Cisco

Cisco and AT&T to expand connectivity for hybrid workforces

Cisco and AT&T today announced new solutions to enhance connectivity and advance the calling landscape for hybrid workforces. Whether on the shop floor, the top floor, at the branch office, the home office, or the commute in between, the modern workforce is not tethered to a single space, device, or geography. With the new offerings, including Cisco’s Webex Calling and SD-WAN solutions alongside AT&T mobile network, businesses of any size can offer employees a simple, secure, consistent experience to thrive in any setting.

The companies today announced plans that will help ensure a seamless and reliable mobile-first collaboration experience, allowing users the flexibility to take calls across multiple devices while traveling for work, running errands, and more.

With the dramatic increase in the use of mobile phones as the primary business device, enterprises need connectivity solutions that are easy to manage, secure, and provide the flexibility and reliability desired for work from anywhere. This integration addresses this need with key features including:

- Single number mobile identity: Combining the capabilities of an AT&T wireless smartphone with the native integration of Webex Calling will provide greater functionality and flexibility for on-the-go communication.

- Reduce costs: This integration helps enterprise customers lower costs by reducing or eliminating the need for traditional fixed business lines.

- Crystal clear voice: AT&T Cloud Voice with Webex Go allows users to securely make and receive business calls using AT&T’s fast, reliable nationwide mobile network and seamlessly elevate calls to a fully immersive Webex collaboration experience across the Webex App and devices1, with capabilities like closed captioning, noise removal, and white boarding.

- Fast, efficient, and secure collaboration: AT&T and Cisco’s joint solution will increase the ability to effectively and securely collaborate no matter the location, resulting in improved knowledge sharing and faster decision making.

AT&T Cloud Voice with Webex Go2 will be available for all Webex Calling users from Cisco partners in the United States later this year.

SD-WAN Connectivity without Compromise:

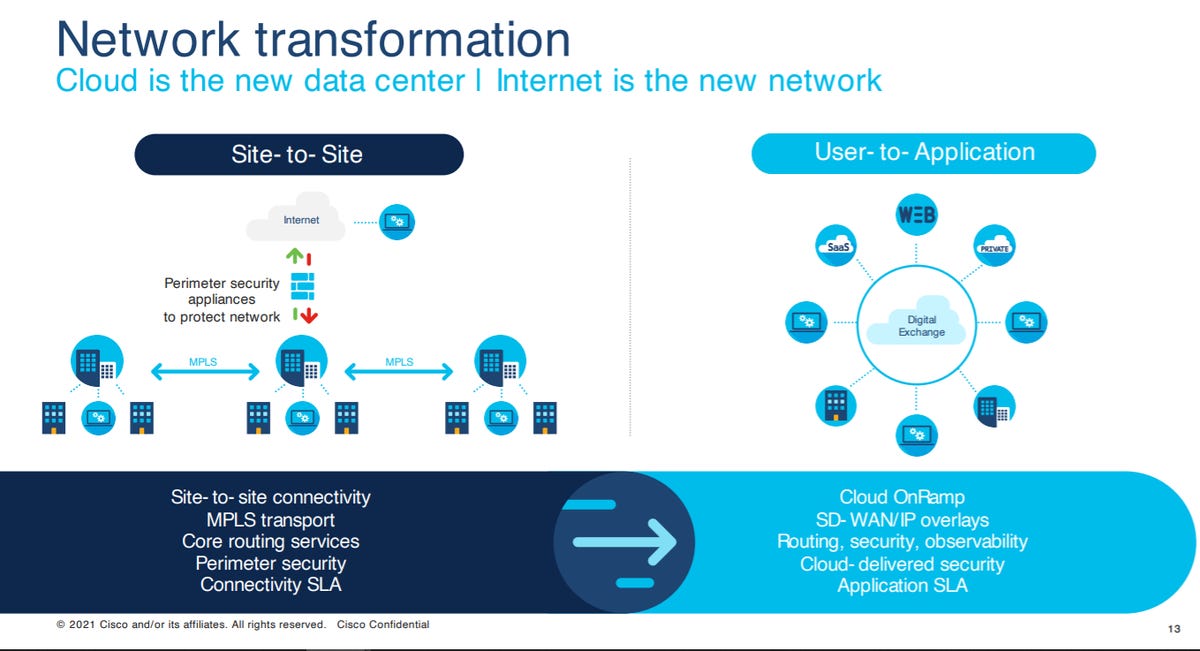

Demand for unified experiences over secure connectivity to the cloud and site-to-site continues to surge. Cisco and AT&T are working together to bring secure on-demand connectivity for SD-WAN with add-on services that may include over mobile 5G and fiber broadband to businesses of every size.

For small and medium businesses, AT&T is launching a new self-service option to simplify and accelerate SD-WAN deployment. Businesses can now easily connect, protect, manage, and scale their networks using AT&T Business Wi-Fi with Cisco Meraki.

For larger enterprises, AT&T SD-WAN with Cisco is a fully managed connectivity solution with embedded security and analytics. Enterprises can now confidently connect a user or device to any application in their multicloud using a secure access service edge (SASE)-enabled architecture. This delivers integrated security and application optimization for end-to-end visibility.

Cisco will also provide the ability to embed AT&T wireless connectivity into Cisco devices enabling zero touch provisioning for Cisco and AT&T customers, through AT&T Control Center powered by Cisco.

“The network is at the core of the modern workforce. The ability to get things done is no longer reliant on where you are, but how you are connected,” said Jonathan Davidson, Executive Vice President and General Manager of Cisco Networking. “Hybrid work only works when there is a seamless, consistent, and secure experience for workers, regardless of location. Together with AT&T, we are giving businesses what they need to securely connect everything and everyone—wherever they are. Because when everything is connected, then anything is possible.”

“Mobility is key to enabling hybrid work. Businesses want a seamless and reliable communication experience,” said Mike Troiano, Senior Vice President, Business Products, AT&T. “At the heart of our collaboration with Cisco is a shared vision to empower organizations with secure connectivity, unmatched reliability, and deep network expertise. By deeply integrating our technology, businesses can be assured their communications are built on a solid foundation. Together we are unlocking new levels of productivity, agility, and connectivity— enabling teams to thrive in the modern work landscape.”

Webex Go with AT&T’s Mobile Network

About AT&T:

We help more than 100 million U.S. families, friends and neighbors, plus nearly 2.5 million businesses, connect to greater possibility. From the first phone call 140+ years ago to our 5G wireless and multi-gig internet offerings today, we @ATT innovate to improve lives. For more information about AT&T Inc. (NYSE:T), please visit us at about.att.com. Investors can learn more at investors.att.com.

About Cisco:

Cisco is the worldwide technology leader that securely connects everything to make anything possible. Our purpose is to power an inclusive future for all by helping our customers reimagine their applications, power hybrid work, secure their enterprise, transform their infrastructure, and meet their sustainability goals. Discover more on The Newsroom and follow us on Twitter at @Cisco.

NTT and Cisco launch IoT as a Managed Service for Enterprise Customers

NTT and Cisco have teamed up to launch a suite of repeatable IoT solutions that can be sold as a managed service. The partnership brings together NTT’s edge infrastructure, managed services, and IT systems integration expertise and Cisco’s IoT capabilities. Together, they promise to offer IoT services that encompass real-time data insights, enhanced security, improved decision-making, and reduced operational costs through predictive maintenance, asset tracking, and supply chain management.

