5G SA/5G Core network

Singtel discloses new 5G SA uses cases for enterprises and residents in Singapore

At its ‘Powering Up Singapore With 5G’ event, Singtel (the leading network operator in Singapore) revealed a number of 5G Standalone (SA) use cases, according to a press release. The new use cases span a variety of sectors from entertainment to mobility and bring to life the benefits of 5G by redefining live, work and play experiences with blazing fast speeds and near-instantaneous response times.

Singtel said it continues to expand its 5G network, which now covers over two-thirds of Singapore, adding sites in densely populated areas like Choa Chu Kang, Punggol, Sembawang and Tampines. In addition, it has expanded its 5G indoor coverage to more major shopping malls island-wide such as Funan, West Mall, Tampines Mall, Northpoint City and Waterway Point.

Minister for Communications and Information Mrs Josephine Teo highlighted the role of 5G, “Mobile networks and data exchanges are key building blocks for the digital infrastructure. 5G, which promises to be ultra-fast and supports near-zero latency, can change the way we live and work in profound ways, and become essential for the digital developments of the future. Building a digital future is certainly about the hardware, software, systems and standards. It is equally about the people and skills. For that, the Government will continue to invest in reskilling and upskilling our people so that they can achieve not just digital literacy but digital mastery. This way, everyone can benefit from the infrastructure.”

Yuen Kuan Moon, CEO of Singtel said: “With the maturing of 5G technology, we’re excited to unlock the benefits of a 5G-enabled reality for consumers and enterprises. Its potential to transform business models and deliver enhanced products and services on a scale like never before, will spur Singapore’s digital economy as the country moves into post-COVID recovery. As part of our strategic reset to focus on 5G, we are accelerating our roll-out and the creation of new services.”

Ookla® recently declared Singtel the ‘Fastest 5G mobile operator in Singapore’ in H1 2021 for clocking in the highest median mobile network speed.

Singtel said the arrival of 5G has proved timely against a backdrop of accelerated digital adoption as a result of safe distancing and remote working. With more people using digital channels to go about their lives, there has been a corresponding increase in demand for fast and reliable connectivity. This is reflected in a recent Singtel survey, in which majority of consumers indicated that 5G-enabled services such as augmented reality books and virtual reality entertainment events appeal to them.

The new use cases powered by Singtel’s 5G SA network include:

- 5G-powered Remote Racing: Partnering with Formula Square to deliver an immersive, lag-free experience racing remote-controlled cars powered by 5G at Southside, Sentosa;

- 4K Live Streaming: Working with S.E.A. Aquarium to bring Singapore’s first underwater 5G livestream of the S.E.A. Aquarium to UNBOXED, Singtel’s unmanned pop-up retail store, where visitors can immerse themselves in the aquatic wonders of the aquarium, viewing manta rays, sharks and shoals of fishes in vivid 4K resolution;

- Enhancing the Arts and Culture Experience: Collaborating with the National Gallery Singapore and Esplanade – Theatres on the Bay to deliver cultural and art experiences over 5G, from the Singtel Special Exhibition Gallery and the Singtel Waterfront Theatre when it opens officially next year. This will enable more people with opportunities to get up close and personal with local artists and performers amid prevailing safe distancing measures;

- Co-creating the future of hybrid work: Teaming up with Samsung and Zoom to introduce a Productivity Data Pass plan offering data-free usage of Zoom, enabling customers to connect to family and colleagues seamlessly and lag-free. This, coupled with Samsung devices such as DeX, will enable customers to set up virtual workstations easily.

Singtel has also signed a Memorandum of Understanding (MoU) with Ericsson and global industry partners to collaborate on the development and deployment of advanced 5G enterprise solutions in Singapore. The agreement will allow companies to leverage Ericsson’s technology expertise and Singtel’s 5G network, test facilities and capabilities to innovate solutions and scale them up for global deployment.

Singtel launched its 5G SA network in May, via a partnership with South Korea’s Samsung. The 5G SA sites run on 3.5 GHz spectrum. Singtel had initially launched its 5G Non-Standalone (NSA) network in September of 2020, using spectrum in the 3.5 GHz frequency as well as existing 2.1 GHz spectrum.

As part of its 5G SA deployment, Singtel has already deployed over 1,000 5G sites across Singapore in strategic locations such as Orchard Road, the Central Business District, Marina Bay, Harbourfront and Sentosa, as well as major residential areas including Sengkang, Punggol, Pasir Ris, Jurong East and Woodlands.

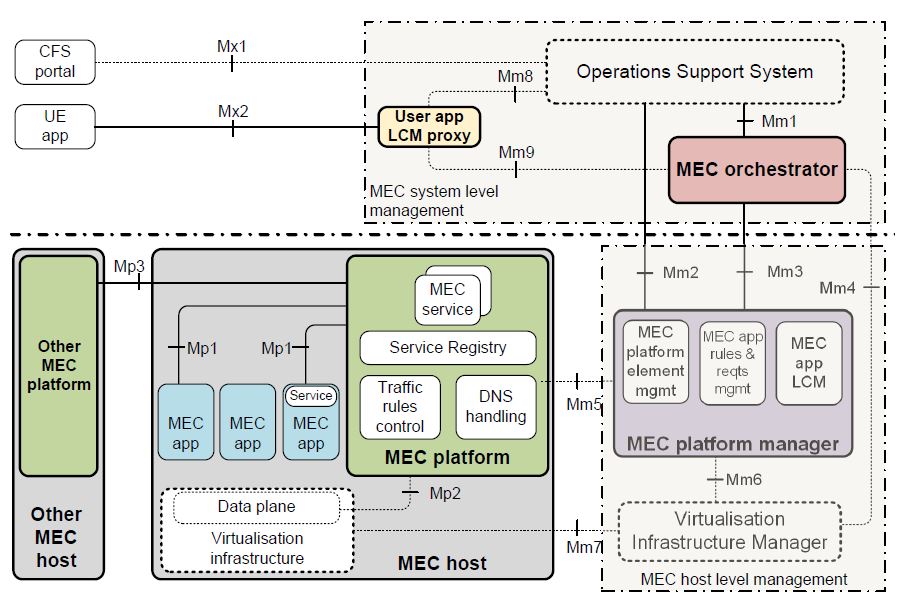

Singtel also demonstrated at the event how 5G is empowering industries and businesses with greater productivity and operational efficiency. Key to this is multi-access edge computing (MEC), an infrastructure that maximizes 5G’s low latency, high bandwidth benefits and enables functions like real-time computing, data storage, data analytics and AI services at the edge. MEC supports massive and faster connectivity of devices, bringing to life more mission critical enterprise applications than before, such as real-time asset tracking and automated quality inspection in factories and smart city planning.

During the event, Guest of Honor Mrs Josephine Teo, Minister of Communications and Information and IMDA’s Chief Executive Mr Lew Chuen Hong were ‘teleported’ into the venue via Singtel’s 5G network, in which their high-resolution likeness were beamed from a separate location. The network’s ultra-low latency meant that Minister Teo and Mr Lew could ‘interact’ seamlessly with Mr Yuen on stage.

Singtel aims to intensify its 5G SA deployment across the island in the coming months as handset manufacturers progressively roll out 5G SA software updates for existing 5G handsets and launch more 5G SA-compatible models in Singapore later this year.

References:

https://www.singtel.com/personal/products-services/mobile/5g#5g1

https://www.rcrwireless.com/20210830/5g/singtel-unveils-new-use-cases-5g-sa-technology-singapore

Singtel starts limited deployment of 5G SA; only 1 5G SA endpoint device; state of 5G SA?

Dell’Oro: 5G SA indecisions slowing 5G Core network growth

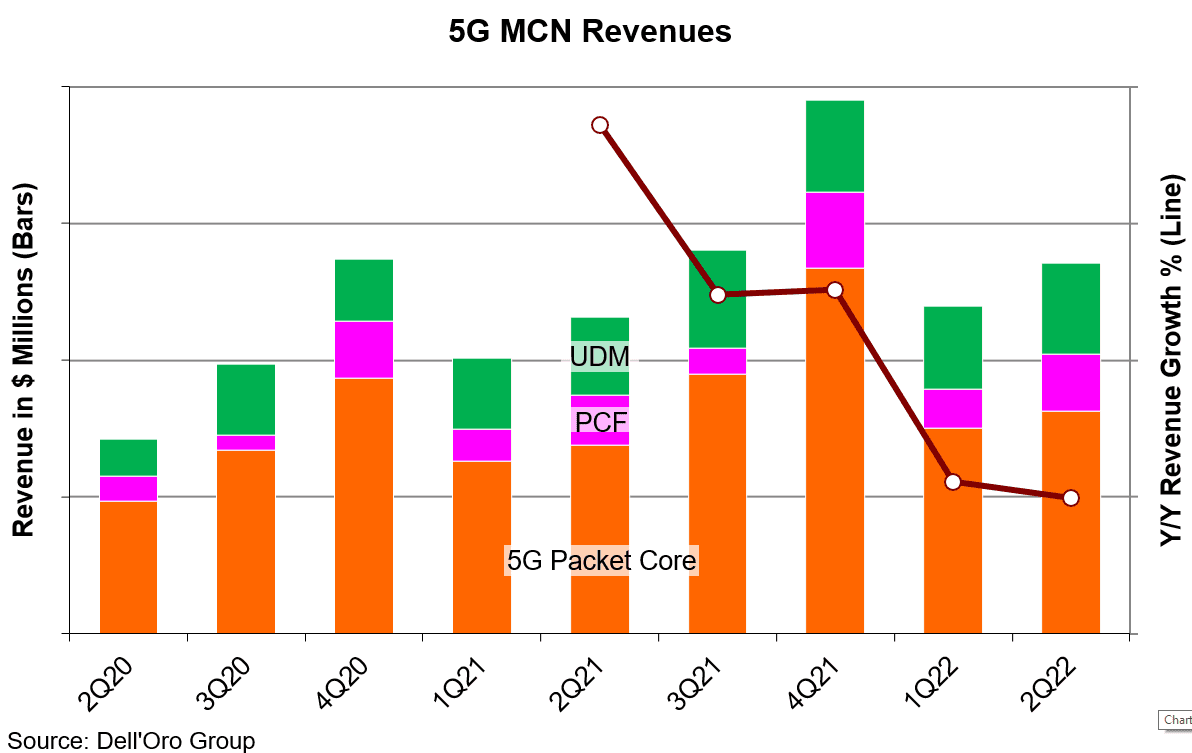

Revenues for the Mobile Core Network (MCN) [1.] market slowed to 6% year-over-year growth in 2Q 2021 after four quarters of double-digit growth, according to a new report by Dell’Oro Group.

Communication Service Providers (CSPs) indecisions about moving forward with 5G Standalone (5G SA/core network are slowing 5G Core market growth (except in China). It is now expected to decelerate over the next four quarters dropping to 17% year-over-year in 2Q 2022.

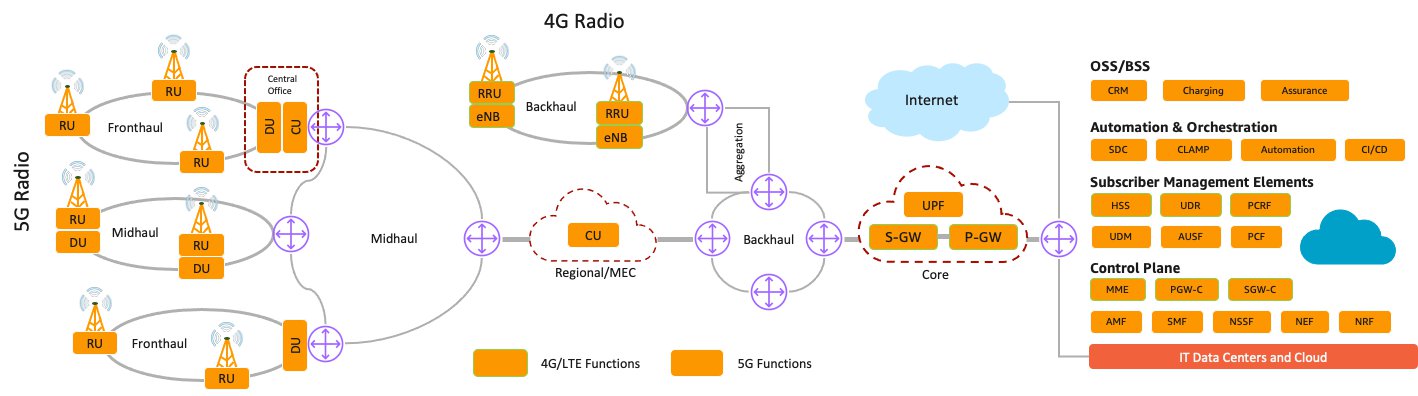

Note 1. The Mobile Core Network is in a transitional stage from 4G to 5G and a new type of core network called the 5G Core Service Based Architecture (SBA). The 5G Core SBA is designed to be a universal core that can be the core for mobile and fixed wireless networks, wireline networks, and Wi-Fi networks. This includes the ability to be the core for 2G/3G/4G, so only one core is necessary for the long term. In addition, the IMS Core will migrate into the 5G Core SBA.

With Network Function Virtualization (NFV) the 5G Core SBA is best served with Cloud-native Network Functions that disaggregates the hardware from the software and operates in a stateless function with the data separated from the control function among other things.

………………………………………………………………………………………………………………………………………………

“We attribute the slowdown to the slow uptake of 5G Standalone (SA) networks. CSPs need to make decisions about which direction to take for 5G SA deployments. CSPs have several options to mull over, with new choices that were not available during the switch from 3G to 4G,” stated David Bolan, Research Director at Dell’Oro Group. “One decision CSPs need to make is about the selection of Network Function Virtualization Infrastructure (NFVI). NFVI can be procured from a 5G core vendor, a third-party, the public cloud, or another platform like the Rakuten Communications Platform.”

Additional highlights from the 2Q 2021 Mobile Core Network Report:

• The Asia Pacific region accounted for 70% of the revenues for 5G Core as the Chinese SPs continue to build and Japanese SPs begin their buildouts.

• Top vendor ranking remains unchanged based on the four trailing quarters ending in 2Q 2021: Huawei, Ericsson, Nokia, ZTE, and Mavenir.

• 4G MCN (EPC) revenues are now in continual decline, but still represented 70% of the mix between 4G and 5G.

About the Report:

The Dell’Oro Group Mobile Core Network Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions.

To purchase this report, please contact at [email protected].

……………………………………………………………………………………………………………………………..

Closing Comments:

The slowdown in 5G SA/core network growth should come as no surprise to IEEE Techblog readers. We’ve pounded the table for a very long time, stating that in the absence of an ITU standard or 3GPP IMPLEMENTATION spec, the 5G SA/core network growth would be slow with many different versions implemented by CSPs. That will inhibit interoperability and portability of 5G endpoints which have 5G SA software.

Equally important is that ALL 5G services and features (e.g. network slicing, automation, MEC, etc) require a 5G Core network while almost all 5G deployments today are 5G NSA which has a 4G core (EPC) network.

References:

CSPs’ Indecisions Slow 5G Core Growth Except for China, According to Dell’Oro Group

Why It’s Important: Rakuten Mobile, Intel and NEC collaborate on containerized 5G SA core network

RootMetrics touts 5G performance in Korea while users complain; No 5G SA in Korea!

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

Dell’Oro: MEC Investments to grow at 140% CAGR from 2020 to 2025

Telcos Loss: Private 5G & MEC/5G SA Core Network – Cloud Giants Take Market Share

T-Mobile Announces “World’s 1st Nationwide Standalone 5G Network” (without a standard)

Evaluating Gaps and Solutions to build Open 5G Core/SA networks

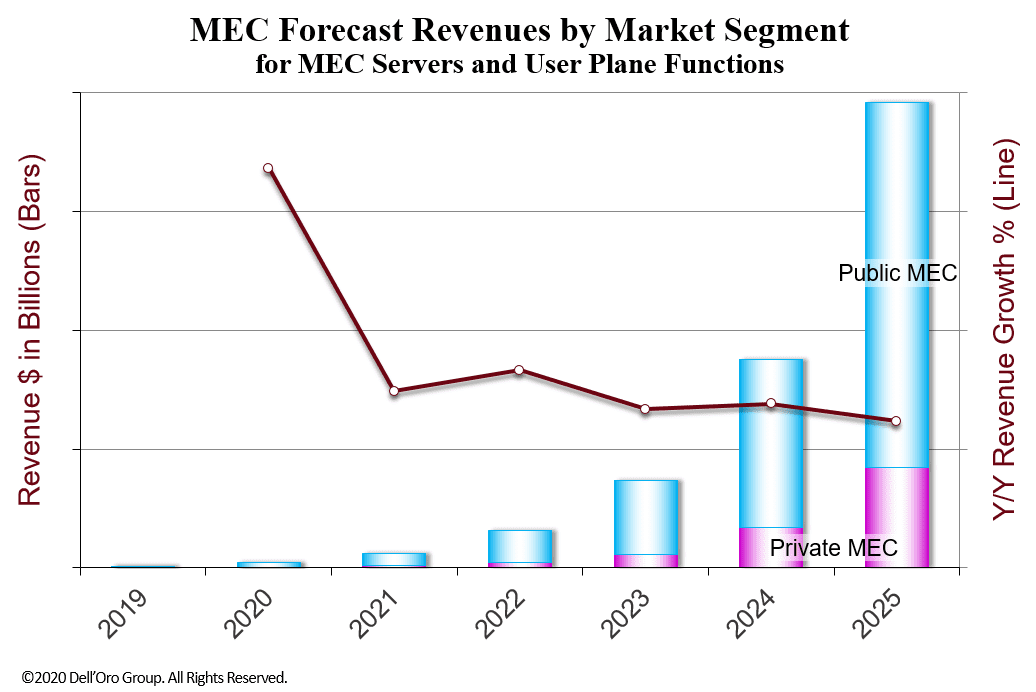

Dell’Oro: MEC Investments to grow at 140% CAGR from 2020 to 2025

Dell’Oro Group has published an update to its Multi-Access Edge Computer (MEC) 5-year forecast report. According to Dave Bolan, Research Director, Dell’Oro has lowered their expectations from the previous forecast, because of the slower start than anticipated for 5G SA buildouts, especially for federated MEC capability.

Singapore’s M1 launches True 5G SA network market trial

- 4x FASTER SPEEDS THAN 5G NON-STANDALONE NETWORKS

- 10X FASTER SPEEDS THAN EXISTING 4G NETWORKS

- 2X BETTER NETWORK RESPONSE, WITH INCREASED RELIABILITY

M1 customers can enjoy an elevated call experience via the world’s first Voice over 5G New Radio (VoNR) service [1.] on M1’s 5G SA network that reinforces the experience of crystal clear high-definition voice calls, improved productivity with 5G speeds on data-driven activities throughout the duration of the calls as well as faster call setup time.

Note 1. Deutsche Telekom claims to have completed VoNR call this past June, which we documented here.

…………………………………………………………………………….

M1 is working closely with some of Singapore’s most exciting enterprises and SMEs to reimagine and redefine how businesses can leverage 5G to boost efficiency, fast-track innovation, and meet customer demands. Working in close synergy with its key shareholder, Keppel Corporation, M1 will continue to explore and develop more 5G-enabled business opportunities and collaborations across the Keppel group of businesses and open up limitless possibilities for corporations.

About M1:

M1, a subsidiary of Keppel Corporation, is Singapore’s first digital network operator, providing a suite of communications services, including mobile, fixed line, and fiber offerings to over two million customers.

Since the launch of its commercial services in 1997, M1 has achieved many firsts – becoming one of the first operators to be awarded one of Singapore’s two nationwide 5G standalone network licences, being the first operator to offer nationwide 4G service, ultra-high-speed fixed broadband, fixed voice, and other services on the Next Generation Nationwide Broadband Network (NGNBN).

M1’s mission is to drive transformation and evolution in Singapore’s telecommunications landscape through cutting-edge technology and its made-to-measure offerings.

Samsung’s Voice over 5G NR (VoNR) Now Available on M1’s 5G SA Network

The VoNR call service fully utilizes 5G SA architecture for an improved high definition quality call experience, while providing 5G speeds for data-driven activities throughout the duration of the voice calls In comparison to calls made on the 5G non-standalone (NSA) network, which rides on existing 4G networks, the VoNR service boasts faster call setup time and seamless voice call continuity, presenting M1 customers with the true 5G experience. M1 customers will be able to enjoy the benefits of VoNR service as M1 gears up for its 5G SA market trial launch on the 27th of July.

The two companies said that VoNR service will open up numerous 5G SA-enabled data services and provide the baseline for quality video conferencing or augmented and virtual reality features, offering a glimpse into the possible connectivity solutions 5G SA will enable M1 to bring to its subscribers. This author is quite skeptical of that claim.

The underlying technology relies on the network having a 5G Core and IMS architecture (IP Multimedia Subsystem, a standard used for voice over LTE (VoLTE) and now voice over 5G networks). M1 also said it was the world’s first to implement VoNR, although that claim also was made by Deutsche Telekom, who implemented VoNR using multiple 5G vendors.

According to M1, VoNR offers faster call setup times, more seamless voice call continuity, and an improved high definition quality call experience when compared to calls made via 5G non-standalone (5G NSA) networks. [5G NSA technology relies on a 4G- LTE anchor for everything except data transmission.]

The new VoNR feature will be available as an over-the-air update to compatible 5G Samsung devices on M1’s 5G Booster Plan, on top of getting data speeds “almost five times faster than 4G.”

Samsung Galaxy S21 Ultra, S21+ and S21 customers on M1 network will be amongst the first in the world to enjoy the benefits of the VoNR network via an over-the-air software update on M1’s 5G Booster Plan. Customers can also look forward to seamless connectivity with an ultra-fast data speed rate that is almost five times faster than 4G. Furthermore, paired with Samsung’s 5G compatible devices, multi-tasking is possible with remarkable productivity improvement.

“We have once again reached a groundbreaking milestone in our 5G SA journey – to be the first in the world to successfully support VoNR service on our 5G SA network. We are glad to work with a like-minded partner like Samsung to achieve high quality call and better 5G experience for our customers. With M1’s imminent market trial of the 5G SA network, we are excited to leverage 5G SA’s low latency, ultra-responsive, highly secured and high-throughput mobile connectivity to deliver high performance and reliable 5G services for our consumers and enterprises. This step in our 5G implementation journey is in line with the Keppel Group’s Vision 2030, which includes enhancing connectivity for communities,” said Mr. Denis Seek, Chief Technical Officer, M1.

“Samsung is proud to play a pioneering role in placing Singapore at the forefront of network technology innovation, turning on next-generation service in the country. Committed to inspiring the world and shaping the future with transformative ideas and technologies, we are taking a meaningful step in realising the full potential of 5G for consumers and industries. With VoNR, we look forward to delivering more transformative experiences to customers and businesses with M1,” said Ms. Sarah Chua, Vice-President, IT and mobile, Samsung Electronics Singapore.

Dell’Oro: Mobile Core Network Market 5 Year Forecast

In a revision of its Mobile Core Network 5-Year Forecast report, Dell’Oro Group predicts the Mobile Core Network (MCN) to have an overall revenue compound annual growth rate (CAGR) of 3% from 2020 to 2025. MCN includes 4G Evolved Packet Core (EPC), IP Multimedia Core Network Subsystem (IMS) and the 5G SA Core Network.

The Dell Oro report estimates the 5G portion of the MCN market to have a 33% CAGR. Strong growth in 5G Core network offsets corresponding declines in 4G and IMS core revenue.

Report Highlights:

- The cumulative investment is expected to be over $50B from 2021 to 2025, with regional shares in the range for North America – 18% to 23%; Europe, Middle East, and Africa – 30% to 35%; Asia Pacific – 40% to 45%; and Caribbean and Latin America – 5% to 10%.

- By the year 2025, MCN functions associated with 5G are expected to represent over 70% of the revenue mix between 4G and 5G MCN functions.

- 5G Core builds by the three incumbent service providers for 5G Standalone (5G SA) networks in China are continuing to exceed our expectations. In addition, in 2021, the new Chinese communications service provider, China Broadcasting Network (CBN) will be beginning construction of its 5G SA network.

- Deployments of more 5G SA networks are expected in the latter half of 2021 in Australia, Germany, Japan, South Korea, Switzerland, and the United Kingdom. AT&T and Verizon should begin in earnest in 2022 and 2023 with their 5G SA networks. Geographic coverage is minimal at launch and is expected to grow throughout the forecast period.

“China was all the action in 2020,” Dave Bolan, research director at Dell’Oro Group for MCN, told Light Reading via email. He expects that trend to continue, especially in the first half of the forecast period. Bolan points out that phase one of the 5G SA rollout in China amounted to over $1 billion in 5GC contracts, and the pace of rollout is accelerating with phase two. Phase three is now being readied.

Dell’Oro does not yet provide vendor market share for MEC (Multi-Access Edge Computing formerly known as Mobile Edge Computing), but Bolan said Huawei and ZTE, given the size of China’s market, are currently in the lead.

In an email to this author, Bolan wrote:

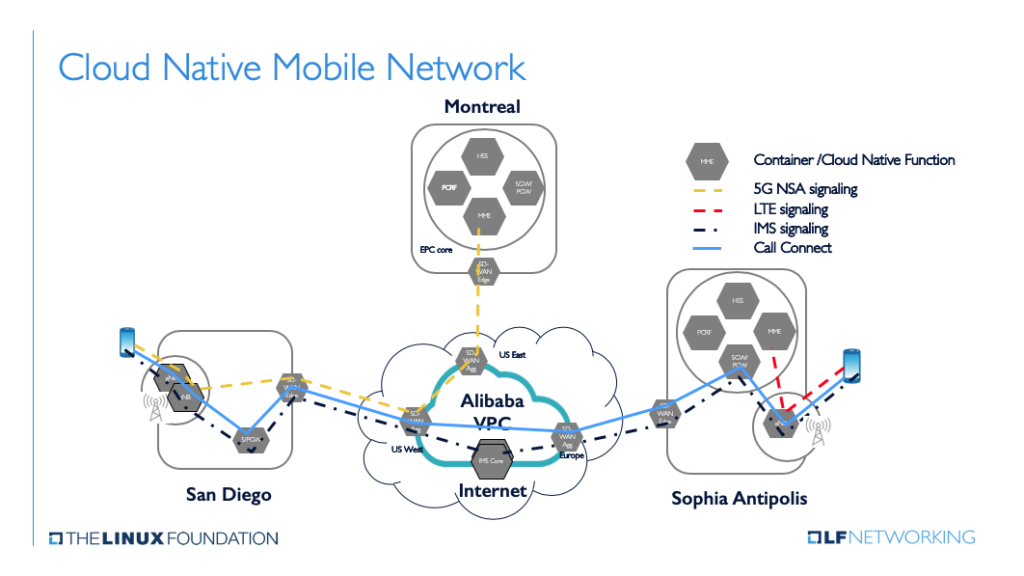

“All of 5G Core network will be Cloud-Native [1.], mostly Container-based. Except there are different cloud-native versions and container versions, not making it truly open. Anyone that wants to put their core on the public cloud will have to customize it for each cloud platform.

Same may be true for the NFVI ((network functions virtualization infrastructure) if it runs on – x86, AMD, ARM, or Nvidia processors – and couple that with the different 5G UPF (user plane function) acceleration techniques, it gets complex very quickly.”

………………………………………………………………………………………………

Note 1. Cloud native, in essence, means the MCN software has been designed for cloud deployment. The software is built up of independent microservices and can run on a container platform, like Kubernetes. In addition to the traditional cloud service providers (AWS, Azure, Google Cloud), many IT vendors have developed 5G cloud native software. The list includes, VMware, Oracle, Cisco, HPE, Mavenir, Samsung, Ericsson, Nokia, Huawei, ZTE, NEC, and Dell Technologies (partnering with either Affirmed Networks or Nokia).

……………………………………………………………………………………………

“The basic network to get the 5G core up and running is the focus today,” Bolan told Light Reading. “NSSF [network slicing service function] and NEF [network exposure function] will come in the second half of the forecast.”

………………………………………………………………………………………………

References:

5-Year Forecast: Mobile Core Network Market Revenues CAGR Projected at 3 Percent from 2020 to 2025

https://www.lightreading.com/the-core/5g-core-spend-is-on-roll-says-delloro/d/d-id/771043?

https://www.opnfv.org/resources/5g-cloud-native-network

Nokia and TPG Telecom launch 5G SA 700MHz network in Australia; 700MHz 5G status report

Nokia and TPG Telecom today announced that they have switched on a live 5G standalone (SA) network in Australia on the 700MHz spectrum band – the first time this has happened in the world. Low band 5G coverage at 700MHz, which is the lowest 5G frequency band deployed in Australia with the largest range, will enable TPG Telecom to provide wide outdoor 5G services, as well as deep indoor 5G coverage in urban and suburban areas to its customers.

Under the partnership, Nokia is supplying equipment from its latest ReefShark based AirScale product range including its unique triple band remote radio unit that supports 700, 850 and 900 MHz bands. The unit also supports 3G, 4G and 5G simultaneously across all TPG Telecom’s low-band frequencies. TPG Telecom’s 5G SA service is now successfully activated in parts of Sydney and this means that the operator’s customers will benefit from having 5G available in more places.

Low band 5G goes further outdoor and deeper into buildings than existing 5G deployments and will allow operators like TPG Telecom to bring 5G to even more customers. TPG Telecom may be targeting the Internet of Things (IoT) with its 700MHz service, because that frequency provides a broader coverage area. Australian homes will contain over 47 million smart devices by 2022, estimates the country’s National Science and Technology Council.

………………………………………………………………………………………………………………………………………………………………..

Other network operators are pursuing 700MHz 5G service.

- Japan’s KDDI said in March that it is using Samsung equipment operating in the 700MHz spectrum as part of its goal of covering 90% of Japan’s population by early 2022.

- CBN/China Mobile have put out tender requests bids for 480,397 5G macro base stations in the 700 MHz band. China granted a 5G license for use of the 700 MHz frequency to CBN, the country’s fourth telecoms operator, in June 2019.

- AT&T’s 5G “low band” network mostly uses 850MHz, but its 700 MHz FirstNet public safety network uses hardware “that can be upgraded to 5G with a simple software release.” AT&T has not publicly announce when that might be done.

The 700MHz spectrum provides “deep indoor penetration, a reliable uplink and large coverage,” notes a Nokia white paper. 700Mhz spectrum was referred to as “beachfront property” in 2007-2008.

………………………………………………………………………………………………………………………………………………………………..

Barry Kezik, Executive General Manager Mobile and Fixed Networks at TPG Telecom, said: “We’re excited to be the first network in the world to realize the true potential of low band 5G SA at 700MHz. TPG Telecom’s low band 5G will expand our 5G coverage, supporting our goal of reaching 85% of the population in Australia’s top six cities by the end of the year and changing the way people and things connect to the TPG Telecom 5G network.”

Dr Robert Joyce, Chief Technology Officer at Nokia Oceania, said: “Nokia is proud to support another 5G world first. We have a long-standing partnership with TPG Telecom, and we have jointly developed our unique triple band radio solution specifically for them. Today we get to see the result of that joint effort and collaboration which will deliver premium wide area 5G SA coverage for TPG Telecom and its customers.”

Other 5G networks in Australia: Telstra’s 5G covers 200 towns and cities, and Optus recently announcing it has connected 1 million 5G devices to its network

References:

https://www.rrt.lt/wp-content/uploads/2018/10/Nokia_5G_Deployment_below_6GHz_White_Paper_EN.pdf

Other Resources:

Activate massive 5G capacity with Nokia AirScale

AirScale baseband | Nokia

AirScale Active Antennas | Nokia

AirScale Radio | Nokia

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

AT&T will run its 5G SA Core network on Microsoft’s Azure public cloud computing platform. Microsoft AZURE, which is the second largest cloud computing provider by revenue behind rival Amazon Web Services, has been building out specific cloud computing offering to attract carriers. AT&T is Microsoft’s first major deal in the 5G SA Core network space.

The two giant companies said that Microsoft will purchase software and intellectual property developed by AT&T to help build out its offerings for carriers. The companies did not disclose the terms of the deals, but said that Microsoft will make job offers to several hundred AT&T Network Cloud engineers.

Microsoft will use AT&T’s software and IP to grow its telecom flagship offering, Azure for Operators. Microsoft is acquiring AT&T’s carrier-grade Network Cloud platform technology, which AT&T’s 5G core network (when completed) will run on.

The companies disclosed a few key details about their new deal, but did not provide any firm numbers or any financial arrangements/guidance:

- Microsoft will “assume responsibility for both software development and deployment of AT&T’s Network Cloud immediately,” according to the companies, and will transition AT&T’s existing network cloud operations into Azure over the next three years. Eventually, all of AT&T’s mobile network traffic will run over Microsoft’s Azure.

- The effort will start with AT&T’s 5G core, but will eventually include virtually all of the company’s network operations, including its 4G core.

- Microsoft will be the company to certify all of AT&T’s software-powered network operations for inclusion in the AT&T network. That will include software from other vendors. AT&T has not yet named its 5G core network vendors.

- Microsoft will acquire AT&T’s Network Cloud technology – including its AT&T engineering and lifecycle management software – and its cloud-network operations team. The companies did not disclose exactly how many AT&T employees that transaction might cover, but an AT&T official suggested it will be in the “low hundreds.” Microsoft will then incorporate AT&T’s intellectual property into its Azure for Operators offering, which is for sale to other 5G network operators.

- Microsoft and AT&T did not provide the logistics of their deal, including exactly how many Azure computing locations might be necessary to power AT&T’s network. It’s an important issue considering AT&T’s cellular network spans an estimated 70,000 cell towers across the country, and the operation of the radios on top of those towers might eventually be handled by programs running inside of Microsoft’s cloud. A top Microsoft executive involved in the deal told Light Reading that Microsoft’s Azure software will be installed into some of AT&T’s existing computing locations. Several of those compute server locations are staffed by AT&T technicians.

- AT&T said the company plans to continue to run its network workloads inside of its own data centers and facilities. However, AT&T added that the deal today is focused on AT&T’s 5G core network and that the companies might explore additional elements of the network such as Open Radio Access Network (O-RAN) technology over the course of the agreement.

…………………………………………………………………………………………………………………………………………………

Sidebar: 5G SA Core networks to run on cloud service provider platforms:

- In late April, Dish Network made a similar deal to have Amazon run its 5G core network on AWS.

- In late May, Telefónica said it had validated AWS Outposts as option for 5G SA core deployment in Brazil.

- Earlier this week, TIM said it was building its 5G SA Core network on “Google’s cloud solutions” (whatever that means?)

Do you think the cloud service providers will essentially take over the implementation, operations, and maintenance of 5G SA Core networks, especially since they will likely all be “cloud native.” Please post a comment in the box below this article to express your opinion and why. Thanks!

………………………………………………………………………………………………………………………………………………………………………

“This deal is not exclusive, so I fully expect Azure will try to assert itself as the telecom cloud provider for many carriers around the world,” said Roger Entner of Recon Analytics LLC.

“It’s the first time a Tier One operator has trusted their existing consumer subscriber base to hyper-scaler technology,” Microsoft’s Shawn Hakl, VP of the company’s 5G strategy, told Light Reading. Before joining Microsoft in 2020, Hakl was a longtime Verizon executive.

The deal follows a $2 billion agreement in 2019 in which AT&T said it would start using Microsoft’s cloud for software development and other tasks. At that time, AT&T said it would continue to run its core networking functions in its own private data centers.

Andre Fuetsch, AT&T’s chief technology officer, said that shifting to a public cloud vendor will let AT&T take advantage of a larger ecosystem of software developers who are working on technologies such as wringing more use out of pricey 5G spectrum or creating new features for users. “That’s what we at AT&T want to do, and we think working with Microsoft gives us that advantage,” Fuetsch told Reuters in an interview.

“AT&T has one of the world’s most powerful global backbone networks serving hundreds of millions of subscribers. Our Network Cloud team has proved that running a network in the cloud drives speed, security, cost improvements and innovation. Microsoft’s decision to acquire these assets is a testament to AT&T’s leadership in network virtualization, culture of innovation, and realization of a telco-grade cloud stack,” said Andre Fuetsch, executive vice president and chief technology officer, AT&T. “The next step is making this capability accessible to operators around the world and ensuring it has the resources behind it to continue to evolve and improve. And do it securely. Microsoft’s cloud expertise and global reach make them the perfect fit for this next phase.”

Microsoft intends to use the newly acquired technology – plus the experience gained helping AT&T run the network – to build out a product it calls Azure for Operators, which it will use to pursue 5G core network business from telecommunications companies in the 60 regions of the world where it operates.

https://azure.microsoft.com/en-us/industries/telecommunications/

https://about.att.com/story/2021/att_microsoft_azure.html

https://www.reuters.com/business/media-telecom/att-run-core-5g-network-microsofts-cloud-2021-06-30/

https://www.lightreading.com/the-core/atandt-to-offload-5g-into-microsofts-cloud/d/d-id/770600?

Orange to launch Europe’s 1st 5G Stand Alone (SA) end-to-end cloud network

Orange announced the official launch of a new research project starting in July, describing it as Europe’s first fully cloud-native 5G standalone network. Running over a two-year period, the experimental network in Lannion (Britanny) will reach further locations in 2022 and be tested by several hundred end-users. It will explore the benefit of a ‘zero-touch’ approach, relying on software-enabled automation and artificial intelligence to minimize human intervention in its operations.

Editor’s Note: Orange’s announcement comes just two days after TIM (previously known as Telecom Italia) said they were launching Europe’s first 5G SA Cloud Network. Both the TIM and Orange 5G SA networks are experimental tests rather than actual 5G SA commercial deployments.

………………………………………………………………………………………………………………………………………….

Orange’s experimental network will be a 100% software-enabled network, be data and AI-driven, fully automated and cloud-native. Crucially, it will also encompass Open RAN technology – underlining its commitment to this technology. By implementing and operating this network it will enable Orange to better understand how these technologies co-exist and their impact on the network lifecycle.

Furthermore, it will enable Orange to better understand the customer experience benefits of a fully cloudified network as well as the full potential of AI and Data. It will also enable Orange to determine the future skills needed – a key strand of its Engage2025 strategy to ‘co-create a future-facing’ company, as well as the environmental benefits – another key pillar of its strategy.

Built on a single Kubernetes-based infrastructure (containers), the network will combine elements from several partners, including the 5G Open RAN software developed by Mavenir. Orange has also selected Casa Systems (cloud 5G SA core network), Hewlett Packard Enterprise (cloud 5G SA subscriber data management), Dell Technologies (servers supporting RAN centralized unit, distributed unit and core) and Xiaomi (devices) as partners in the project.

Network and service management will be automated using orchestration open source tools from GitLab and ONAP. The scope of the forthcoming trials also covers OSS and BSS integration aspects.

The new network sees the setting up of Open RAN and 5G core functions on a single Kubernetes-based infrastructure fully managed by Orange and deploying a fully automated core. From July, the network will start using and testing O-RAN radio equipment, CNF’s (Containerized Network Functions) on a cloud infrastructure, network data collection and AI automation. The experimental network will also host Information System OSS (Operations Support System – network inventory management and network operations), BSS (Business Support System – CRM and billing) as well as scaling Orange’s ambition using AI to secure and optimize the network and predict its behavior. In 2022, the network will expand to further locations to increase the number of users and to test vertical use-cases leveraging dynamic network slicing.

Michaël Trabbia, Chief Technology and Innovation Officer, Orange, commented: “Our ambition is to prepare Orange for the operator of the future by building more resilient and auto-adaptive networks that offer best in class quality of service in each situation. This experimental network represents an important milestone on our way to implement and deploy Open RAN and AI technologies to prepare on-demand connectivity and zero touch operator capabilities.”

References:

https://techblog.comsoc.org/tag/5g-cloud-native-core-network/

Why It’s Important: Rakuten Mobile, Intel and NEC collaborate on containerized 5G SA core network

Rakuten Mobile, NEC and Intel announced today that they have achieved a performance of 640 Gbps per server for the containerized User Plane Function (UPF) on the containerized 5G SA core network jointly developed by Rakuten Mobile and NEC running on the Rakuten Communications Platform (RCP).

In the absence of ITU-T standards or 3GPP implementation specs (beyond architecture and functional requirements) for 5G SA core network or the ultra hyped 5G functions that go with it (e.g. network slicing, automation, service chaining, etc), the Rakuten Mobile-NEC containerized 5G SA core network is a very important development.

We documented that in this IEEE Techblog post. Rakuten has said they plan to sell their RCS platform (which includes 5G SA core network spec and software) to 5G SA network providers. They say they already have at least 15 customers.

According to Dave Bolan of Dell’Oro Group, most 5G SA networks will be based on containers (rather then virtualized network functions/VNF).

Many analysts say that containerized UPF performance is needed to maximize the value of 5G deployment. This is because the control plane (C-plane) and user plane (U-plane), which were historically collocated, are completely decoupled in this disaggregated 5G architecture. Separating them enables an independently scalable UPF which is key to private networks, edge computing, hybrid cloud and to accelerate a variety of deployment scenarios. Rakuten Mobile has adopted 5G architecture from the launch of its network, including a CUPS (Control and User Plane Separated) packet core for its 4G LTE network.

TelecomTV says that control and data plane separation enables the 5G network operator to deploy multiple UPF instances closer to where the traffic originates, rather than at fixed locations in the network. The result is lower latency and a better user experience. It also means UPF instances can be turned on and off as capacity demand dictates, enabling operators to dynamically allocate network resources.

The 640 Gbps performance per server for the containerized UPF on the 5G SA core network was achieved in a laboratory environment in Tokyo. This represents a significant opportunity to drive high performance of the commercial network in the future.

NEC says it leveraged its industry-leading product development based on its advanced telecom and IT expertise to maximize CPU utilization and fast memory access. That software was facilitated by use of Intel’s latest high-performance infrastructure, including 3rd Gen Intel Xeon Scalable processors with built-in AI acceleration and Dual-port 100Gb Intel Ethernet Network Adapter E810-2CQDA2 with Dynamic Device Personalization (DDP).

Rakuten Mobile, Intel and NEC have collaborated on high-speed processing of containerized UPF, which plays a significant role in this initiative, and achieved a performance of 640 Gbps per server. High-speed processing in a containerized environment on Rakuten Mobile’s RCP enables instant and flexible deployment of UPF from edge to central locations based on traffic characteristics, leveraging RCP’s full automation features.

“Rakuten Mobile has successfully designed and built a fully containerized mobile network based on open standards,” commented Tareq Amin, Representative Director, Executive Vice President and CTO of Rakuten Mobile. “With NEC and Intel, we have demonstrated that extremely high-speed processing is possible on containers. We aim to continue to pursue performance improvements in the core to achieve higher throughput and reduce cost and energy consumption in the rollout of network technology in Japan and worldwide.”

“We’re proud that Rakuten Mobile, Intel and NEC were able to demonstrate industry-leading UPF performance,” commented NEC Executive Vice President Atsuo Kawamura. “NEC has been developing high-performance and highly reliable 5G systems by leveraging our vast experience that includes more than 25 years in mobile core networking. Our strong track record, technical capabilities and expertise in both network and computing domains, allowed us to bring high-quality 5G core to virtualization and cloud-native technology. NEC and Intel have a long-term relationship in the hardware business, including CPUs and NICs (Network Interface Cards), and have jointly enhanced the acceleration technology for virtualization, represented by the DPDK (Data Plane Development Kit). NEC performed significant optimization and improvements to pursue higher performance for the cloud-native UPF. In the future, we will continue to contribute to society through 5G in Japan and around the world leveraging the results of this project.”

“The fully virtualized Rakuten mobile network featuring NEC’s containerized 5G UPF software built on the latest Intel technology is another key proof point of how ecosystem collaboration and industry leading technology are both essential to fulfill the promise of 5G,” said Dan Rodriguez, corporate vice president and general manager of Intel’s Network Platforms Group. “The ongoing development and optimization work among the companies on the latest 3rd Gen Intel Xeon Scalable processors and Intel Ethernet 800 Series network adapters not only provides outstanding performance, but the added flexibility to run workloads from core to edge that are designed to offer the best experience for end users.”

Rakuten Mobile and NEC started jointly developing an open, fully containerized SA 5G core network in June 2020 to be utilized in Rakuten Mobile’s mobile network in Japan and made available within RCP.

In the RAN domain, NEC is also providing 5G radio units (5G RU) for Rakuten Mobile’s network in Japan, and recently, Rakuten Mobile and NEC announced the broadening of their collaboration to provide 5G and 4G radios and engineering services for Open RAN systems aligned with O-RAN specifications for global markets, and accelerate the global expansion of the RCP.

Through the joint development of the open and fully cloud native containerized SA 5G core network, Rakuten Mobile and NEC aim to drive innovation in global mobile technology and provide high-quality 5G network technology to customers in Japan and around the world.

Comment and Analysis:

In an email to this author earlier this year, Rakuten Mobile CTO Tareq Amin wrote: “NEC/Rakuten 5GC openness are realized by implementation of “Open Interface” defined in 3GPP specifications (TS 23.501, 502, 503 and related stage 3 specifications). 3GPP 5GC specification requires cloud native architecture as the general concept (service based architecture). It should be distributed, stateless, and scalable. However, an explicit reference model is out of scope for the 3GPP specifications.”

Dell’Oro Group’s Dave Bolan via an email this week: “All of 5G Core will be Cloud-Native, mostly Container-based. Except there are different cloud-native versions and container versions, not making it truly open. Anyone that wants to put their core on the public cloud will have to customize it for each cloud platform. Same may be true for the NFVI if it runs on – x86, AMD, ARM, or Nvidia – and couple that with the different UPF acceleration techniques, it gets complex very quickly.”

Alex Quach, VP of Intel’s Data Platforms Group, said most operators around the world are still leveraging a 4G core network. “The way different service providers implement their 5G core is going to vary,” said Quach. “Every service provider has unique circumstances. The transition to a new 5G core is going to be different for every operator.”

How could 5G SA possibly be open if there are no standards or implementation specs for 5G cloud native core network or true 5G functions like network slicing?

The result will be multiplicity of 5G SA carrier specific software running on different cloud service provider (CSP) compute servers. Note also that each CSP has their own set of APIs and different cloud configurations will be used for the 5G cloud native core network. The upshot is that changing a 5G SA software vendor or cloud service provider will be a huge problem for 5G network operators. Again, that’s because of the proprietary nature of 5G SA deployments in the absence of 5G core network standards/open implementation specs.

What’s worse is that this will have a huge negative impact on PORTABLE/GEOGRAPHICALLY MOBILE 5G endpoints, like smartphones, tablets, notebook computers, gaming consoles, etc. As each network provider’s 5G core network will be different, a unique, carrier specific 5G core download will be required for 5G endpoints for each 5G SA core network provider.

That will severely restrict portability/mobility to within a single carrier serving area and effectively prevent 5G SA roaming. For example, Samsung is providing 5G SA network downloads for its smartphones that operate on T-MobileUS 5G SA network. But those downloads won’t work on any other 5G SA network, so the truly mobile user will fall back to 4G-LTE whenever he or she is outside T-MobileUS’s carrier service area.

……………………………………………………………………………………………………………………………..

References: