Author: Alan Weissberger

Rakuten Communications Platform (RCP) defacto standard for 5G core and OpenRAN?

In Japanese, Rakuten stands for “optimism.” This philosophy lies at the core of the company’s brand. They may be the leader is selling 5G mobile core network specs and virtualization network software to global network operators in the absence of any ITU-T standards or 3GPP detailed implementation specs. [Please refer to References for more details, especially on the 3GPP Technical Specifications 23.501, 23.502, 23.503.]

Rakuten Communications Platform (RCP) has been sold to a total of 15 customers so far, according to the company’s mobile networking CTO Tareq Amin.

“We have already 15 global customers. A lot of people don’t know that the sales already started. And these are not small customers. Some of them are very, very massive,” he said this week during a virtual roundtable with members of the media. “I’m really delighted to see that we finally are reaching a stage where possibly in the next quarter or so we have a very large contract about the entire RCP stack.”

Regarding network performance, Amin explained that success factors are based on virtualization, standardization, optimization and automatizing. Combined, they lead to more cost efficiency, innovation, affordability and growth.

Rakuten Mobile was the first to deploy a large-scale OpenRAN commercial network and the first fully virtualized, cloud-native mobile network. And Amin refutes the perceived limitations of open radio access networks, arguing that Rakuten Mobile’s only limitation today is spectrum assets.

“With less than 20% of spectrum assets compared to our competitors, we are doing great. OpenRAN does not mean we have an average network; the truth is that we have a world-class network,” he added, explaining that once Rakuten Mobile moves from five to 20MHz, there will be a significant improvement in performance, while 5G deployment is also accelerating.

Despite launching a commercial service during a global pandemic, Rakuten Mobile already has received more than 2 million applications, with the majority of applications made online rather than in stores.

Rakuten appears to have broadened its focus a few months later when it announced it acquired operational support system (OSS) provider Innoeye for the “Rakuten Communications Platform (RCP).”

Rakuten officially took the wraps off RCP in October 2020 with an announcement that it was “bringing 5G to the word.” The business is based in Singapore and headed by Rabih Dabboussi, who previously worked at networking giant Cisco and cybersecurity company DarkMatter, according to his LinkedIn profile, before joining Rakuten in May 2020.

RCP essentially is the platform on which Rakuten is building its 4G and 5G networks in Japan. Amin explained that the offering consists of a number of different, interchangeable pieces including network orchestration, cloud management and artificial intelligence provided by a range of participating suppliers. RCP customers can pick and choose which parts of the platform they wish to use.

From Amin’s email to this author: “NEC/Rakuten 5GC is 3GPP based standardized software for network service and a de facto standard container basis infrastructure (“infrastructure agnostic”). It is a forward looking approach, but not proprietary.”

“NEC/Rakuten 5GC openness are realized by implementation of “Open Interface” defined in 3GPP specifications (TS 23.501, 502, 503 and related stage 3 specifications). 3GPP 5GC specification requires cloud native architecture as the general concept (service based architecture). It should be distributed, stateless, and scalable. However, an explicit reference model is out of scope for the 3GPP specification. Therefore NEC 5GC cloud native architecture is based on above mentioned 3GPP concept as well as ETSI NFV treats “container” and “cloud native”, which NEC is also actively investigating to apply its product.”

RCP essentially positions Rakuten against cloud giants like Amazon, Google and Microsoft, companies that are also selling cloud-based network management and operational services to network operators globally. Indeed, Microsoft last year acquired Affirmed Networks and Metaswitch Networks in pursuit of that goal.

Rakuten’s sales of RCP are directly linked to the success of the company’s ongoing 4G and 5G network buildouts in Japan. As a result, the company has been quick to address concerns over the performance of its mobile network in Japan which is both based on RCP.

“What we’ve done in 4G was enabling a world-first virtualized infrastructure. For 5G, we have a world-first containerized architecture, completely cloud-native radio access software that is (made up of) disaggregated micro services,” he explained.

“Between LTE, which is 40MHz and about 500MHz of spectrum assets, we think we have a very strong position to be able to increase capacity and demand.”

“We’re very confident about our business model and our business plan. And the idea to have zero churn in the network is also a unique value proposition that really emphasizes the critical role of the [Rakuten Mobile] ecosystem and the critical role of data for our long term viability,” said Amin.

References:

https://rakuten.today/blog/rakuten-scales-nationwide-mobile-network.html

https://www.etsi.org/deliver/etsi_ts/123500_123599/123501/16.06.00_60/ts_123501v160600p.pdf

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

Rakuten Mobile, Inc. and NEC to jointly develop the containerized standalone (SA) 5G core network

Another Open RAN Consortium: 5G Open RAN Ecosystem led by NTT Docomo

Japan wireless network operator NTT Docomo has partnered with 12 companies to create the ‘5G Open RAN Ecosystem.’ The companies are: Dell Technologies Japan, Fujitsu, Intel, Mavenir, NEC, NTT Data, Nvidia, Qualcomm Technologies, Red Hat, VMware, Wind River and Xilinx.

Their plan is to accelerate open radio access networks (Open RAN) and help enable global network deployment to serve diverse company and operator needs in the 5G era.

The O-RAN Alliance, which NTT Docomo has helped lead since its launch, has developed specifications and promoted products that allow operators to combine disaggregated base station equipment. Docomo has been actively developing the products for its own 4G/5G network in Japan.

Docomo will start talks with the 12 companies on accelerating open RAN introduction to operators.

Specifically, NTT DOCOMO’s target is to package best-of-breed RAN and to introduce, operate and manage them based on demands from operators considering open RAN introduction. By leveraging its years of activities in driving open network and know-how (which realized the world’s first open RAN for 5G using O-RAN), NTT DOCOMO is committed to maximize companies’ strengths in furtherance of the 5G Open RAN Ecosystem, and providing high-quality and flexible networks.

5G Open RAN Ecosystem:

Image courtesy of Viavi Solutions

………………………………………………………………………………………………….

Additionally, NTT DOCOMO will develop vRAN (virtualized RAN) with higher flexibility and scalability to further drive open RAN targeting commercialization in 2022. As COTS (Commercial Off-The-Shelf) servers can be used and dedicated equipment are not required for vRAN, it is possible to realize flexible and cost efficient networks. As of today, NTT DOCOMO will start discussion towards verification of vRAN, including performance assessments. As for the vRAN verification environment that will be constructed, opportunities for remote usage will be made available for operators themselves to freely conduct tests.

NTT DOCOMO says it will continue to cooperate with various industry partners towards accelerating wide adoption of open network, especially O-RAN and vRAN, which can cater for diversifying needs with flexibility and agility.

Comment & Analysis::

As with the two other Open RAN alliances (TIP Open RAN and O-RAN), the new 5G Open RAN Ecosystem does NOT have a formal liaison agreement with either 3GPP or ITU-R WP 5D (4G-LTE and IMT 2020 standards). Yet they are all trying to implement disaggregated network elements/equipment for 4G and 5G.

Last month legacy mobile operators Deutsche Telekom, Orange, Telefonica and Vodafone Group established a collaboration or Memorandum of Understanding (MoU) covering the rollout and development of open RAN technology, in a bid to ensure the continent keeps up with early pacesetters, namely Rakuten Mobile and NTT Docomo in Japan.

Today, Telecom Italia (TIM) said it has joined that initiative to support the development and implementation of Open RAN as the technology of choice for future mobile networks across Europe. TIM said it was committed to the development of innovative mobile network systems that used open virtualized architecture to facilitate increasingly agile, flexible, secure and functional 5G services.

However, there are no standards or 3GPPP specifications on Open RAN. Therefore, one must question if there will be different versions coming out of each consortium? Will the virtualized Open RAN architecture be implemented consistently? Will the 4G/5G endpoints be affected by different Open RAN implementations?

What is Open RAN is a good tutorial on this increasingly important subject.

References:

…………………………………………………………………………………………………

NTT DOCOMO to Establish a 5G Consortium in Thailand

NTT Docomo and an international group of several other companies have recently established a consortium to provide 5G services, first in Thailand and later in other Asia Pacific countries with the possible inclusion of additional partners. The initial members of the 5G Global Enterprise solution Consortium (5GEC) will be Activio, AGC, Advanced Wireless Network, Exeo Asia, Fujitsu, Loxley Public Company, Mobile Innovation, NEC Corp, NEC Networks & System Integration, NTT Communications, NTT Data Institute of Management Consulting, NTT Docomo, and NTT Ltd.

https://www.nttdocomo.co.jp/english/info/media_center/pr/2021/0203_00.html

Analysis: FCC’s C band auction impact on U.S. wireless telcos

by Grant’s Interest Rate Observer:

The Federal Communication Commission’s (FCC’s) ongoing sale of wireless C-band spectrum rights marks a decisive event for the telecommunications industry. As industry players compete for more digital bandwidth to help roll out 5G services, aggressive bidding looks set to generate a windfall for the U.S. government. Estimated proceeds will exceed $80 billion, easily topping the prior record of $45 billion for FCC spectrum in 2015.

As the three-way battle for 5G dominance takes shape, former also-ran T-Mobile U.S., Inc. appears to have the jump on competitors Verizon Communications, Inc. and AT&T, Inc., thanks in large part to substantial midrange spectrum frequency gained from last year’s acquisition of Sprint Corp. “For many years, Verizon hammered its competitors time and time again with the ‘best network’ and their big red coverage map,” Sasha Javid, chief operating officer of wireless company BitPath, told Bloomberg on Jan. 22. “Well, the map is looking quite magenta [signifying T-Mobile’s corporate color] today in terms of 5G coverage around the country.”

The incumbents will need to pay up to catch up. Analysts at New Street Research wrote on Jan. 11 that “if T-Mobile spends less than we expect, Verizon or AT&T will likely account for the shortfall. Neither company has the cash on hand to cover what we expect them to spend in the auction at present; we would expect more debt issuance for the group in coming weeks.”

Extra borrowings that accompany Verizon and AT&T’s 5G spending spree look to do no favors for the pair’s respective capital structures. Craig Moffett, co-founder and one-half eponym of MoffettNathanson, LLC, estimated last Tuesday that triple-B-plus-rated Verizon may spend up to $40 billion on 5G digital real estate, enough to add nearly one full turn of leverage to its 2.3 times reported net borrowings (3.2 times after accounting for operating leases and pension liabilities) as of Dec. 31. Analyst Craig Moffett wrote:

“Higher leverage will mean that capital spending will, by necessity, be pinched and stretched. Lower capital spending will mean that it will take longer to deploy their C-Band spectrum, which, in turn, will mean Verizon will be slower to catch up to T-Mobile.”

Meanwhile, Verizon’s other peer has already tapped the credit markets to finance its own shopping spree. This morning, triple-B-rated AT&T officially entered into a $14.7 billion, 364-day term loan offering at 100 basis points over Libor, with proceeds earmarked for general corporate purposes, including the financing of additional spectrum.

The new borrowings color AT&T’s dubious distinction as the world’s most encumbered non-financial company. Net debt footed to $198 billion, inclusive of operating lease and pension liabilities (equal to 3.6 times consensus 2021 adjusted Ebitda) as of Dec. 31, following efforts to diversify into higher growth businesses via the 2015 and 2018 purchases of DirecTV and TimeWarner for $67 billion and $109 billion, respectively. More debt could further complicate efforts to both tame its bloated balance sheet and improve slumping operating results including sharp subscriber losses and fast-retreating Ebitda within the DirecTV business.

Those problems have helped pressure shares to the tune of negative 18% after accounting for dividends since a bearish analysis in the Dec. 13, 2019 edition of Grant’s Interest Rate Observer, compared to a 24% total return from the S&P 500 over that period. By way of response, AT&T has pivoted to asset sales, including recently shopping DirecTV to private equity companies at a reported $15 billion price tag, while prioritizing its quarterly dividend, now at a 7.2% trailing annual rate. On last week’s conference call, CEO John Stankey reiterated plans “to use free cash flow after dividends for the next couple of years to pay down debt.”

Noting that the company is in danger of exceeding the 3.5 times adjusted leverage limit that Moody’s Investors Service has cited as a projected ceiling for AT&T to maintain its investment grade imprimatur, MoffettNathanson wrote last Wednesday that the spectrum sale left Ma Bell with two bad choices:

Sitting out the auction would have left them far behind in 5G; buying spectrum would leave their dividend looking even more unsustainable. Damned if you do, damned if you don’t.

Selling DirecTV now will help slow the overall rate of Ebitda decline, but it won’t solve the basic problem. AT&T’s leverage is far too high for a shrinking company, and their dividend is too high for them to do anything serious about lowering it. Something’s gotta give.

…………………………………………………………………………………

References:

UPDATED: Mid-band Spectrum for 5G: FCC C-Band Auction at $80.9B Shattering Records

ITU-R M.2150: Detailed specifications of the radio interfaces of IMT-2020

The ITU Radiocommunication Sector (ITU-R) has recently published Recommendation ITU-R M.2150 titled ‘Detailed specifications of the radio interfaces of IMT-2020.’ The newly published Recommendation, formerly called ‘IMT-2020.specs,’ represents a set of three terrestrial radio interface specifications which have been combined into a single document.

The current version of this Recommendation on IMT-2020 specifications (Recommendation ITU-R M.2150) contains 3 radio interface technologies: “3GPP 5G-SRIT”; “3GPP 5G-RIT” and “5Gi” (India/TSDSI). Those technologies are the basis for the implementation of 5G Radio Access Networks (RANs) around the world. After a period of 7-8 years of hard work across the industry, the evaluation of these 3 IMT-2020 technologies has culminated in an approval from ITU’s 193 Member States.

Two more radio interface proposals, submitted by ETSI/DECT Forum and Nufront, have been granted an exceptional review within the IMT-2020 process extension. Based on consideration of additional material, if they successfully complete the evaluation process they will be included in a subsequent revision Recommendation ITU-R M.2150.

It is important to note that the frequencies/spectrum arrangements to be used are not specified in M.2150. Instead they are contained in a yet to be completed revision of ITU-R M.1036: ‘Frequency arrangements for implementation of the terrestrial component of International Mobile Telecommunications (IMT) in the bands identified for IMT in the Radio Regulations.’

5G NR (New Radio) wireless mobile communications will bring higher data rates, reduced latency, and greater system capacity. The first implementation of 5G NR uses existing 4G LTE infrastructure in a non-standalone (NSA) mode.

A full 5G standalone (SA) mode that does not rely on LTE is being progressed by 3GPP which does not plan to liaise their documents to ITU-T. Indeed, it appears that all non-radio aspects of IMT 2020 will be specified by 3GPP and network operators in conjunction with their 5G Core network suppliers.

To facilitate the smooth evolution from 4G LTE to 5G NR, the 5G NR standard offers the possibility of adapting to existing LTE deployments and sharing the spectrum used exclusively by LTE today. The enabling mechanism, known as “dynamic spectrum sharing” (DSS), allows 5G NR and 4G LTE to coexist while using the same spectrum and as such allowing network operators a smooth transition from LTE to 5G NR – presenting one option for an economically viable evolution.

ITU-R Working Party 5D has invited organizations within and external to the ITU Radiocommunication Sector (ITU-R) to provide inputs for its June and October meetings in 2021, which will help the development of the forthcoming report “Future Technology Trends towards 2030 and beyond.” A first draft of this new report contains a list of driving factors in the design of IMT technology, as well as a list of possible technologies to enhance the performance and precision of both the radio interface and radio network.

References:

https://www.itu.int/en/myitu/News/2021/02/02/09/20/Beyond-5G-IMT-2020-update-new-Recommendation

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/default.aspx

Learn more about IMT-2020 on the relevant website and the accompanying FAQ. If you have particular technical or IMT-process related questions, you can also approach the ITU-R SG 5 Counsellor.

Fiber optic coverage in Brazil to reach 5.5K municipalities by 2024; telcos want fiber over underground sewage ducts and systems

By 2024, optical fiber should reach 5,500 Brazilian municipalities that do not now have fiber coverage. This is one of the new objectives of Brazil’s General Plan for Universalization Goals. On Thursday, Brazil’s Communications Ministry approved the issuance of debentures for investments in the telecommunications infrastructure, taking the total initiatives to stimulate the development of the sector to seven. The document was published in the Federal Official Gazette and gathers the obligations that fixed-line operators must fulfill in the next five years.

According to the plan, fiber optic connections should have a minimum capacity of 10 GB per second from the beginning to the end of the stretch that serves the municipality, and cover at least 10% of its territory by December 31, 2021. If the new target is met, the estimate is that internet coverage by fiber optics will reach around 5.500 cities by 2024. This would be equivalent to 99% of Brazilian municipalities.

Anatel (the National Telecommunications Agency in Brazil) has a period of 3 months to draw up the list of cities that will be covered. In Brazil, fiber connections already account for almost a third of total fixed broadband connections, according to data from regulator Anatel. All major carriers are expanding their FTTH network.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Brazilian telecom operators want to be allowed to pass critical telecom transport networks, namely fiber optics, over underground sewage ducts and systems. The topic was discussed during a 5G event held by the Lide group on Thursday, where sector executives called for the issue to be included in the new rules for the sanitation sector. With the aim of making the sector more attractive to private investors, last year saw a new sanitation framework approved by congress and signed into law by President Jair Bolsonaro.

“It’s hard to pass fiber on the surface and sewer systems can be a lever for telecom infrastructure,” said Leonardo Capdeville, chief technology officer at TIM Brasil. “The systems can even be used to pass fiber up to homes and buildings. We could take advantage of the sanitation framework,” he said.

It is a “win-win” relationship, according to the CTO. On the one hand, it generates additional revenue for the sanitation company, while at the same time allowing it to benefit from connectivity that can help improve operating control and management, by preventing leaks in a timely manner for example.

Operators have sought to find alternatives to the obstacles they claim to face in the form of bureaucracy, excessive costs and licenses for rolling out fiber along highways, and also high fees charged by power utilities for the use of lampposts.

Echoing Capdeville, TIM’s regulatory affairs director, Mario Girasole, defended advances in fiber backhaul (transport networks) by joint construction and deployment with power distributors, road concessionaires and sanitation companies. The idea of using sewage systems and other forms of infrastructure sharing was also defended by the CEO of local telco Oi, Rodrigo Abreu, and Ericsson’s Eduardo Ricotta.

“Optical fiber needs a very large investment and we see this [sharing] trend as a way of no return,” said Ricotta, who is head of the Southern Cone at the Swedish telecom infra provider. In São Paulo, state utility Sabesp is currently discussing ways to deploy 5G transport infra via sewage systems, according to Adriano Stringhini, the company’s corporate management officer.

References:

Deutsche Telekom: Access 4.0 in Production Leveraging ONF VOLTHA and SEBA open source software

Deutsche Telekom (DT) recently announced its Access 4.0 (A4) platform began providing services to customers in Stuttgart in December 2020. This marks a major milestone in DT’s efforts building a state-of-the-art disaggregated broadband solution that blends open source and vendor proprietary components into a production-grade highly optimized solution for providing FTTx services.

Deutsche Telekom’s Access 4.0 is the next generation of software-defined access networking. The program constitutes a true paradigm shift, not only in terms of technology but also ecosystem, collaboration, and agility. By leveraging an edge cloud approach, we create a cost-efficient, lean-to-operate, and scalable access platform to deliver gigabit products. It works in our labs and in an early field trial.

A key foundational building block of A4 is ONF’s Virtual OLT Hardware Abstraction (VOLTHA) open source software controlled by the ONF’s ONOS SDN Controller and a set of ONOS Apps. This VOLTHA stack enables operators to extend software defined programming to the fixed access network, and makes it possible to embrace a best-of-breed approach to selection of white box network equipment. In addition to this open source stack, ONF’s SDN-Enabled Broadband Access (SEBA) Reference Design documents the architecture and framework used to assemble open solutions such as DT’s.

VOLTHA™ is an open source project to create a hardware abstraction for broadband access equipment. It supports the principle of multi-vendor, disaggregated, “any broadband access as a service” for the Central Office. VOLTHA currently provides a common, vendor agnostic, GPON control and management system, for a set of white-box and vendor-specific PON hardware devices. With the upcoming introduction of access Technology Profiles, VOLTHA will support other access technologies like EPON, NG-PON2 and G.Fast as well.

VOLTHA, operational in the A4 network, has been developed as a joint effort between ONF, ONF operator partners (particularly AT&T, Deutsche Telekom and Turk Telekom), and additional members and vendors in the VOLTHA ecosystem. The role of the operators is key in shaping the architecture and requirements for VOLTHA and SEBA with their sharing of insight learned in field trials and early commercial deployments. This collaboration has helped to improve, harden and scale VOLTHA and SEBA.

SEBA™ is a lightweight platform based on a variant of R-CORD. It supports a multitude of virtualized access technologies at the edge of the carrier network, including PON, G.Fast, and eventually DOCSIS and more. SEBA supports both residential access and wireless backhaul and is optimized such that traffic can run ‘fastpath’ straight through to the backbone without requiring VNF processing on a server.

- Kubernetes based

- High Speed

- Operationalized with FCAPS and OSS Integration

“Deutsche Telekom is reaching an important milestone in its transformation into a software-based telecommunications provider,” explains Walter Goldenits, CTO Telekom Deutschland, adding, “We are thus consistently shaping the path taken by the industry toward solutions based on open and disaggregated components in the fixed network area as well.”

Abdurazak Mudesir, head of Services & Platforms and Access Disaggregation at Deutsche Telekom Technik, adds: “Disaggregation is now a reality. For the first time we’re producing a BNG on Whitebox hardware and are using software-defined networking technology to control that gateway. That’s a hugely important step toward our broadband network’s future structure. With the software-defined approach of Access 4.0 we’re driving forward automation and can implement lean processes ourselves in combination with our OSS platforms.”

Access 4.0 is primarily tailored to Deutsche Telekom’s broadband internet access for FTTH/B. This use case marks, however, just the start of the transformation. The underlying A4 platform technology should in future be able to support other applications at the network edge, especially in the 5G and Open RAN environment. The next step will see the project team focus on honing the platform for rollout in other regions.

……………………………………………………………………………………………..

References:

https://www.telekom.com/en/company/details/access-4-0-563612

US Ignite Pilot Program for 5G Living Lab at Marine Corps Air Station Miramar in San Diego, CA

- The 1st project will use the Verizon 5G network through a Cooperative Research and Development Agreement (CRADA) to offload data from an automated package-delivery shuttle.

- The 2nd project will track the development of four finalist applications selected in a recent 5G pitch competition, culminating in a demonstration event for U.S. Marine Corps and Department of Defense officials.

“Military bases, like smart cities, are a crucial testing ground for new sensor-driven technologies, particularly as we upgrade the nation’s wireless networks to 5G,” said Nick Maynard, Chief Operating Officer for US Ignite. “We have an opportunity at Miramar not only to experiment with systems to improve overall safety and efficiency on base, but also to help develop a framework of best practices that will serve smart bases and smart communities across the country.”

MCAS Miramar is part of the first wave of military bases deploying 5G networks. Through a partnership with Verizon, the base is fast tracking deployment of 5G and 4G small cells to supplement 4G LTE macro cells already in place. The upgraded wireless network serves as the foundation for the 5G Living Lab at Miramar, making it possible to experiment with digitally connected infrastructure to improve operational resiliency.

“We can create a smarter, more connected military base by working collaboratively across the public and private sector, which is why our partnerships with US Ignite and Verizon are so critical,” said Lieutenant Colonel Brandon Newell, NavalX SoCal Tech Bridge Director and 5G Living Lab Lead. “Through the 5G Living Lab at Miramar, we expect to develop technologies that benefit: military operations, the private sector forging new business models around 5G services, and the public we serve.”

“Since Verizon and Miramar announced the first-ever 5G Ultra Wideband deployment on a military base last July, the NIWC Pacific team has created a true testbed for innovation,” said Andrés Irlando, Senior Vice President and President, Public Sector and Verizon Connect at Verizon. “Leaders across the Department of Defense understand the mission-critical role 5G plays in unlocking innovation for the military, and this new pilot program will accelerate the research to help bring it all to life.”

US Ignite has begun work on both of the initial pilot projects for the MCAS Miramar 5G Living Lab. Team members are designing a route map and finalizing operational details for package delivery service on base using an Olli automated shuttle. Finalists from the recent 5G pitch competition – hosted by the National Security Innovation Network (NSIN) in partnership with NavalX SoCal Tech Bridge and NIWC Pacific – are working on prototype demonstrations of their 5G applications as part of a process facilitated by US Ignite to present the new technology at multiple stages of development to military officials.

Additional pilot projects are planned for 2021, including an effort to connect solar cells on base to the local 5G network. US Ignite will also partner with the University of California San Diego for future data analysis work related to transportation and energy projects.

NIWC Pacific contracted with US Ignite to run the 5G Living Lab pilot program located at MCAS Miramar based on proven technical and project management capabilities. US Ignite has demonstrated its experience through efforts that include: leading a broad portfolio of connected communities in testing applications and services powered by advanced networks; overseeing the development and deployment of multiple city-scale wireless testbeds; and implementing new automated vehicle technology at the United States Army installation at Fort Carson, Colorado.

About US Ignite:

US Ignite is a high-tech nonprofit with a mission to accelerate the smart community movement. We work to guide communities into the connected future, create a path for private sector growth, and advance technology research that’s at the heart of smarter development. For more information, visit www.us-ignite.org.

Media Contact: Sarah Archer-Days, +1 646-596-6103, [email protected], www.us-ignite.org

Cignal AI: Network Operator Spending on Optical and Packet Transport Gear in North America

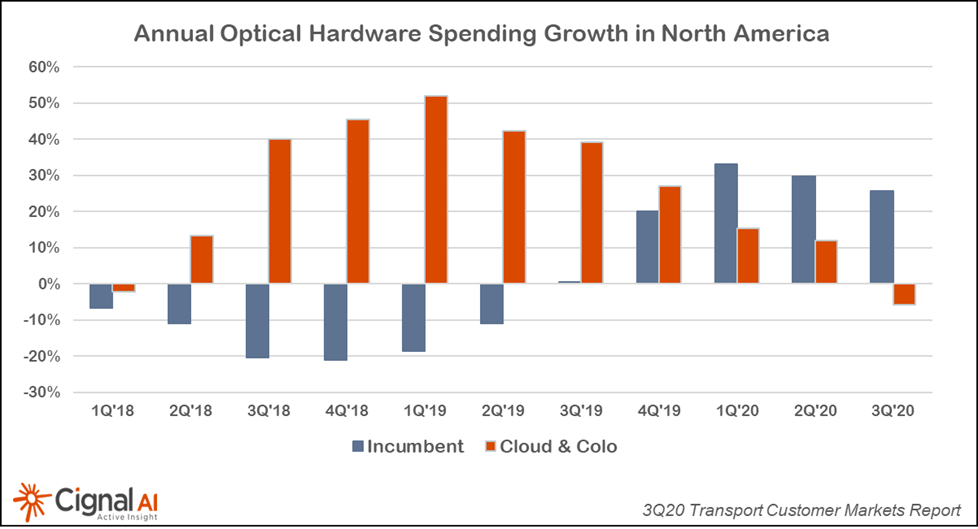

Expenditures by North American cloud and colocation operators on optical and packet transport equipment declined 20 percent year over year in the third quarter of 2020 (3Q20), while incumbent operator spending increased 2 percent, according to the 3Q20 Transport Customer Markets Report from market research firm Cignal AI. It’s quite important that incumbent operator spending grew while cloud and colocation operator spending declined during 2020.

“Equipment suppliers to cloud operators report that sales in the third quarter were depressed because service providers absorbed capacity on networks that were built during the first half of 2020,” said Scott Wilkinson, lead analyst at Cignal AI. “Both incumbent and cloud operators, especially in North America, spent significantly more of their annual budget than typical in the first half of the year.”

| More Key Findings from the 3Q20 Transport Customer Markets Report |

- After uncharacteristically strong growth in 2Q20, sales to cloud and colocation operators in Asia Pacific (APAC) rose dramatically again in the third quarter

- Despite a year-over-year decline in sales, Ciena maintained its worldwide market share leadership in sales to cloud and colocation operators in 3Q20

- The fourth quarter is expected to be challenging for sales outside APAC, with traditional telco and cloud and colocation purchases anticipated to wane worldwide

| About the Transport Customer Markets Report |

| The Cignal AI Transport Customer Markets Report tracks global optical and packet transport equipment spending by end-customer market type, including incumbent, wholesale, cloud and colocation, cable MSO and broadband, enterprise and government network operators. The report includes historical market share and market size and five-year market size forecasts. Vendors examined: Adtran, ADVA, Alaxala, Ciena, Cisco, Ekinops, Ericsson, Fiberhome, Fujitsu, Fujitsu NC, Huawei, Infinera, Juniper Networks, Mitsubishi Electric, NEC, Nokia, Padtec, RAD, Tejas Networks, Ribbon Communications, Telco Systems, Xtera and ZTE. |

| About Cignal AI |

Cignal AI provides active and insightful market research for the networking component and equipment market and its end customers. Our work blends expertise from various disciplines to create a uniquely informed perspective on the evolution of networking communications.

…………………………………………………………………………………………………………………………………………………………………………………….. Some of the Optical Transport Equipment vendors are: Ciena, Cisco, ADVA Optical networking, Aliathon Technology, ECI Telecom, Ericsson, Fujitsu, Alcatel-Lucent, Furukawa Electric / OFS Russia, Huawei Technologies, Micron Optics

|

Telegeography: Strong international bandwidth demand in LatAm; Global Internet traffic and bandwidth increased in 2020

TeleGeography’s latest research on Latin America shows that international bandwidth demand is strong in the region. With an ongoing surge in new submarine cable deployments, content providers are expanding their geographic reach as both owners and anchor customers of new cable systems.

The market research firm reported in August that the average international internet traffic increased 48% in 2020 while internet bandwidth was up 35%, the biggest increase since 2013. In its annual report on submarine networks and capacity, TeleGeography said the global Internet “bent but – for the most part – did not break” during the COVID-19 pandemic. However, the market research firm wrote that the spike in bandwidth and traffic growth in 2020 is probably a one-time event and a return to typical rates of growth is likely when the pandemic restrictions end.

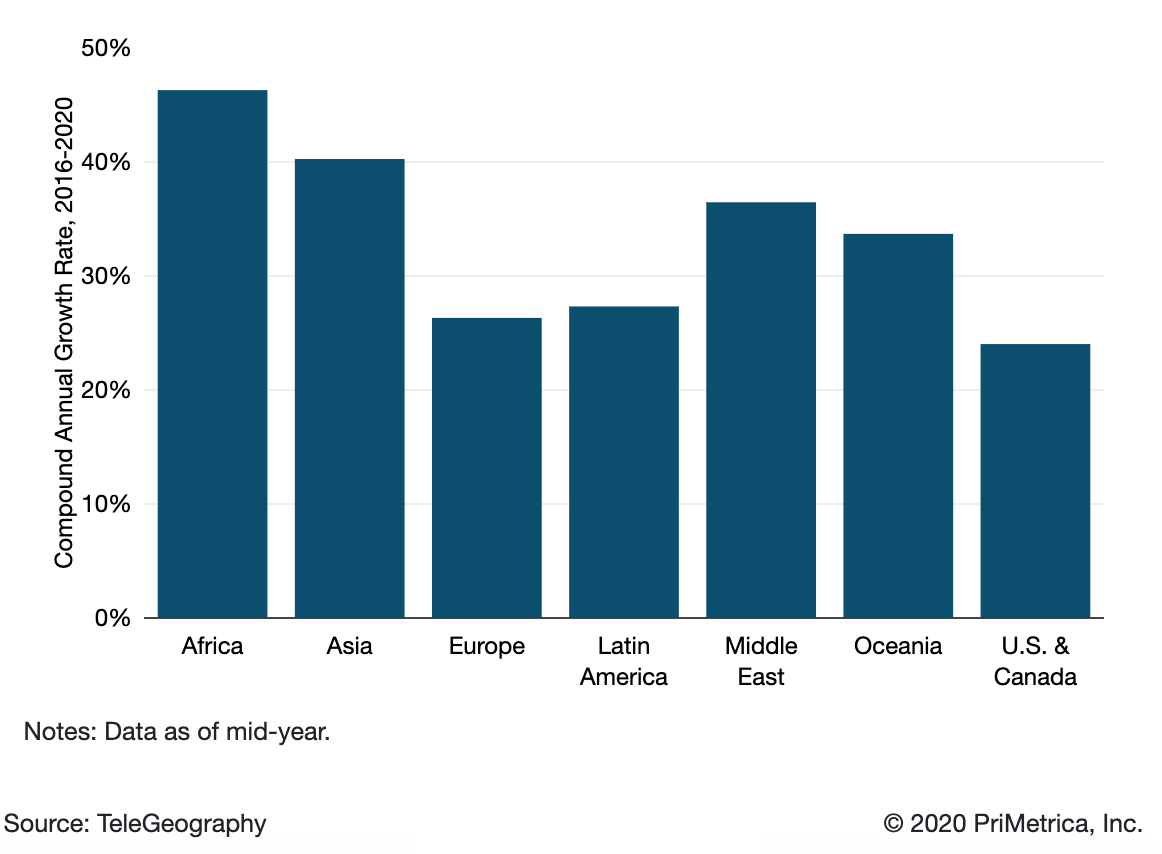

International Internet Bandwidth Growth by Region:

International internet traffic growth largely mirrors that of internet capacity. However, traffic and capacity growth seldom move in perfect tandem. (Network operators will often add capacity in anticipation of traffic growth.). Average and peak international internet traffic increased at a compound annual rate of 30% between 2016 and 2020, comparable to the 29% compound annual growth rate in bandwidth.

Based on discussions with network operators worldwide, TeleGeography believes the trends of recent years will continue. While international Internet bandwidth and traffic growth had been gradually slowing prior to 2020, growth remains brisk. Africa has experienced the most rapid growth in international bandwidth, growing at a compound annual rate of 47% from 2016-2020, with Asia just behind at 40%.

What won’t change is the role of U.S. web giants Google, Microsoft, Facebook and Amazon. They have become far and away the dominant users of international bandwidth, accounting for 64% of all used capacity in 2019. Across six of the world’s seven regions, they added capacity at a compound annual rate of above 70% between 2015 and 2019, compared to a rate of less than 45% for others. Their rapid expansion into subsea capacity has caused a major shift in the global wholesale market, TeleGeography says.

That presence “drives scale to establish new submarine cable systems and lower overall unit costs.” The OTT firms have become a key part of the subsea cable business model. Many of the big cables, invested in by both telcos and Internet players, now rely on the initial capital injection from the Internet content players. This means a share of network capacity or fiber pairs can be allocated to the largest consumers to cover initial costs, with the remaining shares sold as managed wholesale bandwidth.

TeleGeography states that both content players and telcos are trying to cope with massive growth in demand, driven by new applications and greater penetration into emerging markets. “The sheer growth in supply will drive lower unit costs for bandwidth,” it says. “In the face of unrelenting price erosion, the challenge for wholesale operators is to carve out profitable niches where demand trumps competition.” Prices vary enormously even though they are falling sharply. London and Singapore prices have declined 25% since 2017, yet Singapore tariffs are much higher; a 10 GigE port costs roughly three times as much, for example. Thanks to capacity upgrades, the prices for 10 GigE ports in São Paulo and Sydney fell 38% and 22% compounded annually over the past three years. TeleGeography warns that while the unit cost savings from the large cable investments are an incentive to investment for operators, they don’t want to be left with too much excess bandwidth. “It’s often a race to offload wholesale capacity before a new generation of lower-cost supply emerges.”

TeleGeography predicts $8.1 billion worth of new cables will be launched between 2020 and 2022 with the biggest share, $2.3 billion, invested in the trans-Pacific route. But the research firm cautions that the pandemic could disrupt supply. “Temporary cable factory closures combined with delays in permitting and marine installation could hamper the deployment of many planned cables.”

References:

https://blog.telegeography.com/internet-traffic-and-capacity-in-covid-adjusted-terms

https://www2.telegeography.com/covid19-state-of-the-network

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

5G Network Slicing Tutorial:

While there is no ITU-T recommendation to implement 5G network slicing, 3GPP Network Slicing requirements are included in 3GPP TS 22.261, Service requirements for the 5G system Stage 1, for Release 15 and updated for Release 16. As defined by 3GPP, Network slicing allows the 5G network operator to provide customized networks with different QoS capabilities.

A Network Slice is a logical (virtual) network customized to serve a defined business purpose or customer, consisting of an end-to-end composition of all the varied network resources required to satisfy the specific performance and economic needs of that particular service class or customer application. The ideas in play in developing and progressing the ‘slice’ concept draw on a progression of similar but simpler parallels in preceding network architectures including IP/Ethernet networking services (VLANs, IP VPNs, VPLS, etc.), and broaden the scope to include a wide range of access and core network functions from end-to-end and from the top to the bottom of the networking stack. Network slicing offers a conceptual way of viewing and realizing service provider networks by building logical networks on top of a common and shared infrastructure layer. Network slices are created, changed and removed by management and orchestration functions, which must be considerably enhanced to support this level of multi-domain end-to-end virtualization.

Here are a few use cases for 5G network slicing, which will likely to lead to different phases of adoption:

• Network Slicing can be used for operational purposes by a single network operator, to differentiate characteristics and resources for different broad

classes of services

• Network slicing can be used by a service provider seeking to establish a virtual service provider network over the infrastructure of a physical network operator

• Network slicing can allow individual end customers (enterprises) to be able to customize a virtual network for their operations and consume these network resources in a more dynamic way similar to today’s cloud services (i.e. dynamically varying scale, or for temporary needs).

• Network slicing can allow for “traffic splitting” across networks (5G, 4G, and WiFi via hybrid fiber-coax).

………………………………………………………………………………………………………………………………………………………………………………………………..

Ericsson launches 5G RAN Slicing to spur 5G business growth:

- New software solution enables communications service providers to deliver innovative 5G use cases to consumers and enterprises with guaranteed performance

- Built on Ericsson radio expertise and a scalable and flexible architecture, the new solution supports customized business models and growth requirements of advanced use cases

- Ericsson 5G RAN Slicing strengthens end-to-end network slicing capabilities needed to deliver different services over a common infrastructure

Network slicing supports multiple logical networks for different service types over one common infrastructure. It is a key enabler for unlocking 5G revenue opportunities such as enhanced video, in-car connectivity and extended reality, Ericsson said.

Ericsson said what makes its product distinct is that it boosts end-to-end management and orchestration support for fast and efficient service delivery. This gives service providers the differentiation and guaranteed performance needed to monetize 5G investments. Ericsson’s network slicing platform is already in use in the consumer segment and for enterprise applications such as video-assisted remote operations, AR/VR, sports event streaming, cloud gaming, smart city, and applications for Industry 4.0 and public safety. Customers working with the system include KDDI and Swisscom.

An Ericsson report estimates USD 712 billion in an addressable consumer market for service providers by 2030. The addressable market for network slicing alone in the enterprise segment is projected at USD 300 billion by 2025 (GSMA data). As 5G scales up, service providers are looking to maximize returns on their investments by targeting innovative and high revenue-generating use cases such as cloud gaming, smart factories, and smart healthcare.

Toshikazu Yokai, Executive Officer, Chief Director of Mobile Technology, at KDDI, says: “End-to-end slicing is key to monetizing 5G investment and RAN slicing will help make that happen. Across different slices in our mobile networks, RAN slicing will deliver the quality assurance and latency required by our customers.”

Mark Düsener, Head of Mobile and Mass Market Communication at Swisscom, says: “We’re gearing up for the next stage of 5G where we expect to apply end-to-end network slicing, and RAN slicing is key to guaranteed performance. With efficient sharing of network resources across different slices, we will be able to provide communications for diverse 5G applications such as public safety or mobile private networks.”

Sue Rudd, Director, Networks and Service Platforms, Strategy Analytics, says: “Ericsson is the first vendor to offer a fully end-to-end solution with RAN slicing based on dynamic radio resource partitioning in under 1 millisecond using embedded radio control mechanisms to assure Quality of Service, Over the Air, in real time. This truly end-to-end approach integrates radio optimization with policy-controlled network orchestration to deliver inherently secure virtualized private RAN slicing without the loss of the 30 – 40 percent spectrum capacity due to ‘hard slicing’. Ericsson’s real-time dynamic RAN slicing bridges the ‘RAN gap’ to make e2e slicing profitable.”

About Ericsson 5G RAN Slicing:

The Ericsson 5G RAN Slicing solution offers a unique, multi-dimensional service differentiation handling that allows for the effective use of dynamic radio resource partitioning, slice-aware quality of service (QoS) enforcement, and slice orchestration functionality for service-level agreement (SLA) fulfilment. Built on Ericsson radio expertise and a flexible and scalable slicing architecture, the solution dynamically shares radio resources at 1 millisecond scheduling for best spectrum efficiency. This enables service providers to offer a variety of use cases with increased flexibility and versatility. It ensures end-to-end network slice management and orchestration support for fast service delivery and supports business models for virtual, hybrid and dedicated private networks. The solution can also power use cases for mission-critical and time-critical communication services.

References:

https://techblog.comsoc.org/2018/05/18/ieee-comsoc-papers-on-network-slicing-and-5g/

https://www.ericsson.com/en/network-slicing

https://www.telecompaper.com/news/ericsson-releases-5g-ran-slicing-software–1369987

Join an Ericsson live broadcast session: February 4, 2021 at, 3pm CET on LinkedIn, Facebook, Twitter, or YouTube