Author: Alan Weissberger

Fastest ISPs in the US: Google Fiber, Verizon Fios, MetroNet, Cox, and Xfinity

HighSpeedInternet.com analyzed over 3.6 million speed tests from their speed test tool (from July 1, 2020, to July 1, 2021) to determine the fastest internet providers across the US, according to their average download speed.

The firm found that these are the fastest internet providers in the U.S. (according to average download speeds from their speed test):

1. Google Fiber (average download speed of 160.5 Mbps)

2. Verizon (138.0 Mbps)

3. MetroNet (135.2 Mbps)

4. Cox (134.5 Mbps)

5. Xfinity (131.6 Mbps)

Google Fiber (very limited availability) has the fastest average internet speeds in the U.S., followed closely by Verizon Fios. These two fiber internet providers have impressive download speeds, upload speeds, and ping rates.

MetroNet, Cox, and Xfinity (Comcast) also average respectable speeds. Like Google Fiber and Verizon, MetroNet is a fiber internet provider, so it can give equal upload and download speeds. Cox and Xfinity, on the other hand, give customers slower upload speeds than download speeds—17.6 Mbps and 13.9 Mbps, respectively.

References:

https://www.highspeedinternet.com/resources/fastest-internet-providers

IMT towards 2030 and beyond (“6G”): Technologies for ubiquitous computing and data services

From emerging IMT towards 2030 and beyond use cases such as digital twin, cyber-physical systems, mixed reality, industrial/service robots, the following technology trends can be observed:

-

There is a need to process data at the network edge for real-time response, low transport cost, and privacy protection.

-

There is need to scale out device computing capability beyond its physical limitations for advanced application computing workloads.

-

The ubiquity of AI needs ubiquitous computing and data resources.

These new technology trends bring in new technology issues on scalability, dynamic workload distribution, data collection/management/sharing:

-

Scalability – In today’s cloud computing, computing resource are often centralized in a few national or regional data centers. Centralized service discovery and orchestration mechanisms used are given full visibility on computing resources and services in the data centers. When computing resources and services become more widely distributed, the centralized approach is no longer scalable; a more scalable approach is needed for widely distributed computing resources.

-

Dynamic computing workload distribution – Today’s workload distribution between devices and the cloud is based on client-server model with a fixed workload partition between the client and the cloud. The fixed workload partition is application specific and is pre-determined in the application development phase. Such a fixed workload partition is based on the assumption that there are always sufficient computing resources in the cloud to fulfil the server-side workload. Moving forward, as computing resources become distributed, the assumption of unlimited server-side computing resource would likely no longer hold so there needs to be a scheme that allows dynamic device computing scaling out based on conditions such as workload requirements, communication and computing resource availability, etc. To minimize the impact on applications, dynamic computing scaling scheme should be enabled as an IMT system capability with minimal dependency on applications.

-

Data collection, processing, management and sharing – With the widespread application of AI in society/industry, a systematic approach in collecting, processing, management and sharing data to facilitate AI/Machine Learning becomes very important. The conventional data management functions in cellular networks focus on managing subscription information and policies. In IMT-2020, driven by the use of AI tools for network optimization and automation, a network data analytics function (NWDAF) was added into the specifications through which network functions’ measurement data can be collected and used for analytics. Future IMT towards 2030 and beyond are anticipated to have further diversification on data sources, types and consumptions, so it is expected that data plane functions will be part of the IMT system function from the beginning and can support full-blown data services to devices, network functions and applications.

To address the above-mentioned challenges, computing services and data services are expected to become an integral component of the future IMT system. Ubiquitous computing and data services can be enabled alongside the ubiquitous connectivity as integral services of the IMT system. Dynamic computing workload distribution can be inherently supported as an IMT system capability. Applications can use the IMT system’s workload distribution and scaling capability to achieve optimized performance. Data plane services in the IMT system such as data collection, processing, management and sharing can be enabled to support AI needs in air interface, cellular network and applications.

Source: Intel contribution to ITU WP5D: “Further development of working document towards preliminary draft new Report on future technology trends” Sept 21, 2021

Reason magazine: How Internet Access Is Changing Cuba; Project Loon revisited?

IN JULY, thousands of Cubans in dozens of cities took to the streets to protest the island nation’s Communist dictatorship and chronic shortages in food, energy, and medicine, all of which have been made worse by the COVID-19 pandemic. These were the biggest anti-government demonstrations in Cuba in decades. They were enabled by social media and the internet, which came to Cuba in a big way only in late 2018, when President Miguel Diaz-Canel allowed citizens access to data plans on their cellphones.

To better understand exactly how Facebook, YouTube, WhatsApp, and other online platforms are connecting the Cuban people and under-mining state control, Reason’s Nick Gillespie spoke with Ted Henken, who teaches sociology and Latin American studies at City University of New York’s Baruch College and is the co-editor of Cuba’s Digital Revolution (University Press of Florida).

Q: How did the internet come to Cuba?

A: You basically had a period in the ’90s when Cuba was actually pretty advanced in the region in terms of its networking and internet, but Fidel [Castro] called it “a wild colt that needed to be tamed.” They saw it as a mortal threat because it undermined monopoly information control, which is one of the fundamental hallmarks of the Cuban system.

When Raul Castro became president in 2008 and gradually thereafter, Cubans started getting very gradually online. They started getting cellphones. They started to be able to buy and use laptop computers. Internet grew from 3 percent connectivity in about 2008 to 15 or 20 percent by around 2015, enabled partly by the government rollout of internet cafes. The next big thing was that Cubans got Wi-Fi hot spots, set up largely in public parks.

Q: Why did Cuba eventually allow people to use mobile internet on their phones?

A: Because of accumulated pressure and demand. But the other reason is that Cuba is in constant economic crisis. It’s inefficient. It’s unproductive. The system is totally lacking in incentive structures. So the government sees internet access as a cash cow, because it is the sole internet provider through its telecom monopoly.

Q: The demonstrations you documented online weren’t just happening in Havana, right?

A: Exactly. This is what’s unprecedented about them. Even if one of these had happened, it would be quite surprising in Cuba. But the fact that they happened simultaneously and probably between 30 and 50 places around the country is amazing.

Q: What are the ways in which people are using the internet to either protest or share images of protests?

A: You can kind of break the apps that Cubans use in terms of what we’re talking about into two groups: ones that allow horizontal, encrypted, private communication, and others that are broadcast media. Facebook, Instagram, and Twitter are the go-to apps to share with the world what’s going on, including live broadcast in Cuba. A fourth channel is, of course, YouTube. Interestingly enough, President Diaz-Canel angrily gave YouTube an endorsement when he blamed [the protests] on these irresponsible, mercenary YouTubers and influencers.

Q: If you’re doing something on Facebook or YouTube, you are totally public. The government knows exactly who you are.

A: Exactly. That’s been a change over the last, let’s say, 15 years. One of the things they were chanting in the street was, “We’re not afraid.”

A key part of the control in Cuba is keeping people afraid, keeping them isolated from one another and not realizing that other people share their concerns or their complaints, and keeping them afraid of sticking their head up and getting it chopped off. The internet has helped mitigate both of those, because they see other people who share their concerns. And then that helps them lose their fear.

So there’s a lot of people who are out of the political closet, so to speak, in Cuba, who say the same thing in public as they would say in private.

This interview has been condensed and edited for style and clarity. For a podcast version, subscribe to The Reason Interview With Nick Gillespie.

Source: Reason November 2021 issue

…………………………………………………………………………………………………………………………………….

“Internet access for the Cuban people is of critical importance as they stand up against the repressive Communist government,” Florida Gov. Ron DeSantis, a Republican, wrote in a letter to the White House earlier this month, urging President Joe Biden to provide “all necessary authorizations, indemnifications, and funding to American businesses” to get Cubans back online. He noted that the crackdown on internet access in Cuba has left many Floridians without the ability to communicate with loved ones on the island.

DeSantis has become one of the leading advocates, along with Reps. Maria Salazar (R–Fla.) and Carlos Gimenez (R–Fla.), both of whom are Cuban-American, for a radical plan to beam mobile internet service into Cuba from balloons anchored offshore that would effectively serve as temporary cell towers. It’s an idea that would rely on the technological know-how of Google and the diplomatic might of the United States—and even then it might be of limited value. But it might, as DeSantis put it in his letter to Biden, also be “the key to finally bringing democracy to the island” without the need for military intervention.

The diplomatic and political dynamics are actually more straightforward than they might appear. There are plenty of precedents for beaming signals across international borders against the wishes of a domestic government. Radio Free Europe is probably the most famous example, but the better comparison here is Radio Televisión Martí, run by the U.S. Agency for Global Media, which has broadcast news into Cuba since the 1980s. Clearly, the U.S. has no qualms about whatever international laws it might be violating by sending television signals into Cuba against the Cuban regime’s wishes. Sending mobile internet signals is a difference of degree—a slightly different wavelength of light—but should not require a total overhaul of U.S. policy toward Cuba.

“It is time to build on [the Radio Televisión Martí] model and include the delivery of Internet service,” argues Brandon Carr, one of the five commissioners in charge of the Federal Communications Commission (FCC).

Still, due to the diplomatic issues involved, any effort to beam internet into Cuba would have to be cleared by the White House. Earlier this month, press secretary Jen Psaki said the Biden administration was “actively pursuing measures” to “make the internet more accessible to the Cuban people.”

It’s not a slam dunk, of course. Signals could be jammed by the Cuban government, which already tries to block Radio Televisión Martí as much as possible. Many Cubans’ cell phones might not be able to connect due to differences in network protocols. And whatever connectivity is possible will be slow and spotty, at least by American standards.

But it may be worth making the attempt anyway, particularly since the technology already exists and could be deployed for minimal cost. There’s little to lose, and much that could be gained—not just in Cuba, but in other fights against tyrannical regimes.

“Internet shutdowns are increasingly becoming a tool of tyranny for authoritarian regimes across the globe,” says Carr. “America must stand against this anti-democratic tactic and move with haste to provide internet freedom to the Cuban people.”

Ericsson powers Singtel 5G SA core network; lightest and smallest Massive MIMO radio

Ericsson is the vendor of choice for Singtel’s 5G SA network with 5G radio access products and cloud-native dual-mode 5G Core network solutions.

The Ericsson product range will deliver high-quality connectivity for outdoor coverage in densely populated areas and help drive strong indoor-mall coverage across the city-state. The Covid-19 pandemic has fueled the need for better connectivity indoors, due to the numerous travel and lock-down restrictions.

According to the May 2021 ConsumerLab report – Five Ways to a Better 5G – indoor 5G coverage at public places has become two times more important than mobile data speed in delivering satisfactory 5G experiences for consumers in Singapore.

In addition, Ericsson’s solutions for 5G SA will provide super-fast response times and faster access to higher data rates that are required by cloud gaming, immersive media and vehicles or robot control. This connectivity will also help drive the future-readiness of Singtel’s network, creating new business opportunities.

Mark Chong, Group Chief Technology Officer, Singtel, says: “We are pleased to partner Ericsson in our 5G journey. Together, we launched Singapore’s first 5G standalone network and achieved the fastest 5G speeds this year. 5G is a game changer that will drive greater innovation, and in turn strengthen Singapore’s position as a leading digital hub. We look forward to bringing to life the full benefits 5G has to offer to enterprises and consumers in collaboration with ecosystem partners.”

To nurture a growing and vibrant local 5G ecosystem, Ericsson and Singtel have also signed a Memorandum of Understanding (MoU) with several global industry partners to develop advanced 5G enterprise solutions in Singapore. The MoU will utilize test facilities and capabilities to innovate solutions and scale them for global deployment. The partners are ABB, Axis Communications, Bosch, Bosch Rexroth, Cradlepoint, DHL, Hexagon, PTC and Rohde & Schwarz.

Martin Wiktorin, Head of Ericsson Singapore, Brunei and the Philippines, says: “5G SA will allow consumers in Singapore to experience the full benefits of 5G connectivity and also enable businesses across industries to reap the benefits of enhanced mobility, flexibility, reliability and security. As Singtel’s long-standing partner, we are proud to support the roll-out of one of the first 5G SA networks in the world. As a global ICT leader, we have already accumulated a wealth of technology expertise through the deployment close to 100 live 5G networks worldwide.”

For the past 30 years, Ericsson and Singtel have achieved multiple milestones together in Singapore. This partnership includes leading the way in 5G in the city-state – achieving Singapore’s fastest 5G speeds, the launch of Singtel’s GENIE, the world’s first portable 5G-in-a-box platform powered by Ericsson to enable enterprises to experience 5G’s capabilities; and the establishment of 5G Garage, the country’s first live 5G facility to drive 5G solutions for enterprises in collaboration with Singtel and Singapore Polytechnic.

……………………………………………………………………………………………………………………………………

Separately, Ericsson has released the latest addition to its Massive MIMO portfolio – the ultra-lightweight antenna-integrated radio AIR 3268 – for easier and efficient 5G mid-band deployments in dense urban and suburban areas.

At 12 kg (26lb) and 23 liters, AIR 3268 is the lightest and smallest Massive MIMO radio in the industry. With 200W output power, 32 transceivers and passive cooling, the radio weighs about 40 percent less than the earlier generation, making installations easy not only on towers and rooftops, but also on poles and walls.

The radio will help to accelerate 5G mid-band deployment for communications service providers seeking to boost capacity, coverage, speeds and mobile experiences for their subscribers.

Ericsson’s latest radio is 10 percent more energy-efficient than the earlier generation, lowering the total added power consumption when introducing 5G on mid-band. It also supports Ericsson’s unique Massive MIMO architecture and Uplink Booster capabilities that deliver leading network performance.

The AIR 3268 is about 8 kilograms lighter than its predecessor and could threaten the recent efforts by Nokia, Ericsson’s Finnish rival, to seize the leadership position in 5G radios. In June, after a 5G refresh, Nokia began advertising a 5G “massive MIMO” radio unit that included 32 transmitters and 32 receivers (the so-called 32T32R configuration) and weighed 17 kilograms. However, Ericsson’s 12-kilogram base station falls into exact the same 32T32R category, and a 5-kilogram difference is potentially very significant.

Heavy base station equipment puts stress on masts, brackets and other supporting infrastructure. Massive MIMO units usually need to be installed at the edge of a rooftop to get the full benefits of beamforming, says Gabriel Brown, a principal analyst with Heavy Reading (a sister company of Light Reading).

Ericsson has developed AIR 3268 in partnership with BT to address 5G challenges. Through the development process, the ultra-lightweight radio has been designed for 5G mid-band Massive MIMO performance to deliver the benefits of deployment simplicity and improved energy efficiency.

Greg McCall, Managing Director of Service Platforms, BT Group, says: “The 3.5 GHz band and Massive MIMO technology are important to our 5G network strategy to deliver the best customer experience in urban areas. We continue to add capacity within our market-leading 5G coverage, but to maximize our ability to deploy this technology, we need to minimize the burden on our site infrastructure.”

He adds: BT is pleased to be working with Ericsson on this product, which is less than half the size and weight of our current solution, reducing wind loading on existing sites and providing potential for adding 3.5 GHz Massive MIMO in new locations. The reduced power consumption will help BT deliver on our sustainability ambition.”

David Hammarwall, Head of Product Line Radio, Ericsson, says: “We continue to revolutionize Massive MIMO with ultra-lightweight radios that allow easier site upgrades and more seamless 5G mid-band deployments. AIR 3268 widens the options for the radio site, allowing service providers to boost their networks and deliver faster 5G speeds and response times. It is also energy-efficient, which is important to us and our customers.”

With its size and weight, AIR 3268 will simplify upgrades and new site acquisitions even in locations where footprint may prove challenging. The new radio also supports Ericsson’s mini bracket, providing lower total weight and easier installations.

AIR 3268 joins the family of ultra-lightweight radios launched in February this year. Like the rest of the company’s Massive MIMO radios, it is designed with Ericsson Silicon, providing real-time channel estimation and ultra-precise beamforming that improves coverage and user experience.

Ericsson also offers optimized site solutions with integrated transport for dense urban areas as part of its comprehensive transport and site solutions portfolio.

References:

https://www.ericsson.com/en/news/2021/9/ericsson-launches-ultra-lightweight-air-3268-radio

Ericsson and Singtel drive high-end 5G connectivity to benefit Singapore

AT&T CEO John Stankey: 30M or more locations could be passed by AT&T fiber

AT&T CEO John Stankey was interviewed by Brett Feldman, Goldman’s U.S. telecom and cable analyst. AT&T is both a telecom and media company. We focus on the former for the IEEE Techblog. Here are selected telecom related comments Stankey made (BOLD font emphasis added):

We’re pulling (market) share back from our two largest competitors (Verizon and T-Mobile). I feel good about how we’re doing that. There’s more to be done as we invest in fiber, and we can compliment our wireless business with fiber. There’s opportunities for us to take communications further than what we’ve traditionally done at AT&T. And I think that business should be recognized for being a leading global communications business, like it is, very uniquely positioned with more fiber than any other communications company on the face of the planet, with a great wireless asset domestically in the U.S. and in Mexico, an opportunity to bring those things together, and run it incredibly effectively as a focused business. I think we’ve got a great story there.

I think AT&T is in a great position moving forward. I think the industry frankly is in a great position. I think there’s tremendous promise right now in what ubiquitous high capacity bandwidth with the kind of capabilities that 5G brings in terms of the density that it can afford, the number of devices, the ability to use technology to do things like network slice (requires 5G SA core network which Microsoft is building for AT&T) and begin to differentiate the network. I think this is going to be great for society. I think this is going to be great for the U.S. economy as a whole. If I had to bet, we don’t have the numbers for 2021, certainly can’t project 2022, but I have a sense of where this industry is going. (This author totally disagrees, largely because real, standards based 5G has yet to be deployed as there is only a standard for the RAN which doesn’t meet URLLC performance requirements. No standard for 5G SA core network.).

We’re probably going to see record infrastructure investment coming out of this industry in this period of time. And I think it’s going to equip the United States and our economy and our infrastructure in a way that we’ve never seen. I think that’s going to be incredibly powerful. And I think it’s not only going to be good for AT&T, because I think we have the right kind of wherewithal and the right kind of capability to be right alongside others that are investing at a high clip to bring that infrastructure forward. I think we’ll do just fine with where we are there. I believe when unleashed we have some of the best network minds in the country. I believe that dense fiber footprint that we have that’s denser than anybody else in the United States when engineered properly on top of a great spectrum assets and a great wireless business, it’s going to make our combined product offer and our business even better and more capable to deal with what customers need to do. So, I feel really comfortable about that. And I can do nothing more than not ask you to look at my prognostications, but look at how we’re performing in the market today.

We’ve now started doing some things quietly behind the scenes. We have another muscle to build here, which is how do we begin to work on software to differentiate our products and services in a way that makes our product better than what our competitors can do, because we do have a different asset base, and we are able to serve every corner of the market from the largest of enterprises to the smallest apartment somewhere in the United States. And I don’t think we’ve done as much as we can do in that vein, to actually make that real for our customers and the right products and the right services and the right offers. And so, rebuilding that product engine that we can do that and begin to differentiate allows us to do things that won’t necessarily just hinge on, can I get an attractive handset?

Brett Feldman: I believe your fiber network passes something around 15 million customer locations right now, you’re targeting to ultimately get to 30 million by 2025, that would still only be about half roughly half of the customer locations in the AT&T wireline footprint. Question we’ve gotten is how did you decide what the right target was? Why is it 30? And what really dictates the pace at which you build out fiber?

Stankey replied: Getting this kind of an engine (fiber optic build-out) ramped up to go from building 3 million to 4 million to 5 million homes (locations) past, working through the supply chain, all the logistics that are necessary to build network, it’s not a real simple undertaking. And as I’ve said, my goal is I feel very comfortable, we have places we can go to build 30 million homes (he really means residential and business locations combined) right now on an owned and operated basis, that have very attractive returns in the mid to upper teens. We’re demonstrating every day with our existing base, that we can operate that more effectively, we’ve now crossed over places where we have scale where we’re taking cost out of the business based on fiber replacement, the old infrastructure, we’re seeing that flow through in lower call rates, lower repair rates, better churn, all those things are going to continue to give us goodness moving forward.

Do I think there’s a magic number of 30? No, I don’t. I think there’s a combination of things. One is unlike the investment base, to recognize the good work we’ve been doing. And then in fact, we are building and adding value back to our shareholders. And when they start to recognize that in the form of the equity in the stock, do I believe my credibility and the team’s credibility goes up? Yes, do I believe there’s going to be other opportunities for us to come out, as we hit those scaling metrics that we have in place, the supply chain metrics that we might be able to go in and say, there’s more that we could possibly attack, I’d love to be in that position to do that. And I’ve kind of put that out as a challenge to the management team to say the only thing that stands in the way between you doing 30 million and doing more is your execution and performance.

Brett Feldman: Speaking of execution, execution really has two pieces. It’s deploying the network, and then it’s driving penetration of that network. I believe you had about 5.4 million fiber subscribers as of your most recent quarters, that’s about 35% penetration [1.]. What do you think is the right target for your fiber penetration and how are you going to get there?

Note 1. Fiber-based broadband has clearly established itself as a growth engine for AT&T, which added another 246,000 fiber subscribers in Q2 2021, ending the period with 5.43 million. With about 80% of new fiber subscriber additions new to AT&T, overall broadband revenue growth at the company has finally surpassed declines in its legacy, non-fiber-to-the-premises (FTTP) broadband business.

………………………………………………………………………………………………………………………………………………..

Stankey replied: If I look what’s happening right now, and kind of where we are in our maturity scale, one of the things I’m most excited about is our new net adds to fiber right now good, almost 80% of them are new to AT&T. So, we’ve now gotten to this place where we’ve been managing the base. And we’re now shifting over where got a lot of new customers coming in. And in fact, as you saw last quarter, we’re starting to get ourselves to a point where that consumer business is a growth business today, despite the legacy drag on historic telecom products, parts and the like of legacy data products, that the fiber growth is beginning to outstrip that where we have real growth in that business. And we’re now starting to turn that corner real EBITDA growth in that business. And so, I would tell you as I step back from that, we’re going to see consistent growth. But I’m not going to be happy until we have a 50:50 share split in places where there’s two capable broadband providers. And I think there’s no reason with the product is capable as what we have out there and how fiber performs and what we’re able to do and the differentials we see in our customer satisfaction to our most significant competitor often cable in those markets, we were looking at 10, 15 points of difference in satisfaction levels, between other players in the market and ourselves, that we shouldn’t be able to achieve that over time.

Brett Feldman: You had earlier made a slight adjustment to your fiber deployment for this year, you were hoping to do 3 million homes, it’s going to be closer to two and half million and you noted some of the well reported supply chain issues as being a factor. Any update there, is there any further disruption in your supply chains and your ability to secure labor?

Stankey replied:

And we’re talking about what’s probably effectively about a 90 day delay for us to hit those numbers, and really primarily in this case, got to fiber assemblies. The way fibers built in the distribution network is we engineer it, we provide detailed engineering to our manufacturer, the manufacturer in the manufacturing facility, pre-splices and pre-assembles some of that fiber before we receive it. So, when it goes in, we’re doing less field splicing. And we’re able to basically put it up in the air or bring it through infrastructure in a way that lowers labor costs coming in. And we’re having some supply issues in the factory partly labor driven because of COVID, individuals getting sick not being able to run enough shifts, and carry through and partly some raw material issues. But those have been worked through right now our deliveries over the last 30 days have tracked to what our expectations are.

So, we feel like we’re through that dynamic right now. We should be fine with it. But look the supply chain is fragile at all levels. It’s fragile on everything. Last week, it was the number of generators, we’re deploying for power backup on cell sites, there’s, we’re going to miss a target on some of those by a couple 100 because there’s a resin base connector in the harness and we can’t get the resin. And that resin base connector, it’s a $15,000 generator that’s been held up on something that’s $0.25 part, you see these things popping up, left and right, every corner of the business. So, I don’t know what next week brings, we’re aggressively managing it. We’ve got a great supply chain organization. We’re a scaled provider, with all of our vendors. So, we lean into that, we were able to work through the fiber dynamics because we are the largest consumer of fiber in the United States. We use that ability and that expertise to make sure we get what we need to move through. So, I feel we’re managing through it, okay. I don’t think there’s anything around the challenges we’re dealing with, it gives me concern on guidance where we stand right now, but it’s going to be choppy and a little bumpy moving forward on some of these things as we move through the years.

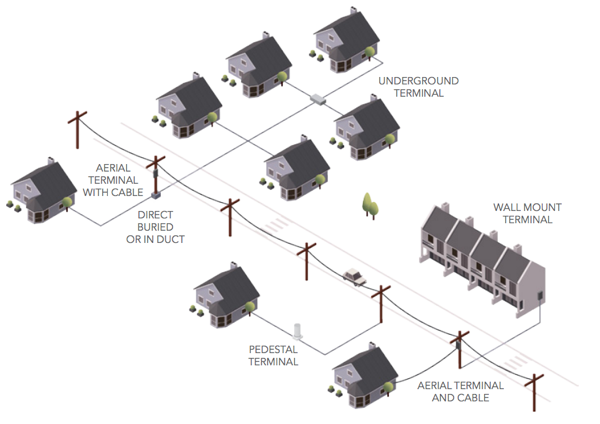

Typical fiber optic deployment to multiple homes via underground and aerial cable

……………………………………………………………………………………………………………………………………

Stankey wouldn’t say how the proposed U.S. infrastructure bill might also alter AT&T’s outlook in a way that encourages the company to explore a buildout that goes beyond 30 million locations.

“There’s a degree of uncertainty there,” he said of the bill. “But in its current form [and if] it does actually make its way into law, that’s going to change the landscape of the broadband business in this country … It will also change my posture and point of view on where we should be playing as a company.”

…………………………………………………………………………………………………………………………………………….

References:

https://techblog.comsoc.org/2021/08/12/atts-fiber-buildout-reduced-due-to-supply-constraints/

Nokia’s new routing silicon improves IP network security and energy efficiency

Nokia today announced the launch of FP5, its fifth generation of high-performance IP routing silicon. As the new heart of Nokia’s IP service routing platforms, FP5 will enable service providers to address today’s unrelenting requirements to efficiently scale network capacity, enable new higher speed IP services, and provide unmatched protection against escalating network security threats. Building upon four generations of industry-leading network processors, Nokia is raising the bar by adding support for high density 800GE routing interfaces, a 75% reduction in power consumption and new embedded line rate, flow-based encryption capabilities. Nokia FP5-based platforms will be available starting in the first half of 2022.

When Nokia unveiled the FP4 platform four years ago it did so amid great fanfare, positioning its in-house silicon as a major advantage over its rivals. In the intervening time Nokia has made some major strategic miscalculations on its proprietary chips, especially for 5G, so this latest launch has been much more muted. However, the FP5’s decrease in power consumption is impressive.

According to an interview in Light Reading, the power consumption reduction is partly a product of more a advanced semiconductor manufacturing process and partly incorporating more stuff on a single piece of silicon, thus reducing the need for interconnects. BT has long been a fan of Nokia routing silicon and is in at the start of this latest effort.

- Nokia FP5 network processing silicon delivers a generational leap in IP network capacity and power efficiency while introducing new capabilities for protecting network traffic from security threats

- FP5 is the industry’s first high performance routing silicon delivering integrated line rate encryption for L2, L2.5 and L3 network services at speeds up to 1.6Tbps

- Nokia’s fully programmable network processor is the first to bring 800GE routing interfaces for service provider applications to market while retaining the agility to adapt to new applications

- FP5 sets a new benchmark for sustainability in IP routing with a 75% reduction in power consumption over previous generations

![]() As cloud architectures, 5G and Industry 4.0 continue to drive network transformation, service providers require mission critical IP networks to be increasingly secure, agile and sustainable. IP networks must provide guaranteed high performance and integrity in the face of growing threats from network-level attacks and security breaches. They must also be able to adapt to address unforeseen changes and to support service evolution over the lifespan of the network. In addition, IP networking equipment must become increasingly power efficient to minimize impact on the environment.

As cloud architectures, 5G and Industry 4.0 continue to drive network transformation, service providers require mission critical IP networks to be increasingly secure, agile and sustainable. IP networks must provide guaranteed high performance and integrity in the face of growing threats from network-level attacks and security breaches. They must also be able to adapt to address unforeseen changes and to support service evolution over the lifespan of the network. In addition, IP networking equipment must become increasingly power efficient to minimize impact on the environment.

With the introduction of Nokia’s fifth generation FP5 network processing silicon, Nokia says it brings a new suite of IP routing solutions to market to help service providers transform mission critical IP networks to address these new and evolving requirements.

Nokia has long been at the forefront of providing an embedded approach to IP network security. With FP4, the company transformed volumetric DDoS defense with router-based detection and mitigation. FP5 brings an additional layer of network protection with the introduction of ‘ANYsec’ – a new line rate, flow-based encryption capability integrated directly into the chipset. ANYsec supports the delivery of secure IP services including MPLS and segment routing, on-demand and at scale without impacting performance or power efficiency. Service providers can now ensure the integrity and confidentiality of all data flowing through their networks.

With FP5, Nokia brings a generational leap in router network capacity to market. Nokia service router platforms are the first to support high-density 800GE and 1.6 Tb/s clear channel routing interfaces for applications including mobile transport, IP core, peering, BNG and provider edge. New FP5-based line cards will support 14.4 Tb/s (19.2 Tb/s with Nokia’s intelligent aggregation capability.) A new series of fixed form factor 7750 Service Router-1 platforms enable the benefits of FP5 to also be realized in smaller network locations.

Nokia’s FP5 network processors drive down power consumption per bit by 75%. As FP5 is backwards compatible with FP4 and fully integrated into the latest versions of Nokia’s Service Router Operating System (SR OS), all existing features are supported from day one on the new hardware. Through this aligned hardware and software evolution strategy, Nokia delivers unmatched and sustainable investment protection to its customers.

As a fully programmable network processor, FP5 enables the agility required to evolve the network as standards and applications change. Its deterministic performance combined with rich telemetry insight ensure network operators can drive a maintainable and serviceable IP network both today and into the future.

Neil McRae, Managing Director and Chief Architect, BT, said: “BT has a long-standing relationship with Nokia, and we are pleased to see that with FP5, Nokia continues to innovate to ensure IP networks have the scale, flexibility and features to help us stay ahead of escalating demand from our residential, mobile and business customers. In particular, we are very happy to see the focus on power optimization as we grow our network, with both BT and Nokia committing to significant reduction in carbon footprint. In the past 18 months, our lives have been turned upside down, and our reliance on networks has been dramatically increased and reliability for customers is crucially important. With security being ever more important for our customers, seeing Nokia’s approach to building more security features into the platform is fantastic.”

Hiroyuki Oto, Senior Vice President and General Manager of Core Network Development Department, NTT DOCOMO, INC., said: “Our network needs to continue to evolve to meet the demands from our consumers, communities, and businesses. With Nokia’s latest generation of silicon innovation and their careful attention to ensuring investment protection with the flexibility to adapt to new requirements, we believe Nokia is delivering the right foundation to ensure IP networks can efficiently scale and transform to stay ahead of ever shifting market demands.”

Christian Gacon, Vice President, Broadband Networks, Orange France, said: “We have had a long relationship with Nokia from the very first silicon processor release. As our network continues to evolve to meet the demands of our customers, innovations such as Nokia’s FP5 silicon will enable us to balance capacity, maintainability and security to deliver the best customer experience. Introducing this exciting innovation into existing platforms will ensure that we can gracefully evolve our networks as we look to manage both planned and unexpected demands in a sustainable way.”

Ray Mota, CEO and Principal Analyst, ACG Research, said: “Nokia does it again and shows its understanding and commitment to service providers, which has been key in its #1 momentum gain in the overall $12 billion service provider market. With the introduction of its fifth generation FP5 routing silicon, we believe Nokia is well-positioned to continue as a vendor of choice for service providers seeking to evolve their IP networks to become more agile, efficient, and secure all the while providing investment protection.”

Federico Guillén, President of Network Infrastructure, Nokia, said: “Of all the things that are surprising about human beings, perhaps the most surprising is our ability to be surprised. Our customers require their networks to be robust, agile and adaptable enough to handle everything life throws at them – from disruptive security threats to a global pandemic. FP5 is a significant step forward in performance, security and efficiency and – in combination with our software excellence and investment in network automation and tools – it opens the next chapter in Nokia’s long-standing leadership in IP networking and IP silicon innovation.”

“This is the industry’s most advanced network-processing silicon for service provider IP networks,” Heidi Adams, VP of IP and optical network marketing at Nokia, said in a phone interview.

Resources:

- Webpage: Nokia FP5

- Video: Master the unexpected with Nokia’s new FP5 silicon

- eBook: Master the unexpected with Nokia FP5

- App Note: Nokia FP5 silicon innovation

- Webpage: IP Network security

- Media Library: Nokia FP5 image

References:

Tata Communications: Bandwidth on Demand/ pay-as-you-go for Ethernet services

Tata Communications today launched the ‘Bandwidth-on-Demand’ (BoD) Ethernet network services for various industry sectors including IT/ITeS, BFSI, eCommerce, and the Media. The new feature enables enterprises to self-provision additional bandwidth capacity on a pay-as-you-go model to address their short-term bandwidth needs through a self-service customer portal, the company said in a statement. “With this feature, Tata Communications powers enterprises to move closer to achieving their digital-first ambitions.”

Editor’s Note: BoD or “liquid bandwidth” was the original premise of Ethernet MAN/WAN services in 2001-2002 when it was first deployed. The premise was FTTB/FTTP which would provide sufficient bandwidth for customers to scale speeds up (or down). The key capability needed was a usage and rate based charging system which evidently is now in place (2o years later!).

……………………………………………………………………………………………………………………………………………..

The BoD feature also helps customers dynamically manage scalable and resilient data center (DC) connectivity. The Ethernet network is built upon the strong foundation of Tata Communications DC ecosystem infrastructure, providing seamless connectivity and maximum coverage across the DC clusters in India with multiple diverse routes.

“The pay-as-you-go network feature will empower enterprises who are increasingly facing fluctuating short-term bandwidth needs to manage their application’s performance. Control at the hands of the customers to adjust their bandwidth dynamically in near real-time, will provide them such agility and flexibility,” said Kapil Kumar Jain, Vice President – Core and Next Gen Connectivity Services, Tata Communications.

- IT, ITES and the Service sectors get the flexibility which increases capacity to handle cloud backups and data replication services

- BFSI (Banking, Financial Services and Insurance) during scheduled data migrations and back-ups.

- eCommerce and retail which benefits by managing network performance during annual or periodic ‘big’ sales days campaigns.

- Media services to enhance their workflows for efficient event-based remote production.

References:

Indosat Ooredoo and Nokia launch commercial 5G service in Indonesia

Nokia and Indosat Ooredoo have launched commercial 5G services in Surabaya city, Indonesia. Under the terms of the deal, Indosat Ooredoo’s customers can explore new enterprise and industrial use cases powered by the new 5G network.

Nokia and Indosat Ooredoo, as well as partners, Sepuluh Nopember Institute of Technology and the University of Oulu, will also open the Nokia 5G Experience Centre at ITS’ facilities in Surabaya. The site includes a Centre of Creativity designed for technology developers and ITS students to explore and develop new 5G use cases to drive innovation and socio-economic development in Indonesia. In addition, the facility includes a Center of Knowledge with 5G millimeter-wave capability to simulate a live 5G environment for testing a range of 5G uses cases. It also includes a Center of Excellence offering professional 5G certifications and other academic programs to support the development of local digital talent.

“I am deeply humbled and proud to launch Indosat Ooredoo’s 5G services in Surabaya aligned with our commitment to being the forefront of the 5G revolution in Indonesia,” said Ahmad Al-Neama (pictured), president director and CEO of Indosat Ooredoo. “This technology will help unleash many opportunities for the region’s education, people, and economy,” he added

Specifically, Nokia will supply equipment from its ReefShark based AirScale product range, which includes its AirScale Single RAN portfolio for both indoor and outdoor coverage. Once deployed, these solutions will deliver faster speeds and wider mobile coverage for Indosat Ooredoo’s customers, while at the same time cutting Ooredoo’s network operating costs.

In addition, Nokia will also deploy its dynamic spectrum sharing (DSS) solution, which will allow Indosat Ooredoo to use its 4G networks spectrum for 5G services, decreasing the time it takes to get 5G up and running.

“We are excited to launch commercial 5G services in Indonesia with Indosat Ooredoo as its trusted partner,” said Tommi Uitto, president of mobile networks at Nokia. “Our AirScale portfolio will deliver best-in-class services to its subscribers and I look forward to working hand in hand with them on this project moving forward. The opening of the Nokia 5G Experience Center will also provide a platform to drive innovation in the country,” he added.

Further to this collaboration, Nokia and Indosat Ooredoo, as well as partners, Sepuluh Nopember Institute of Technology and the University of Oulu, will also open the Nokia 5G Experience Centre at ITS’ facilities in Surabaya.

The site includes a Centre of Creativity designed for technology developers and ITS students to explore and develop new 5G use cases to drive innovation and socioeconomic development in Indonesia.

The facility will also feature a Center of Knowledge with 5G millimeter-wave capability to simulate a live 5G environment for testing a range of 5G uses cases. It will include a Center of Excellence offering professional 5G certifications and other digital academic programs.

“We are thrilled to be partnering with Nokia and Indosat Ooredoo to bring 5G innovation to Indonesia and specifically into Surabaya,” said Prof. Dr. Ir. Mochamad Ashari, Rector of Sepuluh Nopember Institute of Technology.

“Through such industry partnerships, we aim to provide a platform for young minds to collaborate directly with industry and business leaders and develop 5G solutions that will benefit the University and the wider community.”

References:

Russia’s Norilsk Nickel to deploy private 5G network without a network operator

Russian metallurgy company Norilsk Nickel is considering applying for a license to use 5G frequencies, reports Comnews.ru citing CEO Alexander Kudinov’s remarks during the GSMA Mobile 360 Eurasia conference in Russia last week. The company plans to deploy a private 5G network on its own, without cooperating with any telecommunications network operator.

Norilsk Nickel is interested in working with equipment vendors directly. The idea of deploying a private 5G network independently is based on security rather than economic issues.

“At Norilsk Nickel, work directly with the vendor is being worked out very actively. We are considering this model not for economic reasons, but from the point of view of IT security. But such a model of cooperation cannot exist at the moment. There are many incomprehensible points in the law that the government still has. In my opinion, operators have more experience. But Norilsk Nickel is interested in working directly with vendors, “emphasizes Alexander Kudinov.

Dmitry Lakontsev, head of the Skoltech-based NTI Competence Center for wireless communication or the Internet of Things, emphasizes that there is no threat to the operators’ business. Vice versa. The more companies build 5G networks, the higher the demand for equipment will be. And this, in turn, will lead to the growth of the entire industry through additional investment. “It is also worth recalling that it is the industry that gets the maximum effect from the introduction of 5G. Therefore, the creation of private mobile 5G / LTE networks by the enterprises themselves is quite logical,” he says.

According to Dmitry Lakontsev, most companies note such advantages of private networks as full control over data that does not leave the enterprise network perimeter, exact correspondence of the network to use scenarios and the radio environment of the enterprise, and quick setup, reconfiguration and expansion when needs change. In addition, private networks have such advantages as the further development of their own distributed computing resources, at the right point, at the right time, with the necessary characteristics and guaranteed reliability. Also, a private mobile network is a strategic asset of the enterprise and an essential competence.

The disadvantages of private networks are the need to create new competencies for the deployment, optimization and operation of mobile networks, the cost of building a new network and wireless infrastructure, as well as, emphasizes Dmitry Lakontsev, its maintenance and updating. Due to the lack of economies of scale, the purchase of equipment and services takes place on less favorable terms than for mobile operators and owners of a tower business (infrastructure operator). Also the disadvantage is the need to meet the requirements of regulators, which for private 5G networks are still vague and lagging behind technological progress.

At the same time, Dmitry Lakontsev notes, obtaining a license, as a rule, is one of the smallest lines in expenses. To create your own communications infrastructure, you need serious money and relevant competencies. Not all companies can afford it, so this story is unlikely to be massive. However, the demand for private networks is and is only growing, mainly from the largest enterprises. Globally, we are talking about thousands of installations, and on a Russian scale, about dozens, which is quite a lot.

Semyon Zakharov, Director of Project Implementation for Corporate Business of MegaFon PJSC, emphasizes that the operator sees a great interest in private LTE and 5G networks from the corporate market.

The participation of the telecom operator in the construction of private LTE / 5G will allow corporate clients to avoid mistakes when planning a network, taking into account the peculiarities of the territory in which the enterprise is located and the tasks that it faces. “For the same reason, it is more profitable for companies to transfer the operation of networks to operators. If an enterprise builds a network on its own, it must not only obtain frequencies, but also legalize the network itself, carry out radio control and other necessary processes. As a result, the network becomes a non-core asset, which requires significant financial and human resources. Over time, the majority of enterprises give up such non-core activities,” said Semyon Zakharov.

……………………………………………………………………………………………………………………………….

References:

https://www.comnews.ru/content/216481/2021-09-17/2021-w37/nornikel-sdelaet-5g-dlya-sebya

Vodafone and ITU establish new working group to close digital divide

Vodafone and the ITU have launched a major new initiative to address the global digital divide. The program aims to give an additional 3.4 billion worldwide the ability to access and use the internet through a smartphone by 2030, Vodafone announced.

The new working group, co-chaired by Vodafone Group CEO Nick Read and ITU Secretary-General Houlin Zhao, will identify policy, commercial and circular economy actions to increase smartphone access. Launch partners for the initiative include the GSMA, Vodacom Group, Safaricom, Smart Africa, the government of Ghana, the World Wide Web Foundation, and the Alliance for Affordable Internet.

In a statement announcing the initiative, Vodafone cited GSMA Connected Society research showing 82 per cent of the citizens of low- and middle-income countries are now covered by 4G mobile networks, but many lack a capable device.

Nick Read, CEO of Vodafone Group, said: “Vodafone is honored to be part of this monumental global initiative with the UN, to improve the lives of billions of people through smartphone access. As our societies become more digital, everyone should have the ability to find jobs, be able to get public services, financial services and critical information that are increasingly only available through the internet. This is such a complex challenge that no network operator, device manufacturer, financial services provider or national government can solve on their own – but working together we can break through the barriers.”

Houlin Zhao, Secretary General of the ITU, said: “Achieving the Broadband Commission Global Targets requires a multi-stakeholder approach. I am pleased to co-chair this newly established Working Group, which will also help address the challenges posed by the COVID-19 pandemic and ensure that we put smart devices in the hands of those who are left behind.”

Ursula Owusu-Ekuful, Ghana’s Minister for Communications and Digitalization, stated 45 per cent of people in West Africa are covered by mobile broadband networks but do not use the internet.

Maria-Francesca Spatolisano, officer-in-charge of the office of the UN Secretary-General’s Envoy on Technology, explained the Vodafone and ITU working group will play a key role in helping the body achieve its goal of universal connectivity by 2030 by helping ensure the global shift to digital technology “is beneficial and makes our societies more equal and not less.”

The Broadband Commission Working Group will produce a report and set of recommendations including:

-

original analysis and data on the smartphone access gap;

-

quantification of the social and economic impact of providing everyone with smartphone access by 2030, including assessment of moving users from 2G feature phones to 4G smartphones; and

-

analysis of initiatives or pilots designed to increase smartphone access. Vodafone Group has committed to launch two pilot projects on device affordability as part of this process.

“This partnership is key to expand access to the internet,” said Doreen Bogdan-Martin, Director of the ITU Telecommunication Development Bureau. “I am confident that the outcome report will provide guidance to all our stakeholders as we prepare for the ITU World Telecommunication Development Conference in 2022 to build a world where no one is left off-line.”

To coincide with the creation of this new ITU working group, Vodafone, Safaricom and Vodacom have published the second Africa.Connected report in accelerating 4G roll-out in sub-Saharan Africa. The report, prepared by consultancy Caribou Digital, outlines four key steps to boosting digital access across African. This includes making 4G devices more accessible; investing in the demand for 4G services; providing targeted financing for underserved demographics; and re-farming 2G spectrum to enable more people to use 4G services.

References:

https://www.vodafone.com/sites/default/files/2021-09/Vodafone_Africa_Access_Paper.pdf