NTT and Cisco are targeting opportunities in the manufacturing, transportation, healthcare and utility sectors, where they claim there is growing demand for edge computing and IoT solutions. The team has already begun working with Belgian public water distribution utility, Compagnie Intercommunale Liégeoise des Eaux (CISE). CISE has deployed thousands of LoRaWAN sensors on its infrastructure, giving it the visibility it needs to improve efficiency in the areas of water quality, consumption, distribution, and maintenance. It’s being delivered as a managed service by NTT and Cisco.

“We are accelerating our IoT business initiatives to deliver a powerful portfolio of repeatable services that can be tailored to meet customer demand for these kinds of solutions,” said Devin Yaung, SVP of group enterprise IoT products and services at NTT, in a statement. “We’re doubling down on NTT’s IoT capabilities to meet customer demand,” said Yaung. “What we’re doing is pulling together our collective knowledge and skillsets, and putting the full power of NTT behind it, to better service our customers and the increasing need to outfit or retrofit their organisations with the connectivity and visibility they need to improve day-to-day business operations.”

“We are excited to work together to help transition our customers to this IoT-as-a-service model so they can quickly realise the business benefits across industries and around the globe,” added Samuel Pasquier, VP of product management, industrial IoT networking, at Cisco.

According to IoT Analytics, global enterprise IoT spending is expected to grow 19% to $238 billion in 2023, up from $201 billion in 2022. By 2027, it could reach as high as $483 billion.

References:

https://iot-analytics.com/iot-market-size/?utm_source=IoT+Analytics+Master+People+List

Cisco 800G line card for Cisco 8000 Series Routers powered by Silicon One ASIC

Cisco today announced 800G innovations that continue to transform the economics and sustainability of the Internet for the Future, to help its customers connect the nearly 40% of the world’s population that remains unconnected or underserved.

As IoT devices grow from billions to trillions, demand for bandwidth grows not only from connecting devices with 5G and Wi-Fi, but also from the AI/ML workloads required to drive insights from IoT. Applications such as generative AI, search, language processing, and recommendation engines, are driving rapid growth of AI/ML clusters in data center environments that require more bandwidth over traditional workloads. AI/ML fabrics need to scale with denser spines that are critical to support the massive number of processors with low latency, in addition to capacity expansion in Data Center Interconnect.

While bandwidth growth seems unlimited, space and power are limited. Dense and power-efficient platforms are required. Cisco is doubling the capacities of communication service provider and Webscale customer backbones, metro core, and data center networks compared to 400G/100G modular solutions.

The new 28.8Tbps / 36 x 800G line card for Cisco 8000 Series Routers is powered by Cisco Silicon One [1] and lowers operational costs while protecting investments as communication service providers and cloud operators transform networks from 100G to 400G, and 800G capacities. Customers can benefit from carbon savings by using less hardware to scale, and equipment reuse.

Note 1. Cisco Silicon One is claimed to be the only unifying architecture enabling customers to deploy the best-of-breed silicon from Top of Rack (TOR) switches all the way through the web scale data centers and across the service provider networks with a fully unified routing and switching portfolio.

“We continue to expand 800G to more use cases, from AI/ML fabrics to the core, to help our customers meet their performance and sustainability goals,” said Kevin Wollenweber, Senior Vice President and General Manager, Cisco Networking, Data Center and Provider Connectivity. “With our dense core and spine solutions using new double density line cards with Cisco Silicon One, we have accelerated the transition to 800G anywhere.”

Key Benefits of Modular Cisco 8000 Series Router Systems Powered by Cisco Silicon One P100:

- Economics: With up to 83% space savings, customers can build denser networks using much of the same infrastructure to support use cases such as 5G, IoT, broadband and AI/ML. Other benefits include:

- By doubling the capacity in the same chassis footprint, the Cisco 8000 Series Router platform has up to twice the space efficiency over 400G single chassis systems.

- These 800G single chassis systems can now support equivalent traffic loads with up to 6x more space efficiency compared to current 400G distributed chassis solutions, by delivering up to 15 Tbps per Rack Unit.

- New 800G modular systems can also provide the equivalent bandwidth capacity with up to an estimated 68% savings in power compared to 400G solutions to help reduce operational costs.

- Sustainability: With up to 68% power savings, the 800G systems can help customers meet their sustainability goals.

- Assuming a single 800G system is in use 24 hours per day, 365 days per year, the potential energy savings over 400G systems would reduce GHG emissions by up to 215,838 CO2e per year.

- This amount of carbon savings is estimated to be equivalent to reducing carbon emissions from charging 40 million smartphones or burning 366,923 pounds of coal a year [1]

- Customers can also reuse common equipment when upgrading to 800G systems to help cut down on e-waste.

- Architectural Innovations: Powered by Cisco Silicon One P100 ASICs and Cisco pluggable optics, the new line card offers massive throughput for Cisco 8800 Series modular systems. Key features include:

- Advanced 100G SerDes technology allows customers to double current 400G port densities and increase by 8-fold current 100G port densities in the same form factor, supporting 72 x 400G and 288 x 100G ports per slot.

- Ability to scale up to 800G to support increasing traffic demands with four, eight, twelve, and 18-slot chassis. Customers can scale up to 518 Tbps capacity with a single 18-slot modular 800G system.

- Pay-as-you-grow Flexible Consumption Model helps customers futureproof their deployments by right-sizing the network, adding capacity over time to better align to business outcomes.

- Cisco’s new generation of pluggable optics provide investment protection through backwards compatibility with existing QSFP pluggable transceivers.

- Operational Simplicity: With advanced visualization dashboards, services monitoring with actionable insights, and closed-loop network optimization customers can detect issues and troubleshoot faster.

- With the latest enhancements in Crosswork Network Automation the speed at which network elements and services can be added has been significantly improved.

- New IOS XR Path Tracing provides hop-by-hop visibility of the packet’s path through the network.

Industry Response:

“Based on our extensive market research and traffic analysis, we are forecasting continued growth in data traffic with fixed and mobile services, including for 5G, broadband, IoT and cloud. These trends are putting networks under increasing pressure, which is why scaling to 800G throughput in the future with solutions such as Cisco 8000 will be in demand, while helping service providers and cloud providers improve operational efficiency, sustainability, and user experience.” — Simon Sherrington, Research Director, Analysys Mason

“Together with Cisco, we seek new approaches to drive market differentiation and deliver business outcomes through agile, secure infrastructure at every stage of the technology journey. As a key enabler of the kingdom’s Vision 2030, we must ensure that our technology stays at the forefront of technological Innovations. With modular 800G innovations and Silicon One P100 on the Cisco 8000 Series, we continue to push towards new levels of cloud connectivity and digital transformation while benefiting from operational efficiencies that allow stc group to maintain providing a high-performing, lower cost-per-bit service to our customers.” — Bader Allhieb – stc Infrastructure, stc

“Colt is working towards ESG By Design, which means our firm commitment to sustainability spans every part of our business. It’s imperative that we work with partners that share our values and strive to build a better, cleaner planet. Cisco’s latest routing innovation shows its dedication to finding powerful and effective ways of scaling capacity, whilst mitigating the environmental impact. It marks an exciting next stage in the future of sustainable digital infrastructure.” — Kelsey Hopkinson, VP-ESG, Colt Technology Services

“With the implementation of Florida LambdaRail’s new FLRnet4 400G backbone, space becomes one of our primary concerns as we had exhausted our existing footprint in many of our sites. The combination of unbelievable forwarding capacity, operational efficiency, and the dependable IOS XR network operating system made the Cisco 8000 Series the obvious choice for our new network. We couldn’t be more pleased with our choice. We not only have a state-of-the-art network, but the Cisco 8000 series solution ensures there is enough opex savings to scale our network for years to come.” — Chris Griffin, Chief Network Architect, Florida LambdaRail

Supporting Resources:

- Read the Blog: Scaling the Internet for the Future with 800G Innovation, by Satish Surapaneni

- https://blogs.cisco.com/sp/scaling-the-internet-for-the-future-with-800g-innovationsMass-Scale Infrastructure for Core

- Cisco 8000 Series

- Cisco Silicon One

- Cisco Optics

- Crosswork Network Automation

- Cisco IOS XR Path Tracing

References:

Highlights of Qualcomm 5G Fixed Wireless Access Platform Gen 3; FWA and Cisco converged mobile core network

With 5G deployed in more than 90 countries globally, network operators are increasingly considering 5G Fixed Wireless Access (FWA) to enable more homes and businesses can connect and enjoy the power of connected broadband experiences.

