5G SA/5G Core network

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

In separate announcements today, Ericsson and Nokia stated they had completed 5G Network Slicing trials with Google on Pixel 6 Pro smart phones running the Android 13 mobile OS [1.].

Network Slicing is perhaps the most highly touted benefits of 5G, but its commercial realization is taking much longer than most of the 5G cheerleaders expected. That is because Network Slicing, like all 5G features, can only be realized on a 5G standalone (SA) network, very few of which have been deployed by wireless network operators. Network slicing software must be resident in the 5G SA Core network and the 5G endpoint device, in this case the Google Pixel 6 Pro smartphone.

Note 1. On August 15, 2022, Google released Android 13 -the latest version of its mobile OS. It comes with a number of new features and improvements, as well as offers better security and performance fixes. However, it’s implementation on smartphones will be fragmented and slow according to this blog post.

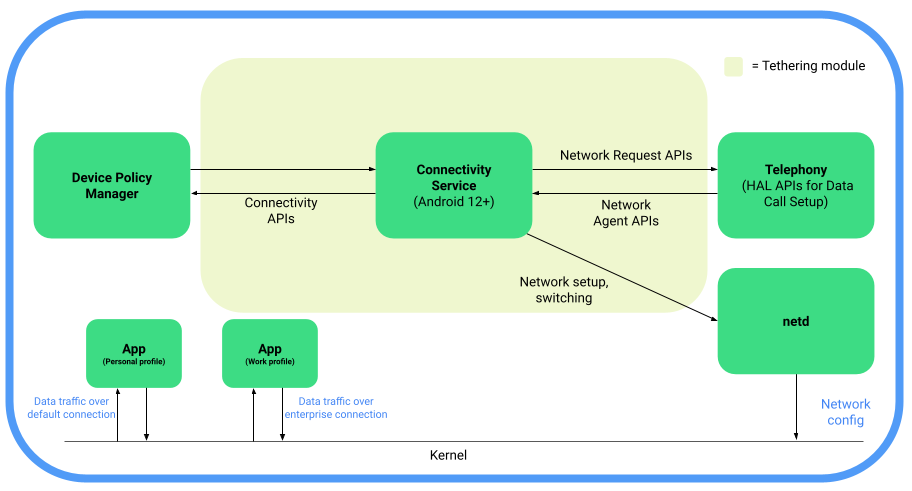

For devices running Android 12 or higher, Android provides support for 5G Network Slicing, the use of network virtualization to divide single network connections into multiple distinct virtual connections that provide different amounts of resources to different types of traffic. 5G network slicing allows network operators to dedicate a portion of the network to providing specific features for a particular segment of customers. Android 12 introduces the following 5G enterprise network slicing capabilities, which network operators can provide to their enterprise clients.

Android 12 introduces support for 5G network slicing through additions to the telephony codebase in the Android Open Source Project (AOSP) and the Tethering module to incorporate existing connectivity APIs that are required for network slicing.

Here’s a functional block diagram depicting 5G network slicing architecture in AOSP:

Image Credit: Android Open Source Project

1. Ericsson and Google demonstrated support on Ericsson network infrastructure for multiple slices on a single device running Android 13, supporting both enterprise (work profile) and consumer applications. In addition, for the first time, a slice for carrier branded services will allow communications service providers (CSP) to provide extra flexibility for customized offerings and capabilities. A single device can make use of multiple slices, which are used according to the on-device user profiles and network policies defined at the CSP level.

The results were achieved in an Interoperability Device Testing (IODT) environment on Google Pixel 6 (Pro) devices using Android 13. The new release sees an expansion of the capabilities for enterprises assigning network slicing to applications through User Equipment Route Selection Policy (URSP ) rules, which is the feature that enables one device using Android to connect to multiple network slices simultaneously.

Two different types of slices were made available on a device’s consumer profile, apart from the default mobile broadband (MBB) slice. App developers can now request what connectivity category (latency or bandwidth) their app will need and then an appropriate slice, whose characteristics are defined by the mobile network, will be selected. In this way either latency or bandwidth can be prioritized, according to the app’s requirements. For example, the app could use a low-latency slice that has been pre-defined by the mobile network for online gaming, or a pre-defined high-bandwidth slice to stream or take part in high-definition video calling.

In an expansion of the network slicing support offered by Android 12, Android 13 will also allow for up to five enterprise-defined slices to be used by the device’s work profile. In situations where no USRP rules are available, carriers can configure their network so traffic from work profile apps can revert to a pre-configured enterprise APN (Access Point Name) connection – meaning the device will always keep a separate mobile data connection for enterprise- related traffic even if the network does not support URSP delivery.

Monica Zethzon, Head of Solution Area Packet Core at Ericsson said: “As carriers and enterprises seek a return on their investment in 5G networks, the ability to provide for a wide and varied selection of use cases is of crucial importance. Communications Service Providers and enterprises who can offer customers the flexibility to take advantage of tailored network slices for both work and personal profiles on a single Android device are opening up a vast reserve of different uses of those devices. By confirming that the new network slicing capabilities offered by Android 13 will work fully with Ericsson network technology, we are marking a significant step forward in helping the full mobile ecosystem realize the true value of 5G.”

Ericsson and partners have delivered multiple pioneering network slicing projects using the Android 12 device ecosystem. In July, Telefonica and Ericsson announced a breakthrough in end-to-end, automated network slicing in 5G Standalone mode.

2. Nokia and Google announced that they have successfully trialed innovative network slice selection functionality on 4G/5G networks using UE Route Selection Policy (URSP) [2.] technology and Google Pixel 6 (Pro) phones running Android 13. Once deployed, the solution will enable operators to provide new 5G network slicing services and enhance the customer application experience of devices with Android 13. Specifically, URSP capabilities enable a smartphone to connect to multiple network slices simultaneously via different enterprise and consumer applications depending on a subscriber’s specific requirements. The trial, which took place at Nokia’s network slicing development center in Tampere, Finland, also included LTE-5G New Radio slice interworking functionality. This will enable operators to maximally utilize existing network assets such as spectrum and coverage.

Note 2. User Equipment Route Selection (URSP) is the feature that enables one device using Android to connect to multiple network slices simultaneously. It’s a feature that both Nokia and Google are supporting.

URSP capabilities extend network slicing to new types of applications and use cases, allowing network slices to be tailored based on network performance, traffic routing, latency, and security. For example, an enterprise customer could send business-sensitive information using a secure and high-performing network slice while participating in a video call using another slice at the same time. Additionally, consumers could receive personalized network slicing services for example for cloud gaming or high-quality video streaming. The URSP-based network slicing solution is also compatible with Nokia’s new 5G radio resource allocation mechanisms as well as slice continuity capabilities over 4G and 5G networks.

The trial was conducted using Nokia’s end-to-end 4G/5G network slicing product portfolio across RAN-transport-core as well as related control and management systems. The trial included 5G network slice selection and connectivity based on enterprise and consumer application categories as well as 5G NR-LTE slice interworking functionalities.

Nokia is the industry leader in 4G/5G network slicing and was the first to demonstrate 4G/5G network slicing across RAN-Transport-Core with management and assurance. Nokia’s network slicing solution supports all LTE, 5G NSA, and 5G SA devices, enabling mobile operators to utilize a huge device ecosystem and provide slice continuity over 4G and 5G.

Nokia has carried out several live network deployments and trials with Nokia’s global customer base including deployments of new slicing capabilities such as Edge Slicing in Virtual Private Networks, LTE-NSA-SA end-to-end network slicing, Fixed Wireless Access slicing, Sliced Private Wireless as well as Slice Management Automation and Orchestration.

Ari Kynäslahti, Head of Strategy and Technology at Nokia Mobile Networks, said: “New application-based URSP slicing solutions widen operator’s 5G network business opportunities. We are excited to develop and test new standards-based URSP technologies with Android that will ensure that our customers can provide leading-edge enterprise and consumer services using Android devices and Nokia’s 4G/5G networks.”

Resources:

…………………………………………………………………………………………………………………………………………………………….

Addendum:

- Google’s Pixel 6 and Pixel 6 Pro, which run on Android 12, are the first two devices certified on Rogers 5G SA network in Canada, which was deployed in October 2021. However, 5G network slicing hasn’t been announced yet.

- Telia deployed a commercial 5G standalone network in Finland using gear from Nokia and the operator highlighted its ability to introduce network slicing now that it has a 5G SA core.

- OPPO, a Chinese consumer electronics and mobile communications company headquartered in Dongguan, Guangdong, recently demonstrated the pre-commercial 5G enterprise network slicing product at its 5G Communications Lab in collaboration with Ericsson and Qualcomm. OPPO has been conducting research and development in 5G network slicing together with network operators and other partners for a number of years now.

- Earlier this month, Nokia and Safaricom completed Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial.

References:

https://source.android.com/docs/core/connect/5g-slicing

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Casa Systems and Google Cloud strengthen partnership to progress cloud-native 5G SA core, MEC, and mobile private networks

Andover, MA based Casa Systems [1.] today announced a strategic technology and distribution partnership with Google Cloud to further advance and differentiate Casa Systems and Google Cloud’s integrated cloud native software and service offerings. The partnership provides for formalized and coordinated global sales, marketing, and support engagement, whereby Casa Systems and Google Cloud will offer Communication Service Providers (CSPs) and major enterprises integrated Google Cloud-Casa Systems solutions for cloud-native 5G core, 5G SA multi-access edge computing (MEC), and enterprise mobile private network use cases. It’s yet another partnership between a telecom company and a cloud service provider (e.g. AWS, Azure are the other two) to produce cloud native services and software.

This new partnership enables Google Cloud and Casa Systems’ technical teams to engage deeply with one another to enable the seamless integration of Casa Systems’ cloud-native software solutions and network functions with Google Cloud, for best-in-class solution offerings with optimized ease-of-use and support for telecom and enterprise customers. Furthermore, Casa Systems and Google Cloud will also collaborate on the development of unique, new features and capabilities to provide competitive differentiation for the combined Google Cloud – Casa Systems solution offering. Additionally, this partnership provides the companies with a foundation on which to build more tightly coordinated and integrated sales efforts between Casa Systems and Google Cloud sales teams globally.

“We are delighted to formalize our partnership with Google Cloud and more quickly drive the adoption of our cloud-native 5G Core and 5G SA MEC solutions, as well as our other software solutions,” said Jerry Guo, Chief Executive Officer at Casa Systems. “This partnership provides the foundation for Casa Systems and Google Cloud’s continued collaboration, ensuring we remain at the cutting edge with our cloud-native, differentiated software solutions, and that the products and services we offer our customers are best-in-class and can be efficiently brought to market globally. We look forward to working with Google Cloud to develop and deliver the solutions customers need to succeed in the cloud, and to a long and mutually beneficial partnership.”

“We are pleased to formalize our relationship with Casa Systems with the announcement of this multifaceted strategic partnership,” said Amol Phadke, managing director and general manager, Global Telecom Industry, Google Cloud. “We have been working with Casa Systems for over two years and believe that they have a great cloud-native 5G software technology platform and team, and that they are a new leader in the cloud-native 5G market segment. The partnership will enable a much wider availability of premium solutions and services for our mutual telecommunications and enterprise customers and prospects.”

Casa also partnered with Google Cloud last year to integrate its 5G SA core with a hyperscaler public cloud, in order to deliver ultra-low latency applications.

Note 1. Casa Systems, Inc. delivers the core-to-customer building blocks to speed 5G transformation with future-proof solutions and cutting-edge bandwidth for all access types. In today’s increasingly personalized world, Casa Systems creates disruptive architectures built specifically to meet the needs of service provider networks. Our suite of open, cloud-native network solutions unlocks new ways for service providers to build networks without boundaries and maximizes revenue-generating capabilities. Commercially deployed in more than 70 countries, Casa Systems serves over 475 Tier 1 and regional service providers worldwide. For more information, please visit http://www.casa-systems.com.

Image Courtesy of Casa Systems

…………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.fiercetelecom.com/cloud/casa-systems-google-cloud-tout-combined-cloud-native-offering

Global Data: Wireless telcos don’t know how to market 5G SA

A study by leading data and analytics company GlobalData reveals that network operators don’t seem to know how to market this new phase of the technology to their customers. The study by GlobalData Technology was a July 2022 audit of around 30 standalone 5G (5G SA) commercial deployments worldwide.

The conclusion was that although operators are keen to promote the adoption of 5G SA in general marketing messages—largely focusing on the improved network quality and capabilities for enterprises—the number of 5G SA references within consumer 5G service portfolios are few and far between. GlobalData found “many operators marketed 5G SA very similarly to how operators have been marketing non-standard 5G for years,” which itself has yet to be a financial success for wireless telcos.

Emma Mohr-McClune, Service Director at GlobalData, comments: “The lack of effective standalone 5G promotion is a real problem for the future of 5G monetization. Standalone 5G will be a vital requirement for a lot of the more exciting 5G use cases, from autonomous devices to commercial augmented and virtual reality.”

The research found that there were a few exceptional cases of standalone 5G marketing and branding, but many operators marketed standalone 5G very similarly to how operators have been marketing non-standard 5G for years.

Mohr-McClune continues: “The few exceptional cases—in Singapore, but also in Germany and elsewhere—make for fascinating study. In the future, we could see more operators position standalone 5G as greener, safer and more reliable than future generations of wireless technology, but the current industry is still waiting for signature use cases to give the upgrade meaning to consumers. In the meantime, we believe that most operators will focus on marketing the technology to the business sector, where there are more immediate and distinctive use cases emerging.

“In the Enterprise sector, it’s an entirely different story. Standalone 5G enables enterprises to set up their own, closed Private 5G networks, to better manage the connectivity in ultra-connected working set-ups, such as ports and mines – or even ‘slice’ the network for prioritized levels of service for mission-critical operations. The benefits, use cases and ROI are far clearer. But in selling Standalone 5G to consumers, operators are going to have to make sure they don’t repeat the same promises they spun out for non-standalone 5G, or risk appearing to contradict themselves.

The GlobalData report echoed one recently put forth by LightCounting, which tied the tepid deployment pace of 5G SA networks to the industry’s inability to produce compelling use and business cases.

The firm noted that ongoing “headwinds” have limited the deployment of 5G SA networks to just 20 at the end of last year. This was just 10% of the 200 5G non-standalone (NSA) commercial networks deployed worldwide.

Those headwinds are led by “the lack of 5G business cases beyond enhanced mobile broadband combined with some network architecture issues” that continue “to inhibit 5GC SBA [5G core service-based architecture] rollouts.”

“Communications service providers are just sweating their EPC/vEPC [evolved packet core/virtualized evolved packet core] assets, in such conditions, there is no rush to move to 5GC SBA,” the firm explained.

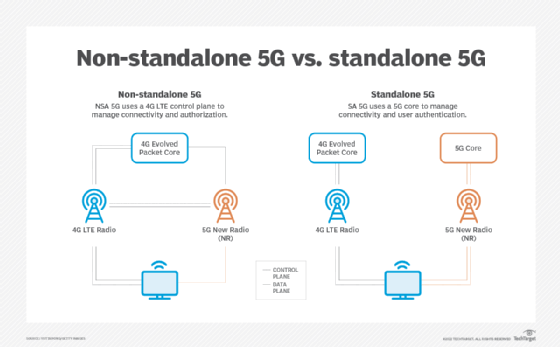

Here’s a simplified block diagram of 5G non-standalone vs 5G standalone networks:

References:

Bouygues Telecom picks Ericsson for cloud native 5G SA core network

France’s Bouygues Telecom is setting the stage for the next phase of its 5G rollout by announcing that Ericsson will be supplying its 5G standalone (5G SA) core network. The strategic partnership between the companies will see the deployment of the cloud-native Ericsson Dual Mode 5G Core.

The French network operator indicated that it will launch 5G SA services in 2023, including solutions supported by 5G network slicing which requires a 5G SA network. Network slicing is a process whereby the amount of network connectivity needed for a task will be secured via a guaranteed ‘slice’ of the network – to help facilitate the broad range of expected use cases as the digitalization of France.

Sectors likely to benefit from the Ericsson-Bouygues Telecom Strategic Partnership include industry, logistics, smart transport, events and healthcare.

Bouygues Telecom’s 5G Standalone connectivity will also use network slicing – a process whereby the amount of network connectivity needed for a task will be secured via a guaranteed ‘slice’ of the network – to help facilitate the broad range of expected use cases as the digitalization of France, and the move to the fourth industrial revolution (4IE), accelerates.

Standalone 5G will also be central to use cases involving artificial intelligence (AI), augmented reality (AR) and automation. Sectors likely to benefit from the Ericsson-Bouygues Telecom Strategic Partnership include industry, logistics, smart transport, events and healthcare. Services resulting from the end-to-end 5G network strategic partnership are expected to be available from early 2023.

Network automation: 5G Core networks must be automated. Automation is required to handle the magnitude of tailor-made services and network slices that will be introduced with 5G. To manually or semi-automate all parts of the network is not feasible if SLAs are to be sustained. To keep up with latest software releases, it’s imperative to have a CI/CD mindset. The faster the latest network capabilities can be introduced, the faster new differentiating services can be rolled out and monetized.

………………………………………………………………………………………………………………………………………………..

Ericsson already provides radio access network (RAN) equipment to Bouygues Telecom. The operator had previously worked with Huawei, but was forced to explore alternative options after the nation’s government effectively banned Huawei from participating in 5G networks after 2028.

Rival operator Orange has already chosen its 5G standalone suppliers in Europe, plumping for Ericsson’s core network in Belgium, Spain, Luxembourg and Poland, and Nokia’s equivalent offering in France and Slovakia.

Iliad’s Free has selected Nokia for its 5G networks in France and Italy. (See Ericsson, Nokia at front of queue for Orange 5G contracts.)

France has not explicitly banned the use of equipment from China-based vendors such as Huawei in 5G networks.

ANSSI, France’s cybersecurity agency, set a very high bar for license authorizations in 5G and previously indicated it will not renew Huawei’s equipment licenses once they run their course.

This decision has posed a logistical and financial challenge to both Bouygues Telecom and rival SFR (Altice France), which have been heavily reliant on Huawei equipment in the past. Indeed, the operators were using Huawei equipment across about half their mobile footprint, according to data provided in 2020 by Strand Consult, a wireless telecom consulting group headed up by colleague John Strand.

In 2021, Bouygues Telecom and SFR began stripping out Huawei equipment from their networks, after unsuccessful legal efforts to challenge France’s stricter security policy for future 5G networks. Bouygues Telecom has said it would have to remove 3,000 Huawei antennas by 2028 in areas with very high population density and that it was prohibited from using Huawei antennas for 5G in Strasbourg, Brest, Toulouse and Rennes.

In a rather curious twist, French newspaper L’Express reported last year that Free filed a case at the Paris Administrative Court against permits given to Bouygues Telecom and SFR to use Huawei 5G antennas. Free claimed that its own request to ANSSI for clearance to use Huawei products was rejected, but Bouygues Telecom and SFR were given the greenlight, which it argued gave its two rivals an unfair advantage.

It seems that it’s not entirely clear the extent to which France’s operators might continue to use Huawei equipment in less sensitive parts of the networks in the coming years.

Meanwhile, Free is leading the charge when it comes to the deployment of 5G-enabled base stations in France. According to the latest update from Arcep, Free has over 14,400 sites compared to Bouygues Telecom’s 7,132; SFR’s 5,721; and Orange’s 3,491. Free’s sites are all in the 700Mhz/800MHz bands.

References:

https://www.ericsson.com/en/news/2022/6/end-to-end-ericsson-sa-5g-for-bouygues-telecom

https://www.lightreading.com/5g/bouygues-telecom-picks-ericsson-as-core-5g-buddy/d/d-id/778363?

T-Mobile Launches Voice Over 5G NR using 5G SA Core Network

T-Mobile has deployed commercial Voice over 5G (VoNR, or Voice Over (5G) New Radio) service in limited areas of Portland, Oregon and Salt Lake City, Utah. The Un-carrier plans to expand VoNR to many more areas this year. Now that Standalone 5G (5G SA) is beginning to carry voice traffic with the launch of VoNR, other real 5G services, such as network slicing and security are likely to be deployed. T-Mobile customers with Samsung Galaxy S21 5G smartphones can take advantage of VoNR today in select areas.

“We don’t just have the leading 5G network in the country. T-Mobile is setting the pace for providers around the globe as we push the industry forward – now starting to roll out another critical service over 5G,” said Neville Ray, President of Technology at T-Mobile. “5G is already driving new levels of engagement, transforming how our customers use their smartphones and bringing unprecedented connectivity to areas that desperately need it. And it’s just going to get better thanks to the incredible T-Mobile team and our partners who are tirelessly innovating and advancing the capabilities of 5G every day.”

Standalone 5G removes the need for an underlying 4G LTE network and 4G core, so 5G can reach its true potential. In other words, it’s “pure 5G”, and T-Mobile was the first in the world to deliver it nationwide nearly two years ago.

The addition of VoNR takes T-Mobile’s standalone 5G network to the next level by enabling it to carry voice calls, keeping customers seamlessly connected to 5G. In the near-term, customers connected to VoNR will notice slightly faster call set-up times, meaning less delay between the time they dial a number and when the phone starts ringing. But VoNR is not just about a better calling experience. Most importantly, VoNR brings T-Mobile one step closer to truly unleashing its standalone 5G network because it enables advanced capabilities like network slicing that rely on a continuous connection to a 5G core.

“VoNR represents the next step in the 5G maturity journey-an application that exists and operates in a complete end-to-end 5G environment,” says Jason Leigh, research manager, 5G & Mobility at IDC. “Migrating to VoNR will be a key factor in developing new immersive app experiences that need to tap into the full bandwidth, latency and density benefits offered by a 5G standalone network.”

“The commercial launch of the VoNR service is another important step in T-Mobile’s successful 5G deployment,” said Fredrik Jejdling, Executive Vice President and Head of Business Area Networks at Ericsson. “It demonstrates how we as partners can introduce 5G voice based on the Ericsson solution.”

“We are proud of our partnership with T-Mobile to bring the full capabilities of 5G to customers in the United States,” said Tommi Uitto, President, Nokia Mobile Networks. “Nokia’s radio and core solutions power T-Mobile’s 5G standalone network – and this VoNR deployment is a critical step forward for the new 5G voice ecosystem.”

“At Samsung, we want to give our users the best possible 5G experience on every device – and today’s announcement represents a big step forward,” said Jude Buckley, Executive Vice President, Mobile eXperience at Samsung Electronics America. “By supporting extensive integration and testing, and working alongside an industry leader like T-Mobile, we’re bringing to life all the benefits of 5G technology with the help of our Samsung Galaxy devices.”

VoNR is available for customers in parts of Portland, Ore. and Salt Lake City with the Samsung Galaxy S21 5G and is expected to expand to more areas and more 5G smartphones this year including the Galaxy S22.

T-Mobile is the U.S. leader in 5G with the country’s largest, fastest and most reliable 5G network. The Un-carrier’s Extended Range 5G covers nearly everyone in the country – 315 million people across 1.8 million square miles. 225 million people nationwide are covered with super-fast Ultra Capacity 5G, and T-Mobile expects to cover 260 million in 2022 and 300 million next year.

………………………………………………………………………………………………………………………………………………………

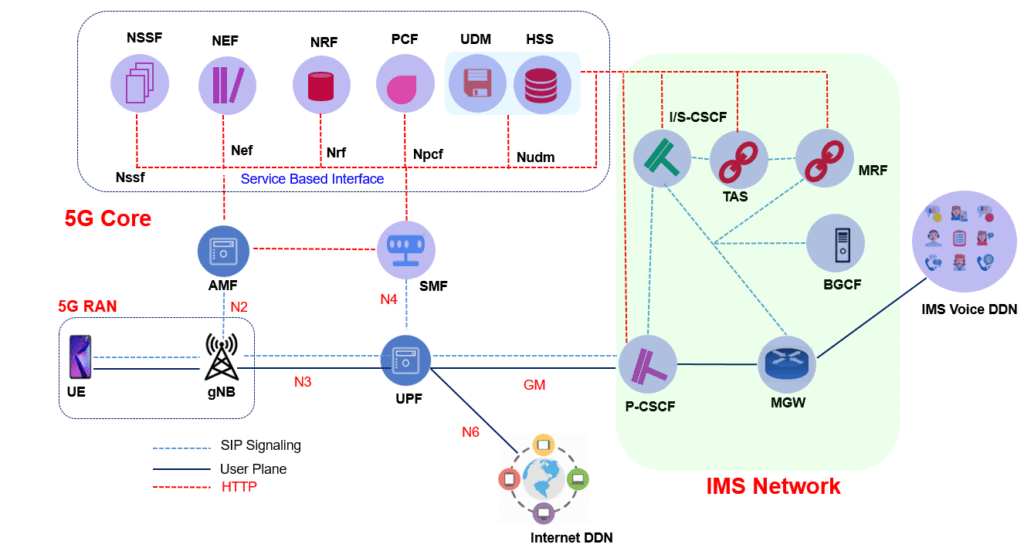

Voice Over NR Network Architecture:

Voice Over NR network Architecture is consist of 5G RAN, 5G Core and IMS network. A high level architecture is shown below. (Only major network functions are included). This network architecture supports Service based interface using HTPP protocol.

VoNR Key Pointers:

- VoNR rely upon IP Multimedia Subsystem (IMS) to manage the setup, maintenance and release or voice call connections.

- UE PDCP should support RTP and RTCP, RoHC compression and MAC layer should support DRX

- SIP is used for signaling procedures between the UE and IMS.

- VoNR uses a QoS Flow with 5QI= 5 for SIP signaling messages and QoS Flow with 5QI= 1

- QoS Flows with 5QI= 5 is non-GBR but should be treated with high priority to ensure that SIP signaling procedures are completed with minimal latency and high reliability.

- QoS Flow with 5QI= 1 is GBR. This QoS Flow is used to transfer the speech packets after connection establishment

- gNB uses RLC-AM mode DRB for SIP signaling and RLC-UM mode for Voice Traffic (RTP) DRBs

- 3GPP has recommended ‘Enhanced Voice Services’ (EVS) codecs for 5G

- EVS codec supports a range of sampling frequencies to capture a range of audio bandwidths.

- These sampling frequencies are categorized as Narrowband, Wideband, Super Wideband and Full band.

- VoNR UE provides capability information during the NAS: Registration procedure with IE ‘ UE’s Usage Setting’ indicates that the higher layers of the UE support the IMS Voice service.

- The AMF can use the UE Capability Request to get UE’s support for IMS Voice services. gNB can get UE Capability with RRC: UE Capability Enquiry and UE Capability response to the UE. The UE indicates its support for IMS voice service with following IEs

-

- ims-VoiceOverNR-FR1-r15: This field indicates whether the UE supports IMS voice over NR FR1

- ims-VoiceOverNR-FR2-r15: This field indicates whether the UE supports IMS voice over NR FR2

- within feature set support IE ims-Parameters: ims-ParametersFRX-Diff, voiceOverNR : supported

-

References:

https://www.techplayon.com/voice-over-nr-vonr-call-flow/

Samsung’s Voice over 5G NR (VoNR) Now Available on M1’s 5G SA Network

STC launches first 5G standalone (SA) core network in Bahrain via Huawei

STC Bahrain [1.] has announced the launch of the first 5G standalone (SA) core network in the kingdom using Huawei network equipment. This 5G SA network will enable new communication services for consumers and enterprises. Examples include high-resolution video, VR, AR, multimedia and online data communication.

The 5G standalone network will support the three ITU-R 5G Use Cases — enhanced mobile broadband (eMBB), ultra-reliable low latency communications (URLLC) and Massive Machine-Type Communications (mMTC) services. It will enable services in the public security, transportation, banking, consumer services, manufacturing, petroleum, port, healthcare and education sectors, among others.

5G SA supports multi-access edge computing (MEC) and uplink-centric broadband connectivity for both B2B and B2C services, STC said.

STC and Zain have deployed commercial 5G SA networks in Saudi Arabia, while STC has also launched 5G SA in Kuwait.

Note 1. STC Bahrain is a telecommunications service provider based in Bahrain. It is owned by the Saudi Telecom Company and started its commercial service in March 2010. The company is headquartered in Manama, Bahrain.

References:

http://www.abc-bahrain.com/News/1/334499

https://www.gsma.com/mobileeconomy/wp-content/uploads/2022/05/GSMA_MENA_ME2022_R_WebSingles.pdf

Viavi’s State of 5G report finds 1,947 5G cities (635 new) -mostly NSA- at end of 2021

As of end-December, the number of cities worldwide with 5G networks was 1,947 , with 635 new cities added in 2021, according to the latest Viavi Solutions report ‘The State of 5G.’

By the end of January 2022, 72 countries had 5G networks, with Argentina, Bhutan, Kenya, Kazakhstan, Malaysia, Malta and Mauritius coming online in the second half of 2021.

Europe, Middle East & Africa (EMEA) passed Asia Pacific including Greater China (APAC), to become the region with the most 5G cities, at 839. APAC has 689 5G cities and the Americas has 419.

China has the most 5G cities (356), ahead of the US (296) and the Philippines (98). However, more than half of China’s so called 5G subscribers are on 4G networks. Robert Clark of Light Reading wrote: “China has tried to kick-start 5G with low prices, with the result that it has a huge population of 5G subscribers on 4G networks. Less than half of China Mobile’s 467 million 5G subs are actually using 5G – a ratio that has remained constant for the past year.”

Most 5G networks deployed are Non-Standalone (NSA) networks. There are only 24 5G Standalone (SA) networks. It is widely considered that many of the next-generation use cases and monetization models associated with 5G, beyond enhanced Mobile Broadband (eMBB) will only be possible when Standalone 5G networks built on new 5G core networks are in place.

![]()

The State of 5G also highlights the growing Open RAN ecosystem, combining mobile operators as well as software and infrastructure vendors, seeking to develop an open, virtualized Radio Access Network (RAN) with embedded Artificial Intelligence (AI) control. As of March 2022, 64 operators have publicly announced their participation in the development of Open RAN networks. This breaks down to 23 live deployments of Open RAN networks, 34 in the trial phase with a further seven operators that have publicly announced they are in the pre-trial phase.

As of March 2022, 64 operators publicly announced their participation in the development of Open RAN networks, of which 23 were live deployments, 34 in the trial phase and another 7 operators in the pre-trial phase.

“5G continued to expand, despite the headwinds of a global pandemic,” said Sameh Yamany, CTO, VIAVI Solutions. “What comes next in 5G is the reinforcement of networks. This will take a couple of forms. Firstly, we expect to see more Standalone 5G networks, which will deliver on much of the promise of 5G, both for the operator and for the wider ecosystem of users. And secondly, we expect to see Open RAN continue its rapid development and start to become a de facto standard. VIAVI will continue to play a central role in testing those new networks as they are built and expanded.”

References:

https://www.viavisolutions.com/en-us/literature/state-5g-may-2022-posters-en.pdf

https://www.lightreading.com/asia/consumers-still-seeking-reason-to-buy-5g/d/d-id/777250?

UK’s Manufacturing Technology Centre (MTC) installs a standalone 5G private network from BT and Nokia

BT is participating in a UK publicly funded 5G Standalone (SA) core network testbed project with Nokia. Officially unveiled this week, the project involves installation of Nokia’s 5G SA equipment at Coventry’s Manufacturing Technology Center (MTC).

This project is part of the West Midlands 5G (WM5G) initiative, which is supported by the UK government’s 5G Test Beds and Trials funding program. It will give SMEs, corporate members, neighboring universities, and the wider industry the opportunity to explore private 5G and on-premises multi-edge computing to drive forward innovation in the region beyond the duration of the programme.

The goal is to “explore private 5G and on-premises multi-edge computing to drive forward innovation in the region beyond the duration of the program,” according to the group’s announcement.

Businesses and universities, along with “wider industry,” are given the chance to use MTC facilities to test the technology. This includes the center’s recently launched “5G-enabled demonstrator system,” which provides features such as 5G-connected robotics, computer vision and edge computing.

One use case under review is an “automated inspection process” to prove how intelligent automation and advanced connectivity could enable manufacturing sites to maximize productivity and utilization of inspection technology (while also reducing footprint and product waste).

MTC points out that traditional in-person inspections can be time consuming and prone to human error. Neither are they automatically recorded.

BT Enterprise CEO Rob Shuter told Light Reading: “It’s why 5G conversations in the enterprise space are more around deploying a private network over a manufacturing facility, a harbor, a military base etc,” he said. “I’d say we’re in the early stages of that. The technology is still maturing and customer needs are sort of emerging in a co-creation phase. I think we’ll be in that phase for most of this year, and it’ll probably be industrial scaling in ’23, ’24 and ’25.”

BT’s new Division X is spearheading the company’s efforts to sell new solutions to enterprise customers. Marc Overton, former Sierra Wireless SVP, was recently appointed Division X managing director.

Quotes:

Andy Street, Mayor of the West Midlands, said: “This innovative collaboration between WM5G and MTC will enable some of our region’s most cutting-edge businesses to power forward their pioneering work in computing and robotics alongside our dynamic universities. Given the commitment to Innovation Accelerators set out in the Levelling Up White Paper, this announcement is wonderfully timed”.

Robert Franks, Managing Director at WM5G, said: “Manufacturing is at the heart of the economy in the West Midlands, and at WM5G we are working collaboratively with our partners to ensure that public and private sector organisations can remain competitive in the global marketplace and develop cutting edge technologies to advance their capabilities.

“We are so pleased to have delivered a successful trial in partnership with nexGworx and BT at the MTC, driving forward the transformation of manufacturing productivity for the region. The learnings and outcomes from our demonstration will now be used and applied across the sector to ensure best practice is carried forward, and to accelerate the adoption of 5G technology more widely.”

Alejandra Matamoros, Technology Manager in the MTC’s Digital Engineering Group, said: “Our connected facility at the MTC will allow manufacturers of all sizes, research, and technology suppliers to explore the benefits of 5G in manufacturing. Through our enduring collaboration with nexGworx and BT we are now planning to further build on the initial capability we’ve created here at the MTC to push the boundaries of what can be achieved with the help of 5G technology.

“We hope that this project will inspire further development of innovative solutions to solve real business challenges and develop new opportunities through advanced wireless connectivity.”

https://www.lightreading.com/5g/bt-gets-into-5g-sa-testbed-with-nokia/d/d-id/776162?

Cisco’s 5G pitch: Private 5G, 5G SA Core network, optical backhaul and metro infrastructure

At MWC 2022 in Barcelona, Cisco revealed its Private 5G market strategy together with partners. It was claimed to usher in “a new wave of productivity for enterprises with mass-scale IoT adoption.” Cisco’s 5G highlights:

- Cisco Private 5G as-a-Service delivered with global partners offers enterprise customers reduced technical, financial, and operations risks with managing enterprise private 5G networks.

- Cisco has worked in close collaboration with two leading Open RAN vendors to include O-RAN technology as part of Cisco Private 5G and is currently in customer trials with Airspan and JMA.

- Multiple private 5G pilots and projects are currently underway spanning education, entertainment, government, manufacturing, and real estate sectors.

- 5G backhaul and metro infrastructure via routed optical networking (rather than optical transceivers like those sold by Ciena)

Cisco Private 5G:

The foundation of the solution is built on Cisco’s industry-leading mobile core technology and IoT portfolio – spanning IoT sensors and gateways, device management software, as well as monitoring tools and dashboards. Open Radio Access Network (ORAN) technology is a key component of the solution. Cisco is working in close collaboration with ORAN vendors, JMA and Airspan, and is currently in customer trials utilizing their technology.

Key differentiators of Cisco Private 5G for Enterprises:

- Delivered as-a-Service: Delivered together with global service providers and system integration partners, the offer reduces technical, financial, and operational risks for enterprise private 5G networks.

- Complementary to Wi-Fi: Cisco Private 5G integrates with existing enterprise systems, including existing and future Wi-Fi versions – Wi-Fi 5/6/6E, making operations simple.

- Visibility across the network and devices: Using a simple management portal, enterprise IT teams can maintain policy and identity across both Wi-Fi and 5G for simplified operations.

- Pay-as-you-use subscription model: Cisco Private 5G is financially simple to understand. With pay-as-you-use consumption models, customers can save money with no up-front infrastructure costs, and ramp up services as they need.

- Speed time to productivity: Businesses can spare IT staff from having to learn, design, and operate a complex, carrier class private network.

Key Benefits of Cisco Private 5G for Partners:

- Path to Profitability for Cisco Partners: For its channel partners, Cisco reduces the required time, energy, and capital to enable a faster path to profitability.

- Private Labeling: Partners can private label/use their own brand and avoid initial capital expenses and lengthy solution development cycles by consuming Cisco Private 5G on a subscription basis. Partners may also enhance Cisco Private 5G with their own value-added solutions.

“Cisco has an unbiased wireless strategy for the future of hybrid work. 5G must work with Wi-Fi and existing IT environments to make digital transformation easy,” said Jonathan Davidson, Executive Vice President and General Manager, Mass-Scale Infrastructure Group, Cisco. “Businesses continuing their digitization strategies using IoT, analytics, and automation will create significant competitive advantages in value, sustainability, efficiency, and agility. Working together with our global partners to enable those outcomes with Cisco Private 5G is our unique value proposition to the enterprise.”

The concept of private networks running on cellular spectrum isn’t new — about 400 private 4G LTE networks exist today — but Cisco expects “significantly more than that in the 5G world,” Davidson said. “We think that in conjunction with the additional capacity or also the need for high-value asset tracking is really important.”

During a MWC interview with Raymond James, Davidson said, “Mobile networks aren’t mobile for very long. They have to get to a wired infrastructure,” and therein lies multiple roles for Cisco to play in the telco market.

Cisco’s opportunity in the telco space includes the buildout of new backhaul and metro infrastructure to handle increased capacity and bandwidth, its IoT Control Center, private networks, and the core of mobile network infrastructure.

“We continue to be a market leader in that space,” Davidson said, referring to Cisco’s 4G LTE and 5G network core products. More than a billion wireless subscribers are connected to Cisco’s 4G LTE core, and it plays a central role on T-Mobile’s 5G standalone core, which serves more than 100 million subscribers on a converged 4G LTE and 5G core, he added.

Davidson also expects Cisco’s flattened infrastructure, or routed optical networking, to gain momentum in wireless networks. But first, a definition. For Cisco, optical refers to the technology that moves bits from point A to point B, not optical transceivers.

“Our belief is there is going to be a transition in the market towards what we call routed optical networking. And this means that takes traditional transponders and moves them from being a shelf, or a separate box, or a device, and turns them into a pluggable optic, which you then plug into a router,” he said.

That’s where Cisco’s $4.5 billion acquisition of Acacia Communications comes into play. In October 2021, we reported that Cisco’s Acacia unit is working together with Microschip to validate the interoperability of their 400G pluggable optics components – Microchip’s DIGI-G5 OTN processor and META-DX1 terabit secured-Ethernet PHY and Acacia’s 400G pluggable coherent optics.

The second phase of this type of network transformation involves the replacement of modems that exist in optical infrastructure with routers that carry pluggable transponders, Davidson added. The third phase places private line emulation onto that same infrastructure.

Supporting Comments:

“DISH Wireless is proud to partner with Cisco to bring smart connectivity to enterprise customers through dedicated private 5G networks. Together, we have the opportunity to drive real business outcomes across industries. We’re actively collaborating with Cisco on transformational projects that will benefit a variety of sectors, including government and education, and we’re working to revolutionize the way enterprises can manage their own networks. As DISH builds America’s first smart 5G network™, we’re offering solutions that are open, secure and customizable. Teaming with Cisco is a great next step, and we look forward to offering more innovative solutions for the enterprises of today and beyond.”

— Stephen Bye, Chief Commercial Officer, DISH Wireless

“Cisco is busting the myth that enterprises can’t cross Wi-Fi, private 5G and IoT streams. Enterprises are now tantalizingly closer to full visibility over their digital and physical environments. This opens up powerful new ways to innovate without compromising the robust control that enterprises require.”

— Camille Mendler, Chief Analyst Enterprise Services, Omdia

“Developing innovative, customized 5G private network solutions for the enterprise market is a major opportunity to monetize the many advantages of 5G technology. Airspan is proud to be one of the first leading Open RAN partners to participate in the Cisco Private 5G solution and offer our cutting edge 5G RAN solutions including systems and software that are optimized for numerous enterprise use cases.”

— Eric Stonestrom, Chairman and CEO, Airspan

“This partnership opens a world of new possibilities for enterprises. With simple downloaded upgrades, our all-software RAN can operate on the same physical infrastructure for 10+ years—no more hardware replacements every 36 months. And as the only system in the world that can accommodate multiple operators on the same private network, it eliminates the need to build separate networks for new licensed band operators.”

— Joe Constantine, Chief Technology & Strategy Officer, JMA

“5G marks a milestone in wireless networking. For organizations, it opens many new opportunities to evolve their business models and create a completely new type of digital infrastructure. We see strong demand in all types of sectors including manufacturing and mining facilities, the logistics and automotive industries, as well as higher education and the healthcare sector. As a leading Cisco Global Gold Partner, we are excited to help drive this evolution. Thanks to our deep expertise, international capability, and close partnership with Cisco, we can support companies in integrating Private 5G into their enterprise networks,”

— Bob Bailkoskiis, Logicalis Group CEO.

“NEC Corporation is working on multiple 5G initiatives with Cisco. We have a Global System Integrator Agreement (GSIA) partnership for accelerating the deployment of innovative 5G IP transport network solutions worldwide. Work is in progress to connect Cisco’s Mobile Core and NEC’s radio over Cisco’s 5G Showcase in Tokyo, a world leading 5G services incubation hub. Leveraging NEC’s applications, Cisco and NEC will investigate expanding the technical trials including Private 5G in manufacturing, construction, transportation, and others.”

—Yun Suhun, General Manager, NEC Corporation

Industry Projects Underway

Cisco is working together with its partners on Private 5G projects for customers across a wide range of industries including Chaplin, Clair Global, Colt Technology Services, ITOCHU Techno-Solutions Corporation, Madeira Island, Network Rail, Nutrien, Schaeffler Group, Texas A&M University, Toshiba, Virgin Media O2, Zebra Technologies and more. See news release addendum for project details and supporting comments.

Final Thoughts:

“Radio access networks themselves are between $30 billion and $40 billion a year. Depending on who you talk to, optical (networking) can be between $10 billion and $15 billion a year. And then routing is below $10 billion a year,” Davidson said. “Our belief is that the optical total addressable market will start to shift over time as routed optical networks become more prevalent, because it will move from the optical domain into the optic transceiver market,” he added.

Finally, although Cisco repeatedly insists it has no interest in becoming a RAN supplier, it remains strongly supportive of Open RAN. The RAN market “is still closed, it’s locked in, even though there are standards,” he said.

“People do not do any interoperability testing between vendors, which is fundamentally changing with open RAN” because operators are forcing vendors to make their equipment interoperate with open RAN implementations, Davidson concluded.

References:

Microchip and Cisco-Acacia Collaborate to Progress 400G Pluggable Coherent Optics

Additional Resources:

- Cisco Private 5G

- Blog: Private 5G Delivered on Your Terms, Masum Mir, Vice President and General Manager, Mobile, Cable and IoT

Bloomberg: 5G in the U.S. Has Been a $100 Billion Box Office Bomb

From the very start of 5G deployments three years ago, there have been challenges with the technology, like when AT&T confusingly branded 4G as “5G E.” Conspiracy theorists have tagged 5G as a source of harmful radiation and a spreader of the coronavirus.

More recently, airlines and the FAA have complained that C-Band frequencies could interfere with radar and jeopardize air safety. To date, the biggest knock against 5G is that it’s been a nonevent. And, by the time it’s in full force, big tech companies including Amazon, Microsoft, and Google may have beaten the wireless carriers to the kinds of data-hungry applications that superfast 5G networks have been expected to spawn. At FCC auctions, U.S. carriers spent $118B on 5G spectrum- about twice as much as they spent on 4G.

Source: FCC

The higher speeds and greater capacity of 5G are needed to meet growing demand for services such as high-definition video streaming. However, the big improvement with 5G technology was supposed to be Ultra High Reliability and Ultra Low Latency (URLLC), which was to spawn a wide variety of new mission critical and real time control applications. That hasn’t happened because the ITU-R M.2150 RAN standard (based on 3GPP release 15 and 16) doesn’t meet the URLLC performance requirements in ITU M.2410 while the 3GPP Release 16 URLLC in the RAN spec (which was to meet those requirements) has not been completed or performance tested.

Also, all the new 5G features, such as network slicing, can only be realized with a 5G SA core network, but very few have actually been deployed. Adjunct capabilities, like virtualization, automation, and multi-access edge computing also require a “cloud native” 5G SA core network. Finally, the highly touted 5G mmWave services (like Verizon’s Ultra-Wideband) consume a tremendous amount of power, require line of sight communications, and have limited range/coverage.

Lacking a compelling reason to persuade customers to upgrade, carriers have been offering $1,000 5G phones for free to help jump-start the conversion process. Such promotions are needed because 5G isn’t even among the top four reasons people switch carriers, according to surveys by Roger Entner of Recon Analytics Inc. Those reasons typically include price or overall network reliability.

Ironically, one area where 5G has had early success is in providing wireless home broadband service (aka Fixed Wireless Access or FAA). That’s because 5G was designed for mobile- not fixed- communications and FAA was not even a targeted use case by either ITU-R or 3GPP. Nonetheless, as faster 5G mid-band frequencies are built out, customers are finding a wireless alternative to landline providers. This threat to cablecos is likely to spark price battles as the cable operators respond by offering cheaper mobile phone service of their own.

This was not the way 5G was envisioned or promoted. Carriers were rolling out 5G to deliver an “oh, wow” experience that customers would willingly pay extra for. Instead the technology has become a standard feature in an arena where mobile phone companies and cable operators are battling it out with similar packages. As that reality started to take hold, the carriers pointed to bigger, more immediate opportunities such as selling 5G to large companies and governments. “It became apparent a while ago that the most compelling use cases for 5G would revolve around businesses rather than consumers,” GlobalData’s Parker said.

To help make that happen, the major carriers formed partnerships with the so-called webscalers, the big cloud service providers including Amazon’s AWS, Microsoft’s Azure, Google, and Meta Platforms that handle data storage, online ordering, and video streaming for big companies. Each cloud giant sees 5G as a valuable entry into new classes of services, such as secure private networks to replace Wi-Fi, factory automation, and edge computing, which brings network hardware closer to end users to increase speeds.

To help make that happen, the major carriers formed partnerships with the so-called webscalers, the big cloud service providers including Amazon’s AWS, Microsoft’s Azure, Google, and Meta Platforms that handle data storage, online ordering, and video streaming for big companies. Each cloud giant sees 5G as a valuable entry into new classes of services, such as secure private networks to replace Wi-Fi, factory automation, and edge computing, which brings network hardware closer to end users to increase speeds.

The wireless carriers are staking their futures on these workplace roles. But because no 5G hyperconnected, cloud-powered commercial ecosystem has been built before, tech giants and telecommunications companies are collaborating to tackle the challenge.

While new partnerships are still being announced and big 5G projects are moving through the planning stages, executives at the wireless companies say they’re confident they can play a role in the information technology infrastructure of the future. “I’m proud to be the only carrier in the world that has partnership agreements with all three of the big webscalers,” says Verizon Communications Inc.’s business services chief Tami Erwin. “We’re creating the platform for the metaverse to really accelerate.”

As 4G showed, the carriers could create a higher-functioning network, but it was other companies such as Uber, Netflix, and Facebook that cashed in on the connectivity. 5G is set to expand the overall pie again, but the size of the carriers’ slice isn’t certain—bad news because they spent $118.4 billion on 5G airwave auctions, almost double the $61.8 billion they paid for 4G spectrum.

T-Mobile US Inc., which has taken the lead in U.S. 5G deployment, plans to focus on its core network strength as the tech giants sort things out, says Neville Ray, T-Mobile’s president of technology. “Facebook, Apple, Microsoft, Google—all of these massive companies are lining up huge investments in this space, and they need mobile networks in a way that they never did before,” he says. “They will need network capabilities that they simply don’t have any desire to build.”

That’s led a bunch of would-be competitors to work arm-in-arm to create a collective business model. “We have a great partnership with Microsoft,” says AT&T’s Sambar. “We’re a customer of Amazon, and they’re a customer of ours. We’re all friends today, we keep a close eye on each other. You have to cooperate to make this happen.”

The carriers provide businesses with a roster of services including voice, data, network management, and security, and they’ll want to keep control of those relationships as services emerge in 5G, says longtime Wall Street industry analyst Peter Supino. But as the cloud providers gain a bigger role in a business’s network infrastructure, running everything from robotics on the production floor to in-office wireless data systems, the carriers’ role may shift to more of a wholesale supplier of network capacity and mobile cellular service to the cloud companies, according to Supino.

“Over time, I’m confident that the cloud operators will provide too much convenience to be ignored,” he says. “The benefits of 5G will be significant, and they will mostly accrue to people who aren’t the telco carriers.”

References:

https://www.verizon.com/about/news/power-verizon-5g-ultra-wideband-coming