Cloud Computing

Strong growth for global cloud infrastructure spending by hyperscalers and enterprise customers

Global cloud service provider (CSP) spending on cloud infrastructure services grew by 35 percent to reach a record $49.4 billion in Q3 2021, according to the latest research from Canalys.

Growth was driven by several factors, including continued remote working and learning, and increasing use of industry-specific cloud applications. Spending has increased by $12.9 billion from Q3 2020 and by $2.4 billion from Q2 2021.

Amazon Web Services (AWS) accounted for 32 percent of total cloud infrastructure services spending in Q3, growing 39 percent year-on-year. Microsoft Azure registered growth of more than 50 percent for the 5th consecutive quarter to capture 21 percent of the market; followed by Google Cloud in 3rd place with an 8 percent share (growth of 54%).

…………………………………………………………………………………………………………………………………..

According to Synergy Research Group (SRG), global enterprise spending on cloud infrastructure services reached $45.4 billion in Q3-2021, up 37 percent from the year-earlier quarter. Trailing 12-month revenues reached $164 billion.

Amazon, Microsoft and Google had market shares of 33, 20 and 10 percent respectively in Q3-2021. Their growth rates are higher than the overall market. Other cloud providers are continuing to experience strong cloud revenue growth, with the next 10 largest cloud providers taking 22 percent of the market between them and achieving 28 percent year-on-year growth in Q3-2021.

Synergy estimates that quarterly cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) were $45.4 billion, with trailing twelve-month revenues reaching $164 billion. Public IaaS and PaaS services account for the bulk of the market and those grew by 39% in Q3. The dominance of the major cloud providers is even more pronounced in public cloud, where the top three control 70% of the market. Geographically, the cloud market continues to grow strongly in all regions of the world.

“Given their scale, ever-expanding worldwide presence and impressive revenue growth rates, it is understandable that Amazon, Microsoft and Google grab the most attention for their cloud activities. However, that makes it easy to overlook the fact that other cloud providers generated $17 billion in the quarter, a figure which grew by 27% from last year,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “By any standards a $17 billion market growing at such a rate is an attractive proposition for many service providers and their suppliers. Clearly there are challenges with the big three companies lurking in the background, so the name of the game is not competing with them head on. Providing companies are smart about targeting the right applications and customer groups, cloud can provide a broad and exciting range of growth opportunities for them.”

References:

Microsoft proposes a 5G overlay on their “Azure for Operators” cloud WAN

In a blog post, Microsoft proposes to sell global data transport and routing services to 5G network operators under its new Azure for Operators business. The proposition (described below) is to use a 5G overlay on Microsoft Azure’s cloud WAN.

“Operators spend a lot of money to manage and maintain their networks and peering relationships, but so does Microsoft. The question then is, why are two massive industries doing the same thing? Because both parties move packets around, doesn’t it make more sense for them to collaborate?” wrote Victor Bahl, Microsoft CTO of the company’s new Azure for Operators business, in a blog post to the company’s website. “Here, the well-managed, reliable, and performant Azure network should be thought of as the backbone that operators trust. With this shift in thinking will come all the advantages of innovation that IT companies like Microsoft are rapidly bringing in.”

Azure’s planet-scale WAN

Azure maintains a massive WAN with significant capacity and one that is continuously growing. We have over 175,000 miles of lit fiber optic and undersea cable systems. This connectivity covers close to 200 network points of presence (PoPs) over 60 regions, across 140 countries.

Azure’s network is connected to many thousands of ISPs and other networks with significant peering capacity. Our global network is well-provisioned, with redundant fiber paths that can handle multiple simultaneous failures, it also has massive reserve capacity in unlit dark fiber. These optical fibers are fully owned or leased by Microsoft, and all traffic between and among Azure datacenters within a region or across regions is automatically encrypted at the physical layer.

This combination of redundant capacity to handle failures, dark capacity for significant growth, and research advancements being made in increasing transmission speeds means that we have a massive amount of spare capacity to serve 5G traffic to a broad array of new operators.

Bahl said Microsoft is selling its network services to large, established 5G network operators that already manage their own routing and transport operations, as well as newer telcos that may not have developed such systems. Under Microsoft’s vision, 5G network operators can focus on erecting cell towers and central offices, but can rely on Microsoft’s Internet backbone to carry their customers’ traffic from those locations across the U.S. and the rest of the world.

Making Azure WAN great for 5G traffic

For many years, Microsoft researchers and engineers have been working on a hybrid-global traffic orchestrator for routing network packets across Azure’s WAN. Our orchestrator takes control away from classic Internet protocols and instead moves that control into software that we build and control for 5G traffic. We place the 5G flows that demand high performance on low-latency, high bandwidth paths to and from the Internet. Network flows that are cost-sensitive are instead routed through cheaper paths.

In effect, we have developed a fast-(packet) forwarding mechanism to build a 5G overlay on our existing WAN, thereby supporting a variety of 5G network slices with different wired transport properties, while avoiding interference with the operation of the underlying enterprise cloud network.

We have also extended our state-of-the-art network verification capability to cover complex network topologies by modeling Virtual WAN, Virtual Networks, and other network function virtualizations (NFVs), as well as modeling reachability using formal methods. Using fast solvers, we can verify reachability constraints on customer topologies, at deployment time or when undergoing a config change.

We have applied machine learning to predict the impact of peering link outages and congestion mitigation strategies and use the data to improve the availability of the WAN peering surface area.

Our expertise in optimization algorithms has been shown to ultimately reduce cloud networking spend. Techniques like these will be invaluable in carving out 5G paths on the overlay that are cost-efficient, but still meet the performance needs of every network slice.

o[

The significant upside for operators

To reiterate, Microsoft is heavily invested in running a well-managed, always-available global network. We have been incorporating multiple groundbreaking technologies, including scalable optimization, formal verification of routing policies, machine learning, and AI. We envision operators to not only be able to use our WAN to transfer 5G packets, with low latency, but also to benefit from multiple network services such as DDoS protection, firewalls, traffic accelerators, connection analytics, load balancers, and rate limiters, many of which we use in running existing Azure network workloads.

At Microsoft, we bring the full power of research and engineering leadership into our networks, rapidly incorporating innovation and new features to provide reliable, low-latency, low-cost service. In turn, this effort will open up the significant potential of next-generation services and applications as envisioned by the community at large. It is no understatement to say that collaboration between operators and Azure is key to unleashing the true power of 5G.

Last year Microsoft acquired telecom software vendors Affirmed Networks and Metaswitch Networks, and subsequently introduced its Azure for Operators to “provide operators with the agility they need to rapidly innovate and experiment with new 5G services on a programmable network.” The company earlier this year doubled down on the opportunity with the purchase of AT&T’s Network Cloud operation, a move that positions AT&T to shift its 5G core network operations into Microsoft’s cloud over the next three years.

More broadly, Microsoft is one of a trio of massive cloud computing companies that are hoping to generate sales among telecom companies, including 5G network operators. Google, Amazon Web Services (AWS) and Microsoft are all now selling various products and services into the telecom space.

Several telecom network providers including Canada’s Telus and Deutsche Telekom – are jumping at the prospect of partnering with a cloud computing service provider. Of note is Dish Network’s massive deal with AWS, whereby it plans to run all of its network software in the Amazon cloud and AT&T outsourcing its 5G SA Core network to run on Microsoft Azure cloud.

References:

https://azure.microsoft.com/en-gb/blog/unleashing-the-true-potential-of-5g-with-cloud-networks/

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

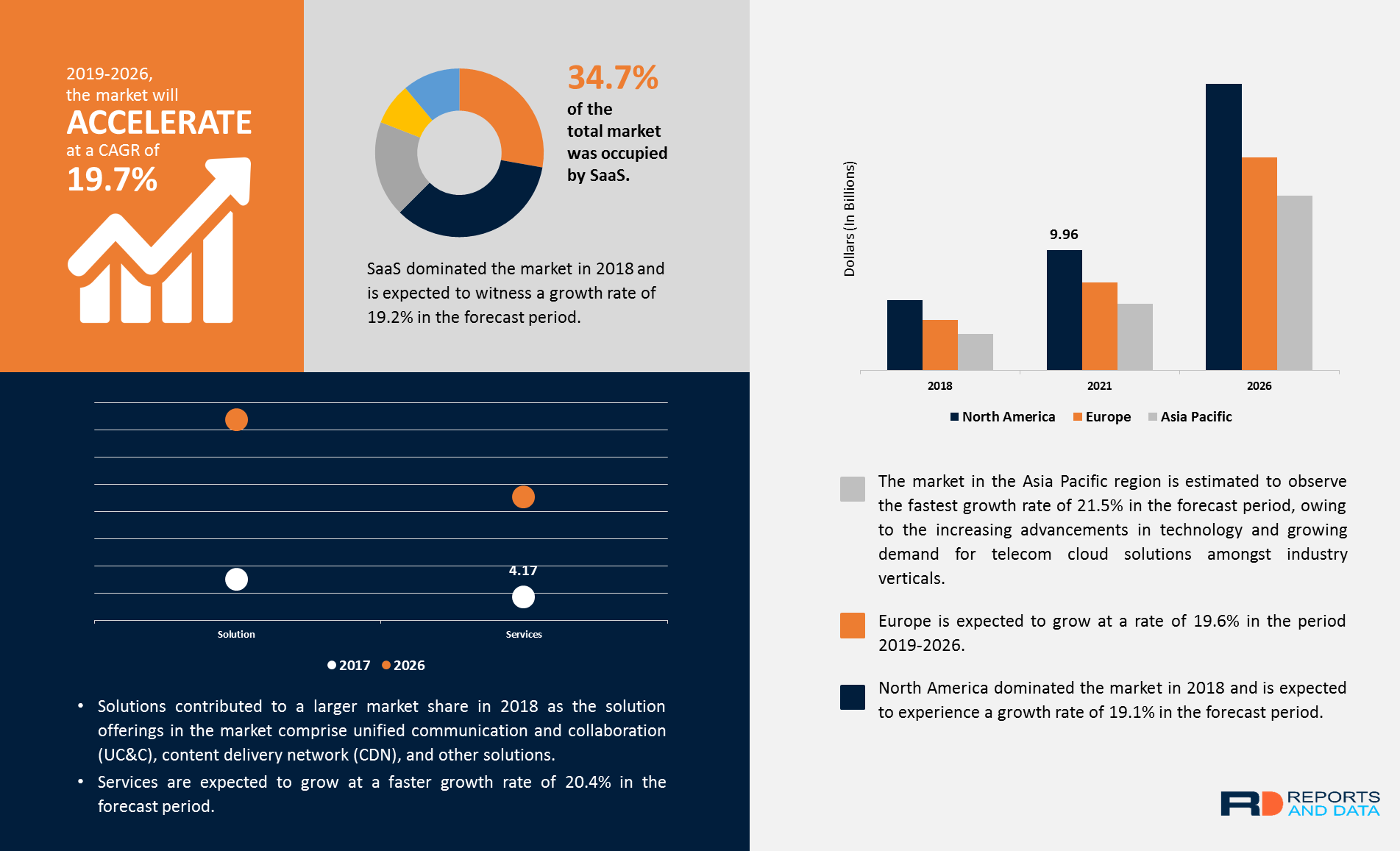

Reports and Data: Telecom Cloud Market to grow at CAGR of 19.7% through 2026

The global Telecom Cloud Market is projected to grow at a CAGR of 19.7% in terms of value, from 2019 to reach USD 59.25 Billion by 2026, according to a new report by Reports and Data. OTT (Over-the-top) consumers demand more flexibility in scheduling, arranging videos, live events, and recording of favorite shows, thereby pushing the service providers to opt for more resources, infrastructure scalability, and computing resources to cater demands. By adopting a cloud-based workflow, video service providers can efficiently hand off duty for the infrastructure and networking supporting their OTT services. Telecom cloud can be instrumental in meeting the needs of OTT service providers, thus resulting in the growth of the market.

The telecom cloud market Modernization of IT platforms is estimated to fuel the growth of the market in the forecast period. As some of the largest communication service providers across the globe modernize their networks, they facilitate large enterprises to transform the way they involve with a progressively digital world. By leveraging IP-based technology, UCaaS (Unified Communications-as-a-Service), embedded communications (such as voice, chat, and video built into web and business applications) and other novelties on an IP network, communication service providers and the organizations they cater to can provide enhanced service to their customers and reap higher margins by reducing their expenses along with the lower total cost of ownership delivered by software-defined real-time communications (RTC).

Increasing demand for over-the-top cloud services is one of the significant factors influencing market growth. The telecom cloud leads to low operational costs, which is expected to drive the market growth in the forecast period. By deploying cloud computing, service providers can host services and software at a considerably lower cost. Provisioning and virtualization software allows organizations to efficiently assign computing resources, thus lowering the cost of hardware. Service providers can locate facilities at low-cost locations, provisioning, which cannot be replicated by most enterprises, resulting in low up-front costs.

Additionally, the proliferation of the internet, especially in developing nations, is expected to propel the growth of the telecom cloud market in the upcoming years.

Key participants include AT&T Inc., Verizon Communications Inc., Ericsson, Deutsche Telekom, BT Group PLC, CenturyLink Inc., Orange Business Services, NTT Communication Services, Singapore Telecommunications Limited, and Telstra Corporation Limited, among others.

Key findings from the report:

• By offering, solutions contributed to a larger market share in 2018 as the solution offerings in the market comprise unified communication and collaboration (UC&C), content delivery network (CDN), and other solutions.

• By service type, SaaS dominated the market in 2018 and is expected to witness a growth rate of 19.2% in the forecast period. The swift growth of on-demand services among consumers has resulted in a high demand for this service type in the telecom cloud market.

• By organization size, small & medium-sized enterprises are expected to witness a higher CAGR of 20.5% in the period 2019-2026 as services and solutions have the potential to produce enhanced efficiency, quality, and business productivity.

• By industry verticals, BFSI (Banking, financial services and insurance) held the largest market share in 2018 and is expected to grow at a rate of 19.6% in the forecast period.

• North America dominated the market in 2018 and is expected to experience a growth rate of 19.1% in the forecast period. The market dominance of North America is attributed to the presence of leading telecom companies mainly in the U.S. and Canada

The growing concerns pertaining to spectrum crunch in the developing nations are driving the market for telecom cloud as it helps telecom companies to increase their profitability in the telecom market. In countries with a high population, especially Countries in the Asia Pacific region, the telecom cloud plays an instrumental role in enabling telecom market players to gain a competitive edge in the market.

Incorporating cloud computing platforms into telecommunication allows Network functions virtualization (NFV) to virtualize servers, networks, and storage augments the utilization of available system resources and lowers infrastructure cost. Besides, network virtualization offers the implementation of numerous applications and features an open environment. Thus, telecom cloud virtualization is linked to many significant advantages, including enhanced scalability, flexibility of deployment, and a reduction in cost of the equipment, which permits reiteration of application software, better support for resolving faults, and enhanced security, among others.

References:

https://www.reportsanddata.com/report-detail/telecom-cloud-market

NEC expands partnership with AWS for global 5G, digital government, hybrid cloud

NEC Corp. expanded its collaboration with Amazon Web Services (AWS) in areas that include global 5G, digital government, and hybrid cloud in support of accelerating digital transformation for business customers.

In November 2020, NEC and AWS concluded a corporate-level strategic collaboration agreement and have been developing offerings and strengthening delivery functionalities since then. NEC will now expand this collaboration and strengthen efforts in the following areas: global 5G, digital government, and hybrid cloud as follows:

1. Global 5G

NEC aims to develop an end-to-end 5G offering and to provide it globally by combining NEC’s high-performance cloud-native open 5G mobile core, OSS/BSS solutions, local 5G use cases etc., and AWS cloud and edge solutions. NEC will accelerate telecom carriers’ cloudification of network workloads and enhance digital transformation for enterprises by deploying 5G-based infrastructure and applications at the network edge. This combined solution stack will be supported by NEC’s system integration services to enable customers to efficiently deploy and scale 5G networks, enhance automation and drive significant improvement in operational economics.

2. Digital government

NEC has been certified as an AWS Government Competency Partner based on the strategic collaboration that started last year and its achievements for governments to date. Going forward, NEC will further strengthen its relationship with AWS and focus on developing and providing a menu of offerings to accelerate the digital transformation for government activities in Japan.

3. Hybrid cloud

By collaborating with AWS, NEC aims to develop and provide a menu of offerings that connects on-premises and cloud environments securely, at high speed, and with low latency. This will contribute to the acceleration of digital transformation through modernization that utilizes the customer’s existing information technology (IT) assets.

To accelerate these initiatives, the NEC Group has increased the number of AWS-certified engineers to 2,000 at present, aiming for 3,000, double the number from the start of collaboration in 2020, and firmly maintains one of Japan’s largest delivery capabilities for cloud projects. Going forward, NEC will continue to strengthen these positions and to ensure that it responds to customers’ digital transformation demands.

NEC also intends to enhance its hybrid cloud offering with support from AWS, providing services that connect both on-premises and cloud environments in order to support enterprise digital transformation strategies. NEC has already been building up expertise in this field. The Japanese IT vendor has increased the number of AWS-certified engineers to 2,000, up from 1,500 in November 2020, and is aiming for 3,000 in three years. Furthermore, NEC has been certified as an AWS Government Competency Partner and said it will focus on “developing and providing a menu of offerings to accelerate the digital transformation for government activities in Japan.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Comments from both companies on this collaboration are as follows:

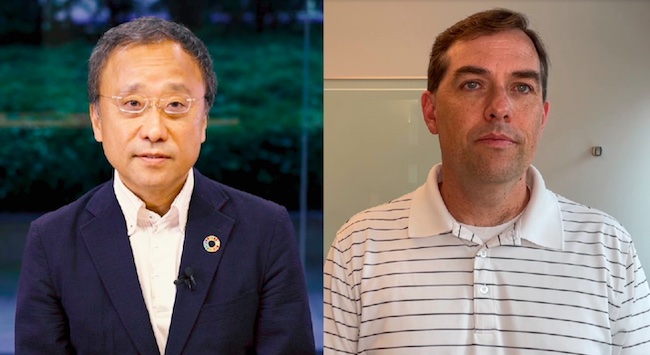

“NEC is pleased to announce the expansion of its strategic collaboration with AWS. Last year, NEC announced this global collaboration as the first of its kind between AWS and a Japanese company. It has been a great year, seeing many successes in the areas of government, modernization and in the skill enhancement of NEC engineers. NEC is now expanding the collaboration with AWS in the areas of global 5G, digital government and in enhanced hybrid cloud offerings. With the strong global support from AWS, NEC will help drive digital transformation in the government sector and across industries as part of orchestrating a brighter world,” says Toshifumi Yoshizaki, Executive Vice President at NEC Corporation.

“We are delighted to deepen our relationship with NEC. AWS welcomes NEC’s commitment and delivery of solutions built on AWS to deliver high-quality solutions that accelerate customers’ digital transformations. We look forward to NEC’s continued expansion of offerings and further expansion of delivery capabilities to optimize these transformations,” says Doug Yeum, Global Head of Alliances & Channels at Amazon Web Services, Inc.

Toshifumi Yoshizaki, Executive Vice President at NEC Corporation and Matt Garman, Senior Vice President at Amazon Web Services Inc.

NEC and its Netcracker subsidiary have already deployed their 5G core and full stack digital BSS/OSS on AWS cloud infrastructure to orchestrate and automate 5G digital services. The service was demonstrated at Mobile World Congress 2021, when NEC deployed its 5G core control plane on an AWS Region and its 5G UPF on an AWS Outposts’ edge location.

Other NEC cloud related partnerships:

- NEC’s collaboration with Rakuten Mobile, Japan’s disruptive open RAN and cloud-native 4G/5G wireless service provider, has certainly raised its open RAN and 5G Core profile. In May, Rakuten Mobile signed MoUs with Fujitsu and NEC to try and accelerate “global expansion” of Rakuten Communications Platform (RCP).

- In June, NEC and Rakuten Mobile said they would jointly develop the containerized standalone (SA) 5G core network (5GC) to be utilized in Rakuten Mobile’s fully virtualized cloud native 5G network.

- Later in June, Rakuten Mobile, NEC and Intel announced that they have achieved a performance of 640 Gbps per server for the containerized User Plane Function (UPF) on the containerized 5G SA core network jointly developed by Rakuten Mobile and NEC running on the Rakuten Communications Platform (RCP).

- In July, NEC expanded its “multi-year strategic partnership” with Microsoft whereby NEC adopted Microsoft Azure as its preferred cloud platform provider. (But now it’s in bed with AWS?)

- In August, NEC announced a collaboration with Fujitsu on interoperability testing for 5G base stations that conform to specifications from the O-RAN Alliance.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

About NEC Corporation:

NEC Corporation has established itself as a leader in the integration of IT and network technologies while promoting the brand statement of “Orchestrating a brighter world.” NEC enables businesses and communities to adapt to rapid changes taking place in both society and the market as it provides for the social values of safety, security, fairness and efficiency to promote a more sustainable world where everyone has the chance to reach their full potential. For more information, visit NEC at https://www.nec.com.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

To view and hear the comments from Toshifumi Yoshizaki, Executive Vice President at NEC Corporation and Matt Garman, Senior Vice President at Amazon Web Services Inc (pictured above), please visit: https://www.nec.com/en/press/202109/global_20210908_01.html

https://www.lightreading.com/5g/nec-expands-aws-tie-up-to-gain-5g-edge/d/d-id/771938?

Rakuten Mobile, Inc. and NEC to jointly develop the containerized standalone (SA) 5G core network

Why It’s Important: Rakuten Mobile, Intel and NEC collaborate on containerized 5G SA core network

ManTech and Google Cloud open joint facility to expedite government adoption of cloud technologies

In April, Google Cloud announced a partnership with ManTech to accelerate US government adoption of cloud technologies. The partnership will combine Google Cloud technology and security capabilities with ManTech’s federal solution delivery capability and public sector domain expertise. The two companies will launch a joint demonstration facility in Northern Virginia to showcase their combined technology capability.

Together, ManTech and Google Cloud’s full range of capabilities and technology know-how can meet government needs across multi and hybrid cloud environments, infrastructure modernization, application development, data management, artificial intelligence, analytics, and cybersecurity. This will enable the two companies to jointly assist agencies with core areas of modernization including multi-cloud and hybrid cloud adoption, hyperscale analytics, security, 5G, and edge-computing.

Google Cloud’s partnership with ManTech was said to be a critical step toward meeting the federal customer mission by expediting cloud adoption, and helping to solve the government’s unique challenges with new solutions and capabilities. As the need for cloud adoption has accelerated, and cybersecurity threats continue to destabilize our critical infrastructure, strategic private sector partnerships that support U.S. government interests have a key role to play in facilitating remote collaboration, and securing the welfare of Americans.

References:

Gartner: AWS, Azure, and Google Cloud top rankings for Cloud Infrastructure and Platform Services

Gartner’s latest Magic Quadrant report for cloud infrastructure and platform services (CIPS) ranks Amazon Web Services (AWS), Microsoft Azure, and Google Cloud as the top cloud service providers.

Beyond the top three players, Gartner placed Alibaba Cloud in the “visionaries” box, and ranked Oracle, Tencent Cloud, and IBM as “niche players,” in that order.

The scope of Gartner’s Magic Quadrant for CIPS includes infrastructure as a service (IaaS) and integrated platform as a service (PaaS) offerings. These include application PaaS (aPaaS), functions as a service (FaaS), database PaaS (dbPaaS), application developer PaaS (adPaaS) and industrialized distributed cloud offerings that are often deployed in enterprise data centers (i.e. private clouds).

Figure 1: Magic Quadrant for Cloud Infrastructure and Platform Services

……………………………………………………………………………………………..

……………………………………………………………………………………………..

1. Gartner analysts praise Amazon AWS for its broad support of IT services, including cloud native, edge compute, and processing mission-critical workloads. Also noteworthy is Amazon’s “engineering prowess” in designing CPUs and silicon. This focus on owning increasingly larger portions of the supply chain for cloud infrastructure bolsters the No. 1 cloud provider’s long-term outlook and earns it advantages against competitors, according to the Gartner report.

“AWS often sets the pace in the market for innovation, which guides the roadmaps of other CIPS providers. As the innovation leader, AWS has materially more mind share across a broad range of personas and customer types than all other providers,” the analysts wrote.

AWS, which recently achieved $59 billion in annual revenues, contributed 13% of Amazon’s total revenue and almost 54% of its profit during second-quarter 2021.

AWS’s future focus is on attempting to own increasingly larger portions of the supply chain used to deliver cloud services to customers. Its operations are geographically diversified, and its clients tend to be early-stage startups to large enterprises.

……………………………………………………………………………………

2. Microsoft Azure, which remains the #2 Cloud Services Provider, sports a 51% annual growth rate. It earned praise from Gartner for its strength “in all use cases, which include the extended cloud and edge computing,” particularly among Microsoft-centric organizations.

The No. 2 public cloud provider also enjoys broad appeal. “Microsoft has the broadest set of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market,” the analysts wrote.

Microsoft has the broadest sets of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market. From the perspective of IaaS and PaaS, Microsoft has compelling capabilities ranging from developer tooling such as Visual Studio and GitHub to public cloud services.

Enterprises often choose Azure because of the trust in Microsoft built over many years. Such strategic alignment with Microsoft gives Azure advantages across nearly every vertical market.

“Strategic alignment with Microsoft gives Azure advantages across nearly every vertical market,” Gartner said. However, Gartner criticized Microsoft for very complex licensing and contracting. Also, Microsoft sales pressures to grow overall account revenue prevent it from effectively deploying Azure to bring down a customer’s total Microsoft costs.

Microsoft Azure’s forays in operational databases and big data solutions have been markedly successful over the past year. Azure’s Cosmos DB and its joint offering with Databricks stand out in terms of customer adoption.

………………………………………………………………………………………

3. Google Cloud Platform (GCP) is strong in nearly all use cases and is slowly improving its edge compute capabilities. Google continues to invest in being a broad-based provider of IaaS and PaaS by expanding its capabilities as well as the size and reach of its go-to-market operations. Its operations are geographically diversified, and its clients tend to be startups to large enterprises.

The company is making gains in mindshare among enterprises and “lands at the top of survey results when infrastructure leaders are asked about strategic cloud provider selection in the next few years,” Gartner analysts wrote. Google is also closing “meaningful gaps with AWS and Microsoft Azure in CIPS capabilities,” and outpacing its larger competitors in some cases, according to the report.

The analysts also noted that Google Cloud “is the only CIPS provider with significant market share that currently operates at a financial loss.” The No. 3 public cloud provider reported a 54% year-over-year revenue increase and a 59% decrease in operating losses during Q2.

………………………………………………………………………………..

Separately, Dell’Oro Group Research Director Baron Fung recently said that hyperscalers make up a big portion of the overall IT market, with the 10 largest cloud-service providers, including AWS, Google, and Alibaba, accounting for up to 40% of global data center spending, and “some of these companies can have really tremendous weight on the ecosystem.”

The Dell’Oro report noted that some providers have deployed accelerated servers using internally developed artificial intelligence (AI) chips, while other cloud providers and enterprises have commonly deployed solutions based on graphics processing units (GPUs) and FPGAs.

Fung explained that this model has also spilled over into those cloud providers also building their own servers and networking equipment to better fit their needs while “moving away from the traditional model in which users are buying equipment from companies like Dell and [Hewlett Packard Enterprise]. … It’s really disrupting the vendor landscape.”

Certain applications—such as cloud gaming, autonomous driving, and industrial automation—are latency-sensitive, requiring Multi-Access Edge Compute, or MEC, nodes to be situated at the network edge, where sensors are located. Unlike cloud computing, which has been replacing enterprise data centers, edge computing creates new market opportunities for novel use cases.

…………………………………………………………………………………

References:

https://www.gartner.com/doc/reprints?id=1-26YXE86I&ct=210729&st=sb

Google Cloud revenues up 54% YoY; Cloud native security is a top priority

Google Cloud revenues increased 54% year over year to $4.62 billion during the second quarter of 2021, parent company Alphabet reported today. Google Cloud’s operating loss shrunk 59%, from $1.42 billion a year ago to $591 million last quarter.

Google Cloud includes both Google Cloud Platform (GCP) and its Workspace (formerly G Suite) cloud computing services and collaboration tools.

Like previous quarters, “GCPs revenue growth was, again, above cloud overall, reflecting significant growth in both infrastructure and platform services,” the company said in a statement.

“As for Google Cloud, we remain focused on revenue growth, and are pleased with the trends we’re seeing across cloud,” Google CFO Ruth Porat said on the company’s 2Q-2021 earnings call today. Porat added that growth in its Google Cloud Platform segment again surpassed overall cloud gains “reflecting significant growth in both infrastructure and platform services.”

“We will continue to invest aggressively, including expanding our go-to-market organization, our channel expansion, our product offerings, and our compute capacity,” she said.

Also on today’s earnings call, Google CEO Sundar Pichai cited security as a competitive differentiator and “our strongest product portfolio.” Google will continue to invest in security and continue its work to integrate its various security products such as Beyond Corp and Chronicle, he added.

“Cyber threats increasingly are on the mind of not just CIOs but CEOs across our partners. So it’s definitely an area where we are seeing a lot of conversations, a lot of interest…so a definite source of strength and you’ll see us continue to invest here,” he said.

“We are cloud native, we pioneered … zero trust and built the architecture out from a security-first perspective. Particularly, over the course of the last couple of years, with the recent attacks, [companies] really started thinking deeply about vulnerabilities, supply chain security has been a major source of consensus, cyber threats are increasingly on the mind of, not just CIOs, but CEOs across our partners. So it’s definitely an area where we are seeing a lot of conversations, a lot of interest.”

Google Cloud, along with its other business units, boosted Alphabet’s revenue 62% year over year, to $61.9 billion. As usual, Google ad revenue represented the biggest piece of the pie. It grew 69% to $50.44 billion. Retail was the biggest contributor to advertising growth.

Google Cloud holds around 7% market share in the cloud services segment, according to a Canalys report released in April 2021. It trails Amazon Web Services (AWS) and Microsoft Azure, which hold 32% and 19% market share, respectively.

Microsoft posted financial results Tuesday, its Intelligent Cloud revenue increased 30% to $17.4 billion. The company stated Azure revenue grew of 51%, but did not break out a dollar figure. Amazon is set to report earnings on Thursday.

Along with their hyper-scale cloud competitors Google Cloud is partnering with telecom companies all over the world to help them drive transformation and accelerate 5G adoption and monetization.

Here are a few of their telco partners:

………………………………………………………………….

References:

https://abc.xyz/investor/static/pdf/2021Q2_alphabet_earnings_release.pdf?cache=4db52a1

https://www.fiercetelecom.com/financial/google-cloud-revenue-climbs-54-q2

https://www.sdxcentral.com/articles/news/google-cloud-losses-shrink-59-revenue-hits-4-6b/2021/07/

Nokia and Vodafone to use machine learning on Google Cloud to detect network anomalies

Nokia and Vodafone have partnered to jointly develop a new machine learning (ML) system designed to detect and remediate network anomalies before they impact customers. Based on Nokia’s Bell Labs algorithm, the Anomaly Detection Service product runs on Google Cloud and is already being rolled out across Vodafone’s pan-European network.

In a joint statement, the partners said the ML system quickly detects and troubleshoots irregularities, such as mobile site congestion and interference, as well as unexpected latency, that may have an impact on customer service quality. Following an initial deployment in Italy on more than 60,000 LTE cells, Vodafone said it will be extending the service to all its European markets by early 2022, and there are plans to eventually apply it on the company’s 5G and core networks.

Vodafone added that it expects that around 80 percent of all its anomalous mobile network issues and capacity demands to be automatically detected and addressed using Anomaly Detection Service.

Vodafone’s deal with Nokia signed last year complements its recent six-year agreement with Google Cloud to jointly build integrated cloud-based capabilities backed by hubs of networking and software engineering expertise.

The platform, called ’Nucleus’, will house a new system ‘Dynamo’, which will drive data throughout Vodafone to enable it to more quickly offer its customers new, personalized products and services across multiple markets. Dynamo is expected to help Vodafone to tailor new connectivity services for homes and businesses through the release of new features such as providing a sudden broadband speed boost.

Capable of processing around 50 TB of data per day, Nucleus and Dynamo are considered “industry firsts”. Being built in-house by Vodafone and Google Cloud specialist teams, the project involves up to 1,000 employees of both companies located in Spain, the UK and the US.

Vodafone said it has already identified more than 700 use-cases to deliver new products and services quickly across its markets, support fact-based decision-making, reduce costs, remove duplication of data sources, and simplify and centralize operations.

Johan Wibergh, Chief Technology Officer, Vodafone, said: “We are building an automated and programmable network that can respond quickly to our customers’ needs. As we extend 5G across Europe, it is important to match the speed and responsiveness of this new technology with a great service. With machine learning, we can ensure a consistently high-quality performance that is as smart as the technology behind it.”

Amol Phadke, Managing Director, Telecom Industry Solutions, Google Cloud, said:

“We are thrilled to partner with Nokia and Vodafone to deliver a data- and AI-driven solution that scales quickly and leverages automation to increase cost efficiency and ensures seamless customer experiences across Europe. As behaviors change and the data needed for analysis increases in velocity, volume, and complexity, automation and a cloud-based data platform are now key in making fast and informed decisions.”

Anil Rao, Research Director, Analysys Mason, said: “Vodafone’s anomaly detection use case, developed in partnership with Nokia and run on Google Cloud, automates root-cause analysis for efficient network planning, optimization, and operations. This type of partnership provides a new opportunity for operators to rethink data management and increase the focus on use cases and application development.”

Raghav Sahgal, President of Cloud and Network Services, Nokia, said: “This first commercial deployment of Anomaly Detection Service with Vodafone on Google Cloud provides a great boost to customer service. It not only addresses the critical need to quickly detect and remedy anomalies impacting network performance using machine learning-based algorithms, but it also highlights Nokia’s technology leadership and the deep technical expertise of Nokia Bell Labs.”

Vodafone said it will convert its entire SAP environment to Google Cloud, including the migration of its core SAP workloads and key corporate SAP modules such as SAP Central Finance.

Bell Canada Partners selects Google Cloud to Deliver Next-Generation Network Experiences

Another major national telco has forged a significant relationship with a public cloud service provider to tap into the latter’s functionality and distributed cloud platform. Today, it’s Bell Canada and Google Cloud.

Bell Canad, Canada’s largest telecommunications company, and Google Cloud today announced a strategic partnership to power Bell’s company-wide digital transformation, enhance its network and IT infrastructure, and enable a more sustainable future. This new, multi-year partnership will combine Bell’s 5G network leadership with Google’s expertise in multi-cloud, data analytics, and artificial intelligence (AI), to deliver next-generation experiences for Bell customers across Canada.

As a strategic technology partner, Google Cloud will enable Bell to drive operational efficiencies, increase network automation, and deliver richer customer experiences through the following initiatives:

- Shifting critical workloads to the cloud: By moving and modernizing IT infrastructure, network functions, and critical applications from on-premise to Google Cloud, Bell will be able to drive greater operational efficiencies and enable better application performance.

- Unlocking multicloud, next-generation network technology: With the combined power of Bell’s 5G network and Anthos, Google Cloud’s multicloud solution, Bell will deliver a consistent customer experience with greater automation and enhanced flexibility that scales with customer demand. The increased speed and bandwidth capacity of the Bell 5G network will support applications that can respond faster and handle greater volumes of data than previous generations of wireless technology.

- Leveraging the power of AI, data and analytics: Bell will leverage Google Cloud’s expertise in AI and big data to gain unique insights through real-time network data analytics that will enhance the customer experience, improve service assurance, and assist with network capacity planning.

- Joining forces on a sustainable future: Bell and Google share a common goal to run more sustainable businesses. As the cleanest cloud in the industry, Google Cloud will contribute to Bell’s target of achieving carbon neutral operations by 2025, and reducing greenhouse gas emissions by 2030 in line with the Paris Climate Agreement.

“We’re excited to partner with Google Cloud as part of our ongoing digital transformation and take Bell’s 5G network leadership to the next level,” said Mirko Bibic, CEO, BCE Inc. and Bell Canada. “Supporting Bell’s goal to advance how Canadians connect with each other and the world, Google’s proven expertise in cloud and leadership in sustainability will provide our customers with even faster, more reliable access to the best broadband network and communications services in Canada.”

“The acceleration of 5G has created new opportunities for industry leaders like Bell to redefine their business and create richer customer experiences,” said Thomas Kurian, CEO, Google Cloud. “We’re proud to partner with Bell to support their transformational shift to the cloud, and power a better network experience for people and businesses across Canada.”

As demands on mobile networks evolve and increase, Bell and Google Cloud will collaborate throughout the next decade on new innovations, including cloud solutions for enterprise customers and consumers powered by Google edge solutions, and enhanced customer service through automation and AI. In addition, the two companies will look at new ways to expand Bell’s existing partnership with Google to evolve the network experience and introduction of next-generation services across residential, mobile, and more.

Bell Canada says its relationship with Google Cloud will enable it to “drive operational efficiencies, increase network automation, and deliver richer customer experiences” through a number of initiatives, namely: Shifting multiple workloads from private systems to its partner’s platforms; leveraging “Google Cloud’s expertise in AI and big data to gain unique insights through real-time network data analytics that will enhance the customer experience, improve service assurance, and assist with network capacity planning; and combining the operator’s 5G connectivity with Anthos-hosted applications for an experience that “can respond faster and handle greater volumes of data than previous generations of wireless technology.”

They even squeezed a sustainability angle from the relationship, boasting that the collaboration would help the operator hit its target of achieving carbon neutral operations by 2025.

And this is just the start: The partners say they will “collaborate throughout the next decade on new innovations, including cloud solutions for enterprise customers and consumers powered by Google edge solutions, and enhanced customer service through automation and AI. In addition, the two companies will look at new ways to expand Bell’s existing partnership with Google to evolve the network experience and introduction of next-generation services across residential, mobile, and more.”

Like many network operators, Bell Canada is not monogamous in its public cloud relationships: Only weeks ago it announced it is teaming up with Amazon Web Services (AWS) for telco edge service developments and will integrate AWS Wavelength Zones into its 5G network in an effort to encourage developers to create new services, particularly low-latency applications that can take advantage of edge compute assets and 5G connectivity.

Same is true for Google Cloud- they have many relationship with many telecom service providers. Earlier this year, Google Cloud signed a 10-year deal with the Canadian telco Telus. Additionally, the cloud company extended its partnership with AT&T to offer edge computing and software tools to create 5G applications. As the growth of 5G and edge computing open up new economic opportunities, the major public cloud providers have been busy inking deals with CSPs and other players in the 5G ecosystem.

In addition to its new telco deals, Google recently announced a partnership with Intel to develop reference architectures and technologies that will accelerate the deployment of 5G and edge network solutions.

References:

https://www.prnewswire.com/news/google-cloud/

https://www.zdnet.com/article/google-cloud-signs-multi-year-deal-with-bell-canada/

Related:

AT&T 5G SA Core Network to run on Microsoft Azure cloud platform

NEC and Microsoft in MAJOR multi-year strategic partnership based on cloud computing

Microsoft and NEC Corporation on Tuesday announced an expansion of their decades-long collaboration. Through a new multi-year strategic partnership, the companies will leverage Microsoft Azure, Microsoft 365, NEC’s network and IT expertise, including 5G technologies, and each other’s AI and IoT solutions to help enterprise customers and the public sector across multiple markets and industries further accelerate their cloud adoption and digital transformation initiatives. Microsoft and NEC have a history of strong collaboration spanning more than 40 years (since NEC introduced its PC running Microsoft software in 1979).

The partnership will have NEC adopt Microsoft Azure as its preferred cloud platform to deliver enhanced capabilities to drive sustained digitalization, help customers transform their business models, and build Digital Workplaces for the post-pandemic “new normal.”

To accelerate NEC’s Digital Workplace innovation and workforce transformation, the companies will work together to migrate NEC’s on-premises IT environment to Azure and deploy Azure Virtual Desktop and other Azure services among the NEC Group’s 110,000 employees worldwide. This modernization builds on NEC’s existing Microsoft 365 platform and will enable a highly sustainable environment that is more secure and robust, accelerating cloud migration for NEC and its customers throughout the commercial and public sector in Japan and around the world.

The companies will work together to help improve digital services for public sector and enterprise customers through workplace and workforce transformation. Greater speed and lower-latency data connections will provide high-performance network experiences to create more efficient workplaces and empower employees to realize more personalized work styles for public sector as well as private sector customers.

Leveraging the assets of both companies, including Microsoft’s Intelligent Edge solutions and NEC’s private 5G networking technologies (?), the companies will work together to help customers across industries transform. In retail, for example, the two companies will work together to analyze customer transaction data in real time using AI to better understand buying patterns, improve operational efficiency and identify new market opportunities.

The combination of Azure and both companies’ AI and IoT technologies and expertise will enhance NEC’s customer experience through advanced solutions and enable more secure maintenance and operation of stores. In addition, NEC and Microsoft plan to explore network innovation initiatives built on Microsoft Azure for enterprise domains and specific industries.

Through the partnership, the companies will work together to double the number of digital-focused engineers within the NEC Group who are specialized in Microsoft technologies. This investment in technical capabilities and the expertise of NEC’s employees will help ensure customers’ digital transformation success, benefiting the market and society.

“As we’ve seen over the past year, digital adoption curves are accelerating across every industry and business function,” said Satya Nadella, chairman and CEO, Microsoft. “Our strategic partnership with NEC brings together the power of Azure and Microsoft 365 with NEC’s services and infrastructure expertise to help public and private sector customers build resilience and transform during this era of rapid change.”

“NEC is pleased to enter into this strategic collaboration with Microsoft Corp.,” said Takayuki Morita, president and CEO of NEC Corporation. “With Microsoft’s trusted cloud and services, the experience that NEC has cultivated in its own systems, and both companies’ AI and IoT technologies, we will enable companies globally to use digital services that are safer and more secure than ever before as they progress with digital initiatives.”

“The need for sustainable transformation to ensure business resiliency and growth has never been more important in the world and especially Japan,” said Hitoshi Yoshida, president & CEO, Microsoft Japan. “Our partnership will help accelerate the industry’s cloud-based digital transformation and utilization of data migration and help Japan’s continued success globally, leading to greater economic and societal prosperity.”

…………………………………………………………………………………………………………………………………………………..

More on NEC:

NEC recently announced it had demonstrated its 4G and 5G Mobile Core Solution on Amazon Web Services for commercial offerings from “multiple” service providers in Japan. “Our core and its associated orchestration products allow us to provide sophisticated capabilities, such as end-to-end slicing, ultra-low latency and multi-cloud deployment options, which are key to realize the promises of 5G monetization,” claimed Patrick Lopez, NEC’s global VP of product management for 5G products.

Of course, NEC has partnered with Rakuten Mobile to develop the Rakuten Communications Platform (RCP) and related 5G SA Cloud Native Core network software.

References:

https://www.lightreading.com/5g/nec-sends-5g-to-cloud-with-microsoft/d/d-id/770831?

Rakuten Mobile, Inc. and NEC to jointly develop the containerized standalone (SA) 5G core network

Rakuten Communications Platform (RCP) defacto standard for 5G core and OpenRAN?

o[

o[