Author: Alan Weissberger

Helium Network Accelerates Multi-Network Protocol Expansion, Announces New Token Rewards to Scale 5G

Highlights:

- After gaining global traction for its incentive-based decentralized wireless network, the Helium Network is adding to Internet of Things (IoT) with a new incentive model to scale any type of network, starting with 5G

- Helium’s new 5G token, MOBILE, is backed by the HNT economic system and rewards individuals in the community for being part of building out nationwide 5G cellular coverage

- The launch is part of a larger push for Helium to be a Network of Networks ~ ultimately serving an unlimited number of wireless protocols

- With 850,000+ Hotspots deployed and 5,000 cities added monthly, the network is seeing massive adoption from DISH Networks, GigSky, FreedomFi, Volvo, Cisco, Salesforce, and dozens more

The Helium Network, the world’s fastest-growing decentralized wireless network, today announced a major model expansion to meet the demand to support an unlimited number of wireless protocols, each with its own incentive model and governance. “Helium’s mission has always been to create an affordable and accessible network built by and for the people. HIP 51 is the culmination of this goal and I’m excited to support the Helium Network’s role in adopting an unlimited number of protocols.”

Starting with 5G, the Helium Network will have a new token called MOBILE that rewards Hotspot owners for providing 5G coverage. As other networks join over time, each network protocol will have its own token and governance. Each new token will be backed by HNT, still redeemable for HNT at any time.

Today’s expansion was made possible through a majority vote of 96.9% from the community by way of a proposal called HIP 51 ~ a community proposal aimed at unlocking more utility for the network and propelling it to be a ‘Network of Networks.’

“The Network of Networks is the next big chapter for Helium, and will help unlock the full potential of its utility,” said Amir Haleem, founder and CEO of Nova Labs, formerly known as Helium Systems, Inc. “Helium’s mission has always been to create an affordable and accessible network built by and for the people. HIP 51 is the culmination of this goal and I’m excited to support the Helium Network’s role in adopting an unlimited number of protocols.”

“As the network began deploying Helium 5G, it became increasingly evident that the original Helium Network incentive model had to be expanded to serve 5G and beyond,“ said Scott Sigel, COO of The Helium Foundation. “We’ve seen the IoT network power nearly one million Hotspots, so I’m eager to see where the opportunity the 5G network brings us next.”

Introducing the Network of Networks via HIP 51:

Intending to open the door for variety to exist in the Helium ecosystem, HIP 51 introduces a blueprint for an unlimited number of wireless protocols to be added to the network, including the governance and deployment of the network’s current incentive model to include multiple tokens. With the HIP 51 approval announced today, Helium can grow exponentially in addition to its roots in IoT.

Growth of the Network

This August marks three years since the Helium Network debuted and incentivized everyday people to be part of building an affordable and secure global wireless network. Since then, more than 850,000 Hotspots have been launched in 177 countries and 64,000+ cities globally. What started as a people-led effort to provide connectivity for IoT devices, the most underserved market in the telecommunications industry, has quickly become a global effort to power more network protocols.

In recent months, other networks have applied Helium’s crypto-economic model to their ecosystems, including WiFi Dabba, which aims to bring affordable connectivity to the masses in India and Boring Protocol, which tackles privacy with a decentralized VPN. This expansion comes as other major enterprises have joined the growing Helium ecosystem, such as FreedomFi, DISH, and GigSky to help build out a nationwide 5G cellular network.

What This Means For The People’s Network:

Known as The People’s Network, the Helium Network uses crypto to reward everyday people for becoming mini cell towers by deploying Hotspots and providing coverage. Helium 5G is the Network’s second wireless protocol, following the success of its global IoT network that today powers IoT applications from independent developers to large Fortune 500 companies.

Existing holdings of HNT remain unaffected and Hotspots will continue to provide the same network coverage for millions of devices. What’s new is that this model gives individuals and communities agency to own and scale any type of network in the future.

To learn more about The Helium Network, please visit helium.com.

About the Helium Network:

The Helium Network is the first decentralized wireless network, democratizing access to the internet worldwide. Launched in Austin, Texas, in 2019 by the founding team at Nova Labs (formerly known as Helium Systems, Inc.), the Network has since become the fastest-growing wireless network providing open-sourced and decentralized coverage worldwide. IoT and network industry leaders including Actility, Senet, Kore, X-TELIA, and DISH use the Helium Network’s coverage for enterprise customers including Volvo Group, Cisco, Schneider Electric, Accenture, Olympus, One Planet, Hoopo, Invoxia, Victor, and others. More information can be found at helium.com.

References:

https://www.webwire.com/ViewPressRel.asp?aId=290234

How to Deploy IoT Devices & Build Complete Applications w/ Helium – The People’s Network!

Telefonica Deutschland in deal with German fiber association (BUGLAS) to connect 5G sites

Germany has been deploying 5G networks for a number of years now. German telecoms regulator Bundesnetzagentur (BNetzA), announced at the end of last year that coverage had reached 53% coverage of the population. However, much work needs to be done to get new 5G sites to be deployed.

Backhaul solutions must be arranged for all of these new sites, delivering the mobile data from the sites back to the network core. Currently, in most mobile markets, this is done through a mix of wireless technologies (primarily microwave spectrum, but increasingly mmWave spectrum) and fibre, both of which can handle the requirements of 5G. In less developed markets, on the other hand, older copper infrastructure is sometimes used, while some of the most remote sites will be forced to use satellite when no other options are practical.

According to the GSMA, microwave and mmWave links will account for at least 60% of global macro and small cell backhaul links from 2021 to 2027.

Nonetheless, it now seems that Telefonica Deutschland is leaning even more heavily into fibre for its backhaul needs, striking a new agreement with BUGLAS to create a pre-negotiated framework agreement. The agreement should provide a basis for all of BUGLAS’s fibre network operators to strike technology, interconnection, maintenance, and service level agreements with Telefonica in a faster and more efficient manner.

BULGAS represents fibre network operators in more than 80 German cities, all of which can now request this framework agreement from BUGLAS.

Image courtesy of Telefonica

“For both 5G and FTTB/H rollout, co-operations are the central, efficient and resource-saving key to the modern gigabit society. In order to bring together the multitude of local, municipal and regional network operators with national providers such as O2 Telefónica, the telecommunications market needs standardized offers and framework agreements,” said Wolfgang Heer, MD of BULGAS. “We are therefore very pleased to have been able to conclude a 5G framework agreement with O2 Telefónica and also invite all other national network operators to join us in discussing further framework agreements and standardization.”

Telefonica views fibre as a more effective choice than terrestrial wireless for its 5G backhaul needs, suggesting that the technology is “significantly faster and more powerful than conventional microwave links”. There is a future-proofing angle here too, with Telefonica suggesting that wireless backhaul will “reach their limits in future” based on the steady growth of mobile and 5G application data that is expected in the coming years.

Telefonica-Deutschland already has over 100 strategic agreements signed with fiber players in Germany, currently connecting its 28,000 mobile sites with fiber. Earlier this year, the network operator agreed to collaborate with NEC to build an OpenRAN, small cell network in Germany which has already been deployed.

References:

https://www.gsma.com/spectrum/wp-content/uploads/2021/02/wireless-backhaul-spectrum-positions.pdf

Telefónica Germany and NEC partner to deliver 1st Open RAN with small cells in Germany

Gartner: AWS still #1 in IaaS market followed by Microsoft, Alibaba, Google and Huawei

The worldwide infrastructure as a service (IaaS) market grew 41.4% in 2021, to total $90.9 billion, up from $64.3 billion in 2020, according to Gartner press release.

Amazon retained the No. 1 position in the IaaS (Infrastructure as a Service) market in 2021, followed by Microsoft, Alibaba, Google and Huawei.

“The IaaS market continues to grow unabated as cloud-native becomes the primary architecture for modern workloads,” said Sid Nag, VP analyst at Gartner. “Cloud supports the scalability and composability that advanced technologies and applications require, while also enabling enterprises to address emerging needs such as sovereignty, data integration and enhanced customer experience.”