This week, Qualcomm unveiled its 5G Fixed Wireless Access Platform Gen 3, the world’s first fully-integrated 5G advanced-ready FWA platform. Besides benefitting from Snapdragon X75 capabilities, Qualcomm FWA Gen 3 key features include:

- Extended-range mmWave and Sub-6 GHz

- Qualcomm Tri-Band Wi-Fi 7 with expert Multi-Link operation for blazing-fast lower latency, reliable connections, and mesh capability for seamless coverage

- Quad-core central processing unit (CPU) and hardware acceleration boosts

- Self-install capabilities facilitated by Qualcomm Dynamic Antenna Steering technology

- Qualcomm RF Sensing Suite to enable indoor mmWave Customer Premises Equipment (CPE) deployments

- Support for 5G Dual-SIM Dual Active (DSDA) and Dual-SIM Dual Standby (DSDS) configurations

Qualcomm FWA Gen 3 is claimed to be the world’s first fully-integrated 5G advanced (???)-ready FWA platform, which includes support for Sub-6 GHz, mmWave, and Wi-Fi 7 connectivity, and boosted with quad-core CPU and hardware acceleration to drive a wide range of applications and value-added services.

The new platform features:

- The recently announced Snapdragon X75 5G Modem-RF, enabling breakthrough 5G performance to achieve unmatched speeds, coverage, and link robustness

- Qualcomm QTM567 mmWave Antenna Module, providing reliable and extended mmWave coverage

- Wi-Fi 7 with 10Gb ethernet, delivering multi-gigabit speeds and wire-like latency to virtually every device in the home

- Converged mmWave-sub 6 hardware architecture, reducing footprint, cost, board complexity, and power consumption

These capabilities will help OEMs accelerate time to launch, improve performance, and lower development effort for building cutting-edge FWA CPEs at scale. The Qualcomm FWA Gen 3 provides a fully-integrated solution that enables product development for multiple mobile broadband product categories and enables OEMs to offer a diverse product portfolio to their customers.

Qualcomm FWA Gen 3 includes the following features:

- Increased coverage through extended range mmWave and extended-range sub-6GHz with eight receiver antennas and support for power class 1.5 (PC 1.5)

- Enhanced self-install capabilities with Qualcomm Dynamic Antenna Steering Gen2

- Qualcomm RF Sensing Suite to help accelerate indoor mmWave CPEs deployments

- Flexible software architecture with support for multiple frameworks, including OpenWRT and RDK-B

- The Qualcomm FWA Gen 3 encapsulates the next-gen modem-RF system technologies intended to springboard 5G forward with superior 5G speeds and flexibility. This breakthrough connectivity is enabled by several capabilities including:

- Unrivalled spectrum aggregation

- Multi-Gigabit speed

- Improved uplink coverage with FDD uplink MIMO and uplink carrier aggregation (CA)

- Significant performance increase with Wi-Fi 7 advanced features:

- Tri-Band support in the 2.4GHz, 5GHz, and 6GHz spectrum bands with 320MHz and 4K QAM modulation

- Multi-Link technology enabling lower latency in heavily congested home environments

With WiFi 7 (IEEE 802.11be) and 5G connectivity, the platform offers consumers a faster and more reliable internet connection in the home. They can tap into the increased capacity and bandwidth offered by Wi-Fi and 5G to deliver multi-gigabit speeds, enabling consumers to connect all their devices and enjoy improved user experiences.

Qualcomm Resources:

Learn more about Fixed Wireless Access and its benefits here and here. Additionally, check out more on our latest Snapdragon X75 5G Modem-RF System enabling this technology here. Solutions such as this, powered by our one technology roadmap, including foundational 5G technologies, further position Qualcomm as the edge partner of choice for the cloud economy. Qualcomm makes an intelligently connected world possible.

…………………………………………………………………………………………………………………………………

FWA and a Converged Mobile Core Network:

In a blog post today, Matt Price of Cisco states that FWA is a great tool for reducing the digital divide when it comes to accessibility and affordability. The economics for providing Internet services were in need of a change and FWA offers some good ones – reducing trenching requirements, increasing serviceable area, offering self-install customer equipment (CPE), and even providing a common wireless network architecture that can serve both Fixed Wireless Access and Mobile Access services. To achieve these goals, Cisco strongly recommends 5G service providers deploy 5G SA core networks, which the vendor has implemented as a converged 4G/5G core for T-Mobile US.

Other carriers, like Verizon [1.] have deployed a 5G NSA FWA network.

Note 1. Verizon has increasingly come to view FWA as an integral part of their broadband access offering everywhere that FiOS isn’t available. At the same time, the telco has argued (with increasing confidence) that the often-assumed capacity constraints on FWA are not only addressable, but that they are not an issue. Verizon views 5G FWA as a major growth opportunity- much more so than 5G mobile services, according to Sowmyanarayan Sampath, Executive Vice President and CEO of Verizon Business. It’s also interesting that Telkom in South Africa and Safaricom in Kenya have deployed 5G NSA networks for FWA but NOT yet for 5G mobile service.

……………………………………………………………………………………………………………………………………………………………..

5G SA’s network architecture can flexibly deploy User Plane Function (UPF) nodes to anchor a FWA subscriber’s user plane traffic for peering at the nearest edge aggregation point. Unlike a typical mobile device such as a cell phone, fixed wireless devices are meant to be always-on and connected for serving end user devices. Meaning that the latency and reliability we commonly expect from traditional wireline services is expected from fixed wireless services too.

In 2022, T-Mobile US became the fastest growing U.S. Internet Service Provider—doubling their number of FWA customers in the past six months. With over 2 million FWA subscribers and counting, the scalability and flexibility of having a Converged Core has proven invaluable to T-Mobile. Being able to deploy UPF nodes for Fixed Wireless Access in remote locations while managing the Session Management Function (SMF) nodes at a central site(s) is effective for scaling the network, optimizing the usage of the transport infrastructure to deliver better end-user latency.

Scaling and extending Fixed Wireless Access with the flexible deployment of UPF nodes, optimizing the routing for user plane traffic. Source: Cisco

…………………………………………………………………………………………………………………………………………………………………

It’s estimated that around 70% of communication service providers today offer a form of Fixed Wireless Access services, most of them still using 4G LTE, which delivers a fraction of the performance of fiber. Upgrading network architectures to meet the needs of new 5G services needs a smooth plan for the transition. Cisco believes that can begin in the mobile core network. With a Converged 4G/5G Core, communication service providers can migrate from 4G to 5G without disruption while scaling to serve the needs of millions of new subscribers.

For More Information:

Learn more about the Cisco Converged Core, and how we are helping rural communities bridge the digital divide. Find out how T-Mobile and Cisco Launched the World’s Largest Cloud Native Converged Core Gateway, read the December 2022 press release.

……………………………………………………………………………………………………………………….

References:

Next-level connectivity: Unveiling our new 5G FWA Platform | Qualcomm

https://blogs.cisco.com/sp/getting-to-the-core-of-the-digital-divide-with-5g-fixed-wireless-access

https://www.verizon.com/about/blog/fixed-wireless-access

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

Research & Markets: 5G FWA Global Market to hit $38.17B by 2026 for a CAGR of 87.1%

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

T-Mobile and Cisco launch cloud native 5G core gateway

T-Mobile US announced today that it has collaborated with Cisco to launch a first-of-its kind cloud native 5G core gateway. T-Mobile has moved all of its 5G and 4G traffic to the new cloud native converged core which provides customers with more than a 10% improvement in speeds and lower latency. The new core gateway also allows T-Mobile to more quickly and easily test and deliver new 5G and IoT services, like network slicing and Voice over 5G (VoNR) thereby expediting time to market.

The T-Mobile US 5G SA core is based on Cisco’s cloud-native control plane that uses Kubernetes to orchestrate containers running on bare metal. The companies said this frees up more than 20% of the CPU cores.

It also uses Cisco’s 8000 Series routers, 5G and 4G LTE packet core gateways, its Unified Computing System (UCS) platform, and Cisco’s Nexus 9000 Series Switches that run the vendor’s Network Services Orchestrator for full-stack automation.

“T-Mobile customers already have access to the largest, most powerful 5G network in the country, and we’re innovating every day to supercharge their experience even further,” said Delan Beah, Senior Vice President of Core Network and Services Engineering at T-Mobile. “This cloud native core gateway takes our network to new heights, allowing us to push 5G forward by delivering next-level performance for consumers and businesses nationwide while setting the stage for new applications enabled by next-gen networks.”

With a fully automated converged core gateway, T-Mobile can simplify network functions across the cloud, edge and data centers to significantly reduce operational life cycle management. The increased efficiency is an immediate benefit for customers, providing them with even faster speeds. The new core is also more distributed than ever before, leading to lower latency and advancing capabilities like edge computing.

“Our strategic relationship with T-Mobile is rooted in co-innovation, with a shared vision to establish best practices for 5G and the Internet for the Future,” said Masum Mir, Senior Vice President and General Manager, Cisco Networking Provider Mobility. “This is the type of network every operator aspires to. It will support the most advanced 5G applications for consumers and businesses today and enables T-Mobile to test and deliver new and emerging 5G and IoT applications with simplicity at scale.”

The fully automated converged core architecture is based on Cisco’s cloud native control plane, optimized with Kubernetes orchestrated containers on bare metal, freeing up over 20% of the CPU (Central Processing Unit) cores. The converged core solution uses a broad mix of Cisco’s flagship networking solutions including the Cisco 8000 Series routers, 5G and 4G packet core gateways, Cisco Unified Computing System (UCS), and Cisco Nexus 9000 Series Switches with Cisco Network Services Orchestrator for full stack automation.

T-Mobile is the U.S. leader in 5G, delivering the country’s largest, fastest and most reliable 5G network. The Un-carrier’s Extended Range 5G covers 323 million people across 1.9 million square miles – more than AT&T and Verizon combined. 260 million people nationwide are covered by T-Mobile’s super-fast Ultra Capacity 5G, and T-Mobile plans to reach 300 million people with Ultra Capacity next year.

For more information on T-Mobile’s network, visit: https://www.t-mobile.com/coverage/4g-lte-5g-networks.

……………………………………………………………………………………………………

Cisco was part of T-Mobile US’ initial 5G SA core launch in 2020. This included the user plane, session management, and policy control functions. Those network functions run on Cisco servers, switching, and its virtualization orchestration stack.

This 5G work built on Cisco providing its packet gateway for T-Mobile’s 4G LTE mobile core, later adding its evolved packet core (EPC), and eventually virtualized the operator’s entire packet core in 2017. T-Mobile was also the first major operator to introduce Cisco’s 4G control and user plane separation (CUPS) in the EPC at production scale in 2018.

Cisco has also been core to 5G SA work by operators like Dish Network and Rakuten Mobile

References:

https://www.sdxcentral.com/articles/news/t-mobile-selects-cisco-for-cloud-native-5g-core/2022/12/

Cisco restructuring plan will result in ~4100 layoffs; focus on security and cloud based products

Cisco’s Restructuring Plan:

Cisco plans to lay off over 4,100 employees or 5% of its workforce, the company announced yesterday. That move is part of a restructuring plan to realign its workforce over the coming months to strengthen its optical networking, security and platform offerings. Cisco noted in financial filings it expects to spend a total of $600 million, with half of that outlay coming in the current quarter. The company will also reduce its real estate portfolio to reflect an increase in hybrid work.

In a transcript of Cisco’s Q1 2023 Earnings Call on November 17th, Cisco Chief Financial Officer Scott Herren characterized the move as a “rebalancing.” On that call, Chairman and Chief Executive Officer Chuck Robbins said the company was “rightsizing certain businesses.”

Herren and CEO Chuck Robbins said the company is looking to put more resources behind its enterprise networking, platform, security and cloud-based products. In the long run, analysts expect Cisco margins to improve as more revenue comes from security and software products.

By inference Cisco is de-emphasizing sales of routers to service providers who are moving towards white boxes/bare metal switches and/or designing their own switch/routers.

A Cisco representative told Fierce Telecom:

“This decision was not taken lightly, and we will do all we can to offer support to those impacted, including generous severance packages, job placement services and other benefits wherever possible. The job placement assistance will include doing “everything we can do” to help affected employees step into other open positions at the company.”

Cisco implemented a similar restructuring plan in mid-2020 which included a substantial number of layoffs.

Growth through Acquisitions:

Much of Cisco’s revenue growth over the years has come from acquisitions. The acquisitions included Ethernet switch companies like Crescendo Communications. Kalpana and Grand Junction from 1993-1995. Prior to those acquisitions, Cisco had not developed its own LAN switches and was primarily a company selling routers to enterprises, telcos and ISPs.

Here are a few of Cisco’s acquisitions over the last five years:

- In 2017, Cisco acquired software maker AppDynamics for $3.7 billion. It bought BroadSoft for $1.9 billion in late 2017.

- In July 2019, Cisco acquired Duo Security for $2.35 billion, marking its biggest cybersecurity acquisition since its purchase of Sourcefire in 2013. Acquiring Duo Security bolstered Cisco in an emerging category called zero trust cybersecurity.

- In late 2019, Cisco agreed to buy U.K.-based IMImobile, which sells cloud communications software, in a deal valued at $730 million.

- In May 2020, Cisco acquired ThousandEyes, a networking intelligence company, for about $1 billion.

Aside from acquisitions, new accounting rules have been a plus for revenue recognition. The rules known as ASC 606 require upfront recognition of multiyear software licenses.

One bright spot for Cisco have been sales of the Catalyst 9000 Ethernet switches. The company claims they are the first purpose-built platform designed for complete access control using the Cisco DNA architecture and software-defined SD access. This means that this series of switches simplifies the design, provision and maintenance of security across the entire access network to the network core.

There is also an opportunity for Cisco in data center upgrades. The so-called “internet cloud” is made up of warehouse-sized data centers. They’re packed with racks of computer servers, data storage systems and networking gear. Most cloud computing data centers now use 100 gigabit-per-second communications gear. A data center upgrade cycle to 400G technology has been delayed.

Routed Optical Networking:

Cisco in 2019 agreed to buy optical components maker Acacia Communications for $2.6 billion in cash. China’s government delayed approval of the deal. In January 2021, Cisco upped its offer for Acacia to $4.5 billion and the deal finally closed on March 1, 2021. Acacia designs, manufactures, and sells a complete portfolio of high-speed optical interconnect technologies addressing a range of applications across datacenter, metro, regional, long-haul, and undersea networks.

Acacia’s Bright 400ZR+ pluggable coherent optical modules can plug into Cisco routers, enabling service providers to deploy simpler and more scalable architectures consisting of Routed Optical Networking, combining innovations in silicon, optics and routing systems.

Routed Optical Networking works by merging IP and private line services onto a single layer where all the switching is done at Layer 3. Routers are connected with standardized 400G ZR/ZR+ coherent pluggable optics.

With a single service layer based upon IP, flexible management tools can leverage telemetry and model-driven programmability to streamline lifecycle operations. This simplified architecture integrates open data models and standard APIs, enabling a provider to focus on automation initiatives for a simpler topology. It may be a big winner for Cisco in the near future as service providers move to 400G transport.

References:

https://www.fiercetelecom.com/telecom/cisco-plans-cut-5-workforce-under-600m-restructuring-plan

https://www.cisco.com/site/us/en/products/networking/switches/catalyst-9000-switches/index.html

https://www.cisco.com/c/en/us/about/corporate-strategy-office/acquisitions/acacia.html

Heavy Reading: Coherent Optics for 400G transport and 100G metro edge

Cisco’s 5G pitch: Private 5G, 5G SA Core network, optical backhaul and metro infrastructure

At MWC 2022 in Barcelona, Cisco revealed its Private 5G market strategy together with partners. It was claimed to usher in “a new wave of productivity for enterprises with mass-scale IoT adoption.” Cisco’s 5G highlights:

- Cisco Private 5G as-a-Service delivered with global partners offers enterprise customers reduced technical, financial, and operations risks with managing enterprise private 5G networks.

- Cisco has worked in close collaboration with two leading Open RAN vendors to include O-RAN technology as part of Cisco Private 5G and is currently in customer trials with Airspan and JMA.

- Multiple private 5G pilots and projects are currently underway spanning education, entertainment, government, manufacturing, and real estate sectors.

- 5G backhaul and metro infrastructure via routed optical networking (rather than optical transceivers like those sold by Ciena)

Cisco Private 5G:

The foundation of the solution is built on Cisco’s industry-leading mobile core technology and IoT portfolio – spanning IoT sensors and gateways, device management software, as well as monitoring tools and dashboards. Open Radio Access Network (ORAN) technology is a key component of the solution. Cisco is working in close collaboration with ORAN vendors, JMA and Airspan, and is currently in customer trials utilizing their technology.

Key differentiators of Cisco Private 5G for Enterprises:

- Delivered as-a-Service: Delivered together with global service providers and system integration partners, the offer reduces technical, financial, and operational risks for enterprise private 5G networks.

- Complementary to Wi-Fi: Cisco Private 5G integrates with existing enterprise systems, including existing and future Wi-Fi versions – Wi-Fi 5/6/6E, making operations simple.

- Visibility across the network and devices: Using a simple management portal, enterprise IT teams can maintain policy and identity across both Wi-Fi and 5G for simplified operations.

- Pay-as-you-use subscription model: Cisco Private 5G is financially simple to understand. With pay-as-you-use consumption models, customers can save money with no up-front infrastructure costs, and ramp up services as they need.

- Speed time to productivity: Businesses can spare IT staff from having to learn, design, and operate a complex, carrier class private network.

Key Benefits of Cisco Private 5G for Partners:

- Path to Profitability for Cisco Partners: For its channel partners, Cisco reduces the required time, energy, and capital to enable a faster path to profitability.

- Private Labeling: Partners can private label/use their own brand and avoid initial capital expenses and lengthy solution development cycles by consuming Cisco Private 5G on a subscription basis. Partners may also enhance Cisco Private 5G with their own value-added solutions.

“Cisco has an unbiased wireless strategy for the future of hybrid work. 5G must work with Wi-Fi and existing IT environments to make digital transformation easy,” said Jonathan Davidson, Executive Vice President and General Manager, Mass-Scale Infrastructure Group, Cisco. “Businesses continuing their digitization strategies using IoT, analytics, and automation will create significant competitive advantages in value, sustainability, efficiency, and agility. Working together with our global partners to enable those outcomes with Cisco Private 5G is our unique value proposition to the enterprise.”

The concept of private networks running on cellular spectrum isn’t new — about 400 private 4G LTE networks exist today — but Cisco expects “significantly more than that in the 5G world,” Davidson said. “We think that in conjunction with the additional capacity or also the need for high-value asset tracking is really important.”

During a MWC interview with Raymond James, Davidson said, “Mobile networks aren’t mobile for very long. They have to get to a wired infrastructure,” and therein lies multiple roles for Cisco to play in the telco market.

Cisco’s opportunity in the telco space includes the buildout of new backhaul and metro infrastructure to handle increased capacity and bandwidth, its IoT Control Center, private networks, and the core of mobile network infrastructure.

“We continue to be a market leader in that space,” Davidson said, referring to Cisco’s 4G LTE and 5G network core products. More than a billion wireless subscribers are connected to Cisco’s 4G LTE core, and it plays a central role on T-Mobile’s 5G standalone core, which serves more than 100 million subscribers on a converged 4G LTE and 5G core, he added.

Davidson also expects Cisco’s flattened infrastructure, or routed optical networking, to gain momentum in wireless networks. But first, a definition. For Cisco, optical refers to the technology that moves bits from point A to point B, not optical transceivers.

“Our belief is there is going to be a transition in the market towards what we call routed optical networking. And this means that takes traditional transponders and moves them from being a shelf, or a separate box, or a device, and turns them into a pluggable optic, which you then plug into a router,” he said.

That’s where Cisco’s $4.5 billion acquisition of Acacia Communications comes into play. In October 2021, we reported that Cisco’s Acacia unit is working together with Microschip to validate the interoperability of their 400G pluggable optics components – Microchip’s DIGI-G5 OTN processor and META-DX1 terabit secured-Ethernet PHY and Acacia’s 400G pluggable coherent optics.

The second phase of this type of network transformation involves the replacement of modems that exist in optical infrastructure with routers that carry pluggable transponders, Davidson added. The third phase places private line emulation onto that same infrastructure.

Supporting Comments:

“DISH Wireless is proud to partner with Cisco to bring smart connectivity to enterprise customers through dedicated private 5G networks. Together, we have the opportunity to drive real business outcomes across industries. We’re actively collaborating with Cisco on transformational projects that will benefit a variety of sectors, including government and education, and we’re working to revolutionize the way enterprises can manage their own networks. As DISH builds America’s first smart 5G network™, we’re offering solutions that are open, secure and customizable. Teaming with Cisco is a great next step, and we look forward to offering more innovative solutions for the enterprises of today and beyond.”

— Stephen Bye, Chief Commercial Officer, DISH Wireless

“Cisco is busting the myth that enterprises can’t cross Wi-Fi, private 5G and IoT streams. Enterprises are now tantalizingly closer to full visibility over their digital and physical environments. This opens up powerful new ways to innovate without compromising the robust control that enterprises require.”

— Camille Mendler, Chief Analyst Enterprise Services, Omdia

“Developing innovative, customized 5G private network solutions for the enterprise market is a major opportunity to monetize the many advantages of 5G technology. Airspan is proud to be one of the first leading Open RAN partners to participate in the Cisco Private 5G solution and offer our cutting edge 5G RAN solutions including systems and software that are optimized for numerous enterprise use cases.”

— Eric Stonestrom, Chairman and CEO, Airspan

“This partnership opens a world of new possibilities for enterprises. With simple downloaded upgrades, our all-software RAN can operate on the same physical infrastructure for 10+ years—no more hardware replacements every 36 months. And as the only system in the world that can accommodate multiple operators on the same private network, it eliminates the need to build separate networks for new licensed band operators.”

— Joe Constantine, Chief Technology & Strategy Officer, JMA

“5G marks a milestone in wireless networking. For organizations, it opens many new opportunities to evolve their business models and create a completely new type of digital infrastructure. We see strong demand in all types of sectors including manufacturing and mining facilities, the logistics and automotive industries, as well as higher education and the healthcare sector. As a leading Cisco Global Gold Partner, we are excited to help drive this evolution. Thanks to our deep expertise, international capability, and close partnership with Cisco, we can support companies in integrating Private 5G into their enterprise networks,”

— Bob Bailkoskiis, Logicalis Group CEO.

“NEC Corporation is working on multiple 5G initiatives with Cisco. We have a Global System Integrator Agreement (GSIA) partnership for accelerating the deployment of innovative 5G IP transport network solutions worldwide. Work is in progress to connect Cisco’s Mobile Core and NEC’s radio over Cisco’s 5G Showcase in Tokyo, a world leading 5G services incubation hub. Leveraging NEC’s applications, Cisco and NEC will investigate expanding the technical trials including Private 5G in manufacturing, construction, transportation, and others.”

—Yun Suhun, General Manager, NEC Corporation

Industry Projects Underway

Cisco is working together with its partners on Private 5G projects for customers across a wide range of industries including Chaplin, Clair Global, Colt Technology Services, ITOCHU Techno-Solutions Corporation, Madeira Island, Network Rail, Nutrien, Schaeffler Group, Texas A&M University, Toshiba, Virgin Media O2, Zebra Technologies and more. See news release addendum for project details and supporting comments.

Final Thoughts:

“Radio access networks themselves are between $30 billion and $40 billion a year. Depending on who you talk to, optical (networking) can be between $10 billion and $15 billion a year. And then routing is below $10 billion a year,” Davidson said. “Our belief is that the optical total addressable market will start to shift over time as routed optical networks become more prevalent, because it will move from the optical domain into the optic transceiver market,” he added.

Finally, although Cisco repeatedly insists it has no interest in becoming a RAN supplier, it remains strongly supportive of Open RAN. The RAN market “is still closed, it’s locked in, even though there are standards,” he said.

“People do not do any interoperability testing between vendors, which is fundamentally changing with open RAN” because operators are forcing vendors to make their equipment interoperate with open RAN implementations, Davidson concluded.

References:

Microchip and Cisco-Acacia Collaborate to Progress 400G Pluggable Coherent Optics

Additional Resources:

- Cisco Private 5G

- Blog: Private 5G Delivered on Your Terms, Masum Mir, Vice President and General Manager, Mobile, Cable and IoT

Highlights of Cisco’s Internet Traffic Report & Forecast

According to statistics from Cisco Systems global average Internet traffic will increase 3.2-fold by 2021 and will reach 717 Tbps. Busy hour Internet traffic will increase 4.6-fold by 2021 and will reach 4.3 Pbps. Globally, the number of DDoS attacks greater than 1 Gbps will grow 2.5-fold from 2016 to 2021, a compound annual growth rate of 20%.

In 2021:

- Fixed access and Wi-Fi networks represented 52.6% of the world’s total Internet traffic in 2021.

- Mobile networks – including 4G and 5G networks – handled just 20.5% of the world’s total Internet traffic in 2021.

According to Cisco’s findings, future trends favor mobile. The firm reported that fixed and Wi-Fi networks were approximately 52.1% of total Internet traffic in 2016 – virtually the same number as 2021.

Global mobile networks handled just 9.8% of total Internet traffic in 2016, but that figure more than doubled in 2021.

It’s interesting that Cisco predicts an average WiFi speed of 92 Mbps by 2023, while the average mobile speed will then be less than half of that at 44 Mbps.

Global – 2021 Forecast Highlights:

Internet users by 2023:

66% of the population will be using the Internet up from 51% in 2018

……………………………………………………………………….

Mobile devices/ connections by 2023:

up from 1.2 in 2018

up from 2.4 in 2018

IP Traffic:

• Globally, IP traffic will grow 3-fold from 2016 to 2021, a compound annual growth rate of 24%.

• Globally, IP traffic will reach 278.1 Exabytes per month in 2021, up from 96.1 Exabytes per month in 2016.

• Global IP networks will carry 9.1 Exabytes per day in 2021, up from 3.2 Exabytes per day in 2016.

• Globally, IP traffic will reach an annual run rate of 3.3 Zettabytes in 2021, up from an annual run rate of 1.2

Zettabytes in 2016.

• Globally, IP traffic will reach 35 Gigabytes per capita in 2021, up from 13 Gigabytes per capita in 2016.

• Globally, average IP traffic will reach 847 Tbps in 2021, and busy hour traffic will reach 5.0 Pbps.

• In 2021, the gigabyte equivalent of all movies ever made will cross Global IP networks every 1 minutes.

Internet Traffic:

• Globally, Internet traffic will grow 3.2-fold from 2016 to 2021, a compound annual growth rate of 26%.

• Globally, busy hour Internet traffic will grow 4.6-fold from 2016 to 2021, a compound annual growth rate of 35%.

• Globally, Internet traffic will reach 235.7 Exabytes per month in 2021, up from 73.1 Exabytes per month in 2016.

• Global Internet traffic will be 7.7 Exabytes per day in 2021, up from 2.4 Exabytes per day in 2016.

• Global Internet traffic in 2021 will be equivalent to 707 billion DVDs per year, 59 billion DVDs per month, or 81 million DVDs per hour.

•In 2021, the gigabyte equivalent of all movies ever made will cross the Internet every 1 minutes.

• Global Internet traffic in 2021 will be equivalent to 135x the volume of the entire Global Internet in 2005.

• Globally, Internet traffic will reach 30 Gigabytes per capita in 2021, up from 10 Gigabytes per capita in

2016.

• Globally, average Internet traffic will increase 3.2-fold by 2021 and will reach 717 Tbps.

• Globally, busy hour Internet traffic will increase 4.6-fold by 2021 and will reach 4.3 Pbps.

• Globally, the number of DDoS attacks greater than 1 Gbps will grow 2.5-fold from 2016 to 2021, a

compound annual growth rate of 20%.

• Globally, the number of DDoS attacks greater than 1 Gbps will be 3.1 million per year in 2021, up from 1.3 million per year in 2016.

Fixed Wireless/Wi-Fi and Mobile Growth:

• Global Fixed/Wi-Fi was 41% of total IP traffic in 2016, and will be 46% of total IP traffic in 2021.

• Global Mobile was 7% of total IP traffic in 2016, and will be 17% of total IP traffic in 2021.

• Global Fixed/Wi-Fi was 52.1% of total Internet traffic in 2016, and will be 52.6% of total Internet traffic in 2021.

• Global Fixed/Wired was 38% of total Internet traffic in 2016, and will be 27% of total Internet traffic in 2021.

• Global Mobile was 9.8% of total Internet traffic in 2016, and will be 20.5% of total Internet traffic in 2021.

• Globally, mobile data traffic will grow 7-fold from 2016 to 2021, a compound annual growth rate of 46%.

• Globally, mobile data traffic will reach 48.3 Exabytes per month in 2021, up from 7.2 Exabytes per month in 2016.

• Global mobile data traffic will grow 2 times faster than Global fixed IP traffic from 2016 to 2021.

• Global Mobile was 7% of total IP traffic in 2016, and will be 17% of total IP traffic in 2021.

• Globally, mobile data traffic in 2021 will be equivalent to 23x the volume of the entire Global Internet in 2005.

Global Fixed/Wired:

51% of total IP traffic in 2016, and will be 37% of total IP traffic in 2021.

References:

https://www.cisco.com/c/en/us/solutions/executive-perspectives/annual-internet-report/index.html

Omdia: Big increase in Gig internet subscribers in 2022; Top 25 countries ranked by Cable

NEC and Cisco in Global Systems Integrator Agreement for 5G IP Transport

NEC Corp and Cisco today announced they have entered into a Global System Integrator Agreement (GSIA) to expand their partnership for accelerating the deployment of innovative 5G IP transport network solutions worldwide.

[Will any other protocol besides IP operate over 5G data plane?]

Under the agreement, the companies will jointly drive new business opportunities for 5G. NEC group companies will work closely with Cisco to complement NEC’s ecosystem with optimized IP metro/access transport and edge cloud computing solutions. Cisco will support NEC’s customer engagements by offering best-in-class products, proposals and execution support.

The new agreement underlines NEC’s successful track record as a Cisco Gold Partner over two decades, and its proven engineering capabilities to provide Cisco products to its global customer base across multiple regions.

“We believe 5G is fueling the internet for the future, and accelerating our customers’ digital transformations,” said Jonathan Davidson, Senior Vice President and General Manager, Mass-Scale Infrastructure Group, Cisco. “Together with NEC, we are creating a powerful force to drive the critical changes needed in networking infrastructure to carry the internet into the next decade.”

“Collaboration across the network solution ecosystem is essential for continued success in meeting diversified customer requirements and establishing a win-win relationship,” said Mayuko Tatewaki, General Manager, Service Provider Solutions Division, NEC Corporation. “This powerful partnership strengthens our global competitiveness as a network integrator that drives the customer journey with innovative solutions.”

NEC and Cisco say they will make collaborative efforts to further enhance their joint solution portfolio and to optimize regional activities for advancing the digital transformation of customers across the globe. Indeed, NEC has a long history of working with Cisco stretching back more than two decades. This includes the two working together on 4G LTE equipment that combined NEC’s RAN and backhaul assets with Cisco’s network equipment.

The two firms last year bolstered efforts in ensuring the security of their networking equipment. This involved using NEC’s blockchain technologies and Cisco’s fraud detection technologies to confirm the authenticity of network equipment used for security and critical industrial infrastructure before it was shipped to a customer, during the construction of those networks, and during operation.

NEC also participated in Rakuten Mobile’s 4G-LTE network deployment in Japan. NEC has so far gained the most from that deployment as it’s been tapped to provide a standalone (SA) 5G core network based on the specification it wrote with Rakuten Mobile.

NEC recently established an Global Open RAN Center of Excellence in the UK, which aims “to accelerate the global adoption of Open RAN and to further strengthen its structure for accelerating the global deployment of 5G.”

The company also developed (with Samsung) and demonstrated an O-RAN Alliance compliant 5G base station baseband unit (5G-CU/DU) on NTT DOCOMO’s commercial 5G network.

Source: NEC Corp.

………………………………………………………………………………………………………………………………….

Cisco was initially part of Rakuten Mobile’s 4G-LTE deployment, but has been conspicuously absent from the Japanese carrier’s more recent 5G plans. Cisco has been steadily bolstering its 5G focus with updates to its routing and networking equipment. This includes updates earlier this year to its router portfolio, and scoring a deal late last year with AT&T to assist with disaggregated IP routing technology for an edge routing platform.

Cisco has also been working with Japanese carrier KDDI on its 5G and network virtualization efforts. This included a proof-of-concept (PoC) last year that demonstrated cloud-native software with Cisco’s Ultra Packet Core platform.

Nonetheless, Cisco continues to lag behind the more established telecom vendors in providing 5G equipment. They don’t make cellular base stations which limits their offerings to routers with 5G interfaces.

A recent Dell’Oro Group report placed Cisco a distant No. 5 among overall telecom equipment vendors, with its market share having shrunk by 1% from 2019 to 2020 to only 6%.

| Top 7 Suppliers | Year 2019 | Year 2020 |

| Huawei | 28% | 31% |

| Nokia | 16% | 15% |

| Ericsson | 14% | 15% |

| ZTE | 9% | 10% |

| Cisco | 7% | 6% |

| Ciena | 3% | 3% |

| Samsung | 3% | 2% |

Source: Dell’Oro Group

………………………………………………………………………………………….

References:

https://www.nec.com/en/press/202104/global_20210408_01.html

https://www.sdxcentral.com/articles/news/cisco-nabs-nec-to-expand-5g-reach/2021/04/

https://www.delloro.com/key-takeaways-total-telecom-equipment-market-2020/

Cisco Plus: Network as a Service includes computing and storage too

Cisco Systems is extending the concept of software-as-a-service (SaaS) technology with the introduction of Cisco Plus, which is a network-as-a-service (NaaS) offering focused on cybersecurity and hybrid cloud services. The new service offering can also provide computing-as-a-service and data-storage-as-a-service.

- Cisco announcing plans to lead the industry with new Network-as-a-Service (NaaS) solutions to deliver simpler IT and flexible procurement for customers looking for greater speed, agility and scale

- Cisco also reveals plans to help customers build a SASE foundation today (with Cisco SD-WAN and security) with as-a-service offer coming soon

- Cisco Plus offers include flexible consumption for data center networking, compute and storage now, and commits to delivering the majority of its portfolio as-a-service over time

“I believe every organization would benefit from simplifying powerful technology,” said Todd Nightingale, Senior Vice President and General Manager, Enterprise Networking and Cloud, Cisco. “Network-as-a-service is a great option for businesses wanting to shift to a cloud operating model without a heavy lift. Cisco is leading the industry in its approach with Cisco Plus. Together with our partners, we intend to offer the majority of our technology portfolio in the simplest, most flexible way: cloud-driven, cloud-delivered, cloud-managed and as-a-service.”

“Network-as-a-service delivery is a great option for businesses wanting to shift to a cloud operating model that makes its easy and simple to buy and consume the necessary components to improve and grow their businesses,” said James Mobley, senior vice president and general manager of Cisco’s Network Services Business Unit.

Cisco Plus NaaS solutions will provide:

- Seamless and secure onramps to applications and cloud providers

- Flexible delivery models, including pay-per-use or pay-as-you-grow options

- End-to-end visibility from the client to the application to the ISP

- Unified policy engine to ensure the right users have access

- Security across everything, not bolted on as another point solution

- Real-time analytics providing AI/ML-driven insights for cost and performance tracking

- API extensibility across the technology stack

- Partners layering additional value and delivering their services faster

The NaaS rollout will first focus on a cloud-based solution as-a-service for secure access service edge (SASE). The Cisco SASE offer currently available enables customers to easily leverage future services with investment protection. Cisco is planning limited release NaaS solutions later this calendar year that will unify networking, security and visibility services across access, WAN and cloud domains.

While Cisco plans in the next few years to introduce what will likely be many service options under Cisco Plus, for now it is introducing two flavors. The first, Cisco Plus Hybrid Cloud, includes the company’s data-center compute, networking, and storage portfolio in addition to third-party software and storage components all controlled by the company’s Intersight cloud management package. Customers can choose the level of services they want for planning, design and installation Mobley said.

Cisco Plus Hybrid Cloud, which will be available mid-year, offers pay-as-you-go with delivery of orders within 14 days, Mobley said.

“As enterprises recommit to their digital transformation strategies, they are increasingly looking for more cloud-like, flexible consumption models for procuring and managing their IT, cloud and network infrastructure. These “as-a-service” deployment options provide much needed flexibility and scalability, along with a simplification of network deployments and ongoing operations. Cisco’s transition to as-a-service via Cisco Plus shows the company is committed to meeting customer needs for predictable costs, cloud-like agility, first-class security, and more.

“With Cisco Plus, it’s taking NaaS and its hybrid cloud offerings to the next level by including hardware and the full portfolio into this as-a-service offer, that provides cloud-like simplicity and flexibility of consumption on one end, and on the other, it provides a rich set of intelligent operational enhancements that go a long way to deliver enhanced IT experiences and outcomes. This has also been made possible by increased embedded intelligence now available in network and IT hardware and software, coupled with advanced telemetry options in many of these platforms.”

— Rohit Mehra, Vice President of Network Infrastructure, IDC.

“With Cisco Plus, we couldn’t be more excited that Cisco is diving deeper into the as-a-service era, helping us in our transformation to deliver IT as a service to our customers. In this way, we are better equipped to help our customers simplify their IT operations, and free up resources to invest in innovation of their core business.” — Jeffrey den Oudsten, CTO Office Solutions Director, Conscia Nederland

“There’s always been a push and pull in how to operationalize and finance IT infrastructure. Cisco Plus is the matching pair to a cloud operating model. Delivering Cisco Plus across the majority of Cisco’s portfolio helps us at Insight to further deliver the transformation to a cloud operating model our clients want. With Cisco Plus, organizations can not only operate their infrastructure as a cloud, but also consume it in a similar fashion, enabling a true hybrid, multi-cloud.” — Juan Orlandini, Chief Architect Cloud + Data Center Transformation, Insight

“At Presidio, we have seen this shift coming for a long time. Our customers are very clear: They want to consume reliable, best of breed infrastructure with consumption-based financial models. And with the launch of Cisco Plus, Presidio and Cisco in partnership are doing just that.” — Raphael Meyerowitz, Engineering VP, Office of the CTO, Data Center, Presidio

The second Cisco Plus service, which did not have an availability timeframe, will feature the company’s secure access services edge (SASE) components, such as Cisco’s SD-WAN and cloud-based Umbrella security software.

Security-as-a-service models offer many advantages for organizations including offloading the maintenance of hundreds or thousands of firewalls and other security appliances, said Neil Anderson, senior director of network solutions at World Wide Technology, a technology and supply-chain services provider.

“With SASE, enterprises can consume that from the cloud and let someone else take care of the toil, which frees up their security team to focus on threat vectors and prevention,” he said.

While the strategy behind delivering network components as a cloud-based service has been around for a few years, it is not a widely used enterprise-customer strategy. Cisco’s entry into NaaS is likely to change that notion significantly.

“Cisco has been on this journey for a few years now—starting with providing subscription-based offers for many of its software solutions—while working on simplifying and enriching the licensing and consumption experience,” Mehra said. “Customers understand and have embraced cloud-like IT-consumption models that are typically subscription-based and provide scalability and other on-demand capabilities,” Mehra said.

Terms such as NaaS are still largely new in an enterprise context to most IT practitioners, although they do understand that operational simplicity and flexibility will be crucial to their success in digital transformation, Mehra said.

While NaaS might be relatively new to some customers, others are already utilizing it, other experts said. For remote-access, customers are more than ready, and it’s starting to go mainstream, Anderson said.

“For connectivity to the cloud edge, it’s coming very soon, and the adoption of SASE models for security will accelerate the demand for NaaS services,” he said. “NaaS in the campus will probably take a bit longer, but we see that coming. Some customer segments, like retail, are probably ready today, while others like global financials will take longer to adopt.”

Networking is no longer just about connecting things within private networks because there is a world of networking to and between clouds to account for, Anderson said. “For example, with private WANs, I typically networked my sites to my other sites like a private data center. Now, I need to network my sites to cloud services, and I may be doing so with public-internet services,” Anderson said.

NaaS for the campus network is another use case on the horizon, he said. “To build campus networks in the past, we had access, distribution, and core layers, and the core spanned my campus and sometimes private data center. It was designed to aggregate traffic from users into my private data center,” Anderson said. “Today, much of the traffic is heading to the cloud—Office 365 is the tipping point for many organizations—so building a core network may not be necessary. I see a new architecture emerging where the goal is to tie each site, including each building of a campus, to the internet directly to connect users to cloud and enable traffic to [reach] the cloud sooner, ultimately improving the user experience.”

Naas is by no means a slam dunk, and there will be challenges for enterprises that use it. “For medium to large organizations with significant investments in existing remote, branch, campus and data-center networking network-security infrastructure, migrating to NaaS will be difficult and time consuming. Multi-vendor environments will further complicate the matter,” stated principal analyst at Doyle Research, Lee Doyle.

Widespread adoption of enterprise NaaS will occur slowly over the next five to 10 years Doyle stated. The best fits for adoption now are greenfield sites, temporary locations, and small branch offices. NaaS offerings will also be attractive to network remote, home and mobile workers who need secure, reliable application performance. Enterprise networks with the requirement to move traffic at high speeds on-site would be more difficult to deliver as a service, Doyle stated.

Key challenges, besides understanding of what NaaS will help deliver, face IT practitioners who are the potential customers as well as vendors and service providers, Mehra said.

“On the customer aspects, what we’ll need to watch will be the changing role of IT and how it can optimally consume these technologies as a service while retaining overall control of its IT environment,” Mehra said. “On the provider side, visibility across issues such as operational flexibility and simplicity will be one area to consider, while another will be the direction the industry takes on what metered-service options it makes available for its clients.”

The challenges depend on the industry and security requirements, WWT’s Anderson said. “If the organization is in a heavily regulated industry like financial, healthcare, or federal [government], one challenge will be trusting the integrated security needed,” Anderson said. “For example, there would be fewer challenges to enable everyone to connect to the internet, akin to a giant hotspot, but to adopt more of a zero-trust model, where you may need to securely isolate sessions and devices from one another, will require building trust in some integrated security technologies.”

“What Cisco is doing is very interesting because what NaaS is out there has been limited to mostly the WAN world but once you start targeting the enterprise that’s where the challenges are because customers still have to move bits and everything can’t be in the cloud,” Doyle said. “Instead of being in the first inning of a game we are really just now defining the rules of the game, so there’s a long way to go.”

References:

https://www.zdnet.com/article/cisco-launches-cisco-plus-a-step-toward-network-as-a-service/