at it with our phone or watch.

Many newer cars have keyless entry systems. This consortium’s new standard enables a vehicle to unlock when a person with a UWB smartphone walks within a certain number of feet of a car. Because access to the car is entirely through a smartphone, it can also be transferred, which could make picking up a rental car at the airport as simple as tapping on a link in a text or email to transform their phone into a “key.”

“The CCC brings together an incredibly unique group of like-minded companies, many of which are natural competitors, in order to deliver a universal digital key capability to the world’s transportation industry,” said Daniel Knobloch, president, CCC. “The strength of this digital key ecosystem rests with our member companies who are sustaining and advancing this interoperable digital key for the future of mobility. I’m confident of their commitment to our mission.”

…………………………………………………………………………………………………………….

While UWB is still in its early days for consumers, it is already embedded in smartphones and being used in selected applications. The UWB microchips and antennae that have been in every model of iPhone since the iPhone 11 (launched in 201), as well as newer smartphones from Google, Samsung, Xiaomi, Oppo and others. It’s also been in the Apple Watch since 2020’s Series 6 model.

UWB applications include iPhone owners finding their AirTags, sharing files via AirDrop, or amusing their friends with a party trick you can only do with Apple’s HomePod Mini. Owners of newer Samsung phones are using UWB when they find their Galaxy SmartTag+, that company’s answer to AirTags.

The FiRA Consortium is developing UWB specifications and certification programs ensuring interoperability among chipsets, devices, and solutions. They say, “UWB is the most effective available technology for delivering accurate ranging and positioning in challenging real-world environments, allowing devices to add real-time spatial context and enabling new user experiences.”

FiRA is developing additional use cases for UWB, including: SMART CITIES & MOBILITY, SMART BUILDING & INDUSTRIAL, SMART RETAIL, and SMART HOME.

………………………………………………………………………………………………………..

“UWB was developed over the past decade as a way to very precisely locate any object in three-dimensional space,” says Dr. Ardavan Tehrani, who is part of a working group at FiRa and also works for Meta Platforms, the company formerly known as Facebook, in a division called Reality Labs.

Previous attempts to track location indoors with existing wireless technologies, like Wi-Fi and Bluetooth, fell short because they were never intended for anything but transferring data, Tehrani said.

UWB, by contrast, triangulates the position of an object by measuring how long it takes radio waves to travel between devices and beacons. It’s a bit like the Global Positioning System (GPS) technology we use for things like Google Maps, except that GPS involves one-way transmissions from satellites to receivers listening on earth.

For example, UWB enables two-way communications between the chip inside a smartphone and another UWB device. These beacons can be small—the AirTag is roughly the size of four U.S. half-dollar coins, stacked—and last for years on a single battery. But the technology requires at least a few such beacons nearby for a device to locate itself inside a room.

UWB could allow paying at a store checkout without having to figure out exactly where on a payment terminal to mash one’s phone or watch, and entering a building without ever having to swipe a keycard.

A laptop equipped with UWB could recognize that its owner is sitting in front of it, by listening for the signal from her smartphone or smartwatch. It could then automatically log in to any service that person is authorized to use, possibly eliminating the need for passwords, says Dr. Tehrani.

Making smart homes easier and more intuitive to use is another emerging UWB application. Bastian Andelefski, an iOS developer in Germany, has demonstrated its potential. In a YouTube video, he showed his ability to point his iPhone at any of the smart bulb-equipped lamps in his home, and turn them on or off with a single tap, rather than opening an app and scrolling to the appropriate light, as happens today.

Making this work was expensive and complicated, says Mr. Andelefski, and his hacked-together system is hardly ready for nontechnical users. But with more and more companies rolling out affordable beacons, it’s the sort of thing that could be available to consumers sooner rather than later.

UWB has a lot of room to improve, and many more applications could arise as a result, says Dinesh Bharadia, an assistant professor at University of California, San Diego, whose lab works on wireless communications and sensing. In research announced in September, his team demonstrated that, using a new kind of beacon, the speed of UWB could be increased by about a factor of 10, while the amount of power it consumes could be decreased by the same amount.

The resulting improvements, which would require only a software update to existing smartphones that use UWB, could allow an object to be located in space every millisecond. This would allow real-time tracking of VR and AR headsets, robots and other automation, pets and livestock, boxes in a warehouse, and anything else to which an AirTag-type UWB device could be attached.

That UWB could be used for so many different applications doesn’t mean that it will be, cautions Dr. Bharadia. One application for which previous indoor-localization technologies have been touted—maps that help us navigate inside buildings, or direct us to the right item on a grocery shelf—have failed for years. There are two reasons for this, says Dr. Bharadia, neither really technological: No one has figured out how to make money from indoor mapping, and users don’t seem to really care about a technology that can be replaced by something as simple as adequate signage.

A third reason indoor localization technologies might have failed until now is privacy. Mr. Andelefski found, when using Apple’s own UWB technology, that there are many ways the iPhone’s software and hardware limit a developer’s access. Part of this he attributes to the need to maintain user privacy, and to protect data as sensitive as the precise location of their devices.

Indeed, recent reports of people using Apple AirTags to track cars before stealing them, and to stalk others, show just how sensitive this data can be.

Privacy is a “key consideration” of how the company’s UWB-based technology works, and how developers are allowed to use it, says an Apple spokesman. For example, apps can only use the phone’s UWB-powered location tech when they’re open, and after a user grants permission, so it isn’t possible for apps to track a user’s location in the background, he adds.

“UWB is enabling more accurate location data, and how it’s protected is up to Apple, Google and others,” says Mickael Viot, a member of the marketing working group at the FiRa consortium and also a director of business development at U.S. semiconductor company Qorvo.

The ability to know precisely where they are might seem minor in the pantheon of our gadgets’ superpowers, which include near-instantaneous communication with any point on the globe, sophisticated digital photography, real-time health monitoring, high-performance gaming and the like.

Today, UWB is being used as a replacement for car keys and passwords, but in the future it could well be part of making important objects in the physical world announce their position and identity to our smart glasses and other augmented-reality interfaces, says Dr. Tehrani.

Comparison of UWB with Bluetooth Low Energy:

| # | UWB | Bluetooth (BLE Beacons) |

|---|---|---|

| Battery | Low consumption | Low consumption |

| Range | up to 200 meters (656 feet) | up to 70 meters (230 feet) |

| Accuracy | 10 centimeters (3.9 inches) | up to a meter |

| Cost | Low | Low |

| Best For | Proximity Marketing, Customer Analytics, Indoor Navigation, Smart Homes, Factory Automation, Asset-Tracking, Logistics | Proximity Marketing, Customer Analytics, Loyalty, Indoor Location |

References:

https://standards.ieee.org/standard/802_15_4z-2020.html

Car Connectivity Consortium Publishes White Paper on the Future of Vehicle Access with Digital Key

https://news.samsung.com/us/introducing-the-new-galaxy-smarttag-plus/

https://www.firaconsortium.org/

Ericsson and HERE partner for custom mine mapping technology using private mobile networks and location tracking

The Ericsson and HERE partnership, announced during CES 2022, will combine private mobile networks from Ericsson with HERE’s location technology, providing real-time customizable maps of mining projects.

The mining industry is in rapid modernization phase, with smart mining operations projected to increase threefold until 20251. A key driver of this transformation is the access to private cellular networks, enabling safer, more productive, and more sustainable mining operations, through reliable and low latency connectivity. Ericsson’s high-performance 5G private networks are purpose-built for mining operations. A business can deploy an on-premise cellular network for its exclusive use. For mining this includes facilities in very remote areas and underground tunnels, both of which are not typically within public cellular range.

The combination of Ericsson connectivity and HERE location services deliver true smart mining capabilities, from mapping private terrain, to pinpointing and navigating assets in real-time. By using location data to build continuously updated private maps on the HERE location platform, mining companies can create a canvas to improve operational efficiency and safety. The living map can then be used to search or track, and deploy routing powered by HERE, as well as custom-built applications and services.

“We are partnering with HERE because of the breadth of their location services – ranging from mapping to routing, positioning and asset tracking. Combining our advanced private network solutions with HERE services will give mining firms a head start on their digitalization journey,” said Thomas Norén, Head of Dedicated Network and Vice-President at Ericsson.

“We look forward to increasing the productivity and safety of the mining industry by bringing location services to Ericsson’s customers. With our private mapping capabilities, we enable mining companies to unleash the power of their location data in many important use cases,” said Gino Ferru, General Manager EMEAR and Senior Vice-President at HERE Technologies.

In summary:

- HERE is now part of Ericsson’s industry 4.0 partner ecosystem providing location services in combination with private cellular networks for mining operations.

- HERE map making enables mining companies to build custom maps of open pit mining operations.

- Mapping of mining sites helps increase safety, efficiency and sustainability by enabling asset tracking, fleet telematics and analytics.

Photo of a Mine with Staircase

…………………………………………………………………………………………………………………………………………………………………………………………………………….

The partnership becomes part of Ericsson’s growing Industry 4.0 ecosystem, which includes HERE alongside numerous additional technology partners, such as Cisco, Cradlepoint, Dell, and HPE. The value of automation, mapping, and other Industry 4.0 applications making use of the latest connectivity technology cannot be understated. An Ericsson report on ‘Connected Mining’ in December 2020 suggested that 5G private networks could see return on investment at mining operations reach 200% within 10 years, with smart mining operations themselves expected to triple by 2025.

About HERE Technologies:

HERE, the leading location data and technology platform, moves people, businesses and cities forward by harnessing the power of location. By leveraging our open platform, we empower our customers to achieve better outcomes – from helping a city manage its infrastructure or a business optimize its assets to guiding drivers to their destination safely. To learn more about HERE, please visit https://www.here.com and https://360.here.com.

About Ericsson:

Ericsson enables communications service providers to capture the full value of connectivity. The company’s portfolio spans Networks, Digital Services, Managed Services, and Emerging Business and is designed to help our customers go digital, increase efficiency and find new revenue streams. Ericsson’s investments in innovation have delivered the benefits of telephony and mobile broadband to billions of people around the world. The Ericsson stock is listed on Nasdaq Stockholm and on Nasdaq New York. www.ericsson.com

References:

https://www.totaltele.com/512092/Ericsson-and-HERE-partner-for-custom-mine-mapping-tech

Lumen’s big fiber roll-out push from 2.5M to 12M locations passed in the next few years

At the 2022 CitiApps Economy Virtual Conference yesterday, Lumen Technologies, Inc (formerly CenturyLink) President and CEO Jeff Storey said his company plans to increase its fiber deployments from 2.5 million locations to 12 million, which represents a five-times increase over the company’s traditional deployment rate. Storey said Lumen had been investing about 400,000 new fiber locations passed every year. “We have been very strategic and targeted and micro targeted in our approach to. We wanted to build — all digital experience of the quantum fiber platform, we’ve done that our NPS scores are really, really exceptional for quantum fiber. And so we’ve proven that we can build successfully, we proven that we can deliver successfully, and built all of the systems around the customer unnecessary to do that. So we’ll continue to invest there.”

Storey did not state how many years it would take company to reach 12M locations passed.

Separately, Lumen is expecting to close a sale of its local exchange business (formerly US West) to Apollo Funds in the second half of the year, which means it will retain mostly markets in metro areas. “We’ve rewritten the consumer playbook,” said Storey, noting that the company is now positioned as an “all-digital fiber brand.”

Like other broadband providers that have relied, in large part, on traditional copper network infrastructure, Lumen has been losing broadband customers in recent years. The company hopes that its investment in fiber will reverse that trend and has set a goal of returning to revenue growth within two to three years.

“Fiber wins. If you are competing with any other technology, fiber wins. And we’ll continue to deliver the majority of our services over fiber infrastructure and integrate those capabilities into an all digital experience. And when you do that, I think Lumen wins.” Storey said.

Lumen’s office building at 1025 Eldorado Blvd, Broomfield, CO 80021

……………………………………………………………………………………………………………………………………………………………..

Not surprisingly, considering Lumen’s emphasis on the business market for telecom services, Storey went on to note several advantages that are likely to be most appealing to business customers. In particular:

Fiber and data communications are more important than ever. But we don’t just look at it as data growth opportunity. For example, enterprises are shifting. I already said this, but more and more to hybrid environments. With hybrid employees, hybrid computing, hybrid network connect those employees, the computing, the applications that they use in the most sensible manner.

We look at combining our fiber infrastructure with capabilities like SASE, edge computing, and dynamic connections. Dynamic connections is really our network as a service capability. We create hybrid computing and networking environments that empower the enterprises to acquire, analyze and act on their data.

And looking over the Lumen platform, we enable new technologies and expanding our addressable market and we believe we’re in a great position to deliver. At the beginning of last year, we announced we’d have edge computing resources within five milliseconds, from 95% of U.S. enterprises. By the end of the year, we actually completed that somewhere in the middle of June, July, and today we’re around 97%. So we believe we have a great infrastructure tightly coupled with our fiber capabilities and we think there’s a great opportunity. Lumen and industry analysts agree, that is a major opportunity with 10s of billions of dollars in revenue potential. But it’s more than focusing on one product. It’s our ability to combine our services into holistic solutions for our enterprise customers.

Because we are a fiber-based platform… bringing our services to our customers with the connectivity of the fiber but also to cloud service providers, major data center providers,…private data centers of our customers [and] to eyeball networks,” he said, “we are in an excellent position to… help [customers] acquire their data, analyze their data [from] all of these different cloud options… and then act on their data.

In his opening remarks, Storey summed up Lumen’s strategic plan for 2022:

Our top priority is revenue growth, and we’re very focused on that, 2022 will be somewhat an investment year for Lumen, something CapEx and OpEx. CapEx is generally success-based initiatives that we have. But OpEx is a little more proactive investing in things like product development, marketing, brand, and other go-to-market initiatives that we have. We will continue to focus on investing and augmenting the Lumen platform, we believe it’s a great way to enable new technologies and expand our capabilities and our addressable market. We’ve already announced our accelerated quantum fiber bill, and plan to add more than 12 million locations over the coming years in the remaining 16 states that we operate in the states.

Lastly, we continue to invest in transforming our business for better customer experience, and operational efficiencies. We’ve done a great job of improving our customer experience, at the same time taking costs out of the business by using the technologies that we sell to our customers and then using other technologies in our business direct.

This strong increase in fiber deployment echoes what was said earlier this week at the 2022 CitiApps Economy Virtual Conference from Scott Beasley of Frontier Communications and AT&T’s CEO John Stankey. Also, from MSO Cable One’s joint venture with three private equity firms.

References:

Lumen’s Fiber Internet Offerings: https://www.lumen.com/en-us/networking/business-fiber.html

Webcast Replay: https://kvgo.com/citi-apps-economy-conference/lumen-technologies-jan-2022

CEO: Lumen Plans Fiber Deployment Rate of 5x its Historical Rate