In 2021, the top five IaaS providers accounted for over 80% of the market. Amazon continued to lead the worldwide IaaS market with revenue of $35.4 billion in 2021 and 38.9% market share (see Table 1).

Table 1. Worldwide IaaS Public Cloud Services Market Share, 2020-2021 (Millions of U.S. Dollars)

| Company | 2021 Revenue |

2021 Market Share (%) |

2020 Revenue |

2020 Market Share (%) |

2020-2021 Growth (%) |

| Amazon | 35,380 | 38.9 | 26,201 | 40.8 | 35.0 |

| Microsoft | 19,153 | 21.1 | 12,659 | 19.7 | 51.3 |

| Alibaba | 8,679 | 9.5 | 6,117 | 9.5 | 41.9 |

| 6,436 | 7.1 | 3,932 | 6.1 | 63.7 | |

| Huawei | 4,190 | 4.6 | 2,681 | 4.2 | 56.3 |

| Others | 17,056 | 18.8 | 12,697 | 19.8 | 34.3 |

| Total | 90,894 | 100.0 | 64,286 | 100.0 | 41.4 |

Source: Gartner (June 2022)

Microsoft followed in the No. 2 position with 21.1% share and above-market growth, reaching over $19 billion in IaaS revenue in 2021. With many organizations already relying on Microsoft’s enterprise software and services, Azure has been positioned to capture opportunities across nearly every vertical market. “I don’t hear businesses looking to their IT budgets or digital transformation projects as the place for cuts,” Microsoft CEO Nadella said during Microsoft’s third-quarter earnings call. It’s more likely that these projects are going to accelerate companies’ digital transformations and increase demand for the cloud giant’s services, he added.

Alibaba was again the No. 3 IaaS public cloud provider worldwide with 9.5% market share and revenue of $8.7 billion for 2021. While Alibaba continues to lead the Chinese cloud market, it is also poised to be the leading regional provider in Indonesia, Malaysia, and other emerging cloud markets, given its local market understanding and ability to serve as a bridge to digital commerce.

“Regional cloud ecosystems are becoming increasingly important amidst growing geopolitical fragmentation and emerging regulatory and compliance requirements, presenting an opportunity for providers with a strong regional presence,” said Nag.

Google Cloud saw the highest growth rate of the top five IaaS vendors, growing 63.7% in 2021 to reach $6.4 billion in revenue. This growth was driven by steadily increased adoption for traditional enterprise workloads as well as Google’s innovation in more cutting-edge capabilities such as artificial intelligence and Kubernetes container technologies, supported by an expansion of their partner ecosystem to reach a wider customer base.

While Huawei’s growth tempered in 2021 after two straight years of over 200% growth, it still maintained the No. 5 market share position with $4.2 billion in revenue. Huawei has made significant investments in its IaaS ecosystem in the past two years, and through an enhanced strategy of open hardware, open-source software and partner enablement it has been able to provide expanded offerings for universities, developers and startups.

“The next phase of IaaS growth will be driven by customer experience, digital outcomes and the virtual-first world,” said Nag. “Emerging technologies that can help businesses bring experiences closer to their customers, such as the metaverse, chatbots and digital twins, will require hyperscale infrastructure to meet growing demands for compute and storage power.”

Gartner clients can read more in “Market Share: IT Services, Worldwide, 2021.” Learn how to create a strong cloud strategy in the complimentary Gartner webinar “The Gartner Cloud Strategy Cookbook, 2022.”

References:

Gartner: Public Cloud End-User Spending to approach $500B in 2022; $600B in 2023

Gartner: Accelerated Move to Public Cloud to Overtake Traditional IT Spending in 2025

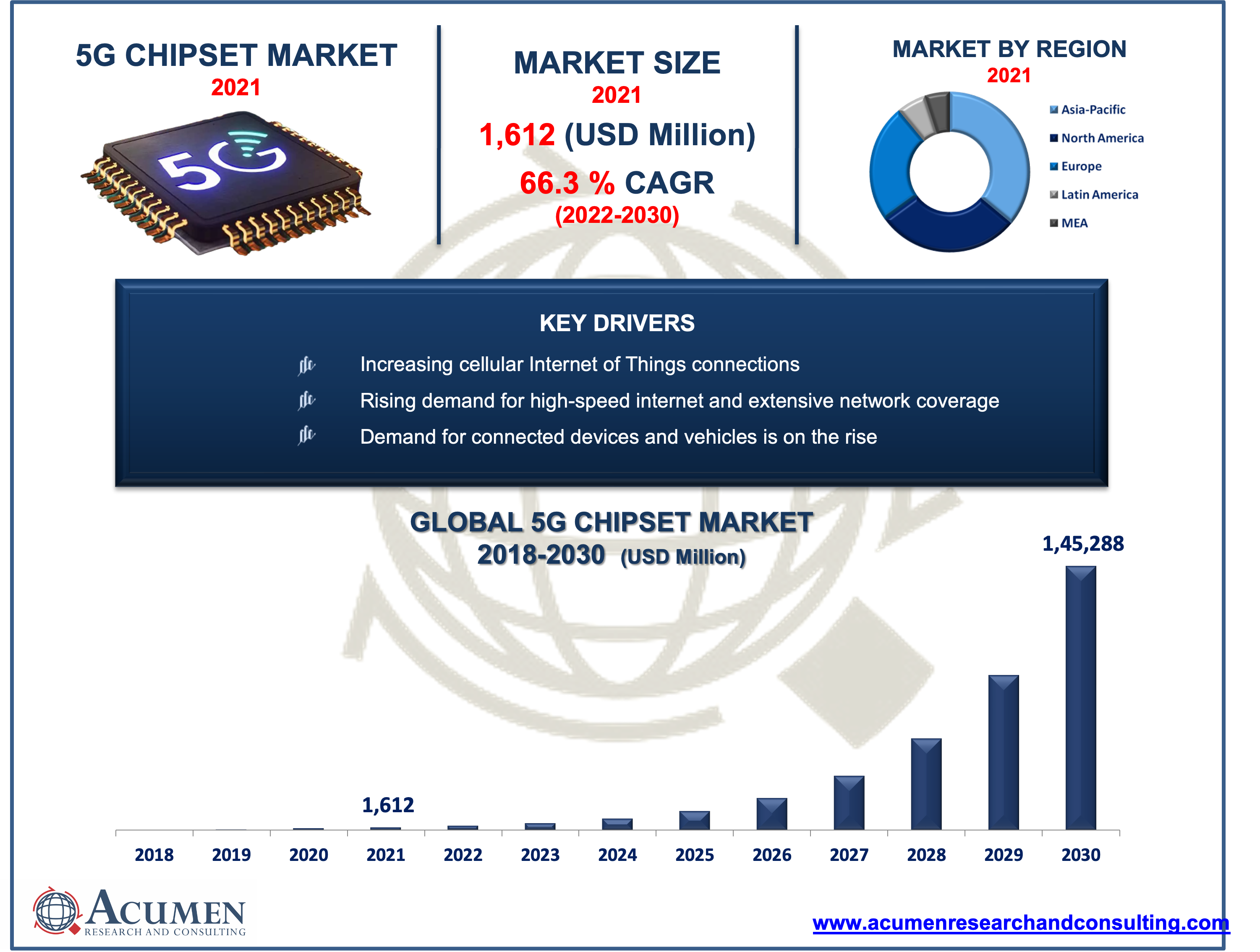

Acumen Research: 5G Chipset Market to Hit $145,288M by 2030 with CAGR=66.3%

According to a new report by Acumen Research, the Global 5G Chipset Market totaled for US$ 1,612 Million in 2021 and is expected to reach US$ 145,288 Million by 2030 with a considerable CAGR of 66.3% during the forecast timeframe of 2022 to 2030.

With the rising reliance on the virtualized environment during the COVID-19 epidemic, the necessity for sophisticated 5G infrastructure became critical. The increased regularity with which organizational processes are migrating to the cloud and other virtual environments has encouraged expenditures in robust interconnection platforms. This trend is expected to continue in the aftermath of the global epidemic crisis, as firms and businesses are unlikely to return to their traditional modes of operation. Furthermore, as business needs become more diverse, organizations are striving to harmonize them, necessitating the need for 5G infrastructure. As a result, rapid growth in the global number of connected devices and vehicles, as well as increased digitalization and smart city programs, are some of the major factors expected to drive the global 5G technology market. However, based on this ongoing trend, researchers project that the market will grow by more than 50x in terms of value.

However, rising demand for high-speed data transmission, mobile broadband technology, and data and information analysis is propelling 5G cellular technology forward. As a result, growing demand for high-speed internet and 5G cellular technologies for a variety of applications, including automated vehicles, distance learning, multiuser gaming, live streaming, videoconferencing, telemedicine, and virtual reality, is expected to propel the 5G chipset market forward. A 5G chipset component is required for 5G-enabled mobile phones, computers, gateways, and telephony base stations. This 5G chipset module enables these devices’ users to connect to next-generation connections and enjoy a more improved experience.

Global 5G Chipset Market Growth Aspects

One of the key factors driving the market is the increasing need for high-speed internet and extensive network availability for multiuser videogames, video broadcasts, and file-sharing. Furthermore, major market players are heavily investing in R&D operations to develop cost-effective technology networks and virtual network configuration management, which are expected to drive 5G chipset market growth. In addition, many businesses use internet of things (IoT) devices and 5G advanced technologies to monitor machine performance in real-time, reducing overall idle time and improving operational efficiency. This, combined with the growing popularity of the internet of things (IoT) in the development of smart cities, infrastructure, and grid projects around the world, is propelling the market growth.

Furthermore, limited global 5G coverage and accessibility of 5G networks in specific areas can raise the cost of establishing tower stations and limit the adoption of 5G chipsets, which is expected to limit market revenue growth to some extent over the forecast period. Besides that, the incorporation of 5G chipsets in production lines and workflows to speed up production and boost Industrial revolution 4.0 has substantially increased demand for 5G chipsets, which is expected to drive 5G chipset market revenue growth during the forecast period.

Drivers:

- Increasing cellular Internet of Things (IoT) connections

- Rising demand for high-speed internet and extensive network coverage

- Growth in mobile data traffic

- Demand for connected devices and vehicles is on the rise

Restraints:

- Concerns about data security and information privacy

- High initial cost for chipsets

Opportunity:

- Increased use of automation in the workplace and on the production line in the industry

- Growing Smart city projects in developing economies

Report Coverage:

| Market | 5G Chipset Market |

| Market Size 2021 | US$ 1,612 Million |

| Market Forecast 2030 | US$ 145,288 Million |

| CAGR | 66.3% During 2022 – 2030 |

| Analysis Period | 2018 – 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 – 2030 |

| Segments Covered | By Frequency Type, By Type, By Process Node, By End Use, By Industry Vertical And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Qualcomm Technologies, Inc., Broadcom, Intel Corporation, Nokia Corporation, Samsung Electronics Co., Ltd., Mediatek Inc., Anokiwave, Xilinx Inc., Huawei Technologies Co., Ltd., Unisoc Communications, Inc., Qorvo, and Infineon Technologies AG. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope | 10 hrs of free customization and expert consultation |

Regional Overview

Regional Overview

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa are the regional classification of the global 5G chipset market. The North America market is expected to account for the largest revenue share over the forecast period due to the increasing adoption of innovative technologies that require high-speed Internet, such as IoT connectivity or machine to machine in different industry sectors. Furthermore, the large presence of major market players in the region’s countries, such as Qualcomm Incorporated, Intel Corporation, MediaTek Inc, and others, is expected to drive revenue growth in the region throughout the projection period. As regulators clear the way for rapidly expanding next-generation services, the United States is expected to be the first in the world to deploy 5G technology, wireless applications, and infrastructures. For example, the US administration announced $400 million in projects to conduct research on 5G wireless connections in July 2016. Furthermore, the Government of Canada is strongly committed to enhancing involvement in next-generation communication networks and 5G technologies by creating an innovation environment that promotes ICT growth.

To receive personalized service, please share your research needs here@ https://www.acumenresearchandconsulting.com/request-customization/2921

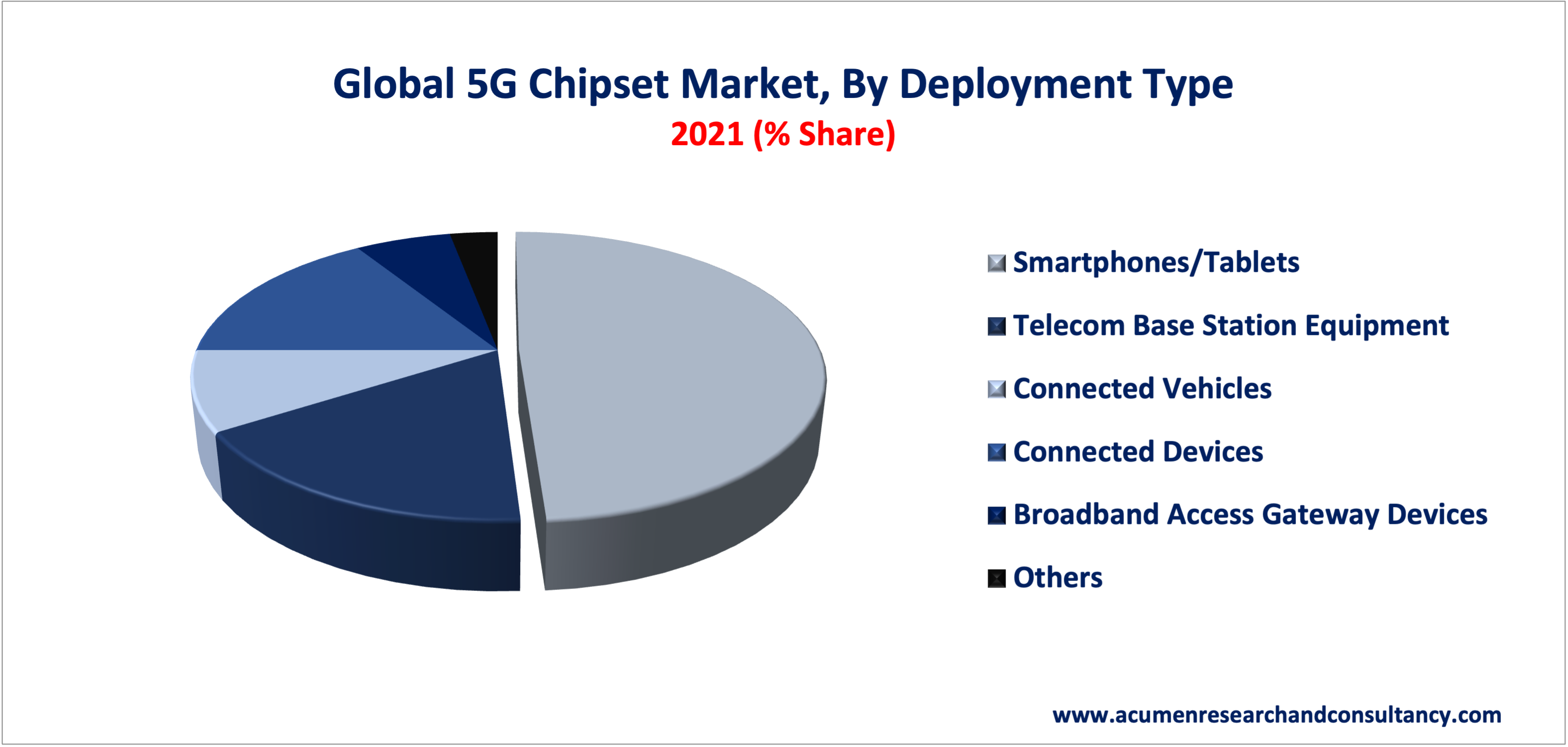

Market Segmentation:

The global 5G chipset market has been segmented by Acumen Research and Consulting based on frequency type, chipset type, process node, deployment type, and industry vertical. Based on the frequency type, the market is divided into sub-6GHz, mmWave, and sub-6GHz + mmWave. Based on chipset type, the market split into modem, and RFIC. Based on process node, the market is classified into 7 nm, 10 nm, and others. Based on deployment type, the market is categorized into smartphones/tablets, telecom base station equipment, connected vehicles, connected devices, broadband access gateway devices, and others. Based on industry vertical, the market is segmented into manufacturing, energy & utilities, media & entertainment, IT & telecom, transportation & logistics, healthcare, and others.

Major Players:

Some key players covered global in the 5G chipset industry are Qualcomm Technologies, Inc., Broadcom, Intel Corporation, Nokia Corporation, Samsung Electronics Co., Ltd., Mediatek Inc., Anokiwave, Xilinx Inc., Huawei Technologies Co., Ltd., Unisoc Communications, Inc., Qorvo, and Infineon Technologies AG [1.].

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Note 1. It’s this author’s opinion that there are only two players in the merchant market for 5G baseband silicon in 5G endpoint devices- Qualcomm and MediaTek. Samsung and Huawei make custom 5G silicon for use in their own 5G phones and base stations, but they do not sell them on the merchant market. A player not mentioned is EdgeQ which offers a “5G base station on a chip” for 5G network equipment (small cells and base stations). Qorvo makes 5G power amplifiers and ultra low noise amplifiers along with other RF products

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Request for a sample of this premium research report @ https://www.acumenresearchandconsulting.com/request-sample/2921

About Acumen:

Acumen Research and Consulting is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

Contact Us:

Mr. Richard Johnson

Acumen Research and Consulting

USA: +1 407 9154157

India: +91 8983225533

E-mail: [email protected]

References:

https://www.acumenresearchandconsulting.com/5g-chipset-market

https://www.qorvo.com/innovation/5g

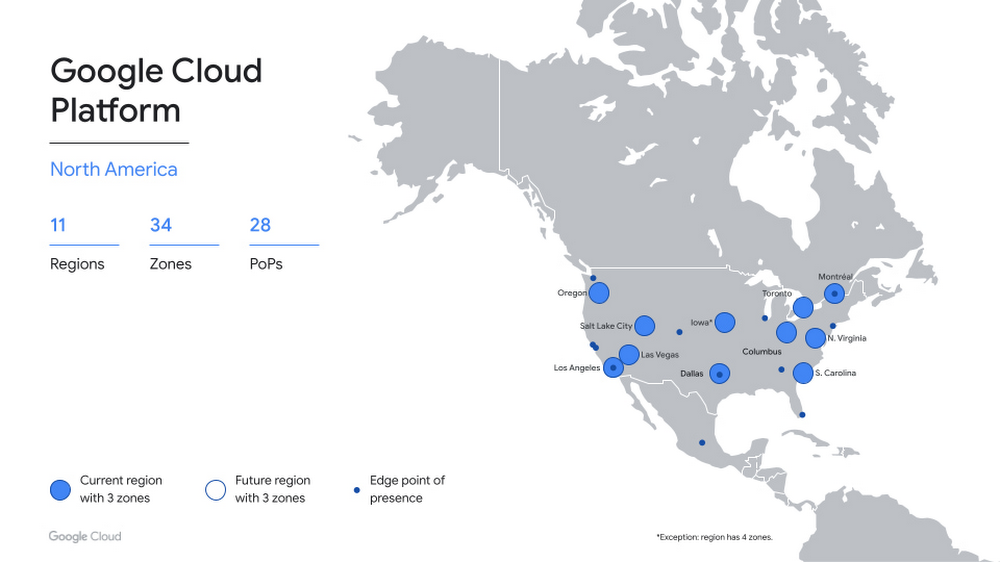

Google Cloud expands footprint with 34 global regions

Google Cloud has added a region in Dallas, Texas, which brings Google Cloud’s total number of global regions to 34. The rollout follows the launch of its 33rd cloud region in Columbus, Ohio late last month. Other recent additions include regions in Milan, Italy; Paris, France; and Madrid, Spain.

“We’ve heard from many of you that the availability of your workloads and business continuity are increasingly top priorities. The Dallas region gives you added capacity and the flexibility to distribute your workloads across the U.S.,” Google Cloud executive Stacy Trackey Meagher wrote in a blog post.

The Texas site is the eleventh region in North America and second in the central U.S., with the other located in Iowa. It also has North American cloud regions in Oregon, Salt Lake City, Los Angeles, Las Vegas, South Carolina and Northern Virginia as well as Montreal and Toronto, Canada.

Diamond State Networks to invest more than $1.66 billion in fiber infrastructure in Arkansas

A new consortium in Arkansas is leading the way forward for electric cooperatives in the rural U.S. can increase bandwidth and save costs by collaborating on fiber broadband delivery.

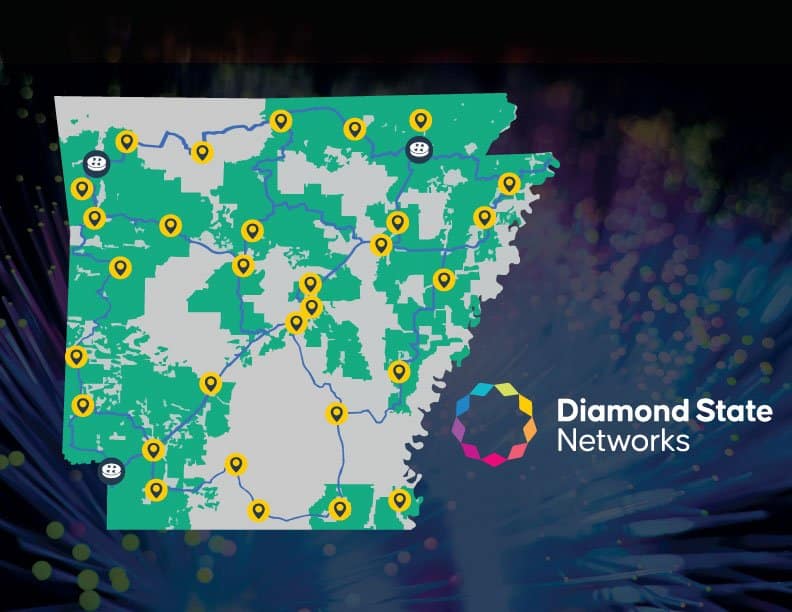

Diamond State Networks (DSN) is a collective of 13 electric co-ops from across the state of Arkansas which are joining forces to deliver wholesale fiber broadband. All in, the cooperative networks’ 50,000 miles of fiber will cover 64% of Arkansas and reach 1.25 million rural Arkansans. The goal for DSN is to serve 600,000 residences and businesses in Arkansas in the next few years, with over 250,000 locations already deployed. Here’s a network coverage map:

The 13 member cooperatives in DSN include: OzarksGo, Clay County Connect, Farmers Electric Cooperative, Petit Jean Fiber, Enlightened by Woodruff Electric, NEXT Powered by NAEC, Wave Rural Connect, Arkansas Fiber Network (AFN), Four States Fiber Internet, empower (delivered by Craighead Electric), MCEC Fiber, South Central Connect and Connect2First.

Doug Maglothin, DSN’s director of operations, says his company expects to add “a couple more cooperatives” to that list. (The state of Arkansas has 17 electric co-ops, served by a central entity called the Arkansas Electric Cooperative Corporation.)

The collective of co-ops that form DSN are at different phases of their service delivery journey. Some, like Farmers Electric, are in the early planning stages. OzarksGo – the subsidiary of Ozarks Electric Cooperative – is furthest along and nearing 40,000 subscribers. Indeed, Maglothin referred to Ozarks Electric CEO Mitchell Johnson as the “visionary” for DSN, who saw the need for the state’s electric co-ops to get involved with broadband delivery in 2015 and 2016.

But as electric co-ops began entering the space in 2017 and 2018, “pretty quickly, you find out how difficult and expensive it can be to buy connectivity to the global Internet,” said Maglothin. It was “from that necessity” that the plan for DSN was born.

While the consolidated electric cooperative model is unique for the broadband space, other states and communities are deploying broadband as collectives or partners. That includes Utopia Fiber’s municipal, open access fiber delivery network in Utah as well as California’s planned open-access statewide middle-mile network. And this week, a group of rural telcos and an electric cooperative in Indiana announced plans to launch HoosierNet, a “multi-year, multi-million-dollar” statewide fiber network.

Maglothin said DSN is collaborating with other states looking for a similar solution and that Diamond State has “kind of become a beacon for cooperative middle mile,” as it offers a model that allows electric co-ops to control their costs.

“The more bandwidth you grow, the more content you collect, the more powerful your voice is in negotiating pricing to get to these big anchor points for your network,” said Maglothin. “So we feel like there’s a potential future for cooperative companies working together like this where we become one of the largest bandwidth aggregators probably in the country.”

The 13 member co-ops are investing more than $1.66 billion in fiber infrastructure for DSN. According to Maglothin, less than 20% of that funding is from federal and state grants. But he expects that DSN will be eligible for Broadband Equity, Access, and Deployment (BEAD) and Middle Mile grant funding, federal programs worth $42.45 billion and $1 billion, respectively.

According to Broadband.Money, a platform connecting local providers and networks with funding opportunities, Arkansas is estimated to receive $1.4 to $1.6 billion for broadband through the Infrastructure Investment and Jobs Act (IIJA). But those numbers are still to be determined by federal broadband mapping data that officials say will be released later this year.

Notably, while existing FCC broadband data is widely understood to undercount the digital divide in the US, a recent presentation by the Broadband Development Group at the Arkansas Rural Connect Broadband Forum revealed that the state’s broadband gap may now be smaller than the FCC’s count shows. While federal data puts Arkansas’ digital divide at 250,000 households or 21% of the population, BDG’s analysis brought that to 209,000 households (17%).

Maglothin attributes this increase in broadband access to the work electric co-ops have done in recent years. “It’s because of the rapid onset of cooperative fiber being pushed out,” he said.

For this reason, and with more funding coming down through the BEAD program, Maglothin thinks that Arkansas can go from being among the lowest-ranked states in the US for connectivity to the highest.

References:

https://www.diamondstatenetworks.com/

https://www.broadbandworldnews.com/document.asp?doc_id=778063&

SK Telecom launches 2nd 5G edge zone in Seoul using AWS Wavelength

SK Telecom has deployed its second 5G edge zone in Seoul, which enables 5G-connected cloud services with ultra-low latency using multi-access edge computing (MEC) [1.], the South Korean telecom company said on Tuesday. SKT’s 5G edge zone is based on Amazon Web Services (AWS) Wavelength [2,]. This 5G edge zone in Seoul is the second launched by SK Telecom, following the one in Daejeon established in December, 2020.

Note 1. MEC refers to technologies that bring computation capabilities and data storage closer to user endpoint devices. It is of critical importance in reducing end to end 5G latency.

Note 2. Amazon’s Wavelength embeds AWS compute and storage services at the edge of communications service providers’ 5G networks while providing seamless access to cloud services running in an AWS Region. By doing so, AWS Wavelength minimizes the latency and network hops required to connect from a 5G device to an application hosted on AWS. With AWS Wavelength and SK Telecom 5G, application developers can now build the ultra-low latency applications needed for use cases like smart factories, interactive live streaming, autonomous vehicles, connected hospitals, and augmented and virtual reality-enhanced experiences.

In 2019, Verizon, Vodafone, SKT and KDDI were among the first operators to partner with AWS to develop commercial edge computing services running on 5G networks.

SK Telecom said that its second edge zone will enhance the efficiency of 5G cloud services, as edge computing workloads will be shared out between the Seoul zone and the Daejeon zone.

The Seoul zone will cover network traffic coming from the top half of the country including the greater Seoul area while the Daejeon zone will cover the rest. Before the Seoul edge zone was set up, the Daejeon edge zone had covered all network traffics across the country.

SK Telecom said that its “SK Edge Discovery” system will automatically allocate the edge zone based on users’ current location.

SKT recently unveiled an enterprise 5G MEC solution called ‘Petasus‘ in collaboration with Dell Technologies. The Petasus 5G MEC solution combines SKT’s 5G MEC solution and Dell PowerEdge servers. It provides network virtualization features specialized for MEC and operational tools. Going forward, the solution will support integration with MEC solutions of other telcos and provide an app store-like feature for MEC services applications.

As a solution that reflects SKT’s extensive experience in 5G MEC commercialization and operation, the platform can be provided in a customized manner. Going forward, it will enable enterprises to deploy MEC in a prompt and stable manner by supporting interworking with public clouds.

SKT and Dell plan to provide the Petasus solution not only to global telcos, but also to businesses and public institutions throughout the globe that plan to adopt private 5G networks. In particular, they will strengthen their cooperation in 5G end-to-end business, which includes consulting, infrastructure deployment and maintenance services.

References:

https://aws.amazon.com/about-aws/whats-new/2022/05/aws-wavelength-zone-seoul/

https://www.sktelecom.com/en/press/press_detail.do?page.page=1&idx=1534&page.type=all&page.keyword=

SK Telecom and AWS launch 5G edge cloud service and collaborate on other projects

NTT & Docomo announce “6G” trials with NEC, Fujitsu, and Nokia

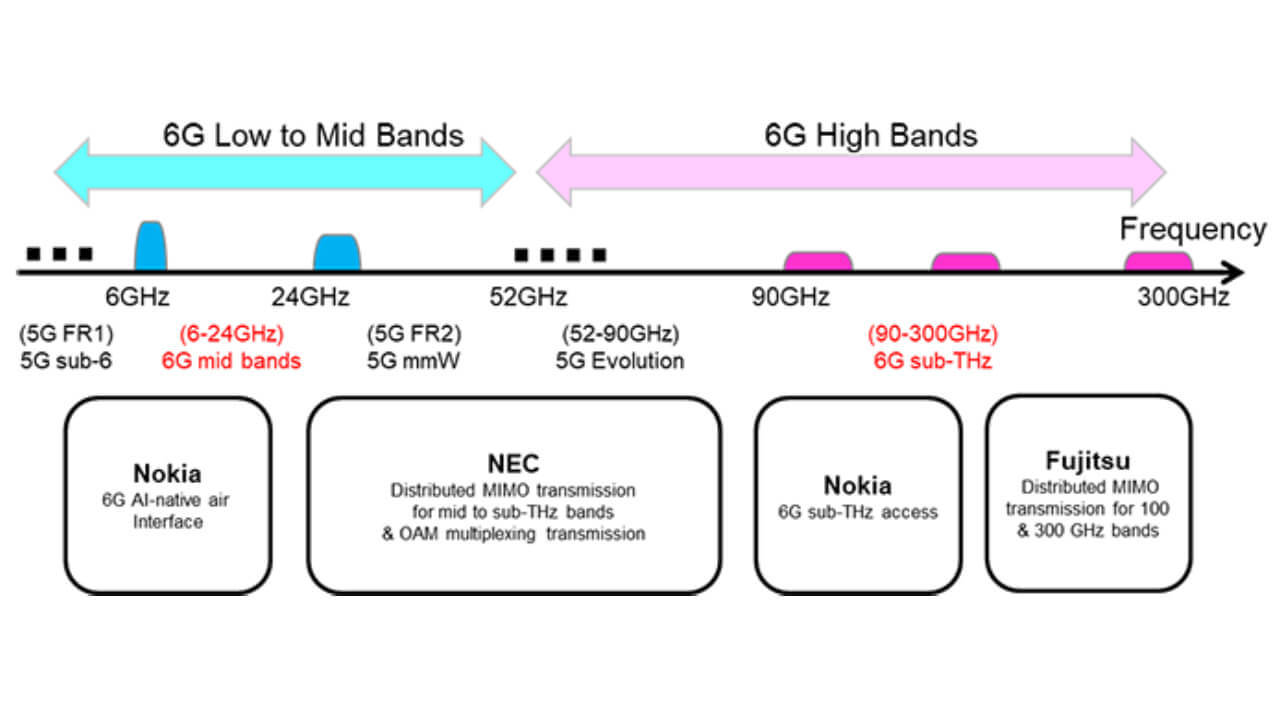

Japanese wireless network operator NTT Docomo and its parent company NTT have teamed up with mobile technology vendors Fujitsu, NEC and Nokia to conduct experimental trials of new mobile communications technologies for the targeted commercial launch of 6G services (?) by 2030.

While 6G technology is totally undefined, most industry bodies aiming for commercialization around 2030. It is already clear that the technology will be required to offer faster speeds, lower latencies, and a larger capacity than 5G wireless technology.

To achieve this, higher frequencies than those currently used for mobile services will be required, with most industry bodies suggesting that frequencies of between 100 GHz and 300 GHz will be best suited for these services.

Launching the envisioned 6G services will require verification of numerous new mobile technologies, including those needed to adopt new frequencies (not yet approved by ITU-R for use in IMT) in the millimeter and sub-terahertz (above 6 GHz) bands, in addition to bands for existing 5G services, NTT said. The trials are also expected to verify AI-based wireless transmission methods.

Docomo and NTT will launch indoor trials within the fiscal year ending in March 2023, and outdoor trials will begin in the following fiscal year. These trials are expected to verify concepts proposed so far by Docomo and NTT and will be reported in global research groups, international conferences and standardization activities related to 6G, and will serve as a foundation for more advanced technologies.

…………………………………………………………………………………………………………………………………….

Note that in April, NTT and Sky Perfect JSAT agreed to establish a joint venture company that will launch an integrated space computing network. The joint venture will build new infrastructures in space. In FY2024, the new joint venture, Space Compass, plans to launch an optical data relay service for high-speed transmission to the ground via a geostationary orbit (GEO) satellite.

Space Compass plans to use high altitude platform stations (HAPSs) to provide low-latency communication services in Japan in FY2025. HAPSs are expected to help provide communication in times of disaster, high-capacity communication for ships and aircraft, and communications services for distant islands and remote areas. NTT says mobile operators can improve their mobile networks by combining HAPSs with an increase in the number of their terrestrial base stations to expand their service coverage.

…………………………………………………………………………………………………………………………………….

Fujitsu announced that it will conduct joint trials of distributed MIMO communication technology where multiple sub-terahertz wave antennas are dispersed to simultaneously emit radio waves from multiple directions to a receiving terminal. Those joint trials will be with Docomo and NTT. Through this joint experiment, the three companies aim to develop technology that is resistant to obstruction and realizes stable high-speed wireless communication over 100 Gbps.

To achieve high-speed and large-capacity communications at sub-terahertz waves with small size and low power consumption, Fujitsu aims to develop high-frequency wireless devices utilizing compound semiconductors such as gallium nitride (GaN) and indium phosphorus (InP).

Nokia reports that its cooperation with Docomo and NTT will focus on two proof-of-concepts for emerging 6G technologies: an AI native air interface and sub-THz radio access. These aim to demonstrate a performance gain with an AI based 6G air interface compared to a conventional air interface, and to show that high-data rate beamformed access can be achieved in a high frequency band at 140 GHz, Nokia added.

Nokia has envisioned six key technologies that will be vital components of future 6G networks. Those include new spectrum technologies, AI native air interface, network as a sensor, extreme connectivity, cognitive, automated and specialized architectures, and security and trust. Among the six key technology components, the initial focus of the partnership is to demonstrate the benefits of AI-based learned waveform in the transmitter with a deep learning receiver in the mid-band, as well as to test high data rate indoor communications in the sub-THz band.

The plan is to set up environments for experiments and demonstrations in Docomo and NTT premises in Japan and Nokia premises in Stuttgart, Germany, and to start performing tests and measurements this year.

As communications technology becomes increasingly politicized, 6G targets are also beginning to be announced by national governments. Earlier this year, the Indian government announced that it would aim to deploy domestically made 6G equipment by 2030, thereby offering a major boost to the Indian economy and reducing the country’s dependence on typical telecoms equipment vendors like Nokia, Ericsson, and Huawei.

6G may only now be beginning to be defined, but the race to achieve 6G milestones has already begun.

References:

https://www.totaltele.com/513502/DOCOMO-and-NTT-announce-raft-of-partnerships-for-6G-trials

https://www.telecompaper.com/news/ntt-starts-6g-trials-with-fujitsu-nec-nokia–1426751

India creates 6G Technology Innovation Group without resolving crucial telecom issues

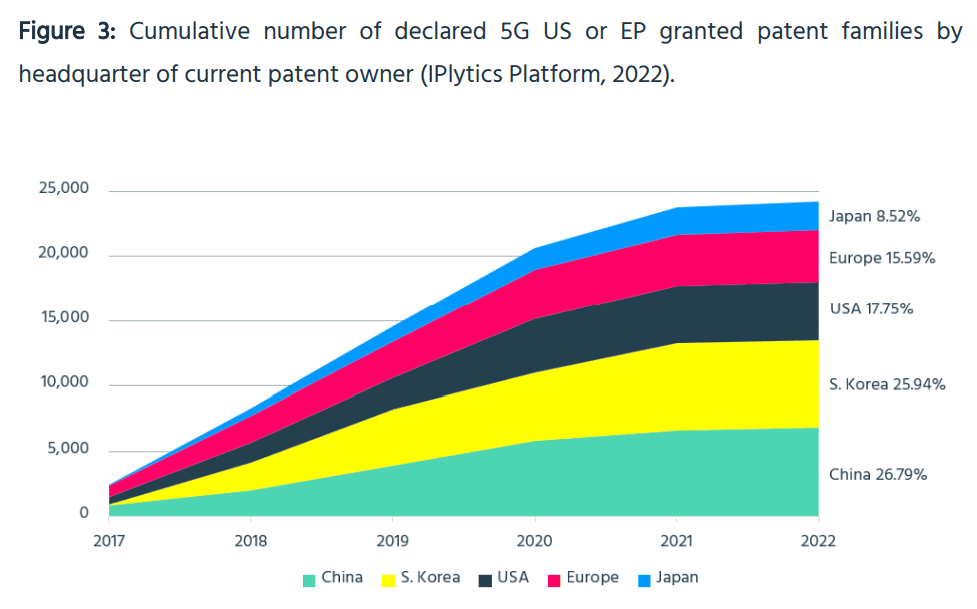

New data from IPlytics and Tech+IP Advisory LLC show regions and companies leading 5G Patent Race

Licensing of 5G Standard Essential Patents (SEPs) [1.] promises to become a highly lucrative market, making the 5G patent race more competitive than ever before – although the latest 5G patent data shows the question of who is currently winning it remains unclear. Although it may be difficult to answer the question about who wins the 5G race, the report shows a shift in the cellular industry. While 4G technology development was mostly dominated by US and European companies, Chinese and South Korean companies have led in 5G development with the highest number of active and granted (US or European) 5G self-declared patent families.

IPlytics data shows that, of the SEP holders that have self-declared at least 10 patent families over the past decade, the number of unique patent owners has risen from 99 in 2010 to 261 in 2021 (by factor 2.6x). The uptick in the number of SEP holders is largely driven by market entrants from China, Taiwan and South Korea, which develop smartphones, network devices, computer chips or semiconductor technology. In Q1 2022, over 50,000 active and granted patent families were declared for 5G following a rapid increase in only four years. Indeed, Chinese and South Korean companies have led in 5G patent development (more below).

Note 1. SEPs is a misnomer as there is only one authentic 5G standard – ITU-R M.2150 and it is incomplete, because the URLLC specification from 3GPP does not meet the ITU-R M.2410 Performance Requirements and the companion ITU-R M.1036 IMT Frequency Arrangements (especially for mmWave spectrum) has yet to be approved. Almost all the SEPs are based on 3GPP Technical Specifications (TSs), some of which have been rubber stamped as ETSI standards.

……………………………………………………………………………………………………………………………………………………………………………………………

While current litigation in the auto industry concerns 3G and 4G SEPs, the question of how much value 5G brings to a vehicle is more difficult to answer when advanced driving systems heavily rely on 5G-enabled connectivity and increasing litigation is anticipated. But adoption of 5G in other industries is expected in the future, as the number of IoT applications that will make use of 5G is endless. One thing is certain: the majority of SEP holders will actively monetize and enforce their SEP portfolios covering 5G standards in this fast-moving, high-investment environment. However, SEP owners as well as standard implementers are faced with the challenge of managing operational and financial risks and cost exposures, while striving to maximize value. This IPlytics report takes a closer look the major 5G patent owner as well as standards developing companies.

……………………………………………………………………………………………………………………………………………………………………………………………

5G smartphone devices announced by the major licensors represent “a substantial increase in royalties over what they received for 4G”, according to an Ankura study published by IAM last year. Using IPlytics data, Ankura argues that “these rises are not explained by an increased share of patent holding.” But is patent counting enough to understand the value of 5G?

Current SEP litigation (Ericsson v Apple; Nokia v Oppo and Vivo; InterDigital v Oppo, among others) has been triggered by the present cycle of upgrading SEP licensing deals from 3G/4G to 3G/4G/5G and the questions of how much additional value 5G brings. It is undeniable that investment in 5G is larger by far compared to all earlier generations (Figure 1), when counting the number of technical standards contributions submitted by standards developers.

Licensing of 5G SEPs takes place globally, while litigation is local. The rise of so-called anti-suit injunctions shows that international courts are competing to set global FRAND (fair, reasonable and non-discriminatory) rates. Regulators (including the current EU Commission communications) in different countries compete to set rules for leadership in technology standards innovation and products alongside the related SEP licensing ecosystem, thus influencing the global technology equilibrium. In this context, a balanced framework for SEP licensing on FRAND terms is more important than ever, while competition for 5G leadership goes beyond companies as it is relevant to entire economies. This poses the question: who is leading the 5G patent race?

Although it may be difficult to answer the question about who wins the 5G race, we can observe a shift in the cellular industry. While 4G technology development was mostly dominated by US and European companies, Chinese and South Korean companies have led in 5G development with the highest number of active and granted (US or European) 5G self-declared patent families. Figure 3 shows that Chinese organizations are leading, even though the 5G patent numbers in Figure 3 only consider European or US granted patent families.

However, not all self-declared patents are essential and valid, also SEPs vary by value – with some covering core technologies of the standard and others only claiming inventions on minor improvements to the standard. One approach to identifying investment in developing 5G technology is to count the number of standards contributions. The IPlytics database enables identification of approved and agreed technical submissions to 5G standards development, ensuring that only technical contributions are counted.

Senior patent directors, licensing executives or legal counsel should bear the following in mind:

• Future technologies that enable connectivity will increasingly rely on patented technology standards, such as 5G.

• The quantity of 5G SEP declarations as well as the number of SEP owners has constantly increased. Licensees must consider royalty costs and appropriate security payments in advance.

• Patent directors and licensing executives ought not only to consider information retrieved from patent data, but also monitor and study patent declaration data, SEP claims and standards section comparisons alongside, for example, technical contributions to understand the landscape of 5G patent holders.

• The essentiality rate differs across self-declared patent portfolios. SEP determination is crucial to make accurate assumptions about 5G leadership. Further refinement and analysis are needed to identify essentiality rates.

• The essentiality rate differs across self-declared patent portfolios. SEP determination is crucial to make accurate assumptions about the 5G leadership situation. Further refinement and analysis are needed to identify essentiality rates.

……………………………………………………………………………………………………………………………………………………………………………………………

Tech + IP 4G-5G SEP Update – Comments and Key Takeaways:

While 4G SEP patent counts are flattening, and precedent is adding up, 5G SEPs are accelerating as patent filings mature and, among other things, international filings turn into issued patents. It is more important than ever to carefully assess 4G data to help guide economically rational practices in a 5G (and coming 6G ) world.

Geographic data — both on the patent side and on the market side — is particularly important in assessing SEP patent importance, and this report goes to great lengths to begin to document such data. At the same time, we posit that other data such as the technical importance (and contribution) of certain technical specifications to which described and claimed inventions relate — as compared to other technical specifications — must also be assessed just as technical contribution and degree of technical difficulty is assessed in engineering and other technical domains.

In addition, most SEP landscapes focus solely on jurisdictions where compliant products are used or sold, ignoring markets where compliant devices are made, despite the black letter law of infringement and real world licensing negotiation outcomes where royalty rates often differ based on these factors.

Despite the large number of patents potentially necessary for any 4G-5G compliant mobile handset or network and the plethora of landscapes published by 3rd parties, however, there is almost no public discussion of: what patent families are truly global (and deserving of premium FRAND rates) versus what patent families are merely regional or national (and deserving of lower FRAND rates) and how the foregoing relates to where an infringing product is made, used or sold; and what assets map to which technical specifications (“TSs”), how do the TSs rank in terms of technical contribution, and whether and why that matters.

The goal of this 4G-5G SEP report is to provide an updated set of statistics related to 4G-5G SEPs for use by the community of patent holders and implementers, and to start to delve into more sophisticated groupings and analysis of such SEPs informed both by recent court decisions and the global marketplace of licensors and licensees. The analysis proposes a method for creating family value scores that is based on real world licensing and value contexts. The methodology is applied to the 4G stack of patents because the data set is less volatile and more mature.

In 2021, approximately 24,000 new patents and applications (“Assets”) were identified to the 4G-5G standards body (ETSI) [2.] as essential to one or both of those standards. The total number of Assets declared essential to 4G-5G standards (“4G-5G SEPs”) is now approximately 200,500 (at least according to their owners). At the same time, a large number (nearly 25% of all declared families) are declared for both 4G & 5G Technical Specifications.

Note 2. ETSI is not the “4G-5G standards body.” In fact, they make contributions to ITU-R WP 5D which is the standards body for all of International Mobile Telecommunications (IMT). As per Note 1, ETSI often rubber stamps (aka “transposes”) 3GPP TS’s as ETSI standards without making any changes. ETSI is the host for 3GPP meetings and manages their website.

In 2021, ~95% of newly issued / declared Assets are related to 5G technology, strongly mirroring the evolution being seen in the market to 5G deployments. The data further shows that there are three core regions of SEPs — the US, “Core EP” and “Core Asia” countries (see the Appendix for our definitions of these regions). However, the data also indicates that many more companies are seeking and receiving SEPs in “Fast Growth” countries like India, Brazil, Indonesia and Malaysia.

Analyzing top company portfolios, we can identify different leaders in different segments of Assets and Families.

-Huawei is the leading company when analyzing overall numbers of Families that are declared to 4G-5G.

-Qualcomm’s coverage stands out when analyzing Core and Fast Growth jurisdictions.

–Samsung leads if one looks at the largest number of Families declared to both 4G & 5G Technical Specifications (TSs).

4G Stack: Out of 145 assignees that have at least one 4G Core TS Family, Samsung leads in declarations, followed by Huawei and ZTE. Together these three hold 28% of total 4G Core TS Families.

5G Stack: Huawei leads in total Family counts across all key geographic regions (Core Global, Core EP, and Core Asia) except Fast Growth regions. Samsung has the most declarations in 2021 (18% of all Assets) declared in Core EP jurisdictions (2,796). In Core Asia jurisdictions OPPO leads in regard to Assets declared in 2021 (2,129), followed by Samsung (1,818) and Vivo (751). Fast Growth “2021” analysis shows that again Samsung and Oppo have the leading positions, holding 162 and 160 Assets, respectively.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Regarding other patent research firms, Plytics and GreyB both put Huawei at the top of their 5G patent rankings. But UK law firm Bird & Bird ranked Ericsson at the top, while PA Consulting put Nokia at the top of its list. Separately, a recent study by the US Patent and Trademark Office suggested that six companies – Ericsson, Huawei, LG, Nokia, Qualcomm and Samsung – are the top 5G patent holders, with no single discernable leader.

References:

https://www.iplytics.com/wp-content/uploads/2022/06/5G-patent-race-June-2022_website.pdf

https://www.lightreading.com/5g/huawei-ranks-1-in-new-5g-patent-survey/d/d-id/777984?

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

USPTO: No clear winners in 5G patent filings; caution urged when reviewing claims of “5G dominance”

Is a new 5G Patent War in the works? Expert Opinion + Review of 5G patent studies

5G Patent Wars: Are Nokia’s 3,000 “5G” Patent Declarations Legit?

T-Mobile Launches Voice Over 5G NR using 5G SA Core Network

T-Mobile has deployed commercial Voice over 5G (VoNR, or Voice Over (5G) New Radio) service in limited areas of Portland, Oregon and Salt Lake City, Utah. The Un-carrier plans to expand VoNR to many more areas this year. Now that Standalone 5G (5G SA) is beginning to carry voice traffic with the launch of VoNR, other real 5G services, such as network slicing and security are likely to be deployed. T-Mobile customers with Samsung Galaxy S21 5G smartphones can take advantage of VoNR today in select areas.

“We don’t just have the leading 5G network in the country. T-Mobile is setting the pace for providers around the globe as we push the industry forward – now starting to roll out another critical service over 5G,” said Neville Ray, President of Technology at T-Mobile. “5G is already driving new levels of engagement, transforming how our customers use their smartphones and bringing unprecedented connectivity to areas that desperately need it. And it’s just going to get better thanks to the incredible T-Mobile team and our partners who are tirelessly innovating and advancing the capabilities of 5G every day.”

Standalone 5G removes the need for an underlying 4G LTE network and 4G core, so 5G can reach its true potential. In other words, it’s “pure 5G”, and T-Mobile was the first in the world to deliver it nationwide nearly two years ago.

The addition of VoNR takes T-Mobile’s standalone 5G network to the next level by enabling it to carry voice calls, keeping customers seamlessly connected to 5G. In the near-term, customers connected to VoNR will notice slightly faster call set-up times, meaning less delay between the time they dial a number and when the phone starts ringing. But VoNR is not just about a better calling experience. Most importantly, VoNR brings T-Mobile one step closer to truly unleashing its standalone 5G network because it enables advanced capabilities like network slicing that rely on a continuous connection to a 5G core.

“VoNR represents the next step in the 5G maturity journey-an application that exists and operates in a complete end-to-end 5G environment,” says Jason Leigh, research manager, 5G & Mobility at IDC. “Migrating to VoNR will be a key factor in developing new immersive app experiences that need to tap into the full bandwidth, latency and density benefits offered by a 5G standalone network.”

“The commercial launch of the VoNR service is another important step in T-Mobile’s successful 5G deployment,” said Fredrik Jejdling, Executive Vice President and Head of Business Area Networks at Ericsson. “It demonstrates how we as partners can introduce 5G voice based on the Ericsson solution.”

“We are proud of our partnership with T-Mobile to bring the full capabilities of 5G to customers in the United States,” said Tommi Uitto, President, Nokia Mobile Networks. “Nokia’s radio and core solutions power T-Mobile’s 5G standalone network – and this VoNR deployment is a critical step forward for the new 5G voice ecosystem.”

“At Samsung, we want to give our users the best possible 5G experience on every device – and today’s announcement represents a big step forward,” said Jude Buckley, Executive Vice President, Mobile eXperience at Samsung Electronics America. “By supporting extensive integration and testing, and working alongside an industry leader like T-Mobile, we’re bringing to life all the benefits of 5G technology with the help of our Samsung Galaxy devices.”

VoNR is available for customers in parts of Portland, Ore. and Salt Lake City with the Samsung Galaxy S21 5G and is expected to expand to more areas and more 5G smartphones this year including the Galaxy S22.

T-Mobile is the U.S. leader in 5G with the country’s largest, fastest and most reliable 5G network. The Un-carrier’s Extended Range 5G covers nearly everyone in the country – 315 million people across 1.8 million square miles. 225 million people nationwide are covered with super-fast Ultra Capacity 5G, and T-Mobile expects to cover 260 million in 2022 and 300 million next year.

………………………………………………………………………………………………………………………………………………………

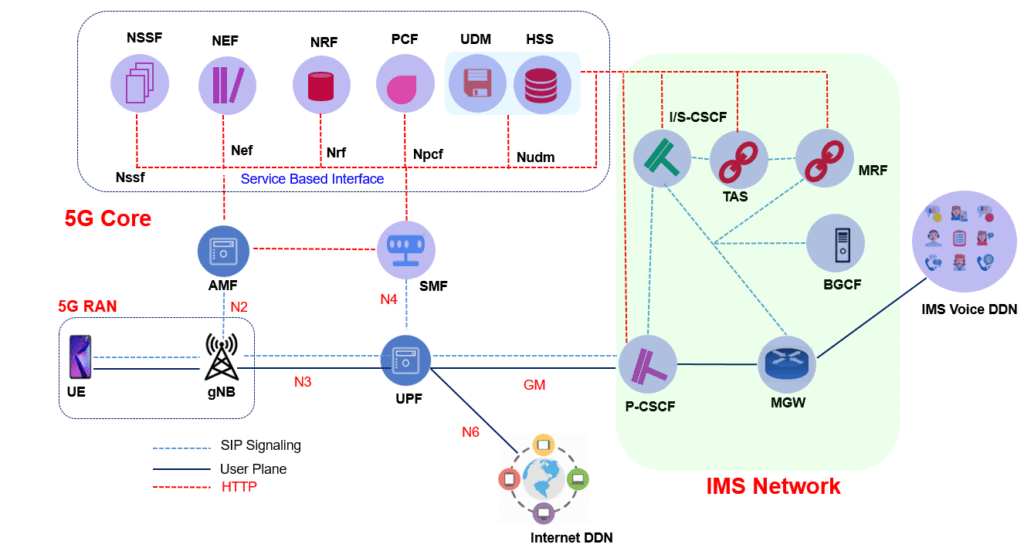

Voice Over NR Network Architecture:

Voice Over NR network Architecture is consist of 5G RAN, 5G Core and IMS network. A high level architecture is shown below. (Only major network functions are included). This network architecture supports Service based interface using HTPP protocol.

VoNR Key Pointers:

- VoNR rely upon IP Multimedia Subsystem (IMS) to manage the setup, maintenance and release or voice call connections.

- UE PDCP should support RTP and RTCP, RoHC compression and MAC layer should support DRX

- SIP is used for signaling procedures between the UE and IMS.

- VoNR uses a QoS Flow with 5QI= 5 for SIP signaling messages and QoS Flow with 5QI= 1

- QoS Flows with 5QI= 5 is non-GBR but should be treated with high priority to ensure that SIP signaling procedures are completed with minimal latency and high reliability.

- QoS Flow with 5QI= 1 is GBR. This QoS Flow is used to transfer the speech packets after connection establishment

- gNB uses RLC-AM mode DRB for SIP signaling and RLC-UM mode for Voice Traffic (RTP) DRBs

- 3GPP has recommended ‘Enhanced Voice Services’ (EVS) codecs for 5G

- EVS codec supports a range of sampling frequencies to capture a range of audio bandwidths.

- These sampling frequencies are categorized as Narrowband, Wideband, Super Wideband and Full band.

- VoNR UE provides capability information during the NAS: Registration procedure with IE ‘ UE’s Usage Setting’ indicates that the higher layers of the UE support the IMS Voice service.

- The AMF can use the UE Capability Request to get UE’s support for IMS Voice services. gNB can get UE Capability with RRC: UE Capability Enquiry and UE Capability response to the UE. The UE indicates its support for IMS voice service with following IEs

-

- ims-VoiceOverNR-FR1-r15: This field indicates whether the UE supports IMS voice over NR FR1

- ims-VoiceOverNR-FR2-r15: This field indicates whether the UE supports IMS voice over NR FR2

- within feature set support IE ims-Parameters: ims-ParametersFRX-Diff, voiceOverNR : supported

-

References:

https://www.techplayon.com/voice-over-nr-vonr-call-flow/

Samsung’s Voice over 5G NR (VoNR) Now Available on M1’s 5G SA Network