Month: October 2024

Reliance Jio vs Starlink: administrative process or auction for satellite broadband services in India?

Reliance Jio has argued that India’s telecom regulator incorrectly concluded that home satellite broadband spectrum should be allocated and not auctioned, according to a letter seen by Reuters. That intensifies Jio’s face-off with Elon Musk’s Starlink.

Starlink is expected to launch broadband satellite service in India soon after receiving a Global Mobile Personal Communication by Satellite (GMPCS) license. The Telecom Ministry has granted in-principle approval, and the Home Ministry is expected to finalize the vetting process. Starlink’s initial strategy was to provide satellite broadband directly to consumers, but the company may now only offer business services in India

India’s telecom regulator, TRAI, is holding a public consultation, but Reliance in a private Oct. 10 letter seen by Reuters asked for the process to be started afresh as the watchdog has “pre-emptively interpreted” that allocation is the way forward. “TRAI seems to have concluded, without any basis, that spectrum assignment should be administrative,” Reliance’s senior regulatory affairs official Kapoor Singh Guliani wrote in the letter to India’s telecoms minister Jyotiraditya Scindia.

References:

https://www.reuters.com/business/media-telecom/ambanis-reliance-lobbies-india-minister-satellite-spectrum-new-face-off-with-2024-10-13/

India’s TRAI releases Recommendations on use of Tera Hertz Spectrum for 6G

FCC: More competition for Starlink; freeing up spectrum for satellite broadband service

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

India’s Trai: Coexistence essential for efficient use of mmWave band spectrum

OneWeb, Jio Space Tech and Starlink have applied for licenses to launch satellite-based broadband internet in India

Starlink to explore collaboration with Indian telcos for broadband internet services

SNS Telecom & IT: $6 Billion Private LTE/5G Market Shines Through Wireless Industry’s Gloom

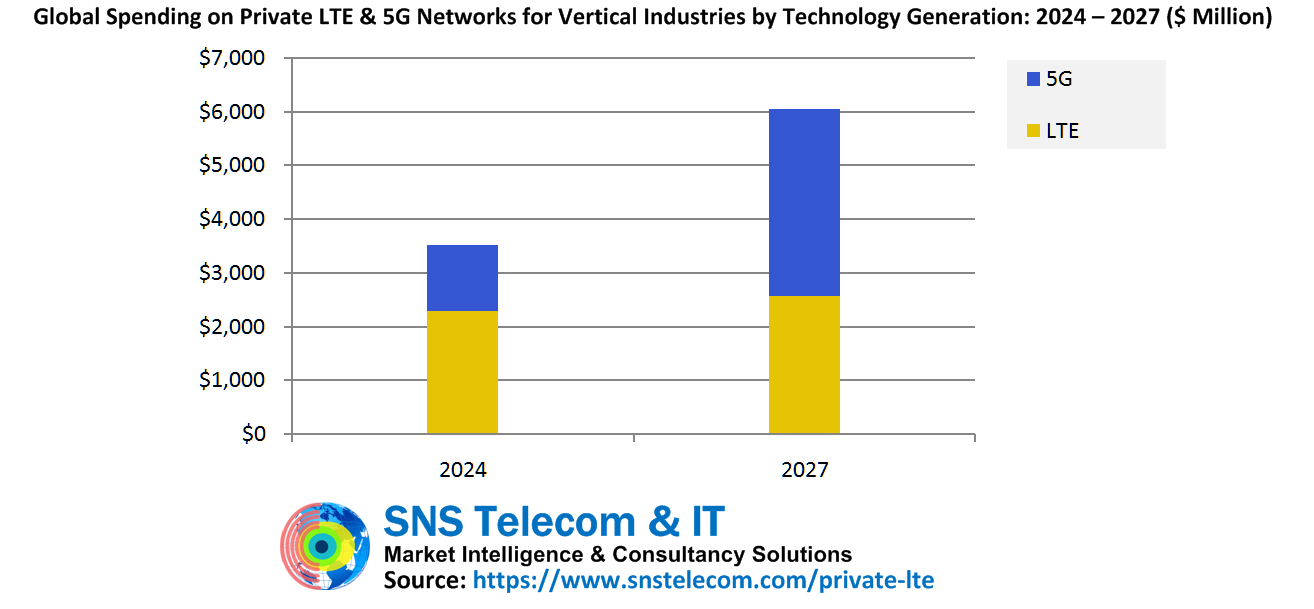

SNS Telecom & IT’s latest research report estimates that the private LTE and 5G network market revenues will be $6 Billion by the end of 2027. It’s one of the few bright spots in the otherwise gloomy wireless telecommunications industry, which is marked by a slowdown in public mobile network infrastructure spending and service providers struggling to monetize their existing 5G investments, particularly in the consumer segment.

Historically a niche segment of the wider wireless telecommunications industry, private 4G-LTE and 5G networks – also referred to as NPNs (Non-Public Networks) in 3GPP terminology – have rapidly gained popularity in recent years due to privacy, security, reliability and performance advantages over public mobile networks and competing wireless technologies as well as their potential to replace hardwired connections with non-obstructive wireless links.

Their expanding influence is evident from the recent use of rapidly deployable private cellular network-in-a-box systems for professional TV broadcasting, enhanced fan engagement and gameplay operations at major sports events, including Paris 2024 Olympics, 2024 UEFA European Football Championship, North West 200 Motorcycle Race, 2024 World Rowing Cup III, New York Sail Grand Prix, 2024 PGA Championship, 2024 UFL Championship Game and 2024 NFL International Games, as well as the Republican and Democratic national conventions in the run up to the 2024 United States presidential election.

Other examples of high-impact private LTE/5G engagements include but are not limited to multi-site, multi-national private cellular deployments at the industrial facilities of Airbus, BMW, Chevron, John Deere, LG Electronics, Midea, Tesla, Toyota, Volkswagen, Walmart and several other household brand names; Aramco’s 450 MHz 3GPP network project in Saudi Arabia and ADNOCS’ 11,000-square kilometer private 5G network for connecting thousands of remote wells and pipelines in the UAE; defense sector 5G programs for the adoption of tactical cellular systems and permanent private 5G networks at military bases in the United States, Germany, Spain, Norway, Japan and South Korea; service territory-wide private wireless projects of 450connect, Ameren, CPFL Energia, ESB Networks, Evergy, Neoenergia, PGE (Polish Energy Group), SDG&E (San Diego Gas & Electric), Tampa Electric, Xcel Energy and other utility companies; and the recent implementation of a private 5G network at Belgium’s Nobelwind offshore wind farm as part of a broader European effort to secure critical infrastructure in the North Sea.

There has also been a surge in the adoption of private wireless small cells as a cost-effective alternative to DAS (Distributed Antenna Systems) for delivering neutral host public cellular coverage in carpeted enterprise spaces, public venues, hospitals, hotels, higher education campuses and schools. This trend is particularly prevalent in the United States due to the open accessibility of the license-exempt GAA (General Authorized Access) tier of 3.5 GHz CBRS spectrum. Some examples of private network deployments supporting neutral host connectivity to one or more national mobile operators include Meta’s corporate offices, City of Hope Hospital, SHC (Stanford Health Care), Sound Hotel, Gale South Beach Hotel, Nobu Hotel, ASU (Arizona State University), Cal Poly (California Polytechnic State University), University of Virginia, Duke University and Parkside Elementary School.

SNS Telecom & IT estimates that global spending on private LTE and 5G network infrastructure for vertical industries will grow at a CAGR of approximately 20% between 2024 and 2027, eventually accounting for more than $6 Billion by the end of 2027. Close to 60% of these investments – an estimated $3.5 Billion – will be directed towards the buildout of standalone private 5G networks, which will become the predominant wireless communications medium to support the ongoing Industry 4.0 revolution for the digitization and automation of manufacturing and process industries. This unprecedented level of growth is likely to transform private LTE and 5G networks into an almost parallel equipment ecosystem to public mobile operator infrastructure in terms of market size by the late 2020s. By 2030, private networks could account for as much as a fifth of all mobile network infrastructure spending.

