5G SA/5G Core network

Nokia to provide 5G SA core network for Volkswagen (private) and KDDI (public)

Nokia has deployed a 5G standalone (SA) core network at Volkswagen’s plant in Wolfsburg, Germany. The 5G private campus network covers the production development center and pilot hall at the plant. This network uses the Nokia Digital Automation Cloud (DAC) system to provide reliable and secure connectivity. Nokia’s DAC provides high-bandwidth and low-latency connectivity for sensors, machines, vehicles and other equipment.

Volkswagen will use the network to improve efficiency in production. The company is initially testing the wireless upload of data to manufactured vehicles and intelligent networking of robots and wireless assembly tools.

“By deploying private wireless to explore and develop its potential in manufacturing, Volkswagen underscores its leading position in leveraging digitalization to enhance efficiency and productivity,” commented Chris Johnson, head of Global Enterprise business for Nokia. “We are delighted to support this effort with the Nokia Digital Automation Cloud and our extensive experience in private wireless networks.”

The pilot network will allow Volkswagen to test whether 5G technology helps the company meet the demanding requirements of vehicle production, as well as increases efficiency and flexibility in series production of the future.

“Predictable wireless performance and the real-time capabilities of 5G have great potential for smart factories in the not-so-distant future. With this pilot deployment, we are exploring the possibilities 5G has to offer and are building our expertise in operating and using 5G technology in an industrial context,” said Dr.-Ing. Klaus-Dieter Tuchs, network planning at Volkswagen.

Nokia’s work with Volkswagen at its main German plant aligns with the vendor’s private 5G ambitions, as reported by German newspaper Handelsblatt in 2019. The company said at the time that it expects to provide 5G networks for German companies following the opening of the application procedure for local firms intending to use 5G frequencies on industrial campuses, highlighting not only its intention to offer its service for network planning, but also aims to operate the networks.

Nokia’s private network reach extends beyond Germany of course. The vendor has worked with industrial-type partners on LTE, 5G-ready and IP/MPLS networks around the world including at the Zeebrugge port in Belgium, the Irish Aviation Authority and the Société du Grand Paris (SGP), the state owned industrial company responsible for the Grand Paris Express metro project.

Resources:

Nokia Industrial Private Wireless

https://www.nokia.com/networks/industry-solutions/private-wireless/industry/

Nokia Digital Automation Cloud | Nokia

……………………………………………………………………………………………………………………….

On December 2nd, Nokia announced that Japanese network operator KDDI selected Nokia’s 5G Core and Converged Charging software to support its transition to a fully automated, cloud-native 5G SA Core network architecture.

Nokia’s cloud-native 5G Core’s near zero-touch automation capabilities help operators drive greater scale and reliability. Following the evolution of KDDI’s networks to 5G standalone core, subscribers will experience lower latency, increased bandwidth and higher capacity.

Nokia’s open 5G Core architecture gives KDDI the flexibility to be responsive to market demands while controlling costs by streamlining operations and unlocking crucial capabilities, such as network slicing. Developed around DevOps principles, Nokia’s 5G Core will automate the lifecycle management of KDDI’s networks, as well as enable continuous software delivery and integration.

Nokia will also deploy 5G monetization and data management software solutions including cloud-native Converged Charging, Signaling, Policy Controller, Mediation and Registers to capture new 5G revenue opportunities, enhance business velocity and agility, and streamline the operator’s network operations.

References:

Nokia deploys 5G private network at Volkswagen plant in Germany

Dell’Oro: 5G SA Core network launches accelerate; 14 deployed

According to a recently published report from Dell’Oro Group, revenues for the Mobile Core Network (MCN) market are poised for growth in 2022. The outlook has turned positive, starting in 4Q 2021, as 5G Standalone (SA) commercial launches begin to accelerate.

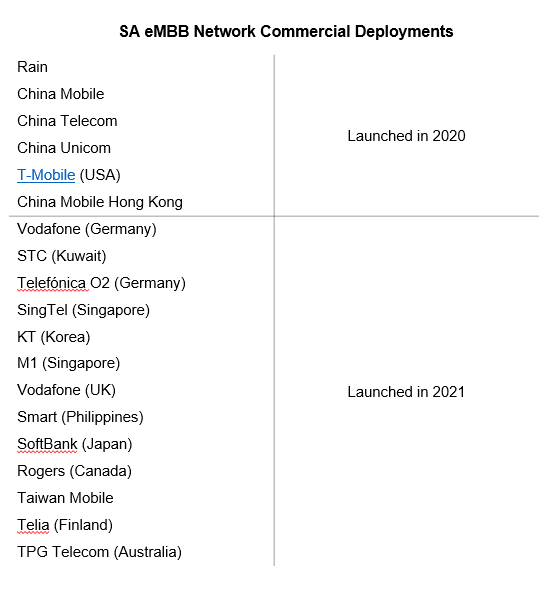

“The expected growth rate for 2022 is more optimistic than reported last quarter with the commercial deployments of more 5G SA enhanced Mobile Broadband (eMBB) networks,” stated Dave Bolan, Research Director at Dell’Oro Group. “We count 14 commercial 5G SA networks deployed by Communication Service Providers for eMBB services. Five of the 14 5G SA networks went commercial after the close of 3Q 2021 quarter. Europe had a surprising uptick in 3Q 2021 with 5G SA network commercial launches primarily in Germany,” Bolan added.

Additional highlights from the 3Q 2021 Mobile Core Network Report:

- MCN market revenues declined into negative growth year-over-year and quarter-over-quarter.

- The slowdown is attributed to a slowing of the 5G SA network buildouts in China.

- 5G Packet Core revenues for the quarter were spread across only six vendors: Ericsson, Huawei, Mavenir, NEC, Nokia, and ZTE.

13 January 2022 Update (SA=Stand Alone; eMBB=Enhanced Mobile Broadband 5G use case):

The Dell’Oro Group Mobile Core Network Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

Opinion:

It’s this author’s belief that the 5G SA core network market will be dominated by the hyperscale cloud service providers. In particular, Amazon AWS, Microsoft AZURE, Google Cloud, Oracle Cloud. 5G SA core network enables many hyped capabilities, such as network slicing, MEC, VoNR, automation, virtualization and others.

Addendum:

Please refer to Dave Bolan’s COMMENT in the box below this article. You can download a free whitepaper from the link there.

References:

5G Standalone Commercial Launches Accelerate Mobile Core Market, According to Dell’Oro Group

The Sorry State of 5G SA Core Networks- Smart Communications in Phillipines

Telcos Loss: Private 5G & MEC/5G SA Core Network – Cloud Giants Take Market Share

TIM Brasil, Ericsson, Qualcomm, Motorola test 5G SA for power distribution in LatAm

TIM Brasil has been carrying out a 5G Standalone (SA) pilot in Sao Paulo since August 2nd. It’s in partnership with energy distribution company Enel, reports Telesintese. The 5G SA tests in an electric substation in the neighborhood of Vila Olímpia are being conducted in the 3.5 GHz band and use Ericsson AIR 6449, AIR3227, and AIR 6488 antennas. Qualcomm provided a 5G Fixed Wireless Access (FWA) gen 2 CPE with Snapdragon X62 5G Modem, while Motorola provided Edge, Moto G 5G and Moto G100 smartphones.

Sensors installed by Enel in the substation allow remote control of the structure and identify in real time if there are faults or maintenance needs. According to the companies, this is the first pilot to use 5G in electrical distribution in Latin America.

Photo Credit: Telesintese

As Leonardo Capdeville explained to Tele.Síntese , the 5G worked as a backhaul link for Qualcomm’s CPE, which radiated the WiFi signal through the power substation. Sensors installed by Enel in the substation allow remote control of the structure and identify in real time if there are failures or maintenance needs.

Another application tested is related to the field team. Enel technicians use smartphones connected directly to 5G. These feature augmented reality programs that allow instant access to substation data and detail how to perform maintenance just by pointing the camera at the equipment.

This was the first pilot to use 5G in electrical distribution in Latin America, according to the companies.

Currently, Enel uses systems that connect via 3G to its control centers. Such a connection is much slower, and results in response times in the seconds.

With 5G, observe Fernando Andrade, responsible for the Engineering and Construction area at the distributor, the response time is between 1 to 5 milliseconds, opening the way for a more intense use of the concept of “self healing” networks, that is, networks that establish routes for energy as problems in one of them are identified.

PROJECT WILL BE BIGGER WHEN 3.5 GHZ SIGNAL IS RELEASED:

According to the executives, the project should evolve. Enel liked the result, noted gains in efficiency and speed in handling incidents. In the city of São Paulo there are 120 power substations that could be connected, but the executive goes further: “We started with the substation because it is a relatively controlled environment, but it is possible to spread the technology to the equipment throughout the network ”, he observed.

Andrade envisions the use of 5G for commanding drones, capturing and analyzing images. It even suggests that, in the future, garbage trucks bring cameras and sensors that analyze energy networks, freeing inspectors for other tasks.

Capdeville, from TIM, points out that the current test is based on a provisional license from Anatel, but that the antenna installed in Vila Olímpia must remain and be used to serve the 5G consumer in general as soon as the 3.5 GHz spectrum is released in the city – the operator was one of the buyers of the track in the auction held by the regulatory agency at the beginning of the month .

The 5G network pilot is part of Enel’s Urban Futurability project, which will transform Vila Olímpia into a digital and sustainable neighborhood with an investment of R$125 million from the Research and Development program of the National Electric Energy Agency (Aneel).

TIM and Enel, both companies with Italian origins, already have a partnership for research and development of products and in different areas. Enel is one of the companies hired by TIM to supply energy from renewable sources. In this case, the built-in solar power plants distributor in Bahia serves the tele consumer units.

In addition, Enel X, the energy company’s innovation arm, has a contract with TIM to develop solutions for smart cities – such as smart grid applications.

References:

https://www.telecompaper.com/news/tim-brasil-launches-5g-standalone-tests-with-enel–1404882

EXFO/Heavy Reading Survey: Nearly half of all mobile network operators plan to deploy 5G SA within 1 year

EXFO worked with Heavy Reading to conduct a survey of Mobile Network Operators (MNOs) across North America and Europe to understand their approach to 5G SA core network and the revenue opportunity it presents. 49% of MNOs are planning to deploy 5G SA within the next year, while a further 39% will deploy 5G SA within one to two years. The main drivers for deploying 5G SA are to support enhanced consumer offerings such as virtual reality, augmented reality and mobile gaming; accelerate time to market for new services; and offer network slice-based services.

While 76% of MNOs believe service assurance will be necessary to sell advanced 5G services and meet stringent service level agreements (SLAs), operations teams don’t have real-time visibility into how outages and degradations impact customers—whether they are humans or “machines” (critical, latency-sensitive applications and devices like emergency services or factory floor robots). 65% of MNOs say that this lack of actionable insight is preventing them from automating networks and fault resolution, which are essential to meeting demanding performance expectations in enterprise applications.

Specifically, most MNOs said they need a range of new tools and capabilities to generate revenues from 5G services:

- 86% say they need real-time network, service and quality of experience intelligence

- 85% say they need to be able to monitor per-service and per-device performance.

- 81% say they need AI-driven anomaly and fault detection, as well as root cause analysis.

- 82% say they need monitoring of end-to-end network slices.

“The opportunity to generate revenues from 5G SA lies in automated networks, which means service providers must deliver on enterprise service level agreements. This survey with Heavy Reading reinforces what we hear regularly from our customers: mobile network operators want greater service assurance and analytics to deliver actionable insights into network performance and user experience,” said Philippe Morin, CEO at EXFO. “This is where EXFO’s unique, adaptive approach to service assurance comes into play. By taking a source-agnostic approach to data collection and analytics, combined with a fully cloud-native architecture, our service assurance platform integrates with legacy and new 5G systems to provide a unified, end-to-end view of customer experience, device and network performance.”

5G NSA (LTE & EPC) 5G SA (NR connected to 5G core)

Benefits of 5G SA core network:

- MNOs can launch new enterprise 5G services such as smart cities, and smart factories

- It is fully virtualized, cloud-native architecture (CNA), which introduces new ways to develop, deploy and manage services

- The architecture enables end to end slicing to logically separate services

- Automation drives up efficiencies while driving down the cost of operating the networks.

- By standardizing on a cloud-native approach, MNOs can also rely on best of breed innovation from both vendors and the open-source communities

“When you look at the number of RFPs that are out there and the dialog we’re having, I think we’re now starting to see the need [to move]from what I would call studying or doing assessment, to potentially now looking at deploying [5G SA],” Morin said. He pointed out that there have been numerous announcements by carriers around 5G private networks and enterprise-based services, which he says are the initial drivers for 5G SA deployment — and are also driving the need for enhanced service assurance capabilities.

“When you’re talking about more business-focused use cases, service-level agreements become even more important and that’s why [there is a]need for service assurance,” Morin said. In contrast to previous network generations, where service assurance was often considered only after a variety of other decisions were made, the expectations of serving enterprise use cases are making service assurance a higher priority. “It’s pretty clear, as you deploy 5G SA, especially in the context of … [having]machines connected to this, IoT devices and so on, and more of an enterprise focus, that service assurance requirements are much more front and center than what we’ve seen in the previous protocols.”

Morin sites two key 5G SA capabilities that offer value:

- The ability to support billions of connections (massive machine-to-machine communications.

- Network slicing to enable differentiated services at scale.

With those opportunities, comes the requirement for MNOs to ensure that they can provide the levels of service and scalability that slicing and massive IoT demand — and that’s where operators will need better monitoring tools, visibility and insights, Morin says, and their acknowledgement of that need is reflected in the survey. EXFO’s joint survey found that 76% of the surveyed MNOs believe that service assurance will be necessary for deploying 5G SA. “I’m pretty sure we would not have the same stats, if you would’ve asked the same questions around 3G and 4G,” Morin added.

“If you’re going to have business use cases that machines are going to be relying on to be able to execute that application, machines won’t be as tolerant as humans, because the service won’t be able to operate. So what this means is that the network operators need a better view of insights on the network performance, that in the past, because it was for humans, maybe was not as required. But clearly, now, for 5G SA and 5G revenues that are going to be driven out of this, getting better visibility on what is happening that is down to the device level– not just the customer; the device, the service and the network — and end-to-end visibility will be really, really critical.”

There’s also the changing nature of service assurance and visibility strategy and tools to consider. As enterprises moved into making use of big data, their strategies and architectures often involved pouring network data into a massive data lake and then retrieving information from there as needed.

“With 5G, and 5G Standalone in particular, we absolutely believe that’s not going to be the architecture of choice. … You cannot wait for the issue to come up, and go into a data lake to try to figure out what happened in the last 15 minutes. We believe that it’s got to be real-time, it’s got to be adaptive — because you can’t start getting information from all the devices and all the IoT. This would have a big impact on your overall cost structure.”

Morin said that 5G SA core network’s cloud-based, orchestrated and automated nature enables the company to support machine-learning and generate insights only when an anomaly or service issue/problem is detected. AI will then determine whether data is needed from the device, service or network layer in order to resolve the issue(s).

“If you’re going to really make 5G SA a success, it will require a higher level of automation, and I do believe that service assurance will be what I would call an automation enabler. If you don’t have that capability to monitor and in an automated way, provide actionable insights to [a specifics]use case and to [a specific]SLA, I think it will be very difficult to go into a high-volume deployment with 5G SA.”

………………………………………………………………………………………………………………………………………………

Author’s Note:

Despite the optimistic results of this 5G SA core network survey, just 13 network operators had launched commercial public 5G SA networks as of the middle of August 2021. Some 45 other operators are planning or deploying 5G SA for public networks, and 23 operators are involved in tests or trials. That’s out of a total of 176 commercial 5G networks launched worldwide (163 of them are 5G NSA networks)!

Note also that there are no ITU standards or 3GPP specifications for how to implement a 5G SA Core network. There are many choices which will lead to different, incompatible implementations of the 5G Core network

References:

https://www.exfo.com/en/products/service-assurance-platform/nova-core/

https://www.exfo.com/en/resources/blog/mobile-private-networks-5g/

https://www.affirmednetworks.com/sa-and-nsa-5g-architectures-the-path-to-profitability/

Google Distributed Cloud for 5G network operators – another form of lock-in?

At Google Cloud Next ’21 the cloud giant announced Google Distributed Cloud, a portfolio of solutions consisting of hardware and software that extend Google cloud infrastructure to the edge and into the customer premises data center. This new offering permits wireless network operators to run their 5G core and radio access network (RAN) functions on Google Distributed Cloud in a variety of locations. These could include a telco’s own facilities, premises owned by customers or Google’s network of about 140 centers. One unifying theme is that hosting functions in a multitude of places – and not just a couple of big data centers – would shorten the distance that data signals must travel and cut service-interfering latency, a measure of the journey time. Functions can also be co-hosted with enterprise applications, according to Google.

In particular, Google Distributed Cloud can run across multiple locations, including:

- Google’s network edge – Allowing customers to leverage over 140+ Google network edge locations around the world.

- Operator edge – Enabling customers to take advantage of an operator’s edge network and benefit from 5G/LTE services offered by our leading communication service provider (CSP) partners. The operator edge is optimized to support low-latency use cases, running edge applications with stringent latency and bandwidth requirements.

- Customer edge – Supporting customer-owned edge or remote locations such as retail stores, factory floors, or branch offices, which require localized compute and processing directly in the edge locations.

- Customer data centers – Supporting customer-owned data centers and colocation facilities to address strict data security and privacy requirements, and to modernize on-premises deployments while meeting regulatory compliance.

The first products under this portfolio include Google Distributed Cloud Edge and Google Distributed Cloud Hosted. Google Distributed Cloud Edge is now available for preview, while Google Distributed Cloud Hosted set to become available in preview in the first half of 2022.

Google Distributed Cloud Edge is primarily aimed at wireless network operators. It is designed to exist in the operator edge, customer edge and Google edge locations, of which there are over 140 around the world.

while Google Distributed Cloud Hosted is meant for public-sector and commercial customers that need to meet strict data residency, security or privacy requirements. Both are fully managed and comprise hardware and software solutions, including artificial intelligence and analytics capabilities.

During a media briefing, Google Cloud’s VP and GM of Open Infrastructure Sachin Gupta said “This portfolio allows customers to focus on applications and business initiatives rather than management of their underlying infrastructure. In other words, they can just leave the complexity to us.”

Gupta added that the Distributed Cloud Edge product enables network operators to run 5G core and radio access network functions closer to users, allowing them to slash latency and “offer their enterprise customers high-speed bandwidth, with private 5G and localized compute.” In a blog, the executive added the product advances previously announced work with Ericsson and Nokia to deliver cloud-native network applications. He said that Distributed Cloud Hosted is a “safe and secure way to modernize on premises deployments without requiring any connectivity to Google Cloud.”

Google Distributed Cloud is built on Anthos, an open-source-based platform that unifies the management of infrastructure and applications across on-premises, edge, and in multiple public clouds, all while offering consistent operation at scale. Google Distributed Cloud taps into our planet-scale infrastructure that delivers the highest levels of performance, availability, and security, while Anthos running on Google-managed hardware at the customer or edge location provides a services platform on which to run applications securely and remotely.

Using Google Distributed Cloud, customers can migrate or modernize applications and process data locally with Google Cloud services, including databases, machine learning, data analytics and container management. Customers can also leverage third-party services from leading vendors in their own dedicated environment. At launch, a diverse portfolio of partners, including Cisco, Dell, HPE, and NetApp, will support the service.

As Google’s global network increases in reach, the company will be building out service-centric networking capabilities to simplify everything from connectivity to observability. For organizations with interconnects, VPNs, and SD-WANs, Networking Connectivity Center provides a centralized management model, with monitoring and visualization through our Network Intelligence Center. And, with Private Service Connect, partners and customers such as Bloomberg, MongoDB, and Elastic are now able to easily connect services without having to configure the underlying network.

Enterprises with workloads both on-premises and in the cloud can leverage hybrid load balancing to securely optimize application delivery. To help you detect and prevent malicious bot attacks, we recently integrated reCAPTCHA Enterprise with Cloud Amor. Together with Cloud IDS, the Google network edge is fortified with best-in-class security.

Obviously, virtualization is a network operator prerequisite so that network software runs on common, off-the-shelf compute servers. After virtualizing, network operators could theoretically integrate their networks with Google’s distributed cloud.

Iain Morris of Light Reading offers his opinion:

Operators might do this if they believe a deal with Google costs less than operating a private cloud, or if it promises other benefits. But it means giving the hyper-scaler a big say over technology strategy and would have been inconceivable just a few years ago, when the valuation gap between telecom players and Internet firms was not so extreme and telcos were much warier of tie-ups.

For a start, it would obviously hand prominent roles to Anthos, Google’s application management platform, and Kubernetes, a container orchestration platform that Google originally designed. Even when Google’s facilities are not being used, it will effectively manage the hardware and software.

Obviously, neither Ericsson or Nokia were listed as partners or systems integrators as their purpose built wireless network equipment and 5G SA core network software are in direct competition with 5G deployments using hyper-scale cloud service providers (AWS, Azure, Google Cloud) technology. Ericsson will launch virtual RAN software next year while Nokia´s AirScale Cloud RAN solution is in trials with major wireless network operators, including AT&T (which has outsourced its 5G SA core network to Amazon AWS). Nonetheless, those two major network equipment vendors made supportive comments:

“The announcement of Google Distributed Cloud supports Ericsson’s vision of the network becoming a platform of innovation, enabling companies across the ecosystem to deliver the applications of the future the way they need to, unlocking the full potential of 5G and edge,” said Rishi Bhaskar, Head of Hyperscale Cloud Providers for Ericsson North America.

“This announcement builds on our on-going partnership with Google Cloud to develop Nokia cloud-native 5G core and Nokia radio solutions for Google’s edge computing platform,” said Nishant Batra, Nokia Chief Strategy and Technology Officer. “By extending this relationship into Google Distributed Cloud Edge, we will increase customer choice and flexibility, ultimately helping our global customer base with multiple cloud-based solutions to deliver 5G services on the network edge.”

Curiously, there was no mention of software partners in Google’s announcement, but any RAN software would have to work with the underlying base station hardware. Who takes responsibility for that is something 5G network operators must resolve before committing to Google Cloud.

Iain says that network operators teaming up with cloud service providers is a new form of lock-in substituting cloud hyper-scalers from wireless network equipment vendors. He wrote:

What’s entirely unclear is why operators should worry less about dependency on Google than they currently do about their heavy reliance on Ericsson, Huawei and Nokia. Switching from one RAN vendor to another is costly but feasible, as swap-outs of Huawei in Europe are showing. Moving from one public cloud to another may be as tricky as quitting a crime syndicate. In 2019, Snapchat developer Snap warned in a regulatory filing that moving systems between public clouds would be “difficult to implement” and demand “significant time and expense.”

If this and other hyper-scaler offers take off, the real losers would probably not be Ericsson and Nokia – which can still sell radio units and provide RAN software – but the vendors of private cloud software, such as VMware and Red Hat (owned by IBM). More generally, the public cloud could also be a threat to some of Google’s own hardware partners. “The server vendors (Dell, HPE etc) also lose out,” says James Crawshaw, a principal analyst with Omdia (a sister company to Light Reading, in an email. “Although they are going to be building and shipping the Google boxes, I suspect the margins on these will be lower than the regular servers they sell enterprises.”

Few telcos have been as brave/reckless (delete according to bias) as Dish and gone all-in with a public cloud. That is partly because brownfield operators would be writing off the servers they already own. Nevertheless, Crawshaw expects public cloud usage to keep rising. “Servers are depreciated over three to seven years depending on the business and how fresh they like their IT,” he says. “So while the telcos will continue to run their own clouds, they will increase their public cloud usage over time and only partially renew their private estate.”

AT&T, Bell Canada, Telus, Telenet, TIM, Reliance Jio and Orange are all on the growing list of operators that have put some IT workloads on Google Cloud. “Some of these are running packet core and RAN applications as well,” says Gupta. Contrast that with Dish Network which is wholly reliant on the AWS public cloud and AT&T which has its own physical 5G RAN, but will use the public AWS cloud for its 5G SA core network.

“Some years ago, everyone was saying we would have vendor lock-in with Ericsson, Huawei and Nokia and no one mentioned Oracle and Cisco and now the light is on hyper-scalers,” said Yves Bellego, Orange’s director of network strategy, during a recent interview with Light Reading. “In fact, that risk is something we have always been very concerned about.” That would imply cloud hyper-scaler lock-in is something network operators must carefully evaluate.

…………………………………………………………………………………………………………………………………………….

References:

https://www.fiercetelecom.com/telecom/google-targets-telcos-new-distributed-cloud-infrastructure

https://telecoms.com/511704/google-launches-a-more-flexible-iteration-of-its-cloud-portfolio/

Telefónica Deutschland/O2 “pure 5G” with DSS, Open RAN and 5G SA

One year after the 5G launch, Telefónica Deutschland / O2 confirms their 5G network will cover over 50 percent of the German population by the end of 2022. The company is also on track to cover of over 30 percent of the population by the end of 2021. The basis for this 5G network expansion is the investment of around four billion euros until the end of 2022.

The focus of this 5G network expansion is on so-called “pure 5G” via the mid-band 3.6 GHz frequency. The 3,000th 3.6 GHz antenna just went live in the O2 5G network. Meanwhile, Telefónica Deutschland / O2 is installing around 180 of these 5G antennas in the network every week, tendency further increasing. The company is expanding 5G twice as fast overall compared to 4G and is fully on track to supply all of Germany with 5G by the end of 2025.

As with 2G, 3G and 4G, we are also bringing 5G to mass market readiness in Germany through rapid network expansion, network investments in the billions and products with the best price-performance ratio,” said CEO Markus Haas on the first anniversary of the 5G launch in the O2 network.

“Since the beginning, we have aligned the 5G roll-out with the concrete benefits for private customers and businesses. This is the most effective way for us to drive forward the urgently needed digitisation for business and consumers. Today, one year after the launch, our 5G network is already live in a hundred cities. And current international tests confirm that it is the fastest 5G network in Germany. Now we will also quickly bring the O2 5G network to the area.”

The added value of 5G for private customers in this early expansion phase, beyond the performance advantages, lies primarily in the additional network capacities provided by the new mobile communications standard. In the first half of 2021, the O2 mobile network transported 1 billion gigabytes of data, an absolute record. Cities are data traffic hotspots. The growing number of urban 5G users is increasingly shifting parts of this data traffic to the 5G network, thus relieving the 4G network. In this way, the O2 5G network also ensures a consistently good network experience for 4G users of all Telefónica Deutschland / O2 brands and partner brands.

Market penetration with 5G is visibly gaining speed. In the meantime, 5G smartphones account for more than 50 percent of all end devices sold through Telefónica Deutschland / O2 sales channels. In line with this, Telefónica Deutschland / O2 is now moving the 5G network expansion more strongly into the area. Here, too, the telecommunications company is focusing on so-called “pure 5G” via the 3.6 GHz frequency. In the future, it will provide private and business users with multiple gigabit data speeds and response times (latency) of just a few milliseconds.

This is where “pure 5G” differs from the combined 4G/5G via Dynamic Spectrum Sharing (DSS), which currently prevails in other German 5G networks [1.]. 5G shares lower frequency bands with 4G at comparable performance levels. Where it is a useful 4G extension in selected areas, the company will also use Dynamic Spectrum Sharing. In addition, it is partially rolling out 5G purely over the 700 MHz frequency to accelerate area rollout and lay the groundwork for the upcoming 5G Stand Alone in the O2 network. The first sites are already live.

Note 1. Both Vodafone Germany and Telekom Deutschland use DSS to facilitate the rollout of 5G by sharing spectrum between 4G and 5G networks: Vodafone has deployed the technology to switch 700MHz frequencies back and forth between 4G and 5G, while Telekom Deutschland is rolling out DSS as part of a 5G expansion drive and is apportioning 5MHz of its 2.1GHz resource for 4G and 5G as needed. Telefónica Deutschland, which has already said it would use DSS for deployment in rural areas, conceded it will use DSS for 4G expansion in “selected areas.” The operator also appeared to indicate that its 5G deployment over 700MHz will be only partially “pure,” in order to accelerate its network expansion.

Photo Credits: Henning Koepke / Telefónica Deutschland

Photo Credits: Henning Koepke / Telefónica Deutschland

Telefónica Deutschland / O2 is continuously increasing its 5G network expansion despite parallel major projects such as the 3G switch-off and densification of the 4G network. In addition, the company has set the course for its 5G network of the future in the last twelve months. Telefónica Deutschland / O2 was the first German network operator to bring the innovative open architecture Open RAN for the mobile access network out of the laboratory and into live operation.

The conversion to Open RAN will start before the end of this year. It will give the company greater flexibility in the choice of manufacturers and, as a primarily software-based solution, simplify and accelerate the upgrading of base stations. Telefónica Group has appointed NEC as systems integrator for open RAN trials in its four main markets – Spain, Germany, the UK and Brazil.

O2 plans to deploy Open RAN later this year

In addition, Telefónica Deutschland / O2 achieved the first frequency bundling in the 5G live network in this country via carrier aggregation, which further accelerates 5G for customers and ensures a stable high data throughput. The O2 network also recently saw the German premiere of the first voice call directly via the 5G live network. These 5G calls do not take a diversion via the 4G network and thus no longer interrupt ongoing 5G data connections. Finally, Telefónica Deutschland / O2 now operates an independent 5G core network (no explanation given for what that means?).

The company has thus created the basis for freeing the new network from its technical dependence on 4G and will provide a 5G core network for 5G Stand Alone (SA). In future, this will enable private and business customers to use even the most demanding 5G applications. Technically, the company is already in a position to roll out a nationwide 5G Stand Alone network.

As soon as 5G Stand Alone offers real added value for customers, O2 will activate the technology. For example, when enough end devices in the market support 5G SA. Telefónica Deutschland is working with Ericsson for its 5G core network, but noted that the deployment of open radio access network (RAN) technology will ensure access to a wider group of vendors.

Over the past year of 5G service, Telefónica Deutschland / O2 has started to move their 5G core network for industrial applications to the cloud. This will significantly simplify the establishment of 5G campus networks, accelerate the introduction of new industrial applications for companies and shorten the time to market for new products and applications, according to the company.

The rapid expansion of the 5G network helps Telefónica Deutschland / O2 to pursue its corporate goal of offering its customers the greenest mobile network in Germany by 2025. 5G transmits significantly more energy-efficiently than the predecessor standards. The conversion of 3G to 4G and 5G network technology alone will reduce the power consumption of the O2 network by up to 90 percent per transported byte. In addition, the company will make a significant contribution to achieving Germany’s climate targets overall. Its 5G network will pave the way for digital solutions and all-round connectivity, helping other industries to save CO2 emissions and develop sustainable business models.

References:

https://www.lightreading.com/5g/o2-germany-boasts-of-pure-5g-but-concedes-dss-need/d/d-id/772583?

The Sorry State of 5G SA Core Networks- Smart Communications in Phillipines

Very few 5G SA core networks of any size have been launched to date. According to the Global Mobile Suppliers Association (GSA), just 13 network operators had launched commercial public 5G SA networks as of the middle of August 2021. Some 45 other operators are planning on deploying 5G SA for public networks, and 23 operators are involved in tests or trials. That’s out of a total of 176 commercial 5G networks launched worldwide (163 of them are 5G NSA networks)!

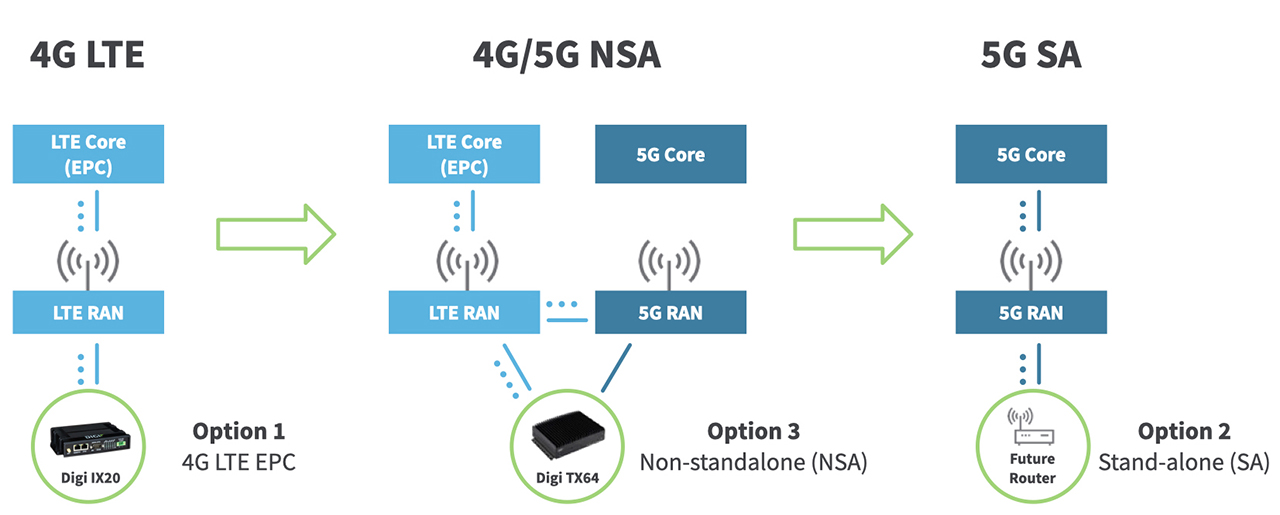

Note that there is NO 5G core network in 5G NSA as per middle of this chart:

In the U.S., T-Mobile’s 5G SA has not provided the much touted benefits such as network slicing, automation, service chaining, network management, etc. “The light version of 5G standalone,” summed up analyst Roger Entner, founder of Recon Analytics.

For T-Mobile, the immediate incentive and upside to deploy SA 5G was making its midband 2.5GHz 5G more relevant, Entner said. As in, keeping its low band 600MHz 5G non-standalone as the pilot signal would lead to fewer phone screens lighting up with its mid band 5G, especially indoors.

“Now that 2.5GHz signal can piggyback on the 600 pilot,” he said. “With that, they get better penetration in the building with 2.5.”

Karri Kuoppamaki, SVP of radio network technology and strategy at T-Mobile, said that “the vast majority” of the carrier’s 5G customers had SA-ready SIMs, but he didn’t offer more specifics about the state of its standalone deployment. Those customers may not necessarily realize they’ve gotten anything special from SA 5G at T-Mobile, but that may not matter either, given the superiority of the carrier’s mid-band 5G.

“Standalone 5G is a means to an end,” said Craig Moffett, analyst with MoffettNathanson. “Ultimately, what matters is network capability. Being first gives T-Mobile just one more edge in network performance.” Avi Greengart, founder and lead analyst at Techsponential, concurred.

“For now, smartphone buyers should focus on finding the best combination of speed and coverage that is available in their area,” he said in an email. “That is often T-Mobile’s 5G network, but the technical underpinnings are somewhat less important to average consumers than the amount and frequency of the spectrum that T-Mobile has to deploy thanks to its acquisition of Sprint.”

………………………………………………………………………………………………………………………………………….

Smart Communications is one of the few wireless network operators in the world to have launched a 5G standalone (SA) network. The Philippines-based telco is using a separate 5G core and operating a network that is no longer anchored to 4G LTE (5G NSA). The new infrastructure supports network slicing and opens up industrial and enterprise opportunities, for example.

Smart’s 5G SA network is not yet widely available. In fact, it has been launched only in Makati – a city in the Metro Manila region and the country’s financial hub. PLDT-owned Smart said its “first batch” of 5G SA sites is fully operational. Smart noted that it has now deployed more than 4,000 non-standalone 5G sites nationwide, supported by PLDT’s 524,000 kilometer fiber network. Smart first launched 5G services in 2020.

Smart has collaborated with Ericsson, Huawei and Nokia on 5G, although it only name-checked the Swedish vendor in today’s release. For example, Smart said it has teamed up with Ericsson to develop 5G use cases at the PLDT-Smart Technolab, which currently hosts one of the 5G SA sites.

“Through the years, PLDT and Smart have been at the forefront of breakthrough innovations in the telco industry, including 5G. With the first batch of our 5G SA sites now fully operational, we are starting to see the true capabilities of 5G which will play a critical role in the advancement of massive IoT, health care and smart cities, delivering customer experience that is truly world-class” said Alfredo Panlilio, PLDT and Smart Communications president and CEO.

“Technology plays an important role in today’s society as evidently seen during the pandemic. 5G SA, as an innovation platform, will create new opportunities for enterprises and consumers that will maximize its ultra-reliable and low latency capabilities. This enables industrial automation, autonomous mobile robotics deployment, safe remote crane operations, fast response in gaming and interactive video streaming, among others. We are creating opportunities for the Filipino Enterprises to compete in the global arena,” said Mario Tamayo, head of technology at PLDT and Smart.

With the activation of the first 5G SA sites at the PLDT and Smart headquarters in Makati, Smart has upgraded its 5G facilities, enabling them to connect with the 5G core network.

With 5G SA in place, Smart said it will be able to offer Voice over New Radio (VoNR) and network slicing capabilities in the short term, as well as support new industrial and enterprise opportunities. Smart made its first successful VoNR call in July this year at the Technolab in Smart Tower in Makati City.

Smart is certainly the first to launch 5G SA in the Philippines, while rival Globe Telecom is testing the technology. Globe had 81.7 million mobile subscribers and Smart 71.7 million at the end of the second quarter. Smart and Globe still dominate the Philippines mobile market, despite a challenge from China Telecom-backed newcomer Dito Telecom.

About Smart Communications:

More than 650 global brands—including those in the most highly regulated industries and all the G15 investment banks, rely on Smart Communications to deliver meaningful customer communications across the entire lifecycle—empowering them to succeed in today’s digital-focused, customer-driven world while also simplifying processes and operating more efficiently. This is what it means to scale the conversation.

References:

https://www.lightreading.com/asia/smart-trumpets-standalone-milestone-with-5g/d/d-id/772511?

https://www.smartcommunications.com/resources/press-releases/

https://www.rcrwireless.com/20211004/5g/smart-activates-5g-sa-network-headquarters-philippines

Telcos Loss: Private 5G & MEC/5G SA Core Network – Cloud Giants Take Market Share

Canada’s TeraGo to Complete 5G Core Network for 5G FWA and private 5G network applications

Canadian network operator TeraGo said it is on track to complete its planned 5G core network expansion projects for this year, as the company prepares to deploy 5G fixed wireless access services to its existing customer base and 5G private networking applications for new customers.

TeraGo plans to achieve its goal using the capital raised earlier this year to increase capacity and throughput in its core network and to its wireless hub sites. This initiative is necessary to provide the network bandwidth that 5G fixed wireless access and private networks will require.

5G private networking applications are expected to take advantage of the security, high speed, and low latency that TeraGo’s licensed mmWave spectrum offers (not that 5G mmWave frequencies have yet to be agreed on in the still uncompleted revision 6 to ITU-R M.1036).

TeraGo 5G: TeraGo has Canada’s largest nationwide millimeter wave spectrum holdings, including the 7 largest cities in the country. Throughout 2021 and beyond, TeraGo will continue to invest in 5G technology trials and proof of concepts to explore how 5G Fixed Wireless solutions can be brought to market and solve real-world problems for our customers.

KEY FEATURES:

- Largest mmWave spectrum holder in Canada, including the 7 largest cites in the country

- Edge Computing (requires 5G SA Core network)

- Industrial IoT Applications (can use 5G NSA or 5G SA Core network)

SOURCE: TeraGo

………………………………………………………………………………………………………………………………..

To enable these new applications, TeraGo is expanding its overall network capacity this year by five to six times its pre-expansion levels. Nokia supplies TeraGo with 5G network equipment with customer premises gear from Askey Computer and Inseego.

“We continue to diligently work through our network upgrade plan, which includes over 50 projects that we expect to complete by year-end,” said Matthew Gerber, Chief Executive Officer (CEO) at TeraGo.

“Some of these projects include things like new fiber optic connections to our hub sites and core network link upgrades to 100 Gbps. We have completed over 40 of these projects to date and are currently on track to achieve our project objectives by the end of the calendar year. We will continue to target installing some of our first customer pilot installations over the next couple of months and remain confident in our ability to establish TeraGo as one of the first operators to launch commercial mmWave 5G fixed wireless and private networking services in Canada.”

About TeraGo:

TeraGo owns a national spectrum portfolio of exclusive 24 GHz and 38 GHz wide-area spectrum licenses including 2,120 MHz of spectrum across Canada’s 6 largest cities. TeraGo provides businesses across Canada with cloud, colocation and connectivity services. TeraGo manages over 3,000 cloud workloads, operates five data centers in the Greater Toronto Area, the Greater Vancouver Area, and Kelowna, and owns and manages its own IP network.

TeraGo offers a managed SD-WAN service as described in this blog post.

The Company serves business customers in major markets across Canada including Toronto, Montreal, Calgary, Edmonton, Vancouver, Ottawa and Winnipeg.

For more information about TeraGo, please visit www.terago.ca.

References:

https://terago.ca/what-is-managed-sd-wan-and-why-you-need-it/

http://www.apofc.com/news/show.php?itemid=359

IBM will build Telefónica’s 5G core network with Cloud Pak for Network Automation, Red Hat OpenShift and Juniper networking

IBM has been awarded a multi-year contract to help Telefonica build its new ‘Unica Next’ cloud-based 5G core network platform. In a statement, IBM said the Spanish operator has engaged IBM Global Business Services – the consultancy arm of IBM, Red Hat and Juniper Networks – to deploy an “open-standard open-networking” platform across multiple central, regional and distributed data centers to deliver low latency and high bandwidth services.

As a member of the IBM Cloud for Telecommunications ecosystem, Juniper is proud to support IBM and Red Hat as they work with Telefónica to build and deploy a modern 5G network. Juniper says it is committed to bringing the power of open hybrid cloud architecture to clients around the world.

The partners said the first Unica Next data centers are set to be inaugurated in October 2021 with a scalable architecture designed to address ETSI and other relevant industry standards (there are none for 5G SA core network). The new network is built on IBM Cloud Pak for Network Automation, Red Hat OpenShift and Juniper Networks Apstra and QFX technology to deliver end-to-end orchestration and operations.

These new capabilities will be engineered to allow Telefónica to more quickly deploy network services and new network functions, leveraging the IBM Cloud for Telecommunications partner ecosystem. Telefónica, as a pioneer in the adoption of open networks, has already deployed a live implementation using the IBM Cloud for Telecommunications in Europe and is continuing to innovate for their customers with speed and improved value.

IBM added that the combination will give Telefonica increased observability and control for managing the Unica Next Kubernetes environment and drive 5G and edge innovation more quickly and with less complexity. Its IBM Cloud Pak for Network Automation product is AI-powered automation software designed to provide extreme automation, zero-touch provisioning and closed loop operation capabilities.

“We are proud to partner with Telefónica to reach this historic moment for the telecommunications industry in Europe,” said Steve Canepa, managing director, IBM Global Communications Sector. “This implementation of Telefónica’s cloud-native, 5G core network platform reflects IBM’s significant investments in AI-powered automation software and the telco prime systems integration expertise required to deploy modern telecommunication networks – core, access, and edge. We are energized by the opportunity to enable Telefónica and all our clients to modernize their networks and enable new revenue-generating services that deliver tremendous value to consumer and enterprise customers.”

IBM Global Telco Solutions Lab in Coppell, Texas, connected along with Telefónica’s Network Cloud Lab in Madrid, will help accelerate UNICA Next’s evolution by building new fully integrated releases using CI/CD methodology for ongoing life-cycle upgrades to the existing UNICA Next platform. By working with IBM in this way, Telefónica will be able to increase agility and data security and continue to innovate and transform, drawing on IBM’s large network function ecosystem, Red Hat’s vast ecosystem of certified partners, and Juniper’s relationships with network function and hardware vendors.

Telefonica has already deployed a live implementation of the open network using the IBM cloud for telecommunications in Europe. The partners also announced that IBM Global Telco Solutions Lab in Coppell, Texas, will be connected to Telefonica’s Network Cloud Lab in Madrid to help accelerate Unica Next’s evolution by building new fully integrated releases using CI/CD methodology for ongoing life-cycle upgrades.

“Building out the UNICA Next platform with its next-generation network architecture shows how important it is to build the infrastructure now to support the deployment of 5G. 5G has the potential to support thousands of use cases and applications for consumers and enterprises in all industries. Our collaboration will not only help us to harness the potential of 5G, but also prepare for the future through a hybrid-cloud led technology and business transformation. With IBM, Telefónica is combining the latency and bandwidth advancements of 5G with the customization and intelligence of the cloud: we anticipate the results will be transformative in Europe and beyond,” said Javier Gutierrez, director of strategy, network, and IT development for Telefónica.

It’s interesting that last year, Telefónica Germany said it would build it’s 5G core network on AWS for the public cloud infrastructure and Ericsson for the core and orchestration components.

References:

https://www.telecompaper.com/news/ibm-to-help-telefonica-build-5g-core-network-platform–1398173

https://www.ibm.com/industries/telecommunications/network-automation

Telefónica Germany builds 5G core network on AWS to capture Industry 4.0 market

Nokia & Vodafone Turkey new milestone in optical transmission speed; Nokia -UScellular 5G SA/Core Network agreement

Nokia claims a new speed record with Vodafone Turkey with a regional demonstration of a 1 Tbps per channel coherent transmission over a live optical network. The companies proved a capacity increase of 150 percent over a single channel coherent transmission, and the ability to scale network capacity up to 70 Tbps per fiber. This capacity milestone is part of an ongoing modernization effort with Nokia to future-proof Vodafone Turkey’s optical network architecture.

This optical transmission test builds upon an earlier trial conducted by Nokia and Vodafone Turkey that validated a 1Tbps clear channel IP router interface, further preparing the operator’s network for the future.

The optical network speed test showcased 1 Tbps capacity over 130 GHz bandwidth without any errors on Vodafone Turkey’s live optical network between its data centers. The trial was conducted over the operator’s in-service optical network, based on Nokia’s wavelength routing technology, which includes its non-blocking CDC-F ROADM optical switch architecture. Supporting operation over C+L bands, Nokia’s optical line system also enables a doubling of the total fibre capacity of Vodafone Turkey’s network.

Nokia’s photonic service engine (PSE) technology, providing maximum performance and spectral efficiency. The Nokia PSE coherent optics are deployed in Vodafone Turkey’s network using the 1830 PSI-M (Photonic Service Interconnect-Modular) compact modular optical networking platform, optimized for data center interconnect applications over metro, regional and long-haul distances.

Thibaud Rerolle, CTO at Vodafone Turkey, said: “At Vodafone Turkey, we are committed to using next generation technology to provide the most convenient services to our customers – uninterrupted and reliably. Our fiber optic backbone is an important step on the way to 5G and, with Nokia, we continue to equip our optical network with the latest technologies and innovations for our services today and in the future.”

James Watt, Head of Optical Networks Division, Nokia, said: “Our field-proven optical technologies and solutions are enabling service providers like Vodafone Turkey to meet growing capacity demand and provide the best end-user experience. We are pleased to complement our deployment of advanced optical transport solutions with the successful and timely completion of this crucial trial to modernize Vodafone Turkey’s optical network. Together, we are accelerating their digital transformation with solutions that can be easily scaled to meet 5G demands.”

References:

………………………………………………………………………………………………………………………………..

Separately, Nokia today announced that it has been selected to roll out UScellular’s standalone 5G core network with deployment expected to be completed by the end of 2022.

- UScellular will deploy Nokia’s portfolio of hardware, software and services to enable its 5G standalone (SA) core network

- UScellular’s 5G SA network will provide its 5 million customers with superior service, capacity, and reliability

By implementing Nokia’s 5G SA core, UScellular will be able to unlock the full potential of 5G for its customers, delivering the high speeds and low latencies that will power new applications such as virtual and augmented reality. UScellular will also be able to leverage Nokia’s cloud-native, open modular structure to rapidly introduce and scale future network functions for new revenue opportunities.

UScellular’s deployment of Nokia’s 5G core adds to its existing support for the Radio Access Network (RAN) where Nokia is supplying its AirScale radios for both low-band and mmWave 5G.

Mike Irizarry, Executive Vice President and Chief Technology Officer, UScellular:

“As we continue to expand and enhance our 5G network, we value the innovation and support that Nokia provides to help us deliver a superior wireless experience to our residential and business customers. As we deploy 5G SA core, Nokia brings expertise, technology excellence and the right mix of hardware, software and services to meet our requirements for high performance and low latency.”

Ed Cholerton, President of Nokia North America:

“We are thrilled to be selected by UScellular to deliver a full 5G experience to its customers. Our 5G SA core and 5G radios provide not only new capabilities, scale, operational efficiencies, and revenue opportunities, but drive a far better user experience that customers expect. Working with UScellular to provide the core network function software and cloud infrastructure continues our momentum in the North American standalone 5G core market.”

Nokia’s 5G SA core is a cloud-native architecture with network functions deployed as microservices that can be moved to the network edge to meet low latency requirements for software-driven services, like network slicing. Globally, Nokia has already deployed over 250+ cloud core networks and 70+ 5G standalone core networks.

……………………………………………………………………………………………………………………….

Nokia said its 5G SA core is currently deployed in more than 70 networks globally, but very few of those are commercially available.

Nokia also sold its 5G SA core to T-Mobile US, the first operator to deploy a 5G SA core. It remains the only U.S. operator with a commercially available standalone 5G network.

5G SA cores remain incredibly scarce. Most of the 141 live 5G networks at the end of April 2021 were still operating in non-standalone mode (5G NSA), Stéphane Téral, chief analyst at LightCounting, noted during a panel discussion at MWC Barcelona 2021. As of the end of July, there were only nine standalone networks globally, he said. The latest was KT Corp.’s 5G SA core deployment using Samsung’s technology.

A 5G SA core introduces many unique 5G features, including higher data throughput and performance, lower latency, network slicing. It separates the data and control planes which is required for mobile edge computing and many industrial applications.

References: