Year: 2023

3GPP 5G Broadcast: Evolved Universal Terrestrial Radio Access (E-UTRA); User Equipment (UE) radio transmission and reception

On September 29th, 3GPP published the latest version of its technical specs for 5G Broadcast: version 18.3.0 of 36.101 Evolved Universal Terrestrial Radio Access (E-UTRA). The updated specs show approval for “LTE based 5G terrestrial broadcast” to operate in a new 108 band (470MHz – 698MHz).

This updated spec effectively makes all U.S. low-power UHF stations 3GPP-eligible to broadcast using a 5G RAN. The revised specs surfaced a couple of weeks after WWOO-LD – a Boston-area TV station – kicked off the nation’s first 5G Broadcast field trial.

After being granted an experimental license granted by the FCC, WWOO-LD and its partners are using 5G Broadcast initially to test the delivery of select live TV feeds and emergency alerting signals to 5G-capable TV receivers (using 5G FWA) and to Qualcomm-based smartphone reference designs that can filter in UHF frequencies.

Supporters hope the trial is the start of a broader initiative to build a national 5G Broadcast system that taps into low-power UHF frequencies for one-way (downstream-only) services and applications that can complement existing mobile 5G networks.

The broadcast/multicast technology offered by 3GPP specs brings multiple benefits:

- Services can be provided over the existing infrastructure and spectrum, often requiring only incremental adjustments to deployed mobile network.

- 3GPP broadcast/multicast technology can offload different types of traffic from unicast. For example, streaming of identical or live content. Considering that the multimedia services, especially video, occupies much of the bandwidth, this functionality can enhance network efficiency.

- 3GPP broadcast/multicast technology provides scalability of broadcasting services, with large numbers of users or UEs able to access content.

Initial use cases being explored for 5G Broadcast include broadcasting local TV signals to 5G smartphones, transmitting alerts to consumers and delivering large files (including video and other critical information) to first responders.

……………………………………………………………………………………………………………………………….

Startup XGen Network intends to act as a broker for the 5,300-plus US LPTV stations, effectively serving as a one-stop shop for wireless carriers and content owners interested in the proposed, national 5G Broadcast platform. XGen Network was founded by Frank Copsidas, founder of the Low Power TV Broadcasters Association (and former manager of the late James Brown), and Bill Christian, a fellow broadcast industry vet who owns WWOO-LD.

Ateme, a specialist in video compression, delivery and streaming solutions, has announced that it was behind the first transmission of a 5G signal over a licensed broadcast facility, in a proof of concept of 5G Broadcast. Executed by Boston-based, Milachi Media -owned TV station WWOO-LD and wireless technology innovator Qualcomm Technologies, Ateme says the demonstration represents a significant milestone in the U.S. media industry and heralds a new era for video delivery and public safety.

5G Broadcast is also emerging as a potential competitor to ATSC 3.0, the next-gen, IP-based broadcast signaling standard, that is being rolled out to dozens of U.S. markets under the consumer branding of “NextGenTV.” The former technology has received some critical reaction from U.S. broadcasters that are big backers of ATSC 3.0. Earlier this month, a pair of execs at Sinclair Broadcast Corp. argued that ATSC 3.0 and 5G Broadcast “are not equal” and warned the industry not to get too worked up over the “hype” suggesting that 5G Broadcast holds an edge because of its ties to 3GPP standards.

References:

https://portal.3gpp.org/desktopmodules/Specifications/SpecificationDetails.aspx?specificationId=2411

https://www.lightreading.com/5g/3gpp-publishes-5g-broadcast-specs

https://www.3gpp.org/technologies/broadcast-multicast1

https://www.lightreading.com/5g/boston-tv-station-lights-up-5g-broadcast-field-trial

New broadcast TV standard ATSC 3.0 “Next Gen TV” to cover 82% of U.S. households by end of 2022

LightCounting & TÉRAL RESEARCH: India RAN market is buoyant with 5G rolling out at a fast pace

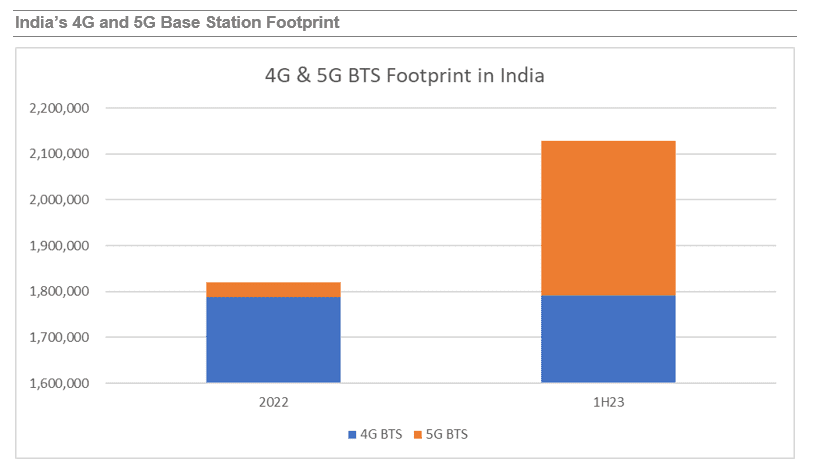

The India Wireless Infrastructure Report provides an update on the 5G radio access (RAN) developments in India, including geopolitics trends and technology. The report says that The RAN market in India is buoyant with a swelling local ecosystem that boasts big international ambitions.

Reliance Jio is rolling out 5G at a fast pace, followed by Bharti Airtel. As a result,1H23 RAN sales surged 300% YoY, and kept Ericsson in the driver’s seat, followed by Nokia and Samsung. Although the rollout pace has slowed down, 2023 is looking up, looks like the peak year, and we expect RAN equipment sales to more than double compared to last year, still driven by Jio and Airtel while BSNL will contribute with its 4G deployment.

“It’s a two-horse race, the near Jio / Airtel duopoly is quickly blanketing the country with 5G while the rest are struggling and catching up with 4G.” said Stéphane Téral, Chief Analyst at LightCounting Market Research and Founder of TÉRAL RESEARCH.

Source: LightCounting

………………………………………………………………………………………………………………………….

- 2024 is shaping up as a shift year from 5G network buildout to how to foster utilization and some midband FWA experiments.

- Due to the looming formation of a CSP duopoly, the looming merger of MTNL into BSNL, and Vodafone Idea’s unsustainable indebtment, our long-term forecast points to a lumpy RAN market. There is no surprise that India is a tough cellular market characterized by flat subscriber growth, ultralow ARPUs and low equipment average sales pricing.

- Open RAN is the brightest spot with a penetration of the total RAN market that will surpass 50% by 2028.

- At the same time, a mushrooming energetic local ecosystem is rising with great international ambitions enabled by strong ties between the U.S. and India.

…………………………………………………………………………………………………………..

References:

https://www.lightcounting.com/report/september-2023-india-wireless-infrastructure-217

https://www.lightcounting.com/report/september-2023-open-vran-market-213

Reliance Jio in talks with Tesla to deploy private 5G network for the latter’s manufacturing plant in India

OTT players in India struggle in telco partnerships

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

India to set up 100 labs for developing 5G apps, business models and use-cases

Adani Group to launch private 5G network services in India this year

SNS Telecom & IT: CBRS Network Infrastructure a $1.5 Billion Market Opportunity

SNS Telecom & IT‘s latest research report indicates that annual spending on LTE and 5G NR-based CBRS network infrastructure – which includes RAN (Radio Access Network), mobile core and transport network equipment – will account for more than $1.5 Billion by the end of 2026.

After many years of regulatory, standardization and technical implementation activities, the United States’ dynamic, three-tiered, hierarchical framework to coordinate shared use of 150 MHz of spectrum in the 3.5 GHz CBRS (Citizens Broadband Radio Service) band has finally become a commercial success. Although the shared spectrum arrangement is access technology neutral, the 3GPP cellular wireless ecosystem is at the forefront of CBRS adoption, with more than half of all active CBSDs (Citizens Broadband Radio Service Devices) based on LTE and 5G NR air interface technologies.

LTE-based CBRS network deployments have gained considerable momentum in recent years and encompass hundreds of thousands of cell sites – operating in both GAA (General Authorized Access) and PAL (Priority Access License) spectrum tiers – to support use cases as diverse as mobile network densification, FWA (Fixed Wireless Access) in rural communities, MVNO (Mobile Virtual Network Operator) offload, neutral host small cells for in-building coverage enhancement, and private cellular networks in support of IIoT (Industrial IoT), enterprise connectivity, distance learning and smart city initiatives.

Commercial rollouts of 5G NR network equipment operating in the CBRS band have also begun, which are laying the foundation for advanced application scenarios that have more demanding performance requirements in terms of throughput, latency, reliability, availability and connection density – for example, Industry 4.0 applications such as connected production machinery, mobile robotics, AGVs (Automated Guided Vehicles) and AR (Augmented Reality)-assisted troubleshooting.

Examples of 5G NR-based CBRS network installations range from luxury automaker BMW Group’s industrial-grade 5G network for autonomous logistics at its Spartanburg plant in South Carolina and the U.S. Navy’s standalone private 5G network at NAS (Naval Air Station) Whidbey Island to mobile operator Verizon’s planned activation of 5G NR-equipped CBRS small cells to supplement its existing 5G service deployment over C-band and mmWave (Millimeter Wave) spectrum.

SNS Telecom & IT estimates that annual investments in LTE and 5G NR-based CBRS RAN (Radio Access Network), mobile core and transport network infrastructure will account for nearly $900 Million by the end of 2023. Complemented by an expanding selection of 3GPP Band 48/n48-compatible end user devices, the market is further expected to grow at a CAGR of approximately 20% between 2023 and 2026 to surpass $1.5 Billion in annual spending by 2026. Much of this growth will be driven by private cellular, neutral host and fixed wireless broadband network deployments, as well as 5G buildouts aimed at improving the economics of the cable operators’ MVNO services.

The “LTE & 5G NR-Based CBRS Networks: 2023 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents a detailed assessment of the market for LTE and 5G NR in CBRS spectrum including the value chain, market drivers, barriers to uptake, enabling technologies, key trends, future roadmap, business models, use cases, application scenarios, standardization, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also provides forecasts for LTE and 5G NR-based CBRS network infrastructure and terminal equipment from 2023 to 2030. The forecasts cover three infrastructure submarkets, two air interface technologies, two cell type categories, five device form factors, seven use cases and 11 vertical industries.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a database of over 800 LTE/5G NR-based CBRS network engagements – as of Q3’2023.

The report has the following key findings:

-

SNS Telecom & IT estimates that annual investments in LTE and 5G NR-based CBRS network infrastructure will account for nearly $900 Million by the end of 2023. Complemented by an expanding selection of 3GPP Band 48/n48-compatible end user devices, the market is further expected to grow at a CAGR of approximately 20% between 2023 and 2026 to surpass $1.5 Billion in annual spending by 2026.

-

LTE-based CBRS network deployments have gained considerable momentum in recent years and encompass hundreds of thousands of cell sites to support use cases as diverse as mobile network densification, fixed wireless broadband in rural communities, MVNO offload, neutral host small cells for in-building coverage enhancement, and private cellular networks for vertical industries and enterprises.

-

Commercial rollouts of 5G NR network equipment operating in the CBRS band have also begun, which are laying the foundation for Industry 4.0 and advanced application scenarios that have more demanding performance requirements in terms of throughput, latency, reliability, availability and connection density.

-

By eliminating the entry barriers associated with exclusive-use licensed spectrum, CBRS has spurred the entry of many new players in the cellular industry – ranging from private 4G/5G network specialists such as Celona, Betacom, Ballast Networks, Kajeet and BearCom to neutral host solutions provider InfiniG.

-

The secondary market for leasing and monetizing CBRS PAL spectrum rights is starting to get off the ground with the availability of spectrum exchange platforms – from the likes of Federated Wireless and Select Spectrum – which connect license holders with prospective third-party users to streamline transactions of under-utilized PAL spectrum.

Summary of CBRS Network Deployments

Summarized below is a review of LTE and 5G NR-based CBRS network across the United States and its territories:

-

Mobile Network Densification: Verizon has progressively rolled out CBRS spectrum for its LTE service across thousands of cell sites and is in the final stage of activating 5G NR-equipped CBRS small cells to supplement its existing 5G service deployment over C-band and mmWave (Millimeter Wave) spectrum. Claro Puerto Rico and several other mobile operators are also using CBRS to expand the capacity of their networks in high-traffic density environments.

-

Fixed Wireless Broadband Services: Frontier Communications, Mediacom, Midco, Nextlink Internet, Mercury Broadband, Surf Internet, Cal.net, IGL TeleConnect, OhioTT and MetaLINK are some of the many WISPs (Wireless Internet Service Providers) that have deployed 3GPP-based CBRS networks for fixed wireless broadband services in rural and underserved markets with limited high-speed internet options.

-

Mobile Networks for New Entrants: Comcast and Charter Communications are leveraging their licensed CBRS spectrum holdings to install RAN infrastructure for targeted wireless coverage in strategic locations where subscriber density and data consumption is highest. The CBRS network buildouts are aimed at improving the economics of the cable operators’ MVNO services by offloading a larger proportion of mobile data traffic from host networks.

-

Neutral Host Networks: Among other neutral host CBRS network installations, social media and technology giant Meta has built an in-building wireless network – using small cells operating in the GAA tier of CBRS spectrum and MOCN (Multi-Operator Core Network) technology – to provide reliable cellular coverage for mobile operators Verizon, AT&T and T-Mobile at its properties in the United States.

-

Private Cellular Networks: The availability of CBRS spectrum is accelerating private LTE and 5G network deployments across a multitude of vertical industries and application scenarios, extending from localized wireless systems for geographically limited coverage in factories, warehouses, airports, rail yards, maritime terminals, medical facilities, office buildings, sports venues, military bases and university campuses to municipal networks for community broadband, distance learning and smart city initiatives. Some notable examples of recent and ongoing deployments are listed below:

-

Education: Higher education institutes are at the forefront of hosting on-premise LTE and 5G networks in campus environments. Texas A&M University, Purdue University, Johns Hopkins University, Duke University, Cal Poly, Virginia Tech, University of Wisconsin-Milwaukee, Stanislaus State, West Chester University and Howard University are among the many universities that have deployed cellular networks for experimental research or smart campus-related applications. Another prevalent theme in the education sector is the growing number of private LTE networks aimed at eliminating the digital divide for remote learning in school districts throughout the United States.

-

Governments & Municipalities: The City of Las Vegas is deploying one of the largest private cellular networks in the United States, which will serve as an open connectivity platform available to local businesses, government, and educational institutions for deploying innovative solutions within the city limits. Local authorities in Tucson and Glendale (Arizona), Santa Maria (California), Longmont (Colorado), Shreveport (Louisiana), Montgomery (Alabama), and Dublin (Ohio) and several other municipalities have also deployed their own private wireless networks using CBRS spectrum.

-

Healthcare: During the height of the COVID-19 pandemic, regional healthcare provider Geisinger took advantage of CBRS spectrum to deploy a private LTE network for telemedicine services in rural Pennsylvania while Memorial Health System utilized a temporary CBRS network to provide wireless connectivity for frontline staff and medical equipment in COVID-19 triage tents and testing facilities at its Springfield (Illinois) hospital. Since then, healthcare providers have begun investing in CBRS-enabled private wireless networks on a more permanent basis to facilitate secure and reliable communications for critical care, patient monitoring and back office systems in hospital campuses and other medical settings.

-

Manufacturing: German automotive giant BMW has deployed an industrial-grade 5G network for autonomous logistics at its Spartanburg plant in South Carolina. Rival automaker Tesla is migrating PROFINET/PROFIsafe-based AGV (Automated Guided Vehicle) communications from Wi-Fi to private 5G networks at its factories. Agricultural equipment manufacturer John Deere is installing private cellular infrastructure at 13 of its production facilities. Dow, another prominent name in the U.S. manufacturing sector, has adopted a private LTE network to modernize plant maintenance at its Freeport chemical complex in Texas. FII (Foxconn Industrial Internet), Del Conca USA, Logan Aluminum, OCI Global, Schneider Electric, Bosch Rexroth, CommScope, Ericsson, Hitachi and many other manufacturers are also integrating private 4G/5G connectivity into their production operations.

-

Military: All branches of the U.S. military are actively investing in private cellular networks. One noteworthy example is the U.S. Navy’s standalone private 5G network at NAS (Naval Air Station) Whidbey Island in Island County (Washington). Operating in DISH Network’s licensed 600 MHz and CBRS spectrum, the Open RAN-compliant 5G network delivers wireless coverage across a geographic footprint of several acres to support a wide array of applications for advanced base operations, equipment maintenance and flight line management.

-

Mining: Compass Minerals, Albemarle, Newmont and a number of other companies have deployed 3GPP-based private wireless networks for the digitization and automation of their mining operations. Pronto’s off-road AHS (Autonomous Haulage System) integrates private cellular technology to support the operation of driverless trucks in remote mining environments that lack coverage from traditional mobile operators.

-

Oil & Gas: Cameron LNG has recently implemented a private LTE network for industrial applications at its natural gas liquefaction plant in Hackberry (Louisiana). Chevron, EOG Resources, Pioneer Natural Resources and Oxy (Occidental Petroleum Corporation) are also engaged in efforts to integrate LTE and 5G NR-based CBRS network equipment into their private communications systems.

-

Retail & Hospitality: Private cellular networks have been installed to enhance guest connectivity and internal operations in a host of hotels and resorts, including the Sound Hotel in Seattle (Washington), Gale South Beach and Faena Hotel in Miami (Florida), and Caribe Royale in Orlando (Florida). The American Dream retail and entertainment complex in East Rutherford (New Jersey) and regional shopping mall Southlands in Aurora (Colorado) are notable examples of early adopters in the retail segment.

-

Sports: The NFL (National Football League) is utilizing CBRS spectrum and private wireless technology for coach-to-coach and sideline (coach-to-player) communications during football games at all 30 of its stadiums. HSG (Haslam Sports Group) and other venue owners have installed 3GPP-based private wireless infrastructure at stadiums, arenas and other sports facilities for applications such as mobile ticket scanning, automated turnstiles, POS (Point-of-Sale) systems, digital signage, immersive experiences, video surveillance, crowd management and smart parking. FOX Sports and ARA (American Rally Association) have employed the use of private 4G/5G networks to support live broadcast operations.

-

Transportation: Private cellular networks have been deployed or are being trialed at some of the busiest international and domestic airports, including Chicago O’Hare, Newark Liberty, DFW (Dallas Fort Worth), Dallas Love Field and MSP (Minneapolis-St. Paul), as well as inland and maritime ports such as SSA Marine’s (Carrix) terminals in the ports of Oakland and Seattle. Other examples in the transportation segment range from on-premise 4G/5G networks at Amazon’s FCs (Fulfillment Centers), CalChip Connect’s Bucks County distribution center and Teltech’s Dallas-Fort Worth warehouse to Freight railroad operator’s private LTE network for rail yard workers at its outdoor rail switching facilities.

-

Utilities: Major utility companies spent nearly $200 Million in the CBRS PAL auction to acquire licenses within their service territories. Southern Linc, SDG&E (San Diego Gas & Electric), SCE (Southern California Edison) and Hawaiian Electric are using their licensed spectrum holdings to deploy 3GPP-based FANs (Field Area Networks) in support of grid modernization programs while Duke Energy has installed a private LTE network operating in the unlicensed GAA tier of CBRS spectrum. Among other examples, Enel has deployed a CBRS network for business-critical applications at a remote solar power plant.

-

Other Verticals: LTE and 5G NR-ready CBRS networks have also been deployed in other vertical sectors, including agriculture, arts and culture, construction and forestry. In addition, CBRS networks for indoor wireless coverage enhancement and smart building applications are also starting to be implemented in office environments, corporate campuses and residential buildings. Prominent examples include the Cabana Happy Valley residential complex in Phoenix (Arizona) and Rudin Management Company’s 345 Park Avenue multi-tenant commercial office building in New York City.

-

References:

https://www.snstelecom.com/cbrs

SNS Telecom: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

Netherlands again delays 5G spectrum auction

The 5G spectrum auction in the Netherlands has been delayed again, much to the local telecom companies’ frustration. “An auction this year is no longer a possibility,” a spokesperson for the National Digital Infrastructure Service (RDI) confirmed to NU.nl. “A new date for the auction has yet to be announced.”

KPN, Vodaphone, and Odido, formerly T-Mobile, are eagerly awaiting the chance to bid on frequencies so they can offer 5G mobile services. Mobile internet traffic in the Netherlands is growing by 30 to 50 percent per year, and consumers expect faster internet on their phones.

The RDI intended to release the 5G spectrum on the 3.5GHz band before the end of the year. But an adjustment to the National Frequency Plan (NFP) has thrown a spanner in the works. According to the Ministry of Economic Affairs and Climate, several parties have appealed against the adjustment. “The court will hear the appeal on October 11 and 12,” a spokesperson for the ministry told NU.nl. “Only then can we provide more clarity about when the auction can take place.”

The Dutch telecom companies were disappointed by this new delay. “This auction should have taken place a long time ago,” a KPN spokesperson told the newspaper. “We are several years out of step with other countries in Europe, and there is still a lot of uncertainty.”

“The 3.5GHz band is particularly important to us and an essential part of the development of our network,” a spokesperson for Vodafone said. “We hope that this will be available for national mobile communications in the short term.”

The Netherlands is at risk of losing its position as the country with the best mobile networks in the world, Odibo said. The new frequencies are desperately needed to handle the ever-increasing mobile internet traffic and enable faster mobile internet traffic. The latter is especially vital for Dutch industry, the Odido spokesperson told the newspaper. Mobile internet traffic is expected to grow by 30% to 50% per year in the country.

Telecom towers – Credit: mrfotos / DepositPhotos – License: DepositPhotos

…………………………………………………………………………………………………………………….

References:

https://nltimes.nl/2023/09/22/dutch-delay-5g-spectrum-auction

Potential delays in Netherlands’ 5G 3.5GHz frequency auction

Ericsson and Google Cloud expand partnership with Cloud RAN solution

Ericsson has announced an expansion of its successful and long-standing partnership with Google Cloud to develop an Ericsson Cloud RAN solution on Google Distributed Cloud (GDC) [1.] that offers integrated automation and orchestration and leverages AI/ML for additional communications service providers (CSP) benefits. The companies have successfully demonstrated the full implementation of the Ericsson vDU and vCU on GDC Edge and the solution is running live in the Ericsson Open Lab in Ottawa, Canada, with joint ambition for market development.

Note 1. GDC is a portfolio of fully managed hardware and software solutions which extends Google Cloud’s infrastructure and services to the edge and into your data centers.

Deploying Ericsson Cloud RAN on GDC Edge enables the delivery of a fully automated and very large-scale distributed cloud, resulting in an efficient, reliable, highly performant and secured software centric radio access network infrastructure. In this setup, the on-premises GDC Edge is managed using functions such as fleet management from the public cloud through a dedicated secure connection between on-prem hardware and the cloud, while also addressing sovereignty and privacy requirements of the CSP customers. This architecture ensures the clear path for CSPs toward the implementation of a fully hybrid cloud solution for RAN.

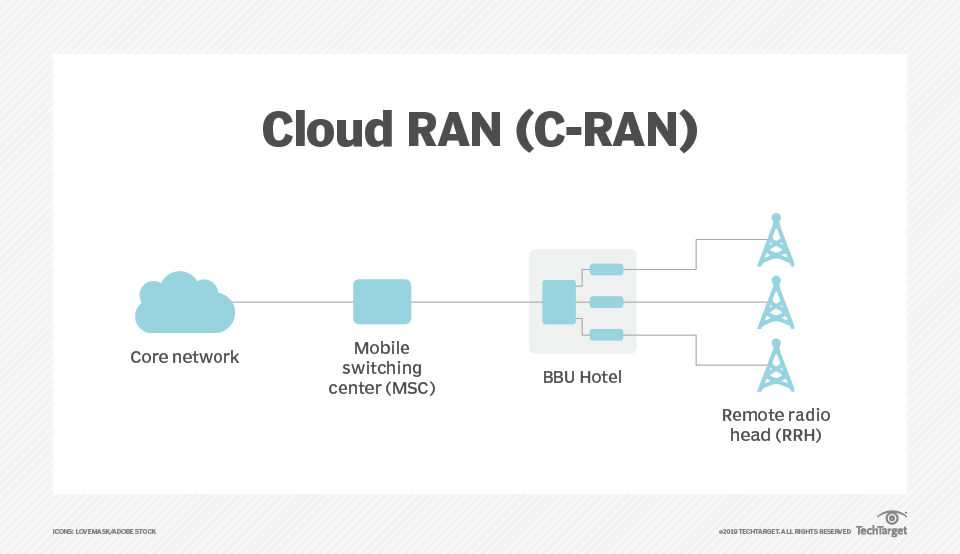

Cloud RAN comprises a mobile switching center, a BBU hotel and a remote radio head

C-RAN networks comprise three primary components:

- A BBU hotel. This is a centralized site that functions as a data or processing center. Individual units can stack together without direct linkage or interconnect to dynamically allocate resources based on network needs. Communication between units has high bandwidth and low latency.

- A remote radio unit (RRU) network. Also known as a remote radio head, an RRU is a traditional network that connects wireless devices to access points.

- A fronthaul or transport network. Also known as a mobile switching center, a fronthaul or transport network is the connection layer between a BBU and a set of RRUs that use optical fiber, cellular or mmWave communication.

………………………………………………………………………………………………………………………………………………………………………………………………………….

Running Ericsson Cloud RAN on GDC Edge will enable CSPs to utilize Google Cloud Vertex AI, BigQuery and other cloud services, to improve the usability of the massive data sets being provided by Cloud RAN applications. This in turn, will open a number of opportunities for CSPs to control, inspect, configure, and optimize their RAN infrastructure.

Ericsson Cloud RAN provides CSPs additional choice for creating networks based on open standards and interfaces using multiple vendors. The Ericsson Cloud RAN solution is infrastructure agnostic, allowing RAN applications to be deployed on any infrastructure chosen by the CSP. Ericsson is continuously collaborating with ecosystem partners and adapting its Cloud RAN applications to work on different infrastructures and configurations.

To further a cloud-native automation approach to network workloads, Ericsson and Google Cloud are jointly enhancing the solution through the Linux Foundation open-source project Nephio (a Kubernetes-based automation platform for deploying and managing highly distributed, interconnected workloads such as 5G network functions), where we jointly drive standardization of critical functionality.

Mårten Lerner, Head of Product Line Cloud RAN, Ericsson, says: “This partnership enables us to deepen and expand our valuable collaboration with Google Cloud, and it opens new opportunities for operators to utilize the benefits of cloud-native solutions and automation. Ericsson remains committed to ensuring the adaptability of its Cloud RAN applications on diverse cloud infrastructures, offering operators enhanced flexibility and choice in deploying Cloud RAN as well as supporting the evolving hybrid cloud architectures together with Google Cloud.”

Gabriele Di Piazza, Senior Director, Telecom Products, Google Cloud, says:

“We’re proud to enable Ericsson Cloud RAN to run on Google Distributed Cloud Edge infrastructure, which includes access to our AI/ML capabilities as well as cloud-native automations. We’re delighted to recognize Ericsson as a distinguished Google Cloud Partner and look forward to a continued strong partnership in support of our mutual customers.”

https://www.techtarget.com/searchnetworking/definition/cloud-radio-access-network-C-RAN

Ericsson and O2 Telefónica demo Europe’s 1st Cloud RAN 5G mmWave FWA use case

Cloud RAN with Google Distributed Cloud Edge; Strategy: host network functions of other vendors on Google Cloud

Vodafone Trials Nokia’s Cloud RAN; Other 5G Research Partnerships

Nokia launches anyRAN to drive CloudRAN partnerships for mobile network operators and enterprises

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

AST SpaceMobil announced its latest satellite-based connectivity milestone, making “5G” voice and data connections between a standard smartphone and a satellite. We say “5G” because there are no 5G satellite standards – only ITU-R M.2150 for terrestrial 5G. 3GPP Rel 17-20 will specify 5G SatCom.

Using the BlueWalker 3 test satellite and its 693-square-foot array — the largest such commercial telecommunications array in low Earth orbit — engineers at AST SpaceMobile made history on September 8, 2023, by demonstrating the first-ever 5G cellular connectivity from space directly to everyday smartphones. The company proved the feat using AT&T cellular spectrum in Maui, Hawaii, to make a voice call to Vodafone in Madrid, Spain. The call was facilitated by Nokia’s network core. The company also recently achieved other firsts in space-based cellular broadband, an industry it pioneered: voice calls, 4G data downloads of more than 14 Mbps, and 4G video calls.

AST SpaceMobile has included a YouTube link of its own in its latest announcement.

The two new milestones come in the wake of AST SpaceMobile’s announcement in April that it had completed the first ever space-based voice calls using normal smartphones.

It has, of course, come under scrutiny for that claim. In July Lynk, which is building an LEO constellation to create what it terms ‘cell towers in space,’ also claimed to have completed the world’s first voice calls over its network. Lynk seemed to hang much of its claim on the fact that it had a video as proof, although opinions vary on how conclusive such a video could be.

“Once again, we have achieved a significant technological advancement that represents a paradigm shift in access to information. Since the launch of BlueWalker 3, we have achieved full compatibility with phones made by all major manufacturers and support for 2G, 4G LTE, and now 5G,” said AST SpaceMobile CEO Abel Avellan. It’s worth noting that BlueWalker 3 is a test satellite; AST Space Mobile plans to launch its first five commercial satellites in the first quarter of next year.

“Making the first successful 5G cellular broadband connections from space directly to mobile phones is yet another significant advancement in telecommunications AST SpaceMobile has pioneered,” Avellan declared. Vodafone, AT&T and Nokia also contributed – slightly less self-congratulatory – statements about their own roles in proceedings and the potential of the technology to connect the unconnected.

It’s hard to argue with that last point, which is part of the reason why satellite-based connectivity is having something of an extended moment in the spotlight, with AST SpaceMobile, Lynk, Sateliot and others talking up their various achievements.

AST SpaceMobile describes itself as “the company building the first and only space-based cellular broadband network accessible directly by standard mobile phones.”

………………………………………………………………………………………………………………………….

References:

First-Ever 5G Connectivity from Space to Everyday Smartphones Achieved by AST SpaceMobile

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

AST SpaceMobile achieves 4G LTE download speeds >10 Mbps during test in Hawaii

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

FCC proposes regulatory framework for space-mobile network operator collaboration

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

China’s answer to Starlink: GalaxySpace planning to launch 1,000 LEO satellites & deliver 5G from space?

Betacom and UScellular Introduce 1st Private/Public Hybrid 5G Network

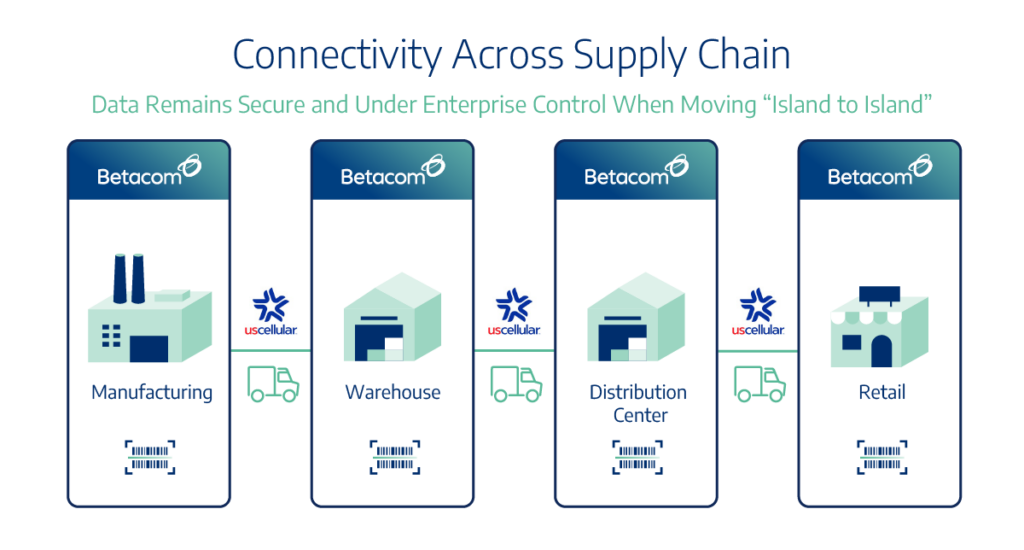

Private wireless network provider Betacom today announced a partnership with UScellular to deliver the industry’s first private/public hybrid 5G networks, advancing Industry 4.0 initiatives across the United States. The service provides security and control over business data, both on-premises and while roaming among company facilities. This seems to be similar to the “hybrid cloud” concept where a public cloud is used for general computing while a private cloud is used for mission critical applications and secure storage.

The private/public hybrid 5G network service allows organizations with multiple sites across numerous locations to maintain connectivity between locations. Enterprises working to modernize their operations across dispersed locations now have a cohesive mobility strategy with trusted partners for Industry 4.0. Uptime and performance are assured for improved operational efficiency and productivity with Betacom-backed Service Level Agreements (SLAs).

“This relationship with Betacom helps to establish a new bar for how the entire wireless industry thinks about, builds, delivers and utilizes wireless networks,” said Kim Kerr, senior vice president, enterprise sales and operations for UScellular. “These new capabilities significantly accelerate the return on investment for digital transformation and modernization initiatives for organizations of all types, from enterprise to retail to government, and move the industry as a whole forward, faster.”

Nationwide Mobility:

UScellular’s network and extensive access agreements give customers connectivity across the United States. UScellular also provides data backhaul between sites. Enabling devices to use a single SIM with profiles for both Betacom private CBRS networks and the UScellular network ensures mobility, while integrated communication and coordination between the two companies’ 5G network cores enables seamless roaming across the country.

“Betacom and UScellular are breaking new ground for their customers and setting new precedents for the industry,” said Joe Madden, Founder and President, Mobile Experts Inc. “Enabling device mobility from facility to facility with a transition from CBRS to cellular in both directions has never been solved. This makes private/public hybrid 5G networks extremely valuable for a wide range of industries.”

Michael Davies, VP of business partner strategy and 5G-as-a-service at Betacom, explained in an interview that Betacom’s authentication system is the “secret sauce” to securing this seamlessness within an “island” environment. “We have joined together to provide a single SIM that is authenticated within the static network and then is accepted, secured and maintained throughout the mobile network into the next static environment of the island,” Davies said.

David Allen, director of emerging technologies at UScellular, added that this approach also is key to how the operator segments the private network service. “We treat that private cellular network as a peer of ours, and so when we see that SIM in the public cellular domain, whether it’s on our native network or it’s on one of our roaming partners network, we will authenticate against that private [home subscriber server], that private cellular network, get the corresponding authentication, accept or deny and then that device can proceed with the policy controls that that private network has put in place for it,” Allen said.

“You may see other people claim hybridization. We’ve been early in that messaging of hybridization of networks, the public-private hybrid networks. Others have started saying that as well, but it’s really when you peel back the layers it’s typically a two-SIM solution. That’s for the most part, historically, the way that solution’s gone. We’re working together to drive toward that single-SIM solution so that we’re authenticating a private SIM and a private device that happens to be in the public network against that private network.”

Improved Security and Control:

The solution establishes and maintains end-to-end security, utilizing virtual private networks (VPNs) to ensure that all data effectively remains on the customer premises while devices and sensors are in transit between locations. It also provides unmatched resiliency by using the cellular network for failover in cases where the CBRS network or local internet service providers (ISPs) suffer an outage. The new network architecture utilized for this service facilitates mission-critical Command, Control, Communication, Computers, and Intelligence (C4I) services and solutions which require the highest degrees of data and device security. Reducing dependency on public clouds for data transfer by creating a private network through the carrier network results in fewer vulnerabilities and fewer attacks.

“The service we are announcing today recognizes that the wireless world is changing, and that connectivity, in all of its forms, must change with it,” said Betacom CEO Johan Bjorklund. “Organizations today need seamless mobility with incredibly high densities of sensors and devices to accelerate their Industry 4.0 initiatives. This new service acknowledges and uniquely meets that need.”

About Betacom:

Betacom offers the first fully-managed private 5G network, building on its long history as a wireless infrastructure provider to AT&T, T-Mobile, and Verizon. Founded in 1991 and headquartered in Bellevue, Washington, the company has regional offices throughout the country. Having completed more than 800 large-scale design and deployment projects, Betacom inspires confidence among their customers who have worked closely with them to meet their pressing high-performance connectivity needs. Its secure private 5G wireless service is the first managed service of its kind in the United States.

Betacom earlier this year expanded the ecosystem around its platform with more than a dozen partners. This included mobile edge compute work with Google Cloud, Ingram Micro and Intel; application work with ADB SAFEGATE Americas, Evolon, Ingram Micro and Solis Energy; industrial IoT devices from Axis Communications, Ingram Micro, Qualcomm Technologies, SVT Robotics and Vecna Robotics; 5G work with Airspan, Druid Software, FibroLAN and Qualcomm; and system integration work with CDW, Ingram Micro and QuayChain.

The vendor at that time said the expanded ecosystem alleviates ongoing concerns by enterprise IT departments that they will need to manage a disparate combination of equipment, services and connectivity to deploy a private network. This should be beneficial to those enterprise IT staffs that have so far eschewed potential network complexity by going with a private network platform.

For more information, visit https://www.betacom.com.

References:

UScellular’s Home Internet/FWA now has >100K customers

UScellular Launches 5G Mid-Band Network in parts of 10 states

US Cellular touts 5G millimeter wave and cell tower agreement with Dish Network

Ooredoo Qatar is first operator in the world to deploy 50G PON

Ooredoo Qatar announced that it has become the first operator in the world to deploy 50G PON (Passive Optical Network) connectivity, the 50 Gbps-capable fiber-based access connection for consumers. According to Ooredoo, the 50G PON technology, which has been adopted as an ITU standard, delivers fiber-based access connections with speeds of up to 50 Gbps on a single connection.

The 50G-PON system capitalizes on fundamental advances in the optical transceiver components working in conjunction with enhanced error correction and coding. It also introduces key innovations in activation procedures, contention-based operation, and expanded cryptographic features. With these improved capabilities, the 50G-PON system is ready to meet the new, and demanding, requirements of emerging services.

This new technology enables consumers to use high-bandwidth latency-sensitive applications such as 8k-interactive video applications, online collaboration and coordination solutions, 3D cloud design, high-graphic/high-quality AI applications, etc.

Dell’Oro Group believes total 50G-PON equipment revenue will increase from less than $3M in 2023 to $1.5B in 2027. Much more significant growth is expected after 2027, as operators begin to evolve their 10Gbps PON networks to next-generation technologies.

Sheikh Ali Bin Jabor Al Thani, Chief Executive Officer, Ooredoo Qatar, said: “We’re proud to be the first operator globally capable of deploying such powerful technology, which aligns perfectly with our overarching aim of upgrading our customers’ worlds. We have long had a strategic commitment to partnering with global leaders in technology and innovation, enabling us to leverage both our expertise and experience and our partners’ capabilities. This latest launch is an excellent example of the benefits we, and our customers, enjoy as a result of such partnerships. We look forward to further enhancing our offering as technology develops ever further in the years to come.”

Ooredoo’s 50G PON technology can meet the bandwidth requirements of both consumers and enterprises. Initial deployment will be for B2B customers and areas that require high-speed connectivity, with roll-out to consumers – for 8k content and AR/VR gaming, as an example – to follow.

ITU-T standards for 50G PON:

In April 2021, the ITU-T reached a major mile-stone, consenting the first three Recommendations defining a 50G PON system:

- General Requirements (G.9804.1): The legacy features linked to deployed fiber infra-structure are complemented by support for new services requiring high capacity, efficiency, low latency, and security. Coexistence with, and migration from, the installed PON systems are essential.

- Common Transmission Convergence Layer (ComTC) specification (G.9804.2): This is defined in a line rate agnostic way and thus applicable to future single-wavelength time-division multiplexing (TDM) and multi-wavelength time-and-wavelength-divi-sion multiplexing (TWDM) PON systems.

- The single-wavelength 50G-PON PMD (G.9804.3) specification is the first in the HS-PON PMD family.

References:

https://ieeexplore.ieee.org/document/9743347

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

New research from Juniper Research forecasts that network operators will generate $17 billion of additional revenue from 3GPP‑compliant 5G satellite networks between 2024 and 2030.

Editor’s Note: There is no serious work in ITU-R on 5G satellite networks as we’ve previously detailed. The real SatCom air interface specifications work is being done by 3GPP, under the umbrella term of NTN (Non-terrestrial Networks), in Release 17 and the forthcoming Release 18.

ITU-R WP5D is responsible for terrestrial IMT radio interfaces (IMT-2000, IMT-Advanced and IMT-2020/M.2150 as well as IMT for 2030 and Beyond), so it won’t be involved in standardizing radio interfaces satellite networks.

ITU-R Working Party 4B (WP 4B) is responsible for recommendations related to: Systems, air interfaces, performance and availability objectives for FSS, BSS and MSS, including IP-based applications and satellite news gathering.

…………………………………………………………………………………………………………………..

The market research firm urges network operators to sign partnerships with SNOs (Satellite Network Operators) which will enable operators to launch monetizable satellite-based 5G services to their subscribers. SNOs possess capabilities to launch next-generation satellite hardware into space, as well as being responsible for the operation and management of the resulting networks.

The new report, Global 5G Satellite Networks Market 2023-2030 offers the most reliable source of data for the market.

Operators Hold the Key Billing Relationship:

Juniper Research predicts the first commercial launch of a 5G satellite network will occur in 2024, with over 110 million 3GPP‑compliant 5G satellite connections in operation by 2030. To capitalise on this growth, the research urges operators to prioritise immediate partnerships with SNOs that can launch GSO (Geostationary Orbit) satellites. These satellites follow the rotation of the earth to always be located above the country that the operator serves; providing consistent connectivity.

Additionally, operators must leverage their pre-existing billing relationship with mobile subscribers and enterprises as a platform to grow 5G satellite connectivity revenue over the next seven years. The report anticipates this existing billing relationship will enable operators to rapidly drive the adoption of satellite connectivity by integrating satellite services into existing terrestrial networks.

Key Forecasts:

- Total Operator-billed 5G Satellite Revenue 2024-2030: $17bn

- Total 3GPP-compliant 5G Satellite Connections in 2030; $110mn

- Average Revenue per 5G Satellite Connection in 2030: $7.98

………………………………………………………………………………………………………………….

3GPP Releases related to SatCom:

3GPP Rel-17 is enabling the launch of satellite-based communications. Unlike traditional telecommunications ecosystems, the development of this market will be defined by the entrance of a new category of players – satellite vendors. These vendors will work with network operators to deploy NTNs (Non-terrestrial Networks) that side alongside terrestrial networks.

NTNs are a joint development between network operators and satellite vendors to drive growth of telecommunications services. In the future, NTNs will integrate directly with satellite-based networks to provide connectivity with comprehensive services.

However, the development of NTN specifications is far from complete, the 3GPP roadmap includes provisions in 3GPP Releases 18 and 19 for enhancements to satellite services. 3GPP Release 20 includes the provision of satellite-based standards for future 6G networks. It is only with these standards that satellite networks can progress past traditional use cases, such as weather monitoring, global positioning services and broadcasting, which require low-to-medium throughput rates and do not need low latency.

Additionally, satellites have not been required, as the low data rates provided by previous iterations of satellite technologies, combined with the high costs of satellite connectivity, have not been able to compete with the service provided by terrestrial networks.

These will be the most immediate benefits of satellite-based services for 5G networks:

• Increased network coverage: Satellites will provide increased coverage to areas where terrestrial networks are financially unviable. This is most notable in rural areas where there is little demand for cellular connectivity; leaving operators with no return on investment into the needed backhaul infrastructure and base stations.

• Increased support of backhaul infrastructure: Given the data-intensive nature of 5G services, satellite infrastructure will be used to carry data in a similar fashion to fibre services in terrestrial networks.

• Increase network capacity and throughput: Satellites can offload data from terrestrial networks. As the number of 5G connections increases, so will the data generated. In turn, satellites can not only provide coverage in areas where there is little support for 5G services, but they can also alleviate geographical areas that require high throughput and support for a large number of connections.

• More network resilience: Satellites will provide an additional layer of network redundancy for communication services during natural disasters or network outages. When terrestrial networks are inoperable, satellites will be used for connectivity in the absence of terrestrial network.

Preparation for 6G Networks:

However, the research predicts operators will increasingly rely on SNOs for service provision as 6G development accelerates. Research author Sam Barker commented:

“Operators must not only think of 5G satellite services when choosing an SNO partner, but also the forward plan for 6G networks, including coverage and throughput capabilities.”

About the Research Suite:

This new Juniper market research suite offers the most comprehensive assessment of the 3GPP‑compliant 5G satellite network to date; providing analysis and forecasts of over 24,000 data points across 60 markets over five years.

View the 5G Satellite Networks market research: https://www.juniperresearch.com/researchstore/operators-providers/5g-satellite-networks-research-report

Download a free sample: https://www.juniperresearch.com/whitepapers/5g-satellite-networks-the-17bn-operator

References:

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

Samsung and VMware Collaborate to Advance 5G SA Core & Telco Cloud

Samsung and VMware are continuing their collaboration to offer a powerful and comprehensive 5G solution—combining Samsung 5G Core and VMware Telco Cloud Platform 5G [1.]. This partnership makes it easier for telecom operators using the VMware platform to deploy Samsung’s 5G components. The validation supports Samsung’s ongoing attempts to boost its 5G core market share and further enhances VMware’s telecom efforts.

Note 1. VMware’sTelco cloud is a next-generation network architecture that combines software-defined networking, network functions virtualization, and cloud native technology into a distributed computing network. Since the network and the computing resources are distributed across sites and clouds, automation and orchestration are required.

………………………………………………………………………………………………………………………..

Joining Samsung’s expertise in 5G Core with the power of the VMware Telco Cloud, the combined 5G solution improves the performance and reliability of core networks. In addition, the collaboration offers increased agility and scalability for network infrastructure, enabling operators to rapidly adapt to changing market conditions and customer demands.

The companies have been involved in continuous testing, certification and validation efforts to ensure that Samsung’s 5G Core network functions are fully compatible with VMware Telco Cloud Platform 5G. After validation, Samsung received certification for its 5G Core network functions by the VMware Ready for Telco Cloud program, ensuring compatibility and reliability with VMware technology.

VMware Ready for Telco Cloud certification has been granted to Samsung’s Core network functions, including UPF, NSSF, SMF, AMF, and NRF. The Ready for Telco Cloud certification ensures that network functions are ready for deployment and lifecycle operations with VMware technology. These certified network functions will deliver improved performance, enhanced security features and increased agility and scalability for core networks.

VMware initially rolled out its overarching Telco Cloud Platform in early 2021, which itself was an expansion of its reorganized and repacked stack of technologies for network operators. It has since updated that specific platform as well as expanded its reach into other 5G markets like private 5G and mobile edge compute.

Specific to its work with Samsung, VMware began those efforts in late 2020. That move called for Samsung to integrate its network core, edge, and radio access network (RAN) offerings with VMware and for Samsung to extend its support for cloud-native architecture by adapting its suite of products for containerized network functions (CNFs) and virtual network functions (VNFs) on VMware’s software stack and network automation services.

earlier this year announced the first commercial collaboration with Samsung, which involved integrating Samsung’s virtualized RAN (vRAN) with VMware’s Telco Cloud Platform as part of Dish Network’s ongoing 5G network deployment.

That work built on Dish Network’s plan to deploy 24,000 Samsung open RAN-compliant radios and 5G vRAN software systems running on VMware’s platform that underlines Dish Network’s nascent 5G network.

The companies’ continued collaboration will accelerate the advancement of 5G Core networks and help operators to introduce innovative services that will lead to revenue growth and enhanced customer experiences.

References:

https://www.vmware.com/in/topics/glossary/content/telco-cloud.html