Year: 2023

STELLAR Broadband offers 10 Gigabit Symmetrical Fiber Internet Access in Hudsonville, Michigan

STELLAR Broadband, a fiber internet and technology service provider, will provide leading edge technologies and Internet connectivity up to 10Gbps to Elmwood Lake Apartments in Hudsonville, Michigan.

Elmwood Lake Apartments is a suburban haven of elevated comfort, where sweet serenity meets desirable convenience. From cozy interiors and relaxing leisure spaces to an idyllic setting next to private Elmwood Lake, the welcoming apartments in Hudsonville, MI, are ready to deliver a heightened living experience.

“With STELLAR Broadband, residents of Elmwood Lake Apartments will enjoy the fastest and most reliable internet service available. STELLAR Broadband’s fiber optic network provides symmetrical speeds of up to 10Gbps so residents can stream, game, and work from home without any lag or buffering,” said Richard Laing, president of STELLAR Broadband.

“Bosgraaf Homes has been building homes in West Michigan for four generations. Over the years, we’ve seen the industry change dramatically thanks to advances in technology. Construction methods have evolved, and the amenities that homeowners expect have grown more sophisticated. We’re grateful for our partnership with STELLAR Broadband, a company that has been at the forefront of the industry for 22 years. Their experience and leadership have helped us make the transition into multi-family housing,” said Mike Bosgraaf, president of Bosgraaf Homes.

The first in the U.S. to bring 10Gbps Internet to the apartment in student housing, STELLAR today serves over 149 communities totaling over 10,000 residents with a wide range of technology solutions, from managed Wi-Fi, TV, and access control to security.

“DTN is excited to partner with Bosgraaf Homes and STELLAR Broadband to provide Elmwood Lake residents with a unique and enjoyable experience. Bosgraaf is building beautiful homes that will be easy to lease, and STELLAR will provide residents and our office with the best possible internet service,” said Dayle Braden, DTN property manager.

“We’ve seen and have been on the forefront of technology evolving from a desired amenity to a necessity. We are proud to partner with Bosgraaf to provide the high-quality technology that their residents expect and deserve,” Laing stated.

About Spartan Net Co, dba STELLAR Broadband:

STELLAR Broadband is the largest residential fiber internet service provider in Michigan, servicing over 149 communities with multi-Gigabit fiber internet. STELLAR provides technology design and installation services for the full portfolio of technologies for multi-tenant developments, including network design, structured wiring, consulting, door entry and access control, engineered Wi-Fi, security, voice, television services, and various Internet of Things solutions. To learn more, visit: www.stellarbb.com

References:

Opensignal’s new Coverage Experience metric finds Singapore #1 in 5G

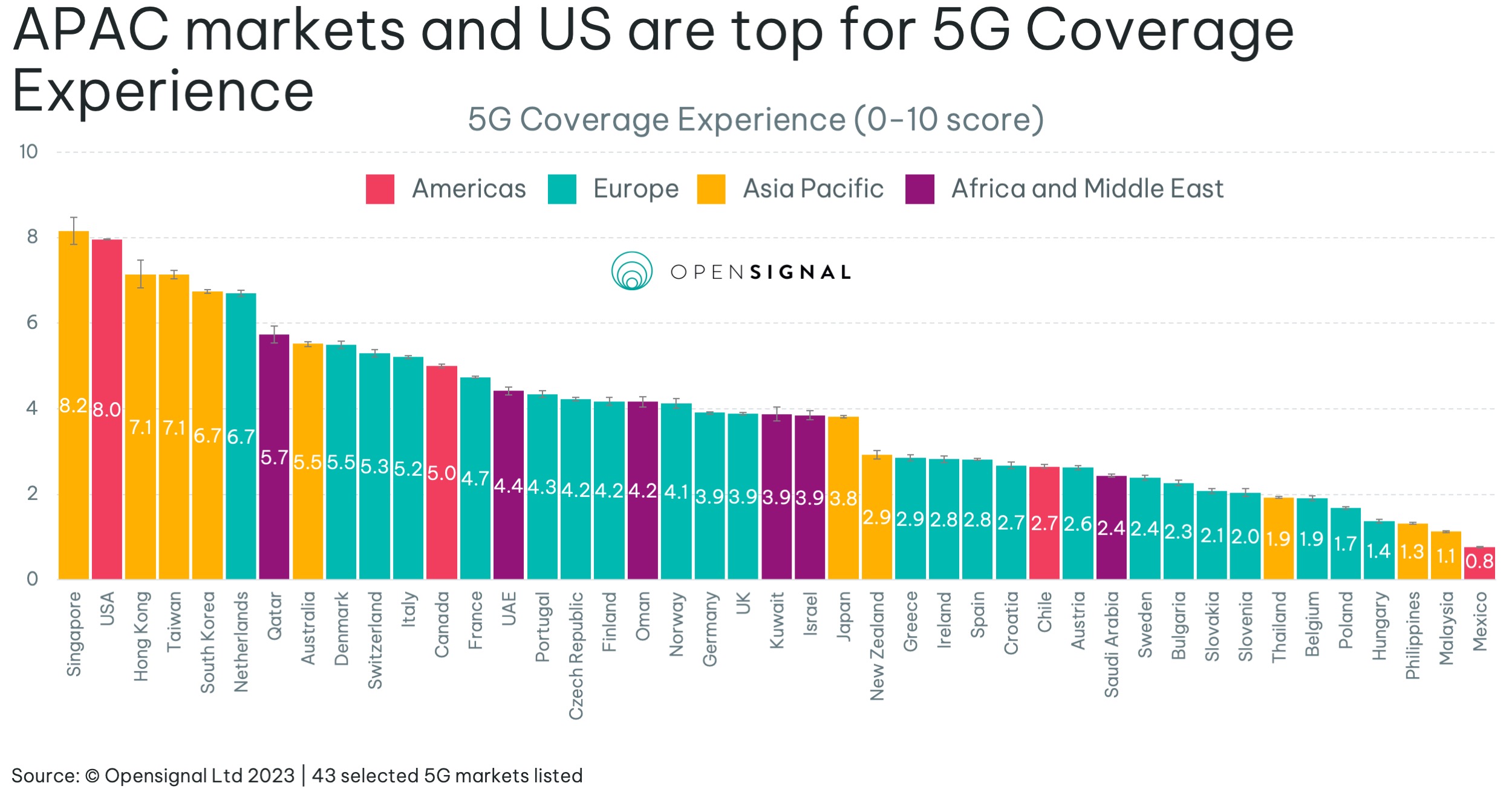

Opensignal is now measuring coverage experience to track 5G network quality. Their analysts believe coverage more accurately reflects users’ expectations and experience. Opensignal’s new Coverage Experience metric measures the geographic coverage of populated areas on a 10-point scale to represent the experience users receive as they travel around areas where they would reasonably expect to find coverage. The new Coverage Experience metric completes the picture of how expansive a market’s coverage is, along with the coverage experienced by our users on each national operator within the market.

Singapore, which rolled out 5G two years after the USA, is now on par in offering the world’s best experience – both countries rate a 10. In Singapore, Singtel rates 7.9, StarHub 7.1, and M1 7.0 out of 10.

South Korea and the USA score relatively high for 5G Coverage Experience — with the USA statistically tying for the top spot with Singapore. This is due to, in part, more widespread deployments of 5G in the USA on low frequency bands, enabling greater geographic reach compared to many other markets with large land areas.

Hong Kong, Taiwan, South Korea and the Netherlands round out the leaderboard.

Some telcos have opened up a massive lead over their competitors. Australia’s Telstra rates 5.2 points out of 10, almost double both of its rivals. In Japan, NTT Docomo scores 3.3, while newcomer Rakuten (which has just signed a 5G roaming agreement with KDDI) is just 0.4. In Europe, Belgium scores just 1.9, while Sweden, Austria, Spain, Greece and Ireland all tally below 3 points.

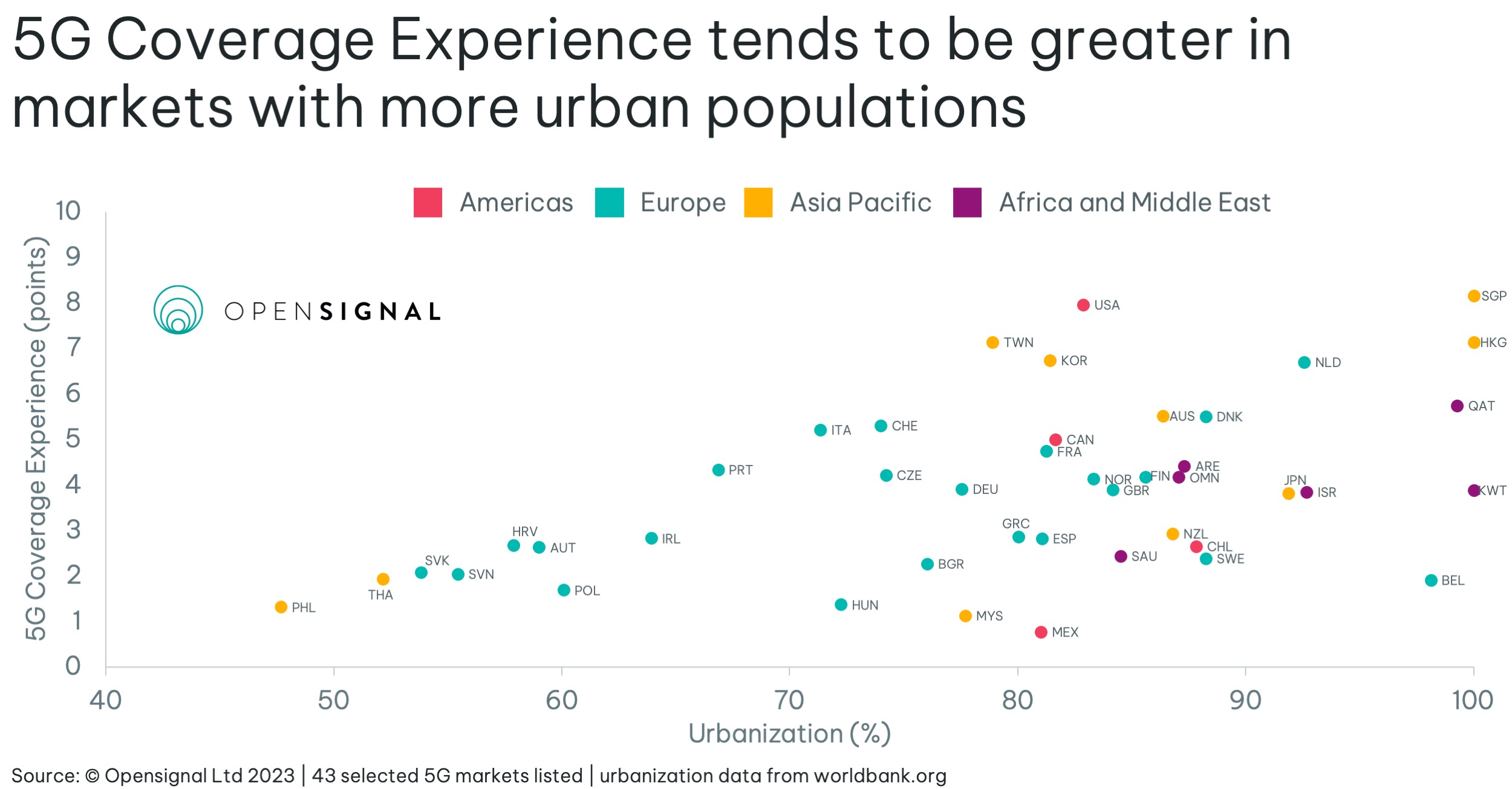

A higher percentage of urbanization in a market means that — all else being equal — operators are able to serve proportionally more users with the same number of base stations, which reflects in higher 5G Coverage Experience across such markets. The graph above shows that the score increases along with urbanization percentage, with markets below 65% struggling to score above three points.

Some markets such as Singapore and Hong Kong have nearly 100% of their population living in urban areas. This greatly benefits them when it comes to rolling out infrastructure for 5G. Singapore launched 5G two years after the USA and South Korea, yet it ranks joint first for 5G Coverage Experience.

Coverage is an important metric as it quantifies the extent to which users will be able to use their network in their home market. Opensignal’s new Coverage Experience metric represents the real-world experience users receive as they travel around areas where they would reasonably expect to find coverage.

……………………………………………………………………………………………………………………………………………………..

Robert Clark of Light Reading wrote:

he one shortcoming of the 5G survey is the lack of data from India and China, the Asian giants who by their size are among the biggest drivers of global 5G. India’s absence is understandable as it’s still a nascent 5G market. In the case of China, where not even domestic organizations are allowed to track network performance, it’s hardly a surprise that foreign research efforts are blocked as well.

Chinese telcos and the Ministry for Industry and IT are barely any more informative. Their favored metric is base station population, which reveals nothing about user or geographic reach.

Right now China’s base station total, which is faithfully tallied up monthly, is 2.38 million – supposedly representing more than 60% of the global number. China Mobile and the China Telecom-Unicom partnership account for roughly half each.

The fact that some 600 million customers have signed up for China 5G may suggest they are happy enough with their user experience. On the other hand, that another 600 million have become ‘5G customers’ while remaining on the 4G network may indicate that they think 5G is simply better value.

References:

https://www.opensignal.com/2023/05/17/understanding-5g-and-overall-coverage-worldwide

https://cdn.opensignal.com/public/202305_coverage_operators_charts_5g_0.pdf

UAE’s Du demonstrates 5G VoNR with Huawei and Nokia

Du, the United Arab Emirates (UAE) Integrated Telecommunications Company, has achieved a significant milestone by successfully demonstrating Voice over 5G (3GPP) New Radio (VoNR) capabilities in collaboration with Huawei and Nokia. The demonstration showcases the cutting-edge 5G core network developed in partnership with Huawei and the utilisation of Nokia’s IP Multimedia Subsystem (IMS) Platform.

Du said the successful demonstration of VoNR represents a crucial step towards future immersive calling applications for 5G and the realization of complete 5G Standalone (SA) capabilities. With VoNR, du is able to provide seamless 5G connections, offering enhanced call setup times and uninterrupted high-speed data transmission.

According to the statement, customers connected to VoNR will experience slightly faster call setup times and continued file downloads in the background during a phone call without switching to 4G network technology. 5G Voice calls to conserve battery by eliminating the need to switch to 4G.

Du said, “It is thrilled to announce the upgrade to the most cutting-edge 5G-enabled Network as a Service (NaaS) architecture. This enhanced Network will strengthen Du’s relationship with their partners.”

VoNR leverages the advanced capabilities of 5G SA, such as network slicing, which requires a constant connection to a 5G core. This integration of technologies opens up a world of possibilities for du and its customers, enabling the delivery of innovative services like 3D audio and holographic calls, providing an immersive communication experience.

Saleem AlBlooshi, Chief Technology Officer at Du, said: “The successful demonstration of 5G network VoNR capabilities represents a significant milestone at a time when the digital sector is entering a new era. It enables unprecedented simultaneous voice and data transmissions and provides incredibly rapid connectivity transmission rates. We are thrilled to announce, in collaboration with our key partners, the upgrade to the most cutting-edge 5G-enabled Network as a Service (NaaS) architecture. This enhanced network will strengthen our relationship with our partners while also fostering service innovation to improve the customer experience and push the boundaries of what is possible.”

The successful demonstration of VoNR highlights Du’s commitment to staying at the forefront of technological advancements and delivering superior connectivity solutions to its customers.

As the demand for seamless and immersive 5G experiences grows, du’s continued efforts to enhance its network capabilities will contribute to shaping the future of communication and content consumption.

References:

https://www.nokia.com/networks/core-networks/voice-over-5g-vo5g-core/

No Surprise: AT&T tops leaderboard of commercial fiber lit buildings for 7th year!

Once again, AT&T ranked #1 in the U.S. Fiber Lit Buildings Leaderboard fromVertical Systems Group (VSG) for a seventh consecutive year. The fiber focused U.S. carrier retained the top spot with the highest number of fiber lit buildings across its footprint in 2022. But there’s a whole lot more AT&T #1 rankings that the carrier has not gotten proper credit for achieving:

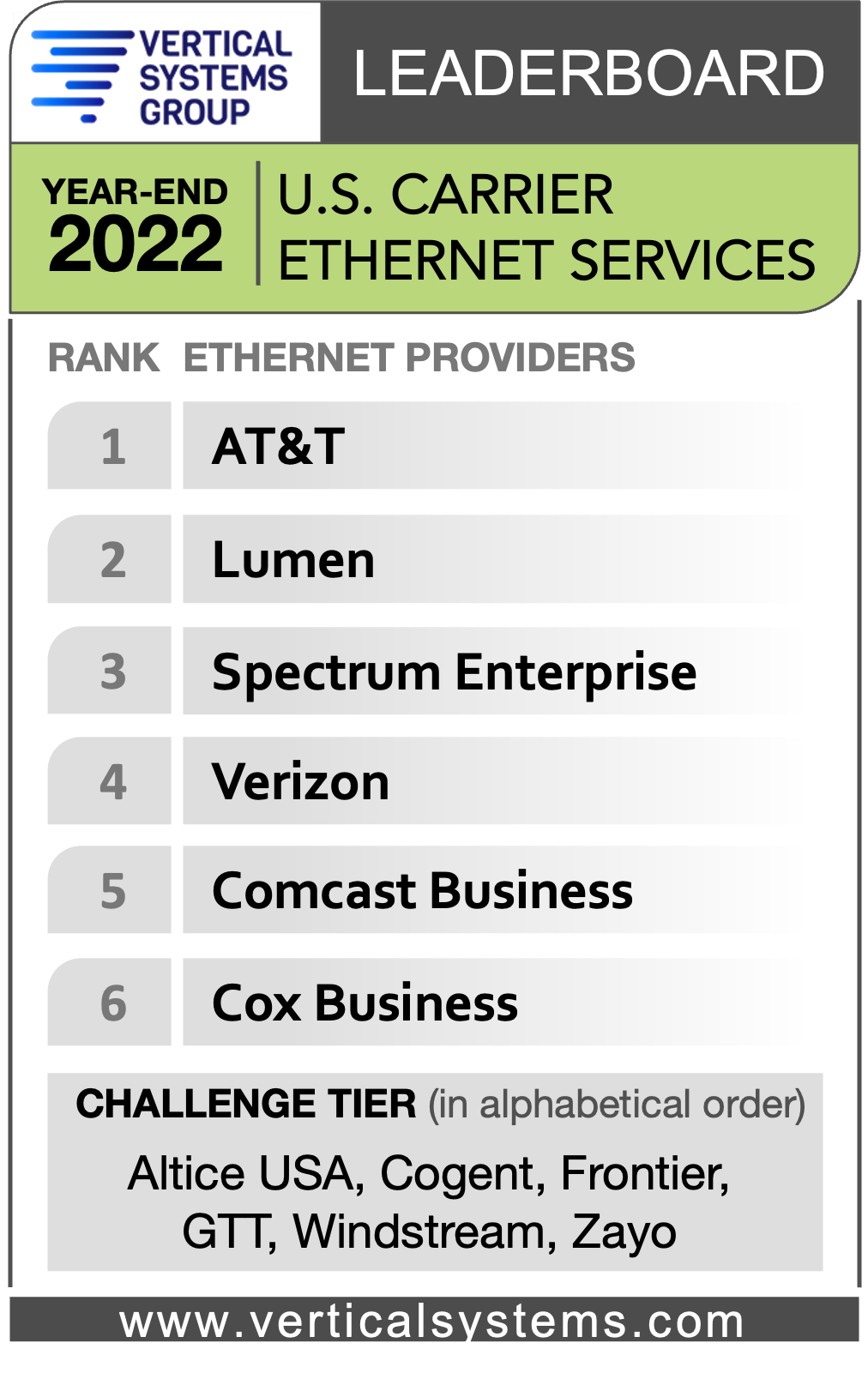

- AT&T also holds the #1 ranking in VSG 2022 U.S. Carrier Ethernet LEADERBOARD.

- AT&T ranked #1 for the fifth consecutive year in VSG’s year end 2022 U.S. managed carrier SD-WAN leaderboard.

–>Please see the images below, courtesy of VSG.

Major mobile operators like AT&T and Verizon are actively installing new fiber for their 5G network backhaul, which facilitates new fiber connectivity to nearby commercial sites. T-Mobile no longer has any fiber assets from their Sprint acquisition. They were sold to Cogent along with all other wireline assets in a deal that closed May 1, 2023.

Verizon, Spectrum Enterprise, Lumen, Comcast Business, Cox Business, Zayo, Crown Castle, Frontier, Brightspeed, Breezeline and Optimum followed. Those retail and wholesale fiber providers qualified for the leaderboard with 15,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2022.

-

“Fiber installations at U.S. commercial sites increased in 2022, driven by escalating requirements for gigabit-speed connectivity to support cloud-based services, data centers, 5G rollouts, and other applications,” said Rosemary Cochran, principal of Vertical Systems Group. “New fiber investments in the U.S. will continue to be impacted by pending federal programs and funding initiatives. Opportunities in the commercial segment include monetizing the millions of small buildings underserved.”

U.S. Fiber Lit Buildings LEADERBOARD Highlights:

- The 2022 LEADERBOARD roster increases to twelve commercial fiber providers, up from eleven in 2021.

- AT&T retains the #1 rank on the 2022 U.S. Fiber Lit Buildings LEADERBOARD for the seventh consecutive year.

- Rankings for the top six companies on the 2022 LEADERBOARD are unchanged from 2021, which includes AT&T, Verizon, Spectrum Enterprise, Lumen, Comcast Business, and Cox Business.

- The next six LEADERBOARD provider rankings change as compared to the previous year. Zayo advances to rank seventh ahead of Crown Castle, which dips to eighth. Frontier moves up to ninth position from tenth. Brightspeed debuts in tenth position with fiber assets acquired from Lumen. Breezeline (formerly Atlantic Broadband) falls to eleventh position from ninth. Optimum (Altice USA brand) drops from eleventh to the twelfth and final position.

- The number of 2022 Challenge Tier citations expands from eight to nine with the addition of Ritter Communications.

Market Players include all other fiber providers with fewer than 5,000 U.S. commercial fiber lit buildings. The 2022 Market Players tier covers more than two hundred metro, regional and other fiber providers, including the following companies (in alphabetical order): 11:11 Systems, ACD, Alaska Communications, American Telesis, Armstrong Business Solutions, Astound Business, C Spire, Centracom, Cogent, Conterra, DFN, DQE Communications, Everstream, ExteNet Systems, Fatbeam, FiberLight, First Digital, Flo Networks, Fusion Connect, Google Fiber, GTT, Horizon, Hunter Communications, Logix Fiber Networks, LS Networks, Mediacom Business, MetroNet Business, Midco, Pilot Fiber, PS Lightwave, Shentel Business, Silver Star Telecom, Sonic Business, Sparklight Business, Syringa, T-Mobile, TDS Telecom, TPx, U.S. Signal, Vast Networks, WOW!Business, Ziply Fiber and others.

For this analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

……………………………………………………………………………………………………………………………………..

References:

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

https://www.verticalsystems.com/2023/02/15/2022-u-s-ethernet-leaderboard/

AT&T tops VSG’s U.S. Carrier Managed SD-WAN Leaderboard for 4th year

VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

AT&T is expanding its network of fiber-optic cables to deliver fast internet speeds for customers, including those in places where it doesn’t already provide broadband. The plan will cost billions of dollars over the next several years, a price tag that the company—whose debt load outstrips its annual revenue—will not carry alone. AT&T formed a joint venture with BlackRock to fund the project and also wants to access government funding to accelerate the build-out. AT&T and BlackRock have collectively invested $1.5 billion in the venture—named Gigapower—to date, the company said.

Gigapower plans to provide a state-of-the-art fiber network to internet service providers and other businesses in parts of select metro areas throughout the country using a commercial wholesale open access platform. Both companies believe now is the time to create the United States’ largest commercial wholesale open access fiber network to bring high-speed connectivity to more Americans.

AT&T will serve as the anchor tenant of the Gigapower network, but other companies could also provide internet service over the network. That so-called open-access model has become common throughout Europe, but has yet to be widely embraced in the U.S. Gigapower recently introduced plans to build out fiber in Las Vegas, northeastern Pennsylvania and parts of Arizona, Alabama and Florida.

Doubling down on fiber optics sets AT&T on a different path than its rivals Verizon and T-Mobile US, which are relying on improved technology that beams broadband internet service from the same cellular towers that link their millions of mobile smartphone customers. AT&T is testing a similar fixed wireless access service but on a smaller scale, but executives say fiber remains the long-term focus.

AT&T updated shareholders on its vision for fiber internet and 5G cellular networks at its annual meeting, but the documentation/replay was not available at press time. AT&T spent about $24 billion on its fiber and 5G networks last year, and it forecast a similar level of spending this year. The company is confident it will get a very good return on investment (ROI).

The Dallas-based company and its peers face heightened competition in the cellphone business—their core profit engine. After the Covid-19 pandemic brought a surge in new accounts, the cellphone business has cooled, pushing companies to seek alternate paths for growth. AT&T, which has nearly 14 million consumer broadband customers, has provided internet service for years, and executives say that keeping customers plugged in requires faster connections as more data is used.

“We should be putting more fiber out faster, quicker and in more places than anybody else,” AT&T Chief Executive John Stankey said in a recent interview. “If we do that, that means our network is always going to be ahead of anybody else’s.”

Fiber-optic cables, wired directly to or near Americans’ homes, contain easy-to-upgrade glass strands that can carry much more data than radio waves. That higher capacity is crucial for video calls, streaming, videogames and other services, which use more internet data than most smartphone apps. As of last year, fiber was available at some 63 million homes, or more than half of primary residences, according to the Fiber Broadband Association.

AT&T wants its fiber network to cover more than 30 million homes and businesses within its current service area by the end of 2025. In many cases, fiber will replace internet connections over copper wirelines.

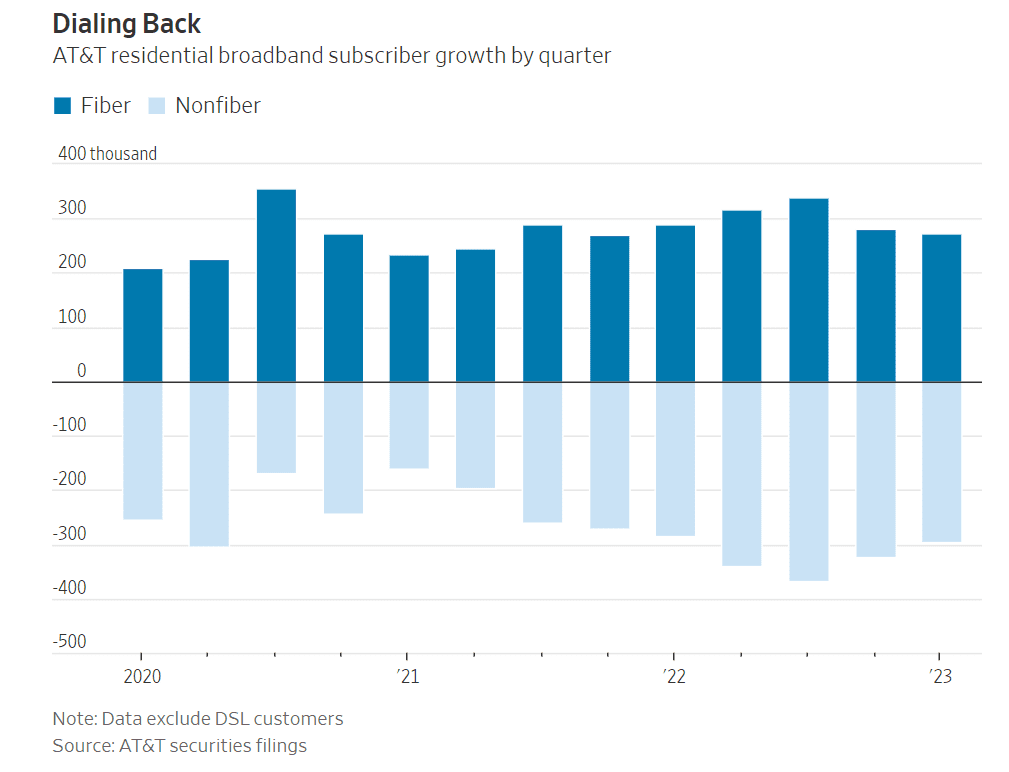

Laying the fiber is one thing, but progress in getting customer sign-ups has been slower than some analysts expected. In the first three months of the year, AT&T signed up 272,000 home fiber subscribers, a deceleration from the December quarter and the same period last year.

The results also marked the fourth straight quarter during which residential fiber sign-ups failed to offset declines in broadband customers overall. Stankey said he isn’t expecting the trend to reverse this year.

AT&T offers its fiber service at various speed tiers, starting at $55 a month for downloads up to 300 megabits a second. Prices run as high as $180 a month for 5-gigabit speeds.

In the March quarter, the average AT&T fiber internet customer paid about $66 a month. That total was up 9% from last year but still slightly less than the sums paid by customers of cable rivals Charter Communications and Comcast, according to Roger Entner, the founder of Recon Analytics.

While AT&T’s fiber build-out continues, it hopes its Internet Air service—which uses cell towers to beam broadband to homes—can stem customer defections in the short term. The service, which costs $55 a month, isn’t yet widely available, said Stankey, who took over as CEO in 2020 and unwound AT&T’s bet on entertainment.

Reuters: Telcos draft proposal to charge Big Tech for EU 5G rollout; Meta offers a rebuttal

Big tech companies accounting for more than 5% of a telecoms provider’s peak average internet traffic should help fund the rollout of 5G and broadband across Europe, according to a draft proposal by the telecoms industry. The proposal is part of feedback to the European Commission which launched a consultation into the issue in February. The deadline for responses is Friday.

Alphabet’s Google, Apple Facebook-owner Meta, Amazon, Netflix and TikTok would most likely be hit with fees, according to industry estimates. Google, Apple, Meta, Netflix, Amazon and Microsoft together account for more than half of data internet traffic.

The document, which was reviewed by Reuters and has not been published, was compiled by telecoms lobbying groups GSMA and ETNO. They represent 160 operators in Europe, including Deutsche Telekom, Orange, Telefonica and Telecom Italia. Telecom operators have lobbied for years for leading technology companies to help foot the bill for 5G and broadband roll-out, saying that they create a huge part of the region’s internet traffic. This is the first time they have tried to define a threshold for who should pay.

“We propose a clear threshold to ensure that only large traffic generators, who impact substantially on operators’ networks, fall within the scope,” the draft stated. “Large traffic generators would only be those companies that account for more than 5% of an operator’s yearly average busy hour traffic measured at the individual network level,” it said. The European Commission declined to comment.

Meta on Wednesday urged Brussels to reject any proposals to charge Big Tech for additional network costs. In a Facebook blog post, Markus Reinisch, Meta’s VP for Public Policy for Europe, described potential fees as a “private sector handout for selected telecom operators” that would disincentivize innovation and investment, and distort competition. “We urge the Commission to consider the evidence, listen to the range of organizations who have voiced concerns, and abandon these misguided proposals as quickly as possible,” he said. Here are Meta’s takeaways:

- Network fee proposals misunderstand the value that content platforms bring to the digital ecosystem.

- We support the Commission’s goal of “ensuring access to excellent connectivity for everyone,” but network fee proposals will hurt European consumers and businesses.

- We urge the Commission to consider the evidence, listen to the range of organizations who have voiced concern, and drop these proposals.

References:

Network Fee Proposals Will Ultimately Hurt European Businesses and Consumers

https://www.euractiv.com/section/5g/news/eu-telcos-call-for-big-tech-to-share-5g-network-costs/

GSMA: Europe’s 5G rollout is too slow at 6% of mobile customer base

European telcos need to address very high 5G energy consumption

Strand Consult: Market for 5G RAN in Europe: Share of Chinese and Non-Chinese Vendors in 31 European Countries

Vodafone Idea (Vi) is worth ZERO; needs additional liquidity support from lenders

While announcing its FY23 earnings, UK telecom company, Vodafone Plc said the Group’s carrying value of investment in Indian listed firm Vodafone Idea (Vi) is Zero. Also, that the Group is recording no further losses related to Vi. The troubled-laden Vi is still in need of additional liquidity and plans to raise funds going forward. In its FY23 report, Vodafone Plc said, “VIL remains in need of additional liquidity support from its lenders and intends to raise additional funding.”

Vodafone seems to be backing away from Vi. The business needs more money, that Vodafone is certainly not willing to provide, and that zero valuation indicates that it will put no more effort into saving it. There are significant uncertainties in relation to Vi’s ability to make payments in relation to any remaining liabilities covered by the mechanism and no further cash payments are considered probable from the Group as at 31 March 2023, it added.

“VIL [Vodafone Idea Ltd] remains in need of additional liquidity support from its lenders and intends to raise additional funding. There are significant uncertainties in relation to VIL’s ability to make payments in relation to any remaining liabilities covered by the mechanism and no further cash payments are considered probable from the Group as at 31 March 2023,” Vodafone said, in the notes to its consolidated financial statements for the 2023 financial year.

Furthermore, Vodafone said, “the carrying value of the Group’s investment in VIL is nil and the Group is recording no further share of losses in respect of VIL.”

It should be noted that Vi is the only Indian telco that has NOT yet deployed 5G services. Since the launch of 5G last October, Reliance Jio’s 5G services have become available in more than 400 cities and towns, while Airtel’s 5G services can be accessed in more than 500. Jio plans to provide all-India 5G coverage by December, with Airtel aiming for blanket availability by March next year.

Recently, Vodafone Idea complained to the Telecom Regulatory Authority of India (TRAI), accusing its rivals of predatory 5G pricing. Although it has been shedding customers for years, there can be little doubt that losses have accelerated since the launch of 5G. Vodafone Idea had lost about 7 million in the four months leading up to 5G’s launch in October last year. In the four months following the introduction of 5G services by Airtel and Jio, its losses soared to about 10 million.

Vodafone Idea is known to have a significant percentage of high-spending customers who have remained loyal to it. These customers typically show limited interest in lower tariffs, but many will have been drawn to 5G services available only from other telcos, with Vodafone Idea’s 5G plan nowhere close to fruition. Airtel and Jio, accordingly, are racing to build 5G networks and attract as many Vodafone Idea subscribers as possible.

………………………………………………………………………………………………………………………………………………………………………………..

When Vodafone and Idea Cellular entered into an merger agreement in 2017, the parties had agreed to a mechanism for payments between the Group and Vodafone Idea, pursuant to the difference between the crystallisation of certain identified contingent liabilitiesin relation to legal, regulatory, tax and other matters, and refunds relating to Vodafone India and Idea Cellular. Cash payments s or cash receipts relating to these matters must have been made or received by Vi before any amount becomes due from or owed to the Group.

Hence, any future future payments by the Group to VIL as a result of this agreement would only be made after satisfaction of this and other contractual conditions. Thereby, the UK-based telco said, “Vodafone Group’s potential exposure to liabilities within VIL is capped by the mechanism described above; consequently, contingent liabilities arising from litigation in India concerning operations of Vodafone India are not reported.”

Vodafone Plc’s potential exposure under this mechanism is capped at ₹64 billion n (€719 million) following payments made under this mechanism from Vodafone to VIL, in the year ended 31 March 2021, totalling ₹19 billion (€235 million).

In FY23, Vodafone Plc’s revenue increased by 0.3% to €45.7 billion driven by growth in Africa and higher equipment sales, offset by lower European service revenue and adverse exchange rate movements. While adjusted EBITDAal declined by 1.3% to €14.7 billion due to higher energy costs, and commercial underperformance in Germany.

References:

https://telecoms.com/521728/vodafone-sees-no-remaining-value-in-indian-operation/

Big 5G Conference: 6G spectrum sharing should learn from CBRS experiences

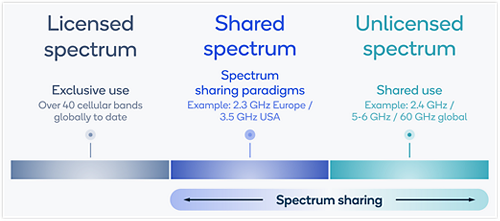

Spectrum sharing is a methodology that allows multiple wireless networks to access the same frequency band dynamically and efficiently. It can reduce the spectrum scarcity issue and enable more wireless applications and services, but also requires careful coordination and management to avoid interference and ensure fair access.

Examples of spectrum sharing techniques include Licensed Shared Access (LSA), which uses a regulatory framework to permit licensed users to share spectrum with incumbent users, Dynamic Spectrum Access (DSA), which enables wireless networks to sense and adapt to the spectrum environment, and Spectrum Aggregation, which combines multiple spectrum bands or channels into a larger bandwidth. LSA can be used by mobile operators to access spectrum that is not used by TV broadcasters, DSA can be employed by cognitive radio networks to detect and avoid channels occupied by primary users, Spectrum Aggregation can be used by 5G networks for coverage and speed.

The wireless telecom industry has to take a “concerted look at revolutionizing spectrum sharing” and to take a closer look at the lessons learned from CBRS spectrum sharing [1.], which took about a decade to be successfully implemented, according to Andrew Thiessen, chair of the spectrum working group at the Next G Alliance who was speaking at the Informa Big 5G conference panel session in Austin, TX. He opined that the industry needs to be pushing ahead with spectrum sharing technologies and techniques at speeds similar to the innovations that are being applied to smartphones.

Note 1. Citizens Broadband Radio Service (CBRS), which allows for dynamic spectrum sharing between the Department of Defense and commercial spectrum users. The DOD users have protected, prioritized use of the spectrum. When the government isn’t using the airwaves, companies and the public can gain access through a tiered licensing arrangement. This means the DOD can use the same spectrum for its critical missions while companies can use it for 5G and high-speed Internet deployment.

“Innovative spectrum sharing frameworks are key to unlocking additional bandwidth for wireless connectivity across the country,” Deputy Assistant Secretary of Commerce for Communications and Information April McClain-Delaney said. “The success and growth of the CBRS band shows the promise of dynamic spectrum sharing to make more efficient use of this finite resource.”

………………………………………………………………………………………………………………………………………………..

Joe Kochan, executive director of the National Spectrum Consortium, agreed that spectrum sharing for 6G does present challenges as it faces a wide range of commercial users, federal users and non-federal users, as well as different types of technologies, such as radar. That elicits a need for the industry to build new tools and to get more creative about how that spectrum can be shared.

The Biden administration’s National Spectrum Strategy will “lay the framework” to get everything moving, said Derek Khlopin, deputy associate administrator, spectrum planning policy, at the NTIA. “We’re tech and application-neutral. But the better we understand, the better we can plan.” he explained.

“We’ve started listening, to be frank,” Khlopin said. “But it’s not necessarily the role of the government to figure all of this out. We need help, so we’re working closely with industry, with academia and others. Spectrum sharing is here to stay between federal and non-federal users,” he added.

Khlopin was asked about NTIA’s exploration of the 7GHz band and its potential for 6G. “It’s a very complicated band,” he said. “There’s a lot there … We’re aware of the industry interest there.”

Thiessen said one challenge for 6G will be a lack of contiguous spectrum. He believes that 6G will likely be made up of a lot of pieces of spectrum, and those pieces will likely need to be targeted to specific use cases. However, that presumption is premature as neither 3GPP or ITU-R WP5D has started any serious work on defining 6G specifications. That is why all the buzz about 6G is irrelevant at this time.

References:

https://www.linkedin.com/advice/1/how-can-wireless-network-coexistence-interference

https://ntia.gov/blog/2023/innovative-spectrum-sharing-framework-connecting-americans-across-country

https://www.lightreading.com/6g/spectrum-sharing-will-be-key-to-unlocking-6g/d/d-id/784884?

Vodafone tests 5G Dynamic Spectrum Sharing (DSS) in its Dusseldorf lab

GSMA: Closing the digital divide in Central Asia and the South Caucasus

The GSMA has published a report – Closing the digital divide in Central Asia and the South Caucasus – which affirms that mobile technology is fundamental to expanding connectivity across the region, with over 40% of the population living in rural areas where mobile connectivity is the primary, and often only, form of internet access. The report assesses the state of mobile adoption and infrastructure availability in Armenia; Azerbaijan; Georgia; Kazakhstan; Kyrgyzstan; Tajikistan; Turkmenistan; and Uzbekistan.

GSMA Intelligence estimated around 45 million people across the eight countries used mobile internet (as of the date of publication). This represented a significant increase from 14.1 million recorded a decade earlier, though it still leaves around 50 million unconnected. Although lack of coverage was cited as still a challenge in parts of Central Asia, where around 10 per cent of the population in some markets lived in underserved areas, it generally noted the pace of adoption was lagging rollout.

GSMA Intelligence noted collaboration as key to addressing the digital divide in the regions, adding there is a need to “increase digital skills and literacy and improve affordability, in addition to investing in local digital ecosystems and an enabling policy environment that can accelerate growth in local content, services and applications”

The new report was launched to mark the opening of M360 Eurasia 2023, which today welcomed global leaders from the mobile ecosystem and adjacent industries for two days of learning, debate and networking at the Four Seasons Hotel in Baku, Azerbaijan.

“Since the first mobile phone call 50 years ago, our industry has evolved, adapted and advanced the world around us, serving 5.4 billion unique customers. As we enter the era of intelligent connectivity, it feels like anything is possible, but it has also never been more important for us to focus on closing the digital divide. Together we must keep working to build a firm foundation for the next generation of intelligent connectivity and ensure that no one is left behind in our global digital economy,” said Mats Granryd, Director General of the GSMA, on stage for the opening ceremony and keynote.

“I am delighted to welcome the global connectivity community to Baku for M360 Eurasia,” said H.E. Rashad Nabiyev, Minister of Digital Development and Transport for the Republic of Azerbaijan. “As we continue our digital transformation journey in Azerbaijan, we look forward to hearing leaders in mobile and technology explore the latest trends in connectivity and the importance of digital resilience.”

As of April 2023, commercial 5G services were only available in Kazakhstan, Tajikistan and Uzbekistan, though GSMA Intelligence noted activities around the latest generation of mobile technology were ramping more widely.

“Although 5G is on the horizon in several markets in Central Asia and the South Caucasus, the focus for many operators in the medium term is to expand 4G capacity in urban areas and 4G coverage to underserved areas, and accelerate uptake among consumers.”

Closing the Digital Divide in Eurasia:

M360 Eurasia comes to Baku, Azerbaijan as progress to build the digitally powered economy of the future continues in the region, driven by ambitious digital transformation initiatives and a general trend towards greater digitisation.

The new report from the GSMA, which evaluates the connectivity landscape of eight countries1 in Central Asia and the South Caucasus, outlines the digital divide and spotlights ongoing initiatives in the region to close it with recommended action points for stakeholders to accelerate progress.

Other key findings from the report include:

- While 45 million people are now using mobile internet across the eight countries evaluated, a digital divide remains with nearly 50 million unconnected people at risk of missing out on the benefits of mobile internet.

- The adoption of mobile internet services has not kept pace with the expansion of network coverage, resulting in a significant usage gap2. As of 2022, the regional usage gap was widest in Georgia (52%) and Turkmenistan (50%), and lowest in Armenia (33%) and Azerbaijan (31%) versus a global average of 41%.

- While 4G is now the dominant technology in Azerbaijan (59%) and Kazakhstan (62%), 3G still accounts for over 40% of total connections across the region versus a global average of 17%.

- The region’s 5G uptake is still in its infancy with commercial 5G services only available in Kazakhstan, Tajikistan and Uzbekistan as of April 2023. The medium-term focus for operators in the region is to expand 4G capacity in urban areas and 4G coverage to underserved areas.

- While 4G coverage has reached 83% of the population in Central Asia, extending coverage to the last frontier can be costly and complex. This has led to operators increasingly turning to alternate technologies, such as satellite backhaul, and innovative partnerships as a means of closing the digital divide.

- Closing the region’s digital divide will require substantial collaborative actions. To this end, governments and policymakers should implement measures that can attract investment in the deployment of network infrastructure in underserved areas; create innovative digital services to stimulate demand; and address the various non-infrastructure barriers to mobile internet adoption.

M360 Series: Regional focus, global impact:

M360 Eurasia marks this year’s first iteration of the M360 Series. Presented by the GSMA, M360 is a series of global events that unifies the regional mobile ecosystem to discover, develop and deliver innovation that is the foundation to positive business environments and societal change.

The events facilitate inspirational keynotes, engaging panel discussions and insightful case studies across mobile technology and adjacent industry verticals.

To download the report, please click here: Closing the digital divide in Central Asia and the South Caucasus

About GSMA:

The GSMA is a global organisation unifying the mobile ecosystem to discover, develop and deliver innovation foundational to positive business environments and societal change. Our vision is to unlock the full power of connectivity so that people, industry, and society thrive. Representing mobile operators and organisations across the mobile ecosystem and adjacent industries, the GSMA delivers for its members across three broad pillars: Connectivity for Good, Industry Services and Solutions, and Outreach. This activity includes advancing policy, tackling today’s biggest societal challenges, underpinning the technology and interoperability that make mobile work, and providing the world’s largest platform to convene the mobile ecosystem at the MWC and M360 series of events.

References:

GSMA REPORT HIGHLIGHTS PIVOTAL ROLE OF MOBILE TECHNOLOGY IN EXPANDING CONNECTIVITY IN EURASIA REGION

EU wants to build a subsea internet cable in the Black Sea

Since 2021, the EU and the nation of Georgia (previously in the USSR) have highlighted a need to install an underwater (subsea) internet cable through the Black Sea to improve the connectivity between Georgia and other European countries.

After the start of war in Ukraine, the project has garnered increased attention as countries in the South Caucasus region have been working to decrease their reliance on Russian resources—a trend that goes for energy as well as communications infrastructure. Internet cables have been under scrutiny because they could be tapped into by hackers or governments for spying.

“Concerns around intentional sabotage of undersea cables and other maritime infrastructure have also grown since multiple explosions on the Nord Stream gas pipelines last September, which media reports recently linked to Russian vessels,” the Financial Times reported. The proposed cable, which will cross international water through the Black Sea, will be 1,100 kilometers, or 684 miles long, and will link the Caucasus nations to EU member states. It’s estimated to cost €45 million (approximately $49 million).

“Russia is one of multiple routes through which data packages move between Asia and Europe and is integral to connectivity in some parts of Asia and the Caucasus, which has sparked concern from some politicians about an over-reliance on the nation for connectivity,” The Financial Times reported.

Across the dark depths of the globe’s oceans there are 552 cables that are “active and planned,” according to TeleGeography. All together, they may measure nearly 870,000 miles long, the company estimates. Take a look at a map showing existing cables, including in the Black Sea area, and here’s a bit more about how they work.

The Black Sea cable is just one project in the European Commission’s infrastructure-related Global Gateway Initiative. According to the European Commission’s website, “the new cable will be essential to accelerate the digital transformation of the region and increase its resilience by reducing its dependency on terrestrial fibre-optic connectivity transiting via Russia. In 2023, the European Investment Bank is planning to submit a proposal for a €20 million investment grant to support this project.”

Currently, the project is still in the feasibility testing stage. While the general route and the locations for the converter stations have already been selected, it will have to go through geotechnical and geophysical studies before formal construction can go forward.

References:

Why the EU wants to build an underwater cable in the Black Sea

China seeks to control Asian subsea cable systems; SJC2 delayed, Apricot and Echo avoid South China Sea

SEACOM telecom services now on Equiano subsea cable surrounding Africa

Bharti Airtel and Meta extend 2Africa Pearls subsea cable system to India

Google’s Equiano subsea cable lands in Namibia en route to Cape Town, South Africa

Google’s Topaz subsea cable to link Canada and Japan

Altice Portugal MEO signs landing party agreement for Medusa subsea cable in Lisbon

2Africa subsea cable system adds 4 new branches

Echo and Bifrost: Facebook’s new subsea cables between Asia-Pacific and North America