The “Private LTE & 5G Network Ecosystem: 2024 – 2030 – Opportunities, Challenges, Strategies, Industry Verticals & Forecasts” report presents an in-depth assessment of the private LTE and 5G network ecosystem, including the value chain, market drivers, barriers to uptake, enabling technologies, operational and business models, vertical industries, application scenarios, key trends, future roadmap, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2024 to 2030. The forecasts cover three infrastructure submarkets, two technology generations, four spectrum licensing models, 16 vertical industries and five regional markets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a database of over 7,300 global private LTE/5G engagements – as of Q4’2024.

The report will be of value to current and future potential investors into the private LTE and 5G market, as well as LTE/5G equipment suppliers, system integrators, private network specialists, mobile operators and other ecosystem players who wish to broaden their knowledge of the ecosystem.

For further information concerning the SNS Telecom & IT publication “Private LTE & 5G Network Ecosystem: 2024 – 2030 – Opportunities, Challenges, Strategies, Industry Verticals & Forecasts” please visit: https://www.snstelecom.com/private-lte

About SNS Telecom & IT:

SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 6G, 5G, LTE, Open RAN, vRAN (Virtualized RAN), small cells, mobile core, xHaul (Fronthaul, Midhaul & Backhaul) transport, network automation, mobile operator services, FWA (Fixed Wireless Access), neutral host networks, private 4G/5G cellular networks, public safety broadband, critical communications, MCX (Mission-Critical PTT, Video & Data), IIoT (Industrial IoT), V2X (Vehicle-to-Everything) communications and vertical applications.

References:

https://www.snstelecom.com/private-lte

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

Dell’Oro: Private RAN revenue declines slightly, but still doing relatively better than public RAN and WLAN markets

Wipro and Cisco Launch Managed Private 5G Network-as-a-Service Solution

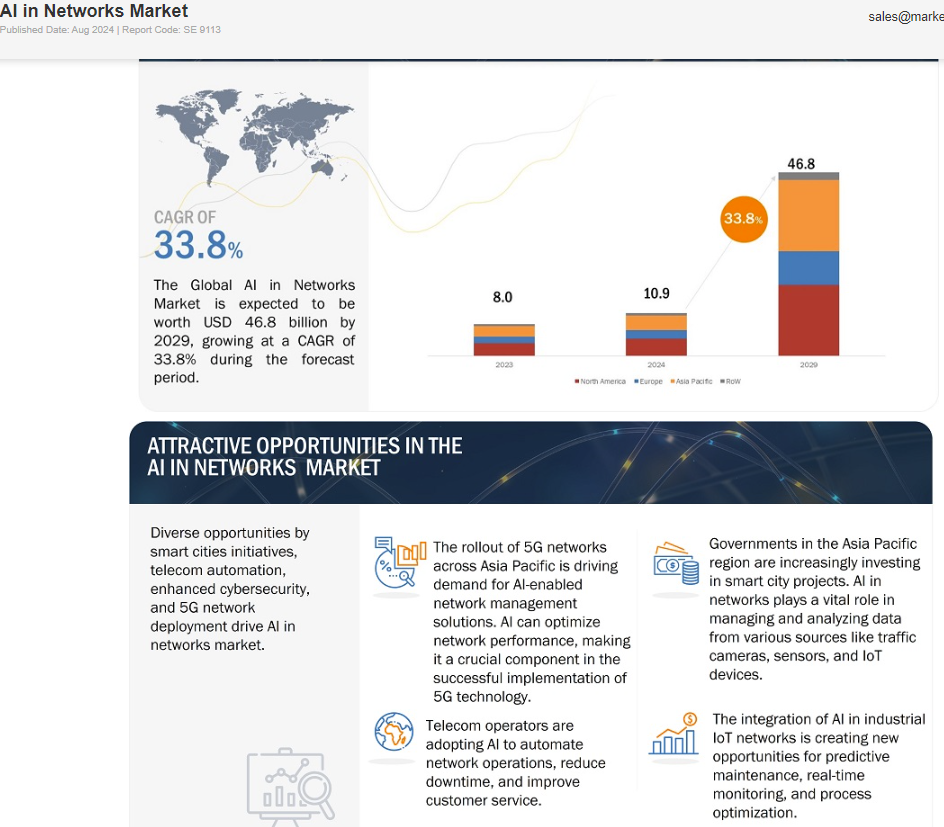

Markets and Markets: Global AI in Networks market worth $10.9 billion in 2024; projected to reach $46.8 billion by 2029

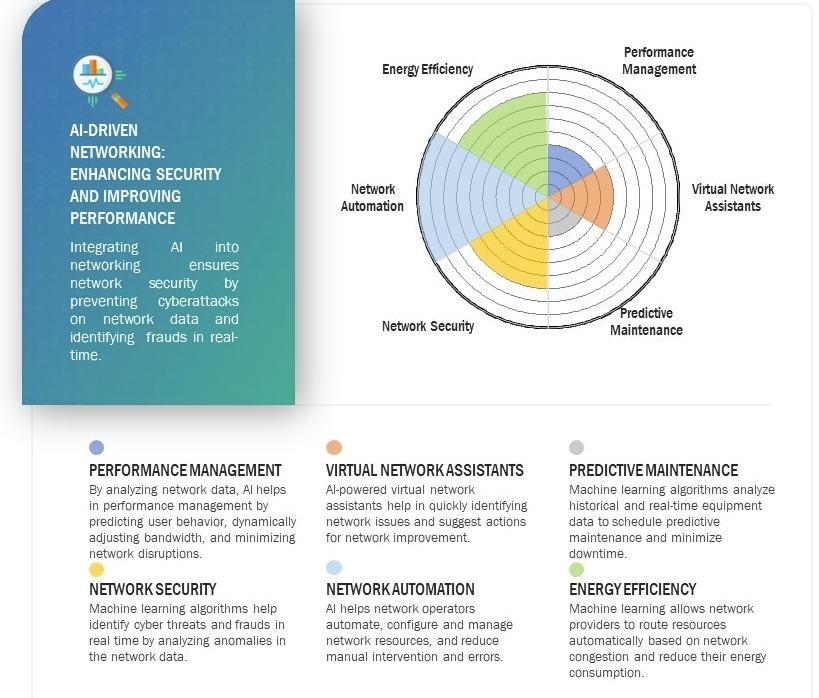

According to research firm Markets and Markets, the global AI in Networks market is expected to be valued at USD 10.9 billion in 2024 and is projected to reach USD 46.8 billion by 2029 and grow at a CAGR of 33.8% from 2024 to 2029. AI in networks market is experiencing high growth driven by increasing adoption of 5G technology, edge computing, IoT connected devices, and expansion of smart cities. Increasing deployment of 5G networks has led to the vast amount of network data, generated by high bandwidth application such as video streaming and online gaming, driving network operators to integrate AI driven solutions to manage network data and allocate resources to reduce network congestion. Network operators are also integrating AI driven solutions to automate network operations and predictive maintenance, to reduce human dependency and errors, leading to efficient network management.

Network operators invest heavily in developing AI-driven solutions to manage and optimize network traffic. AI in networks allows operators to efficiently perform network management tasks such as traffic routing, resource allocation, and network security. As the 5G technology advances, the demand for cybersecurity solutions will also rise, driving the AI in networks market.

Constraint: Data privacy and security concerns in AI in networks

Integration of artificial intelligence technology in the networking leads to various risks affiliated with collecting, storing, and transmitting network traffic data. AI driven network collect users and network operations data information, creating a high risk environment of privacy breaches, due to the rising cyberthreats. These cyberattacks may lead to unauthorized access to network and user data, disrupting network operations. Additionally, data generated by connected and Iot devices such as smartphones, smart home systems, surveillance system is collected by network, leads to concerns regarding unauthorized surveillance and cyberattacks.

Opportunity: Increasing prevalence of smart city initiatives

Rapid urbanization has led to the exapsnion of smart cities globally. Countries around the world are investing heavily towards smart infrastructure by integrating advanced technologies such as artificial intelligence (AI). For instance, smart city ecosystem consist of various sensors and connected and IoT devices, and to ensure efficient transmission and processing of data generated by these sensor and devices. AI driven network solutions play a vital role in collecting and processing of data, identifying anomalies and equipment failure based on present and historical data, helping network operator to schedule maintenance in advance and reduce downtime.

