Author: Alan Weissberger

Technavio: Disaster Recovery-as-a-Service market CAGR > 44.65% from 2021-2025

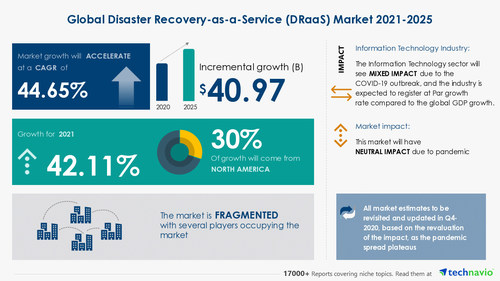

The disaster recovery-as-a-service (DRaaS) market is set to grow by $40.97 billion, progressing at a CAGR (compound annual growth rate) of over 44.65% during 2021-2025 (43.19% till 2024), according to this Technavio report.

The report identifies and provides a detailed analysis of the market participants in dominant positions including Amazon.com, Broadcom, Cisco Systems, Dell Technologies, and International Business Machines Corp.

Various factors such as growing improvements in manageability and protection, increasing adoption of cloud-based disaster recovery solutions, and rising need to meet RTO and RPO objectives of enterprises will offer immense growth opportunities for market growth.

In addition, the surging adoption of AI for disaster recovery and deployment of DRaaS by enterprises to reduce the need for secondary data centers will further lead the market to flourish during the forecast period. However, the availability of open-source disaster recovery tools is one of the primary factors anticipated to limit the market’s growth during the next few years.

The market is fragmented, and the degree of fragmentation will accelerate during the forecast period. Some of the other major vendors of the disaster recovery-as-a-service (DRaaS) market in IT Consulting & Other Services include iland Internet Solutions, Microsoft Corp., NTT Communications Corp., Oracle Corp., and Sungard Availability Services LP.

To help businesses improve their market position and leverage the current opportunities, market vendors must strengthen their foothold in the fast-growing segments, while maintaining their positions in the slow-growing segments. Backed with competitive intelligence and benchmarking, our research report on the disaster recovery-as-a-service (DRaaS) market is designed to provide entry support, customer profile & M&As as well as go-to-market strategy support.

……………………………………………………………………………………….

Disaster Recovery-as-a-Service (DRaaS) Market is segmented as follows:

- Deployment

- Public Cloud

- Private Cloud

- Hybrid Cloud

- Geography

- North America

- Europe

- APAC

- South America

- MEA

…………………………………………………………………………..

Separately, Technavio forecasts the fiber optics market will grow at a CAGR of 4.77% till 2024. During the forecast period, the market will show an accelerating growth of $2443.66 million.

References:

Gartner: AWS, Azure, and Google Cloud top rankings for Cloud Infrastructure and Platform Services

Gartner’s latest Magic Quadrant report for cloud infrastructure and platform services (CIPS) ranks Amazon Web Services (AWS), Microsoft Azure, and Google Cloud as the top cloud service providers.

Beyond the top three players, Gartner placed Alibaba Cloud in the “visionaries” box, and ranked Oracle, Tencent Cloud, and IBM as “niche players,” in that order.

The scope of Gartner’s Magic Quadrant for CIPS includes infrastructure as a service (IaaS) and integrated platform as a service (PaaS) offerings. These include application PaaS (aPaaS), functions as a service (FaaS), database PaaS (dbPaaS), application developer PaaS (adPaaS) and industrialized distributed cloud offerings that are often deployed in enterprise data centers (i.e. private clouds).

Figure 1: Magic Quadrant for Cloud Infrastructure and Platform Services

……………………………………………………………………………………………..

……………………………………………………………………………………………..

1. Gartner analysts praise Amazon AWS for its broad support of IT services, including cloud native, edge compute, and processing mission-critical workloads. Also noteworthy is Amazon’s “engineering prowess” in designing CPUs and silicon. This focus on owning increasingly larger portions of the supply chain for cloud infrastructure bolsters the No. 1 cloud provider’s long-term outlook and earns it advantages against competitors, according to the Gartner report.

“AWS often sets the pace in the market for innovation, which guides the roadmaps of other CIPS providers. As the innovation leader, AWS has materially more mind share across a broad range of personas and customer types than all other providers,” the analysts wrote.

AWS, which recently achieved $59 billion in annual revenues, contributed 13% of Amazon’s total revenue and almost 54% of its profit during second-quarter 2021.

AWS’s future focus is on attempting to own increasingly larger portions of the supply chain used to deliver cloud services to customers. Its operations are geographically diversified, and its clients tend to be early-stage startups to large enterprises.

……………………………………………………………………………………

2. Microsoft Azure, which remains the #2 Cloud Services Provider, sports a 51% annual growth rate. It earned praise from Gartner for its strength “in all use cases, which include the extended cloud and edge computing,” particularly among Microsoft-centric organizations.

The No. 2 public cloud provider also enjoys broad appeal. “Microsoft has the broadest set of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market,” the analysts wrote.

Microsoft has the broadest sets of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market. From the perspective of IaaS and PaaS, Microsoft has compelling capabilities ranging from developer tooling such as Visual Studio and GitHub to public cloud services.

Enterprises often choose Azure because of the trust in Microsoft built over many years. Such strategic alignment with Microsoft gives Azure advantages across nearly every vertical market.

“Strategic alignment with Microsoft gives Azure advantages across nearly every vertical market,” Gartner said. However, Gartner criticized Microsoft for very complex licensing and contracting. Also, Microsoft sales pressures to grow overall account revenue prevent it from effectively deploying Azure to bring down a customer’s total Microsoft costs.

Microsoft Azure’s forays in operational databases and big data solutions have been markedly successful over the past year. Azure’s Cosmos DB and its joint offering with Databricks stand out in terms of customer adoption.

………………………………………………………………………………………

3. Google Cloud Platform (GCP) is strong in nearly all use cases and is slowly improving its edge compute capabilities. Google continues to invest in being a broad-based provider of IaaS and PaaS by expanding its capabilities as well as the size and reach of its go-to-market operations. Its operations are geographically diversified, and its clients tend to be startups to large enterprises.

The company is making gains in mindshare among enterprises and “lands at the top of survey results when infrastructure leaders are asked about strategic cloud provider selection in the next few years,” Gartner analysts wrote. Google is also closing “meaningful gaps with AWS and Microsoft Azure in CIPS capabilities,” and outpacing its larger competitors in some cases, according to the report.

The analysts also noted that Google Cloud “is the only CIPS provider with significant market share that currently operates at a financial loss.” The No. 3 public cloud provider reported a 54% year-over-year revenue increase and a 59% decrease in operating losses during Q2.

………………………………………………………………………………..

Separately, Dell’Oro Group Research Director Baron Fung recently said that hyperscalers make up a big portion of the overall IT market, with the 10 largest cloud-service providers, including AWS, Google, and Alibaba, accounting for up to 40% of global data center spending, and “some of these companies can have really tremendous weight on the ecosystem.”

The Dell’Oro report noted that some providers have deployed accelerated servers using internally developed artificial intelligence (AI) chips, while other cloud providers and enterprises have commonly deployed solutions based on graphics processing units (GPUs) and FPGAs.

Fung explained that this model has also spilled over into those cloud providers also building their own servers and networking equipment to better fit their needs while “moving away from the traditional model in which users are buying equipment from companies like Dell and [Hewlett Packard Enterprise]. … It’s really disrupting the vendor landscape.”

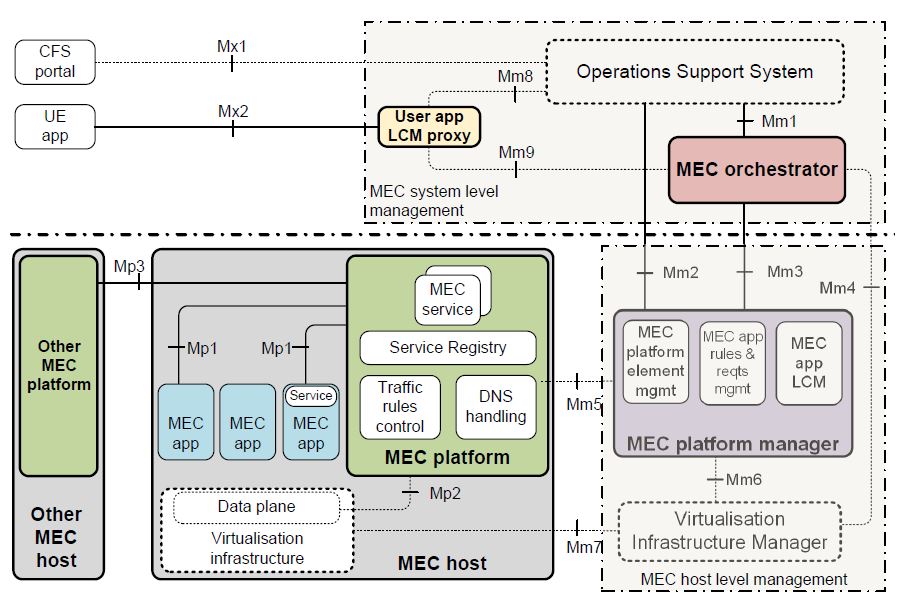

Certain applications—such as cloud gaming, autonomous driving, and industrial automation—are latency-sensitive, requiring Multi-Access Edge Compute, or MEC, nodes to be situated at the network edge, where sensors are located. Unlike cloud computing, which has been replacing enterprise data centers, edge computing creates new market opportunities for novel use cases.

…………………………………………………………………………………

References:

https://www.gartner.com/doc/reprints?id=1-26YXE86I&ct=210729&st=sb

2Africa subsea cable system adds 4 new branches

2Africa, which will be the largest subsea cable project in the world, will deliver faster, more reliable internet service to each country where it lands. Communities that rely on the internet for services from education to healthcare, and business will experience the economic and social benefits that come from this increased connectivity.

Alcatel Submarine Networks (ASN) has been selected to deploy the new branches, which will increase the number of 2Africa landings to 35 in 26 countries, further improving connectivity into and around Africa. As with other 2Africa cable landings, capacity will be available to service providers at carrier-neutral data centers or open-access cable landing stations on a fair and equitable basis, encouraging and supporting the development of a healthy internet ecosystem.

Marine surveys completed for most of the cable and cable manufacturing is underway. Since launching the 2Africa cable in May 2020, the 2Africa consortium has made considerable progress in planning and preparing for the deployment of the cable, which is expected to ‘go live’ late 2023. Most of the subsea route survey activity is now complete. ASN has started manufacturing the cable and building repeater units in its factories in Calais and Greenwich to deploy the first segments in 2022.

Egypt terrestrial crossing already completed

One of 2Africa’s key segments, the Egypt terrestrial crossing that interconnects landing sites on the Red and the Mediterranean Seas via two completely diverse terrestrial routes, has been completed ahead of schedule. A third diverse marine path will complement this segment via the Red Sea.

About MTN GlobalConnect

GlobalConnect is a Pan-African digital wholesale and infrastructure services company, and an operating company in the MTN Group. GlobalConnect manages MTN’s international and national major wholesale activities, in addition to offering reliable wholesale and infrastructure solutions for fixed connectivity and wholesale mobility solutions that include international mobile services, Voice, SMS, signalling, roaming and interconnect. The MTN Group launched in 1994 is a leading emerging market operator with a clear vision to lead the delivery of a bold new digital world and is inspired by the belief that everyone deserves the benefits of a modern connected life. Embracing the Ambition 2025 strategy, MTN is anchored on building the largest and most valuable platform business, with a clear focus on Africa. The MTN Group is listed on the JSE Securities Exchange in South Africa under the share code “MTN”.

For more information, please visit www.globalconnect.solutions – https://www.mtn.com

About stc

With its headquarter in Riyadh, stc group is the largest in the Middle East and North Africa based on market cap. stc’s revenue for 2020 amounted to 58,953million SAR (15,721 million US dollars) and the net profit amounted to 10,995 million SAR (2,932 million US dollars). stc was established in 1998 and currently has customers around the globe. It is ranking among the world’s top 50 digital companies and the first in the Middle East and North Africa according to Forbes. It focuses on providing services to enterprise and consumer customers through a fiber-optic network that spans 217,000 kilometers. stc group was among the first in MENA region to launch 5G networks and was considered one of the fastest globally in deploying 5G network as stc already deployed around 4,000 5G towers as end of 2020. stc group has 14 subsidiaries in the Kingdom, gulf and around the world, and its own 100% of stc Bahrain, 51.8% stake in stc Kuwait and 25% stake in Binariang GSM Holding in Malaysia which owns 62% of Maxis in Malaysia.

In Saudi Arabia (the group’s main operation site) stc operates the largest modern mobile network in the Middle East as it covers more than 99% of the country’s populated areas in addition to providing 4G mobile broadband to about 90% of the population across the Kingdom of Saudi Arabia. In addition to the above-mentioned, stc is a strong regional player in IoT, managed services, system integration, cloud computing, information security, big data Analytics fintech and artificial intelligence.

For more information, please visit https://www.stc.com.sa; or to follow us on Twitter: @stc , @stc_ksa

About Telecom Egypt

Telecom Egypt is the first total telecom operator in Egypt providing all telecom services to its customers including fixed and mobile voice and data services. Telecom Egypt has a long history serving Egyptian customers for over 160 years maintaining a leadership position in the Egyptian telecom market by offering its enterprise and consumer customers the most advanced technology, reliable infrastructure solutions and the widest network of submarine cables. Aside from its mobile operation “WE”, the company owns a 45% stake in Vodafone Egypt. Telecom Egypt’s shares and GDRs (Ticker: ETEL.CA; TEEG.LN) are traded on The Egyptian Exchange and the London Stock Exchange. Please refer to Telecom Egypt’s full financial disclosure on ir.te.eg

For more information, email: [email protected]

…………………………………………………………………………………………

References:

https://www.orange.com/en/newsroom/press-releases/2021/new-branches-2africa-subsea-cable-system

China (led by Huawei) in bid to take over Africa’s telecom networks

Telecommunications networks funded and built by China are taking over Africa’s cyberspace, a dependence that analysts suggest puts Beijing in a position to exert political influence in some of the continent’s countries.

Bulelani Jili, a doctoral candidate at Harvard University’s Department of African and African American Studies, said that “Huawei is working and partnering with many governments across the continent, and it is those governments that are using quality technology to undermine democratic values.”

Huawei, the world’s leading seller of 5G network equipment is seen by the U.S. and other countries as a pawn of the Chinese government, which could use the company for spying, an accusation Huawei denies, according to the Council on Foreign Relations.

The Center for Strategic and International Studies (CSIS), a think tank in Washington, reported in May that worldwide, “the majority of [Huawei’s] deals (57%) are in countries that are middle-income and partly free or not free.”

The CSIS report added that Huawei’s cloud infrastructure and e-government services are handling sensitive data, services that “could provide Chinese authorities with intelligence and even coercive leverage.”

The “intelligence and even coercive leverage” language stems from China’s 2017 National Intelligence Law, which stipulated that any organization and Chinese citizen should “support, assist and cooperate with the state intelligence work.” The law does not limit these activities to China.

Goals and needs

The African Union has set the goal of connecting every individual, business and government on the continent by 2030, an expansion that is supported by the World Bank Group.

Africa needs 1,000 megawatts (MW) of new facility capacity or about 700 new data center facilities to meet growing demand in the continent, according to the Africa Data Centers Association.

The scale of need for data centers to meet population growth “is astoundingly significant,” Guy Zibi, principal analyst at Xalam Analytics, who is tracking the African data center boom, told the website DataCenterKnowledge.

On June 22nd, the West African nation of Senegal opened a national data center just outside Dakar, the capital. Financed by the Export-Import Bank of China, the center was built with equipment and technical backing from Huawei. Senegal’s status declined from free to partly free in the Freedom in the World 2020 report from Freedom House.

In July 2020, Cameroon completed a government data center on the outskirts of Yaounde, the capital. It was funded by the Export-Import Bank of China, built by the Beijing-controlled China Shenyang International Economic & Technical Cooperation Corporation and equipped with Huawei gear. Freedom House in 2020 rated Cameroon as not free.

In April 2019, Kenya and Huawei signed a deal for a data center, a smart city and surveillance project, according to DataCenterDynamics. The site also reported Huawei was working with the government of Zambia on a $75 million data center. Freedom House rated Kenya as partly free in 2020.

Huawei’s e-government services include elections, document digitization, national ID systems and tax services, according to the CSIS report.

While the digitization of government records may allow greater surveillance, it can also mean more effective tax collection and less corruption, according to a March 2021 post on a tech site of the Brookings Institution a Washington think tank.

“As the continent recovers from the COVID-19 pandemic, its leaders face a choice between harnessing emerging technology to improve government effectiveness, increase transparency and foster inclusion, or as a tool of repression, division and conflict,” said the TechStream post.

China’s expansion

China has a history of financing and supplying telecom and information and computer technology (ICT) throughout Africa, according to an April 2021 report from the Atlantic Council’s African Center.

Over the past two decades, Huawei has built about 50% of Africa’s 3G networks and 70% of its 4G networks, according to the report.

The expansion began in 1999, when China launched its Go Out policy, which pushed Chinese companies to invest abroad and strengthen China’s global business presence.

By 2018, China had expanded to at least 40 African nations, according to Africa Times.

Cobus van Staden, a senior China-Africa researcher at the Johannesburg-based think tank South African Institute of International Affairs (SAIIA), outlined why Chinese firms succeed in Africa.

“First is that the continent has very high demand for digital connectivity, at all levels, from network building to consumer handset sales,” he told VOA in an email.

Second, Chinese companies have easy access to large banks closely tied to Beijing. This, according to van Staden, means Chinese companies have the funding to roll out infrastructure quickly in a variety of environments.

Iginio Gagliardone, an associate professor at the University of the Witwatersrand in Johannesburg, South Africa, has done extensive research on the rise of China’s presence in Africa and is the author of China, Africa and the Future of the Internet.

He said that the relationship Chinese companies have with state-affiliated banks means the companies can lower their prices and maintain a competitive advantage over other bidders.

“The Export-Import Bank [of China] has been able to offer large loans, as part of deals with African governments, with the condition that these loans will be used to deploy technology using a Chinese company,” he said in a phone interview with VOA Mandarin.

Chinese state banks provide such generous financing to Huawei’s customers that most commercial banks cannot match the terms, “making Huawei equipment cheaper to deploy at any price,” according to a 2020 report by the Center for American Progress, a Washington think tank.

A third factor, according to van Staden, is that there has been relatively little attention paid to Africa as an emerging tech market. “There aren’t many credible competitors to Chinese companies on the scene,” he added.

Known player

Because Chinese enterprises are known players in Africa’s telecommunications infrastructure, countries transitioning to 5G often remain with the companies they know, according to analysts.

“Although the Trump administration’s policies successfully curbed Chinese expansion in Western countries, they did not address the growing presence of Chinese technology infrastructure on the African continent,” according to the Atlantic Council’s report. “In African markets, a lack of local champions and infrastructure financing and construction capacity constraints have created a dependence on Chinese-financed projects.”

Van Staden said that the dependence raises the question of possible political influence.

“Research has shown that Chinese companies are responsive to local regulations and governance. In both authoritarian and democratic countries, Chinese contractors have tended to follow local laws and to provide the systems these governments wanted, be these open and inclusive, or centrally controlled,” he said.

“There isn’t proof that China is ‘exporting’ its own domestic system or pressuring countries to emulate it,” he continued. “The issue is less that China is using data networks to influence local politics, and more that its position as a network provider is just one aspect of a much broader trade and investment presence. China’s role as a major trade, financing and development partner to many African countries naturally makes these countries less willing to cross any of Beijing’s ‘red lines.’ ”

References:

VSG Global SD-WAN Leaderboard Rankings and Results

Orange Business Services (France), AT&T (U.S.), and Verizon (U.S.) topped Vertical Systems Group’s (VSG) latest leaderboard for global carrier-managed SD-WAN. They were followed in the rankings by NTT (Japan), BT (UK), Telefonica Global Solutions (Spain), and Vodafone (UK). [The rank order is based on site share outside of the provider’s home country, as of June 30, 2021.]

Rosemary Cochran, principal analyst and co-founder of Vertical Systems Group said that global networks are far more complex to manage and administer compared to domestic SD-WAN offerings. They often require service providers to negotiate contracts with multiple countries, meet diverse regulatory requirements, and support numerous network technologies.

This industry benchmark for multinational SD-WAN market presence ranks companies that hold a 5% or higher share of billable retail sites outside of their respective home countries.

Twelve companies qualify for the Mid-2021 Global Provider Managed SD-WAN Challenge Tier (in alphabetical order):

Aryaka (U.S.), Colt (U.K.), Deutsche Telekom (Germany), Global Cloud Xchange (India), GTT (U.S.), Hughes (U.S.), Lumen (U.S.), PCCW Global (Hong Kong), Singtel (Singapore), Tata (India), Telia (Sweden) and Telstra (Australia).

The Challenge Tier includes companies with site share between 1% and 5% of this defined SD-WAN segment.

“We’re pleased to release the first benchmark that measures Global Provider market presence based on multinational managed SD-WAN customer sites,” said Rick Malone, principal of Vertical Systems Group. “Enterprises with business-essential applications that span multiple regions of the world are choosing SD-WAN solutions from network operators with the global infrastructures, experience, partnerships and technical expertise necessary to deliver world-class services.”

Research Highlights for Global Provider SD-WAN Services:

- Orange Business Services gained the top share rank on the Mid-2021 Global Provider Managed SD-WAN LEADERBOARD with the largest number of customer sites installed.

- Vertical’s SD-WAN Coverage Analysis for five regional markets – North America, Latin America, Europe, Africa/Middle East, Asia/Pacific – shows that all seven companies ranked on the Mid-2021 Global Provider SD-WAN LEADERBOARD have good to strong coverage in at least three of these regions.

- COVID-19 continues to appreciably impact every region of the world. Just being able to get the SD-WAN equipment and support the services has been a disruptive experience for service providers and their customers.

- Challenges cited by Global SD-WAN operators include: workforce health protection, tracking the shift back from remote to office environments, service disconnects due to business closures, and supply chain disruptions.

- Most multinational Managed SD-WAN customer implementations are hybrid network configurations that incorporate MPLS, IP VPN, Cloud connectivity or other services, plus multiple security capabilities that are integral or supplied by technology partners.

- SD-WAN customers with MPLS connections are migrating to more cloud-suitable broadband services that provide bandwidth flexibility and lower pricing.

- Ethernet DIA (Dedicated Internet Access) is the preferred choice for SD-WAN customers that require dedicated, symmetrical connectivity.

Fictitious image of a global mesh connected SD-WAN

…………………………………………………………………………………………..

Five of the seven companies on the Mid-2021 Global Provider SD-WAN LEADERBOARD are ranked on the 2020 Global Provider Ethernet LEADERBOARD (in rank order): AT&T, Orange Business Services, Verizon, BT Global Services and NTT.

- Two companies ranked on the Mid-2021 Global Provider SD-WAN LEADERBOARD – AT&T and Verizon – have attained MEF 3.0 SD-WAN Services Certification to date. Additionally, three companies cited in the Challenge Tier – Colt, PCCW Global and Telia – have MEF 3.0 SD-WAN Services certification.

- The primary technology suppliers to the nineteen Mid-2021 Carrier Managed SD-WAN LEADERBOARD and Challenge Tier companies are as follows (in alphabetical order): Cisco, Fortinet, HPE Aruba, Nuage Networks (Nokia), Versa and VMware.

The Market Player tier includes providers with site share below 1%. Companies in the Mid-2021 Market Player tier are as follows (in alphabetical order):

Batelco (Bahrain), China Telecom (China), Claro Enterprise Solutions (Mexico), CMC Networks (South Africa), Cogent (U.S.), Epsilon (Singapore), Etisalat (Abu Dhabi), Expereo (Netherlands), HGC Global (Hong Kong), Intelsat (U.S.), KDDI (Japan), Masergy (U.S.), Meriplex (U.S.), PLDT Enterprise (Philippines), SES (Luxembourg), Sparkle (Italy), StarHub (Singapore), Syringa Networks (U.S.), T-Mobile (U.S.), Telenor (Norway), Telin(Singapore), Transtelco (U.S.), Virgin Media (U.K.), Zayo (U.S.) as well as other providers (unnamed) selling SD-WAN services outside their home country.

Closing Comment:

This VSG report highlights the disparate implementations of global SD-WANs. “…implementations are hybrid network configurations that incorporate MPLS, IP VPN, Cloud connectivity or other services, plus multiple security capabilities that are integral or supplied by technology partners.”

That is because there is no clear definition of functionality (yeah we know about MEF’s definition) and no specification of any exposed interfaces, e.g. UNI, network node to network node, or NNI between two SD-WAN networks.

As such, global SD-WANs are really a concept, not a set of required networking technologies with defined reference points and standardized interfaces/APIs. As a result, it’s a serious challenge for the global SD-WAN operator to ensure interoperability between each of the different subnetwork interfaces so that end to end connectivity is achieved.

…………………………………………………………………………………………….

References:

Shift from SDN to SD-WANs to SASE Explained; Network Virtualization’s important role

NTT launches “global” private 5G network as Network-as-a-Service platform

NTT today announced the launch of its Private 5G platform (P5G), the first globally available private LTE/5G Network-as-a-Service (NaaS) platform. The Japanese company states that NTT P5G will enable Chief Information Officers and Chief Digital Officers leverage the benefits of private 5G (?) to solve business problems and innovate to keep pace with the future of enterprise.

NTT says that their Private 5G platform provides a suite of services built to help Chief Information Officers and Chief Digital Officers drive business outcomes and unlock innovative business models that drive the future of enterprise across industries.

- NTT Private 5G platform offers a single end-to-end management and service creation platform with global visibility, eliminating friction and increasing ROI.

- NTT Private 5G is purpose-built to solve enterprise business challenges with a platform that goes beyond connectivity, providing security, device and edge management, application development, big data analytics and deep back-office integration.

- Wireless industry leader Shahid Ahmed joins NTT as EVP of New Ventures and Innovation to pioneer the Private 5G service portfolio and accelerate ecosystem collaboration.

Running on a cloud-native architecture, the platform can be delivered via cloud, on-premises, or at the edge. The platform is pre-integrated with leading network and software partners (unnamed), allowing enterprises to secure, scale and segment their network flexibly. With patent-pending MicroSlicing™ technology (?), NTT P5G allows mission-critical apps to leverage the advantages of private 5G.

Fueling enterprise digital transformation with cloud-based economics and automation is at the heart of NTT’s vision for private 5G. NTT is focused on driving the global acceleration of private 5G to meet the fast-evolving needs of enterprises across industries, including automotive, manufacturing, healthcare, and retail to create unprecedented alignment of data, connectivity, security, and communications. NTT is the only provider that offers a best-in-class global network, deep vertical expertise, and a full suite of application development and management capabilities.

“As a key partner in our digital transformation journey, NTT has an impressive track record of building and supporting new technologies that help CXOs solve critical business challenges,” said Javier Polit, Chief Information & Global Digital Services Officer of Mondelēz International. “NTT’s unique approach to Private 5G offerings provides the kind of agility and insight that we will need to further accelerate our business.”

NTT appointed wireless industry leader Shahid Ahmed as EVP of New Ventures and Innovation to pioneer the Private 5G service portfolio, drive digital transformation outcomes for clients, and deepen ecosystem collaboration.

Shahid Ahmed, NTT EVP of New Ventures and Innovation

Shahid brings over 25 years of technology experience focused on business transformation, including key leadership roles at Accenture, Pricewaterhouse Coopers, and Sprint. In addition, he is an appointed advisor to the United States Federal Communications Commission (FCC).

“Global enterprises are looking for a single private 5G solution to deploy across multiple countries. They need one truly private network, one point of accountability, one management platform, and one solution partner that eliminates all the major friction points across the entire global footprint of the enterprise,” said Shahid Ahmed, NTT Ltd. EVP New Ventures and Innovation. “Our NTT P5G offering supports many of the CXO requirements today, and we will continue to invest in P5G as enterprise adoption evolves.”

“The private 5G technology has the potential to fundamentally change the way enterprises drive digital transformation,” said Ghassan Abdo, Research Vice President at IDC. “NTT has a strong track record of focusing on breadth of service, and NTT P5G capabilities extend far beyond basic connectivity to offer a comprehensive suite of services geared toward important business outcomes.”

“As data and mobility become more critical to business operations, 5G will enable enterprises to reinvent business operations. With faster speeds and more data, 5G will facilitate advances in artificial intelligence, automation, and IoT,” said Eric Clark, NTT Data Services North America Chief Digital and Strategy Officer. “How a company collects, stores, and uses that data in real-time will be critical to success, and NTT is well positioned to guide our clients on this journey.”

NTT group companies are jointly accelerating the adoption of open and virtualized 5G solutions globally in collaboration with ecosystem stakeholder. The company says this comprehensive approach enables NTT to provide a full suite of digital transformation services (undefined).

………………………………………………………………………………………..

Missing Pieces:

Names of partner companies were not disclosed. The only reference was that NTT P5G was “pre-integrated with leading network and software partners.”

Mondelēz International, with a presence in over 150 countries, is a customer (see above quote), but it was unclear whether they were an active user of NTT P5G and, if so, in which countries.

No other customers were announced or quoted, although the Cologne Bonn Airport said in May that they had “partnered with NTT to develop a wholly private 5G mobile network across its 1,000 hectares premises. Under this joint research and cooperation project, the duo will work on technological innovations, including border control and intelligent luggage checking. The aim of the collaboration is to enhance the operational efficiency of the airport.

Finally, NTT’s “patent-pending MicroSlicing technology,” was not defined other than it “allows mission-critical apps to leverage the advantages of private 5G.”

In conclusion, NTT needs to produce case studies which demonstrate the benefits that P5G brings to enterprise customers, such as Bonn-Cologne airport and Mondelēz International. Also, more details on the functionality are urgently needed.

…………………………………………………………………………………….

References:

https://hello.global.ntt/private5g

https://www.enterprisetimes.co.uk/2021/08/11/ntt-takes-a-leap-into-the-future-with-private-5g/

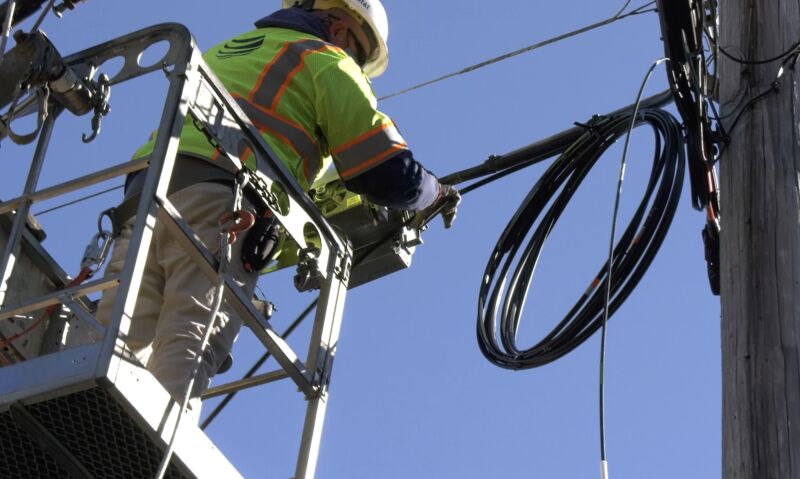

AT&T’s fiber buildout reduced due to supply constraints

AT&T has experienced recent disruptions in the supply of fiber optic cable, which has caused the company to trim back its planned fiber-to-the-premises (FTTP) buildout for 2021, according to senior EVP and CFO Pascal Desroches.

AT&T had previously said it would build out its fiber network to an additional 3 million homes passed this year. But that’s now been reduced by 1/2 million.

“Since the start of the third quarter, we are seeing dislocation across the board, including in fiber supply. We’re probably going to come in a little bit light of 3 million homes passed, probably around 2.5 million,” Desroches said Tuesday at the Oppenheimer Technology, Internet & Communications Conference, according to this transcript.

An AT&T technician working on a fiber project

………………………………………………………………………………………….

Specifically, this is what Pascal said:

But since the start of the third quarter, we are seeing dislocation across the board, including in fiber supply. And as a result of those dislocations, we had previously provided guidance of 3 million homes past this year (unedited- very bad grammar). We’re probably going to come in a little bit in light of that, probably around 2.5 million. We don’t think it’s going to impact us long term. But I think it’s really important context because if we’re feeling the pain of this, I can only imagine what others in the industry are experiencing.

John Stankey (AT&T CEO) has always been a believer in fiber. I think when he took over he identified that as a priority area because he understood from a technology standpoint, there is no better technology for connectivity. And therefore, in a world where the demands for symmetrical speed are increasing significantly, this is the technology to bet heavily on. And so we have a great position, and we are leaning into adding to that position. So it’s really a function of when you — and I think others are now recognizing it as a result of what you’ve seen in the last year in the pandemic, the need to do what we’re doing now, 2-way communication can only happen with symmetrical speed. So I think everyone has had an aha moment, like we need to deploy fiber. And so we’ve long believed that. John has long believed that, and this is just really leading into that opportunity.

As we deploy fiber, our goal is to get at least 40% penetration on homes passed. And we think in certain markets, we’ll have an opportunity to do better than that. And the other thing that is great about is when you lay fiber, you lay fiber to a community where there is both homes and businesses. So it also helps boost returns in your enterprise business. And so that’s why it is so critical that we roll this out because the ability to grow both your enterprise and your consumer business is attractive. And we think these investments will provide us with mid-teen returns over time.

I know we’re largest fiber purchaser in the country. And we have prices that are at the best and most competitive among the industry. So we feel really good about the ability to secure inventory, fiber inventory and at attractive price points and the ability to execute and the build-out at scale, something that many others don’t have.

Oppenheimer moderator question: “Can you talk a little bit about where your supply comes from, I guess, both the fiber and the optical components or any other key suppliers? Is that U.S. sourced? Or is it a lot of it outsourced internationally?”

Pascal’s answer: “It is a U.S. company which has locations both domestically and outside the U.S.” [We suspect that it’s Corning].

AT&T typically has had no problem getting fiber at a low cost, Desroches said. “We’re the largest fiber purchaser in the country and we have prices that are the best and most competitive in the industry,” he said. “We feel really good about the ability to secure fiber inventory at attractive price points and the ability to execute the buildout at scale, something that many others don’t have.”

AT&T expects to catch up to its original fiber-construction estimates in the years after 2021, largely because of what Desroches called its “preferred place in the supply chain” and “committed pricing.” As AT&T said in a news release yesterday, AT&T is “working closely with the broader fiber ecosystem to address this near-term dislocation” and “is confident it will achieve the company’s target of 30 million customer locations passed by the end of 2025.”

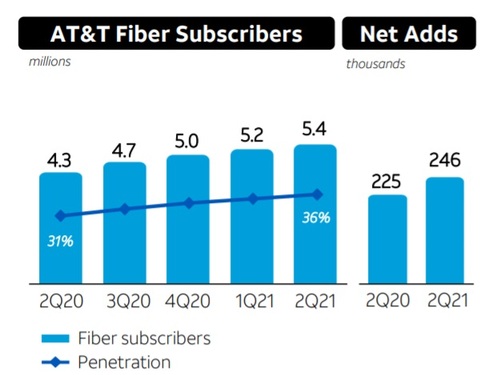

AT&T added another 246,000 fiber broadband subs in Q2 2021, extending its total to 5.43 million, and said last month it was on pace to add about 1 million net fiber subscribers for all of 2021.

AT&T has estimated that nearly 80% of new fiber subscribers are also new AT&T customers, reversing a previous trend that saw a sizable portion of its FTTP customer net adds coming from upgrades of existing AT&T high-speed Internet customers on older VDSL and DSL platforms (which have been largely discontinued).

Speaking on AT&T’s 2Q-2021 earnings call last month, Desroches stated that the company’s consumer wireline business had reached a “major inflection point” as broadband revenues continue to surpass legacy declines. Meanwhile, AT&T’s broadband average revenue per user (ARPU) reached $54.76 in Q2 2021, improving from $51.61 in the year-ago period.

References:

Will AT&T’s huge fiber build-out win broadband market share from cablecos/MSOs?

Broadcom, Cisco and Facebook Launch TIP Group for open source software on 6 GHz Wi-Fi

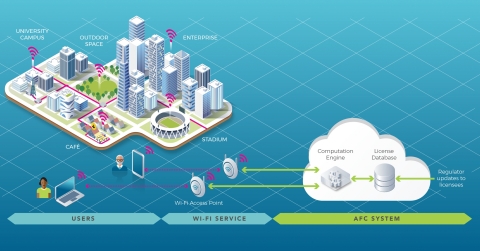

The purpose of this new TIP project group is to develop a common reference open source software for an AFC system. The AFC will be used by unlicensed devices in the newly available 6 GHz band to operate outdoor and increased range indoor while ensuring incumbent services are protected.

The US, EU, Canada, and Brazil, among others, have approved or are finalizing the approval of 6 GHz unlicensed spectrum use, opening up a huge bandwidth for Wi-Fi services.

By 2025, the Wi-Fi Alliance estimates that the 6 GHz Wi-Fi will deliver USD 527.5 billion in incremental economic benefits to the global economy [1]. Standard outdoor power operations will be a key part of the value proposition of 6 GHz Wi-Fi and is critical for enabling more affordable wireless broadband for consumer access.

The FCC is the first regulator to enable its use under an AFC, ISED Canada authorized standard power with AFC in May 2021, with others expected to follow. The AFC will enhance Wi-Fi to provide a consistent wireless broadband user experience in stadiums, homes, enterprises, schools, and hospitals.

“The 6 GHz Wi-Fi momentum is unmistakable. In the year following the historic FCC ruling to open up the band for unlicensed access, we already have an entire ecosystem of Wi-Fi 6E devices delivering gigabit speeds indoors. As we work towards closing the digital divide and further realizing the value of the 6 GHz band, AFC-enabled standard power Wi-Fi operation becomes critical. As Wi-Fi 7 comes along, AFC will turbocharge the user experience by enabling over 60 times more power for reliable, low latency, and multi-gigabit wireless broadband both indoors and outdoors. With this vision in mind, Broadcom is excited to join hands with Cisco and Facebook to create the TIP Open AFC Software Group aimed at enabling a cost effective and scalable AFC system,” said Vijay Nagarajan, Vice President of Marketing, Wireless Communications & Connectivity Division, Broadcom.

“The creation of the TIP Open AFC Software Group represents the immense momentum behind unlicensed spectrum and the potential it holds to deliver innovation,” said Rakesh Thaker, VP of Wireless Engineering, Cisco. “Many of the applications and use cases we’re just beginning to dream up with the introduction of Wi-Fi 6 and the 6 GHz spectrum will rely on standard power, greater range and reliability. This software group will play an important role in ensuring those applications can become reality, while also protecting important incumbent services. We’re thrilled to join Broadcom and Facebook on this effort, and to share a vision with TIP of providing high-quality, reliable connectivity for all.”

Facebook developed a proof of concept Open AFC system, which will protect 6 GHz incumbent operations and enable faster adoption of standard power operations in the 6 GHz band. This prototype system will be contributed to the TIP community through today’s launch of the Open AFC Software Group, with the goal of enabling the proliferation of standard power devices in the United States to start, with other markets to follow.

Broadcom and Cisco have committed to driving the industry forward in developing Open AFC to ensure that the code continues to be developed to meet the needs of the industry and regulators, such that an AFC operator could take the code and build upon it for rapid certification.

The vast majority of Wi-Fi use is indoors, but there are situations where people will want to use Wi-Fi outdoors. The use of AFC provides the flexibility for outdoor deployments in open air stadiums and similar venues.

“Bringing AFC technology to the TIP Open AFC Software Group is a huge milestone for the unlicensed spectrum community,” said Dan Rabinovitsj, vice president for Facebook Connectivity. “We are excited to see the contributions and innovations by Open AFC and we look forward to celebrating the widespread adoption of the 6 GHz band, which will rapidly accelerate the performance and bandwidth of Wi-Fi networks around the world”.

David Hutton, Chief Engineer of TIP, said: “The industry is coming together to support 6 GHz for unlicensed use for Wi-Fi and TIP will be providing the forum to contribute to make this happen, supporting regulatory efforts by ensuring that AFC systems are developed under a common code base that is available to all industry stakeholders.”

Closing Comment:

We wonder why this new WiFi 6GHz group is in TIP rather than the WiFi Alliance. From the WiFi Alliance Certified 6:

“Wi-Fi Alliance is leading the development of specifications and test plans that can help ensure that standard power Wi-Fi devices operate in 6 GHz spectrum under favorable conditions, avoiding interference with incumbent devices.”

In this author’s opinion, there are way too many alliances/ fora/ consortiums that produce specifications that are to be used with existing standards. In this case (IEEE 802.11ax) there is potential overlap amongst amongst groups, which leads to inconsistent implementations that inhibit interoperability.

References:

Verizon CFO talks up fixed wireless, C-band, mmWave, infra bill; Says no to cloud based 5G core

Speaking at an Oppenheimer investor conference, Verizon’s CFO Matt Ellis said the telco is very optimistic about its fixed wireless business (that despite its FTTH leadership position with FiOS):

Yes, I’m very excited about it (fixed wireless). I think it continues to be a very significant opportunity for us as we think about the next few years ahead of us. We’ve talked about how great the LTE network is and it’s been obviously a very, very huge part of our success. But when you bring the bandwidth that comes in 5G, it really opens up the opportunity, not just do mobility wirelessly but also to do home broadband wirelessly as well. So as I think about fixed wireless in kind of 3 different buckets, the first is our millimeter-wave bucket and our 5G home internet. That’s now in almost 50 markets across the country, continuing to expand the number of open for sale as we build out the millimeter-wave network. The second piece that’s in market today is our 4G Home, which we launched late last year. It’s now available in over 200 markets in every — in parts of all 50 states. So we recently doubled the amount of the size of the footprint that our 4G Home is available. And then it comes back to my comment on to the previous questions around monetizing the network that we’ve built and where we have the capacity in addition to our Mobility customers to offer the LTE Home product. We’re doing that. We’re seeing good take rates on that. Customers are seeing great performance on it.

And then last month, we upgraded the hardware, you think the router that customers get. So it doesn’t just support LTE Home, it’s also got C-band in it. So as soon as we turn the C-band network on, that customer can upgrade to 5G Home on C-band without having to change out hardware. So we’re excited that we’re starting to populate the base of LTE Home customers with customers that already have a C-band-ready device and C-band being the third one of the levers here within fixed wireless access. So excited about the opportunity that will kick in when we turn C-band on later this year. But fixed wireless access gives us the opportunity to monetize the network in a way that we haven’t previously been able to, where we can offer not just mobility solutions for our consumers but also home broadband and also for businesses as well. We talk about fixed — LTE Home, but we also have the similar product in 5G Home for business as well. You think 5G office the same way. So it gives us the opportunity to take that network that you built out mobility and yet monetize it with another use case. We’re just scratching the surface here, and I think the next few years are going to be very exciting for us on fixed wireless access.

Ellis also commented about the $1T U.S. infrastructure bill that passed the Senate today (August 10th). He said it takes a technology-neutral approach to broadband funding which would allow Verizon to deploy a mix of fiber and fixed wireless access.

I think one of the important things in the way that the bill has been crafted at this point in time is that it doesn’t favor any particular technology. It’s more based off of outcomes. And so there’s areas where it could make sense to build more broadband. There’s areas where it makes sense to provide a better experience to customers through building out fixed wireless faster than otherwise may happen. So we think it’s a good approach that’s in the bill today. Obviously, it’s got to get all the way through the legislative process. But certainly, the requirement that we continue to build out high-quality broadband throughout the country is something that the bill is focused on, is something that we’re very supportive of. And now we’re looking at geography by geography, where do we think it would make the most sense to either deploy fiber or to deploy fixed wireless as a solution to bring that to the faster broadband to consumers and businesses.

Asked how C-band and mmWave deployments are performing versus your expectations, Matt replied:

For mmWave, we’ve been deploying it for a couple of years now. And we set a target this year to do another 14,000 sites. We’re ahead of pace on that already and that’s by design. We wanted to be ahead of pace in the first half of the year on millimeter-wave, so that when the C-band started picking up in the second half of the year, we had the capacity to do that as well. But the millimeter wave equipment is up and running, has been for a couple of years and is working very well.

On the C-band side, we said we’d have 7,000 to 8,000 sites up by the end of the year or when we launch in December, the expected launch date. But the vast majority of those radios, we already have in our warehouses. The rest of them, purchase orders are out there for the vast majority that we haven’t already received. So I know there’s been a fair amount of concern about the supply chain, just given what we’re seeing not just in our sector but across all sectors with chipsets. I can tell you that in terms of building out the radios for the C-band, those are in good shape.

And we’ve started to test those and we’ve got the first few sites up. Obviously, we can’t turn those on yet because we don’t have the licenses approved from the FCC until we get to the clearing date. But with the early testing we’ve been doing, we’re seeing the equipment perform as we would expect it to, which really isn’t a surprise. This is one of the things that made C-band such an attractive spectrum for us because it’s a global 5G band. And so our partners at Samsung and Nokia and Ericsson aren’t just building C-band equipment for the U.S. market. And so they’ve got the scale there to really have high-performing equipment available. So the supply chain ecosystem is bringing the radio equipment to market as we expected it to.

Noting that some competing telcos (especially AT&T) are looking to take advantage of cloud-based technologies to lower network costs, operating costs, the Oppenheimer moderator asked if Verizon was looking at doing the same? “Or what are you doing on that front?”

Absolutely, we’ve been deploying cloud technologies for the last few years now, both within the network and also within the core operations of the business. It brings significant efficiencies in the right place. We went through an interesting transition from cloud from the standpoint of initially being skeptical about it. Kind of how comfortable am I moving these applications and so on into the cloud?

Then you get comfortable with it and you say, okay, we’re going to move everything. And then if you look at it further, you think about there are some things that some should move and there’s some things that shouldn’t.

And so the team has done a really good job over the past few years of identifying where it makes sense for things to move (to the cloud), and we’ve got that underway. Some things have transitioned already. Other things are still in the process of transitioning.

And then there are some pieces where we don’t think it makes sense, because of the scale we have and so on, and there are certain pieces like the network core [1.], for example, is something that we have our own cloud product that we’re deploying there that we think that’s part of what makes Verizon.

So it’s an application-by-application analysis. That analysis is largely done. Where it makes sense to do to transition to public cloud, we have. Where it doesn’t, we won’t. But it really comes down to finding the most efficient and effective ways of running all parts of the business.

Note 1. Cloud Native 5G Core Network:

The 3GPP System architecture for the 5G System (5GS); Stage 2 [3GPP TS 23.501] specifies a Service Based Architecture (SBA), where the control plane functionality and common data repositories of a 5G network are delivered by way of a set of interconnected Network Functions (NFs), each with authorization to access each other’s services. “Network functions within the 5GC Control Plane shall only use service-based interfaces for their interactions.”

The latest 3GPP TS 23.501 V17.1.1 spec is dated June 24, 2021, so its a work in progress for 3GPP Release 17 (not yet approved).

Although the 5G Core (5GC) implementation is the choice of the network operator, in practice, the expectation is that 5GC will be deployed on software-defined infrastructure which implies a “cloud-native” deployment. In broad terms, this means 5GC implementations that use microservices, containers, centralized orchestration, CI/CD, open APIs, service meshes, and more such new cloud software jargon.

Network Functions are self-contained, independent and reusable. Each Network Function service exposes its functionality through a Service Based Interface (SBI), which employs a well-defined REST interface using HTTP/2.

ETSI (3GPP’s host and secretariat) is transposing their 5G specifications which then become ETSI standards. There is no equivalent work being done in ITU-T.

……………………………………………………………………………

References:

https://www.3gpp.org/ftp/Specs/archive/23_series/23.501/

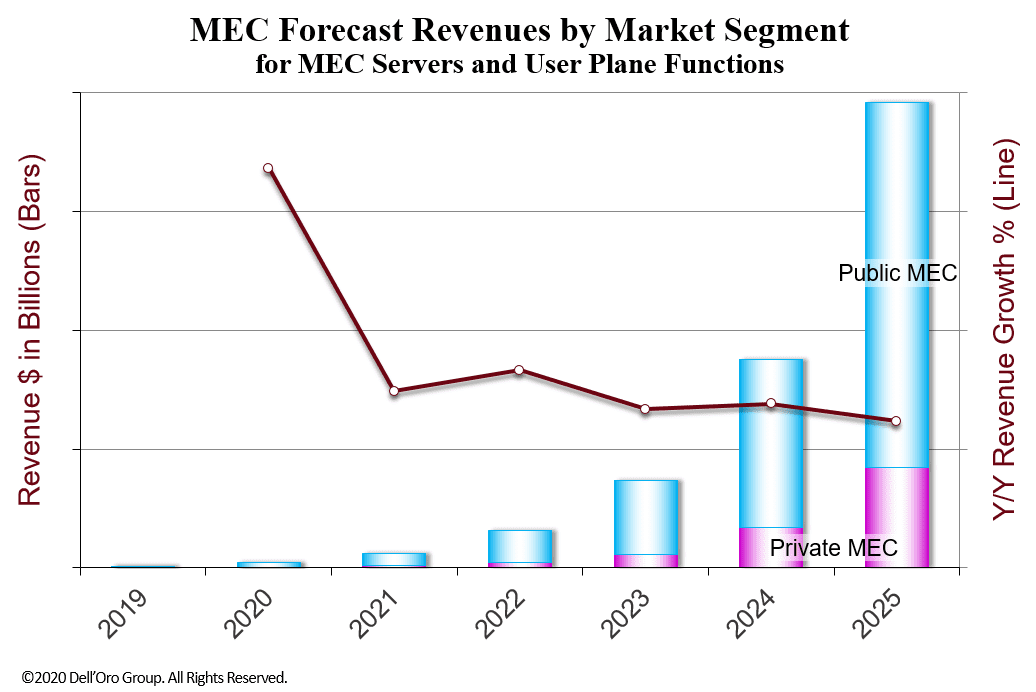

Dell’Oro: MEC Investments to grow at 140% CAGR from 2020 to 2025

Dell’Oro Group has published an update to its Multi-Access Edge Computer (MEC) 5-year forecast report. According to Dave Bolan, Research Director, Dell’Oro has lowered their expectations from the previous forecast, because of the slower start than anticipated for 5G SA buildouts, especially for federated MEC capability.