Month: January 2022

China’s answer to Starlink: GalaxySpace planning to launch 1,000 LEO satellites & deliver 5G from space?

Chinese state media is reporting that start-up satellite Internet firm GalaxySpace is planning to launch 1,000 low-Earth orbit (LEO) satellites, ultimately aiming to compete with SpaceX’s high-profile Starlink constellation.

GalaxySpace was founded in 2016. The company says it’s “committed to mass produce low-cost, high-performance small satellite through agile and fast-iterative development mode, and build the world’s leading LEO broadband satellite constellation and a global coverage with 5G communication network. Our mission is to improve the network connection condition of all regions and individuals, and to provide cost-effective, efficient and convenient broadband networks and services.Providing more accessible knowledge, more equal and extensive information, simpler and convenient communication and more development opportunities for everyone. The mission of GalaxySpace is to Creating global converged 5G communication network.”

Image Credit: GalaxySpace

According to the South China Morning Post (via Yahoo), the first batch of six satellites have already been produced, tested, and delivered to an undisclosed launch site. Beijing-based start-up GalaxySpace, has said it wants to extend China’s 5G coverage around the world and compete with Starlink, owned by Elon Musk’s firm SpaceX, in the market for high-speed internet services in remote areas. Of course, GalaxySpace’s new constellation of satellites will have quite a bit of catching up with Starlink, which has already launched around 2,000 LEO “birds,” with plans to increase the constellation size to 42,000. Starlink says they offer speeds of up to 110Mbps for consumer use.

According to Chinese media reports, GalaxySpace’s differentiating factor is that it will be the first constellation to deliver 5G connectivity to consumers, potentially offering download speeds of over 500Mbps. That’s an interesting claim, as there are no standards or implementation specs for 5G from anywhere in space. ITU-R M.2150 (formerly IMT 2020.specs) only covers terrestrial 5G services.

Naturally, like all satellite connectivity services, the quality of service will potentially be reduced significantly by poor weather. However, GalaxySpace claims that they will be able to deliver at least 80Mbps second even in the worst possible weather, according to their research.

5G is already prolific throughout China, according to the CCP (if you believe them). Recent figures suggest that by the end of 2021 there were 730 million 5G subscribers in China, over half the total population. As a result, GalaxySpace’s 5G services will likely be offered primarily to overseas companies as well as Chinese government and military activities.

But GalaxySpace is not China’s only growing broadband constellation. Both the Hongyan and Hongyun projects – owned by the state-owned China Aerospace Science and Technology Corporation and China Aerospace Science and Industry Corporation, respectively – have been launching test satellites since as early as 2018.

Hongyan is aiming for 324 total satellites in its constellation, while Hongyun will have 157, with the two constellations operating at different altitudes and with different frequencies.

In 2021, with Starlink’s rise to prominence, Chinese authorities were reportedly considering making “major changes” to both the Hongyan and Hongyun projects. What these changes might be is unclear, but it seems likely to be some sort of acceleration in deployment and perhaps scale; China has said repeatedly in recent month that it fears Starlink’s dominance of this emerging industry could represent a threat to national security, especially if these devices are being used clandestinely by the US military.

Last year, Zhu Kaiding, a space engineer from the China Academy of Space Technology, which is working with GalaxySpace on the project, wrote in an academic article that the rise of Starlink had caused a Chinese satellite production line to increase its productivity by more than a third.

In addition to commercial LEO satellite Internet service rivalry, China has identified Starlink, which has signed multimillion dollar contracts with the U.S. military, as a threat to China’s national security. In 2020, researchers with the Chinese National University of Defense Technology estimated that it could increase the average global satellite communication bandwidth available to the U.S. military from 5Mbps to 500Mbps. The researchers also warned that existing anti-satellite weapons technology would find it virtually impossible to destroy a constellation the size of Starlink.

Zhu Kaiding, a space engineer from the China Academy of Space Technology, which is working with GalaxySpace on the project, said the Chinese project was struggling to keep pace with Starlink, which according to Musk is producing six satellites a day.

Zhu did not disclose how quickly China was producing satellites, but in a paper published in domestic journal Aerospace Industry Management in October last year, he said the Starlink program had forced a satellite assembly line in China to increase its productivity by more than a third. Zhu and colleagues have said that more than half the routine checks carried out at the launch site of high-frequency operations have been cancelled to save time.

The new satellites also use many components produced by private companies that have not previously been involved in Chinese space projects – a move that helped reduce the total hardware price of a high-speed internet satellite by more than 80 per cent.

Zhu said that the race against Starlink had put enormous pressure on China’s space industry, because “the technology is complex, the competition fierce, the deadlines tight and the workloads heavy.”

It is likely that the number of civilian users of satellite internet service in China will be limited – most urban residents can access 5G through their phone and broadband services are available in most rural areas – so the most likely customers are overseas companies or the Chinese government and military.

……………………………………………………………………………………………………………………………………………………………………………………………………….

Stepping away from the geopolitical dimension of the satellite broadband space race, it is worth noting that the potential negatives for introducing such an enormous number of satellites into LEO could have for society, from Kessler syndrome caused by the build-up of space debris to the obstruction of terrestrial observatories. In fact, just this week there was a new study, published in The Astrophysical Journal Letters, suggests that Starlink satellites are hindering the detection of near-Earth asteroids.

“There is a growing concern about an impact of low-Earth-orbit (LEO) satellite constellations on ground-based astronomical observations, in particular, on wide-field surveys in the optical and infrared,” explained the study.

In 2020, SpaceX had responded to astronomers initial concerns about Starlink disrupting their imagine technology by attaching visors to their new satellites to dampen their brightness. This new study, however, would suggest that this problem is only going to be further exacerbated as the various players continue to launch devices into orbit throughout this year.

References:

https://www.totaltele.com/512227/Is-GalaxySpace-Chinas-answer-to-Starlink

https://www.yahoo.com/now/china-start-building-5g-satellite-093000905.html

http://www.yinhe.ht/aboutusEn.html

Starlink’s huge ambition and deployment plan may clash with reality

Ookla: Starlink’s Satellite Internet service vs competitors around the world

Starlink Internet could be a game changer with 100 megabytes per second download speed

PCMag Study: Starlink speed and latency top satellite Internet from Hughes and Viasat’s Exede

Starlink to explore collaboration with Indian telcos for broadband internet services

Dell’Oro Group, Kenneth Research and Heavy Reading’s optimistic forecasts for Open RAN

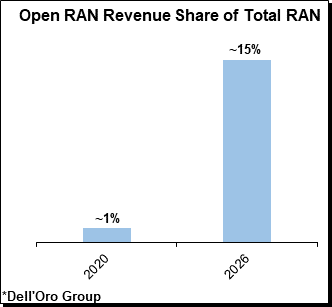

Dell’Oro Group recently published the January 2022 edition of its Open RAN report. Preliminary findings suggest that total Open RAN revenues, including O-RAN and OpenRAN radio and baseband, surprised on the upside both in 2020 and during 2021, bolstering the thesis that Open RAN is here to stay and the architecture will play an important role before 6G (this author disagrees).

- The Asia Pacific region is dominating the Open RAN market in this initial phase and is expected to play a leading role throughout the forecast period, accounting for more than 40 percent of total 2021-2026 revenues.

- Risks around the Open RAN projections remain broadly balanced, though it is worth noting that risks to the downside have increased slightly since the last forecast update.

- The shift towards Virtualized RAN (vRAN) is progressing at a slightly slower pace than Open RAN. Still, total vRAN projections remain mostly unchanged, with vRAN on track to account for 5 percent to 10 percent of the RAN market by 2026.

-Market.jpg)

The global open radio access network (O-RAN) market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Amongst the market in these regions, the market in the Asia Pacific generated the largest revenue of $70 Million in the year 2020 and is further expected to hit $8200 Million by the end of 2028. The market in the region is further segmented by country into Japan, South Korea, India, and the Rest of Asia Pacific. Amongst the market in these countries, the market in India is expected to grow with the highest CAGR of 102% during the forecast period, while the market in Japan is projected to garner the second-largest revenue of $1900 Million by the end of 2028. Additionally, in the year 2020, the market in Japan registered a revenue of $60 Million.

The market in North America generated a revenue of $50 Million in the year 2020 and is further expected to touch $7000 Million by the end of 2028. The market in the region is further segmented by country into the United States and Canada. Out of these, the market in the United States is expected to display the highest market share by the end of 2028, whereas the market in Canada is projected to grow with the highest CAGR of 137% during the forecast period.

Key companies covered in the Open Radio Access Network (O-RAN) Market Research Report are: Metaswitch Networks, Mavenir, NTT DOCOMO, INC., Sterlite Technologies Limited, Huawei Technologies Co., Ltd., Radisys Corporation, Casa Systems, VIAVI Solutions Inc., Parallel Wireless, Inc., NXP Semiconductors, and other key market players.

Reference:

https://www.kennethresearch.com/report-details/open-radio-access-network-o-ran-market/10352259

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

The latest Heavy Reading Open RAN Operator Survey indicates a positive outlook with real signs of momentum over the past year. Network operators and the wider RAN ecosystem are making steady progress, according to the survey results.