Challenge: Rapid change in the technology landscape

As the technology landscape evolves rapidly, AI presents a major challenge in the network market. As new technologies appear and current technology evolves, companies in the ecosystem must continuously invest in the research and development of changing market demand and advancements. Additionally, intense competition in the market and pressure to offer innovative solutions further restrict companies from maintaining market leadership. Companies’ negligence in identifying the technological shift can result in a decline in market share and revenue.

AI in networks market in North America will hold the highest market share during the forecast period.

The AI in networks market for North America is expected to hold the highest market share during the forecast period. This growth is attributed to the presence of leading AI and network technology companies in the region. These companies are investing heavily towards the advancement of technologies such as AI, 5G, edge computing, due to the high internet penetration rate in the region. The demand for high bandwidth network application such as video streaming and online gaming also on the rise, driving the investments and innovations towards AI driven solutions in network management.

******************************

References:

https://www.marketsandmarkets.com/Market-Reports/ai-in-networks-market-131514910.html

AI adoption to accelerate growth in the $215 billion Data Center market

Allied Market Research: Global AI in telecom market forecast to reach $38.8 by 2031 with CAGR of 41.4% (from 2022 to 2031)

Nvidia enters Data Center Ethernet market with its Spectrum-X networking platform

Will AI clusters be interconnected via Infiniband or Ethernet: NVIDIA doesn’t care, but Broadcom sure does!

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

The case for and against AI in telecommunications; record quarter for AI venture funding and M&A deals

2021 U.S. Broadband Infrastructure law has been a colossal failure – who’s to blame?

The 2021 U.S. Investment and Jobs Act (IIJA), AKA the Bipartisan Infrastructure Law was signed into law November 15, 2021. It included $42.5 billion for states to expand broadband to “unserved,” mostly rural, communities. The White House said it would “Ensure every American has access to high-speed internet…. The Bipartisan Infrastructure Deal will deliver $65 billion to help ensure that every American has access to reliable high-speed internet through a historic investment in broadband infrastructure deployment. The legislation will also help lower prices for internet service and help close the digital divide, so that more Americans can afford internet access.”

In his speech at the Democratic National Convention, President Joe Biden trumpeted his broadband program in historic terms, calling it a national build-out “not unlike what Roosevelt did with electricity.” Democratic presidential nominee Kamala Harris helped create and promote the program as vice president, and on the campaign trail it could offer a way to show how the White House has delivered for rural Americans.

Yet almost three years later, ground hasn’t been broken on a single project! The Biden-Harris Administration recently said construction won’t start until next year at the earliest, meaning many projects won’t be up and running until the end of the decade. Who’s to blame?

- NTIA was expected to play a major role in the endeavor to connect every American to high-speed, affordable broadband. They intended to work closely with all stakeholders, including State and local governments, Tribal governments, industry, and community leaders, as well as across the Federal government to ensure that this bold investment is targeted to those who need it most. But they haven’t helped a bit!

- States must submit plans to the U.S. Commerce Department about how they’ll use the funds and their bidding process for providers. The Commerce Dept. has piled on mandates that are nowhere in the law and has rejected state plans that don’t advance progressive goals. Commerce hoped to spread the cash to small rural cooperatives, but the main beneficiaries will be large providers that can better manage the regulatory burden. Bigger businesses always win from bigger government.

- Commerce is all but refusing to fund anything other than fiber broadband, though satellite services like SpaceX’s Starlink and wireless carriers 5G FWA can expand coverage at lower cost. Extending 5G to rural communities costs a couple thousand dollars per connection. Building out fiber runs into the tens of thousands. Fiber networks will require more permits, which delay construction. But fiber will require more union labor to build. Commerce wants grant recipients to pay union-scale wages and not oppose union organizing.

- The Administration has also stipulated hiring preferences for “underrepresented” groups, including “aging individuals,” prisoners, racial, religious and ethnic minorities, “Indigenous and Native American persons,” “LGBTQI+ persons,” and “persons otherwise adversely affected by persistent poverty or inequality.”

- In Virginia, that leaves thousands of mostly rural residents stuck in a long-outdated version of the internet. According to the official state count, there are more than 100,000 homes and offices across Virginia with connection speeds slow enough to qualify for the $1.48 billion in funding. “People need to see it,” said Lynlee Thorne, a political director for Democratic campaign group Rural Ground Ggame, which helps lead campaigns for Virginia state seats. “It’s got to be a lot more concrete. We’re past the point of being able to earn people’s votes based on the status quo or just hope.”

- Last week, Cox Communications last week sued Rhode Island over the state’s plan to “build taxpayer-subsidized and duplicative high-speed broadband internet in affluent areas of Rhode Island like the Breakers Mansion in Newport and affluent areas of Westerly,” where Taylor Swift owns a $17 million vacation home. Cox says there are better ways to spend taxpayer dollars. According to the Federal Communications Commission, 99.97% of U.S. households already have access to high-speed internet.

References:

https://www.politico.com/news/2024/09/04/biden-broadband-program-swing-state-frustrations-00175845

Dell’Oro: Global telecom CAPEX declined 10% YoY in 1st half of 2024

According to a recent report by Dell’Oro Group, telecom operators are now scaling back their investments in 5G and fixed broadband technologies. Of course, that’s nothing new as telco CAPEX has been declining for quite some time (see References below). Preliminary Dell’Oro findings show that the more challenging conditions that shaped the second half of 2023 extended into the first half of 2024.

Worldwide telecom capex, the sum of wireless and wireline/other telecom carrier investments, declined 10% year-over-year (YoY) in the first half of 2024, partly due to built-up inventory, weaker demand in China, India, and US, challenging 5G comparisons, excess capacity, and elevated uncertainty.

“The high-level message is clear. The flattish revenue trajectory and the difficulties with monetizing new technologies and opportunities are impacting the risk appetite and willingness to raise the capital intensity levels for extended periods,” said Stefan Pongratz, Vice President for RAN and Telecom Capex research at Dell’Oro Group. “In addition, the reduced gap between advanced and less advanced regions, when it comes to adopting new technologies, is impacting the investment intensity on the way up and down,” continued Pongratz.

Additional highlights from the September 2024 Telecom Capex report:

- Global carrier revenues are expected to increase at a 1 percent CAGR over the next 3 years.

- Worldwide telecom capex is projected to decline at a mid-single-digit rate in 2024 and at a negative 2 percent CAGR by 2026.

- The mix between wireless and wireline remains largely unchanged, reflecting challenging times still ahead for wireless. Wireless-related capex will decline at a 3 percent CAGR by 2026.

- Capital intensity ratios are modeled to approach 15 percent by 2026, down from 17 percent in 2023.

In a previous Dell’Oro report last month, telecom equipment revenues fell by 17% worldwide during the first half of the year. Dell’Oro described that as ‘abysmal results’ and again blamed excess inventory, weaker demand in China, ‘challenging 5G comparisons’, and elevated uncertainty.

In a previous Dell’Oro report last month, telecom equipment revenues fell by 17% worldwide during the first half of the year. Dell’Oro described that as ‘abysmal results’ and again blamed excess inventory, weaker demand in China, ‘challenging 5G comparisons’, and elevated uncertainty.

The Dell’Oro Group Telecom Capex Report provides in-depth coverage of around 50 telecom operators, highlighting carrier revenue, capital expenditure, and capital intensity trends. The report provides actual and 3-year forecast details by carrier, by region by country (United States, Canada, China, India, Japan, and South Korea), and by technology (wireless/wireline). To purchase this report, please contact by email at [email protected].

References:

Telecom Capex Down 10 Percent in 1H24, According to Dell’Oro Group

Dell’Oro: Abysmal revenue results continue: Ethernet Campus Switch and Worldwide Telecom Equipment + Telco Convergence Moves to Counter Cable Broadband

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Analysys Mason’s gloomy CAPEX forecast: “there will not be a cyclical recovery”

China Mobile & China Unicom increase revenues and profits in 2023, but will slash CAPEX in 2024

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Highlights of Dell’Oro’s 5-year RAN forecast

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices