Author: Alan Weissberger

Aruba Introduces Industry’s 1st Enterprise-Grade Wi-Fi 6E Access Point

HPE subsidiary Aruba today announced the first commercially available, enterprise-grade Wi-Fi 6E [1.] solution set – the 630 Series of campus access points (APs), starting with the AP-635.

Note 1. Wi-Fi 6E refers to IEEE 802.11ax (Wi-Fi 6) products that support 6GHz wireless spectrum. Wi-Fi 6E enables faster speeds and lower latencies than Wi-Fi 6 and earlier iterations of WiFi (IEEE 802.11). WiFi 6 products are starting to appear in routers [2.] and silicon. Cisco has been selling a WiFi AP for enterprises since 2019.

Note 2. List of best WiFi 6 routers:

- Asus RT-AX86U. The best Wi-Fi 6 router overall. …

- Netgear Nighthawk RAXE500. The Wi-Fi 6e speed demon. …

- Netgear Orbi with Wi-Fi 6 (RBK852) Best Wi-Fi 6 mesh router. …

- Netgear Nighthawk XR1000. …

- Eero Pro 6. …

- Netgear Nighthawk AX8 (RAX80) …

- TP-Link Deco X20. …

- Linksys Max Stream MR9600

In April 2020, the Federal Communications Commission (FCC) allocated 1,200 megahertz of spectrum in the 6 GHz band for unlicensed WiFi use. That was the largest swath of spectrum approved for WiFi since 1989. Opening the 6 GHz band more than doubles the amount of RF spectrum available for Wi-Fi use, allowing for less congested airwaves, broader channels, and higher-speed connections and enabling a range of innovations across industries. Since the FCC decision to open the 6 GHz band, 39 additional countries that are home to over 1.3 billion people have opened the 6 GHz unlicensed band for Wi-Fi 6E. (Source: Wi-Fi Alliance)

The industry’s first enterprise-grade Wi-Fi 6E solution, the new Aruba 630 Series delivers greater performance, lower latency, and faster data rates to support high-bandwidth applications and use cases. The new Aruba 630 Series APs will be available in calendar third quarter 2021.

Currently, as organizations increase their use of bandwidth-hungry video, cope with increasing numbers of client and IoT devices connecting to their networks, and speed up their transition to cloud, the demand for Wi-Fi continues to rise. As a result, wireless networks are becoming oversubscribed, throttling application performance. This frustrates all network users by negatively impacting the user experience, reduces productivity, puts digital initiatives at risk, and stifles innovation.

“The Aruba 630 Series campus access points are the first enterprise-grade WiFi 6E access points to be introduced by any of the main enterprise networking providers,” Gayle Levin, marketing manager at Aruba, wrote in response to questions. “We’re seeing the most interest from large public venues, such as airports, stadiums, and lecture halls, as well as healthy interest from health care and higher education,” she added.

“With connectivity demands growing exponentially, Wi-Fi 6E can take advantage of up to seven, super wide 160 MHz channels and uncongested bandwidth in the 6 GHz band to deliver unprecedented multi-gigabit and low latency connectivity,” said Kevin Robinson, SVP of Marketing at Wi-Fi Alliance. “Wi-Fi 6E will spur enhanced innovations and exciting new services. Wi-Fi Alliance is pleased to see longtime member Aruba bringing Wi-Fi 6E solutions to market that will help organizations better support critical activities like videoconferencing, telemedicine, and distance learning.”

According to leading market intelligence research firm 650 Group, Wi-Fi 6E will see rapid adoption in the next couple of years, with over 350M devices entering the market in 2022 that support 6 GHz. 650 Group expects over 200% unit growth of Wi-Fi 6E enterprise APs in 2022.

The new Aruba Wi-Fi 6E solutions are part of Aruba ESP (Edge Services Platform), the industry’s first AI-powered, cloud-native platform designed to unify, automate, and secure the Edge. Able to predict and resolve problems at the network edge before they happen, Aruba ESP’s foundation is built on AIOps, Zero trust network security, and a unified campus to branch infrastructure to deliver an automated, all-in-one platform that continuously analyzes data across domains, tracks SLAs, identifies anomalies, and self-optimizes, while seeing and securing unknown devices on the network.

With Aruba’s new Wi-Fi 6E offerings, organizations can take advantage of the increased capacity, wider channels in 6 GHz, and significantly reduced signal interference with 3.9 Gbps maximum aggregate throughput to support high bandwidth, low latency services and applications such as high definition video, next-generation unified communications, augmented reality/virtual reality (AR/VR), IoT, and cloud. Additionally, with a new ultra tri-band filtering capability, which minimizes interference between the 5 GHz and 6 GHz bands, organizations can truly maximize use of the new spectrum.

“As we progress in our digital transformation, we are continually adding an increasing number of IoT devices to our network and transitioning to Wi-Fi as our primary network connection rather than Ethernet. We are being asked to support an expanded array of mission-critical, high bandwidth applications that support research as well as hyflex learning and entertainment, like streaming video, video communications, and AR/VR for our students, professors, and staff,” said Mike Ferguson, network manager and enterprise architect at Chapman University.

“With Aruba’s Wi-Fi 6E APs, we’re confident that we’ll be able to not just support our short-term needs, but we’ll have room to grow as well, which will keep all of our users happy, increase our competitiveness, and allow us to extend the lifecycle of this network deployment by 50%,” he added.

Aruba 630 Series Access Point Key Features:

- Comprehensive tri-band coverage across 2.4 GHz, 5 GHz, and 6 GHz with 3.9 Gbps maximum aggregate data rate and ultra-triband filtering to minimize interference

- Up to seven 160 MHz channels in 6 GHz to better support low-latency, high bandwidth applications like high-definition video and AR/VR

- Operates on existing IEEE 802.3at standards for PoE power so there is no need to rip and replace existing power supplies

- Advanced security with WPA3 and Enhanced Open to better protect passwords and data

- Flexible failover with two HPE Smart Rate Ethernet ports for 1-2.5 Gbps, offering true hitless failover from one port to another for both data and power

- Application assurance to guarantee stringent application performance for latency sensitive and high bandwidth uses by dynamically allocating and adjusting radio resources

- Cloud, controller, or controllerless operation modes to address campus, branch, and remote deployments

“Consumer appetite for ubiquitous wireless connectivity is limitless, whether at home or traveling the world,” said Mike Kuehn, president at Astronics CSC. “As a leading global provider of advanced technologies for the aerospace and defense industries – including some of the largest major airlines in the world – Aruba’s new Wi-Fi 6E AP gives us the ability to offer compelling and unique solutions that deliver a new, enhanced and more secure wireless experience to our customers.”

“Aruba has two decades of leadership in Wi-Fi innovations, backed by an unwavering commitment to providing our customers with the reliable, fast, high capacity, and secure connectivity they need to pursue and exceed their organizational objectives,” said Chuck Lukaszewski, vice president and wireless chief technology officer at Aruba.

“Since 2016 we have helped lead the advocacy effort that has led to the 6 GHz band being opened all over the world. As such, we are extremely proud to be the first vendor to bring enterprise-grade Wi-Fi 6E solutions to market so our customers can take advantage of the huge increase in capacity that 6 GHz delivers,” he added.

Aruba is also framing the new WiFi 6E access points as “an important element of Aruba’s Edge Services Platform (ESP)” because the equipment will sit at the edge of the network, Levin added. “By virtue of their position and role within the network, access points are vital in collecting edge data from client devices and IoT that feeds back into Aruba ESP.”

The vendor entered the edge services market with the cloud-native platform last year to target campuses, data centers, branches, and remote workers, but it only works with Aruba’s access points, switches, and SD-WAN gateways.

…………………………………………………………………………………………………………………………………….

References:

https://www.businesswire.com/news/home/20210525005243/en/

https://www.sdxcentral.com/articles/news/aruba-claims-first-enterprise-wifi-6e-aps/2021/05/

https://www.tomsguide.com/news/wi-fi-6e-explained

North Carolina School District deploys WiFi 6 from Cambium Networks; WiFi 6 vs 6E Explained

FCC to open up 6 GHz band for unlicensed use – boon for WiFi 6 (IEEE 802.11ax)

Nokia and Proximus (Belgium) demonstrate 1st implementation of 25GS-PON

Nokia and Proximus turned on what they call the world’s fastest fiber access network at a media event in Antwerp attended by the Belgian Minister of Telecommunications, the Mayor of Antwerp and executives and engineers from the two companies.

Operating over existing fiber with Nokia equipment deployed in the Proximus network, the first ever 25G PON live network connects the Havenhuis building in the Port of Antwerp with the Proximus central office in the middle of the city. The network speed exceeded 20 Gbps, making it the fastest fiber network in the world.

Proximus is the leading provider of fixed broadband networks in Belgium with 45.9% market share. The operator is accelerating the move to fiber, adding 10% coverage each year and is on target to reach at least 70% of homes and business by 2028. As part of its inspire 2022 vision, it is creating a high capacity open network which will be available to all operators, eliminating the need for fiber overbuild.

Rupert Wood, Research Director for Fiber Networks at Analysys Mason, said: “Today’s 25G PON achievement demonstrates the unlimited potential of fiber. This next evolution in fiber technology will provide enterprises with greater than 10 Gbs connectivity and the capacity needed to support 5G transport along with future next generation services such as massive scale Virtual Reality and real time digital twins.”.

Guillaume Boutin, CEO Proximus, said: “The activation of the first 25G PON network worldwide shapes our bold ambition to be a trendsetter, to become a reference operator in Europe and, why not, across the globe. Together with Nokia, we have achieved a technological leap forward that will become a key enabler of the digital and economy and society that we stand for. Today’s announcement is also an occasion to stand still and look at the pace at which we connect the citizens of Antwerp to the technology of the future. Thanks to huge investments, we are realizing an acceleration that is unseen in Europe, and I am convinced this will be crucial to remain competitive for us as a company, but also for Antwerp as a city and for our entire economy.”

Federico Guillén, President Network Infrastructure Nokia, said: “10 years ago our companies launched the technology which enabled a switch to HD TV. Today we make history again with a network that is 200x faster. We are proud to support Proximus in enabling the world’s first 25G PON network, powered by Nokia’s Quillion chipset, which supports three generations of PON technologies. Quillion has been adopted by more than 100 operators since its launch last year and all operators deploying the Quillion based GPON and XGS-PON solution today have the capabilities to easily evolve to 25G PON.”

Nokia’s 25G PON solution utilizes the world’s first implementation of 25GS-PON technology and includes Lightspan access nodes, 25G/10G optical cards and fiber modems.

Nokia Lightspan FX and MX are high-capacity access nodes for massive scale fiber roll-outs. Usually located in telecom central office, they connect thousands of users via optical fibre, aggregate their broadband traffic and send it deeper in the network. The fiber access nodes can support multiple fiber technologies including GPON, XGS-PON, 25GS-PON and Point-to-Point Ethernet to deliver l wide range of services with the best fit technology..

Nokia ONT (Optical Network Termination) devices, or fiber optic modems, are located at the user location. They terminate the optical fiber connection and delivers broadband services within the user premises or cell sites.

Nokia supplied PON line cards with their Quillion chipset, which can handle 25 Gbps. The chipset can grow with gradual updates on an operator’s network. Nokia is already shipping the technology to 100 customers worldwide.

Nokia executives admitting during a webcast press conference today that its 25G PON tech still needed some work for large-scale deployments, but that it would be ready for large, prime-time rollouts in 2022, with enterprise and 5G backhaul applications expected to fuel initial demand.

PON (Passive Optical Networking) eliminates the need for active equipment on the connection, between the control panel and the end user’s network connection point. On the last mile, there is system of optical splitters that breaks the light signal into different wavelengths. This means the 25G connection can be shared by up to 32 households. Since end users do not constantly use the full connection, a high bandwidth per connection is still achievable.

Media Inquiries:

Nokia Communications

Phone: +358 10 448 4900

Email: [email protected]

References:

Singtel starts limited deployment of 5G SA; only 1 5G SA endpoint device; state of 5G SA?

Singtel 5G SA:

Singtel is boasting that it is the first operator to launch a 5G standalone (5G SA) network in Singapore. Their 5G SA is in partnership with South Korean-based vendor Samsung.

The operator said it has deployed over a thousand 5G sites across Singapore in strategic locations such as Orchard Road, the Central Business District, Marina Bay, Harbourfront and Sentosa, as well as major residential areas including Sengkang, Punggol, Pasir Ris, Jurong East, Woodlands, and more.

However, it appears that service availability will be fairly limited at first. Indeed, Singtel indicated that only “selected customers” are being given “early access” to the new 5G SA network. The ONLY 5G SA device currently available is the Samsung Galaxy S21 Ultra 5G smartphone, said to be running a “Singtel-exclusive beta release of Samsung’s 5G SA software.”

“We are thrilled to introduce supercharged connectivity on Singapore’s most powerful 5G network. Our customers will be among the first in the world to enjoy the benefits that 5G SA can deliver. Wherever they are, consumers can stream 4K videos seamlessly, share favorite photos and moments with friends instantaneously, and enjoy lag-free gameplay and video conferencing. 5G SA will also fuel new innovations, being a key enabler of the digital transformation across industry sectors,” said Ms. Anna Yip, CEO, Consumer Singapore, Singtel.

Customers can register their interest at www.singtel.com/5GSAearlyaccess to be one of the first customers to experience Singtel’s 5G SA network. Customers with creative entries on how 5G will transform their lives will be selected to receive a “5G Power Up” kit that comprises a 5G SA SIM card, a Samsung Galaxy S21 Ultra 5G handset and cool accessories.

Winners who receive the 5G Power Up Kit will need to perform just TWO tasks to be eligible to exchange their test phone for a brand New Samsung Galaxy S21 Ultra 5G:

- Test the Samsung Galaxy S21 Ultra 5G SA-ready handset on Singtel 5G and provide feedback at singtel.com/5gfeedback

- Post a video of yourself on either Facebook or Instagram with a caption on how Singtel 5G transforms the way you live, work and play. Remember to make the post public, tag @singtel and hashtag #FirstonSingtel5GSA #galaxy5G #Galaxy5GxSingtel

Since September 2020, Singtel claims to have been operating Singapore’s fastest 5G NSA network under a market trial, offering 5G speeds of up to 1.2 Gbps. Within a year of receiving its 5G licence, Singtel has now turned on 5G SA and deployed over a thousand 5G sites across Singapore in strategic locations such as Orchard Road, the Central Business District, Marina Bay, Harbourfront and Sentosa, as well as major residential areas including Sengkang, Punggol, Pasir Ris, Jurong East, Woodlands, and more. It is the only telco in Singapore to roll out in-building 5G, covering popular malls such as VivoCity and Ngee Ann City, and will continue to expand its indoor 5G footprint in the coming months.

Singtel is focused on accelerating 5G innovation and 5G adoption in enterprises, launching Genie, the world’s first portable 5G-in-a-box platform and expanding its 5G ecosystem with 5G Multi-access Edge Compute trials in collaboration with Microsoft Azure and Amazon Web Services.

Samsung’s 5G Core Network has been developed and verified in a cloud native environment. Designed based on ‘Micro-services’, ‘Containers’ and ‘Stateless’ architectures,’ it will take full advantage of the cloud, acting as the key enabler for the rapid realization of 5G innovation. Samsung says it will boost 5G Core network function development and verification capabilities as well as enable automatic service upgrades and deployments for optimized operational efficiency.

Samsung vCore for 5G SA:

Image courtesy of Samsung

…………………………………………………………………………………………………………………………..

Other 5G SA networks coming to Singapore:

Antina Pte. Ltd. (Antina), the #2 mobile operator in Singapore has selected Nokia for its 5G SA network deployment. Antina is a very new telco which was incorporated on September 3 , 2020 in Singapore. It has been operating for 256 days before that.

Nokia has already laid claim to launching the first 5G RAN and SA network for the M1-StarHub Joint Venture, although the commercial deployment of the network has not yet been announced.

Nokia will provide equipment from its comprehensive AirScale portfolio and CloudRAN solution to build the Radio Access Network (RAN) for the 5G SA infrastructure, utilizing the 3.5GHz spectrum band. Nokia will supply 5G base stations and its small cells solution for indoor coverage, as well as other radio access products. Nokia’s 5G SA technology will provide Singaporean enterprises with the opportunity to explore multiple new use cases due to the network’s higher bandwidth, higher uplink speeds and lower-latency.

M1 and StarHub plan to jointly build a 5G network but will offer services independently. In April 2020, the Singapore regulator awarded two 5G licenses to Singtel and Antina, the joint venture (JV) between the second- and third-largest telcos, StarHub and M1.

Singtel and the JV were assigned 100MHz of 3.5GHz spectrum, while Singtel, StarHub and M1 each received 800MHz of mmWave spectrum for “localized coverage.”

All three operators nevertheless decided to offer 5G NSA in the meantime, in order to give users an early taste of 5G services.

………………………………………………………………………………………………………………………………………..

State of 5G SA Networks:

5G SA network rollouts remain scarce and underwhelming (e.g. T-Mobile US) as most operators around the world are initially focusing on the less complicated 5G NSA.

That’s really a no brainer: 5G NSA is based on 4G LTE core network (EVC), signaling and network management, while 5G SA. 5G Core Network implementation has not been standardized and there is no definitive spec that will lead to similar implementations. Hence, 5G SA/5G Core network is proprietary to each network operator and requires a UNIQUE 5G SA software update for each 5G endpoint (smartphone, tablet, laptop, IoT, robot, etc). Most 5G network operators say they will implement 5G SA in a “cloud native core network,” whatever that is?

According to a March 2021 update from the Global Mobile Suppliers Association (GSA), about 68 operators in 38 countries have been investing in public 5G SA networks in the form of trials, planned or actual deployments. This compares with over 400 operators known to be investing in 5G licenses, trials or deployments, the GSA said.

………………………………………………………………………………………………………………………………

References:

https://www.samsung.com/global/business/networks/products/core/cloud-core/

https://www.lightreading.com/asia/singtel-trumpets-launch-of-standalone-5g/d/d-id/769752?

Cloud Service Providers Increase Telecom Revenue; Telcos Move to Cloud Native

https://www.sgpbusiness.com/company/Antina-Pte-Ltd

Dell’Oro: Optical Transport Equipment Market Stagnant in 1Q 2021; Jimmy Yu’s Take

The Optical Transport equipment market came in roughly flat with the year ago quarter in 1Q 2021, according to a new report by Dell’Oro group. The North American market was the main reason for this stagnant growth rate, offsetting all of the year-over-year growth in the other regions.

“Although the North American region was down this quarter compared to last year, it did improve from last quarter,” said Jimmy Yu, Vice President at Dell’Oro Group. “In fact, the growth quarter-over-quarter was really strong. It grew just a little over 15 percent, and we think this strength will carry forward through the remainder of the year,” added Yu.

Highlights from the 1Q 2021 Quarterly Report:

- The top manufacturers by revenue share were Huawei, Ciena, ZTE, and Nokia. Among the top four, Nokia gained the most revenue share over the year ago quarter.

- Three vendors (Ciena, Huawei, and Infinera) are actively shipping 800 Gbps-capable coherent line cards. However, due to the company’s early entry, Ciena holds the lion share of shipment volume.

- Communication service providers comprised 71 percent of WDM market revenue in the quarter.

- The year-over-year revenue growth in each region was as follows:

| Regions | Growth Rate in 1Q 2021 |

| North America | -15% |

| Europe, Middle East and Africa | 10% |

| Asia Pacific | 0% |

| Caribbean and Latin America | 15% |

In an email to this author, Jimmy Yu provided additional information on the optical transport market:

For coherent 400 Gbps, shipment volumes have been growing quite rapidly over the past year. Ciena was first to market with a 400 Gbps coherent solution and was followed by vendors introducing 600 Gbps-capable coherent solutions that can operate at 400 Gbps. The primary buyers of this wavelength speed were the Internet Content Providers (ICPs), often referred to as hyperscale. We think 400 Gbps wavelength shipments will enter the broader market this year (2021) and be a mainstream deployment speed in 2022. So, most if not all vendors have a 400 Gbps offering at this point.

800 Gbps transport has just started with Ciena entering the market first with the WaveLogic 5 based line cards. Other vendors that have a 800 Gbps-capable line card include Huawei and Infinera. (We are expecting only three vendors to have this type of line card in the market.) It is still early days for 800 Gbps, but this technology will be an important driver for delivering longer un-regenerated spans of 400 Gbps and 600 Gbps wavelengths for long haul and subsea applications.

Yes, 5G should drive more optical backhaul and fronthaul. However, with so much optical capacity put in place for 4G, we think the timing for demand generation for 5G backhaul is later. That is, we need 5G roll out to commence outside current 4g coverage areas and for operators to begin 5G densification that will require more fronthaul and backhaul.

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

https://www.delloro.com/news/optical-transport-equipment-market-growth-stagnant-in-1q-2021/

……………………………………………………………………………………………………………………………………

A different Optical Transport Network report from Market Quest states:

The global Optical Transport Network (OTN) equipment market size is expected to gain market growth in the forecast period of 2020 to 2025, with a CAGR of 4.1%% in the forecast period of 2020 to 2025 and will expected to reach USD 18270 million by 2025, from USD 15550 million in 2019.

Juniper CEO: Cloud and AI-driven strategy: #1 in Cloud WAN routing

“Ultimately cloud is not just a market segment. When people think cloud, they think AWS, Azure and Google. Certainly, these are companies that have built their entire businesses around cloud-service delivery models but I view cloud as a way of life for every customer across every vertical. CIOs of enterprises wake up in the morning and wonder how they are going to protect their companies from disruption that’s happening outside of their four walls and do so while they don’t really have unlimited budgets and most of their employees are stuck in just keeping the lights on. Up to 80, 90% of the IT of an enterprise company are just keeping status quo running. That’s not a recipe for success,” said Juniper CEO Rami Rahim.

Expansion into Cloud Majors is a priority as it’s seen as the growth driver of enterprise digitalization:

– Accelerated enterprise shift of workloads into public clouds

– Direct Cloud connectivity drives growth in MX edge routers

– Two-sided business opportunity: Cloud + Enterprise WAN

Growth driver of 400G core upgrades

– Comprehensive 400G fixed & modular platform portfolio

– Investment in custom, high-performance Triton silicon for 400Gb/sec

• >100 customers for 400Gb/sec WAN solutions

Speaking at the JP Morgan 49th Annual Global Technology, Media and Communications conference today, Rahim said that the company’s enterprise business has never been as strong as it is today and he attributes much of that strength to the company’s AI-driven enterprise strategy.

“AI-driven enterprise is not just a marketing slogan,” Rahim said. “There is technical substance. We have an AI engine that drives the solutions that we are offering customers today,” he added.

Much of the company’s AI-driven enterprise strategy is a result of its 2019 acquisition of Mist Systems, which had an AI-powered wireless platform that Juniper then used to enhance its own networking solutions.

“We’ve been taking share [from competitors] in the face of meaningful headwinds,” Rahim said. “I expect once those headwinds lessen as we emerge from Covid, we will see even more improved dynamics.”

Juniper said that it plans to extend that AI-driven focus to other areas of its business, such as SD-WAN. Juniper purchased 128 Technology last October for $450 million and is in the process of combining 128 Technology and Mist’s AI capabilities into its SD-WAN solution.

Rahim said that he believes Juniper’s IP routing and transport business will see the most opportunity because the move to 5G will mean more traffic from the radio access network (RAN) to the transport network and the cloud.

Security is also a potential area of growth from 5G investments. Rahim said that future 5G networks are going to be more prone to threats, and service providers will need to invest in more high-end security.

He also said that Juniper projects that its service provider business will grow close to 2% for the full year with the revenue increasing 17% year over year.

On the supply chain front, Juniper executives warned during the company’s first quarter earnings report last month that it could be negatively impacted by the ongoing semiconductor shortage. Those shortages are still a concern, the company said, noting that it will continue to need extended lead times for products through the rest of the year.

Cloud Service Providers Increase Telecom Revenue; Telcos Move to Cloud Native

MTN Consulting publishes quarterly vendor share in the telecom vertical, covering more than 100 suppliers of hardware, software and services. Many of them are starting to call out the cloud service providers as among their key competitors. VMware is an obvious one. It notes that “providers of public cloud infrastructure and SaaS-based offerings, such as Amazon AWS, Google GCP, Oracle Cloud and Microsoft Azure” are direct competitors.

Nearly a decade ago, as cloud services began gaining popularity, many telcos hoped to be direct beneficiaries on the revenue side. The cloud market went a much different direction, though, with large internet-based providers proving to have the global scale and deep pockets able to develop the market effectively. From 2011-2020 webscale operators invested over $700 billion in capex, a big portion of it devoted to building out their cloud infrastructure.

Amazon Web Services (AWS) made the earliest strides in telecom, in 2015 (with Verizon), but Azure and GCP were serious about the market by 2017.

By 2020, cloud service providers had made significant progress in the telecom sector. The figure below, courtesy of MTN Consulting, provides an estimate of cloud revenues in the telecom vertical for the three top U.S. based cloud service providers as well as China-based Alibaba and Tencent.

Here is how cloud computing helps telecom operators thrive and provide better services:

- Ensure high scalability: telcos who have made their journey to the cloud can easily scale up for today and scale back down once the demand for telecommunication services returns to its normal.

- Guarantee resilience: cloud computing helps telecom companies quickly recover from stressful situations such as sporadic high loads, hacker attacks, hardware failures, etc. It is based on a well-architected approach that allows the self-healing of a system in time. Anomaly detection, automation, and adaptiveness are the key concepts of it.

- Offer quick disaster recovery: anything from a power outage at a data center to a security breach may cause data loss. If you have backups of databases stored in the cloud, you can quickly restore all the data.

- Improve time-to-market: with cloud computing, telecom companies can deliver their products and services faster, because they no longer have to procure individual pieces of hardware for each function in the network. They can now develop network functions from the outset as software and run them on servers hosted in a cloud environment.

- Cut expenses: in terms of cost economics, cloud reduces the operating expense of a company setting up and managing its own data center. This includes various costs associated with hardware, software, servers, energy bills, IT experts, etc. With cloud infrastructure, a telecom company simply pays only for services it uses.

- Enhance customer experience: cloud computing helps telecom operators minimize latency, strengthen security, provide automated customer support, predict customer preferences, and offer new omnichannel digital experiences.

- Enable network automation: cloud helps automate today’s manual processes regarding designing and testing new network components; deploying, orchestrating, and monitoring networks. This becomes possible thanks to continuous integration, continuous testing, and continuous deployment. Modern networks are able to analyze their performance and respond to issues in real-time that only boosts customer satisfaction.

- Make use of data: telecom companies process huge volumes of customer data. And cloud enables operators to drive valuable insights from this data with the help of data science and data analytics. As a result, telcos can use these insights to further improve their operations. For example, during the pandemic, telecom operators provide data to monitor how people and crowds are spreading the virus.

- Generate new revenue streams: telecom operators can monetize their physical infrastructures by partnering with cloud service providers. Until recently, operators and hyperscalers were seen as competitors. But partnerships between telecommunications companies and cloud providers will only support further market growth. Telcos can offer their infrastructures to cloud providers to help them get closer to customers at the edge by launching platform solutions dedicated to telecoms infrastructure and integrate directly with 5G networks.

- The latest of such solutions include: Wavelength from AWS, Azure Edge Zones from Microsoft and Anthos for Telecom from Google Cloud.

Several new telco-cloud collaboration announcements in the last few weeks:

- Telefonica signed a collaboration agreement with Microsoft for Azure Private Edge Zone, combining private 5G connections from Telefonica with Azure edge computing capabilities on the customer premise. (May 11)

- Vodafone expanded on existing work with Google Cloud to create a six-year partnership to jointly build a new integrated data platform to help Vodafone “more quickly offer its customers new, personalized products and services across multiple markets” (May 3)

- Dish Network, a greenfield open RAN-based operator in the U.S., agreed to build its 5G core network on AWS: Local Zones to support low latency, Outposts to extend capabilities to customer premises, Graviton2-based instances for compute workloads, and EKS to run containerized workloads. (April 21)

- Google Cloud and AT&T announced a collaboration to help enterprises take advantage of Google Cloud’s technologies and capabilities using AT&T network connectivity at the edge, including 5G. Additionally, AT&T and Google Cloud intend to deliver a portfolio of 5G edge computing solutions that bring together AT&T’s network, Google Cloud’s leading technologies, and edge computing to help enterprises address real business challenges.

The cloud service providers are leaving no stone unturned in their efforts to go after business in the telecom vertical. Moreover, they are also partnering with the traditional vendors to the telecom vertical to develop joint offerings. Nokia announced three such deals last quarter, one each with AWS, Azure and GCP. There are many other examples. NEC and AWS teamed up in 2019 on a mobile core solution, for instance, and Amdocs has collaborations in place with each of the big three. Just last month Amdocs won a digital transformation deal at Singapore’s M1 which leverages their Azure relationship.

Matt Walker, founder and Chief Analyst of MTN Consulting LLC wrote in a Fierce Telecom article: “Whether the cloud players are competitors, partners, suppliers or all of those, they’re going to continue to reshape telecom’s landscape for years to come.”

…………………………………………………………………………………………………………………………………….

Telco’s Move from Virtual Network Functions (VNFs) to Cloud Native Core Networks:

With VNFs, many network operators (e.g. AT&T) have automated portions of their infrastructures. But to satisfy new performance demands and meet the needs of modern customers, telcos are now migrating to fully cloud-native infrastructures.

Cloud-native network functions (CNFs) are a new way of providing a required network functionality using containers.

CNFs are dynamic, flexible, and easily scaled, making them a favored solution in the transition to 5G. While a VM with its own operating system may consume several gigabytes of storage space, a container might only be tens of megabytes in size. Therefore, a single server can host more containers than VMs, significantly boosting data-center efficiency while reducing equipment, maintenance, power, and other costs.

In the near future, it is expected that many of the deployments on the road to 5G will consist of a mix of CNFs and VNFs as we are now at the transition stage of moving to fully cloud-native architectures.

Image courtesy of N-iX (a Ukraine and Poland based provider of software development outsourcing and professional services)

Here are some suggestions to facilitate telco’s move to cloud native core networks from N-iX:

- Decide on the cloud strategy: choose the best deployment model: public, private, or hybrid clouds, select the most suitable approach: single cloud or multi-cloud, settle on the cloud provider (s).

- Create a clear migration plan: it should include your goals, costs estimates, timelines, services and technology to use, etc.

- Choose a VNF migration strategy: define which network functions need to remain as VMs and which can be re-architected as cloud-native microservices.

- Assess and prioritize your apps, processes, and operations: understand app dependencies; categorize your apps into mission-critical applications, business-critical applications, customer-facing applications, and other non-critical apps; define operations that can be automated; simplify processes so that they consist of fewer steps.

- Adopt microservices architecture: transform your monolith architecture into a number of loosely coupled microservices to be able to quickly develop, test, and deploy new features and fixes without impacting other components of the application.

- Make use of containers: Containers make it easy to move applications between environments while retaining full functionality. They also make it possible to build and run scalable applications across public, private, and hybrid clouds.

- Leverage edge computing: edge computing is among the top telecom trends. Telcos should make use of edge networks to reduce latency and improve network performance by bringing workloads closer to the users who need to access them. As opposed to the content delivery network (CDN), which is considered to be the predecessor of edge computing and only stores cached data, edge networks, by contrast, can accommodate a wider array of functionality (they can store and process data in real-time) and device types.

Nokia is a strong supporter of Cloud Native. Here’s what they say:

For 5G, service providers need more from cloud. Cloud must be re-architected to cloud-native so that they can get breakthrough business agility in rapidly onboarding new apps and deploying & operating new services.

The scale of 5G brings many more devices and a very diverse mix of services, there’s no way legacy operations can keep up, they need much more automation, especially for slicing. 5G brings new performance demands, so the cloud needs to move towards the edge, for the sake of low-latency, localized reliability, and traffic steering; for that CSP need cloud-native’s efficiency.

………………………………………………………………………………………………………………………………………..

References:

https://www.n-ix.com/cloud-computing-telecom/

https://www.nokia.com/networks/portfolio/cloud-native-solutions/

Heavy Reading: “The Journey to Cloud Native” – Will it be a long one?

x-China Mobile Chairman: 5G phones have no new features, new 5G devices urgently needed

The 2021 Sohu Technology 5G&AI Summit was held in Beijing on May 17. Wang Jianzhou, former chairman of China Mobile and senior consultant at GSMA shared his views on 5G in his speech.

Wang Jianzhou believes that the current 5G industry applications have achieved many results, such as smart control, smart logistics, smart security, telemedicine, etc., but the perception of the consumer market is not strong.

“There is no ready-made experience for 5G consumer-level applications to learn from. Every year at the Barcelona Communications Exhibition, I am most concerned about what applications are there, but they are all industrial applications.” Wang Jianzhou said.

In addition to chips and antenna modules, 5G mobile phones don’t really have any new features. Indeed, compared with the overwhelming hype, the perception of 5G on the consumer side is not strong. Major mobile phone manufacturers are looking forward to using 5G to boost mobile phone sales, but with the limited application of 5G consumption scenarios and expensive packages, it is unknown whether 5G can stimulate significant smartphone upgrades.

Despite the huge scale of China’s 5G efforts, with 819,000 base stations deployed and 285 million package subscribers signed up, industry leaders are worried about the lack of innovative services and rising energy costs. Wang said only “massive consumer-level applications” could take full advantage of the coverage and huge capacity of 5G networks. He said that while many industrial use cases had already become a reality, new consumer 5G applications were rare.

“I think the tipping point of 5G consumer-level applications is likely to be the device,” he said.

“They are not yet ideal 5G mobile phones. Consumers need 5G mobile devices with new functions,” he said, citing the impact of browser-enabled phones, led by the iPhone, that drove the explosion of 3.5G and 4G mobile Internet.

“Except for a faster video download speed, I didn’t find any other use for 5G. The 5G package is so expensive, and the first thing a 5G phone is to turn off 5G. So what’s the use of 5G? But it only increases power consumption.”

A repeat complaint of China’s “5G package” customers is: “I got a 5G package upgrade, I have a 4G mobile phone, and I don’t have a 5G network, so I got lonely.” That’s according to China’s Weibo microblogging website.

Indeed, global smartphone sales have recently decreased:

- According to Gartner, global smartphone sales fell by 20.2% and 20.4% year-on-year, in the quarter and second quarter of 2020, respectively.

- According to the latest data from IDC, global smartphone shipments fell 1.3% year-on-year in the third quarter of this year.

- According to a report from the China Academy of Information and Communications Technology, the cumulative shipments of 5G mobile phones from January to September last year were 108 million, and the total number of new models on the market was 167, accounting for 47.7% and 46.5%, respectively. Whether it is shipments or models, it accounts for less than half.

Wang Jianzhou made several suggestions for 5G consumer-level applications:

First, pay attention to consumer-level IoT applications. “Consumers will pay more attention to entertainment, such as cloud gaming. In addition, if we can combine AR, VR and the Internet of Things, we can create many new consumer-level applications.”

Second, extend the functions of mobile phones. “The explosion of 3G applications is the popularization of smart phones. The tipping point of 5G consumer-level applications is likely to be terminals. Except for 5G chips and 5G antenna modules, current 5G mobile phones do not see new functions, which is not ideal. The state of 5G mobile phone.”

“I think the functions of 5G mobile phones should extend from communication, social networking, browsing, shopping, payment, navigation, verification, entertainment to the Internet of Things and artificial intelligence, and make mobile phones a controller that connects everything. This extension is actually becoming a reality. Nowadays, some mobile phones have been equipped with laser rangefinders, so that the mobile phones have the function of measuring distance, which can produce some new applications.”

Third, focus on wearable devices. “5G’s application flashpoint is also likely to be wearable devices. The combination with 5G smartphones will produce many new functions. For example, camera and laser systems are installed in glasses and helmets and connected to 5G mobile phones for processing.” Wang Jianzhou said.

5G’s outlook was clouded by “a serious shortage” of both low-end and middle-range spectrum, Wang said. “It is essential to establish multi-band coordinated 5G networks as soon as possible.”

He also said operators should be further encouraged to expand network co-construction and sharing.

Network sharing and rollout had already become a trend, he noted, with China Unicom and China Telecom saving billions of dollars from their shared 5G project.

Jianzhou also called on the industry to drive down energy consumption by adding network intelligence. The huge power consumption and high operating costs of 5G networks meant it was necessary to further improve 5G network efficiency and to implement intelligent networks.

References:

https://min.news/en/economy/339e0871cb5dccd09cf1f411dcf0e226.html

Has MPLS networking reached its end as enterprises move to the cloud?

by Amir Khan (edited by Alan J Weissberger)

MPLS networking has been a staple feature of service providers for over 20 years, and it’s a technology that remains widely in use. But there is every indication that MPLS is nearing the end of its usefulness as an effective enterprise WAN solution.

Enterprise networking is moving to the cloud, and connectivity is required that fits the bill, mirroring cloud’s ease of deployment and able to adapt to business needs at cloud speed.

Will carriers and service providers keep relying on MPLS to the bitter end? Or will they take a proactive approach by assisting their enterprise customers with a migration journey to a future of networking built in the cloud and designed for the cloud era? If they act now, and make the right strategic partnerships, service providers can take credit for leading this migration in an orderly, secure and planned manner, empowering their customers to operate ‘at the speed of business.’

It is certainly clear that service providers must avoid the trap made by previous generations who failed to move fast enough away from legacy revenue streams, such as voice. The evolutionary pace of cloud is much more rapid than any previous transitional phase, meaning telcos have minimal time to decide on a strategy. Acting now to adopt a cloud-native approach could be the difference between being a disruptor and one of the disrupted. The tipping point is at hand.

Why might MPLS networking no longer be appropriate for contemporary enterprise customers? For that, we need to consider the recent past from the viewpoint of the enterprise. MPLS was designed for connecting sites to sites, and sites to data centers, globally.

As a CIO, you had to call your MPLS service provider and they provisioned a connection for you. This typically took weeks, if not months. How long would depend on what capacity the service provider had available in the region where you needed the connectivity. The cost for the bandwidth in question would be quite high too, compared to basic Internet service. The SLAs are good with MPLS, compared to Internet, but there’s a price to be paid for that.

As enterprises started to become more and more reliant on cloud services, the dynamics began to change. The task of a WAN has moved on from just connecting campuses and data centers. Cloud has created new traffic patterns, with enterprises now running many workloads in many different clouds. You can’t optimize that kind of complexity with MPLS, because it’s too rigid.

What’s needed instead is an approach that is designed from the ground up for the modern needs, one that lives in the cloud. That means more than just an on-ramp that connects to the edge of the cloud. It’s about cloud-native technology, available as a service, able to seamlessly interconnect multiple clouds but also reach beyond cloud boundaries into enterprise on-premise locations.

Service providers need to realize that unless they can come up with an offer based around these principles, one that takes their enterprise customers beyond MPLS, then somebody else will do it instead.

Cloud networking is a solution that the customer will eventually be drawn to, with or without the service provider. By moving now to meet this need, the service provider can prove that they are a trusted partner, looking beyond the short term, offering something beyond the familiar. Service providers don’t have the luxury now of sitting around deciding. Those that do will lose over time, and get left so far behind they will no longer be able to compete.

Service providers already know that existing revenue streams are declining as cloud takes over. But it’s not just about adding a new product line to their portfolio. They must take a hard look at their own business models, transforming themselves away from what’s safe and traditional and embracing something much more radical.

They must review internal processes and cultures, preparing themselves not just for a new technology but for a whole new market. The way they approach the customer has to be right. Being cloud-relevant, for example, is about offering services on a global scale. Even small businesses have people working for them across the globe now. Customers will expect not just a global footprint, but one with security and full visibility baked in.

If service providers can reengineer their business for the new age of cloud then they will gain agility, free themselves to explore new revenue opportunities and look forward to continued relevance.

About Amir Khan:

Amir is a computer networking visionary who founded and led Viptela’s market-leading, cloud-first, Software-Defined Wide Area Networking (SD-WAN) business before its acquisition by Cisco.

As prescient as he was in identifying the $8B opportunity for SD-WAN, Amir recognized that the network hampered the cloud journey and founded Alkira in 2018 with CTO Atif Khan to reinvent networking for the cloud era. Amir’s vision is to deliver the Cloud Network as-a-Service (CNaaS).

Alkira has delivered the industry’s first Network Cloud, a global unified cloud network infrastructure delivered as-a-service with 1) connectivity for hybrid and multi-cloud networks 2) integrated network and security services, and 3) end-to-end operational visibility and governance. Alkira CSX, is an on-demand, as-a-service, point and click, unified CNaaS that enables cloud architects to design, build, and deploy a global multi-cloud network in minutes. Alkira enables enterprises to implement 50% less firewall capacity, and reduce TCO by up to 40%. Before Viptela, Amir held leadership roles at Cisco, Juniper, and Nortel. He holds 4 patents. Amir earned an MS in Electrical Engineering from the University of Colorado at Boulder, and a BS in Electrical Engineering from the University of Mississippi.

References:

SiFi Networks is building 10G b/sec open access fiber networks in the U.S.

SiFi Networks is a privately owned, U.S. based company that builds and operates competitive fiber networks which service providers use to deliver first class service to their customers; internet, TV, phone and more. The company was founded in 2013 and operates using a wholesale model focused on getting carriers onboard as tenants. It is now offering 10 Gb/sec fiber access networks to U.S. operators, hoping to entice them to adopt a more European infrastructure model and sign on as tenants to its wholesale fiber network rather than building out the last mile themselves.

SiFi Networks is delivering open access fiber networks right across the US called FiberCities®, called so because fiber passes every single home and business in the city and Smart City access points are put in place as standard, developing a future proofed city for generations to come.

The company is a big advocate of dig once and only once, therefore removing costs and disruption that could be associated with future connectivity, and by operating the network independently of any end service provision it removes the requirement for others to go to the expense and disruption of building separate networks.

Earlier this month, the city of Salem, MA, signed a contract attracting over $35 million of private investment to create a citywide, fully fiber-based broadband network. The project will be privately funded by SiFi Networks, with no taxpayer subsidy. With projects like this, the company hopes to transform the U.S. broadband model by operating citywide networks that can be used by multiple service providers, mobile carriers and even the municipality itself.

SiFi president Scott Bradshaw told Fierce Telecom that SiFi has build commitments in place covering 13 cities across seven states. This will eventually yield a projected footprint of “well over” 40 million feet of fiber covering more than half a million homes and businesses, he said.

CEO Ben Bawtree-Jobson added it expects to announce several additional projects in the coming months. The CEO noted its open access network model is fairly revolutionary in the U.S. “It’s very much commonplace in other countries, in particular in Europe, but in the U.S. having last mile infrastructure that’s independently operated, that isn’t under the control of the service provider is a new model,” Bawtree-Jobson said.

Jeff Heynen, VP of broadband access and home networking at analyst firm Dell’Oro Group, explained in an email to Fierce this is primarily due to the “the legislative influence of the big telco and cable operators.” He said major incumbents like Verizon and AT&T “were able to successfully lobby legislators that they should own their networks and equipment because they bear the heavy cost of the initial deployment.” In states like North Carolina, these players even convinced lawmakers to “block the roll out of municipal fiber networks because they were argued to be unnecessary.”

While a handful of open fiber networks have sprung up in cities across the country, Heynen said, “The influence of the big carriers on legislation (local, state, and national) has limited their advance over the years.”

Bawtree-Jobson noted reactions to its offer have varied, with smaller ISPs “happy to get onto networks, share infrastructure and gain access to customers” without having to spend massive amounts in capex and opex. Incumbent local exchange carriers (ILECs) are a tougher nut to crack, he said.

Bolstering its pitch, though, is SiFi’s plan to roll out 10 Gbps capabilities from day one. Bawtree-Jobson said the idea is to be “ahead of the game in terms of philosophy, thinking, concept. Ahead of the game in terms of network architecture. Ahead of the game in terms of network capability and speed as well.”

SiFi is planning to use micro-trenching for its fiber rollouts, which is expected to help accelerate its deployments. Bawtree-Jobson said depending on the size of the project, its city deployments are expected to take anywhere from two to five years to complete.

References:

https://sifinetworks.com/corporate/

https://www.fiercetelecom.com/telecom/sifi-networks-aims-to-bring-european-fiber-model-to-us

O2 UK and Microsoft to test MEC in a Private 5G Network

UK mobile network operator O2 (Telefónica UK) has partnered with Microsoft to test the benefits of on-premise Mobile Edge Computing (MEC) within a Private 5G network, with a focus on low latency and security.

The MEC Proof of Concept (PoC) involves technology running on Microsoft Azure, which will be the first Azure deployment using a UK Private 5G network. It is designed to support secure data management, with all confidential data staying on premises at all times.

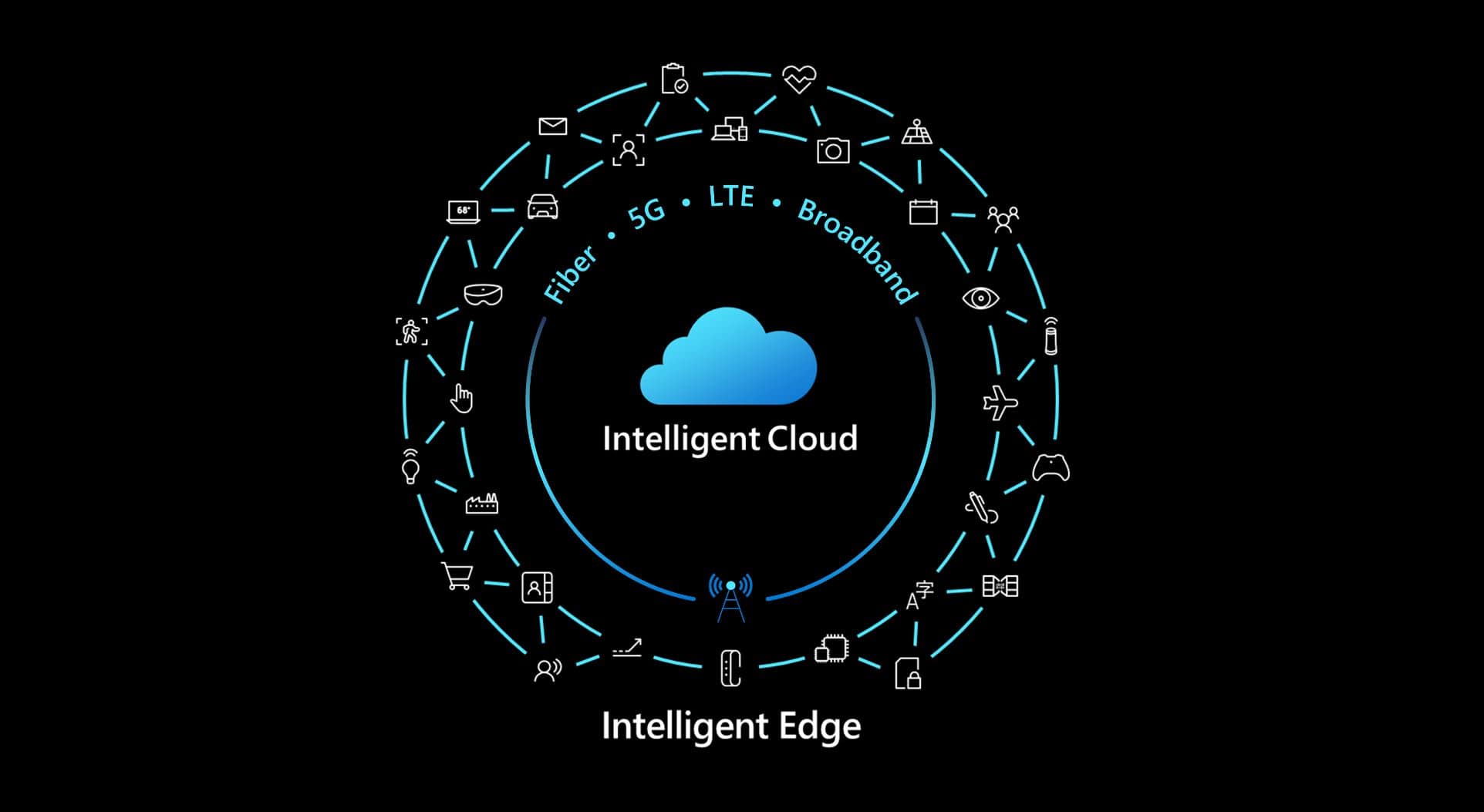

Image credit: Microsoft Azure for Operators

O2 (Telefónica UK) will provide Secure 5G Network capabilities and various Industry 4.0 applications. The computing service will be delivered via Azure Private Edge Zones, bringing compute, intelligence and storage to the edge where data is created. O2 and Microsoft will also support start-ups in developing new 5G solutions through the ‘Microsoft for Startups’ program.

O2 recently announced it had launched a Private 5G Network initiative with Leonardo, a global high technology company in the Aerospace, Defence & Security sector. This trial with Microsoft will be similar, however will involve MEC to broaden the use cases and benefits.

Jo Bertram, MD of Business at O2, said, “We’re incredibly proud of our track record of supporting business partners with innovative network solutions. This particular trial with the Microsoft Azure platform will provide secure and superfast capabilities that will maximise productivity and efficiency, as well as peace of mind. We pride ourselves on having a secure 5G network and being champions of coverage and reliability, as recognised in industry awards.”

Yousef Khalidi, corporate vice president, Azure for Operators at Microsoft, said: “Through our collaboration with O2, we will enable enterprises to leverage 5G to unlock new scenarios that accelerate digital transformation within their own private, on-premises environments. Combining Azure technology with O2 services is critical to bringing MEC to the enterprise edge, and we look forward to seeing customers leverage this platform to drive innovation across a broad range of information and operational technology applications.”

Key Deliverables:

- O2 partners with Microsoft to trial the benefits of on premise Mobile Edge Computing (MEC) within a Private 5G Network, focusing on security and low latency

- The Proof of Concept (PoC) aims to pave the way for secure data management, enabling confidential information to stay on premises at all times

- Technology will be run via the Microsoft Azure platform, its first deployment utilizing a UK Private 5G Network

References:

https://azure.microsoft.com/en-us/industries/telecommunications/