The first question in the survey was designed to help understand how operator sentiment toward open RAN has changed over the past year, in light of better knowledge of the technology, experience from trials, the increased maturity of solutions and changes in the policy environment. The figure below shows just over half (54%) of survey respondents say their company has not changed the pace of its planned open RAN rollout in the past year. There has been movement in the other half, split between those accelerating their plans (20%) and those slowing down (27%). This volatility essentially cancels out, and the overall finding is therefore that operators as a group are working at a steady, measured pace toward open RAN.

A steady outlook is a positive outlook at this stage of the market because it recognizes that open RAN is a major change in RAN architecture and is a long-term, multiyear exercise. After several years of inflated expectations, it is encouraging to see a measured perspective on open RAN coming to the fore.

n=82 Source: Heavy Reading

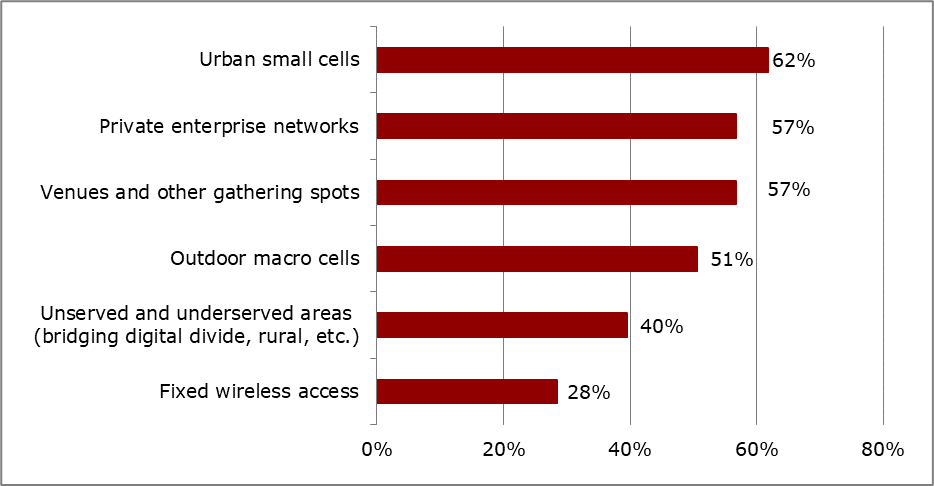

Another area of interest that helps gauge sentiment toward open RAN development relates to operators’ preferred use cases. The figure below reveals that operator intentions for how they will use open RAN are varied. Asked to select their top three use cases, 81 respondents representing 39 operators placed a total of 294 votes for an average of 3.6 per respondent, showing that there is no single open RAN use case or deployment scenario that stands out. Urban small cells (62%), private enterprise networks (57%) and venues and other gathering spots (also 57%) lead the responses.

n=81 Source: Heavy Reading

A positive way to interpret this finding is that open RAN is being pursued across a broad base of mobile communication scenarios. Once these models solidify and become “product ready,” then the market might see widespread adoption. Over time, open RAN could become the predominant mode of operation.

A less positive analysis, but one nevertheless worth considering, is that open RAN is a technology still in search of a solution. That is, the industry has committed to open RAN, and now it needs to find ways to make it work. Pursuing a diversity of use cases will help identify which are most promising and warrant investment and deployment at a wider scale.

It is notable that operator preferences for open RAN use cases have not changed much since Heavy Reading’s first survey in 2018; the same three use cases also led at that time. This reinforces the key message that open RAN progress is steady and consistent.

To download a copy of the 2021 Heavy Reading Open RAN Operator Survey, click here.

— Gabriel Brown, Principal Analyst, Heavy Reading

Reference:

https://www.lightreading.com/open-ran-steady-as-she-goes-/a/d-id/774765?

Ziply Fiber deploys 2 Gig & 5 Gig fiber internet tiers in 60 cities – AT&T can now top that!

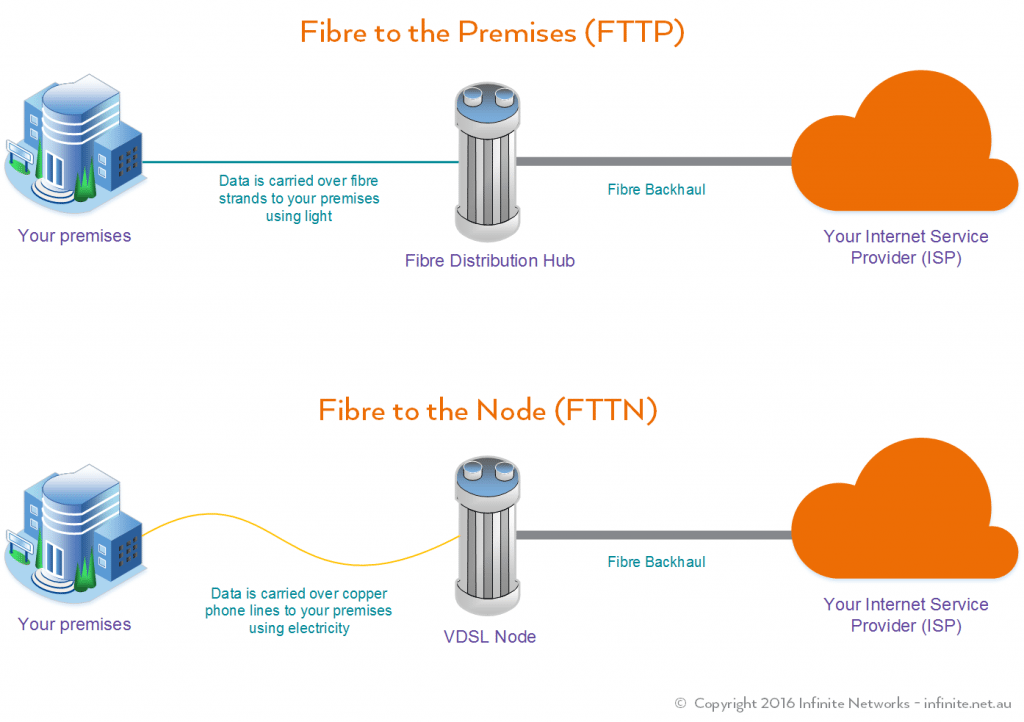

Ziply Fiber has launched two multi-gigabit, symmetrical broadband Internet tiers– at 2 Gbit/s and 5 Gbit/s – in 60 cities and towns in parts of Washington, Oregon, and Idaho. The two new fiber Internet service plans will initially be available to nearly 170,000 physical addresses in those three states. This comes after Ziply conducted a successful small market test in Kirkland, Washington. Customers in Montana will gain access to the multi-gig options later this quarter, with availability expected across most of the company’s existing footprint by the middle of the year.

Pricing for the 2-Gig tier runs $120 per month while the 5-Gig tier costs $300 per month. Both multi-gig tiers will require users to get a special router that includes WiFi 6 compatibility, a 10G WAN port and either a 2.5G LAN port for the 2-gig plan or a greater than 5G LAN port for the 5-gig option.

Ziply is the first among regional and national residential providers — those with a customer base of more than 1% of the US population — to deliver these speeds. By doing so, Ziply has become the fastest major internet provider not only in the Northwest, but across the entire U.S.

Ziply Fiber, formed in 2020 via the acquisition of Frontier Communications’ operations in Washington, Oregon, Idaho and Montana, expects to launch the new multi-Gig tiers to the rest of its footprint by the second quarter of 2022, and to make them available in every new fiber market launched thereafter, said Harold Zeitz, Ziply Fiber’s CEO.

Zeitz told Fierce Telecom that more than half of Ziply’s customers already take its 1 Gbps plan, “so we already have customers who seem to want faster speeds compared to others.” He added the December trial covered five markets across Washington and Oregon and included a sample group of “tens of customers” who proactively sought access to the faster speed tiers. “There were no problems whatsoever,” Zeitz said of the trial. “We were able to demonstrate measured speed and it gave us confidence to go ahead and launch it broadly.”

Ziply Fiber’s new uncapped and no-contract tiers follow the company’s ongoing deployment of a 10-Gig capable XGS-PON access network and underlying core network. Zeitz said the launches prove that consumers don’t have to live in a big city to get big speeds. “It’s a revitalization opportunity,” he said. “It demonstrates the future-proof element of the technology.”

The company also sells a 50Mbit/s tier for $20 per month and a 200Mbit/s service for $40 per month. Zeitz estimates that “well over half” of Ziply Fiber’s broadband customers choose the 1-Gig tier.

Zeitz said offering broadband without a cap or a contract puts welcome pressure on the company. “Yes, we think it’s a differentiator, but I also think it helps motivate us to make sure we’re delivering great service, he said.

Other Gig FTTP Internet competitors:

Ziply Fiber’s 5-Gig service appears to raise the bar on a fiber-to-the-premises (FTTP) residential broadband offering offered in multiple states. With the exception of Google Fiber and Xfinity, none of the top internet providers have dared to push the internet speed limit past a single gig. Google Fiber offers a 2-gigabit plan throughout most service areas while a limited few Xfinity customers can sign up for 3 gigs, but no 5 Gig yet. Among smaller regional players, EPB of Chattanooga, Tennessee, currently offers a residential 10-Gig service starting at $299 per month in select areas.North Dakota’s MLGC debuted a 5 Gbps service tier in 2020, while TDS rolled out a 2-gig offering and Dobson Fiber launched a 10 Gbps offering last year.

Here’s the current competitive status from nationwide FTTP providers:

- Comcast’s targeted residential FTTP service, Gigabit Pro, was recently upgraded to deliver speeds of 3 Gbit/s for $299.95 per month (with a two-year contract).

- Google Fiber has been expanding the availability of a fiber-based service that delivers 2 Gbit/s down by 1 Gbit/s up.

- AT&T has hinted that a multi-gigabit service is in the works, but has not announced pricing or launch timing.

Analysis:

The burning question this author has is how will Zipply customers use even a fraction of their allotted 2 Gig or 5 Gig upload and download speeds? I have over 10 connected WiFi devices in my home where my 100 Mb/sec download speed is sufficient.

“This is for people to develop new use cases, et cetera,” Zeitz concluded. “I think we don’t know all the things that people will do and so we’re an enabler.”

Also, the extra gear needed won’t be cheap. To open up any potential in-home bottlenecks, Ziply Fiber is recommending an Asus AX6000 Wi-Fi 6 router or a similar device. Customers will also need an SFP+ (enhanced small form-factor pluggable) with an RJ-45 connector that’s compatible with the router to deliver up to 5-Gig. Ziply Fiber is also selling such products online – an Asus router for $449.95, and the SFP+ for $42.99, or both bundled together for $492.94.

For the full 5-Gig, customers will need a wired Ethernet connection to the router. Depending on the performance capabilities the computer, a customer on Ziply Fiber’s multi-gig service will likely need an Ethernet adapter/dongle that supports 2.5-Gig or 5-Gig.

……………………………………………………………………………………………………………………………………………………..

24 January 2022 Update: AT&T can now equal 2 Gig and 5 Gig FTTP speeds

AT&T has boosted its existing fiber in parts of more than 70 metro areas around the U.S. to offer 2-Gig and 5-Gig symmetrical upload and download speeds.

“Where we’re launching 2-Gig and 5-Gig, we previously had 1-Gig speeds available,” said AT&T’s SVP of Broadband Product Development Cheryl Choy. The upgrades announced today affect about 5.2 million people out of about 16 million households that AT&T currently passes with gigabit speeds.

Asked why AT&T isn’t increasing speeds for all 16 million households that it passes with fiber, Choy said it’s because the company is “on a PON evolution.” It is in the process of moving from GPON to XGS PON via card upgrades and software improvements. These upgrades allow it to boost speeds above 1-Gig. Choy said that since 2019 all of AT&T’s newly laid fiber has been capable of multi-gig speeds.

Although the news of multi-gig fiber today did not require any new fiber to be laid, the company is also laying new fiber, and its goal is to cover 30 million customer locations with fiber by year-end 2025.

Pricing:

AT&T also announced it’s rolling out “straightforward pricing” across its AT&T Fiber portfolio. The 2-Gig fiber service costs $110 per month plus taxes with autopay; and the 5-Gig service costs $180 per month plus taxes with autopay.

Prices are a little higher for businesses at $225 per month for 2-Gig; and $395 per month for 5-Gig.

The company will not charge any equipment fees, nor will it require an annual contract or implement any data caps. The service also includes Wi-Fi.

Choy said, “We’ve amped up our Wi-Fi technology.” In late 2020 AT&T launched its Wi-Fi 6 enabled gateway, which provides more capacity for more connected devices. Those Wi-Fi devices will be able to take advantage of the new multi-gig speeds. AT&T’s Wi-Fi currently uses 2.4 Ghz and 5 Ghz spectrum.

According to a survey conducted in 2021 by Recon Analytics on behalf of AT&T, the average consumer has 13 connected devices in their home. But that’s expected to boom in the coming years, which will require more bandwidth.

Finally, as part of today’s news, AT&T said it has achieved up to 10-Gig speeds on fiber in its labs.

https://www.fiercetelecom.com/broadband/att-upgrades-its-fiber-network-offer-2-gig-5-gig-speeds

Ziply Fiber References:

https://www.fiercetelecom.com/broadband/ziply-debuts-2-gig-5-gig-internet-tiers-60-cities

https://www.broadbandworldnews.com/author.asp?section_id=733&doc_id=774718&

https://ziplyfiber.com/news/release/735

New Findings in Aryaka’s 2022 State of the WAN Report: Cloud Adoption, Hybrid Workplaces, Convergence of Network and Security with SASE

Overview:

Aryaka®, a leader in fully managed Cloud-First WAN solutions, today published its 2022 State of the WAN Report, offering a compendium of insights into global SD-WAN and SASE planning. 1,600 information technology (IT) enterprise decision makers across global enterprises answered the survey, the largest response to the survey since its inception.

Key trends identified in this year’s report include:

- A quarter of the respondents state they have closed 25-50% of their office sites, dovetailing into overall hybrid work initiatives where 75% state that at least a quarter of their employees will remain remote permanently post-pandemic.

- Accelerating digital transformation initiatives also impact legacy data centers, with 51% planning to eliminate their use within the next 24 months as they move to the cloud.

- The surveyed group says Microsoft Teams (58%) and Office 365 (55%) are among the most widely adopted SaaS applications, followed by Zoom and Google Docs (35%).

- A quarter of respondents expect budgets to grow by 25% or more in the next year, with a full three-quarters projecting at least a 10% growth. Investment appears to be accompanied via cost savings.

- A move to simplify, adopting a more cloud-centric and agile approach, is driving convergence. In the context of network and security, trends include the Secure Access Service Edge (SASE), with 64% deploying or planning to deploy over the next year. Over two-thirds will opt for a managed SASE to help address complexity and costs, but challenges include complexity at 40%, a single or dual-vendor approach at 39%, and developing a phased migration strategy at 33%. Observability and control should help with deployments, identified by over two-thirds as a top imperative.

- 29% state that they are already deploying what they consider to be a SASE architecture, with another 56% planning to deploy in the next 12-24 months.

- What capabilities do the respondence require? The top responses are SD-WAN at 34%, a Cloud Secure Web Gateway (SWG) at 30%, and Firewall as a Service (FWaaS) at 17%.

“This year’s Aryaka State of the WAN includes many valuable insights backing up trends we see in the industry. These include the effects of hybrid work, with 75% projecting a quarter of their employees to remain at least part-time remote, and cloud connectivity demands skyrocketing with 51% planning to move away from traditional data centers over the next two years. Both initiatives will require more sophisticated network-as-a-service (NaaS) solutions with integrated security offerings,” said Scott Raynovich founder and chief analyst of Futuriom.

“The sixth edition of the Global State of the WAN (SOTW) is one of the largest such surveys in the world,” said Shashi Kiran, CMO of Aryaka. “It packages an enormous number of insights from decisions makers from all over the world, drawn from CIOs, CISOs as well as network, security and cloud practitioners. The 2022 edition reveals new enterprise trends on workplaces, cloud adoption, convergence and several other areas putting a spotlight on the impact of the Covid-19 pandemic in the process. We hope this resource serves as a handy companion for enterprise architects engaged in planning their WAN, security and cloud infrastructure for years ahead.”

SD-WAN vendors have long touted the technology’s application- and policy-based routing capabilities as the antidote to network performance and complexity. However, customers are increasingly looking for ways to offload that complexity and consolidate services under a single roof. “There’s a fragmented value chain for SD-WAN, which we’ve seen before and now for SASE as well,” Kiran said.

Of those surveyed, 45% said they were considering a consolidated SASE architecture, up from 39% last year. However, enterprises’ desire for managed services doesn’t stop at SD-WAN or SASE. Respondents expressed a desire for managed last-mile and multi-cloud connectivity. “There is inherent complexity in all of these areas and having something that is managed and delivered as a service appears to be important,” Kiran said.

Year-on-Year Trends and Shifting Priorities:

In Aryaka’s 2021 State of the WAN Report, 21% indicated that half of their workforce would be working remote post-pandemic. This year that number increased by 11%, with 32% reporting that at least half of their workforce would be permanently remote.

Collaboration and Productivity suites have gained traction. The Microsoft suite has gained momentum, with Teams identified by respondents as the most deployed application, growing its footprint by over half, from 34% in 2021 to 58% this year. Conversely, Google Docs dropped from 41% last year to 35% today with Microsoft 365 now at 55%.

For China, basic connectivity concerns dropped noticeably from the last report, at 45% in 2021 to 30% today. In contrast, compliance and regulatory issues are now in the lead at 50%.

A renewed interest in ROI was reflected in this year’s report, with 36% of those responding having cost concerns, an increase of 16% compared to last year. Though budgets are expected to increase by 25%, both for networking and security, the focus on ROI implies that these increases must be spent judiciously.

IT professionals were less concerned vs previous years about the newness of the technology (28% vs 31% in 2021), and whether applications will perform properly (29% vs 36% in 2021), speaking to a greater confidence in application support. As change management takes priority, there is an increased focus on observability and control, increasing by 9% (69% vs 60% last year).

Aryaka 6th Annual State of the WAN 2022 – Four Themes:

1. Acceleration of Remote and Hybrid Work: The report looks at challenges in supporting the hybrid workforce, hybrid work trends, and investments planned to support this new environment. 75% state that at least a quarter of their employees will remain hybrid post-pandemic, aligned with the closure of physical facilities, with a quarter stating they have closed 25-50% of their office sites. Effectively managing worker movement between on-premises and remote requires dynamic bandwidth reallocation, identified by 61% as very important.

2. Application Performance and Consumption: In addition, the report dives into the diversity of applications in use and resulting challenges, how enterprises plan to address these, and potential concerns. As noted earlier, collaboration and productivity applications like Microsoft Teams and Office 365 experienced some of the strongest growth, but there was an overall uptick in SaaS application adoption including Zoom (35%), Salesforce (28%), and SAP/HANA (25%). Performance still must improve, with 42% identifying slow performance for remote and mobile users a key issue, followed by 37% calling out slow performance at the branch.

3. Managing Complexity and Managed Services Adoption: The report addresses what managed services enterprises expect, including SD-WAN and SASE implementation plans and budgets, as well as perceived barriers to adoption. This section also looks at MPLS migration. In evaluating managed services, enterprises continue to demand more from their providers, and are looking for a wider set of offers, an all-in-one SD-WAN and SASE that includes the WAN (45%), security (67%), application optimization (40%), last mile management (29%), and multi-cloud connectivity (27%). The movement to SD-WAN and SASE also follows the movement away from MPLS, with 46% planning to terminate some or all contracts over the next year. Enterprises are generally bullish on their budgets, with a quarter expecting it to grow by 25% or more, and a total of three quarters expecting at least 10% growth.

4. Networking and Security Convergence Including a SASE Architecture: SASE represents a promise of a converged Cloud-First architecture, but there are concerns on complexity and adoption. 42% state that lackluster application performance is a time sink, and 34% consider security to be a major priority. This path to SASE adoption includes setting a strategy (35%), phasing out of legacy VPNs (32%), as well as consolidating cloud security with zero-trust (29%).

Top desired capabilities include a SWG (47%), SD-WAN (36%), and FWaaS (28%). Implementation concerns identified earlier are balanced by expected advantages that include time and cost reduction (37%), as well as agility (33%), while decision-making is still mostly distributed across networking and security, 41% state it is now consolidated. Finally, over two-thirds plan to consume SASE as a managed offer.

What are the biggest challenges you’re facing with your WAN?

Total Responses 1,386

- High complexity/difficult to manage or maintain 37%

- Slow access to cloud services & SaaS applications 33%

- Slow performance of on-premises applications 32%

- Long deployment times to bring up new sites 29%

- Lack of adequate security 28%

- Poor voice or video quality 23%

- High cost 20%

- Lack of visibility 20%

*Respondents chose maximum three responses

–>The WAN continues to be a challenge, impacting manageability, performance, security, agility, and cost.

Study Methodology:

The Sixth Annual Global Aryaka 2022 State of the WAN study surveyed over 1600 enterprise decision makers and practitioners including CIOs, CTOs, as well as IT, network, and security managers. Respondents were based in the Americas, EMEA, and APAC, with their companies representing every vertical, led by technology, software, manufacturing, financial, and retail. The survey asked respondents about their networking and performance challenges, priorities, and their plans for 2022 and beyond.

Download the Report:

Download Aryaka’s 6th Annual State of the WAN Report here.

…………………………………………………………………………………………………………………………………………………………………………………………………..

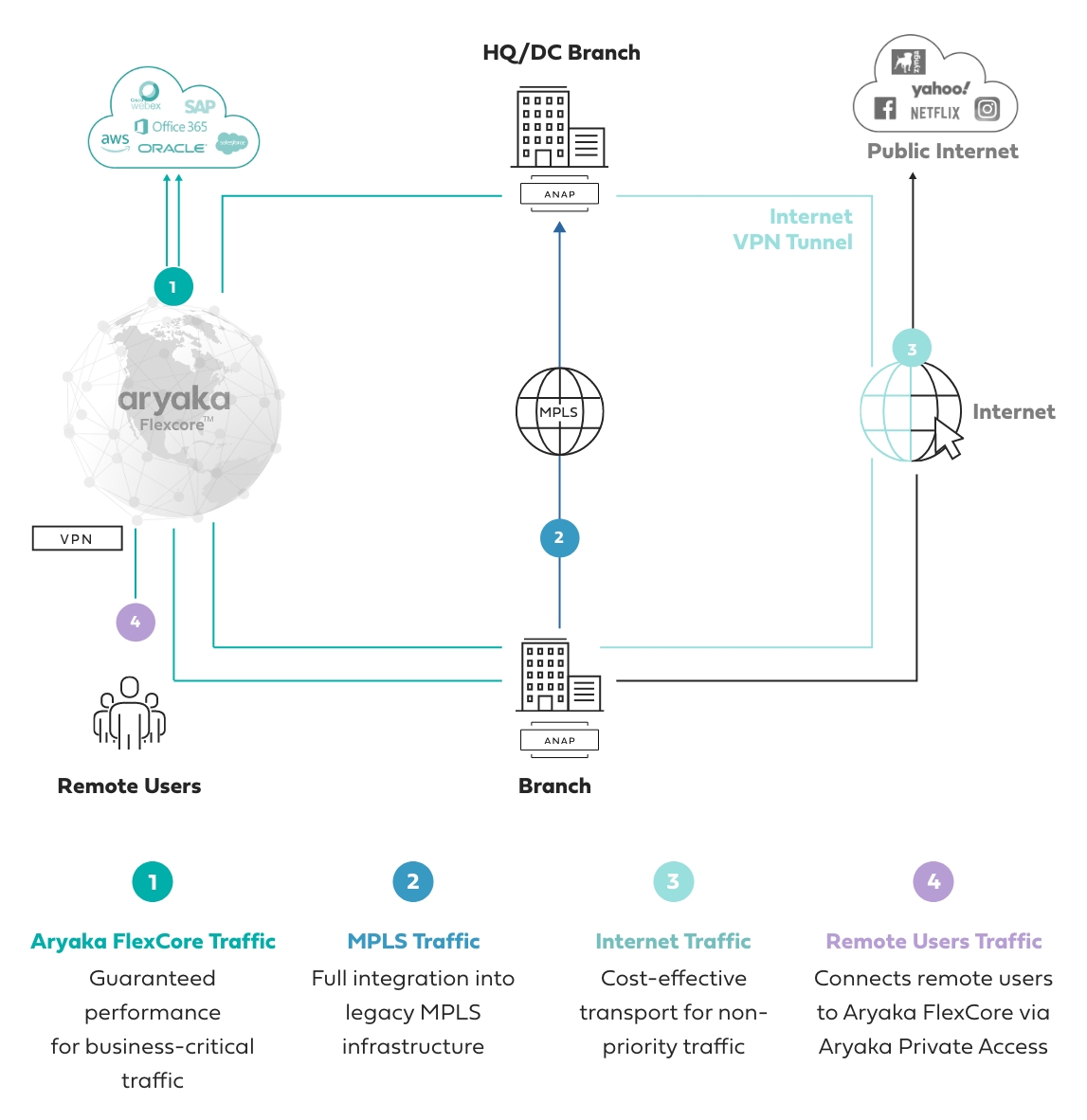

MPLS to SD-WAN Migration (Source: Aryaka):

Aryaka’s fully managed SD-WAN and SASE solution leverages a flexible core architecture, FlexCoreTM, optimized for per-site and per-application performance requirements. It offers full per customer resource reservation, end-to-end, at a global level. The HybridWAN solution also leverages direct MPLS and public internet connectivity options.

Aryaka manages the last-mile internet link performance with patented technology to eliminate packet loss and deliver on superior latency and jitter performance. By leveraging a private global L2 network, Aryaka eliminates the issue of guaranteeing deterministic QoS when multiple service provider administrative domains are involved (which is almost always the case in a global network).

Aryaka customers rely on its architecture to deliver on better-than-MPLS performance at a global level and at reduced cost, either augmenting the existing MPLS infrastructure or replacing it altogether over time.

Source: Aryaka

References:

Shift from SDN to SD-WANs to SASE Explained; Network Virtualization’s important role

Dell’Oro: SD-WAN market grew 45% YoY; Frost & Sullivan: Fortinet wins SD-WAN leadership award

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

The slow uptake of 5G Standalone (SA) networks is decreasing the growth for the overall Mobile Core Network (MCN), which also includes IMS Core and 4G Core (EPC). Dell’Oro Group [1.] forecasts worldwide MCN 5-year growth will be at a 3% compounded annual growth rate (CAGR).

- 5G MCN, IMS Core, and Multi-Access Network Computing (MEC) will have positive growth rates for the forecast period while 4G MCN will experience negative growth.

- By 2026, 99% of the revenue for network functions will be from cloud native Container-based CNFs.

Via email, Dave wrote: The journey for network virtualization started in 2015 with ETSI NFV. We went from Physical Network Functions (PNFs) to Virtual Network Functions (VNFs) to cloud-ready VNFs, to Cloud- Native VNFs (CNF), to Container-Based Cloud-Native VNFs. Container-Based (CNF) enable microservices.

…………………………………………………………………………………………………………………

Separately, the Global mobile Suppliers Association (GSA) recently wrote that only 99 operators in 50 countries are investing in 5G standalone (SA) core network, which includes those planning/testing and launched 5G SA networks.

The GSA said at least 20 network operators (Dell’Oro says 13) in 16 countries or territories are believed to have launched public 5G SA networks. Another five have deployed the technology, but not yet launched commercial services or have only soft-launched them. So only 20.6% of the 481 5G network operators (investing in 5G licenses, trials or deployments of any type) have deployed 5G and that percentage is lower if you go by Dell’Oro’s 13 5G SA network operators.

From GSA’s The Power of Standalone 5G – published 19th January 2022:

Importantly, the 5G standalone core is cloud-native and is designed as a service-based architecture, virtualizing all software network functions using edge computing and providing the full range of 5G features. Some of these are needed in the enterprise space for advanced uses such as smart factory automation, smart city applications, remote control of critical infrastructure and autonomous vehicle operation. However, 5G standalone does mean additional investment and can bring complexity in running multiple cores in the network.

This will be a potential source of new revenue for service providers, as digital transformation — with 5G standalone as a cornerstone — will enable them to deliver reliable low-latency communications and massive Internet of things (IoT) connectivity to customers in different industry sectors. The low latency and much higher capacity needed by those emerging service areas will only be feasible with standalone 5G and packet core network architecture.

In addition, the service-based architecture opens up the ability to slice the 5G network into customized virtual pieces that can be tailored to the needs of individual enterprises, while maximizing the network’s operational efficiency. Advanced uses for 5G NR aren’t backward- compatible with LTE infrastructure, so all operators will eventually need to get to standalone 5G.

Standalone 5G metrics:

- Volume: Gbps per month

- Speed: Mbps (peak), Mbps (guaranteed)

- Location: Network Slice, service per location

- Latency per service or location (dependent on URLLC in the 5G RAN and 5G Core)

- Reliability or packet loss

- Number of devices per square km

- Dynamic service-level agreements per location

- Full end-to-end encryption and authentication

Source: CCS Insight

……………………………………………………………………………………………………………….

Note 1. Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

………………………………………………………………………………………………………………….

Feb 8, 2022 Update from Dave Bolan of Dell’Oro Group:

As of December 31, 2021 there were 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

References:

Slow Uptake for 5G Standalone Drags on Mobile Core Network Growth, According to Dell’Oro Group

Why It’s Important: Rakuten Mobile, Intel and NEC collaborate on containerized 5G SA core network

T-Mobile US: 5G SA Core network to be deployed 3Q-2020; cites 5G coverage advantage

Heavy Reading: “The Journey to Cloud Native” – Will it be a long one?

Starlink’s huge ambition and deployment plan may clash with reality

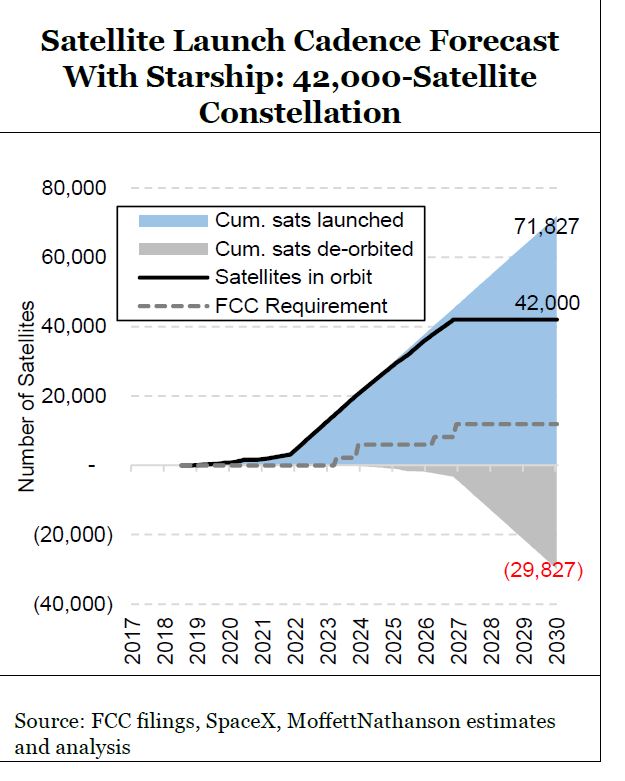

Starlink’s first mission of 2022 launched another 49 satellites into orbit, extending its grand total to nearly 2,000. But since completing its first orbital shell of about 1,600 satellites last May, “Starlink’s launch frequency has slowed dramatically with only four rocket launches over the past seven months, or roughly one every seven weeks,” explained Craig Moffett, principal analyst at MoffettNathanson in a note to clients. Craig wrote:

Starlink’s ambition is huge (a constellation of as many as 42,000 satellites). And the implied valuation for the still-private company is huge ($100B+ for all of SpaceX).

This “hugeness” has captured investors’ imaginations and no doubt hugeness itself is very much part of its appeal. But we haven’t yet seen investors come to grips with all of the implications of this bigness. We were struck by Elon Musk’s recent tweet conceding a “genuine risk of bankruptcy” – immediately dismissed by some as hyperbole – and it got us thinking about scale, and risk, in ways we really hadn’t considered before.

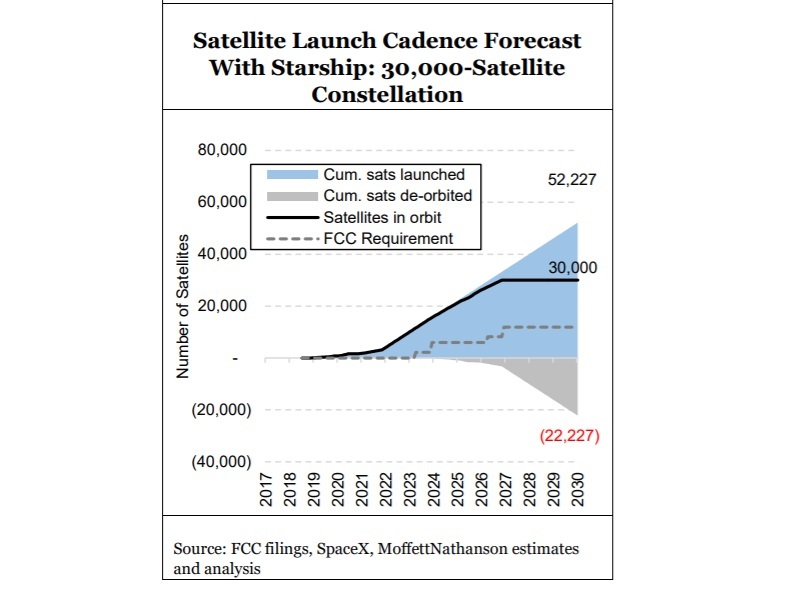

Moffett notes that the new Starlink V1.5 satellites are heavier, leading to fewer satellites per launch. “At a payload of 50 satellites per launch for Falcon 9 rockets – down from 60 per launch for V1.0 satellites – SpaceX would need to drastically increase launch frequency to once every seven days for five consecutive years just to launch the satellites required for their planned constellation of ~12,000 by their FCC deadline in 2027.”

In low-Earth orbit, satellites will drift back to Earth and burn up on re-entry. Assuming the satellites have an average lifespan of five years, the number of launches to simply replace expiring satellites will, by year five, be as large as the number of launches required over the next five years to grow the constellation. By the end of 2030, just nine years from now, they would have had to launch nearly 23,000 satellites in support of a 12,000 bird constellation. Assuming a Falcon 9 payload of 50 satellites, that would imply 48 launches each year – roughly one every seven days – just to sustain a constellation of 12,000 satellites even after the constellation is “finished.”

Privately held SpaceX (Starlink’s owner) will also need to strongly increase manufacturing capacity and manage tricky supply chain logistics to meet the needs for Starlink, as well as for SpaceX’s clients.

Based on $30 million per launch, Moffett estimates that it would cost about $15 billion to build a constellation of 30,000 satellites, with satellite replacement (production and launch) alone costing more than $3.6 billion per year. Please see chart below.

Starlink hopes to beef up its capabilities with Starship, a larger launch vehicle that’s had its share of problems, with an orbital test flight that could take place as soon as March. However, Craig suggests that Starship isn’t necessarily the answer to the problem, considering that new V2.0 satellites will be perhaps four times as massive as previous generation Starlink LEO satellites.

In November 2021, Elon Musk distributed a companywide email stating that a production crisis centered on the Starship rocket engine puts SpaceX on a path to “genuine risk of bankruptcy if we cannot achieve a Starship flight rate of at least once every two weeks next year.”

However, the costs will be very high. Moffett says the “sustenance” cost of the constellation, before considering any costs associated with overhead, engineering, ground facilities, network operations centers, or end-user support, installation, and/or maintenance, could tally $5B per year as per this chart:

Satellite projects are, by their very nature, huge. A defining characteristic of big infrastructure investments is that they demand that investors be confident about the success and payoffs from infrastructures that may take as much as a decade to build.

Moffett is concerned that investors [1.] have yet to “come to grips with all of the implications” of the audaciousness of the Starlink’s huge ambitions.

Note 1. It’s important to note that Starlink is part of SpaceX, which is still a privately owned company. As of October 2021, Barron’s said that “Elon Musk owns roughly 50% of SpaceX.” It is not known who or whom owns the other half of SpaceX

…………………………………………………………………………………………………………………………….

References:

https://www.barrons.com/articles/elon-musk-net-worth-trillionaire-51634679420?tesla=y

NGMN Alliance: Green benchmark for mobile networks

The Next Generation Mobile Networks Alliance (NGMN Alliance) [1.] announced plans to create a new ‘green’ benchmark for mobile networks. The industry standard will be based initially on high-level sustainability indicators, with more detailed assessments to follow. It creates a new way to compare mobile networks, alongside service quality and user experience metrics.

Note 1. The NGMN Alliance (Next Generation Mobile Networks Alliance) is an open forum founded by world-leading mobile network operators. Its goal is to ensure that next generation network infrastructure, service platforms and devices will meet the requirements of operators and, ultimately, will satisfy end user demand and expectations.

NGMN seeks to incorporate the views of all interested stakeholders in the telecommunications industry and is open to three categories of participants (NGMN Partners): Mobile network operators (Members), vendors, software companies and many other leading industry players (Contributors), and research institutes contributing substantially to mid- to long-term innovation (Advisors).

…………………………………………………………………………………………………………………

The new initiative is part of the alliance’s ‘Green Future Networks‘ program, set up in 2020 to help the mobile industry address the need to reduce carbon emissions while network traffic continues to grow. The project aims to improve energy efficiency, reduce carbon emissions and increase the use of recyclable materials. The project will be guided by recommendations made in the NGMN 5G White Paper 2, which focuses on four main areas: on-board metering to control energy consumption; network energy efficiency; eco-design of equipment and products; and end-to-end services footprint.

The general objectives of this NGMN initiative are:

- to establish globally applicable KPIs and methodologies,

- to define a global evaluation methodology, and

- to define the data sources for the assessment and how such data are obtained

With the new benchmark, operators will have an incentive to work on sustainability, as well as a tool to verify and market their credentials to customers and public authorities.

The NGMN initiative plans to establish globally applicable KPIs and methodologies, defining data sources, data collection methods and a global evaluation methodology. Interested industry players are invited to join the project to help develop the new benchmark.

Arash Ashouriha, SVP Group Technology Innovation, Deutsche Telekom and Chairman of the NGMN Board states: ”Implementing concrete actions to mitigate climate action is a key priority for our industry. At Deutsche Telekom, our goal is to make sure that everyone can #takepart and connect over a green network. We are committed to ambitious net zero targets and are continuously optimizing our network to ensure the best quality for our customers while striving to systematically reduce the energy consumption. The Global Green Networks Benchmark from NGMN will certainly help the entire telco industry by providing transparency regarding the operator’s sustainability. In addition, it offers operators a unique opportunity to prove their sustainability credentials towards their customers and be recognized for the positive environmental and societal impact.”

Anita Döhler, CEO at NGMN, emphasizes: “There is a clear need for a Global Green Networks Benchmark. Being recognized for the operation of Green Networks will encourage Mobile Network Operators to engage even more in exploring innovative methods and solutions to implement their networks in an energy efficient manner and to increase the focus on reducing the E2E services’ environmental footprint, for instance, through improved eco-design of products and the implementation of new business models fostering a circular economy. Such efforts will also stimulate supplier innovation.”

NGMN invites interested industry players to join this new endeavor for the benefit of the global ecosystem.

………………………………………………………………………………………………………….

References:

NGMN Defines Industry Standard for a “Global Green Networks Benchmark”

Heavy Reading: “The Journey to Cloud Native” – Will it be a long one?

To gauge how carriers are planning and implementing cloud-native technology, and in collaboration with Juniper, Nokia and Red Hat, Heavy Reading asked 92 global telco service providers about their plans for transition to cloud native. In their report, “The Journey to Cloud Native,” Heavy Reading analyzes the choices service providers are making along the road to cloud native and what challenges they are encountering along the way.

The migration to cloud native brings largescale shifts for the communications service providers (CSPs), including:

- The move to microservices

- Standardized access to these microservices via API exposure

- The integration of multiple operational layers and domains for application management

- Automation across the application lifecycle through the use of DevOps

These are profound changes to the application development and management environment of the CSPs, and will be tackled with dedicated internal resources and expanded partnerships with telecommunication equipment vendors (TEMs), integrators and hyper-scalers (Amazon, Google, Microsoft, Facebook, etc.).

Editor’s Note: There are no standards or implementation specs for “Cloud Native” 5G SA core network or anything else. Rakuten Symphony (Japan) and Reliance Jio (India) claim they are going to implement “Cloud Native” 5G SA core network themselves and sell the specifications and software to other service providers. Good luck! We think it will be a very long journey to cloud native for telecom network operators/5G SA core network service providers.

The prospect of cloud native:

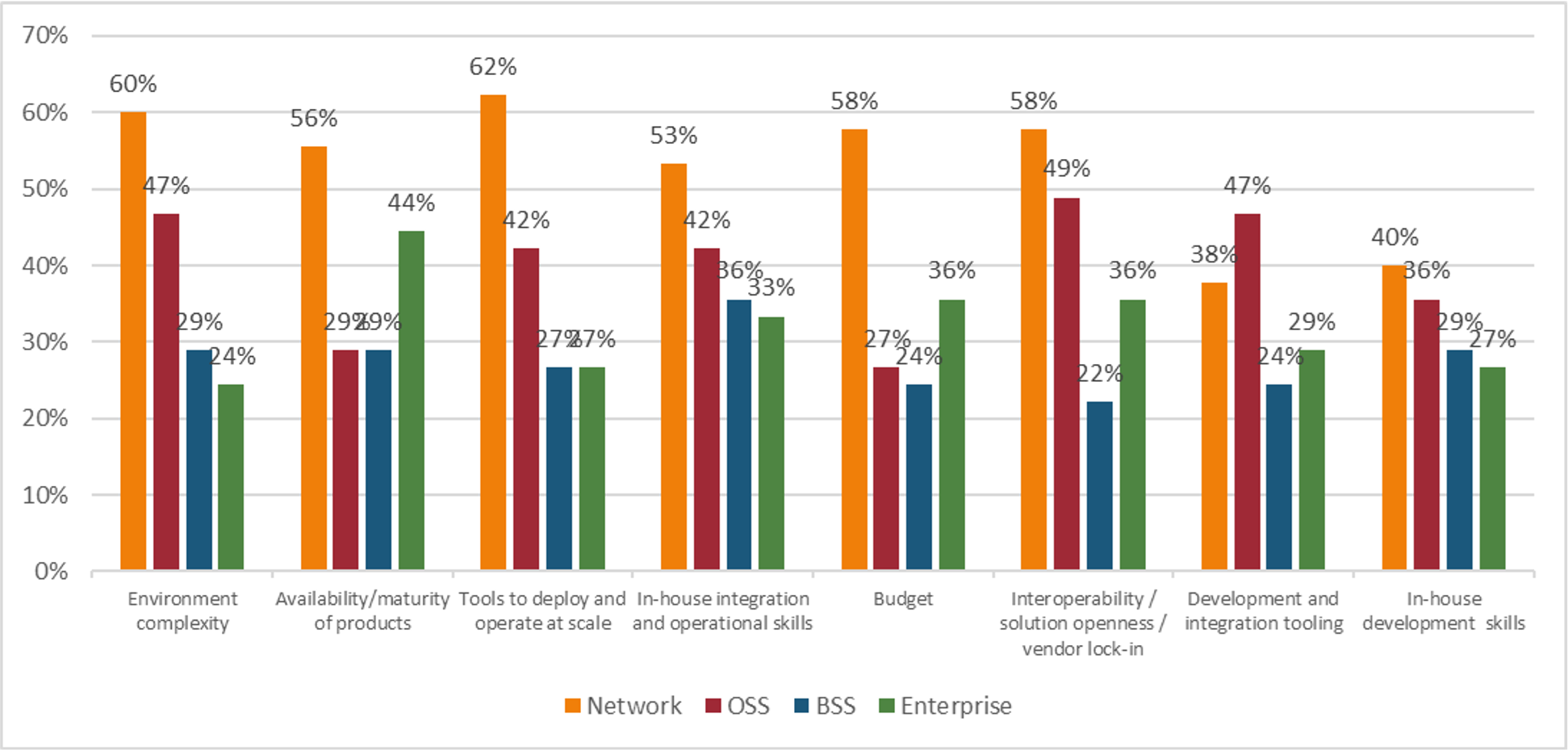

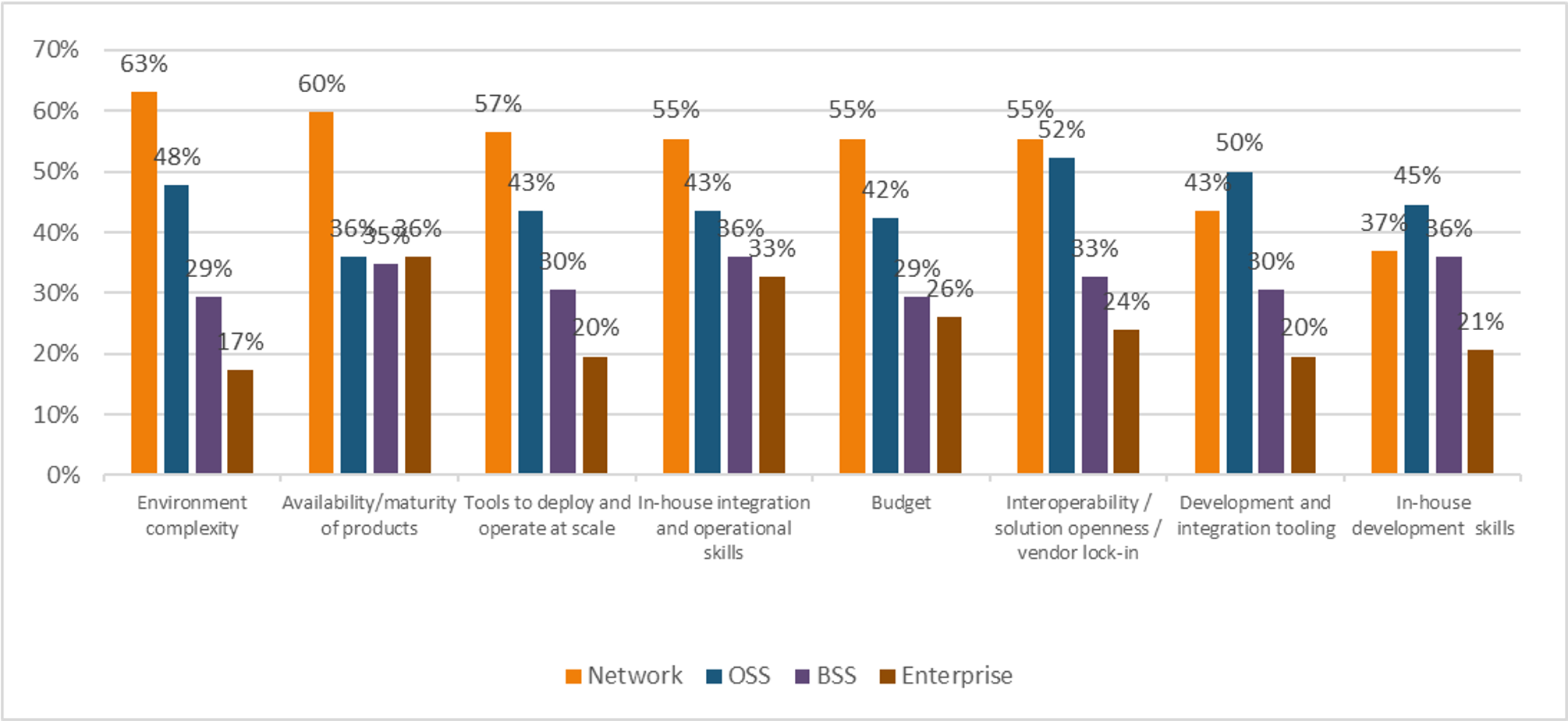

Heavy Reading queried the survey pool about where they were experiencing the greatest challenge in deploying cloud native: the network, operations support systems (OSS), business support systems (BSS), or the enterprise (see Figure 1). Heavy Reading established earlier in the survey that cloud native will be deployed first for network workloads. Respondents plan to transition workloads to the OSS business areas next, then BSS, and lastly, the enterprise.

In almost all cases, respondents ranked the challenges in that same order: first network, then OSS, BSS, and enterprise. The only challenges that were considered more severe in an area other than the network were “in-house development and integration skills” and “development and integration tooling,” where the OSS space was recognized as a greater challenge than the network. This is not surprising given that most Tier 1 carriers have dozens of OSS solutions in operation. They do much of any integration work between systems internally and some OSS systems are stand-alone – dedicated to siloed services.

Figure 1: The network space is seeing the most implementations and the most challenges N=92

Q: In which business areas are you experiencing significant challenges to going cloud native? Check all that apply. Source: Heavy Reading

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Looking only at the survey results from respondents who have already deployed cloud native, (see figure 2), which is half of the respondent pool, there are significant differences compared to the rest of the survey base. In the network area, “tools to deploy and operate at scale” is a greater challenge by 11 percentage points compared to respondents planning to deploy cloud native in one to two years.

“Budget” in the OSS area plummets between those who have not yet deployed cloud native, (57% of respondents considering it a challenge), and those who have already deployed cloud native, (27% of the respondents finding it to be a concern).

Those who have already deployed cloud native also consider all of the challenges in the enterprise area to be greater than the survey base as a whole and all of the challenges in the BSS area to be less of a challenge. Their firsthand experience with implementing cloud native in the network area has opened their eyes to the challenges that await them in the enterprise space. However, they are more confident that they have the support needed, near term, for BSS tasks which include billing, revenue, and customer management.

n=45: only respondents that have already implemented Cloud Native

Source: Heavy Reading

Heavy Reading’s findings might be a good indication that CSPs today are committed to their journey to cloud native, but face daunting challenges that will require expanded partnerships with the cloud-native ecosystem, including platform vendors, ISVs (Independent Software Vendors), TEMs (Telecom Equipment Manufacturers???) and hyper-scalers.

To gain more in-depth details of service providers’ perspective on cloud-native migration, download and read the full report now.

— Jennifer Clark, Principal Analyst, Cloud Infrastructure and Edge Computing, Heavy Reading

References:

https://www.lightreading.com/new-report-highlights-cloud-native-migration-challenges/a/d-id/774623?

https://www.lightreading.com/lg_redirect.asp?piddl_lgid_docid=773720

New partnership targets future global wireless-connectivity services combining satellites and HAPS

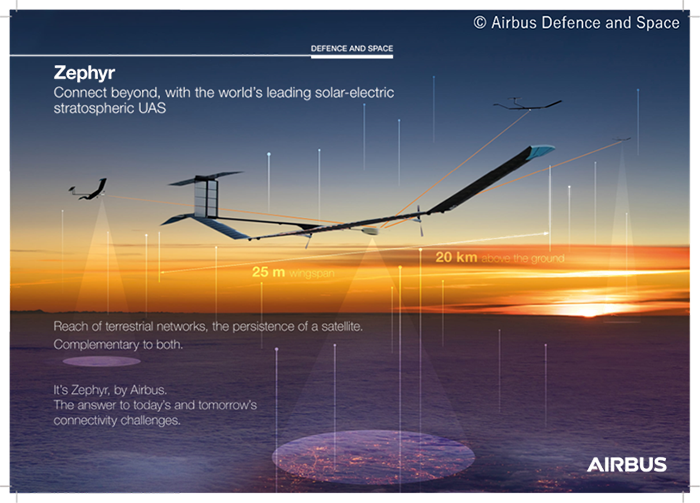

NTT, its mobile subsidiary DoCoMo, aircraft maker Airbus, and Japanese satcoms Sky Perfect JSAT Corporation are partnering to conduct a feasibility study on high altitude platform stations (HAPS). Deployed at altitudes of around 20 kilometers, they are essentially flying base stations that can provide coverage to a radius of around 50 kilometers.

Launched with a memorandum of understanding (MOU), the study will attempt to identify the early deployment requirements of a HAPS-based network. The collaboration will investigate the use of the Airbus Zephyr, the leading solar-powered, stratospheric unmanned aerial system (UAS), and the wireless communication networks of NTT, DOCOMO and SKY Perfect JSAT in order to test HAPS connectivity, identify practical applications, develop required technologies and ultimately launch space-based wireless broadband services.

Illustration of Airbus “Zephyr” HAPS aircraft:

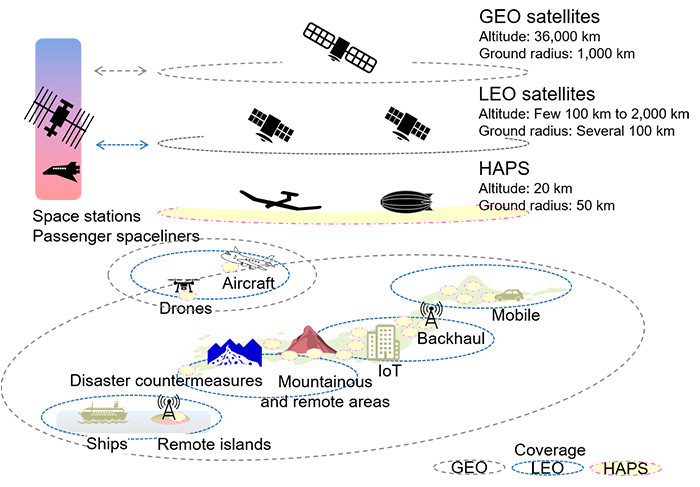

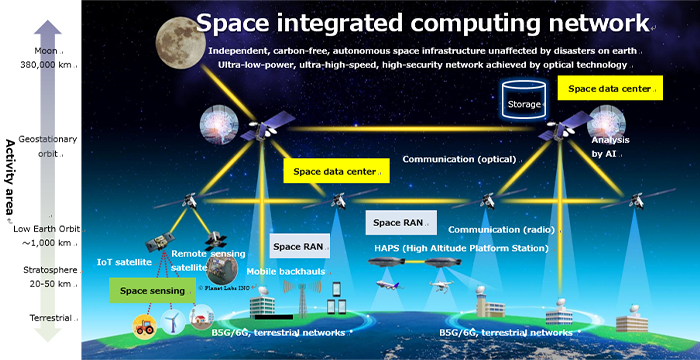

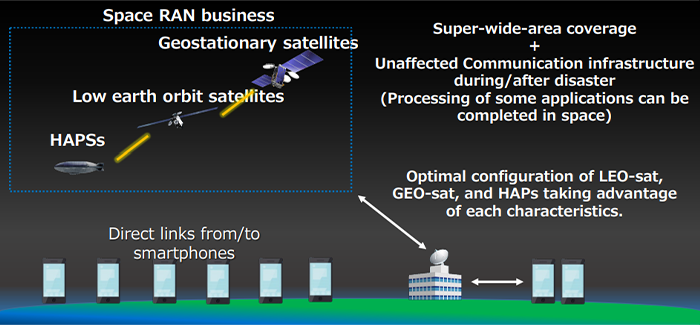

In the global push to further advance 5G and eventually introduce 6G, initiatives are under way to expand coverage worldwide, including in the oceans and in the air. Such initiatives will include HAPS, which fly in the stratosphere about 20 km above the earth, and non-terrestrial network (NTN) technologies using geostationary-orbit (GEO) satellites and low Earth-orbit (LEO) satellites.

HAPS networks are deemed to be a relatively easy solution for air and sea connectivity and an effective platform for deploying disaster countermeasures and many industrial applications. The provision of space-based radio access network services using NTN technologies, collectively called Space RAN (radio access network), is expected to support worldwide mobile communications with ultra-wide coverage and improved disaster resistance as well enhanced 5G and 6G. In addition,

HAPS platforms can also interconnect to the nearest terrestrial network gateway and extend the reach of existing mobile services directly to end-user devices, providing service options including as rural, emergency and maritime connectivity.

With the signing of the MOU, the four companies will discuss and identify possible future developments necessary to unlock future HAPS-based connectivity services, lobby for standardization and institutionalization of HAPS operations, and explore business models for commercializing HAPS services.

Specific themes will include the applicability of HAPS for mobile connectivity on the ground and base station backhaul,1 the performance of various frequency bands in HAPS systems, the technological considerations for linking HAPS with satellites and ground base stations, and the establishment of a cooperative system to test a network combining NTN technology, satellites and HAPS.

As separately announced on November 15, 2021, DOCOMO and Airbus have successfully conducted a propagation test between the ground and a “Zephyr S” HAPS aircraft in the stratosphere, demonstrating the possibility of providing stable communication with such a configuration.

…………………………………………………………………………………………………………….

Nick Wood of Telecoms.com wrote:

If the group achieves its stated objectives, it will have succeeded where a few other big names have failed.

Google, which has a long and rich history of dabbling, had a go at HAPS in 2011. Project Loon as it was called, consisted of a fleet of stratospheric balloons with base stations dangling beneath them. It was spun out of Google’s ‘X’ lab into a standalone company in 2018 and launched its first commercial service in partnership with Telkom Kenya in 2020. However, Project Loon couldn’t drive the costs down low enough to turn it into a viable long-term business, and the whole enterprise ceased operations around this time last year. Alongside Project Loon, Google also flirted with drone-based connectivity. This one was called Project Titan, and it fared even worse than Loon. Test flights began in 2015, but amid rumours of funding issues and technical difficulties, the whole thing was canned in early 2016.

Meta (previously known as Facebook) also had a crack at HAPS. As part of its effort to connect the unconnected and sell their data to advertisers, in 2016 it showed off Aquila: a portable fleet of unmanned, solar-powered drones that would deliver service to rural areas. It gave up on the idea two years later after reaching the not-so-startling conclusion that it wasn’t particularly good at building aircraft.

Despite these high-profile failures, the aviation and telecoms industries are clearly not ready to give up on HAPS just yet. They even launched their own lobby group in February 2020, the HAPS Alliance. Last month it announced the successful test flight of Sunglider, an unmanned, solar-powered aircraft equipped with an LTE base station. Funnily enough, Airbus, DoCoMo and Sky Perfect JSAT are all members of the HAPS Alliance, which aims to create an ecosystem around the technology that will turn it into a sustainable business.

DoCoMo et al are undoubtedly aware of the unproven business case for this technology, and so spreading the risk across several experts – rather than going it alone like Google and Facebook – is probably better than the HAPS-hazard approach taken by those giants of Silicon Valley.

References:

https://www.nttdocomo.co.jp/english/info/media_center/pr/2022/0117_00.html

https://www.nttdocomo.co.jp/english/info/media_center/pr/2021/1115_00.html

NTT hopes to succeed where Google Loon and Facebook Aquila failed

ETSI Experiential Networked Intelligence – Release 2 Explained

ETSI has now completed Release 2 of its Experiential Networked Intelligence (ENI) specifications with the ETSI GS ENI 005 system architecture.

ETSI GS ENI 005 and associated documents will provide better insight into network operations – allowing more effective closed-loop decision making plus better lifecycle management. Through its use, network operators will be able to leverage acquired data and apply artificial Intelligence (AI) algorithms to it. This will mean that operators will be able to respond much quicker to changing situations and gain far greater agility.

The services being delivered across their networks may thereby be rapidly adapted and the resources they have available correctly assigned in accordance with subscribers’ requirements, or any other alterations in circumstances (either operationally or commercially driven).

An industry specification group (ISG) focused on ENI was first established by ETSI five years ago. The organisations involved include many of the leading mobile operators worldwide – full list available here.

ETSI ENI Release 2 defines the key architectural requirements (GS ENI 002), and provides a more comprehensive array of potential use cases (GS ENI 001) and applicable proof of concept (PoC) specifications. To support this release, the ENI ISG has produced a series of reports. These cover data characterization, fault identification, the different types of AI mechanisms that can be employed (along with details of the associated bias and ethical implications), the constituent functional blocks needed for modular design implementations and how to assure their interoperability.

“ENI will have an important part to play in how next generation networks are managed, making them contextually aware and giving them greater inherent flexibility,” states Dr Raymond Forbes, Chair of the ETSI ENI ISG. “Use cases and PoCs are already enabling its validity to be demonstrated, and with ETSI ENI Release 2 we are providing a framework upon which operators and their technology partners can implement it into their infrastructure.”

ETSI’s ENI Release 2 includes the following specifications and reports:

-

- GS ENI 001 Use Cases

- GS ENI 002 Requirements

- GR ENI 004 Terminology

- GS ENI 005 System Architecture

- GR ENI 008 Intent Aware Network Autonomicity

- GR ENI 009 Data Mechanisms

- GR ENI 010 Evaluation of categories for AI application to Networks

- GR ENI 016 Functional Concepts for Modular System Operation

- GR ENI 017 Overview of Prominent Control Loop Architectures

- GR ENI 018 Artificial Intelligence Mechanisms for Modular Systems

From the Systems Architecture Spec:

The ENI System is an innovative, policy-based, model-driven functional architecture that improves operator experience. In addition to network automation, the ENI System assists decision-making of humans as well as machines, to enable a more maintainable and reliable system that provides context-aware services that more efficiently meet the needs of the business.

For example, the ENI System enables the network to change its behaviour (e.g. the set of services offered) in accordance with changes in context, including business goals, environmental conditions, and the varying needs of end-users.

This is achieved by using policy-driven closed control loops that use emerging technologies, such as big data analysis, analytics, and artificial intelligence mechanisms, to adjust the configuration and monitoring of networks and networked applications. It dynamically updates its acquired knowledge to understand the environment, including the needs of end-users and the goals of the operator, by learning from actions taken under its direction as well as those from other machines and humans (i.e. it is an experiential architecture).

It also ensures that automated decisions taken by the ENI System are correct and increase the reliability and stability, and lower the maintenance required, of the network and the applications that it supports. It improves and simplifies the management of network services through their visualization, and enables the discovery of otherwise hidden trends and interdependencies.

About ETSI:

ETSI provides members with an open and inclusive environment to support the development, ratification and testing of globally applicable standards for ICT systems and services across all sectors of industry and society. We are a non-profit body, with more than 950 member organizations worldwide, drawn from 64 countries and five continents. The members comprise a diversified pool of large and small private companies, research entities, academia, government, and public organizations. ETSI is officially recognized by the EU as a European Standards Organization (ESO). For more information, please visit us at https://www.etsi.org/

References:

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I